UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-23342

Name of Fund: FDP Series II, Inc.

FDP BlackRock CoreAlpha Bond Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, FDP Series II, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800)441-7762

Date of fiscal year end: 05/31/2019

Date of reporting period: 05/31/2019

Item 1 – Report to Stockholders

MAY 31, 2019

| | |

ANNUAL REPORT | |  |

FDP Series II, Inc.

| Ø | | FDP BlackRock CoreAlpha Bond Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call (800) 441-7762 to inform BlackRock that you wish to continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC, BlackRock Fund Advisors or their affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) accessing the BlackRock website at www.blackrock.com/edelivery and logging into your accounts, if you hold accounts directly with BlackRock, or (ii) contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

In the 12 months ended May 31, 2019, the U.S. equity and bond markets posted mixed returns while weathering significant volatility. Less volatile U.S. large cap equities and U.S. bonds posted positive returns, while equities at the high end of the risk spectrum — emerging markets, international developed, and U.S. small cap — all declined during the reporting period.

Volatility rose in emerging markets, as the rising U.S. dollar and higher interest rates in the United States disrupted economic growth abroad. U.S.-China trade relations and debt concerns adversely affected the Chinese stock market, while Turkey and Argentina became embroiled in currency crises, largely due to hyperinflation in both countries. An economic slowdown in Europe also led to negative performance for European equities. However, recent economic data indicates that Europe may emerge from its economic soft patch, reinvigorated by a manufacturing rebound and China’s economic stimulus.

In the U.S. equity market, volatility spiked in late 2018, as a wide range of risks were brought to bear on markets, ranging from rising interest rates and slowing global growth to heightened trade tensions and political turmoil in several countries, including the United States. These risks manifested in a broad-based sell-off in December, leading to the worst December performance on record since 1931.

By comparison, fixed-income securities delivered modest positive returns with relatively low volatility. Short-term U.S. Treasury yields rose, while longer-term yields declined. This led to positive returns for U.S. Treasuries and a substantial flattening of the yield curve. Investment-grade and high-yield corporate bonds also posted positive returns, as the credit fundamentals in corporate markets remained relatively solid.

As global economic growth slowed, the U.S. Federal Reserve (the “Fed”) shifted to a more patient perspective on the economy in January 2019, which led to a strong rebound in the equity market. In its last four meetings, the Fed left interest rates unchanged and signaled a slower pace of rate hikes in response to the global economic slowdown. Relatively low inflation and modest economic growth give the Fed room to maintain support for the economy until the economic data builds the case for changing interest rates. Signs of slowing economic growth also prompted investors to increase expectations for Fed rate cuts in the latter half of 2019. Similarly, the European Central Bank signaled a continuation of accommodative monetary policy, while China committed to looser credit conditions and an increase in fiscal spending.

We continue to believe the probability of recession in 2019 remains relatively low. In our view, a slowing expansion with room to run is the most likely scenario. However, escalating trade tensions and the resulting disruptions in global supply chains have become the greatest risk to the global expansion.

Despite the crosscurrents, U.S. and emerging market equities remain relatively attractive. Within U.S. equities, we believe that companies with high-quality earnings and strong balance sheets offer the most attractive risk/reward trade-off. For bonds, U.S. Treasuries are likely to help buffer against volatility in risk assets, while income from other types of bonds can continue to offer steady returns.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visitblackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of May 31, 2019 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 0.74% | | 3.78% |

U.S. small cap equities

(Russell 2000® Index) | | (3.72) | | (9.04) |

International equities

(MSCI Europe, Australasia, Far East Index) | | 2.41 | | (5.75) |

Emerging market equities

(MSCI Emerging Markets Index) | | 1.33 | | (8.70) |

3-month Treasury bills

(ICE BofAML 3-Month U.S. Treasury Bill Index) | | 1.20 | | 2.26 |

U.S. Treasury securities

(ICE BofAML 10-Year U.S. Treasury Index) | | 9.11 | | 8.81 |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | 6.72 | | 6.40 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 5.68 | | 6.06 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 5.19 | | 5.50 |

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGEISNOT PARTOF YOUR FUND REPORT |

Table of Contents

FDP Series II, Inc. is part of the Funds Diversified PortfoliosSM (“FDP”) Service. You may receive separate shareholder reports for other funds available through the FDP Service.

| | |

| Fund Summary as of May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund |

Investment Objective

FDP BlackRock CoreAlpha Bond Fund’s (the “Fund”) investment objective is to seek to provide a combination of income and capital growth.

On May 1, 2019, the Board of Directors of FDP Series II, Inc. and the Board of Trustees of BlackRock Funds VI each approved the reorganization of the Fund with and into BlackRock CoreAlpha Bond Fund, a series of BlackRock Funds VI. The reorganization is expected to occur during the third quarter of 2019 and is not subject to approval by the Fund’s shareholders.

PORTFOLIO MANAGEMENT COMMENTARY

How did the Fund perform?

For the 12-month period ended May 31, 2019, the Fund underperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

What factors influenced performance?

During the period, the Fund’s positioning with respect to mortgage-backed securities (“MBS”) was the largest detractor from relative performance. Specifically, the Fund’s pool selection within 30-year residential MBS and its preference toward higher-coupon securities weighed on performance as the yield curve flattened.

Asset allocation was the primary contributor to performance, as the Fund was overweight in high-yield corporate bonds as well as securitized sectors including MBS, asset-backed securities (“ABS”) and commercial mortgage-backed securities (“CMBS”). This positioning benefited performance because of continued spread tightening during the period as well as the incremental income it provided. Selection within corporate credit also contributed positively to Fund performance, due principally to the Fund’s positioning within the communication services sector. In particular, an overweight allocation to the cable & wireless industry added to relative return.

The Fund held derivatives in the form of futures contracts during the period as a means to manage risk. The Fund’s use of derivatives had a positive impact on Fund performance. The Fund also held a modest amount of cash at period end. This cash balance was committed for pending transactions and did not have a material impact on performance during the period.

Describe recent portfolio activity.

During the 12-month period, the Fund maintained its overweight allocation to industrials, albeit at a reduced level. The Fund increased its overweight to communication services but decreased its overweight allocation to consumer cyclicals. In consumer non-cyclicals, the Fund moved from an overweight position to an underweight, especially with respect to the pharmaceutical industry. Finally, the Fund continued to reduce its overweight position in the energy sector, driven largely by a shift to an underweight position in the independent energy segment.

Describe portfolio positioning at period end.

Relative to the benchmark, the Fund was underweight in U.S. Treasury securities. Within spread sectors, the Fund was overweight in investment-grade corporate credit, agency MBS, and ABS, with underweights in consumer non-cyclicals, capital goods, and basic materials. The Fund also held a non-benchmark allocation to high yield corporate credit. Within investment grade credit, the portfolio was overweight in the communication services sector, as well as banking names among financials and select issues within information technology.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of May 31, 2019 (continued) | | FDP BlackRock CoreAlpha Bond Fund |

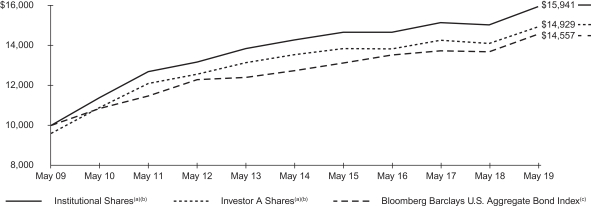

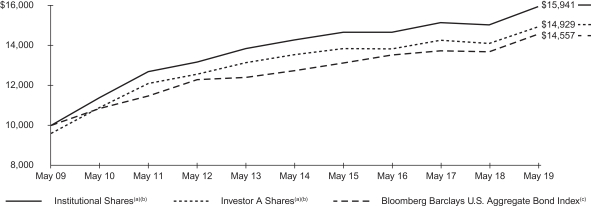

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund invests, under normal circumstances, at least 80% of its assets in bonds and futures and other instruments that have economic characteristics similar to bonds. On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of FDP BlackRock CoreAlpha Bond Fund (the “Predecessor Fund”), a series of FDP Series, Inc., through a tax free organization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. The Predecessor Fund’s total return prior to March 10, 2017 are the returns of the Predecessor Fund when it followed a different investment objective and investment strategies under the name FDP BlackRock Franklin Templeton Total Return Fund. |

| (c) | A market-weighted index, comprised of investment-grade U.S. Treasury bonds, government-related bonds, corporate bonds, mortgage-backed pass-through securities, CMBS and ABS that are publicly offered for sale in the United States with $250 million or more of outstanding face value and at least one year to maturity. |

Performance Summary for the Period Ended May 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Average Annual Total Returns (a)(b) | |

| | | | | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | Standardized

30-Day Yields | | | 6-Month

Total Returns | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | | | | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | 2.96 | % | | | 6.76 | % | | | | | | | 6.10 | % | | | N/A | | | | | | | | 2.22 | % | | | N/A | | | | | | | | 4.77 | % | | | N/A | |

Investor A | | | 2.60 | | | | 6.73 | | | | | | | | 5.93 | | | | 1.69 | % | | | | | | | 1.97 | | | | 1.14 | % | | | | | | | 4.51 | | | | 4.09 | % |

