UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23333

----------------------------------------------------------------

Cliffwater Corporate Lending Fund

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

Registrant’s telephone number, including area code: (414) 299-2000

Terrance P. Gallagher

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

----------------------------------------------------------------

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Item 1. Report to Shareholders

CLIFFWATER CORPORATE LENDING FUND

Annual Report

For the Year Ended March 31, 2023

Cliffwater Corporate Lending Fund |

Table of Contents For the Year Ended March 31, 2023 |

2 | ||

4 | ||

5 | ||

6-61 | ||

62 | ||

63 | ||

64 | ||

65-66 | ||

67-68 | ||

69-109 | ||

110-111 | ||

112-113 | ||

114-115 |

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management and other information.

www.cliffwaterfunds.com

1

To our shareholders:

We recently completed three and three-quarter years of operation and want to thank you for the continued trust you have placed in us. Performance has been consistently strong relative to our objective.

The Cliffwater Corporate Lending Fund (the “Fund”) produced a net 8.15% annualized return from its June 5, 2019 inception, through March 31, 2023. This compares to a 3.59% annualized return for the Morningstar LSTA US Leveraged Loan Index. The Fund also reported relatively consistent monthly returns. Its annualized standard deviation measured 2.08% for the same period compared to 8.02% for the Morningstar LSTA US Leveraged Loan Index.

The Fund experienced strong investor inflows over the trailing year, with net-asset-value growing from $6.7 billion on March 31, 2022, to $11.1 billion on March 31, 2023. This asset growth has been supported by significant investment in personnel and technology to grow our platform and the onboarding of additional strategic lending partners to access high quality senior corporate loans. Factors materially affecting the Fund’s performance during the most recently completed quarter include a high current cash yield, and few realized losses.

We remain confident in the Fund’s continued performance despite the uncertain economic environments brought by inflation and the Fed’s increase in interest rates. The Fund’s 10.6% net current yield remains attractive, and we believe that the floating rate nature of our loans should continue to react favorably in a rising interest rate economy.

We again sincerely thank you for your support.

Regards,

Stephen L. Nesbitt

Chief Investment Officer

Cliffwater LLC

The performance data shown represents past performance which does not guarantee future results. It is net of all fees. Current performance may be lower or higher than the performance quoted. All performance shown assumes reinvestment of dividends.

2

Cliffwater Corporate Lending Fund |

Letter to Shareholders March 31, 2023 (Unaudited) (Continued) |

Important Disclosures

The Fund’s investment program is speculative and entails substantial risks. There can be no assurance that the Fund’s investment objectives will be achieved or that its investment program will be successful. Investors should consider the Fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment.

Shares are an illiquid investment.

We do not intend to list the Fund’s shares (“Shares”) on any securities exchange and we do not expect a secondary market in the Shares to develop.

You should generally not expect to be able to sell your Shares (other than through the limited repurchase process), regardless of how we perform.

Although we are required to implement a Share repurchase program, only a limited number of Shares will be eligible for repurchase by us.

You should consider that you may not have access to the money you invest for an indefinite period of time.

An investment in the Shares is not suitable for you if you have foreseeable need to access the money you invest.

Because you will be unable to sell your Shares or have them repurchased immediately, you will find it difficult to reduce your exposure on a timely basis during a market downturn.

The Fund is a non-diversified management investment company and may be more susceptible to any single economic or regulatory occurrence than a diversified investment company. Cybersecurity risks have significantly increased in recent years and the Fund could suffer such losses in the future. One of the fundamental risks associated with the Fund’s investments is the risk that an issuer will be unable to make principal and interest payments on its outstanding debt obligations when due. Other risk factors include interest rate risk (a rise in interest rates causes a decline in the value of debt securities) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments).

3

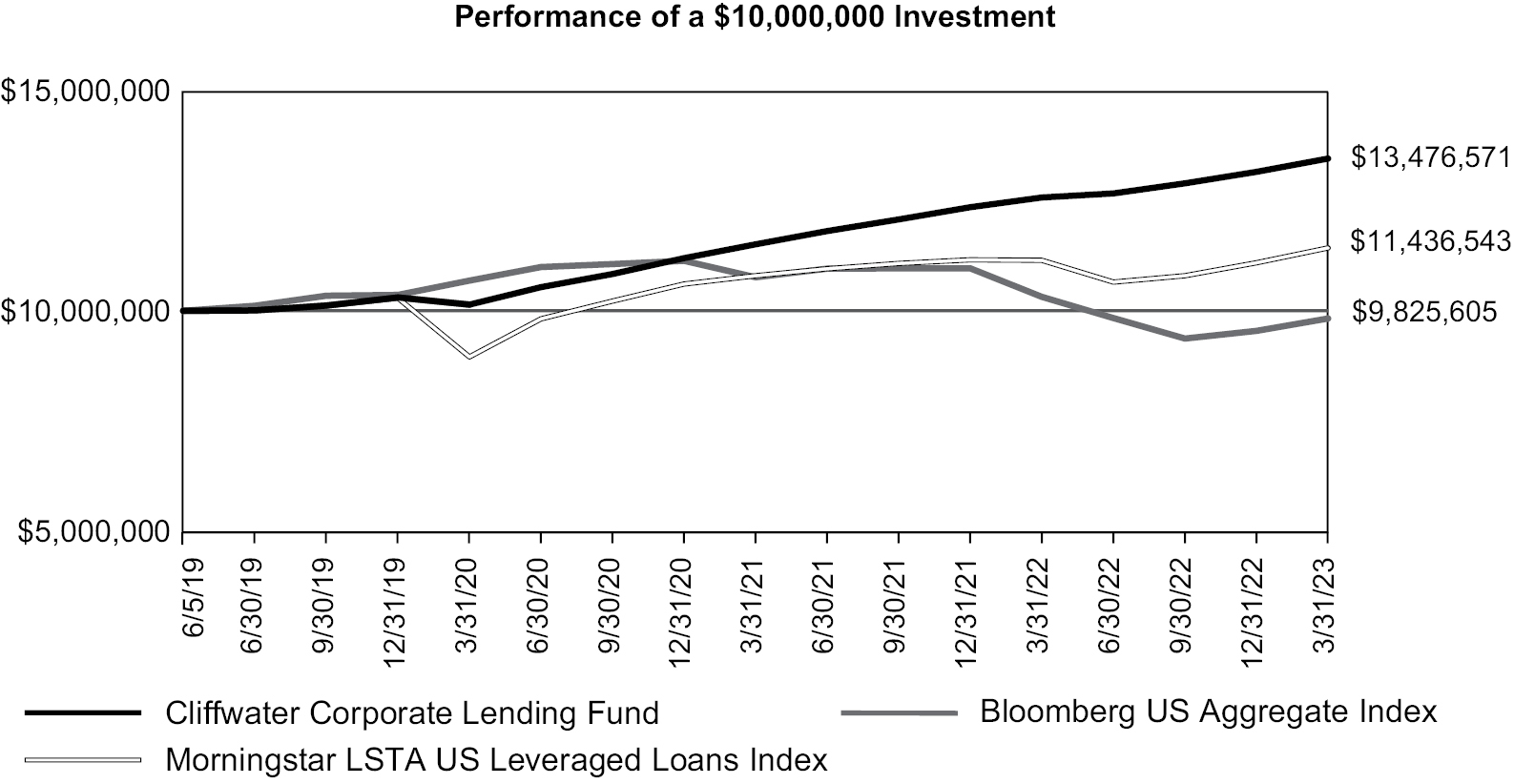

This graph compares a hypothetical $10,000,000 investment in the Fund’s Class I Shares with a similar investment in the Morningstar LSTA US Leveraged Loans Index and Bloomberg US Aggregate Index. These indices do not serve as benchmarks for the Fund and are shown for illustrative purposes only. The Fund does not have a designated performance benchmark. Results include the reinvestment of all dividends and capital gains. These indices do not reflect expenses, fees, or sales charges, which would lower performance.

The Morningstar LSTA US Leveraged Loans Index (previously named S&P LSTA Leveraged Loans Index) is designed to deliver comprehensive, precise coverage of the US leveraged loan market. The Morningstar LSTA US Leveraged Loans Index is a market value weighted index tracking institutional leveraged loans in the United States based upon market weightings, spreads and interest payment, including Term Loan A, Term Loan B and Second Lien tranches. The Morningstar LSTA US Leveraged Loans Index is unmanaged and it is not available for investment.

The Bloomberg US Aggregate Index is a broad based, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The index is unmanaged and it is not available for investment.

Average Annual Total Returns as of March 31, 2023 | 1 Year | 3 Year | Since | ||||||

Cliffwater Corporate Lending Fund (Inception Date June 5, 2019) | 7.06 | % | 9.94 | % | 8.15 | % | |||

Morningstar LSTA US Leveraged Loans Index | 2.54 | % | 8.52 | % | 3.59 | % | |||

Bloomberg US Aggregate Index | -4.78 | % | -2.77 | % | -0.46 | % | |||

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1 (888) 442-4420.

Effective March 6, 2023, the Fund terminated the Expense Limitation and Reimbursement Agreement. Prior to March 6, 2023, the Fund had entered into an expense limitation agreement that limits the Fund’s annualized ordinary fund-wide operating expenses to 2.25% through March 6, 2023 (the “Waiver”). Ordinary fund-wide operating expenses exclude any taxes, fees and interest payments on borrowed funds, distribution and servicing fees, brokerage and distribution costs and expenses, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary or non-routine expenses, such as litigation expenses. Ordinary fund-wide operating expenses include, for the voidance of doubt, the Investment Management Fee and the Fund’s start-up, offering and organizational expenses. The performance quoted above reflects the Waiver in effect and would have been lower in its absence.

For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

To the Shareholders and Board of Trustees of

Cliffwater Corporate Lending Fund

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedules of investments, swap contracts and forward foreign currency exchange contracts, of Cliffwater Corporate Lending Fund (the “Fund”) as of March 31, 2023, the related consolidated statements of operations, cash flows, and changes in net assets, the related notes, and the consolidated financial highlights for each of the periods indicated below (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2023, the results of its operations, its cash flows, the changes in net assets, and the financial highlights for each of the periods indicated below, in conformity with accounting principles generally accepted in the United States of America.

