UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811- 23334

Symmetry Panoramic Trust

(Exact name of registrant as specified in charter)

________

151 National Drive

Glastonbury, CT 06033

(Address of principal executive offices) (Zip code)

Sara A. Taylor

Symmetry Partners, LLC

151 National Drive

Glastonbury, CT 06033

(Name and address of agent for service)

Copy to:

Mark C. Amorosi, Esq.

K&L Gates LLP

1601 K Street NW

Washington, D.C. 20006

Registrant’s telephone number, including area code: (844) 796-3863

Date of fiscal year end: August 31, 2019

Date of reporting period: August 31, 2019

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act or 1940, as amended (the “1940 Act”) (17 CFR § 270.30e-1), is attached hereto.

Symmetry Panoramic Trust

ANNUAL REPORT

AUGUST 31, 2019

Symmetry Panoramic US Equity Fund (SPUSX)

Symmetry Panoramic International Equity Fund (SPILX)

Symmetry Panoramic Global Equity Fund (SPGEX)

Symmetry Panoramic Tax-Managed Global Equity Fund (SPGTX)

Symmetry Panoramic US Fixed Income Fund (SPUBX)

Symmetry Panoramic Municipal Fixed Income Fund (SPMFX)

Symmetry Panoramic Global Fixed Income Fund (SPGBX)

Symmetry Panoramic Alternatives Fund (SPATX)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports no longer will be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, or, if you are a direct investor, by calling 1-844-796-3863.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-844-796-3863. Your election to receive reports in paper will apply to all funds held with your financial intermediary if you invest through a financial intermediary or all Symmetry Panoramic Funds if you invest directly with the Funds.

SYMMETRY PANORAMIC TRUST

AUGUST 31, 2019

TABLE OF CONTENTS

| | |

Shareholders’ Letter | 1 |

Management Discussion of Fund Performance | 5 |

Schedules of Investments | 13 |

Statements of Assets and Liabilities | 88 |

Statements of Operations | 91 |

Statements of Changes in Net Assets | 94 |

Financial Highlights | 98 |

Notes to Financial Statements | 106 |

Report of Independent Registered Public Accounting Firm | 148 |

Trustees and Officers of the Trust | 149 |

Disclosure of Fund Expenses | 155 |

Notice to Shareholders | 158 |

The Funds file their complete schedules of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after period end. The Funds’ Forms N-Q are available on the SEC’s website at http://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to fund securities, as well as information relating to how the Funds voted proxies relating to fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-844-796-3863; and (ii) on the SEC’s website at http://www.sec.gov.

SYMMETRY PANORAMIC TRUST

AUGUST 31, 2019

(Unaudited)

Dear Shareholders,

On behalf of the Symmetry Panoramic Trust, I am pleased to present you with our first annual report. The Symmetry Panoramic Funds are a series of eight mutual funds that feature a best-of-breed multi-factor approach designed to enable advisers and their investors to build diversified, fully asset-allocated investment portfolios.

Our results reflect an abbreviated year, as we launched our Funds on November 12, 2018 and our fiscal year ends August 31, 2019. Fortuitously, capital markets delivered largely positive results over that timeframe. Bond markets have performed very well, with US and global aggregate bonds turning in equity-like performances in excess of 10 percent. Global equity indices have mostly increased too, though small caps are a caveat, losing more than 2 percent.

Factor exposures were mixed for the year. While momentum, quality and minimum volatility factors all outperformed, the aforementioned small cap factor as well as the value factor, have underperformed the market. While value in particular has undergone a prolonged period of drought, our read of the evidence is that there is not a good reason to abandon the intuition behind value investing. We believe that buying stocks at a low price relative to fundamentals should lead to higher expected returns over time. See below for index return information representing major asset classes and style factors.

The Symmetry Panoramic Mutual Funds invest your assets based on a simple premise: that the best place to look for insights into capital markets is in the findings of academic research. Those findings have led us to an evidence-based approach that emphasizes stocks with characteristics, or factors, that have tended to outperform over the long haul. We advocate a patient, disciplined approach that relies on markets, not individual manager insights, to help our clients meet their goals.

We thank you for placing your trust in us and being a part of the launch year of the Symmetry Panoramic Trust.

| 11/12/2018 -

8/31/2019 |

Benchmarks | |

S&P 500 TR USD | 7.01% |

Russell 2000 TR USD | -2.37% |

NASDAQ Composite TR USD | 8.50% |

MSCI EAFE NR USD | 2.71% |

DJ Industrial Average TR USD | 3.70% |

BBgBarc US Agg Bond TR USD | 11.80% |

BBgBarc Global Aggregate TR USD | 9.93% |

BBgBarc US Govt/Credit 1-5 Yr TR USD | 6.20% |

1

SYMMETRY PANORAMIC TRUST

AUGUST 31, 2019

(Unaudited)

| 11/12/2018 -

8/31/2019 |

MSCI ACWI Ex USA IMI NR USD | 2.70% |

BBgBarc Global Aggregate TR Hdg USD | 11.43% |

DJ US Select REIT TR USD | 12.90% |

MSCI US Broad Market GR USD | 6.49% |

MSCI World All Cap NR USD | 4.65% |

S&P S/T National AMT Free Muni TR USD | 3.88% |

Factor Indices | |

MSCI ACWI Value NR USD | -0.19% |

MSCI ACWI Small NR USD | 0.51% |

MSCI ACWI Momentum NR USD | 10.66% |

MSCI ACWI Quality NR USD | 9.61% |

MSCI ACWI Minimum Vol (USD) NR USD | 11.22% |

MSCI ACWI IMI NR USD | 4.53% |

MSCI USA Value GR USD | 2.91% |

MSCI USA Small Cap GR USD | 1.64% |

MSCI USA Momentum GR USD | 11.09% |

MSCI USA Quality GR USD | 11.70% |

MSCI USA Minimum Volatility (USD) GR USD | 14.81% |

MSCI USA GR USD | 7.24% |

MSCI World Ex USA Value NR USD | -3.55% |

MSCI World Ex USA Small Cap NR USD | -0.33% |

MSCI World ex US Momentum NR USD | 7.35% |

MSCI World ex USA Quality NR USD | 10.82% |

MSCI World ex USA Min Vol (USD) NR USD | 8.14% |

MSCI World ex USA NR USD | 3.19% |

MSCI EM Value NR USD | -1.84% |

MSCI EM Small NR USD | 0.32% |

MSCI EM Momentum NR USD | 9.95% |

MSCI EM Quality NR USD | 6.87% |

MSCI EM Minimum Vol (USD) NR USD | 4.30% |

MSCI EM NR USD | 3.11% |

HFRI | |

HFRI FOF: Conservative Index | 3.84% |

Source: Morningstar

Sincerely,

Dana D’Auria

President, Symmetry Panoramic Trust

2

SYMMETRY PANORAMIC TRUST

AUGUST 31, 2019

(Unaudited)

Symmetry Partners, LLC is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered, or excluded or exempted from registration requirements. No one should assume that future performance of any specific investment, investment strategy, product, or non-investment related content made reference to directly or indirectly in this material will be profitable. As with any investment strategy, there is the possibility of profitability as well as loss.

Carefully consider the funds’ investment objectives, risk, and charges and expenses. This and other information can be found in the funds’ prospectus which may be obtained by visiting www.panoramicfunds.com or by calling 1-844-SYM-FUND (844-796-3863). Please read the prospectus carefully before investing.

The funds are distributed by SEI Investment Distribution Company (SIDCO). SIDCO is not affiliated with Symmetry Partners, LLC.

Diversification seeks to improve performance by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market. Past performance does not guarantee future results.

© Morningstar 2018. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

3

SYMMETRY PANORAMIC TRUST

AUGUST 31, 2019

(Unaudited)

Description of the Funds’ Indices

MSCI US Broad Market Index (Primary Benchmark for the Symmetry Panoramic US Equity Fund) captures broad US equity coverage. The index includes 3,021 constituents across large, mid, small and micro capitalizations, representing about 99% of the US equity universe.

MSCI ACWI ex USA Investable Market Index (net) (IMI) (Primary Benchmark for the Symmetry Panoramic International Equity Fund) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 26 Emerging Markets (EM) countries. With 6,392 constituents, the index covers approximately 99% of the global equity opportunities set outside of the US.

MSCI ACWI Investable Market Index (net) (IMI) (Primary Benchmark for the Symmetry Panoramic Global Equity Fund and Symmetry Panoramic Tax-Managed Global Equity Fund) captures large, mid and small representation across 23 Developed Markets (DM) and 26 Emerging Markets (EM) countries. With 8,820 constituents, the index id comprehensive, covering approximately 99% of the global equity investment opportunity set.

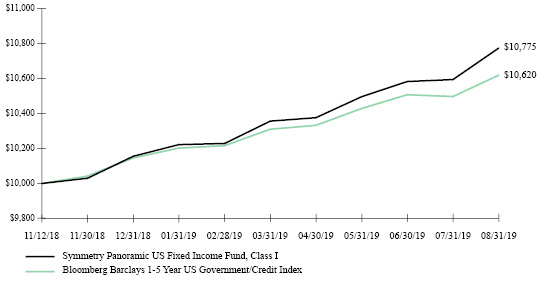

Bloomberg Barclays 1-5 Year US Government/Credit Index (Primary Benchmark for the Symmetry Panoramic US Fixed Income Fund) measures the performance of U.S. dollar-denominated U.S. Treasury, government related (i.e., U.S. and non-U.S. agencies, sovereign, quasi-sovereign, supranational and local authority debt) and investment grade U.S. corporate fixed rate bonds that have a remaining maturity of greater than or equal to one year and less than five years.

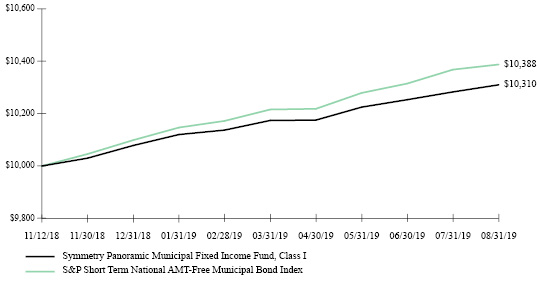

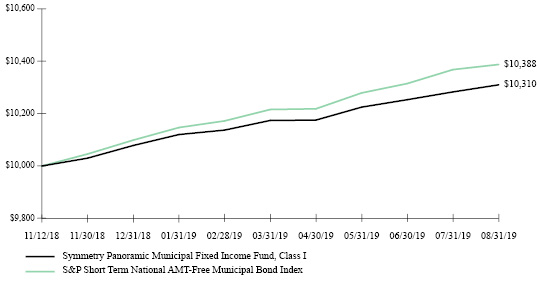

S&P Short Term National AMT-Free Municipal Bond Index (Primary Benchmark for the Symmetry Panoramic Municipal Fixed Income Fund) is a market-value weighted index that is designed to measure the performance of investment-grade tax-exempt U.S. municipal bonds with an effective maturities of 1 month to 5 years. Bonds issued by U.S. territories, including Puerto Rico, are excluded from this index.