Investor C | | | 2.20 | | | | 6.46 | | | | | | | | 5.38 | | | | 4.38 | | | | | | | | 1.41 | | | | 1.41 | | | | | | | | 3.94 | | | | 3.94 | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | — | | | | 6.72 | | | | | | | | 6.40 | | | | N/A | | | | | | | | 2.70 | | | | N/A | | | | | | | | 3.83 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees. | |

| | (b) | The Fund invests, under normal circumstances, at least 80% of its assets in bonds and futures and other instruments that have economic characteristics similar to bonds. On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of FDP BlackRock CoreAlpha Bond Fund (the “Predecessor Fund”), a series of FDP Series, Inc., through a tax free organization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. The Predecessor Fund’s total return prior to March 10, 2017 are the returns of the Predecessor Fund when it followed a different investment objective and investment strategies under the name FDP BlackRock Franklin Templeton Total Return Fund. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (b) | | | | |

| | | Beginning

Account Value (12/01/18) | | | Ending

Account Value

(05/31/19) | | | Expenses

Paid During

the Period (a) | | | | | | Beginning

Account Value (12/01/18) | | | Ending

Account Value (05/31/19) | | | Expenses

Paid During

the Period (a) | | | Annualized

Expense

Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,067.60 | | | $ | 3.30 | | | | | | | $ | 1,000.00 | | | $ | 1,021.74 | | | $ | 3.23 | | | | 0.64 | % |

Investor A | | | 1,000.00 | | | | 1,067.30 | | | | 4.64 | | | | | | | | 1,000.00 | | | | 1,020.44 | | | | 4.53 | | | | 0.90 | |

Investor C | | | 1,000.00 | | | | 1,064.60 | | | | 7.31 | | | | | | | | 1,000.00 | | | | 1,017.85 | | | | 7.14 | | | | 1.42 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). | |

| | (b) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

See “Disclosure of Expenses” on page 6 for further information on how expenses were calculated.

About Fund Performance

On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of FDP BlackRock CoreAlpha Bond Fund (the “Target Fund”), a series of FDP Series, Inc. in a tax-free reorganization (the “Reorganization”). The Target Fund is the performance and accounting survivor of the Reorganization. Accordingly, information provided herein for periods prior to the Reorganization is that of the Target Fund. See Note 1 of the Notes to Financial Statements for additional information regarding the Reorganization.

Shares are only available for purchase through the FDP Service.

Institutional Sharesare not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Investor A Sharesare subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase.

Investor C Sharesare subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. In addition, these shares are subject to a 1.00% CDSC if redeemed within one year of purchase. Effective November 8, 2018, the Fund adopted an automatic conversion feature whereby Investor C Shares held for approximately ten years will be automatically converted into Investor A Shares, and, thereafter, investors will be subject to lower ongoing fees.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer towww.blackrock.com to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend/payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. The Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver may be reduced or discontinued at any time after the applicable termination date of such agreement. See Note 6 of the Notes to Financial Statements for additional information on waivers and reimbursements.

Disclosure of Expenses

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other fund expenses. The expense examples on previous pages (which are based on a hypothetical investment of $1,000 invested on December 1, 2018 and held through May 31, 2019) are intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 6 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Portfolio Information as of May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund |

PORTFOLIO COMPOSITION

| | | | |

| Asset Type | | Percent of

Total Investments (a) | |

Corporate Bonds | | | 43 | % |

U.S. Government Sponsored Agency Securities | | | 40 | |

Asset-Backed Securities | | | 8 | |

U.S. Treasury Obligations | | | 4 | |

Non-Agency Mortgage-Backed Securities | | | 3 | |

Foreign Agency Obligations | | | 1 | |

Municipal Bonds | | | 1 | |

Floating Rate Loan Interests | | | — | (b) |

Common Stocks | | | — | (b) |

| | (a) | Total investments exclude short-term securities and TBA sale commitments. | |

| | (b) | Represents less than 1% of total investments. | |

| | |

Schedule of Investments May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Shares | | | Value | |

| | | |

Common Stocks — 0.0% | | | | | | | | | | | | |

| | | |

| Diversified Financial Services — 0.0% | | | | | | | | | |

HoldCo 2 NPV, Class A(a)(b) | | | | | | | 1,643,572 | | | $ | — | |

HoldCo 2 NPV, Class B(a)(b) | | | | | | | 163,543 | | | | — | |

| | | | | | | | |

| |

Total Common Stocks — 0.0%

(Cost — $0) | | | | — | |

| | | | | | | | |

| | | |

| | | | | | Par

(000) | | | | |

| | | |

| Asset-Backed Securities — 8.6% | | | | | | | | | |

AmeriCredit Automobile Receivables Trust,Series 2017-3, Class C, 2.69%, 06/19/23 | | | USD | | | | 450 | | | | 452,651 | |

Ameriquest Mortgage Securities, Inc.,Series 2004-R4, Class M1, (1 mo. LIBOR US + 0.83%), 3.25%, 06/25/34(c) | | | | | | | 87 | | | | 87,392 | |

Argent Securities, Inc.,Series 2005-W2, Class A2C, (1 mo. LIBOR US + 0.36%), 2.79%, 10/25/35(c) | | | | | | | 70 | | | | 70,604 | |

Avant Loans Funding Trust, Class A(d): | | | | | | | | | | | | |

Series 2018-A, 3.09%, 06/15/21 | | | | | | | 34 | | | | 34,215 | |

Series 2019-A, 3.48%, 07/15/22 | | | | | | | 384 | | | | 384,602 | |

Chase Funding Trust,Series 2004-2, Class 2A2, (1 mo. LIBOR US + 0.50%), 2.93%, 02/26/35(c) | | | | | | | 120 | | | | 114,604 | |

Conn’s Receivables Funding LLC, Class A(d): | | | | | | | | | | | | |

Series 2018-A, 3.25%, 01/15/23 | | | | | | | 118 | | | | 117,801 | |

Series 2019-A, 3.40%, 10/16/23 | | | | | | | 410 | | | | 410,943 | |

Conseco Finance Corp.,Series 1996-9, Class M1, 7.63%, 08/15/27(e) | | | | | | | 57 | | | | 62,161 | |

Countrywide Asset-Backed Certificates,Series 2004-1, Class M1, (1 mo. LIBOR US + 0.75%), 3.18%, 03/25/34(c) | | | | | | | 31 | | | | 30,756 | |

Drive Auto Receivables Trust: | | | | | | | | | | | | |

Series 2017-3, Class D, 3.53%, 12/15/23(d) | | | | | | | 500 | | | | 504,261 | |

Series 2018-3, Class B, 3.37%, 09/15/22 | | | | | | | 50 | | | | 50,174 | |

Series 2019-2, Class B, 3.17%, 11/15/23 | | | | | | | 425 | | | | 429,938 | |

Exeter Automobile Receivables Trust,Series 2015-1A, Class C, 4.10%, 12/15/20(d) | | | | | | | 44 | | | | 44,450 | |

Flagship Credit Auto Trust,Series 2016-4, Class B, 2.41%, 10/15/21(d) | | | | | | | 85 | | | | 85,204 | |

GSAA Home Equity Trust,Series 2005-5, Class M3, (1 mo. LIBOR US + 0.95%), 3.37%, 02/25/35(c) | | | | | | | 91 | | | | 92,049 | |

Home Equity Mortgage Trust,Series 2004-4, Class M3, (1 mo. LIBOR US + 0.98%), 3.40%, 12/25/34(c) | | | | | | | 25 | | | | 24,703 | |

Marlette Funding Trust,Series 2019-2A, Class A, 3.13%, 07/16/29(d) | | | | | | | 400 | | | | 401,624 | |

Morgan Stanley ABS Capital I Trust, Inc.,Series 2005-WMC1, Class M2, (1 mo. LIBOR US + 0.74%), 3.16%, 01/25/35(c) | | | | | | | 8 | | | | 8,174 | |

National Collegiate Student Loan Trust(c): | | | | | | | | | | | | |

Series 2006-3, Class A4, (1 mo. LIBOR US + 0.27%), 2.70%, 03/26/29 | | | | | | | 166 | | | | 165,332 | |

Series 2007-1, Class A3, (1 mo. LIBOR US + 0.24%), 2.67%, 07/25/30 | | | | | | | 277 | | | | 274,922 | |

Prosper Marketplace Issuance Trust,Series 2019-3A, Class A, 3.19%, 07/15/25(d)(f) | | | | | | | 400 | | | | 399,985 | |

Santander Drive Auto Receivables Trust: | | | | | | | | | | | | |

Series 2016-1, Class C, 3.09%, 04/15/22 | | | | | | | 358 | | | | 358,667 | |

Series 2016-3, Class D, 2.80%, 08/15/22 | | | | | | | 450 | | | | 451,880 | |

Series 2017-2, Class C, 2.79%, 08/15/22 | | | | | | | 730 | | | | 730,142 | |

Series 2017-2, Class D, 3.49%, 07/17/23 | | | | | | | 200 | | | | 202,028 | |

SLM Private Education Loan Trust,Series 2011-B, Class A2, 3.74%, 02/15/29(d) | | | | | | | 15 | | | | 14,905 | |

SoFi Consumer Loan Program LLC, Class A(d): | | | | | | | | | | | | |

Series 2017-3, 2.77%, 05/25/26 | | | | | | | 211 | | | | 211,294 | |

Series 2017-4, 2.50%, 05/26/26 | | | | | | | 283 | | | | 282,537 | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | | |

| Asset-Backed Securities (continued) | | | | | | | | | |

SoFi Consumer Loan Program Trust,Series 2018-3, Class A1, 3.20%, 08/25/27(d) | | | USD | | | | 94 | | | $ | 93,761 | |

