HIGHLY CONFIDENTIAL ℠ Utz Brands, Inc. Q1 2021 Earnings Presentation May 13, 2021 1

℠ Disclaimer 2 Forward-Looking Statements Certain statements made herein are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as “will”, “expect”, “intends”, “goal” or other similar words, phrases or expressions. These forward-looking statements include the expected effects from the COVID-19 pandemic, future plans for the Company, the estimated or anticipated future results and benefits of the Company’s future plans and operations, future capital structure, future opportunities for the Company, and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties and the Company’s business and actual results may differ materially. Factors that may cause such differences include, but are not limited to: the risk that the recently completed business combination with Collier Creek Holdings and other acquisitions recently completed by the Company (collectively, the “Business Combinations”) disrupt plans and operations; the ability to recognize the anticipated benefits of such Business Combinations, which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably and retain its key employees; the outcome of any legal proceedings that may be instituted against the Company following the consummation of such Business Combinations; changes in applicable law or regulations; costs related to the Business Combinations; the inability of the Company to maintain the listing of the Company’s Class A Common Stock on the New York Stock Exchange; the inability of the Company to develop and maintain effective internal controls; the risk that the Company’s gross profit margins may be adversely impacted by a variety of factors, including variations in raw materials pricing, retail customer requirements and mix, sales velocities and required promotional support; changes in consumers’ loyalty to the Company’s brands due to factors beyond the Company’s control; changes in demand for the Company’s products affected by changes in consumer preferences and tastes or if the Company is unable to innovate or market its products effectively; costs associated with building brand loyalty and interest in the Company’s products, which may be affected by the Company’s competitors’ actions that result in the Company’s products not suitably differentiated from the products of competitors; fluctuations in results of operations of the Company from quarter to quarter because of changes in promotional activities; the possibility that the Company may be adversely affected by other economic, business or competitive factors; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “Commission”) for the fiscal year ended January 3, 2021, as amended, and other reports filed by the Company with the Commission. In addition, forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. Except as required by law, the Company undertakes no obligation to update such statements to reflect events or circumstances arising after such date and cautions investors not to place undue reliance on any such forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law. Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”) including, but not limited to, Pro Forma Net Sales, Adjusted Gross Profit, Pro Forma Adjusted Gross Profit, Adjusted SG&A, EBITDA, Adjusted EBITDA, Further Adjusted EBITDA, Normalized Further Adjusted EBITDA, Adjusted Net Income and certain ratios and other metrics derived there from. These non-GAAP financial measures do not represent financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are set forth in the appendix to this presentation. We believe (i) these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date; and (ii) that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance.

HIGHLY CONFIDENTIAL Business Overview Dylan Lissette, Chief Executive Officer 3

℠ 4 Key Messages Q1 net sales growth of 18% and Adjusted EBITDA growth of 30% and remain on track to deliver our full-year 2021 outlook Utz IRI retail sales two-year CAGR of 5.9% shows continued strength across our platform Continued to increase distribution in Emerging and Expansion geographies Completed the ERP go-live and remain on target to increase productivity from 1% to 2% of COGS in 2021 Announced acquisition of Festida Foods and expected to close in Q2 2021 M&A pipeline remains robust as we continue to enhance our growth and margin profile with value enhancing acquisitions targeted at geographic, sub-category, and channel share growth as well as margin-enhancing opportunities

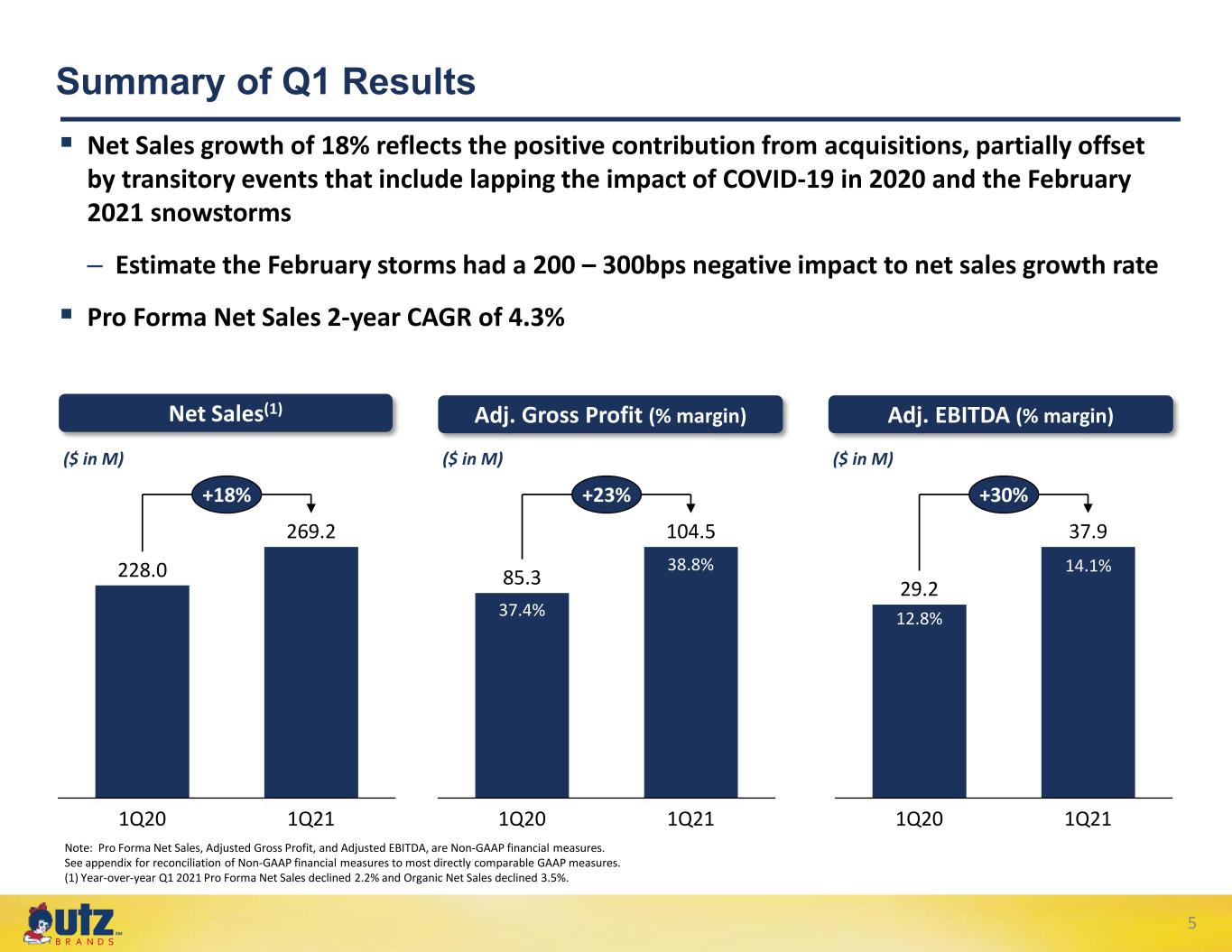

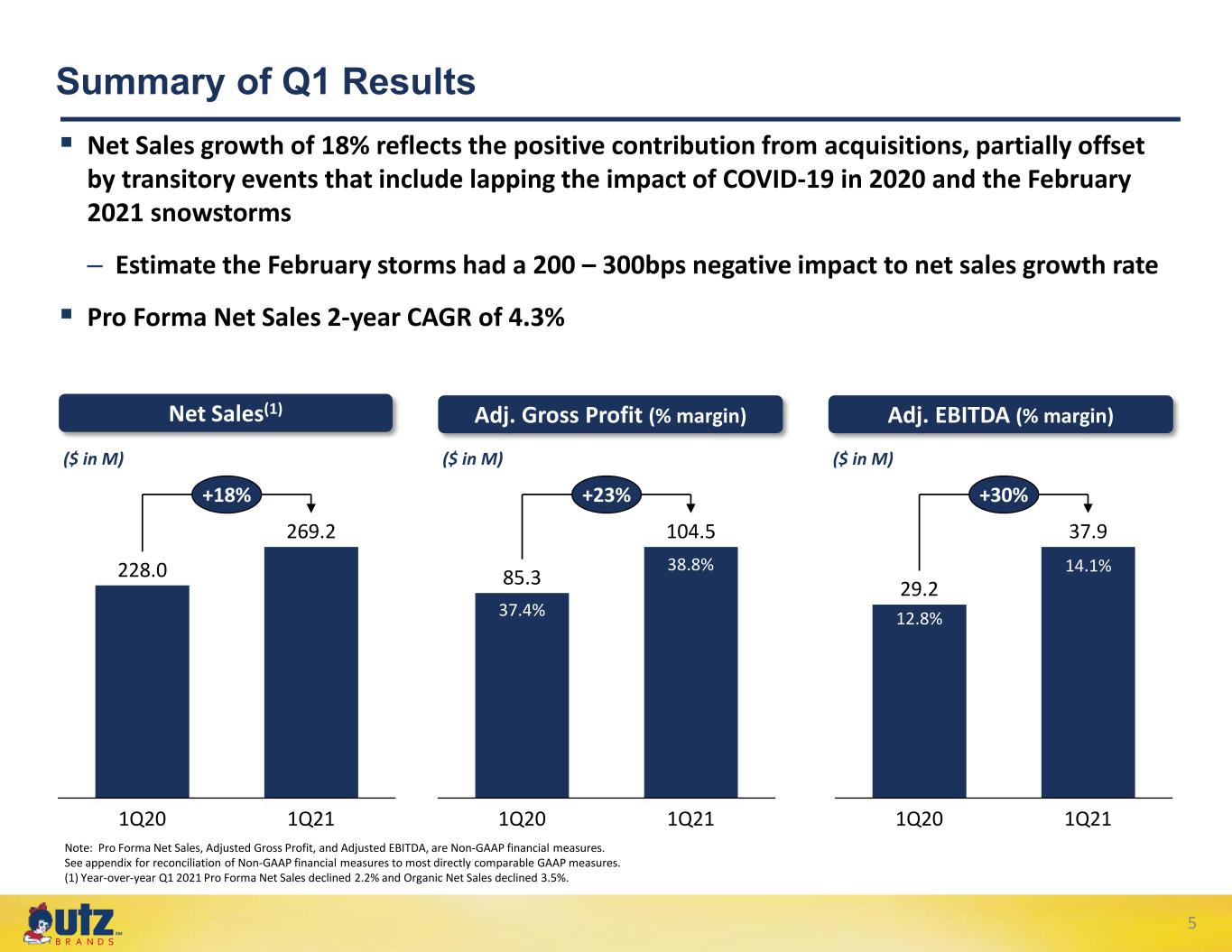

℠ 5 228.0 269.2 1Q211Q20 +18% Net Sales(1) Adj. Gross Profit (% margin) Adj. EBITDA (% margin) ($ in M) ($ in M) ($ in M) 85.3 104.5 1Q20 1Q21 +23% 29.2 37.9 1Q20 1Q21 +30% 37.4% 38.8% 14.1% Net Sales growth of 18% reflects the positive contribution from acquisitions, partially offset by transitory events that include lapping the impact of COVID-19 in 2020 and the February 2021 snowstorms – Estimate the February storms had a 200 – 300bps negative impact to net sales growth rate Pro Forma Net Sales 2-year CAGR of 4.3% Summary of Q1 Results Note: Pro Forma Net Sales, Adjusted Gross Profit, and Adjusted EBITDA, are Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) Year-over-year Q1 2021 Pro Forma Net Sales declined 2.2% and Organic Net Sales declined 3.5%. 12.8%

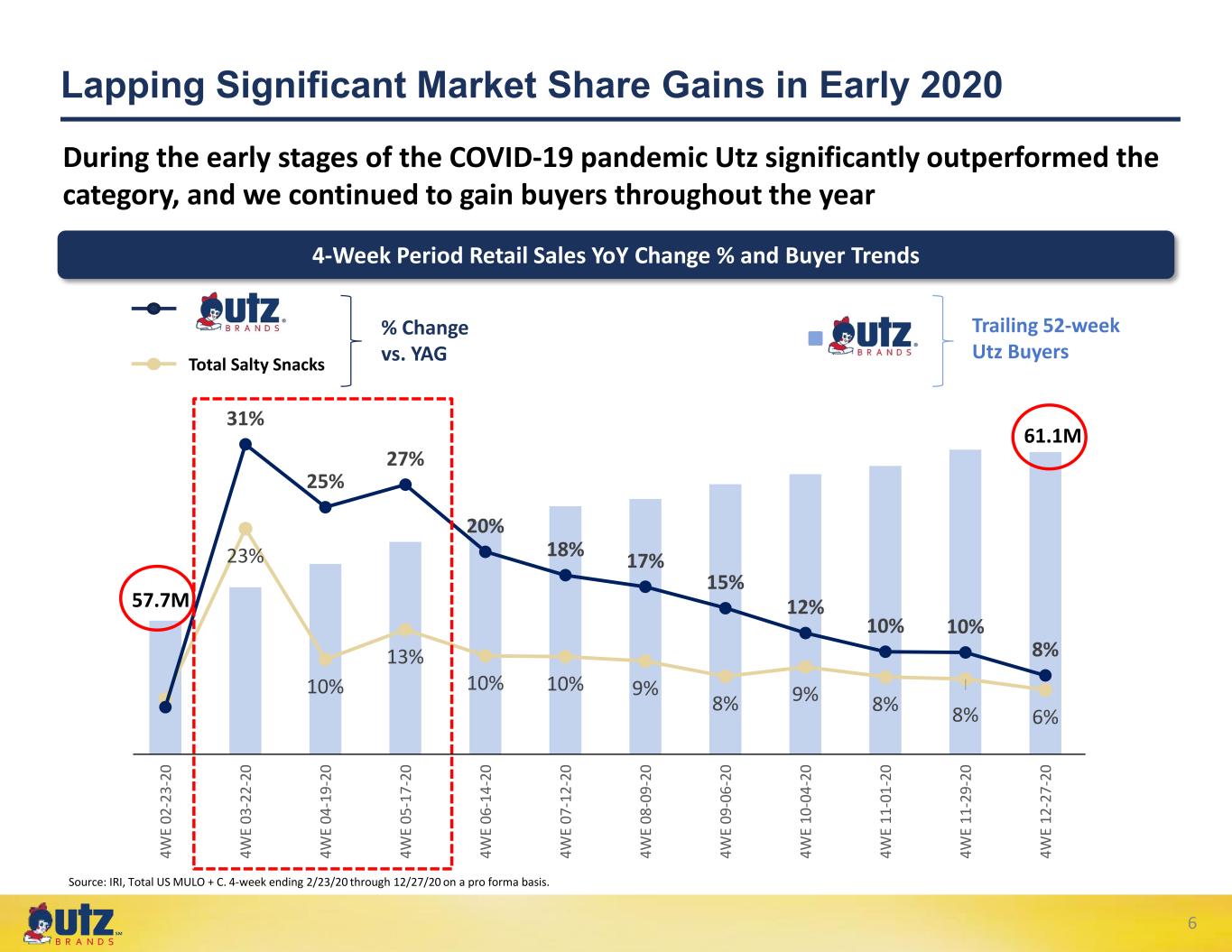

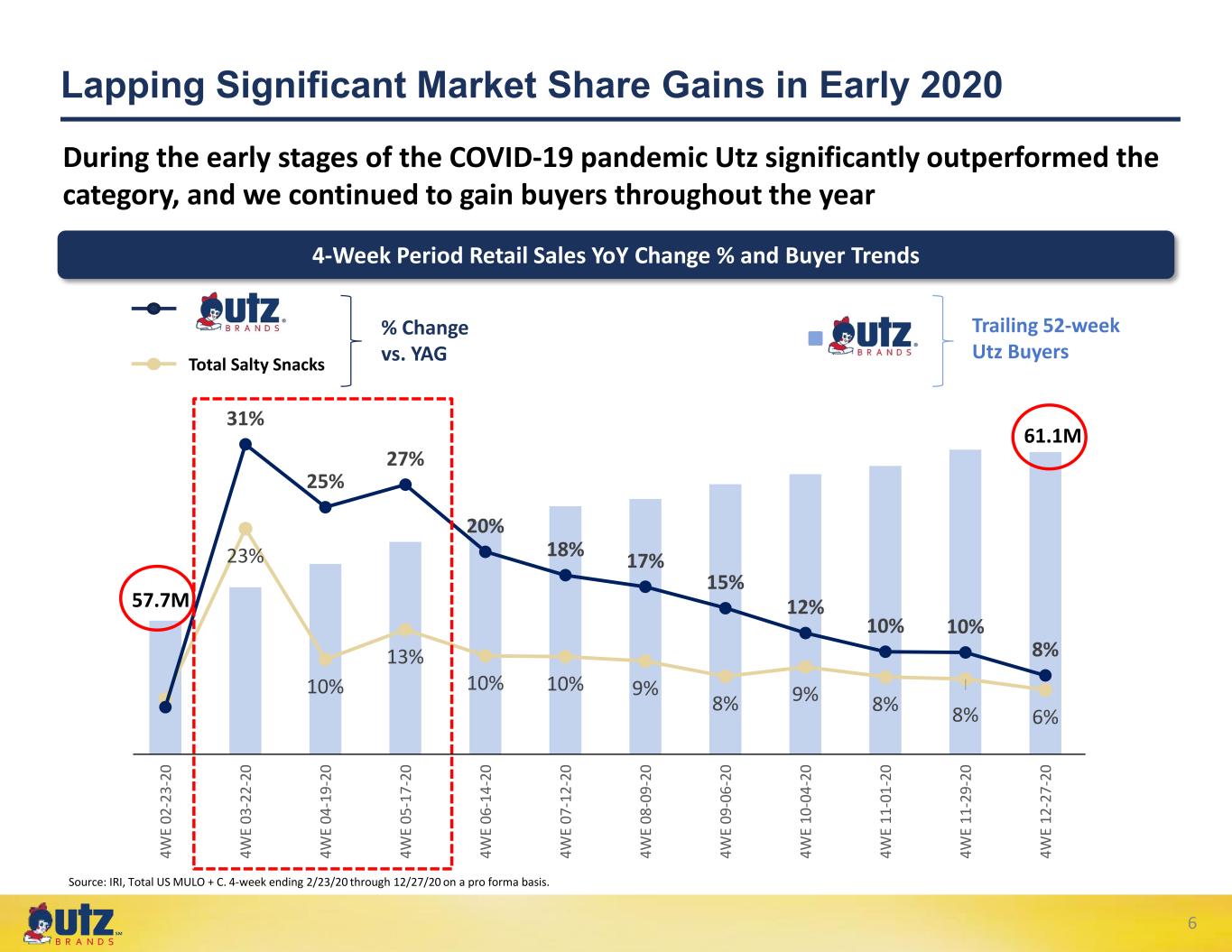

℠ Lapping Significant Market Share Gains in Early 2020 6 23% 10% 13% 10% 10% 9% 8% 9% 8% 8% 6% 31% 25% 27% 20% 18% 17% 15% 12% 10% 10% 8% 55,000,000 56,000,000 57,000,000 58,000,000 59,000,000 60,000,000 61,000,000 62,000,000 0% 5% 10% 15% 20% 25% 30% 35% 4W E 02 -2 3- 20 4W E 03 -2 2- 20 4W E 04 -1 9- 20 4W E 05 -1 7- 20 4W E 06 -1 4- 20 4W E 07 -1 2- 20 4W E 08 -0 9- 20 4W E 09 -0 6- 20 4W E 10 -0 4- 20 4W E 11 -0 1- 20 4W E 11 -2 9- 20 4W E 12 -2 7- 20 Total Salty Snacks Source: IRI, Total US MULO + C. 4-week ending 2/23/20 through 12/27/20 on a pro forma basis. 4-Week Period Retail Sales YoY Change % and Buyer Trends Trailing 52-week Utz Buyers % Change vs. YAG 61.1M 57.7M During the early stages of the COVID-19 pandemic Utz significantly outperformed the category, and we continued to gain buyers throughout the year