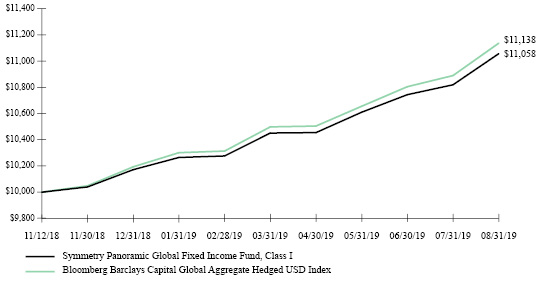

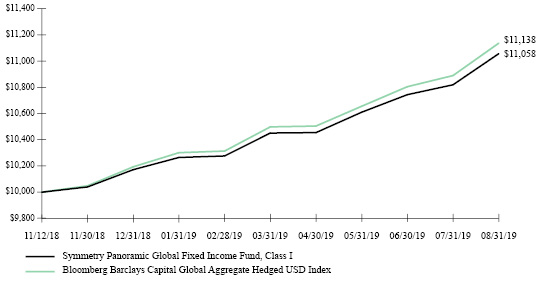

Bloomberg Barclays Capital Global Aggregate Hedged USD Index (Primary Benchmark for the Symmetry Panoramic Global Fixed Income Fund) measures global investment grade debt from twenty-four local currency markets hedged to the U.S. dollar. The multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

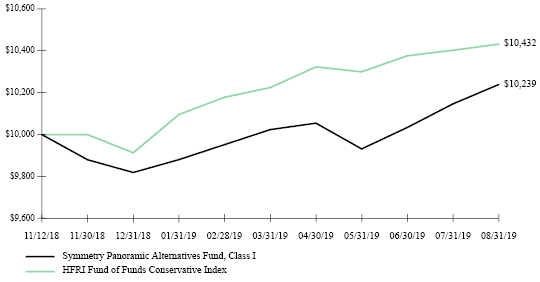

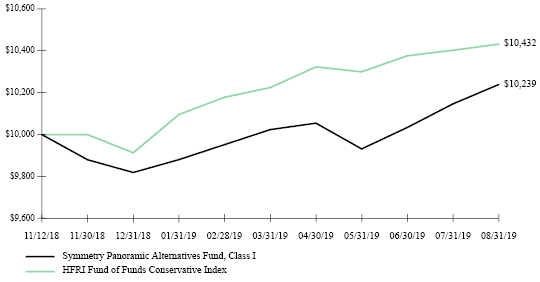

HFRI Fund of Funds Conservative Index (Primary Benchmark for the Symmetry Panoramic Alternatives Fund) measures the performance of funds of funds that exhibit one or more of the following characteristics: seeks consistent returns by primarily investing in funds that generally engage in more “conservative” strategies such as Equity Market Neutral, Fixed Income Arbitrage, and Convertible Arbitrage; exhibits a lower historical annual standard deviation than the HFRI Fund of Funds Composite Index. A fund in the HFRI Fund of Funds Conservative Index shows generally consistent performance regardless of market conditions.

4

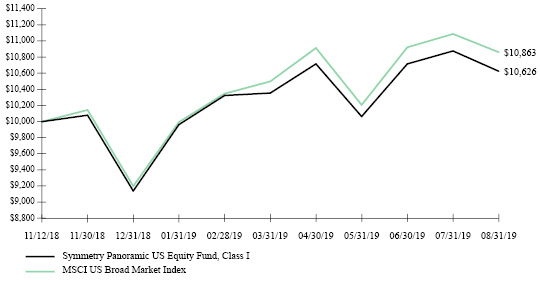

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

(Unaudited)

Management Discussion of Fund Performance |

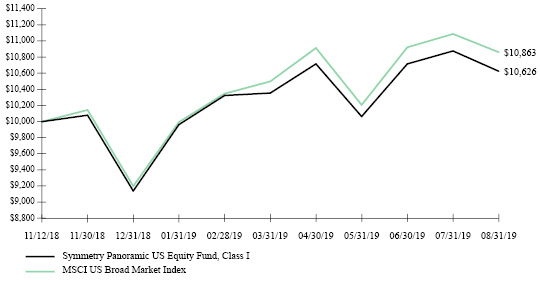

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic US Equity Fund, Class I | 6.26% |

MSCI US Broad Market Index | 8.63% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

5

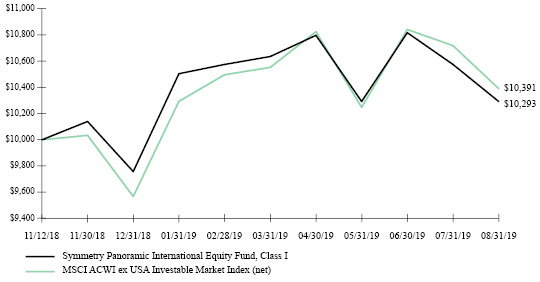

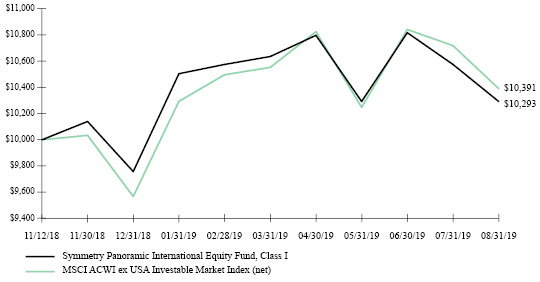

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic International Equity Fund, Class I | 2.93% |

MSCI ACWI ex USA Investable Market Index (net) | 3.91% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Net total return indexes reinvest dividends after the deduction of withholding taxes, using (for international indexes) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

See definition of comparative indices on page 4.

6

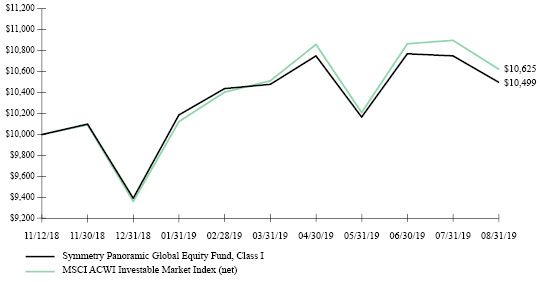

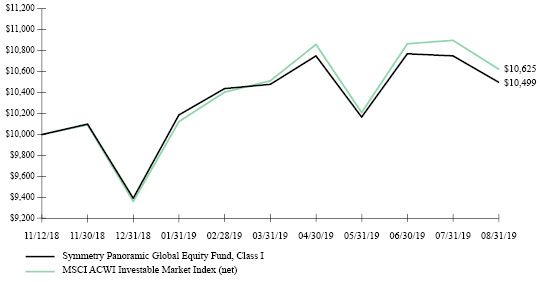

SYMMETRY PANORAMIC GLOBAL EQUITY FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic Global Equity Fund, Class I | 4.99% |

MSCI ACWI Investable Market Index (net) | 6.25% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Net total return indexes reinvest dividends after the deduction of withholding taxes, using (for international indexes) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

See definition of comparative indices on page 4.

7

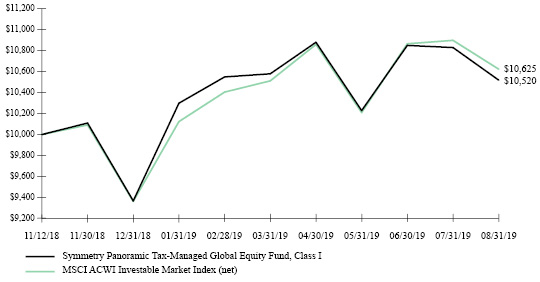

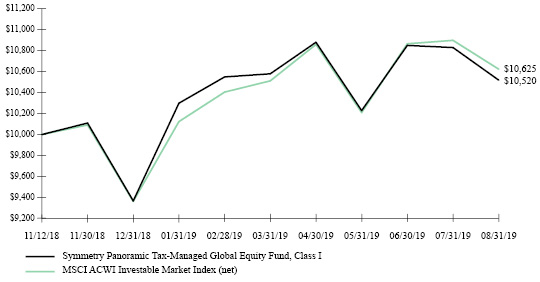

SYMMETRY PANORAMIC TAX-MANAGED GLOBAL EQUITY FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic Tax-Managed Global Equity Fund, Class I | 5.20% |

MSCI ACWI Investable Market Index (net) | 6.25% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Net total return indexes reinvest dividends after the deduction of withholding taxes, using (for international indexes) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

See definition of comparative indices on page 4.