Trafigura Securitisation Finance PLC,Series 2017-1A, Class A1, 3.29%, 12/15/20 | | | | | | | 750 | | | | 749,642 | |

| | | | | | | | |

| |

Total Asset-Backed Securities — 8.6%

(Cost — $7,291,289) | | | | 7,341,401 | |

| | | | | | | | |

| | | |

Corporate Bonds — 43.1% | | | | | | | | | | | | |

| | | |

Aerospace & Defense — 0.4% | | | | | | | | | | | | |

Boeing Co., 3.60%, 05/01/34 | | | | | | | 200 | | | | 203,364 | |

Spirit AeroSystems, Inc., 3.95%, 06/15/23 | | | | | | | 125 | | | | 128,426 | |

| | | | | | | | |

| | | | | | | | | | | 331,790 | |

|

| Auto Components — 0.2% | |

Fiat Chrysler Automobiles NV, 4.50%, 04/15/20 | | | | | | | 200 | | | | 201,000 | |

| | | | | | | | |

|

| Automobiles — 0.2% | |

Ford Motor Co., 6.63%, 10/01/28 | | | | | | | 100 | | | | 109,442 | |

General Motors Co., 5.20%, 04/01/45 | | | | | | | 100 | | | | 90,588 | |

| | | | | | | | |

| | | | | | | | | | | 200,030 | |

|

| Banks — 6.4% | |

Barclays Bank PLC, 2.65%, 01/11/21 | | | | | | | 200 | | | | 199,652 | |

Capital One Financial Corp., 3.45%, 04/30/21 | | | | | | | 106 | | | | 107,460 | |

Capital One NA, 2.65%, 08/08/22 | | | | | | | 300 | | | | 299,839 | |

Citibank NA: | | | | | | | | | | | | |

2.84%, 05/20/22(e) | | | | | | | 250 | | | | 250,773 | |

3.65%, 01/23/24 | | | | | | | 250 | | | | 259,692 | |

Compass Bank, 3.50%, 06/11/21 | | | | | | | 250 | | | | 253,299 | |

Discover Bank, 3.10%, 06/04/20 | | | | | | | 1,000 | | | | 1,002,990 | |

HSBC Bank USA NA, 4.88%, 08/24/20 | | | | | | | 400 | | | | 409,796 | |

HSBC Holdings PLC: | | | | | | | | | | | | |

3.60%, 05/25/23 | | | | | | | 800 | | | | 819,073 | |

3.03%, 11/22/23(e) | | | | | | | 200 | | | | 200,326 | |

4.30%, 03/08/26 | | | | | | | 200 | | | | 209,850 | |

3.97%, 05/22/30(e) | | | | | | | 200 | | | | 202,309 | |

ING Groep NV, 4.10%, 10/02/23 | | | | | | | 200 | | | | 207,791 | |

Santander UK PLC, 3.75%, 11/15/21 | | | | | | | 200 | | | | 204,619 | |

SunTrust Bank, 2.80%, 05/17/22 | | | | | | | 200 | | | | 201,239 | |

Synchrony Bank, 3.65%, 05/24/21 | | | | | | | 250 | | | | 253,276 | |

Wells Fargo & Co., 3.75%, 01/24/24 | | | | | | | 100 | | | | 103,813 | |

Wells Fargo Bank NA(3 mo. LIBOR US + 0.61%), 2.90%, 05/27/22(c) | | | | | | | 250 | | | | 251,098 | |

| | | | | | | | |

| | | | | | | | | | | 5,436,895 | |

|

| Beverages — 0.3% | |

Keurig Dr. Pepper, Inc.(d): | | | | | | | | | | | | |

3.55%, 05/25/21 | | | | | | | 110 | | | | 111,684 | |

5.09%, 05/25/48 | | | | | | | 25 | | | | 26,694 | |

PepsiCo, Inc., 3.45%, 10/06/46 | | | | | | | 100 | | | | 98,534 | |

| | | | | | | | |

| | | | | | | | | | | 236,912 | |

|

| Biotechnology — 0.2% | |

Baxalta, Inc., 3.60%, 06/23/22 | | | | | | | 120 | | | | 121,820 | |

Celgene Corp., 3.45%, 11/15/27 | | | | | | | 31 | | | | 31,534 | |

| | | | | | | | |

| | | | | | | | | | | 153,354 | |

|

| Capital Markets — 1.8% | |

CME Group, Inc., 4.15%, 06/15/48 | | | | | | | 100 | | | | 108,659 | |

Goldman Sachs Group, Inc.: | | | | | | | | | | | | |

3.75%, 05/22/25 | | | | | | | 300 | | | | 307,102 | |

3.27%, 09/29/25(e) | | | | | | | 200 | | | | 199,828 | |

3.75%, 02/25/26 | | | | | | | 200 | | | | 203,954 | |

4.22%, 05/01/29(e) | | | | | | | 300 | | | | 311,760 | |

| | |

| 8 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (continued) May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Capital Markets (continued) | |

Morgan Stanley: | | | | | | | | | | | | |

2.75%, 05/19/22 | | | USD | | | | 200 | | | $ | 199,900 | |

3.88%, 01/27/26 | | | | | | | 200 | | | | 207,714 | |

4.43%, 01/23/30(e) | | | | | | | 40 | | | | 42,939 | |

| | | | | | | | |

| | | | | | | | | | | 1,581,856 | |

|

| Chemicals — 0.1% | |

DuPont de Nemours, Inc., 3.77%, 11/15/20 | | | | | | | 95 | | | | 96,543 | |

| | | | | | | | |

|

| Commercial Services & Supplies — 0.4% | |

Aviation Capital Group LLC, 6.75%, 04/06/21(d) | | | | | | | 300 | | | | 320,849 | |

Park Aerospace Holdings Ltd., 5.50%, 02/15/24(d) | | | | | | | 50 | | | | 52,416 | |

| | | | | | | | |

| | | | | | | | | | | 373,265 | |

|

| Communications Equipment — 0.2% | |

CommScope Technologies LLC, 5.00%, 03/15/27(d) | | | | | | | 50 | | | | 42,328 | |

Motorola Solutions, Inc., 4.60%, 02/23/28 | | | | | | | 137 | | | | 141,309 | |

| | | | | | | | |

| | | | | | | | | | | 183,637 | |

|

| Construction Materials — 0.1% | |

Allegion US Holding Co., Inc., 3.55%, 10/01/27 | | | | | | | 125 | | | | 121,351 | |

| | | | | | | | |

|

| Consumer Discretionary — 0.1% | |

Royal Caribbean Cruises Ltd., 2.65%, 11/28/20 | | | | | | | 65 | | | | 65,016 | |

| | | | | | | | |

|

| Consumer Finance — 2.0% | |

American Express Co., 2.75%, 05/20/22 | | | | | | | 200 | | | | 200,687 | |

Ford Motor Credit Co. LLC: | | | | | | | | | | | | |

2.43%, 06/12/20 | | | | | | | 245 | | | | 243,200 | |

3.16%, 08/04/20 | | | | | | | 500 | | | | 499,402 | |

Synchrony Financial, 2.70%, 02/03/20 | | | | | | | 600 | | | | 599,679 | |

Total System Services, Inc., 4.00%, 06/01/23 | | | | | | | 200 | | | | 207,272 | |

| | | | | | | | |

| | | | | | | | | | | 1,750,240 | |

|

| Containers & Packaging — 0.1% | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer, 7.00%, 07/15/24(d) | | | | | | | 100 | | | | 100,665 | |

| | | | | | | | |

|

| Diversified Financial Services — 5.4% | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 4.25%, 07/01/20 | | | | | | | 250 | | | | 253,798 | |

Bank of America Corp.: | | | | | | | | | | | | |

3.50%, 05/17/22(e) | | | | | | | 200 | | | | 202,909 | |

3.00%, 12/20/23(e) | | | | | | | 542 | | | | 544,055 | |

3.86%, 07/23/24(e) | | | | | | | 100 | | | | 103,533 | |

3.97%, 02/07/30(e) | | | | | | | 175 | | | | 181,342 | |

(3 mo. LIBOR US + 1.81%), 4.24%, 04/24/38(c) | | | | | | | 100 | | | | 104,640 | |

4.08%, 04/23/40(e) | | | | | | | 100 | | | | 102,455 | |

Brookfield Finance, Inc., 4.85%, 03/29/29 | | | | | | | 100 | | | | 106,579 | |

Citigroup, Inc.: | | | | | | | | | | | | |

3.35%, 04/24/25(e) | | | | | | | 165 | | | | 166,946 | |

4.65%, 07/23/48 | | | | | | | 100 | | | | 110,647 | |

General Motors Financial Co., Inc.: | | | | | | | | | | | | |

3.20%, 07/13/20 | | | | | | | 400 | | | | 401,136 | |

4.20%, 11/06/21 | | | | | | | 140 | | | | 142,730 | |

3.55%, 07/08/22 | | | | | | | 195 | | | | 195,947 | |

3.70%, 05/09/23 | | | | | | | 200 | | | | 200,023 | |

4.15%, 06/19/23 | | | | | | | 155 | | | | 156,618 | |

5.25%, 03/01/26 | | | | | | | 100 | | | | 104,727 | |

Intercontinental Exchange, Inc., 3.75%, 09/21/28 | | | | | | | 30 | | | | 31,546 | |

