UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23334

Symmetry Panoramic Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Michael Beattie

c/o SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 786-3309

Date of fiscal year end: August 31, 2024

Date of reporting period: August 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR § 270.30e-1), is attached hereto. |

Symmetry Panoramic US Equity Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic US Equity Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/us-equity-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic US Equity Fund, Class I Shares | $62 | 0.55% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 26.27% and bested its benchmark, the MSCI US Broad Market Index, by 0.13%. With respect to style factors, small capitalization and low volatility trailed the broad market benchmark in the US while quality, value, and momentum outperformed. In the trailing 3-year period, the Fund was up 8.26% annualized and bested its benchmark by 0.34%.

Fiscal 2024 was a very strong year for both equity and fixed income investors across the globe. As economies that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. The Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024 . Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, equity returns were strong globally and especially so in the United States.

Multi-factor equity investors have focused on an expected recovery in the equity value factor, after having historically challenging times leading up to and into the COVID pandemic and again in Fiscal 2023. In contrast, Fiscal 2022 and 2024 were strong periods for value investors. While we welcome the contribution to performance that the value factor has provided in the most recent three years, we remain aware that each style factor may be in or out of favor over different time periods. Thus, we diversify the funds’ exposure across multiple style factors to reduce the risk inherent in any one factor. Our investment philosophy is based on evidence that style factors have the potential to outperform market capitalization weighted benchmarks over the long-term. We expect the style factors to contribute to long-term relative performance. This remains particularly true with respect to value stocks as they return to a valuation spread with growth stocks that is more in line with historical averages.

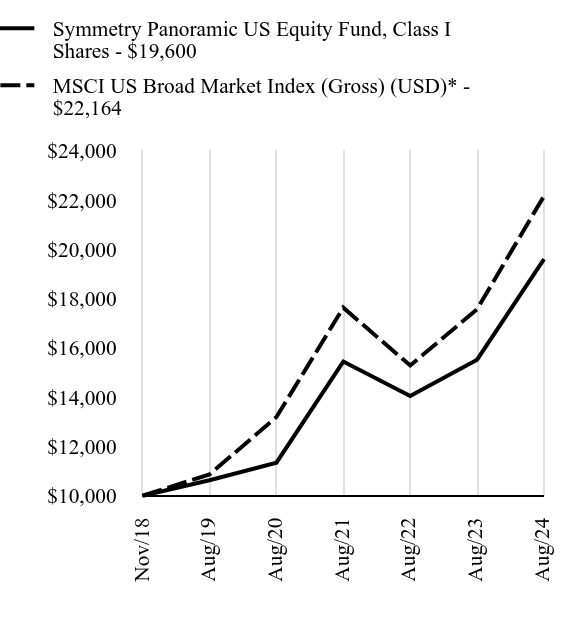

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic US Equity Fund, Class I Shares - $19600 | MSCI US Broad Market Index (Gross) (USD)* - $22164 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10626 | $10863 |

| Aug/20 | $11341 | $13192 |

| Aug/21 | $15446 | $17632 |

| Aug/22 | $14050 | $15285 |

| Aug/23 | $15522 | $17571 |

| Aug/24 | $19600 | $22164 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/us-equity-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic US Equity Fund, Class I Shares | 26.27% | 13.02% | 12.29% |

| MSCI US Broad Market Index (Gross) (USD)* | 26.14% | 15.33% | 14.69% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $461,301,285 | 610 | $1,497,648 | 33% |

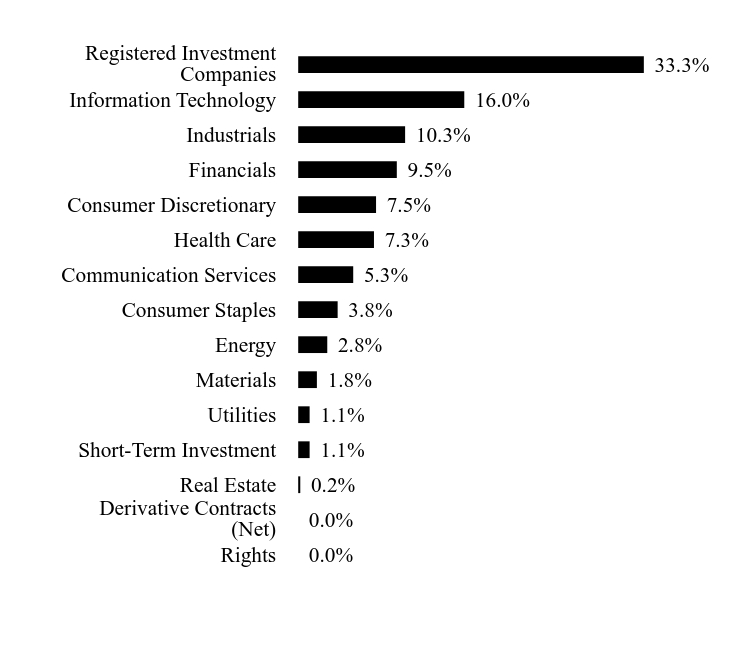

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Rights | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Real Estate | 0.2% |

| Short-Term Investment | 1.1% |

| Utilities | 1.1% |

| Materials | 1.8% |

| Energy | 2.8% |

| Consumer Staples | 3.8% |

| Communication Services | 5.3% |

| Health Care | 7.3% |

| Consumer Discretionary | 7.5% |

| Financials | 9.5% |

| Industrials | 10.3% |

| Information Technology | 16.0% |

| Registered Investment Companies | 33.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| iShares MSCI USA Min Vol Factor ETF | | | 4.9% |

| DFA Real Estate Securities Portfolio, Cl I | | | 4.8% |

| DFA US Targeted Value Portfolio, Cl I | | | 4.3% |

| Dimensional US Targeted Value ETF | | | 3.4% |

| Microsoft | | | 3.2% |

| Apple | | | 2.9% |

| NVIDIA | | | 2.8% |

| Avantis U.S. Small Capital Value ETF | | | 2.7% |

| Vanguard US Value Factor ETF | | | 2.4% |

| iShares MSCI USA Momentum Factor ETF | | | 2.4% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

Effective December 29, 2023, following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic US Equity Fund / Class I Shares - SPUSX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-7

Symmetry Panoramic International Equity Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic International Equity Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/international-equity-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic International Equity Fund, Class I Shares | $71 | 0.65% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 17.37% but trailed its benchmark, the MSCI ACWI ex USA IMI NR, by 0.41%. With respect to style factors, in ex USA Developed Markets, size and low volatility underperformed while value and momentum outperformed. In Emerging Markets, size and low volatility underperformed while value, quality, and momentum outperformed. In the trailing 3-year period, the Fund was up 1.96% annualized and bested its benchmark by 0.25%.

Fiscal 2024 was a very strong year for both equity and fixed income investors across the globe. As economies that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. The Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024. Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, equity returns were strong globally.

Multi-factor equity investors have focused on an expected recovery in the equity value factor, after having historically challenging times leading up to and into the COVID pandemic and again in Fiscal 2023. In contrast, Fiscal 2022 and 2024 were strong periods for value investors. While we welcome the contribution to performance that the value factor has provided in the most recent three years, we remain aware that each style factor may be in or out of favor over different time periods. Thus, we diversify the funds’ exposure across multiple style factors to reduce the risk inherent in any one factor. Our investment philosophy is based on evidence that style factors have the potential to outperform market capitalization weighted benchmarks over the long-term. We expect the style factors to contribute to long-term relative performance. This remains particularly true with respect to value stocks as they return to a valuation spread with growth stocks that is more in line with historical averages.