Fund Name | Consolidated Statement of Operations | Consolidated Statement of Cash Flows | Consolidated Statements of Changes in Net Assets | Consolidated Financial Highlights | ||||

Cliffwater Corporate Lending Fund | For the year ended March 31, 2023 | For the year ended March 31, 2023, for the period January 1, 2022 through March 31, 2022 and for the year ended December 31, 2021 | For the year ended March 31, 2023, for the period January 1, 2022 through March 31, 2022, for the years ended December 31, 2021, and 2020, and for the period March 6, 2019 (commencement of operations) through December 31, 2019 | |||||

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2023, by correspondence with the custodian, brokers, agent banks, and underlying fund administrators or managers; when replies were not received, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2019.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

June 7, 2023

5

Principal | Value | |||||

SENIOR SECURED LOANS — 84.8% | ||||||

| COMMUNICATIONS — 2.5% |

| ||||

$ | 2,917,500 | 1236904 B.C. Ltd. | $ | 2,826,404 | ||

| 24,680,398 | AG-Twin Brook Communication Services |

| 24,580,657 | ||

| Aspen Opco, LLC |

| ||||

| 2,840,909 | Revolver, 0.500%, 12/1/20272,4,6 |

| 2,774,974 | ||

| 21,875,000 | First Lien Term Loan, 10.771% (LIBOR+550 basis points), 12/1/20272,3,4 |

| 21,367,298 | ||

| 4,962,312 | BrightSign |

| |||

| First Lien Term Loan, 10.909% (LIBOR+575 basis points), 10/14/20272,3,4 |

| 4,837,197 | |||

| CM Acquisitions Holdings, Inc. |

| ||||

| 810,971 | Incremental Term Loan, 9.798% (SOFR+490 basis points), 5/6/20252,3,4 |

| 775,899 | ||

| 2,600,593 | First Lien Term Loan, 9.798% (SOFR+490 basis points), 5/6/20252,3,4 |

| 2,488,128 | ||

| 298,125 | Delayed Draw, 9.799% (SOFR+490 basis points), 5/6/20252,3,4 |

| 285,233 | ||

| GBP 1,772,638 | CSL DualCom Ltd. |

| 2,151,404 | ||

| 10,000,000 | EP Purchaser, LLC |

| 9,583,985 | ||

| Fingerpaint Marketing, Inc. |

| ||||

| 1,209,677 | Revolver, 0.500%, 12/30/20262,4,6 |

| 1,163,423 | ||

| 2,335,714 | Delayed Draw, 1.000%, 12/30/20262,4,6 |

| 2,293,968 | ||

| 5,961,682 | Delayed Draw, 11.409% (LIBOR+625 basis points), 12/30/20262,3,4 |

| 5,733,726 | ||

| 8,058,140 | First Lien Term Loan, 11.409% (LIBOR+625 basis points), 12/30/20262,3,4 |

| 7,750,022 | ||

| 3,379,331 | First Lien Term Loan, 11.627% (LIBOR+625 basis points), 12/30/20262,3,4 |

| 3,318,932 | ||

| 2,633,891 | Delayed Draw, 11.749% (LIBOR+625 basis points), 12/30/20262,3,4 |

| 2,586,815 | ||

| 470,430 | Revolver, 13.250% (LIBOR+625 basis points), 12/30/20262,3,4 |

| 452,442 | ||

| 12,250,564 | FuseFX, LLC |

| 12,201,519 | ||

| 15,000,000 | HH Global Finance Limited |

| 13,622,474 | ||

| HPS Telecommunications |

| ||||

| 9,725,000 | First Lien Term Loan, 11.159% (LIBOR+600 basis points), 5/30/20252,3,4,5 |

| 9,394,271 | ||

| 10,000,000 | First Lien Term Loan, 10.617% (LIBOR+600 basis points), 7/23/20262,3,4,5 |

| 9,971,021 | ||

| Iconic Purchaser Corporation |

| ||||

| 1,025,641 | Revolver, 0.500%, 11/5/20272,4,6 |

| 1,006,358 | ||

| 512,821 | Revolver, 9.959% (LIBOR+525 basis points), 11/5/20272,3,4 |

| 503,179 | ||

| 18,230,769 | First Lien Term Loan, 10.090% (LIBOR+525 basis points), 11/5/20282,3,4 |

| 17,858,787 | ||

| 9,707,143 | KeyImpact Holdings, Inc. |

| 9,506,160 | ||

| 2,000,000 | Lifesize |

| 621,000 | ||

| MBS Holdings, Inc. |

| ||||

| 1,271,186 | Revolver, 0.500%, 4/6/20272,4,6 |

| 1,232,132 | ||

| 13,488,559 | First Lien Term Loan, 10.590% (LIBOR+575 basis points), 4/6/20272,3,4 |

| 13,074,150 | ||

See accompanying Notes to Consolidated Financial Statements.

6

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| COMMUNICATIONS (Continued) |

| ||||

$ | 12,371,145 | MBS Services Holdings, LLC | $ | 12,123,722 | ||

| Mc Group Ventures Corporation |

| ||||

| 1,634,615 | Delayed Draw, 1.000%, 6/30/20272,4,6 |

| 1,608,141 | ||

| 15,115,385 | First Lien Term Loan, 10.325% (LIBOR+550 basis points), 6/30/20272,3,4 |

| 14,870,570 | ||

| 7,889,904 | Delayed Draw, 10.325% (LIBOR+550 basis points), 6/30/20272,3,4 |

| 7,762,116 | ||

| OneCare Media, LLC |

| ||||

| 1,333,333 | Revolver, 0.500%, 9/29/20262,4,6 |

| 1,306,395 | ||

| 9,381,366 | First Lien Term Loan, 11.340% (LIBOR+650 basis points), 9/29/20262,3,4 |

| 9,191,827 | ||

| AUD 2,800,000 | Permaconn TopCo Pty, Ltd. |

| 1,805,717 | ||

| Royal Buyer, LLC |

| ||||

| 191,667 | Revolver, 0.500%, 8/31/20282,4,6 |

| 187,833 | ||

| 471,250 | Delayed Draw, 1.000%, 8/31/20282,4,6 |

| 466,538 | ||

| 58,333 | Revolver, 10.399% (SOFR+600 basis points), 8/31/20282,3,4 |

| 57,167 | ||

| 2,493,750 | First Lien Term Loan, 10.399% (SOFR+600 basis points), 8/31/20282,3,4 |

| 2,443,875 | ||

| 28,750 | Delayed Draw, 10.874% (SOFR+600 basis points), 8/31/20282,3,4 |

| 28,463 | ||

| 11,970,000 | TA TT Buyer |

| 11,760,525 | ||

| Trunk Acquisition, Inc. |

| ||||

| 2,500,000 | Revolver, 0.500%, 2/19/20262,4,6 |

| 2,404,408 | ||

| 1,193,049 | Revolver, 0.500%, 2/19/20262,4,5,6 |

| 1,147,431 | ||

| 22,243,057 | First Lien Term Loan, 10.659% (LIBOR+550 basis points), 2/19/20272,3,4 |

| 21,392,553 | ||

|

| 272,518,839 | ||||

| CONSUMER DISCRETIONARY — 7.3% |

| ||||

| A1 Garage Equity, LLC |

| ||||

| 1,515,152 | Revolver, 0.500%, 12/22/20282,4,6 |

| 1,472,172 | ||

| 3,143,561 | Delayed Draw, 1.000%, 12/22/20282,4,6 |

| 3,093,435 | ||

| 1,020,548 | Delayed Draw, 11.124% (SOFR+650 basis points), 12/22/20282,3,4 |

| 1,004,275 | ||

| 9,294,886 | First Lien Term Loan, 11.498% (SOFR+650 basis points), 12/22/20282,3,4 |

| 9,031,223 | ||

| ADS Buyer, Inc. |

| ||||

| 11,556,049 | First Lien Term Loan, 10.298% (SOFR+525 basis points), 12/30/20272,3,4 |

| 11,287,841 | ||

| 6,475,590 | First Lien Term Loan, 10.298% (SOFR+525 basis points), 12/30/20272,3,4 |

| 6,325,296 | ||

| AG-Twin Brook Consumer Discretionary |

| ||||

| 24,651,888 | First Lien Term Loan, 12.043% (SOFR+675 basis points), 2/14/20242,3,4,5 |

| 24,371,163 | ||

| 9,775,302 | First Lien Term Loan, 11.660% (SOFR+650 basis points), 4/22/20262,3,4,5 |

| 9,745,269 | ||

| 19,739,515 | First Lien Term Loan, 11.660% (SOFR+650 basis points), 4/22/20262,3,4,5 |

| 19,678,869 | ||

| 14,850,000 | First Lien Term Loan, 10.660% (SOFR+550 basis points), 11/30/20262,3,4,5 |

| 14,806,966 | ||

| 23,824,333 | First Lien Term Loan, 10.659% (LIBOR+550 basis points), 12/14/20272,3,4,5 |

| 23,622,386 | ||

See accompanying Notes to Consolidated Financial Statements.

7

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| CONSUMER DISCRETIONARY (Continued) |

| ||||

| Archimede |

| ||||

| EUR 8,500,000 | First Lien Term Loan, 8.265% (EURIBOR+525 basis points), 10/17/20272,3,4,7 | $ | 8,893,324 | ||

| EUR 1,500,000 | Delayed Draw, 8.265% (EURIBOR+525 basis points), 10/27/20272,3,4,7 |

| 1,569,410 | ||

| EUR 7,800,000 | First Lien Term Loan, 8.265% (EURIBOR+525 basis points), 10/27/20272,3,4,7 |

| 8,160,933 | ||

$ | 10,766,498 | Astro Acquisition, LLC |

| 8,206,196 | ||

| Auveco Holdings, Inc. |

| ||||

| 986,842 | Revolver, 0.500%, 5/5/20282,4,6 |

| 951,580 | ||

| 1,973,684 | Delayed Draw, 1.000%, 5/5/20282,4,6 |

| 1,903,160 | ||

| 328,947 | Revolver, 10.291% (SOFR+575 basis points), 5/5/20282,3,4 |

| 317,193 | ||

| 9,141,447 | First Lien Term Loan, 10.291% (SOFR+575 basis points), 5/5/20282,3,4 |

| 8,814,803 | ||

| Bendon |

| ||||

| 1,800,000 | Revolver, 0.750%, 12/11/20252,4,6 |

| 1,722,157 | ||

| 11,848,858 | First Lien Term Loan, 12.548% (LIBOR+750 basis points), 12/11/20252,3,4 |

| 11,336,443 | ||

| 2,943,844 | Chop’t Creative Salad Company LLC |

| 2,961,474 | ||

| Club Car Wash |

| ||||

| 2,142,334 | Delayed Draw, 1.000%, 6/16/20272,4,6 |

| 2,078,064 | ||

| 2,844,423 | Delayed Draw, 8.972% (SOFR+650 basis points), 6/16/20272,3,4 |

| 2,759,090 | ||

| Denali Midco 2 LLC |

| ||||

| 4,300,000 | Delayed Draw, 1.000%, 12/22/20272,4,6 |

| 4,165,657 | ||

| 3,196,250 | Delayed Draw, 11.407% (SOFR+650 basis points), 12/22/20272,3,4 |

| 3,096,391 | ||

| 7,462,500 | First Lien Term Loan, 11.407% (SOFR+650 basis points), 12/22/20272,3,4 |

| 7,229,352 | ||

| Evergreen Acqco 1 LP |

| ||||

| 10,908,961 | First Lien Term Loan, 10.660% (LIBOR+550 basis points), 3/26/20282,3 |

| 10,472,602 | ||

| FQSR, LLC |

| ||||

| 3,875,488 | Delayed Draw, 1.000% PIK, 5/26/20272,4,6,8 |

| 3,659,356 | ||

| 2,210,205 | Delayed Draw, 11.616% PIK (LIBOR+650 basis points), 5/26/20272,3,4,8 |

| 2,086,945 | ||

| Gateway US Holdings, Inc. |

| ||||

| 409,091 | Revolver, 0.500%, 9/22/20242,4,6 |

| 397,763 | ||

| 191,424 | Delayed Draw, 1.000%, 9/22/20242,4,6 |

| 186,124 | ||

| 800,000 | Delayed Draw, 1.000%, 9/22/20262,4,6 |

| 777,849 | ||

| 6,166,593 | Delayed Draw, 11.548% (SOFR+650 basis points), 9/22/20262,3,4 |

| 5,995,844 | ||

| 500,000 | Revolver, 11.548% (SOFR+650 basis points), 9/22/20262,3,4 |

| 486,155 | ||

| 23,756,818 | First Lien Term Loan, 11.548% (SOFR+650 basis points), 9/22/20262,3,4 |

| 23,099,008 | ||

| 29,696,203 | GSM Acquisition Corp. |

| 29,319,359 | ||

| GSV Holding, LLC |

| ||||

| 33,327,505 | Delayed Draw, 10.548% (LIBOR+550 basis points), 4/3/20282,3,4 |

| 32,637,470 | ||

| 16,535,262 | Delayed Draw, 1.000%, 4/30/20282,4,6 |

| 16,192,905 | ||

| 17,000,000 | Harbor Purchaser, Inc. |

| 16,492,404 | ||

See accompanying Notes to Consolidated Financial Statements.