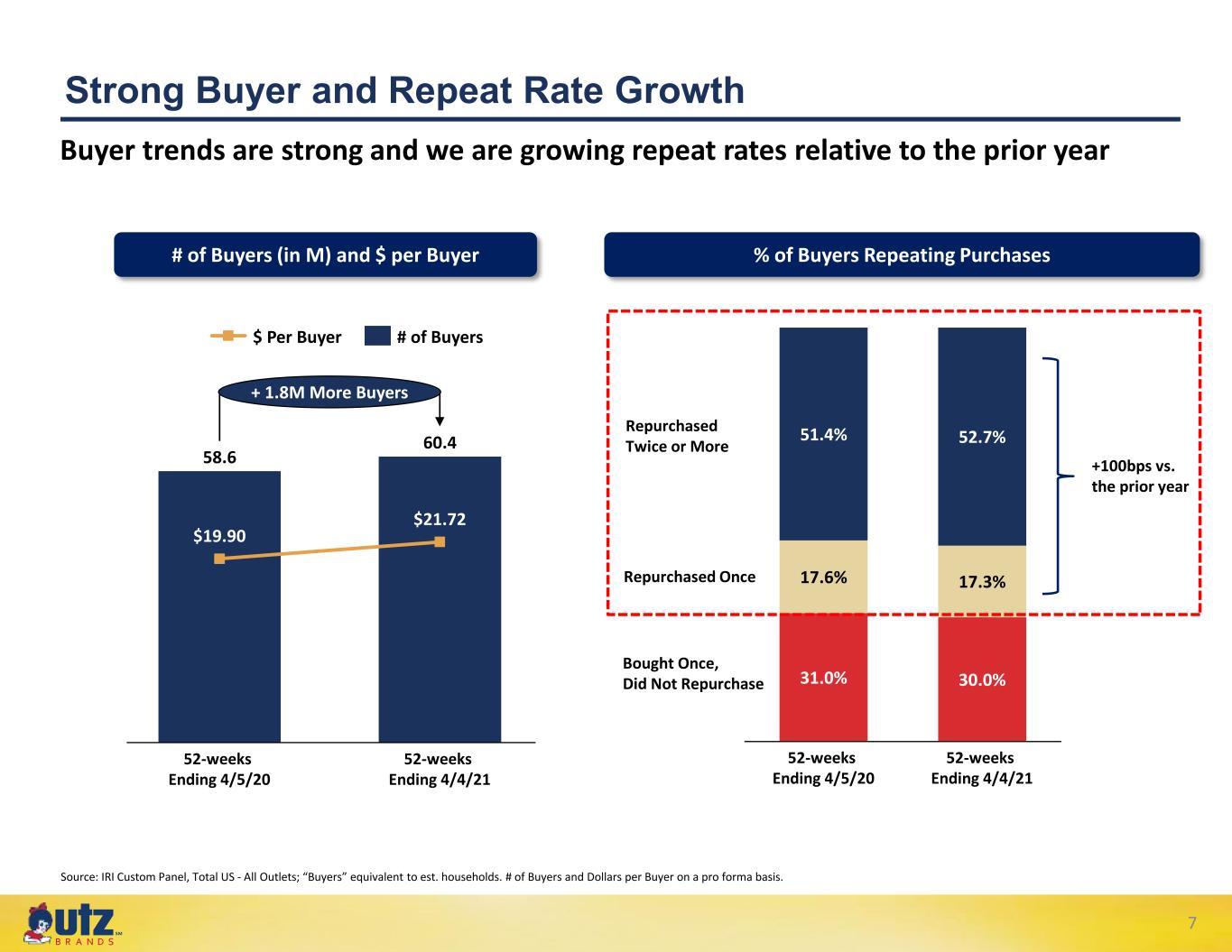

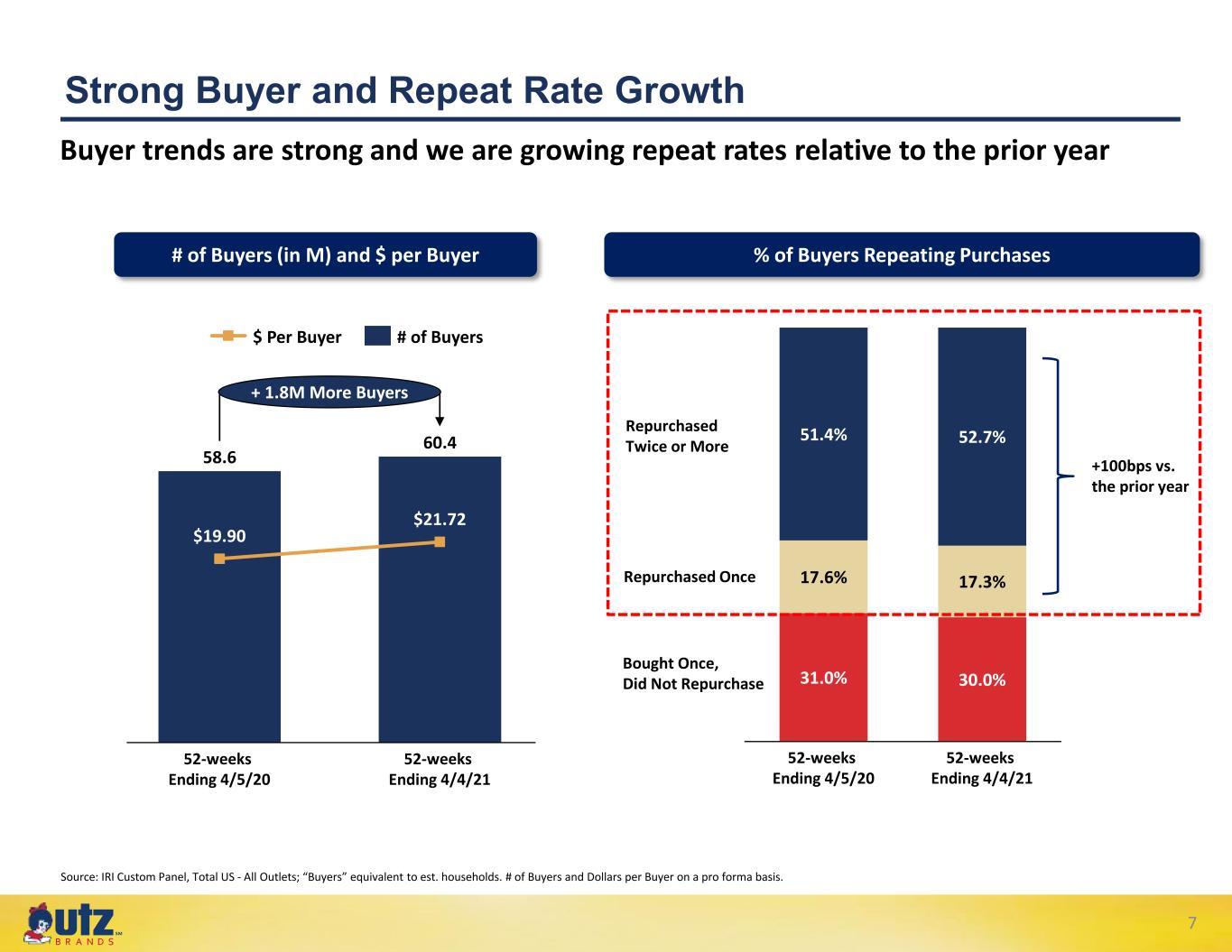

℠ 7 Source: IRI Custom Panel, Total US - All Outlets; “Buyers” equivalent to est. households. # of Buyers and Dollars per Buyer on a pro forma basis. Strong Buyer and Repeat Rate Growth Repurchased Twice or More Repurchased Once Bought Once, Did Not Repurchase # of Buyers (in M) and $ per Buyer % of Buyers Repeating Purchases 58.6 60.4 $19.90 $21.72 0 5 10 15 20 25 30 35 25 30 35 40 45 50 55 60 65 52-weeks Ending 4/5/20 52-weeks Ending 4/4/21 + 1.8M More Buyers $ Per Buyer # of Buyers 31.0% 30.0% 17.6% 17.3% 51.4% 52.7% 52-weeks Ending 4/5/20 52-weeks Ending 4/4/21 Buyer trends are strong and we are growing repeat rates relative to the prior year +100bps vs. the prior year

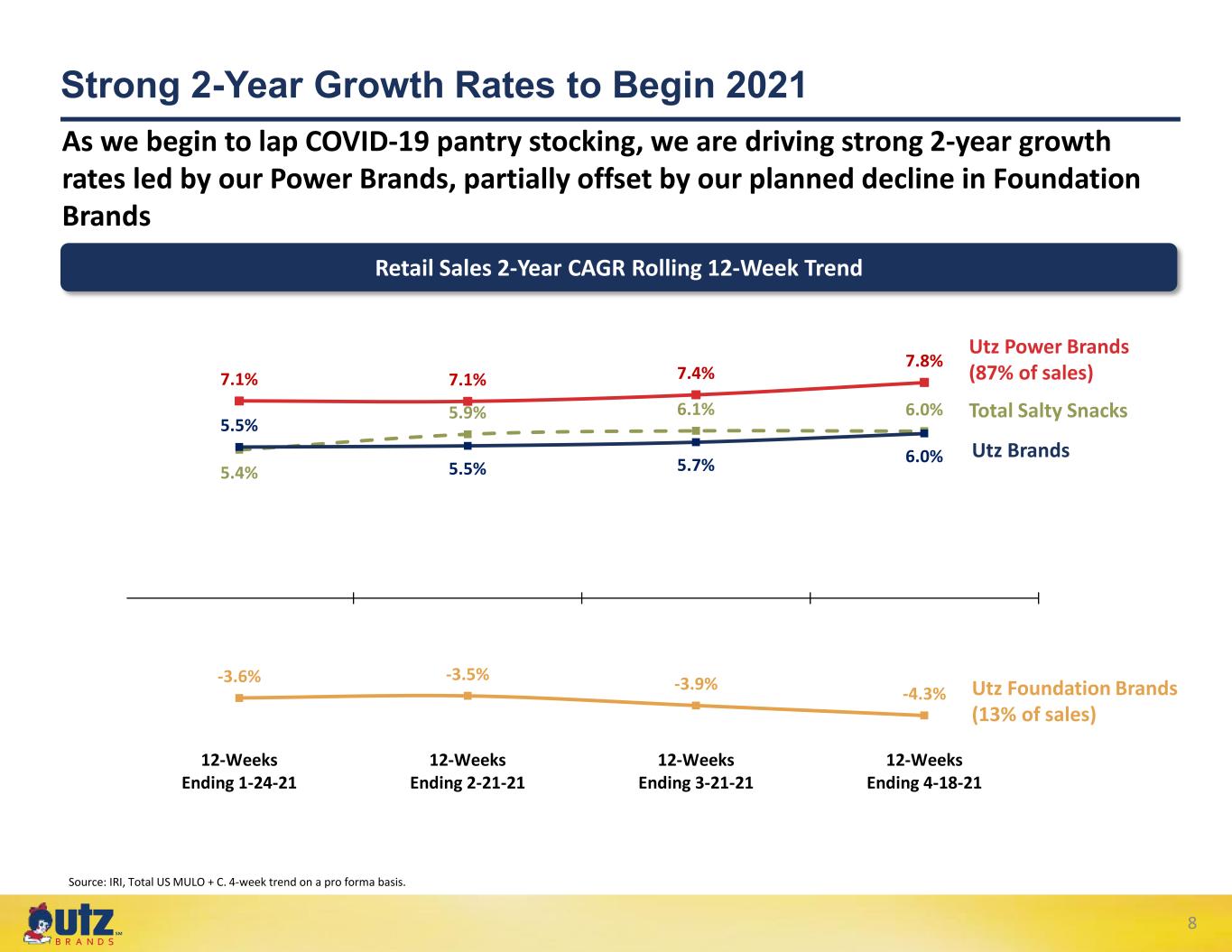

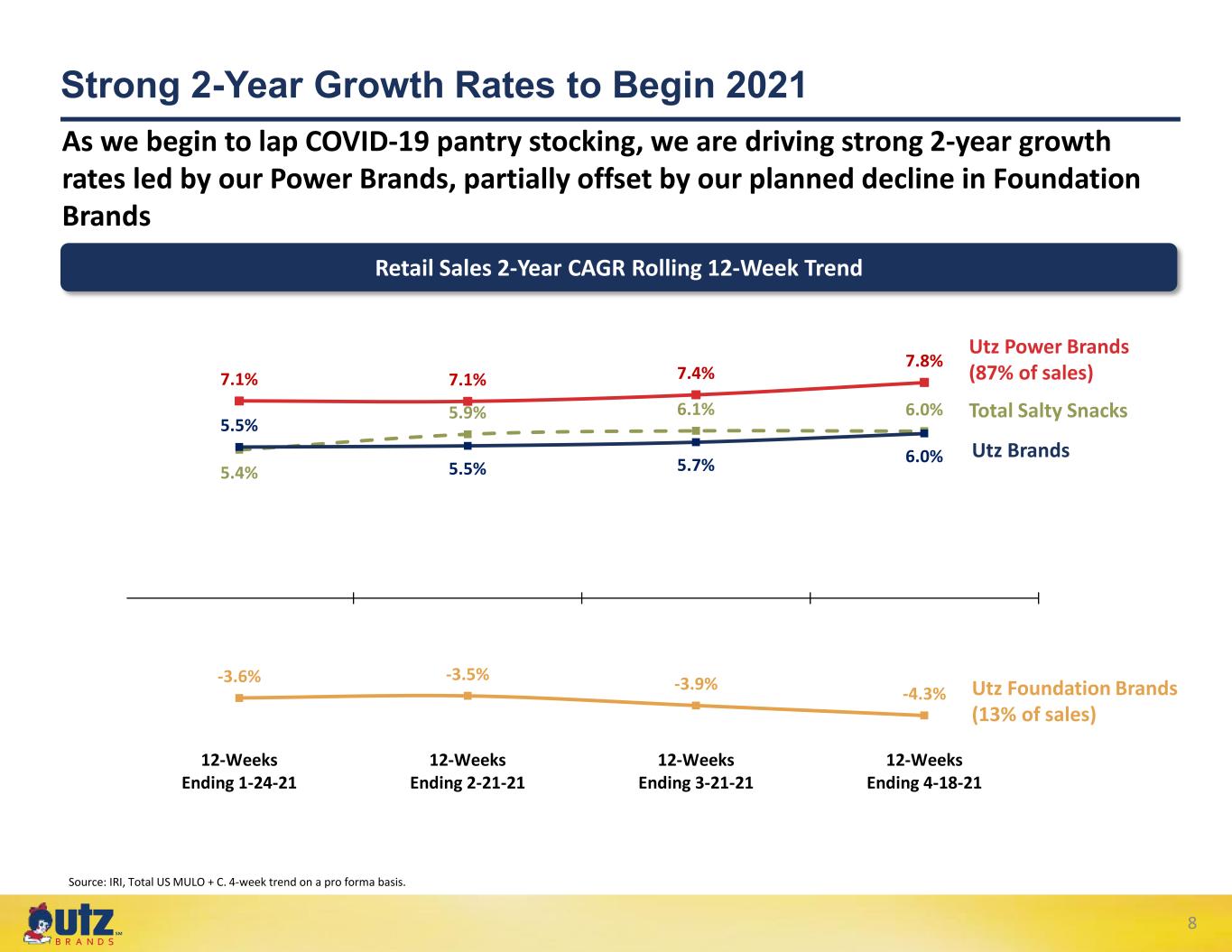

℠ Strong 2-Year Growth Rates to Begin 2021 8 Retail Sales 2-Year CAGR Rolling 12-Week Trend Source: IRI, Total US MULO + C. 4-week trend on a pro forma basis. As we begin to lap COVID-19 pantry stocking, we are driving strong 2-year growth rates led by our Power Brands, partially offset by our planned decline in Foundation Brands 5.4% 5.9% 6.1% 6.0% 5.5% 5.5% 5.7% 6.0% 7.1% 7.1% 7.4% 7.8% -3.6% -3.5% -3.9% -4.3% -5% 0% 5% 10% 12-Weeks Ending 1-24-21 12-Weeks Ending 2-21-21 12-Weeks Ending 3-21-21 12-Weeks Ending 4-18-21 Utz Foundation Brands (13% of sales) Utz Power Brands (87% of sales) Total Salty Snacks Utz Brands

