NW Natural Holdings SiEnergy Acquisition November 19, 2024

Investor Information Company Information NW Natural Holdings 250 SW Taylor Street Portland, OR 97204 nwnaturalholdings.com Nikki Sparley Director, Investor Relations and Treasury (503) 721-2530 nikki.sparley@nwnatural.com FORWARD LOOKING STATEMENTS This and other presentations made by NW Natural Holdings from time to time, may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, which are subject to the safe harbors created by such Act. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “will,” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements regarding the following: plans; objectives; estimates; timing; goals; strategies; future events; projections; expectations; forecasts; outlook; acquisitions and timing, completion and integration thereof; pipeline, gas utility and other infrastructure investments; safety; gross domestic product, population and employment growth; economic conditions and development; customer growth; scale and diversification; regulatory, policy and political environments; rate base growth; earnings; growth opportunities; customer backlog; growth rate; financings; regulatory mechanisms; invested capital; system safety and reliability; risk profile; strategic fit; financial profile; shareholder value; financial targets, including FFO/Debt targets; return on invested capital; rate case execution; customer and business growth; business risk; regulatory recovery; water and wastewater industry and investments including timing, completion and integration of such investments; accretion, financial positions and performance; shareholder return and value; capital expenditures; strategic goals and visions; renewable natural gas projects or investments and timing related thereto; return on equity; capital structure; return on invested capital; revenues and earnings and timing thereof; margins; net income; operations and maintenance expense; credit ratings and profile; debt and equity issuances; timing or effects of future regulatory proceedings or future regulatory approvals; timing, outcome and effects of regulatory dockets or mechanisms or approvals; and other statements that are other than statements of historical facts. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements, so we caution you against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed by reference to the factors described in Part I, Item 1A “Risk Factors,” and Part II, Item 7 and Item 7A “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosure about Market Risk” in the Company’s most recent Annual Report on Form 10-K, and in Part I, Items 2 and 3 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures About Market Risk”, and Part II, Item 1A, “Risk Factors”, in the Company’s quarterly reports filed thereafter. All forward-looking statements made in this presentation and all subsequent forward-looking statements, whether written or oral and whether made by or on behalf of NW Holdings, are expressly qualified by these cautionary statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. 2

Leadership Presenting Today David H. Anderson Chief Executive Officer Ray J. Kaszuba SVP & CFO Justin B. Palfreyman President 3

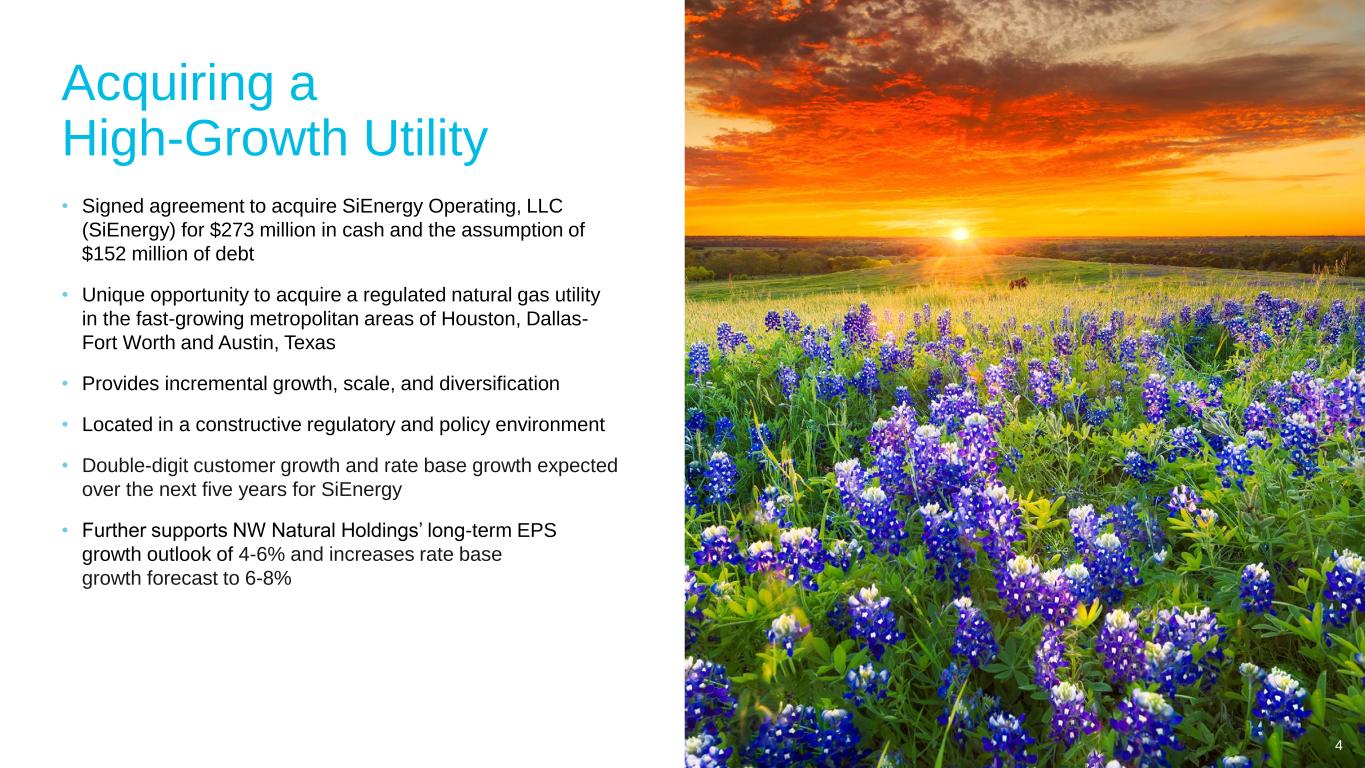

4 • Signed agreement to acquire SiEnergy Operating, LLC (SiEnergy) for $273 million in cash and the assumption of $152 million of debt • Unique opportunity to acquire a regulated natural gas utility in the fast-growing metropolitan areas of Houston, Dallas- Fort Worth and Austin, Texas • Provides incremental growth, scale, and diversification • Located in a constructive regulatory and policy environment • Double-digit customer growth and rate base growth expected over the next five years for SiEnergy • Further supports NW Natural Holdings’ long-term EPS growth outlook of 4-6% and increases rate base growth forecast to 6-8% Acquiring a High-Growth Utility