8

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| CONSUMER DISCRETIONARY (Continued) |

| ||||

| HPS Consumer Discretionary |

| ||||

$ | 4,056,795 | First Lien Term Loan, 13.159% PIK (LIBOR+800 basis points), 10/31/20242,3,4,5,8 | $ | 3,666,361 | ||

| 5,118,325 | First Lien Term Loan, 10.635% (LIBOR+600 basis points), 6/27/20252,3,4,5 |

| 4,935,303 | ||

| 15,385,685 | First Lien Term Loan, 11.557% (LIBOR+675 basis points), 7/26/20262,3,4,5 |

| 14,499,976 | ||

| HS Spa Holdings, Inc. |

| ||||

| 311,429 | Revolver, 0.500%, 6/2/20282,4,6 |

| 303,608 | ||

| 2,163,650 | First Lien Term Loan, 10.445% (SOFR+575 basis points), 6/2/20292,3,4 |

| 2,106,714 | ||

| 7,103,998 | Hudson’s Bay Company |

| 7,007,512 | ||

| 13,968,181 | HY Cite Enterprises LLC |

| 13,532,040 | ||

| 14,606,996 | Ingenio, LLC |

| 14,136,275 | ||

| Innovetive Petcare, LLC |

| ||||

| 587,633 | Delayed Draw, 1.000%, 12/2/20262,4,6 |

| 579,881 | ||

| 1,350,118 | Delayed Draw, 9.778% (LIBOR+500 basis points), 12/2/20262,3,4,5 |

| 1,332,309 | ||

| KBP Investments LLC |

| ||||

| 3,444,691 | Delayed Draw, 1.000% PIK, 5/26/20272,4,6,8 |

| 3,252,584 | ||

| 23,992,297 | Delayed Draw, 11.616% PIK (LIBOR+650 basis points), 5/26/20272,3,4,5,8 |

| 22,654,272 | ||

| 13,509,812 | Leonard Group, Inc. |

| 13,442,352 | ||

| 8,650,296 | Mammoth Holdings, LLC |

| 8,625,228 | ||

| Margaritaville Enterprises LLC |

| ||||

| 312,500 | Revolver, 0.500%, 6/17/20272,4,6 |

| 301,886 | ||

| 5,108,297 | Delayed Draw, 1.000%, 6/17/20272,4,6 |

| 4,934,793 | ||

| 10,620,148 | First Lien Term Loan, 9.650% (SOFR+475 basis points), 6/17/20272,3,4 |

| 10,259,434 | ||

| EUR 5,769,231 | NKD Group GmbH |

| 6,154,810 | ||

| NL1 Acquire Corp. |

| ||||

| CAD 369,740 | Revolver, 0.500%, 5/26/20262,4,6,7 |

| 262,870 | ||

| CAD 960,260 | Revolver, 10.520% (CDOR+550 basis points), 5/26/20262,3,4,7 |

| 682,706 | ||

| CAD 1,930,959 | Delayed Draw, 1.000%, 5/26/20282,4,7 |

| 1,372,833 | ||

| 1,182,780 | Delayed Draw, 1.000%, 5/26/20282,4,6 |

| 1,076,529 | ||

| CAD 1,939,218 | Delayed Draw, 10.520% (CDOR+550 basis points), 5/26/20282,3,4,7 |

| 1,378,705 | ||

| CAD 9,633,300 | First Lien Term Loan, 10.520% (CDOR+550 basis points), 5/26/20282,3,4,7 |

| 6,848,885 | ||

| 235,155 | Delayed Draw, 10.659% (LIBOR+550 basis points), 5/26/20282,3,4 |

| 214,030 | ||

| 2,079,000 | First Lien Term Loan, 10.659% (LIBOR+550 basis points), 5/26/20282,3,4 |

| 1,892,241 | ||

| 29,656,571 | Owl Rock Consumer Discretionary |

| 28,968,265 | ||

| 6,137,868 | Penney Borrower LLC |

| 6,095,640 | ||

See accompanying Notes to Consolidated Financial Statements.

9

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| CONSUMER DISCRETIONARY (Continued) |

| ||||

| POY Holdings, LLC |

| ||||

$ | 2,406,511 | Revolver, 0.500%, 11/17/20272,4,6 | $ | 2,350,658 | ||

| 989,658 | Delayed Draw, 1.000%, 11/17/20272,4,6 |

| 966,689 | ||

| 911,247 | Delayed Draw, 10.230% (LIBOR+550 basis points), 11/17/20272,3,4 |

| 890,097 | ||

| 19,218,397 | First Lien Term Loan, 10.548% (LIBOR+550 basis points), 11/17/20272,3,4 |

| 18,772,353 | ||

| 1,477,132 | Quality Automotive Services, LLC |

| 1,398,454 | ||

| Race Winning Brands, Inc. |

| ||||

| 1,305,774 | Revolver, 0.500%, 11/16/20272,4,6 |

| 1,262,386 | ||

| 1,819,226 | Revolver, 10.090% (LIBOR+525 basis points), 11/16/20272,3,4 |

| 1,758,778 | ||

| 26,187,857 | First Lien Term Loan, 10.090% (LIBOR+525 basis points), 11/16/20272,3,4 |

| 25,317,698 | ||

| 9,038,081 | First Lien Term Loan, 10.090% (LIBOR+525 basis points), 11/16/20272,3,4,5 |

| 8,737,768 | ||

| 1,939,850 | RCS Consumer Discretionary |

| 1,909,403 | ||

| RefrigiWear, LLC |

| ||||

| 1,506,389 | First Lien Term Loan, 9.615% (SOFR+475 basis points), 11/2/20272,3,4 |

| 1,463,881 | ||

| 2,601,896 | Revolver, 0.500%, 11/2/20272,4,6 |

| 2,528,474 | ||

| 15,501,878 | First Lien Term Loan, 9.615% (SOFR+475 basis points), 11/2/20272,3,4 |

| 15,064,439 | ||

| Regent Holding Company, LLC |

| ||||

| 1,409,774 | Revolver, 0.500%, 2/25/20262,4,6 |

| 1,365,756 | ||

| 11,495,301 | First Lien Term Loan, 12.590% (LIBOR+775 basis points), 2/25/20261,2,3,4,9,10 |

| 11,136,372 | ||

| 1,409,774 | Revolver, 12.590% (LIBOR+775 basis points), 2/25/20262,3,4 |

| 1,365,756 | ||

| 1,099,624 | First Lien Term Loan, 12.590% (LIBOR+775 basis points), 2/26/20262,3,4 |

| 1,065,290 | ||

| Showtime Acquisition, L.L.C |

| ||||

| 203,148 | Delayed Draw, 1.000%, 2/6/20282,4,6 |

| 199,580 | ||

| 3,555,094 | First Lien Term Loan, 12.197% (SOFR+750 basis points), 8/7/20282,3,4 |

| 3,439,466 | ||

| Spanx, LLC |

| ||||

| 8,548,279 | Revolver, 0.500%, 11/18/20272,4,6 |

| 8,142,290 | ||

| 71,845,104 | First Lien Term Loan, 9.885% (LIBOR+550 basis points), 11/18/20282,3,4 |

| 68,039,152 | ||

| 3,548,342 | Revolver, 10.095% (LIBOR+525 basis points), 11/18/20272,3,4 |

| 3,379,818 | ||

| Speedstar Holding Corporation |

| ||||

| 1,320,828 | First Lien Term Loan, 12.161% (SOFR+725 basis points), 1/22/20272,3,4 |

| 1,277,624 | ||

| 310,345 | Delayed Draw, 12.306% (SOFR+725 basis points), 1/22/20272,3,4 |

| 300,194 | ||

| Spotless Brands, LLC |

| ||||

| 200,000 | Revolver, 0.500%, 6/21/20282,4,6 |

| 196,000 | ||

| 50,000 | Revolver, 11.000% (SOFR+665 basis points), 6/21/20282,3,4 |

| 49,000 | ||

| 7,565,386 | First Lien Term Loan, 11.310% (SOFR+665 basis points), 6/21/20282,3,4 |

| 7,414,078 | ||

| 2,700,358 | Delayed Draw, 11.340% (SOFR+660 basis points), 6/21/20282,3,4 |

| 2,673,354 | ||

| 7,470,670 | Delayed Draw, 1.000%, 7/25/20282,4,6 |

| 7,358,610 | ||

| 4,980,447 | First Lien Term Loan, 11.520% (SOFR+665 basis points), 7/25/20282,3,4 |

| 4,880,838 | ||

See accompanying Notes to Consolidated Financial Statements.

10

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| CONSUMER DISCRETIONARY (Continued) |

| ||||

| Stanton Carpet Corp. |

| ||||

$ | 1,189,468 | Revolver, 0.500%, 10/1/20262,4,6 | $ | 1,152,924 | ||

| 9,210,536 | First Lien Term Loan, 10.159% (LIBOR+500 basis points), 10/1/20272,3,4 |

| 8,927,560 | ||

| 303,719 | First Lien Term Loan, 10.159% (SOFR+500 basis points), 10/1/20272,3,4 |

| 294,388 | ||

| Summit Buyer, L.L.C. |

| ||||

| 1,382,979 | Revolver, 0.500%, 1/14/20262,4,6 |

| 1,341,182 | ||

| 1,898,298 | Delayed Draw, 1.000%, 1/14/20262,4,6 |

| 1,840,927 | ||

| 3,270,591 | Delayed Draw, 1.000%, 1/14/20262,4,6 |

| 3,171,747 | ||

| 16,559,162 | Delayed Draw, 10.741% (LIBOR+585 basis points), 1/14/20262,3,4 |

| 16,058,710 | ||

| 14,811,923 | First Lien Term Loan, 10.741% (LIBOR+585 basis points), 1/14/20262,3,4 |

| 14,364,276 | ||

| 10,000,000 | Travel Leaders Group, LLC |

| 9,760,297 | ||

| Truck-Lite Co., LLC |

| ||||

| 218,406 | First Lien Term Loan, 11.141% (SOFR+625 basis points), 12/13/20262,3,4 |

| 208,085 | ||

| 9,897,959 | First Lien Term Loan, 11.142% (SOFR+625 basis points), 12/13/20262,3,4 |

| 9,430,248 | ||

| 8,000,000 | Woof Holdings, Inc. |

| 7,732,226 | ||

| 7,444,223 | Zips Car Wash, LLC |

| 7,295,339 | ||

|

| 807,208,113 | ||||

| CONSUMER STAPLES — 0.9% |

| ||||

| 1,555,383 | AmerCareRoyal, LLC |

| 1,542,091 | ||

| 13,847,069 | BCPE North Star US Holdings Co. |

| 12,747,958 | ||

| 3,486,509 | C.P. Converters, Inc. |

| 3,476,405 | ||

| JTM Foods, LLC |

| ||||

| 386,122 | Delayed Draw, 0.500%, 5/14/20272,4,6 |

| 372,325 | ||

| 559,597 | Revolver, 0.500%, 5/14/20272,4,6 |

| 539,601 | ||

| 772,244 | Delayed Draw, 9.980% (LIBOR+525 basis points), 5/14/20272,3,4 |

| 744,650 | ||

| 1,119,194 | Revolver, 10.122% (LIBOR+525 basis points), 5/14/20272,3,4 |

| 1,079,203 | ||

| 7,606,603 | First Lien Term Loan, 10.122% (LIBOR+525 basis points), 5/14/20272,3,4 |

| 7,334,803 | ||

| 1,354,225 | First Lien Term Loan, 10.409% (LIBOR+525 basis points), 5/14/20272,3,4 |

| 1,305,836 | ||

| LJ Perimeter Buyer, Inc. |

| ||||

| 2,964,579 | Delayed Draw, 1.000%, 10/31/20282,4,6 |

| 2,920,111 | ||

| 2,106,177 | Delayed Draw, 1.000%, 10/31/20282,4,6 |

| 2,079,527 | ||

| 109,013 | Delayed Draw, 7.500% (SOFR+650 basis points), 10/31/20282,3,4 |

| 107,633 | ||

| 18,203,189 | First Lien Term Loan, 11.326% (SOFR+650 basis points), 10/31/20282,3,4 |

| 17,675,082 | ||

See accompanying Notes to Consolidated Financial Statements.

