1 Piper Sandler 23rd Annual Energy Conference March 2023

2 Disclaimer & Forward-looking Statements Cautionary Statement on Forward-looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. This presentation includes forward-looking statements that reflect our current expectations, projections and goals relating to our future results, performance and prospects. Forward-looking statements include all statements that are not historical in nature and are not current facts, including our preliminary estimated financial information for Q4 2022. When used in this news release (and any oral statements made regarding the subjects of this release, including on the conference call announced herein), the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “might,” “should,” “could,” “will” or the negative of these terms or similar expressions are intended to identify forward-looking statements, although not all forward- looking statements contain such identifying words. Such forward-looking statements involve risks and uncertainties. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events with respect to, among other things: our operating cash flows; the availability of capital and our liquidity; our ability to renew and refinance our debt; our future revenue, income and operating performance; our ability to sustain and improve our utilization, revenue and margins; our ability to maintain acceptable pricing for our services; future capital expenditures; our ability to finance equipment, working capital and capital expenditures; our ability to execute our long-term growth strategy and to integrate our acquisitions; our ability to successfully develop our research and technology capabilities and implement technological developments and enhancements; and the timing and success of strategic initiatives and special projects. The Company’s actual experience and results may differ materially from the experience and results anticipated in such statements. Factors that might cause such a difference include those discussed in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), which include its Annual or Transition Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. For more information, see the section entitled “Forward-Looking Statements” contained in the Company’s Annual Report on Form 10-K and in other filings. Any forward-looking statements included in this presentation are made only as of the date of this presentation and, except as required by federal securities laws and rules and regulations of the SEC, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures This presentation includes Adjusted EBITDA which is a "non-GAAP financial measure" as defined in Regulation G of the Securities Exchange Act of 1934. Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA is not a measure of net earnings or cash flows as determined by GAAP. We define Adjusted EBITDA as net earnings (loss) before interest, taxes, depreciation and amortization, further adjusted for (i) goodwill and/or long-lived asset impairment charges, (ii) stock-based compensation expense, (iii) restructuring charges, (iv) transaction and integration costs related to acquisitions, (v) costs incurred related to the COVID-19 pandemic and (vi) other expenses or charges to exclude certain items that we believe are not reflective of ongoing performance of our business. Adjusted EBITDA is used to calculate the Company's leverage ratio, consistent with the terms of the Company's ABL facility. We believe Adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP, or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company's financial performance, such as a company's cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. The Company’s results for the periods Q1’19 through Q1’20 are presented on a pre-merger combined basis, which is the sum of KLX Energy Services Holdings, Inc. (“KLXE”) and Quintana Energy Services, Inc. (“QES”) results as disclosed for the given period, without any pro forma adjustments. Note that legacy QES fiscal year ended on December 31 and legacy KLXE fiscal year ended on January 31, which continued for KLXE until the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. As a result, our pre-merger combined quarterly data for Q1’19 includes legacy KLXE for three months ended April 30, 2019 and legacy QES for three months ended March 31, 2019; for Q2’19 includes legacy KLXE for three months ended July 31, 2019 and legacy QES for three months ended June 30, 2019; for Q3’19 includes legacy KLXE for three months ended October 31, 2019 and legacy QES for three months ended September 30, 2019; for Q4’19 includes legacy KLXE for three months ended January 31, 2020 and legacy QES for three months ended December 31, 2019; and for Q1’20 includes legacy KLXE for three months ended April 30, 2020 and legacy QES for three months ended March 31, 2020. Additional information is available from KLXE at its website, www.klxenergy.com.

3 Company Overview

4 KLX Energy Services (KLXE) Overview Company Overview Areas of Operation Diversified Product Offering Diversified Business Model • Leading U.S. onshore provider of value-added, mission critical services focused on the entire well life-cycle for the most technically demanding wells across major US oil and gas basins • ~2,030 total team members as of Q4 (pro forma for Greene’s), including a deeply experienced ops leadership team with an average of 30 years of industry experience and 10 years with KLXE • Vertical integration with in-house machining and R&D • Long-standing relationships with blue-chip customer base • Platform created through combination of organic and inorganic growth and well positioned to continue to grow via both Q4 ‘22 Revenue by Product Line Q4 ‘22 Revenue by RegionDrilling • 110 measurement-while-drilling kits • Over 850 mud motors (~60% are latest gen) Completion • 23 modern, large-diameter Coiled Tubing Units • 75+ Wireline Units (split with Production) • 120+ Frac Trees and 50 Guardian Isolation Tools • 490+ accommodation trailers (split with Drilling) • 4 frac spreads (2 staffed and operating) • Suite of proprietary tools & consumables Production & Intervention • Leading fleet of fishing and rentals tools • 16 small diameter (2’’ or less) Coiled Tubing Units • 34 rig-assisted Snubbing Units • Downhole production services Source: Company filings and disclosure Facility listing and product offering detail include facilities and tools acquired via the March 8, 2023 Greene’s acquisition . 39 Core Facilities Rockies 30% Southwest 33% Midcon/Northeast 37% Drilling Completions Production & Intervention 21% 30% 49%