OVERVIEW • SiEnergy is a regulated utility founded in 1997 that distributes natural gas to residential and commercial customers in the desirable and fast-growing major metropolitan areas of the Texas Triangle1 • Strong historic customer growth of 20%+ with Texas economic development expected to continue, supporting projections for double-digit customer and rate base growth long term • Provides NW Natural Holdings regulated growth opportunities in a constructive regulatory and policy environment • Meaningful acquisition that further improves growth opportunities, scale and diversification of NW Natural Holdings’ portfolio • Further supports NW Natural Holdings’ long-term EPS growth outlook of 4-6% 5 1 Includes the Houston, Dallas-Fort Worth, and Austin areas 2 Reflects counties in which SiEnergy has active and backlog customers F Indicates a Forecasted number E Indicates an Expected number based on current information for 2024 KEY STATISTICS AND PROJECTIONS 70,000+ Gas LDC Customers (12/31/24E) 180,000+ Contracted Backlog of New Customers $247 million Rate Base (12/31/24E) $450 - $650 million Cap-Ex (2025F-2030F) 22% Historical Customer CAGR (2019A-2024E) One of the Fastest Growing Natural Gas Utilities in the Nation through Organic Customer Additions SERVICE TERRITORIES Acquisition of SiEnergy Strategic investment in high-growth, constructive market that further supports NWN’s long-term EPS growth target 26% Historical Rate Base CAGR (2019A-2024E) Service Territories2 DALLAS-FORT WORTH AUSTIN HOUSTON Up to 20% Customer CAGR (2025F-2030F)