JPMorgan Chase & Co.: | | | | | | | | | | | | |

3.30%, 04/01/26 | | | | | | | 600 | | | | 607,166 | |

3.96%, 01/29/27(e) | | | | | | | 180 | | | | 187,714 | |

3.70%, 05/06/30(e) | | | | | | | 200 | | | | 204,528 | |

3.96%, 11/15/48(e) | | | | | | | 100 | | | | 101,021 | |

Lloyds Banking Group PLC, 4.45%, 05/08/25 | | | | | | | 200 | | | | 208,892 | |

Mitsubishi UFJ Financial Group, Inc., 3.54%, 07/26/21 | | | | | | | 45 | | | | 45,861 | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Diversified Financial Services (continued) | |

National Rural Utilities Cooperative Finance Corp., 3.70%, 03/15/29 | | | USD | | | | 100 | | | $ | 106,252 | |

ORIX Corp., 2.90%, 07/18/22 | | | | | | | 80 | | | | 80,463 | |

| | | | | | | | |

| | | | | | | | | | | 4,651,528 | |

|

| Diversified Telecommunication Services — 1.1% | |

AT&T, Inc.: | | | | | | | | | | | | |

4.45%, 04/01/24 | | | | | | | 115 | | | | 122,664 | |

3.95%, 01/15/25 | | | | | | | 200 | | | | 208,144 | |

4.35%, 03/01/29 | | | | | | | 100 | | | | 104,421 | |

4.85%, 03/01/39 | | | | | | | 80 | | | | 81,992 | |

Verizon Communications, Inc., 4.50%, 08/10/33 | | | | | | | 400 | | | | 432,124 | |

| | | | | | | | |

| | | | | | | | | | | 949,345 | |

|

| Electric Utilities — 1.8% | |

Berkshire Hathaway Energy Co., 4.45%, 01/15/49 | | | | | | | 100 | | | | 108,742 | |

Commonwealth Edison Co., 4.00%, 03/01/49 | | | | | | | 90 | | | | 93,633 | |

Consolidated Edison Co. of New York, Inc., Series A, 4.13%, 05/15/49 | | | | | | | 50 | | | | 51,894 | |

Duke Energy Ohio, Inc., 4.30%, 02/01/49 | | | | | | | 100 | | | | 108,733 | |

Eversource Energy, Series L, 2.90%, 10/01/24 | | | | | | | 170 | | | | 170,833 | |

Oncor Electric Delivery Co. LLC, 3.80%, 06/01/49(d) | | | | | | | 20 | | | | 20,488 | |

Public Service Co. of Colorado, 4.05%, 09/15/49 | | | | | | | 20 | | | | 21,396 | |

Public Service Electric & Gas Co., 3.00%, 05/15/27 | | | | | | | 500 | | | | 501,250 | |

Southern Co., 3.25%, 07/01/26 | | | | | | | 400 | | | | 399,636 | |

Virginia Electric & Power Co., Series C, 2.75%, 03/15/23 | | | | | | | 60 | | | | 60,381 | |

| | | | | | | | |

| | | | | | | | | | | 1,536,986 | |

|

| Electronic Equipment, Instruments & Components — 0.2% | |

Seagate HDD Cayman, 4.75%, 01/01/25 | | | | | | | 100 | | | | 99,211 | |

Tyco Electronics Group SA, 3.13%, 08/15/27 | | | | | | | 40 | | | | 40,000 | |

| | | | | | | | |

| | | | | | | | | | | 139,211 | |

|

| Energy Equipment & Services — 0.6% | |

CNOOC Finance 2013 Ltd., 3.00%, 05/09/23 | | | | | | | 500 | | | | 500,928 | |

| | | | | | | | |

|

| Equity Real Estate Investment Trusts (REITs) — 0.9% | |

EPR Properties, 4.95%, 04/15/28 | | | | | | | 200 | | | | 213,679 | |

Hospitality Properties Trust, 4.50%, 06/15/23 | | | | | | | 135 | | | | 139,509 | |

MPT Operating Partnership LP/MPT Finance Corp., 5.25%, 08/01/26 | | | | | | | 100 | | | | 100,810 | |

Omega Healthcare Investors, Inc., 4.95%, 04/01/24 | | | | | | | 300 | | | | 314,998 | |

| | | | | | | | |

| | | | | | | | | | | 768,996 | |

|

| Food & Staples Retailing — 0.5% | |

Lamb Weston Holdings, Inc., 4.88%, 11/01/26(d) | | | | | | | 100 | | | | 100,250 | |

McCormick & Co., Inc., 2.70%, 08/15/22 | | | | | | | 180 | | | | 179,821 | |

Mondelez International, Inc., 3.63%, 02/13/26 | | | | | | | 130 | | | | 134,313 | |

| | | | | | | | |

| | | | | | | | | | | 414,384 | |

|

| Food Products — 0.1% | |

Kraft Heinz Foods Co., 3.50%, 07/15/22 | | | | | | | 100 | | | | 101,572 | |

| | | | | | | | |

|

| Health Care Equipment & Supplies — 0.6% | |

Baxter International, Inc., 2.60%, 08/15/26 | | | | | | | 250 | | | | 244,141 | |

Becton Dickinson & Co., 2.89%, 06/06/22 | | | | | | | 105 | | | | 105,430 | |

Stryker Corp., 3.50%, 03/15/26 | | | | | | | 100 | | | | 103,086 | |

Zimmer Biomet Holdings, Inc., 3.70%, 03/19/23 | | | | | | | 55 | | | | 56,361 | |

| | | | | | | | |

| | | | | | | | | | | 509,018 | |

|

| Health Care Providers & Services — 1.1% | |

Anthem, Inc., 3.35%, 12/01/24 | | | | | | | 185 | | | | 188,459 | |

Cigna Corp., 3.75%, 07/15/23(d) | | | | | | | 130 | | | | 133,392 | |

HCA, Inc.: | | | | | | | | | | | | |

5.88%, 05/01/23 | | | | | | | 100 | | | | 106,188 | |

5.50%, 06/15/47 | | | | | | | 118 | | | | 124,012 | |

Humana, Inc., 2.90%, 12/15/22 | | | | | | | 155 | | | | 155,215 | |

MPH Acquisition Holdings LLC, 7.13%, 06/01/24(d) | | | | | | | 50 | | | | 49,750 | |

| | | | |

| SCHEDULE OF INVESTMENTS | | | 9 | |

| | |

Schedule of Investments (continued) May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Health Care Providers & Services (continued) | |

UnitedHealth Group, Inc., 3.10%, 03/15/26 | | | USD | | | | 150 | | | $ | 151,613 | |

| | | | | | | | |

| | | | | | | | | | | 908,629 | |

|

| Hotels, Restaurants & Leisure — 1.1% | |

GLP Capital LP/GLP Financing II, Inc.: | | | | | | | | | | | | |

5.38%, 11/01/23 | | | | | | | 100 | | | | 106,208 | |

5.25%, 06/01/25 | | | | | | | 100 | | | | 105,595 | |

5.38%, 04/15/26 | | | | | | | 170 | | | | 179,724 | |

5.75%, 06/01/28 | | | | | | | 50 | | | | 54,350 | |

5.30%, 01/15/29 | | | | | | | 150 | | | | 159,608 | |

KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC, 5.00%, 06/01/24(d) | | | | | | | 100 | | | | 101,250 | |

Starbucks Corp., 3.55%, 08/15/29 | | | | | | | 200 | | | | 203,291 | |

| | | | | | | | |

| | | | | | | | | | | 910,026 | |

|

| Household Durables — 0.1% | |

PulteGroup, Inc., 5.00%, 01/15/27 | | | | | | | 50 | | | | 50,500 | |

| | | | | | | | |

|

| Insurance — 0.7% | |

Aflac, Inc., 3.63%, 06/15/23 | | | | | | | 500 | | | | 522,083 | |

Marsh & McLennan Cos., Inc., 4.90%, 03/15/49 | | | | | | | 50 | | | | 56,369 | |

| | | | | | | | |

| | | | | | | | | | | 578,452 | |

|

| Interactive Media & Services — 0.1% | |

VeriSign, Inc., 4.75%, 07/15/27 | | | | | | | 100 | | | | 101,770 | |

| | | | | | | | |

|

| Internet & Direct Marketing Retail — 0.1% | |

Expedia Group, Inc., 3.80%, 02/15/28 | | | | | | | 100 | | | | 99,972 | |

| | | | | | | | |

|

| IT Services — 1.1% | |

Alibaba Group Holding Ltd., 4.50%, 11/28/34 | | | | | | | 300 | | | | 319,593 | |

Fidelity National Information Services, Inc., 3.75%, 05/21/29 | | | | | | | 30 | | | | 30,643 | |

First Data Corp., 5.00%, 01/15/24(d) | | | | | | | 200 | | | | 204,375 | |

International Business Machines Corp.: | | | | | | | | | | | | |

2.85%, 05/13/22 | | | | | | | 200 | | | | 201,536 | |

4.25%, 05/15/49 | | | | | | | 100 | | | | 101,794 | |

Mastercard, Inc., 2.95%, 06/01/29 | | | | | | | 70 | | | | 70,756 | |

| | | | | | | | |

| | | | | | | | | | | 928,697 | |

|

| Media — 3.3% | |

Charter Communications Operating LLC/Charter Communications Operating Capital: | | | | | | | | | | | | |

