PLEASE CONTACT YOUR MERRILL FINANCIAL ADVISER TO ENSURE THE PROPER COMPLETION AND SUBMISSION OF THE NECESSARY DOCUMENTATION

LETTER OF TRANSMITTAL

REGARDING

SHARES OF BENEFICIAL INTEREST

IN

HEDGE FUND GUIDED PORTFOLIO SOLUTION

TENDERED PURSUANT TO THE OFFER TO PURCHASE

DATED JUNE 27, 2024

The Offer will expire

at, and this Letter of Transmittal must be

received by, 12:00 midnight, Eastern Time,

on Friday, July 26, 2024, unless the Offer is extended.

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution | | Page 1 |

Ladies and Gentlemen:

The undersigned hereby tenders to Hedge Fund Guided Portfolio Solution, a closed-end, non-diversified, management investment company organized under the laws of the State of Delaware (the “Fund”), the shares of beneficial interest (“Shares”) in the Fund or portion thereof held by the undersigned, described and specified below, on the terms and conditions set forth in the offer to purchase dated June 27, 2024 (“Offer to Purchase”), receipt of which is hereby acknowledged, and in this Letter of Transmittal (which together constitute the “Offer”). All capitalized terms used herein have the meaning as defined in the Fund’s Declaration of Trust. The tender and this Letter of Transmittal are subject to all the terms and conditions set forth in the Offer to Purchase, including, but not limited to, the absolute right of the Fund to reject any and all tenders determined by it, in its sole discretion, not to be received timely and in the appropriate form.

The undersigned hereby sells to the Fund the Shares of the Fund tendered hereby pursuant to the Offer. The undersigned hereby warrants that the undersigned has full authority to sell the Shares tendered hereby and that the Fund will acquire good title thereto, free and clear of all liens, charges, encumbrances, conditional sales agreements or other obligations relating to the sale thereof, and not subject to any adverse claim, when and to the extent the same are purchased by the Fund. Upon request, the undersigned will execute and deliver any additional documents necessary to complete the sale in accordance with the terms of the Offer.

The undersigned recognizes that under certain circumstances set forth in the Offer, the Fund may not be required to purchase any of the Shares of the Fund or portion thereof tendered hereby. The undersigned recognizes that, if the Offer is oversubscribed, not all the undersigned’s Shares of the Fund may be purchased.

A non-transferable, non-interest bearing promissory note for the purchase price will be paid to the undersigned if the Fund accepts for purchase the Shares tendered hereby. The undersigned acknowledges that the promissory note will be held for the undersigned by BNY Mellon Investment Servicing (U.S.) Inc., the Fund’s administrator. The cash payment(s) of the purchase price for the Shares tendered by the undersigned and accepted for purchase by the Fund will be made by wire transfer of the proceeds to the undersigned’s account at Merrill. The undersigned hereby represents and warrants that the undersigned understands that upon a withdrawal of such cash payment from the account, the institution at which the account is held may subject such withdrawal to any fees that it would customarily assess upon the withdrawal of cash from such account. The undersigned hereby represents and warrants that the undersigned understands that any payment in the form of marketable securities would be made by means of special arrangement with the tendering member in the sole discretion of the Fund’s Board of Trustees.

If the undersigned’s Shares are tendered and accepted for purchase, the promissory note will also provide for a contingent payment portion of the purchase price, if any, as described in Section 7 of the Offer to Purchase. Any contingent payment of cash due pursuant to a note will also be made by wire transfer to the undersigned’s account as designated in this Letter of Transmittal. The undersigned recognizes that the amount of the purchase price for Shares will be based on the unaudited net asset value of the Fund as of September 30, 2024 (the “Valuation Date”), subject to an extension of the Offer as described in Section 8 of the Offer to Purchase. The contingent payment portion of the purchase price, if any, will generally be made within 120 days of the Valuation Date.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the undersigned and the obligation of the undersigned hereunder shall be binding on the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in Section 6 of the Offer to Purchase, this tender is irrevocable.