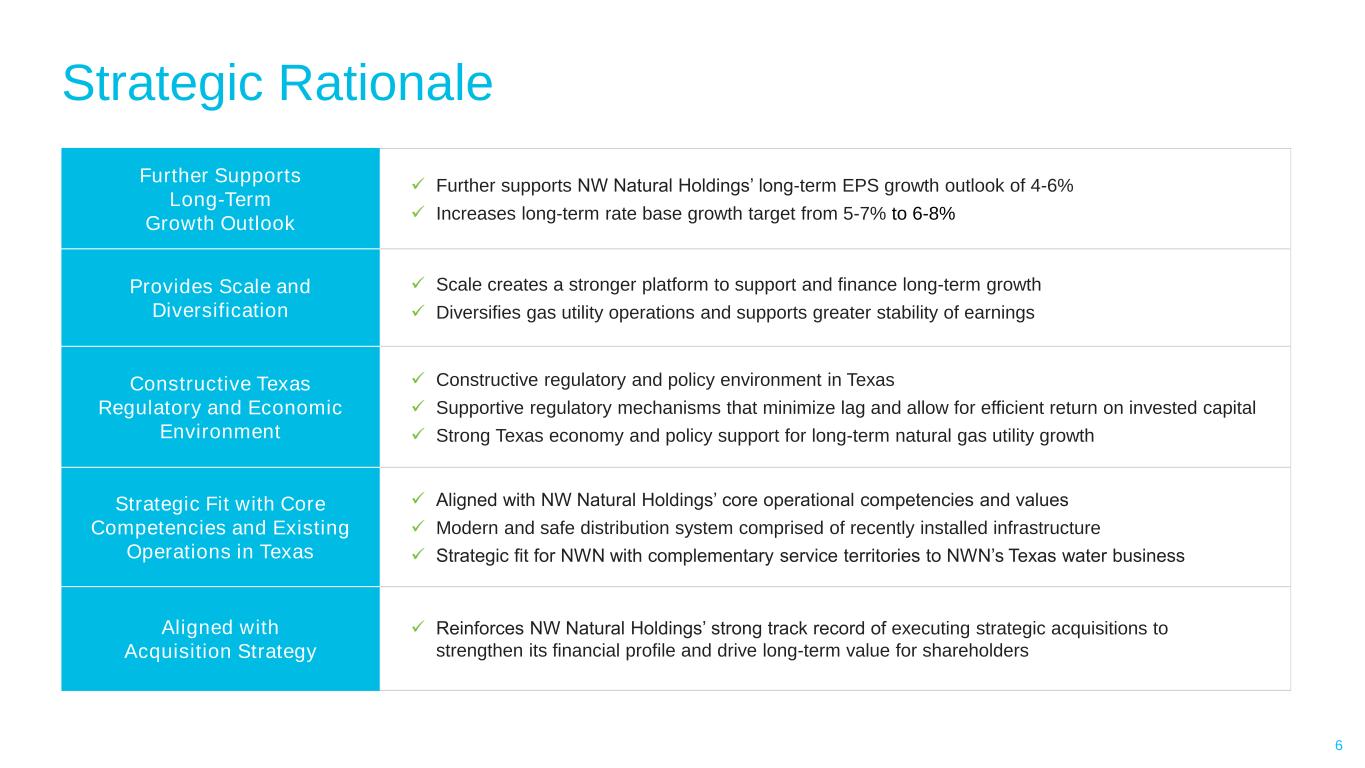

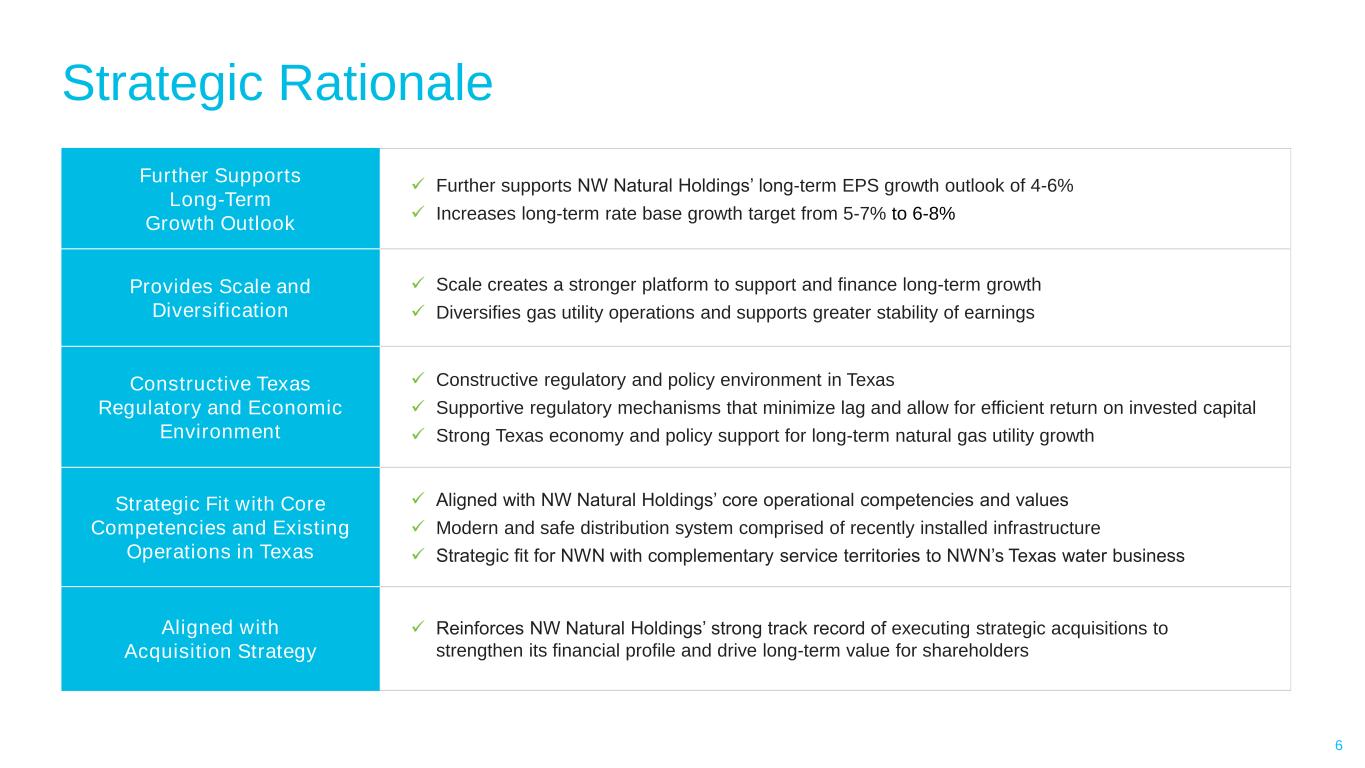

Strategic Rationale Further Supports Long-Term Growth Outlook ✓ Further supports NW Natural Holdings’ long-term EPS growth outlook of 4-6% ✓ Increases long-term rate base growth target from 5-7% to 6-8% Provides Scale and Diversification ✓ Scale creates a stronger platform to support and finance long-term growth ✓ Diversifies gas utility operations and supports greater stability of earnings Constructive Texas Regulatory and Economic Environment ✓ Constructive regulatory and policy environment in Texas ✓ Supportive regulatory mechanisms that minimize lag and allow for efficient return on invested capital ✓ Strong Texas economy and policy support for long-term natural gas utility growth Strategic Fit with Core Competencies and Existing Operations in Texas ✓ Aligned with NW Natural Holdings’ core operational competencies and values ✓ Modern and safe distribution system comprised of recently installed infrastructure ✓ Strategic fit for NWN with complementary service territories to NWN’s Texas water business Aligned with Acquisition Strategy ✓ Reinforces NW Natural Holdings’ strong track record of executing strategic acquisitions to strengthen its financial profile and drive long-term value for shareholders 6

LIQUIDITY OF AND FINANCINGStrong Texas Triangle Growth 7 Service territories in three of the fastest growing metro areas in the U.S. and is forecasted to continue delivering outsized growth • On average, ~400,000 new residents moved to Texas each year from 2000 - 2022 • Houston, Dallas and Austin are among the top 10 metro areas with the most annual new home starts in the U.S. • Roughly 300 corporations relocated to Texas between 2015 and April 2024 • Three of the Top 20 Hottest U.S. Job Markets per the WSJ are in the Texas Triangle • SiEnergy has strong relationships with housing developers, providing line-of-sight to new customers and continued growth • Current customer backlog of approximately 180,000 connections SiEnergy’s service territories are seeing… …1.4x faster real GDP growth… … 3.3x faster population growth… …and 2.3x faster employment growth than the U.S. Real GDP Growth1 (2018-2022) Population Growth (2018-2023) Employment Growth2 (2018-2023) 1.6% 0.5% TX Triangle U.S. Total 2.3% 1.0% TX Triangle U.S. Total Source: U.S. Bureau of Labor Statistics, U.S. Department of the Treasury, U.S. Census Bureau., Wall Street Journal as of April 2024; 1 Real GDP growth by metro area is only available through 2022; 2 Based on non-farm payrolls 3.2% 2.2% TX Triangle U.S. Total

