Exhibit 99.34

CANOPY GROWTH CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS OF THE FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FOR THE THREE MONTHS ENDED JUNE 30, 2017

AUGUST 13, 2017

1

Canopy Growth Corporation (“the Company” or “Canopy Growth”) is a publicly traded corporation, incorporated in Canada, with its head office located at 1 Hershey Drive, Smiths Falls, Ontario. Canopy Growth trades on the Toronto Stock Exchange (“TSX”) under the ticker symbol “WEED”.

This Management’s Discussion and Analysis of the Financial Condition and Results of Operation (“MD&A”) is dated August 13, 2017. It should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements (the “Interim Financial Statements”) for the three months ended June 30, 2017, including the accompanying notes.

Unless otherwise indicated, all financial information in this MD&A is reported in thousands of Canadian dollars, except share amounts. We prepared this MD&A with reference to National Instrument 52-109 – Continuous Disclosure Obligations of the Canadian Securities Administrators. This MD&A provides information for the three months ended June 30, 2017 and up to and including August 13, 2017.

By their nature, the Interim Financial Statements do not include all the information required for full annual financial statements. Accordingly, this MD&A should be read in conjunction with our audited consolidated financial statements and notes thereto for the year ended March 31, 2017 and the related MD&A for the year ended March 31, 2017 dated June 26, 2017.

The Interim Financial Statements and this MD&A have been reviewed by the Company’s Audit Committee and approved by the Company’s Board of Directors.

The accompanying Interim Financial Statements were prepared in compliance with International Financial Reporting Standard 34 Interim Financial Reporting (“IAS 34”), in accordance with subparagraph 3.2(1) (b) of NI 52-107 and include the accounts of the Company and its wholly-owned subsidiaries which include Tweed Inc. (“Tweed”), Tweed Farms Inc. (“Tweed Farms”), Bedrocan Canada Inc. (“Bedrocan”) and Mettrum Health Corp. (“Mettrum”), which includes wholly-owned subsidiaries, Mettrum Ltd. and Agripharm Corp., and Tweed Grasslands Cannabis Inc. (“Tweed Grasslands”) which are all licensed producers of medical cannabis in Canada in addition to other subsidiaries and investments held. All intercompany balances and transactions have been eliminated on consolidation.

Additional information filed by us with the Canadian Securities Administrators, including quarterly reports, annual reports and annual information forms are available on-line at www.sedar.com and also on our website at www.canopygrowth.com, and Short Form Prospectus with respect to the bought deals dated April 8, 2016, August 18, 2016 and December 16, 2016 are available on-line at www.sedar.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains certain “forward-looking statements” and forward-looking information within the meaning of Canadian securities laws, including such statements relating to:

| | • | | assumptions and expectations described in the Company’s critical accounting policies and estimates; |

| | • | | the Company’s expectations regarding the adoption and impact of certain accounting pronouncements; |

| | • | | the Company’s expectations regarding legislation, regulations and licensing related to the cultivation, production and sale of cannabis products by the company’s wholly-owned subsidiaries; |

| | • | | the expected number of users of medical cannabis or the size of the medical cannabis market in Canada; |

| | • | | the potential time frame for the implementation of legislation to legalize recreational cannabis use in Canada and the potential form of implementing the final legislation will take; |

| | • | | the potential size of the recreational cannabis market in Canada should recreational use be legalized; |

2

| | • | | the ability to enter and participate in international market opportunities; |

| | • | | the Company’s expectations with respect to the company’s future financial and operating performance; |

| | • | | product sales expectations; |

| | • | | production capacity expectations; and |

| | • | | the Company’s ability to achieve profitability without further equity financing. |

The words “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates” “forecasts”, “intends”, “anticipates”, or “believes” or variation (including negative variations) of such words and phrases, or statements that certain actions, events, or results “may”, “could”, “would”, “might”, or “will” be taken, occur or to achieve are all forward-looking statements. Forward-looking statements are based on the reasonable assumptions, estimates, internal and external analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable at the date that such statements are made. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, but are not limited to, the factors discussed in the section entitled “RISKS AND UNCERTAINTIES”. Although the Company has attempted to identify important factors that could cause actions, events or results to differ materially from those described in the forward-looking statements, there may be other factors that cause actions, events, or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as at the date of the MD&A. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements. The Company does not undertake to update any forward-looking statements except as required by applicable securities laws.

3

FIRST QUARTER 2018 HIGHLIGHTS

Financial

| | • | | First quarter revenue was $15,873; a 127% increase over the three month period quarter ended June 30, 2016 when revenue totaled $6,984, and an 8% increase over fourth quarter of fiscal 2017 revenues of $14,661. The first quarter’s focus was on a major shift to a single platform to offer all our customers access to all brands through a single online store. Launching the Tweed Main Street online store, which required moving individual Tweed, Mettrum and Bedrocan e-commerce sites offline and the migration of customers to a single new e-commerce platform, reduced sales activity over a period of approximately 10 business days in April to partially impact revenues in the quarter. In addition, Mettrum growing operations were mostly inactive through the latter half of the fourth quarter fiscal 2017 and through most of the first quarter fiscal 2018 while being reset and integrated with new standard operating and quality control procedures resulting in lower availability for sale of Mettrum branded products in the first quarter fiscal 2018; |

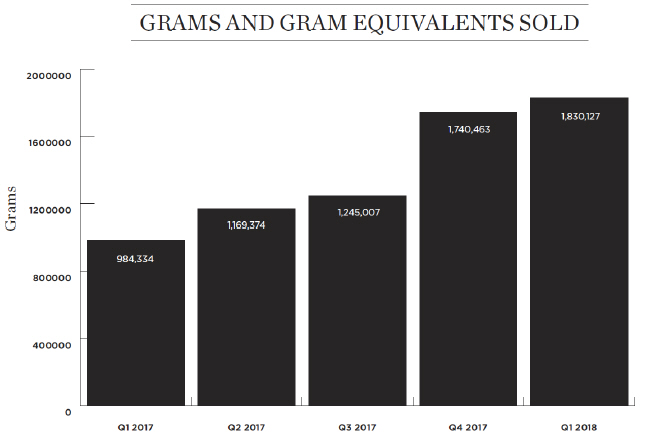

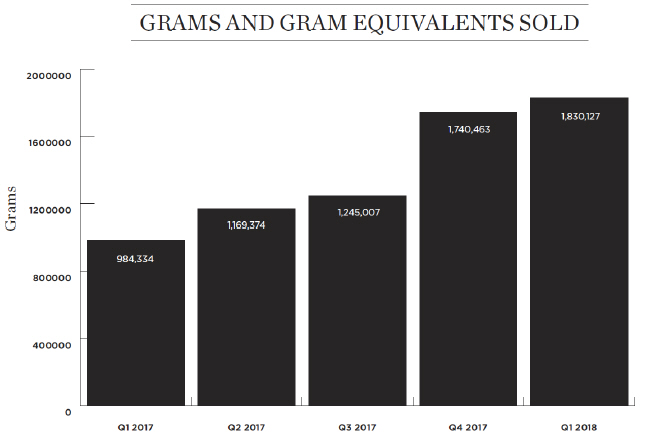

| | • | | 1,830 kilograms and kilogram equivalents1 sold in the first quarter ended June 30, 2017, representing an increase of 86% over the first quarter of last year, and an increase of 5% over the fourth quarter of fiscal 2017; |

| | • | | Oil sales, including gel caps, accounted for 19% of first quarter revenue. Oil shipments in the first quarter accounted for 1,797 litres (or approximately 198 kilogram equivalents) of the kilogram and kilogram equivalents stated above; |

| | • | | Average sales price per gram was $7.96 for the first quarter, as compared to $7.09 last year in the same quarter and $8.03 in the fourth quarter of fiscal 2017. The slight decrease from Q4 was due to a lower proportion of oils sold in the first quarter; |

| | • | | The first quarter weighted average cost per gram to produce, harvest and sell cannabis was $2.78 as compared to $2.65 in the same quarter of last year and $2.90 in the fourth quarter of fiscal 2017. Of the total weighted average cost per gram, the weighted average cost per gram of harvesting and post-harvest costs before shipping and fulfilment was $1.28 per gram. This compares to $1.64 per gram in Q1 of last year and to $1.46 per gram in the fourth quarter of last year. Of note, the cost per gram to point of harvest was $0.76 per gram, the fourth consecutive quarter when the cost to point of harvest was less than $1 per gram. |

| | • | | The first quarter gross margin before non-cash gains or losses was $9,025 or 57% of revenue as compared to $4,205 and 60% of revenue in the same quarter of last year, and 64% for the fourth quarter of fiscal 2017. The first quarter gross margin before non-cash gains or losses includes the costs associated with resetting the Mettrum grow operations and centralizing all shipping and fulfilment activities in Smiths Falls as part of the “one store” implemented in the first quarter, as well as costs associated with subsidiaries that are not yet cultivating or selling cannabis. Excluding these costs totaling $1,416, the gross margin before non-cash gains or losses would have been $10,441, or 66% of revenue; |

| | • | | Net loss in the first quarter of fiscal 2018 amounted to $4,444, or $0.03 per basic and diluted share, compared to net loss of $3,949, or $0.04 per basic and diluted share in the first quarter of fiscal 2017. The net loss included acquisition costs of $836 in the first quarter, as well as other non-cash expenses totaling $9,068, and included the net non-cash effects of the IFRS accounting for biological assets and inventory which combined to $10,670; and |

| | • | | Consolidated cash and cash equivalents were $115,494 at June 30, 2017. |

| 1 | Kilogram equivalents refers to cannabis oils where 8 ml is the equivalent of approximately 1 gram of dried cannabis. |