3.58%, 07/23/20 | | | | | | | 1,000 | | | | 1,008,368 | |

4.46%, 07/23/22 | | | | | | | 200 | | | | 207,273 | |

4.20%, 03/15/28 | | | | | | | 300 | | | | 301,201 | |

5.05%, 03/30/29 | | | | | | | 100 | | | | 106,753 | |

5.38%, 04/01/38 | | | | | | | 100 | | | | 102,310 | |

Comcast Corp.: | | | | | | | | | | | | |

4.15%, 10/15/28 | | | | | | | 200 | | | | 214,745 | |

4.70%, 10/15/48 | | | | | | | 100 | | | | 111,158 | |

Fox Corp. (d): | | | | | | | | | | | | |

4.03%, 01/25/24 | | | | | | | 65 | | | | 68,064 | |

4.71%, 01/25/29 | | | | | | | 55 | | | | 60,065 | |

Hughes Satellite Systems Corp., 6.63%, 08/01/26 | | | | | | | 50 | | | | 49,938 | |

Interpublic Group of Cos., Inc., 3.75%, 10/01/21 | | | | | | | 25 | | | | 25,577 | |

Nexstar Broadcasting, Inc., 5.63%, 08/01/24(d) | | | | | | | 50 | | | | 50,375 | |

Walt Disney Co., 6.15%, 02/15/41(d) | | | | | | | 50 | | | | 67,448 | |

Warner Media LLC, 4.05%, 12/15/23 | | | | | | | 400 | | | | 419,709 | |

| | | | | | | | |

| | | | | | | | | | | 2,792,984 | |

|

| Metals & Mining — 0.2% | |

Rio Tinto Finance USA PLC, 4.13%, 08/21/42 | | | | | | | 25 | | | | 26,610 | |

Vale Overseas Ltd., 6.88%, 11/21/36 | | | | | | | 100 | | | | 112,000 | |

| | | | | | | | |

| | | | | | | | | | | 138,610 | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Multi-Utilities — 1.0% | |

Dominion Energy, Inc.: | | | | | | | | | | | | |

2.58%, 07/01/20 | | | USD | | | | 40 | | | $ | 39,880 | |

3.90%, 10/01/25 | | | | | | | 500 | | | | 525,114 | |

DTE Energy Co., Series D, 3.70%, 08/01/23 | | | | | | | 75 | | | | 77,760 | |

Sempra Energy: | | | | | | | | | | | | |

2.90%, 02/01/23 | | | | | | | 30 | | | | 30,010 | |

3.75%, 11/15/25 | | | | | | | 200 | | | | 204,001 | |

| | | | | | | | |

| | | | | | | | | | | 876,765 | |

|

| Office Supplies & Equipment — 0.7% | |

VMware, Inc.: | | | | | | | | | | | | |

2.30%, 08/21/20 | | | | | | | 80 | | | | 79,607 | |

2.95%, 08/21/22 | | | | | | | 250 | | | | 249,875 | |

3.90%, 08/21/27 | | | | | | | 300 | | | | 296,351 | |

| | | | | | | | |

| | | | | | | | | | | 625,833 | |

|

| Oil, Gas & Consumable Fuels — 2.3% | |

Cheniere Corpus Christi Holdings LLC, 5.88%, 03/31/25 | | | | | | | 100 | | | | 107,500 | |

Energy Transfer Operating LP, 7.50%, 10/15/20 | | | | | | | 200 | | | | 212,253 | |

ONEOK, Inc.: | | | | | | | | | | | | |

4.00%, 07/13/27 | | | | | | | 225 | | | | 227,520 | |

4.55%, 07/15/28 | | | | | | | 300 | | | | 316,050 | |

4.35%, 03/15/29 | | | | | | | 300 | | | | 310,084 | |

Petroleos Mexicanos, 6.75%, 09/21/47 | | | | | | | 100 | | | | 90,280 | |

Sabine Pass Liquefaction LLC: | | | | | | | | | | | | |

5.75%, 05/15/24 | | | | | | | 200 | | | | 219,622 | |

5.88%, 06/30/26 | | | | | | | 50 | | | | 55,544 | |

5.00%, 03/15/27 | | | | | | | 214 | | | | 228,317 | |

4.20%, 03/15/28 | | | | | | | 86 | | | | 86,932 | |

Shell International Finance BV, 4.00%, 05/10/46 | | | | | | | 75 | | | | 78,652 | |

TransCanada PipeLines Ltd., 4.88%, 05/15/48 | | | | | | | 47 | | | | 49,333 | |

| | | | | | | | |

| | | | | | | | | | | 1,982,087 | |

|

| Pharmaceuticals — 0.8% | |

AstraZeneca PLC, 3.50%, 08/17/23 | | | | | | | 200 | | | | 205,824 | |

Bausch Health Cos., Inc., 6.13%, 04/15/25(d) | | | | | | | 50 | | | | 48,719 | |

GlaxoSmithKline Capital PLC, 3.38%, 06/01/29 | | | | | | | 300 | | | | 308,856 | |

Zoetis, Inc., 3.90%, 08/20/28 | | | | | | | 125 | | | | 130,485 | |

| | | | | | | | |

| | | | | | | | | | | 693,884 | |

|

| Professional Services — 0.7% | |

IHS Markit Ltd.: | | | | | | | | | | | | |

4.13%, 08/01/23 | | | | | | | 148 | | | | 152,292 | |

4.75%, 08/01/28 | | | | | | | 45 | | | | 47,655 | |

4.25%, 05/01/29 | | | | | | | 100 | | | | 101,290 | |

Verisk Analytics, Inc.: | | | | | | | | | | | | |

4.00%, 06/15/25 | | | | | | | 200 | | | | 211,007 | |

4.13%, 03/15/29 | | | | | | | 50 | | | | 52,622 | |

| | | | | | | | |

| | | | | | | | | | | 564,866 | |

|

| Road & Rail — 0.3% | |

Canadian National Railway Co., 3.65%, 02/03/48 | | | | | | | 200 | | | | 203,122 | |

Ryder System, Inc., 2.88%, 06/01/22 | | | | | | | 40 | | | | 40,275 | |

| | | | | | | | |

| | | | | | | | | | | 243,397 | |

|

| Semiconductors & Semiconductor Equipment — 2.5% | |

Broadcom Corp./Broadcom Cayman Finance Ltd.: | | | | | | | | | | | | |

3.63%, 01/15/24 | | | | | | | 700 | | | | 693,005 | |

3.88%, 01/15/27 | | | | | | | 100 | | | | 95,096 | |

Broadcom, Inc., 4.25%, 04/15/26(d) | | | | | | | 200 | | | | 197,518 | |

Maxim Integrated Products, Inc., 3.38%, 03/15/23 | | | | | | | 1,000 | | | | 1,015,428 | |

QUALCOMM, Inc., 3.25%, 05/20/27 | | | | | | | 100 | | | | 99,830 | |

| | | | | | | | |

| | | | | | | | | | | 2,100,877 | |

| | |

| 10 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (continued) May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Software — 0.2% | |

CDK Global, Inc.: | | | | | | | | | | | | |

5.88%, 06/15/26 | | | USD | | | | 20 | | | $ | 20,700 | |

4.88%, 06/01/27 | | | | | | | 60 | | | | 58,725 | |

MSCI, Inc., 4.75%, 08/01/26(d) | | | | | | | 100 | | | | 101,970 | |

| | | | | | | | |

| | | | | | | | | | | 181,395 | |

|

| Specialty Retail — 0.2% | |

Dollar Tree, Inc., 4.20%, 05/15/28 | | | | | | | 200 | | | | 202,134 | |

| | | | | | | | |

|

| Technology Hardware, Storage & Peripherals — 0.4% | |

Dell International LLC/EMC Corp.(d): | | | | | | | | | | | | |

4.00%, 07/15/24 | | | | | | | 200 | | | | 201,049 | |

5.30%, 10/01/29 | | | | | | | 49 | | | | 50,122 | |

8.35%, 07/15/46 | | | | | | | 100 | | | | 122,072 | |

| | | | | | | | |

| | | | | | | | | | | 373,243 | |

|

| Tobacco — 0.4% | |

Altria Group, Inc.: | | | | | | | | | | | | |

3.49%, 02/14/22 | | | | | | | 30 | | | | 30,535 | |

5.80%, 02/14/39 | | | | | | | 100 | | | | 108,312 | |

Philip Morris International, Inc.: | | | | | | | | | | | | |

6.38%, 05/16/38 | | | | | | | 100 | | | | 127,680 | |

4.25%, 11/10/44 | | | | | | | 100 | | | | 100,333 | |

| | | | | | | | |

| | | | | | | | | | | 366,860 | |

|

| Water Utilities — 0.1% | |

Aqua America, Inc., 3.57%, 05/01/29 | | | | | | | 60 | | | | 61,147 | |

| | | | | | | | |

|

| Wireless Telecommunication Services — 2.0% | |

American Tower Corp.: | | | | | | | | | | | | |

3.50%, 01/31/23 | | | | | | | 500 | | | | 511,671 | |

4.40%, 02/15/26 | | | | | | | 400 | | | | 421,237 | |

Crown Castle International Corp.: | | | | | | | | | | | | |

5.25%, 01/15/23 | | | | | | | 600 | | | | 644,777 | |

3.20%, 09/01/24 | | | | | | | 125 | | | | 125,179 | |

Sprint Communications, Inc., 6.00%, 11/15/22 | | | | | | | 50 | | | | 51,016 | |

| | | | | | | | |

| | | | | | | | | | | 1,753,880 | |

| | | | | | | | |

| |

Total Corporate Bonds — 43.1%

(Cost — $36,130,168) | | | | 36,940,530 | |

| | | | | | | | |

|

Floating Rate Loan Interests(c) — 0.0% | |

|

Pharmaceuticals — 0.0% | |

Valeant Pharmaceuticals International, Inc., 2018 Term Loan B, (1 mo. LIBOR + 3.00%), 5.47%, 06/02/25 | | | | | | | 15 | | | | 14,716 | |

| | | | | | | | |

| |

Total Floating Rate Loan Interests — 0.0%

(Cost — $14,774) | | | | 14,716 | |

| | | | | | | | |

|

Foreign Agency Obligations — 1.3% | |

Colombia Government International Bond: | | | | | | | | | | | | |

4.50%, 01/28/26 | | | | | | | 200 | | | | 210,700 | |

3.88%, 04/25/27 | | | | | | | 200 | | | | 202,700 | |

Indonesia Government International Bond, 3.50%, 01/11/28 | | | | | | | 200 | | | | 197,000 | |

