Exhibit 99.1

Daktronics Inc. (Nasdaq: DAKT)

Disclaimer This presentation is being furnished by Alta Fox Capital Management LLC (“AltaFox”,“AFC”,or “theFirm”)and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy any securities, investment products, or investment advisory services. This presentation is being provided for general informational purposes only, and is not intended to provide and should not be relied upon for accounting, legal, or tax advice or investment recommendations. The investment thesis presented in this presentation reflects the analysis and opinions of the Firm based upon the information presented, which is gathered from public filings, company statements, and other data sources believed to be reliable, as noted throughout the presentation. We have not independently verified such information and do not guarantee its accuracy. None of Alta Fox, its affiliates, its or their representatives, agents or any other person makes any express or implied representation or warranty as to the reliability, accuracy or completeness of the information contained in this presentation, or in any other written or oral communication transmitted or made available to the recipient. Information presented from third parties has been obtained from sources believed to be reliable, however, no representation or warranty is made, express or implied, as to the reliability, accuracy or completeness of such information. Past successes are not necessarily indicative of the future success of any plans or proposals included herein. There is no guarantee that any measures proposed herein will be successful or will result in gains for Daktronics or its shareholders. Any written or verbal statements included in this presentation that are not facts are forward-looking statements, including any statements that relate to expected future market conditions, results, operations, strategies, or other future conditions or developments and any statements regarding objectives, opportunities, positioning, or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates, and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guarantee about future events. Such statements, estimates, projections, opinions, and conclusions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Alta Fox’s control. There is no assurance or guarantee with respect to the prices at which any securities of the company will trade, and such securities may not trade at prices that may be implied herein. The estimates, projections, pro forma information and potential impact of the analyses set forth herein are based on assumptions that the Firm believes to be reasonable as of the date of this presentation, but there can be no assurance or guarantee that actual results or performance of the company discussed herein will not differ, and such differences may be material. Key assumptions and criteria for target prices, estimates, and other projections are incorporated herein. Recipients should not base any investment decisions in reliance upon any statements contained herein, including any projections or estimates incorporated into this presentation. The Firm has a long investment position in the company discussed herein and, as such believes that it stands to benefit by actions undertaken by such company that are being advocated for herein. Alta Fox’s investment in Daktronics will increase in value if the trading price of Daktronics’s common stock increases and will decline in value if the trading price of Daktronic’s common stock decreases. Alta Fox may change its views about or its investment positions in Daktronics at any time, for any reason or no reason. Alta Fox may buy, sell, or otherwise change the form or substance of its Daktronics investment. Alta Fox disclaims any obligation to notify the market of any such changes except as required by applicable law. Alta Fox also undertakes no commitment to take or refrain from taking any action with respect to Daktronics or any other company. Except where otherwise indicated herein, this presentation is as of the date indicated on the cover, is not complete and is subject to change.

TABLE OF CONTENTS Section Page Numbers About Alta Fox Capital Management 4-5 Summary: Why We Are Here Today 6-7 DAKT Overview 8-13 Lack of Accountability & Culture of Complacency have Resulted in DAKT Significantly Underperforming its Potential 14-19 The Case for Adding Shareholder Representation to DAKT’s Board 20-24 The Alta Fox Path to $40+/Share 25-29 Conclusion 30 Contact Info 31

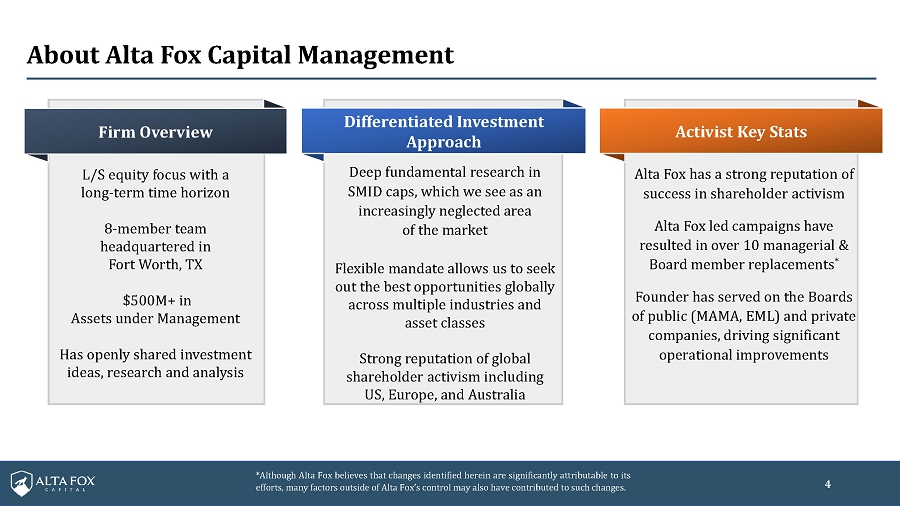

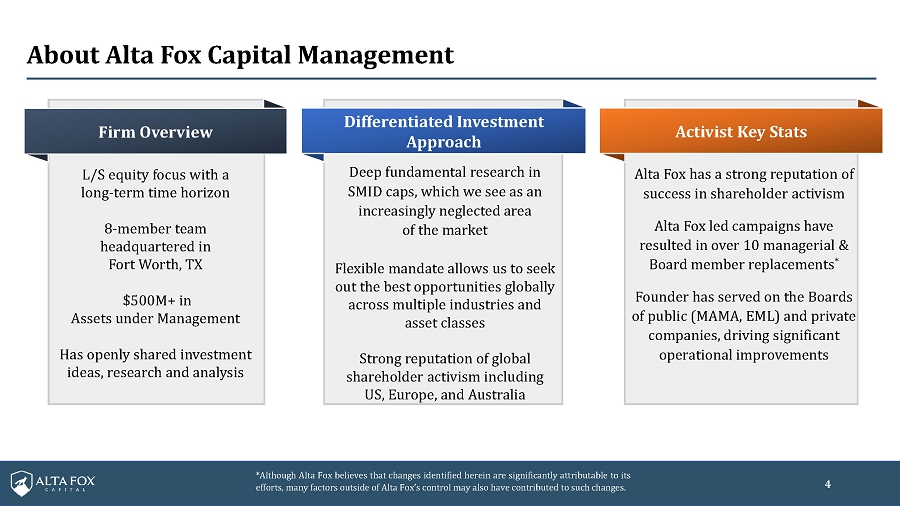

About Alta Fox Capital Management L/S equity focus with a long-term time horizon 8-member team headquartered in Fort Worth, TX $500M+ in Assets under Management Has openly shared investment ideas, research and analysis Deep fundamental research in SMID caps, which we see as an increasingly neglected area of the market Flexible mandate allows us to seek out the best opportunities globally across multiple industries and asset classes Strong reputation of global shareholder activism including US, Europe, and Australia Alta Fox has a strong reputation of success in shareholder activism Alta Fox led campaigns have resulted in over 10 managerial & Board member replacements* Founder has served on the Boards of public (MAMA, EML) and private companies, driving significant operational improvements