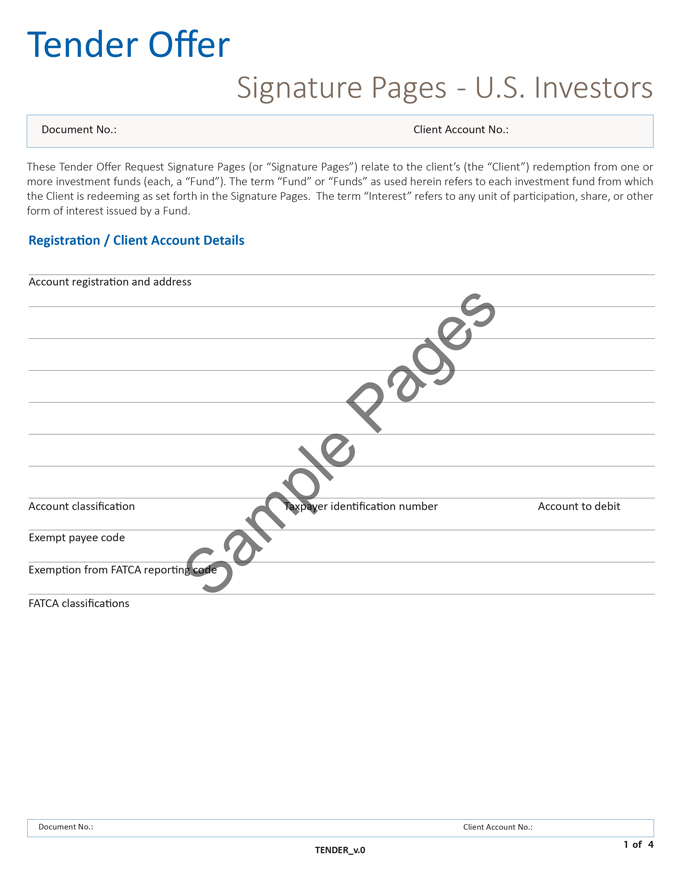

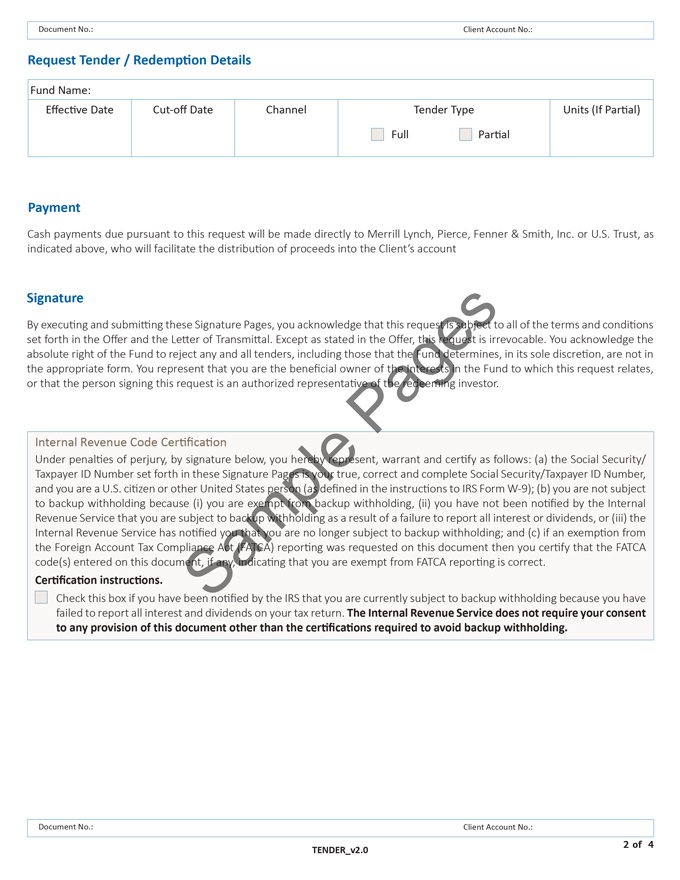

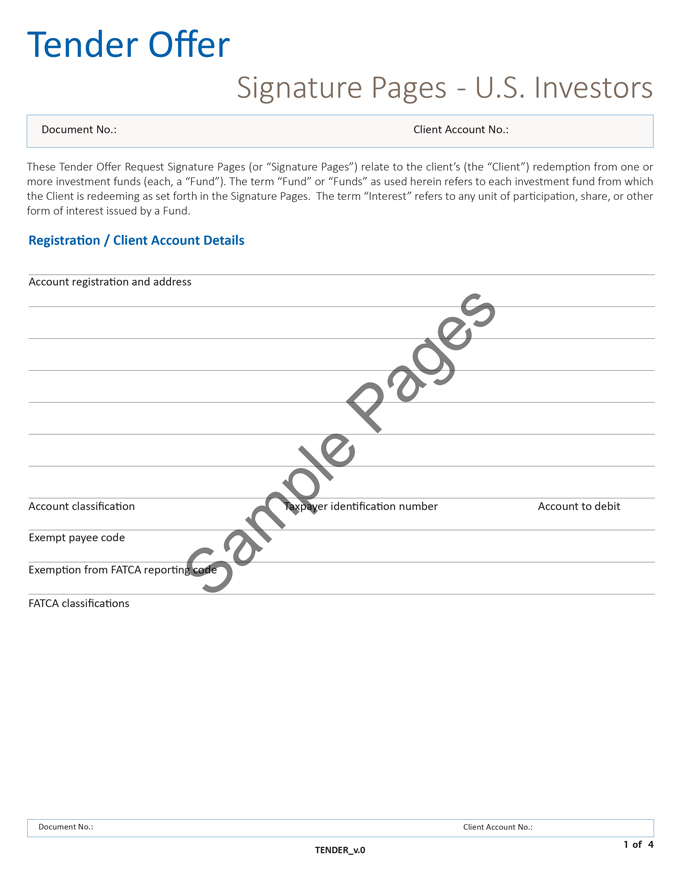

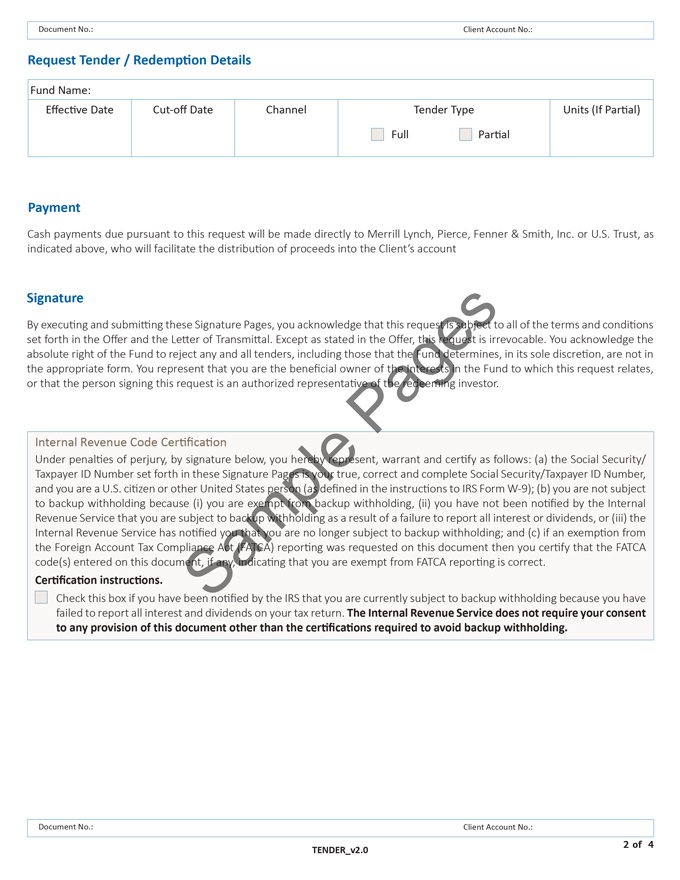

Investors wishing to tender Shares pursuant to the Offer should contact their Merrill Financial Adviser (“Merrill FA”) who will enter the order and provide the Investor with a customized Tender Offer Form for its account. Included with this Offer material is a sample Tender Offer Form which is for reference only. The Tender Offer Form generated for an Investor’s account will need to be signed and returned to the Investor’s Merrill FA. Upon receiving signed documentation, the Investor’s Merrill FA will submit the form for processing. An Investor’s Merrill FA must submit the form by the Expiration Date.

