UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

________________________

| | | | | | | | |

Filed by the Registrant þ | Filed by a party other than the Registrant ¨ |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Arcosa, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | |

| | Arcosa, Inc. Chairman Letter |

|

| | Dear Fellow Shareholders: We are pleased to invite you to our Annual Meeting of Shareholders on Wednesday, May 8, 2024 at 8:30 a.m., Central Daylight Time. The Annual Meeting of Shareholders will be held virtually via the Internet through a live, audio-only webcast. Shareholders will be able to participate, listen, vote, and submit questions from any remote location with Internet connectivity. A notice of the meeting and a proxy statement containing information about the matters to be acted upon are attached to this letter. Your vote is important to us. Whether or not you plan to attend virtually, we encourage you to vote in advance of the Annual Meeting of Shareholders by telephone, by Internet, or by signing, dating, and returning your proxy card (or voting instruction form, if you hold shares through a broker or other nominee) by mail. You may also vote virtually during the Annual Meeting of Shareholders by following the instructions included in Arcosa, Inc.’s 2024 Proxy Statement. Thank you for being a shareholder and for your continued support and interest in Arcosa, Inc. Best regards, /s/ Rhys J. Best Rhys J. Best Chairman of the Board |

| Rhys J. Best |

|

| | | | | | | | | | | | | | |

| | Arcosa, Inc. Notice of Annual Meeting of Shareholders |

|

| | | To Our Shareholders: Please join us for the 2024 Annual Meeting of Shareholders of Arcosa, Inc. ("Arcosa" or the "Company"). The meeting will be held on Wednesday, May 8, 2024, at 8:30 a.m., Central Daylight Time, via live webcast at www.virtualshareholdermeeting.com/ACA2024. At the meeting, the shareholders will act on the following matters: |

|

MEETING DATE Wednesday, May 8, 2024 |

|

| |

|

MEETING TIME 8:30 a.m., CDT |

| 01 | Election of the nine (9) Directors named in this Proxy Statement and nominated by the Board of Directors, each to serve for a one-year term ending at the 2025 Annual Meeting of Shareholders; |

| 02 | Advisory vote on named executive officer compensation; |

|

| |

|

MEETING PLACE Live webcast at www.virtualshareholdermeeting.com/ACA2024 | 03 | Ratification of the appointment of Ernst & Young LLP ("Ernst & Young") as Arcosa’s independent registered public accounting firm for the year ending December 31, 2024; and |

| 04 | Any other matters that may properly come before the meeting, or any adjournments or postponements thereof. |

| |

| |

|

VOTING Shareholders as of the record date are entitled to vote. | All shareholders of record at the close of business on March 14, 2024 are entitled to vote during the virtual meeting, or at any postponement or adjournment of the meeting. A list of the shareholders will be available during the ten (10) day period ending on the day prior to the shareholder meeting at Arcosa’s offices in Dallas, Texas, and will also be made available to shareholders in secure electronic format during the virtual shareholder meeting. By Order of the Board of Directors, Mark J. Elmore Vice President, Corporate Secretary and Associate General Counsel |

|

| |

|

YOUR VOTE IS IMPORTANT We urge you to cast your vote promptly, even if you plan to attend the virtual Annual Meeting of Shareholders. You may vote in advance via the Internet, by telephone or, if you have received or requested a printed version of these proxy materials, by mail. |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 8, 2024: This Proxy Statement and the Annual Report to Shareholders for the fiscal year ended December 31, 2023 are available at www.proxyvote.com. Proxy materials or a Notice of Internet Availability of Proxy Materials are being first released or mailed to shareholders on or about March 26, 2024. |

| | | | | | | | | | | | | | | | | |

| Arcosa, Inc. Table of Contents |

|

| | | | | | | | |

|

| Proxy Statement Summary |

|

| Director Nominees 7 - Director Nominee Highlights 8 - Director Skills Matrix |

|

| Proposal 1 - Election of Nominated Directors 10 - Director Nominee Biographies 19 - Director Nomination Process |

|

| Corporate Governance 20 - Independence of Directors 20 - Board Leadership Structure 21 - Board Meetings and Committees 25 - Board's Role in Risk Oversight 26 - Risk Assessment of Compensation Policies and Practices 26 - Communications with Directors 26 - Employee, Officer, and Director Pledging and Hedging Policy |

|

|

|

|

|

|

|

| Transactions with Related Persons 27 - Review, Approval, and Ratification of Transactions with Related Persons |

| |

| Proposal 2 - Advisory Vote to Approve Named Executive Officer Compensation |

|

| Executive Compensation 29 - Compensation Discussion and Analysis 48 - Human Resources Committee Report 49 - Compensation of Executives 49 - Summary Compensation Table 50 - Grants of Plan-Based Awards 51 - Discussion Regarding Summary Compensation Table and Grants of Plan-Based Awards |

|

|

|

|

| | | | | |

| 51 - Outstanding Equity Awards at Year-End 53 - Stock Vested in 2023 53 - Nonqualified Deferred Compensation 54 - Deferred Compensation Discussion 54 - Potential Payments Upon Termination or Change in Control |