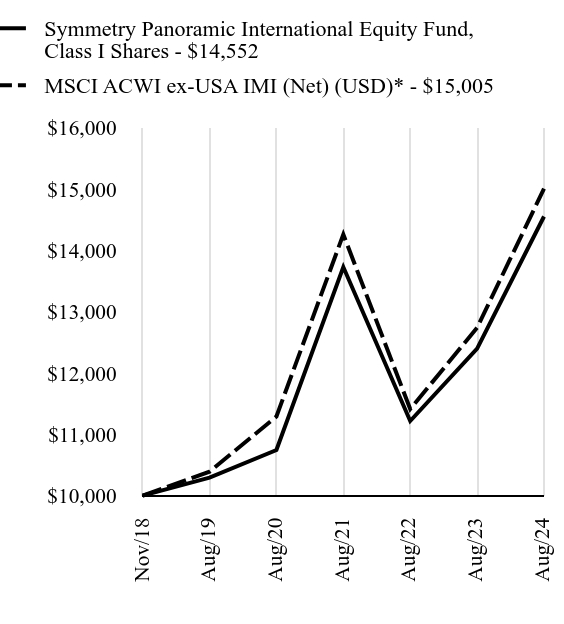

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic International Equity Fund, Class I Shares - $14552 | MSCI ACWI ex-USA IMI (Net) (USD)* - $15005 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10293 | $10391 |

| Aug/20 | $10744 | $11291 |

| Aug/21 | $13728 | $14260 |

| Aug/22 | $11218 | $11413 |

| Aug/23 | $12398 | $12739 |

| Aug/24 | $14552 | $15005 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/international-equity-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic International Equity Fund, Class I Shares | 17.37% | 7.17% | 6.68% |

| MSCI ACWI ex-USA IMI (Net) (USD)* | 17.78% | 7.63% | 7.24% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $231,275,757 | 362 | $824,834 | 29% |

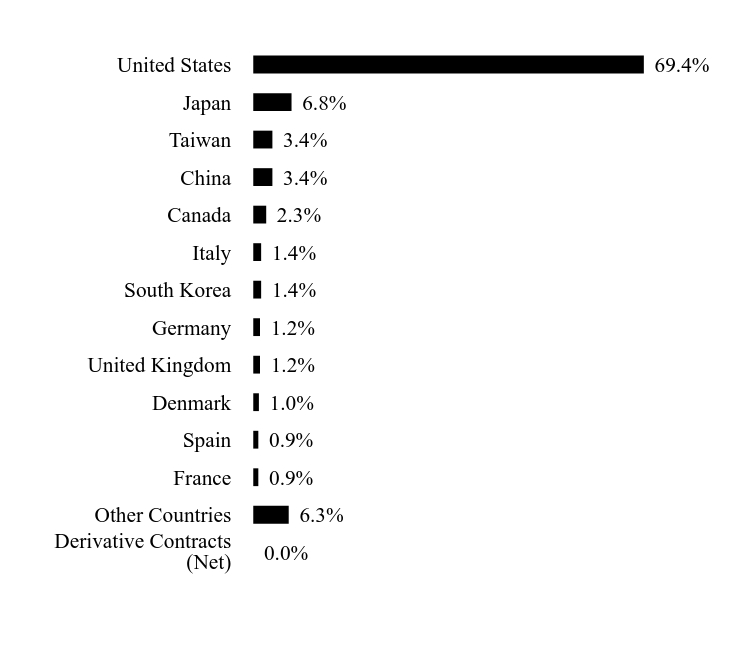

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Derivative Contracts (Net) | 0.0% |

| Other Countries | 6.3% |

| France | 0.9% |

| Spain | 0.9% |

| Denmark | 1.0% |

| United Kingdom | 1.2% |

| Germany | 1.2% |

| South Korea | 1.4% |

| Italy | 1.4% |

| Canada | 2.3% |

| China | 3.4% |

| Taiwan | 3.4% |

| Japan | 6.8% |

| United States | 69.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| DFA Large Cap International Portfolio, Cl I | | | 10.1% |

| DFA Emerging Markets Portfolio, Cl I | | | 7.4% |

| DFA International High Relative Profitability Portfolio, Cl I | | | 5.4% |

| Avantis Emerging Markets Equity ETF | | | 5.3% |

| DFA International Value Portfolio, Cl I | | | 5.1% |

| DFA International Small Cap Value Portfolio, Cl I | | | 5.0% |

| DFA Emerging Markets Small Cap Portfolio, Cl I | | | 4.6% |

| iShares MSCI EAFE Min Vol Factor ETF | | | 3.5% |

| iShares MSCI Emerging Markets Min Vol Factor ETF | | | 3.5% |

| AQR International Defensive Style Fund, Cl R6 | | | 3.2% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

Effective December 29, 2023, following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic International Equity Fund / Class I Shares - SPILX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-4

Symmetry Panoramic Global Equity Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic Global Equity Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/global-equity-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic Global Equity Fund, Class I Shares | $62 | 0.56% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 22.57% but trailed its benchmark, the MSCI ACWI ex USA IMI NR, by 0.05%. With respect to style factors in the US, small capitalization and low volatility trailed the broad market benchmark, while quality (profitability), value, and momentum outperformed. In ex USA Developed Markets, size and low volatility underperformed while value and momentum outperformed. In Emerging Markets, size and low volatility underperformed while value, quality, and momentum outperformed. Fiscal 2024 was a strong year for equity investors across the globe. The global equity market was up more than 20% for the fiscal year, with ex USA developed equities and emerging markets equities strongly positive but trailing the US equity market which was up over 26%. In the trailing 3-year period, the Fund was up 5.64% annualized and bested its benchmark by 0.45%.

As global economies that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. In the US, the Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024 . Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, equity returns were strong globally.

Multi-factor equity investors have focused on an expected recovery in the equity value factor, after having historically challenging times leading up to and into the COVID pandemic and again in Fiscal 2023. In contrast, Fiscal 2022 and 2024 were strong periods for value investors globally. While we welcome the contribution to performance that the value factor has provided in the most recent three years, we remain aware that each style factor may be in or out of favor over different time periods. Thus, we diversify the funds’ exposure across multiple style factors to reduce the risk inherent in any one factor. Our investment philosophy is based on evidence that style factors have the potential to outperform market capitalization weighted benchmarks over the long-term. We expect the style factors to contribute to long-term relative performance. This remains particularly true with respect to value stocks as they return to a valuation spread with growth stocks that is more in line with historical averages.

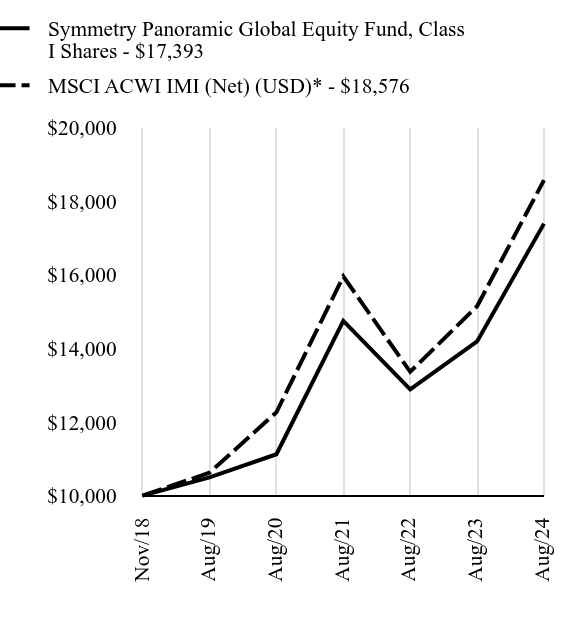

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic Global Equity Fund, Class I Shares - $17393 | MSCI ACWI IMI (Net) (USD)* - $18576 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10499 | $10625 |

| Aug/20 | $11126 | $12266 |

| Aug/21 | $14752 | $15959 |

| Aug/22 | $12889 | $13367 |

| Aug/23 | $14190 | $15149 |

| Aug/24 | $17393 | $18576 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/global-equity-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic Global Equity Fund, Class I Shares | 22.57% | 10.62% | 10.00% |

| MSCI ACWI IMI (Net) (USD)* | 22.62% | 11.82% | 11.26% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $426,631,863 | 915 | $1,301,411 | 31% |