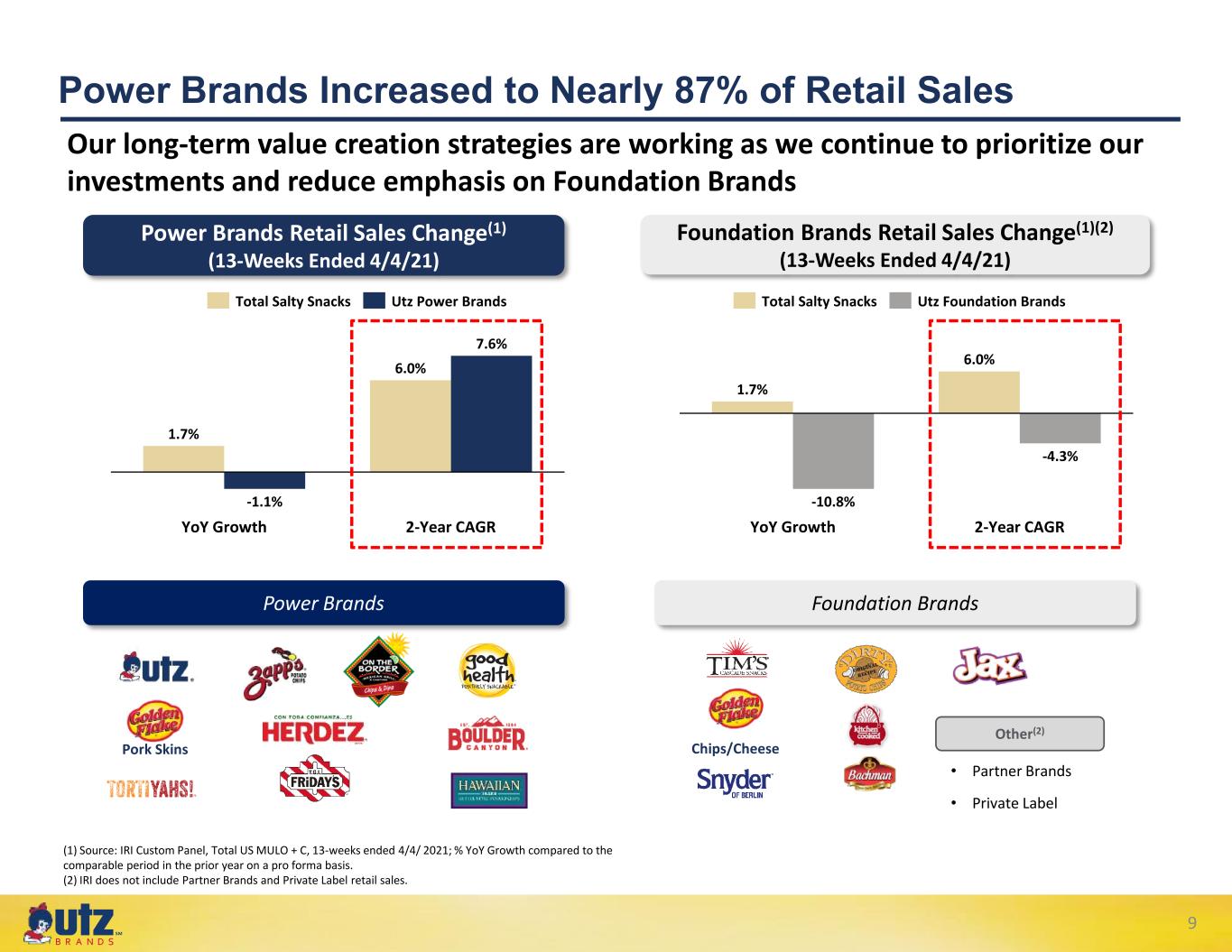

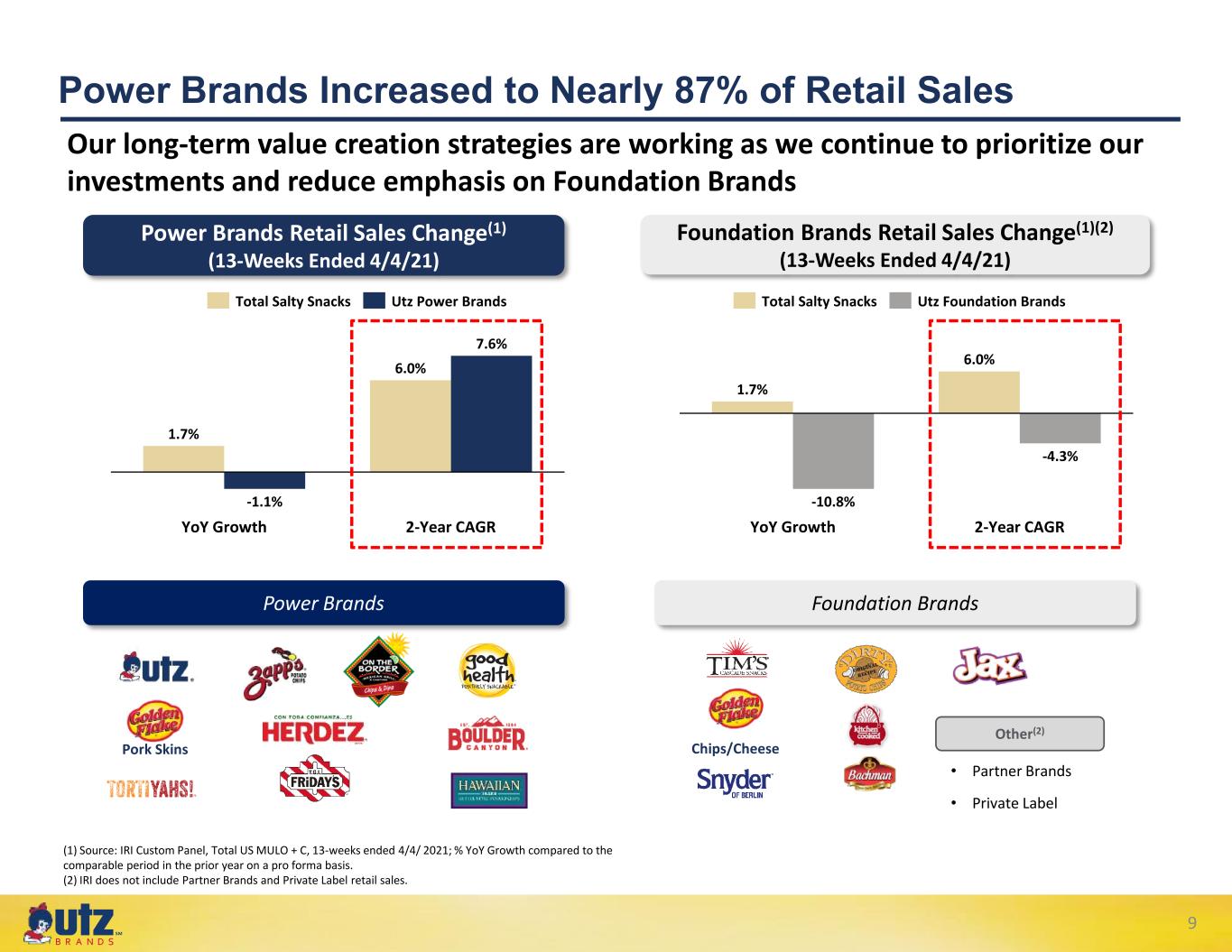

℠ (1) Source: IRI Custom Panel, Total US MULO + C, 13-weeks ended 4/4/ 2021; % YoY Growth compared to the comparable period in the prior year on a pro forma basis. (2) IRI does not include Partner Brands and Private Label retail sales. 9 Pork Skins Chips/Cheese Other(2) • Partner Brands • Private Label Power Brands Increased to Nearly 87% of Retail Sales Power Brands Retail Sales Change(1) (13-Weeks Ended 4/4/21) Foundation Brands Retail Sales Change(1)(2) (13-Weeks Ended 4/4/21) Power Brands Foundation Brands 6.0% -1.1% 2-Year CAGRYoY Growth 1.7% 7.6% Total Salty Snacks Utz Power Brands YoY Growth 2-Year CAGR 1.7% 6.0% -10.8% -4.3% Total Salty Snacks Utz Foundation Brands Our long-term value creation strategies are working as we continue to prioritize our investments and reduce emphasis on Foundation Brands

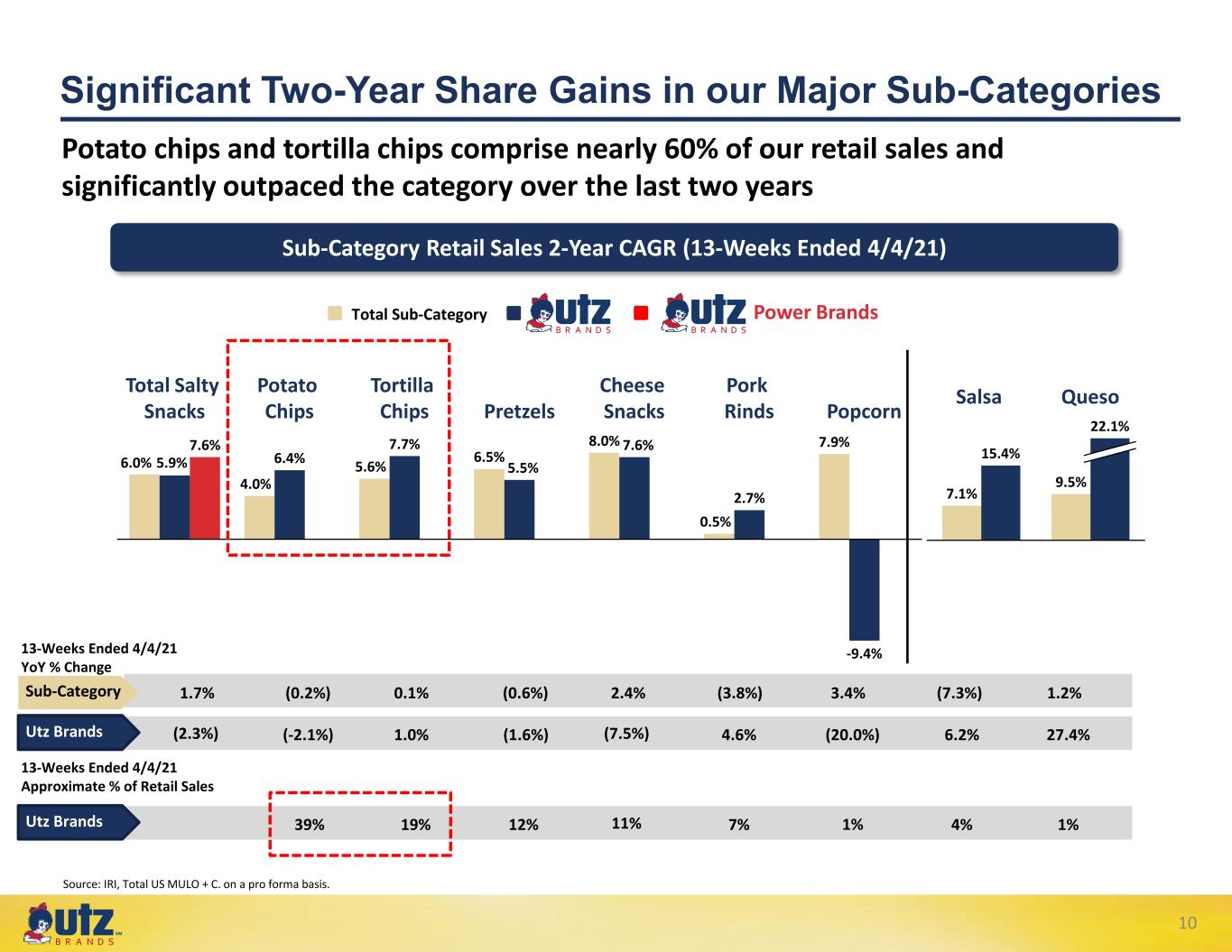

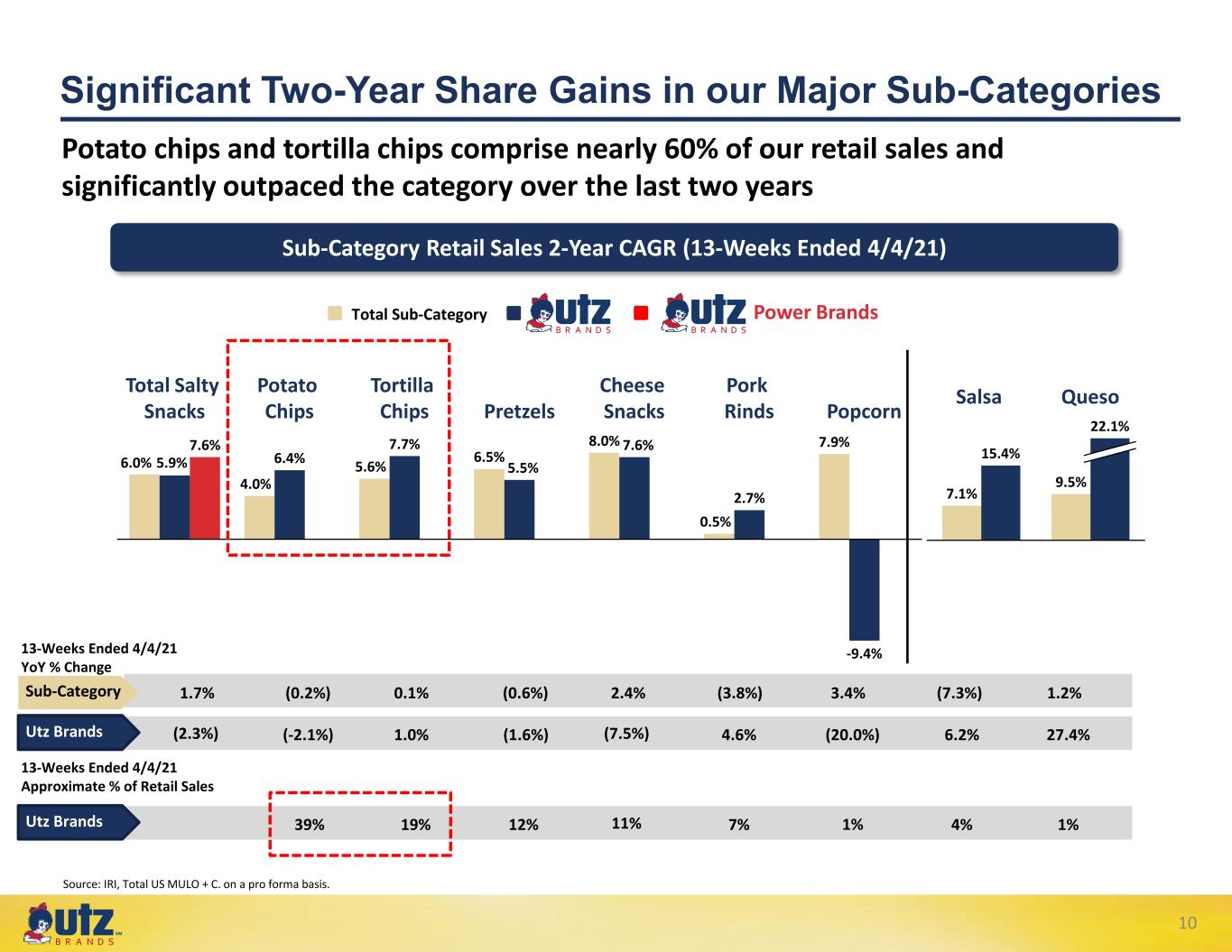

℠ 10 Source: IRI, Total US MULO + C. on a pro forma basis. Significant Two-Year Share Gains in our Major Sub-Categories Sub-Category Retail Sales 2-Year CAGR (13-Weeks Ended 4/4/21) 0.5% Total Salty Snacks Potato Chips Tortilla Chips Pretzels Popcorn Pork Rinds Cheese Snacks 7.6% 4.0% 6.4% 5.6% 7.7% 6.5% 5.5% 8.0% 2.7% 7.6% 7.9% -9.4%13-Weeks Ended 4/4/21 YoY % Change Sub-Category Utz Brands 1.7% (0.2%) 0.1% (0.6%) 2.4% (3.8%) 3.4% (7.3%) 1.2% (2.3%) (-2.1%) 1.0% (1.6%) (7.5%) 4.6% (20.0%) 6.2% 27.4% Utz Brands 39% 19% 12% 11% 7% 1% 4% 1% 13-Weeks Ended 4/4/21 Approximate % of Retail Sales QuesoSalsa 9.5% 7.1% 15.4% 22.1% Total Sub-Category Power Brands Potato chips and tortilla chips comprise nearly 60% of our retail sales and significantly outpaced the category over the last two years 5.9%6.0%