11

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| CONSUMER STAPLES (Continued) |

| ||||

| Nellson Nutraceutical, Inc. |

| ||||

$ | 14,970,376 | First Lien Term Loan, 10.493% (SOFR+575 basis points), 12/23/20252,3,4 | $ | 14,545,720 | ||

| Purfoods, LLC |

| ||||

| 4,387,500 | First Lien Term Loan, 11.114% (LIBOR+625 basis points), 8/12/20262,3,4 |

| 4,329,625 | ||

| 2,964,494 | Delayed Draw, 11.119% (LIBOR+625 basis points), 8/12/20262,3,4 |

| 2,925,389 | ||

| RB Holdings Interco, LLC |

| ||||

| 230,847 | Revolver, 0.500%, 5/4/20282,4,6 |

| 222,598 | ||

| 2,770,160 | Delayed Draw, 1.000%, 5/4/20282,4,5,6 |

| 2,685,052 | ||

| 1,154,234 | Revolver, 9.782% (SOFR+500 basis points), 5/4/20282,3,4,5 |

| 1,112,990 | ||

| 5,026,742 | Specialty Ingredients, LLC |

| 4,926,207 | ||

| SWK Buyer, Inc. |

| ||||

| 521,930 | Revolver, 0.500%, 3/11/20292,4,6 |

| 478,443 | ||

| 3,070,176 | Delayed Draw, 1.000%, 3/11/20292,4,6 |

| 2,814,370 | ||

| 706,140 | Revolver, 10.099% (SOFR+525 basis points), 3/11/20292,3,4 |

| 647,305 | ||

| 13,135,746 | First Lien Term Loan, 10.739% (SOFR+525 basis points), 3/11/20292,3,4 |

| 12,041,283 | ||

| 4,974,874 | Woodland Foods, Inc. |

| 4,470,658 | ||

|

| 103,124,865 | ||||

| ENERGY — 0.6% |

| ||||

| 3,429,266 | Brock Holdings III, Inc. |

| 3,326,388 | ||

| 4,783,546 | Drilling Info Holdings, Inc. |

| 4,681,045 | ||

| 12,501,869 | Floating Infrastructure Holdings Finance LLC |

| 12,251,831 | ||

| Integrated Power Services |

| ||||

| 2,225,125 | Revolver, 0.500%, 11/22/20272,4,5,6 |

| 2,145,617 | ||

| 505,710 | Revolver, 9.340% (LIBOR+450 basis points), 11/22/20272,3,4,5 |

| 487,640 | ||

| Island Energy Services |

| ||||

| 2,894,230 | Delayed Draw, 1.000%, 1/13/20282,4,6 |

| 2,804,632 | ||

| 2,592,403 | First Lien Term Loan, 13.249% (INDEX SPREAD+825 basis points), 1/13/20282,3,4 |

| 2,512,149 | ||

| Kene Acquisition, Inc. |

| ||||

| 9,975,000 | First Lien Term Loan, 8.900% (LIBOR+425 basis points), 8/8/20262,3,4 |

| 9,943,354 | ||

| 14,925,000 | First Lien Term Loan, 9.409% (LIBOR+425 basis points), 8/8/20262,3,4 |

| 14,877,650 | ||

| Service Compression, LLC |

| ||||

| 1,581,333 | Delayed Draw, 0.500% PIK, 5/6/20272,4,6,8 |

| 1,507,877 | ||

| 2,586,560 | Delayed Draw, 14.907% PIK (SOFR+1,000 basis points), 5/6/20272,3,4,5,8 |

| 2,466,410 | ||

| 13,085,446 | First Lien Term Loan, 14.907% PIK (SOFR+1,000 basis points), 5/6/20272,3,4,5,8 |

| 12,477,603 | ||

|

| 69,482,196 | ||||

See accompanying Notes to Consolidated Financial Statements.

12

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| FINANCIALS — 11.6% |

| ||||

| 1364720 B.C. LTD |

| ||||

| CAD 2,000,000 | Revolver, 0.500%, 9/9/20282,4,6,7 | $ | 1,467,730 | ||

| CAD 5,000,000 | Delayed Draw, 1.000%, 9/9/20282,4,6,7 |

| 3,687,856 | ||

| CAD 11,471,250 | First Lien Term Loan, 9.528% (SOFR+450 basis points), 9/9/20282,3,4,7 |

| 8,418,347 | ||

| Adenza Group, Inc. |

| ||||

$ | 731,098 | Revolver, 0.500%, 12/3/20252,4,6 |

| 721,455 | ||

| 713,267 | Delayed Draw, 1.000%, 12/3/20272,4,6 |

| 711,004 | ||

| 10,862,161 | First Lien Term Loan, 10.590% (LIBOR+575 basis points), 12/3/20272,3,4 |

| 10,718,880 | ||

| Alera Group Holdings, Inc. |

| ||||

| 510,853 | Delayed Draw, 1.000%, 9/30/20282,4,6 |

| 500,636 | ||

| 1,012,500 | Delayed Draw, 1.000%, 9/30/20282,4,6 |

| 989,594 | ||

| 2,003,316 | Delayed Draw, 10.687% (SOFR+650 basis points), 9/30/20282,3,4 |

| 1,963,249 | ||

| 24,818,016 | Delayed Draw, 10.907% (SOFR+600 basis points), 9/30/20282,3,4 |

| 23,931,214 | ||

| 24,811,083 | First Lien Term Loan, 10.907% (SOFR+600 basis points), 9/30/20282,3,4 |

| 23,924,529 | ||

| 3,742,558 | First Lien Term Loan, 11.407% (SOFR+650 basis points), 9/30/20282,3,4 |

| 3,661,182 | ||

| 3,970,531 | Delayed Draw, 11.407% (SOFR+650 basis points), 9/30/20282,3,4 |

| 3,880,705 | ||

| Amba Buyer, Inc. |

| ||||

| 14,257,915 | Delayed Draw, 1.000%, 7/30/20272,4,6 |

| 13,784,159 | ||

| 12,350,919 | First Lien Term Loan, 10.215% (SOFR+525 basis points), 7/30/20272,3,4 |

| 11,878,659 | ||

| Amerilife Holdings LLC |

| ||||

| 2,454,545 | Revolver, 0.500%, 8/31/20282,4,6 |

| 2,354,544 | ||

| 1,636,364 | Delayed Draw, 1.000%, 8/31/20292,4,6 |

| 1,577,893 | ||

| 3,264,545 | Delayed Draw, 10.150% (SOFR+575 basis points), 8/31/20292,3,4 |

| 3,147,896 | ||

| 19,587,273 | First Lien Term Loan, 10.879% (SOFR+575 basis points), 8/31/20292,3,4 |

| 18,789,260 | ||

| GBP 10,791,367 | Apus Bidco Limited |

| 12,603,716 | ||

| AQ Sage Buyer, LLC |

| ||||

| 11,268,606 | Delayed Draw, 10.696% (SOFR+575 basis points), 1/25/20272,3,4 |

| 10,837,730 | ||

| 13,593,870 | First Lien Term Loan, 10.792% (SOFR+575 basis points), 1/25/20272,3,4 |

| 12,971,943 | ||

| AQ Sunshine, Inc. |

| ||||

| 200,000 | Revolver, 0.500%, 4/15/20242,4,6 |

| 193,354 | ||

| 1,883,333 | Revolver, 11.409% (LIBOR+625 basis points), 4/15/20242,3,4 |

| 1,820,755 | ||

| 22,698,021 | Delayed Draw, 11.409% (LIBOR+625 basis points), 4/15/20252,3,4 |

| 21,943,820 | ||

| CC SAG Acquisition Corp. |

| ||||

| 699,301 | Revolver, 0.500%, 6/29/20272,4,6 |

| 665,724 | ||

| 1,356,643 | Delayed Draw, 1.000%, 6/29/20282,4,6 |

| 1,291,505 | ||

| 3,864,292 | Delayed Draw, 10.909% (LIBOR+575 basis points), 6/29/20282,3,4 |

| 3,678,751 | ||

| 18,770,105 | First Lien Term Loan, 10.909% (LIBOR+575 basis points), 6/29/20282,3,4 |

| 17,868,871 | ||

See accompanying Notes to Consolidated Financial Statements.

13

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| FINANCIALS (Continued) |

| ||||

| Cerity Partners, LLC |

| ||||

$ | 443,192 | Revolver, 0.500%, 7/28/20292,4,6 | $ | 412,926 | ||

| 17,500,000 | Delayed Draw, 1.000%, 7/28/20292,4,6 |

| 16,977,160 | ||

| 7,183,873 | First Lien Term Loan, 11.291% (SOFR+650 basis points), 7/28/20292,3,4 |

| 6,693,273 | ||

| 12,500,000 | First Lien Term Loan, 11.541% (SOFR+650 basis points), 7/28/20292,3,4 |

| 12,126,543 | ||

| CFGI Holdings, LLC |

| ||||

| 1,751,825 | Revolver, 0.500%, 11/2/20272,4,6 |

| 1,698,003 | ||

| 2,189,781 | Delayed Draw, 1.000%, 11/2/20272,4,6 |

| 2,138,958 | ||

| 15,897,810 | First Lien Term Loan, 10.157% (LIBOR+525 basis points), 11/2/20272,3,4 |

| 15,409,382 | ||

| Cherry Bekaert Advisory LLC |

| ||||

| 1,661,392 | Revolver, 0.500%, 6/30/20282,4,6 |

| 1,626,994 | ||

| 712,025 | Revolver, 10.307% (SOFR+550 basis points), 6/30/20282,3,4,5 |

| 697,283 | ||

| Credit Connection, LLC |

| ||||

| 9,689,500 | First Lien Term Loan, 10.909% (LIBOR+575 basis points), 7/30/20262,3,4 |

| 9,611,056 | ||

| 600,000 | Revolver, 0.500%, 7/30/20262,4,6 |

| 595,142 | ||

| 9,080,098 | Cresset Asset Management, LLC |

| 8,979,972 | ||

| EUR 627,356 | Dreamstart BidCo |

| 662,520 | ||

| EdgeCo Buyer, Inc. |

| ||||

| 10,000,000 | Delayed Draw, 1.000%, 6/30/20232,4,6 |

| 9,685,757 | ||

| 2,475,000 | First Lien Term Loan, 9.715% (SOFR+475 basis points), 9/29/20232,3,4 |

| 2,397,225 | ||

| 11,969,925 | Eisner Advisory Group LLC |

| 11,509,005 | ||

| EP Wealth Advisors, LLC |

| ||||

| 8,640,000 | Delayed Draw, 1.000%, 9/4/20262,4,6 |

| 8,525,494 | ||

| 3,960,000 | Delayed Draw, 10.728% (SOFR+575 basis points), 9/4/20262,3,4 |

| 3,907,518 | ||

| 5,386,500 | First Lien Term Loan, 10.798% (SOFR+575 basis points), 9/4/20262,3,4 |

| 5,234,172 | ||

| Exegy, Inc. |

| ||||

| 10,779,645 | First Lien Term Loan, 10.907% (LIBOR+600 basis points), 5/17/20262,3,4 |

| 10,466,821 | ||

| Foundation Risk Partners, Corp. |

| ||||

| 5,090,909 | Delayed Draw, 1.000%, 10/29/20282,4,6 |

| 5,004,458 | ||

| 4,772,727 | Delayed Draw, 1.000%, 10/29/20282,4,6 |

| 4,691,679 | ||

| 21,136,364 | First Lien Term Loan, 11.748% (SOFR+675 basis points), 10/29/20282,3,4 |

| 20,461,029 | ||

| Galway Borrower, LLC |

| ||||

| 127,566 | Delayed Draw, 1.000%, 9/30/20232,4,6 |

| 122,369 | ||

| 545,223 | Revolver, 0.500%, 9/30/20272,4,6 |

| 523,010 | ||

| 576,059 | Revolver, 0.500%, 9/30/20272,4,6 |

| 552,589 | ||

| 690,616 | Revolver, 0.500%, 9/30/20272,4,6 |

| 662,479 | ||

| 293,856 | Revolver, 0.500%, 9/30/20272,4,6 |

| 281,884 | ||

See accompanying Notes to Consolidated Financial Statements.