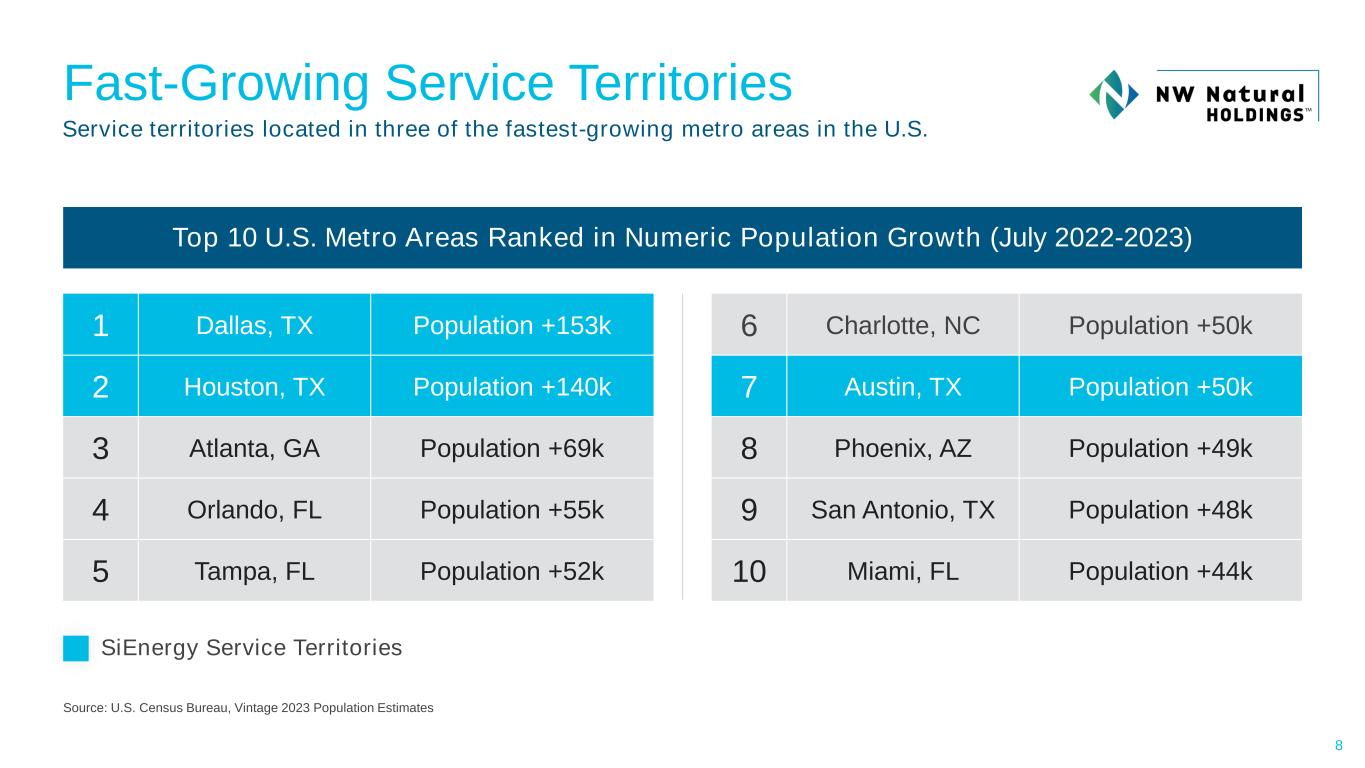

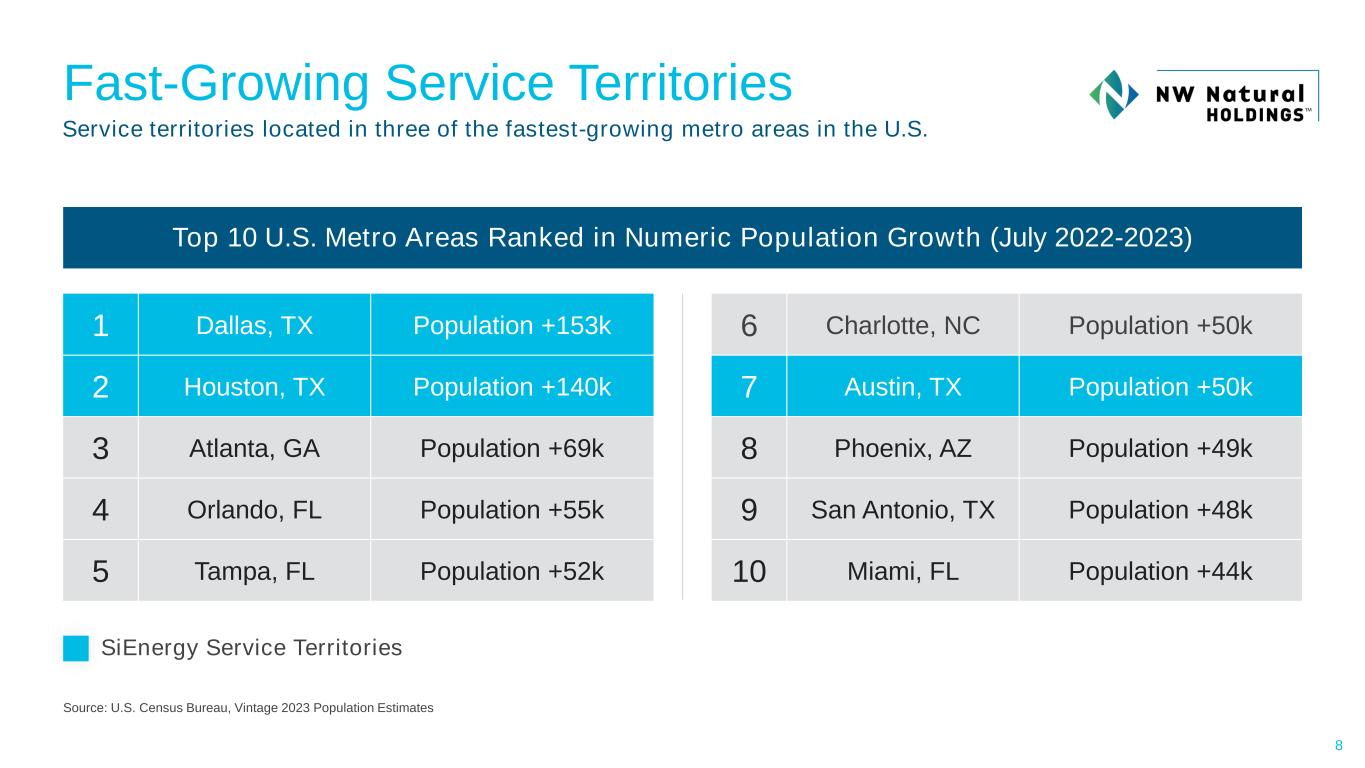

LIQUIDITY OF AND FINANCING Fast-Growing Service Territories 8 Source: U.S. Census Bureau, Vintage 2023 Population Estimates Service territories located in three of the fastest-growing metro areas in the U.S. SiEnergy Service Territories Top 10 U.S. Metro Areas Ranked in Numeric Population Growth (July 2022-2023) 1 Dallas, TX Population +153k 2 Houston, TX Population +140k 3 Atlanta, GA Population +69k 4 Orlando, FL Population +55k 5 Tampa, FL Population +52k 6 Charlotte, NC Population +50k 7 Austin, TX Population +50k 8 Phoenix, AZ Population +49k 9 San Antonio, TX Population +48k 10 Miami, FL Population +44k