If you do not want to sell your Shares at this time, please disregard this notice. This is simply notification of the Fund’s tender offer. If you decide to tender, you are responsible for confirming that your Merrill Financial Adviser has received your documents in good order.

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution | | Page 2 |

LETTER OF TRANSMITTAL

REGARDING

SHARES OF BENEFICIAL INTEREST

IN

HEDGE FUND GUIDED PORTFOLIO SOLUTION

TENDERED PURSUANT TO THE OFFER TO PURCHASE

DATED JUNE 27, 2024

The Offer will expire

at, and this Letter of Transmittal must be

received by, 12:00 midnight, Eastern Time,

on Friday, July 26, 2024, unless the Offer is extended.

Complete this Letter of Transmittal and Return by Mail or E-Mail:

By Mail:

Grosvenor Funds

c/o BNY Mellon TA Alternative Investment RIC Funds

PO Box 534408

Pittsburgh, PA 15253-4408

Phone: (877) 355-1469

By E-Mail:

grosvenordeinvservices@bnymellon.com

Please include the words “Grosvenor Funds Tender Documents” in the subject line.

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (GSLLC) | | Page 1 |

Ladies and Gentlemen:

The undersigned hereby tenders to Hedge Fund Guided Portfolio Solution, a closed-end, non-diversified, management investment company organized under the laws of the State of Delaware (the “Fund”), the shares of beneficial interest (“Shares”) in the Fund or portion thereof held by the undersigned, described and specified below, on the terms and conditions set forth in the offer to purchase dated June 27, 2024 (“Offer to Purchase”), receipt of which is hereby acknowledged, and in this Letter of Transmittal (which together constitute the “Offer”). All capitalized terms used herein have the meaning as defined in the Fund’s Declaration of Trust. The tender and this Letter of Transmittal are subject to all the terms and conditions set forth in the Offer to Purchase, including, but not limited to, the absolute right of the Fund to reject any and all tenders determined by it, in its sole discretion, not to be received timely and in the appropriate form.

The undersigned hereby sells to the Fund the Shares of the Fund tendered hereby pursuant to the Offer. The undersigned hereby warrants that the undersigned has full authority to sell the Shares tendered hereby and that the Fund will acquire good title thereto, free and clear of all liens, charges, encumbrances, conditional sales agreements or other obligations relating to the sale thereof, and not subject to any adverse claim, when and to the extent the same are purchased by the Fund. Upon request, the undersigned will execute and deliver any additional documents necessary to complete the sale in accordance with the terms of the Offer.

The undersigned recognizes that under certain circumstances set forth in the Offer, the Fund may not be required to purchase any of the Shares of the Fund or portion thereof tendered hereby. The undersigned recognizes that, if the Offer is oversubscribed, not all the undersigned’s Shares of the Fund may be purchased.

The undersigned acknowledges that this Letter of Transmittal must be received by the Fund by either mail or e-mail by 12:00 midnight, Eastern Time, on July 26, 2024, and that the method of delivery of any document is at the election and the complete risk of the undersigned, including, but not limited to, the failure of the Fund, to receive any Letter of Transmittal or other document.

A non-transferable, non-interest bearing promissory note for the purchase price will be paid to the undersigned if the Fund accepts for purchase the Shares tendered hereby. The undersigned acknowledges that the promissory note will be held for the undersigned by BNY Mellon Investment Servicing (U.S.) Inc., the Fund’s administrator. The cash payment(s) of the purchase price for the Shares tendered by the undersigned and accepted for purchase by the Fund will be made by wire transfer of the proceeds to the undersigned’s account of record, or wire transferred directly to the account designated by the Investor in this Letter of Transmittal. The undersigned hereby represents and warrants that the undersigned understands that upon a withdrawal of such cash payment from the account, the institution at which the account is held may subject such withdrawal to any fees that it would customarily assess upon the withdrawal of cash from such account. The undersigned hereby represents and warrants that the undersigned understands that any payment in the form of marketable securities would be made by means of special arrangement with the tendering member in the sole discretion of the Fund’s Board of Trustees.