|

|

|

| |

| CEO Pay Ratio |

| |

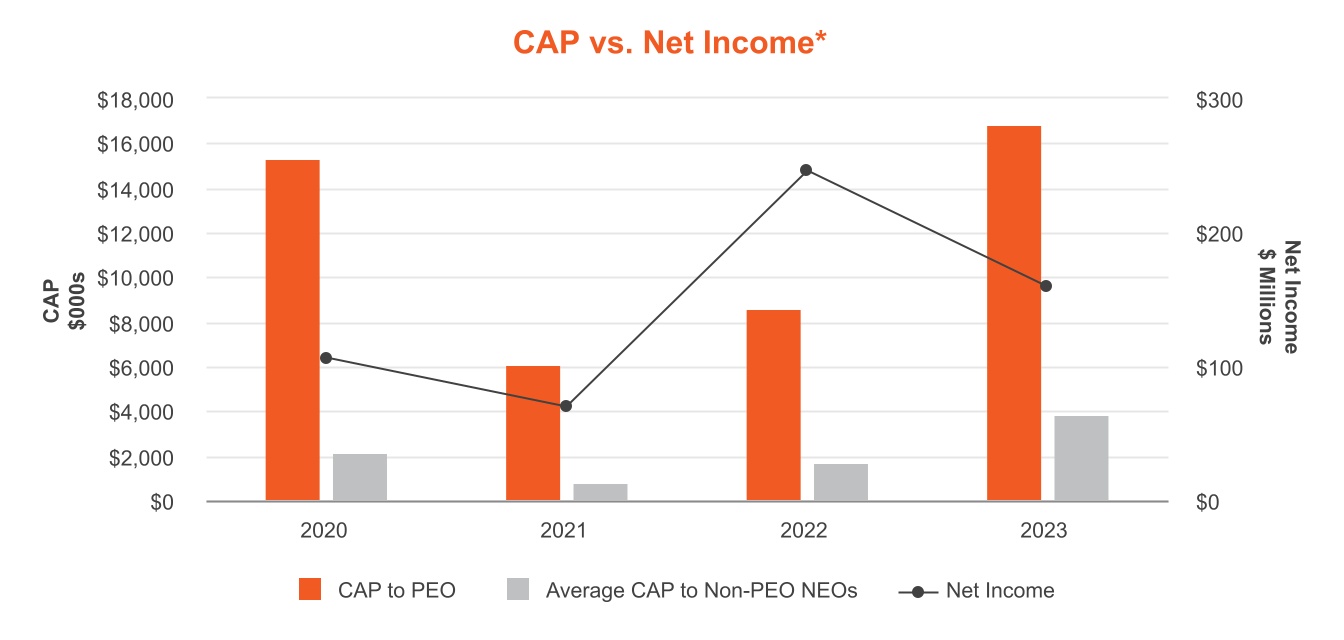

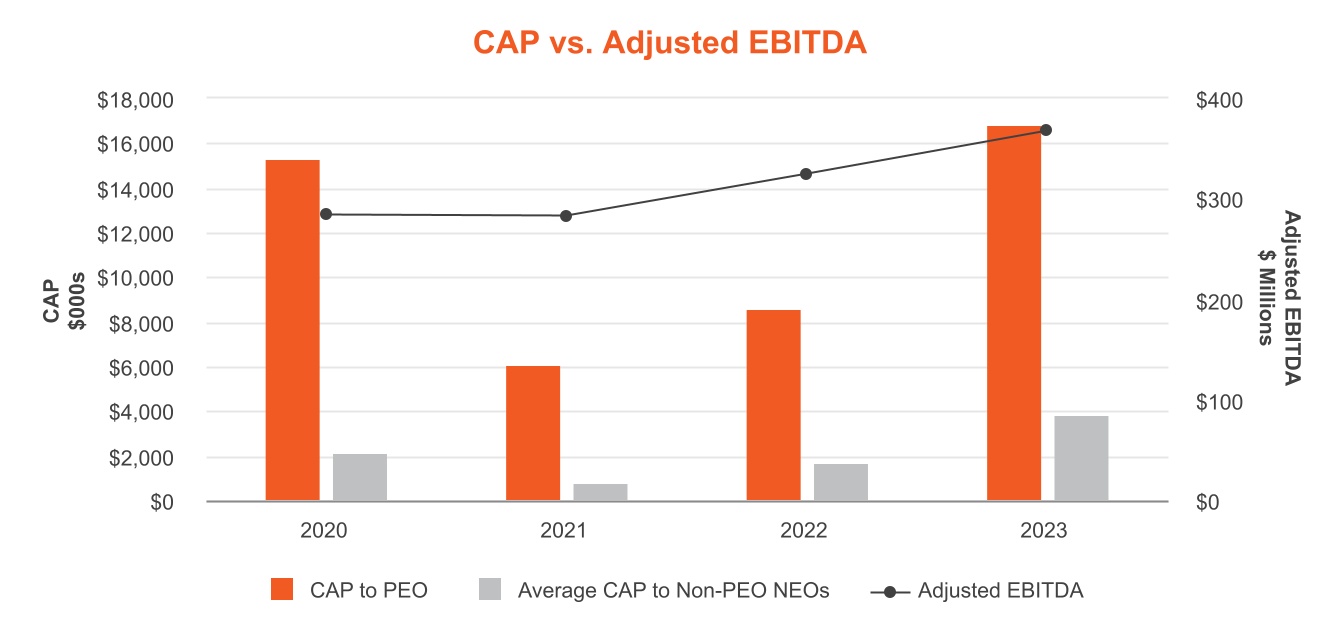

| Pay Versus Performance |

|

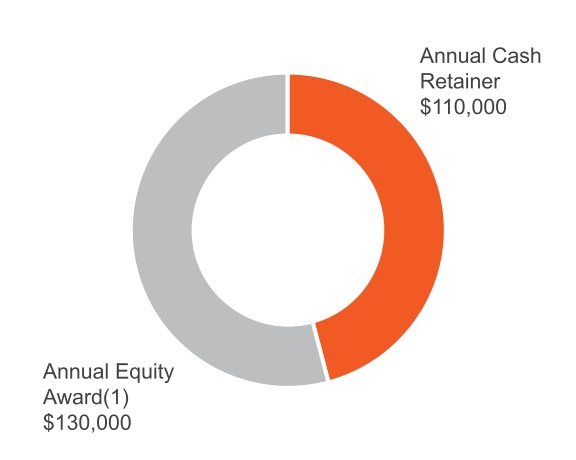

| Director Compensation |

|

| Proposal 3 - Ratification of the Appointment of Ernst & Young LLP 65 - Report of the Audit Committee 66 - Fees of Independent Registered Public Accounting Firm for Fiscal Years 2023 and 2022 |

|

| Security Ownership of Certain Beneficial Owners and Management |

|

| Additional Information 69 - Shareholder Proposals for the 2025 Proxy Statement 69 - Director Nominations or Other Business for Presentation at the 2025 Annual Meeting 69 - Annual Report on Form 10-K |

|

|

|

| Questions and Answers About the Meeting |

|

| Other Business |

|

| ANNEX A - Reconciliation of Non-GAAP Financial Measures |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Arcosa, Inc. Proxy Statement Summary |

|

| | | This Proxy Statement is being provided to the shareholders of Arcosa in connection with the solicitation of proxies by the Board of Directors of Arcosa to be voted at the 2024 Annual Meeting of Shareholders (the "Annual Meeting") to be held virtually at www.virtualshareholdermeeting.com/ACA2024 on Wednesday, May 8, 2024, at 8:30 a.m., Central Daylight Time, or at any postponement or adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Arcosa’s mailing address is 500 N. Akard St., Suite 400, Dallas, Texas 75201. Agenda and Voting Recommendations |

|

MEETING DATE Wednesday, May 8, 2024 |

|

| |

|

MEETING TIME 8:30 a.m., CDT |

| Proposal | Description | Board Recommendation | Page |

| 01 | Election of nine (9) Directors to serve on the Board | FOR | |

| 02 | Advisory vote to approve named executive officer compensation | FOR | |

|

| |

|

MEETING PLACE Live webcast at www.virtualshareholdermeeting.com/ACA2024 | 03 | Ratification of Ernst & Young as Arcosa’s independent registered public accounting firm for the year ending December 31, 2024 | FOR | |

| How to Vote | | |

| | |

| |

|

RECORD DATE March 14, 2024 | ONLINE Go to www.proxyvote.com You will need the 16-digit control number provided in your proxy materials. | TOLL-FREE NUMBER Use the toll-free number on the Notice or Proxy Card. |

| | |

| |

|

VOTING Shareholders as of the record date are entitled to vote. | MAIL Mark, sign, date, and promptly mail the enclosed Proxy Card in the postage-paid envelope. | SMART PHONE Scan the QR code on your Notice Card to vote. |

This summary provides an overview and highlights of the information contained in this Proxy Statement. It does not contain all information you should consider, and you should read the entire Proxy Statement carefully before voting.

Commitment to Build a Better World

| | | | | | | | | | | |

| | | |

| Vision | | Unified in our commitment to build a better world. |

| | | |

|

| | | |

| Values | | We advance a safety-focused and ESG-driven culture. |

| |

We are committed •Innovative •Focused •Results-Oriented | We act with integrity •Principled •Honest •Fair |

| |

We make things happen •Agile •Driven •Passionate | We win together •Collaborative •Dedicated •United |

| | | |

|

| | | |

| Promise | | At Arcosa: •We activate the potential of our people. •We care for our customers. •We optimize operations. •We integrate sustainability into our daily practices as well as our long-term strategy. •We promote a results-driven culture that is aligned with long-term value creation. |

| | | |

Financial Highlights

We achieved healthy financial performance in line with the targets set by the Board of Directors (the "Board") and the Human Resources Committee (the "HR Committee") for 2023. Our financial highlights for 2023 include:

| | | | | | | | |

| | |

$2,308M Total Revenue | | $368M* Total Adjusted EBITDA |

| | |

| | |

| | |

19.3%* Return on Capital | | 15.9%* Adjusted EBITDA Margin |

| | |

* See Annex A for a reconciliation of Non-GAAP measures to the most comparable GAAP measures.

Focus on Growth

We continued to grow in attractive markets. We completed multiple acquisitions, expanding our presence in Florida with both recycled aggregates and natural aggregates and adding Houston manufacturing for our trench shoring business. In addition to our acquisitions, we focused on organic growth projects by opening new or expanding existing plants, increasing our production capabilities and geographic footprints.

| | | | | |

| |

| |

| Acquisitions | Organic Projects |

| |

Deployed approximately $120 million

in Florida, Texas, and Arizona. | Invested in a new concrete utility pole plant in Florida

and a new wind tower facility in New Mexico. |

| |

Focus on Sustainability

We continued to integrate environmental, social, and governance ("ESG") initiatives into our businesses in our united efforts to build a better world through our strategic planning, ESG-focused initiatives, and innovative improvement projects. We are proud of achieving the following milestones in our continuous efforts to integrate sustainability into our daily practices and long-term strategies.

MAJOR ESG MILESTONES

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Published our third annual Sustainability Report with continued disclosure of select social and environmental metrics, including measurement against our 5-year emissions goal of a 10% reduction in Scope 1 and Scope 2 GHG emissions intensity by 2026. | | | Invested in the communities where we operate through educational support projects and funding, school supply drives, food pantry donations, and meal packaging to alleviate food insecurity. | | | Focused on high impact emissions reductions projects, including generator to line power conversions, energy-efficient equipment replacements, and lighting and fixture upgrades. | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earned a second, consecutive silver medal for our year-over-year improvement on sustainability efforts from third party ESG assessor, EcoVadis. Ranked in Newsweek's Most Responsible Companies. | | | Completed 1st Arcosa Leadership, Exploration, and Development (LEAD) cohort, with goal to develop high-performing, high-potential internal talent for broader leadership roles. More than 50% of participants have been promoted into plant leadership roles. | | | Conducted 2nd Employee Engagement Survey, with 57% response rate and a favorable overall company rating. | |

| | | | | | | | |

Focus on Safety

We are committed to safety across our operations. We continued down the path of enhancing our safety culture through our company-wide safety culture initiative, ARC 100. We believe our continued efforts have driven safety improvements positively impacting our employees on a day to day basis.

| | | | | | | | | | | |

| | | |

â 60% | | We have seen a 60% year-over-year decline in total lost workdays due to injuries, and a 50% year-over-year decline in hospitalizations. | |

| | |

â 50% | | |

| | | |

Focus on Diversity

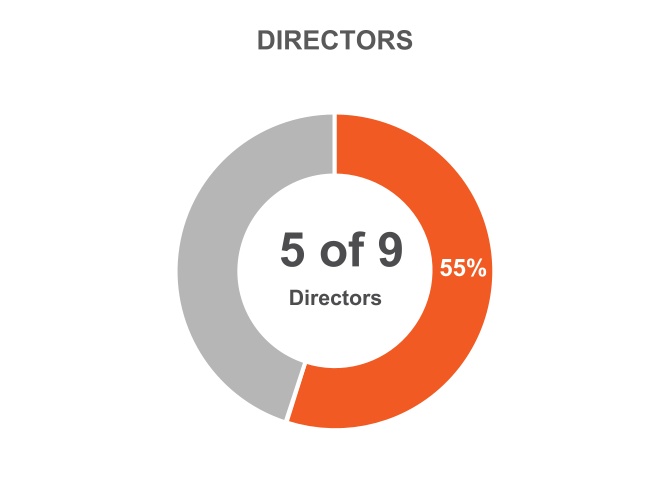

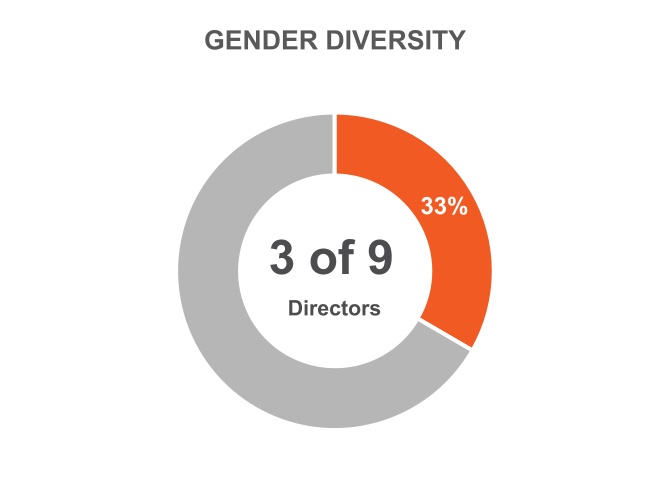

Having a diverse Board and leadership team is an important part of who we are. Five out of nine members of our Board (all of which are nominated for election this year) and half of our senior leaders are comprised of diverse members.

* Reflects racial or gender diversity.

