UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23341

Name of Fund: BlackRock Funds IV

BlackRock Global Long/Short Credit Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds IV, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 07/31/2024

Date of reporting period: 07/31/2024

Item 1 – Report to Stockholders

(a) The Reports to Shareholders is attached herewith.

BlackRock Global Long/Short Credit Fund

Institutional Shares | BGCIX

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Global Long/Short Credit Fund (the “Fund”) for the period of August 1, 2023 to July 31, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441-7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $153 | 1.46% |

How did the Fund perform last year?

The global fixed-income markets produced positive returns during the reporting period, with income making a sizable contribution in the high interest rate environment.

Credit-oriented investments performed particularly well, as positive investor sentiment contributed to a narrowing of yield spreads.

What contributed to performance?

The Fund’s U.S. and European absolute return strategies and European traditional strategies contributed to performance. Specifically, idiosyncratic long positions, event-related trades, and thematic trades all made meaningful contributions. European absolute return strategies, particularly event-related trades, also contributed. European traditional strategies further helped results, primarily in high yield, financials, and mezzanine collateralized loan obligations.

As part of its investment strategy, the Fund used derivatives to manage duration (sensitivity to interest rate movements) and currency risk. The Fund also has the flexibility to utilize derivatives in order to express a positive or negative view on a particular issuer or sector, or to manage overall credit risk. Derivatives may also serve as a more liquid way to establish positions. The use of derivatives had a marginally positive impact on the Fund’s performance during the reporting period.

What detracted from performance?

At a time of positive returns for the broader market, few aspects of the Fund’s positioning detracted. With that said, idiosyncratic short positions in the Fund’s U.S. absolute return strategies, along with U.S. and European risk-management strategies, had small adverse effects.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

