Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-224069

| | |

| Dear Sohu.com Inc. Stockholders: | | April 23, 2018 |

You are cordially invited to attend a special meeting (including any adjournment or postponement thereof, the “Special Meeting”) of stockholders of Sohu.com Inc., a Delaware corporation (“Sohu Delaware”), to be held at our office at Level 2, Sohu.com Media Plaza, Block 3, No. 2 Kexueyuan South Road, Haidian District, Beijing 100190, People’s Republic of China, on May 29, 2018 at 10:00 A.M., Beijing time.

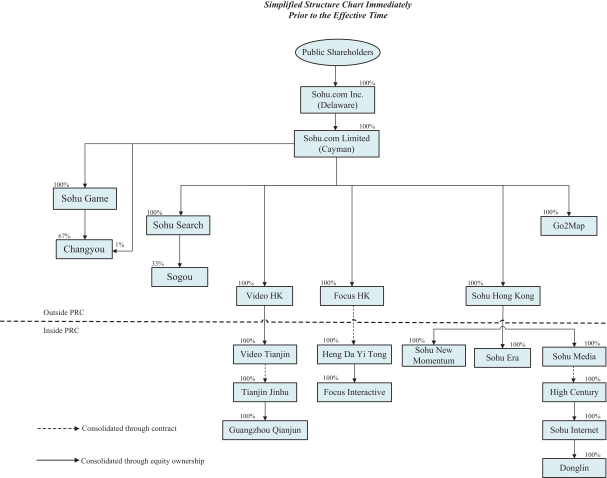

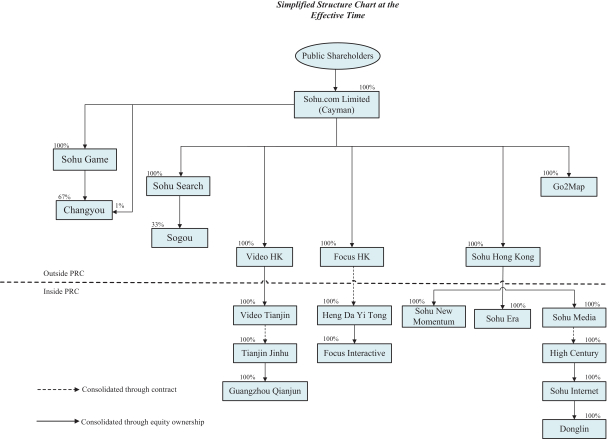

At the Special Meeting, you will be asked to approve the dissolution of Sohu Delaware (the “Liquidation”) and adopt the Plan of Complete Liquidation and Dissolution of Sohu Delaware (the “Plan of Liquidation”) attached hereto as Annex A (the “Liquidation Proposal”). The Liquidation pursuant to the Plan of Liquidation will result in, among other things, the dissolution of Sohu Delaware, the cancellation of all outstanding shares of the common stock of Sohu Delaware, and the pro rata distribution to the stockholders of Sohu Delaware of American depositary shares (the “ADSs”) representing ordinary shares of Sohu.com Limited, a Cayman Islands company (“Sohu Cayman”). You will also be asked to grant discretionary authority to our Board of Directors to adjourn the Special Meeting to solicit additional proxies in the event that there are insufficient shares present in person or by proxy voting in favor of the Liquidation Proposal.

The Liquidation will result in Sohu Cayman becoming thetop-tier, publicly-traded holding company of the Sohu Group (as defined herein), which currently consists of Sohu Delaware and its subsidiaries (including Sohu Cayman) and variable interest entities. If the Liquidation is approved by our stockholders, it is anticipated that Sohu Delaware will file a Certificate of Dissolution with the Secretary of State of the State of Delaware (the time of such filing or such later effective time is set forth in the Certificate of Dissolution, the “Effective Time”) and as of the Effective Time Sohu Delaware will distribute ADSs to you as a stockholder of Sohu Delaware, each representing one ordinary share of Sohu Cayman, equal to the number of shares of the common stock of Sohu Delaware that you held immediately prior to the Effective Time. From and after the Effective Time, the Sohu Group’s business, operations, and assets will be substantially the same as they were prior to the Effective Time, except that Sohu Cayman will be thetop-tier publicly-traded holding company of the Sohu Group, and ADSs representing Sohu Cayman ordinary shares will be listed and traded on the NASDAQ Global Select Market under the “SOHU” symbol in place of the shares of the common stock of Sohu Delaware.

