On April 20, 2018, Xanthic signed a binding letter of intent with Green Mile Solutions LLC (“GMS”) to develop plans to manufacture and distribute Xanthic-branded cannabis-infused products in the U.S. states of Oregon, Nevada and Ohio. GMS facilitates the manufacturing of cannabis-infused powders in licensed facilities using the proprietary Xanthic process to create water soluble tetrahydrocannabinol (“THC”) and CBD. GMS procures sales of the finished products into the local licensed dispensary networks through existing sales and distribution channels.

On May 1, 2018, Xanthic signed a letter of intent with Pasaverde Labs LLC to commercialize the Company’s existing patent-pending powder process in the state of California.

On May 7, 2018, Xanthic also signed a binding letter of intent with Nutritional High International Inc. for the production and distribution of Xanthic-branded, water-soluble cannabis-infused powders in the state of California.

On June 11, 2018, Xanthic signed a letter of intent with ABH Pharma Inc. (“ABH”), a leadingFDA-registered andGMP-certified manufacturer ofin-house branded and private label dietary supplements in the United States. Through its partnership with the Company, ABH was to offer “Xanthic Powered”CBD-infused products to customers across its broad range of dietary supplements, which would be sold by variousbrick-and-mortar retailers ande-commerce websites. On July 3, 2018, Xanthic terminated its letter of intent with ABH due to the parties’ inability to reach agreement on key business terms.

On June 26, 2018, Dr. Gunther Hintz resigned from the Company’s board of directors (the “Board”).

Subsequent to the Year Ended June 30, 2018

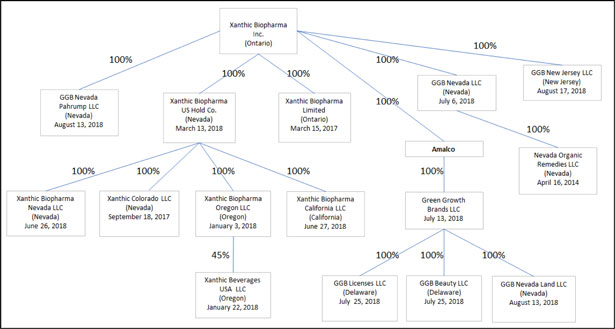

On July 13, 2018, GGB Nevada LLC (“GGB Nevada”), a wholly-owned subsidiary of Xanthic, entered into a membership interest purchase agreement (the “NOR Agreement”) withinter alios, Andrew Jolley and Stephen Byrne (together, the “NOR Sellers”), pursuant to which GGB Nevada acquired 95% of the issued and outstanding membership interests of Nevada Organic Remedies (“NOR”) and the obligation to acquire the remaining 5% of the issued and outstanding membership interests of NOR (the “NOR Acquisition”) for a total purchase price of US$56,750,000, plus all accrued interest pursuant to a secured promissory note for US$21,565,000 as payment of deferred purchase price consideration. The NOR Acquisition was completed on September 4, 2018. For the current fiscal year, the NOR Acquisition will be immediately accretive to Xanthic’s net income.

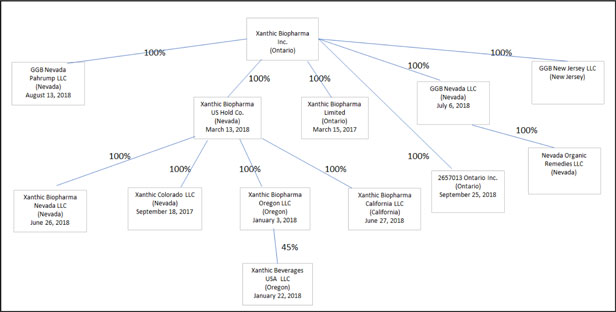

On July 13, 2018, Xanthic and Green Growth Brands Ltd. (“GGB”) entered into a transaction agreement, as amended on August 30, 2018, and as amended and restated on October 30, 2018 (the “Transaction Agreement”) to combine Xanthic and GGB by way of amalgamation between GGB and a wholly-owned subsidiary of Xanthic, 2657013 Ontario Inc., to form one company as a wholly-owned subsidiary of Xanthic (the “Business Combination”).

On July 13, 2018, in connection with the Business Combination, the Board was reconstituted to include existing Board members Carli Posner as Chair, Tim Moore, Igor “Gary” Galitsky and new GGB nominees Jean Schottenstein, Peter Horvath, Steve Stoute and Marc Lehmann.

On August 30, 2018, Xanthic, GGB, All Js Greenspace LLC, Chiron Ventures Inc., and WMBGG Resources LLC entered into a nomination rights agreement (the “Nomination Rights Agreement”) setting out certain Xanthic director nomination rights of All JS Greenspace LLC, Chiron Ventures Inc., and WMBGG Resources LLC. The Nomination Rights Agreement was amended and restated on

4