8

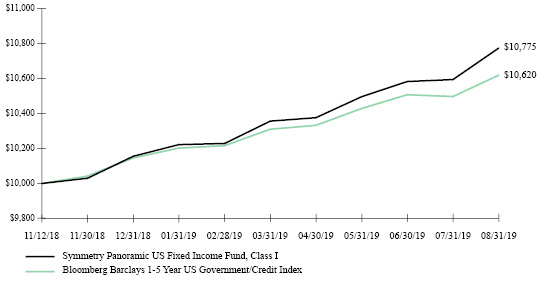

SYMMETRY PANORAMIC US FIXED INCOME FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic US Fixed Income Fund, Class I | 7.75% |

Bloomberg Barclays 1-5 Year US Government/Credit Index | 6.20% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

9

SYMMETRY PANORAMIC MUNICIPAL FIXED INCOME FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic Municipal Fixed Income Fund, Class I | 3.10% |

S&P Short Term National AMT-Free Municipal Bond Index | 3.88% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

10

SYMMETRY PANORAMIC GLOBAL FIXED INCOME FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic Global Fixed Income Fund, Class I | 10.58% |

Bloomberg Barclays Capital Global Aggregate Hedged USD Index | 11.38% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

11

SYMMETRY PANORAMIC ALTERNATIVES FUND

AUGUST 31, 2019

(Unaudited)

MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

Growth of a $10,000 Investment

CUMULATIVE TOTAL RETURN FOR

THE PERIOD ENDED AUGUST 31, 2019 |

| Cumulative

Inception to Date* |

Symmetry Panoramic Alternatives Fund, Class I | 2.39% |

HFRI Fund of Funds Conservative Index | 4.47% |

* | The Fund commenced operations on November 12, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

12

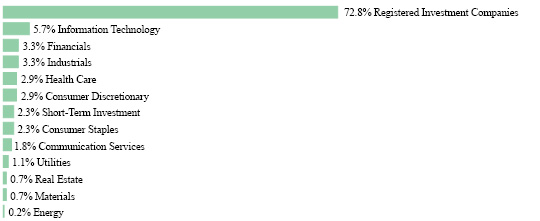

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

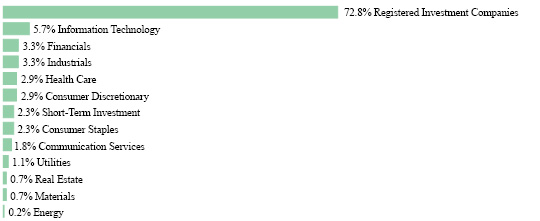

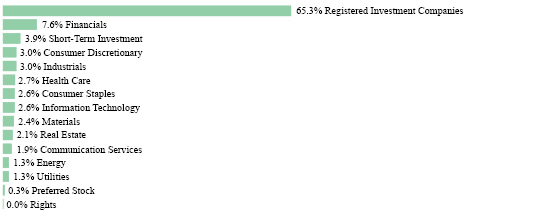

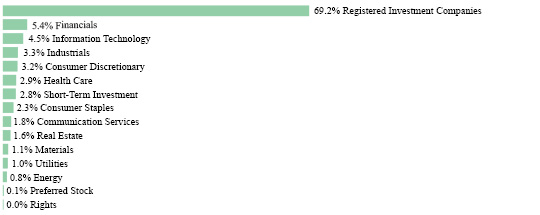

SECTOR WEIGHTINGS† (UNAUDITED) |

†Percentages are based on total investments.

SCHEDULE OF INVESTMENTS |

REGISTERED INVESTMENT COMPANIES — 72.8% |

| | | Shares | | | Value | |

EQUITY FUNDS — 72.8% | | | | | | | | |

DFA Real Estate Securities Portfolio, Cl I | | | 875,158 | | | $ | 35,793,977 | |

DFA US Core Equity 2 Portfolio, Cl I (A) | | | 6,426,780 | | | | 139,461,118 | |

DFA US Vector Equity Portfolio, Cl I (A) | | | 7,852,568 | | | | 139,226,024 | |

iShares Edge MSCI Min Vol USA ETF | | | 850,965 | | | | 54,253,273 | |

Total Registered Investment Companies | | | | | | | | |

(Cost $350,611,817) | | | | | | | 368,734,392 | |

COMMON STOCK — 24.9% |

COMMUNICATION SERVICES — 1.8% | | | | | | | | |

AMC Networks, Cl A * | | | 1,291 | | | | 62,613 | |

AT&T | | | 10,613 | | | | 374,214 | |

Cable One | | | 297 | | | | 385,393 | |

Cinemark Holdings | | | 2,117 | | | | 80,785 | |

Comcast, Cl A | | | 29,005 | | | | 1,283,761 | |

Discovery * | | | 7,483 | | | | 206,531 | |

DISH Network, Cl A * | | | 4,843 | | | | 162,531 | |

IAC * | | | 1,686 | | | | 429,323 | |

Interpublic Group | | | 2,870 | | | | 57,056 | |

Live Nation Entertainment * | | | 965 | | | | 67,077 | |

Match Group | | | 4,757 | | | | 403,394 | |

New York Times, Cl A | | | 5,844 | | | | 170,645 | |

The accompanying notes are an integral part of the financial statements.

13

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

COMMUNICATION SERVICES — continued | | | | | | | | |

Nexstar Media Group, Cl A | | | 3,001 | | | $ | 296,769 | |

Omnicom Group | | | 2,491 | | | | 189,465 | |

Sinclair Broadcast Group, Cl A | | | 7,168 | | | | 319,478 | |

T-Mobile US * | | | 8,515 | | | | 664,596 | |

Twitter * | | | 1,478 | | | | 63,037 | |

Verizon Communications | | | 31,737 | | | | 1,845,824 | |

Viacom, Cl B | | | 9,371 | | | | 234,087 | |

Walt Disney | | | 13,218 | | | | 1,814,303 | |

| | | | | | | | 9,110,882 | |

CONSUMER DISCRETIONARY — 2.9% | | | | | | | | |

AutoZone * | | | 492 | | | | 542,031 | |

Best Buy | | | 1,170 | | | | 74,470 | |

Bright Horizons Family Solutions * | | | 1,002 | | | | 165,380 | |

Burlington Stores * | | | 650 | | | | 131,618 | |

Chipotle Mexican Grill, Cl A * | | | 300 | | | | 251,526 | |

Columbia Sportswear | | | 2,047 | | | | 191,988 | |

Darden Restaurants | | | 3,614 | | | | 437,222 | |

Dick’s Sporting Goods | | | 2,663 | | | | 90,649 | |

Dollar General | | | 4,070 | | | | 635,286 | |

Domino’s Pizza | | | 427 | | | | 96,861 | |

DR Horton | | | 4,190 | | | | 207,279 | |

Etsy * | | | 4,018 | | | | 212,110 | |

Expedia Group | | | 940 | | | | 122,294 | |

Garmin | | | 4,548 | | | | 370,980 | |

Gentex | | | 8,426 | | | | 224,132 | |

Genuine Parts | | | 1,067 | | | | 96,340 | |

Graham Holdings, Cl B | | | 192 | | | | 135,180 | |

Grand Canyon Education * | | | 1,200 | | | | 150,720 | |

H&R Block | | | 6,011 | | | | 145,586 | |

Hasbro | | | 1,024 | | | | 113,121 | |

Home Depot | | | 292 | | | | 66,550 | |

Hyatt Hotels, Cl A | | | 1,779 | | | | 128,355 | |

Lowe’s | | | 5,456 | | | | 612,163 | |

Lululemon Athletica * | | | 3,161 | | | | 583,742 | |

McDonald’s | | | 4,779 | | | | 1,041,679 | |

NIKE, Cl B | | | 13,131 | | | | 1,109,570 | |

NVR * | | | 14 | | | | 50,386 | |

O’Reilly Automotive * | | | 1,527 | | | | 586,002 | |

The accompanying notes are an integral part of the financial statements.

14

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

CONSUMER DISCRETIONARY — continued | | | | | | | | |

Penske Automotive Group | | | 1,240 | | | $ | 53,047 | |

Planet Fitness, Cl A * | | | 2,713 | | | | 191,565 | |

Pool | | | 709 | | | | 139,233 | |

PulteGroup | | | 10,623 | | | | 359,057 | |

Ross Stores | | | 2,515 | | | | 266,615 | |

ServiceMaster Global Holdings * | | | 2,316 | | | | 132,105 | |

Skechers U.S.A., Cl A * | | | 3,878 | | | | 122,777 | |

Starbucks | | | 13,185 | | | | 1,273,143 | |

Target | | | 5,959 | | | | 637,852 | |

Tempur Sealy International * | | | 4,189 | | | | 323,056 | |

TJX | | | 13,373 | | | | 735,114 | |

Toll Brothers | | | 3,014 | | | | 109,077 | |

Tractor Supply | | | 3,527 | | | | 359,331 | |

Ulta Beauty * | | | 1,383 | | | | 328,781 | |

Under Armour, Cl A * | | | 6,938 | | | | 129,116 | |

VF | | | 2,554 | | | | 209,300 | |

Williams-Sonoma | | | 4,589 | | | | 301,956 | |

Yum! Brands | | | 1,954 | | | | 228,188 | |

| | | | | | | | 14,472,533 | |

CONSUMER STAPLES — 2.3% | | | | | | | | |

Casey’s General Stores | | | 2,181 | | | | 366,081 | |

Church & Dwight | | | 5,934 | | | | 473,415 | |

Clorox | | | 1,964 | | | | 310,626 | |

Costco Wholesale | | | 4,096 | | | | 1,207,337 | |

Estee Lauder, Cl A | | | 1,087 | | | | 215,215 | |

General Mills | | | 5,252 | | | | 282,558 | |

Hershey | | | 2,512 | | | | 398,102 | |

Hormel Foods | | | 5,658 | | | | 241,087 | |

Kimberly-Clark | | | 2,434 | | | | 343,462 | |

Lamb Weston Holdings | | | 846 | | | | 59,550 | |

McCormick | | | 3,030 | | | | 493,496 | |

Mondelez International, Cl A | | | 9,119 | | | | 503,551 | |

PepsiCo | | | 8,322 | | | | 1,137,867 | |

Philip Morris International | | | 6,145 | | | | 442,993 | |

Pilgrim’s Pride * | | | 1,382 | | | | 43,063 | |

Post Holdings * | | | 1,914 | | | | 190,807 | |

Procter & Gamble | | | 20,179 | | | | 2,426,121 | |

Sysco | | | 4,746 | | | | 352,770 | |

The accompanying notes are an integral part of the financial statements.