Shareholder Engagement

We maintain an ongoing, proactive outreach effort with our shareholders. Throughout the year, members of our Investor Relations team and senior management, including our Chief Executive Officer ("CEO"), Chief Financial Officer ("CFO"), and other named executive officers ("NEO" or "NEOs"), engage with our shareholders to seek their input, to remain well-informed regarding their perspectives, and to help increase their understanding of our business. In particular, we leverage the discussions to cover topics of interest to our shareholders, including our performance, strategy, risk management, corporate governance, ESG initiatives, and executive compensation. The feedback received from our shareholder outreach efforts is communicated to and considered by the Board, and our engagement activities have produced valuable feedback that helps inform our decisions and our strategy, when appropriate.

| | | | | | | | | | | |

Shareholder Outreach Program with 75% of Top 25 Holders of Arcosa Stock |

| Shareholder engagement with our Board | CEO, CFO, Investor Relations and Board solicited feedback from shareholders | Active calendar of in-person and virtual events throughout the year |

| â |

| Engaged Rivel Research Group |

| Performed a Perception Study | Provided further insight from shareholders |

Governance Highlights

We are committed to strong corporate governance practices, which we believe recognize shareholder interests and support the success of our enterprise. Our corporate governance practices are highlighted below:

| | | | | | | | |

| Independent Board Chairman | 9 of 10 current Board members are independent | New York Stock Exchange compliant clawback policy in place |

| Limits on other public company board service | Regularly-scheduled executive sessions of independent Board members | Extensive shareholder engagement program |

| Majority voting policy for uncontested director elections | Culture that values ESG responsibility | Annual Board and Committee self-performance evaluations |

| Shareholders' ability to nominate directors through proxy access | Enterprise Risk Management program with full Board and Committee oversight | Robust director and senior officer stock ownership requirements |

| 100% Independent Audit, Human Resources, and Governance and Sustainability Committees | Policies prohibiting short sales, hedging, margin accounts, and pledging of Arcosa stock | More than 50% of Board members identify as diverse |

Compensation Highlights

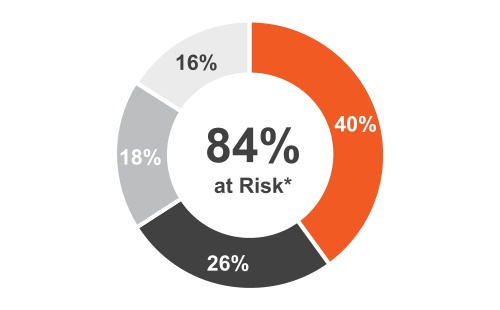

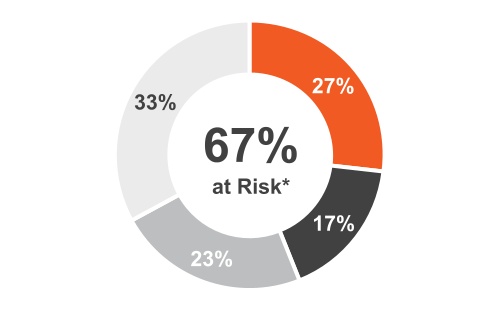

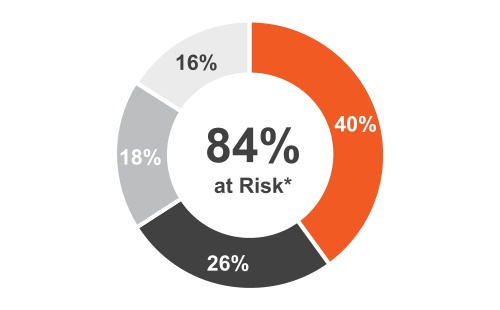

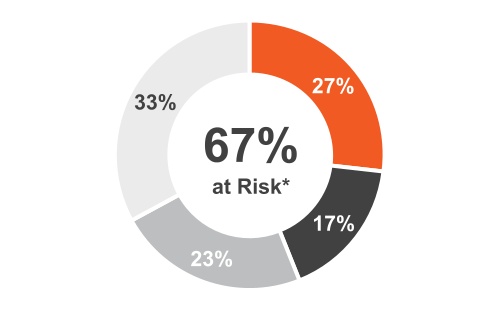

Our shareholders continue to show strong support for our pay-for-performance philosophy (receiving 99% of votes cast in favor of our compensation program during the 2023 Annual Meeting). We believe weighting a significant portion of our named executive officers’ compensation with performance-based compensation and value creation in the form of stock appreciation aligns with our shareholders' expectations. With these expectations in mind, the HR Committee designed a compensation package for the CEO that was 84% at risk and for the other NEOs 67% at risk.

The HR Committee modified the prior year's compensation program to reflect the priorities of the business and its shareholders. For the 2023 annual incentive program (the "AIP"), we introduced new metrics to further focus management on cost and expense control by including a measure of the percentage of non-production costs to our revenue for the Corporate Plan and a metric of Adjusted EBITDA margin for the Group President Plans. We continued to align management's interest with those of our shareholders by linking the payout of the performance-based portion of our long-term compensation program to our financial performance and our Total Shareholder Return ("TSR") performance relative to the S&P SmallCap 600 Index.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| n PBRSU | | n TBRSU | | n AIP | | n Base | |

* Charts above reflect an approximation of the 2023 annual target total compensation mix.

We encourage you to read the more fulsome description of our compensation program in the "Executive Compensation - Compensation Discussion and Analysis" section beginning on page 29.

The charts and graphs below contain information regarding our director nominees for election at the 2024 Annual Meeting.

Director Nominee Highlights

| | | | | | | | | | | | | | |

| Director | Age | Tenure on Board* | Independence | Diversity** |

| Joseph Alvarado | 71 | 6 | | |

| Rhys J. Best | 77 | 19 | | |

| Antonio Carrillo | 57 | 10 | | |

| Jeffrey A. Craig | 63 | 6 | | |

| Steven J. Demetriou | 65 | 1 | | |

| John W. Lindsay | 63 | 6 | | |

| Kimberly S. Lubel | 59 | 3 | | |

| Julie A. Piggott | 63 | 3 | | |

| Melanie M. Trent | 59 | 6 | | |

* Includes years of service combined on both boards of Arcosa and Trinity Industries, Inc., the former parent company of Arcosa ("Former Parent" or "Trinity").

** Reflects either racial or gender diversity.

BOARD TENURE

Average: 6.6 Years

BOARD REFRESHMENT*

| | | | | | | | | | | |

| New Directors since 2018 | Directors Retired since 2018 | |

*Ronald J. Gafford has announced his retirement effective May 8, 2024.

Director Skills Matrix

The following matrices highlight the mix of skills, attributes, and industry experience of the nine nominees that supported the recommendation by the Governance and Sustainability Committee ("G&S Committee") and the Board’s nomination for election.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Alvarado | Best | Carrillo | Craig | Demetriou | Lindsay | Lubel | Piggott | Trent |

| | | | | | | | | |

| Cyclical Industry | § | § | § | § | § | § | § | § | § |

| Multi-industry - Manufacturing, Energy, Construction, Minerals, Mining | § | § | § | § | § | § | § | § | § |

| Industrial Equipment Manufacturing | § | § | § | § | § | § | § | § | § |

| Technical Expertise Applicable to Arcosa Products | § | § | § | § | § | § | § | § | § |

| C-level Corporate Executive Position; Strategic Leadership | § | § | § | § | § | § | § | § | § |

| International/Cross-Border | § | § | § | § | § | § | § | § | § |

| Broad Manager in Scale Organization | § | § | § | § | § | § | § | § | § |

| IT Knowledge | § | § | § | § | § | § | § | § | § |

| ESG Knowledge | § | § | § | § | § | § | § | § | § |

| Finance, Banks, Public Securities | § | § | § | § | § | § | § | § | § |

| Human Resources/Cultural | § | § | § | § | § | § | § | § | § |

| Legal/Risk; Management/Compliance | § | § | § | § | § | § | § | § | § |

| Mergers & Acquisitions | § | § | § | § | § | § | § | § | § |

| Public Company/Corporate Governance | § | § | § | § | § | § | § | § | § |

| SOX/Financial Expert | § | § | § | § | § | § | § | § | § |

| Independent | § | § | § | § | § | § | § | § | § |

| Diversity | § | § | § | § | § | § | § | § | § |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Industry and Sector Experience |

| | | | | | | | |

| Manufacturing | | | Engineering & Construction | | | Oil & Gas | |

| Transportation | | | Industrial Products | | | Consulting | |

| Chemicals | | | Retail | | | Distribution | |

| Steel & Other Metals Manufacturing | | | Banking | | | Energy | |

| | | | | | | | |

Proposal One Election of Nominated Directors |

| | |

10 Current Members | The Board of Directors currently consists of ten members. Mr. Ronald J. Gafford is retiring when his term expires in 2024 and will not stand for re-election at the Annual Meeting. On the recommendation of the G&S Committee, the Board has nominated the nine incumbent candidates to be re-elected at the Annual Meeting. If elected, each of the directors will serve for a one-year term expiring at the 2025 Annual Meeting of Shareholders, or when their successors are duly elected and qualified or earlier upon death, resignation, retirement, disqualification, or removal. |

| |

| |

9 Candidates for re-election | All of the nominees are incumbent directors, and, pursuant to Arcosa's Amended and Restated Bylaws, an incumbent director nominee who is not elected is required to tender his or her resignation for consideration by the G&S Committee and the Board (with the affected director recusing himself or herself from the deliberations). The Board will be free to accept or reject the resignation and will make its decision known publicly within 90 days of certification of the vote results. If a director’s resignation is accepted by the Board, then the Board may fill the resulting vacancy.

Each nominee has agreed to be named in this Proxy Statement and to serve if elected. We have no reason to believe that any of the nominees would be unable to serve if elected, but, if any nominee is unavailable for election, the proxy holders may vote for another nominee proposed by the Board, in which case your shares will be voted for such other nominee.

The Board of Directors believes that each of the director nominees possesses the qualifications described in the "Director Nomination Process" section.