AFC History of Activist Involvement Company Name / Ticker Years AFC Active Business Description AFC Involvement Outcome: Successful / Unsuccessful Total Shareholder Return During AFC Campaign* Board Member Turnover Management Members Replaced Collectors Card & coin-grading Open letter & nominated slate of Universe: 2020-2021 business operating in oligopoly directors with mandate to improve Successful 240% 2 CEO CLCT with significant pricing power capital allocation Enlabs: NLAB SS 1) Supportive investor presentation iGaming business 2) Open letter with blocking stake 2020-2021 in the Baltics with 50% market share demanding higher price following in key market of Latvia Entain's lowball take-out offer Successful 143% N/A N/A Hasbro: HAS Nominated slate of directors alongside Wizards of the Coast ("WOTC") is a investor presentation with a mandate to 2022 high-quality gaming business spin-off WOTC and improve capital trapped inside a toy conglomerate allocation. Unsuccessful -8% 2 CFO Daktronics: DAKT 1) Open letter to Board in Jan 2023 calling for managerial and Board Scoreboard & virtual display accountability 2023-present manufacturer in the US 2) In May 2023, Alta Fox made a $25M with nearly 50% market share convertible notes investment to bolster DAKT's balance sheet, signing a 16-month standstill TBD 498% TBD CFO EML Payments: EML AU High quality payments business Alta Fox replaced half the Board with set to benefit from rising rates, our own directors,replacedthe “out of 2023-2024 but plagued by poor capital touch”CEO, and EMLsuccessfully exited allocation unprofitable businesses Successful 72% 3 CEO

Summary: Why We Are Here Today • Daktronics (“DAKT”) is ahigh-quality business with market-leading share in a secular growth industry. • DAKT has underperformed its potential and the S&P 500 by 195%1 during Chairman Reece Kurtenbach’s tenure, operating like a private family business with little accountability to shareholders. • Alta Fox holds ~5x the number of shares held by the entire Daktronics Board combined, representing ~12% ownership.2 We are advocating for long-overdue Board refreshment and governance enhancements. • Alta Fox has tried to work constructively with DAKT’s Board for overtwo years, but governance has worsened. The Board seems more focused on protecting the status quo than embracing shareholder ideas. • With a more aligned Board and improved management team, we believe growth and efficiency at Daktronics will dramatically improve in the years to come. • We believe that shareholder-led improvements to operations and investor communication can help drive DAKT’s share price to >$40by FY28, over 100% upside from currentlevels.

DAKT’s Board Remains Unwilling to Constructively Engage Alta Fox has tried, on numerous occasions, to engage privately with the Board of Directors to result in substantive change. 1. https://investor.daktronics.com/node/19161/html 2. https://investor.daktronics.com/news releases/news release details/daktronics inc strengthens financial position securing 100 3. https://investor.daktronics.com/news releases/news release details/daktronics inc amends and extends shareholder rights agreement Event Number Date Alta Fox Engagement/Event Aftermath 1 9/26/2022 Alta Foxvisits Daktronics’ Headquarters inSouthDakota, urges operational improvements and financial discipline, tells Daktronics to call if there is ever a capital concern as we would like to invest additional capital into the business. Unfortunately, nothing. DAKT did not follow up on any ofAFC’s suggestions, nor didtheycall for desperatelyneeded equity capital. 2 12/5/2022 Daktronics files an8Koutlining theirauditors have issued“doubtabouttheirability to operate as a going concern.”1 AFCcalls Daktronics’ mainline onlyto discoverthatCEO & CFO are both working from home that day. 3 5/11/2023 Daktronics inserts $25 million in direct financing convertible debt2 while stock is distressed at a 20-year low. Alta Fox abides by a punitive ~16-month standstill and offers private, constructive thoughts over the subsequent 1.5 years. 4 6/5/2024 AFC sent a private letter to the Lead Independent Director on the Board. We outlined: a) governance concerns, b) the need for a new CFO, and c) the need for shareholder-appointed Board members. Daktronics fails to respond to a specific, respectful, private letter from its largest shareholder. 5 9/5/2024 AFC sent a private letter to the entire Board of Directors outlining governance and managerial concerns. A call was set up with Board members Reece Kurtenbach and Andrew Siegel. No substantive commitments were made. 6 11/11/2024 AFC requests questionnaire to prepare a potential special meeting of shareholders. Daktronics reduces threshold of their poison pill just days later. 7 11/20/2024 Daktronics issues a press release announcing they have lowered the threshold of their poison pill from 20% to 15%, further entrenching the Board of Directors.3 Stock falls 5%+ on the day. Alta Fox prepares for a proxy contest as we have exhausted all avenues for an amicable resolution. 7

DAKT IS A HIGH-QUALITY AND SECULAR GROWTH BUSINESS, SEVERELY UNDERVALUED BY THE MARKET TODAY About Daktronics Daktronics is a manufacturer of electronic scoreboards and large screen video displays for sporting, commercial and transportation applications. The company was founded in 1968 and has been public since 1994. The company is known for making the highest quality products due to exceptional engineering prowess. This has led to Daktronics being the market share leader in nearly all its end markets. The company is based in Brookings, South Dakota and at the time of Alta Fox’s position initiation, had zero sellside analyst coverage and a ~$200M market cap. Key Financial Metrics1 12/9/24 Stock Price $18.27 FDSO (including convert) 51.7M Market Cap $944.6M Cash $134.4M Debt (excluding convert) $14.6M Enterprise Value $824.8M FY26 Multiples2 FY26 Valuation Metrics 4/30/2026 PE (+) net cash/share 11.7x EV/EBITDA 7.5x