15

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

CONSUMER STAPLES — continued | | | | | | | | |

Tyson Foods, Cl A | | | 2,686 | | | $ | 249,905 | |

Walmart | | | 17,880 | | | | 2,042,969 | |

| | | | | | | | 11,780,975 | |

ENERGY — 0.2% | | | | | | | | |

Cabot Oil & Gas | | | 2,138 | | | | 36,602 | |

Chevron | | | 5,621 | | | | 661,704 | |

Kinder Morgan | | | 2,862 | | | | 58,013 | |

Phillips 66 | | | 2,406 | | | | 237,304 | |

Valero Energy | | | 539 | | | | 40,576 | |

| | | | | | | | 1,034,199 | |

FINANCIALS — 3.3% | | | | | | | | |

Aflac | | | 9,454 | | | | 474,402 | |

Alleghany * | | | 456 | | | | 341,685 | |

Allstate | | | 2,963 | | | | 303,382 | |

Ally Financial | | | 11,314 | | | | 354,694 | |

American Express | | | 6,607 | | | | 795,285 | |

American Financial Group | | | 1,361 | | | | 137,420 | |

Ameriprise Financial | | | 1,920 | | | | 247,642 | |

Aon | | | 1,794 | | | | 349,561 | |

Arch Capital Group * | | | 9,561 | | | | 377,659 | |

Assurant | | | 1,374 | | | | 169,002 | |

Assured Guaranty | | | 6,470 | | | | 275,298 | |

Axis Capital Holdings | | | 4,645 | | | | 285,157 | |

BB&T | | | 7,696 | | | | 366,714 | |

Capital One Financial | | | 1,825 | | | | 158,081 | |

Chubb | | | 3,348 | | | | 523,225 | |

Cincinnati Financial | | | 1,993 | | | | 224,193 | |

Citizens Financial Group | | | 3,134 | | | | 105,741 | |

CME Group, Cl A | | | 1,934 | | | | 420,239 | |

Commerce Bancshares | | | 1,367 | | | | 78,015 | |

Credit Acceptance * | | | 728 | | | | 329,529 | |

Discover Financial Services | | | 5,314 | | | | 424,961 | |

East West Bancorp | | | 893 | | | | 36,729 | |

Erie Indemnity, Cl A | | | 880 | | | | 192,993 | |

Evercore, Cl A | | | 793 | | | | 63,250 | |

Everest Re Group | | | 1,418 | | | | 334,478 | |

Fidelity National Financial | | | 2,058 | | | | 90,429 | |

Fifth Third Bancorp | | | 4,929 | | | | 130,372 | |

The accompanying notes are an integral part of the financial statements.

16

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

FINANCIALS — continued | | | | | | | | |

First American Financial | | | 2,418 | | | $ | 141,332 | |

First Citizens BancShares, Cl A | | | 116 | | | | 51,574 | |

Franklin Resources | | | 1,216 | | | | 31,956 | |

Globe Life | | | 911 | | | | 81,316 | |

Hanover Insurance Group | | | 1,940 | | | | 258,311 | |

Huntington Bancshares | | | 15,565 | | | | 206,236 | |

JPMorgan Chase | | | 18,896 | | | | 2,075,915 | |

Kemper | | | 1,256 | | | | 87,895 | |

KeyCorp | | | 6,318 | | | | 104,879 | |

Lincoln National | | | 5,690 | | | | 300,887 | |

MarketAxess Holdings | | | 626 | | | | 248,910 | |

Marsh & McLennan | | | 3,072 | | | | 306,862 | |

Mercury General | | | 3,542 | | | | 189,497 | |

MetLife | | | 9,711 | | | | 430,197 | |

MGIC Investment | | | 31,450 | | | | 397,842 | |

Nasdaq | | | 1,248 | | | | 124,600 | |

Navient | | | 11,010 | | | | 140,267 | |

Old Republic International | | | 8,930 | | | | 208,605 | |

Popular | | | 4,160 | | | | 218,691 | |

Primerica | | | 836 | | | | 99,626 | |

Progressive | | | 10,569 | | | | 801,130 | |

Prosperity Bancshares | | | 663 | | | | 43,042 | |

Prudential Financial | | | 3,313 | | | | 265,338 | |

Regions Financial | | | 8,485 | | | | 124,051 | |

Reinsurance Group of America, Cl A | | | 376 | | | | 57,893 | |

RenaissanceRe Holdings | | | 1,201 | | | | 216,841 | |

SVB Financial Group * | | | 460 | | | | 89,525 | |

Synchrony Financial | | | 11,101 | | | | 355,787 | |

T Rowe Price Group | | | 2,355 | | | | 260,510 | |

TCF Financial | | | 2,067 | | | | 79,703 | |

Travelers | | | 4,281 | | | | 629,136 | |

US Bancorp | | | 6,137 | | | | 323,359 | |

WR Berkley | | | 6,054 | | | | 431,347 | |

| | | | | | | | 16,973,196 | |

HEALTH CARE — 2.9% | | | | | | | | |

Abbott Laboratories | | | 11,719 | | | | 999,865 | |

Amgen | | | 1,150 | | | | 239,913 | |

The accompanying notes are an integral part of the financial statements.

17

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

HEALTH CARE — continued | | | | | | | | |

Anthem | | | 2,508 | | | $ | 655,892 | |

Bio-Rad Laboratories, Cl A * | | | 401 | | | | 135,422 | |

Bio-Techne | | | 249 | | | | 47,701 | |

Boston Scientific * | | | 4,018 | | | | 171,689 | |

Bruker | | | 5,809 | | | | 250,774 | |

Charles River Laboratories International * | | | 979 | | | | 128,445 | |

Chemed | | | 570 | | | | 244,775 | |

Danaher | | | 5,669 | | | | 805,508 | |

DexCom * | | | 816 | | | | 140,034 | |

Edwards Lifesciences * | | | 805 | | | | 178,581 | |

Eli Lilly | | | 7,962 | | | | 899,467 | |

Encompass Health | | | 1,184 | | | | 71,975 | |

Exact Sciences * | | | 1,724 | | | | 205,535 | |

Exelixis * | | | 3,029 | | | | 60,126 | |

HCA Healthcare | | | 1,339 | | | | 160,948 | |

Henry Schein * | | | 4,803 | | | | 295,961 | |

Hill-Rom Holdings | | | 809 | | | | 87,113 | |

Horizon Therapeutics * | | | 12,709 | | | | 351,150 | |

Humana | | | 281 | | | | 79,582 | |

ICU Medical * | | | 429 | | | | 69,391 | |

IDEXX Laboratories * | | | 676 | | | | 195,864 | |

Intuitive Surgical * | | | 313 | | | | 160,050 | |

Ionis Pharmaceuticals * | | | 3,809 | | | | 240,767 | |

Jazz Pharmaceuticals * | | | 409 | | | | 52,413 | |

Johnson & Johnson | | | 8,182 | | | | 1,050,242 | |

Laboratory Corp of America Holdings * | | | 514 | | | | 86,126 | |

Masimo * | | | 1,825 | | | | 279,681 | |

McKesson | | | 922 | | | | 127,485 | |

Medtronic | | | 6,013 | | | | 648,743 | |

Merck | | | 20,745 | | | | 1,793,820 | |

Mettler-Toledo International * | | | 338 | | | | 221,995 | |

Molina Healthcare * | | | 723 | | | | 94,192 | |

Premier, Cl A * | | | 2,877 | | | | 101,443 | |

Quest Diagnostics | | | 524 | | | | 53,642 | |

ResMed | | | 1,539 | | | | 214,383 | |

STERIS | | | 1,111 | | | | 171,538 | |

Thermo Fisher Scientific | | | 3,541 | | | | 1,016,479 | |

UnitedHealth Group | | | 1,981 | | | | 463,554 | |

The accompanying notes are an integral part of the financial statements.

18

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

HEALTH CARE — continued | | | | | | | | |

Universal Health Services, Cl B | | | 1,998 | | | $ | 288,871 | |

Veeva Systems, Cl A * | | | 2,831 | | | | 454,036 | |

Zimmer Biomet Holdings | | | 899 | | | | 125,141 | |

Zoetis, Cl A | | | 3,214 | | | | 406,314 | |

| | | | | | | | 14,526,626 | |

INDUSTRIALS — 3.3% | | | | | | | | |

Acuity Brands | | | 1,220 | | | | 153,000 | |

AGCO | | | 5,808 | | | | 401,449 | |

Alaska Air Group | | | 1,595 | | | | 95,254 | |

Allegion | | | 2,437 | | | | 234,610 | |

Allison Transmission Holdings | | | 5,860 | | | | 260,360 | |

AMETEK | | | 720 | | | | 61,870 | |

Armstrong World Industries | | | 2,743 | | | | 261,874 | |

Boeing | | | 1,418 | | | | 516,280 | |

Carlisle | | | 1,965 | | | | 284,846 | |

CH Robinson Worldwide | | | 657 | | | | 55,510 | |

Cintas | | | 1,318 | | | | 347,688 | |

Clean Harbors * | | | 1,422 | | | | 104,588 | |

Copart * | | | 2,046 | | | | 154,248 | |

CSX | | | 8,156 | | | | 546,615 | |

Cummins | | | 2,426 | | | | 362,129 | |

Curtiss-Wright | | | 535 | | | | 65,612 | |

Delta Air Lines | | | 3,937 | | | | 227,795 | |

Donaldson | | | 931 | | | | 45,023 | |

Dover | | | 3,728 | | | | 349,463 | |

Eaton | | | 4,619 | | | | 372,846 | |

Emerson Electric | | | 5,485 | | | | 326,851 | |

Expeditors International of Washington | | | 3,667 | | | | 260,723 | |

Fastenal | | | 5,830 | | | | 178,515 | |

Flowserve | | | 2,497 | | | | 106,572 | |

Gardner Denver Holdings * | | | 5,957 | | | | 170,847 | |

HD Supply Holdings * | | | 2,085 | | | | 81,127 | |

HEICO | | | 2,752 | | | | 398,132 | |

Honeywell International | | | 5,159 | | | | 849,275 | |

Hubbell, Cl B | | | 1,886 | | | | 247,330 | |

IDEX | | | 853 | | | | 140,498 | |

Ingersoll-Rand | | | 4,673 | | | | 565,854 | |

ITT | | | 4,885 | | | | 278,054 | |

The accompanying notes are an integral part of the financial statements.

