SCC Growth IV Holdco A, Ltd. is wholly owned by Sequoia Capital China Growth Fund IV, L.P. The general partner of Sequoia Capital China Growth Fund IV, L.P. is SC China Growth IV Management, L.P., whose general partner is SC China Holding Limited. The general partner of each of Sequoia Capital China Growth Fund V, L.P., Sequoia Capital China Growth Partners Fund V, L.P. and Sequoia Capital China Growth V Principals Fund, L.P. is SC China Growth V Management, L.P., whose general partner is SC China Holding Limited. SC China Holding Limited is wholly owned by SNP China Enterprises Limited, which in turn is wholly owned by Mr. Nanpeng Shen. Mr. Shen, together with SCC Growth IV Holdco A, Ltd., Sequoia Capital China Growth Fund IV, L.P., SC China Growth IV Management, L.P., Sequoia Capital China Growth Fund V, L.P., Sequoia Capital China Growth Partners Fund V, L.P. and Sequoia Capital China Growth V Principals Fund, L.P., SC China Growth V Management, L.P., SC China Holding Limited and SNP China Enterprises Limited, are collectively referred to as Sequoia Capital China. SC GGFII Holdco, Ltd. is owned by Sequoia Capital Global Growth Fund II, L.P. and Sequoia Capital Global Growth II Principals Fund, L.P., whose general partner is SC Global Growth II Management, L.P. The general partner of SC Global Growth II Management, L.P. is SC US (TTGP), Ltd. The directors and stockholders of SC US (TTGP), Ltd. who exercise voting and investment discretion with respect to the shares held by SC GGFII Holdco, Ltd. are Messrs. Roelof Botha and Douglas Leone. The general partner of each of Sequoia Capital Global Growth Fund III—Endurance Partners, L.P. and Sequoia Capital Global Growth Fund III—Endurance Partners Principals Fund, L.P. is SCGGF III—Endurance Partners Management, L.P. The general partner of SCGGF III—Endurance Partners Management, L.P. is SC US (TTGP), Ltd. The directors and stockholders of SC US (TTGP), Ltd. who exercise voting and investment discretion with respect to the shares held by each of Sequoia Capital Global Growth Fund III—Endurance Partners, L.P., L.P. and Sequoia Capital Global Growth Fund III—Endurance Partners Principals Fund, are Messrs. Botha and Leone. Messrs. Botha and Leone, together with SC GGFII Holdco, Ltd., Sequoia Capital Global Growth Fund II, L.P., Sequoia Capital Global Growth II Principals Fund, L.P., SC Global Growth II Management, L.P., Sequoia Capital Global Growth Fund III—Endurance Partners, L.P., Sequoia Capital Global Growth Fund III—Endurance Partners Principals Fund, L.P., SCGGF III—Endurance Partners Management, L.P. and SC US (TTGP), Ltd., are collectively referred to as Sequoia Capital Global Growth. Sequoia Capital China and Sequoia Capital Global Growth may be deemed to be a group within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, with respect to their ownership of our shares, and are collectively referred to as Sequoia Funds. The registered address of SCC Growth IV Holdco A, Ltd., Sequoia Capital China Growth Fund V, L.P., Sequoia Capital China Growth Partners Fund V, L.P. and Sequoia Capital China Growth V Principals Fund, L.P. is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands, and the address for each of the Sequoia Capital Global Growth entities is 2800 Sand Hill Road, Suite 101, Menlo Park, CA, the United States of America.

To our knowledge, as of April 13, 2020, a total of 1,101,729,676 Class A ordinary shares are held by one record holder in the United States, representing approximately 23.0% of our total outstanding shares. The holder is Deutsche Bank Trust Company Americas, the depositary of our ADS program. None of our outstanding Class B ordinary shares are held by record holders in the United States. The number of beneficial owners of our ADSs in the United States is likely to be much larger than the number of record holders of our ordinary shares in the United States.

Item 7. Major Shareholders and Related Party Transactions

A. Major Shareholders

Please refer to “Item 6. Directors, Senior Management and Employees—E. Share Ownership.”

B. Related Party Transactions

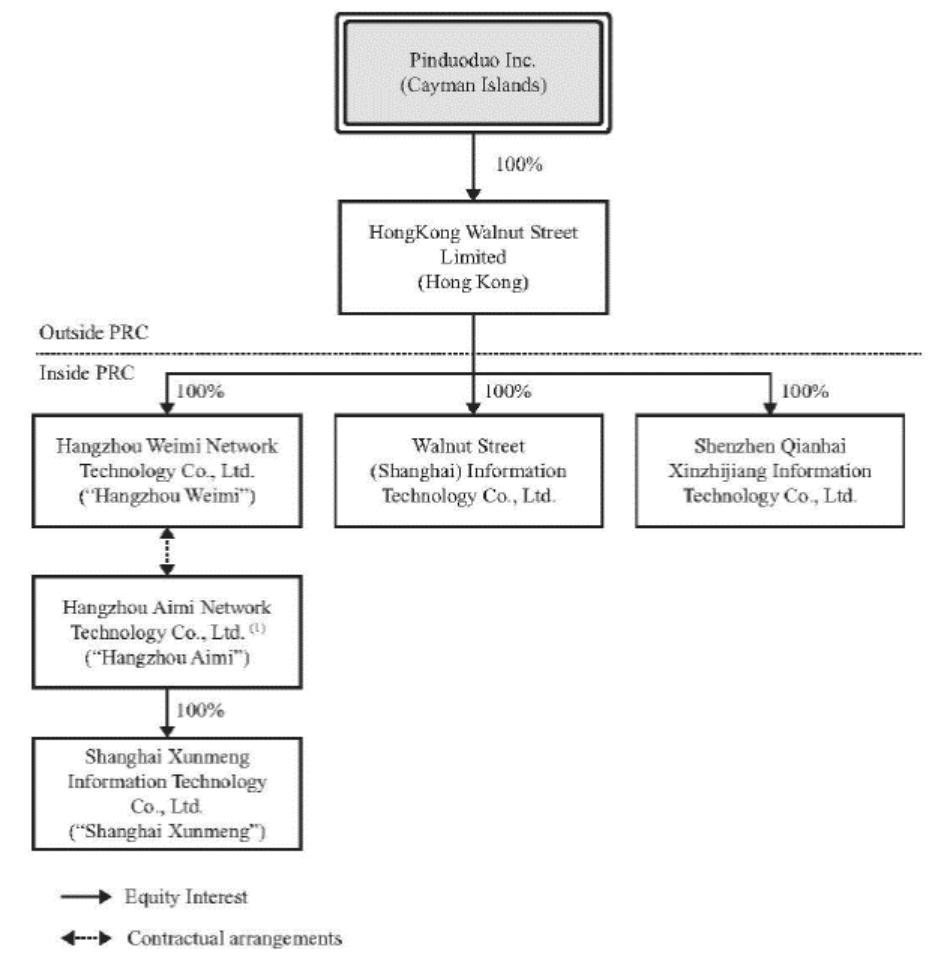

Contractual Arrangements with Our Variable Interest Entity and its Shareholders

For a description of these contractual arrangements, see “Item 4. Information on the Company—C. Organizational Structure.”