If the undersigned’s Shares are tendered and accepted for purchase, the promissory note will also provide for a contingent payment portion of the purchase price, if any, as described in Section 7 of the Offer to Purchase. Any contingent payment of cash due pursuant to a note will also be made by wire transfer to the undersigned’s account as designated in this Letter of Transmittal. The undersigned recognizes that the amount of the purchase price for Shares will be based on the unaudited net asset value of the Fund as of September 30, 2024 (the “Valuation Date”), subject to an extension of the Offer as described in Section 8 of the Offer to Purchase. The contingent payment portion of the purchase price, if any, will generally be made within 120 days of the Valuation Date.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the undersigned and the obligation of the undersigned hereunder shall be binding on the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in Section 6 of the Offer to Purchase, this tender is irrevocable.

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (GSLLC) | | Page 2 |

If you do not want to sell your Shares at this time, please disregard this notice. This is simply notification of the Fund’s tender offer. If you decide to tender, you are responsible for confirming that the Fund has received your documents in good order.

Name of Investor:

Address of Investor:

Account Number: Phone Number:

E-Mail Address for Confirmation of Receipt:

|

PART 2 – Amount of Beneficial Interest Shares of the Fund to be Tendered |

Please check one:

| ☐ | Portion of Shares expressed as number of units: |

Partial tenders are subject to maintenance of a minimum account balance of at least $10,000. The undersigned understands that if the undersigned tenders an amount that would cause the undersigned’s account balance to fall below $10,000, the Fund reserves the right to reduce the amount to be purchased from the undersigned so a minimum $10,000 account balance is maintained.

The promissory note for the purchase price will be held for you by BNY Mellon Investment Servicing (U.S.) Inc., the Fund’s administrator.

Cash payments will be wire transferred directly to the account designated by the Investor. Cash payments wired directly to such Investor accounts may be subject upon withdrawal from the account to any fees that the institution at which the account is held would customarily assess upon the withdrawal of cash from the account.

| ☐ | Wire the proceeds into my account already on file with the Fund. |

Institution:

ABA Number:

Account Number:

Account Name:

For Further Credit Name:

For Further Credit Account Number:

Reference Information: Hedge Fund Guided Portfolio Solution

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (GSLLC) | | Page 3 |

The undersigned Investor acknowledges that this request is subject to all the terms and conditions set forth in the Fund’s Declaration of Trust. The undersigned represents that the undersigned is the beneficial owner of the Shares in the Fund to which this tender request relates, or that the person signing this request is an authorized representative of the tendering Investor.

In the case of joint accounts, each joint holder must sign this tender request. Requests on behalf of a foundation, partnership or any other entity must be accompanied by evidence of the authority of the person(s) signing.

FOR INDIVIDUAL INVESTORS (including spouses invested jointly):

| | | | | | |

| | | | | | |

Signature of Investor(s) or Authorized Person(s) | | | | Signature of Investor(s) or Authorized Person(s) | | |

| | | |

| | | | | | |

Name of Signatory (please print) | | | | Name of Signatory (please print) | | |

| | | |

| | | | | | |

Title of Authorized Person (please print) | | | | Title of Authorized Person (please print) | | |

| | | |

| | | | | | |

Date | | | | Date | | |

FOR ENTITY INVESTORS (e.g., trusts, endowments, foundations, corporations, and partnerships):

| | | | | | |

| | | |

| | | | | | |

Signature of Investor(s) or Authorized Person(s) | | | | Signature of Investor(s) or Authorized Person(s) | | |

| | | |

| | | | | | |

Name of Signatory (please print) | | | | Name of Signatory (please print) | | |

| | | |

| | | | | | |

Title of Authorized Person (please print) | | | | Title of Authorized Person (please print) | | |

| | | |

| | | | | | |

Date | | | | Date | | |

| | | |

| | | | | | |

Signature of Investor(s) or Authorized Person(s) | | | | Signature of Investor(s) or Authorized Person(s) | | |

| | | |

| | | | | | |

Name of Signatory (please print) | | | | Name of Signatory (please print) | | |

| | | |

| | | | | | |

Title of Authorized Person (please print) | | | | Title of Authorized Person (please print) | | |

| | | |

| | | | | | |

Date | | | | Date | | |

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (GSLLC) | | Page 4 |

LETTER OF TRANSMITTAL

REGARDING

SHARES OF BENEFICIAL INTEREST

IN

HEDGE FUND GUIDED PORTFOLIO SOLUTION

TENDERED PURSUANT TO THE OFFER TO PURCHASE

DATED JUNE 27, 2024

The Offer will expire

at, and this Letter of Transmittal must be

received by, 12:00 midnight, Eastern Time,

on Friday, July 26, 2024, unless the Offer is extended.