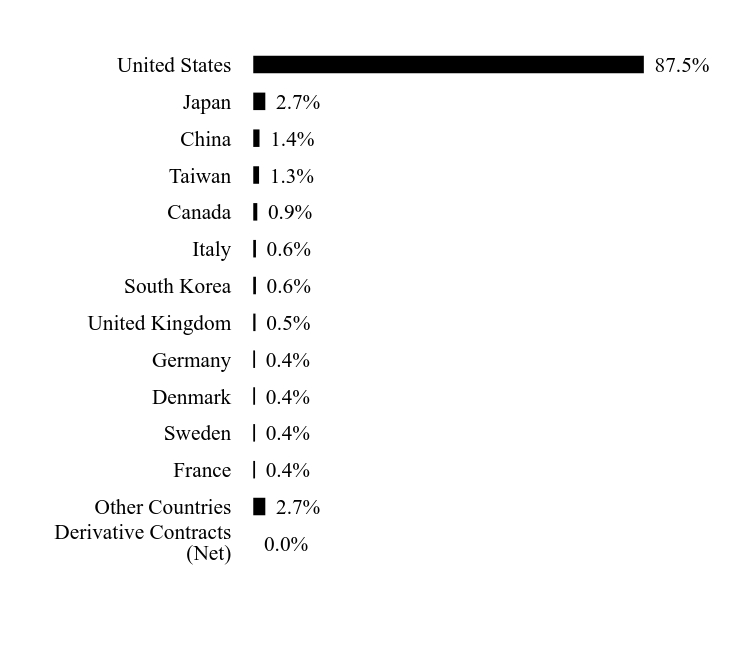

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Derivative Contracts (Net) | 0.0% |

| Other Countries | 2.7% |

| France | 0.4% |

| Sweden | 0.4% |

| Denmark | 0.4% |

| Germany | 0.4% |

| United Kingdom | 0.5% |

| South Korea | 0.6% |

| Italy | 0.6% |

| Canada | 0.9% |

| Taiwan | 1.3% |

| China | 1.4% |

| Japan | 2.7% |

| United States | 87.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| DFA US Targeted Value Portfolio, Cl I | | | 4.1% |

| DFA Large Cap International Portfolio, Cl I | | | 3.7% |

| DFA Real Estate Securities Portfolio, Cl I | | | 2.9% |

| iShares MSCI Global Min Vol Factor ETF | | | 2.9% |

| iShares MSCI USA Momentum Factor ETF | | | 2.9% |

| DFA International High Relative Profitability Portfolio, Cl I | | | 2.2% |

| DFA International Value Portfolio, Cl I | | | 2.0% |

| Microsoft | | | 1.8% |

| DFA International Small Cap Value Portfolio, Cl I | | | 1.7% |

| Apple | | | 1.7% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

Effective December 29, 2023, following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic Global Equity Fund / Class I Shares - SPGEX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-2

Symmetry Panoramic Tax-Managed Global Equity Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic Tax-Managed Global Equity Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/global-equity-fund-2/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic Tax-Managed Global Equity Fund, Class I Shares | $46 | 0.42% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 21.08% but trailed its benchmark, the MSCI ACWI ex USA IMI NR, by 1.54%. With respect to style factors in the US, small capitalization and low volatility trailed the broad market benchmark, while quality, value, and momentum outperformed. In ex USA Developed Markets, size and low volatility underperformed while value and momentum outperformed. In Emerging Markets, size and low volatility underperformed while value, quality, and momentum outperformed. Fiscal 2024 was a strong year for equity investors across the globe. The global equity market was up more than 20% for the fiscal year, with ex USA developed equities and emerging markets equities strongly positive but trailing the US equity market which was up over 26%. In the trailing 3-year period, the Fund was up 5.52% annualized and bested its benchmark by 0.33%.

As global economies that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. In the US, the Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024. Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, equity returns were strong globally.

Multi-factor equity investors have focused on an expected recovery in the equity value factor, after having historically challenging times leading up to and into the COVID pandemic and again in Fiscal 2023. In contrast, Fiscal 2022 and 2024 were strong periods for value investors globally. While we welcome the contribution to performance that the value factor has provided in the most recent three years, we remain aware that each style factor may be in or out of favor over different time periods. Thus, we diversify the funds’ exposure across multiple style factors to reduce the risk inherent in any one factor. Our investment philosophy is based on evidence that style factors have the potential to outperform market capitalization weighted benchmarks over the long-term. We expect the style factors to contribute to long-term relative performance. This remains particularly true with respect to value stocks as they return to a valuation spread with growth stocks that is more in line with historical averages.

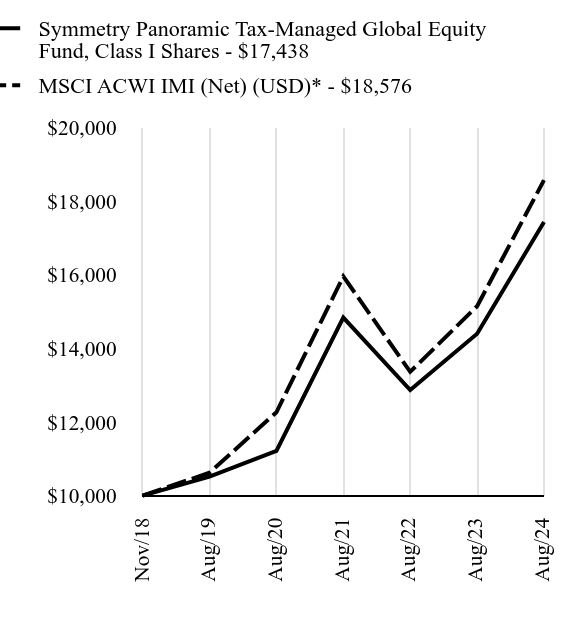

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic Tax-Managed Global Equity Fund, Class I Shares - $17438 | MSCI ACWI IMI (Net) (USD)* - $18576 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10520 | $10625 |

| Aug/20 | $11219 | $12266 |

| Aug/21 | $14840 | $15959 |

| Aug/22 | $12869 | $13367 |

| Aug/23 | $14402 | $15149 |

| Aug/24 | $17438 | $18576 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/global-equity-fund-2/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic Tax-Managed Global Equity Fund, Class I Shares | 21.08% | 10.64% | 10.05% |

| MSCI ACWI IMI (Net) (USD)* | 22.62% | 11.82% | 11.26% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $148,976,373 | 32 | $206,072 | 3% |

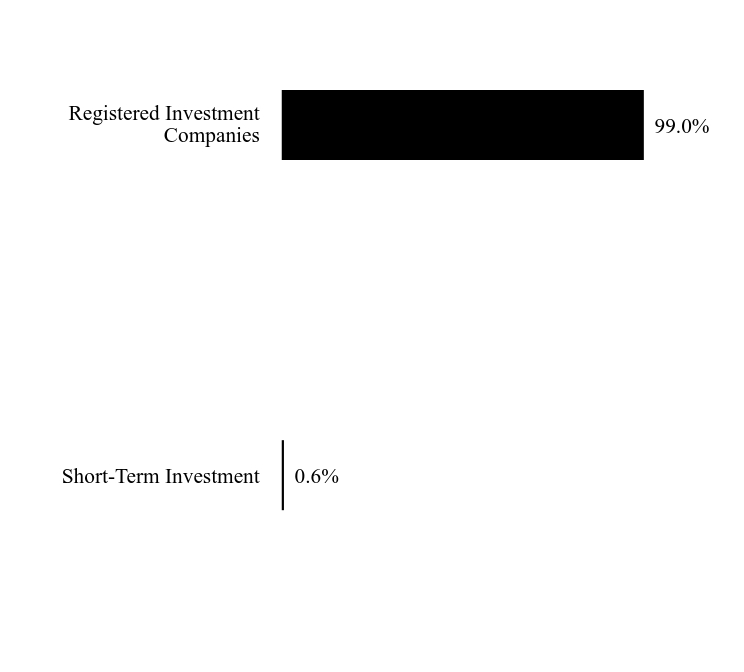

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Short-Term Investment | 0.6% |

| Registered Investment Companies | 99.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| AQR Large Capital Multi-Style Fund, Cl R6 | | | 14.4% |

| Dimensional US Equity ETF | | | 12.8% |

| AQR International Multi-Style Fund, Cl R6 | | | 10.0% |

| DFA US High Relative Profitability Portfolio, Cl I | | | 6.7% |

| Dimensional US Targeted Value ETF | | | 6.7% |

| Dimensional US Marketwide Value ETF | | | 6.0% |

| iShares MSCI Global Min Vol Factor ETF | | | 5.1% |

| AQR Emerging Multi-Style II Fund, Cl R6 | | | 5.1% |

| DFA Large Cap International Portfolio, Cl I | | | 3.8% |

| Dimensional US Core Equity 2 ETF | | | 3.3% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

Effective December 29, 2023, following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic Tax-Managed Global Equity Fund / Class I Shares - SPGTX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-6

Symmetry Panoramic US Systematic Fixed Income Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic US Systematic Fixed Income Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/us-systematic-fixed-income-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic US Systematic Fixed Income Fund, Class I Shares | $50 | 0.48% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 6.79% but trailed its current benchmark, the Bloomberg US Aggregate Index, by 0.51%. The Fund outperformed its previous lower duration benchmark, the Bloomberg US Govt/Credit 1-5 Index, by 0.12% in FY 2024. In the trailing 3-year period, the Fund returned -1.01% and bested the Bloomberg US Aggregate Index by 1.10% but trailed the Bloomberg US Govt/Credit 1-5 YR by 1.55%. Symmetry welcomed JP Morgan Investment Management as sub-advisor to the Fund effective December 31, 2023.