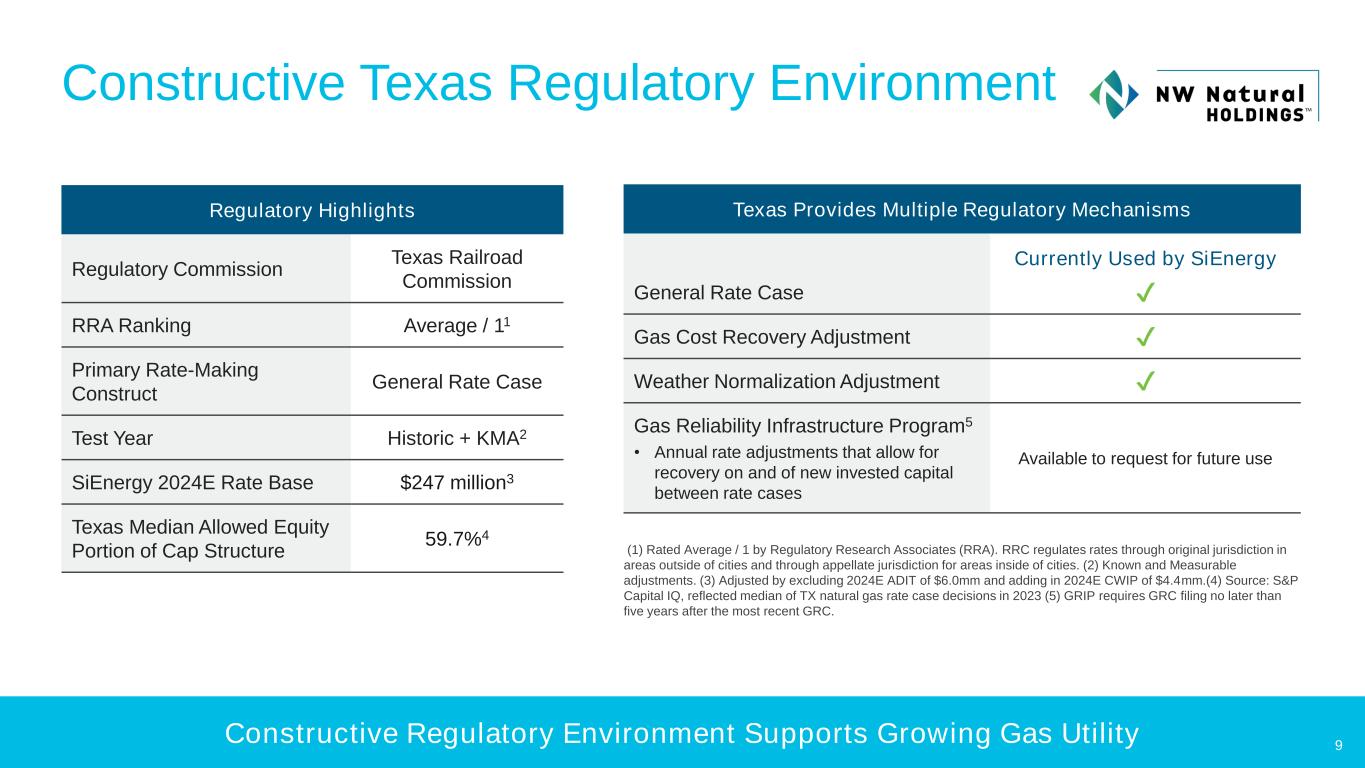

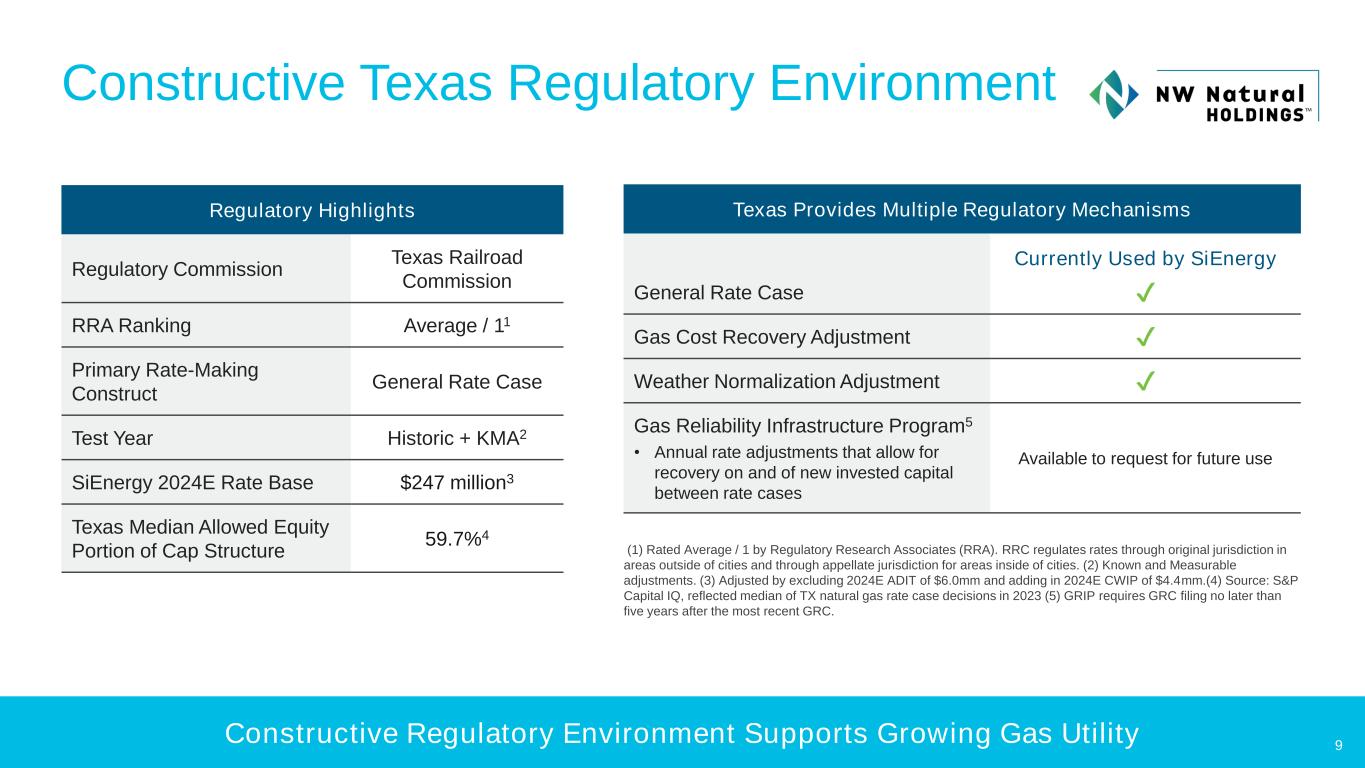

Constructive Regulatory Environment Supports Growing Gas Utility LIQUIDITY OF AND FINANCINGConstructive Texas Regulatory Environment 9 (1) Rated Average / 1 by Regulatory Research Associates (RRA). RRC regulates rates through original jurisdiction in areas outside of cities and through appellate jurisdiction for areas inside of cities. (2) Known and Measurable adjustments. (3) Adjusted by excluding 2024E ADIT of $6.0mm and adding in 2024E CWIP of $4.4mm.(4) Source: S&P Capital IQ, reflected median of TX natural gas rate case decisions in 2023 (5) GRIP requires GRC filing no later than five years after the most recent GRC. Regulatory Highlights Regulatory Commission Texas Railroad Commission RRA Ranking Average / 11 Primary Rate-Making Construct General Rate Case Test Year Historic + KMA2 SiEnergy 2024E Rate Base $247 million3 Texas Median Allowed Equity Portion of Cap Structure 59.7%4 Texas Provides Multiple Regulatory Mechanisms Currently Used by SiEnergy General Rate Case Gas Cost Recovery Adjustment Weather Normalization Adjustment Gas Reliability Infrastructure Program5 • Annual rate adjustments that allow for recovery on and of new invested capital between rate cases Available to request for future use