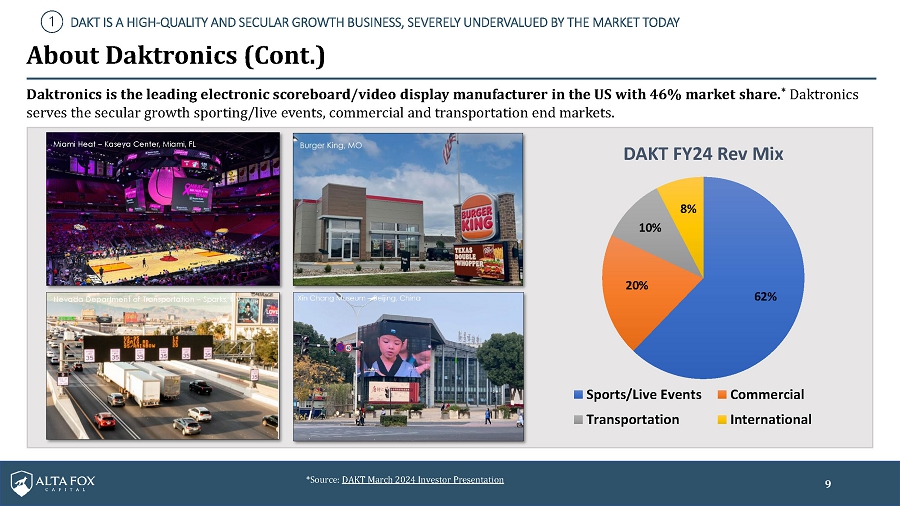

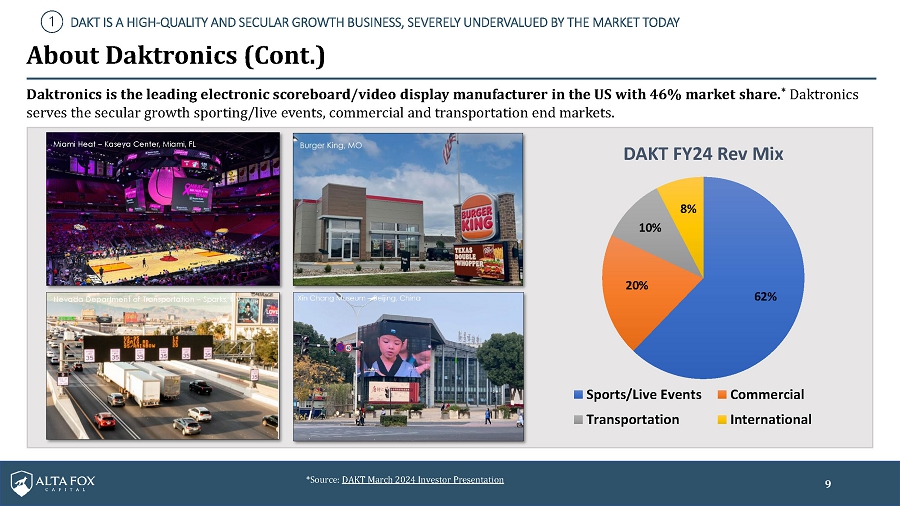

About Daktronics (Cont.) Daktronics is the leading electronic scoreboard/video display manufacturer in the US with 46% market share.* Daktronics serves the secular growth sporting/live events, commercial and transportation end markets.

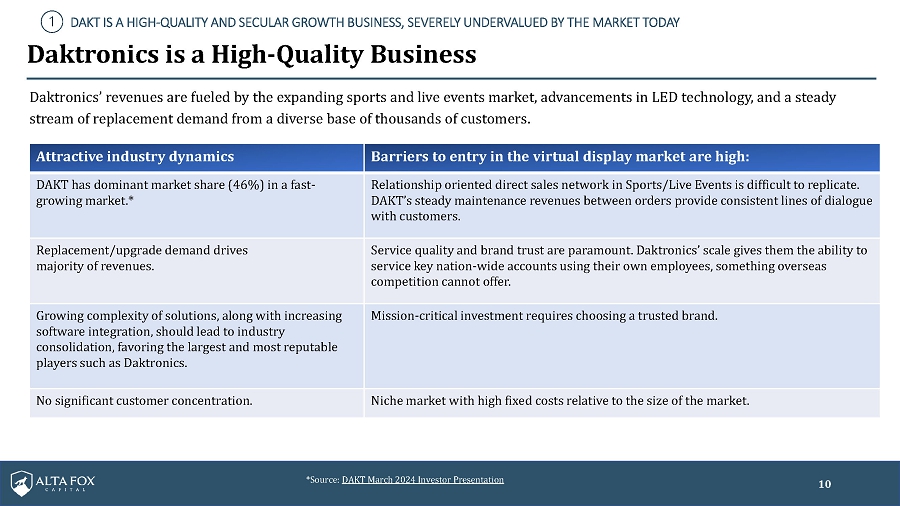

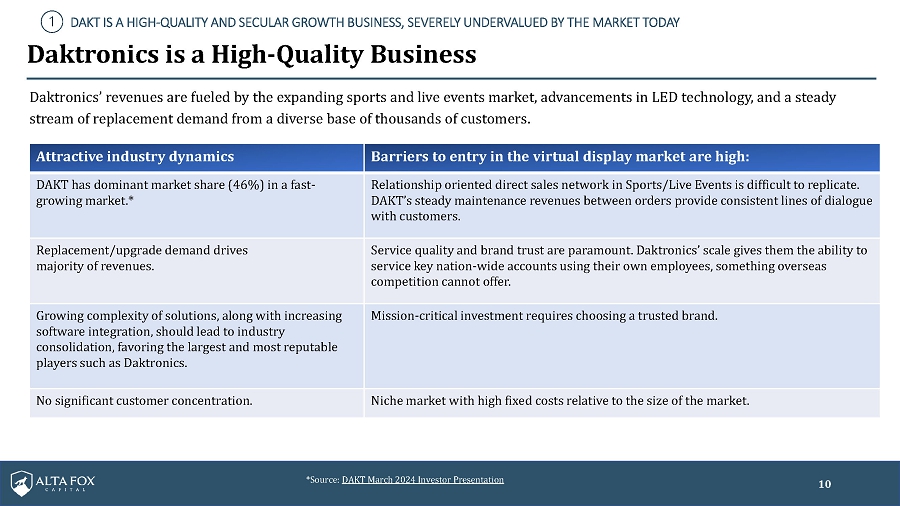

Daktronics is a High-Quality Business Daktronics’ revenues are fueled by the expanding sports and live events market, advancements in LED technology, and a steady stream of replacement demand from a diverse base of thousands of customers. Attractive industry dynamics Barriers to entry in the virtual display market are high: DAKT has dominant market share (46%) in a fast- Relationship oriented direct sales network in Sports/Live Events is difficult to replicate. growing market.* DAKT’s steady maintenance revenues between orders provide consistentlines of dialogue with customers. Replacement/upgrade demand drives Service qualityand brand trust are paramount. Daktronics’ scale givesthem the ability to majority of revenues. service key nation-wide accounts using their own employees, something overseas competition cannot offer. Growing complexity of solutions, along with increasing software integration, should lead to industry consolidation, favoring the largest and most reputable players such as Daktronics. Mission-critical investment requires choosing a trusted brand. No significant customer concentration. Niche market with high fixed costs relative to the size of the market.

Daktronics Makes Exceptional Products For the largest, most advanced, and most spectacular video displays in the world, Daktronics is the industry standard. For example, Daktronics is a supplier to: 17 out of the 32 NFL teams 16 out of the 30 MLB teams including 4 of the top 5 largest video displays including 3 of the top 5 largest video displays