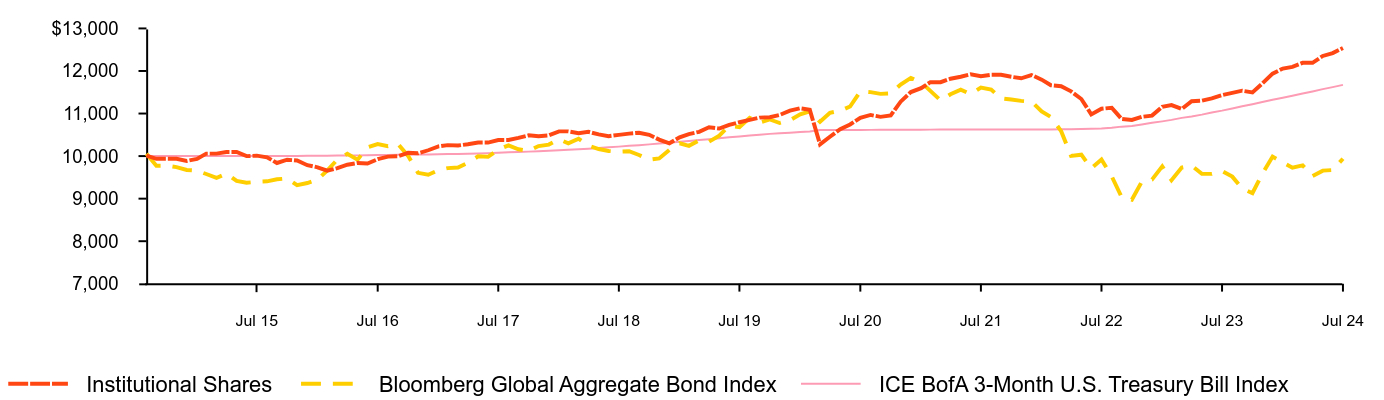

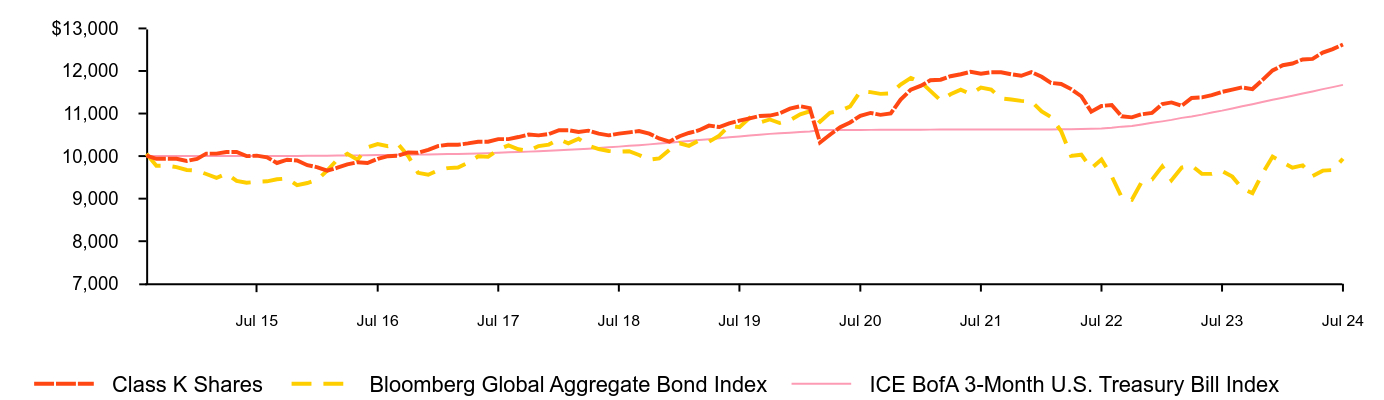

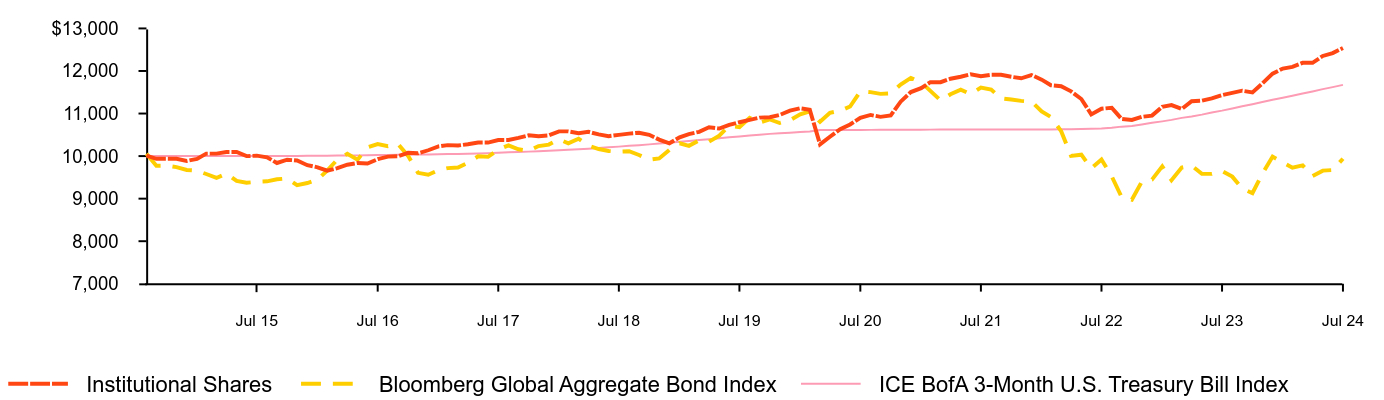

Cumulative performance: August 1, 2014 through July 31, 2024

Initial investment of $10,000

| Institutional Shares | Bloomberg Global Aggregate Bond Index | ICE BofA 3-Month U.S. Treasury Bill Index |

