UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| Hasbro, Inc. |

(Name of Registrant as Specified in Its Charter) |

| |

Alta Fox Opportunities Fund, LP Alta Fox SPV 3, LP Alta Fox SPV 3.1, LP Alta Fox GenPar, LP Alta Fox Equity, LLC Alta Fox Capital Management, LLC Connor Haley Matthew Calkins Jon Finkel Marcelo Fischer Rani Hublou Carolyn Johnson |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Alta Fox Opportunities Fund, LP, together with the other participants named herein (collectively, “Alta Fox”), intends to file a preliminary proxy statement and accompanying GOLD proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of shareholders of Hasbro, Inc., a Rhode Island corporation (the “Company”).

Item 1: On February 18, 2022, Connor Haley, Managing Partner of Alta Fox Opportunities Fund, LP, took part in an interview with Yahoo Finance. A written transcript of the interview is not currently available, but is being prepared and will be filed under the cover of a separate filing as soon as practicable.

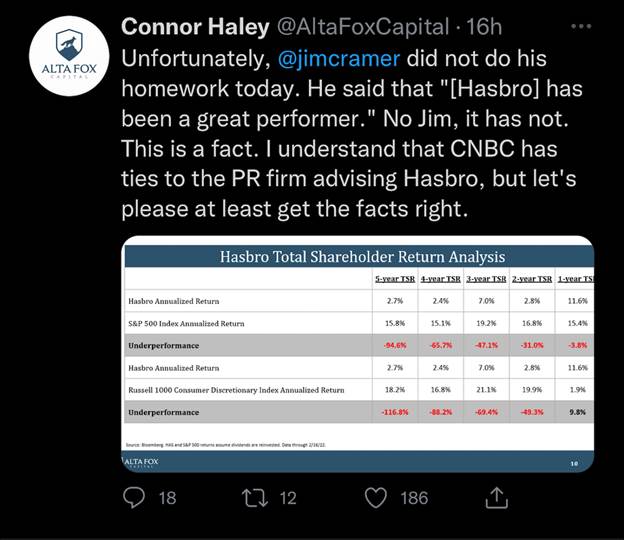

Item 2: Also on February 18, 2022, members of Alta Fox issued the following statement via social media:

Item 3: On February 17, 2022, Connor Haley, Managing Partner of Alta Fox Opportunities Fund, LP was quoted in the following article published by Barron’s:

Hasbro Activist Investor Seeks Board Overhaul, Spinoff. What It Could Mean for the Stock.

Barron’s

By Logan Moore

February 17, 2022

Hasbro should spin off its Wizards of the Coast business, which is worth more than investors give it credit for, according to Alta Fox Capital. The activist investor nominated several directors to the toy company’s board of directors.

Alta Fox Managing Partner Connor Haley said in a letter to shareholders Thursday morning that the stock has gone nowhere over the past five years, while the S&P 500 has taken off. Alta Fox has a 2.5% stake in Hasbro worth roughly $325 million.

In a release, Hasbro said no shareholder action was required. “The board and management team believe Hasbro is on the right path to deliver sustainable growth for shareholders, and consistent with its shareholder value creation plans, regularly review the business and its strategic direction,” its statement said. “To that end, members of the Board and management team have held discussions with Alta Fox to better understand its views on the Company’s strategy.”

Haley nominated five director candidates for election to Hasbro’s 11-member board at the 2022 annual meeting of shareholders. And he said that spinning off the fast-growing Wizards business, which includes games such as Dungeons & Dragons, would unlock up to $100 per share, or more than $13 billion, in value for shareholders in the years to come.

The Wall Street Journal reported on Alta Fox’s move on Wednesday. Hasbro said in a statement that it would review the candidates, adding it is excited to welcome its new chief executive officer, Chris Cocks, who served as president and chief operating officer of the Wizards of the Coast and digital gaming division. He will take over the position from interim CEO Richard Stoddart on Feb. 25.

“Already last year, Wizards of the Coast was roughly 47% of total EBITDA which makes it the largest individual segment and the fastest-growing,” Haley told Barron’s. “We believe that spinning off with the Coast will create tremendous value for shareholders.”