4

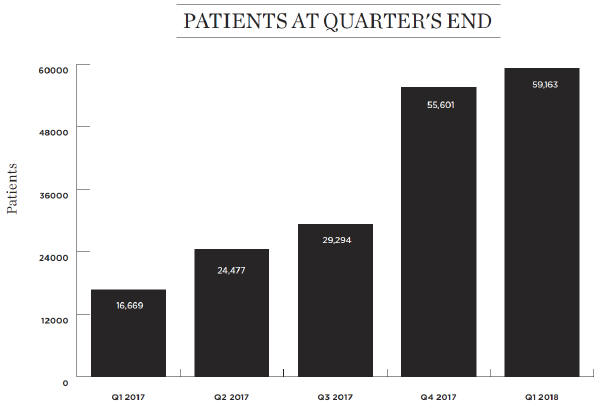

Operations

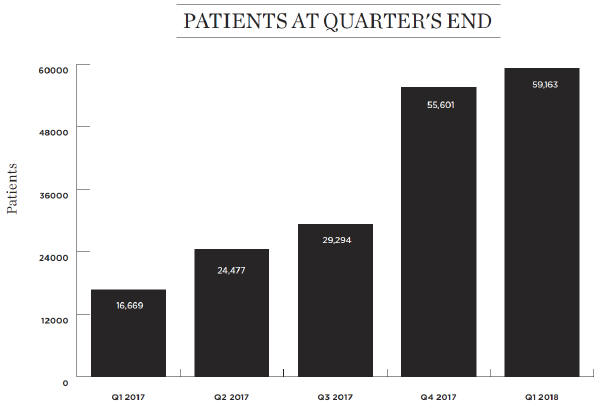

| | • | | Over 59,000 registered patients at June 30, 2017 compared to approximately 16,000 at June 30, 2016; |

| | • | | Harvested 5,575 kilograms in the quarter, mostly attributed to the harvest at the Tweed Farms greenhouse in Niagara-on-the-Lake, as compared to 1,980 kilograms in the fourth quarter of fiscal 2017; |

| | • | | On June 16, 2017, Tweed Grasslands, based in Yorkton, Saskatchewan, became Canopy Growth’s sixth licensed production site, having received its cultivation license on that date from Health Canada. Planting and growing activities began in July 2017 to support increased demand from medical patients around the world; |

| | • | | Canopy Growth announced, on June 19, 2017, that soft gel capsules produced at our Smiths Falls facility were licensed and available for sale; |

| | • | | On June 19, 2017, Canopy Growth announced that its indoor facility in Smiths Falls, Ontario and its greenhouse facility in Niagara-on-the-lake, Ontario received certificates of Good Manufacturing Practices (GMP) as issued by the German authority, Regierungspräsidium Tübingen; |

| | • | | Commissioning of industrial capacity extraction equipment announced on June 24, 2017; |

| | • | | On June 24, 2017, Canopy Growth announced the licensing of new grow rooms at its Smiths Falls campus that increased flowering space by 33 percent; and |

| | • | | On June 24, 2017, Canopy Growth announced completion and licensing of expanded Mettrum Bowmanville, facility, adding 200% more production capacity along with completion of the retrofit at the existing flowering rooms at that facility. |

Corporate Initiatives

Product Diversity

| | • | | On April 11, 2017, the Company’s new online store, Tweed Main Street, became operational; and |

| | • | | On April 19, 2017, Canopy Growth announced the launch of Tweed’s curated CraftGrow line, which brings high quality cannabis grown by a diverse set of producers to Tweed Main Street’s customers. By participating in CraftGrow, Access to Cannabis for Medical Purposes Regulations (“ACMPR”) license applicants and Licensed Producers can utilize components of the Company’s platform including high quality genetics sourced from around the world, industrial scale cannabis oil extraction infrastructure, a rigorous product Quality Assurance program, the Tweed Main Street online marketplace as well as award winning customer care and call centre capabilities. Access to these Canopy Growth platform components can be expected to significantly reduce the resources that new entrants are required to invest to enter the market and help get them get to market much faster to the benefit of all medical cannabis patients. As a starting point, four distinct partners have joined CraftGrow, all with different growing styles and approaches to cannabis. They are: AB Laboratories Inc., Canada’s Island Garden, JWC Ltd, PUF Ventures Inc. and more recently on August 8, 2017 added PheinMed Inc. Dried cannabis products from Canada’s Island Garden became available for sale through Tweed Main Street on June 19, 2017. |

Capacity Expansion

| | • | | On April 27, 2017, Canopy Growth announced the commitment of $20 million in seed capital funding for a complementary but distinct company that will provide financial support to ACMPR applicants and existing Licensed Producers. Canopy Rivers Corporation (“Canopy Rivers”), a wholly-owned subsidiary of Canopy Growth, plans to enter agreements to secure a portion of cannabis production in exchange for upfront capital, strategic support, and genetics materials as may be required. On June 16th, 2017, Canopy Rivers closed an offering to raise aggregate gross proceeds of $36,230. The offering was led by GMP Securities L.P. as the sole lead agent in a syndicate that also included PI Financial Corp., Cormark Securities Inc., and INFOR Financial Inc. This offering increased the cash resources available for Canopy Rivers to provide growth capital and strategic support within the regulated cannabis industry to approximately $56,000; |

5

| | • | | On June 24, 2017, Canopy Growth announced that the Company had entered into an agreement to acquire a 100,000 sq. ft. facility in Fredericton, New Brunswick with the intention of launching a Tweed indoor production facility; and |

| | • | | On June 24, 2017, Canopy Growth announced that the company had entered into an agreement with Goldman Holdings, Ltd. pursuant to previously announced MOU to begin build-out and licensing process for a 160,000 sq. ft. indoor facility in Edmonton, Alberta |

International Development

| | • | | On June 5, 2017, Canopy Growth’s German subsidiary submitted a response to the German government’s Request for Proposals from parties interested in obtaining one of up to 10 licenses to produce medical marijuana in Germany; and |

| | • | | On June 19, 2017, Canopy Growth announced a new international medical brand that will serve as the Company’s physician and patient-facing identity in strictly medical markets outside North America, Spectrum Cannabis. The Company’s German subsidiary, renamed Spektrum Cannabis GmbH, has distributed cannabis products to over 400 pharmacies across Germany, up from 200 pharmacies in April 2017. Spektrum’s facility in Germany is GMP certified by Regierungspraesidium Tübingen. The Company established Spectrum Chile SpA to ensure Chilean patients have access to high-quality cannabis products. |

RECENT DEVELOPMENTS

| | • | | On July 6, 2017, the Canadian AIDS Society announced a first of its kind research program funded by Canopy Growth Corporation. The program is designed to provide up-to-date information on the current state of evidence and research pertaining to the use of cannabis for medical purposes and to build tools for healthcare professionals to allow them to confidently assess and prescribe cannabis to appropriate patients. Funded over two years at $100,000 per year by Canopy Growth Corporation, and guided by a newly created Cannabis Research Task Force of experts in the field of cannabinoid medicine, the project aims to develop guidelines and recommendations regarding the medical use of cannabis for optimal wellness, quality of life and pain management; |

| | • | | On July 14, 2017, Bedrocan Canada commenced arbitration proceedings against Bedrocan International BV seeking performance of Bedrocan International’s contractual obligations under the licensing and distribution agreement (“LDA”) between the parties. Bedrocan Canada asserts the Licensor has withdrawn and/or withheld services, designs and support contrary to the Licensor’s contractual obligations. Because of this, and due to the fact that Bedrocan International procedures cannot be altered independently of the Licensor, Bedrocan Canada is now seeking redress through the process set out in the LDA. Management believes the impact of the arbitration proceedings on the Company and its customers to be negligible and is hopeful for a positive resolution; |

| | • | | On July 20, 2017, Isodiol International Inc. announced that it had signed a licensing agreement with the Company. Under this licensing agreement, Canopy Growth will have the right to manufacture and distribute the Company’s “Pot-O-Coffee” and “Pot-O-Tea” branded marijuana infused single serve K-Cup products in Canada and certain other markets internationally as federal regulations allow; |

| | • | | On July 26, 2017, the Company completed a private placement with one investor (the “Offering”) of common shares (the “Shares”). Pursuant to the Offering, the Company issued 3,105,590 Shares at a price of $8.05 per Share, for aggregate gross and net proceeds of $25,000. The Company intends to use the proceeds of the Offering for capacity growth initiatives. No finder’s fees were paid by the Company as part of the Offering; and |

6

| | • | | Subsequent to June 30, 2017, Canopy Rivers entered into funding arrangements with two pre-license ACMPR applicants totaling $7,975 comprised of two $2,000 in convertible debentures, $2,500 to be held in trust in respect of a share subscription agreement and $975 in respect of shares subscribed in one of the ACMPR applicant parties. |

DESCRIPTION OF THE BUSINESS

MEDICAL MARIJUANA REGULATORY FRAMEWORK IN CANADA

In 2001, Canada became the second country in the world to recognize the medicinal benefits of cannabis and to implement a government-run program for medical cannabis access. Health Canada replaced the prior regulatory framework and issued the Marihuana for Medical Purposes Regulations (“MMPR”) in June 2013 to replace government supply and home-grown medical cannabis with highly secure and regulated commercial operations capable of producing consistent, quality medicine. The MMPR regulations issued in June 2013 covered the production and sale of dried cannabis flowers only. A court injunction in early 2013 preserved the production and access methods of the prior legislation for those granted access prior to the injunction.