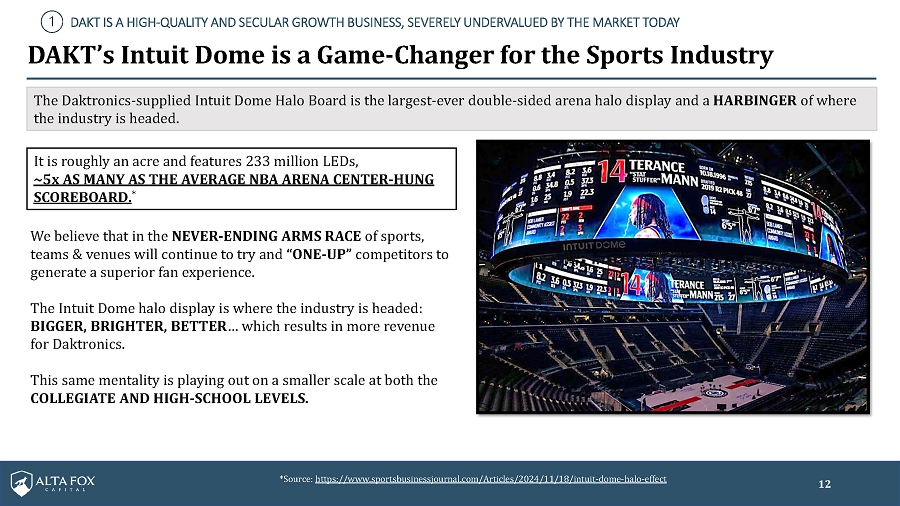

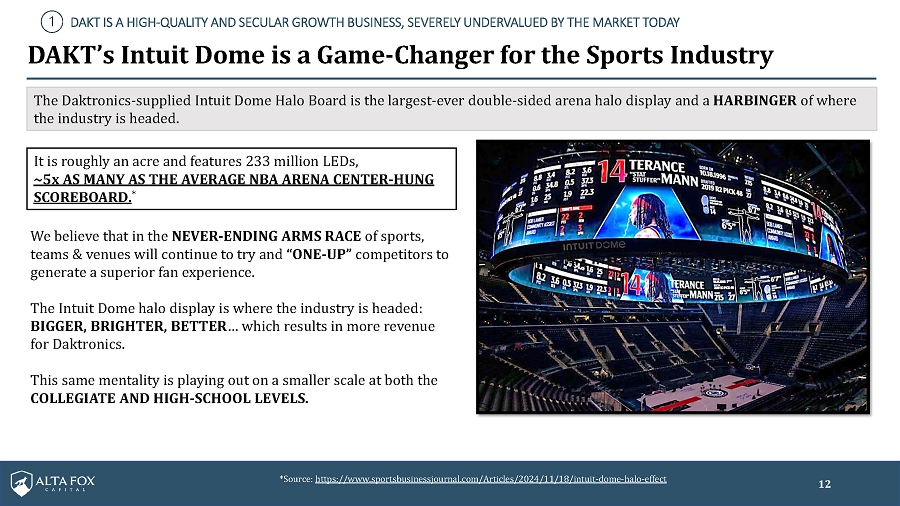

DAKT’s Intuit Dome is a Game-Changer for the Sports Industry The Daktronics-supplied Intuit Dome Halo Board is the largest-ever double-sided arena halo display and a HARBINGER of where the industry is headed. It is roughly an acre and features 233 million LEDs, ~5x AS MANY AS THE AVERAGE NBA ARENA CENTER-HUNG SCOREBOARD.* We believe that in the NEVER-ENDING ARMS RACE of sports, teams & venues will continue to try and “ONE-UP” competitors to generate a superior fan experience. The Intuit Dome halo display is where the industry is headed: BIGGER, BRIGHTER, BETTER…which results in more revenue for Daktronics. This same mentality is playing out on a smaller scale at both the COLLEGIATE AND HIGH-SCHOOL LEVELS.

DAKT IS A HIGH-QUALITY AND SECULAR GROWTH BUSINESS, SEVERELY UNDERVALUED BY THE MARKET TODAY Growth has been Secular, Not Cyclical DAKT Revenue & EBIT Margin History • DAKT has CAGR’ed revenues at 11% since its earliest $900 23% reported metrics (1993). $800 • We believe the biggest issue historically has not been 18% $700 revenue volatility, but rather inconsistent EBIT margins. This is a result of poor execution and weak financial $600 8% $300 13% EBIT Margin Revenue (M) planning/pricing. • Increased shareholder pressure following DAKT’s going $500 $400 concern notice in 2022 has led to an improved emphasis on driving higher margins and a focus on generating significant $200 3% FCF, though significantly more accountability is needed. $100 $0 -2% History shows that DAKT is a secular growth business. With shareholder-driven leadership improvements, we believe margins can similarly stabilize and grow. Revenue EBIT Margin International Contribution Margin Source: DAKT public filings Note thatDAKT’sInternational Contribution Margins have gone negative in recent years.

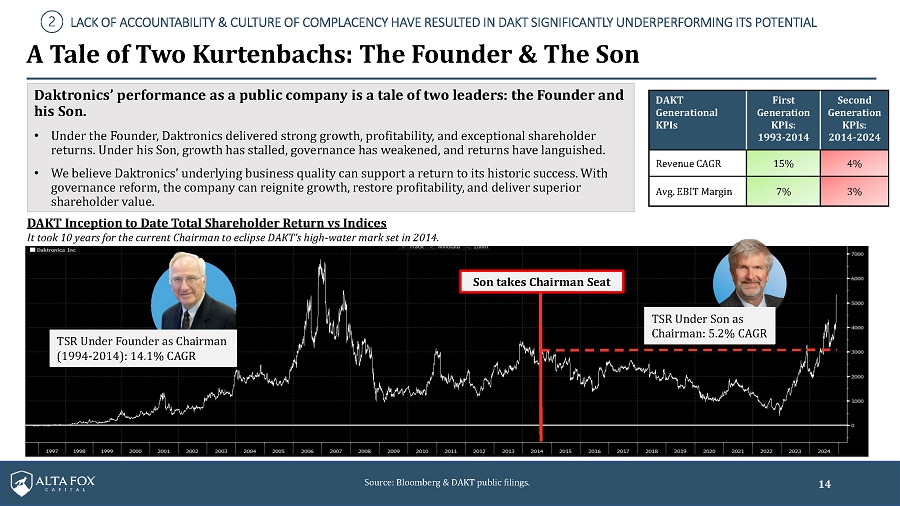

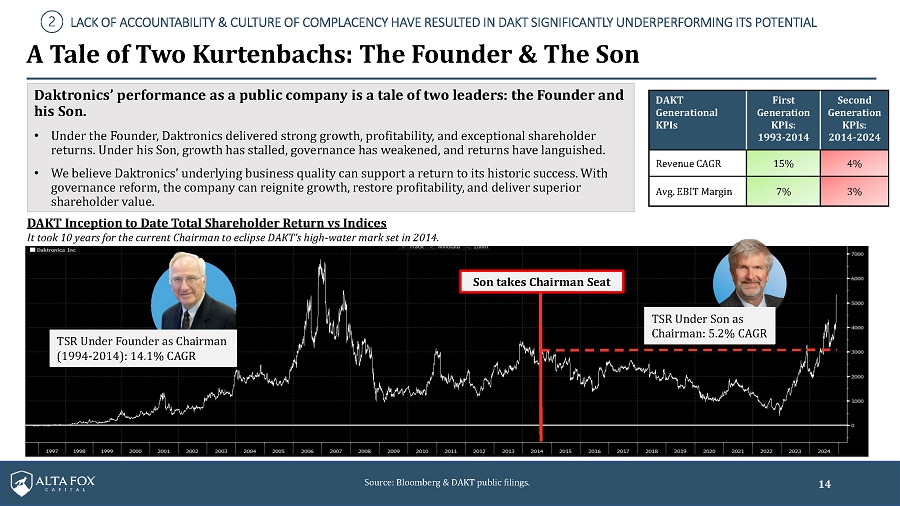

A Tale of Two Kurtenbachs: The Founder & The Son Daktronics’ performance as a public company is a tale of two leaders: the Founder and his Son. • Under the Founder, Daktronics delivered strong growth, profitability, and exceptional shareholder returns. Under his Son, growth has stalled, governance has weakened, and returns have languished. • We believe Daktronics’ underlying business quality can supporta return to its historic success. With governance reform, the company can reignite growth, restore profitability, and deliver superior shareholder value. DAKT First Second Generational Generation Generation KPIs KPIs: KPIs: 1993 2014 2014 2024 Revenue CAGR 15% 4% Avg. EBIT Margin 7% 3% DAKT Inception to Date Total Shareholder Return vs Indices It took 10 years for the current Chairman to eclipse DAKT’s high-water mark set in 2014. Son takes Chairman Seat

A Tale of Two Kurtenbachs: The Founder & The Son (Cont.) Second generation leadership has demonstrated that it would rather run DAKT for the benefit of the Kurtenbach family, rather than for the benefit of all shareholders. Lack of equity ownership limits leaderships incentives • Board & Named Officers own only ~5% of DAKT. to drive shareholder value. • 95% of FY24 CEO comp paid in cash. Leadership has actively avoided accountability to • No guidance or long-term targets. shareholders. • Sell side coverage has dwindled under CEO’stenure. • Lowered poison pill threshold from 20% to 15%. • Staggered Board. Nepotism results in subpar leadership that continues to • 3/5 named executive officers are directly related. underperform. • No sales team commissions.