The "Director Nominees" section contains biographical information about each of the director nominees, including a description of the experience, qualifications, attributes, and skills that led the Board to conclude that the individual should be nominated for election as a director of Arcosa. |

|

1-year Term expiring in 2025 |

|

| | |

| | "FOR" The Board of Directors recommends that you vote FOR each of the Nominees for Director. |

| | |

Director Nominee Biographies

| | | | | | | | | | | | | | |

| | Joseph Alvarado Mr. Alvarado's significant management experience provides the Board with additional perspective on Arcosa's operations, including its construction products and steel fabrication businesses. Mr. Alvarado received a B. A. in Economics from the University of Notre Dame and an M.B.A. in Finance from Cornell University-Johnson College of Business. Professional Experience •Commercial Metals Company, global manufacturer, recycler, and marketer of steel and other metals –Chief Executive Officer (2011-2017) –President and Chief Operating Officer (2011) –Executive Vice President and Chief Operating Officer (2010-2011) •U.S. Steel Tubular Products of U.S. Steel Corp., President (2007-2009) •Lone Star Technologies, Inc., President and Chief Operating Officer (2004 to 2007) •Ispat North America Inc. (now Arcelor Mittal), Vice President (1998-2004) •Birmingham Steel Company, Executive Vice President (1997-1998) •Inland Bar Company –President (1995-1997) –Vice President and General Manager, Sales and Marketing (1988-1995) Current Public Company Boards: •PNC Financial Services Group, Inc. (2019-present) •Kennametal, Inc. (2018-present) •Trinseo plc (2017-present) Prior Public Company Boards: •Commercial Metals Company, Chair (2013 to 2018) •Spectra Energy Corp (2011-2017) Private Boards & Other Affiliations: •Board member of various industry trade associations and community organizations |

| | |

| | |

| Age: 71 Director Since: 2018 INDEPENDENT Board Committees: •Human Resources (Chair)

| |

| | |

| | | | | | | | | | | | | | |

| | Rhys J. Best Mr. Best has extensive experience in managing and leading significant industrial enterprises. His executive experience and service on the boards of other significant companies provides the Board with additional perspective on Arcosa’s operations, including its construction products and engineered structures businesses, as well as its international operations and any future international opportunities. Mr. Best received a B.B.A. in Accounting from the University of North Texas and an M.B.A. in Banking and Finance from Southern Methodist University-Cox School of Business. Professional Experience: •Lone Star Technologies, Inc., producer of casing, tubing, line pipe and couplings for oil and gas, industrial, automotive, and power generation industries –Chief Executive Officer (2004-2007) –President, and Chief Executive Officer (1999-2004) Current Public Company Boards: •Texas Pacific Land Corporation (2022-present), Non-Executive Chair (2023-present) Prior Public Company Boards: •MRC Global, Inc. (2008-2022), Non-Executive Chair (2016-2022) •Commercial Metals Company (2010-2022) •Cabot Oil & Gas Corporation (2008-2021), Lead Director (2020-2021) •Trinity Industries, Inc. (2005-2018), Lead Director (2009-2011) •Crosstex Energy, L.P. (2004-2014), Non-Executive Chair (2009-2014) •Lone Star Technologies, Inc., Chair (1997-2007) Private Boards & Other Affiliations: •Austin Industries, Inc. (2007-2018), Non-Executive Chair (2013-2018) •National Association of Corporate Directors, 2014 Director of the Year •Advisory Board of SMU's Maguire Energy Institute |

| | |

| | |

| Age: 77 Director Since: 2018 Non-Executive Chair INDEPENDENT Board Committees: None | |

| |

| | |

| | | | | | | | | | | | | | |

| | Antonio Carrillo Mr. Carrillo brings significant knowledge and understanding of Arcosa’s products, services, operations, and business environment. In addition, he has broad experience in managing and leading a significant industrial enterprise in Mexico, where Arcosa has a number of operations. Mr. Carrillo received a B.S. in Mechanical and Electrical Engineering from the Universidad Anáhuac in Mexico and an M.B.A. in Finance from Wharton School of the University of Pennsylvania. Professional Experience: •Arcosa, Inc., President and Chief Executive Officer (2018-present) •Trinity Industries, Inc. (1996-2012; 2018) –Senior Vice President and Group President of Construction, Energy, Marine, and Components –Senior Vice President and Group President of Energy Equipment Group and responsible for Mexico operations •Orbia Advance Corporation (formerly Mexichem S.A.B. de C.V.), a specialty chemicals and construction materials company –Chief Executive Officer (2012-2018) Current Public Company Boards: •NRG Energy, Inc. (2019-present) Prior Public Company Boards: •Dr. Pepper Snapple Group, Inc. (2015-2018) •Trinity Industries, Inc. (2014-2018) Private Boards & Other Affiliations: •United Way of Metropolitan Dallas, Board Member and Vice Chair •Dallas Citizens Council, Board of Directors •Wharton School of the University of Pennsylvania, Chairman of Executive Board for Latin America |

| | |

| | |

| Age: 57 Director Since: 2018 Board Committees: None | |

| |

| | |

| | |

| | | | | | | | | | | | | | |

| | Jeffrey A. Craig Mr. Craig's significant management experience provides the Board with additional perspective on Arcosa’s operations, including its transportation products businesses. Mr. Craig received a B.S. in Accounting from Michigan State University and an M.B.A. from Duke University-The Fuqua School of Business. Professional Experience: •Meritor, Inc., a global supplier for commercial vehicle manufacturers –Chief Executive Officer and President (2015-2021) –President and Chief Operating Officer (2014-2015) –Senior Vice President and President of Commercial Truck & Industrial (2013-2014) –Senior Vice President and Chief Financial Officer (2009-2013) •General Motors Acceptance Corp. –President and CEO of Commercial Finance (2001-2006) –President and CEO of Business Credit Division (1999-2001) Current Public Company Boards: •Hyliion Holdings Corp., Chair (2022-present) Prior Public Company Boards: •Meritor, Inc. (2015-2021), Executive Chair (2021) Private Boards & Other Affiliations: •Dean’s Advisory Board at Michigan State University’s Broad College of Business |

| | |

| | |

| Age: 63 Director Since: 2018 INDEPENDENT Financial Expert Board Committees: •Audit (Chair) | |

| |

| |

| | |

| | | | | | | | | | | | | | |

| | Steven J. Demetriou Mr. Demetriou's international business experience and over 35 years in senior management roles, combined with his extensive background, provide the Board with an additional perspective on Arcosa’s operations, including its engineered structures businesses, and driving ESG initiatives. Mr. Demetriou received a B.S. in Chemical Engineering from Tufts University. Professional Experience: •Jacobs Solutions Inc., a global professional services company that designs and deploys technology centric solutions –Executive Chair (2023-present) –Chief Executive Officer (2015-2023) •Aleris Corporation, Chief Executive Officer (2004-2015) •Noveon, Inc., Chief Executive Officer (2001-2004) •IMC Global Inc., Executive Vice President (1999-2001) •Cytec Industries, Inc. (1997-1999) •Exxon Mobil Corporation (1981-1997) Current Public Company Boards: •Jacobs Solutions, Inc., Chair (2016-present) •FirstEnergy Corporation (2017-present) Prior Public Company Boards: •C5 Acquisition Corporation (SPAC), Chair (2021-2023) •Kraton Performance Polymers (2009-2017) •Foster-Wheeler, Non-Executive Chair (2011-2014) •OM Group (2005-2015) •Aleris Corporation, Chair (2004-2015) Private Boards & Other Affiliations: •PA Consulting Group Limited, Director •U.S.-Saudi Business Council, Co-Chair •Cuyahoga Community College Foundation, Board Member Additional Information: The G&S Committee considered Mr. Demetriou’s current commitment as Executive Chair of Jacobs when examining his ability to dedicate sufficient time to fulfill his duties as a member of the Board, with the following relevant to the decision to nominate him for election: – Mr. Demetriou’s prior service on the board of C5 Acquisition Corporation has concluded. – Mr. Demetriou has assured the Board that he is fully committed to continuing to dedicate the appropriate amount of time to fulfill his duties on the Board and the G&S Committee. The Board believes it is in the best interest of the shareholders that Mr. Demetriou continue to serve as a director and a member of the G&S Committee to leverage his skills of driving sustainability initiatives. |

| | |

| | |

| Age: 65 Director Since: 2023 INDEPENDENT Board Committees: •Governance & Sustainability | |

| |

| | |

| | | | | | | | | | | | | | |

| | John W. Lindsay Mr. Lindsay's significant management experience provides the Board with additional perspective on Arcosa's operations, including its engineered structures businesses. Mr. Lindsay received a B.S. in Petroleum Engineering from the University of Tulsa. Professional Experience: •Helmerich & Payne, Inc., a provider of drilling services and technologies (1987-present) –President and Chief Executive Officer (2014-present) –President and Chief Operating Officer (2012-2014) –Executive Vice President and Chief Operating Officer (2010-2012) –Executive Vice President, U.S. and International Operations (2006-2010) –Vice President, U.S. Land Operations, Helmerich & Payne International Drilling Co. (1997-2006) Current Public Company Boards: •Helmerich & Payne, Inc. (2012-present) Private Boards & Other Affiliations: •Advisory Board of University of Tulsa Petroleum Engineering •Girl Scouts of Eastern Oklahoma, Board Member •Tulsa Regional Chamber, Board Member •The Nature Conservancy Oklahoma Chapter, Board Member |

| | |

| | |

| Age: 63 Director Since: 2018 INDEPENDENT Financial Expert Board Committees: •Audit •Human Resources | |

| |

| |

| | | | | | | | | | | | | | |

| | Kimberly S. Lubel Ms. Lubel’s strong legal background, strategic leadership skills and experience as a public company CEO and independent board member provide the Board with additional perspective on Arcosa’s operations. Ms. Lubel received a B.A. in Spanish and International Studies from Miami University (Ohio), an M.A. in International Relations from Baylor University, and a Juris Doctorate from the University of Texas School of Law. She is also a graduate of the Executive Program at Stanford University. Professional Experience: •CST Brands, Inc., a publicly traded fuel and convenience retailer –President and Chief Executive Officer (2013-2017) •Valero Energy Corporation –Executive Vice President and General Counsel (2006-2013) –Vice President of Legal Services (2003-2006) Current Public Company Boards: •Westlake Corporation (formerly Westlake Chemical) (2020-present) •PBF Energy Inc. (2017-present) Prior Public Company Boards: •WPX Energy, Inc. (2013-2020) •CST Brands, Inc., Chair (2013-2017) •CrossAmerica GP, LLC (2014-2017) Private Boards & Other Affiliations: •United Ways of Texas, Board Chair •Southwest Research Institute, Vice Chair •Inspire Trust Company, Director •The ExCo Group, Executive Coach & Mentor |