On July 8, 2015 Health Canada issued certain exemptions under the Controlled Drugs and Substances Act (Canada) (“CDSA”), which includes a Section 56 Class Exemption for Licensed Producers under the MMPR to conduct activities with cannabis (the “Section 56 Exemption”), which permits Licensed Producers to apply for a supplemental license to produce and sell cannabis oil and fresh cannabis buds and leaves, in addition to dried cannabis (this does not permit Licensed Producers to sell plant material that can be used to propagate cannabis).

On August 24, 2016, the Government of Canada introduced new regulations governing the use of cannabis for medical purposes. These new regulations, known as the ACMPR, were introduced in response to the February 24, 2016 decision rendered by the Federal Court of Canada in the Allard et al v the Federal Government of Canada case. The plaintiffs in the Allard case argued that the MMPR violates their Charter of Rights and the court, in a lengthy and detailed judgment, agreed with the plaintiffs. The court gave the Government of Canada until August 24, 2016 to determine how existing regulations should be amended to ensure that patients have the access to medical cannabis that they need.

The ACMPR, remained largely consistent with the former MMPR, but restores the ability of patients to grow their own cannabis at home, including the ability to designate a third-party grower through regulations akin to the former Medical Marijuana Access Regulations (MMAR). Under the ACMPR, patients who choose to grow at home, subject to a maximum number of plants, will be required to register their production sites and provide copies of their medical authorization to Health Canada in order to allow for monitoring and auditing of their activities.

Under ACMPR, patients are required to obtain a medical approval from their healthcare practitioner and provide a medical document to the licensed producer from which they wish to purchase cannabis. Since the requirements under the new regulations are both simpler and involve fewer obstacles to access than the previous regulatory regime, it is anticipated that the growth in the number of approved patients will accelerate. Moreover, the new system allows for competition among licensed producers on a host of factors including product quality, customer service, price, variety and brand awareness, allowing for well-positioned and capitalized producers to leverage their position in the marketplace.

Health Canada recently reported that over 168,000 patients had enrolled into the ACMPR program by March 31, 20172. By 2024, Health Canada estimates that the number of patients using medical marijuana will grow to 450,000, creating a medical cannabis market worth an estimated $1.3 billion.

| 2 | http://www.hc-sc.gc.ca/dhp-mps/marihuana/info/market-marche-eng.php |

7

When recreational cannabis use is legalized (see “Legalization of Recreational Use of Marijuana in Canada”), it is expected that the ACMPR will be replaced by a new regulatory framework that will cover both the medical and recreational markets.

LEGALIZATION OF RECREATIONAL USE OF MARIJUANA IN CANADA

Background

CIBC World Markets reports estimates of the potential value of the recreational cannabis market in Canada range from $5 billion to $10 billion per year. The lower market value of $5 billion per year translates into yearly consumption of 770,000 kilograms of cannabis, assuming a price of approximately $6.50 per gram.3 To put the potential size of the Canadian recreational market in context, Statistics Canada valued the beer market in Canada, in 2014, at $8.7 billion.4

On April 13, 2017, the Canadian Federal Government tabled legislation (Bill C-45) which aims to legalize recreational marijuana in Canada. Government officials are targeting on or before July 1, 2018 as the timing of implementation for the Cannabis Act. Bill C-45 has passed second reading in the House of Commons. It was referred to the Standing Committee on Health for study. This committee is meeting prior to the House of Commons’ return in the fall. Third reading is the next stage in the legislative process after which it will be referred to the Senate for consideration where it may require amendments. As expected, Canadian Licensed Producers (“LP”), which currently supply the medical marijuana market, will also be responsible for supplying marijuana to the recreational market.

While the Task Force’s recommendations leaned toward a model where LPs would not be allowed to advertise as with the tobacco industry, the Company believes Bill C-45 will be more lenient and allow some form of brand differentiation. Canopy Growth looks forward to continued discussion on this topic as regulations are developed. The legislation does not prescribe specific limitations other than details on overly promotional language or targeting youth. Prohibiting promotion aimed at children is a common-sense approach and Canopy applauds these limitations as expressed in the bill.

Federal legislation, once created, will enable provinces to retail and distribute Cannabis. Each Canadian province and territory is preparing for the sale and distribution of recreational cannabis. The revenue generating opportunities and economic development potential of the control and sale of recreational cannabis is not lost on provinces. Despite calls from some Premiers for more time to consider, the Federal government remains committed to pre-July 2018 legalization. In addition, Federal Finance Minister Bill Morneau committed to a mail order system for recreational cannabis where provinces may not be ready.

Canopy Growth’s Positioning for the Recreation Market

While responsible government agencies and/or designated private companies in their respective provinces are likely to begin rolling out physical retail storefront locations in the months after the legal recreational market opens, Canopy Growth believes that, in certain provinces, it will take two years and possibly longer to rollout the full network of regulated cannabis retail stores that is required to satisfy consumer demand. As such, Canopy Growth believes that the majority of sales in the first two years of the recreational market will go through the mail order system.

With the anticipated importance of online sales to a successful recreational market, Canopy Growth has undertaken a number of initiatives in the first half of calendar 2017 to ready the Company to lead the online market. The Company launched the Tweed Main Street online store, a single online marketplace that enables customers to purchase cannabis from multiple producers across numerous brands – delivering a delivering a shopping experience that consumers expect (See Overview of Canopy Growth Corporation, Tweed Main Street). In addition, the Company has made significant investments in fulfillment, shipping and transactional IT system capabilities.

| 3 | http://research.cibcwm.com/economic_public/download/eijan16.pdf |

| 4 | http://www.statcan.gc.ca/daily-quotidien/150504/dq150504a-eng.htm |

8

As it relates to future production needs, Canopy Growth is a diversified cannabis producer. It will continue to place the highest priority on meeting the needs of medical patients, expanding internationally as federal laws permit, and increasing its capacity to serve recreational customers across Canada in the future. With that in mind, widespread capacity expansion is already well underway across the company. From day one, Canopy Growth has focused on capacity building, brand development and the highest customer care and product quality. These areas will continue to be our focus today and into the future.

LEGALIZATION OF CANNABIS IN INTERNATIONAL JURISDICTIONS

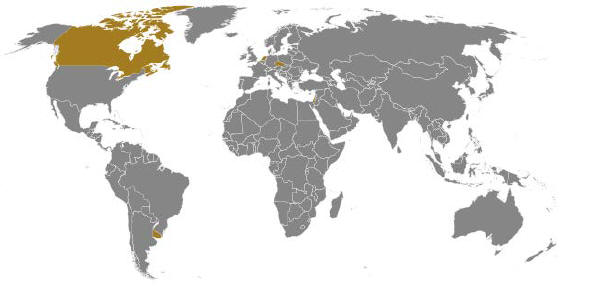

In 2014, a limited number of countries in the world, in addition to Canada, specifically, Israel, Czech Republic, Netherlands and Uruguay had established federally-legal cannabis access regimes.