19

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

INDUSTRIALS — continued | | | | | | | | |

Jacobs Engineering Group | | | 3,241 | | | $ | 287,995 | |

JB Hunt Transport Services | | | 840 | | | | 90,754 | |

Johnson Controls International | | | 9,026 | | | | 385,320 | |

Landstar System | | | 522 | | | | 58,213 | |

Lennox International | | | 591 | | | | 149,984 | |

ManpowerGroup | | | 2,552 | | | | 208,600 | |

Masco | | | 3,249 | | | | 132,332 | |

Middleby * | | | 2,055 | | | | 225,351 | |

Nordson | | | 554 | | | | 75,322 | |

Norfolk Southern | | | 3,043 | | | | 529,634 | |

Old Dominion Freight Line | | | 1,014 | | | | 166,053 | |

Oshkosh | | | 4,851 | | | | 340,880 | |

PACCAR | | | 3,513 | | | | 230,312 | |

Parker-Hannifin | | | 945 | | | | 156,653 | |

Republic Services, Cl A | | | 5,686 | | | | 507,476 | |

Robert Half International | | | 2,425 | | | | 129,665 | |

Roper Technologies | | | 841 | | | | 308,445 | |

Snap-on | | | 1,206 | | | | 179,308 | |

Southwest Airlines | | | 3,201 | | | | 167,476 | |

Teledyne Technologies * | | | 933 | | | | 287,914 | |

Textron | | | 1,018 | | | | 45,810 | |

Timken | | | 1,532 | | | | 61,556 | |

Toro | | | 1,733 | | | | 124,793 | |

Union Pacific | | | 5,939 | | | | 961,880 | |

United Airlines Holdings * | | | 5,198 | | | | 438,243 | |

United Parcel Service, Cl B | | | 1,383 | | | | 164,107 | |

United Technologies | | | 1,574 | | | | 204,998 | |

Verisk Analytics, Cl A | | | 2,546 | | | | 411,281 | |

Wabtec | | | 545 | | | | 37,719 | |

Waste Management | | | 4,288 | | | | 511,773 | |

Woodward | | | 3,086 | | | | 332,825 | |

WW Grainger | | | 361 | | | | 98,788 | |

Xylem | | | 1,535 | | | | 117,596 | |

| | | | | | | | 16,633,894 | |

INFORMATION TECHNOLOGY — 5.7% | | | | | | | | |

Accenture, Cl A | | | 2,134 | | | | 422,895 | |

Adobe * | | | 695 | | | | 197,734 | |

Akamai Technologies * | | | 1,765 | | | | 157,314 | |

The accompanying notes are an integral part of the financial statements.

20

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

INFORMATION TECHNOLOGY — continued | | | | | | | | |

Analog Devices | | | 3,319 | | | $ | 364,526 | |

ANSYS * | | | 684 | | | | 141,287 | |

Apple | | | 28,172 | | | | 5,880,623 | |

Aspen Technology * | | | 1,183 | | | | 157,576 | |

Atlassian, Cl A * | | | 924 | | | | 124,287 | |

Autodesk * | | | 257 | | | | 36,705 | |

Automatic Data Processing | | | 3,140 | | | | 533,298 | |

Avalara * | | | 2,406 | | | | 202,922 | |

Avnet | | | 1,195 | | | | 50,059 | |

Booz Allen Hamilton Holding, Cl A | | | 5,479 | | | | 413,719 | |

Broadridge Financial Solutions | | | 1,732 | | | | 224,190 | |

Cadence Design Systems * | | | 4,319 | | | | 295,765 | |

CDW | | | 3,429 | | | | 396,049 | |

Ciena * | | | 5,381 | | | | 220,244 | |

Cisco Systems | | | 31,926 | | | | 1,494,456 | |

Coupa Software * | | | 1,743 | | | | 242,155 | |

EPAM Systems * | | | 1,102 | | | | 210,846 | |

Euronet Worldwide * | | | 1,753 | | | | 268,454 | |

Fair Isaac * | | | 694 | | | | 244,788 | |

FleetCor Technologies * | | | 177 | | | | 52,817 | |

FLIR Systems | | | 2,053 | | | | 101,151 | |

Fortinet * | | | 2,907 | | | | 230,176 | |

Intel | | | 12,237 | | | | 580,156 | |

Intuit | | | 2,690 | | | | 775,688 | |

Jack Henry & Associates | | | 1,090 | | | | 158,006 | |

Keysight Technologies * | | | 5,030 | | | | 487,206 | |

KLA | | | 1,108 | | | | 163,873 | |

Lam Research | | | 1,761 | | | | 370,708 | |

Leidos Holdings | | | 2,932 | | | | 256,139 | |

Manhattan Associates * | | | 2,935 | | | | 242,519 | |

Mastercard, Cl A | | | 1,835 | | | | 516,314 | |

Maxim Integrated Products | | | 1,401 | | | | 76,411 | |

Microsoft | | | 46,608 | | | | 6,425,379 | |

MongoDB, Cl A * | | | 1,599 | | | | 243,544 | |

Motorola Solutions | | | 2,167 | | | | 392,032 | |

Okta, Cl A * | | | 2,318 | | | | 293,227 | |

Oracle | | | 15,980 | | | | 831,919 | |

Palo Alto Networks * | | | 475 | | | | 96,720 | |

The accompanying notes are an integral part of the financial statements.

21

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

INFORMATION TECHNOLOGY — continued | | | | | | | | |

Paychex | | | 1,646 | | | $ | 134,478 | |

Paycom Software * | | | 910 | | | | 227,609 | |

PayPal Holdings * | | | 1,453 | | | | 158,450 | |

QUALCOMM | | | 1,627 | | | | 126,532 | |

Sabre | | | 6,144 | | | | 145,244 | |

salesforce.com * | | | 261 | | | | 40,734 | |

ServiceNow * | | | 1,479 | | | | 387,261 | |

Smartsheet, Cl A * | | | 3,195 | | | | 155,277 | |

Splunk * | | | 516 | | | | 57,699 | |

Teradyne | | | 6,702 | | | | 355,005 | |

Trimble * | | | 984 | | | | 36,920 | |

Twilio, Cl A * | | | 615 | | | | 80,239 | |

Ubiquiti | | | 2,469 | | | | 272,849 | |

Universal Display | | | 393 | | | | 80,750 | |

VeriSign * | | | 2,126 | | | | 433,385 | |

ViaSat * | | | 1,121 | | | | 88,929 | |

Visa, Cl A | | | 1,558 | | | | 281,718 | |

VMware, Cl A | | | 2,700 | | | | 381,888 | |

Workday, Cl A * | | | 796 | | | | 141,115 | |

Xilinx | | | 1,622 | | | | 168,785 | |

Zebra Technologies, Cl A * | | | 1,722 | | | | 353,062 | |

Zendesk * | | | 2,418 | | | | 193,924 | |

Zscaler * | | | 3,735 | | | | 256,744 | |

| | | | | | | | 29,132,474 | |

MATERIALS — 0.7% | | | | | | | | |

Air Products & Chemicals | | | 2,148 | | | | 485,276 | |

AptarGroup | | | 1,196 | | | | 146,175 | |

Ashland Global Holdings | | | 611 | | | | 44,750 | |

Ball | | | 6,562 | | | | 527,650 | |

Celanese, Cl A | | | 586 | | | | 66,435 | |

CF Industries Holdings | | | 3,409 | | | | 164,280 | |

Crown Holdings * | | | 4,402 | | | | 289,828 | |

Eastman Chemical | | | 550 | | | | 35,953 | |

Ecolab | | | 3,284 | | | | 677,522 | |

PPG Industries | | | 941 | | | | 104,253 | |

Reliance Steel & Aluminum | | | 2,421 | | | | 235,394 | |

RPM International | | | 1,706 | | | | 115,445 | |

Scotts Miracle-Gro | | | 1,599 | | | | 170,006 | |

The accompanying notes are an integral part of the financial statements.

22

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

MATERIALS — continued | | | | | | | | |

Sonoco Products | | | 4,094 | | | $ | 234,177 | |

| | | | | | | | 3,297,144 | |

REAL ESTATE — 0.7% | | | | | | | | |

Apartment Investment & Management, Cl A ‡ | | | 5,229 | | | | 266,679 | |

CBRE Group, Cl A * | | | 3,755 | | | | 196,274 | |

EPR Properties ‡ | | | 2,607 | | | | 203,998 | |

Equity Commonwealth ‡ | | | 3,313 | | | | 111,516 | |

Equity Residential ‡ | | | 4,449 | | | | 377,097 | |

Extra Space Storage ‡ | | | 1,004 | | | | 122,408 | |

HCP ‡ | | | 8,029 | | | | 278,687 | |

Jones Lang LaSalle | | | 627 | | | | 84,049 | |

Kimco Realty ‡ | | | 7,187 | | | | 132,097 | |

Liberty Property Trust ‡ | | | 825 | | | | 42,999 | |

Life Storage ‡ | | | 987 | | | | 104,582 | |

Medical Properties Trust ‡ | | | 19,490 | | | | 362,319 | |

National Retail Properties ‡ | | | 1,555 | | | | 87,313 | |

Omega Healthcare Investors ‡ | | | 8,585 | | | | 349,238 | |

Spirit Realty Capital ‡ | | | 1,512 | | | | 72,485 | |

Sun Communities ‡ | | | 1,181 | | | | 174,552 | |

Ventas ‡ | | | 5,328 | | | | 391,022 | |

Welltower ‡ | | | 4,826 | | | | 432,216 | |

| | | | | | | | 3,789,531 | |

UTILITIES — 1.1% | | | | | | | | |

AES | | | 10,893 | | | | 166,989 | |

Ameren | | | 6,061 | | | | 467,606 | |

American Electric Power | | | 7,229 | | | | 658,923 | |

Atmos Energy | | | 2,357 | | | | 259,812 | |

CMS Energy | | | 7,482 | | | | 471,740 | |

DTE Energy | | | 4,656 | | | | 603,697 | |

Duke Energy | | | 1,122 | | | | 104,054 | |

Entergy | | | 2,144 | | | | 241,929 | |

Eversource Energy | | | 1,736 | | | | 139,106 | |

Exelon | | | 8,667 | | | | 409,603 | |

Hawaiian Electric Industries | | | 2,753 | | | | 122,233 | |

NextEra Energy | | | 635 | | | | 139,116 | |

OGE Energy | | | 7,600 | | | | 325,812 | |

Pinnacle West Capital | | | 4,182 | | | | 398,586 | |

Public Service Enterprise Group | | | 2,839 | | | | 171,675 | |

The accompanying notes are an integral part of the financial statements.

23

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

UTILITIES — continued | | | | | | | | |

Vistra Energy | | | 1,685 | | | $ | 42,041 | |

Xcel Energy | | | 10,876 | | | | 698,457 | |

| | | | | | | | 5,421,379 | |

| | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $111,827,693) | | | | | | | 126,172,833 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT — 2.3% |

Invesco Government & Agency Portfolio, Cl Institutional, 2.020% (B) | | | | | | | | |

(Cost $11,880,734) | | | 11,880,734 | | | | 11,880,734 | |

Total Investments — 100.0% | | | | | | | | |

(Cost $474,320,244) | | | | | | $ | 506,787,959 | |

A list of open futures contracts held by the Fund at August 31, 2019, is as follows:

Type of

Contract | Number of

Contracts

Long | Expiration

Date | | Notional

Amount | | | Value | | | Unrealized

Appreciation | |

S&P 500 Index E-MINI | 19 | Sep-2019 | | $ | 2,737,751 | | | $ | 2,778,560 | | | $ | 40,809 | |

A list of open total return swap agreements held by the Fund at August 31, 2019, is as follows:

Counterparty | Reference

Entity/

Obligation | Fund Pays | Fund

Receives | Payment

Frequency | Termination

Date | Currency | | Notional

Amount | | | Value | | | Net

Unrealized

Appreciation | |

ReFlow | SPUSX NAV | SOFR +25 BPS | SPUSX | Annually | 02/05/2020 | USD | | | 8,119,411 | | | $ | 144,844 | | | $ | 144,844 | |

Percentages are based on Net Assets of $506,766,453.

