Exhibit 99.91

NEXTECH AR SOLUTIONS CORP.

c/o Suite 1200 – 750 West Pender Street

Vancouver, BC V6C 2T8

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF

SHAREHOLDERS

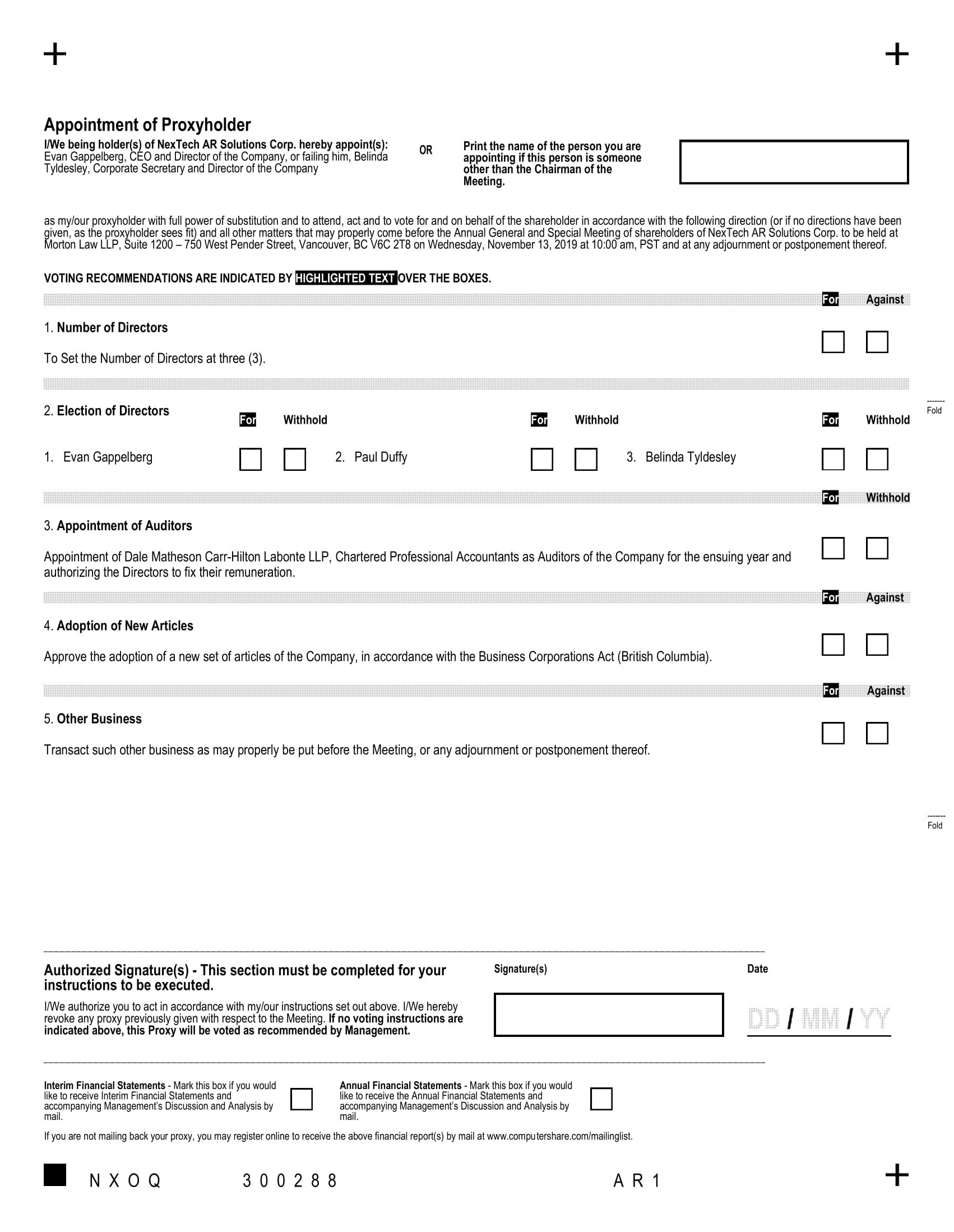

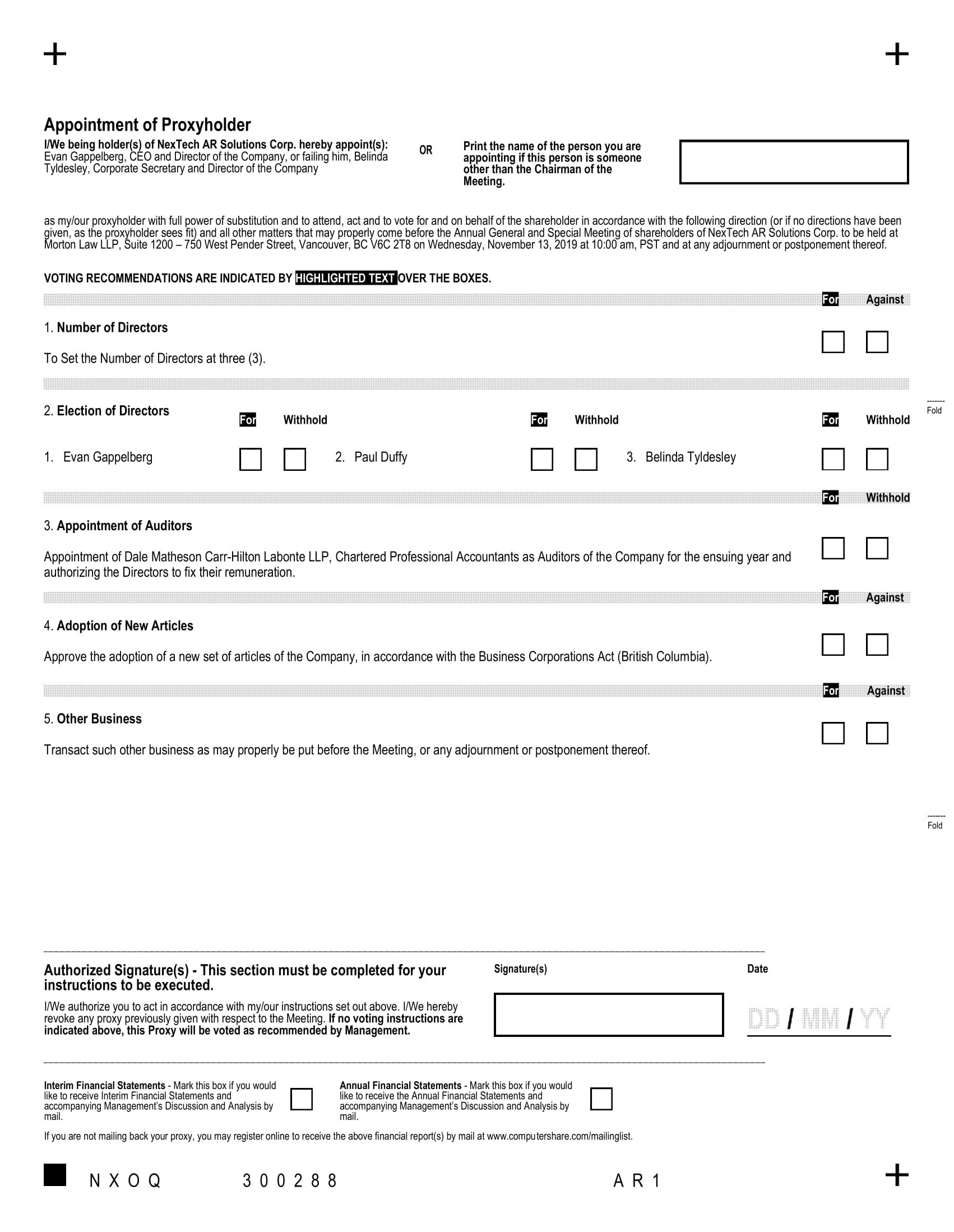

NOTICE IS HEREBY GIVEN that an annual general and special meeting (the “Meeting”) of the shareholders of NexTech AR Solutions Corp. (the “Company”) will be held at Morton Law LLP, Suite 1200 – 750 West Pender, Vancouver, BC V6C 2T8 on Wednesday, November 13, 2019 at 10:00 a.m. (Vancouver, British Columbia time). At the Meeting, the shareholders will receive the financial statements for the year ended May 31, 2019, together with the auditor’s report thereon, and consider resolutions to:

| 1. | fix the number of directors at three (3); |

| 2. | elect directors for the ensuing year; |

| 3. | appoint Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year andauthorize the directors to determine the remuneration to be paid to the auditor; |

| 4. | approve the adoption of a new set of articles of the Company, in accordance with the Business Corporations Act (British Columbia); and |

| 5. | transact such other business as may properly be put before the Meeting, or any adjournment or postponement thereof. |

