Exhibit 3.73

00153595392

| | | | |

| | | | FILED In the Office of the Secretary of State of Taxas SEP 30 1992 Corporation Section |

ARTICLES OF MERGER

Pursuant to the provisions of Article 5.04 of the Texas Business Corporation Act, the undersigned corporations adopt the following Articles of Merger for the purpose of merging them into one of such corporations:

The Plan of Merger attached hereto as Exhibit “A” and incorporated herein by this reference was approved by the shareholders of each of the undersigned corporations in the manner prescribed by the Texas Business Corporation Act and the Oklahoma General Corporation Act, as applicable to the respective corporations.

As to each of the undersigned corporations, the number of shares outstanding and the designation and number of outstanding shares of each class entitled to vote as a class on such Plan, are as follows:

| | | | | | | | |

Name of Corporation | | Designation of Class | | | Number of Shares Outstanding | |

Universal Ensco, Inc. | | | Common | | | | 578,687 | |

Jeffries & Associates, Inc. | | | Common | | | | 1,172 | |

No shares are entitled to vote as a Class on the Plan.

As to each corporation, the number of shares voted for and against such Plan are as follows:

| | | | | | | | | | | | |

Name of Corporation | | Class | | | Total Voted For | | | Total Voted Against | |

Universal Ensco, Inc. | | | Common | | | | 556,087 | | | | 22,600 | |

Jeffries & Associates, Inc. | | | Common | | | | 1,172 | | | | 0 | |

Dated September 25, 1992.

| | | | | | |

| | | | UNIVERSAL ENSCO, INC. |

| ATTEST: | | | | | | |

| | | |

| | | | By: | | /s/ Wiley Hatcher |

| (SEAL) Assistant Secretary | | | | | | Wiley Hatcher, President |

| | | | JEFFRIES & ASSOCIATES, INC. |

| | | |

| ATTEST: | | | | | | |

| | | |

| | | | By: | | /s/ R. T. Benson |

| (SEAL) Secretary | | | | | | R. T. Benson, Executive Vice President |

FEF/09-92354L

0015359592

| | |

| State of Texas | | ) |

| | ) SS. |

| County of Harris | | ) |

Before me, a notary public, on this day personally appeared Wiley Hatcher and R. T. Benson, known to me to be the persons whose names are subscribed to the foregoing document and, being by me first duly sworn, declared that the statements therein contained are true and correct.

Given under my hand and seal of office this 25th, day of September, 1992.

|

/s/ Tom carter |

| Notary Public, State of Texas |

|

My Commission Expires: |

1/20/93 |

-2-

PLAN AND AGREEMENT OF MERGER

BETWEEN UNIVERSAL ENSCO, INC.

AND JEFFRIES & ASSOCIATES, INC.

This Plan of Merger (the “Plan”) is made and entered into as of September 25, 1992, by and between Universal Ensco, Inc., a Texas corporation (“Ensco”), and Jeffries & Associates, Inc., an Oklahoma corporation (“Jeffries”).

Preliminary Statements

A. Ensco is an engineering service company which has experienced a dramatically increased level of profitability and demand for its services in the past few years. In an attempt to meet the broadening demand for its services, Ensco has diversified its operations and has offered project design, surveying, mapping and other related services.

B. Universal Associates, Inc., (“Associates”), the parent corporation of Ensco, owns over 80% of the outstanding stock of Ensco and also owns 100% of the stock of Jeffries & Associates, Inc. (“Jeffries”). Jeffries is primarily a surveying and mapping company which has established a special niche in its market and has built an established customer base for its surveying and mapping services. Jeffries has also expanded its services in an attempt to fully meet its clients’ needs and demands on various projects.

C. Because of the diversification by Ensco and Jeffries of their respective lines of business, there exists a potential for overlap in their various operations even though the corporations have operated with complete autonomy in the past.