14

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| FINANCIALS (Continued) |

| ||||

$ | 149,329 | Revolver, 10.413% (SOFR+525 basis points), 9/30/20272,3,4 | $ | 143,245 | ||

| 238,257 | Revolver, 10.413% (SOFR+525 basis points), 9/30/20272,3,4 |

| 228,550 | ||

| 189,150 | Revolver, 10.413% (SOFR+525 basis points), 9/30/20272,3,4 |

| 181,443 | ||

| 261,395 | Delayed Draw, 1.000%, 9/30/20282,4,6 |

| 250,745 | ||

| 42,135,248 | First Lien Term Loan, 10.409% (SOFR+525 basis points), 9/30/20282,3,4 |

| 40,418,601 | ||

| EUR 8,500,000 | Groupe Premium |

| 9,191,376 | ||

| Helibron Midco B.V. |

| ||||

| EUR 322,466 | First Lien Term Loan, 7.698% (EURIBOR+500 basis points), 9/17/20262,3,4,7 |

| 334,234 | ||

| EUR 14,409,908 | First Lien Term Loan, 7.698% (EURIBOR+500 basis points), 9/18/20262,3,4,7 |

| 14,935,799 | ||

| EUR 26,551,148 | HG Genesis 9 Sumoco Limited |

| 28,563,991 | ||

| Higginbotham Insurance Agency, Inc. |

| ||||

| 5,357,500 | Delayed Draw, 1.000%, 11/25/20262,4,6 |

| 5,301,322 | ||

| 9,557,129 | Delayed Draw, 1.000%, 11/25/20262,4,6 |

| 9,456,914 | ||

| 9,611,435 | Delayed Draw, 10.090% (LIBOR+525 basis points), 11/25/20262,3,4 |

| 9,510,651 | ||

| 17,145,634 | Delayed Draw, 10.090% (LIBOR+525 basis points), 11/25/20262,3,4,5 |

| 16,965,846 | ||

| 18,112,780 | First Lien Term Loan, 10.090% (LIBOR+525 basis points), 11/25/20262,3,4,5 |

| 17,922,850 | ||

| HPS Financials |

| ||||

| 2,677,508 | First Lien Term Loan, 12.159% (LIBOR+700 basis points), 6/29/20232,3,4,5 |

| 2,706,877 | ||

| EUR 3,570,450 | First Lien Term Loan, 7.602% (EURIBOR+550 basis points), 9/30/20262,3,4,7 |

| 3,860,865 | ||

| GBP 4,517,888 | First Lien Term Loan, 9.055% (SONIA+500 basis points), 9/30/20262,3,4,7 |

| 5,557,359 | ||

| HPS Specialty Loan Fund V Feeder LP |

| ||||

| 116,250,000 | First Lien Term Loan, 7.954%, 5/14/20312,4,11 |

| 116,250,000 | ||

| 71,250,000 | First Lien Term Loan, 7.954%, 5/14/20312,4,6 |

| 71,250,000 | ||

| EUR 3,700,000 | iM Global Partner |

| 3,891,311 | ||

| Integrity Marketing Acquisition, LLC |

| ||||

| 1,477,496 | Revolver, 0.500%, 8/27/20252,4,6 |

| 1,362,990 | ||

| 2,927,367 | Delayed Draw, 1.000%, 8/27/20252,4,6 |

| 2,874,089 | ||

| 13,061,603 | Delayed Draw, 10.911% (SOFR+602 basis points), 8/27/20252,3,4,5 |

| 12,823,881 | ||

| 1,477,496 | First Lien Term Loan, 11.391% (SOFR+650 basis points), 8/27/20252,3,4 |

| 1,451,640 | ||

| J S Held, LLC |

| ||||

| 7,620,003 | Delayed Draw, 1.000%, 7/1/20252,4,6 |

| 7,581,324 | ||

| 45,344,635 | First Lien Term Loan, 10.659% (LIBOR+550 basis points), 7/1/20252,3,4,5 |

| 45,114,466 | ||

| 9,789,028 | Delayed Draw, 10.230% (LIBOR+550 basis points), 7/1/20252,3,4,5 |

| 9,739,339 | ||

| 8,767,395 | First Lien Term Loan, 10.230% (LIBOR+550 basis points), 7/1/20252,3,4,5 |

| 8,722,892 | ||

| 2,977,017 | Delayed Draw, 10.319% (LIBOR+550 basis points), 7/1/20252,3,4,5 |

| 2,961,906 | ||

| Kensington Private Equity Fund |

| ||||

| 6,800,000 | Delayed Draw, 1.000%, 3/28/20262,4,5,6 |

| 6,708,959 | ||

| 6,800,000 | First Lien Term Loan, 11.900% PIK (SOFR+700 basis points), 3/28/20262,3,4,5,8 |

| 6,708,959 | ||

See accompanying Notes to Consolidated Financial Statements.

15

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| FINANCIALS (Continued) |

| ||||

| Keystone Agency Investors |

| ||||

$ | 6,163,035 | Delayed Draw, 1.000%, 5/3/20272,4,6 | $ | 6,054,572 | ||

| 8,952,750 | Delayed Draw, 10.798% (SOFR+575 basis points), 5/3/20272,3,4 |

| 8,795,191 | ||

| 5,596,875 | Delayed Draw, 10.798% (SOFR+575 basis points), 5/3/20272,3,4 |

| 5,498,376 | ||

| 3,786,555 | Delayed Draw, 10.798% (SOFR+575 basis points), 5/3/20272,3,4 |

| 3,719,915 | ||

| 15,406,910 | First Lien Term Loan, 10.798% (SOFR+575 basis points), 5/3/20272,3,4 |

| 15,135,765 | ||

| KWOR Acquisition, Inc. |

| ||||

| 1,154,699 | Revolver, 0.500%, 12/22/20272,4,6 |

| 1,125,007 | ||

| 954,340 | Revolver, 12.000% (LIBOR+525 basis points), 12/22/20272,3,4 |

| 929,800 | ||

| 15,313,231 | Delayed Draw, 1.000%, 12/22/20282,4,5,6 |

| 15,072,883 | ||

| 15,109,154 | First Lien Term Loan, 10.090% (LIBOR+525 basis points), 12/22/20282,3,4 |

| 14,720,639 | ||

| Mclarens Midco, Inc. |

| ||||

| 580,838 | Revolver, 0.500%, 12/19/20252,4,5,6 |

| 567,357 | ||

| 2,904,188 | Revolver, 10.514% (LIBOR+575 basis points), 12/19/20252,3,4,5 |

| 2,836,784 | ||

| Oakbridge Insurance Agency LLC |

| ||||

| 343,966 | Revolver, 0.500%, 12/31/20262,4,6 |

| 333,019 | ||

| 12,008,621 | Delayed Draw, 1.000%, 12/31/20262,4,6 |

| 11,626,446 | ||

| 3,021,632 | Delayed Draw, 10.657% (SOFR+575 basis points), 12/31/20262,3,4 |

| 2,925,469 | ||

| 259,483 | Revolver, 10.657% (SOFR+575 basis points), 12/31/20262,3,4 |

| 251,225 | ||

| 1,792,241 | First Lien Term Loan, 10.657% (SOFR+575 basis points), 12/31/20262,3,4 |

| 1,735,203 | ||

| Patriot Growth Insurance Services, LLC |

| ||||

| 2,660,377 | Revolver, 0.500%, 10/14/20282,4,6 |

| 2,571,979 | ||

| 1,854,545 | Delayed Draw, 1.000%, 10/14/20282,4,6 |

| 1,820,793 | ||

| 24,830,120 | Delayed Draw, 1.000%, 10/14/20282,4,6 |

| 24,378,210 | ||

| 5,795,536 | Delayed Draw, 10.401% (LIBOR+550 basis points), 10/14/20282,3,4 |

| 5,690,057 | ||

| 24,703,138 | First Lien Term Loan, 10.663% (LIBOR+550 basis points), 10/14/20282,3,4 |

| 23,882,312 | ||

| Peter C. Foy & Associates Insurance Services, LLC |

| ||||

| 53,353,616 | Delayed Draw, 11.124% (SOFR+600 basis points), 11/1/20282,3,4 |

| 53,199,001 | ||

| 21,321,429 | First Lien Term Loan, 11.124% (SOFR+600 basis points), 11/1/20282,3,4 |

| 21,259,640 | ||

| Petrus Buyer, Inc. |

| ||||

| 1,923,077 | Revolver, 0.500%, 10/17/20292,4,6 |

| 1,869,747 | ||

| 5,494,505 | Delayed Draw, 1.000%, 10/17/20292,4,6 |

| 5,424,744 | ||

| 17,582,418 | First Lien Term Loan, 10.699% (SOFR+650 basis points), 10/17/20292,3,4 |

| 17,094,829 | ||

| 16,039,152 | Retail Services Corporation |

| 15,524,494 | ||

| Riveron Acquisition Holdings, Inc. |

| ||||

| 855,545 | First Lien Term Loan, 8.001% (LIBOR+575 basis points), 5/22/20252,3,4 |

| 853,066 | ||

| 7,926,061 | First Lien Term Loan, 10.909% (LIBOR+575 basis points), 5/22/20252,3,4 |

| 7,903,091 | ||

| RSC Acquisition, Inc. |

| ||||

| 48,299,149 | First Lien Term Loan, 10.326% (SOFR+550 basis points), 10/30/20262,3,4,5 |

| 46,452,345 | ||

| 2,641,633 | Delayed Draw, 10.541% (SOFR+550 basis points), 10/30/20262,3,4,5 |

| 2,540,626 | ||

| 3,330,549 | Revolver, 0.500%, 11/1/20262,4,5,6 |

| 3,203,199 | ||

| 16,289,385 | First Lien Term Loan, 10.326% (SOFR+550 basis points), 11/1/20262,3,4 |

| 15,666,532 | ||

See accompanying Notes to Consolidated Financial Statements.

