| O L S H A N | 1325 AVENUE OF THE AMERICAS ● NEW YORK, NEW YORK 10019

TELEPHONE: 212.451.2300 ● FACSIMILE: 212.451.2222 |

EMAIL: AFREEDMAN@OLSHANLAW.COM

DIRECT DIAL: 212.451.2250

July 2, 2020

VIA EDGAR AND ELECTRONIC MAIL

Daniel F. Duchovny

Special Counsel

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Collectors Universe, Inc. (“CLCT” or the “Company”)

Soliciting Materials on Schedule 14A filed by Alta Fox Capital Management, LLC et al. (collectively, “Alta Fox”)

Filed on June 18, 2020

File No. 001-34240 |

Dear Mr. Duchovny:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission, dated June 24, 2020 (the “Staff Letter”), with regard to the above-referenced matter. We have reviewed the Staff Letter with Alta Fox and provide the following responses on its behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meanings ascribed to them in the above referenced soliciting materials filed with the SEC in connection with the upcoming annual meeting of stockholders of the Company.

Soliciting Materials

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. With a view toward revised disclosure, provide support for your statement that you are offering “speed and certainty” in connection with your offer. |

| · | You “believe shares in CLCT are materially undervalued due to inadequate shareholder engagement, poor capital allocation, and a lack of digital innovation.” |

| · | Your opinion that “CLCT’s lack of innovation and margin improvement is primarily attributable to a complacent and disengaged Board that has not demonstrated or executed on a thoughtful capital allocation plan.” |

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

Alta Fox acknowledges the Staff’s comments and advises the Staff that future statements or assertion of opinions or belief will be clearly characterized as such, and a reasonable factual basis will be included.

| 2. | You state that you “have a plan to increase intrinsic value to $100/share…” in the next three years. The inclusion of valuations in proxy materials is only appropriate and consonant with Rule 14a-9 when made in good faith and on a reasonable basis. Valuation information must therefore be accompanied by disclosure which facilitates securityholders’ understanding of the basis for and limitations of the valuation information. If you choose to include the $100 figure in soliciting materials, you must include supporting disclosure of the kind described in Exchange Act Release No. 16833 (May 23, 1980). In addition, supplementally explain why your valuation is not so qualified and subject to such material limitations and qualifications as to make inclusion of the $100 figure unreasonable. We do not believe the information included in your solicitation materials provides sufficient support. |

Alta Fox acknowledges the Staff’s comments and advises the Staff that if the $100 figure is used in future soliciting materials then there will be included supporting disclosure of the kind described in Exchange Act Release No. 16833. Additionally, Alta Fox intends to release a detailed public presentation and we expect such public presentation would include all of the supporting disclosure, material limitations and qualifications that would make any future inclusion of the $100 figure reasonable and in good faith.

| 3. | We note your references to the “minuscule” ownership the incumbent directors have in the company. Please confirm that in all future soliciting materials you will (i) clarify that none of your nominees own any shares in the company, (ii) explain whether the shares beneficially owned by Alta Fox are for its own account or that of its clients, and (iii) explain how this aspect of the perception of the alignment of interests will be addressed by your nominees given their lack of ownership of any shares in the company. If the shares beneficially owned by Alta Fox are attributable to its clients, please include Mr. Haley in disclosure addressing clauses (i) and (iii) above. |

Alta Fox acknowledges the Staff’s comment and confirms that in all future soliciting materials it will (i) clarify its Nominees’ ownership in securities of the Company, (ii) explain whether the shares beneficially owned by Alta Fox are for its own account or that of its clients, and (iii) explain how this aspect of the perception of the alignment of interests will be addressed by Alta Fox’s nominees given their lack of ownership of any shares in the Company.

| 4. | With a view toward revised future disclosure, please tell us what support you have for the availability and magnitude of market opportunities you describe in the first strategic path forward for the company. |

Alta Fox acknowledges the Staff’s comment and offers the Staff the following information on a supplemental basis in support of such statement.

There are estimated to be as many as 30 million active coin/card collectors in the marketplace today1 that are being underserved by current market offerings. Alta Fox believes that CLCT can offer the following suite of services to improve the collectors’ experience: (i) a suite of trading card/coin specific portfolio management and market analytics tools with accurate, up to date pricing data for holdings for a monthly subscription fee, (ii) giving customers the option to both store and sell their cards/coins through CLCT auctions with CLCT charging a flat fee irrespective of the item value and (iii) partnering with banks to allow customers to borrow against the value of their stored cards/coins. Conservative estimates show that these strategic initiatives can more than double the earnings power and equity value of CLCT.

Source: Alta Fox estimates and analysis

| 5. | With a view toward revised future disclosure, please tell us what support you have for the second strategic path forward for the company. |

Alta Fox acknowledges the Staff’s comment and offers the Staff the following information on a supplemental basis in support of such statement.

Alta Fox believes that interested strategic buyers of CLCT’s assets could come from a number of sources, including any of the following parties: (i) other grading companies attempting to increase their dominance within their respective market, (ii) collectible marketplace companies aiming to vertically integrate their business and (iii) U.S. sports betting operators – trading cards represent a way to bet on players and a sports betting operator owning PSA (Professional Sports Authenticator, a division of CLCT) and creating a marketplace would more easily facilitate the buying and selling of trading cards, storage of trading cards (especially if stored at PSA) and could easily cross-sell PSA’s grading services with their own sports betting products.