| | |

| | |

| Age: 59 Director Since: 2021 INDEPENDENT Board Committees: •Governance & Sustainability •Human Resources | |

| |

| |

| | | | | | | | | | | | | | |

| | Julie A. Piggott Ms. Piggott’s strategic leadership skills, financial expertise and background in the supply chain industry provide the Board with invaluable knowledge regarding the financial and other aspects of business operations, including Arcosa's transportation products businesses. Ms. Piggott received a B.S. in Accounting from Minnesota State University Moorhead, an M.B.A. from Southern Methodist University-Cox School of Business, and is a graduate of the Advanced Management Program at Harvard Business School. She has an inactive CPA license from the state of Minnesota. Professional Experience: •BNSF Railway Company, leading freight transportation company in North America –Executive Vice President and Chief Financial Officer (2014-2021) –Vice President, Planning & Studies and Controller (2009-2014) –Vice President, Finance and Treasurer (2008-2009) –Vice President, Finance (2006-2008) •Prior to her career at BNSF, Ms. Piggott’s experience includes finance, accounting and tax roles at a private investment management company and Ernst & Young LLP (formerly Ernst & Whinney) Current Public Company Boards: •Olin Corporation (2023-present) Private Boards & Other Affiliations: •Lena Pope, a non-profit charity, Board Member •Advisory Board of College of Business, Analytics & Communications at Minnesota State University Moorhead |

| | |

| | |

| Age: 63 Director Since: 2021 INDEPENDENT Financial Expert Board Committees: •Audit •Governance & Sustainability | |

| |

| |

| | | | | | | | | | | | | | |

| | Melanie M. Trent Ms. Trent’s strong legal and executive management experience, diverse background, and knowledge of oil and gas industry provide the Board with additional perspective on Arcosa’s operations. Ms. Trent received a B.A. in Italian from Middlebury College and a Juris Doctorate from Georgetown University. Professional Experience: •Rowan Companies plc (now Valaris plc), a global offshore contract drilling company –Executive Vice President, General Counsel, and Chief Administrative Officer (2014-2017) –Senior Vice President, Chief Administrative Officer, and Corporate Secretary (2011-2014) –Vice President and Corporate Secretary (2010-2011) –Compliance Officer and Corporate Secretary (2005-2010) •Reliant Energy Incorporated, VP, Investor Relations (1998-2003) Current Public Company Boards: •Diamondback Energy, Inc., Lead Independent Director (2018-present) •Hyliion Holdings Corp. (2023-present) Prior Public Company Boards: •Noble Corporation (2021-2022) •Frank’s International N.V. (now Expro Holding N.V.) (2019-2021) Private Boards & Other Affiliations: •Women Corporate Directors, Co-Chair of Houston Chapter •Houston Endowment Inc., Chair •YES Prep Public Schools, Board Member |

| | |

| | |

| Age: 59 Director Since: 2018 INDEPENDENT Board Committees: •Governance & Sustainability (Chair) | |

| |

| |

| | |

Director Nomination Process

The G&S Committee is responsible for recommending qualified candidates to the Board for nomination. In accordance with our Corporate Governance Principles, the G&S Committee should consider the following qualifications in making its recommendation of candidates to serve as a director of Arcosa: (i) the candidate's depth of experience at the policy-making level in business, government, or education; (ii) the candidate's ability to make a meaningful contribution to the Board’s oversight of the business and affairs of Arcosa and a willingness to exercise independent judgment; and (iii) whether the candidate has an impeccable reputation for honest and ethical conduct in both professional and personal activities. In addition, the G&S Committee examines a candidate’s availability and willingness to devote time to Board duties, the candidate’s ability to make analytical and probing inquiries, and financial independence to ensure he or she will not be financially dependent on director compensation.

The G&S Committee identifies potential nominees by asking, from time to time, current directors and executive officers for their recommendations of persons meeting the criteria described above who might be available to serve on the Board. The G&S Committee may also engage qualified firms that specialize in identifying director candidates. As described below, the G&S Committee will also consider candidates recommended by shareholders.

Once a person has been identified as a potential candidate, the G&S Committee makes an initial determination regarding the need for additional Board members to fill vacancies or expand the size of the Board. If the G&S Committee determines that additional consideration is warranted, the G&S Committee will review such information and conduct interviews as it deems necessary to fully evaluate each director candidate. In addition to the qualifications of a candidate, the G&S Committee will consider such relevant factors as it deems appropriate, including the current composition of the Board, the evaluations of other prospective nominees, and the need for any required expertise on the Board or one of its committees. The G&S Committee considers potential candidates in light of the skills, experience, and attributes possessed by current directors and as identified by the Board. The G&S Committee also contemplates multiple dynamics that promote and advance diversity among its members. Although the G&S Committee does not have a formal diversity policy, the G&S Committee considers a number of factors regarding diversity of personal and professional backgrounds (both domestic and international), national origins, specialized skills and acumen, and breadth of experience in industry, manufacturing, financial transactions, and business combinations.

The G&S Committee will consider director candidates recommended by shareholders. In considering candidates submitted by shareholders, the G&S Committee will take into consideration the needs of the Board and the qualifications of the candidate. To have a candidate considered by the G&S Committee, a shareholder must submit the recommendation in writing and must include the following information:

•the name of the shareholder, evidence of the person’s ownership of Arcosa stock, including the number of shares owned and the length of time of ownership, and a description of all arrangements or understandings regarding the submittal between the shareholder and the recommended candidate; and

•the name, age, business address, and residence address of the candidate, the candidate’s resumé or a listing of his or her qualifications to be a director of Arcosa, and the person’s consent to be a director if selected by the G&S Committee, nominated by the Board, and elected by the shareholders.

The shareholder recommendation and information described above must be sent to the Corporate Secretary at 500 N. Akard St., Suite 400, Dallas, Texas 75201, and must be received by the Corporate Secretary not less than 120 days prior to the anniversary date of the date that Arcosa’s Proxy Statement was released in connection with the previous year’s Annual Meeting of Shareholders in order to be included in Arcosa's Proxy Statement and form of proxy relating to the next Annual Meeting of Shareholders pursuant to Securities and Exchange Commission ("SEC") Rule 14a-8. The G&S Committee’s evaluation process will not vary based on whether or not a candidate is recommended by a shareholder.

Our business affairs are managed under the direction of the Board in accordance with the General Corporation Law of the State of Delaware, our Restated Certificate of Incorporation, and our Amended and Restated Bylaws. The role of the Board is to oversee our management for the benefit of the shareholders. This responsibility includes monitoring senior management’s conduct of our business operations and affairs; reviewing and approving our financial objectives, strategies, and plans; risk management oversight; evaluating the performance of the CEO and other executive officers; and overseeing our policies and procedures regarding corporate governance, legal compliance, ethical conduct, and maintenance of financial and accounting controls.

The Board has adopted Corporate Governance Principles, which are reviewed annually by the G&S Committee. We have a Code of Conduct, which is applicable to all of our employees, including the CEO, the CFO, and principal accounting officer and controller, as well as members of the Board. We intend to post any amendments to or waivers from our Code of Conduct on our website at ir.arcosa.com to the extent applicable to an executive officer, principal accounting officer and controller, or a director of Arcosa. The Corporate Governance Principles and the Code of Conduct are available on our website at ir.arcosa.com under the heading "Corporate Governance — Additional Governance Documents."

Independence of Directors

The Board makes all determinations with respect to director independence in accordance with the New York Stock Exchange ("NYSE") listing standards and the rules and regulations promulgated by the SEC. In addition, the Board established certain guidelines to assist it in making any such determinations regarding director independence (the "Independence Guidelines"), which are available on our website at ir.arcosa.com under the heading "Corporate Governance — Additional Governance Documents — Arcosa Categorical Standards of Director Independence." The Independence Guidelines set forth commercial and charitable relationships which may not rise to the level of material relationships that would impair a director’s independence as set forth in the NYSE listing standards and SEC rules and regulations. The determination of whether such relationships as described in the Independence Guidelines actually impair a director’s independence is made by the Board on a case-by-case basis.

The Board undertook its annual review of director independence and considered transactions and relationships between each director, or any member of his or her immediate family, and Arcosa and its subsidiaries and affiliates. In making its determination, the Board applied the NYSE listing standards and SEC rules and regulations, together with the Independence Guidelines.

As a result of its review, the Board affirmatively determined that the following directors are independent of Arcosa and its management under the standards set forth in the NYSE listing standards and the SEC rules and regulations: Joseph Alvarado, Rhys J. Best, Jeffrey A. Craig, Steven J. Demetriou, John W. Lindsay, Kimberly S. Lubel, Julie A. Piggott, and Melanie M. Trent. The Board determined that Antonio Carrillo is not independent because of his employment by Arcosa.

Board Leadership Structure

As our independent, non-executive Chairman of the Board, Mr. Best (i) presides over all meetings of the Board, non-management executive sessions, and shareholder meetings; (ii) reviews and approves meeting agendas, meeting schedules, and other information, as appropriate; (iii) acts as a liaison between the outside directors and management; (iv) consults on shareholder engagement and governance matters; (v) has the right to call special board or shareholder meetings; and (vi) performs such other duties as the Board requires from time to time. Having a separate non-executive Chairman allows our CEO to focus on operating and managing Arcosa and leverages our Chairman’s experience in guidance and oversight. While the Board believes that this structure is currently in the best interests of Arcosa and its shareholders, the Board does not have

a policy with respect to separating the Chairman of the Board and the CEO roles and could adjust the structure in the future as it deems appropriate.

Our Audit Committee, G&S Committee, and HR Committee are each comprised entirely of independent directors, providing a structure for strong independent oversight of our management.

Board Succession

The G&S Committee and the full Board routinely discuss board succession. Board composition is one of the most critical areas of focus for the Board. Having the right mix of directors who bring diverse perspectives, business and professional experiences, and skills provides a foundation for robust dialogue, informed advice, and collaboration. The Board considers current Board skills, composition, tenure, and anticipated retirements to identify gaps that may need to be filled through Board succession planning and the Board refreshment process. The Board strives to ensure an environment that encourages diverse critical thinking and values innovative, strategic discussions to achieve a higher level of success for Arcosa.