Fiscal 2024 was a very strong year for fixed income investors in the US. Fixed income investors benefited from both falling interest rates and narrowing credit spreads. The U.S. Treasury yield curve shifted downward during the fiscal year, especially for shorter maturities. The market yield on the 10-year Constant Maturity US Treasury fell 0.18% (i.e.,4.09% to 3.91%) over the fiscal year , while the market yield on the 1-year Constant Maturity Treasury fell nearly 1% (i.e., 5.37% to 4.38%) over the same period . Corporate credit spreads in the US generally narrowed during the year for both investment grade and high-yield debt .

As the US economy that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. The Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024 . Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, fixed income returns were strong in the US.

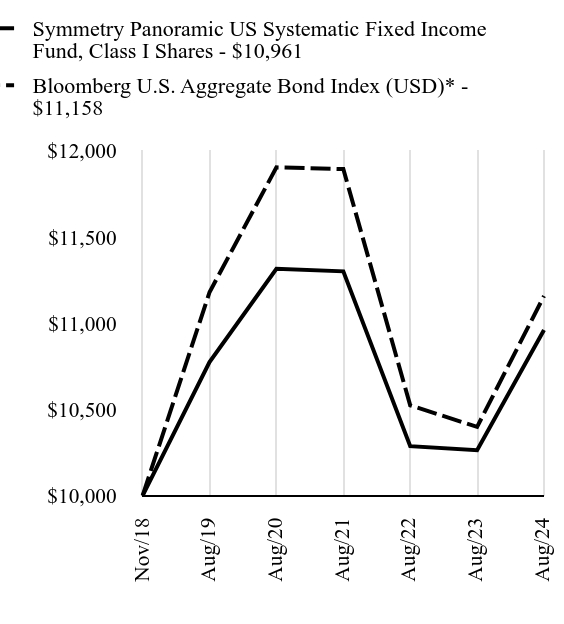

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic US Systematic Fixed Income Fund, Class I Shares - $10961 | Bloomberg U.S. Aggregate Bond Index (USD)* - $11158 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10775 | $11180 |

| Aug/20 | $11316 | $11904 |

| Aug/21 | $11301 | $11894 |

| Aug/22 | $10287 | $10524 |

| Aug/23 | $10264 | $10399 |

| Aug/24 | $10961 | $11158 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/us-systematic-fixed-income-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic US Systematic Fixed Income Fund, Class I Shares | 6.79% | 0.34% | 1.59% |

| Bloomberg U.S. Aggregate Bond Index (USD)* | 7.30% | -0.04% | 1.90% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $177,128,943 | 347 | $374,340 | 232% |

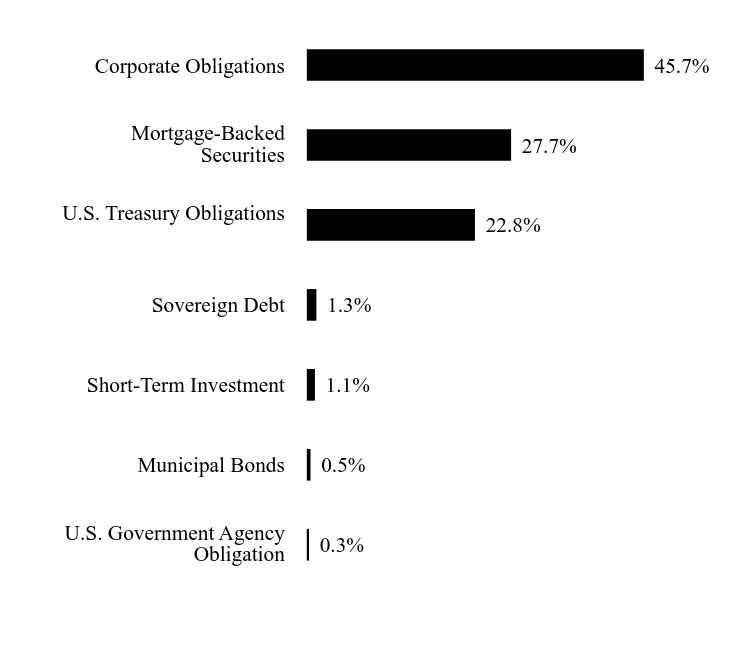

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| U.S. Government Agency Obligation | 0.3% |

| Municipal Bonds | 0.5% |

| Short-Term Investment | 1.1% |

| Sovereign Debt | 1.3% |

| U.S. Treasury Obligations | 22.8% |

| Mortgage-Backed Securities | 27.7% |

| Corporate Obligations | 45.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| FNMA, 2.00%, 3/1/2052 | | | 2.7% |

| FNMA, 3.00%, 6/1/2052 | | | 2.1% |

| FNMA, 3.50%, 12/1/2052 | | | 1.5% |

| FNMA, 2.50%, 1/1/2052 | | | 1.5% |

| FNMA, 2.50%, 10/1/2051 | | | 1.3% |

| U.S. Treasury Bonds, 1.88%, 2/15/2041 | | | 1.2% |

| U.S. Treasury Bonds, 1.38%, 11/15/2040 | | | 1.2% |

| U.S. Treasury Bonds, 1.38%, 8/15/2050 | | | 1.1% |

| FNMA, 2.00%, 4/1/2052 | | | 1.1% |

| U.S. Treasury Bonds, 2.88%, 5/15/2049 | | | 1.1% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

o Effective as of December 29, 2023:

Following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

J.P. Morgan Investment Management Inc. (“JPMIM”) became a sub-adviser of the Fund.

The name of the Fund changed from the “Symmetry Panoramic U.S. Fixed Income Fund” to the “Symmetry Panoramic U.S. Systematic Fixed Income Fund.”

The investment objective of the Fund changed from seeking total return through exposure to US fixed income securities to seeking income and capital appreciation through systematic exposure to US fixed income securities.

The principal investment strategies of the Fund changed from Symmetry Partners, LLC (“Symmetry”), the Fund’s investment adviser, investing the Fund’s assets pursuant to Symmetry’s investment style, which primarily utilized investments in underlying investment companies, to JPMIM investing the Fund’s assets primarily in securities and derivative instruments directly.

Pursuant to the new principal investment strategies, the Fund is subject to the following new principal risks: Asset-Backed, Mortgage-Related and Mortgage-Backed Securities Risk; Credit Default Swaps Risk; Foreign (Non-U.S.) Investment Risk; Forward and Futures Contract Risk; Investment Style Risk; Quantitative Investing Risk; and Short Position Risk.

The following are no longer principal risks for the Fund: Asset Allocation Risk, Index Tracking Error Risk, Investment Companies and Exchange-Traded Funds Risk and Underlying Fund Risk.

o Effective as of January 1, 2024, the Fund’s contractual expense limit increased from 0.41% to 0.52% of the average daily net assets of the Fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic US Systematic Fixed Income Fund / Class I Shares - SPUBX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-8

Symmetry Panoramic Municipal Fixed Income Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic Municipal Fixed Income Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/municipal-fixed-income-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic Municipal Fixed Income Fund, Class I Shares | $42 | 0.41% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 3.87% but trailed its new benchmark, the Bloomberg US Municipal Bond Index, by 2.22%. The Fund also trailed its previous shorter-duration benchmark, the S&P S/T National AMT Free Muni Index, by 0.33%. In the trailing 3-year period, the Fund returned 0.48% annualized and trailed the S&P S/T National AMT Free Muni Index by 0.47%.

Fiscal 2024 was a very strong year for fixed income investors across the globe. Fixed income investors benefitted from both falling interest rates and narrowing credit spreads. The U.S. Treasury yield curve shifted downward during the fiscal year, especially for shorter maturities. The market yield on the 10-year Constant Maturity US Treasury fell 0.18% (i.e.,4.09% to 3.91%) over the fiscal year, while the market yield on the 1-year Constant Maturity Treasury fell nearly 1% (i.e., 5.37% to 4.38%) over the same period. Corporate credit spreads in the US generally narrowed during the year for both investment grade and high-yield debt.

As economies that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. The Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024. Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, municipal bond returns were strong.