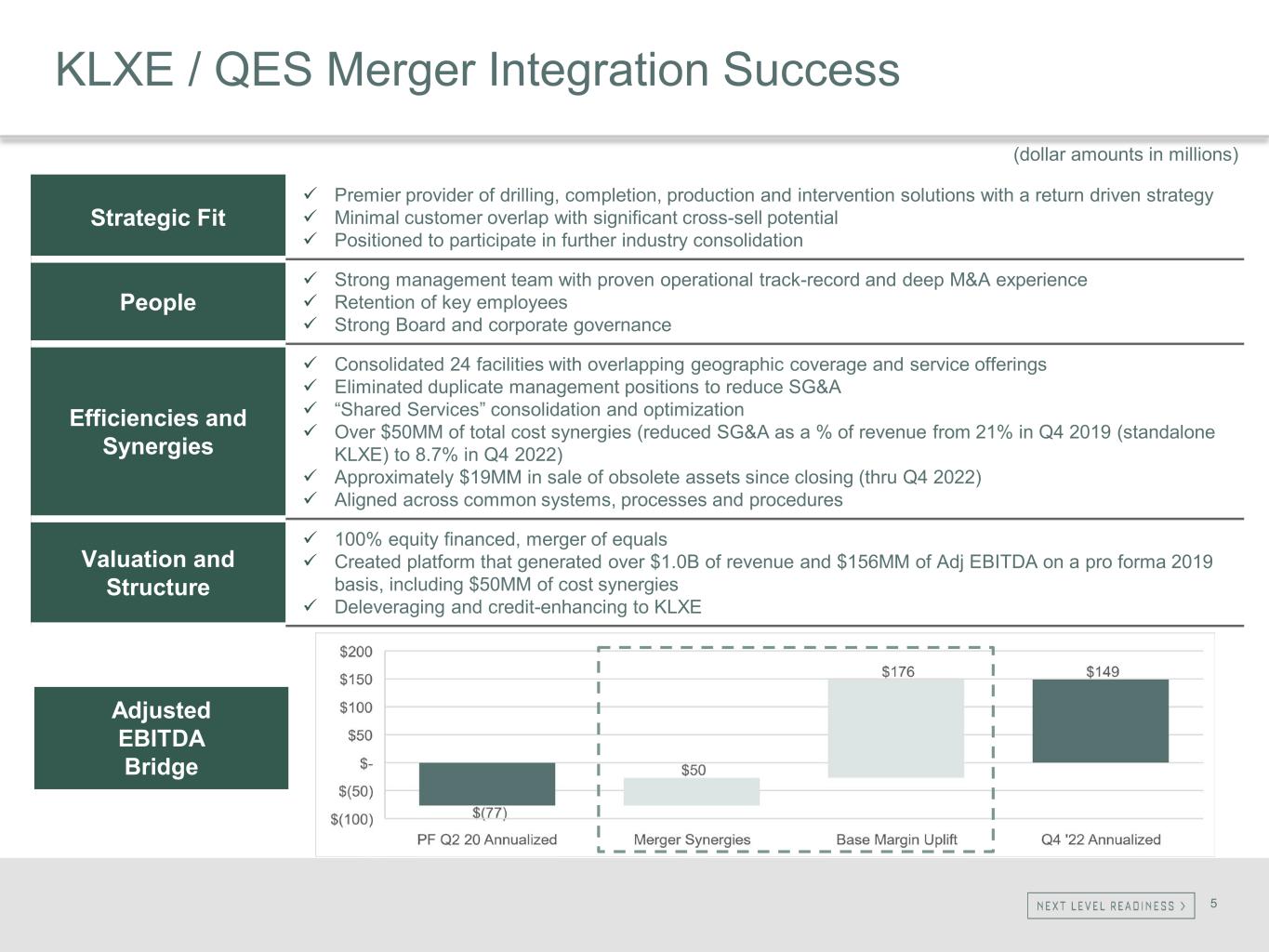

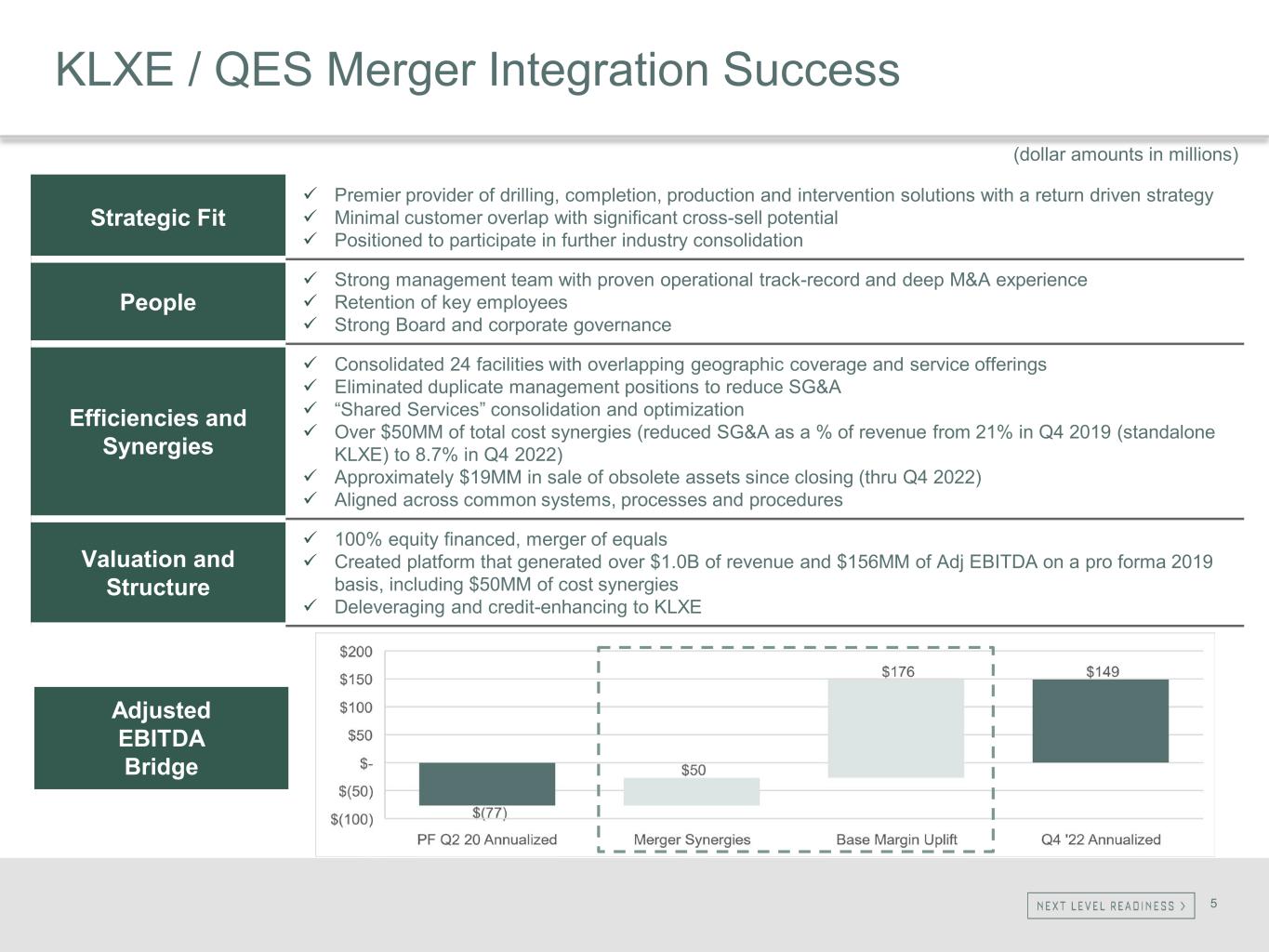

5 KLXE / QES Merger Integration Success Strategic Fit Premier provider of drilling, completion, production and intervention solutions with a return driven strategy Minimal customer overlap with significant cross-sell potential Positioned to participate in further industry consolidation People Strong management team with proven operational track-record and deep M&A experience Retention of key employees Strong Board and corporate governance Efficiencies and Synergies Consolidated 24 facilities with overlapping geographic coverage and service offerings Eliminated duplicate management positions to reduce SG&A “Shared Services” consolidation and optimization Over $50MM of total cost synergies (reduced SG&A as a % of revenue from 21% in Q4 2019 (standalone KLXE) to 8.7% in Q4 2022) Approximately $19MM in sale of obsolete assets since closing (thru Q4 2022) Aligned across common systems, processes and procedures Valuation and Structure 100% equity financed, merger of equals Created platform that generated over $1.0B of revenue and $156MM of Adj EBITDA on a pro forma 2019 basis, including $50MM of cost synergies Deleveraging and credit-enhancing to KLXE (dollar amounts in millions) Adjusted EBITDA Bridge

6 A Transformed KLXE People Performance Asset Integrity Safety Customer Focus Profitability Veteran operators throughout the organization Deep technical expertise Transparent alignment of incentives Significant operating leverage Return on capital orientation Performance culture Detailed KPI tracking and data-driven decision making Rigorous maintenance program to minimize downtime and ensure equipment integrity and consistency in service quality Selective evaluation of opportunities to ensure equipment integrity Employees value safe, professional field operations Strong interdependent safety culture and track record of strong safety metrics affords KLXE the opportunity to work for the largest operators Long-term relationships with blue-chip customers Strong visibility into drilling and completion programs

7 Diversified and Complementary Product Service Offering PSL1 Approximate Q4 2022 Rev. Contribution Rockies Southwest Northeast/ Mid Con Select Products & Services Directional Drilling 24% MWD, proprietary K-Series mud motor, directional electronics and other modules Accommodations 6% Living accommodations, water & sewage services, light plants, generators and other Coiled Tubing 15% 1-1/4” to 2-5/8” coiled tubing units Pressure Pumping 15% Acidizing, cement, f Other Completion Products and Services 9% Flowback, frac valve rental, proprietary composite & dissolvable plugs and other proprietary products Wireline 7% Pump down, pipe recovery, logging Tech Services 12% Fishing tools & services, thru tubing, reverse units and snubbing Rentals 12% Pressure control equipment, tubulars, torque & testing, and pipe handling Pr od uc tio n & In te rv en tio n C om pl et io n D ril lin g Source: Company. As of Q4 2022. 1 Product Service Line Primary Product Line Diversified product service offering positions KLXE to capture a larger percentage of customer spending across the lifecycle Refocused product service offering across core geographies to improve scale, utilization and returns