D. In order to seize the opportunities created by demands of the respective customers of Ensco and Jeffries, and in recognition of the potential overlap of services which the corporations may render, the Boards of Directors of Associates, Ensco and Jeffries deem it advisable to combine the operations of Ensco and Jeffries to secure numerous benefits, which include, without limitation, the following:

| | – | The customers of each of Ensco and Jeffries will secure the benefit of services offered by the other corporation. |

| | – | To the extent that Ensco and Jeffries offer identical services, economies of scale will be realized through the combination of the business activities of the two corporations. |

| | – | Potential duplication of effort by the two corporations will be eliminated as the Jeffries operations are integrated into the operations of Ensco. |

FEB/09-92354B

001535896

| | – | The employees of each of the corporations will have expanded resources available in the form of the expertise and experience of the employees of the other corporation and will be able to consult with these employees for the purposes of more effectively bidding on, securing and performing on contracts. |

| | – | The combination of Ensco and Jeffries will result in a corporation with greater financial resources and with a greater net worth. |

| | – | The financial statements of the surviving corporation will show a much greater book value, which is often a favorable factor when making proposals for major projects, particularly when operating in foreign jurisdictions and when seeking working capital financing. |

| | – | Quality control and consistency of methodology should be enhanced in the surviving corporation, thereby reducing risk. |

| | – | Potential confusion in the marketplace concerning the relationship of Ensco and Jeffries will be reduced, although every effort has been made in the past to inform third parties of the brother-sister corporation relationship between Ensco and Jeffries. |

The Board of Directors of Ensco and the Board of Directors of Jeffries have each unanimously approved the merger of Jeffries and Ensco (the “Merger”) in accordance with the Texas Business Corporation Act (the “Texas Act”) and the Oklahoma General Corporation Act (the “Oklahoma Act”) and have recommended to their respective shareholders that this Plan be approved. The shareholders have approved this Plan in accordance with the Texas Act and the Oklahoma Act.

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, Ensco and Jeffries hereby agree as follows:

1.Merger; Effective Date. Pursuant to the terms and provisions of this Plan of Merger, Texas Act Articles 5.01et seq. and Oklahoma Act Section 1082, Jeffries shall be merged with and into Ensco, effective 12:01 a.m., September 30, 1992 (the

“Effective Date”), as confirmed by the filing of Articles of Merger with the Secretary of State of Texas and the filing of a Certificate of Merger with the Secretary of State of Oklahoma. Ensco shall be the surviving corporation (the “Surviving Corporation”). Ensco and Jeffries shall be referred to hereinafter collectively as the “Constituent Corporations”. On

-2-

00158505896

the Effective Date, the separate existence and corporate organization of Jeffries, except insofar as it may be continued by statute, shall cease and Ensco shall continue as the Surviving Corporation which shall succeed, without other transfer or further act or deed whatsoever, to all the rights, property and assets of the Constituent Corporations and shall be subject to and liable for all the debts and liabilities of each. The corporate name of Ensco and its identity, existence, purposes, rights, immunities, properties, liabilities and obligations shall be unaffected and unimpaired by the merger except as expressly provided herein.

2.Certificate of Incorporation; Bylaws. The Certificate of Incorporation of the Surviving Corporation shall be as amended by the Articles of Merger and the Certificate of Merger, and the Bylaws of the Surviving Corporation shall be the Bylaws of Ensco as in effect on the Effective Date.

3.Board of Directors. The members of the Board of Directors of the Surviving Corporation from and after the Effective Date, who shall hold office until their successors are duly elected and qualified, subject to the provisions of the Bylaws and the Certificate of Incorporation, as amended by the Articles of Merger and Certificate of Merger, shall be as follows:

| | |

| Wiley Hatcher | | Robert E. McFadden |

| R. T. Benson | | Loys A. Gray, III |

| John R. Bowers | | Bob Pate |

| Gene A. Land | | Jerry Jeffries |

4.Officers. The officers of the Surviving Corporation from and after the Effective Date, subject to such powers with respect to the designation of officers as the Directors of the Surviving Corporation may have under its Bylaws, shall be as follows:

| | |

| Name | | Office |

| Wiley Hatcher | | President and Treasurer |

| R. T. Benson | | Executive Vice President and Secretary |

| John Braun | | Vice President |

| John R. Bowers | | Vice President |

| James Stephen Dracos | | Vice President |

| Loys A. Gray, III | | Vice President |

| Duane Alan Haines | | Vice President |

| Robert C. Imler | | Vice President |

| Jerry L. Jeffries | | Vice President |

| Gene A. Land | | Vice President |

| Robert E. McFadden | | Vice President |

| Michael D. McGuinness | | Vice President |

| Bob R. Pate | | Vice President |

| W. H. Porter | | Vice President |

-3-

0015858597

| | |

| M. Doyle Sanders | | Vice President |

| Richard Sanchez | | Vice President |

| H. G. Wells | | Vice President |

| Sidney W. Wheeler | | Vice President |

| Diana W. Stucky | | Assistant Secretary |

| Charlotte S. Head | | Assistant Secretary |

5.Manner of Conversion. The manner of converting the shares of common stock of the Constituent Corporations into shares of the Surviving Corporation shall be as follows:

5.1General. The conversion of Jeffries stock into Ensco stock shall be based on an exchange ratio equal to the proportionate book value of Jeffries as compared to Ensco as of the Effective Date of the Merger. Because financial statements for the year ended September 30, 1992, for the Constituent Corporations (the “1992 Financial Statements”) will not be available until after the Effective Date of the Merger, the conversion of shares of the Constituent Corporations will be made on the basis of the estimated book value of the Constituent Corporations and later will be adjusted based on the actual book value as shown in the 1992 Financial Statements.

5.2Initial Exchange Ratio. The Board of Directors of Associates projects that the book value of Ensco will be approximately $2,400,000, or $4.15 per share, as of September 30, 1992 and that the book value of Jeffries will be approximately $1,250,000, or $1,066.55 per share, as of September 30, 1992. There are 578,687 shares of Ensco stock and 1,172 shares of Jeffries stock currently outstanding. Because the respective book values of Ensco and Jeffries cannot be determined until the issuance of the 1992 Financial Statements by the independent certified public accountants, 200,000 shares of Ensco stock, which is a conservative estimate of the number of shares to be issued, will be issued at the time of the Merger, and an additional 200,000 shares will be held as conditional shares to be issued upon the determination of the final exchange ratio after the issuance of the 1992 Financial Statements. Thus, on the Effective Date, each of the shares of Jeffries common stock shall be cancelled and shall be converted into 170.65 shares of common stock, par value $1.00, of Ensco (the “Initial Exchange Ratio”).

5.3Contingent Right to Receive Additional Ensco Stock. Upon completion by Arthur Andersen & Co., independent certified public accountants, of the 1992 Financial Statements of the Constituent Corporations, a final exchange ratio for the exchange of Jeffries common stock for Ensco common stock shall be calculated based on the actual book value of each Constituent Corporation on September 30, 1992 (the “Final Exchange Ratio”). Based on the Final Exchange Ratio, if the number of shares of Ensco common stock to be exchanged for each share of Jeffries common stock is determined to be greater than 170.65 shares, Ensco shall issue to each Jeffries shareholder of record

- 4 -

0015853598

immediately prior the Effective Date additional shares of Ensco common stock (the “Additional Shares”) so that the exchange ratio of Ensco stock for Jeffries stock is equal to the respective book values of the Constituent Corporations as of September 30, 1992. The issuance of the Additional Shares shall occur as soon as possible after completion of the 1992 Financial Statements but in no event later than September 15, 1993.

Notwithstanding the foregoing, the total number of shares of Ensco common stock issued in the Merger must not exceed 400,000; thus, the maximum number of Additional Shares issued pursuant to this section shall not exceed 200,000 (the “Maximum Additional Shares”). If the total number of Additional Shares as calculated pursuant to the Final Exchange Ratio is greater than the Maximum Additional Shares, Ensco shall issue to each Jeffries shareholder of record immediately prior to the Effective Date 170.65 additional shares of Ensco common stock for each share of Jeffries common stock held immediately prior to the Effective Date. If the Final Exchange Ratio results in fewer Ensco shares being issued for each Jeffries share than the Initial Exchange Ratio, then the Initial Exchange Ratio shall be deemed to be the Final Exchange Ratio, and the number of shares of Ensco stock held by former Jeffries shareholders shall not be decreased.

5.4Common Stock Ownership. The common stock ownership of the shareholders of Ensco and Jeffries before and after the Effective Date of the Merger and the maximum number of shares of Ensco stock that could be received is set forth on Exhibit “A”,

which is by this reference incorporated as a part hereof.