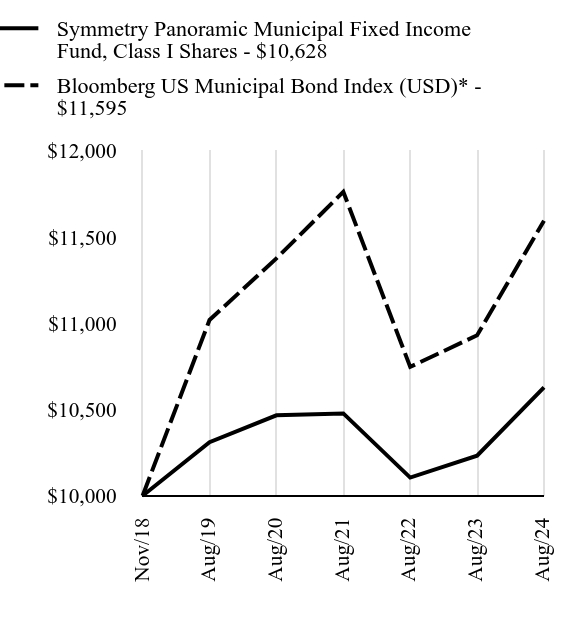

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic Municipal Fixed Income Fund, Class I Shares - $10628 | Bloomberg US Municipal Bond Index (USD)* - $11595 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10310 | $11019 |

| Aug/20 | $10466 | $11376 |

| Aug/21 | $10477 | $11762 |

| Aug/22 | $10105 | $10747 |

| Aug/23 | $10232 | $10930 |

| Aug/24 | $10628 | $11595 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/municipal-fixed-income-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic Municipal Fixed Income Fund, Class I Shares | 3.87% | 0.61% | 1.05% |

| Bloomberg US Municipal Bond Index (USD)* | 6.09% | 1.02% | 2.58% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $35,967,522 | 6 | $0 | 7% |

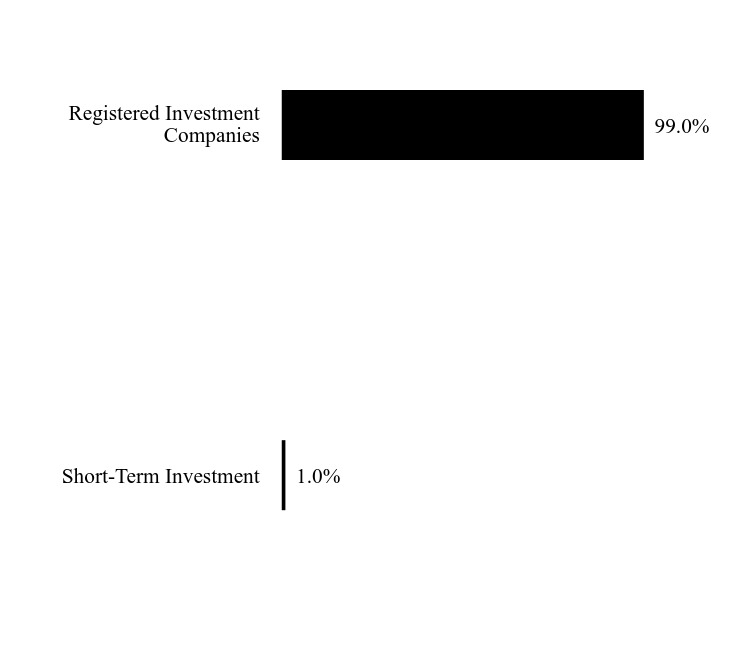

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Short-Term Investment | 1.0% |

| Registered Investment Companies | 99.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| DFA Short-Term Municipal Bond Portfolio, Cl I | | | 48.0% |

| DFA Intermediate-Term Municipal Bond Portfolio, Cl I | | | 24.9% |

| iShares Short-Term National Muni Bond ETF | | | 11.0% |

| Vanguard Tax-Exempt Bond Index ETF | | | 9.9% |

| iShares National Muni Bond ETF | | | 5.1% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

Effective December 29, 2023, following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic Municipal Fixed Income Fund / Class I Shares - SPMFX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-5

Symmetry Panoramic Global Systematic Fixed Income Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic Global Systematic Fixed Income Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/global-systematic-fixed-income-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic Global Systematic Fixed Income Fund, Class I Shares | $54 | 0.52% |

How did the Fund perform in the last year?

The Fund had strong absolute performance in FY 2024 and was up 6.97% but trailed its benchmark, the Bloomberg Global Aggregate Hedged Index, by 0.51%. In the trailing 3-year period, the Fund returned -1.96% annualized and trailed its benchmark by 1.04%. Symmetry welcomed JP Morgan Investment Management as sub-advisor to the Fund effective December 31, 2023.

Fiscal 2024 was a very strong year for fixed income investors across the globe. Fixed income investors benefited from both falling interest rates and narrowing credit spreads. The U.S. Treasury yield curve shifted downward during the fiscal year, especially for shorter maturities. The market yield on the 10-year Constant Maturity US Treasury fell 0.18% (i.e.,4.09% to 3.91%) over the fiscal year , while the market yield on the 1-year Constant Maturity Treasury fell nearly 1% (i.e., 5.37% to 4.38%) over the same period . Corporate credit spreads in the US generally narrowed during the year for both investment grade and high-yield debt .

As global economies that had been aggressively stimulated during the pandemic returned to normal levels of activity, inflation emerged. In the US, the Fed responded with a series of increases in the Federal Funds rate to combat inflation and the US inflation data suggest the Fed’s actions to tame inflation have been effective. As of the end of August 2024, the Fed funds target stood at 525-575 bps. The economy stayed strong with GDP growth remaining positive throughout the hiking cycle, while US inflation as measured by year over year CPI change decreased from 3.7% to 2.6% over Fiscal 2024 . Despite the concerns of heightened inflation and the impact of the Fed’s actions on output, fixed income returns were strong globally.

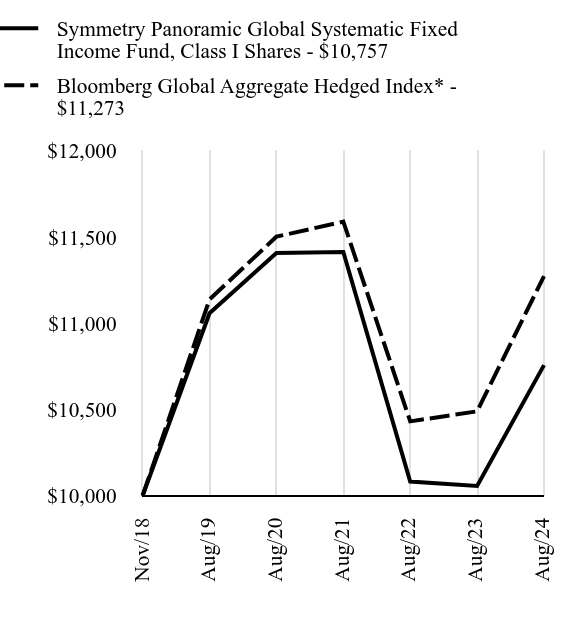

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic Global Systematic Fixed Income Fund, Class I Shares - $10757 | Bloomberg Global Aggregate Hedged Index* - $11273 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $11058 | $11138 |

| Aug/20 | $11407 | $11502 |

| Aug/21 | $11413 | $11589 |

| Aug/22 | $10082 | $10431 |

| Aug/23 | $10056 | $10489 |

| Aug/24 | $10757 | $11273 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/global-systematic-fixed-income-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic Global Systematic Fixed Income Fund, Class I Shares | 6.97% | -0.55% | 1.26% |

| Bloomberg Global Aggregate Hedged Index* | 7.48% | 0.24% | 2.09% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $282,008,899 | 363 | $776,628 | 261% |

