Asian Infrastructure Investment Bank

Management’s Report Regarding the Effectiveness of Internal Controls over Financial Reporting for the year ended Dec. 31, 2019

Responsibility for Financial Reporting

Management’s responsibility

Management’s report regarding the effectiveness of internal controls over financial reporting

The Management of the Asian Infrastructure Investment Bank (the Bank) is responsible for the preparation, integrity, and fair presentation of its published financial statements and associated disclosures for the year ended Dec. 31, 2019. The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

The financial statements have been audited by an independent audit firm, which has been given unrestricted access to all financial records and related data, including minutes of all meetings of the Board of Directors and Committees of the Board. Management believes that all representations made to the external auditor during its audit were valid and appropriate. The external auditor’s report accompanies the audited financial statements.

Management is responsible for establishing, implementing and maintaining effective internal control over financial reporting for financial presentation and measurement in conformity with IFRS. The system of internal control contains monitoring mechanisms, and actions are taken to correct deficiencies identified. Management believes that internal controls over financial reporting—which are subject to scrutiny and testing by Management and are revised, as considered necessary, taking account of any related internal audit recommendations—support the integrity and reliability of the financial statements.

However, even an effective internal control system has inherent limitations, including the possibility of human error and the circumvention of overriding controls. Therefore it can only provide reasonable assurance with respect to the preparation of financial statements. Furthermore, the effectiveness of an internal control system can change with circumstances, such as changes in business and operating environment, including the increased relevance of technology and considerations on outsourcing of functions/systems/platforms.

The Bank’s Board of Directors has appointed an Audit and Risk Committee, which assists the Board in its responsibility to ensure the soundness of the Bank’s accounting practices and the effective implementation of the internal controls that Management has established relating to finance and accounting matters. The Audit and Risk Committee comprises members of the Board of Directors and external members. The Audit and Risk Committee meets periodically with Management to review and monitor the financial, accounting and auditing procedures of the Bank and its financial reports, and reviews the scope of work and the effectiveness of the internal audit function and internal control system. The external auditor and the internal auditor regularly meet with the Audit and Risk Committee, to discuss the adequacy of internal controls over financial reporting and any other matters that they believe should be brought to the attention of the Audit and Risk Committee.

The Bank’s assessment of the effectiveness of internal controls over financial reporting as at Dec. 31, 2019 was based on the criteria established in the Internal Control Integrated

I

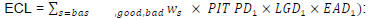

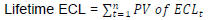

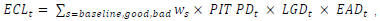

where ws is the weight of each scenario—46.6% for Baseline, 26.7% for both Good and Bad scenarios.

where ws is the weight of each scenario—46.6% for Baseline, 26.7% for both Good and Bad scenarios.