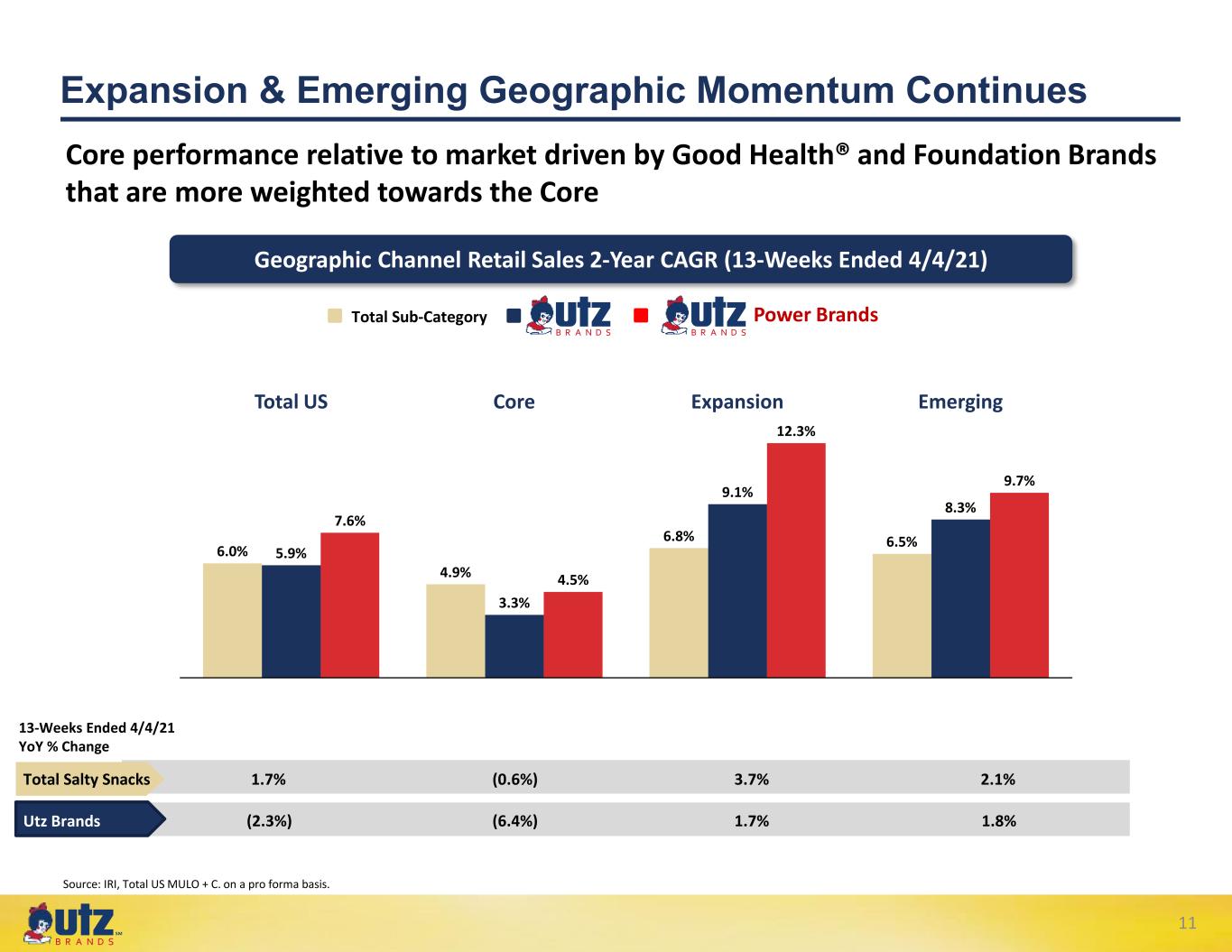

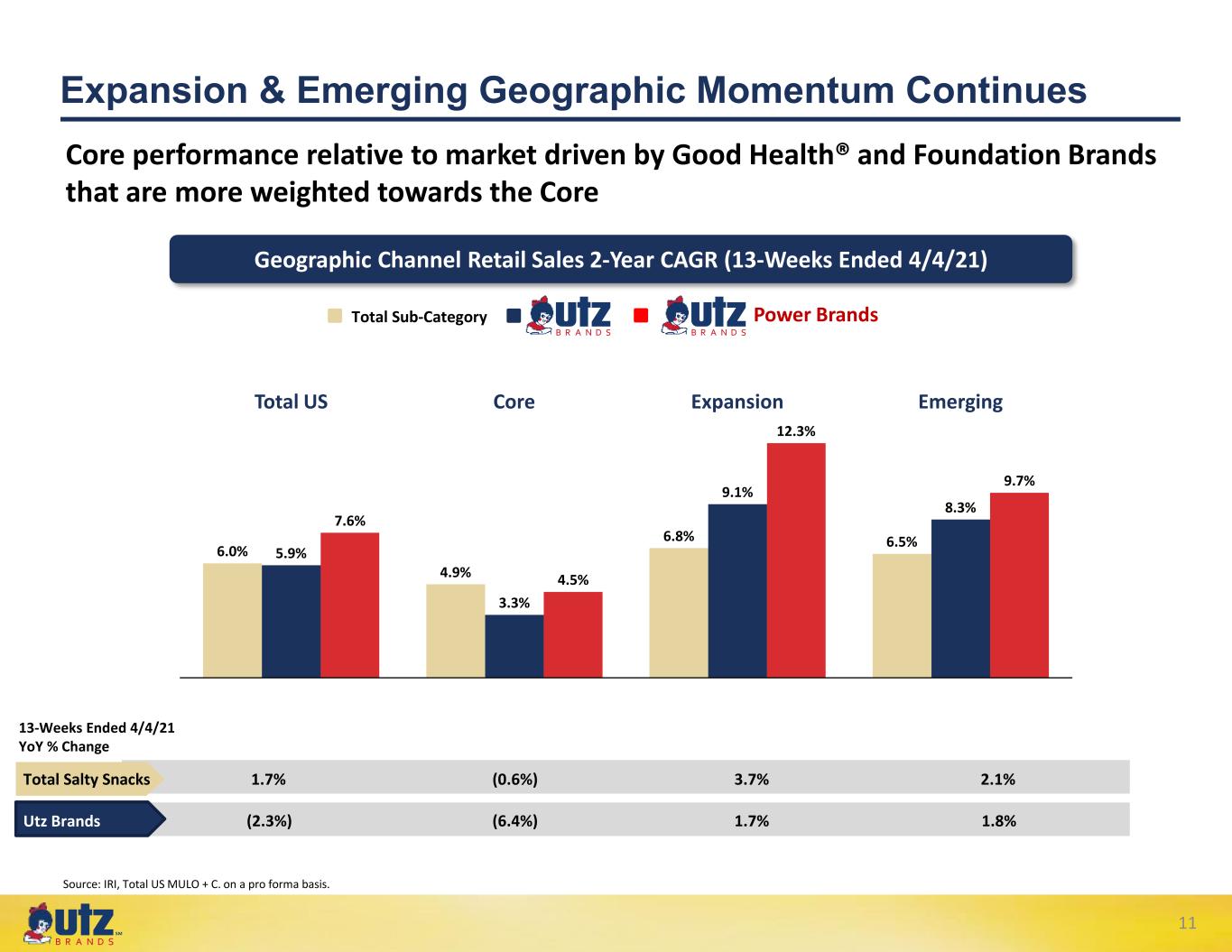

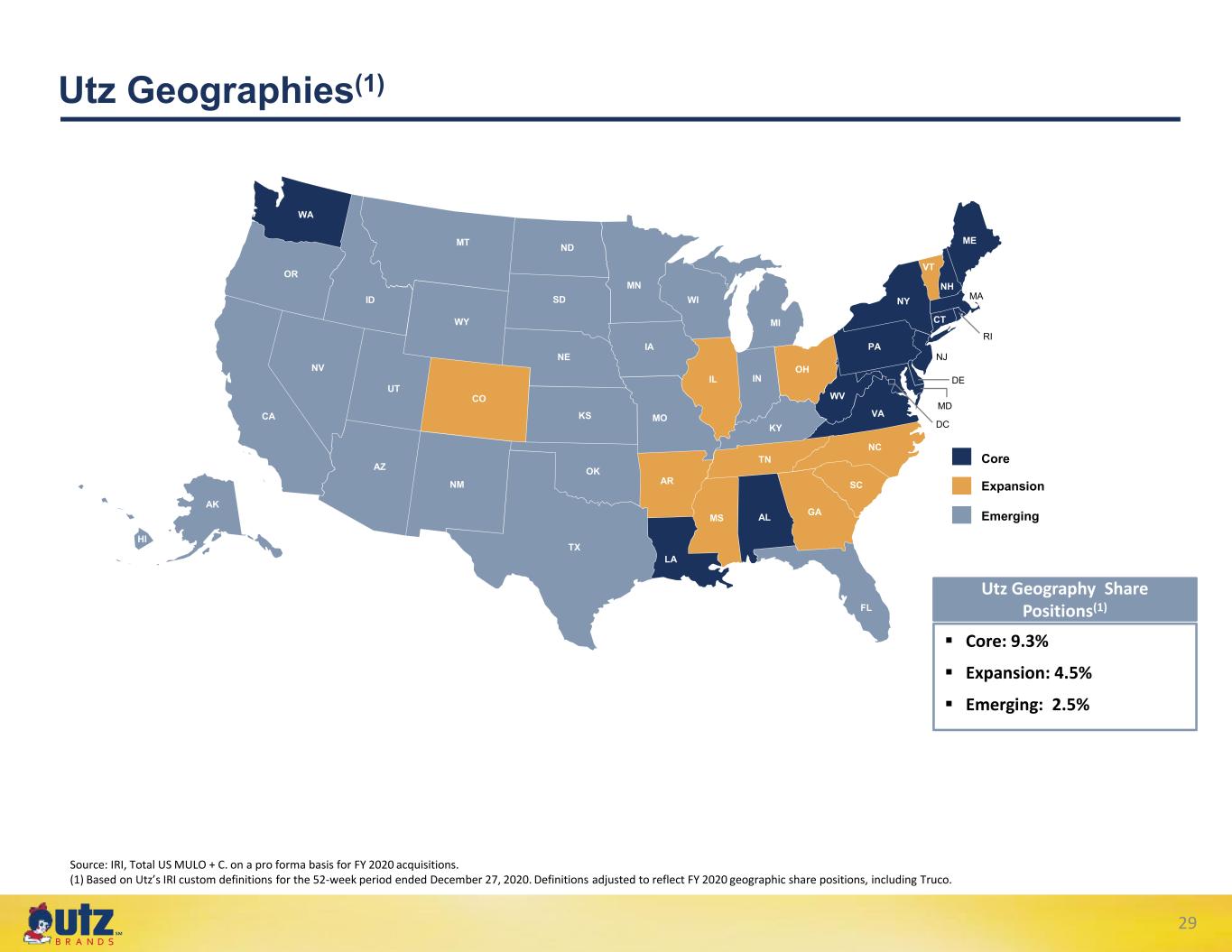

℠ 11 Source: IRI, Total US MULO + C. on a pro forma basis. Expansion & Emerging Geographic Momentum Continues Geographic Channel Retail Sales 2-Year CAGR (13-Weeks Ended 4/4/21) ExpansionTotal US Core Emerging 6.0% 5.9% 9.7% 4.9% 7.6% 3.3% 12.3% 4.5% 6.8% 9.1% 6.5% 8.3% 13-Weeks Ended 4/4/21 YoY % Change Total Salty Snacks Utz Brands 1.7% (0.6%) 3.7% 2.1% (2.3%) (6.4%) 1.7% 1.8% Core performance relative to market driven by Good Health® and Foundation Brands that are more weighted towards the Core Total Sub-Category Power Brands

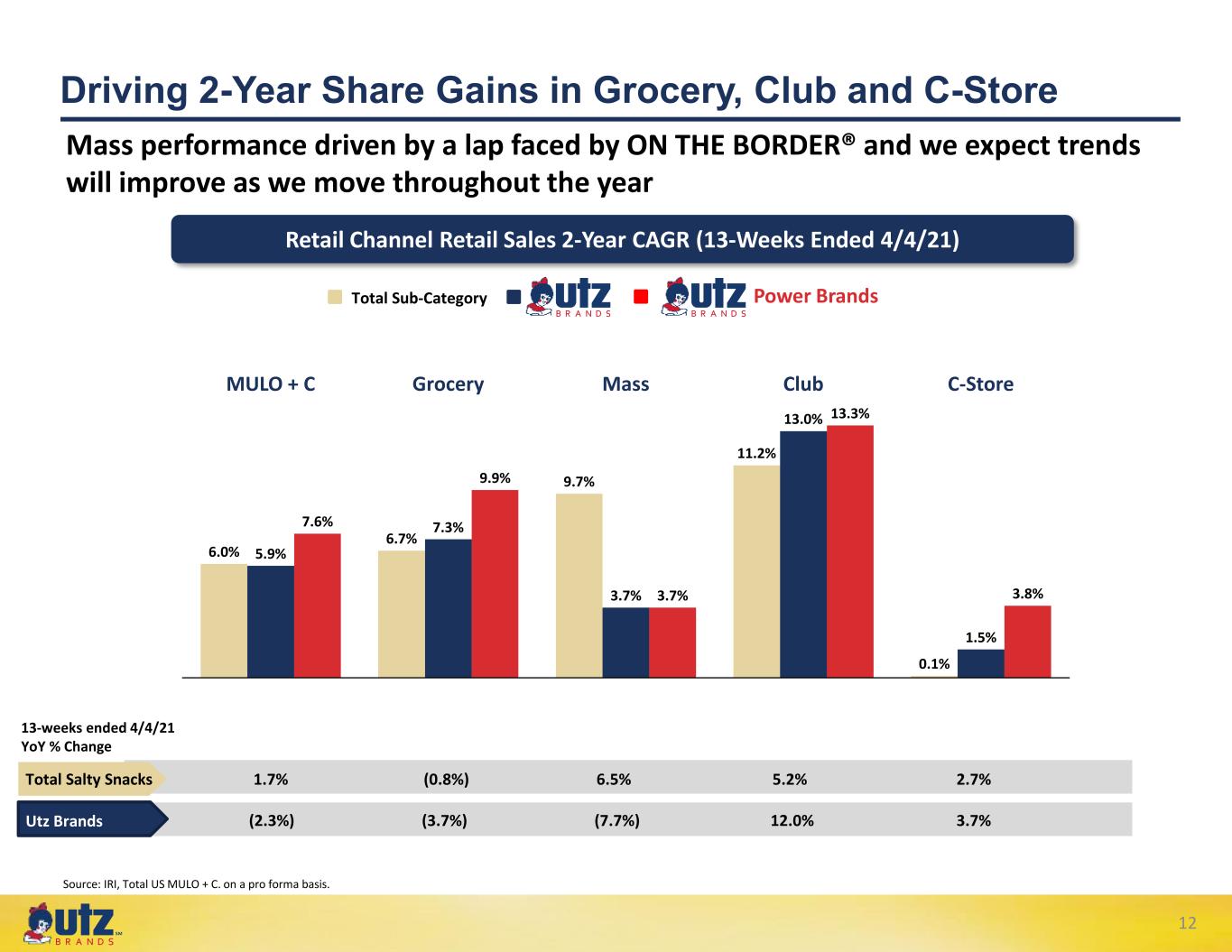

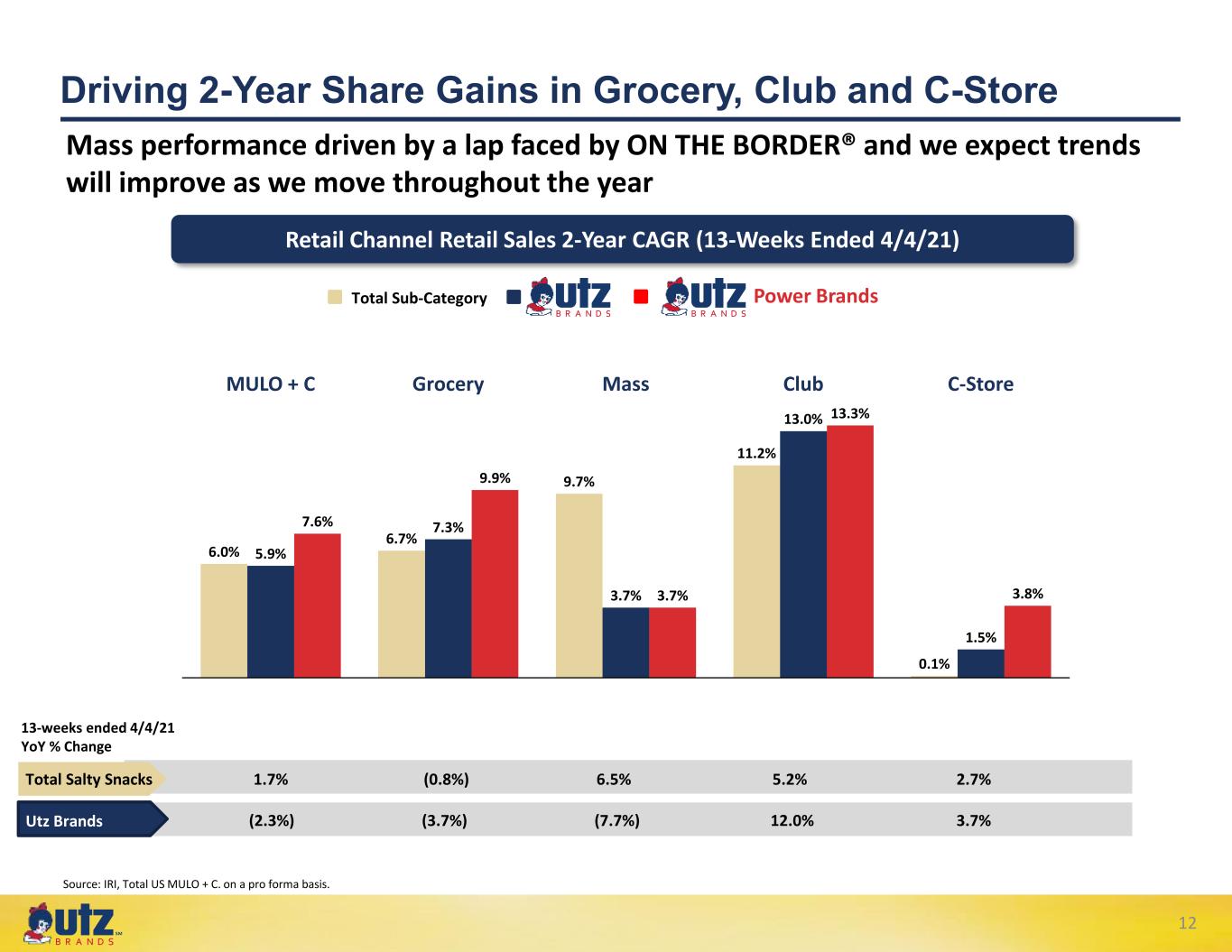

℠ 12 Source: IRI, Total US MULO + C. on a pro forma basis. Driving 2-Year Share Gains in Grocery, Club and C-Store Retail Channel Retail Sales 2-Year CAGR (13-Weeks Ended 4/4/21) 1.5% 5.9%6.0% 3.7% Mass 13.0% MULO + C Grocery C-StoreClub 7.6% 6.7% 7.3% 9.9% 9.7% 3.7% 11.2% 13.3% 0.1% 3.8% 13-weeks ended 4/4/21 YoY % Change Total Salty Snacks Utz Brands 1.7% (0.8%) 6.5% 5.2% 2.7% (2.3%) (3.7%) (7.7%) 12.0% 3.7% Total Sub-Category Power Brands Mass performance driven by a lap faced by ON THE BORDER® and we expect trends will improve as we move throughout the year

℠ Integration teams working very well together across both platforms On track to deliver cost synergy targets across manufacturing, procurement, selling expenses, and general and administrative for both transactions Early ON THE BORDER® revenue synergy wins include folding the brand into Utz's DSD system, winning new customers, and gaining placement in new channels Vitner's benefitting from Utz DSD integration and Utz leveraging Vitner's DSD network for the benefit of its Power Brands in the Chicago area, with strong early reads on Power Brand growth and continued market share gains Executing our Acquisition Strategy 13 Festida Foods is the largest manufacturer of tortilla chips for the ON THE BORDER® tortilla chip brand Purchase price of $41 million, funded from the Company’s revolving credit facility FY 2020 Adjusted EBITDA of $6M, resulting in a purchase multiple of 5.1x, which assumes run-rate cost synergies of at least $1 million and NPV of tax benefits of approximately $5 million Acquisition expected to close in Q2 2021 Truco Enterprises and Vitner’s Integration Updates Festida Foods Acquisition

HIGHLY CONFIDENTIAL 14 Financial Performance Cary Devore, Chief Financial Officer