All shareholders are entitled to attend and vote at the Meeting in person or by proxy. The Board of Directors (the “Board”) requests that all shareholders who will not be attending the Meeting in person read, date and sign the accompanying proxy and deliver it to Computershare Investor Services Inc. (“Computershare”). If a shareholder does not deliver a proxy to Computershare, Attention: Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, by 10:00 a.m. (Vancouver, British Columbia time) on Friday, November 8, 2019 (or before 48 hours, excluding Saturdays, Sundays and holidays before any adjournment or postponement of the meeting at which the proxy is to be used) then the shareholder will not be entitled to vote at the Meeting by proxy. Only shareholders of record at the close of business on Monday, October 7, 2019 will be entitled to vote at the Meeting.

An information circular and a form of proxy accompany this notice.

DATED at Vancouver, British Columbia, the 7th day of October, 2019.

| | ON BEHALF OF THE BOARD |

| | |

| | “Evan Gappelberg” |

| | Evan Gappelberg |

| | Chief Executive Officer |

Annual General and Special Meeting

to be held on November 13, 2019

Notice of Annual General and Special Meeting and

Information Circular

October 7, 2019

NEXTECH AR SOLUTIONS CORP.

c/o Suite 1200 – 750 West Pender Street

Vancouver, BC V6C 2T8

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF

SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual general and special meeting (the “Meeting”) of the shareholders of NexTech AR Solutions Corp. (the “Company”) will be held at Morton Law LLP, Suite 1200 – 750 West Pender, Vancouver, BC V6C 2T8 on Wednesday, November 13, 2019 at 10:00 a.m. (Vancouver, British Columbia time). At the Meeting, the shareholders will receive the financial statements for the year ended May 31, 2019, together with the auditor’s report thereon, and consider resolutions to:

| 1. | fix the number of directors at three (3); |

| 2. | elect directors for the ensuing year; |

| 3. | appoint Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year andauthorize the directors to determine the remuneration to be paid to the auditor; |

| 4. | approve the adoption of a new set of articles of the Company, in accordance with the Business Corporations Act (British Columbia); and |

| 5. | transact such other business as may properly be put before the Meeting, or any adjournment or postponement thereof. |

All shareholders are entitled to attend and vote at the Meeting in person or by proxy. The Board of Directors (the “Board”) requests that all shareholders who will not be attending the Meeting in person read, date and sign the accompanying proxy and deliver it to Computershare Investor Services Inc. (“Computershare”). If a shareholder does not deliver a proxy to Computershare, Attention: Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, by 10:00 a.m. (Vancouver, British Columbia time) on Friday, November 8, 2019 (or before 48 hours, excluding Saturdays, Sundays and holidays before any adjournment or postponement of the meeting at which the proxy is to be used) then the shareholder will not be entitled to vote at the Meeting by proxy. Only shareholders of record at the close of business on Monday, October 7, 2019 will be entitled to vote at the Meeting.

An information circular and a form of proxy accompany this notice.

DATED at Vancouver, British Columbia, the 7th day of October, 2019.

| | ON BEHALF OF THE BOARD |

| | |

| | “Evan Gappelberg” |

| | |

| | Evan Gappelberg |

| | Chief Executive Officer |

NEXTECH AR SOLUTIONS CORP.

c/o Suite 1200 – 750 West Pender Street

Vancouver, BC V6C 2T8

INFORMATION CIRCULAR

(as at October 7, 2019 except as otherwise indicated)

SOLICITATION OF PROXIES

This information circular (the “Circular”) is provided in connection with the solicitation of proxies by the Management of NexTech AR Solutions Corp. (the “Company”). The form of proxy which accompanies this Circular (the “Proxy”) is for use at the annual general and special meeting of the shareholders of the Company to be held on Wednesday, November 13, 2019 (the “Meeting”), at the time and place set out in the accompanying notice of Meeting (the “Notice of Meeting”). The Company will bear the cost of this solicitation. The solicitation will be made by mail, but may also be made by telephone.

All references to “$” in this Circular are to Canadian dollars, unless stated otherwise.

APPOINTMENT AND REVOCATION OF PROXY

The persons named in the Proxy are directors and/or officers of the Company. A registered shareholder who wishes to appoint some other person to serve as their representative at the Meeting may do so by striking out the printed names and inserting the desired person’s name in the blank space provided. The completed Proxy should be delivered to Computershare Investor Services Inc. (“Computershare”) by 10:00 a.m. (local time in Vancouver, British Columbia) on Friday, November 8, 2019, or before 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment or postponement of the Meeting at which the Proxy is to be used.

The Proxy may be revoked by:

| (a) | signing a proxy with a later date and delivering it at the time and place noted above; |

| (b) | signing and dating a written notice of revocation and delivering it to Computershare, or by transmitting a revocation by telephonic or electronic means, to Computershare, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment or postponement of it, at which the Proxy is to be used, or delivering a written notice of revocation and delivering it to the Chairman of the Meeting on the day of the Meeting or adjournment or postponement of it; or |

| (c) | attending the Meeting or any adjournment or postponement of the Meeting and registering with the scrutineer as a shareholder present in person. |

Provisions Relating to Voting of Proxies

The shares represented by Proxy in the form provided to shareholders will be voted or withheld from voting by the designated holder in accordance with the direction of the registered shareholder appointing him. If there is no direction by the registered shareholder, those shares will be voted for all proposals set out in the Proxy and for the election of directors and the appointment of the auditors as set out in this Circular. The Proxy gives the person named in it the discretion to vote as such person sees fit on any amendments or variations to matters identified in the Notice of Meeting, or any other matters which may properly come before the Meeting. At the time of printing of this Circular, the management of the Company (the “Management”) knows of no other matters which may come before the Meeting other than those referred to in the Notice of Meeting.

Advice to Beneficial Holders of Common Shares

The information set forth in this section is of significant importance to many shareholders, as a substantial number of shareholders do not hold common shares in their own name. Shareholders who hold their common shares through their brokers, intermediaries, trustees or other persons, or who otherwise do not hold their common shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only proxies deposited by shareholders who appear on the records maintained by the Company’s registrar and transfer agent as registered holders of common shares will be recognized and acted upon at the Meeting. If common shares are listed in an account statement provided to a Beneficial Shareholder by a broker, then those common shares will, in all likelihood, not be registered in the shareholder’s name. Such common shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms). In the United States, the vast majority of such common shares are registered under the name of Cede & Co., the registration name for The Depository Trust Company, which acts as nominee for many United States brokerage firms. Common shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted or withheld at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholder meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. The form of instrument of proxy supplied to a Beneficial Shareholder by its broker (or the agent of the broker) is substantially similar to the instrument of proxy provided directly to registered shareholders by the Company. However, its purpose is limited to instructing the registered shareholder (i.e., the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The vast majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. (“Broadridge”) in Canada. Broadridge typically prepares a machine-readable voting instruction form (“VIF”), mails those forms to Beneficial Shareholders and asks Beneficial Shareholders to return the VIFs to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting. A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote common shares directly at the Meeting. The VIFs must be returned to Broadridge (or instructions respecting the voting of common shares must otherwise be communicated to Broadridge) well in advance of the Meeting in order to have the common shares voted. If you have any questions respecting the voting of common shares held through a broker or other intermediary, please contact that broker or other intermediary for assistance.