Complete this Letter of Transmittal and Return by Mail or E-Mail:

By Mail:

Grosvenor Funds

c/o BNY Mellon TA Alternative Investment RIC Funds

PO Box 534408

Pittsburgh, PA 15253-4408

Phone: (877) 355-1469

By E-Mail:

grosvenordeinvservices@bnymellon.com

Please include the words “Grosvenor Funds Tender Documents” in the subject line.

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (Schwab Custody) | | Page 1 |

Ladies and Gentlemen:

The undersigned hereby tenders to Hedge Fund Guided Portfolio Solution, a closed-end, non-diversified, management investment company organized under the laws of the State of Delaware (the “Fund”), the shares of beneficial interest (“Shares”) in the Fund or portion thereof held by the undersigned, described and specified below, on the terms and conditions set forth in the offer to purchase dated June 27, 2024 (“Offer to Purchase”), receipt of which is hereby acknowledged, and in this Letter of Transmittal (which together constitute the “Offer”). All capitalized terms used herein have the meaning as defined in the Fund’s Declaration of Trust. The tender and this Letter of Transmittal are subject to all the terms and conditions set forth in the Offer to Purchase, including, but not limited to, the absolute right of the Fund to reject any and all tenders determined by it, in its sole discretion, not to be received timely and in the appropriate form.

The undersigned hereby sells to the Fund the Shares of the Fund tendered hereby pursuant to the Offer. The undersigned hereby warrants that the undersigned has full authority to sell the Shares tendered hereby and that the Fund will acquire good title thereto, free and clear of all liens, charges, encumbrances, conditional sales agreements or other obligations relating to the sale thereof, and not subject to any adverse claim, when and to the extent the same are purchased by the Fund. Upon request, the undersigned will execute and deliver any additional documents necessary to complete the sale in accordance with the terms of the Offer.

The undersigned recognizes that under certain circumstances set forth in the Offer, the Fund may not be required to purchase any of the Shares of the Fund or portion thereof tendered hereby. The undersigned recognizes that, if the Offer is oversubscribed, not all the undersigned’s Shares of the Fund may be purchased.

The undersigned acknowledges that this Letter of Transmittal must be received by the Fund by either mail or e-mail by 12:00 midnight, Eastern Time, on July 26, 2024, and that the method of delivery of any document is at the election and the complete risk of the undersigned, including, but not limited to, the failure of the Fund, to receive any Letter of Transmittal or other document.

A non-transferable, non-interest bearing promissory note for the purchase price will be paid to the undersigned if the Fund accepts for purchase the Shares tendered hereby. The undersigned acknowledges that the promissory note will be held for the undersigned by BNY Mellon Investment Servicing (U.S.) Inc., the Fund’s administrator. The cash payment(s) of the purchase price for the Shares tendered by the undersigned and accepted for purchase by the Fund will be made by wire transfer of the proceeds to the undersigned’s Custodian of record for the Shares and allocated to the Investor’s account with such Custodian. The undersigned hereby represents and warrants that the undersigned understands that upon a withdrawal of such cash payment from the account, the institution at which the account is held may subject such withdrawal to any fees that it would customarily assess upon the withdrawal of cash from such account. The undersigned hereby represents and warrants that the undersigned understands that any payment in the form of marketable securities would be made by means of special arrangement with the tendering member in the sole discretion of the Fund’s Board of Trustees.