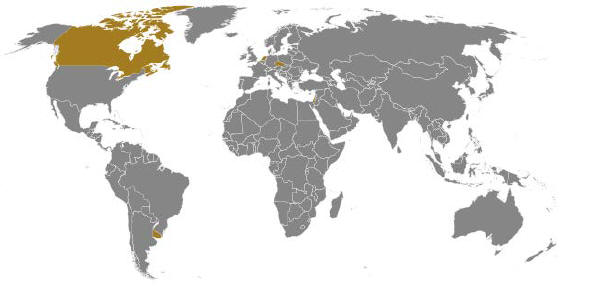

Figure 1: Map of countries with federally-legal cannabis access regimes in 2014

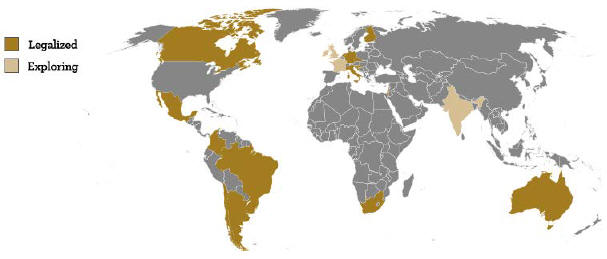

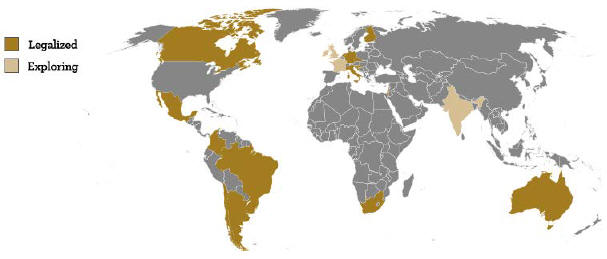

Since 2014, the actions of governments around the world have signaled a significant change in attitudes towards cannabis. To date, federal governments in at least 13 additional countries including Argentina, Australia, Brazil, Germany, Chile, Columbia, Israel, Italy, Mexico, Puerto Rico and South Africa have formally legalized cannabis access to either foster research into cannabis-based medical treatments and/or towards increasing legal access to medical cannabis for their citizens. For example, on January 19, 2017, the German parliament passed legislation that legalized medical cannabis and included provisions for medical cannabis treatment expenses to be covered by health insurance.

In addition, a number of other countries including Ireland, England, France, Jamaica and India have established formal government efforts to explore the legalization of medicinal cannabis access.

9

Figure 2: Map of countries with/exploring federally-legal cannabis access regimes in 2017

Canopy Growth, with the assistance of international subsidiaries or partners, has secured the necessary agreements to export medicinal cannabis to Australia, Brazil and Germany. To date, Canopy Growth through its various subsidiaries has exported a total of 69 kilograms of medicinal cannabis. Canopy Growth believes that an opportunity will exist, for some time to come, to export medical cannabis to countries that require a secure supply of medicinal cannabis but have yet to develop domestic production capabilities.

The Company believes that over time many countries will move to establish domestic production capabilities, in part due to the economic development opportunities that this represents. With cannabis continuing to emerge from the shadows, many countries are looking to Canada, and its regulatory framework for the production and commercialization of medical cannabis, with much interest and respect. As Canada has developed an enviable regulatory model, companies acting within that framework have expertise, knowledge and potentially product to share with the global community.

OVERVIEW OF CANOPY GROWTH CORPORATION

Canopy Growth is a publicly-traded company, incorporated in Canada, with its head office located at 1 Hershey Drive, Smiths Falls, Ontario. The Company’s common shares are listed on the TSX under the symbol “WEED”. The Company was added to the S&P/TSX Composite Index, effective after the close of trading on March 17, 2017.

At June 30, 2017, there were 637 full-time employees in the Company as compared to 168 at June 30, 2016.

Canopy Growth, an early mover in the Canadian market, is a multi-brand cannabis company that believes its strong focus on and investment in brand, market and product differentiation, increased cannabis supply through Company and partner cannabis production platforms, and education, to help citizens safely, effectively and responsibly use cannabis, will create a dominant global business with the potential to generate a significant and sustained return on invested capital over the long-term.

As discussed above (SEE Legalization of Cannabis in International Jurisdictions), many countries around the world are moving to provide their citizens with legal access to cannabis products produced by a commercial regulated industry, similar to that pioneered in Canada.

10

BRANDS

The Company’s core brands are:

Tweed Main Street

The Company has established Tweed Main Street as the brand for its core customer engagement vehicles, both online and physical “brick and mortar” locations.

With expected dominance of online sales during the initial rollout of the recreational market, Canopy Growth has undertaken a number of initiatives in the first half of calendar 2017 to ready the Company to lead the online order/direct delivery market. These initiatives include the launch of the Tweed Main Street online store, a single online marketplace that enables registered customers to purchase medicinal cannabis from multiple producers across numerous brands. Through the Tweed Main Street online marketplace, registered customers can purchase all dried, oil and soft gel cannabis products available from the Company including varieties from Tweed, Sun-Grown, Bedrocan Canada, Mettrum, DNA Genetics and Leafs By Snoop as well as cannabis products available from partner LPs through the CraftGrow Program (See CraftGrow).

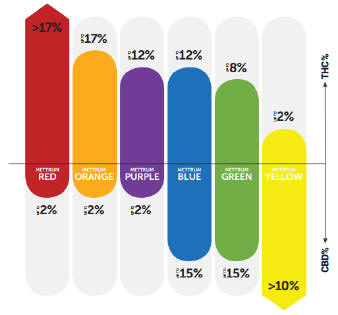

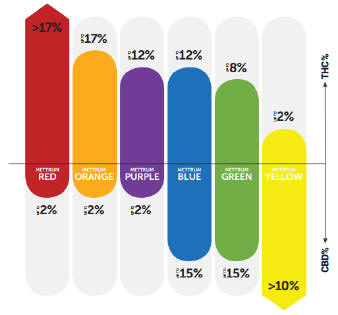

To strengthen engagement with customers and aid their selection of the cannabis products that are right for them, Tweed Main Street provides tools and information to help patients search for cannabis products based on cannabinoids, form and time of use. In addition, Tweed Main Street provides a “Spectrum” tool, originally developed by Mettrum that allows customers to categorize strains according to THC potency, as well as CBD levels using a straight forward colour code system. Product availability in Tweed Main Street is subject to multiple factors including customer demand, cultivation schedule and the time required for post-harvest processing, quality assurance testing and regulatory approval.

Further engagement between the Company’s brands and customers is facilitated by the Company’s expanding network of Tweed Main Street Community Engagement Centers. These physical “brick and mortar” locations in Southern Ontario (Barrie, Etobicoke, Guelph, Hamilton and Toronto) provide an opportunity for interested individuals to learn about medical cannabis in a helpful, supportive and consumer-friendly environment. The Company is actively seeking partners to expand the network of Tweed Main Street locations, through licensing partnerships, to strategic locations across Canada.

Tweed Main Street does not offer volume discounts to end users, but has developed an income-tested Compassionate Pricing Promise whereby eligible low-income patients may obtain a 20% discount off regular prices.

11

Tweed

A key focus of the Company, since its inception, has been the development of its Tweed brand. From the name, logo and design aesthetic, to the approachable tone and light-hearted copy, Tweed is branded and positioned in a unique way. Tweed deliberately chose to incorporate a sense of texture and approachability that welcomes customers and encourages an intimate relationship with the brand. In support of its brand, Tweed focuses heavily on its social media and earned media presence as an engagement strategy. Tweed has emerged as the most dynamic brand in the industry with exceptionally strong appeal and recognition in the medical cannabis market in Canada across value and premium product segments. In February 2017, Tweed, alongside other brands Canada Goose, Levi’s and Fender, was named an Emerging Cult Brand of the Year at The Gathering, a one-of-a-kind festival that connects like-minded marketers and entrepreneurs and celebrates “the world’s bravest brands” who have developed cult-like followings.

Tweed is currently positioned as a premium medicinal cannabis brand offering high-quality cannabis in multiple product forms – dried, oil and easy-to-consume, soft gels. The Tweed brand will evolve towards an adult lifestyle brand to best serve the needs of the future adult recreational market in Canada.

Tweed dried cannabis is sold at prices ranging from $6 per gram to $12 per gram for premium strains. Typically, growth time, strain yield and market comparatives determine a strain’s price. Very particular strains may be priced higher, but this would be the exception. Tweed sells Cannabis Oils made with GMO-free, organic sunflower oil. Prices for Cannabis Oils range from $50 per 40 ml bottle to $100 per 40 ml bottle depending on the strains incorporated.

Black Label

On June 19, 2017, Tweed launched the sale of the sector’s first encapsulated cannabis oil soft gels under the Black Label brand. Produced in a variety of strains and strengths, including Bakerstreet 2.5 mg THC, and hybrid Devon 8 mg THC/20 mg CBD, Black Label soft gels provide a very convenient delivery format that is easy to carry and easy to consume. Prices for Black Label soft gel caps range from $45 (Qty. 60, Bakerstreet 2.5 mg THC) to $52.50 (Qty 15, Devon 8 mg THC/20 mg CBD).

Under development for more than a year, the Black Label encapsulated cannabis oil soft gels demonstrate the Company’s strong commitment to developing new value added cannabis-based products.

Sun-Grown

Sun-Grown varieties signify quality cannabis grown in an environmentally-friendly greenhouse using the natural energy of the sun and recycled rainwater. The quality of the cannabis grown at the Company’s greenhouse in Niagara-on-the-lake, Ontario, has been certified as meeting the standards of DNA-Genetics and Leafs By Snoop and operation of the greenhouse has been certified as meeting Good Manufacturing Practices (GMP) standards by the German authority, Regierungspraesidium Tübingen.