The Notice of Meeting, Circular, Proxy and VIF, as applicable, are being provided to both registered shareholders and Beneficial Shareholders. Beneficial Shareholders fall into two categories - those who object to their identity being known to the issuers of securities which they own (“OBOs”) and those who do not object to their identity being made known to the issuers of the securities which they own (“NOBOs”). Subject to the provisions of National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), issuers may request and obtain a list of their NOBOs from intermediaries directly or via their transfer agent and may obtain and use the NOBO list for the distribution of proxy-related materials directly (not via Broadridge) to such NOBOs. If you are a Beneficial Shareholder and the Company or its agent has sent these materials directly to you, your name, address and information about your holdings of common shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding the common shares on your behalf.

Pursuant to the provisions of NI 54-101, the Company is providing the Notice of Meeting, Circular and Proxy or VIF, as applicable, to both registered owners of the securities and non-registered owners of the securities. If you are a non-registered owner, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. By choosing to send these materials to you directly, the Company (and not the intermediary holding common shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the VIF. As a result, if you are a non-registered owner of the securities, you can expect to receive a scannable VIF from Computershare. Please complete and return to Computershare in the envelope provided or by facsimile. In addition, telephone voting and internet voting instructions can be found on the VIF. Computershare will tabulate the results of the VIFs received from the Company’s NOBOs and will provide appropriate instructions at the Meeting with respect to the common shares represented by the VIFs they receive.

The Company’s OBOs can expect to be contacted by Broadridge or their brokers or their broker’s agents as set out above. Pursuant to the provisions of NI 54-101, the Company does not intend to pay for intermediaries to deliver the Notice of Meeting, Circular and VIF to OBOs and accordingly, if the OBO’s intermediary does not assume the costs of delivery of those documents in the event that the OBO wishes to receive them, the OBO may not receive the documents.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting common shares registered in the name of his broker, a Beneficial Shareholder may attend the Meeting as proxyholder for the registered shareholder and vote the common shares in that capacity. NI 54-101 allows a Beneficial Shareholder who is a NOBO to submit to the Company or an applicable intermediary any document in writing that requests that the NOBO or a nominee of the NOBO be appointed as proxyholder. If such a request is received, the Company or an intermediary, as applicable, must arrange, without expenses to the NOBO, to appoint such NOBO or its nominee as a proxyholder and to deposit that proxy within the time specified in this Circular, provided that the Company or the intermediary receives such written instructions from the NOBO at least one business day prior to the time by which proxies are to be submitted at the Meeting, with the result that such a written request must be received by 9:30 a.m (Vancouver, British Columbia time) on the day which is at least three business days prior to the Meeting. A Beneficial Shareholder who wishes to attend the Meeting and to vote their common shares as proxyholder for the registered shareholder, should enter their own name in the blank space on the VIF or such other document in writing that requests that the NOBO or a nominee of the NOBO be appointed as proxyholder and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker.

All references to shareholders in the Notice of Meeting, Circular and the accompanying Proxy are to registered shareholders of the Company as set forth on the list of registered shareholders of the Company as maintained by the registrar and transfer agent of the Company, Computershare, unless specifically stated otherwise.

Financial Statements

The audited financial statements of the Company for the year ended May 31, 2019, together with the auditor’s report on those statements and Management Discussion and Analysis, will be presented to the shareholders at the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As at the date of the accompanying Notice of Meeting, the Company’s authorized capital consists of an unlimited number of common shares of which 56,309,250 common shares are issued and outstanding. All common shares in the capital of the Company carry the right to one vote.

Shareholders registered as at October 7, 2019 are entitled to attend and vote at the Meeting. Shareholders who wish to be represented by proxy at the Meeting must, to entitle the person appointed by the Proxy to attend and vote, deliver their Proxies at the place and within the time set forth in the notes to the Proxy.

To the knowledge of the directors and executive officers of the Company, as of the date of this Circular, thepersons who beneficially own, directly or indirectly, or exercise control or direction over, 10% or more of the issued and outstanding common shares of the Company are:

| Name | | Number of Common Shares Owned, or Controlled or Directed, Directly or Indirectly(1) | | | Approximate Percentage of Total Outstanding Common Shares | |

| Evan Gappelberg(2) | | | 6,734,166 | | | | 11.96 | % |

Notes:

| (1) | The above information was derived from the shareholder list maintained by the Company’s registrar and transfer agent, or from insider and beneficial ownership reports available at www.sedi.com and www.sedar.com. |

| (2) | Mr. Gappelberg is the Company’s Chief Executive Officer and a director. |

ELECTION OF DIRECTORS

The directors of the Company are elected annually and hold office until the next annual general meeting of the shareholders or until their successors are elected or appointed. Management of the Company (“Management”) proposes to nominate the persons listed below for election as directors of the Company to serve until their successors are elected or appointed. In the absence of instructions to the contrary, Proxies given pursuant to the solicitation by Management will be voted for the nominees listed in this Circular. Management does not contemplate that any of the nominees will be unable to serve as a director. Shareholders will be asked at the Meeting to pass an ordinary resolution to set the number of directors for the ensuing year at three (3).

The following table sets out the names of the nominees for election as directors, the offices they hold within the Company, their occupations, the length of time they have served as directors of the Company, and the number of shares of the Company which each beneficially owns, directly or indirectly, or over which control or direction is exercised, as of the date of this Circular.

| Name, province or state and country of residence and position, if any, held in the Company | | Principal occupation during the past five years | | Served as director of the Company since | | Number of common shares of the Company beneficially owned, directly or indirectly, or controlled or directed at present(1) | |

Evan Gappelberg(2)

Director and Chief Executive Officer New York, USA | | CEO of the Company since January 12, 2018; Managing director at Atlas Advisors, LLC, an independent investment advisory and money management firm that offers small- cap companies consulting services. | | January 12, 2018 | | | 6,734,166 | |

Paul Duffy(2)(3) Director and President Ontario, Canada | | President of the Company since June 14, 2018; Co-Founder, Chief Architect & UX Officer of ARHT Media Inc. | | February 8, 2018 | | | 3,530,416 | |

Belinda Tyldesley(3) Director and Corporate Secretary British Columbia, Canada | | Corporate Secretary of the Company since March 26, 2018; President of Closing Bell Services, a consulting company providing corporate secretarial services. | | March 26, 2018 | | | 359,345 | |

Notes:

| (1) | The information as to principal occupation, business or employment and common shares beneficially owned or controlled has been provided by the nominees themselves. |

| (2) | A member of the Audit Committee. |

| (3) | A member of the Compensation Committee. |

No proposed director is being elected under any arrangement or understanding between the proposed director and any other person or company.

Corporate Cease Trade Orders or Bankruptcies

No director or proposed director of the Company is and, or within the ten years prior to the date of this Circular has been, a director, chief executive officer or chief financial officer of any company, including the Company:

| (a) | that while that person was acting in that capacity, was the subject of a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days; or |

| (b) | was subject to, after the proposed director ceased to be a director, chief executive officer or chief financial officer of the company and which resulted from an event that occurred while that person was acting in that capacity, of a cease trade order or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

| (c) | that while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. |

Individual Bankruptcies

No director or proposed director of the Company has, within the ten years prior to the date of this Circular, become bankrupt or made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

Penalties or Sanctions

None of the proposed directors have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority, has entered into a settlement agreement with a securities regulatory authority or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable securityholder making a decision about whether to vote for the proposed director.

EXECUTIVE COMPENSATION

Named Executive Officers

During the financial year ended May 31, 2019, the Company had four Named Executive Officers (“NEOs”) being, Evan Gappelberg, the Chief Executive Officer (the “CEO”), David Miles, the former Chief Financial Officer (the “CFO”), Paul Duffy, the President and Reuben Tozman, the former Chief Operating Officer of the Company.