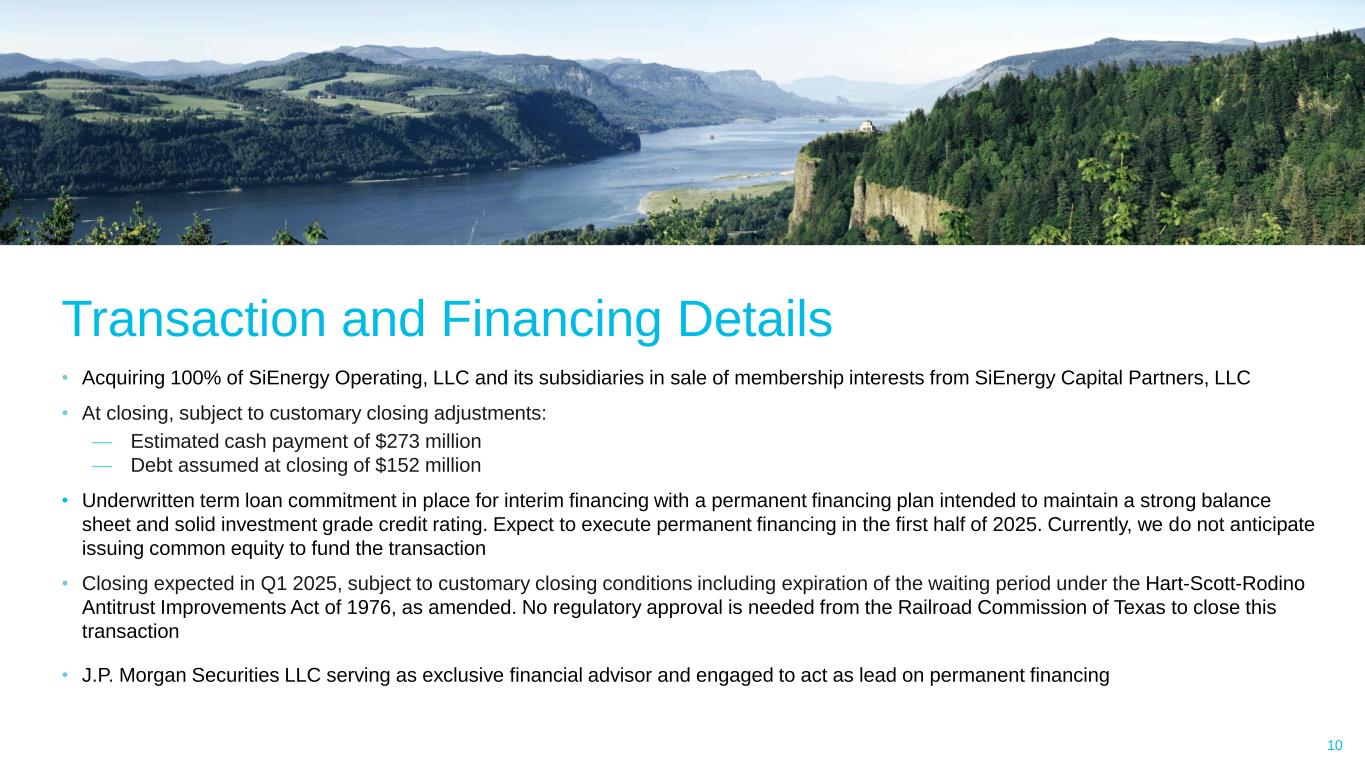

LIQUIDITY OF AND FINANCING Transaction and Financing Details 10 • Acquiring 100% of SiEnergy Operating, LLC and its subsidiaries in sale of membership interests from SiEnergy Capital Partners, LLC • At closing, subject to customary closing adjustments: — Estimated cash payment of $273 million — Debt assumed at closing of $152 million • Underwritten term loan commitment in place for interim financing with a permanent financing plan intended to maintain a strong balance sheet and solid investment grade credit rating. Expect to execute permanent financing in the first half of 2025. Currently, we do not anticipate issuing common equity to fund the transaction • Closing expected in Q1 2025, subject to customary closing conditions including expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. No regulatory approval is needed from the Railroad Commission of Texas to close this transaction • J.P. Morgan Securities LLC serving as exclusive financial advisor and engaged to act as lead on permanent financing