Sun-Grown varieties may sell at lower prices than similar strains offered under the Tweed brand, with the lowest price strains sold at $6 per gram.

12

Mettrum

Mettrum, with its unique colour-based strength and dosage system, the Mettrum Spectrum, its robust online physician portal, significant investment in medical research and multiple production facilities, is the leading natural health brand in the Canadian medical cannabis market. Brought under the Canopy on February 1, 2017, Mettrum is a perfect complement to Canopy Growth’s existing brand portfolio by occupying the natural health and wellness space in between the lifestyle and pure medical plays.

Figure 3: Strain categorization by colour spectrum

Mettrum dried cannabis currently sells for between $7.60 and $8.60 per gram and oil extracts for $90.00 per 40 ml bottle.

Spectrum Cannabis

On June 19, 2017, Canopy Growth announced a new international medical brand that will serve as the Company’s physician and patient-facing identity in strictly medical markets outside North America, Spectrum Cannabis. Based on the intuitive colour-based system that has served to position Mettrum as an approachable cannabis brand in Canada, Spectrum will focus on physician interactions, stakeholder outreach, and patient education. The industry-leading expertise developed in Canada will be applied to markets around the world through this new brand. The most immediate examples are in Germany and Chile, as described below.

Spektrum Cannabis GmbH. The Company’s subsidiary, renamed Spektrum Cannabis GmbH, has distributed cannabis products to over 400 pharmacies across Germany, up from 200 pharmacies in April 2017. Spektrum’s facility in Germany is GMP certified by Regierungspraesidium Tübingen.

Spectrum Chile SpA. Canopy Growth established Spectrum Chile SpA on June 19th, 2017. Medical markets in Chile are emerging and Canopy Growth plans to enter the market aggressively in order to position itself as a leader in the Chilean market. Through a strategic partnership with Cannagrow, a domestic Chilean medical cannabis company, Spectrum Chile has been created to ensure Chilean patients have access to high-quality cannabis products.

13

Bedrocan Canada

The Bedrocan brand has been associated with the trusted supply of high quality, standardized cannabis to medical patients in the Netherlands for more than 20 years. The Company acquired the Bedrocan Canada brand in 2015 to strengthen the Company’s position in the Canadian medical cannabis market. The Company intends for Bedrocan to remain solely focused on the medical market, even when a legalized recreational market is implemented in Canada.

The price for all Bedrocan strains purchased by patients new to Bedrocan products has been set at $8.50 per gram, but with compassionate pricing available for qualified customers. For existing Bedrocan patients, prices for Bedrocan strains set in September 2016 and January 2016 ($6.75 per gram and $5.00 per gram, respectively) will be serviced for the duration of their medical document.

Leafs by Snoop

Tweed has partnered with Snoop Dogg, a renowned cannabis connoisseur and business pioneer in the Cannabis sector. Snoop and business partner Ted Chung recently launched online media platform MERRY JANE, the definitive cultural destination for news and original content. He is also the first celebrity to release a branded line of products, Tweed and Snoop Dogg have partnered to bring the Leafs By Snoop offering of diverse whole-flower strains, including a high CBD option and mid to high-range THC options, to Canada and exclusively available to Tweed customers.

On October 27, 2016, Tweed began selling three Leafs By Snoop varieties—Sunset, Ocean View and Palm Tree CBD. Leafs By Snoop strains currently available include Sunset, Ocean View, Moonbeam and Palm Tree CBD. Prices for Leafs by Snoop Strains range from $9 to $12 per gram.

It is expected that Leafs By Snoop will be a full spectrum offering of diverse strains including a high CBD option and mid to high-range THC options.

DNA-Certified

DNA Genetics have won awards in every category in the Cannabis Cup, the world’s preeminent cannabis competition. In October 2015, Tweed and DNA Genetics announced an exclusive partnership that would see Tweed leverage DNA’s expertise in cannabis breeding to bring new, exclusive DNA Certified strains to Tweed customers. Working with DNA, Tweed will be breeding new strains for customers that simply are not available anywhere else in the world, and bringing the best of existing DNA genetics to Tweed customers, bred and grown to the DNA standards the world expects. With an official certification on select indoor and greenhouse grown strains, DNA is adding a stamp of approval. DNA Certified cannabis has been personally bred, phenotyped and inspected by DNA Genetics.

On September 15, 2016, Tweed launched Lemon Skunk, the first strain certified by DNA Genetics and selected through phenotyping by DNA Genetics. DNA certified strains sold to Tweed customers include Lemon Skunk, Super Lemon OG, Golden Lemons and Banana Kush. Prices for DNA-Certified strains range from $7 to $12 per gram.

CraftGrow

CraftGrow is the brand developed for the Company’s partner program that gives licensed producers access to the Company’s platform including rigorous product Quality Assurance program, online market place, award winning customer care and call centre capabilities as well as Tweed’s large and growing customer base. Access to the Company’s platform can be expected to significantly reduce the resources that new entrants are required to invest to enter the market and help get them to market much faster to the benefit of all medical cannabis patients. The CraftGrow program benefits our customers by bringing the best variety of cannabis cultivated by some of the best producers in Canada, no matter their size, to the Company’s online marketplace.

14

Through the CraftGrow program, partners will benefit from co-branding efforts that will see their brand featured prominently alongside the CraftGrow and the Company’s other brands. CraftGrow co-branding extends to copy that showcases the history and unique growing methods of each partner.

CANNABIS PRODUCTION – COMPANY OWNED FACILITIES

Through its wholly owned-subsidiaries, Canopy Growth operates numerous state-of-the-art production facilities with over half a million square feet of indoor and greenhouse production capacity. The Company has eight licenses to cultivate and sell cannabis under the ACMPR program. The Company’s subsidiaries are licensed to produce and sell annually, 21,100 kilograms of dried cannabis and 9,800 kilograms of cannabis oil and has a combined licensed vault monetary capacity of $437,500.

The Company’s wholly-owned subsidiaries operate licensed cannabis production facilities in locations across Canada as described below.

Smiths Falls, Ontario

The commercial license for this facility covers 168,000 square feet and covers 24 completed grow rooms and related vegetation, nutrient delivery and production infrastructure as is required to support the full 39 grow room configuration that is to be built. On June 19, 2017, the Company announced that its Smiths Falls facility received a certificate of Good Manufacturing Practices (GMP) as issued by the German authority, Regierungspräsidium Tübingen.

The Smiths Falls facility also includes an in-house laboratory and R&D area, cannabis oil extraction infrastructure, a high-level security vault and a breeding facility that features several breeding rooms, phenotyping rooms, as well as male and female plant rooms.

The Smiths Falls facility currently cultivates Tweed, Leafs by Snoop and DNA Certified strains.

Tweed received a Dealer’s License pursuant to the provisions of the Controlled Drugs and Substances Act and its Regulations and will now begin operating this purpose-built area, built to Good Manufacturing Practice (“GMP”) specifications, within the Smiths Falls facility. The issuance of the license followed an extensive multi-year process that included application, design, construction and security clearance of key personnel. As a licensed dealer, Tweed will be able to conduct research and possess cannabis and cannabis derivatives in forms that are not currently covered by the ACMPR. Tweed can also begin development of innovative products for future market opportunities, and with necessary approvals undertake the export of non-dried form of cannabis to other jurisdictions.

This facility’s commercial license will be up for renewal on July 18, 2018.The total footprint of the existing Smiths Falls facility, at 472,000 square feet, can support a significant increase in production, processing and order fulfillment capacity. Canopy Growth has begun construction in the remaining unlicensed portion, approximately 300,000 square feet, of the Smiths Falls facility. In addition, the 42-acre site at 1 Hershey Drive could house hundreds of thousands of square feet of additional production and processing space.

Niagara-on-the-Lake, Ontario

The production facility in Niagara-on-the-Lake, Ontario (“Niagara”) is comprised of a greenhouse facility that is 375,000 square feet, of which 350,000 square feet represents the greenhouse and 25,000 square feet is used for post-harvest processing storage, shipping and offices. This location received its full commercial license to produce, possess, ship and sell dried cannabis on March 31, 2016. Currently, all dried cannabis produced in the Niagara greenhouse is transferred to the Company’s facility in Smiths Falls for final processing and sale. As at March 31, 2017, all 350,000 square feet of the greenhouse was utilized for the production of medical cannabis. The Niagara greenhouse currently cultivates Tweed “Sun Grown”, Leafs by Snoop and DNA Certified strains.

15

On June 19, 2017, the Company announced that its Niagara facility received a certificate of Good Manufacturing Practices (GMP) as issued by the German authority, Regierungspraesidium Tübingen.

With the ability to grow high-quality strains that support premium price points, in a low-cost greenhouse environment, the Company can be expected to generate higher margins on the premium strains cultivated in the Niagara greenhouse facility.

This facility’s license will be up for renewal on July 13, 2018.

The Niagara location consists of 23 acres of land with the current greenhouse occupying approximately 8 acres which leaves an additional 14 acres (approximate) to support future expansion.