“Named Executive Officer” means: (a) each CEO, (b) each CFO, (c) each of the three most highly compensated executive officers of the company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000; and (d) each individual who would be a NEO under (c) above but for the fact that the individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of that financial year.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis

The Company’s compensation policies and programs are designed to be competitive with similar technology companies and to recognize and reward executive performance consistent with the success of the Company’s business. These policies and programs are intended to attract and retain capable and experienced people while complying with regulatory requirements. The compensation committee’s (the “Compensation Committee”) role and philosophy is to ensure that the Company’s compensation goals and objectives, as applied to the actual compensation paid to the Company’s CEO and other executive officers, are aligned with the Company’s overall business objectives and with shareholder interests.

In addition to industry comparables, the Compensation Committee considers a variety of factors when determining both compensation policies and programs and individual compensation levels. These factors include the long-range interests of the Company and its shareholders, the implications of the risks associated with the Company’s compensation policies and practices in light of the financial performance of the Company, the overall financial and operating performance of the Company and the Compensation Committee’s assessment of each executive’s individual performance and contribution toward meeting corporate objectives. Since last year’s Meeting, neither the Board nor the Compensation Committee of the Company has proceeded to a formal evaluation of the implications of the risks associated with the Company’s compensation policies and practices. Risk management is a consideration of the Board when implementing its compensation programme, and the Board does not believe that the Company’s compensation programme results in unnecessary or inappropriate risk taking including risks that are likely to have a material adverse effect on the Company.

The current members of the Compensation Committee are Paul Duffy and Belinda Tyldesley. Mr. Reuben Tozman resigned as a director of the Company effective October 10, 2019 and previously was a member of the Company’s Compensation Committee. The Company may appoint a third member to the Compensation Committee after the Meeting. The function of the Compensation Committee is to assist the Board in fulfilling its responsibilities relating to the compensation practices of the executive officers of the Company. The Compensation Committee has been empowered to review the compensation levels of the executive officers of the Company and to report thereon to the Board; to review the strategic objectives of the stock option and other stock-based compensation plans of the Company and to set stock based compensation; and to consider any other matters which, in the Compensation Committee’s judgment, should be taken into account in reaching the recommendation to the Board concerning the compensation levels of the Company’s executive officers. The Board has adopted a charter for the Compensation Committee, which is attached as Schedule “A” to this Circular.

Report on Executive Compensation

This report on executive compensation has been authorized by the Compensation Committee. The Board assumes responsibility for reviewing and monitoring the long-range compensation strategy for the senior management of the Company although the Compensation Committee guides it in this role. The Board determines the type and amount of compensation for the CEO. The Board also reviews the compensation of the Company’s senior executives.

Philosophy and Objectives

The compensation program for the senior management of the Company is designed to ensure that the level and form of compensation achieves certain objectives, including:

| (a) | attracting and retaining talented, qualified and effective executives; |

| (b) | motivating the short and long-term performance of these executives; and |

| (c) | better aligning the interests of these executives with those of the Company’s shareholders. |

In compensating its senior management, the Company has employed a combination of base salary and equity participation through its stock option plan.

Elements of the Compensation Program

The significant elements of compensation awarded to the NEOs (as defined above) are a cash salary and stock options. The Company does not presently have a long-term incentive plan for its NEOs. There is no policy or target regarding allocation between cash and noncash elements of the Company’s compensation program. The Compensation Committee reviews annually the total compensation package of each of the Company’s executives on an individual basis, against the backdrop of the compensation goals and objectives described above, and make recommendations to the Board concerning the individual components of their compensation.

Cash Salary

The Compensation Committee and the Board approve the salary ranges for the NEOs. The base salary review for each NEO is based on assessment of factors such as current competitive market conditions, compensation levels within the peer group and particular skills, such as leadership ability and management effectiveness, experience, responsibility and proven or expected performance of the particular individual. The Compensation Committee, using this information, together with budgetary guidelines and other internally generated planning and forecasting tools, performs an annual assessment of the compensation of all executive and employee compensation levels.

Equity Participation

The Company believes that encouraging its executives and employees to become shareholders is the best way of aligning their interests with those of its shareholders. Equity participation is accomplished through the Company’s stock option plan. Stock options are granted to senior executives taking into account a number of factors, including the amount and term of options previously granted, base salary and bonuses and the Company’s goals. Options are generally granted to senior executives and vest on terms established by the Compensation Committee.

Use of Financial Instruments

The Company does not have a policy that would prohibit a NEO or director from purchasing financial instruments, including prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director. However, Management is not aware of any NEO or director purchasing such an instrument.

Perquisites and Other Personal Benefits

The Company’s NEOs are not generally entitled to significant perquisites or other personal benefits not offered to the Company’s other employees.

Stock Options

The Company has had a stock option plan in effect since May 16, 2018 (the “Stock Option Plan”), the purpose of which is to advance the interests of the Company and its shareholders by (a) ensuring that the interests of officers and employees are aligned with the success of the Company; (b) encouraging stock ownership by such persons; and (c) providing compensation opportunities to attract, retain and motivate such persons. The Stock Option Plan provides optionees with the opportunity through the exercise of options to acquire an ownership interest in the Company.

The Stock Option Plan is administered by the Compensation Committee, which determines, from time to time the eligibility of persons to participate in the Stock Option Plan, when options will be granted, the number of common shares subject to each option, the exercise price of each option, the expiration date of each option and the vesting period for each option, in each case in accordance with applicable securities laws and stock exchange requirements.

It is not the Company’s practice to grant stock options to existing executive officers on an annual basis, but grants of stock options will be considered as the circumstances of the Company and the contributions of the individual warrant. Previous grants of options are taken into account when considering new grants as part of the Company’s plan to achieve its objective of retaining quality personnel.

Terms of the Stock Option Plan

The following is a summary of the material terms of the Stock Option Plan:

Eligible Optionees. Under the Stock Option Plan, the Company can grant options (the “Options”) to acquire common shares of the Company (the “Common Shares”) to directors, officers and consultants of the Company or affiliates of the Company, as well as to employees of the Company and its subsidiaries.

Number of Shares Reserved. The number of Common Shares which may be issued pursuant to Options granted under the Stock Option Plan may not exceed 10% of the issued and outstanding Common Shares from time to time at the date of the grant of Options.

Maximum Term of Options. The term of any Options granted under the Plan is fixed by the Board and may not exceed ten years from the date of grant.

Exercise Price. The exercise price of Options granted under the Stock Option Plan is determined by the Board, but may not be less than the closing price of the Company’s Common Shares on the Canadian Securities Exchange (the “Exchange”) on the trading day immediately preceding the award date.

Vesting Provisions. Options granted under the Stock Option Plan may be subject to vesting provisions. Such vesting provisions are determined by the Board or the Exchange, if applicable.

Termination. Any Options granted pursuant to the Stock Option Plan will terminate generally within 90 days of the option holder ceasing to act as a director, officer, employee or consultant of the Company, unless such cessation is on account of death or disability. If such cessation is on account of death or disability, the Options terminate one year from the date of such cessation. Directors or officers who are terminated for failing to meet the qualification requirements of corporate legislation, removed by resolution of the shareholders, or removed by order of a securities commission or the Exchange shall have their options terminated immediately. Employees or consultants who are terminated for cause or breach of contract, or by order of a securities commission or the Exchange shall have their Options terminated immediately.

Transferability. The Options are non-assignable and non-transferable.

Amendments. Any substantive amendments to the Stock Option Plan shall be subject to the Company first obtaining the approvals, if required, of (a) the shareholders or disinterested shareholders, as the case may be, of the Company at a general meeting where required by the rules and policies of the Exchange, or any stock exchange on which the Common Shares may then be listed for trading; and (b) the Exchange, or any stock exchange on which the Common Shares may then be listed for trading.

Board Discretion. The Stock Option Plan provides that, generally, the number of Common Shares subject to each Option, the exercise price, the expiry time, the extent to which such option is exercisable, including vesting schedules, and other terms and conditions relating to such Options shall be determined by the Board.