5.5Nontransferability. The contingent right to receive the Additional Shares set forth in Section 5.3 above shall not assigned or transferred, except by operation of law, and shall be limited to receipt of only the common stock of Ensco.

6.Tax Treatment. The merger of Ensco and Jeffries shall be accomplished as atax-free reorganization as defined in Section 368(a)(1)(A) of the Internal Revenue Code of 1986, as amended.

7.Authorized Shares. The aggregate number of shares which the Surviving Corporation is and shall be authorized to allot is 1,000,000 shares in a single class. The number of shares and the par value of the shares is and shall be as follows:

| | | | | | | | | | | | |

Class | | Series | | | Number of Shares | | | Par Value of Shares | |

Common | | | None | | | | 1,000,000 | | | $ | 1.00 | |

8.Stated Capital. The amount of stated capital of the Surviving Corporation shall be the aggregate par value of the shares of common stock issued and outstanding after the Effective Date.

-5-

0015893539

9.Registered Office and Agent. The name of the registered agent and the address of the registered office of the Surviving Corporation in Oklahoma shall be R. T. Benson, 5505 East 51st Street, Tulsa, OK 74135 and the name of the registered agent and address of the registered office of the Surviving Corporation in Texas shall be Wiley Hatcher, 1811 Bering Drive, Suite 400, Houston, TX 77257-0248.

10.Articles and Certificate of Merger. Upon the approval of the Merger by the shareholders of Ensco and by the shareholders of Jeffries, the officers of Ensco and Jeffries shall file with the Secretary of State of the State of Texas, the Articles of Merger, and the officers of Ensco shall file with the Secretary of State of the State of Oklahoma a Certificate of Merger, both containing terms and provisions consistent with this Plan of Merger.

11.Service on Surviving Corporation in Oklahoma. The Surviving Corporation hereby agrees that it may be served with process in the State of Oklahoma in any proceeding for enforcement of any obligation of any Constituent Corporation in the State of Oklahoma, as well as for enforcement of any obligation of the Surviving Corporation arising from the Merger, including any suit or other proceeding to enforce the right of any shareholders as determined in appraisal proceedings pursuant to the provisions of Section 1091 of the Oklahoma Act. The Surviving Corporation irrevocably appoints the Secretary of State of Oklahoma as its agent to accept service of process in any such suit or other proceedings and a copy of such process shall be mailed by the Secretary of State to the following address: 1811 Bering Drive, Suite 400, Houston, Texas 77057-3100.

12.Obligation to Dissenting Shareholders of SurvivingCorporation. Ensco, as the surviving Corporation will be obligated for the payment of the fair value of any shares held by a shareholder of Ensco who complies with Article 5.12 of the Texas Act.

-6-

0015350594

| | | | | | | | |

| Executed as of the25th day of September, 1992. | | | | |

| | | | | | UNIVERSAL ENSCO,INC., a Texas corporation |

| | | | |

| ATTEST: | | | | | | | | |

| | | |

| | | | By: | | /s/ Wiley Hatcher |

| (SEAL) | | Secretary | | | | | | Wiley Hatcher, President |

| | | |

| | | | | | JEFFRIES & ASSOCIATES,INC., an Oklahoma corporation |

| | | | |

| ATTEST: | | | | | | By: | | /s/ R.T Benson |

| | | | | | R.T Benson, |

| (SEAL) | | Secretary | | | | | | Executive Vice-President |

-7-

00159505901

EXHIBIT “A”

to

Plan and Agreement of Merger

Between Universal Ensco, Inc. and

Jeffries & Associates, Inc.

| | | | | | | | | | | | | | | | |

Shareholder | | Before Merger

Ensco Stock

Outstanding | | | Before Merger

Jeffries Stock

Outstanding | | | Ensco Stock

To Be

Received

Initially | | | Maximum

Ensco Stock

That Could be

Received | |

Universal Associates, Inc. | | | 486,487 | | | | 1,172 | | | | 200,000 | | | | 400,000 | |