If the undersigned’s Shares are tendered and accepted for purchase, the promissory note will also provide for a contingent payment portion of the purchase price, if any, as described in Section 7 of the Offer to Purchase. Any contingent payment of cash due pursuant to a note will also be made by wire transfer to the undersigned’s Custodian of record for the Shares and allocated to the Investor’s account with such Custodian. The undersigned recognizes that the amount of the purchase price for Shares will be based on the unaudited net asset value of the Fund as of September 30, 2024 (the “Valuation Date”), subject to an extension of the Offer as described in Section 8 of the Offer to Purchase. The contingent payment portion of the purchase price, if any, will generally be made within 120 days of the Valuation Date.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the undersigned and the obligation of the undersigned hereunder shall be binding on the heirs, personal representatives, successors and assigns of the undersigned. Except as stated in Section 6 of the Offer to Purchase, this tender is irrevocable.

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (Schwab Custody) | | Page 2 |

If you do not want to sell your Shares at this time, please disregard this notice. This is simply notification of the Fund’s tender offer. If you decide to tender, you are responsible for confirming that the Fund has received your documents in good order.

Name of Investor:

Address of Investor:

Account Number: Phone Number:

E-Mail Address for Confirmation of Receipt:

| | |

PART 2 – Amount of Beneficial Interest Shares of the Fund to be Tendered |

Please check one:

| | |

☐ | | All Shares |

| |

☐ | | Portion of Shares expressed as number of units: |

| |

| | Partial tenders are subject to maintenance of a minimum account balance of at least $10,000. The undersigned understands that if the undersigned tenders an amount that would cause the undersigned’s account balance to fall below $10,000, the Fund reserves the right to reduce the amount to be purchased from the undersigned so a minimum $10,000 account balance is maintained. |

The promissory note for the purchase price will be held for you by BNY Mellon Investment Servicing (U.S.) Inc., the Fund’s administrator.

Cash payments will be wired to the Investor’s Custodian of record for the Shares and allocated to the Investor’s account with such Custodian. Cash payments wired to such Investor accounts may be subject upon withdrawal from the account to any fees that the institution at which the account is held would customarily assess upon the withdrawal of cash from the account.

The undersigned Investor acknowledges that this request is subject to all the terms and conditions set forth in the Fund’s Declaration of Trust. The undersigned represents that the undersigned is the beneficial owner of the Shares in the Fund to which this tender request relates, or that the person signing this request is an authorized representative of the tendering Investor.

In the case of joint accounts, each joint holder must sign this tender request. Requests on behalf of a foundation, partnership or any other entity must be accompanied by evidence of the authority of the person(s) signing.

FOR INDIVIDUAL INVESTORS (including spouses invested jointly):

| | | | | | | | |

| | | | | | | | | |

Signature of Investor(s) or Authorized Person(s) | | | | Signature of Investor(s) or Authorized Person(s) | | | | |

| | | |

| | | | | | | | | |

Name of Signatory (please print) | | | | Name of Signatory (please print) | | | | |

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (Schwab Custody) | | Page 3 |

| | | | | | | | |

| | | | | | | | | |

Title of Authorized Person (please print) | | | | Title of Authorized Person (please print) | | | | |

| | | |

| | | | | | | | | |

Date | | | | Date | | | | |

FOR ENTITY INVESTORS (e.g., trusts, endowments, foundations, corporations, and partnerships):

| | | | | | | | |

| | | | | | | | | |

Signature of Investor(s) or Authorized Person(s) | | | | Signature of Investor(s) or Authorized Person(s) | | | | |

| | | |

| | | | | | | | | |

Name of Signatory (please print) | | | | Name of Signatory (please print) | | | | |

| | | |

| | | | | | | | | |

Title of Authorized Person (please print) | | | | Title of Authorized Person (please print) | | | | |

| | | |

| | | | | | | | | |

Date | | | | Date | | | | |

| | | |

| | | | | | | | | |

Signature of Investor(s) or Authorized Person(s) | | | | Signature of Investor(s) or Authorized Person(s) | | | | |

| | | |

| | | | | | | | | |

Name of Signatory (please print) | | | | Name of Signatory (please print) | | | | |

| | | |

| | | | | | | | | |

Title of Authorized Person (please print) | | | | Title of Authorized Person (please print) | | | | |

| | | |

| | | | | | | | | |

Date | | | | Date | | | | |

| | |

| Letter of Transmittal – Hedge Fund Guided Portfolio Solution (Schwab Custody) | | Page 4 |