On February 29, 2024, Ronald J. Gafford announced that he would not be standing for re-election at the 2024 Annual Meeting and would retire from the Board after 25 years of dedicated service to both Arcosa and our Former Parent. With Mr. Gafford's retirement, the Board intends to resize the Board to consist of nine members.

Board Meetings and Committees

The Board holds regular and special meetings and spends such time on our affairs as their duties require. The Board held five meetings and a total of 14 committee meetings in 2023. The Board also meets regularly in non-management executive sessions. In 2023, all directors of Arcosa attended at least 75% of the meetings of the Board and the committees on which they served. Each director also attended the 2023 Annual Meeting of Shareholders, which is required pursuant to Arcosa's Corporate Governance Principles.

The standing committees of the Board are the Audit Committee, G&S Committee, and HR Committee. Each of the committees is governed by a charter, current copies of which are available on our website at ir.arcosa.com under the heading "Corporate Governance — Board Committees & Charters." Mr. Carrillo, the CEO and President of Arcosa, and Mr. Best, our non-executive Chairman of the Board, do not serve on any Board committees. Director membership of the committees and the number of committee meetings held in 2023 are identified below.

| | | | | | | | | | | |

| | | |

| Director | Audit Committee | Governance and Sustainability Committee | Human Resources Committee |

| | | |

| Joseph Alvarado | | | p |

| Rhys J. Best | | | |

| Antonio Carrillo | | | |

| Jeffrey A. Craig | p | | |

| Steven J. Demetriou | | l | |

| Ronald J. Gafford | | l | l |

| John W. Lindsay | l | | l |

| Kimberly S. Lubel | | l | l |

| Julie A. Piggott | l | l | |

| Melanie M. Trent | | p | |

| 2023 Meetings | 6 | 3 | 5 |

l Member p Chair

| | | | | | | | | | | | | | | | | |

| | | | | |

| Audit

Committee | | | Roles and Responsibilities: The purpose of the Audit Committee is to oversee, on behalf of the Board: •the integrity of Arcosa’s financial statements and related disclosures; •Arcosa’s compliance with legal and regulatory requirements; •the qualifications, independence, and performance of Arcosa’s independent auditing firm; •the performance of Arcosa’s internal audit function; •Arcosa’s internal accounting and disclosure control systems; and •Arcosa’s procedures for monitoring compliance with its Code of Conduct. In addition, among other responsibilities, the Audit Committee will periodically: •review the Company’s major risks or exposures, including information security and cybersecurity risks, to assess the steps taken by management to monitor and control such risks and exposures and to review the Company’s policies and procedures relating to risk assessment, management, and reporting; •review with management, our internal audit officer, and the independent auditors, Arcosa’s financial statements, the accounting principles applied in their preparation, the scope of the audit, any comments made by the independent auditors upon the financial condition of Arcosa and its accounting controls and procedures; •review with management its processes and policies related to risk assessment, management, and mitigation, compliance with corporate policies, compliance programs, internal controls, and summaries of management’s travel and entertainment reports; •pre-approve all auditing and all allowable non-audit services provided to Arcosa by the independent auditors; •select and retain the independent auditors for Arcosa and approves audit fees; •perform such other matters as the Audit Committee or the Board deems appropriate; and •meet with management to review certain enumerated risks for its oversight as may be assigned by the Board as part of Arcosa's annual enterprise risk management process or otherwise. | |

| | | | |

| | | | |

| Meetings in 2023: 6 | | | |

| | | | |

| | | | |

| Committee Members: Jeffrey A. Craig (Chair) John W. Lindsay Julie A. Piggott | | | |

| | | | |

| | | | |

|  Independent IndependentEach Committee Member is "independent" as defined by the SEC rules and NYSE listing standards. | | | |

| | | | |

| | | | |

|  Financial Expert Financial ExpertEach Committee Member is qualified as an audit committee financial expert within the meaning of SEC regulations. | | | |

| | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Governance and Sustainability

Committee | | | Roles and Responsibilities: The purpose of the G&S Committee is to: •identify and recommend to the Board individuals qualified to be nominated for election to the Board; •review and recommend to the Board the members and chairperson for each Board committee; •periodically review and assess the Corporate Governance Principles and our Code of Conduct and make recommendations for changes thereto to the Board; •periodically review our orientation program for new directors and our practices for continuing education of existing directors; •annually review director compensation and benefits; •oversee the annual self-evaluation of the performance of the Board and its committees; and •review and assess our activities and practices regarding sustainability and ESG matters that are significant to Arcosa. In conjunction with the above duties, the G&S Committee will periodically: •review the criteria for persons to be nominated for election to the Board and its committees as set forth in the Corporate Governance Principles; •review the qualifications of the members of each committee (including the independence of directors) to ensure that each committee’s membership meets applicable criteria established by the SEC and NYSE; •make recommendations to the Board regarding director compensation and benefits, utilizing reports from independent compensation consultants from time to time in its discretion; •annually conduct an individual director performance review of each incumbent director; •establish and maintain a process for shareholders to send communications to the Board; •review, approve, and ratify all transactions with related persons that are required to be disclosed under the rules of the SEC; and •meet with management to review certain enumerated risks for its oversight as may be assigned by the Board as part of Arcosa's annual enterprise risk management process or otherwise. | |

| | | | |

| | | | |

| Meetings in 2023: 3 | | | |

| | | | |

| | | | |

| Committee Members: Melanie M. Trent (Chair) Steven J. Demetriou Kimberly S. Lubel Julie A. Piggott | | | |

| | | | |

| | | | |

|  Independent IndependentEach Committee Member is "independent" as defined by the SEC rules and NYSE listing standards. | | | |

| | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Human Resources

Committee | | | Roles and Responsibilities: The purpose of the HR Committee is to: •assist the Board in the discharge of its fiduciary responsibilities relating to agreements with, and the fair and competitive compensation of, the CEO and other executives; •administer and make awards under Arcosa's incentive compensation and equity based plans; •oversee and administer the recovery of incentive-based compensation pursuant to Arcosa's Clawback Policy; •review plans for management succession; and •prepare a report for inclusion in the Proxy Statement, annual report on Form 10-K, or other applicable filings. These responsibilities require the HR Committee to: •make recommendations to the independent members of the Board in its responsibilities relating to the competitive compensation of our CEO; •review and approve compensation for the CFO and the other NEOs; •approve awards under our incentive compensation and equity-based plans; •review and discuss with management compensation related information, including the "pay versus performance" measures provided for under the SEC rules; •evaluate the leadership and performance of our CEO and recommend his compensation to our Board; •review our compensation philosophy and specific compensation plans; •discuss succession plans for senior management, including recommended successor candidates for the CEO; and •meet with management to review certain enumerated risks for its oversight as may be assigned by the Board as part of Arcosa's annual enterprise risk management process or otherwise. The HR Committee has been delegated authority by the Board to make compensation decisions with respect to the other named executive officers identified in this Proxy Statement. | |

| | | | |

| | | | |

| Meetings in 2023: 5 | | | |

| | | | |

| | | | |

| Committee Members: Joseph Alvarado (Chair) John W. Lindsay Kimberly S. Lubel | | | |

| | | | |

| | | | |

|  Independent IndependentEach Committee Member is "independent" as defined by the SEC rules and NYSE listing standards, including those standards applicable specifically to members of compensation committees. | | | |

| | | | |

| | | | | |

The Role of the Compensation Consultant

For 2023, the HR Committee retained Pay Governance LLC (the "Compensation Consultant") to provide a variety of executive compensation consultant services as an independent compensation consultant. The services provided by the Compensation Consultant in 2023 included: (i) reviewing and assisting in the design of our executive compensation programs, (ii) providing insight into executive compensation practices used by other companies, (iii) benchmarking our executive compensation pay levels with relevant peer survey data, (iv) providing proxy disclosure information for comparator companies, and (v) providing input to the HR Committee on the risk assessment, structure, and overall competitiveness of our executive compensation programs.

The Compensation Consultant’s ownership structure, limited service lines, and policies and procedures are designed to ensure that such Compensation Consultant’s work for the HR Committee does not raise any conflicts of interest. The amount of fees paid in 2023 to the Compensation Consultant by Arcosa represented less than one percent (1%) of such Compensation

Consultant’s total annual revenues for 2023. The internal policies of the Compensation Consultant prohibit its members, partners, consultants, and employees from engaging in conduct that could give rise to conflicts of interest and from acquiring securities in their client organizations. The employees of the Compensation Consultant providing consulting services to the HR Committee have no other business or personal relationship with any member of the HR Committee or any executive officer of Arcosa. After a review of these factors and the considerations outlined in applicable SEC and NYSE rules, the HR Committee has concluded that the work of the Compensation Consultant has not raised any conflicts of interest and that the Compensation Consultant is independent from Arcosa and from management.

The Role of Management

The CEO, the CFO, and the Chief Human Resources Officer work with the HR Committee and the Compensation Consultant to develop the framework and to design the plans for all compensation components. The CEO and CFO recommend the financial performance measurements for the annual incentive awards and the long-term performance-based equity awards, subject to HR Committee approval. The CFO certifies the achievement of these financial performance measures. The HR Committee recommends the CEO's compensation to the independent directors for their approval. The CEO makes recommendations to the HR Committee on compensation for each of the other named executive officers, as well as other senior leaders.

The Role of the HR Committee

Throughout the year, the CEO provides the HR Committee with his ongoing assessment of the performance of the other named executive officers. These assessments provide background information for any adjustment to base salary, annual incentives, or long-term incentives. Both annual incentives and long-term incentives are established with threshold, target, and maximum payout levels.

The HR Committee realizes that benchmarking and comparing peer group proxy disclosure data require certain levels of interpretation due to the complexities associated with executive compensation plans. The HR Committee uses the benchmarking information and the peer group proxy disclosure data provided by the Compensation Consultant as general guidelines and makes adjustments to compensation levels based on what the HR Committee believes is in the best interests of our shareholders. The HR Committee uses its judgment and bases its consideration of each executive’s compensation on performance in respect to the value of the executive’s contributions to Arcosa, the executive’s tenure, and peer survey data that establishes the ranges against which compensation is benchmarked.