|---|

| Aug 14 | 10,009 | 10,055 | 10,000 |

| Sep 14 | 9,936 | 9,774 | 10,001 |

| Oct 14 | 9,936 | 9,776 | 10,001 |

| Nov 14 | 9,936 | 9,740 | 10,001 |

| Dec 14 | 9,886 | 9,673 | 10,001 |

| Jan 15 | 9,934 | 9,658 | 10,001 |

| Feb 15 | 10,058 | 9,579 | 10,001 |

| Mar 15 | 10,058 | 9,487 | 10,001 |

| Apr 15 | 10,096 | 9,588 | 10,002 |

| May 15 | 10,096 | 9,416 | 10,002 |

| Jun 15 | 10,000 | 9,375 | 10,002 |

| Jul 15 | 10,010 | 9,396 | 10,001 |

| Aug 15 | 9,972 | 9,407 | 10,003 |

| Sep 15 | 9,838 | 9,455 | 10,003 |

| Oct 15 | 9,915 | 9,475 | 10,002 |

| Nov 15 | 9,896 | 9,318 | 10,003 |

| Dec 15 | 9,787 | 9,368 | 10,006 |

| Jan 16 | 9,737 | 9,449 | 10,007 |

| Feb 16 | 9,657 | 9,659 | 10,009 |

| Mar 16 | 9,717 | 9,920 | 10,014 |

| Apr 16 | 9,797 | 10,052 | 10,016 |

| May 16 | 9,837 | 9,917 | 10,017 |

| Jun 16 | 9,827 | 10,207 | 10,021 |

| Jul 16 | 9,927 | 10,284 | 10,024 |

| Aug 16 | 9,987 | 10,234 | 10,026 |

| Sep 16 | 9,997 | 10,290 | 10,031 |

| Oct 16 | 10,077 | 10,005 | 10,033 |

| Nov 16 | 10,067 | 9,607 | 10,035 |

| Dec 16 | 10,137 | 9,563 | 10,039 |

| Jan 17 | 10,228 | 9,671 | 10,044 |

| Feb 17 | 10,258 | 9,717 | 10,048 |

| Mar 17 | 10,248 | 9,732 | 10,049 |

| Apr 17 | 10,278 | 9,841 | 10,056 |

| May 17 | 10,318 | 9,994 | 10,061 |

| Jun 17 | 10,318 | 9,985 | 10,070 |

| Jul 17 | 10,378 | 10,153 | 10,078 |

| Aug 17 | 10,378 | 10,253 | 10,088 |

| Sep 17 | 10,428 | 10,161 | 10,096 |

| Oct 17 | 10,488 | 10,122 | 10,105 |

| Nov 17 | 10,468 | 10,235 | 10,114 |

| Dec 17 | 10,488 | 10,270 | 10,125 |

| Jan 18 | 10,580 | 10,393 | 10,137 |

| Feb 18 | 10,580 | 10,301 | 10,147 |

| Mar 18 | 10,539 | 10,410 | 10,161 |

| Apr 18 | 10,570 | 10,243 | 10,174 |

| May 18 | 10,509 | 10,166 | 10,190 |

| Jun 18 | 10,468 | 10,121 | 10,207 |

| Jul 18 | 10,499 | 10,104 | 10,223 |

| Aug 18 | 10,529 | 10,114 | 10,241 |

| Sep 18 | 10,549 | 10,027 | 10,257 |

| Oct 18 | 10,499 | 9,915 | 10,275 |

| Nov 18 | 10,387 | 9,946 | 10,296 |

| Dec 18 | 10,302 | 10,147 | 10,315 |

| Jan 19 | 10,442 | 10,302 | 10,335 |

| Feb 19 | 10,517 | 10,242 | 10,354 |

| Mar 19 | 10,571 | 10,371 | 10,377 |

| Apr 19 | 10,678 | 10,340 | 10,396 |

| May 19 | 10,646 | 10,480 | 10,420 |

| Jun 19 | 10,732 | 10,712 | 10,443 |

| Jul 19 | 10,796 | 10,682 | 10,462 |

| Aug 19 | 10,850 | 10,900 | 10,483 |

| Sep 19 | 10,904 | 10,789 | 10,502 |

| Oct 19 | 10,914 | 10,861 | 10,522 |

| Nov 19 | 10,968 | 10,778 | 10,535 |

| Dec 19 | 11,067 | 10,841 | 10,550 |

| Jan 20 | 11,123 | 10,980 | 10,564 |

| Feb 20 | 11,090 | 11,053 | 10,580 |

| Mar 20 | 10,276 | 10,806 | 10,611 |

| Apr 20 | 10,454 | 11,018 | 10,611 |

| May 20 | 10,633 | 11,066 | 10,612 |

| Jun 20 | 10,744 | 11,165 | 10,613 |

| Jul 20 | 10,900 | 11,521 | 10,615 |

| Aug 20 | 10,967 | 11,503 | 10,616 |

| Sep 20 | 10,922 | 11,462 | 10,617 |

| Oct 20 | 10,956 | 11,473 | 10,618 |

| Nov 20 | 11,279 | 11,681 | 10,619 |

| Dec 20 | 11,505 | 11,838 | 10,620 |

| Jan 21 | 11,597 | 11,734 | 10,621 |

| Feb 21 | 11,737 | 11,532 | 10,622 |

| Mar 21 | 11,737 | 11,310 | 10,623 |

| Apr 21 | 11,818 | 11,453 | 10,623 |

| May 21 | 11,864 | 11,560 | 10,624 |

| Jun 21 | 11,922 | 11,458 | 10,623 |

| Jul 21 | 11,876 | 11,611 | 10,624 |

| Aug 21 | 11,910 | 11,563 | 10,624 |

| Sep 21 | 11,910 | 11,357 | 10,625 |

| Oct 21 | 11,864 | 11,330 | 10,624 |

| Nov 21 | 11,829 | 11,297 | 10,625 |

| Dec 21 | 11,905 | 11,281 | 10,626 |

| Jan 22 | 11,797 | 11,050 | 10,625 |

| Feb 22 | 11,665 | 10,918 | 10,627 |

| Mar 22 | 11,641 | 10,586 | 10,630 |

| Apr 22 | 11,521 | 10,006 | 10,632 |

| May 22 | 11,341 | 10,033 | 10,639 |

| Jun 22 | 10,981 | 9,711 | 10,642 |

| Jul 22 | 11,113 | 9,918 | 10,647 |

| Aug 22 | 11,137 | 9,526 | 10,665 |

| Sep 22 | 10,873 | 9,037 | 10,692 |

| Oct 22 | 10,849 | 8,975 | 10,709 |

| Nov 22 | 10,921 | 9,397 | 10,743 |

| Dec 22 | 10,952 | 9,448 | 10,782 |

| Jan 23 | 11,160 | 9,758 | 10,816 |

| Feb 23 | 11,199 | 9,434 | 10,851 |

| Mar 23 | 11,108 | 9,732 | 10,898 |

| Apr 23 | 11,290 | 9,775 | 10,932 |