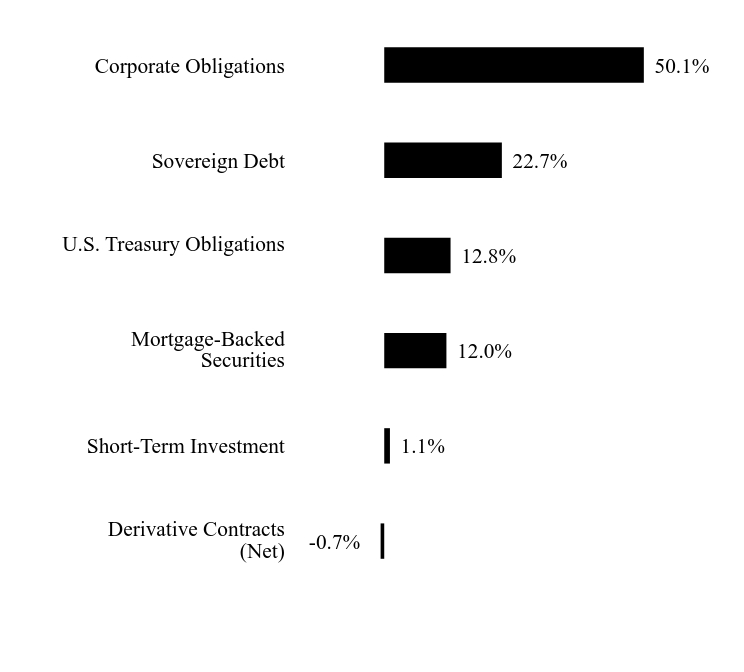

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Derivative Contracts (Net) | -0.7% |

| Short-Term Investment | 1.1% |

| Mortgage-Backed Securities | 12.0% |

| U.S. Treasury Obligations | 12.8% |

| Sovereign Debt | 22.7% |

| Corporate Obligations | 50.1% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| U.S. Treasury Bonds, 1.75%, 8/15/2041 | | | 5.6% |

| French Republic Government Bond OAT | | | 3.8% |

| U.S. Treasury Notes, 2.63%, 7/31/2029 | | | 3.3% |

| Japan Government Twenty Year Bond | | | 2.4% |

| U.S. Treasury Notes, 1.38%, 11/15/2031 | | | 1.7% |

| United Kingdom Gilt | | | 1.7% |

| Spain Government Bond | | | 1.6% |

| Bundesschatzanweisungen | | | 1.3% |

| U.S. Treasury Notes, 3.38%, 5/15/2033 | | | 1.2% |

| FNMA, 2.00%, 3/1/2052 | | | 1.1% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

o Effective as of December 29, 2023:

Following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

J.P. Morgan Investment Management Inc. (“JPMIM”) became a sub-adviser of the Fund.

The name of the Fund changed from the “Symmetry Panoramic Global Fixed Income Fund” to the “Symmetry Panoramic Global Systematic Fixed Income Fund.”

The investment objective of the Fund changed from seeking total return through exposure to global fixed income securities to seeking income and capital appreciation through systematic exposure to global fixed income securities.

The principal investment strategies of the Fund changed from Symmetry Partners, LLC (“Symmetry”), the Fund’s investment adviser, investing the Fund’s assets pursuant to Symmetry’s investment style, which primarily utilized investments in underlying investment companies, to JPMIM investing the Fund’s assets primarily in securities and derivative instruments directly.

Pursuant to the new principal investment strategies, the Fund is subject to the following new principal risks: Asset-Backed, Mortgage-Related and Mortgage-Backed Securities Risk; Credit Default Swaps Risk; Emerging Markets Risk; Investment Style Risk; Quantitative Investing Risk; and Short Position Risk.

The following are no longer principal risks for the Fund: Asset Allocation Risk, Index Tracking Error Risk, Investment Companies and Exchange-Traded Funds Risk and Underlying Fund Risk.

o Effective as of January 1, 2024, the Fund’s contractual expense limit increased from 0.43% to 0.57% of the average daily net assets of the Fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic Global Systematic Fixed Income Fund / Class I Shares - SPGBX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-3

Symmetry Panoramic Alternatives Fund

The Symmetry Panoramic Trust

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Class I Shares of the Symmetry Panoramic Alternatives Fund (the "Fund") for the period from September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://panoramicfunds.com/alternatives-fund/. You can also request this information by contacting us at 1-844-Sym-Fund (844-796-3863). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Symmetry Panoramic Alternatives Fund, Class I Shares | $53 | 0.51% |

How did the Fund perform in the last year?

The Fund was up 7.97% in FY 2024. In comparison, global equities as represented by the MSCI ACWI IMI was up 22.62%. In the trailing 5-year period, the Fund was up 6.33% annualized while the MSCI ACWI IMI was up 11.82%.

Our alternatives fund has three main themes. Specifically, managed futures, long-short styles across asset classes, and diversified arbitrage strategies. In FY 2024, the long-short style and diversified arbitrage themes both resulted in positive performance for the Panoramic Alternative Fund while the managed futures theme was down slightly for the period. The Fund seeks to provide an uncorrelated return stream to equity markets and with lower risk as measured by standard deviation of returns. Over the previous 3-years, the pairwise correlation using monthly returns of the Fund to the global equity returns was -0.09 with a standard deviation of monthly returns less than half of that for global equity. Investors can benefit from having additional diversification to alternative asset classes as compared to portfolios with exposure only to traditional asset classes such as global equity.

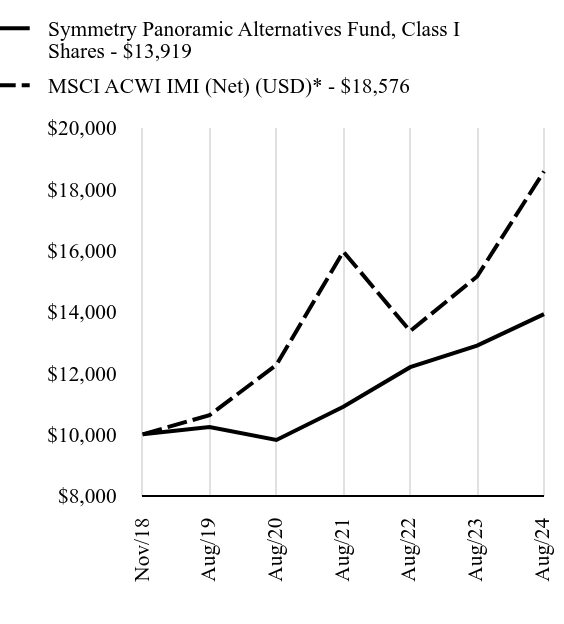

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Symmetry Panoramic Alternatives Fund, Class I Shares - $13919 | MSCI ACWI IMI (Net) (USD)* - $18576 |

|---|

| Nov/18 | $10000 | $10000 |

| Aug/19 | $10239 | $10625 |

| Aug/20 | $9815 | $12266 |

| Aug/21 | $10899 | $15959 |

| Aug/22 | $12190 | $13367 |

| Aug/23 | $12892 | $15149 |

| Aug/24 | $13919 | $18576 |

Since its inception on November 12, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-Sym-Fund (844-796-3863) or visit https://panoramicfunds.com/alternatives-fund/ for current month-end performance.

Footnote Reference*As of August 2024, pursuant to the new regulatory requirements, this index replaced the prior index as the Fund's primary benchmark to represent a broad-based securities market index.

Average Annual Total Returns as of August 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Symmetry Panoramic Alternatives Fund, Class I Shares | 7.97% | 6.33% | 5.86% |

| MSCI ACWI IMI (Net) (USD)* | 22.62% | 11.82% | 11.26% |

Key Fund Statistics as of August 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $6,764,142 | 5 | $0 | 11% |

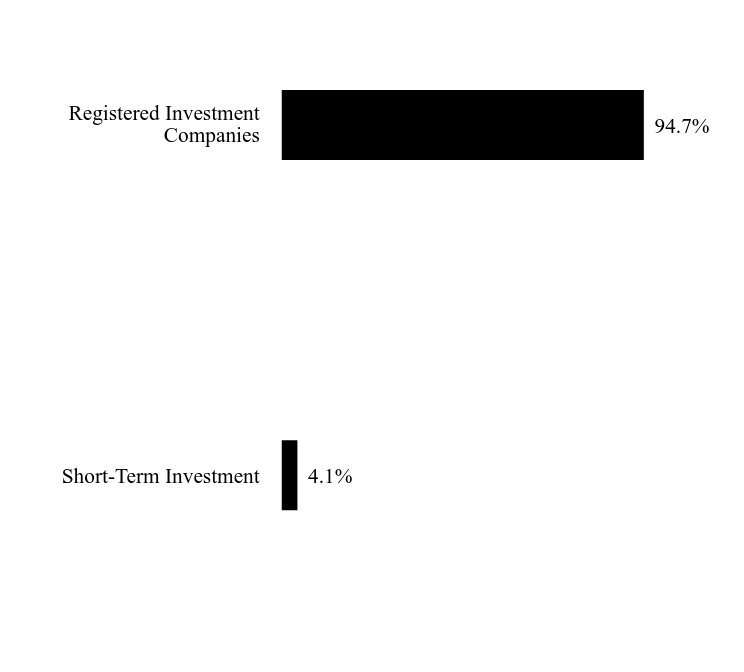

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Short-Term Investment | 4.1% |

| Registered Investment Companies | 94.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| AQR Diversified Arbitrage Fund, Cl R6 | | | 47.6% |

| AQR Managed Futures Strategy Fund, Cl R6 | | | 23.1% |

| AQR Style Premia Alternative Fund, Cl R6 | | | 19.3% |

| AQR Alternative Risk Premia Fund, Cl R6 | | | 4.7% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

This is a summary of material changes made to the Fund since September 1, 2023:

Effective December 29, 2023, following the election of new Trustees by the shareholders of the Symmetry Panoramic Trust, the Trust, including the Fund, transitioned onto the SEI Advisors’ Inner Circle mutual-fund platform.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Symmetry Panoramic Trust

Symmetry Panoramic Alternatives Fund / Class I Shares - SPATX

Annual Shareholder Report - August 31, 2024

SYM-AR-TSR-2024-1

Item 2. Code of Ethics.