Loys A. Gray, III | | | 21,500 | | | | | | | | | | | | | |

B. R. Pate | | | 16,300 | | | | | | | | | | | | | |

John J. Braun | | | 7,000 | | | | | | | | | | | | | |

Sid Wheeler | | | 6,500 | | | | | | | | | | | | | |

James S. Dracos | | | 3,600 | | | | | | | | | | | | | |

Michael D. Felt | | | 2,000 | | | | | | | | | | | | | |

H. G. Wells | | | 2,000 | | | | | | | | | | | | | |

M. Doyle Sanders | | | 1,500 | | | | | | | | | | | | | |

Bing T. Djie | | | 1,000 | | | | | | | | | | | | | |

Gary Greer | | | 1,000 | | | | | | | | | | | | | |

Duane A. Haines | | | 1,000 | | | | | | | | | | | | | |

Don Johnson | | | 1,000 | | | | | | | | | | | | | |

Corbin Porter | | | 1,000 | | | | | | | | | | | | | |

Johnny B. Sellers | | | 1,000 | | | | | | | | | | | | | |

Edward L. Smiers, Jr. | | | 1,000 | | | | | | | | | | | | | |

Andrew J. Bontje | | | 500 | | | | | | | | | | | | | |

Tim Boyd | | | 500 | | | | | | | | | | | | | |

Linda Carter | | | 500 | | | | | | | | | | | | | |

Gerald Farmer | | | 500 | | | | | | | | | | | | | |

William P. Graper | | | 500 | | | | | | | | | | | | | |

Daryl F. Johnson | | | 500 | | | | | | | | | | | | | |

Phil Maddox | | | 500 | | | | | | | | | | | | | |

John Mathews | | | 500 | | | | | | | | | | | | | |

S. L. Sikes | | | 500 | | | | | | | | | | | | | |

J. D. Stringer | | | 500 | | | | | | | | | | | | | |

Jeff E. Watson | | | 500 | | | | | | | | | | | | | |

Danny Wilhite | | | 500 | | | | | | | | | | | | | |

Richard T. Sanchez | | | 2,500 | | | | | | | | | | | | | |

Robert E. McFadden | | | 16,300 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | 578,687 | | | | 1,172 | | | | 200,000 | | | | 400,000 | |

| | | | | | | | | | | | | | | | |

TEXAS COMPTROLLEROF PUBLIC ACCOUNTS

JOHN SHARP • COMPTROLLER • AUSTIN, TEXAS 78774

jam2h17

CERTIFICATION OF ACCOUNT STATUS

THE STATE OF TEXAS

COUNTY OF TRAVIS

I, John Sharp, Comptroller of Public Accounts of the State of Texas, DO HEREBY CERTIFY that according to the current records of this office

JEFFRIES & ASSOCIATES INC

Is out of business, that all required reports for taxes administered by the Comptroller have been filed and that the taxes due on those reports have been paid. This certificate may be used for the purpose of dissolution, merger or withdrawal.

This certificate is valid through December 31, 1992

GIVEN UNDER MY HAND AND

SEAL OF OFFICE in the

City of Austin, this

30thday ofSeptember,19 92 A.D.

|

/s/ JOHN SHARP |

| JOHN SHARP |

| Comptroller of Public Accounts |

Form 05-305 (Rev.8-91/6) Charter/C O.A number 000418954-6

| | | | |

Corporations Section P.O. Box 13697 Austin, Texas 78711-3697 | |  | | ☐ 0194303835 Antonio O. Garza, Jr. Secretary of State |

