Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934.

Subject to Completion, dated June 14, 2018

INFORMATION STATEMENT

RETAIL VALUE INC.

COMMON SHARES

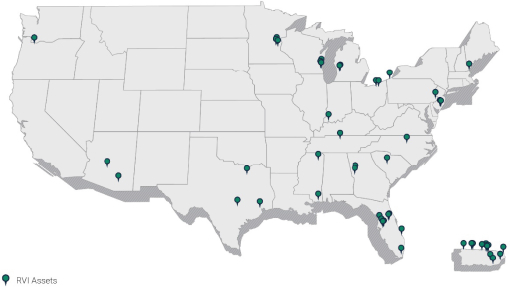

This Information Statement is being furnished in connection with the distribution by DDR Corp., or DDR, an Ohio corporation and self-administered and self-managed real estate investment trust, or REIT, whose common shares are listed on the New York Stock Exchange, or NYSE, to its shareholders of all of the outstanding common shares of Retail Value Inc., a wholly-owned subsidiary of DDR (together with its consolidated subsidiaries, the Company or RVI). The Company is an Ohio corporation that holds 49 assets, comprised of 37 continental U.S. assets and 12 assets in Puerto Rico.

The Company will be externally managed and advised by one or more wholly-owned subsidiaries of DDR, which the Company refers to collectively as the Manager.

For every ten common shares of DDR held of record by you as of the close of business on June 26, 2018, or the distribution record date, you will receive one of the Company’s common shares, or the distribution. However, as discussed under “The Company’s Separation from DDR—Market for Common Shares—Trading Between the Distribution Record Date and Distribution Date,” if you sell your common shares of DDR in the“regular-way” market after the distribution record date and before the Company’s separation from DDR, or the separation, you also will be selling your right to receive the Company’s common shares in connection with the separation. The Company expects its common shares will be distributed by DDR to you on or about July 1, 2018, or the distribution date.

No vote of DDR’s shareholders is required in connection with the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send either DDR or the Company a proxy, in connection with the separation. You will not be required to pay any consideration or to exchange or surrender your existing common shares of DDR or take any other action to receive your RVI common shares on the distribution date.

There is no current trading market for the Company’s common shares, although the Company expects that a limited market, commonly known as a “when-issued” trading market, will develop on or shortly before the distribution record date, and the Company expects“regular-way” trading of the Company’s common shares to begin on the first trading day following the distribution date. The Company intends to apply to list its common shares on the NYSE under the symbol “RVI.”

The Company intends to elect and qualify to be taxed as a REIT for U.S. federal income tax purposes, commencing with its taxable year ending December 31, 2018. To assist the Company in maintaining its qualification as a REIT for U.S. federal income tax purposes, the Articles of Incorporation contain certain restrictions on ownership of the Company’s common shares. See “Description of Common Shares—Restrictions on Ownership and Transfer.”

The Company is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and may elect to comply with certain reduced public company reporting requirements.

Owning the Company’s common shares involves risks. See “Risk Factors” beginning on page 33 of this Information Statement for a description of various risks you should consider in owning the Company’s common shares.

Neither the Securities and Exchange Commission, or the SEC, nor any state or other securities commission has approved or disapproved of these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

This Information Statement was first provided to DDR shareholders on or about , 2018.

The date of this Information Statement is , 2018.