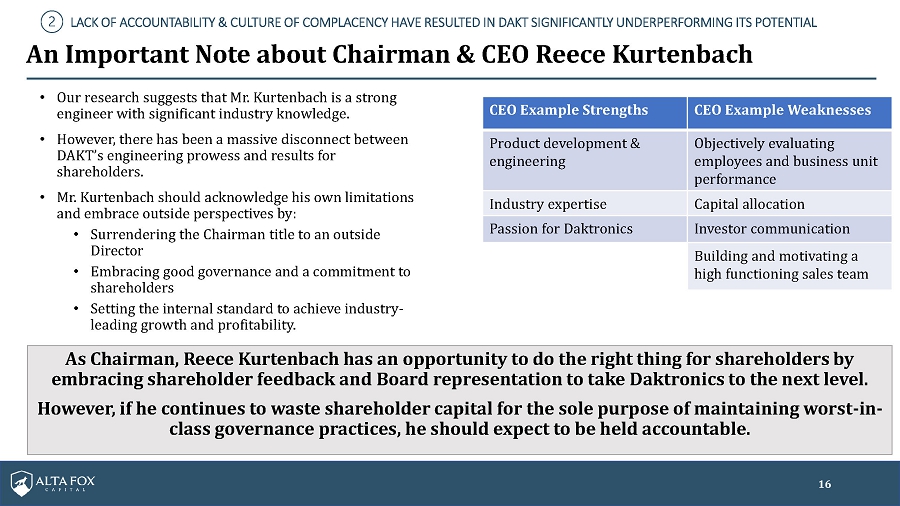

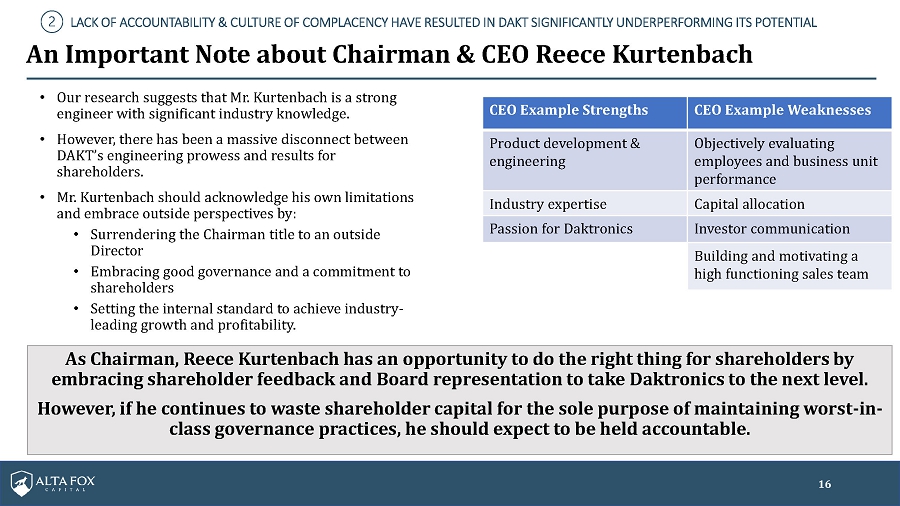

An Important Note about Chairman & CEO Reece Kurtenbach • Our research suggests that Mr. Kurtenbach is a strong engineer with significant industry knowledge. • However, there has been a massive disconnect between DAKT’sengineering prowess andresults for shareholders. Product development & Objectively evaluating engineering employees and business unit performance • Mr. Kurtenbach should acknowledge his own limitations and embrace outside perspectives by: Industry expertise Capital allocation • Surrendering the Chairman title to an outside Passion for Daktronics Investor communication Director Building and motivating a • Embracing good governance and a commitment to shareholders high functioning sales team • Setting the internal standard to achieve industry- leading growth and profitability. As Chairman, Reece Kurtenbach has an opportunity to do the right thing for shareholders by embracing shareholder feedback and Board representation to take Daktronics to the next level. However, if he continues to waste shareholder capital for the sole purpose of maintaining worst-inclass governance practices, he should expect to be held accountable.

An Assessment of Recent Additions to the Daktronics Board • There have been two additions to the DAKT Board over the last two years. However, it required activism to force these changes into action. Andrew Siegel was a large investor and signed a cooperation agreement in June 20221 that led to his appointment and the later appointment of Howard Atkins to the Board.2 Alta Fox always welcomes shareholder-driven input. o It is worth noting that Daktronics spent significant shareholder capital defending against this previous form of activism as well. In fact, Andrew Siegel had to go as far as hiring a proxy solicitor before Daktronics begrudgingly agreed to a settlement agreement. • However, Siegel is no longer a large shareholder (he recently divested 87% of his equity stake),3 and the Board once again is bereft of any significant equity owners. Following his divestment, governance at DAKT has worsened with the Board lowering the poison pill threshold from 20% to 15% in recent weeks. • Despite these changes to the Board, shareholder communication gaffes continue to plague the investor narrative: o For example, DAKT still does not provide any type of guidance (annual or medium-term), did not even provide a functional webcast link on their investor relations page for the last conference call, and leadership continues to mention ROIC targets below FY24 levels, etc. • Alta Fox owns ~5x the number of shares of the entire Daktronics Board combined. Alta Fox input at the Board level would radically transform the attention given to shareholders. Alta Fox’s expertise, as the largest investor in DAKT, is needed to properly represent minority shareholder interests.

Complacency Has Infected the Board of Directors of Daktronics The Board has failed to set adequate targets for a management team that owns minimal stock.* • There are no medium-term or long-term targets management is incentivized to achieve. • The Board has not changed management’s non-equity-based bonus targets in over a decade. Management’s EBIT margin targets are the samein 2024 that they were in 2012 (this accounts for ~100% of performance-based compensation). • Management has not been explicitly incentivized to grow the business (revenue or EPS). • There is similarly no explicit % of compensation tied to total shareholder return. When reviewing the incentives of the team, it should come as no surprise why consistent revenue growth, margin expansion, and EPS growth have not been the norm under current leadership. FY12 Proxy Non-Equity Incentive Target

Employee Reviews Support Alta Fox’s Alignment Concerns Date Notable DAKT Employee Commentary Employee Background 11.7.24 "Daktronics is a great organization, with a great product, but they are stuck in their old ways and not open to change… The Kurtenbach family fills much of the leadership, and they became stagnant over the years from not listening to ideas and being open to change.They are very rigid in theirways and the culture is to travel and “see the world” whichis pretty glamorous butnot much thought about being frugal." Former employee, more than 10 years 9.27.24 "Everyone at the C-Suite is related to the company's original founder, so nothing is ever going to change." Former employee, tenure not disclosed 11.24.23 “Middle management is stuck in their ways, which is bleeding the company dry by hiring more employees to do unnecessary data entry. The answer is always to hire more people, opposed to automation… Most upper management seems to be related – nepotism runs strong.” Current employee, more than 10 years 4.10.23 "For anyone trying to advance their sales career, save your time. There is an anti-sales culture. 0 upward mobility. No commissions or even any sort of concrete comp plan… Nepotism runs very deep." Former employee, more than 5 years 7.7.23 "No pay for performance. Received a minuscule bonus (1 out of 4 years) based on a very subjective review. Engineering rules the roost; sales is an afterthought." Former employee, more than 3 years 1.27.23 "The company has many talented employees but upper management is pretty bad." Current employee, more than 5 years Source: All reviews are publicly available on Glassdoor, save the 11.7.24 review which was expert network provided Q&A from a former employee.