* | Non-income producing security. |

‡ | Real Estate Investment Trust |

(A) | Represents greater than 25% of the Fund’s total investments. For further financial information, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov. |

(B) | The rate reported is the 7-day effective yield as of August 31, 2019. |

The accompanying notes are an integral part of the financial statements.

24

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2019

BPS — Basis Points

Cl — Class

ETF — Exchange-Traded Fund

MSCI — Morgan Stanley Capital International

S&P — Standard & Poor’s

SOFR — Secured Overnight Financing Rate

SPUSX — Symmetry Panoramic US Equity Fund

USD — United States Dollar

The following table summarizes the inputs used as of August 31, 2019, in valuing the Fund’s investments and other financial instruments carried at value:

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Registered Investment Companies | | $ | 368,734,392 | | | $ | — | | | $ | — | | | $ | 368,734,392 | |

Common Stock | | | 126,172,833 | | | | — | | | | — | | | | 126,172,833 | |

Short-Term Investment | | | 11,880,734 | | | | — | | | | — | | | | 11,880,734 | |

Total Investments in Securities | | $ | 506,787,959 | | | $ | — | | | $ | — | | | $ | 506,787,959 | |

Other Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Futures Contracts^ | | | | | | | | | | | | | | | | |

Unrealized Appreciation | | $ | 40,809 | | | $ | — | | | $ | — | | | $ | 40,809 | |

Total Return Swap^ | | | | | | | | | | | | | | | | |

Unrealized Appreciation | | | — | | | | 144,844 | | | | — | | | | 144,844 | |

Total Other Financial Instruments | | $ | 40,809 | | | $ | 144,844 | | | $ | — | | | $ | 185,653 | |

^ | Futures contracts and swap contracts are valued at the unrealized appreciation on the instrument. |

Amounts designated as “—” are $0.

For the period ended August 31, 2019, there were no Level 3 securities.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

25

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

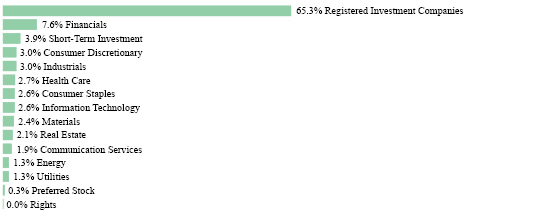

SECTOR WEIGHTINGS† (UNAUDITED) |

†Percentages are based on total investments.

SCHEDULE OF INVESTMENTS |

REGISTERED INVESTMENT COMPANIES — 65.3% |

| | | Shares | | | Value | |

EQUITY FUNDS — 65.3% | | | | | | | | |

DFA Emerging Markets Core Equity Portfolio, Cl I | | | 2,625,992 | | | $ | 51,259,354 | |

DFA International Core Equity Portfolio, Cl I | | | 1,830,390 | | | | 22,660,233 | |

DFA International Real Estate Securities, Cl I | | | 3,995,803 | | | | 20,977,964 | |

DFA International Vector Equity Portfolio, Cl I | | | 4,661,050 | | | | 50,479,175 | |

iShares Edge MSCI Min Vol EAFE ETF | | | 246,049 | | | | 17,694,614 | |

iShares Edge MSCI Min Vol Emerging Markets ETF | | | 176,315 | | | | 10,012,929 | |

Total Registered Investment Companies | | | | | | | | |

(Cost $172,530,142) | | | | | | | 173,084,269 | |

COMMON STOCK — 30.5% |

AUSTRALIA — 1.2% | | | | | | | | |

Alumina | | | 35,731 | | | | 52,188 | |

Aristocrat Leisure | | | 1,697 | | | | 34,023 | |

Australia & New Zealand Banking Group | | | 5,700 | | | | 102,635 | |

Brambles | | | 20,505 | | | | 155,635 | |

Coca-Cola Amatil | | | 5,783 | | | | 42,271 | |

Commonwealth Bank of Australia | | | 1,476 | | | | 78,414 | |

Crown Resorts | | | 5,225 | | | | 42,222 | |

CSL | | | 787 | | | | 127,865 | |

Dexus ‡ | | | 22,038 | | | | 191,619 | |

Flight Centre Travel Group | | | 931 | | | | 29,145 | |

The accompanying notes are an integral part of the financial statements.

26

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

AUSTRALIA — continued | | | | | | | | |

Fortescue Metals Group | | | 30,857 | | | $ | 166,341 | |

Goodman Group ‡ | | | 27,644 | | | | 270,664 | |

GPT Group ‡ | | | 29,441 | | | | 126,710 | |

Macquarie Group | | | 3,391 | | | | 281,937 | |

Mirvac Group ‡ | | | 68,430 | | | | 147,009 | |

Orica | | | 4,107 | | | | 59,519 | |

QBE Insurance Group | | | 10,442 | | | | 87,734 | |

REA Group | | | 683 | | | | 47,941 | |

Santos | | | 27,374 | | | | 132,579 | |

Scentre Group ‡ | | | 40,551 | | | | 110,381 | |

Suncorp Group | | | 5,246 | | | | 48,690 | |

Telstra | | | 80,186 | | | | 200,493 | |

Vicinity Centres ‡ | | | 21,714 | | | | 37,899 | |

Wesfarmers | | | 9,609 | | | | 252,756 | |

Woodside Petroleum | | | 7,471 | | | | 161,274 | |

Woolworths Group | | | 4,125 | | | | 105,011 | |

| | | | | | | | 3,092,955 | |

BELGIUM — 0.1% | | | | | | | | |

Ageas | | | 1,181 | | | | 63,231 | |

Proximus SADP | | | 4,183 | | | | 123,701 | |

UCB | | | 2,207 | | | | 164,753 | |

| | | | | | | | 351,685 | |

BRAZIL — 1.3% | | | | | | | | |

Atacadao | | | 20,500 | | | | 110,545 | |

Banco Bradesco ADR | | | 28,270 | | | | 225,877 | |

Banco do Brasil | | | 12,300 | | | | 137,257 | |

Banco Santander Brasil ADR | | | 10,365 | | | | 106,241 | |

CCR | | | 7,600 | | | | 29,824 | |

Centrais Eletricas Brasileiras | | | 15,400 | | | | 172,371 | |

Cia de Saneamento Basico do Estado de Sao Paulo ADR | | | 11,466 | | | | 141,949 | |

Cia Siderurgica Nacional | | | 35,800 | | | | 122,936 | |

Engie Brasil Energia | | | 10,600 | | | | 115,266 | |

IRB Brasil Resseguros S | | | 6,600 | | | | 168,865 | |

Itau Unibanco Holding ADR | | | 42,010 | | | | 346,163 | |

Itausa - Investimentos Itau | | | 89,200 | | | | 265,597 | |

JBS | | | 40,200 | | | | 289,778 | |

Lojas Renner | | | 15,300 | | | | 187,029 | |

The accompanying notes are an integral part of the financial statements.

27

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

BRAZIL — continued | | | | | | | | |

Natura Cosmeticos | | | 9,200 | | | $ | 147,742 | |

Petrobras Distribuidora | | | 21,800 | | | | 150,826 | |

Porto Seguro | | | 7,100 | | | | 96,170 | |

Sul America | | | 18,000 | | | | 208,645 | |

TIM Participacoes ADR | | | 2,133 | | | | 31,696 | |

Vale ADR, Cl B | | | 33,387 | | | | 367,257 | |

| | | | | | | | 3,422,034 | |

CANADA — 1.9% | | | | | | | | |

Alimentation Couche-Tard, Cl B | | | 5,811 | | | | 365,752 | |

Bank of Montreal | | | 3,806 | | | | 260,880 | |

Bausch Health * | | | 4,859 | | | | 103,538 | |

BCE | | | 5,820 | | | | 275,394 | |

Brookfield Asset Management, Cl A | | | 6,810 | | | | 351,190 | |

CAE | | | 5,359 | | | | 140,274 | |

Canadian National Railway | | | 4,818 | | | | 443,658 | |

Canadian Pacific Railway | | | 1,165 | | | | 280,505 | |

Canadian Tire, Cl A | | | 174 | | | | 17,575 | |

CGI, Cl A * | | | 3,609 | | | | 283,049 | |

Constellation Software | | | 164 | | | | 159,727 | |

Empire | | | 7,037 | | | | 194,133 | |

Gildan Activewear | | | 4,300 | | | | 157,641 | |

H&R Real Estate Investment Trust ‡ | | | 6,435 | | | | 109,377 | |

iA Financial | | | 506 | | | | 21,043 | |

Imperial Oil | | | 962 | | | | 23,606 | |

Intact Financial | | | 1,928 | | | | 188,427 | |

Loblaw | | | 1,936 | | | | 105,961 | |

Magna International | | | 471 | | | | 23,582 | |

Manulife Financial | | | 13,450 | | | | 223,156 | |

Metro, Cl A | | | 1,722 | | | | 73,063 | |

National Bank of Canada | | | 2,474 | | | | 116,174 | |

Open Text | | | 1,399 | | | | 54,735 | |

Power Financial | | | 2,327 | | | | 49,620 | |

RioCan Real Estate Investment Trust ‡ | | | 3,068 | | | | 61,019 | |

Rogers Communications, Cl B | | | 4,999 | | | | 247,472 | |

Royal Bank of Canada | | | 5,586 | | | | 417,796 | |

Shopify, Cl A * | | | 69 | | | | 26,577 | |

SmartCentres Real Estate Investment Trust ‡ | | | 2,013 | | | | 47,868 | |

Sun Life Financial | | | 402 | | | | 16,477 | |

The accompanying notes are an integral part of the financial statements.