Compensation Governance

The Board has established a Compensation Committee comprised of the following directors; Paul Duffy and Belinda Tyldesley. Ms. Tyldesley is considered an independent member of the Compensation Committee. Mr. Reuben Tozman resigned as Chief Operating Officer and as a director of the Company effective October 10, 2019 and previously was a member of the Company’s Compensation Committee. The Company may appoint a third member to the Compensation Committee after the Meeting. The function of the Compensation Committee is to review, on an annual basis, the compensation paid to the Company’s executive officers and to the directors, and to make recommendations to the Board on the Company’s compensation policies. In addition, the Committee reviews the Company’s succession plans for the CEO and makes recommendations with respect to severance paid to executives. The Board’s Compensation Committee is responsible for approving stock options grants and administering the Stock Option Plan. The process adopted with respect to the review of compensation for the Company’s directors and senior officers is set out under the heading “Compensation Discussion and Analysis” above.

The Compensation Committee members’ collective experience in leadership roles, their extensive knowledge of the technology industry and their extensive experience in operations, financial matters and corporate strategy provide the Compensation Committee with the collective skills, knowledge and experience necessary to effectively carry out its mandate. The Board has adopted a formal charter for the Compensation Committee, which is attached as Schedule “A” to this Circular.

The Company has not retained a compensation consultant or advisor at any time since the Company’s most recently completed financial year.

Director and Named Executive Officer Compensation

The following table is a summary of compensation paid, payable, awarded, granted, given, or otherwise provided, directly or indirectly, by the Company, or a subsidiary of the Company, to each NEO and director, for services provided and for services to be provided, directly or indirectly to the Company or a subsidiary of the Company, for each of the two most recently completed financial years, other than stock options and other compensation securities.

| Table of compensation excluding compensation securities |

| Name and position | | Year Ended | | Salary, consulting fee, retainer or commission ($) | | Bonus ($) | | Committee or meeting fees ($) | | Value of

perquisites

($) | | Value of all other compensation ($) | | Total compensation ($) |

Evan Gappelberg(1) Director, CEO | | 2019

2018(6 | | 196,862

89,966 | | Nil

Nil | | Nil

Nil | | Nil

Nil | | Nil

Nil | | 196,862

89,966 |

David Miles(2) Former CFO | | 2019

2018(6) | | Nil

Nil | | Nil

Nil | | Nil

Nil | | Nil

Nil | | 119,000(3)

Nil | | 119,000

89,966 |

Paul Duffy(4) Director, President | | 2019

2018(6) | | 188,250

NA | | Nil

Nil | | Nil

Nil | | Nil

Nil | | Nil

Nil | | 188,250

NA |

| Reuben Tozman(5) Former Director, COO | | 2019

2018(6) | | 201,663

N/A | | Nil

N/A | | Nil

N/A | | Nil

N/A | | Nil

N/A | | Nil

N/A |

| Belinda Tyldesley(7) Director, Corporate Secretary | | 2019

2018(6) | | $5,261

N/A | | Nil

N/A | | Nil

N/A | | Nil

N/A | | $13,565

$3,830 | | $18,826

$3,830 |

William Gildea(8) Former Director | | 2019

2018(6) | | $5,261

N/A | | Nil

N/A | | Nil

N/A | | Nil

N/A | | Nil

N/A | | $5,261

N/A |

Notes:

| (1) | Mr. Gappelberg has a consulting agreement with the Company pursuant to which the Company has agreed to pay Mr. Gappelberg US$180,000 (effective January 1, 2019) annually. The payments are paid in substantially equal regular monthly payments. Mr. Gappelberg was appointed to the board of directors and as the Company’s CEO on January 12, 2018. |

| (2) | Mr. Miles was appointed as the Company’s CFO on March 26, 2018 and resigned as the CFO on October 10, 2019. |

| (3) | $119,000 was invoiced by Seabord Services Corp., a service company that provides CFO, accounting and other services. Mr. Miles did not receive any compensation directly from the Company. Mr. Miles resigned as the CFO on October 10, 2019. |

| (4) | Mr. Duffy has a consulting agreement with the Company to be compensated $156,000 (effective January 2019) annually. The payments are paid in substantially equal regular monthly payments. Mr. Duffy was appointed to the board of directors on February 8, 2018 and as the Company’s President on June 14, 2018. |

| (5) | Mr. Tozman has a consulting agreement with the Company to be compensated $219,996 (effective July 2019) annually. The payments are paid in substantially equal regular monthly payments. Mr. Tozman was appointed to the board of directors on February 8, 2018 and as the Company’s Chief Operating Officer on June 14, 2018 and resigned as a director and officer effective October 10, 2019. |

| (6) | For the financial year beginning on incorporation on January 12, 2018 to May 31, 2018. |

| (7) | Ms. Tyldesley received $3,830 in 2018 and $13,565 in the year ended 2019s for her services rendered to the Company as Corporate Secretary. |

| (8) | Mr. Gildea served as a director from January 12, 2018 and resigned on August 1, 2019. |

Stock Options and Other Compensation Securities

The following compensation securities were granted or issued to the directors and NEOs by the Company or its subsidiary in the most recently completed financial year for services provided or to be provided, directly or indirectly, to the Company or any of its subsidiaries.

| Compensation Securities |

| Name and position | | Type of compensation security | | Number of compensation securities, number of underlying securities, and percentage of class | | | Date of issue or grant | | Issue, conversion or exercise price ($) | | | Closing price of security or underlying security on date of grant ($) | | | Closing price of security or underlying security at year end ($) | | | Expiry date |

Evan Gappelberg

Director, CEO | | Stock Options | | | 60,000 | | | Nov 2,

2018 | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.63 | | | Nov 2,

2021 |

| David Miles Former CFO | | Stock Options | | | 200,000 | | | Nov 2,

2018 | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.63 | | | Nov 2,

2021 |

| Paul Duffy Director, President | | Stock Options | | | 60,000 | | | Nov 2,

2018 | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.63 | | | Nov 2,

2021 |

| Reuben Tozman Former Director, COO | | Stock Options | | | 60,000 | | | Nov 2,

2018 | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.63 | | | Nov 2,

2021 |

Belinda Tyldesley

Director, Corporate Secretary | | Stock Options | | | 60,000 | | | Nov 2,

2018 | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.63 | | | Nov 2,

2021 |

Notes:

| (1) | As at May 31, 2019, Mr. Gappelberg held 60,000 stock options expiring on November 2, 2021. |

| (2) | As at May 31, 2019, Mr. Miles held 200,000 stock options expiring on November 2, 2021. |

| (3) | As at May 31, 2019, Mr. Duffy held 60,000 stock options expiring on November 2, 2021. |

| (4) | As at May 31, 2019, Mr. Tozman held 60,000 stock options expiring on November 2, 2021. |

| (5) | As at May 31, 2019, Ms. Tyldesley held 60,000 stock options expiring on November 2, 2021. |

No compensation securities were exercised by a director or NEO during the Company’s most recently completed financial year.

Stock option plans and other incentive plans

See “Terms of the Stock Option” above for the material terms of the Company’s Stock Option Plan.

Employment, Consulting and Management Agreements

Other than disclosed below, the Company does not have any agreement or arrangement under which compensation was provided during the most recently completed financial year or is payable in respect of services provided to the Company or any of its subsidiaries that were performed by a director or NEO, or performed by any other party but are services typically provided by a director or a NEO.

Effective February 1, 2018, the Company entered into a consulting agreement with Evan Gappelberg for an annual amount of US$120,000 to be paid in equal regular monthly payments for services rendered as CEO. Effective January 1, 2019, Mr. Gappelberg’s annual compensation was increased to US$180,00 annually.

Effective January 2019, the Company entered into a consulting agreement with Paul Duffy for an annual amount of $156,000 to be paid in equal regular monthly payments for services rendered as President.

Effective July 2019, the Company entered into a consulting agreement with Reuben Tozman for an annual amount of $219,996 to be paid in equal regular monthly payments for services rendered as Chief Operating Officer. Mr Tozman resigned as Chief Operating Officer and as a director effective October 10, 2019 and the agreement was terminated.