16

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| FINANCIALS (Continued) |

| ||||

$ | 5,360,000 | Revolver, 10.683% (SOFR+550 basis points), 11/1/20262,3,4,5 | $ | 5,155,050 | ||

| 1,414,737 | Delayed Draw, 1.000%, 5/31/20292,4,6 |

| 1,360,642 | ||

| 157,895 | Delayed Draw, 10.541% (SOFR+550 basis points), 5/31/20292,3,4 |

| 151,857 | ||

| Spirit RR Holdings, Inc. |

| ||||

| 100,316 | Revolver, 0.500%, 9/13/20282,4,6 |

| 97,307 | ||

| 1,217,466 | First Lien Term Loan, 11.498% (SOFR+650 basis points), 9/13/20282,3,4 |

| 1,180,942 | ||

| 1,500,000 | StarCompliance Intermediate, LLC |

| 1,405,076 | ||

| 1,424,528 | The Ultimus Group Midco, LLC |

| 1,402,170 | ||

| THG Acquisition, LLC |

| ||||

| 619,903 | Revolver, 0.500%, 12/2/20252,4,6 |

| 614,831 | ||

| 123,981 | Revolver, 10.590% (LIBOR+575 basis points), 12/2/20252,3,4 |

| 122,966 | ||

| 4,327,750 | Delayed Draw, 1.000%, 12/2/20262,4,6 |

| 4,259,824 | ||

| 9,909,961 | Delayed Draw, 10.340% (LIBOR+550 basis points), 12/2/20262,3,4 |

| 9,754,420 | ||

| Turbo Buyer, Inc. |

| ||||

| 3,000,000 | Delayed Draw, 1.000%, 12/2/20252,4,6 |

| 2,897,312 | ||

| 4,949,000 | Delayed Draw, 11.151% (LIBOR+600 basis points), 12/2/20252,3,4 |

| 4,779,598 | ||

| 4,937,500 | First Lien Term Loan, 11.151% (LIBOR+600 basis points), 12/2/20252,3,4 |

| 4,768,492 | ||

| 1,998,667 | Delayed Draw, 11.151% (LIBOR+600 basis points), 12/2/20252,3,4 |

| 1,930,253 | ||

| Vale Insurance Services LLC |

| ||||

| 2,419,355 | Revolver, 0.500%, 12/1/20272,4,6 |

| 2,337,269 | ||

| 22,354,839 | First Lien Term Loan, 10.048% (LIBOR+500 basis points), 12/1/20272,3,4 |

| 21,596,364 | ||

| 439,990 | Wealth Enhancement Group, LLC |

| 425,371 | ||

| World Insurance Associates, LLC |

| ||||

| 5,405,000 | Delayed Draw, 1.000%, 5/26/20282,4,6 |

| 5,245,440 | ||

| 12,264,344 | Delayed Draw, 10.648% (SOFR+575 basis points), 12/1/20272,3,4 |

| 11,902,291 | ||

| 2,677,869 | First Lien Term Loan, 10.648% (SOFR+575 basis points), 4/1/20262,3,4 |

| 2,598,816 | ||

| 14,595,000 | Delayed Draw, 10.648% (SOFR+575 basis points), 5/26/20282,3,4 |

| 14,164,144 | ||

|

| 1,283,424,837 | ||||

| GOVERNMENTS — 0.3% |

| ||||

| Govdelivery Holdings, LLC |

| ||||

| 7,063 | First Lien Term Loan, 0.000%, 1/29/20272,4,6 |

| 6,935 | ||

| 254,493 | Revolver, 0.500%, 1/29/20272,4,6 |

| 249,862 | ||

| 6,054,193 | First Lien Term Loan, 10.340% PIK (SOFR+550 basis points), 1/29/20272,3,4,8 |

| 5,944,006 | ||

| 281,908 | Revolver, 11.170% (SOFR+650 basis points), 1/29/20272,3,4 |

| 276,777 | ||

| 8,370,190 | Delayed Draw, 10.841% (SOFR+600 basis points), 1/29/20272,3,4 |

| 8,217,851 | ||

| Prime Buyer, LLC |

| ||||

| 3,213,443 | Revolver, 0.500%, 12/22/20262,4,6 |

| 3,109,566 | ||

| 642,689 | Revolver, 10.157% (LIBOR+525 basis points), 12/22/20262,3,4 |

| 621,913 | ||

| 9,369,294 | First Lien Term Loan, 10.157% (LIBOR+525 basis points), 12/22/20262,3,4 |

| 9,066,423 | ||

|

| 27,493,333 | ||||

See accompanying Notes to Consolidated Financial Statements.

17

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE — 16.5% |

| ||||

| 123Dentist, Inc. |

| ||||

| CAD 6,681,175 | Delayed Draw, 1.000%, 8/10/20292,4,6,7 | $ | 4,927,843 | ||

| CAD 3,333,333 | Delayed Draw, 1.000%, 8/10/20292,4,7 |

| 2,446,228 | ||

| CAD 50,030,877 | First Lien Term Loan, 10.673% (CDOR+575 basis points), 8/10/20292,3,4,7 |

| 36,468,908 | ||

| AAH Topco, LLC |

| ||||

$ | 423,729 | Revolver, 0.500%, 12/22/20272,4,6 |

| 407,527 | ||

| 1,423,117 | Delayed Draw, 1.000%, 12/22/20272,4,6 |

| 1,379,395 | ||

| 2,932,143 | Delayed Draw, 10.340% (LIBOR+550 basis points), 12/22/20272,3,4 |

| 2,842,059 | ||

| 4,066,947 | First Lien Term Loan, 10.340% (LIBOR+550 basis points), 12/22/20272,3,4 |

| 3,911,440 | ||

| ACI Group Holdings, Inc. |

| ||||

| 2,214,643 | Delayed Draw, 1.000% PIK, 8/2/20282,4,6,8 |

| 2,167,014 | ||

| 1,529,985 | Delayed Draw, 10.590% PIK (LIBOR+575 basis points), 8/2/20282,3,4,8 |

| 1,497,081 | ||

| 10,057,686 | First Lien Term Loan, 10.657% PIK (LIBOR+575 basis points), 8/2/20282,3,4,8 |

| 9,841,384 | ||

| ADCS Clinics Intermediate Holdings, LLC |

| ||||

| 5,433,471 | Delayed Draw, 1.000%, 5/7/20272,4,6 |

| 5,015,595 | ||

| 10,913,058 | First Lien Term Loan, 11.428% (LIBOR+650 basis points), 5/7/20272,3,4 |

| 10,001,601 | ||

| 2,236,999 | Delayed Draw, 11.747% (LIBOR+650 basis points), 5/7/20272,3,4 |

| 2,064,957 | ||

| ADMA Bilogics, Inc. |

| ||||

| 3,571,429 | Delayed Draw, 1.000%, 3/23/20272,4,5,6 |

| 3,561,079 | ||

| 22,246,818 | First Lien Term Loan, 14.407% PIK (SOFR+950 basis points), 3/23/20272,3,4,5,8 |

| 22,182,348 | ||

| Advarra Holdings, Inc. |

| ||||

| 352,200 | Delayed Draw, 1.000%, 8/24/20292,4,6 |

| 349,118 | ||

| 3,888,055 | First Lien Term Loan, 10.557% (SOFR+575 basis points), 8/24/20292,3,4 |

| 3,820,015 | ||

| 1,123,541 | AEC Parent Holdings, Inc. |

| 1,103,092 | ||

| Affinity Hospice Intermediate Holdings, LLC |

| ||||

| 2,724,335 | Delayed Draw, 1.000%, 12/17/20272,4,5,6 |

| 2,654,281 | ||

| 11,153,583 | First Lien Term Loan, 9.909% (LIBOR+475 basis points), 12/17/20272,3,4,5 |

| 10,838,846 | ||

| AG-Twin Brook Healthcare |

| ||||

| 7,570,000 | Delayed Draw, 11.438% (SOFR+650 basis points), 4/2/20242,3,4 |

| 7,533,082 | ||

| 12,114,999 | First Lien Term Loan, 11.652% (SOFR+650 basis points), 4/2/20242,3,4 |

| 12,055,916 | ||

| 19,432,886 | First Lien Term Loan, 11.381% (SOFR+650 basis points), 5/16/20242,3,4,5 |

| 19,334,201 | ||

| 29,441,256 | First Lien Term Loan, 12.160% (SOFR+700 basis points), 7/1/20242,3,4,5 |

| 28,896,575 | ||

| 13,783,430 | First Lien Term Loan, 11.409% (LIBOR+625 basis points), 11/27/20242,3,4,5 |

| 13,716,276 | ||

| 1,676,549 | First Lien Term Loan, 11.172% (SOFR+625 basis points), 7/3/20252,3,4,5 |

| 1,664,792 | ||

| 19,749,338 | First Lien Term Loan, 10.910% (SOFR+575 basis points), 9/25/20252,3,4,5 |

| 19,553,099 | ||

| 6,865,682 | First Lien Term Loan, 11.160% (SOFR+600 basis points), 3/5/20262,3,4,5 |

| 2,963,915 | ||

| 9,850,520 | First Lien Term Loan, 10.922% (LIBOR+600 basis points), 6/10/20262,3,4,5 |

| 9,788,407 | ||

| CAD 24,625,000 | First Lien Term Loan, 10.778% (LIBOR+575 basis points), 7/23/20262,3,4,7 |

| 17,999,266 | ||

| 14,812,500 | First Lien Term Loan, 11.422% (LIBOR+650 basis points), 8/20/20262,3,4,5 |

| 14,676,863 | ||

| 24,625,000 | First Lien Term Loan, 10.401% (LIBOR+525 basis points), 9/22/20262,3,4,5 |

| 24,321,098 | ||

| 19,800,000 | First Lien Term Loan, 11.085% (SOFR+600 basis points), 10/8/20262,3,4,5 |

| 19,673,603 | ||

| 19,895,555 | Delayed Draw, 11.410% (SOFR+625 basis points), 10/29/20262,3,4,5 |

| 19,684,195 | ||

See accompanying Notes to Consolidated Financial Statements.

18

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE (Continued) |

| ||||

$ | 19,700,000 | First Lien Term Loan, 10.590% (LIBOR+575 basis points), 12/14/20262,3,4,5 | $ | 19,569,811 | ||

| 14,850,000 | First Lien Term Loan, 11.160% (LIBOR+600 basis points), 12/31/20262,3,4,5 |

| 14,647,005 | ||

| 9,930,556 | Delayed Draw, 1.000%, 2/23/20272,4,6 |

| 9,840,067 | ||

| 2,200,000 | Delayed Draw, 11.160% (SOFR+600 basis points), 2/23/20272,3,4 |

| 2,179,953 | ||

| 12,718,750 | First Lien Term Loan, 11.160% (SOFR+600 basis points), 2/23/20272,3,4 |

| 12,602,855 | ||

| AHR Intermediate, Inc. |

| ||||

| 10,500,000 | Delayed Draw, 1.000%, 7/29/20272,4,6 |

| 10,424,719 | ||

| 24,316,250 | First Lien Term Loan, 10.902% (SOFR+575 basis points), 7/29/20272,3,4 |

| 24,118,262 | ||

| Alcami Corporation |

| ||||

| 3,052,838 | Revolver, 0.500%, 12/21/20282,4,6 |

| 2,950,949 | ||

| 1,908,023 | Delayed Draw, 1.000%, 12/21/20282,4,6 |

| 1,844,343 | ||

| 22,839,041 | First Lien Term Loan, 11.907% (SOFR+710 basis points), 12/21/20282,3,4 |

| 22,076,790 | ||

| 5,253,731 | Alegeus Technologies Holding Corp. |

| 5,223,905 | ||

| 11,790,000 | American Renal Associates Holdings, Inc. |

| 11,002,768 | ||

| 7,860,000 | AWC-MH Acquisition |

| 4,699,836 | ||

| Biocare Medical LLC |

| ||||

| 2,583,333 | Revolver, 0.500%, 12/9/20272,4,6 |

| 2,497,495 | ||

| 194,444 | Revolver, 10.704% (LIBOR+575 basis points), 12/9/20272,3,4 |

| 187,984 | ||

| 21,944,444 | First Lien Term Loan, 10.741% (LIBOR+575 basis points), 12/9/20272,3,4 |

| 21,215,283 | ||

| 12,003,487 | Bridges Consumer Healthcare |

| 11,634,703 | ||

| Carevet LLC |

| ||||

| 4,530,505 | Delayed Draw, 1.000%, 9/1/20252,4,6 |

| 4,466,205 | ||

| 9,850,000 | Delayed Draw, 11.340% (LIBOR+650 basis points), 9/1/20252,3,4 |

| 9,710,202 | ||

| 7,581,000 | Delayed Draw, 11.340% (LIBOR+650 basis points), 9/1/20252,3,4 |

| 7,473,405 | ||

| 5,712,041 | First Lien Term Loan, 16.840% (LIBOR+1,200 basis points), 9/1/20252,3,4 |

| 5,637,339 | ||

| CNSI Holdings LLC |

| ||||

| 1,735,776 | Revolver, 0.500%, 12/17/20272,4,6 |

| 1,678,101 | ||

| 18,218,563 | First Lien Term Loan, 11.093% (SOFR+650 basis points), 12/17/20282,3,4 |

| 17,613,204 | ||

| 41,000,000 | Color Intermediate, LLC |

| 40,253,995 | ||

| Community Medical Acquisition Corp. |

| ||||

| 2,578,774 | Revolver, 0.500%, 12/15/20272,4,6 |

| 2,467,252 | ||

| 1,105,189 | Revolver, 9.504% (LIBOR+475 basis points), 12/15/20272,3,4 |

| 1,057,394 | ||

| 4,333,814 | Delayed Draw, 1.000%, 12/15/20282,4,6 |

| 4,178,957 | ||

| 25,470,048 | First Lien Term Loan, 9.519% (LIBOR+475 basis points), 12/15/20282,3,4 |

| 24,368,571 | ||

See accompanying Notes to Consolidated Financial Statements.