The Registrant (also referred to as the “Trust”) has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, controller or principal accounting officer, and any person who performs a similar function. There have been no amendments to or waivers granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

(a) (1) The Registrant’s Board of Trustees has determined that the Registrant has an audit committee financial expert serving on the audit committee.

(a) (2) The audit committee financial experts Thomas P. Lemke and Jay Nadel are independent trustees as defined in Form N-CSR Item 3 (a) (2).

Item 4. Principal Accountant Fees and Services.

Fees billed by Cohen & Company, Ltd (Cohen) related to the Registrant.

Cohen billed the Registrant aggregate fees for services rendered to the Registrant for the last two fiscal years as follows:

| | 2024 | 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees | $137,800 | N/A | N/A | $110,000 | N/A | N/A |

| (b) | Audit-Related Fees | $1,500 | N/A | N/A | N/A | N/A | N/A |

| (c) | Tax Fees | $30,750 | N/A | N/A | $28,750 | N/A | N/A |

| (d) | All Other Fees | N/A | N/A | N/A | N/A | N/A | N/A |

(e)(1) The Trust’s Audit Committee must pre-approve all audit and non-audit services provided by the Trust’s independent registered public accounting firm (the "Auditor") relating to the operations or financial reporting of the funds. The Trust’s Audit Committee has adopted, and the Board of Trustees has ratified, an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the Audit Committee’s considerations of audit-related and non-audit services provided by the Auditor. As a general matter, the Policy requires that the Audit Committee shall pre-approve all audit services and permissible non-audit services rendered to a fund or to the Adviser or its Affiliated Persons that provide ongoing services to the Funds if such engagement relates to the operations and financial reporting of the Trust.

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | 2024 | 2023 |

Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

(f) Not Applicable.

(g) The aggregate non-audit fees and services billed by Cohen for the fiscal years 2024 and 2023 were $30,750 and $28,750, respectively.

(h) During the past fiscal year, all non-audit services provided by the Registrant’s principal accountant either to the Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with the Registrant’s investment adviser that provides ongoing services to the Registrant, were pre-approved by the audit committee of the Registrant’s Board of Trustees. Included in the audit committee’s pre-approval was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not Applicable. The Registrant is not a “foreign issuer,” as defined in 17 CFR § 240.3b-4.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end management investment companies.

Item 6. Schedule of Investments.

(a) The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial statements and financial highlights are filed herein.

Symmetry Panoramic Trust

Annual Financials and Other Information

AUGUST 31, 2024

Symmetry Panoramic US Equity Fund (SPUSX)

Symmetry Panoramic International Equity Fund (SPILX)

Symmetry Panoramic Global Equity Fund (SPGEX)

Symmetry Panoramic Tax-Managed Global Equity Fund (SPGTX)

Symmetry Panoramic US Systematic Fixed Income Fund (formerly, Symmetry Panoramic US Fixed Income Fund) (SPUBX)

Symmetry Panoramic Municipal Fixed Income Fund (SPMFX)

Symmetry Panoramic Global Systematic Fixed Income Fund (formerly, Symmetry Panoramic Global Fixed Income Fund) (SPGBX)

Symmetry Panoramic Alternatives Fund (SPATX)

SYMMETRY PANORAMIC TRUST

AUGUST 31, 2024

Table of Contents

Financial Statements (Form N-CSR Item 7) | |

Schedules of Investments | 1 |

Statements of Assets and Liabilities | 111 |

Statements of Operations | 115 |

Statements of Changes in Net Assets | 119 |

Financial Highlights | 127 |

Notes to Financial Statements | 135 |

Report of Independent Registered Public Accounting Firm | 174 |

Notice to Shareholders | 176 |

Sub-Advisory Agreement Approval Disclosure (Form N-CSR Item 11) | 178 |

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2024

SCHEDULE OF INVESTMENTS |

COMMON STOCK — 65.6% |

| | | Shares | | | Value | |

BERMUDA — 0.0% |

RenaissanceRe Holdings | | | 287 | | | $ | 73,125 | |

| | | | | | | | |

CHINA — 0.1% |

NXP Semiconductors | | | 1,090 | | | | 279,432 | |

| | | | | | | | |

IRELAND — 0.4% |

Accenture, Cl A | | | 5,702 | | | | 1,949,799 | |

| | | | | | | | |

MEXICO — 0.0% |

Southern Copper | | | 456 | | | | 46,384 | |

| | | | | | | | |

UNITED STATES — 65.1% |

COMMUNICATION SERVICES — 5.3% |

Alphabet, Cl A | | | 29,850 | | | | 4,876,893 | |

Alphabet, Cl C | | | 17,975 | | | | 2,967,852 | |

AT&T | | | 30,892 | | | | 614,751 | |

Atlanta Braves Holdings, Cl C * | | | 87 | | | | 3,713 | |

Charter Communications, Cl A * | | | 532 | | | | 184,891 | |

Comcast, Cl A | | | 20,717 | | | | 819,772 | |

Electronic Arts | | | 938 | | | | 142,407 | |

Fox, Cl A | | | 2,772 | | | | 114,678 | |

Fox, Cl B | | | 2,648 | | | | 101,763 | |

GCI Liberty *(1) | | | 1,489 | | | | — | |

Interpublic Group | | | 3,520 | | | | 114,787 | |

Liberty Media -Liberty Formula One, Cl C * | | | 2,002 | | | | 156,256 | |

Liberty Media -Liberty SiriusXM * | | | 2,176 | | | | 51,854 | |

Liberty Media -Liberty SiriusXM, Cl A * | | | 1,491 | | | | 35,501 | |

Live Nation Entertainment * | | | 1,417 | | | | 138,398 | |

Meta Platforms, Cl A | | | 17,319 | | | | 9,028,568 | |

Netflix * | | | 2,447 | | | | 1,716,203 | |

News, Cl A | | | 2,994 | | | | 84,820 | |

News, Cl B | | | 1,153 | | | | 33,933 | |

Omnicom Group | | | 2,174 | | | | 218,335 | |

Pinterest, Cl A * | | | 1,763 | | | | 56,487 | |

ROBLOX, Cl A * | | | 653 | | | | 28,725 | |

Snap, Cl A * | | | 4,654 | | | | 43,468 | |

Spotify Technology * | | | 140 | | | | 48,003 | |

Take-Two Interactive Software * | | | 528 | | | | 85,383 | |

T-Mobile US | | | 2,437 | | | | 484,281 | |

The accompanying notes are an integral part of the financial statements.

1

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2024

COMMON STOCK — continued |

| | Shares | | | Value | |

UNITED STATES — continued |

COMMUNICATION SERVICES — continued |

Trade Desk, Cl A * | | | 1,417 | | | $ | 148,119 | |

Verizon Communications | | | 32,911 | | | | 1,375,022 | |

Walt Disney | | | 5,223 | | | | 472,055 | |

Warner Bros Discovery * | | | 17,166 | | | | 134,581 | |

| | | | | | | | 24,281,499 | |

| | | | | | | | |

CONSUMER DISCRETIONARY — 7.5% |

Airbnb, Cl A * | | | 497 | | | | 58,303 | |

Amazon.com * | | | 44,361 | | | | 7,918,438 | |

Aptiv * | | | 1,406 | | | | 100,571 | |

AutoNation * | | | 7,727 | | | | 1,375,251 | |

AutoZone * | | | 177 | | | | 563,122 | |

Best Buy | | | 2,631 | | | | 264,152 | |

Booking Holdings | | | 97 | | | | 379,195 | |

Burlington Stores * | | | 468 | | | | 125,536 | |

CarMax * | | | 898 | | | | 75,926 | |

Carnival * | | | 5,725 | | | | 94,463 | |

Chipotle Mexican Grill, Cl A * | | | 6,100 | | | | 342,088 | |

Choice Hotels International | | | 751 | | | | 95,820 | |

Churchill Downs | | | 381 | | | | 52,948 | |

Darden Restaurants | | | 1,101 | | | | 174,123 | |

Deckers Outdoor * | | | 633 | | | | 607,231 | |

Dick's Sporting Goods | | | 6,448 | | | | 1,527,918 | |

Domino's Pizza | | | 462 | | | | 191,365 | |

DoorDash, Cl A * | | | 1,624 | | | | 209,025 | |

DR Horton | | | 6,143 | | | | 1,159,553 | |

DraftKings, Cl A * | | | 1,540 | | | | 53,130 | |

eBay | | | 3,214 | | | | 189,947 | |

Expedia Group * | | | 868 | | | | 120,730 | |

Floor & Decor Holdings, Cl A * | | | 548 | | | | 61,617 | |

Ford Motor | | | 32,219 | | | | 360,531 | |

Gap | | | 15,506 | | | | 347,800 | |

Garmin | | | 1,592 | | | | 291,798 | |

General Motors | | | 6,153 | | | | 306,296 | |

Genuine Parts | | | 1,331 | | | | 190,679 | |

H&R Block | | | 1,278 | | | | 80,910 | |

Hilton Worldwide Holdings | | | 836 | | | | 183,619 | |

Home Depot | | | 4,177 | | | | 1,539,225 | |

Hyatt Hotels, Cl A | | | 425 | | | | 64,566 | |

Las Vegas Sands | | | 3,090 | | | | 120,479 | |

The accompanying notes are an integral part of the financial statements.