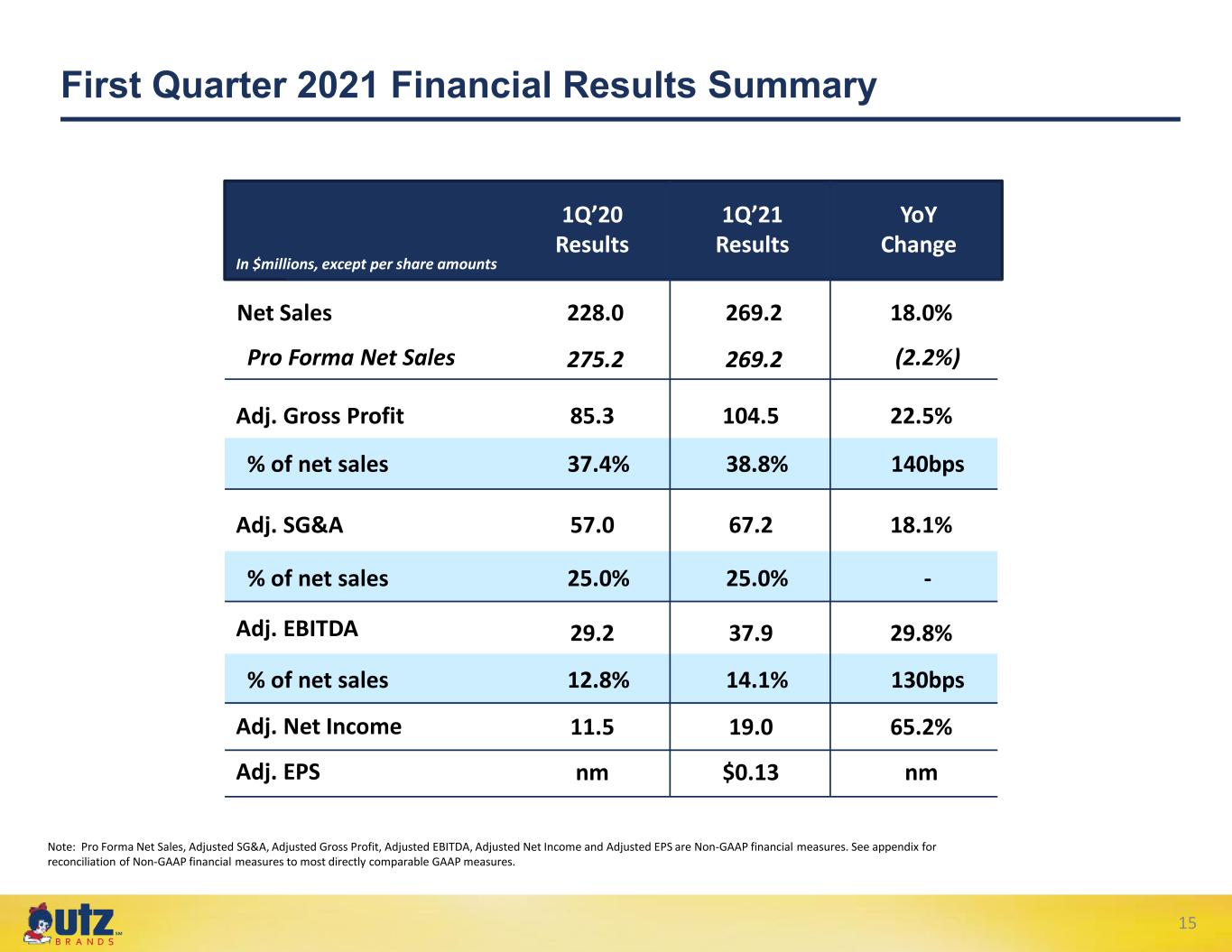

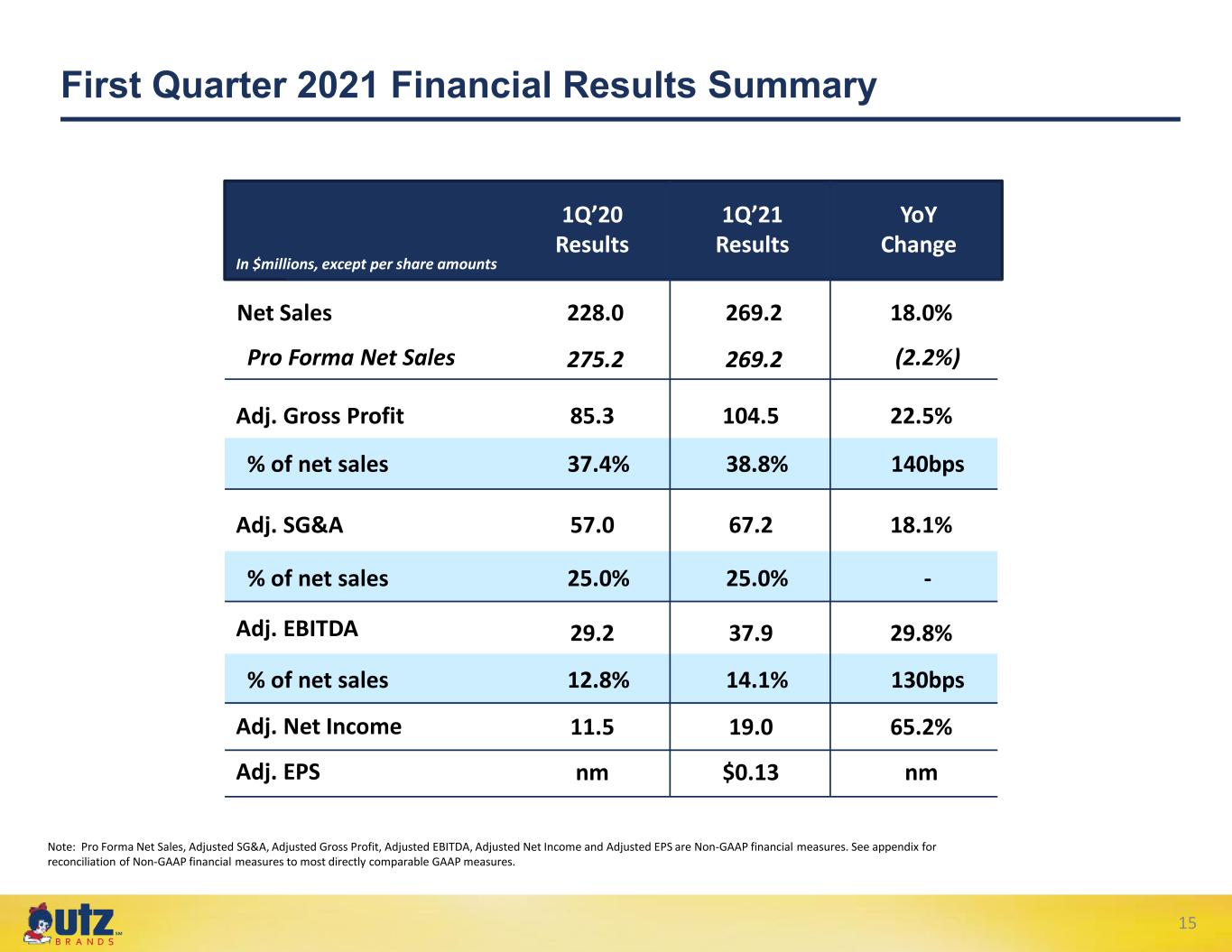

℠ First Quarter 2021 Financial Results Summary 15 Note: Pro Forma Net Sales, Adjusted SG&A, Adjusted Gross Profit, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS are Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. 1Q’20 Results 1Q’21 Results In $millions, except per share amounts Net Sales Adj. SG&A % of net sales 228.0 57.0 25.0% Adj. Gross Profit % of net sales 85.3 37.4% YoY Change Adj. EBITDA % of net sales Adj. Net Income Pro Forma Net Sales 29.2 12.8% 11.5 269.2 67.2 25.0% 104.5 38.8% 37.9 14.1% 19.0 18.0% 18.1% - 22.5% 140bps (2.2%) 29.8% 130bps 65.2% Adj. EPS nm $0.13 nm 275.2 269.2

℠ Price/Mix IO Discounts Acquisitions -4.7% Volume -0.6% 21.5% 18.0% 1Q21 1.9% 16 Q1 Net Sales Bridge (1) Estimated impact due to conversion of employee-serviced DSD routes to independent operator-serviced routes. (2) Acquisitions include partial period results of Truco Enterprises from 12/14/2020 to 4/4/2021; H.K. Anderson from 11/2/2020 to 4/4/2021; Vitners from 2/8/2021 to 4/4/2021. Q1 Net Sales YoY Growth Decomposition (1) (2) Year-over-year growth driven by positive price/mix and acquisitions Volumes impacted by COVID-19 overlap and February 2021 snowstorms Pro Forma Net Sales 2-year CAGR of 4.3%

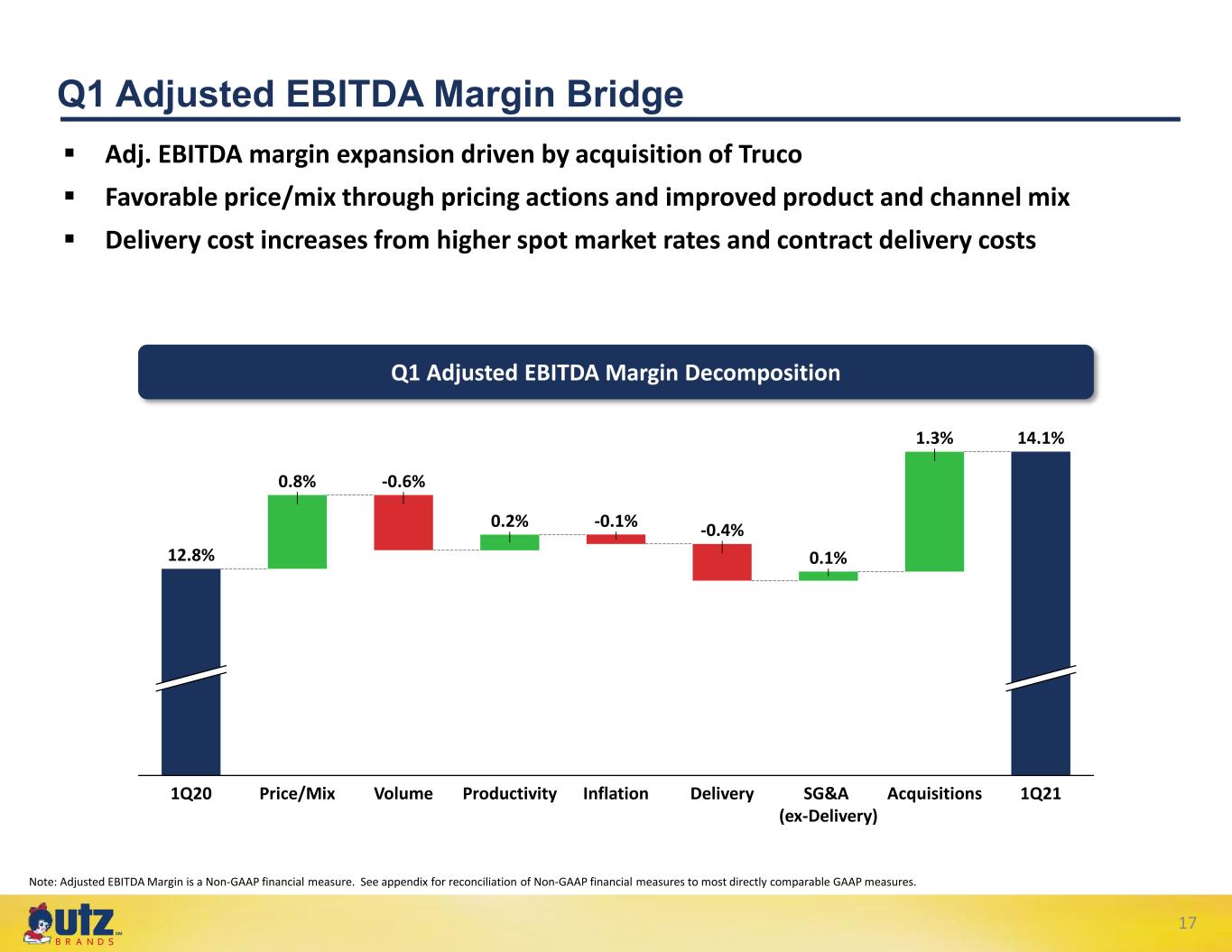

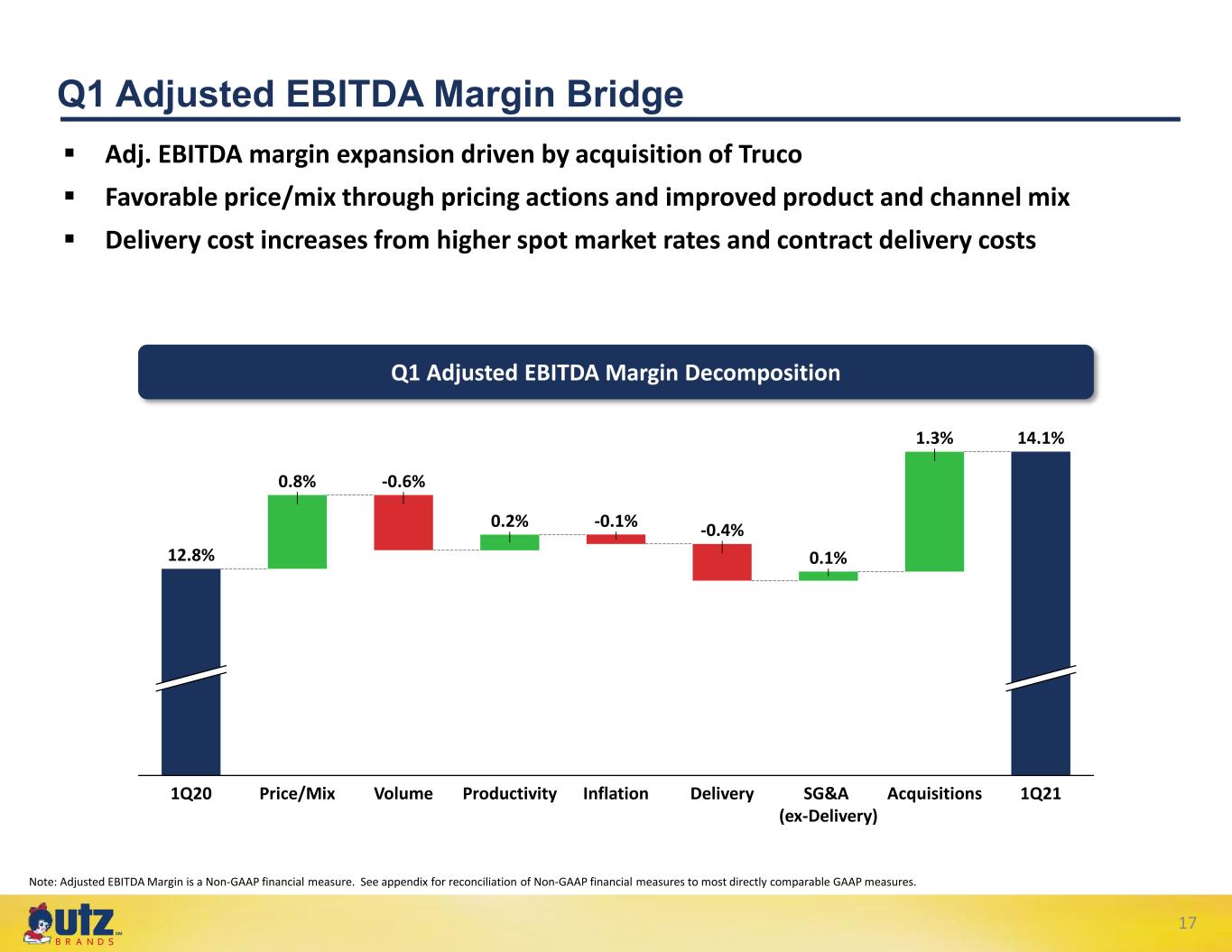

℠ -0.1% 0.8% InflationProductivity1Q20 Price/Mix -0.6% -0.4% Delivery 0.1% SG&A (ex-Delivery) 1.3% Acquisitions 1Q21 0.2% Volume 12.8% 14.1% 17 Q1 Adjusted EBITDA Margin Bridge Q1 Adjusted EBITDA Margin Decomposition Note: Adjusted EBITDA Margin is a Non-GAAP financial measure. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Adj. EBITDA margin expansion driven by acquisition of Truco Favorable price/mix through pricing actions and improved product and channel mix Delivery cost increases from higher spot market rates and contract delivery costs