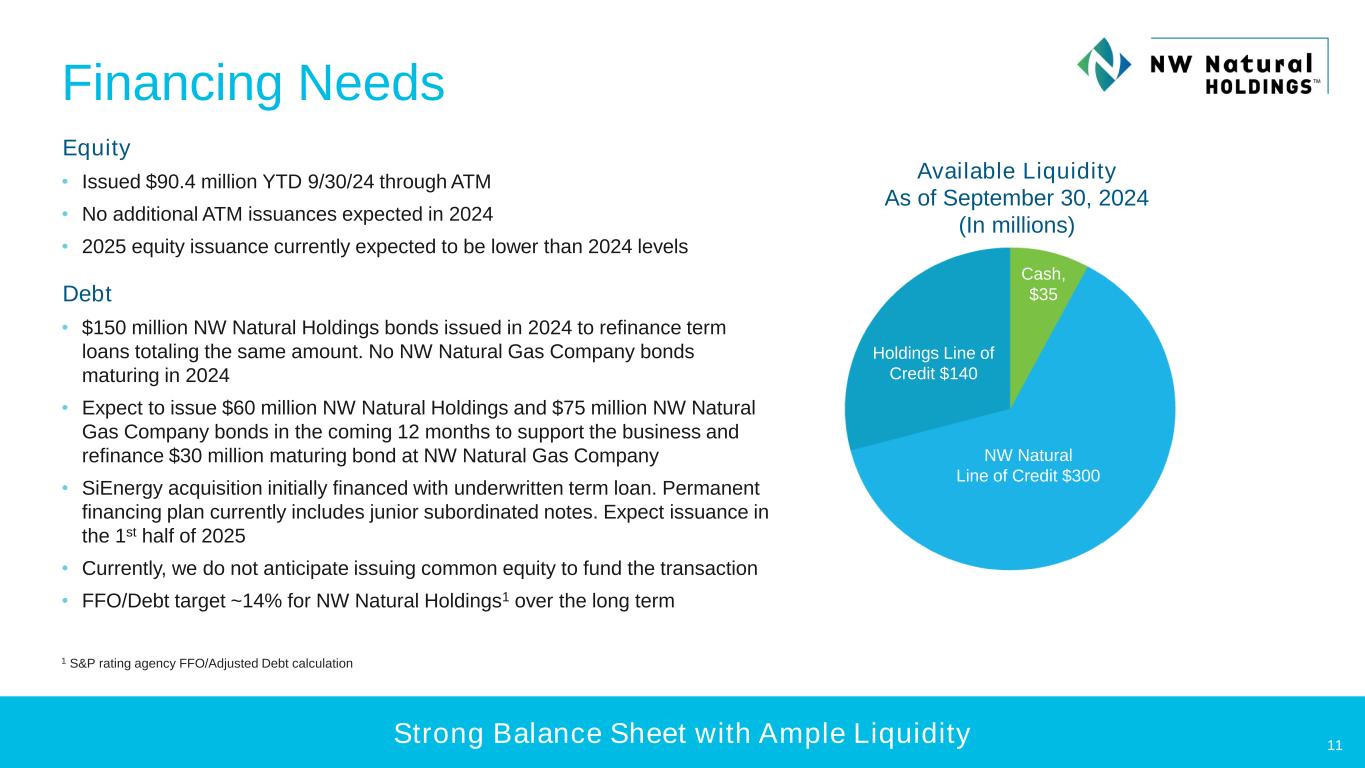

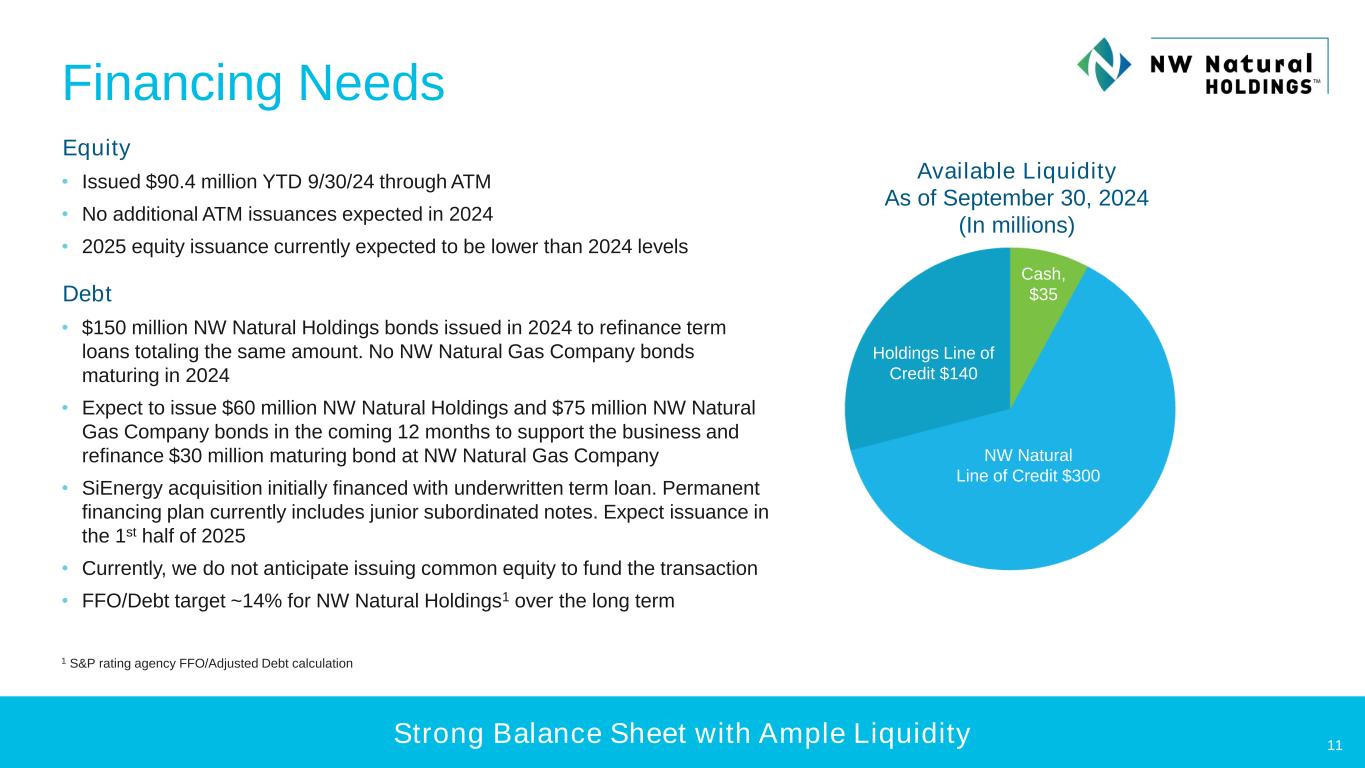

1 S&P rating agency FFO/Adjusted Debt calculation Strong Balance Sheet with Ample Liquidity Financing Needs Equity • Issued $90.4 million YTD 9/30/24 through ATM • No additional ATM issuances expected in 2024 • 2025 equity issuance currently expected to be lower than 2024 levels Debt • $150 million NW Natural Holdings bonds issued in 2024 to refinance term loans totaling the same amount. No NW Natural Gas Company bonds maturing in 2024 • Expect to issue $60 million NW Natural Holdings and $75 million NW Natural Gas Company bonds in the coming 12 months to support the business and refinance $30 million maturing bond at NW Natural Gas Company • SiEnergy acquisition initially financed with underwritten term loan. Permanent financing plan currently includes junior subordinated notes. Expect issuance in the 1st half of 2025 • Currently, we do not anticipate issuing common equity to fund the transaction • FFO/Debt target ~14% for NW Natural Holdings1 over the long term Available Liquidity As of September 30, 2024 (In millions) 11 Cash, $35 NW Natural Line of Credit $300 Holdings Line of Credit $140