Mexico Government International Bond, 4.15%, 03/28/27 | | | | | | | 375 | | | | 382,500 | |

Uruguay Government International Bond: | | | | | | | | | | | | |

4.38%, 01/23/31 | | | | | | | 55 | | | | 57,735 | |

4.98%, 04/20/55 | | | | | | | 50 | | | | 52,675 | |

| | | | | | | | |

| |

Total Foreign Agency Obligations — 1.3%

(Cost — $1,076,841) | | | | 1,103,310 | |

| | | | | | | | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

Municipal Bonds — 0.8% | |

Bay Area Toll Authority, RB, Build America Bonds, San Francisco Toll Bridge,Series S-1, 6.92%, 04/01/40 | | | USD | | | | 50 | | | $ | 71,855 | |

New Jersey State Turnpike Authority, RB, Build America Bonds, Series A, 7.10%, 01/01/41 | | | | | | | 50 | | | | 74,749 | |

Port Authority of New York & New Jersey, ARB, 192nd Series, 4.81%, 10/15/65 | | | | | | | 50 | | | | 62,721 | |

Port Authority of New York & New Jersey, RB, 191th Series, 4.82%, 06/01/45 | | | | | | | 200 | | | | 218,156 | |

State of California, GO, Build America Bonds, Various Purpose, 7.55%, 04/01/39 | | | | | | | 25 | | | | 39,176 | |

State of Illinois, GO, Pension, 5.10%, 06/01/33 | | | | | | | 30 | | | | 30,953 | |

University of California, Refunding RB, Series J, 4.13%, 05/15/45 | | | | | | | 150 | | | | 164,768 | |

| | | | | | | | |

| |

Total Municipal Bonds — 0.8%

(Cost — $607,729) | | | | 662,378 | |

| | | | | | | | |

|

Non-Agency Mortgage-Backed Securities — 2.8% | |

|

Collateralized Mortgage Obligations — 1.7% | |

American Home Mortgage Investment Trust,Series 2004-3, Class 4A, (6 mo. LIBOR US + 1.50%), 4.14%, 10/25/34(c) | | | | | | | 60 | | | | 60,128 | |

Bear Stearns Alternative A Trust,Series 2004-13, Class A2, (1 mo. LIBOR US + 0.88%), 3.31%, 11/25/34(c) | | | | | | | 5 | | | | 4,744 | |

Citigroup Mortgage Loan Trust,Series 2013-A, Class A, 3.00%, 05/25/42(d)(e) | | | | | | | 25 | | | | 25,116 | |

Connecticut Avenue Securities Trust,Series 2019-R03, Class 1M1, 3.18%, 09/25/31(d)(e) | | | | | | | 346 | | | | 346,183 | |

Credit Suisse First Boston Mortgage Securities Corp.,Series 2004-6, Class 3A1, 5.00%, 09/25/19 | | | | | | | 8 | | | | 7,270 | |

Credit Suisse Mortgage Capital Certificates,Series 2009-15R, Class 3A1, 5.16%, 03/26/36(d)(e) | | | | | | | 27 | | | | 27,632 | |

Fannie Mae Connecticut Avenue Securities,Series 2017-C06, Class 1M2A, 5.08%, 02/25/30(e) | | | | | | | 430 | | | | 440,436 | |

Freddie Mac STACR Trust, Series 2019-HQA2, Class M1, 3.13%, 04/25/49(d)(e) | | | | | | | 260 | | | | 260,260 | |

STACR Trust, Series 2018-HRP1, Class M2, 4.08%, 04/25/43(d)(e) | | | | | | | 207 | | | | 207,877 | |

Wells Fargo Mortgage-Backed Securities Trust: | | | | | | | | | | | | |

Series 2004-W, Class A9, 4.85%, 11/25/34(e) | | | | | | | 39 | | | | 39,925 | |

Series 2007-3, Class 3A1, 5.50%, 04/25/22 | | | | | | | 4 | | | | 4,252 | |

| | | | | | | | |

| | | | | | | | | | | 1,423,823 | |

| Commercial Mortgage-Backed Securities — 1.1% | |

Citigroup Commercial Mortgage Trust,Series 2006-C5, Class AJ, 5.48%, 10/15/49 | | | | | | | 25 | | | | 24,731 | |

Core Industrial Trust, Series 2015-CALW, Class A, 3.04%, 02/10/34(d) | | | | | | | 380 | | | | 386,298 | |

Eleven Madison Avenue Mortgage Trust, Series 2015-11MD, Class A, 3.67%, 09/10/35(d)(e) | | | | | | | 150 | | | | 157,635 | |

GE Commercial Mortgage Corp.,Series 2007-C1, Class AM, 5.61%, 12/10/49(e) | | | | | | | 66 | | | | 55,289 | |

Greenwich Capital Commercial Funding Corp. Commercial Mortgage Trust,Series 2006-GG7, Class AM, 5.83%, 07/10/38(e) | | | | | | | 47 | | | | 46,838 | |

JPMBB Commercial Mortgage Securities Trust,Series 2014-C22, Class A4, 3.80%, 09/15/47 | | | | | | | 200 | | | | 210,746 | |

JPMorgan Chase Commercial Mortgage Securities Trust, Series 2006-CB16, Class B, 5.67%, 05/12/45(e) | | | | | | | 210 | | | | 11,185 | |

Wells Fargo Commercial Mortgage Trust, Series 2014-LC16, Class A5, 3.82%, 08/15/50 | | | | | | | 90 | | | | 94,750 | |

| | | | | | | | |

| | | | | | | | | | | 987,472 | |

| | | | | | | | |

| |

TotalNon-Agency Mortgage-Backed Securities — 2.8%

(Cost — $2,538,625) | | | | 2,411,295 | |

| | | | | | | | |

| | | | |

| SCHEDULE OF INVESTMENTS | | | 11 | |

| | |

Schedule of Investments (continued) May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

U.S. Government Sponsored Agency Securities — 40.5% | |

|

Collateralized Mortgage Obligations — 6.4% | |

Fannie Mae Connecticut Avenue Securities: | | | | | | | | | | | | |

Series 2017-C05, Class 1M2A, (1 mo. LIBOR US + 2.20%), 4.63%, 01/25/30(c) | | | USD | | | | 250 | | | $ | 253,408 | |

Series 2017-C07, Class 2M2A, 4.93%, 05/25/30(e) | | | | | | | 250 | | | | 257,274 | |

Series 2014-C03, Class 2M2, (1 mo. LIBOR US + 2.90%), 5.33%, 07/25/24(c) | | | | | | | 88 | | | | 93,124 | |

Series 2016-C05, Class 2M2, (1 mo. LIBOR US + 4.45%), 6.88%, 01/25/29(c) | | | | | | | 120 | | | | 129,471 | |

Series 2015-C01, Class 2M2, (1 mo. LIBOR US + 4.55%), 6.98%, 02/25/25(c) | | | | | | | 367 | | | | 389,617 | |

Series 2014-C04, Class 1M2, (1 mo. LIBOR US + 4.90%), 7.33%, 11/25/24(c) | | | | | | | 81 | | | | 91,383 | |

Series 2014-C04, Class 1M2, (1 mo. LIBOR US + 5.00%), 7.43%, 11/25/24(c) | | | | | | | 148 | | | | 163,902 | |

Freddie Mac Structured Agency Credit Risk Debt Notes: | | | | | | | | | | | | |

Series 2016-DNA1, Class M2, (1 mo. LIBOR US + 2.90%), 5.38%, 07/25/28(c) | | | | | | | 144 | | | | 145,634 | |

Series 2017-DNA3, Class M1, 3.18%, 03/25/30(e) | | | | | | | 311 | | | | 311,191 | |

Series 2016-HQA3, Class M2, (1 mo. LIBOR US + 1.35%), 3.78%, 03/25/29(c) | | | | | | | 241 | | | | 242,155 | |

Series 2014-DN1, Class M2, (1 mo. LIBOR US + 2.20%), 4.63%, 02/25/24(c) | | | | | | | 139 | | | | 141,018 | |

Series 2016-DNA2, Class M2, (1 mo. LIBOR US + 2.20%), 4.63%, 10/25/28(c) | | | | | | | 296 | | | | 297,182 | |

Series 2016-HQA2, Class M2, (1 mo. LIBOR US + 2.25%), 4.68%, 11/25/28(c) | | | | | | | 429 | | | | 434,611 | |

Series 2015-HQA1, Class M2, (1 mo. LIBOR US + 2.65%), 5.08%, 03/25/28(c) | | | | | | | 367 | | | | 372,052 | |