Office of the Secretary of State

January 20, 1995

CT Corporation System

811 Dallas Ave.

Houston, TX 77002

| | |

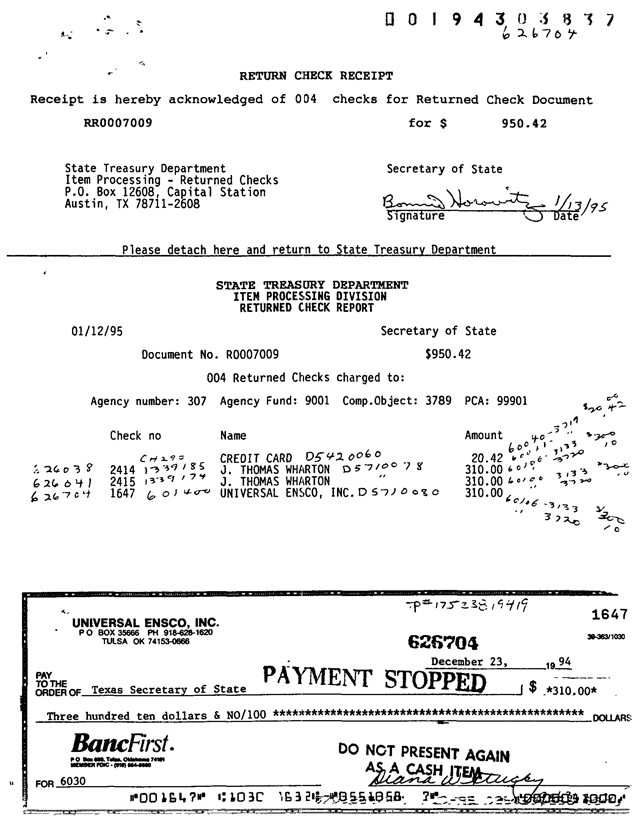

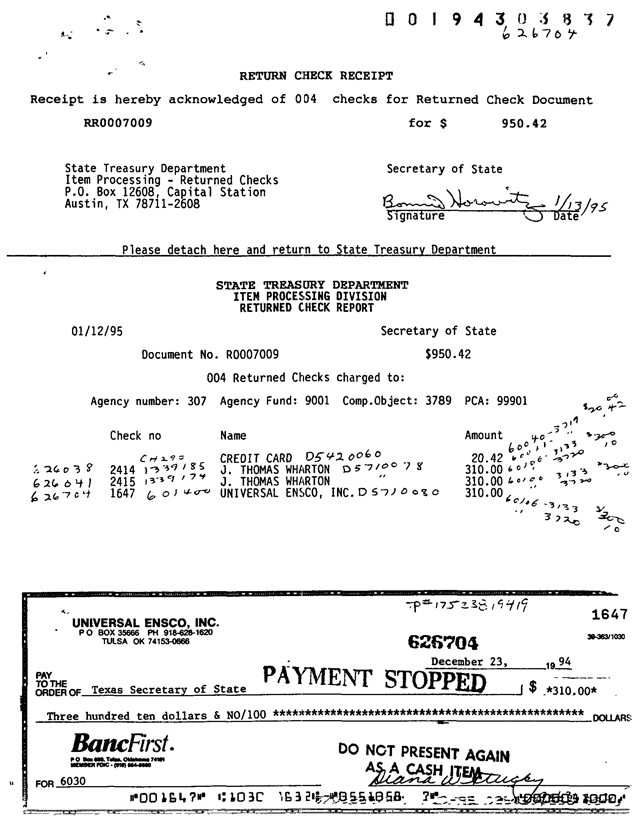

| RE: | | Universal Ensco, Inc File Number 601400 Check Number 1647; In the Amount of $310.00 Drawn on BancFirst Register Number 626704 |

Dear Sir:

On December 29, 1994, this Office filed Articles of Merger for the above referenced entity. The check described

above was submitted as the statutory fee for filing the document. The check was dishonored when presented for payment.

This letter will serve as formal notification of the revocation of the document pursuant to Article 3916B, Title 61, Texas Revised Civil Statutes Annotated. The result of the revocation of a document filed with this office is to void the document as though it had never been filed.

If you wish to refile the document, you must submit the document anew together with a cashier’s check or money order to cover the amount of the returned check and a $25.00 returned check processing fee, authorized under Article 9022, Texas Revised Civil Statutes Annotated.

If you have any questions, please do not hesitate to contact this Office

Sincerely,

/s/ Delores A. Eitt

Delores A. Eitt

Administrative Technician

Statutory Filings Division

Corporation Section

Enclosures

CO/LSW/dae

| | |

| cc: | | Nell Hays, Accountant Financial Management Section |

| |

| c: | | Universal Ensco, Inc. P.O. Box 35666 Tulsa, OK 74153-0666 |

| | | | |

| (512) 463-5586 | | FAX (512) 463-5709 | | TDD (800) 735-2989 |

The Office of the Secretary of State dose note discriminate on the basis of race color, national origin, sex, religion, age or disability in employment of the provision of services.