Toronto, Ontario

Canopy Growth’s indoor facility in the Greater Toronto Area leverages over two decades of indoor standardized cannabis growing experience of Netherlands-based Bedrocan International BV (“Bedrocan International”). This 52,000 square feet production facility is fully-licensed, and includes 34 vegetative and growing rooms, the building’s two-floor high security level vault, and the ability to dispose of cannabis refuse via composting. The Toronto facility exclusively cultivates Bedrocan Canada strains.

On July 14, 2017, the Company’s wholly-owned subsidiary, Bedrocan Canada commenced arbitration proceedings against Bedrocan International seeking performance of Bedrocan International’s contractual obligations under the licensing and distribution agreement (“LDA”) between the parties. Bedrocan Canada asserts the Licensor has withdrawn and/or withheld services, designs and support contrary to the Licensor’s contractual obligations. Because of this, and due to the fact that Bedrocan International procedures cannot be altered independently of the Licensor, Bedrocan Canada is now seeking redress through the process set out in the LDA. Management believes the arbitration proceedings with Bedrocan International will have a negligible impact on the Company and its customers.

The facility’s Commercial License to produce domestic medical cannabis will be up for renewal on February 17, 2018.

The Company acquired its facility in Toronto on August 28, 2015 as part of the acquisition of Bedrocan pursuant to a definitive plan of arrangement, in which the Company acquired all of the issued and outstanding securities of Bedrocan.

Creemore, Ontario

This facility in Creemore, Ontario was licensed by Health Canada on December 11, 2014. This license allows for the production, sale or provision, possession, shipping, transportation, delivery and destruction of dried marijuana and marijuana plants or seeds. The facility’s Creemore’s Commercial License covers 20,000 square feet and includes 40 growing pods as well as necessary vegetation, nutrient delivery, oil extraction infrastructure and plant destruction. Mettrum Creemore sits on a 20 acre site which provides the opportunity for future expansion. The Company is in the beginning stages of planning the expansion of the Mettrum Creemore site. The Creemore facility cultivates various Mettrum strains.

The facility’s license will be up for renewal on December 12, 2017.

16

Bowmanville South, Ontario

The Bowmanville South facility was licensed by Health Canada on December 17, 2015. The facility’s current license allows for the production, sale or provision, possession, shipping, transportation, delivery and destruction of dried marijuana and marijuana plants or seeds. The license covers 60,000 square feet and includes 13 growing rooms as well as necessary vegetation, nutrient delivery and plant destruction. The Company plans to construct 5 additional flowering rooms with construction expected to begin early in the second half of calendar year 2017. The Bowmanville South facility cultivates various Mettrum strains.

The Bowmanville South facility sits on a 7 acre site which provides the opportunity for future expansion. The Company is currently planning the expansion of this location, by up to 100,000 square feet of growing capacity, as the market for legal cannabis develops.

Bowmanville North, Ontario

This facility in Bowmanville, Ontario received its first license from Health Canada on November 1, 2013. On September 20, 2016 Mettrum announced that it entered into an agreement with Cannabis Care Canada Inc. (“CCC”) to sell the Bowmanville North facility. The transaction is expected to close in the first half of fiscal 2018 subject to certain conditions including receiving a license amendment from Health Canada. CCC is financially backed by Laborers International Union of North America (“LiUNA”), North America’s single largest construction union with over 100,000 Canadian members. As per the terms of the agreement, CCC paid $7 million in cash to acquire Bowmanville North and entered into a three-year Supply Agreement with CCC. As part of the transaction, CCC will also assume all outstanding obligations associated with the Bowmanville North facility. The Company acquired Creemore, Bowmanville South and Bowmanville in its acquisition of Mettrum. On January 31, 2017, Canopy Growth and Mettrum announced the closing of the acquisition of Mettrum by the Company pursuant to the terms of an arrangement agreement dated November 30, 2016 and previously announced by the Companies on December 1, 2016.

Yorkton, Saskatchewan

The Company’s facility in Yorkton, Saskatchewan received its license from Health Canada on June 16, 2017. Now licensed, the facility will operate as Tweed Grasslands. Tweed Grasslands will operate a 90,000 square feet facility, of which approximately 15,000 sq. ft. is currently licensed, with the capacity to expand operations to over 300,000 square feet as the market for legal cannabis develops.

The Company acquired this facility on closing of the acquisition of all issued and outstanding shares of rTrees Producers Limited (“rTrees”) that the Company announced on May 1, 2017. On closing, the Company issued 698,901 common shares, and another 698,901 common shares when the cultivation license was received, and up to another 2,096,703 common shares will be held in escrow and issued if, and when, specific licensing and capacity expansion related milestones are achieved, for a total of up to 3,494,505 shares on successful completion of all milestones.

Saint-Lucien, Quebec

On November 2016, the Company acquired a pre-license applicant, Vert Cannabis (formerly Vert Marijuana), and the lease on a production facility in Drummondville, Quebec. The details of the acquisition and related milestone payments are described in the notes to the financial statements. Since being acquired by Canopy Growth, the Company has fully upgraded the site’s facility to the Company’s and Health Canada’s status so that it is ready for inspection for the cultivation of cannabis under the ACMPR.

The Company also has the right to purchase the 90 acres of leased land and building located in Saint-Lucien, Québec.

The acquisition of Vert is not a “significant acquisition” for the purposes of Part 8 of National Instrument 51-102 – Continuous Disclosure Obligations.

The Company may continue to expand production capacity through the acquisition of select ACMPR licensed producers and license applicants. The Company will continue to utilize its documented and compliant standard operating procedures to improve the operations of ACMPR licensed producers or

17

pursue completion of an ACMPR license application. Given the Company’s knowledge of and experience applying the ACMPR regulations as well as its business, operational and capital markets experience, the Company is able to conduct detailed business, finance and operational reviews of potential acquirees.

CANNABIS PRODUCTION – PARTNER OWNED FACILITIES

To help the Company expedite the expansion of its production capacity, Canopy Growth announced on November 1, 2016 that it had entered into a Memorandum of Understanding (“MoU”) with The Goldman Group to expand the Company’s cannabis production capacity and geographic footprint. The MoU is the culmination of a shared view that high quality cannabis grown through secure production channels will continue to be the preferred model for Canadian cannabis production and distribution, and that current capacity is insufficient to meet the growing demand for medical and future recreational cannabis. The growth strategy will see The Goldman Group purchase or build new properties, subject to Canopy Growth’s approval and built to Canopy Growth’s proprietary specifications, and lease those properties back to the Company on a cost plus basis. The partnership with The Goldman Group gives the Company access to a non-dilutive capital with which to accelerate the development of additional licensed production facilities. Leveraging this source of development capital is expected to reduce, but not eliminate, the Company’s need to raise additional capital in the future.

Canopy Growth announced on June 23, 2017 that it will expand its footprint into Edmonton, Alberta with a 160,000 square foot facility that, per the terms of the MoU, will be leased to Canopy Growth by the Goldman Group with an option to purchase the facility at the end of each 5-year quarter of the 20-year lease. The transaction is expected to close in August 2017 with the existing tenants vacating October 1, 2017. The agreement and licensing are contingent upon Health Canada and municipal approvals.

CANNABIS PRODUCTION – PARTNER CAPACITY OFFTAKE

The Company has established a number of programs designed to help sector partners, both license applicants and LPs, establish and/or grow their licensed operations and achieve greater success faster. Through these programs, additional cannabis production capacity will be secured for sale to the Company’s customers.

Tweed’s Curated CraftGrow Line: On April 19, 2017, Canopy Growth announced the launch of Tweed’s curated CraftGrow line, which brings high quality cannabis grown by a diverse set of producers to Tweed Main Street’s customers. By participating in CraftGrow, Access to Cannabis for Medical Purposes Regulations (“ACMPR”) license applicants and Licensed Producers can utilize components of the Company’s platform including high quality genetics sourced from around the world, industrial scale cannabis oil extraction infrastructure, a rigorous product Quality Assurance program, the Tweed Main Street online marketplace as well as award winning customer care and call centre capabilities. Access to these Canopy Growth platform components can be expected to significantly reduce the resources that new entrants are required to invest to enter the market and help get them get to market much faster to the benefit of all medical cannabis patients. As a starting point, five distinct partners, AB Laboratories Inc., Canada’s Island Garden, JWC Ltd., PheinMed Inc. and PUF Ventures Inc., have joined CraftGrow, all with different growing styles and approaches to cannabis. Cannabis grown by Canada’s Island Garden, located in Prince Edward Island, became available for sale in Tweed Main Street on June 19, 2017. The Company is currently in discussions with a number of additional LPs concerning potential participation in the CraftGrow program and expects to announce additional partnerships over the coming months.

Canopy Rivers: On April 27, 2017, Canopy Growth announced the commitment of $20 million in seed capital funding for a complementary but distinct company that will provide financial and strategic support to ACMPR applicants and existing Licensed Producers. Specifically, the newly formed company, Canopy Rivers Corporation (“Canopy Rivers”), will operate as a joint venture with Canopy Growth.