| May 23 | 11,303 | 9,584 | 10,975 |

| Jun 23 | 11,355 | 9,583 | 11,025 |

| Jul 23 | 11,433 | 9,649 | 11,069 |

| Aug 23 | 11,485 | 9,517 | 11,119 |

| Sep 23 | 11,537 | 9,239 | 11,170 |

| Oct 23 | 11,498 | 9,129 | 11,220 |

| Nov 23 | 11,706 | 9,589 | 11,270 |

| Dec 23 | 11,936 | 9,988 | 11,323 |

| Jan 24 | 12,057 | 9,850 | 11,371 |

| Feb 24 | 12,098 | 9,726 | 11,418 |

| Mar 24 | 12,192 | 9,780 | 11,469 |

| Apr 24 | 12,192 | 9,533 | 11,518 |

| May 24 | 12,353 | 9,658 | 11,573 |

| Jun 24 | 12,420 | 9,672 | 11,621 |

| Jul 24 | 12,541 | 9,939 | 11,673 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|

Institutional Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.69% | 3.04% | 2.29% |

Bloomberg Global Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.00 | (1.43) | (0.06) |

ICE BofA 3-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.45 | 2.21 | 1.56 |

The Fund has added the Bloomberg Global Aggregate Bond Index in response to new regulatory requirements.

On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock Global Long/Short Credit Fund (the “Predecessor Fund”), a series of BlackRock FundsSM, through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization.

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $872,029,693 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 926 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $9,223,077 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 110% |

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

Credit quality allocation

| Percent of Total InvestmentsFootnote Reference(a) |

|---|

| Country/Geographic Region | Long | Short | Total |

|---|

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 47.2% | 1.1% | 48.3% |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.5 | 0.6 | 10.1 |

Ireland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.9 | - | 9.9 |

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.3 | 0.3 | 6.6 |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 | - | 3.9 |

Italy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.3 | 0.3 | 3.6 |

Spain........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 | 0.4 | 3.2 |

Luxembourg........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 | - | 2.4 |

Sweden........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.2 | 0.7 | 1.9 |

Portugal........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 | - | 1.8 |

OtherFootnote Reference(b) | 7.9 | 0.4 | 8.3 |

Total........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 96.2% | 3.8% | 100.0% |

Credit RatingFootnote Reference(c) | Percent of Total InvestmentsFootnote Reference(d) |

|---|

AAA/AaaFootnote Reference(e)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.3% |

AA/Aa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.3 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 25.9 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 30.3 |

CCC/Caa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.3 |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.4 |

C........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.0Footnote Reference(f) |

D........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

NR........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.2 |

| Footnote | Description |

Footnote(a) | Includes the gross market value of long and short securities and excludes short-term securities and options, if any. |

Footnote(b) | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Footnote(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated NR are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(d) | Excludes short-term securities, short investments and options, if any. |

Footnote(e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

Footnote(f) | Rounds to less than 0.1%. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited, ICE Data Indices, LLC, and their respective affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the companies listed above.