8 Significant Operating Leverage Tied To Market Recovery US Land Rig Count and KLXE Quarterly Adj EBITDA (Including Pre-merger Combined) Source: Company & Baker Hughes Rig Count. The Company’s results for the periods Q1’19 through Q1’20 are presented on a pre-merger combined basis, which is the sum of legacy KLX Energy Services Holdings, Inc. (“KLXE”) and Quintana Energy Services, Inc. (“QES”) results as disclosed for the given periods, without any pro forma adjustments. Note that legacy QES fiscal year ended on December 31 and legacy KLXE fiscal year ended on January 31, which continued for KLXE until the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. As a result, our pre-merger combined quarterly data for Q1’19 includes legacy KLXE for three months ended April 30, 2019 and legacy QES for three months ended March 31, 2019, for Q2’19 includes legacy KLXE for three months ended July 31, 2019 and legacy QES for three months ended June 30, 2019, for Q3’19 includes legacy KLXE for three months ended October 31, 2019 and legacy QES for three months ended September 30, 2019, for Q4’19 includes legacy KLXE for three months ended January 31, 2020 and legacy QES for three months ended December 31, 2019, and for Q1’20 includes legacy KLXE for three months ended April 30, 2020 and legacy QES for three months ended March 31, 2020. Furthermore, note that we have presented Q2’20 on a pro forma basis as the results of legacy KLXE and legacy QES assuming the Merger had occurred on February 1, 2020. We have presented Q3’21 on a pro forma basis as three months ended September 30, 2021, and we have presented Q4’21 on a pro forma basis as three months ended December 31, 2021. Pre-merger periods exclude the value of deal synergies (dollar amounts in millions) ($20) ($10) $0 $10 $20 $30 $40 $50 $60 - 200 400 600 800 1,000 1,200 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Quarterly average rig count (US Land) KLXE Adj EBITDA

9 Greene’s Acquisition Case Study Cost Synergies Identified $2.0MM to $3.0MM recurring cost synergies Expect to realize savings within 12 months of transaction closing Accretive Expect the transaction to be accretive across all key metrics Deleveraging Greene’s was unlevered with $1.7MM of cash at closing KLX 2022 Net Leverage Ratio improves to approximately 2.0x and approximately 1.4x based on annualized pro forma 2H 2022 results Strategic Fit Augments KLXE’s frac rentals and flowback/well testing offerings in the Permian and Eagle Ford with the addition of Greene’s proprietary isolation tool and their Eagle Ford flowback and well testing business • On March 8, 2023, KLXE announced the all-stock acquisition of Greene’s Energy Services (“Greene’s”) • Implied enterprise value of approximately $30.3 million based on a 30-day volume weighted average price ("VWAP") as of March 7, 2023, and less acquired cash • Greene’s generated 2022 Revenue and Adj EBITDA of $69.0MM and $14.7MM, respectively