We currently anticipate that the Effective Time will be shortly after the completion of trading on the NASDAQ Global Select Market on May 31, 2018, although the Liquidation may be postponed or abandoned by our Board of Directors at any time, including after stockholder approval.

We will submit an application to NASDAQ and anticipate that, immediately following the Effective Time, the ADSs will be listed on the NASDAQ Global Select Market under the symbol “SOHU,” which is the current NASDAQ symbol for shares of the common stock of Sohu Delaware, which will be delisted as of the Effective Time and will not trade thereafter.

Commencing at the Effective Time, Sohu Cayman will become subject to the reporting requirements of the U.S. securities laws, including the mandates of the Sarbanes-Oxley Act, and to the Listing Rules of the NASDAQ Stock Market LLC (the “NASDAQ Listing Rules”), and Sohu Cayman will report consolidated financial results for the Sohu Group in U.S. dollars and in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). However, Sohu Cayman, unlike Sohu Delaware, will report as a “foreign private issuer” under the U.S. securities laws.

Generally, for U.S. federal income tax purposes (i) the Liquidation will be a taxable transaction for Sohu Delaware, (ii) stockholders of Sohu Delaware who are U.S. taxpayers can be expected to recognize gain or loss as a result of the Liquidation, and (iii) subject to certain exceptions, stockholders of Sohu Delaware who are not U.S. taxpayers are not expected to be subject to U.S. federal income tax as a result of the Liquidation, but may be subject to tax under their respective jurisdictions of domicile.

The Liquidation cannot be completed unless the Liquidation Proposal is approved by the holders of a majority of Sohu Delaware’s outstanding shares of common stock entitled to vote at the Special Meeting. The accompanying proxy statement/prospectus (the “Proxy Statement/Prospectus”) contains important detailed information about the Liquidation and the Special Meeting. The Proxy Statement/Prospectus also represents a prospectus for the offering by Sohu Cayman of the ADSs representing ordinary shares of Sohu Cayman that will be distributed to existing stockholders of Sohu Delaware upon the Liquidation. We encourage you to read the Proxy Statement/Prospectus carefully before voting, including the sections entitled “Special Note Regarding Forward-Looking Statements” on page 2 and “Risk Factors” beginning on page 14.

Our Board of Directors has determined that Liquidation is advisable and in the best interests of Sohu Delaware and our stockholders and has unanimously approved the Liquidation and the Plan of Liquidation as described in the Proxy Statement/Prospectus. Our Board of Directors recommends that you vote “FOR” the Liquidation Proposal and “FOR” the proposal to grant discretionary authority to our Board of Directors to adjourn the Special Meeting to solicit additional proxies in the event that there are insufficient shares present in person or by proxy voting in favor of the Liquidation Proposal. A copy of the Plan of Liquidation is attached to the Proxy Statement/Prospectus as Annex A and is incorporated herein by reference.

Holders of Sohu Delaware common stock will not be entitled to appraisal rights under Delaware law in connection with Liquidation.

Every stockholder’s vote is important to us. Whether or not you expect to attend the Special Meeting in person, we urge you to submit your proxy as soon as possible. You may submit your proxy over the Internet, by telephone, or by mail. For specific information regarding the voting of your shares, please refer to the section entitled “The Special Meeting” beginning on page 72 of the Proxy Statement/Prospectus.

We look forward to seeing those of you who are able to attend the Special Meeting in person.

Sincerely,

Dr. Charles Zhang

Chief Executive Officer

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities offered under the accompanying Proxy Statement/Prospectus or determined if the accompanying Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus is dated April 23, 2018 and is first being mailed to Sohu Delaware stockholders on or about April 27, 2018.