Press Releases Highlight Disconnect Between Board and Shareholders Even the company’s latest press releases, meant to inspire market confidence, instead highlight just how disconnected the Board is from shareholder priorities. Arecent example of the disconnectbetween the Board vs investorprioritiesis illustrated in Daktronics’ press release announcement of theirBusiness TransformationOffice (“BTO”)1 on October 21st, 2024: THE CASE FOR ADDING SHAREHOLDER REPRESENTATION TO DAKT’S BOARD

Market Reactions Validate Alta Fox’s Case The market has spoken: it does not have faith in the BTO, it has low tolerance for further governance setbacks, and it welcomes shareholder-driven change. Announcement Topic DAKT Share Price Day Movement S&P 500 Average Price Day Movement DAKT Relative Performance Alta Fox’s Interpretation of Market Reaction • Investorsare not assigning any credibilityto the Board’s transformation plan. The skepticism is unsurprising as the CEO is on the transformation committee. • DAKT’s corporate governance discount grew in real time, and investors are increasingly asking the question of if they can continue to invest alongside this Board of Directors and management team. 10.21.24 Business Transformation Office 0.1% -0.2% ~0% 11.20.24 Reducing Poison Pill Threshold from 20% to 15% (5.4)% 0.0% ~(5)% 12.2.24 Alta Fox Files 13D Showing 11.7% Ownership in DAKT 2.1% 0.1% ~2% • The market has welcomed Alta Fox’s willingness to engage on behalf of all shareholders. Shareholder activism is required to drive significant improvement to governance and strategic direction that will help eliminate DAKT’s valuation discount, benefiting all shareholders.

Shareholder Representation Needed to Ensure Accountability Given the Board’s historical inability to properly assess the CFO’s performance, we have serious concerns about this same Board’s ability to run an effective CFO search process. In December 2022, Daktronics announced the discovery of material weaknesses in its internal controls over financial reporting, which caused the Company to delay its earnings release and the filing of its 10-Q. The stock fell over 50% in the days following the disclosure. Poor forecasting and planning caused the company’s cash balance to dwindle to less than $7 million in 2022 with limited access to further liquidity. As a result, on October 31, 2022, DAKT’s auditor issued reasonable doubt about Daktronics’ ability to operate as a going concern, which led shares to a 20-year low. The company has consistently made vague and confusing statement around financial KPIs, including margins, limiting management accountability. For example, the CFO recently guided margins using terminology such as “the mid to upperend of the 5-10%range.”* Shareholder activism is required to ensure Daktronics hires a proper CFO with the right skillset and incentives to drive operational efficiencies and a clear investor narrative.

Board Changes Are Needed to Help DAKT Reach Its Potential Reversing the entrenched, worst-in-class governance policies that have contributedto yearsof underperformancefor Daktronics’ equity holders. Introducing shareholder-nominated and highly qualified Board members who are committed to prioritizing shareholder interests—not rubber stamping the agenda of Reece Kurtenbach and his allies. Establishing a high-performance culture starting at the Board level, fostering a more dynamic and effective sales team, and culminating in a clear and compelling investor narrative.

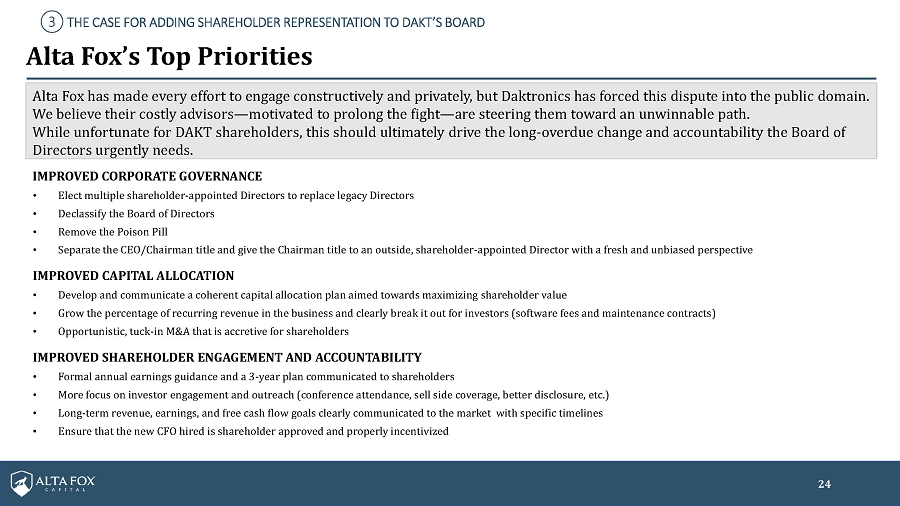

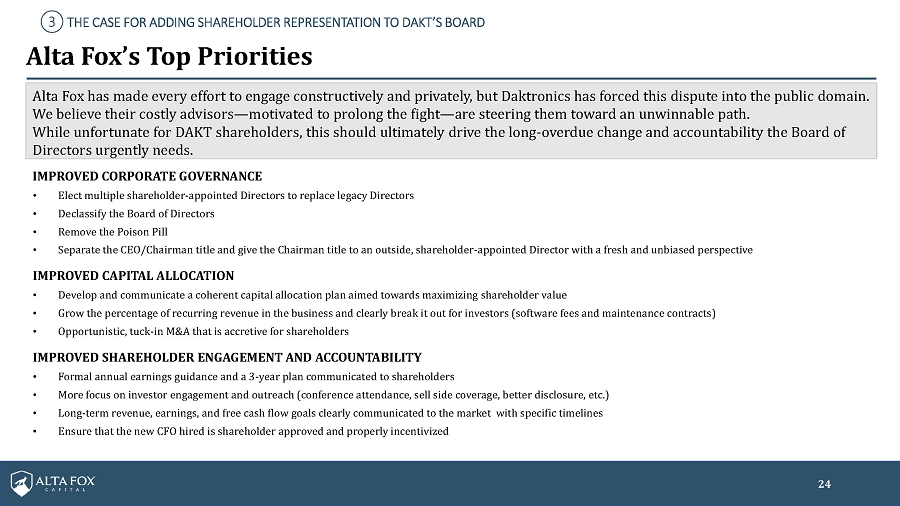

Alta Fox’s Top Priorities Alta Fox has made every effort to engage constructively and privately, but Daktronics has forced this dispute into the public domain. We believe their costly advisors—motivated to prolong the fight—are steering them toward an unwinnable path. While unfortunate for DAKT shareholders, this should ultimately drive the long-overdue change and accountability the Board of Directors urgently needs. IMPROVED CORPORATE GOVERNANCE • Elect multiple shareholder-appointed Directors to replace legacy Directors • Declassify the Board of Directors • Remove the Poison Pill • Separate the CEO/Chairman title and give the Chairman title to an outside, shareholder-appointed Director with a fresh and unbiased perspective IMPROVED CAPITAL ALLOCATION • Develop and communicate a coherent capital allocation plan aimed towards maximizing shareholder value • Grow the percentage of recurring revenue in the business and clearly break it out for investors (software fees and maintenance contracts) • Opportunistic, tuck-in M&A that is accretive for shareholders IMPROVED SHAREHOLDER ENGAGEMENT AND ACCOUNTABILITY • Formal annual earnings guidance and a 3-year plan communicated to shareholders • More focus on investor engagement and outreach (conference attendance, sell side coverage, better disclosure, etc.) • Long-term revenue, earnings, and free cash flow goals clearly communicated to the market with specific timelines • Ensure that the new CFO hired is shareholder approved and properly incentivized