10 Top Operators Choose KLXE Served over 760 unique customers in 2022 with no one customer accounting for more than 5% of 2022 revenue Diverse customer base – Top 10 2022 customers accounted for 30% of 2022 Revenue Significant leverage to the most active operators in the United States – MSAs with 19 of top 20 operators by rig count Source: Company Disclosure. As of Q4 2022 Select Customer Relationships

11 • Rapidly improving financial results • Q4 2022 Revenue, Net Income and Adj EBITDA of $223.3MM, $13.2MM and $37.3MM, respectively • Q4 Net Debt reduced 11% sequentially and Q4 annualized Net Leverage ratio of approximately 1.4x (pro forma for Greene’s acquisition) Profitability and Net Leverage Continue to Improve Source: Company Disclosure Summary (dollar amounts in millions) PF Calendar Quarter Q4'21 Q1'22 Q2'22 Q3 '22 Q4'22 Revenue Rockies $35.3 $43.3 $53.1 $66.5 $66.1 Southwest 50.2 51.9 60.0 68.5 74.8 Mid-Con / Northeast 59.5 57.1 71.3 86.6 82.4 Revenue $145.0 $152.3 $184.4 $221.6 $223.3 Revenue Growth 13% 5% 21% 20% 1% Adjusted EBITDA Rockies $2.3 $4.7 $9.3 $17.3 $17.9 Southwest 4.2 4.2 6.4 10.2 12.4 Mid-Con / Northeast 6.2 2.7 11.1 21.3 19.7 Corporate & Other (6.0) (6.7) (9.4) (11.7) (12.7) Adjusted EBITDA $6.7 $4.9 $17.4 $37.1 $37.3 Adjusted EBITDA Margin Rockies 6.5% 10.9% 17.5% 26.0% 27.1% Southwest 8.4% 8.1% 10.7% 14.9% 16.6% Mid-Con / Northeast 10.4% 4.7% 15.6% 24.6% 23.9% Adjusted EBITDA Margin 4.6% 3.2% 9.4% 16.7% 16.7% Net Debt Cash $28.0 $19.4 $31.5 $41.4 $57.4 Total Det 274.8 275.1 295.4 295.6 283.4 Net Debt $246.8 $255.7 $263.9 $254.2 $226.0

12 Go-Forward Strategy Cost Controls Continue to manage supply chain constraints and pass costs onto customers Retain personnel and maintain equipment quality while continuing to proactively manage the cost structure to drive incremental margins Continue to proactively manage working capital Strategic Continue to pursue value-creating, de-leveraging consolidation opportunities Continue to de-lever through a combination of EBITDA growth, free cash flow generation, debt reduction and consolidation Organic Growth Expand share of wallet with top customers Expand certain PSLs geographically Continue asset redeployment and expansion in certain PSLs as returns warrant Re-allocate assets across geographies as demand and pricing warrant Sales & Pricing Return pricing to levels that drive acceptable margins and support reinvestment in our asset base and generate free cash flow Drive margin enhancing utilization