© 2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Global Long/Short Credit Fund

Institutional Shares | BGCIX

Annual Shareholder Report — July 31, 2024

BlackRock Global Long/Short Credit Fund

Investor A Shares | BGCAX

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Global Long/Short Credit Fund (the “Fund”) for the period of August 1, 2023 to July 31, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441-7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor A Shares | $176 | 1.68% |

How did the Fund perform last year?

The global fixed-income markets produced positive returns during the reporting period, with income making a sizable contribution in the high interest rate environment.

Credit-oriented investments performed particularly well, as positive investor sentiment contributed to a narrowing of yield spreads.

What contributed to performance?

The Fund’s U.S. and European absolute return strategies and European traditional strategies contributed to performance. Specifically, idiosyncratic long positions, event-related trades, and thematic trades all made meaningful contributions. European absolute return strategies, particularly event-related trades, also contributed. European traditional strategies further helped results, primarily in high yield, financials, and mezzanine collateralized loan obligations.

As part of its investment strategy, the Fund used derivatives to manage duration (sensitivity to interest rate movements) and currency risk. The Fund also has the flexibility to utilize derivatives in order to express a positive or negative view on a particular issuer or sector, or to manage overall credit risk. Derivatives may also serve as a more liquid way to establish positions. The use of derivatives had a marginally positive impact on the Fund’s performance during the reporting period.

What detracted from performance?

At a time of positive returns for the broader market, few aspects of the Fund’s positioning detracted. With that said, idiosyncratic short positions in the Fund’s U.S. absolute return strategies, along with U.S. and European risk-management strategies, had small adverse effects.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