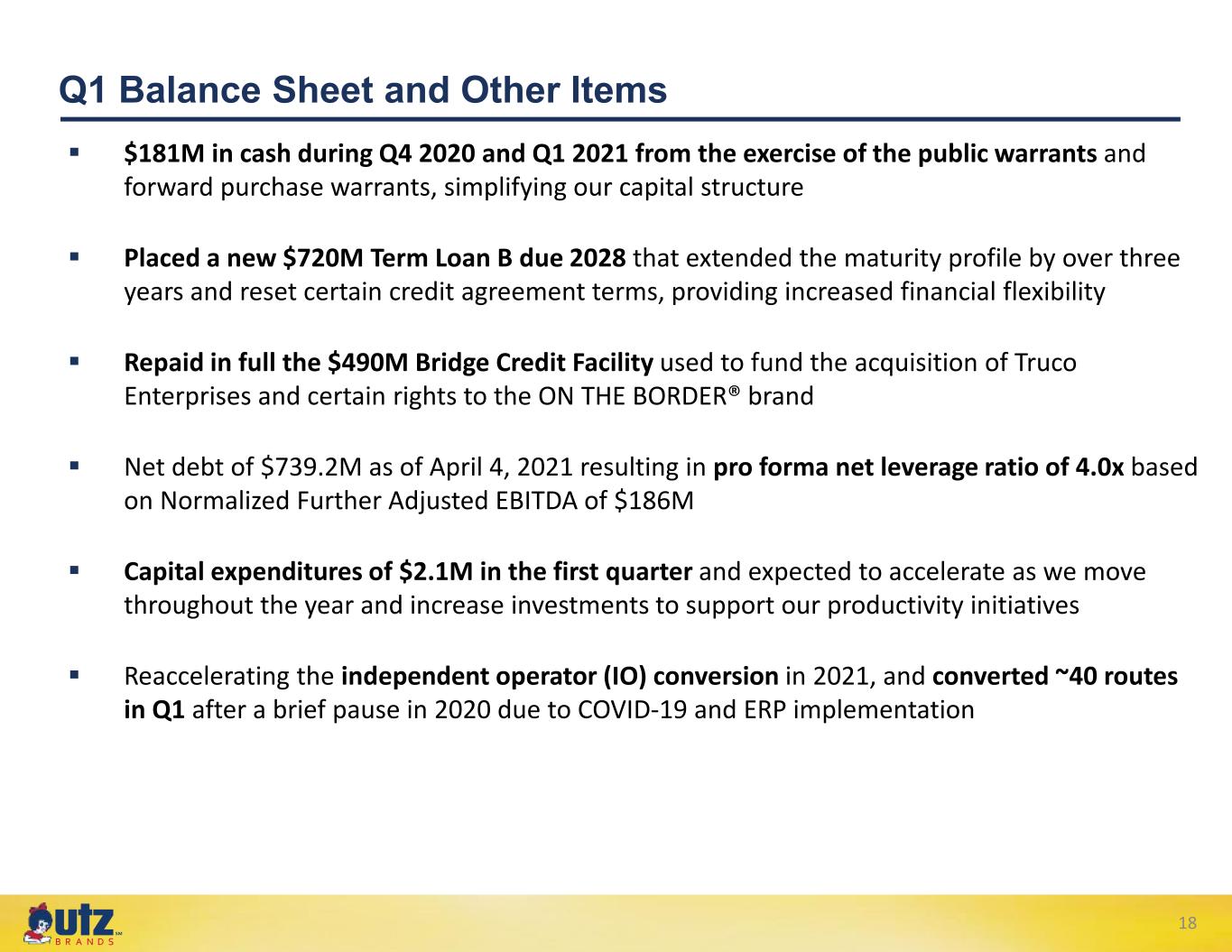

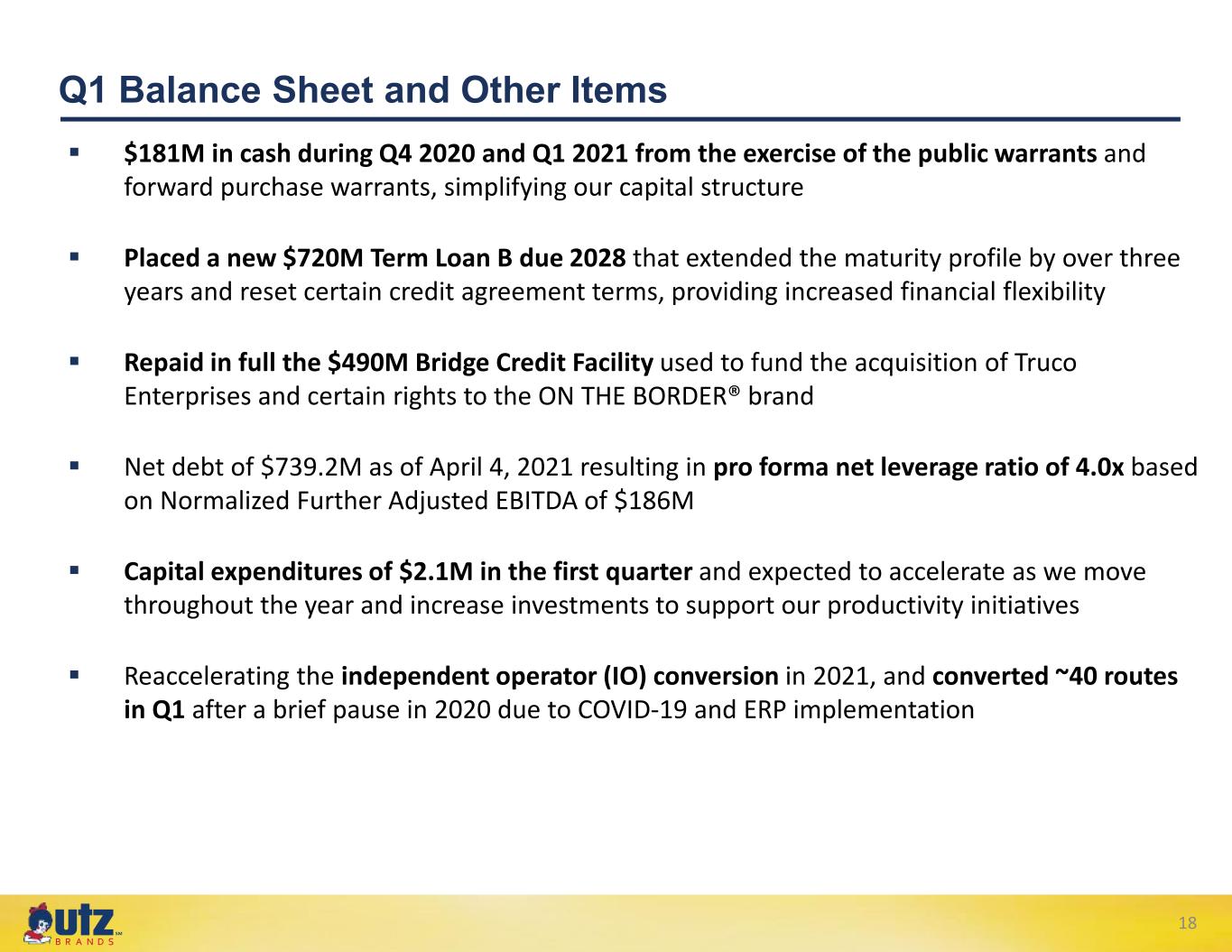

℠ 18 Q1 Balance Sheet and Other Items $181M in cash during Q4 2020 and Q1 2021 from the exercise of the public warrants and forward purchase warrants, simplifying our capital structure Placed a new $720M Term Loan B due 2028 that extended the maturity profile by over three years and reset certain credit agreement terms, providing increased financial flexibility Repaid in full the $490M Bridge Credit Facility used to fund the acquisition of Truco Enterprises and certain rights to the ON THE BORDER® brand Net debt of $739.2M as of April 4, 2021 resulting in pro forma net leverage ratio of 4.0x based on Normalized Further Adjusted EBITDA of $186M Capital expenditures of $2.1M in the first quarter and expected to accelerate as we move throughout the year and increase investments to support our productivity initiatives Reaccelerating the independent operator (IO) conversion in 2021, and converted ~40 routes in Q1 after a brief pause in 2020 due to COVID-19 and ERP implementation

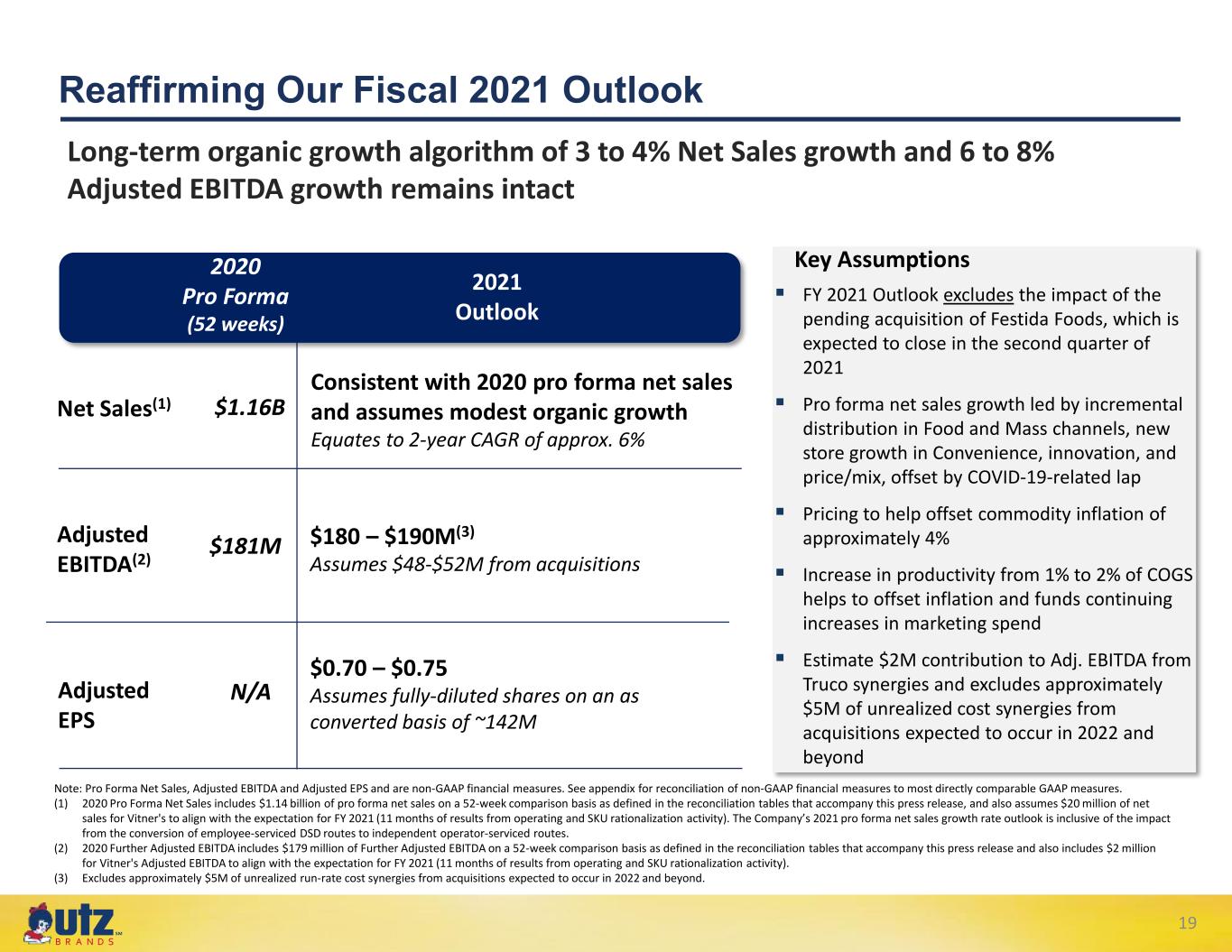

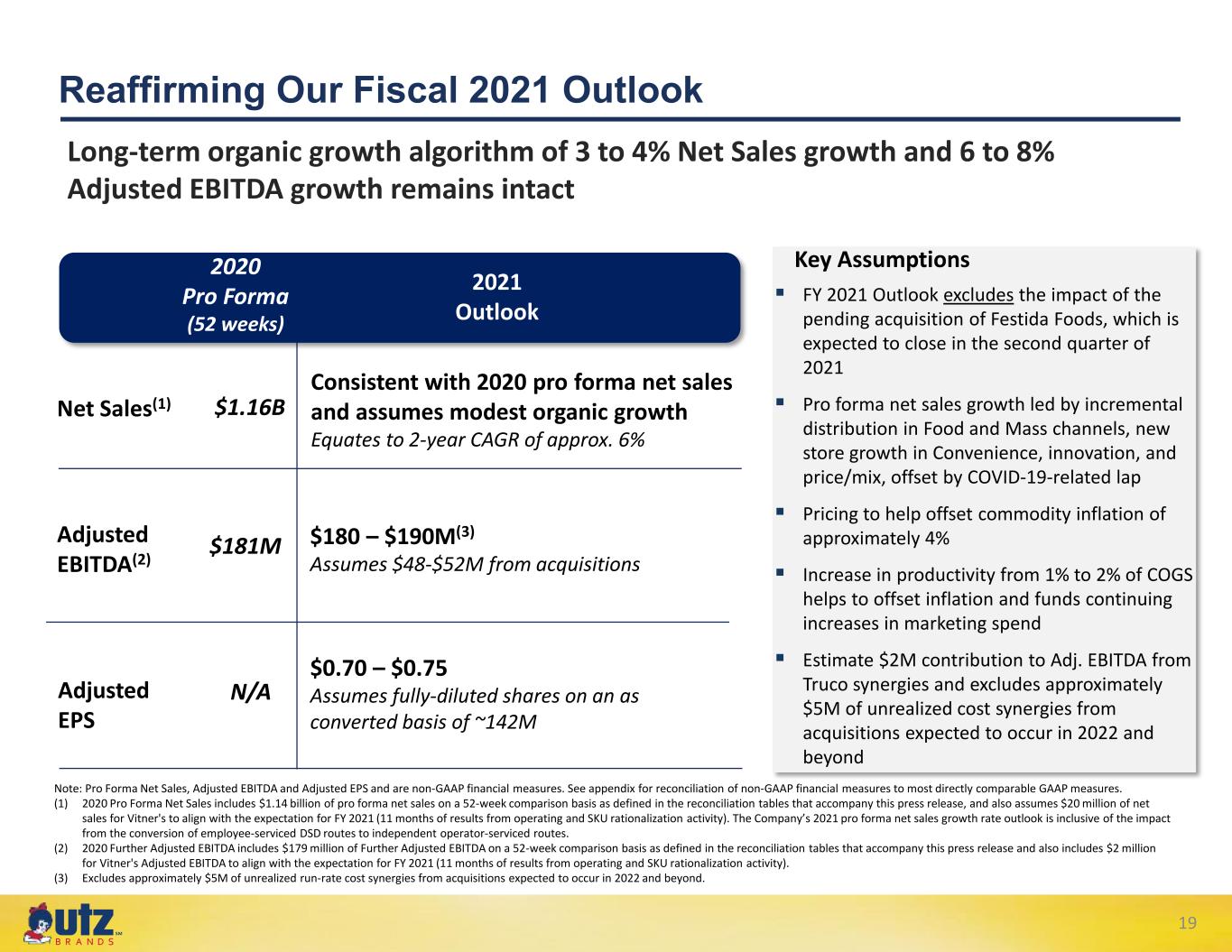

℠ 19 Reaffirming Our Fiscal 2021 Outlook FY 2021 Outlook excludes the impact of the pending acquisition of Festida Foods, which is expected to close in the second quarter of 2021 Pro forma net sales growth led by incremental distribution in Food and Mass channels, new store growth in Convenience, innovation, and price/mix, offset by COVID-19-related lap Pricing to help offset commodity inflation of approximately 4% Increase in productivity from 1% to 2% of COGS helps to offset inflation and funds continuing increases in marketing spend Estimate $2M contribution to Adj. EBITDA from Truco synergies and excludes approximately $5M of unrealized cost synergies from acquisitions expected to occur in 2022 and beyond Note: Pro Forma Net Sales, Adjusted EBITDA and Adjusted EPS and are non-GAAP financial measures. See appendix for reconciliation of non-GAAP financial measures to most directly comparable GAAP measures. (1) 2020 Pro Forma Net Sales includes $1.14 billion of pro forma net sales on a 52-week comparison basis as defined in the reconciliation tables that accompany this press release, and also assumes $20 million of net sales for Vitner's to align with the expectation for FY 2021 (11 months of results from operating and SKU rationalization activity). The Company’s 2021 pro forma net sales growth rate outlook is inclusive of the impact from the conversion of employee-serviced DSD routes to independent operator-serviced routes. (2) 2020 Further Adjusted EBITDA includes $179 million of Further Adjusted EBITDA on a 52-week comparison basis as defined in the reconciliation tables that accompany this press release and also includes $2 million for Vitner's Adjusted EBITDA to align with the expectation for FY 2021 (11 months of results from operating and SKU rationalization activity). (3) Excludes approximately $5M of unrealized run-rate cost synergies from acquisitions expected to occur in 2022 and beyond. Net Sales(1) Key Assumptions $1.16B Consistent with 2020 pro forma net sales and assumes modest organic growth Equates to 2-year CAGR of approx. 6% 2020 Pro Forma (52 weeks) 2021 Outlook $181M $180 – $190M (3) Assumes $48-$52M from acquisitions Adjusted EPS N/A $0.70 – $0.75 Assumes fully-diluted shares on an as converted basis of ~142M Adjusted EBITDA(2) Long-term organic growth algorithm of 3 to 4% Net Sales growth and 6 to 8% Adjusted EBITDA growth remains intact

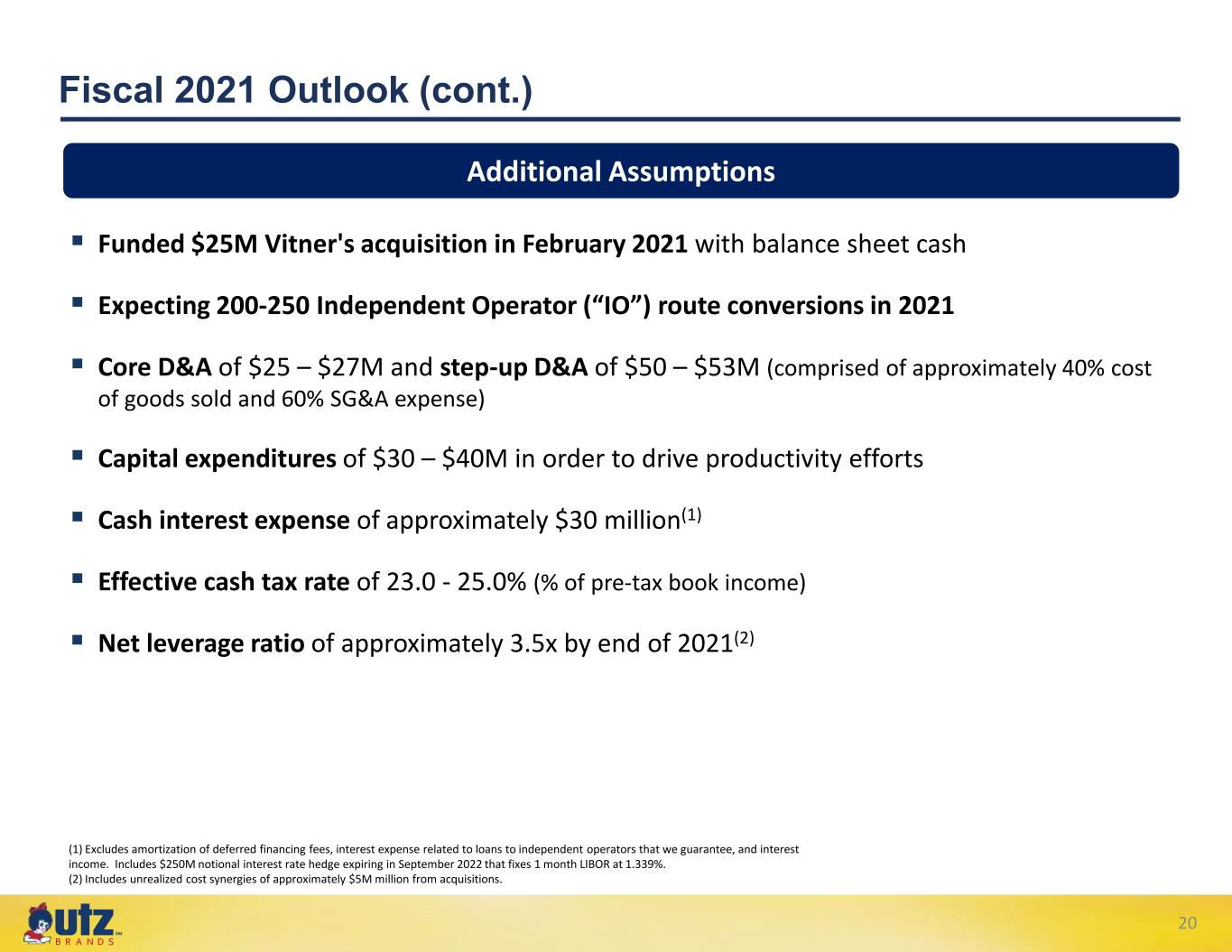

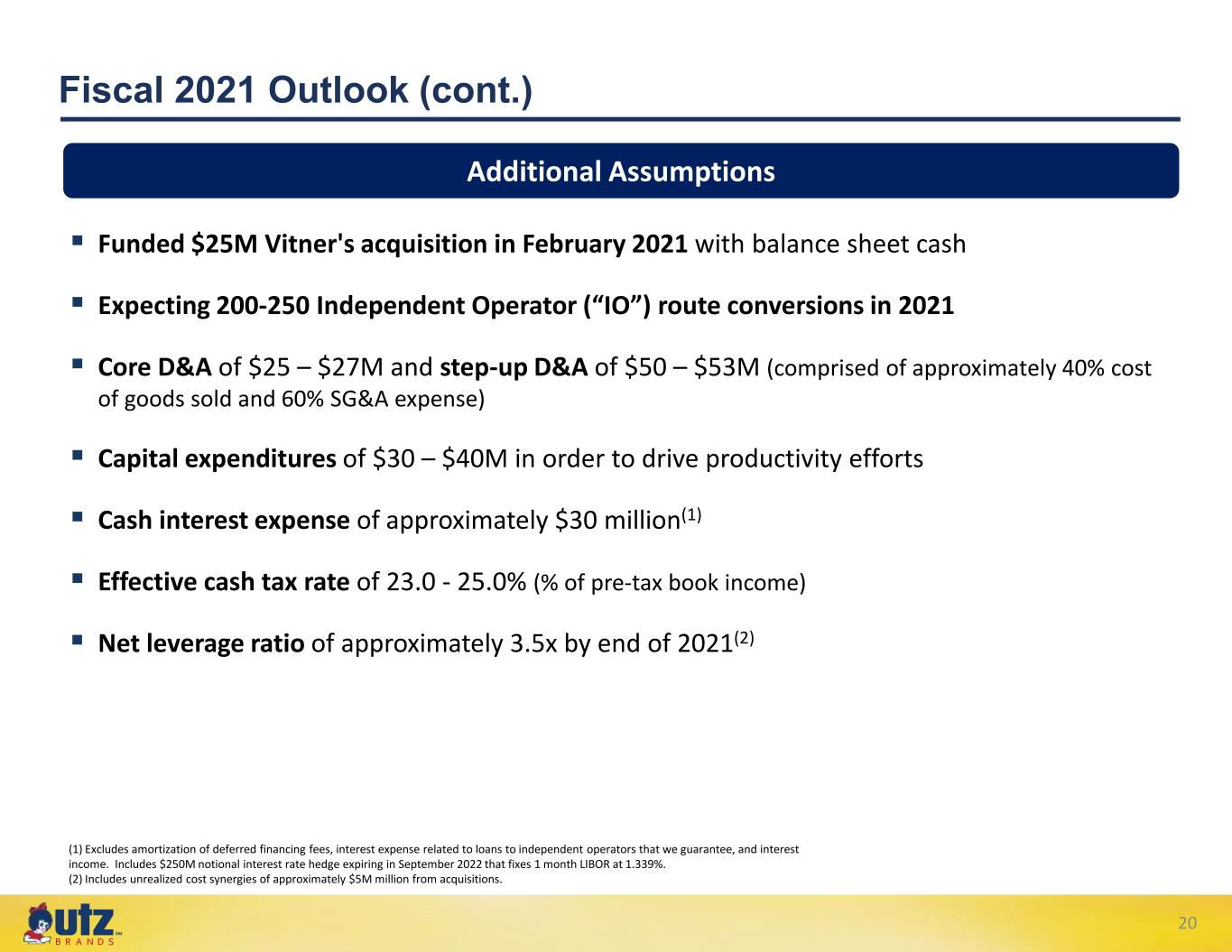

℠ 20 Fiscal 2021 Outlook (cont.) Additional Assumptions Funded $25M Vitner's acquisition in February 2021 with balance sheet cash Expecting 200-250 Independent Operator (“IO”) route conversions in 2021 Core D&A of $25 – $27M and step-up D&A of $50 – $53M (comprised of approximately 40% cost of goods sold and 60% SG&A expense) Capital expenditures of $30 – $40M in order to drive productivity efforts Cash interest expense of approximately $30 million(1) Effective cash tax rate of 23.0 - 25.0% (% of pre-tax book income) Net leverage ratio of approximately 3.5x by end of 2021(2) (1) Excludes amortization of deferred financing fees, interest expense related to loans to independent operators that we guarantee, and interest income. Includes $250M notional interest rate hedge expiring in September 2022 that fixes 1 month LIBOR at 1.339%. (2) Includes unrealized cost synergies of approximately $5M million from acquisitions.