DAKT Trades at a Substantial Governance Discount vs Comps Source: Bloomberg • Dominant sports & live events adjacent companies tend to trade at premium multiples. • DAKT is exposed to the same underlying themes that drive results for its sports & live events adjacent comps. However, DAKT trades at a greater than 30%+ discount to the peer set. • We believe that the market ascribes a heavy corporate governance discount to DAKT due to its lack of accountability to shareholders. o Core Example: DAKT’ssell side coverage has dwindled from 4 analysts to 2 analysts over the CEO’s tenure. • Alta Fox values DAKT at a 11x EBITDA multiple (~20x PE), the low end of where comps suggest DAKT should trade and in-line with its own history. Sports & Live Events EV/FY26 FY25-27 Rev Market Cap Adjacent DAKT Comps EBITDA FY26 PE CAGR (USD M) ge LYTS US 9.5x 15.4x 6.1% $604 ighting &Signa CCO US 9.9x N/A 2.8% $758 L LAMR US 14.4x 21.4x 3.6% $13,437 ents LYV US 12.8x 41.1x 9.1% $31,184 Live Ev SPHR US 16.3x N/A 7.0% $1,355 MSGE US 10.8x 17.7x 3.3% $1,800 Average 12.3x 23.9x 5.3% $8,190 Median 11.8x 19.5x 4.9% $1,578 DAKT US 7.5x 14.4x 6.0% $848 DAKT Discount to Avg -39% -40% 0.7% DAKT Discount to Median -37% -26% 1.1% Source: Bloomberg, AFC DAKT estimates Note that Alta Fox uses FY26 for comparison purposes to show DAKT on normalized profitability vs comps

Shareholders Have a Clear Opportunity to Choose Progress The Daktronics Status Quo • Worst-in-class governance practices: staggered Board, severely punitive (andrecently made worse) “poison pill,” andcombined CEO/Chairman role. • Negligent nepotism: 3out of the 5 named “executive officers” are related family members. • Complacent sales culture: Daktronics has zero commissions for its salesstaff because,“that’s the way they have always done it.” • Irresponsible financial stewardship • Unprofessional and confusing investor communications. • Zero legitimate sell-side research coverage. • Lack of accountability for management or the Board: o CFO was never fired and just transferred to a new role even 2+ years after the going concern. o CEO, Reece Kurtenbach, continues to operate unchecked from a Board that does not care and owns little stock.1 The Alta Fox Path Forward • A Shareholder-Friendly Board with highly qualified, independent nominees and a history of driving excellent business performance. • Best-in-Class Governance Practices: remove the staggered board, split the CEO/Chairman role, remove the poison pill, and establish compensation aligned with share price outperformance. • Establish a merit-based culture: employees succeed or fail at Daktronics based on the merits of their ideas and accomplishments, not on their last name. • Recruit a highly qualified CFO, well incentivized to drive shareholder value. • Institute accountability for management initiating short-term and long-term guidance and a clear capital allocation strategy. • Greater engagement with the investment community, attendance at sought-after investor conferences, and a clear investor narrative aided by proper sell-side coverage. DAKT Trades in-line or better than Comps with Accelerating Fundamentals

Margins have Significant Room to Expand Higher • Since 2012, DAKT’sBoard has consistently set a 12.5% EBIT margin upper DAKT EBIT Margin Targets target for management. We question why this outdated margin target has from FY12 to FY24 not already been moved higher as both revenues and margins have increased significantly in the last 12 years. • International margins have collapsed under the CEO’s tenure due to execution issues. We believe independent and shareholder-focused nominees could provide a fresh perspective on what has been a losing international strategy. • With an improved Board and management team laser focused on efficiency, we see no structural reason why EBIT margins cannot expand into the mid-teens over time. • Our research into private competitors suggests that smaller industry peers are already achieving these elevated levels of profitability. We expect that the market’s perception and valuation of Daktronics would significantly improve if Daktronics demonstrated a credible plan to sustainably achieve mid-teens EBIT margins.