18

Canopy Rivers plans to engage in strategic transactions with LPs and selected LP applicants. For example, for those that have received a pre-license inspection affirmation letter, Canopy Rivers will leverage best operating and infrastructure practices developed by partner Canopy Growth to help streamline and simplify the licensing process, de-risking their access to growth capital, and supplementing their operating practices and methodologies.

Each potential partner will be evaluated separately, and individual streaming, royalty and support service contracts entered by Canopy Rivers will be priced and structured consistently with the risks, value proposition, and requirements of our counterparties. Capital invested in each partner may involve an upfront payment, may include additional license or production based milestone or royalty payments, and may also involve equity or and/or equity linked securities.

Canopy Rivers’ relationship and joint venture agreement with Canopy Growth also provides partners with potential access to the industry’s largest portfolio of patients and potential consumers via Canopy Growth’s Tweed Main Street and Craft Grow programs and platform.

For the Company, this strategic agreement with Canopy Rivers provides Canopy Growth with a secure, and predictable source of incremental cannabis supply, increased diversification of its products available for sale, and an ideal partner to generate referral and introduction opportunities for Tweed Main Street and Canopy’s Craft Grow programs and platforms.

On May 12, 2017, the Company advanced $20,000 in the form of a convertible debenture. On June 16, 2017, Canopy Rivers closed an offering to raise aggregate gross proceeds of $36,230, at which time the convertible debenture including interest was converted to equity. The offering was led by GMP Securities L.P. as the sole lead agent and included Cormark Securities Inc., INFOR Financial Inc., and PI Financial Corp. This offering increased the cash resources available for Canopy Rivers to provide growth capital and strategic support within the regulated cannabis industry to approximately $56,000.

19

CANNABIS EDUCATION AND SOCIAL RESPONSIBILITY

Since the founding of Tweed, the Company has provided a variety of support to patients and doctors in order to improve knowledge with respect to cannabis for medical purposes and ultimately advance the sector. For example, the Company supports the Canadian AIDS Society (“CAS”) in the form of an unrestricted grant to CAS for the development of a patient-focused series that explains the science of cannabis as a therapy, the rules and regulations surrounding access and different ways to consume cannabis for safer use and better health. In addition, the Company has research partnerships in place with researchers from the University of Ottawa and Ryerson University, and has provided funding for education to the Chronic Pain Association of Canada.

Tweed has been the sole licensed producer supporter of the Primary Care Updates across Canada reaching thousands of doctors, and supports countless efforts by local educators to improve the understanding of cannabis for medical purposes through a team of detailers visiting doctors throughout Ontario. Tweed has also partnered with Canabo Medical Corporation to conduct scientific and medical research through its network of healthcare practitioners at its medical clinics. This research data will be used to generate data to clarify the role of cannabis in various chronic conditions, including the management of chronic pain.

Tweed was also, to the Company’s knowledge, the first Licensed Producer to have an accredited M1 continuing medical education program to assist doctors, and in partnership with Bedrocan, one other Licensed Producer and the Collège des médecins du Québec, proudly contributed startup funding for the creation of a registry for medical cannabis patients in the Province of Quebec. The first of its kind, the anticipated 10-year Registry will gather information on the demographic profiles of patients who use medical cannabis, the medical purpose for which they use it, and at what dosage, while tracking the effectiveness and safety of cannabis used in the management of symptoms associated with particular health conditions.

Tweed announced on May 16, 2016 its plan to fund a national campaign to raise awareness of impairment in relation to operating a motor vehicle under the influence of cannabis. The campaign will be developed and administered by two of the country’s leading organizations in promoting evidence based drug policy and safe driving, the Canadian Drug Policy Coalition (CDPC) and Mothers Against Drunk Driving (MADD Canada). Funding will be provided to MADD Canada over three years by the Company, whose wholly-owned subsidiaries Tweed and Bedrocan Canada will fund the campaign using proceeds from a previously announced education fund dedicated towards responsible use of cannabis.

CORPORATE DEVELOPMENT

The Company’s core focus is strengthening the Company’s market share position in federally-legal cannabis markets in Canada, medical today and non-medical should it be legalized in the future, and to help establish similar positions in markets abroad. To achieve this, the Company will continue making specific and deliberate investments, including acquisitions, to:

| | • | | Increase the strength and differentiation of the Company’s multiple brands; |

| | • | | Increase the efficiency and effectiveness of the Company’s customer engagement resources, including online marketplace(s) and a telephone accessible customer care centre; |

| | • | | Increase the diversity, quality and inventory of products, across value and premium cannabis market segments, available to customers across value and premium cannabis market segments; |

| | • | | Significantly increase the cannabis supply to Tweed Main Street, both through owned production capacity as well as offtake of partner capacity; |

| | • | | Drive growth in international markets in which cannabis is federally legal; |

| | • | | Expand the Company’s business into the production, sale and marketing of allowed value-added products when permitted by regulations; |

20

| | • | | Diversify the Company’s business in the distinct but complimentary legal cannabis markets; and |

| | • | | Drive production and yield efficiencies and focus on cost reduction efforts. |

Seeking to improve efficiencies in the Company’s e-commerce infrastructure and increase the product variety available to customers, Canopy Growth sought and received approval from Health Canada to develop a single online marketplace, Tweed Main Street, through which customers could purchase all products and brands available from the Company’s subsidiaries. On April 11, 2017, Canopy Growth launched Tweed Main Street (www.tweedmainstreet.com). Tweed Main Street replaces the separate online marketplaces operated by Tweed, Bedrocan Canada and Mettrum. Through Tweed Main Street, all customers can purchase all dried and oil cannabis products available from the Company’s subsidiaries including varieties from Tweed, Sun-Grown, Bedrocan, Mettrum, DNA Genetics and Leafs By Snoop. To assist customers in identifying which of the cannabis products is right for them, Tweed Main Street provides tools and information to help patients search for cannabis products based on cannabinoids, form and time of use. In addition, Tweed Main Street provides a “Spectrum” tool, originally developed by Mettrum that allows customers to categorize strains according to THC potency, as well as CBD levels using a straight forward colour code system.

INTERNATIONAL DEVELOPMENT

Management believes that a significant opportunity exists today to leverage the Company’s expertise, financial strength and business model in federally legal cannabis markets around the world. In addition, management believes future opportunities are likely to exist for the Company in jurisdictions where governments are actively moving towards such a legal framework. Subject to regulatory approval, strategic international business opportunities pursued by the Company could include:

| | • | | Providing advisory services to third-parties that are interested in establishing licensed cannabis cultivation and sales operations; |

| | • | | The export of medical cannabis to third-parties in countries outside of Canada; and |

| | • | | Ownership of cannabis cultivation and sales operations in countries outside of Canada, where it is federally lawful to do so. |

Canopy Growth, with the assistance of international subsidiaries or partners, has secured the necessary agreements to export medicinal cannabis to Brazil and Germany, beginning exports to both countries in 2016. Canopy Growth believes that an opportunity will exist, for some time to come, to export medical cannabis to countries to secure a supply of medicinal cannabis but have yet to develop domestic production capabilities.

In early April 2017, the German government issued a Request for Proposal seeking submissions from parties interested in obtaining one of up to 10 licenses to produce medical marijuana in Germany. Reponses were due on June 5, 2017. The Company’s subsidiary Spektrum Cannabis GmbH submitted a proposal and has passed the first stage of the tender application process.

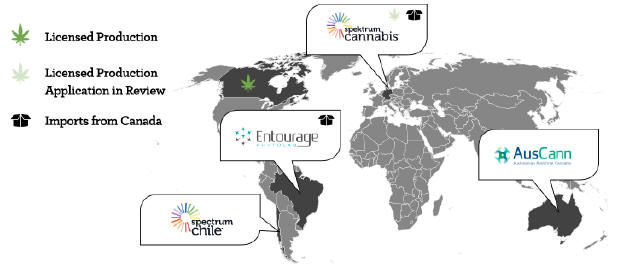

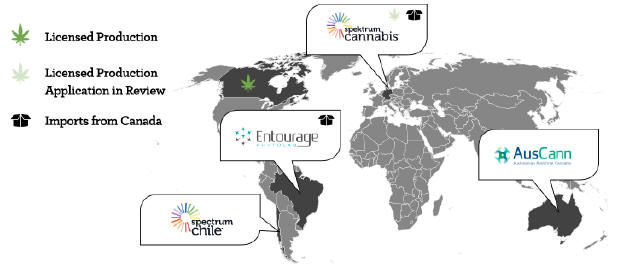

To date, the Company has announced subsidiaries, partnerships or business activities in Australia, Brazil, Chile and Germany as described below.

21

Figure 4: International subsidiaries, partnerships or business activities

BEDROCAN BRASIL S.A. AND ENTOURAGE PHYTOLAB S.A.