The Company is not party to any contracts, and have not entered in to any plans or arrangements which require compensation to be paid to any of the NEOs in the event of:

| (a) | resignation, retirement or any other termination of employment (whether voluntary, involuntary or constructive) with the Company or one of its subsidiaries; |

| (b) | a change of control of the Company or one of its subsidiaries; or |

| (c) | a change in the director, officer or employee’s responsibilities. |

Pension Benefits

The Company does not have a pension plan that provides for payments or benefits to the NEOs at, following, or in connection with retirement.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out those securities of the Company which have been authorized for issuance under equity compensation plans, as at the end of the most recently completed financial year:

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a) | | | Weighted-average exercise price of outstanding options, warrants and rights

(b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c) | |

| Equity compensation plans approved by the securityholders | | | 5,324,000 | | | $ | 0.36 | | | | 50,937 | |

| Equity compensation plans not approved by the securityholders | | | N/A | | | | N/A | | | | N/A | |

| Total | | | 5,324,000 | | | $ | 0.36 | | | | 50,937 | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

Other than routine indebtedness, no Director, Executive Officer or Senior Officer of the Company, or any proposed nominee for election as a Director of the Company, or any associate or affiliate of any such Director, Executive Officer or Senior Officer or proposed nominee, is or has been indebted to the Company or any of its subsidiaries, or to any other entity that was provided a guarantee or similar arrangement by the Company or any of its subsidiaries in connection with the indebtedness, at any time since the beginning of the most recently completed financial year of the Company.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company or any proposed nominee of Management for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, since the beginning of the Company’s last financial year in matters to be acted upon at the Meeting, other than the election of directors and the appointment of auditors.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other than as disclosed below and elsewhere in this Circular, no other informed person (a director, officer or holder of 10% or more Common Shares) or any associate or affiliate of any informed person had any interest in any transaction which has materially affected or would materially affect the Company or any of its subsidiaries, within the two most recently completed financial years or during the current financial year.

On December 4, 2018, the Company issued 300,000 common shares to Reuben Tozman, a director and officer of the Company at such time, pursuant to the terms of an Asset Purchase Agreement whereby the Company acquired the intellectual property and other related assets of edCetra’s eLearning Platform.

On January 14, 2019, the Company acquired 100% of the membership interests in AR Ecomm, LLC from directors and executive officers of the Company at such time, Evan Gappelberg and Reuben Tozman, in consideration for an aggregate of 2,000,000 common shares of the Company.

Certain directors and/or officers of the Company have subscribed for Common Shares pursuant to the private placement financings of the Company. In addition, certain directors and/or officers of the Company have been granted stock options under the Company’s Stock Option Plan.

APPOINTMENT OF AUDITOR

Auditor

The auditors of the Company are Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants (“DMCL”), located at 1500 – 1140 West Pender Street, Vancouver, British Columbia, V6E 4G1. DMCL was first appointed as the Company’s auditor on March 8, 2018.

Proxies given pursuant to this solicitation will, on any poll, be voted as directed and, if there is no direction, for the appointment of DMCL, as auditor for the Company to hold office for the ensuing year with remuneration to be fixed by the Board.

MANAGEMENT CONTRACTS

There are no management functions of the Company, which are to any substantial degree performed by a person or company other than the directors or senior officers of the Company.

AUDIT COMMITTEE

Pursuant to National Instrument 52-110 of the Canadian Securities Administrators ("NI 52-110") the Company is required to have an audit committee (the “Audit Committee”) comprised of not less than three directors, a majority of whom are not officers, control persons or employees of the Company or an affiliate of the Company. NI 52-110 requires the Company, as a venture issuer, to disclose annually in its Information Circular certain information concerning the constitution of its audit committee and its relationship with its independent auditor, as set forth below.

The primary function of the Audit Committee is to assist the Board in fulfilling its financial oversight responsibilities by: (i) reviewing the financial reports and other financial information provided by the Company to regulatory authorities and Shareholders; (ii) reviewing the systems for internal corporate controls which have been established by the Board and management; and (iii) overseeing the Company’s financial reporting processes generally. In meeting these responsibilities the Audit Committee monitors the financial reporting process and internal control system; reviews and appraises the work of external auditors and provides an avenue of communication between the external auditors, senior management and the Board. The Audit Committee is also mandated to review and approve all material related party transactions.

Audit Committee Charter

The Audit Committee’s charter is attached as Schedule “B” to this Circular.

Composition of Audit Committee and Independence

The Company’s current Audit Committee consists of Paul Duffy and Evan Gappelberg. Reuben Tozman resigned as Chief Operating Officer and as a director of the Company effective October 10, 2019 , and previously was a member of the Company’s audit Committee. The Company proposes to appoint a third member to the Audit Committee after the Meeting.

National Instrument 52-110 - Audit Committees (“NI 52-110”) provides that a member of an audit committee is “independent” if the member has no direct or indirect material relationship with the Company, which could, in the view of the Company’s Board, reasonably interfere with the exercise of the member’s independent judgment. None of the Company’s current Audit Committee members are “independent” within the meaning of NI 52-110. NI 52-110 provides that an individual is “financially literate” if he or she has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements. All of the members of the Audit Committee are “financially literate” as that term is defined. The following sets out the Audit Committee members’ education and experience that is relevant to the performance of his responsibilities as an audit committee member.

Relevant Education and Experience

All members of the audit committee have:

| ● | an understanding of the accounting principles used by the Company to prepare its financial statements, and the ability to assess the general application of those principles in connection with estimates, accruals and provisions; |

| ● | experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements, or experience actively supervising individuals engaged in such activities; and |

| ● | an understanding of internal controls and procedures for financial reporting. |

The relevant education and/or experience of each member of the Audit Committee is described below:

Paul Duffy – Mr. Duffy is the creator of the HumaGram and inventor of the patent for Holographic Telepresence over the Internet (TOIP), Mr. Duffy is a serial entrepreneur with over 25 years of experience in successfully starting, expanding, diversifying and selling global technology companies. Mr. Duffy co- founded Corporate Communications Interactive (CCI) in 1992 and grew it to one of the largest online learning and communication companies in North America. With clients such as AT&T, GE, IBM, Microsoft, Pearson Education and Manulife Financial, CCI was sold to SkillPath Seminars in 2003. Mr. Duffy is also a former member of the Board of Governors for the Michener Institute for Applied Health Sciences, and holds a Bachelor of Science in Applied Computer Science from Ryerson University.

Evan Gappelberg - Mr. Gappelberg is an accomplished entrepreneur with an expertise in creating, funding and running start-ups, and he has extensive experience both as a hands-on operating executive and well as a public markets professional. From 2000 to 2005, Mr. Gappelberg was the co- founder and CEO of EG Products, where he funded, patented, imported and distributed the market’s first LED light-up toy. He secured license deals from Disney, Universal Studios, Clear Channel Communication and built a national sales channel, landing contracts with Walgreen’s, Macy’s, and live event shows like Ringling Bros. He was also was co-founder and CEO of an app development company which created and published over 200 successful apps for both Apples iTunes store and the Google Play store. Prior to being a successful entrepreneur, Mr. Gappelberg worked on Wall Street and has more than 20 years of extensive experience as both a hedge fund manager and Senior Vice President of Finance.

Audit Committee Oversight

Since the commencement of the Company’s most recently completed financial year, the Audit Committee of the Company has not made any recommendations to nominate or compensate an external auditor which were not adopted by the Board.

Reliance on Certain Exemptions

Since the commencement of the Company’s most recently completed financial year, the Company has not relied on:

| (a) | the exemption in section 2.4 (De Minimis Non-audit Services) of NI 52-110; or |

| (b) | an exemption from NI 52-110, in whole or in part, granted under Part 8 (Exemptions). |

Pre-Approval Policies and Procedures

The Audit Committee has not adopted any specific policies and procedures for the engagement of non-audit services.