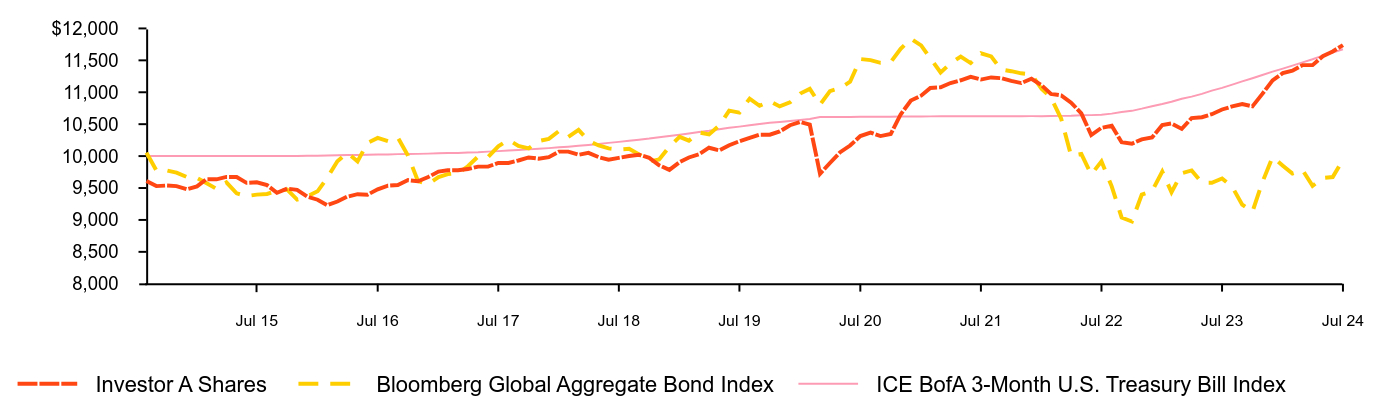

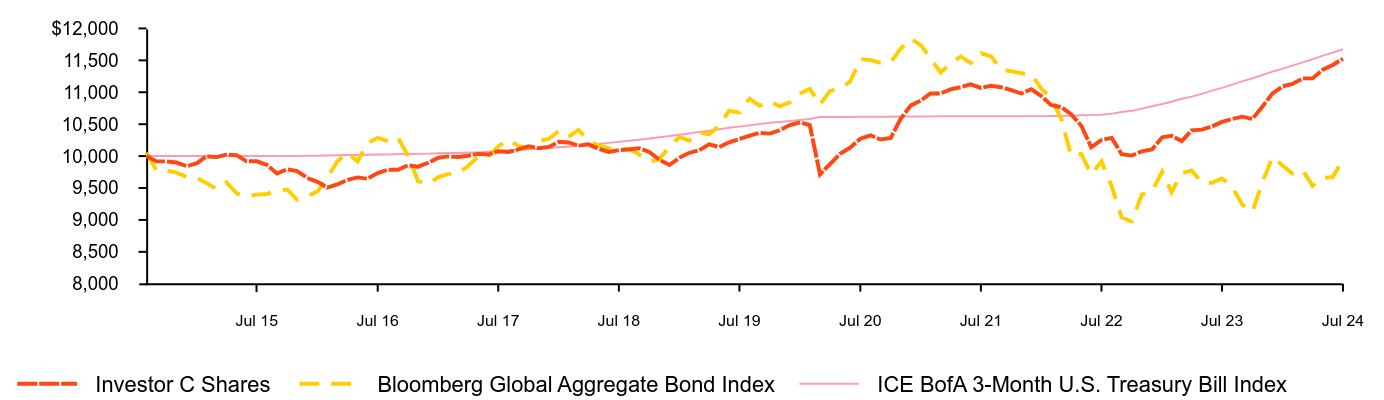

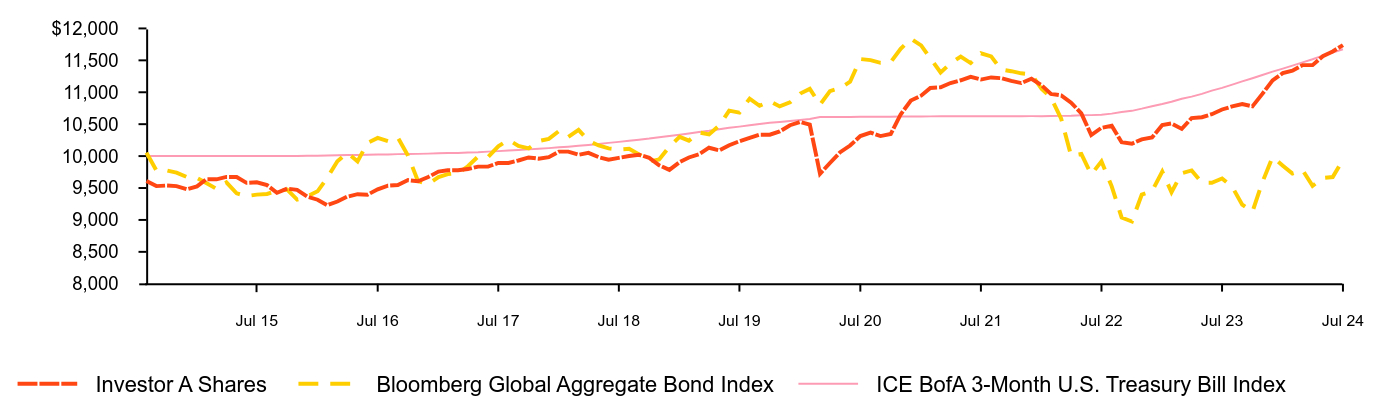

Cumulative performance: August 1, 2014 through July 31, 2024

Initial investment of $10,000

| Investor A Shares | Bloomberg Global Aggregate Bond Index | ICE BofA 3-Month U.S. Treasury Bill Index |