13 Appendix

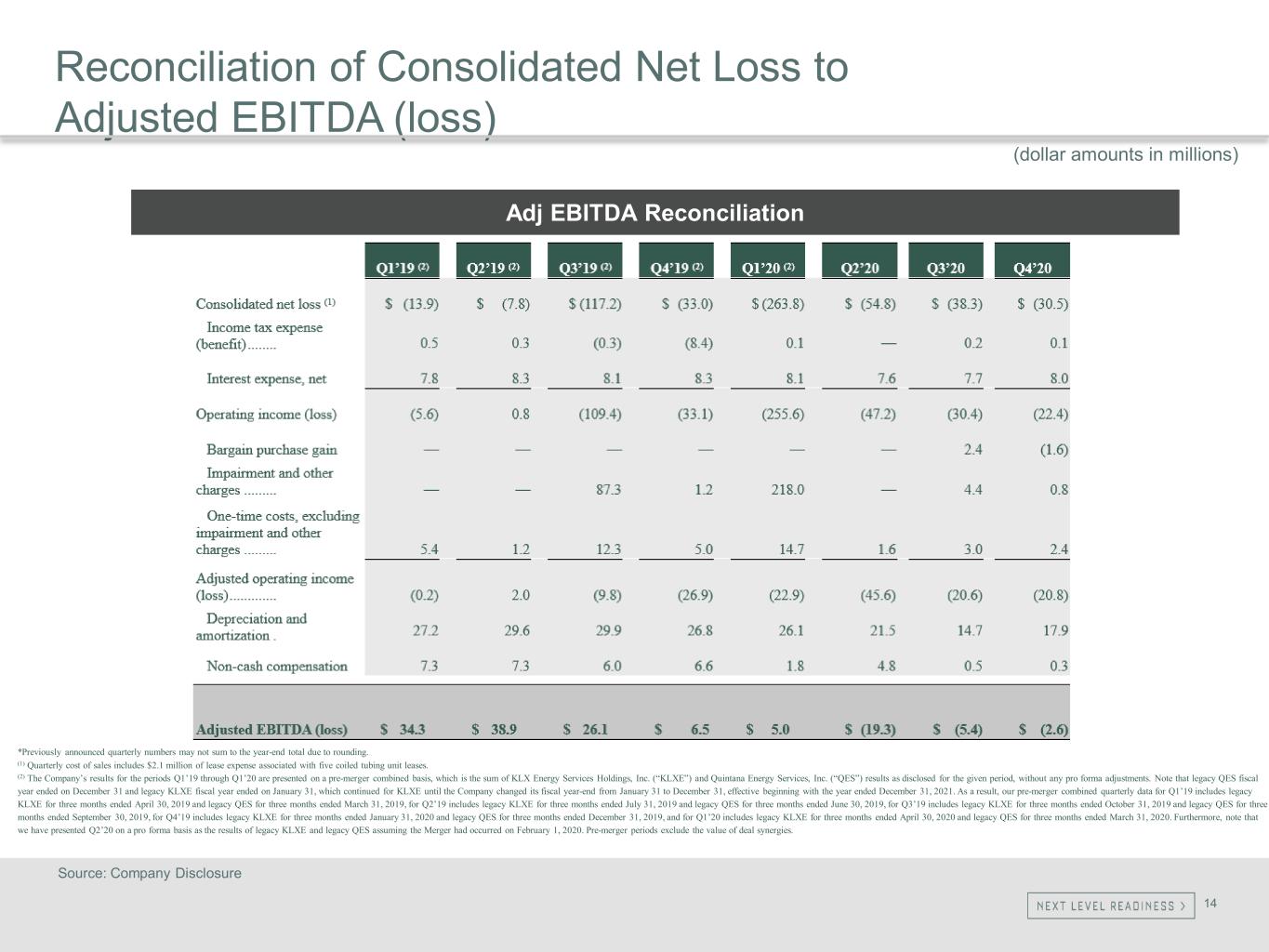

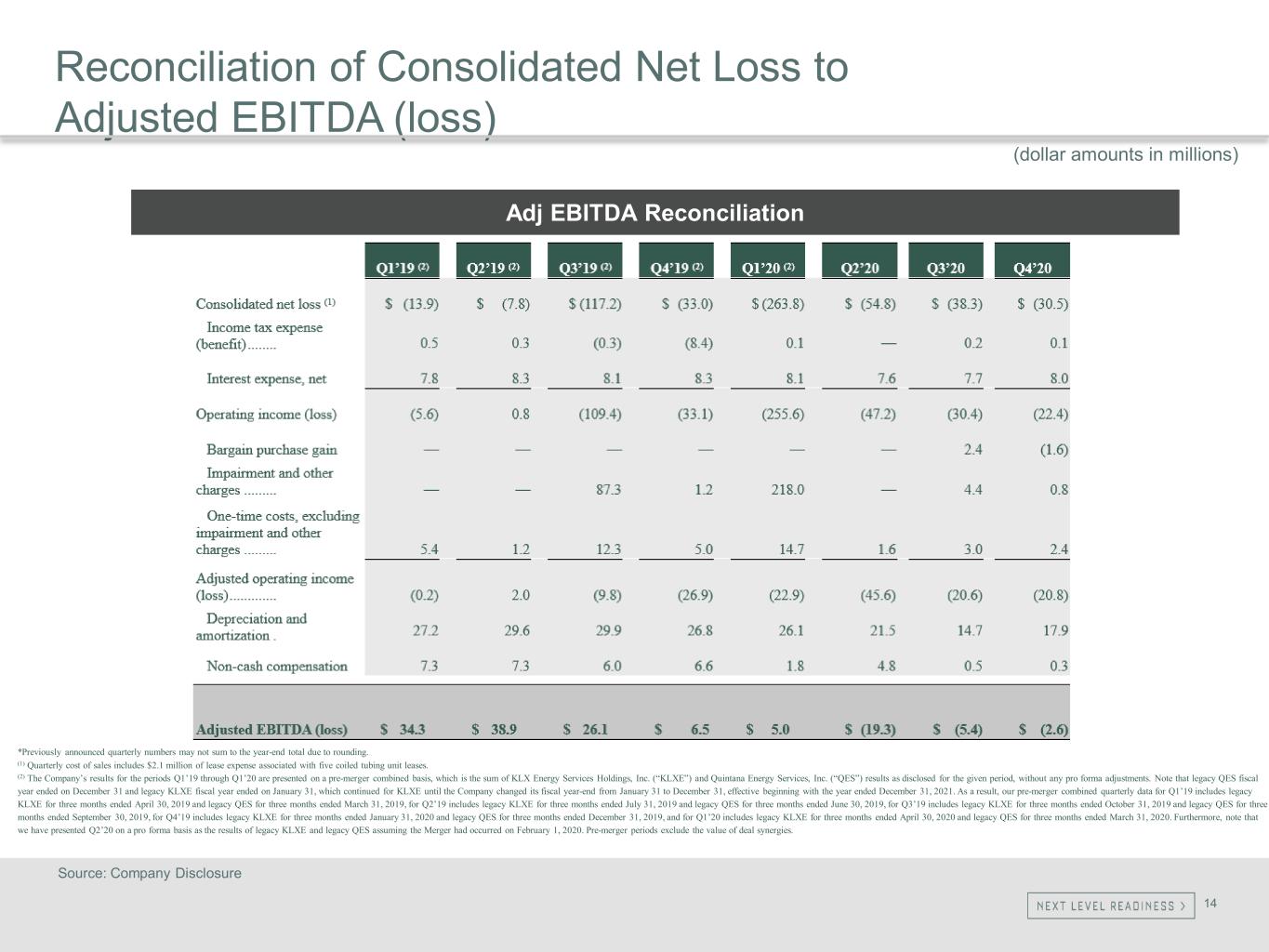

14 Reconciliation of Consolidated Net Loss to Adjusted EBITDA (loss) (dollar amounts in millions) Source: Company Disclosure Adj EBITDA Reconciliation *Previously announced quarterly numbers may not sum to the year-end total due to rounding. (1) Quarterly cost of sales includes $2.1 million of lease expense associated with five coiled tubing unit leases. (2) The Company’s results for the periods Q1’19 through Q1’20 are presented on a pre-merger combined basis, which is the sum of KLX Energy Services Holdings, Inc. (“KLXE”) and Quintana Energy Services, Inc. (“QES”) results as disclosed for the given period, without any pro forma adjustments. Note that legacy QES fiscal year ended on December 31 and legacy KLXE fiscal year ended on January 31, which continued for KLXE until the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. As a result, our pre-merger combined quarterly data for Q1’19 includes legacy KLXE for three months ended April 30, 2019 and legacy QES for three months ended March 31, 2019, for Q2’19 includes legacy KLXE for three months ended July 31, 2019 and legacy QES for three months ended June 30, 2019, for Q3’19 includes legacy KLXE for three months ended October 31, 2019 and legacy QES for three months ended September 30, 2019, for Q4’19 includes legacy KLXE for three months ended January 31, 2020 and legacy QES for three months ended December 31, 2019, and for Q1’20 includes legacy KLXE for three months ended April 30, 2020 and legacy QES for three months ended March 31, 2020. Furthermore, note that we have presented Q2’20 on a pro forma basis as the results of legacy KLXE and legacy QES assuming the Merger had occurred on February 1, 2020. Pre-merger periods exclude the value of deal synergies.