HIGHLY CONFIDENTIAL Appendix 21

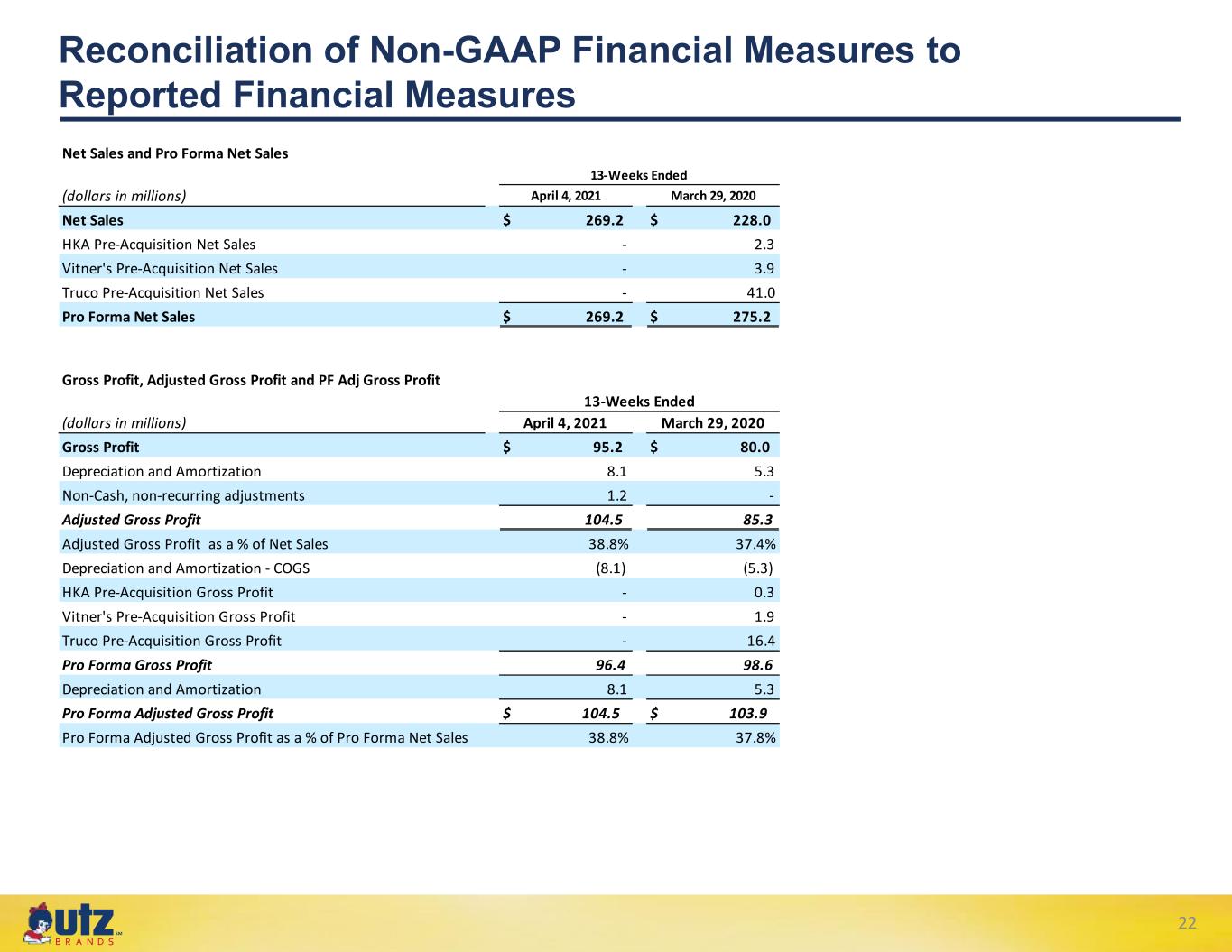

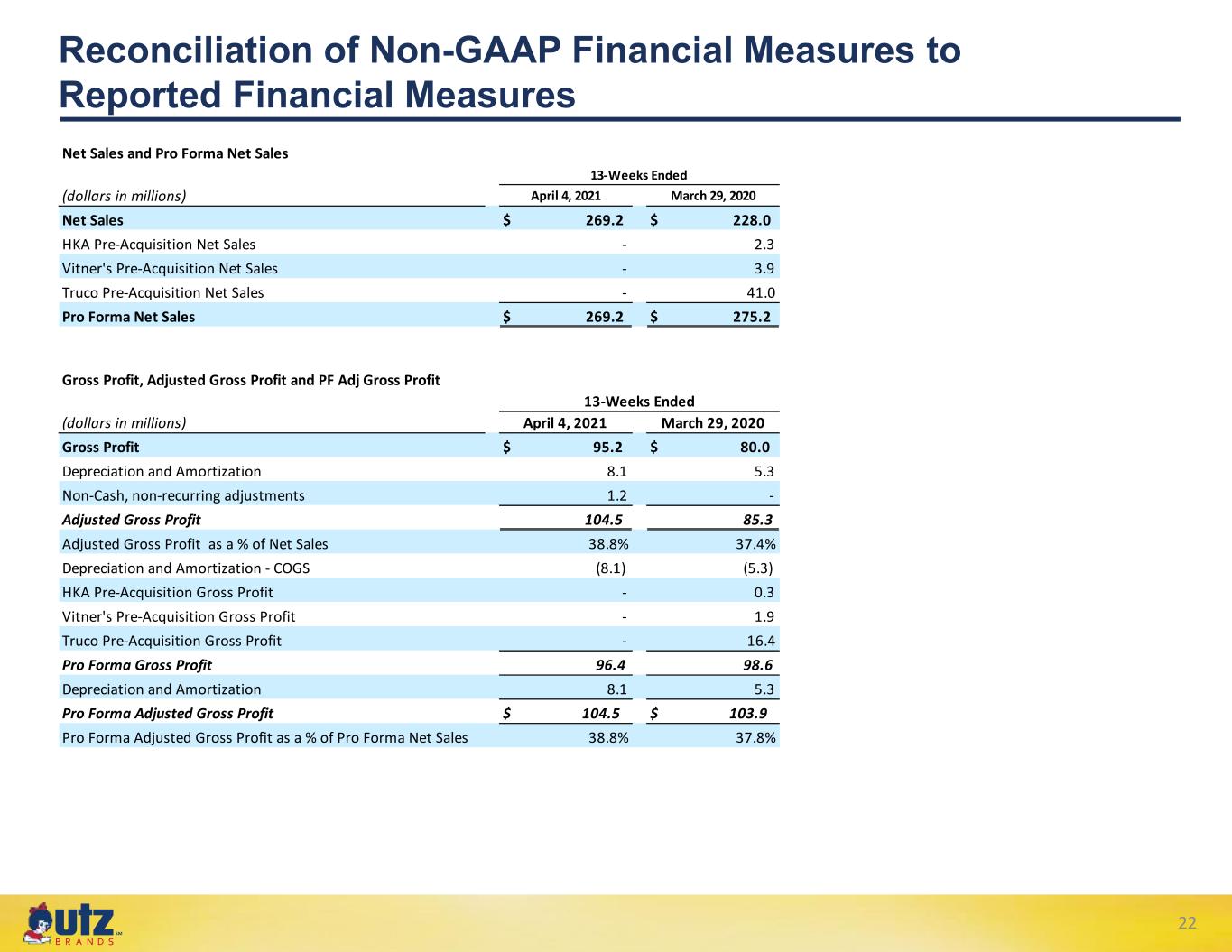

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 22 Net Sales and Pro Forma Net Sales (dollars in millions) April 4, 2021 March 29, 2020 Net Sales $ 269.2 $ 228.0 HKA Pre-Acquisition Net Sales - 2.3 Vitner's Pre-Acquisition Net Sales - 3.9 Truco Pre-Acquisition Net Sales - 41.0 Pro Forma Net Sales $ 269.2 $ 275.2 13-Weeks Ended Gross Profit, Adjusted Gross Profit and PF Adj Gross Profit (dollars in millions) April 4, 2021 March 29, 2020 Gross Profit $ 95.2 $ 80.0 Depreciation and Amortization 8.1 5.3 Non-Cash, non-recurring adjustments 1.2 - Adjusted Gross Profit 104.5 85.3 Adjusted Gross Profit as a % of Net Sales 38.8% 37.4% Depreciation and Amortization - COGS (8.1) (5.3) HKA Pre-Acquisition Gross Profit - 0.3 Vitner's Pre-Acquisition Gross Profit - 1.9 Truco Pre-Acquisition Gross Profit - 16.4 Pro Forma Gross Profit 96.4 98.6 Depreciation and Amortization 8.1 5.3 Pro Forma Adjusted Gross Profit $ 104.5 $ 103.9 Pro Forma Adjusted Gross Profit as a % of Pro Forma Net Sales 38.8% 37.8% 13-Weeks Ended

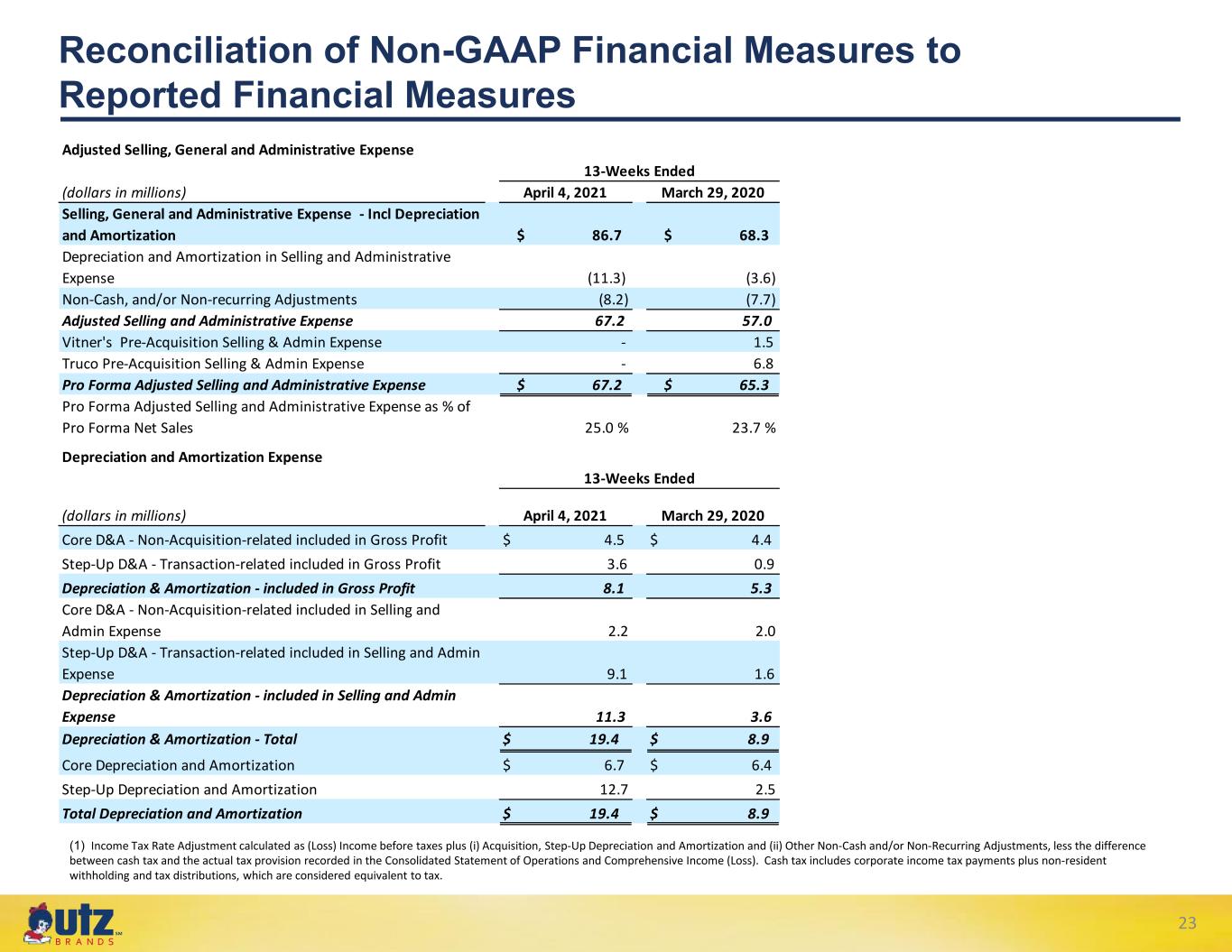

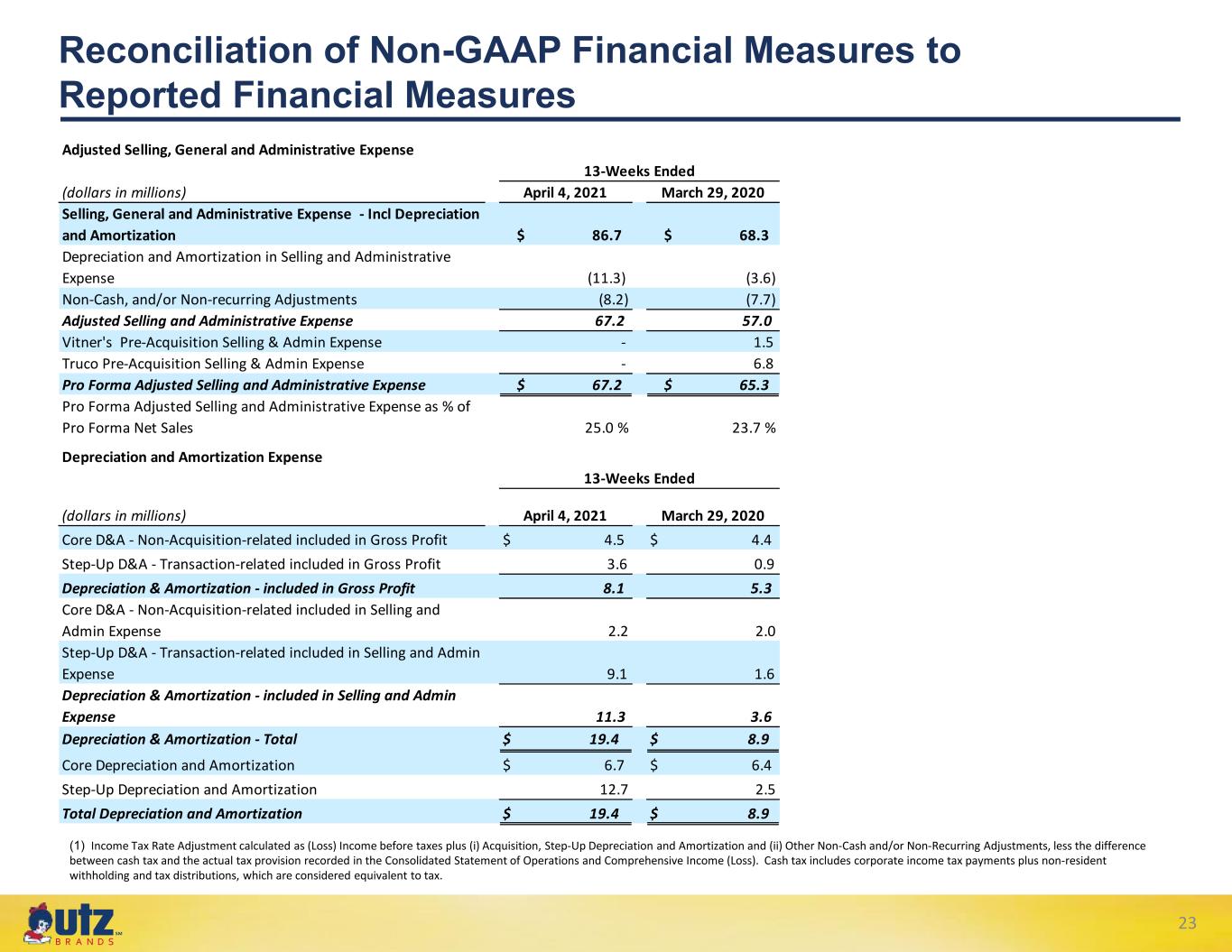

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 23 Adjusted Selling, General and Administrative Expense (dollars in millions) April 4, 2021 March 29, 2020 Selling, General and Administrative Expense - Incl Depreciation and Amortization $ 86.7 $ 68.3 Depreciation and Amortization in Selling and Administrative Expense (11.3) (3.6) Non-Cash, and/or Non-recurring Adjustments (8.2) (7.7) Adjusted Selling and Administrative Expense 67.2 57.0 Vitner's Pre-Acquisition Selling & Admin Expense - 1.5 Truco Pre-Acquisition Selling & Admin Expense - 6.8 Pro Forma Adjusted Selling and Administrative Expense $ 67.2 $ 65.3 Pro Forma Adjusted Selling and Administrative Expense as % of Pro Forma Net Sales 25.0 % 23.7 % 13-Weeks Ended Depreciation and Amortization Expense (dollars in millions) April 4, 2021 March 29, 2020 Core D&A - Non-Acquisition-related included in Gross Profit $ 4.5 $ 4.4 Step-Up D&A - Transaction-related included in Gross Profit 3.6 0.9 Depreciation & Amortization - included in Gross Profit 8.1 5.3 Core D&A - Non-Acquisition-related included in Selling and Admin Expense 2.2 2.0 Step-Up D&A - Transaction-related included in Selling and Admin Expense 9.1 1.6 Depreciation & Amortization - included in Selling and Admin Expense 11.3 3.6 Depreciation & Amortization - Total $ 19.4 $ 8.9 Core Depreciation and Amortization $ 6.7 $ 6.4 Step-Up Depreciation and Amortization 12.7 2.5 Total Depreciation and Amortization $ 19.4 $ 8.9 13-Weeks Ended (1) Income Tax Rate Adjustment calculated as (Loss) Income before taxes plus (i) Acquisition, Step-Up Depreciation and Amortization and (ii) Other Non-Cash and/or Non-Recurring Adjustments, less the difference between cash tax and the actual tax provision recorded in the Consolidated Statement of Operations and Comprehensive Income (Loss). Cash tax includes corporate income tax payments plus non-resident withholding and tax distributions, which are considered equivalent to tax.