|---|

| Aug 14 | 9,609 | 10,055 | 10,000 |

| Sep 14 | 9,530 | 9,774 | 10,001 |

| Oct 14 | 9,539 | 9,776 | 10,001 |

| Nov 14 | 9,530 | 9,740 | 10,001 |

| Dec 14 | 9,480 | 9,673 | 10,001 |

| Jan 15 | 9,526 | 9,658 | 10,001 |

| Feb 15 | 9,636 | 9,579 | 10,001 |

| Mar 15 | 9,636 | 9,487 | 10,001 |

| Apr 15 | 9,673 | 9,588 | 10,002 |

| May 15 | 9,673 | 9,416 | 10,002 |

| Jun 15 | 9,581 | 9,375 | 10,002 |

| Jul 15 | 9,590 | 9,396 | 10,001 |

| Aug 15 | 9,545 | 9,407 | 10,003 |

| Sep 15 | 9,426 | 9,455 | 10,003 |

| Oct 15 | 9,490 | 9,475 | 10,002 |

| Nov 15 | 9,471 | 9,318 | 10,003 |

| Dec 15 | 9,365 | 9,368 | 10,006 |

| Jan 16 | 9,317 | 9,449 | 10,007 |

| Feb 16 | 9,231 | 9,659 | 10,009 |

| Mar 16 | 9,288 | 9,920 | 10,014 |

| Apr 16 | 9,365 | 10,052 | 10,016 |

| May 16 | 9,403 | 9,917 | 10,017 |

| Jun 16 | 9,394 | 10,207 | 10,021 |

| Jul 16 | 9,480 | 10,284 | 10,024 |

| Aug 16 | 9,538 | 10,234 | 10,026 |

| Sep 16 | 9,547 | 10,290 | 10,031 |

| Oct 16 | 9,624 | 10,005 | 10,033 |

| Nov 16 | 9,605 | 9,607 | 10,035 |

| Dec 16 | 9,672 | 9,563 | 10,039 |

| Jan 17 | 9,758 | 9,671 | 10,044 |

| Feb 17 | 9,778 | 9,717 | 10,048 |

| Mar 17 | 9,778 | 9,732 | 10,049 |

| Apr 17 | 9,797 | 9,841 | 10,056 |

| May 17 | 9,835 | 9,994 | 10,061 |

| Jun 17 | 9,835 | 9,985 | 10,070 |

| Jul 17 | 9,893 | 10,153 | 10,078 |

| Aug 17 | 9,893 | 10,253 | 10,088 |

| Sep 17 | 9,931 | 10,161 | 10,096 |

| Oct 17 | 9,979 | 10,122 | 10,105 |

| Nov 17 | 9,960 | 10,235 | 10,114 |

| Dec 17 | 9,983 | 10,270 | 10,125 |

| Jan 18 | 10,070 | 10,393 | 10,137 |

| Feb 18 | 10,070 | 10,301 | 10,147 |

| Mar 18 | 10,021 | 10,410 | 10,161 |

| Apr 18 | 10,050 | 10,243 | 10,174 |

| May 18 | 9,983 | 10,166 | 10,190 |

| Jun 18 | 9,944 | 10,121 | 10,207 |

| Jul 18 | 9,973 | 10,104 | 10,223 |

| Aug 18 | 10,002 | 10,114 | 10,241 |

| Sep 18 | 10,021 | 10,027 | 10,257 |

| Oct 18 | 9,973 | 9,915 | 10,275 |

| Nov 18 | 9,857 | 9,946 | 10,296 |

| Dec 18 | 9,784 | 10,147 | 10,315 |

| Jan 19 | 9,906 | 10,302 | 10,335 |

| Feb 19 | 9,978 | 10,242 | 10,354 |

| Mar 19 | 10,029 | 10,371 | 10,377 |

| Apr 19 | 10,131 | 10,340 | 10,396 |

| May 19 | 10,090 | 10,480 | 10,420 |

| Jun 19 | 10,171 | 10,712 | 10,443 |

| Jul 19 | 10,233 | 10,682 | 10,462 |

| Aug 19 | 10,284 | 10,900 | 10,483 |

| Sep 19 | 10,335 | 10,789 | 10,502 |

| Oct 19 | 10,335 | 10,861 | 10,522 |

| Nov 19 | 10,386 | 10,778 | 10,535 |

| Dec 19 | 10,483 | 10,841 | 10,550 |

| Jan 20 | 10,536 | 10,980 | 10,564 |

| Feb 20 | 10,493 | 11,053 | 10,580 |

| Mar 20 | 9,723 | 10,806 | 10,611 |

| Apr 20 | 9,892 | 11,018 | 10,611 |

| May 20 | 10,061 | 11,066 | 10,612 |

| Jun 20 | 10,166 | 11,165 | 10,613 |

| Jul 20 | 10,314 | 11,521 | 10,615 |

| Aug 20 | 10,367 | 11,503 | 10,616 |

| Sep 20 | 10,314 | 11,462 | 10,617 |

| Oct 20 | 10,346 | 11,473 | 10,618 |

| Nov 20 | 10,652 | 11,681 | 10,619 |

| Dec 20 | 10,871 | 11,838 | 10,620 |

| Jan 21 | 10,947 | 11,734 | 10,621 |

| Feb 21 | 11,068 | 11,532 | 10,622 |

| Mar 21 | 11,078 | 11,310 | 10,623 |

| Apr 21 | 11,144 | 11,453 | 10,623 |

| May 21 | 11,188 | 11,560 | 10,624 |

| Jun 21 | 11,242 | 11,458 | 10,623 |

| Jul 21 | 11,199 | 11,611 | 10,624 |

| Aug 21 | 11,232 | 11,563 | 10,624 |

| Sep 21 | 11,221 | 11,357 | 10,625 |

| Oct 21 | 11,177 | 11,330 | 10,624 |

| Nov 21 | 11,144 | 11,297 | 10,625 |

| Dec 21 | 11,211 | 11,281 | 10,626 |

| Jan 22 | 11,109 | 11,050 | 10,625 |

| Feb 22 | 10,974 | 10,918 | 10,627 |

| Mar 22 | 10,951 | 10,586 | 10,630 |