Series 2015-HQA2, Class M2, (1 mo. LIBOR US + 2.80%), 5.23%, 05/25/28(c) | | | | | | | 86 | | | | 87,484 | |

Series 2015-DNA3, Class M2, (1 mo. LIBOR US + 2.85%), 5.28%, 04/25/28(c) | | | | | | | 501 | | | | 513,076 | |

Series 2015-HQ1, Class M3, (1 mo. LIBOR US + 3.80%), 6.23%, 03/25/25(c) | | | | | | | 916 | | | | 957,403 | |

Series 2015-DN1, Class M3, (1 mo. LIBOR US + 4.15%), 6.58%, 01/25/25(c) | | | | | | | 352 | | | | 372,718 | |

Series 2014-DN4, Class M3, (1 mo. LIBOR US + 4.55%), 6.98%, 10/25/24(c) | | | | | | | 173 | | | | 188,405 | |

| | | | | | | | |

| | | | | | | | | | | 5,441,108 | |

|

| Commercial Mortgage-Backed Securities — 0.9% | |

Freddie Mac Multifamily Structured Pass-Through Certificates, Class A2: | | | | | | | | | | | | |

Series K057, 2.57%, 07/25/26 | | | | | | | 250 | | | | 250,786 | |

Series K062, 3.41%, 12/25/26 | | | | | | | 520 | | | | 550,492 | |

| | | | | | | | |

| | | | | | | | | | | 801,278 | |

| | | |

| Mortgage-Backed Securities — 33.2% | | | | | | | | | |

Fannie Mae Mortgage-Backed Securities: | | | | | | | | | | | | |

(11th District Cost of Funds + 1.25%), 2.42%, 09/01/34(c) | | | | | | | 174 | | | | 173,013 | |

3.00%, 03/01/45 - 08/01/47 | | | | | | | 527 | | | | 530,463 | |

3.50%, 02/01/45 - 11/01/51(g) | | | | | | | 3,206 | | | | 3,289,972 | |

(6 mo. LIBOR US + 1.19%), 3.88%, 05/01/33(c) | | | | | | | 7 | | | | 6,956 | |

4.00%, 06/01/34 - 06/01/49(g) | | | | | | | 3,790 | | | | 3,912,712 | |

(6 mo. LIBOR US + 1.36%), 4.14%, 10/01/32(c) | | | | | | | 27 | | | | 27,810 | |

(12 mo. LIBOR US + 1.37%), 4.38%, 04/01/35(c) | | | | | | | 96 | | | | 99,353 | |

4.50%, 02/01/48 - 06/01/49(f)(g) | | | | | | | 4,433 | | | | 4,706,634 | |

(1 year CMT + 1.94%), 4.56%, 04/01/35(c) | | | | | | | 16 | | | | 16,017 | |

5.00%, 08/01/35 - 04/01/48 | | | | | | | 960 | | | | 1,014,835 | |

5.50%, 11/01/34 - 01/01/47 | | | | | | | 958 | | | | 1,055,475 | |

6.00%, 06/01/21 - 09/01/38 | | | | | | | 233 | | | | 258,081 | |

6.50%, 01/01/36 | | | | | | | 18 | | | | 19,664 | |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Mortgage-Backed Securities (continued) | |

Freddie Mac Mortgage-Backed Securities: | | | | | | | | | | | | |

(11th District Cost of Funds + 1.25%), 2.21%, 11/01/27(c) | | | USD | | | | 88 | | | $ | 87,702 | |

3.00%, 08/01/46 - 06/01/47 | | | | | | | 230 | | | | 233,260 | |

3.50%, 10/01/42 - 04/01/49(g) | | | | | | | 1,679 | | | | 1,718,789 | |

4.00%, 06/01/46 - 08/01/46 | | | | | | | 5,757 | | | | 5,974,187 | |

4.50%, 09/01/20 - 10/01/48 | | | | | | | 53 | | | | 56,969 | |

(12 mo. LIBOR US + 1.79%), 4.54%, 09/01/32(c) | | | | | | | 3 | | | | 3,078 | |

(1 year CMT + 2.34%), 4.95%, 04/01/32(c) | | | | | | | 34 | | | | 35,579 | |

5.00%, 07/01/23 - 07/01/48 | | | | | | | 572 | | | | 590,118 | |

5.50%, 11/01/37 | | | | | | | 1 | | | | 936 | |

6.00%, 10/01/21 - 04/01/38 | | | | | | | 28 | | | | 29,700 | |

6.50%, 09/01/38 | | | | | | | 1 | | | | 753 | |

Ginnie Mae Mortgage-Backed Securities: | | | | | | | | | | | | |

3.00%, 06/01/40 - 12/20/47(g) | | | | | | | 562 | | | | 572,124 | |

3.50%, 10/20/42 - 06/01/49(g) | | | | | | | 2,467 | | | | 2,538,608 | |

4.00%, 07/20/47 - 06/01/49(g) | | | | | | | 398 | | | | 411,321 | |

4.50%, 04/20/48 - 01/20/49 | | | | | | | 247 | | | | 256,885 | |

5.00%, 05/20/48 | | | | | | | 686 | | | | 716,536 | |

6.50%, 12/20/37 - 07/15/38 | | | | | | | 75 | | | | 87,584 | |

| | | | | | | | |

| | | | | | | | | | | 28,425,114 | |

| | | | | | | | |

| |

Total U.S. Government Sponsored Agency Securities — 40.5%

(Cost — $34,450,503) | | | | 34,667,500 | |

| | | | | | | | |

|

U.S. Treasury Obligations — 4.3% | |

U.S. Treasury Notes: | | | | | | | | | | | | |

2.50%, 05/31/20 | | | | | | | 2,000 | | | | 2,004,844 | |

2.38%, 04/15/21 | | | | | | | 1,000 | | | | 1,007,070 | |

2.13%, 03/31/24 | | | | | | | 500 | | | | 504,141 | |

2.63%, 02/15/29 | | | | | | | 138 | | | | 143,795 | |

| | | | | | | | |

| |

Total U.S. Treasury Obligations — 4.3%

(Cost — $3,633,379) | | | | 3,659,850 | |

| | | | | | | | |

| |

Total Long-Term Investments — 101.4%

(Cost — $85,743,308) | | | | 86,800,980 | |

| | | | | | | | |

| | | |

| | | | | | Shares | | | | |

|

Short-Term Securities — 3.4% | |

|

| Money Market Funds — 3.3% | |

BlackRock Liquidity Funds,T-Fund, Institutional Class, 2.29%(h)(i) | | | | | | | 2,856,428 | | | | 2,856,428 | |

| | | | | | | | |

| |

Total Money Market — 3.3%

(Cost — $2,856,428) | | | | 2,856,428 | |

| | | | | | | | |

| | | |

| | | | | | Par

(000) | | | | |

|

Time Deposits — 0.1% | |

|

| Europe — 0.1% | |

BNP Paribas SA, (0.57%), 06/03/19 | | | EUR | | | | 59 | | | | 65,583 | |

| | | | | | | | |

| |

Total Time Deposits — 0.1%

(Cost — $65,583) | | | | 65,583 | |

| | | | | | | | |

| |

Total Short-Term Securities — 3.4%

(Cost — $2,922,011) | | | | 2,922,011 | |

| | | | | | | | |

| |

Total Investments Before TBA Sale Commitments — 104.8%

(Cost — $88,665,319) | | | | 89,722,991 | |

| | | | | | | | |

| | |

| 12 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (continued) May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| TBA Sale Commitments — (0.2%) | |

|

Mortgage-Backed Securities — (0.2%) | |

Fannie Mae Mortgage-Backed Securities, 4.50%, 06/13/49(g) | | | USD | | | | 125 | | | $ | (130,586 | ) |

Ginnie Mae Mortgage-Backed Securities, 4.50%, 06/20/49(g) | | | | | | | 29 | | | | (30,159 | ) |

| | | | | | | | |

| |

Total TBA Sale Commitments — (0.2)%

(Proceeds — $160,353) | | | | (160,745 | ) |

| | | | | | | | |

| |

Total Investments, Net of TBA Sale Commitments — 104.6%

(Cost — $88,504,966) | | | | 89,562,246 | |

| |

Liabilities in Excess of Other Assets — (4.6)% | | | | (3,917,843 | ) |

| | | | | | | | |

| |

Net Assets — 100.0% | | | $ | 85,644,403 | |

| | | | | | | | |

| (a) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| (b) | Non-income producing security. |

| (c) | Floating rate security. Rate shown is the rate in effect as of period end. |

| (d) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (e) | Variable or floating rate security, which interest rate adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. Rate shown is the rate in effect as of period end. |

| (f) | When-issued security. |

| (g) | Represents or includes a TBA transaction. |

| (h) | Annualized7-day yield as of period end. |

| (i) | During the year ended May 31, 2019, investments in issuers considered to be an affiliate/affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares

Held at

05/31/18 | | | Net

Activity | | | Shares

Held at

05/31/19 | | | Value at

05/31/19 | | | Income | | | Net

Realized

Gain (Loss) (a) | | | Change in

Unrealized

Appreciation

(Depreciation) | |

BlackRock Liquidity Funds,T-Fund, Institutional Class | | | 1,425,386 | | | | 1,431,042 | | | | 2,856,428 | | | $ | 2,856,428 | | | $ | 106,136 | | | $ | — | | | $ | — | |

| | (a) | Includes net capital gain distributions, if applicable. | |

For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industrysub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industrysub-classifications for reporting ease.