2

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2024

COMMON STOCK — continued |

| | Shares | | | Value | |

UNITED STATES — continued |

CONSUMER DISCRETIONARY — continued |

Lennar, Cl A | | | 3,993 | | | $ | 726,966 | |

Lennar, Cl B | | | 300 | | | | 50,649 | |

LKQ | | | 2,392 | | | | 99,483 | |

Lowe's | | | 3,180 | | | | 790,230 | |

Lululemon Athletica * | | | 1,561 | | | | 405,033 | |

Marriott International, Cl A | | | 891 | | | | 209,109 | |

McDonald's | | | 2,047 | | | | 590,887 | |

NIKE, Cl B | | | 3,907 | | | | 325,531 | |

NVR * | | | 30 | | | | 275,174 | |

Ollie's Bargain Outlet Holdings * | | | 831 | | | | 74,424 | |

O'Reilly Automotive * | | | 426 | | | | 481,367 | |

Penske Automotive Group | | | 7,045 | | | | 1,198,355 | |

Pool | | | 835 | | | | 293,603 | |

PulteGroup | | | 9,286 | | | | 1,222,502 | |

Ralph Lauren, Cl A | | | 644 | | | | 110,291 | |

Rivian Automotive, Cl A * | | | 3,071 | | | | 43,393 | |

Ross Stores | | | 2,120 | | | | 319,293 | |

Royal Caribbean Cruises * | | | 7,313 | | | | 1,203,866 | |

Service International | | | 517 | | | | 40,466 | |

Starbucks | | | 2,498 | | | | 236,236 | |

Tesla * | | | 6,228 | | | | 1,333,477 | |

TJX | | | 6,110 | | | | 716,520 | |

Toll Brothers | | | 12,071 | | | | 1,739,069 | |

TopBuild * | | | 1,359 | | | | 534,114 | |

Tractor Supply | | | 2,843 | | | | 760,645 | |

Ulta Beauty * | | | 475 | | | | 167,599 | |

Williams-Sonoma | | | 9,258 | | | | 1,243,627 | |

Wingstop | | | 431 | | | | 166,413 | |

Yum! Brands | | | 1,600 | | | | 215,872 | |

| | | | | | | | 34,800,549 | |

| | | | | | | | |

CONSUMER STAPLES — 3.8% |

Altria Group | | | 5,769 | | | | 310,199 | |

Archer-Daniels-Midland | | | 3,138 | | | | 191,387 | |

BJ's Wholesale Club Holdings * | | | 613 | | | | 49,016 | |

Brown-Forman, Cl A | | | 359 | | | | 16,424 | |

Brown-Forman, Cl B | | | 2,007 | | | | 91,499 | |

Bunge Global | | | 1,542 | | | | 156,328 | |

Campbell Soup | | | 2,634 | | | | 130,962 | |

Casey's General Stores | | | 1,107 | | | | 401,077 | |

The accompanying notes are an integral part of the financial statements.

3

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2024

COMMON STOCK — continued |

| | Shares | | | Value | |

UNITED STATES — continued |

CONSUMER STAPLES — continued |

Celsius Holdings * | | | 1,041 | | | $ | 39,589 | |

Church & Dwight | | | 1,433 | | | | 145,994 | |

Clorox | | | 754 | | | | 119,366 | |

Coca-Cola | | | 13,951 | | | | 1,011,029 | |

Colgate-Palmolive | | | 3,023 | | | | 321,950 | |

Conagra Brands | | | 2,688 | | | | 83,866 | |

Constellation Brands, Cl A | | | 809 | | | | 194,734 | |

Costco Wholesale | | | 1,448 | | | | 1,292,166 | |

Dollar General | | | 1,613 | | | | 133,831 | |

Dollar Tree * | | | 2,152 | | | | 181,822 | |

General Mills | | | 4,001 | | | | 289,232 | |

Hershey | | | 969 | | | | 187,075 | |

Hormel Foods | | | 2,061 | | | | 67,086 | |

Kellanova | | | 3,205 | | | | 258,355 | |

Kenvue | | | 9,502 | | | | 208,569 | |

Keurig Dr Pepper | | | 5,805 | | | | 212,521 | |

Kimberly-Clark | | | 1,284 | | | | 185,743 | |

Kraft Heinz | | | 5,219 | | | | 184,909 | |

Kroger | | | 8,706 | | | | 463,246 | |

McCormick | | | 1,225 | | | | 97,954 | |

Mondelez International, Cl A | | | 4,741 | | | | 340,451 | |

Monster Beverage * | | | 3,613 | | | | 170,281 | |

PepsiCo | | | 7,413 | | | | 1,281,559 | |

Performance Food Group * | | | 1,259 | | | | 93,972 | |

Philip Morris International | | | 4,407 | | | | 543,339 | |

Procter & Gamble | | | 8,363 | | | | 1,434,589 | |

Sysco | | | 4,239 | | | | 330,515 | |

Target | | | 8,080 | | | | 1,241,250 | |

Tyson Foods, Cl A | | | 374 | | | | 24,052 | |

US Foods Holding * | | | 3,133 | | | | 185,505 | |

Walmart | | | 60,101 | | | | 4,641,600 | |

WK Kellogg | | | 1,078 | | | | 18,501 | |

| | | | | | | | 17,331,543 | |

| | | | | | | | |

ENERGY — 2.8% |

Baker Hughes, Cl A | | | 8,583 | | | | 301,864 | |

Cheniere Energy | | | 2,322 | | | | 430,174 | |

Chevron | | | 7,970 | | | | 1,179,161 | |

ConocoPhillips | | | 6,648 | | | | 756,476 | |

Coterra Energy | | | 4,350 | | | | 105,836 | |

The accompanying notes are an integral part of the financial statements.

4

SYMMETRY PANORAMIC US EQUITY FUND

AUGUST 31, 2024

COMMON STOCK — continued |

| | Shares | | | Value | |

UNITED STATES — continued |

ENERGY — continued |

Devon Energy | | | 12,909 | | | $ | 578,065 | |

Diamondback Energy | | | 5,824 | | | | 1,136,321 | |

EOG Resources | | | 3,951 | | | | 508,968 | |

EQT | | | 2,836 | | | | 95,034 | |

Exxon Mobil | | | 27,200 | | | | 3,207,921 | |

Halliburton | | | 11,488 | | | | 357,162 | |

Hess | | | 2,582 | | | | 356,471 | |

Kinder Morgan | | | 12,238 | | | | 263,974 | |

Marathon Oil | | | 7,032 | | | | 201,467 | |

Marathon Petroleum | | | 4,453 | | | | 788,715 | |

Occidental Petroleum | | | 9,302 | | | | 530,028 | |

ONEOK | | | 4,390 | | | | 405,460 | |

Phillips 66 | | | 1,929 | | | | 270,658 | |

Range Resources | | | 1,104 | | | | 32,988 | |

Schlumberger | | | 6,500 | | | | 285,935 | |

Targa Resources | | | 2,988 | | | | 438,937 | |

Texas Pacific Land | | | 192 | | | | 166,827 | |

Valero Energy | | | 2,777 | | | | 407,469 | |

Williams | | | 4,842 | | | | 221,618 | |

| | | | | | | | 13,027,529 | |

| | | | | | | | |

FINANCIALS — 9.5% |

Aflac | | | 5,841 | | | | 644,613 | |