Compensation Committee Interlocks and Insider Participation

Messrs. Alvarado, Gafford, and Lindsay, and Ms. Lubel served on the HR Committee during the last completed fiscal year. None of the members of the HR Committee has ever served as an executive officer or employee of Arcosa or any of its subsidiaries. There are no compensation committee interlocks.

Board’s Role in Risk Oversight

While management is responsible for the day-to-day management and mitigation of risk, our Board has ultimate responsibility for risk oversight. Management reviews and discusses risks with the Board as part of the business and operating review conducted at each of the regular meetings of the Board. While the Board has primary responsibility for overseeing Arcosa’s risk management, each committee of the Board also considers risk within its area of responsibility and regularly reports back to the Board on its risk oversight activities.

The Audit Committee (i) assesses major financial risk exposures and steps taken by management to address the same, (ii) is responsible for the review and assessment of information technology and cybersecurity risk exposures and the steps taken to monitor and control those exposures, and (iii) reviews risks identified during the internal and external auditors’ risk assessment procedures. The HR Committee reviews risks arising from our executive compensation programs and management succession planning. As a result of the HR Committee's review, management and the HR Committee have concluded that the Company's compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. The G&S Committee oversees risks related to our governance structure, certain ESG-related matters, and director compensation programs.

Risk Assessment of Compensation Policies and Practices

The Compensation Consultant performed a risk assessment with respect to our 2023 incentive compensation plans applicable to our executive officers. Based on this review, the Compensation Consultant concluded that our executive incentive programs do not encourage excessive risk-taking behaviors. We also conducted a detailed risk assessment of our 2023 compensation policies and practices (the "Compensation Policies") for our employees, including our executive officers, and assessed the likelihood and potential impact of the risk presented by the Compensation Policies. Participants in the risk assessment included our management, human resources group, internal audit group, and the HR Committee. Based on this review, management has concluded that sufficient controls exist to mitigate the risks related to the Compensation Policies.

Communications with Directors

The Board has established a process to receive communications by mail from shareholders and other interested parties. Shareholders and other interested parties may contact any member of the Board or the non-management directors as a group, any Board committee, or any chair of any such committee. All such correspondence should be sent to the Corporate Secretary of Arcosa at 500 N. Akard St., Suite 400, Dallas, Texas 75201.

All communications received as set forth in the preceding paragraph will be opened by the office of the Corporate Secretary for the sole purpose of determining whether the contents represent a message to directors. Any contents that are not in the nature of advertising, promotions of a product or service, or offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary will make sufficient copies of the contents to send to each director, group, or committee to which the envelope is addressed.

Employee, Officer, and Director Pledging and Hedging Policy

Arcosa has adopted a policy prohibiting pledging and hedging. The policy prohibits officers, directors, and employees of Arcosa and their respective related persons from (i) selling Arcosa securities short, (ii) pledging or hypothecating any Arcosa securities (e.g. using Arcosa securities for margin loans or to collateralize other indebtedness), or (iii) engaging in derivative transactions, including, without limitation, hedging, puts and calls, or other transactions involving Arcosa securities.

| | | | | | | | |

| Transactions with Related Persons |

Review, Approval, and Ratification of Transactions with Related Persons

The G&S Committee has adopted a Policy and Procedures for the Review, Approval, and Ratification of Related Person Transactions. In accordance with the written policy, the G&S Committee, or the chair of such committee, as applicable, is responsible for the review, approval, and ratification of all transactions with related persons that are required to be disclosed under the rules of the SEC. Under the policy, a related person includes any of Arcosa’s directors, executive officers, certain shareholders, and any of their respective immediate family members. The policy applies to any "Related Person Transaction," which is a transaction in which Arcosa participates, a related person has a direct or indirect material interest, and the amount exceeds $120,000. Under the policy, the Chief Legal Officer (the "CLO") will review potential transactions and, in consultation with the CEO and CFO, will assess whether the proposed transaction would be a Related Person Transaction. If the CLO determines the proposed transaction would be a Related Person Transaction, the proposed transaction is submitted to the G&S Committee, or the chair of such committee, as applicable, for review and consideration. In reviewing Related Person Transactions, the G&S Committee, or the chair of such committee, as applicable, shall consider all relevant facts and circumstances available, including, but not limited to the following:

•the benefits to Arcosa of the Related Person Transaction;

•the impact of a director’s independence if the related person is a director, an immediate family member of a director, or an entity in which a director is a partner, shareholder, or executive officer;

•the availability of other sources for comparable products and services;

•the terms of the transaction; and

•the terms available to unrelated third parties or employees generally.

After reviewing such information, the G&S Committee, or its chair, as applicable, may approve the Related Person Transaction if the G&S Committee or the G&S Committee chair concludes in good faith that the Related Person Transaction is in, or is not inconsistent with, the best interests of Arcosa and its shareholders.

Under the policy, the HR Committee must approve hiring of immediate family members of executive officers or directors and any subsequent material changes in employment or compensation. In 2023, Arcosa did not enter into any Related Person Transaction of the type required to be disclosed under Item 404 of Regulation S-K under the Exchange Act.

| | | | | | | | |

Proposal Two Advisory Vote to Approve Named Executive Officer Compensation |

| | |

| Arcosa's executive compensation program: | Arcosa seeks approval, on an advisory basis, from its shareholders of the compensation of its named executive officers as described in this Proxy Statement. |

Encourages high levels of performance and accountability + Aligns interests of executives and shareholders + Links compensation to business objectives and strategies

| |

|

As described in the "Compensation Discussion and Analysis," Arcosa’s executive compensation program (i) encourages high levels of performance and accountability, (ii) aligns the interests of executives with those of shareholders, and (iii) links compensation to business objectives and strategies.

This proposal provides shareholders the opportunity to approve, or not approve, Arcosa’s executive compensation program through the following resolution:

"RESOLVED, that the compensation paid to Arcosa’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and the related narrative discussion, is hereby approved." Because this is an advisory vote, it will not be binding upon the Board. However, the HR Committee will take into account the outcome of the vote when considering future executive compensation arrangements. After the 2024 Annual Meeting, the next advisory vote to approve the compensation of the named executive officers will occur at the 2025 Annual Meeting of Shareholders unless the Board modifies its policy on the frequency of holding such advisory votes. |

|

|

"FOR" The Board of Directors recommends that you vote FOR approval of this resolution. |

|

| | | | | | | | |

Executive Compensation

Compensation Discussion and Analysis |

This Compensation Discussion and Analysis ("CD&A") describes our executive compensation philosophy and pay programs in 2023.

2023 COMPENSATION PROGRAM PHILOSOPHY

Our executive compensation program reflects our pay-for-performance philosophy. The HR Committee utilizes a combination of fixed and variable pay elements in order to achieve the following objectives:

| | | | | | | | | | | | | | |

| | | | |

| Support Arcosa’s overall business strategy and results to drive long-term shareholder value creation without incentivizing excessive risk taking. | | | Attract, retain, and motivate key executives by providing market-competitive total compensation opportunities. |

| | | | |

| | | | |

| | | | |

| Emphasize a strong link between pay and performance with predefined short- and long-term performance goals that place the majority of total compensation at risk. | | | Align executive and investor interests by establishing market-relevant metrics that address shareholder expectations. |

| | | | |

2023 NAMED EXECUTIVE OFFICERS

For 2023, our NEOs and their titles were:

| | | | | |

| Name | Principal Position |

| Antonio Carrillo | President and CEO |

| Gail M. Peck | CFO |

| Kerry S. Cole | Group President |

| Jesse E. Collins, Jr. | Group President |

| Reid S. Essl | Group President |

| Bryan P. Stevenson | CLO |

2023 Program Highlights

ANNUAL INCENTIVE PROGRAM

Payouts to the NEOs and other key executives under our 2023 AIP reinforced our strong pay-for-performance philosophy. In designing the AIP for 2023, the HR Committee approved performance metrics that were in furtherance of our strategic goals and in line with our initial 2023 earnings guidance. The HR Committee linked a significant portion of each of the NEO’s AIP awards to the performance of the business at the enterprise level or the group level of businesses, as applicable.

In 2023, the HR Committee approved four AIP plans for the NEOs -- the Corporate Plan and three Group President Plans, with each Group President Plan comprised of the businesses reporting to the particular Group President.

| | | | | | | | |

| | |

CORPORATE PLAN (Antonio Carrillo, Gail Peck, and Bryan Stevenson) Enterprise | | GROUP PRESIDENT PLAN A (Reid Essl) Natural Aggregates Recycled Aggregates Specialty Materials |

| | |

| | |

| | |

GROUP PRESIDENT PLAN B (Kerry Cole) Utility and Related Structures Marine Products

| | GROUP PRESIDENT PLAN C (Jesse Collins) Steel Components Wind Towers Shoring Products |

| | |

The HR Committee approved the design of the 2023 AIP plans to include a measure of the percentage of non-production costs to our revenue ("Adjusted Corporate SE&A") and Adjusted EBITDA margin ("Group Adjusted EBITDA Margin") as new metrics for the Corporate and Group President Plans, respectively. The new design focused management's attention on cost and expense control for each of the Corporate Plan and the Group President Plans to complement the already established profitability goals reflected in the Adjusted EBITDA metrics.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Plan (CEO, CFO, CLO) | | | | Group President Plans (3 Group Presidents) | |

| Performance Metric | Weighting | | | | Performance Metric | Weighting | |

| Enterprise Adjusted EBITDA | 60% | | | | Group Adjusted EBITDA | 60% | |

| Adjusted Corporate SE&A | 20% | | | | Group Adjusted EBITDA Margin | 20% | |

| Execution of Strategic Initiatives | 20% | | | | Execution of Strategic Initiatives | 20% | |