On June 28, 2016, the Company announced an agreement with São Paulo, Brazil-based Entourage Phytolab S.A. (“Entourage”). Under the agreement, wholly-owned subsidiary Bedrocan Canada, Bedrocan International BV (formerly Bedrocan Beheer BV) and local Brazilian partners created a new company called Bedrocan Brasil S.A. (“Bedrocan Brasil”), which will facilitate the importation of Bedrocan’s proprietary standardized cannabis varieties and know-how into the Brazilian market. Additionally, Canopy Growth will partner with Entourage to develop cannabis-based pharmaceutical medical products for the Brazilian and international markets.

The transaction formally closed on September 20, 2016, whereby Canopy Growth owned a 50% interest in Entourage and Bedrocan Canada owned a 41.75% interest in Bedrocan Brasil S.A. Canopy, Entourage and Bedrocan Brasil completed an initial funding round of USD$3 million from independent investors on November 23, 2016 in exchange for common shares in Entourage and Bedrocan Brasil. The funding round reduced Canopy’s holding in Entourage from 50% to 38.462% and reduced its holding in Bedrocan Brasil from 41.75% to 39.387% after all tranches were received. These funds will be used both for the continuing development of Bedrocan Brasil and the launch of the Entourage clinical research plan.

AUSCANN GROUP HOLDINGS LTD.

On May 20, 2016, the Company closed a partnership with AusCann Group Holdings Ltd. (“AusCann”) (ASX:AC8), whereby Canopy Growth will provide consultation in a number of areas including production, quality assurance and operations, and strategic advisory services. In exchange for these services, the Company owns an 11.17% interest in AusCann, including its pro rata participatory investment of $1,214 in AusCann’s recent financing which closed in May 2017.

The expertise and advisory services offered or performed by Canopy Growth subsidiaries will be exclusively carried out by Tweed Inc. and Tweed Farms Inc.

Procedures, expertise, and/or intellectual property under license from Bedrocan BV as to medicinal cannabis and so employed by Bedrocan Canada or any affiliates of Canopy Growth will not be shared or form the basis for any cooperation, consultation or other form of consulting provided under the terms of the partnership with AusCann. Canopy Growth and its affiliates are exclusively entitled to utilize any of its rights under the Bedrocan BV license for Canada and South-America only.

22

SPEKTRUM CANNABIS GMBH

Spektrum Cannabis GmbH (“Spektrum” and formerly MedCann GmbH Pharma and Nutraceuticals) is a German-based pharmaceutical distributor that was acquired by the Company on December 12, 2016.

On July 25, 2016, the Corporation announced that Tweed had received necessary approvals in Canada and Germany to begin export of medical cannabis for sale to German patients, and will be working with Spektrum, a then privately held pharmaceutical importer and manufacturer in Germany. Since then, Spektrum has placed Tweed-branded cannabis strains in German pharmacies.

Details of the December 12, 2016 acquisition of Spektrum are described in Note 8 to the financial statements. The acquisition of Spektrum is not a “significant acquisition” for the purposes of Part 8 of National Instrument 51-102 – Continuous Disclosure Obligations.

Over the longer term, with a base of operations in Germany provided by Spektrum, along with Canopy’s track record of producing consistent and stabilized cannabis strains, management believes the Company is well positioned to pursue domestic production inside Germany should the regulatory environment shift.

On January 19, 2017, the German parliament passed legislation that legalized medical cannabis and included provisions for medical cannabis treatment expenses to be covered by health insurance. In early April 2017, the German government issued a Request for Proposal seeking submissions from parties interested in obtaining one of up to 10 licenses to produce medical marijuana in Germany, a market that is expected to grow by a minimum of 10,000 new patients a year. Parties who submit successful proposals must have the ability to produce certain quantities required by the government. For those in already regulated jurisdictions, such as Canada, production over the last three years will be weighed in this decision process. During the second round of the bid evaluation, the business structure of the proposal will also be evaluated. On June 5, 2017, Spektrum submitted the Company’s response to the German government RFP. It is expected that the German government will issue the results of its evaluation by September 2017. The Company’s subsidiary Spektrum Cannabis GmbH submitted a proposal and has successfully passed the first stage of the tender application process and its participation in the second and final stage of the application process which involves a competitive bid proposal and contract negotiations, had been requested.

SPECTRUM CHILE SPA

The Company announced on June 20, 2017 its complementary expansion into South America with Spectrum Chile SpA (“Spectrum Chile”). Medical markets in Chile are emerging and the Company plans to enter the market aggressively in order to position itself as a leader in the Chilean market. Through a strategic partnership with a domestic Chilean medical cannabis company, Spectrum Chile will work to ensure Chilean patients have access to high-quality cannabis products.

CORPORATE POSITION ON CONDUCTING BUSINESS IN INTERNATIONAL JURISDICTIONS WHERE CANNABIS IS FEDERALLY ILLEGAL

Canopy Growth remains committed to only conduct business, related to growing cannabis, in jurisdictions where it is federally legal to do so. The Company will not conduct business, related to growing cannabis, in jurisdictions, such as the United States, in which cannabis is federally-illegal.

Canopy Growth believes that conducting activities which are federally illegal, or investing in companies which do, puts the company at risk of prosecution, puts at risk its ability to operate freely, and potentially could jeopardize its listing on major exchanges now and in the future, limiting access to capital from reputable US-based funds.

23

PRODUCT DIVERSIFICATION

Management also believes a significant potential future opportunity exists, within an appropriate regulatory framework, to improve the Company’s margins by vertically integrating up the value chain.

The Company’s ongoing investment in brand development, increased cannabis production capacity, global expansion and product diversification is likely to delay when the Company’s business becomes cash flow positive. Management believes the focus on growing the Company’s market share will drive significantly higher cash earnings and shareholder returns over the long-term.

CANNABIS-BASED MEDICAL THERAPIES

In the medical market, this could be cannabis-based therapies for the treatment of a wide-range of medical symptoms, from sleeping disorders to neuropathic pain. The Company established the cannabis research incubator, Canopy Health Innovations Inc. (“Canopy Health”), to develop and research clinically ready cannabis drug formulations and dose delivery systems. Canopy Growth is the preferred commercialization partner for Intellectual Property (“IP”) developed by Canopy Health.

On December 9, 2016, Canopy Growth announced the closing of an offering of Canopy Health shares for aggregate gross proceeds of approximately $7,000 to reduce Canopy Growth’s interest to 46.15% of Canopy Health common shares. To facilitate participation in Canopy Health research efforts by notable medical scientists and provide equity ownership opportunities, the Company’s initial ownership in Canopy Health has been limited to a minority position and is likely to be reduced over time. Canopy Health is a Canadian Controlled Private Corporation.

Canopy Health will operate as a research incubator and will focus on creating an intellectual property (“IP”) portfolio that can be built into commercial opportunities for the Company and its subsidiaries. Pursuant to agreements entered into between Canopy Health and Canopy Growth, Canopy Growth and its subsidiaries will work closely with Canopy Health whereby Canopy Growth will act as a primary supplier of cannabis products for clinical research, as a research partner through its subsidiary Tweed. Tweed’s Controlled Drugs and Substance Dealer’s License from Health Canada, will allow it to, among other things, possess cannabis and cannabis by-products for the purposes of analytical testing, and in the commercialization of IP created by Canopy Health.

CANNABIS-BASED CONSUMER PRODUCTS

In a future recreational cannabis market, Canopy Growth believes regulations will evolve, in the near term, to allow for the production and sale of cannabis related consumer products. Canopy Growth is laying the foundation for a consumer products business, marketed under the Tweed brand that will leverage the Company’s world-class cannabis cultivation and oil extraction infrastructure. The Company is in active partnership negotiations with a variety of third-parties related to the manufacture, marketing, and sale, as federal regulations allow, of a variety of cannabis-based consumer products.

On July 20, 2017, Isodiol International Inc. (“Isodiol”) announced that it had signed a licensing agreement with the Company. Under this licensing agreement, Canopy Growth will have the right to manufacture and distribute Isodiol’s “Pot-O-Coffee” and “Pot-O-Tea” branded cannabis infused single serve K-Cup products in Canada and certain other markets internationally as federal regulations allow. Licensed products include caffeinated and de-caffeinated product lines as well as Isodiol’s single serve “Pot-O-Coco”. In addition to the Canadian rights, Canopy Growth shall have the right of first refusal to sell the “Pot-O” brand products in any territory outside of the US, Mexico and Puerto Rico.

The availability of the various licensed products in Canada and elsewhere will differ depending on applicable laws and regulation. While Canadian law does not yet permit the manufacture and sale of cannabis marijuana infused products, the Company anticipates that such products will be permitted in the near future. Furthermore, currently proposed regulations which would permit the sale of infused products, would not allow such products to contain both marijuana and caffeine. As such, the specific product offerings in Canada and elsewhere may be limited. Canopy Growth anticipates that it will enter into additional agreements with third parties in the coming weeks and months and may continue doing so for the foreseeable future.

24

HEMP-BASED PRODUCTS