15 Reconciliation of Consolidated Net Loss to Adjusted EBITDA (Loss) (dollar amounts in millions) Source: Company Disclosure Adj EBITDA Reconciliation (Continued) *Previously announced quarterly numbers may not sum to the year-end total due to rounding. (1) The one-time benefits during the fourth quarter of 2022 relate to non-recurring gain on debt extinguishment, partially offset by non-recurring legal costs, costs related to testing and treatment of COVID-19 and additional non-recurring costs. (2) Quarterly cost of sales includes $2.1 million of lease expense associated with five coiled tubing unit leases. (3) We have presented Q3’21 on a pro forma basis as three months ended September 30, 2021, and we have presented Q4’21 on a pro forma basis as three months ended December 31, 2021.

16 Consolidated Net Income (Loss) Margin Reconciliation Source: Company Disclosure Consolidated Net Income (Loss) Margin Reconciliation (dollar amounts in millions)

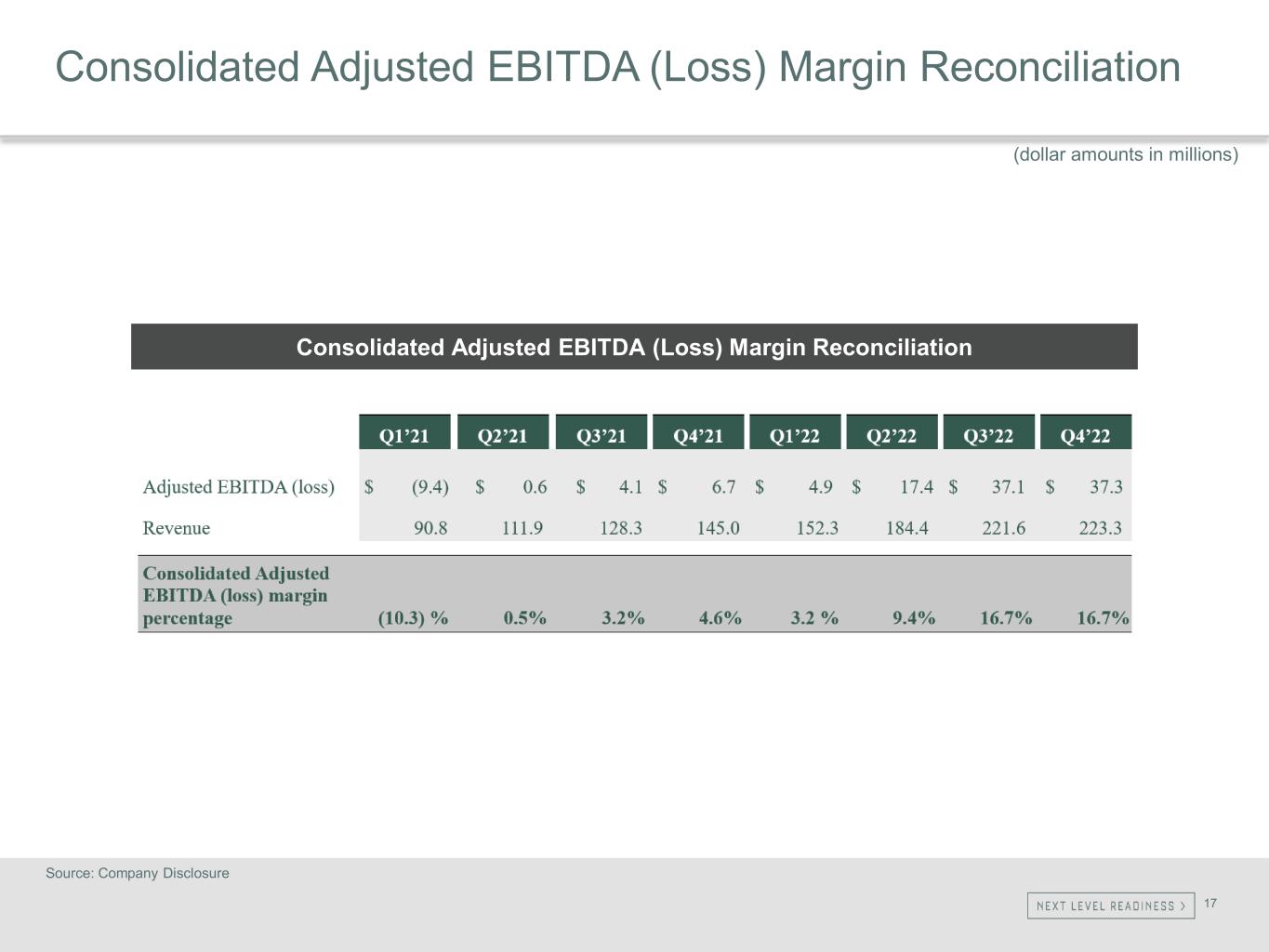

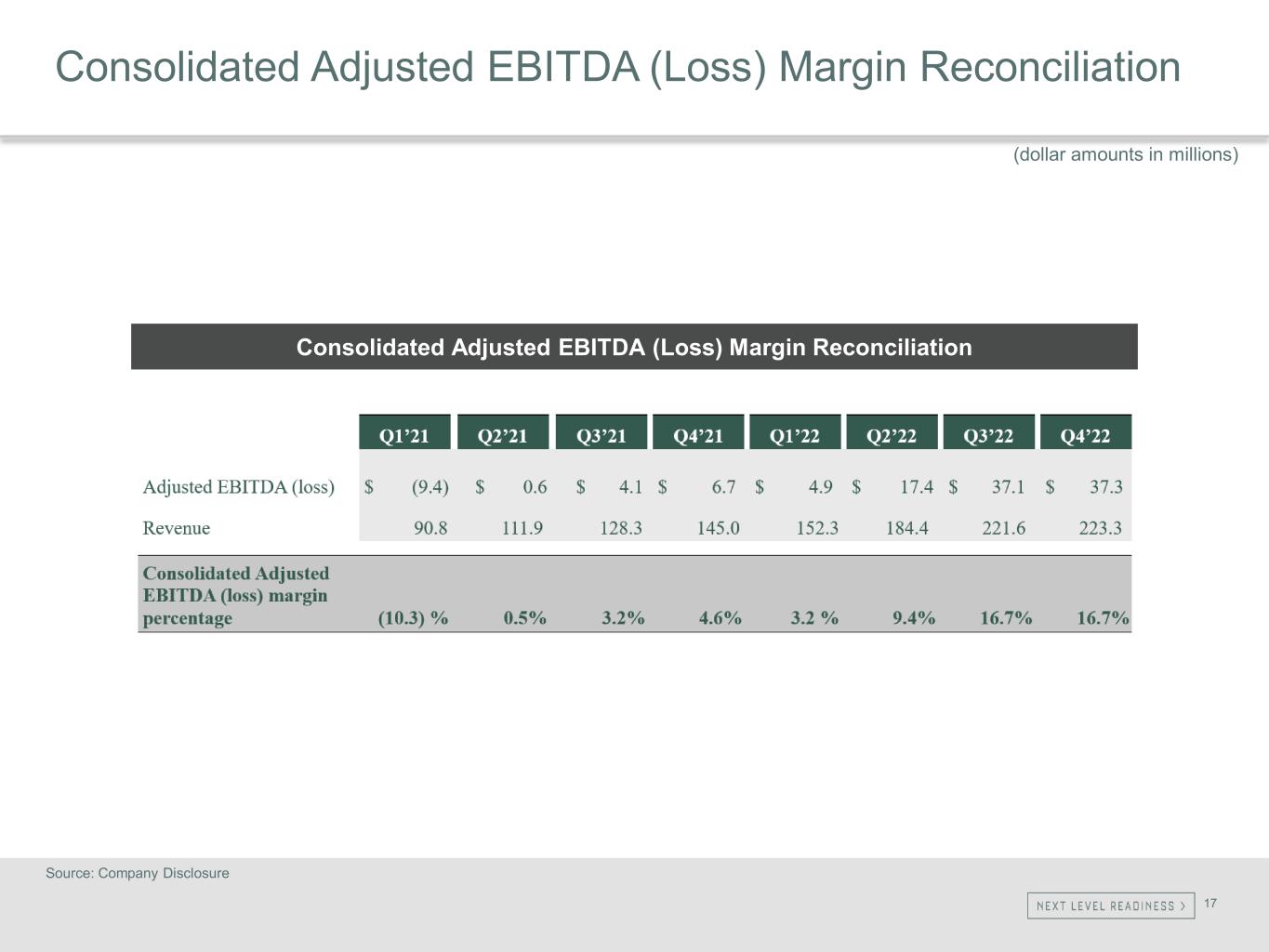

17 Consolidated Adjusted EBITDA (Loss) Margin Reconciliation Source: Company Disclosure Consolidated Adjusted EBITDA (Loss) Margin Reconciliation (dollar amounts in millions)

18 Reconciliation of Segment Operating Income (loss) to Adjusted EBITDA (loss) (dollar amounts in millions) Rocky Mountains Segment Adj EBITDA (Loss) Reconciliation Source: Company Disclosure

19 Reconciliation of Segment Operating Income (Loss) to Adjusted EBITDA (Loss) Source: Company Disclosure (dollar amounts in millions) Southwest Segment Adj EBITDA (Loss) Reconciliation