28

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

CANADA — continued | | | | | | | | |

Toronto-Dominion Bank | | | 5,622 | | | $ | 304,873 | |

| | | | | | | | 5,144,142 | |

CHINA — 0.2% | | | | | | | | |

Agricultural Bank of China, Cl A | | | 35,800 | | | | 17,032 | |

Bank of Beijing, Cl A | | | 31,100 | | | | 22,863 | |

Bank of China, Cl A | | | 32,800 | | | | 16,203 | |

Bank of Communications, Cl A | | | 25,400 | | | | 19,232 | |

Bank of Ningbo, Cl A | | | 2,908 | | | | 9,291 | |

Bank of Shanghai, Cl A | | | 15,700 | | | | 19,827 | |

BYD, Cl A | | | 1,300 | | | | 8,999 | |

China Everbright Bank, Cl A | | | 35,600 | | | | 18,734 | |

China Fortune Land Development, Cl A | | | 3,500 | | | | 13,077 | |

China Merchants Bank, Cl A | | | 3,600 | | | | 17,269 | |

China Merchants Securities, Cl A | | | 4,300 | | | | 9,617 | |

China Merchants Shekou Industrial Zone Holdings, Cl A | | | 6,100 | | | | 16,855 | |

China Minsheng Banking, Cl A | | | 28,800 | | | | 23,413 | |

China Railway Construction, Cl A | | | 14,700 | | | | 18,711 | |

China State Construction Engineering, Cl A | | | 24,300 | | | | 18,615 | |

China United Network Communications, Cl A | | | 12,800 | | | | 10,480 | |

China Vanke, Cl A | | | 4,900 | | | | 17,689 | |

Daqin Railway, Cl A | | | 9,000 | | | | 9,745 | |

Guotai Junan Securities, Cl A | | | 4,300 | | | | 10,290 | |

Haier Smart Home, Cl A | | | 4,342 | | | | 9,666 | |

Huaxia Bank, Cl A | | | 24,900 | | | | 25,214 | |

Industrial & Commercial Bank of China, Cl A | | | 19,500 | | | | 14,697 | |

Industrial Bank, Cl A | | | 7,200 | | | | 17,310 | |

Kweichow Moutai, Cl A | | | 100 | | | | 15,986 | |

Ping An Bank, Cl A | | | 6,400 | | | | 12,682 | |

Ping An Insurance Group of China, Cl A | | | 900 | | | | 10,993 | |

Poly Developments and Holdings Group, Cl A | | | 7,700 | | | | 14,486 | |

SAIC Motor, Cl A | | | 5,600 | | | | 19,660 | |

Shanghai Pudong Development Bank, Cl A | | | 12,100 | | | | 19,108 | |

Shenwan Hongyuan Group, Cl A | | | 14,600 | | | | 9,764 | |

Suning.com, Cl A | | | 6,799 | | | | 10,220 | |

Tsingtao Brewery, Cl H | | | 14,000 | | | | 94,391 | |

| | | | | | | | 572,119 | |

The accompanying notes are an integral part of the financial statements.

29

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

DENMARK — 0.2% | | | | | | | | |

Carlsberg, Cl B | | | 197 | | | $ | 29,144 | |

Chr Hansen Holding | | | 294 | | | | 24,703 | |

Coloplast, Cl B | | | 1,069 | | | | 127,339 | |

Demant * | | | 1,159 | | | | 35,119 | |

DSV | | | 838 | | | | 83,026 | |

Orsted | | | 664 | | | | 63,501 | |

Tryg | | | 3,167 | | | | 94,669 | |

Vestas Wind Systems | | | 1,907 | | | | 139,900 | |

| | | | | | | | 597,401 | |

FINLAND — 0.3% | | | | | | | | |

Elisa | | | 1,640 | | | | 82,467 | |

Kone, Cl B | | | 3,127 | | | | 180,896 | |

Neste | | | 6,144 | | | | 193,673 | |

Nokia | | | 12,583 | | | | 62,326 | |

Orion, Cl B | | | 2,501 | | | | 92,914 | |

Stora Enso, Cl R | | | 3,223 | | | | 36,165 | |

UPM-Kymmene | | | 3,263 | | | | 88,234 | |

| | | | | | | | 736,675 | |

FRANCE — 1.3% | | | | | | | | |

Air Liquide | | | 964 | | | | 134,449 | |

Airbus | | | 677 | | | | 93,425 | |

AXA | | | 8,517 | | | | 195,697 | |

Carrefour | | | 4,661 | | | | 79,472 | |

Cie Generale des Etablissements Michelin SCA | | | 1,296 | | | | 136,479 | |

Dassault Systemes | | | 438 | | | | 61,787 | |

Edenred | | | 695 | | | | 33,843 | |

EssilorLuxottica | | | 704 | | | | 103,957 | |

Hermes International | | | 429 | | | | 293,391 | |

Kering | | | 327 | | | | 158,241 | |

L’Oreal | | | 863 | | | | 236,029 | |

LVMH Moet Hennessy Louis Vuitton | | | 1,686 | | | | 672,909 | |

Peugeot | | | 8,665 | | | | 194,006 | |

Sanofi | | | 5,180 | | | | 445,161 | |

Sartorius Stedim Biotech | | | 527 | | | | 81,709 | |

SCOR | | | 878 | | | | 35,016 | |

Sodexo | | | 1,017 | | | | 115,253 | |

Suez | | | 1,461 | | | | 22,676 | |

Teleperformance | | | 127 | | | | 27,762 | |

The accompanying notes are an integral part of the financial statements.

30

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

FRANCE — continued | | | | | | | | |

Thales | | | 301 | | | $ | 34,848 | |

TOTAL | | | 4,133 | | | | 206,698 | |

Ubisoft Entertainment * | | | 258 | | | | 20,834 | |

| | | | | | | | 3,383,642 | |

GERMANY — 1.1% | | | | | | | | |

adidas | | | 1,038 | | | | 307,899 | |

Allianz | | | 2,677 | | | | 590,598 | |

Aroundtown | | | 13,266 | | | | 110,418 | |

Brenntag | | | 1,621 | | | | 78,247 | |

Carl Zeiss Meditec | | | 1,075 | | | | 124,234 | |

Deutsche Boerse | | | 889 | | | | 131,026 | |

Deutsche Telekom | | | 17,170 | | | | 286,666 | |

E.ON | | | 9,103 | | | | 84,664 | |

Evonik Industries | | | 3,690 | | | | 94,331 | |

Hannover Rueck | | | 1,586 | | | | 252,971 | |

MTU Aero Engines | | | 636 | | | | 174,048 | |

Muenchener Rueckversicherungs-Gesellschaft in Muenchen | | | 848 | | | | 203,284 | |

Puma | | | 777 | | | | 59,108 | |

QIAGEN * | | | 2,228 | | | | 77,552 | |

RWE | | | 1,495 | | | | 42,620 | |

Volkswagen | | | 433 | | | | 70,748 | |

Vonovia | | | 5,481 | | | | 273,313 | |

Wirecard | | | 151 | | | | 24,291 | |

| | | | | | | | 2,986,018 | |

HONG KONG — 5.9% | | | | | | | | |

Agile Group Holdings | | | 26,000 | | | | 33,174 | |

Agricultural Bank of China, Cl H | | | 649,000 | | | | 249,499 | |

Air China, Cl H | | | 68,000 | | | | 58,733 | |

Anhui Conch Cement, Cl H | | | 48,500 | | | | 272,183 | |

BAIC Motor, Cl H | | | 40,000 | | | | 22,528 | |

Bank of China, Cl H | | | 1,150,000 | | | | 437,660 | |

Bank of Communications, Cl H | | | 484,000 | | | | 315,978 | |

Beijing Enterprises Holdings | | | 12,000 | | | | 56,941 | |

BOC Aviation | | | 13,500 | | | | 117,314 | |

BYD Electronic International | | | 95,500 | | | | 114,015 | |

China Aoyuan Group | | | 84,000 | | | | 98,804 | |

China CITIC Bank, Cl H | | | 63,000 | | | | 32,889 | |

The accompanying notes are an integral part of the financial statements.

31

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

HONG KONG — continued | | | | | | | | |

China Coal Energy, Cl H | | | 36,000 | | | $ | 14,266 | |

China Construction Bank, Cl H | | | 1,286,000 | | | | 950,781 | |

China Everbright Bank, Cl H | | | 496,000 | | | | 206,463 | |

China Jinmao Holdings Group | | | 218,000 | | | | 121,410 | |

China Longyuan Power Group, Cl H | | | 17,000 | | | | 9,344 | |

China Mengniu Dairy | | | 7,000 | | | | 27,728 | |

China Merchants Bank, Cl H | | | 200,000 | | | | 909,056 | |

China Minsheng Banking, Cl H | | | 385,000 | | | | 253,014 | |

China Mobile | | | 101,000 | | | | 834,019 | |

China Oriental Group | | | 64,000 | | | | 25,260 | |

China Overseas Land & Investment | | | 86,000 | | | | 271,341 | |

China Resources Beer Holdings | | | 6,000 | | | | 34,071 | |

China Resources Cement Holdings | | | 12,000 | | | | 10,616 | |

China Resources Gas Group | | | 34,000 | | | | 167,545 | |

China Resources Land | | | 62,000 | | | | 251,421 | |

China Resources Power Holdings | | | 14,000 | | | | 18,453 | |

China Shenhua Energy, Cl H | | | 41,500 | | | | 80,872 | |

China Telecom, Cl H | | | 534,000 | | | | 238,620 | |

China Vanke, Cl H | | | 81,300 | | | | 280,219 | |

CIFI Holdings Group | | | 54,000 | | | | 28,920 | |

CITIC | | | 135,000 | | | | 159,679 | |

CLP Holdings | | | 19,000 | | | | 195,153 | |

CNOOC | | | 241,000 | | | | 358,501 | |

COSCO SHIPPING Ports | | | 42,000 | | | | 36,786 | |

Country Garden Holdings | | | 44,000 | | | | 54,554 | |

CSPC Pharmaceutical Group | | | 10,000 | | | | 19,954 | |

ENN Energy Holdings | | | 3,900 | | | | 44,386 | |

Far East Horizon | | | 82,000 | | | | 73,456 | |

Future Land Development Holdings | | | 154,000 | | | | 121,617 | |

Great Wall Motor, Cl H | | | 133,500 | | | | 84,568 | |

Guangdong Investment | | | 86,000 | | | | 181,089 | |

Guangzhou R&F Properties | | | 45,200 | | | | 72,599 | |

Haier Electronics Group | | | 9,000 | | | | 23,434 | |

Hang Lung Properties | | | 72,000 | | | | 162,808 | |

Hang Seng Bank | | | 3,800 | | | | 79,017 | |

Henderson Land Development | | | 50,300 | | | | 233,742 | |

Hong Kong & China Gas | | | 103,400 | | | | 199,363 | |

Hua Hong Semiconductor | | | 43,000 | | | | 71,594 | |

The accompanying notes are an integral part of the financial statements.