| Apr 22 | 10,838 | 10,006 | 10,632 |

| May 22 | 10,669 | 10,033 | 10,639 |

| Jun 22 | 10,330 | 9,711 | 10,642 |

| Jul 22 | 10,443 | 9,918 | 10,647 |

| Aug 22 | 10,476 | 9,526 | 10,665 |

| Sep 22 | 10,217 | 9,037 | 10,692 |

| Oct 22 | 10,194 | 8,975 | 10,709 |

| Nov 22 | 10,262 | 9,397 | 10,743 |

| Dec 22 | 10,292 | 9,448 | 10,782 |

| Jan 23 | 10,487 | 9,758 | 10,816 |

| Feb 23 | 10,511 | 9,434 | 10,851 |

| Mar 23 | 10,426 | 9,732 | 10,898 |

| Apr 23 | 10,596 | 9,775 | 10,932 |

| May 23 | 10,609 | 9,584 | 10,975 |

| Jun 23 | 10,657 | 9,583 | 11,025 |

| Jul 23 | 10,730 | 9,649 | 11,069 |

| Aug 23 | 10,779 | 9,517 | 11,119 |

| Sep 23 | 10,816 | 9,239 | 11,170 |

| Oct 23 | 10,779 | 9,129 | 11,220 |

| Nov 23 | 10,974 | 9,589 | 11,270 |

| Dec 23 | 11,187 | 9,988 | 11,323 |

| Jan 24 | 11,300 | 9,850 | 11,371 |

| Feb 24 | 11,338 | 9,726 | 11,418 |

| Mar 24 | 11,425 | 9,780 | 11,469 |

| Apr 24 | 11,425 | 9,533 | 11,518 |

| May 24 | 11,564 | 9,658 | 11,573 |

| Jun 24 | 11,639 | 9,672 | 11,621 |

| Jul 24 | 11,739 | 9,939 | 11,673 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|

Investor A Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.40% | 2.79% | 2.03% |

Investor A Shares (with sales charge)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.03 | 1.95 | 1.62 |

Bloomberg Global Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.00 | (1.43) | (0.06) |

ICE BofA 3-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.45 | 2.21 | 1.56 |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

The Fund has added the Bloomberg Global Aggregate Bond Index in response to new regulatory requirements.

On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock Global Long/Short Credit Fund (the “Predecessor Fund”), a series of BlackRock FundsSM, through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization.

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $872,029,693 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 926 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $9,223,077 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 110% |

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

Credit quality allocation

| Percent of Total InvestmentsFootnote Reference(a) |

|---|

| Country/Geographic Region | Long | Short | Total |

|---|

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 47.2% | 1.1% | 48.3% |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.5 | 0.6 | 10.1 |

Ireland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.9 | - | 9.9 |

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.3 | 0.3 | 6.6 |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 | - | 3.9 |

Italy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.3 | 0.3 | 3.6 |

Spain........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 | 0.4 | 3.2 |

Luxembourg........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 | - | 2.4 |

Sweden........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.2 | 0.7 | 1.9 |

Portugal........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 | - | 1.8 |

OtherFootnote Reference(b) | 7.9 | 0.4 | 8.3 |

Total........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 96.2% | 3.8% | 100.0% |

Credit RatingFootnote Reference(c) | Percent of Total InvestmentsFootnote Reference(d) |

|---|

AAA/AaaFootnote Reference(e)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.3% |

AA/Aa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.3 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 25.9 |