1 https://www.marketwatch.com/story/how-to-follow-the-money-in-rare-coin-collecting-2012-09-06; https://www.trendfollowing.com/2019/04/04/ep-751-brent-huigens-interview-michael-covel-trend-following-radio/ (time stamp: 34:30)

Additionally, Alta Fox believes there is demand from financial buyers who share similar views as Alta Fox regarding the ancillary scalable and digital services CLCT could be offering. As a private company, CLCT would be better positioned to pursue these opportunities as it could avoid public disclosure regarding operational performance and could more flexibly invest capital where needed. Alta Fox estimates that average annual public company costs typically range from $1-2M+ per year. Alta Fox believes that in taking the Company private, board and upper level management compensation can be reduced by 60%, which in FY2019 would have yielded over $1.25M in additional pre-tax profit; assuming that the average public cost for CLCT is $1.5M, total savings of $2.75M would increase EPS by 20% with no change in tax rate.

| 6. | Similarly, provide supplemental support for your assertion that “[c]ustomer demand for CLCT’s grading services far exceeds CLCT’s current level of grading capacity.” |

Alta Fox acknowledges the Staff’s comment and offers the Staff the following information on a supplemental basis in support of such statement.

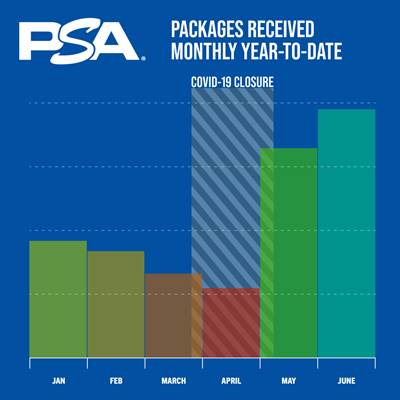

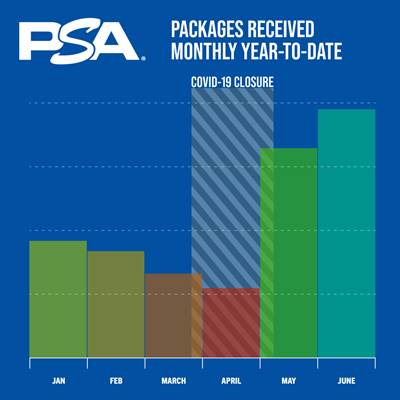

Consumers and collectors of CLCT’s products and services have long agonized over PSA’s exceptionally long wait times and have even resorted to using other grading companies simply because PSA’s turnaround times have become too lengthy and are frequently longer than the Company claims on their website.2 CLCT continues to announce all-time-high PSA backlogs, detailed in their earnings updates.

“On a positive note, some of the early efforts made during our operational revamp are helping improve efficiency, but the PSA submission backlog continues to grow to unprecedented levels. Currently, the trading card backlog alone remains north of 1 million units.”3

- CEO Joe Orlando, Q3 2020 Earnings Call

“Some of the early modifications made during our operational revamp are helping improve efficiency, but the backlog continues to grow to unprecedented levels. The faster we have returned the product to our customer base, the faster the submissions come back to us. In Q2, PSA receiving averaged over 68,000 submissions per week, with peaks north of 85,000 units towards the end of the quarter, the highest weekly figures in our history.”4

- Joe Orlando, Q2 2020 Earnings Call

2 https://www.blowoutforums.com/showthread.php?t=1387002; https://www.reddit.com/r/pkmntcgcollections/comments/7qp9ek/lets_talk_about_psas_service/; https://forums.collectors.com/discussion/1013555/message-from-psa-president

3 https://seekingalpha.com/article/4346051-collectors-universes-clct-ceo-joseph-orlando-on-q3-2020-results-earnings-call-transcript

4 https://seekingalpha.com/article/4321416-collectors-universes-clct-ceo-joseph-orlando-on-q2-2020-results-earnings-call-transcript

Furthermore, evidenced by an email sent from PSA President, Steve Sloan, to all PSA collectors just last week, the business has been unable to handle the recent surge in the submission of collectibles to PSA for authentication and grading as a result of the impact of COVID-19 on the industry. Mr. Sloan states that “[t]he majority of the PSA backlog is Ultra-Modern cards (2017 to present) submitted through our Value service. We are receiving so many of these cards on a daily basis that it is affecting our ability to expeditiously receive packages from other submission types.”

Source: Email from Steve Sloan to PSA Customers.

| 7. | On a related note to comment 2 above, provide us supplemental support for your estimates of the company’s trading multiple of 25x of EPS target, of your 2023 EPS target of $2.01 and that digital alternatives in the grading business could be worth an incremental $50/share. |

Alta Fox acknowledges the Staff’s comment and offers the Staff the following information on a supplemental basis in support of such statement.

Alta Fox respectfully advises the Staff to refer to its response to Comment 4 above as there is overlap in the responses provided.

Alta Fox believes that in a normalized environment and with efficient management, better cost discipline, and continued revenue growth, CLCT’s core grading business could achieve 25-30% EBIT margins. Through a 9% revenue compound annual growth rate and margin expansion, Alta Fox’s Plan envisions a pathway to +$2.00 in EPS by FY2023 and believes achievement of $50/share in intrinsic value is reasonable given CLCT’s economic moat, core business growth opportunities highlighted above and free cash flow in excess of net income.

CLCT’s core grading business has generally traded at a 22x LTM EPS multiple; however, there are three aspects that are different today that Alta Fox believes warrant significant multiple expansion relative to history: (1) demand for PSA’s service continues to meaningfully increase, and PSA is accounting for a larger percentage of CLCT’s overall revenue and operating income, (2) Professional Coin Grading Service (PCGS) is showing meaningful overseas growth and (3) Alta Fox’s slate of nominees intend to rectify the current board’s history of shareholder and customer ambivalence which should yield a more profitable, transparent, and customer friendly CLCT resulting in a more valuable business.

* * * * *

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

Sincerely,

/s/ Andrew M. Freedman

Andrew M. Freedman

| cc: | Connor Haley, Alta Fox Capital Management, LLC |