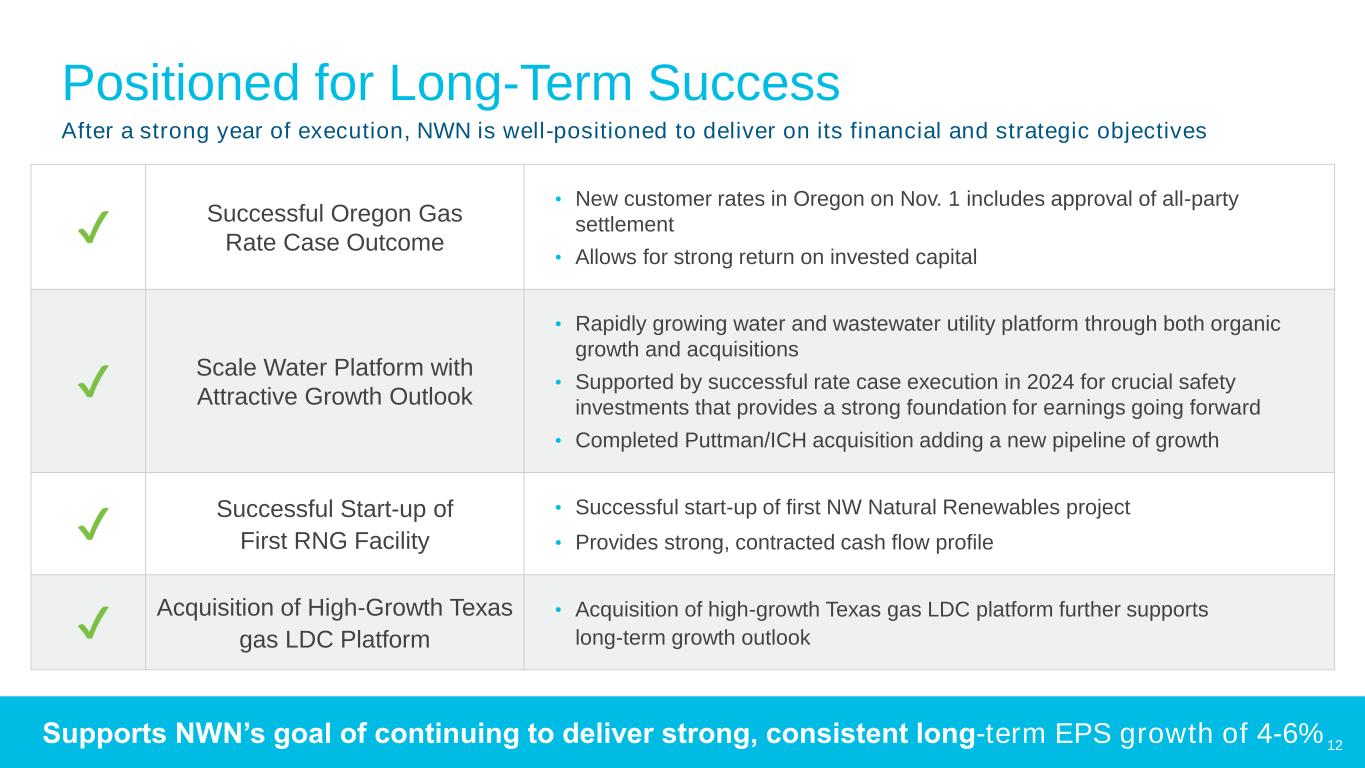

Supports NWN’s goal of continuing to deliver strong, consistent long-term EPS growth of 4-6% Positioned for Long-Term Success After a strong year of execution, NWN is well-positioned to deliver on its financial and strategic objectives Successful Oregon Gas Rate Case Outcome • New customer rates in Oregon on Nov. 1 includes approval of all-party settlement • Allows for strong return on invested capital Scale Water Platform with Attractive Growth Outlook • Rapidly growing water and wastewater utility platform through both organic growth and acquisitions • Supported by successful rate case execution in 2024 for crucial safety investments that provides a strong foundation for earnings going forward • Completed Puttman/ICH acquisition adding a new pipeline of growth Successful Start-up of First RNG Facility • Successful start-up of first NW Natural Renewables project • Provides strong, contracted cash flow profile Acquisition of High-Growth Texas gas LDC Platform • Acquisition of high-growth Texas gas LDC platform further supports long-term growth outlook 12