19

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE (Continued) |

| ||||

| Connect America.com, LLC |

| ||||

$ | 216,146 | Revolver, 0.500%, 6/30/20262,4,6 | $ | 202,901 | ||

| 7,346,835 | First Lien Term Loan, 12.041% (LIBOR+700 basis points), 6/30/20262,3,4 |

| 6,896,628 | ||

| 462,915 | Revolver, 12.048% (LIBOR+700 basis points), 6/30/20262,3,4 |

| 434,548 | ||

| CORA Health Holdings Corp. |

| ||||

| 5,169,567 | Delayed Draw, 0.500%, 6/15/20272,4,6 |

| 4,958,951 | ||

| 134,615 | Revolver, 0.500%, 6/15/20272,4,6 |

| 129,131 | ||

| 13,621,489 | First Lien Term Loan, 10.717% (LIBOR+575 basis points), 6/15/20272,3,4 |

| 13,066,531 | ||

| 634,615 | Revolver, 10.870% (LIBOR+575 basis points), 6/15/20272,3,4 |

| 608,760 | ||

| 230,861 | Delayed Draw, 10.878% (LIBOR+575 basis points), 6/15/20272,3,4 |

| 221,456 | ||

| Covaris Intermediate 3, LLC |

| ||||

| 789,474 | Revolver, 0.500%, 1/21/20282,4,6 |

| 755,728 | ||

| 5,921,053 | Delayed Draw, 1.000%, 1/21/20282,4,6 |

| 5,667,957 | ||

| 394,737 | Revolver, 9.909% (LIBOR+475 basis points), 1/21/20282,3,4 |

| 377,864 | ||

| 7,835,526 | First Lien Term Loan, 9.909% (LIBOR+475 basis points), 1/21/20282,3,4 |

| 7,500,596 | ||

| CPC/Cirtec Holdings, Inc. |

| ||||

| 826,873 | Revolver, 0.500%, 10/31/20282,4,6 |

| 797,766 | ||

| 206,718 | Revolver, 11.067% (SOFR+625 basis points), 10/31/20282,3,4 |

| 199,441 | ||

| 8,966,408 | First Lien Term Loan, 11.148% (SOFR+625 basis points), 1/30/20292,3,4 |

| 8,650,771 | ||

| CPF Dental, LLC |

| ||||

| 587,121 | Delayed Draw, 1.000%, 8/30/20242,4,6 |

| 574,082 | ||

| 5,314,906 | First Lien Term Loan, 13.500% (LIBOR+850 basis points), 8/30/20242,3,4,5 |

| 5,196,875 | ||

| 2,861,089 | Delayed Draw, 13.688% (LIBOR+850 basis points), 8/30/20242,3,4,5 |

| 2,797,552 | ||

| 7,225,481 | Delayed Draw, 13.688% (LIBOR+850 basis points), 8/30/20242,3,4,5 |

| 7,065,022 | ||

| 13,825,000 | Crossroads Holding, LLC |

| 13,296,376 | ||

| D4C Dental Brands, Inc. |

| ||||

| 357,143 | Revolver, 0.500%, 12/30/20262,4,6 |

| 356,108 | ||

| 376,771 | Delayed Draw, 1.000%, 12/30/20262,4,6 |

| 378,653 | ||

| 357,143 | Revolver, 11.429% (SOFR+650 basis points), 12/30/20262,3,4 |

| 356,108 | ||

| 2,625,810 | Delayed Draw, 11.541% (SOFR+650 basis points), 12/30/20262,3,4 |

| 2,638,920 | ||

| 1,921,001 | Delayed Draw, 11.541% (SOFR+650 basis points), 12/30/20262,3,4 |

| 1,930,592 | ||

| 6,458,482 | First Lien Term Loan, 11.548% (SOFR+650 basis points), 12/30/20262,3,4 |

| 6,490,728 | ||

| DCA Holdings LLC |

| ||||

| 15,789,663 | First Lien Term Loan, 10.386% (LIBOR+600 basis points), 3/12/20272,3,4,5 |

| 15,105,242 | ||

| 3,934,938 | Delayed Draw, 10.718% (LIBOR+600 basis points), 3/12/20272,3,4,5 |

| 3,764,373 | ||

| Deca Dental Holdings, LLC |

| ||||

| 74,074 | Revolver, 0.500%, 8/26/20282,4,6 |

| 71,019 | ||

| 3,333,333 | Delayed Draw, 1.000%, 8/26/20282,4,6 |

| 3,195,859 | ||

| 1,459,259 | Delayed Draw, 10.909% (LIBOR+575 basis points), 8/26/20282,3,4 |

| 1,399,076 | ||

| 1,037,037 | Revolver, 10.909% (LIBOR+575 basis points), 8/26/20282,3,4 |

| 994,267 | ||

| 13,862,963 | First Lien Term Loan, 10.909% (LIBOR+575 basis points), 8/26/20282,3,4 |

| 13,291,222 | ||

See accompanying Notes to Consolidated Financial Statements.

20

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE (Continued) |

| ||||

| Dermatopathology Laboratory Of Central States, LLC |

| ||||

$ | 6,900,806 | First Lien Term Loan, 10.442% (SOFR+575 basis points), 6/1/20282,3,4 | $ | 6,724,052 | ||

| 10,351,210 | First Lien Term Loan, 10.542% (SOFR+575 basis points), 6/1/20282,3,4 |

| 10,086,077 | ||

| DOCS MSO LLC |

| ||||

| 967,742 | Revolver, 0.500%, 6/1/20282,4,6 |

| 942,955 | ||

| 645,161 | Revolver, 0.500%, 6/1/20282,4,6 |

| 628,636 | ||

| 3,629,032 | Delayed Draw, 1.000%, 6/1/20282,4,6 |

| 3,536,080 | ||

| 2,419,355 | Delayed Draw, 1.000%, 6/1/20282,4,6 |

| 2,357,386 | ||

| Emmes Blocker, Inc. |

| ||||

| 7,107,473 | Delayed Draw, 1.000%, 7/7/20282,4,5,6 |

| 7,049,322 | ||

| 3,475,610 | Delayed Draw, 1.000%, 7/7/20282,4,6 |

| 3,447,173 | ||

| 8,211,128 | First Lien Term Loan, 9.519% (SOFR+550 basis points), 7/7/20282,3,4 |

| 8,061,685 | ||

| 4,104,566 | Delayed Draw, 10.243% (SOFR+550 basis points), 7/7/20282,3,4,5 |

| 4,070,984 | ||

| 2,007,165 | Delayed Draw, 10.243% (SOFR+550 basis points), 7/7/20282,3,4 |

| 1,990,743 | ||

| 10,696,250 | Ensemble RCM, LLC |

| 10,287,260 | ||

| ERC Holdings, LLC |

| ||||

| 852,071 | Revolver, 0.500%, 11/10/20272,4,6 |

| 808,820 | ||

| 3,994,755 | Revolver, 0.500%, 11/10/20272,4,6 |

| 3,791,982 | ||

| 2,663,169 | Revolver, 10.150% (LIBOR+550 basis points), 11/10/20272,3,4,5 |

| 2,527,987 | ||

| 568,047 | Revolver, 10.267% (LIBOR+550 basis points), 11/10/20272,3,4 |

| 539,213 | ||

| 15,651,538 | First Lien Term Loan, 10.659% (LIBOR+550 basis points), 11/10/20282,3,4 |

| 14,857,070 | ||

| 14,812,500 | FH MD Buyer, Inc. |

| 14,246,118 | ||

| 20,000,000 | Finthrive Software Intermediate Holdings, Inc. |

| 19,125,817 | ||

| Fortis Life Sciences, LLC |

| ||||

| 1,095,652 | Revolver, 0.500%, 9/17/20272,4,6 |

| 1,061,990 | ||

| 8,671,280 | Delayed Draw, 1.000%, 9/17/20272,4,6 |

| 8,404,872 | ||

| 1,339,130 | Revolver, 10.351% (LIBOR+525 basis points), 9/17/20272,3,4 |

| 1,297,988 | ||

| 2,434,783 | Delayed Draw, 10.384% (LIBOR+525 basis points), 9/17/20272,3,4 |

| 2,359,979 | ||

| 14,305,059 | First Lien Term Loan, 10.409% (LIBOR+525 basis points), 9/17/20272,3,4 |

| 13,865,564 | ||

| CAD 36,758,217 | FYI Optical Acquisitions, Inc. & FYI USA Inc. |

| 26,275,288 | ||

| Helium Acquirer Corporation |

| ||||

| 1,325,448 | Revolver, 0.500%, 1/5/20292,4,6 |

| 1,287,291 | ||

| 3,313,620 | Delayed Draw, 1.000%, 1/5/20292,4,6 |

| 3,267,993 | ||

| 331,362 | Revolver, 11.998% (SOFR+710 basis points), 1/5/20292,3,4 |

| 321,823 | ||

| 10,904,570 | First Lien Term Loan, 11.998% (SOFR+710 basis points), 1/5/20292,3,4 |

| 10,590,646 | ||

| 9,596,286 | HPS Healthcare |

| 9,568,476 | ||

See accompanying Notes to Consolidated Financial Statements.