Audit Fees

The following table sets forth the fees paid by the Company and its subsidiaries to Dale Matheson Carr- Hilton Labonte LLP, Chartered Professional Accountants, for services rendered in the last two financial years:

| Financial Year Ending | | Audit Fees(1) | | Audit Related Fees(2) | | Tax Fees(3) | | All Other Fees(4) |

| May 31, 2019 | | NA | | NA | | NA | | NA |

| May 31, 2018 | | 15,000 | | NA | | NA | | NA |

Notes

| (1) | “Audit fees” include aggregate fees billed by the Company’s external auditor in each of the last two financial years for audit fees. The Company’s financial statements for the year ended May 31, 2019 have been completed and filed on SEDAR however no fees have been billed yet for fiscal 2019 as as at the date of this Cicular. |

| (2) | “Audited related fees” include the aggregate fees billed in each of the last two financial years for assurance and related services by the Company’s external auditor that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “Audit fees” above. The services provided include employee benefit audits, due diligence assistance, accounting consultations on proposed transactions, internal control reviews and audit or attest services not required by legislation or regulation. |

| (3) | “Tax fees” include the aggregate fees billed in each of the last two financial years for professional services rendered by the Company’s external auditor for tax compliance, tax advice and tax planning. The services provided include tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from tax authorities. |

| (4) | “All other fees” include the aggregate fees billed in each of the last two financial years for products and services provided by the Company’s external auditor, other than “Audit fees”, “Audit related fees” and “Tax fees” above. |

Exemption in Section 6.1

The Company is a “venture issuer” as defined in NI 52-110 and is relying on the exemption in section 6.1 of NI 52-110 relating to Parts 3 (Composition of Audit Committee) and 5 (Reporting Obligations).

CORPORATE GOVERNANCE DISCLOSURE

National Instrument 58-101 - Disclosure of Corporate Governance Practices, requires all reporting issuers to provide certain annual disclosure of their corporate governance practices with respect to the corporate governance guidelines (the “Guidelines”) adopted in National Policy 58-201. These Guidelines are not prescriptive, but have been used by the Company in adopting its corporate governance practices. The Board and Management consider good corporate governance to be an integral part of the effective and efficient operation of Canadian corporations. The Company’s approach to corporate governance is set out below.

Board of Directors

Management is nominating three (3) individuals to the Board, all of whom are current directors of the Company.

The Guidelines suggest that the board of directors of every reporting issuer should be constituted with a majority of individuals who qualify as “independent” directors under NI 52-110, which provides that a director is independent if he or she has no direct or indirect “material relationship” with the Company. The “material relationship” is defined as a relationship which could, in the view of the Company’s Board, reasonably interfere with the exercise of a director’s independent judgement. Belinda Tyldesley is the only member of the Board who is considered “independent” within the meaning of NI 52-110.

The Board has a stewardship responsibility to supervise the management of and oversee the conduct of the business of the Company, provide leadership and direction to Management, evaluate Management, set policies appropriate for the business of the Company and approve corporate strategies and goals. The day- to-day management of the business and affairs of the Company is delegated by the Board to the CEO. The Board will give direction and guidance through the CEO to Management and will keep Management informed of its evaluation of the senior officers in achieving and complying with goals and policies established by the Board.

The Board recommends nominees to the shareholders for election as directors, and immediately following each annual general meeting appoints an audit committee and an audit committee chairperson and a compensation committee and compensation committee chairperson. The Board establishes and periodically reviews and updates the committee mandates, duties and responsibilities of each committee, elects a chairperson of the Board and establishes his or her duties and responsibilities, appoints the CEO, CFO and President of the Company and establishes the duties and responsibilities of those positions and on the recommendation of the CEO, appoints the senior officers of the Company and approves the senior management structure of the Company.

The Board exercises its independent supervision over management by its policies that (a) periodic meetings of the Board be held to obtain an update on significant corporate activities and plans; and (b) all material transactions of the Company are subject to prior approval of the Board. The Board shall meet not less than three times during each year and will endeavour to hold at least one meeting in each financial quarter. The Board will also meet at any other time at the call of the President, or subject to the Articles of the Company, of any director.

The mandate of the Board, as prescribed by the Business Corporations Act (British Columbia) (the “Act”), is to manage or supervise management of the business and affairs of the Company and to act with a view to the best interests of the Company. In doing so, the Board oversees the management of the Company’s affairs directly and through its committees.

Directorships

The following directors of the Company are also directors of other reporting issuers as stated:

| Name of Director | | Name of Other Reporting Issuer |

| Evan Gappelberg | | N/A |

| Paul Duffy | | N/A |

| Belinda Tyldesley | | N/A |

Orientation and Continuing Education

When new directors are appointed, they receive orientation on the Company’s business, current projects, reports on operations and results, public disclosure filings by the Company, reports on and industry, and the responsibilities of directors. With respect to continuing education, Board meetings may include presentations by the Company’s management and employees to give the directors additional insight into the Company’s business. In addition, management of the Company makes itself available for discussion with all Board members on an ongoing basis.

Ethical Business Conduct

The Board has adopted a written code of conduct applicable to directors, officers, employees, consultants and contractors of the Company, entitled “Code of Business Conduct and Ethics” (the “Code”). The Board monitors compliance with the Code through the Chair of the Audit Committee and the Chief Executive Officer. The Code provides that each person is personally responsible for and it is their duty to report violations or suspected violations of the Code, and that no person will be discriminated against for reporting what that person reasonably believes to be a breach of the Code or any law or regulation.

The Code also requires each director, officer, employee and consultant of the Company to fully disclose in writing his or her interest in respect of any transaction or agreement to be entered into by the Company. Once such an interest has been disclosed, the Chair of the Audit Committee or Board will determine what course of action should be taken.

A copy of the Code is available on SEDAR at www.sedar.com and on the Company’s website.

The Company requires any director or officer who has a material interest in an entity which is a party to a proposed or actual material contract or transaction with the Company to disclose the nature and extent of such interest in writing to the Company, or at a meeting of directors. Directors are also required to comply with the Company’s “Timely Disclosure, Confidentiality and Insider Trading Policy”.

Nomination of Directors

The Board identifies new candidates for board nomination by an informal process of discussion and consensus-building on the need for additional directors, the specific attributes being sought, likely prospects and timing. Prospective directors are not approached until consensus is reached. This process takes place among the Chairman and a majority of the non-executive directors.

Audit Committee

The members of the Audit Committee are Paul Duffyand Evan Gappelberg. Reuben Tozman resigned as Chief Operating Officer and as a director of the Company effective October 10, 2019, and previously was a member of the Company’s Audit Committee. The Company proposes to appoint a third member to the Audit Committee after the Meeting.

Compensation Committee

The members of the Compensation Committee are Paul Duffy and Belinda Tyldesley. Reuben Tozman resigned as Chief Operating Officer and as a director of the Company effective October 10, 2019, and previously was a member of the Company’s Compensation Committee. The Company may appoint a third member to the Compensation Committee after the Meeting.

The members of the Compensation Committee reviewed the consulting agreement from Evan Gappelberg and the Board unamimously agreed to the terms in the agreement. The Board has decided not to pay director fees at this time.

Assessments

The Board annually, and at such other times as it deems appropriate, reviews the performance and effectiveness of the Board, the directors and its committees to determine whether changes in size, personnel or responsibilities are warranted. To assist in its review, the Board conducts informal surveys of its directors and receives reports from each committee respecting its own effectiveness.

PARTICULARS OF MATTERS TO BE ACTED UPON

Adoption of New Articles

The Shareholders will be asked at the Meeting to approve the replacement of the existing articles of the Company (the “Old Articles”) with new articles (the “New Articles”), in substantially the form attached to this Circular as Schedule “C”. The New Articles have been modernized as compared to the Old Articles, and reflect changes to corporate law in Canada. The New Articles include advance notice provisions, which provide Shareholders, directors and management of the Company with direction on the procedure for Shareholder nomination of directors.

Changes to Articles

The main differences between the Old Articles and the New Articles are as follows: (i) the New Articles provide more flexible quorum requirements for shareholders’ meetings; and (ii) the New Articles provide that certain alterations of the authorized share structure may be approved by an ordinary resolution or directors’ resolution instead of by ordinary resolution, subject to the provisions of the Business Corporations Act (British Columbia).