LONG-TERM INCENTIVE PROGRAM

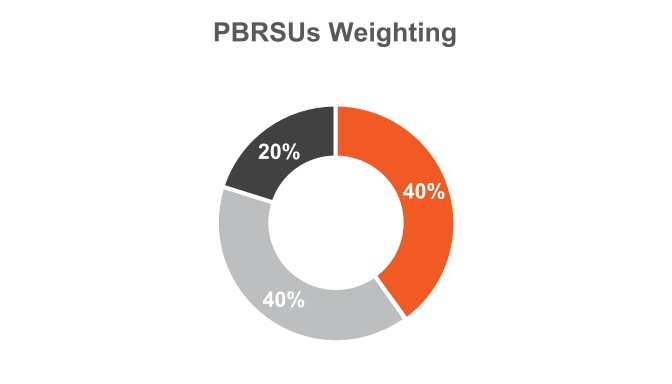

In 2023, the performance-based restricted stock units ("PBRSUs") for our NEOs remain weighted as follows:

| | | | | | | | | | | | | | |

n Average Pre-Tax Return on Capital | | n rTSR | | n Cumulative Adjusted Earnings per Share |

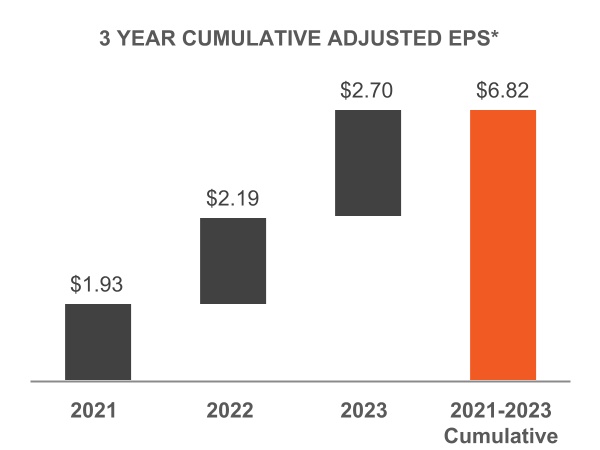

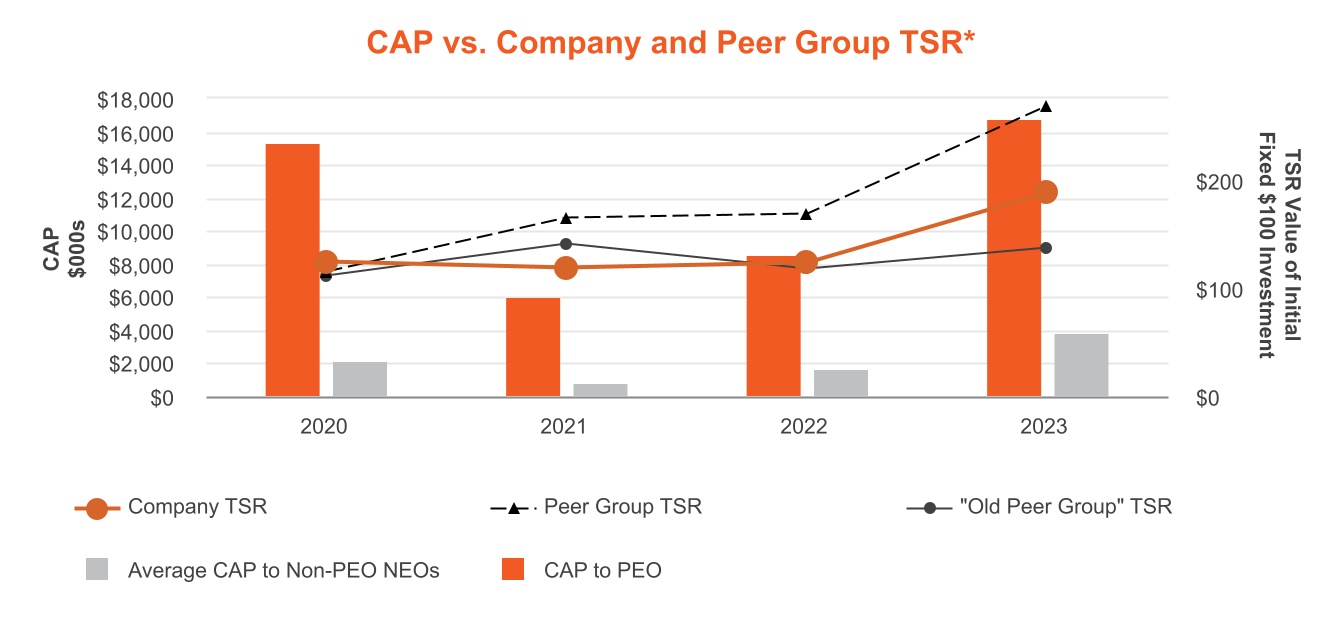

We continued to align management's interest with those of our shareholders by linking the payout of the performance-based portion of our long-term compensation ("LTI") program to our financial performance and our TSR performance relative to the S&P SmallCap 600 Index ("rTSR").

2023 Performance Highlights

In 2023, we continued to execute on the four strategic pillars of our long-term vision.

| | | | | | | | | | | |

| | | |

Grow in attractive markets where we can achieve sustainable competitive advantages | Reduce the complexity and cyclicality of the overall business | Improve long-term returns of invested capital | Integrate Environmental, Social, and Governance initiatives (ESG) into our long-term strategy |

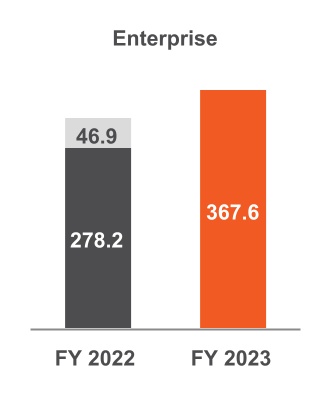

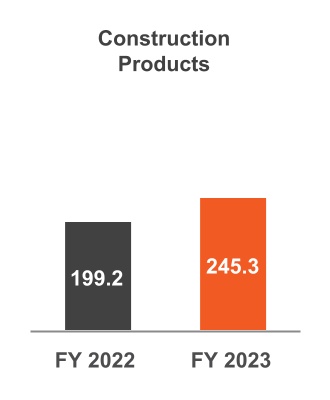

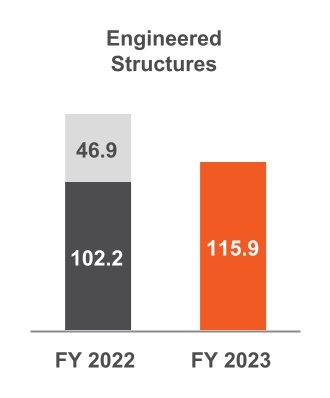

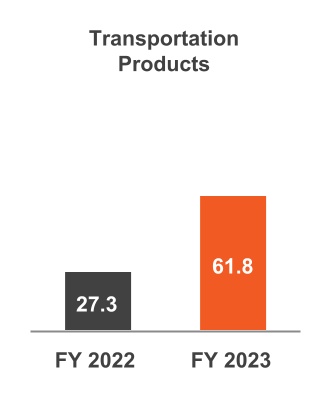

We again set a new record for financial performance exceeding the overall target set by the Board and the HR Committee. Our $367.6 million in Enterprise Adjusted EBITDA increased 32% compared to 2022, normalizing for the divestiture of the Storage Tanks business in 2022, and was fueled by double-digit increases in each of our three segments.

Adjusted EBITDA*

n Storage Tanks

* See Annex A for a reconciliation of Non-GAAP measures to the most comparable GAAP measures.

(1) Percentage increase as compared to 2022 results excluding amount attributable to the divested Storage Tanks business in 2022.

We executed against strategic initiatives important to driving shareholder interest and value. Highlights, which the HR Committee considered in connection with the evaluation of the execution of the strategic initiatives component in the payout of the 2023 AIP, include:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| ESG (including Safety) Tracking ahead of 10% GHG emissions reduction goal by 2026. Advanced the ARC 100 Safety Culture Program throughout our plants. We recorded our second lowest total reportable incidents rate since Arcosa's inception. We engaged with our communities in various charitable ventures. | | | | Growth 32% Adjusted EBITDA growth at the Enterprise level and double-digit Adjusted EBITDA growth at the segment level. Successfully completed six bolt-on acquisitions in our growth businesses for approximately $120 million. Opened new or expanded plants in Oklahoma, New Mexico, and Florida, expanding production capabilities and geographic footprints. | | | | Working Capital Improved our working capital days across the Enterprise with noted improvement in our cyclical businesses. | |

| | | | | | | | | | |

Shareholder Engagement and Say-on-Pay Results

The Board and the HR Committee value the benefits of maintaining a dialogue with our shareholders and understanding their views. During 2023, we engaged in a robust shareholder outreach program with 75% of our top 25 holders of our stock, including shareholder engagement with our Board, where we and the Board solicited the feedback of our shareholders on topics including our performance, strategy, risk management, corporate governance, ESG-related initiatives, and executive compensation. Members of our Investor Relations team along with certain of our senior executives, including at times our CEO, CFO, and Group Presidents, met with shareholders in both in-person and virtual engagements throughout the year. We partnered with an investor relations firm to perform a perception study providing further insight into the drivers important to our shareholders. The continued receipt of positive feedback from our shareholder engagement program signals valuable support from our shareholders to our approach to executive compensation.

| | | | | | | | | | | | | | |

| | | | |

| 99% | | SHAREHOLDER VOTE in favor of Say-on-Pay at 2023 Annual Meeting | |

| | | | |

The HR Committee considered the result of our say-on-pay vote as an additional sign of our shareholders' support of our executive compensation philosophy and plans. Our NEOs' 2023 compensation will be the subject of the advisory, non-binding say-on-pay vote at the 2024 Annual Meeting. The HR Committee will consider the outcome of future say-on-pay votes and shareholder engagement as it evaluates the design of the executive compensation programs and the related specific compensation decisions.

Our Compensation Policies and Practices

We have adopted the following compensation practices, which are intended to promote strong governance and alignment with shareholder interests:

| | | | | | | | |

| What We Do: | |

| | |

| Pay for Performance. We believe in a "pay for performance" philosophy in which a majority of our NEOs’ compensation, as well as a significant portion for other employees throughout the organization, is linked to achievement of specific annual and long-term strategic and financial goals and the realization of increased shareholder value. Approximately 84% of our CEO’s compensation and, on average, 67% of all other NEOs' compensation is "at risk" compensation, comprised of incentive and equity-based compensation. |