21

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE (Continued) |

| ||||

| Integrated Oncology Network, LLC |

| ||||

$ | 83,957 | Revolver, 0.500%, 6/24/20242,4,6 | $ | 83,714 | ||

| 7,422,431 | First Lien Term Loan, 10.743% (SOFR+600 basis points), 6/24/20242,3,4 |

| 7,400,921 | ||

| 134,701 | Revolver, 0.500%, 6/24/20252,4,6 |

| 134,311 | ||

| 1,114,395 | Delayed Draw, 1.000%, 6/24/20252,4,6 |

| 1,111,165 | ||

| 746,794 | Delayed Draw, 10.743% (SOFR+600 basis points), 6/24/20252,3,4 |

| 744,630 | ||

| IvyRehab Intermediate II, LLC |

| ||||

| 3,837,719 | Revolver, 0.500%, 4/21/20292,4,6 |

| 3,604,470 | ||

| 882,675 | Delayed Draw, 1.000%, 4/21/20292,4,6 |

| 833,450 | ||

| 6,766,667 | Delayed Draw, 9.483% (SOFR+485 basis points), 4/21/20292,3,4 |

| 6,389,297 | ||

| 23,310,691 | First Lien Term Loan, 9.483% (SOFR+485 basis points), 4/21/20292,3,4 |

| 21,893,911 | ||

| NZD 6,300,000 | Jon Bidco Limited |

| 3,796,730 | ||

| 14,285,714 | Liberty Dental Plan |

| 14,000,000 | ||

| Life Science Intermediate Holdings, LLC |

| ||||

| 188,281 | Revolver, 0.500%, 6/10/20272,4,6 |

| 181,374 | ||

| 468,376 | Revolver, 0.500%, 6/10/20272,4,6 |

| 451,194 | ||

| EUR 6,000,000 | Delayed Draw, 8.360%, 6/10/20272,4,7 |

| 6,268,188 | ||

| GBP 7,500,000 | Delayed Draw, 10.407% (SONIA+623 basis points), 6/10/20272,3,4,7 |

| 8,912,991 | ||

| 7,042,967 | Delayed Draw, 11.006% (SOFR+600 basis points), 6/10/20272,3,4 |

| 6,784,603 | ||

| 6,550,650 | Delayed Draw, 11.006% (SOFR+600 basis points), 6/10/20272,3,4 |

| 6,310,346 | ||

| 1,553,797 | Delayed Draw, 11.006% (SOFR+600 basis points), 6/10/20272,3,4 |

| 1,496,797 | ||

| 2,878,392 | First Lien Term Loan, 11.026% (SOFR+600 basis points), 6/10/20272,3,4 |

| 2,772,801 | ||

| 820,052 | Revolver, 11.026% (SOFR+600 basis points), 6/10/20272,3,4 |

| 789,969 | ||

| 329,651 | Revolver, 11.026% (SOFR+600 basis points), 6/10/20272,3,4 |

| 317,558 | ||

| MB2 Dental Solutions, LLC |

| ||||

| 1,805,556 | Delayed Draw, 1.000%, 1/29/20272,4,6 |

| 1,792,324 | ||

| 4,426,389 | Delayed Draw, 10.561% (SOFR+600 basis points), 1/29/20272,3,4 |

| 4,393,952 | ||

| 649,752 | Delayed Draw, 10.907% (SOFR+600 basis points), 1/29/20272,3,4 |

| 638,476 | ||

| 1,802,025 | First Lien Term Loan, 10.907% (SOFR+600 basis points), 1/29/20272,3,4 |

| 1,770,750 | ||

| MedMark Services, Inc. |

| ||||

| 7,880,000 | First Lien Term Loan, 10.159% (LIBOR+500 basis points), 6/11/20272,3,4 |

| 7,708,953 | ||

| 1,568,416 | Delayed Draw, 10.163% (LIBOR+500 basis points), 6/11/20272,3,4 |

| 1,534,371 | ||

| 4,518,247 | Delayed Draw, 10.163% (LIBOR+500 basis points), 6/11/20272,3,4 |

| 4,420,172 | ||

| MN Acquisition, Inc. |

| ||||

| 2,166,667 | Revolver, 0.500%, 8/25/20282,4,6 |

| 2,089,247 | ||

| 333,333 | Revolver, 10.261% (SOFR+550 basis points), 8/25/20282,3,4 |

| 321,423 | ||

| 22,387,500 | First Lien Term Loan, 10.407% (SOFR+550 basis points), 8/25/20282,3,4 |

| 21,587,545 | ||

| Myorthos Management, LLC |

| ||||

| 8,972,201 | Delayed Draw, 10.465% (SOFR+550 basis points), 11/1/20272,3,4,5 |

| 8,786,435 | ||

| 4,856,732 | First Lien Term Loan, 10.465% (SOFR+550 basis points), 11/1/20272,3,4,5 |

| 4,756,175 | ||

See accompanying Notes to Consolidated Financial Statements.

22

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE (Continued) |

| ||||

| National Dentex Labs LLC |

| ||||

$ | 137,931 | Revolver, 0.500%, 10/23/20252,4,6 | $ | 135,455 | ||

| 390,805 | Delayed Draw, 1.000%, 10/23/20252,4,6 |

| 383,790 | ||

| 781,609 | Revolver, 11.730% (LIBOR+700 basis points), 4/3/20262,3,4 |

| 767,580 | ||

| 2,973,523 | Delayed Draw, 13.048% PIK (LIBOR+800 basis points), 4/3/20262,3,4,8 |

| 2,920,149 | ||

| 6,960,813 | First Lien Term Loan, 13.048% PIK (LIBOR+800 basis points), 4/3/20262,3,4,8 |

| 6,835,869 | ||

| 528,735 | Delayed Draw, 13.048% PIK (LIBOR+800 basis points), 4/3/20262,3,4,8 |

| 519,245 | ||

| Novotech (Australia) Pty Limited |

| ||||

| 3,125,000 | Delayed Draw, 1.000%, 1/14/20282,4,6 |

| 3,030,644 | ||

| AUD 18,543,750 | Delayed Draw, 9.081% (BBSY+525 basis points), 1/14/20282,3,4,7 |

| 12,016,575 | ||

| 16,437,500 | First Lien Term Loan, 10.488% (SOFR+575 basis points), 1/14/20282,3,4 |

| 15,941,190 | ||

| OB Hospitalist Group |

| ||||

| 1,053,435 | Revolver, 0.500%, 9/27/20272,4,6 |

| 1,033,539 | ||

| 664,122 | Revolver, 10.548% (SOFR+550 basis points), 9/27/20272,3,4 |

| 651,579 | ||

| 37,927,495 | First Lien Term Loan, 10.548% (SOFR+550 basis points), 9/27/20272,3,4 |

| 37,211,165 | ||

| 6,947,368 | Office Ally |

| 6,772,205 | ||

| OIA Acquisition, LLC |

| ||||

| 1,928,571 | Revolver, 0.500%, 10/19/20272,4,6 |

| 1,869,320 | ||

| 459,000 | Delayed Draw, 1.000%, 10/19/20272,4,6 |

| 444,898 | ||

| 1,366,559 | Delayed Draw, 9.965% (LIBOR+500 basis points), 10/19/20272,3,4 |

| 1,324,574 | ||

| 11,088,214 | First Lien Term Loan, 9.965% (LIBOR+500 basis points), 10/19/20272,3,4 |

| 10,747,551 | ||

| OIS Management Services, LLC |

| ||||

| 1,328,205 | Revolver, 0.500%, 11/16/20282,4,6 |

| 1,297,379 | ||

| 4,188,590 | Delayed Draw, 1.000%, 11/16/20282,4,6 |

| 4,091,376 | ||

| 94,872 | Revolver, 10.861% (SOFR+525 basis points), 11/16/20282,3,4 |

| 92,670 | ||

| 12,333,333 | First Lien Term Loan, 10.869% (SOFR+575 basis points), 11/16/20282,3,4 |

| 12,047,086 | ||

| 555,000 | Delayed Draw, 10.998% (SOFR+525 basis points), 11/16/20282,3,4 |

| 542,119 | ||

| Ons Mso, LLC |

| ||||

| 2,763,592 | Revolver, 0.500%, 7/8/20242,4,6 |

| 2,678,686 | ||

| 2,763,592 | Revolver, 9.595% (LIBOR+475 basis points), 7/8/20242,3,4,5 |

| 2,678,686 | ||

| Org USME Buyer, LLC |

| ||||

| 411,942 | Revolver, 0.500%, 11/24/20262,4,6 |

| 401,349 | ||

| 743,478 | Delayed Draw, 1.000%, 11/24/20262,4,6 |

| 724,361 | ||

| 524,290 | Revolver, 10.515% (SOFR+575 basis points), 11/24/20262,3,4 |

| 510,808 | ||

| 16,311,693 | First Lien Term Loan, 10.791% (SOFR+575 basis points), 11/24/20262,3,4 |

| 15,892,256 | ||

| Orthodontic Partners, LLC |

| ||||

| 14,278,356 | Delayed Draw, 1.000%, 10/12/20272,4,6 |

| 14,102,341 | ||

| 9,721,644 | First Lien Term Loan, 11.125% (SOFR+625 basis points), 10/12/20272,3,4 |

| 9,504,813 | ||

See accompanying Notes to Consolidated Financial Statements.

23

Cliffwater Corporate Lending Fund |

Consolidated Schedule of Investments As of March 31, 2023 (Continued) |

Principal | Value | |||||

SENIOR SECURED LOANS (Continued) | ||||||

| HEALTH CARE (Continued) |

| ||||

| Pediatric Home Respiratory Services, LLC |

| ||||

$ | 856,529 | Delayed Draw, 1.000%, 12/4/20242,4,6 | $ | 834,504 | ||

| 4,687,355 | First Lien Term Loan, 10.791% (SOFR+575 basis points), 12/4/20242,3,4 |

| 4,566,825 | ||

| 1,150,894 | Delayed Draw, 11.291% (SOFR+625 basis points), 12/4/20242,3,4 |

| 1,121,300 | ||

| 6,257,209 | PerkinElmer U.S. LLC |

| 6,069,651 | ||

| Pinnacle Dermatology Management, LLC |

| ||||

| 680,412 | Revolver, 0.500%, 5/18/20232,4,6 |

| 673,141 | ||

| 1,221,649 | Delayed Draw, 1.000%, 5/18/20232,4,6 |

| 1,184,117 | ||

| 402,062 | Revolver, 9.500% (SOFR+400 basis points), 5/18/20232,3,4 |

| 397,765 | ||

| 1,318,284 | Delayed Draw, 10.548% (SOFR+425 basis points), 5/18/20232,3,4 |

| 1,277,782 | ||

| 11,262,881 | First Lien Term Loan, 11.125% (SOFR+575 basis points), 5/18/20232,3,4 |

| 10,775,807 | ||

| Pinnacle Treatment Centers, Inc. |

| ||||

| 9,363 | Revolver, 0.500%, 1/2/20262,4,6 |

| 9,168 | ||

| 424,904 | Revolver, 0.500%, 1/2/20262,4,6 |

| 416,079 | ||

| 276,352 | Revolver, 11.557% (SOFR+675 basis points), 1/2/20262,3,4 |

| 270,612 | ||

| 335,143 | Delayed Draw, 11.791% (SOFR+675 basis points), 1/2/20262,3,4 |

| 328,182 | ||

| 14,289,992 | First Lien Term Loan, 11.791% (SOFR+675 basis points), 1/2/20262,3,4 |

| 13,993,207 | ||

| 591,030 | Delayed Draw, 11.791% (SOFR+675 basis points), 1/2/20262,3,4 |

| 578,755 | ||

| 78,958 | Revolver, 11.791% (SOFR+650 basis points), 1/2/20262,3,4 |

| 77,318 | ||

| 157,143 | First Lien Term Loan, 11.791% (SOFR+675 basis points), 1/2/20262,3,4 |

| 153,879 | ||

| PPV Intermediate Holdings LLC |

| ||||

| 2,538,076 | Revolver, 0.500%, 8/31/20292,4,6 |

| 2,472,813 | ||

| 1,611,678 | Delayed Draw, 1.000%, 8/31/20292,4,6 |

| 1,586,382 | ||

| 264,996 | Delayed Draw, 1.000%, 8/31/20292,4,6 |

| 261,993 | ||

| 45,905 | Delayed Draw, 9.009% (SOFR+575 basis points), 8/31/20292,3,4 |

| 45,385 | ||

| 43,459,056 | First Lien Term Loan, 9.009% (SOFR+575 basis points), 8/31/20292,3,4 |

| 42,376,621 | ||

| 279,188 | Delayed Draw, 10.526% (SOFR+575 basis points), 8/31/20292,3,4 |

| 274,806 | ||

| 255,682 | Delayed Draw, 1.000%, 8/31/20302,4,6 |

| 251,669 | ||

| 1,619,318 | Delayed Draw, 13.000% (SOFR+575 basis points), 8/31/20302,3,4 |

| 1,593,902 | ||

| Premier Imaging, LLC |

| ||||

| 10,332,779 | Delayed Draw, 1.000%, 1/2/20252,4,6 |

| 10,196,480 | ||