Earlier this month, Hasbro, also known for games like Monopoly and Twister, said that for all of 2022, it expects revenue growth in the low, single-digit percentage range. Before the numbers were disclosed on Feb. 7, the consensus call among analysts was for annual revenue of $6.67 billion, 3.9% more than the $6.42 billion in annual revenue that Hasbro reported.

While Hasbro’s games like Monopoly and Twister were popular among households during the pandemic, Haley said Wizards of the Coast is a segment that is set to continue strong growth. In 2021, the Wizards of the Coast segment increased its revenues by 42% to nearly $1.29 billion and accounted for roughly 46% of the company’s $1.31 billion adjusted earnings before interest, taxes, depreciation, and amortization.

He also said there are some interesting investment opportunities with the company’s brands, including nonfungible tokens, or NFTs. In October, Hasbro partnered with the Worldwide Asset eXchange blockchain to release its first Power Rangers NFT collection.

“Hasbro has a lot of very valuable brands which lend itself to many exciting reinvestment opportunities,” he said. “I think anyone who owns you know, iconic brands like Hasbro should be looking at all of the different ways to monetize that.”

The stock was up 1.7% to $98.70 on Thursday and has gained 7% the last 12 months.

--

Item 4: Also on February 17, 2022, members of Alta Fox issued the following statement via social media:

Certain Information Concerning the Participants

Alta Fox Opportunities Fund, LP (“Alta Fox Opportunities”), together with the other participants named herein (collectively, “Alta Fox”), intends to file a preliminary proxy statement and an accompanying GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of shareholders of Hasbro, Inc., a Rhode Island corporation (the “Company”).

ALTA FOX STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A GOLD PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are expected to be Alta Fox Opportunities, Alta Fox SPV 3, LP (“Alta Fox SPV 3”), Alta Fox SPV 3.1, LP (“Alta Fox SPV 3.1”), Alta Fox GenPar, LP (“Alta Fox GP”), Alta Fox Equity, LLC (“Alta Fox Equity”), Alta Fox Capital Management, LLC (“Alta Fox Capital”), Connor Haley, Matthew Calkins, Jon Finkel, Marcelo Fischer, Rani Hublou and Carolyn Johnson (collectively, the “Participants”).

As of the date hereof, Alta Fox Opportunities directly beneficially owned 1,112,614 shares of Common Stock, $0.50 par value (the “Common Stock”), of the Company, including 500,000 shares of Common Stock underlying listed call options. As of the date hereof, Alta Fox SPV 3 directly beneficially owned 2,249,838 shares of Common Stock. As of the date hereof, Alta Fox SPV 3.1 directly beneficially owned 748,881 shares of Common Stock. Alta Fox Capital, as the investment manager of each of Alta Fox, Alta Fox SPV 3 and Alta Fox SPV 3.1, may be deemed to beneficially own the 4,111,333 shares of Common Stock beneficially owned in the aggregate by Alta Fox, Alta Fox SPV 3 and Alta Fox SPV 3.1. Alta Fox GP, as the general partner of each of Alta Fox, Alta Fox SPV 3 and Alta Fox SPV 3.1, may be deemed to beneficially own the 4,111,333 shares of Common Stock beneficially owned in the aggregate by Alta Fox, Alta Fox SPV 3 and Alta Fox SPV 3.1. Alta Fox Equity, as the general partner of Alta Fox GP, may be deemed to beneficially own the 4,111,333 shares of Common Stock beneficially owned in the aggregate by Alta Fox, Alta Fox SPV 3 and Alta Fox SPV 3.1. Mr. Haley, as the sole owner, member and manager of each of Alta Fox Capital and Alta Fox Equity, may be deemed to beneficially own the 4,111,333 shares of Common Stock beneficially owned in the aggregate by Alta Fox, Alta Fox SPV 3 and Alta Fox SPV 3.1. As of the date hereof, Mr. Calkins directly beneficially owned 51,495 shares of Common Stock. As of the date hereof, Mr. Fischer directly beneficially owned 5,327 shares of Common Stock. As of the date hereof, Ms. Johnson directly beneficially owned 500 shares of Common Stock. As of the date hereof, none of Mr. Finkel nor Ms. Hublou beneficially owned any shares of Common Stock.