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount (000) | | | Value /

Unrealized

Appreciation

(Depreciation) | |

| Long Contracts: | | | | | | | | | | | | |

10-Year U.S. Treasury Note | | | 10 | | | | 09/19/19 | | | $ | 1,268 | | | $ | 9,916 | |

10-Year U.S. Ultra Long Treasury Note | | | 2 | | | | 09/19/19 | | | | 273 | | | | 5,669 | |

Long U.S. Treasury Bond | | | 18 | | | | 09/19/19 | | | | 2,767 | | | | 55,194 | |

Ultra Long U.S. Treasury Bond | | | 38 | | | | 09/19/19 | | | | 6,680 | | | | 186,833 | |

2-Year U.S. Treasury Note | | | 11 | | | | 09/30/19 | | | | 2,361 | | | | 9,479 | |

5-Year U.S. Treasury Note | | | 43 | | | | 09/30/19 | | | | 5,047 | | | | 40,328 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 307,419 | |

| | | | | | | | | | | | | | | | |

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statement of Assets and Liabilities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Currency

Exchange

Contracts | | | Interest

Rate

Contracts | | | Other

Contracts | | | Total | |

Assets — Derivative Financial Instruments | |

Futures contracts | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net unrealized appreciation(a) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 307,419 | | | $ | — | | | $ | 307,419 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Includes cumulative appreciation on futures contracts, as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. | |

| | | | |

| SCHEDULE OF INVESTMENTS | | | 13 | |

| | |

Schedule of Investments (continued) May 31, 2019 | | FDP BlackRock CoreAlpha Bond Fund |

For the year ended May 31, 2019, the effect of derivative financial instruments in the Statement of Operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Currency

Exchange

Contracts | | | Interest

Rate

Contracts | | | Other

Contracts | | | Total | |

Net Realized Gain (Loss) from: | | | | | | | | | | | | | |

Futures contracts | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 680,584 | | | $ | — | | | $ | 680,584 | |

Swaps | | | — | | | | — | | | | — | | | | — | | | | — | | | | 71,017 | | | | 71,017 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 680,584 | | | $ | 71,017 | | | $ | 751,601 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Net Change in Unrealized Appreciation (Depreciation) on: | |

Futures contracts | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 338,170 | | | $ | — | | | $ | 338,170 | |

Swaps | | | — | | | | — | | | | — | | | | — | | | | — | | | | (45,271 | ) | | | (45,271 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 338,170 | | | $ | (45,271 | ) | | $ | 292,899 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| | | | |

Futures contracts: | | | | |

Average notional value of contracts — long | | $ | 17,533,727 | |

Average notional value of contracts — short | | $ | 422,875 | |

Inflation swaps | | | | |

Average notional amount — pays | | $ | 452,500 | |

Average notional amount — receives | | $ | 477,500 | |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of investments and derivative financial instruments. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, refer to the Notes to Financial Statements.

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Common Stocks | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Asset-Backed Securities | | | — | | | | 7,341,401 | | | | — | | | | 7,341,401 | |

Corporate Bonds | | | — | | | | 36,940,530 | | | | — | | | | 36,940,530 | |

Floating Rate Loan Interests | | | — | | | | 14,716 | | | | — | | | | 14,716 | |

Foreign Agency Obligations | | | — | | | | 1,103,310 | | | | — | | | | 1,103,310 | |

Municipal Bonds | | | — | | | | 662,378 | | | | — | | | | 662,378 | |

Non-Agency Mortgage-Backed Securities | | | — | | | | 2,411,295 | | | | — | | | | 2,411,295 | |

U.S. Government Sponsored Agency Securities | | | — | | | | 34,667,500 | | | | — | | | | 34,667,500 | |

U.S. Treasury Obligations | | | — | | | | 3,659,850 | | | | — | | | | 3,659,850 | |

Short-Term Securities: | | | | | | | | | | | | | | | | |

Money Market Funds | | | 2,856,428 | | | | — | | | | — | | | | 2,856,428 | |

Time Deposits | | | — | | | | 65,583 | | | | — | | | | 65,583 | |

Liabilities: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

TBA Sale Commitments | | | — | | | | (160,745 | ) | | | — | | | | (160,745 | ) |

| | | | | | | | | | | | | | | | |

| | $ | 2,856,428 | | | $ | 86,705,818 | | | $ | — | | | $ | 89,562,246 | |

| | | | | | | | | | | | | | | | |

Derivative Financial Instruments(a) | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Interest rate contracts | | $ | 307,419 | | | $ | — | | | $ | — | | | $ | 307,419 | |

| | | | | | | | | | | | | | | | |

| | (a) | Derivative financial instruments are future contracts. Future contracts are valued at the unrealized appreciation (depreciation) on the investments. | |

See notes to financial statements.

| | |

| 14 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

Statement of Assets and Liabilities

May 31, 2019

| | | | |

| | | FDP BlackRock

CoreAlpha Bond

Fund | |

|

ASSETS | |

Investments at value — unaffiliated (cost — $85,808,891) | | $ | 86,866,563 | |

Investments at value — affiliated (cost — $2,856,428) | | | 2,856,428 | |

Cash pledged for futures contracts | | | 213,000 | |

Foreign currency at value (cost — $51,761) | | | 50,243 | |

Receivables: | | | | |

Investments sold | | | 368,841 | |

TBA sale commitments | | | 160,353 | |

Capital shares sold | | | 163,418 | |

Dividends — affiliated | | | 5,980 | |

Interest — unaffiliated | | | 483,526 | |

Principal paydowns | | | 1,127 | |

Variation margin on futures contracts | | | 133,364 | |

Prepaid expenses | | | 15,348 | |

| | | | |

Total assets | | | 91,318,191 | |

| | | | |

|

LIABILITIES | |

TBA sale commitments at value (proceeds — $160,353) | | | 160,745 | |

Payables: | | | | |

Investments purchased | | | 4,899,328 | |

Capital shares redeemed | | | 158,816 | |

Income dividend distributions | | | 210,631 | |

Investment advisory fees | | | 22,973 | |

Directors’ and Officer’s fees | | | 407 | |

Other accrued expenses | | | 191,603 | |

Other affiliates | | | 276 | |

Service and distribution fees | | | 29,009 | |

| | | | |

Total liabilities | | | 5,673,788 | |

| | | | |

| |

NET ASSETS | | $ | 85,644,403 | |

| | | | |

|

NET ASSETS CONSIST OF | |

Paid-in capital | | $ | 88,607,053 | |

Accumulated loss | | | (2,962,650 | ) |

| | | | |

NET ASSETS | | $ | 85,644,403 | |

| | | | |

|

NET ASSET VALUE | |

Institutional — Based on net assets of $4,266,672 and 418,185 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 10.20 | |

| | | | |

Investor A — Based on net assets of $56,062,474 and 5,492,979 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 10.21 | |

| | | | |

Investor C — Based on net assets of $25,315,257 and 2,480,047 shares outstanding, 100 million shares authorized, $0.10 par value | | $ | 10.21 | |

| | | | |

See notes to financial statements.

Statement of Operations

Year Ended May 31, 2019

| | | | |

| | | FDP BlackRock

CoreAlpha Bond

Fund | |

|

INVESTMENT INCOME | |

Interest — unaffiliated | | $ | 3,138,422 | |

Dividends — affiliated | | | 106,136 | |

| | | | |

Total investment income | | | 3,244,558 | |

| | | | |

|

EXPENSES | |

Service and distribution — class specific | | | 374,764 | |

Investment advisory | | | 365,294 | |

Transfer agent — class specific | | | 99,073 | |

Professional | | | 81,532 | |

Board realignment and consolidation | | | 73,048 | |

Registration | | | 46,114 | |

Accounting services | | | 24,555 | |

Printing | | | 19,817 | |

Directors and Officer | | | 6,500 | |

Custodian | | | 5,361 | |

Miscellaneous | | | 41,742 | |

| | | | |

Total expenses | | | 1,137,800 | |

Less: | | | | |

Fees waived and/or reimbursed by the Manager | | | (149,443 | ) |

Fees paid indirectly | | | (96 | ) |

| | | | |

Total expenses after fees waived and/or reimbursed and paid indirectly | | | 988,261 | |

| | | | |

Net investment income | | | 2,256,297 | |

| | | | |

|

REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) from: | |

Investments — unaffiliated | | | (755,282 | ) |

Futures contracts | | | 680,584 | |

Foreign currency transactions | | | (384 | ) |

Swaps | | | 71,017 | |

| | | | |

| | | (4,065 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated | | | 2,252,667 | |

Futures contracts | | | 338,170 | |

Foreign currency translations | | | 644 | |

Swaps | | | (45,271 | ) |

| | | | |

| | | 2,546,210 | |

| | | | |

Net realized and unrealized gain | | | 2,542,145 | |

| | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 4,798,442 | |

| | | | |

See notes to financial statements.

| | |

| 16 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

Statements of Changes in Net Assets

| | | | | | | | |

| | | FDP BlackRock CoreAlpha

Bond Fund | |

| | | Year Ended May 31, | |

| | | 2019 | | | 2018 | |

| | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

| | |

OPERATIONS | | | | | | | | |

Net investment income | | $ | 2,256,297 | | | $ | 2,576,664 | |

Net realized loss | | | (4,065 | ) | | | (1,479,380 | ) |