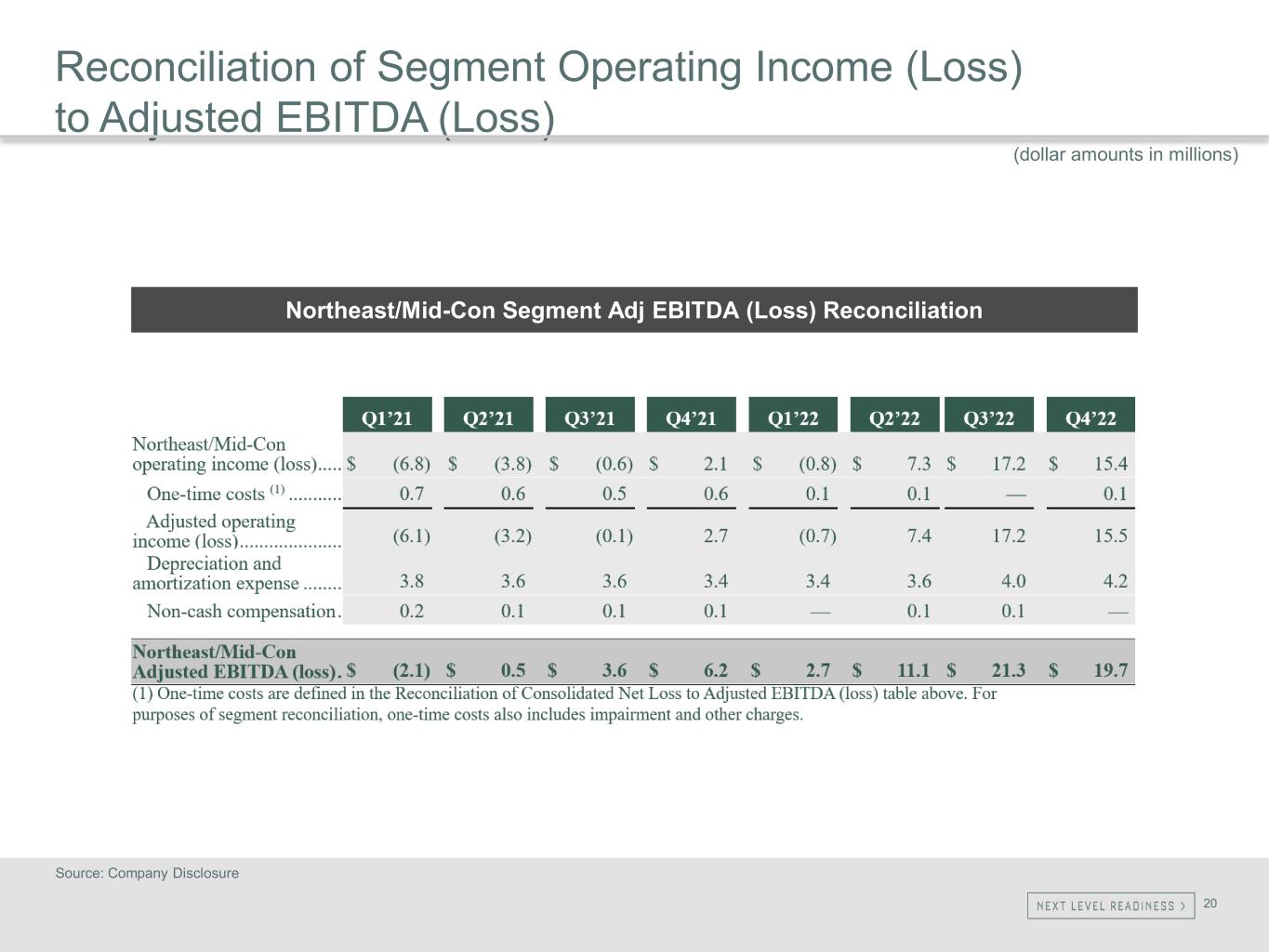

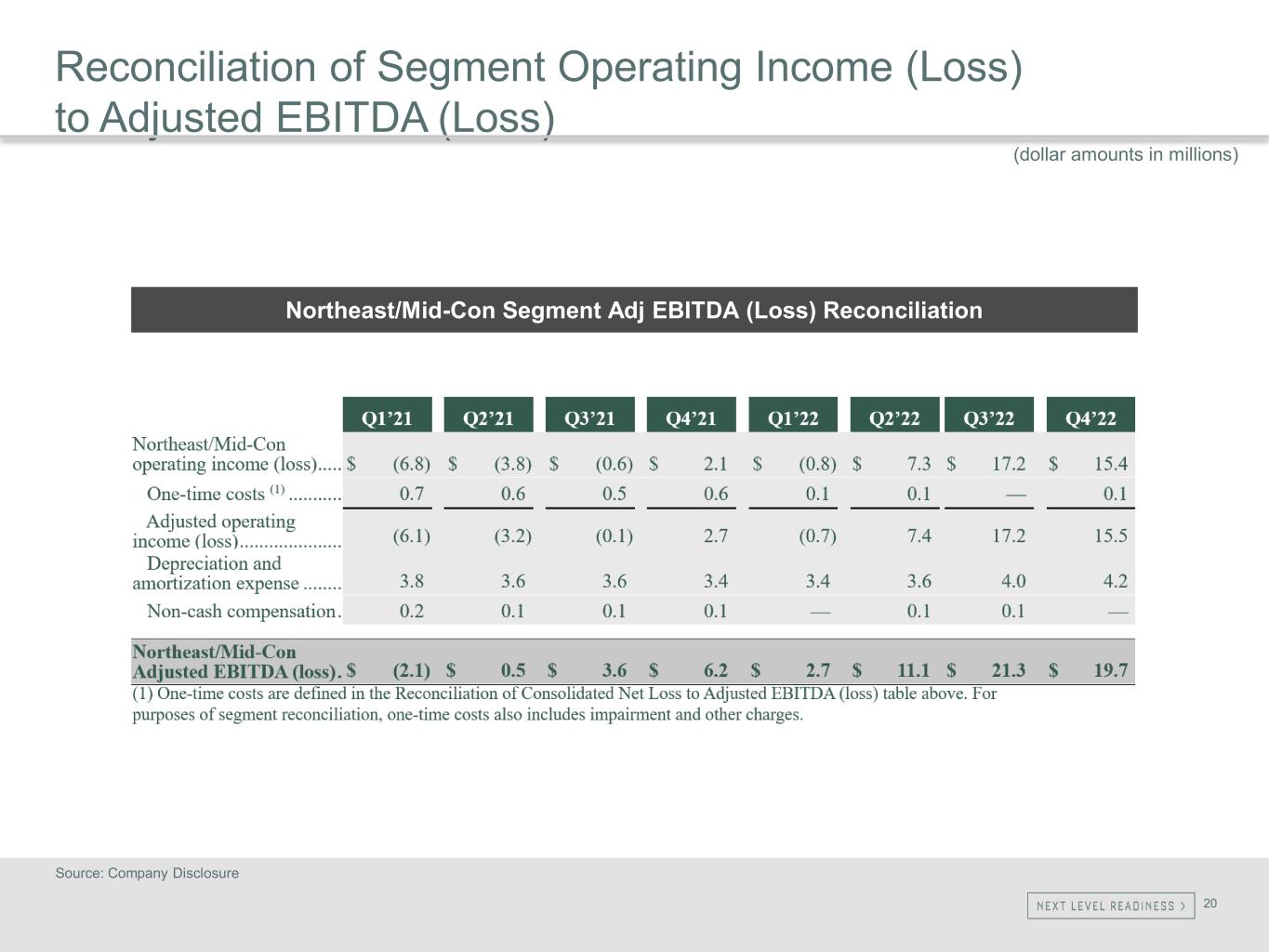

20 Reconciliation of Segment Operating Income (Loss) to Adjusted EBITDA (Loss) Source: Company Disclosure (dollar amounts in millions) Northeast/Mid-Con Segment Adj EBITDA (Loss) Reconciliation

21 Segment Operating Income (Loss) Margin Reconciliation Source: Company Disclosure Segment Operating Income (Loss) Margin Reconciliation (dollar amounts in millions)

22 Segment Adjusted EBITDA (Loss) Margin Reconciliation Source: Company Disclosure Segment Adj EBITDA (Loss) Margin Reconciliation (dollar amounts in millions)

23 SG&A Margin Reconciliation Source: Company Disclosure SG&A Margin Reconciliation (dollar amounts in millions)

24 Annualized Adjusted EBITDA (Loss) Reconciliation Source: Company Disclosure Annualized Quarterly Adj EBITDA (Loss) Reconciliation (dollar amounts in millions)