The New Articles change the quorum for the transaction of business at a meeting of shareholders from two shareholders who, in the aggregate, hold at least 5% of the issued shares entitled to be voted at the meeting are present in person or represented by proxy, irrespective of the number of persons actually present at the meeting to, subject to the special rights and restrictions attached to the shares of any class or series of shares, one person who is a shareholder, or who is otherwise permitted to vote shares of the Company at a shareholders meeting, present in person or by proxy.

The New Articles of the Company will provide that the following matters may be approved either by directors’ resolution or by ordinary resolution, at the election of the directors in their sole discretion:

| (1) | create one or more classes or series of shares or, if none of the shares of a class are allotted or issued, eliminate that class of shares; |

| (2) | increase, reduce or eliminate the maximum number of shares that the Company is authorized to issue out of any class or series of shares or establish a maximum number of shares that the Company is authorized to issue out of any class or series of shares for which no maximum is established; |

| (3) | subdivide or consolidate all or any of its unissued, or fully paid issued, shares; |

| (4) | if the Company is authorized to issue shares of a class of shares with par value: |

| i | decrease the par value of those shares; or |

| ii | if none of the shares of that class of shares are allotted or issued, increase the par value of those shares; |

| (5) | change all or any of its unissued, or fully paid issued, shares with par value into shares without par value or any of its unissued shares without par value into shares with par value; |

| (6) | alter the identifying name of any of its shares; or |

| (7) | otherwise alter its shares or authorized share structure when required or permitted to do so by the Business Corporations Act (British Columbia). |

The Replacement Articles Resolution

Shareholders will be asked to pass the following Special Resolution to approve the adoption of the New Articles (the “Replacement Articles Resolution”), substantially in the following form:

“BE IT RESOLVED THAT:

| 1. | the Company adopt the New Articles, in substantially the form attached as Schedule “C” to this Circular, with such additions and deletions as may be approved by the directors of the Company, in substitution for the Old Articles; |

| 2. | notwithstanding the passage of this special resolution by the shareholders of the Company, the directors of the Company, in their sole discretion and without further notice to or approval of the shareholders of the Company, may decide not to proceed with the adoption of the New Articles or otherwise give effect to this special resolution, at any time prior to the filing of ; and |

| 3. | any one officer or director of the Company is authorized, for and on behalf of the Company, to execute and deliver such documents and instruments and to take such other actions as such officer or director may determine to be necessary or advisable to implement this resolution and the matters authorized hereby including, without limitation, the execution and filing of the Notice of Alteration and any forms prescribed by or contemplated under the British Columbia Act.” |

Management recommends that Shareholders approve the Replacement Articles Resolution.

If the Replacement Articles Resolution is approved by Shareholders, the New Articles will apply to govern the management and affairs of the Company.

Notwithstanding the approval of the Replacement Articles Resolution by Shareholders, the Directors will have the authority, in their sole discretion, to implement or revoke the Replacement Articles Resolution and otherwise implement or abandon the New Articles without further approval from the Shareholders. If the Replacement Articles Resolution is abandoned, the Old Articles will continue to govern the management and affairs of the Company.

General Matters

It is not known whether any other matters will come before the Meeting other than those set forth above and in the Notice of Meeting, but if any other matters do arise, the person named in the Proxy intends to vote on any poll, in accordance with his or her best judgement, exercising discretionary authority with respect to amendments or variations of matters set forth in the Notice of Meeting and other matters which may properly come before the Meeting or any adjournment or postponement of the Meeting.

ADDITIONAL INFORMATION

Additional information relating to the Company may be found on SEDAR at www.sedar.com. Financial information about the Company is provided in the Company’s comparative annual financial statements to May 31, 2019, a copy of which, together with Management’s Discussion and Analysis thereon, can be found on the Company’s SEDAR profile at www.sedar.com. Additional financial information concerning the Company may be obtained by any securityholder of the Company free of charge by contacting the Company, at 1866-274-8493.

BOARD APPROVAL

The contents of this Circular have been approved and its mailing authorized by the directors of the Company.

DATED at Vancouver, British Columbia, the 7th day of October, 2019.

ON BEHALF OF THE BOARD

| “Evan Gappelberg” | |

| Evan Gappelberg | |

| Chief Executive Officer | |

NEXTECH AR SOLUTIONS CORP.

Schedule “A”

Compensation Committee Charter

There shall be a committee of the board of directors (the “Board”) of NexTech AR Solutions Corp. (the “Company”), to be known as the Compensation Committee (the “Committee”).

The purpose of the Committee is to assist the Board in fulfilling its oversight role relating to human resource strategy, policies and programs, and all matters relating to the proper utilization of human resources within the Company, with special focus on management succession, development and compensation. The Committee shall prepare or receive reports and make recommendations to the Board on matters that include:

| a) | compensation of the Company’s senior management; |

| b) | stock options granting procedures; |

| d) | employee pension plans; |

| e) | directors’ compensation; and |

| f) | such other matters as may be determined by the Board. |

The Committee shall consist of three or more members of the Board, and to the extent possible and if practicable the majority of whom, the Board have determined, has no material relationship with the Company and each of whom is otherwise “independent” as defined by National Instrument 52-110 Audit Committees.

The members of the Committee shall be appointed or reappointed at a meeting of the Board to be held immediately following the annual general meeting of shareholders (the “AGM”), and in the normal course of business will serve until the close of the subsequent meeting of shareholders. Each member shall continue to be a member of the Committee until a successor is appointed, unless the member resigns, is removed or ceases to be a director. The Board may fill a vacancy that occurs in the Committee at any time.

The Board or, in the event of the Board’s failure to do so, the members of the Committee, shall appoint or reappoint, at the meeting of the Board immediately following the AGM, a chairman among their number. The chairman to the extent possible, shall not be a former officer of the Company and shall serve as a liaison between the Committee and Management.

Meetings of the Committee shall be held at least once annually, provided that due notice is given and a quorum of a majority of the members is present. Where a meeting is not possible, resolutions in writing which are signed by all members of the Committee are as valid as if they had been passed at a duly held meeting. The frequency and nature of the meeting agendas are dependent upon business matters and affairs which the Company faces from time to time.

In the absence of the appointed Chair from any meeting of the Committee, the members shall elect a Chair from those in attendance to act as Chair of the meeting.

The Committee shall report to the Board on its activities after each of its meetings. In addition, it shall review and assess the adequacy of this charter annually and, where necessary, recommend changes to the Board for approval. The Committee shall undertake and review with the Board an annual performance evaluation of the Committee.

| a) | the Committee shall review and make recommendations to the Board at least annually regarding the following: |

| b) | the appointment, performance, succession and remuneration of executive officers; |

| c) | the Company’s succession and leadership plans at the executive officer level; |

| d) | corporate goals and objectives relevant to the compensation of the Chief Executive Officer, evaluation of the performance of the CEO in light of those goals and objectives, and the CEO’s compensation level based on this evaluation; |

| e) | remuneration and compensation policies, including short and long-term incentive compensation plans, such as stock option and share bonus grants in order to support the Company’s overall business objectives, attract and retain key executives and provide appropriate compensation at a reasonable cost; |

| f) | the granting of stock options to directors, officers and other key employees and consultants of the Company; |

| g) | all other remuneration matters, including severance or similar termination payments proposed to be made to any current or former member of senior management of the Company; |

| h) | in consultation with management, ensure that the Company’s disclosure with respect to executive compensation matters is full, true and complete, prior to its public release; and |

| i) | prepare and issue the reports required under “Committee Reports”. |

The Committee shall have such other powers and duties as delegated to it by the Board.

The Committee shall produce a summary of the actions taken at each Committee meeting or a report of resolutions approved, which shall be presented to the Board at the subsequent Board meeting.

| 7. | Resources and Authority of the Committee |

The Committee shall have the resources and authority appropriate to discharge its duties and responsibilities, including retaining and compensating such independent advisors as it may deem necessary or advisable to fulfill its duties, without seeking approval of the Board or management. The expenses related to such engagement shall be funded by the Company. With respect to compensation consultants retained to assist in the evaluation of director, or senior management compensation, this authority shall be vested solely in the Committee.