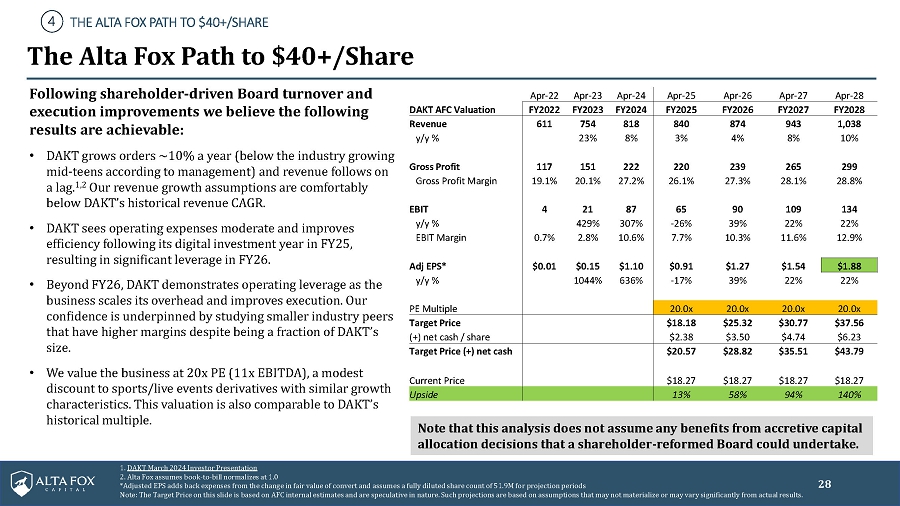

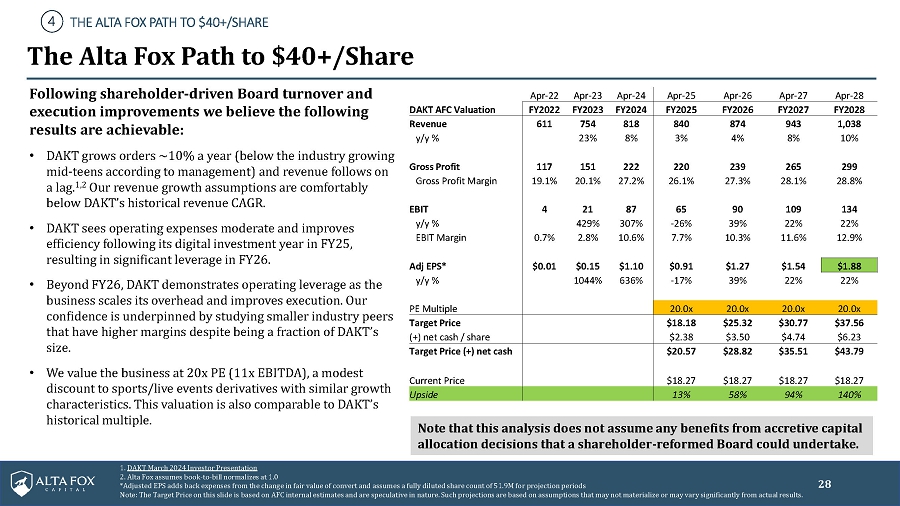

The Alta Fox Path to $40+/Share Following shareholder-driven Board turnover and execution improvements we believe the following results are achievable: • DAKT grows orders ~10% a year (below the industry growing mid-teens according to management) and revenue follows on a lag.1,2 Our revenue growth assumptions are comfortably belowDAKT’s historicalrevenue CAGR. • DAKT sees operating expenses moderate and improves efficiency following its digital investment year in FY25, resulting in significant leverage in FY26. • Beyond FY26, DAKT demonstrates operating leverage as the business scales its overhead and improves execution. Our confidence is underpinned by studying smaller industry peers thathave higher margins despite being afraction ofDAKT’s size. • We value the business at 20x PE (11x EBITDA), a modest discount to sports/live events derivatives with similar growth characteristics. This valuation is also comparable to DAKT’s historical multiple. DAKT AFC Valuation Apr-22 Apr-23 Apr-24 Apr-25 Apr-26 Apr-27 Apr-28 FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 FY2028 Revenue 611 754 818 840 874 943 1,038 y/y % 23% 8% 3% 4% 8% 10% Gross Profit 117 151 222 220 239 265 299 Gross Profit Margin 19.1% 20.1% 27.2% 26.1% 27.3% 28.1% 28.8% EBIT 4 21 87 65 90 109 134 y/y % 429% 307% -26% 39% 22% 22% EBIT Margin Adj EPS* y/y % 0.7% $0.01 2.8% $0.15 1044% 10.6% $1.10 636% 7.7% $0.91 -17% 10.3% $1.27 39% 11.6% $1.54 22% 12.9% $1.88 22% PE Multiple 20.0x 20.0x 20.0x 20.0x Target Price $18.18 $25.32 $30.77 $37.56 (+) net cash / share $2.38 $3.50 $4.74 $6.23 Target Price (+) net cash $20.57 $28.82 $35.51 $43.79 Current Price $18.27 $18.27 $18.27 $18.27 Upside 13% 58% 94% 140% Note that this analysis does not assume any benefits from accretive capital allocation decisions that a shareholder-reformed Board could undertake.

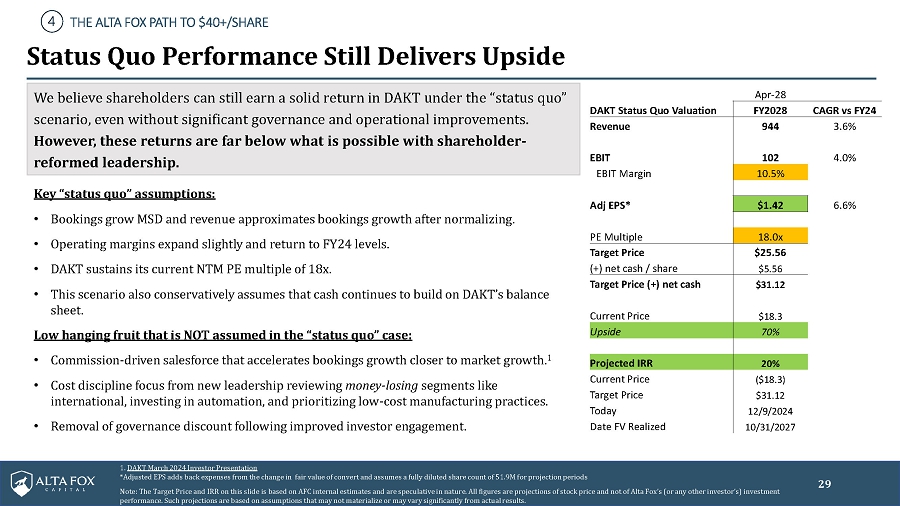

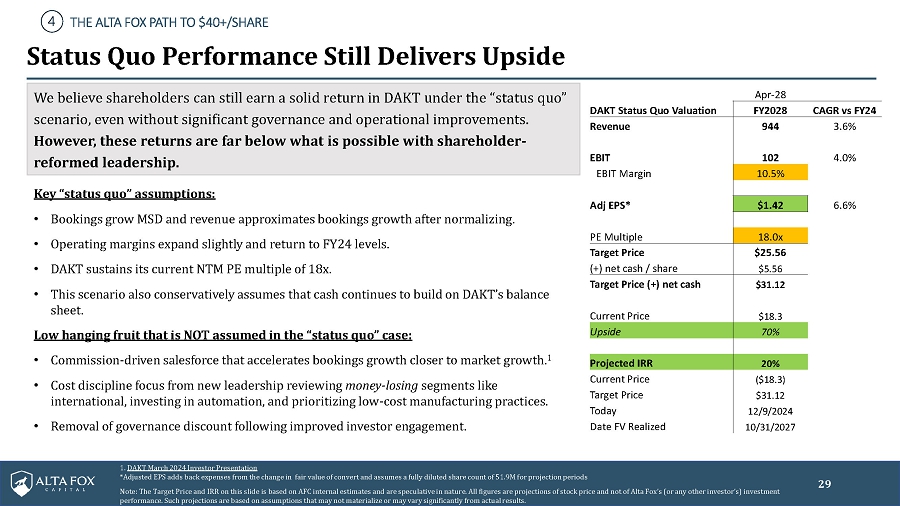

Status Quo Performance Still Delivers Upside Apr-28 We believe shareholders can stillearnasolidreturnin DAKT under the “statusquo” scenario, even without significant governance and operational improvements. However, these returns are far below what is possible with shareholder-reformed leadership. Key “status quo” assumptions: • Bookings grow MSD and revenue approximates bookings growth after normalizing. • Operating margins expand slightly and return to FY24 levels. • DAKT sustains its current NTM PE multiple of 18x. • This scenario also conservatively assumes that cash continues to build on DAKT’s balance sheet. Low hanging fruit that is NOT assumed in the “status quo” case: • Commission-driven salesforce that accelerates bookings growth closer to market growth.1 • Cost discipline focus from new leadership reviewing money-losing segments like international, investing in automation, and prioritizing low-cost manufacturing practices. • Removal of governance discount following improved investor engagement. DAKT Status Quo Valuation FY2028 CAGR vs FY24 Revenue 944 3.6% EBIT 102 4.0% 6.6% EBIT Margin 10.5% Adj EPS* $1.42 PE Multiple 18.0x Target Price $25.56 (+) net cash / share Target Price (+) net cash $5.56 $31.12 Current Price $18.3 Upside 70% Projected IRR 20% Current Price Target Price Today Date FV Realized ($18.3) $31.12 12/9/2024 10/31/2027

Conclusion • Daktronics is a high-quality business with market-leading share in a secular growth industry. • DAKT has underperformed its potential over the last decade, operating like a private family business with little accountability to shareholders. • As Daktronics’ largest shareholder (~12% ownership),* Alta Fox is pushing for long-overdue Board refreshment and governance enhancements. • With a more aligned Board and improved management team, we believe growth and efficiency at Daktronics will dramatically improve in the years to come. • We believe that shareholder-led improvements to operations and investor communication can help drive DAKT’s share priceto >$40by FY28, over100% upside from current levels.

For more information visit: www.FixDaktronics.com