32

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

HONG KONG — continued | | | | | | | | |

Huadian Power International, Cl H | | | 152,000 | | | $ | 59,260 | |

Hysan Development | | | 10,000 | | | | 40,323 | |

Industrial & Commercial Bank of China, Cl H | | | 2,060,000 | | | | 1,296,267 | |

Jiangsu Expressway, Cl H | | | 8,000 | | | | 10,612 | |

Jiangxi Copper, Cl H | | | 52,000 | | | | 58,457 | |

Kaisa Group Holdings | | | 59,000 | | | | 20,397 | |

KWG Group Holdings | | | 45,000 | | | | 39,121 | |

Lenovo Group | | | 200,000 | | | | 130,940 | |

Li Ning | | | 63,500 | | | | 187,164 | |

Link REIT ‡ | | | 23,000 | | | | 257,518 | |

Logan Property Holdings | | | 90,000 | | | | 126,949 | |

Longfor Group Holdings | | | 52,000 | | | | 185,599 | |

Luye Pharma Group | | | 24,000 | | | | 18,603 | |

Maanshan Iron & Steel, Cl H | | | 68,000 | | | | 25,461 | |

Metallurgical Corp of China, Cl H | | | 63,000 | | | | 14,043 | |

MTR | | | 15,000 | | | | 86,740 | |

New China Life Insurance, Cl H | | | 32,400 | | | | 127,555 | |

New World Development | | | 16,000 | | | | 19,903 | |

Ping An Insurance Group of China, Cl H | | | 155,500 | | | | 1,773,451 | |

Postal Savings Bank of China, Cl H | | | 101,000 | | | | 60,730 | |

Shandong Weigao Group Medical Polymer, Cl H | | | 120,000 | | | | 123,709 | |

Shenzhou International Group Holdings | | | 5,000 | | | | 67,852 | |

Shimao Property Holdings | | | 56,500 | | | | 159,368 | |

Shui On Land | | | 79,000 | | | | 16,404 | |

Sihuan Pharmaceutical Holdings Group | | | 425,000 | | | | 75,744 | |

Sino Biopharmaceutical | | | 14,000 | | | | 20,769 | |

Sinopec Engineering Group, Cl H | | | 28,000 | | | | 18,290 | |

Sinopharm Group, Cl H | | | 6,400 | | | | 23,120 | |

Sinotruk Hong Kong | | | 83,000 | | | | 127,730 | |

SJM Holdings | | | 48,000 | | | | 45,062 | |

SSY Group | | | 28,000 | | | | 24,692 | |

Sun Art Retail Group | | | 11,500 | | | | 11,219 | |

Sun Hung Kai Properties | | | 4,500 | | | | 63,438 | |

Sunac China Holdings | | | 45,000 | | | | 179,884 | |

Swire Properties | | | 54,600 | | | | 178,970 | |

Techtronic Industries | | | 26,500 | | | | 182,044 | |

Tingyi Cayman Islands Holding | | | 12,000 | | | | 16,500 | |

Uni-President China Holdings | | | 22,000 | | | | 24,424 | |

The accompanying notes are an integral part of the financial statements.

33

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

HONG KONG — continued | | | | | | | | |

Vitasoy International Holdings | | | 16,000 | | | $ | 74,456 | |

Want Want China Holdings | | | 25,000 | | | | 19,441 | |

Weichai Power, Cl H | | | 147,000 | | | | 223,987 | |

WH Group | | | 217,000 | | | | 174,248 | |

Wheelock | | | 15,000 | | | | 87,218 | |

Yanzhou Coal Mining, Cl H | | | 12,000 | | | | 10,420 | |

Yihai International Holding | | | 6,000 | | | | 35,853 | |

Yue Yuen Industrial Holdings | | | 13,500 | | | | 34,550 | |

Yuexiu Property | | | 464,000 | | | | 99,680 | |

Yuzhou Properties | | | 81,000 | | | | 34,072 | |

Zhejiang Expressway, Cl H | | | 74,000 | | | | 61,794 | |

Zijin Mining Group, Cl H | | | 28,000 | | | | 10,495 | |

| | | | | | | | 15,479,963 | |

HUNGARY — 0.1% | | | | | | | | |

MOL Hungarian Oil & Gas | | | 16,815 | | | | 164,509 | |

OTP Bank Nyrt | | | 2,057 | | | | 81,848 | |

| | | | | | | | 246,357 | |

INDONESIA — 0.6% | | | | | | | | |

Adaro Energy | | | 314,700 | | | | 25,004 | |

Astra International | | | 280,800 | | | | 132,044 | |

Bank Central Asia | | | 156,700 | | | | 336,958 | |

Bank Mandiri Persero | | | 258,700 | | | | 132,086 | |

Bank Negara Indonesia Persero | | | 276,000 | | | | 149,591 | |

Bank Rakyat Indonesia Persero | | | 1,010,900 | | | | 303,902 | |

Gudang Garam | | | 16,600 | | | | 81,269 | |

Indocement Tunggal Prakarsa | | | 64,200 | | | | 98,244 | |

Indofood CBP Sukses Makmur | | | 43,300 | | | | 36,794 | |

Indofood Sukses Makmur | | | 61,700 | | | | 34,451 | |

Jasa Marga Persero | | | 87,100 | | | | 34,402 | |

Pakuwon Jati | | | 2,289,000 | | | | 103,358 | |

Semen Indonesia Persero | | | 27,400 | | | | 25,551 | |

Telekomunikasi Indonesia Persero | | | 236,600 | | | | 74,093 | |

| | | | | | | | 1,567,747 | |

ITALY — 0.6% | | | | | | | | |

Assicurazioni Generali | | | 13,494 | | | | 244,530 | |

Davide Campari-Milano | | | 3,992 | | | | 37,445 | |

Enel | | | 39,060 | | | | 283,521 | |

Eni | | | 22,801 | | | | 343,417 | |

The accompanying notes are an integral part of the financial statements.

34

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

ITALY — continued | | | | | | | | |

Ferrari | | | 455 | | | $ | 71,696 | |

Leonardo | | | 5,774 | | | | 70,827 | |

Mediobanca Banca di Credito Finanziario | | | 11,791 | | | | 116,895 | |

Moncler | | | 2,766 | | | | 103,895 | |

Poste Italiane | | | 19,284 | | | | 207,344 | |

Recordati | | | 379 | | | | 16,611 | |

Terna Rete Elettrica Nazionale | | | 16,553 | | | | 103,947 | |

| | | | | | | | 1,600,128 | |

JAPAN — 5.0% | | | | | | | | |

ABC-Mart | | | 1,900 | | | | 121,357 | |

Advantest | | | 5,100 | | | | 209,140 | |

AGC | | | 600 | | | | 17,291 | |

Alfresa Holdings | | | 1,100 | | | | 24,848 | |

Amada Holdings | | | 11,200 | | | | 116,678 | |

Asahi Intecc | | | 4,600 | | | | 102,836 | |

Asahi Kasei | | | 4,100 | | | | 37,056 | |

Astellas Pharma | | | 14,400 | | | | 199,101 | |

Bandai Namco Holdings | | | 4,500 | | | | 263,530 | |

Bridgestone | | | 4,500 | | | | 171,196 | |

Brother Industries | | | 3,400 | | | | 58,781 | |

Casio Computer | | | 3,500 | | | | 48,911 | |

Central Japan Railway | | | 1,600 | | | | 316,308 | |

Chubu Electric Power | | | 1,200 | | | | 17,696 | |

Chugai Pharmaceutical | | | 3,600 | | | | 257,291 | |

Dai Nippon Printing | | | 3,900 | | | | 84,259 | |

Daiichi Sankyo | | | 4,400 | | | | 288,962 | |

Daikin Industries | | | 500 | | | | 61,800 | |

East Japan Railway | | | 1,200 | | | | 114,279 | |

Fast Retailing | | | 500 | | | | 292,676 | |

Fuji Electric | | | 1,000 | | | | 28,527 | |

FUJIFILM Holdings | | | 4,200 | | | | 179,630 | |

Fujitsu | | | 2,400 | | | | 184,567 | |

Hakuhodo DY Holdings | | | 8,000 | | | | 118,029 | |

Hamamatsu Photonics | | | 700 | | | | 24,158 | |

Hikari Tsushin | | | 600 | | | | 140,457 | |

Hitachi | | | 6,400 | | | | 218,191 | |

Hitachi Chemical | | | 5,300 | | | | 164,160 | |

The accompanying notes are an integral part of the financial statements.

35

SYMMETRY PANORAMIC INTERNATIONAL EQUITY FUND

AUGUST 31, 2019

COMMON STOCK — continued |

| | | Shares | | | Value | |

JAPAN — continued | | | | | | | | |

Hitachi High-Technologies | | | 3,000 | | | $ | 161,834 | |

Honda Motor | | | 1,300 | | | | 30,827 | |

Hoya | | | 3,800 | | | | 309,317 | |

ITOCHU | | | 10,800 | | | | 215,116 | |

Itochu Techno-Solutions | | | 5,400 | | | | 148,916 | |

Japan Airlines | | | 1,300 | | | | 40,557 | |

Japan Airport Terminal | | | 700 | | | | 27,883 | |

Japan Prime Realty Investment ‡ | | | 21 | | | | 95,969 | |

Japan Real Estate Investment ‡ | | | 19 | | | | 126,518 | |

JSR | | | 1,300 | | | | 21,249 | |

Kakaku.com | | | 2,800 | | | | 69,985 | |

Kamigumi | | | 3,200 | | | | 74,920 | |

Kaneka | | | 1,500 | | | | 44,911 | |

Kao | | | 600 | | | | 43,299 | |

KDDI | | | 1,800 | | | | 47,945 | |

Keihan Holdings | | | 3,100 | | | | 129,725 | |

Keio | | | 1,600 | | | | 99,999 | |

Kobayashi Pharmaceutical | | | 400 | | | | 29,922 | |

Kose | | | 100 | | | | 17,151 | |

Kyocera | | | 3,700 | | | | 219,721 | |

Lion | | | 1,200 | | | | 23,297 | |

Marubeni | | | 5,400 | | | | 34,429 | |

Marui Group | | | 1,300 | | | | 25,873 | |

Medipal Holdings | | | 6,300 | | | | 133,602 | |