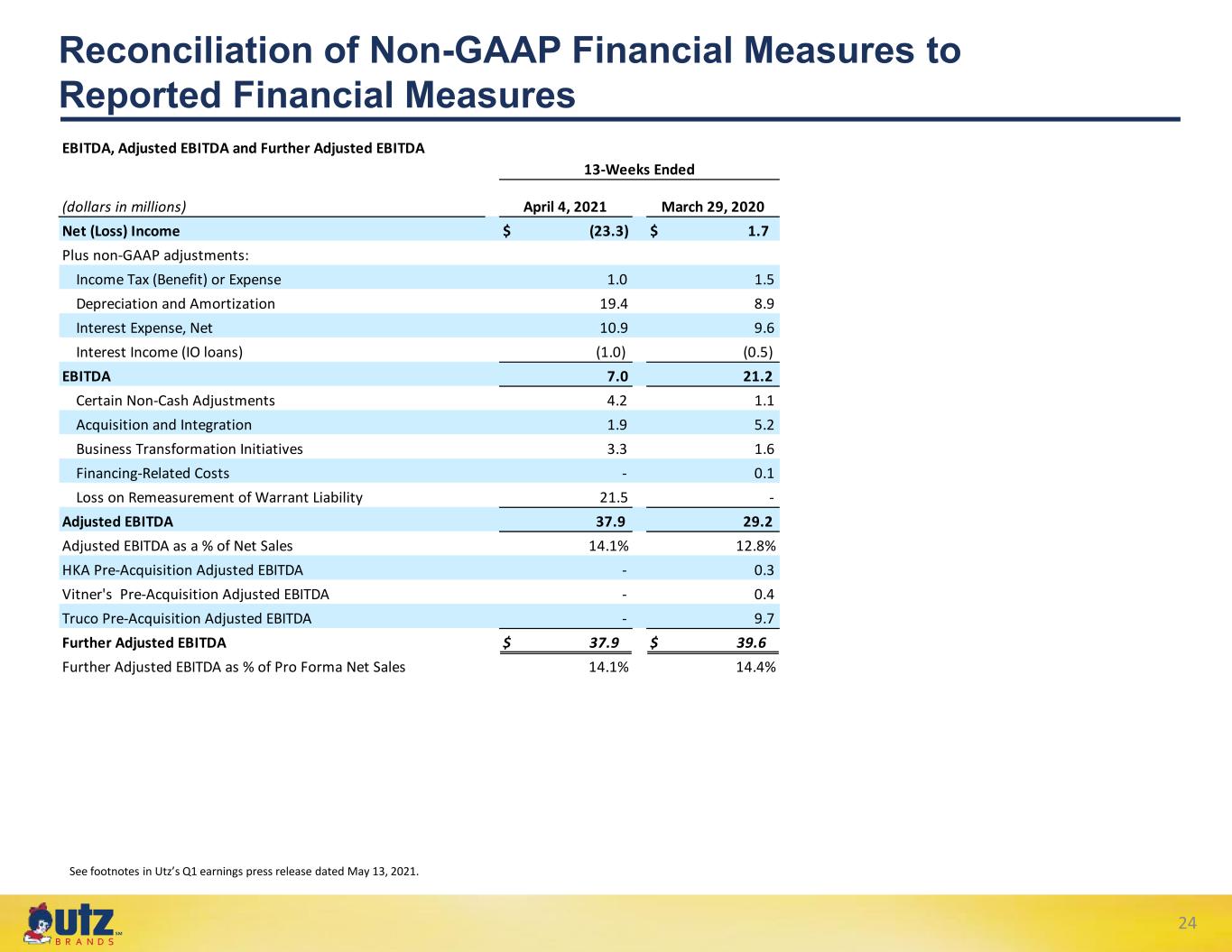

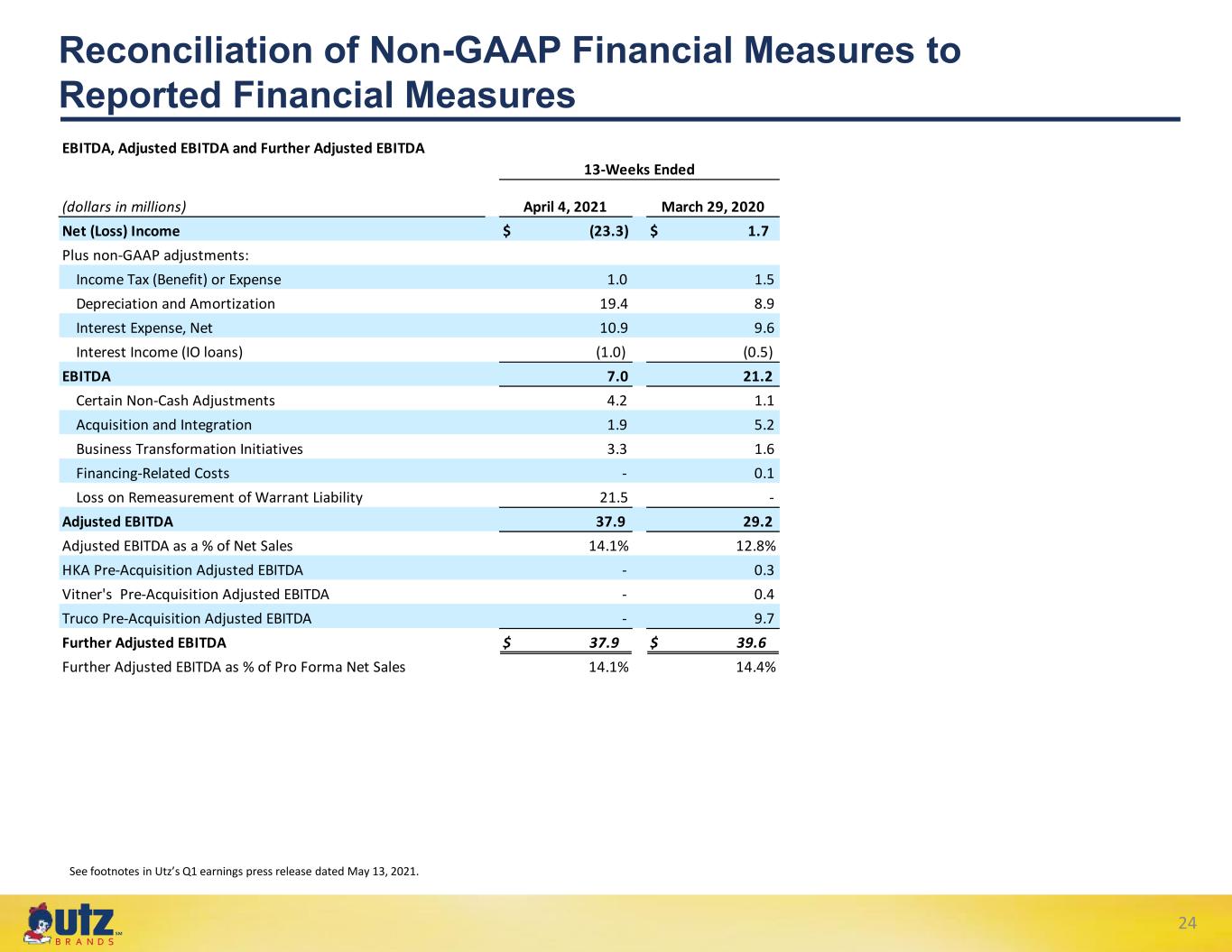

℠ 24 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures See footnotes in Utz’s Q1 earnings press release dated May 13, 2021. EBITDA, Adjusted EBITDA and Further Adjusted EBITDA (dollars in millions) April 4, 2021 March 29, 2020 Net (Loss) Income $ (23.3) $ 1.7 Plus non-GAAP adjustments: Income Tax (Benefit) or Expense 1.0 1.5 Depreciation and Amortization 19.4 8.9 Interest Expense, Net 10.9 9.6 Interest Income (IO loans) (1.0) (0.5) EBITDA 7.0 21.2 Certain Non-Cash Adjustments 4.2 1.1 Acquisition and Integration 1.9 5.2 Business Transformation Initiatives 3.3 1.6 Financing-Related Costs - 0.1 Loss on Remeasurement of Warrant Liability 21.5 - Adjusted EBITDA 37.9 29.2 Adjusted EBITDA as a % of Net Sales 14.1% 12.8% HKA Pre-Acquisition Adjusted EBITDA - 0.3 Vitner's Pre-Acquisition Adjusted EBITDA - 0.4 Truco Pre-Acquisition Adjusted EBITDA - 9.7 Further Adjusted EBITDA $ 37.9 $ 39.6 Further Adjusted EBITDA as % of Pro Forma Net Sales 14.1% 14.4% 13-Weeks Ended

℠ 25 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures Adjusted Net Income (dollars in millions, except per share data) April 4, 2021 March 29, 2020 Net (Loss) Income $ (23.3) $ 1.7 Deferred Financing Fees 2.7 0.8 Depreciation and Amortization 19.4 8.9 Non-Acquisition Related Depreciation and Amortization (6.7) (6.4) Acquisition Step-Up Depreciation and Amortization: 12.7 2.5 Certain Non-Cash Adjustments 4.2 1.1 Acquisition and Integration 1.9 5.2 Business and Transformation Initiatives 3.3 1.6 Financing-Related Costs - 0.1 Loss on Remeasurement of Warrant Liability 21.5 - Other Non-Cash and/or Non-Recurring Adjustments 30.9 8.0 Income Tax-Rate Adjustment (4.0) (1.5) Adjusted Net Income $ 19.0 $ 11.5 Basic Shares Outstanding 136.3 Fully Diluted Shares on an As-Converted Basis 142.0 Adjusted Earnings Per Share $ 0.13 13-Weeks Ended

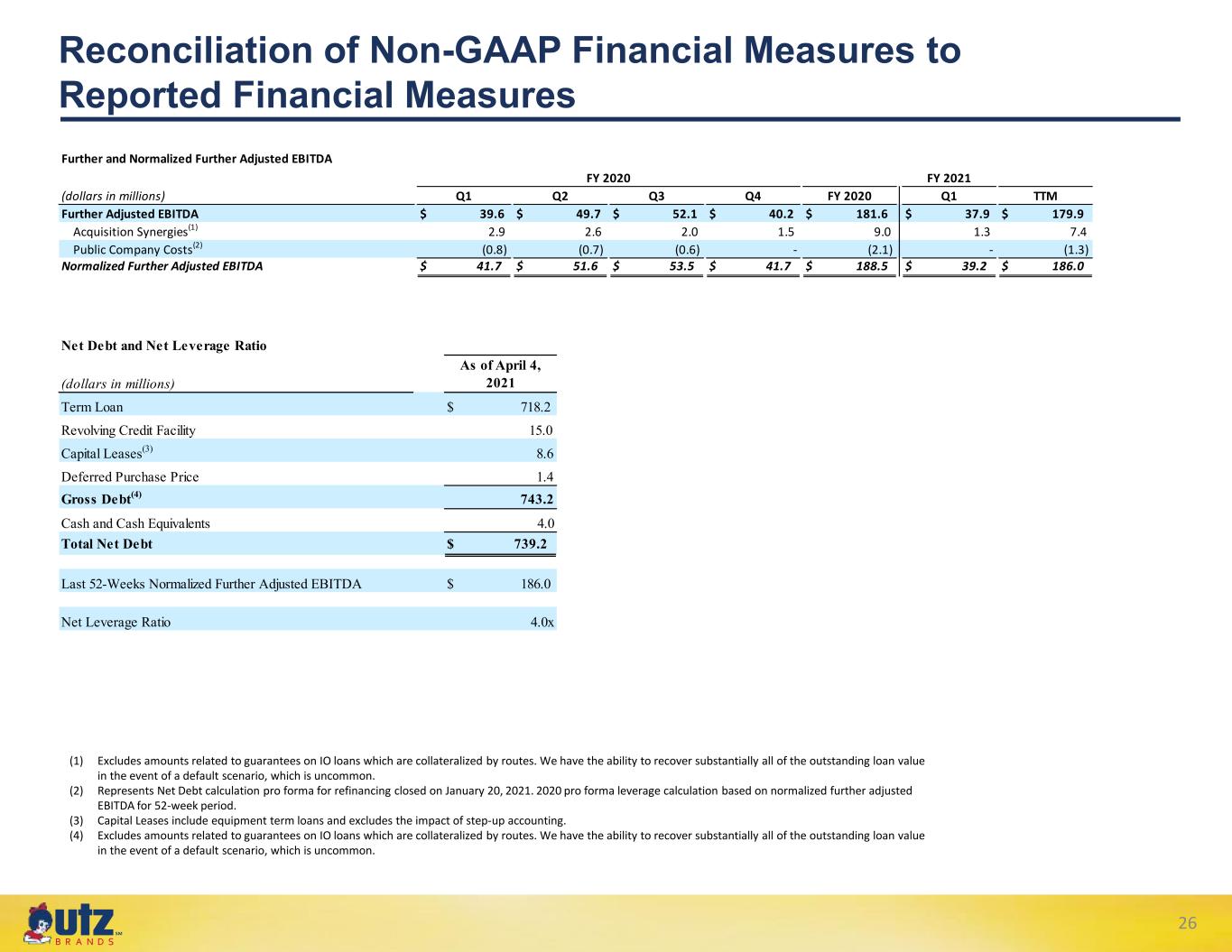

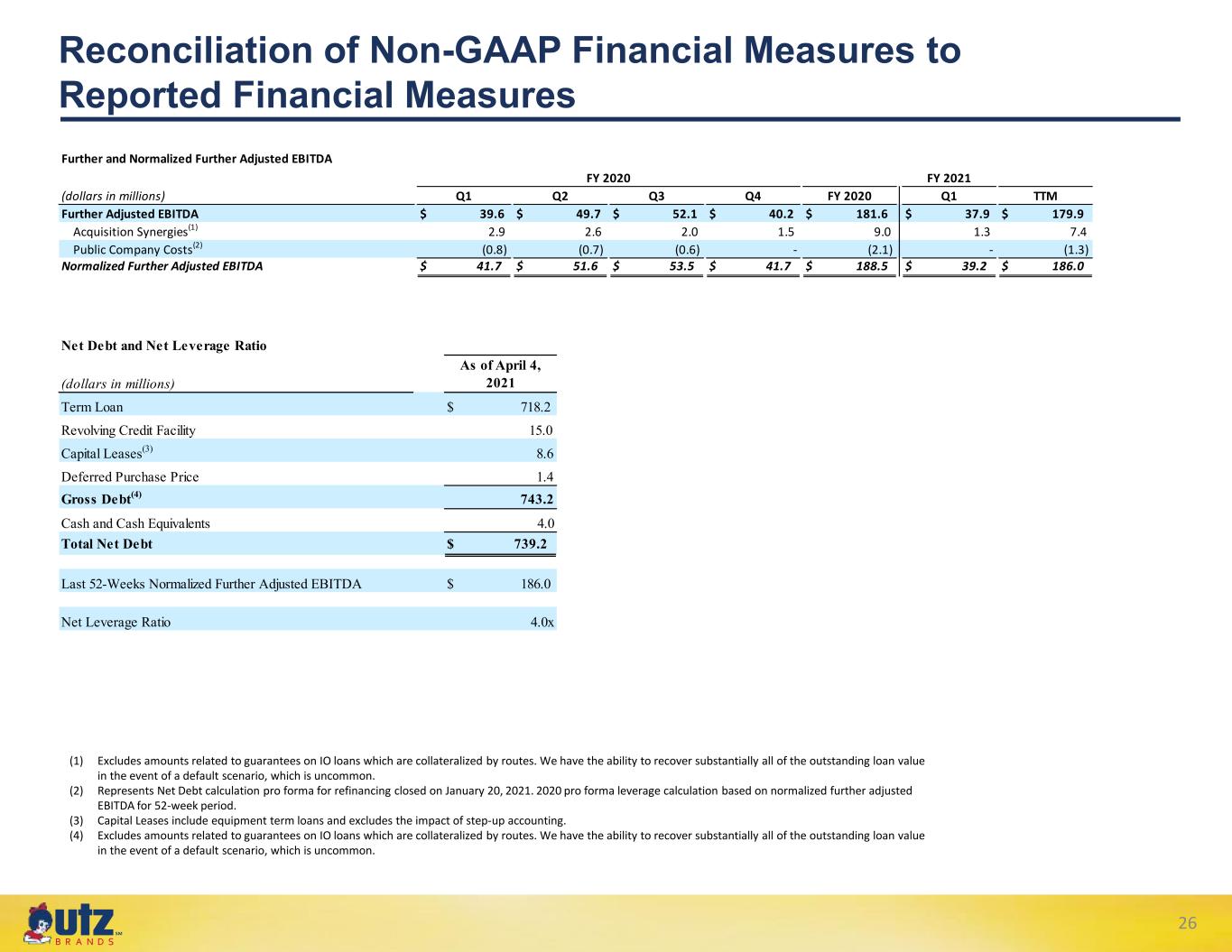

℠ 26 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (1) Excludes amounts related to guarantees on IO loans which are collateralized by routes. We have the ability to recover substantially all of the outstanding loan value in the event of a default scenario, which is uncommon. (2) Represents Net Debt calculation pro forma for refinancing closed on January 20, 2021. 2020 pro forma leverage calculation based on normalized further adjusted EBITDA for 52-week period. (3) Capital Leases include equipment term loans and excludes the impact of step-up accounting. (4) Excludes amounts related to guarantees on IO loans which are collateralized by routes. We have the ability to recover substantially all of the outstanding loan value in the event of a default scenario, which is uncommon. Further and Normalized Further Adjusted EBITDA FY 2021 (dollars in millions) Q1 Q2 Q3 Q4 FY 2020 Q1 TTM Further Adjusted EBITDA $ 39.6 $ 49.7 $ 52.1 $ 40.2 $ 181.6 $ 37.9 $ 179.9 Acquisition Synergies(1) 2.9 2.6 2.0 1.5 9.0 1.3 7.4 Public Company Costs(2) (0.8) (0.7) (0.6) - (2.1) - (1.3) Normalized Further Adjusted EBITDA $ 41.7 $ 51.6 $ 53.5 $ 41.7 $ 188.5 $ 39.2 $ 186.0 FY 2020 Net Debt and Net Leverage Ratio (dollars in millions) As of April 4, 2021 Term Loan $ 718.2 Revolving Credit Facility 15.0 Capital Leases(3) 8.6 Deferred Purchase Price 1.4 Gross Debt(4) 743.2 Cash and Cash Equivalents 4.0 Total Net Debt $ 739.2 Last 52-Weeks Normalized Further Adjusted EBITDA $ 186.0 Net Leverage Ratio 4.0x

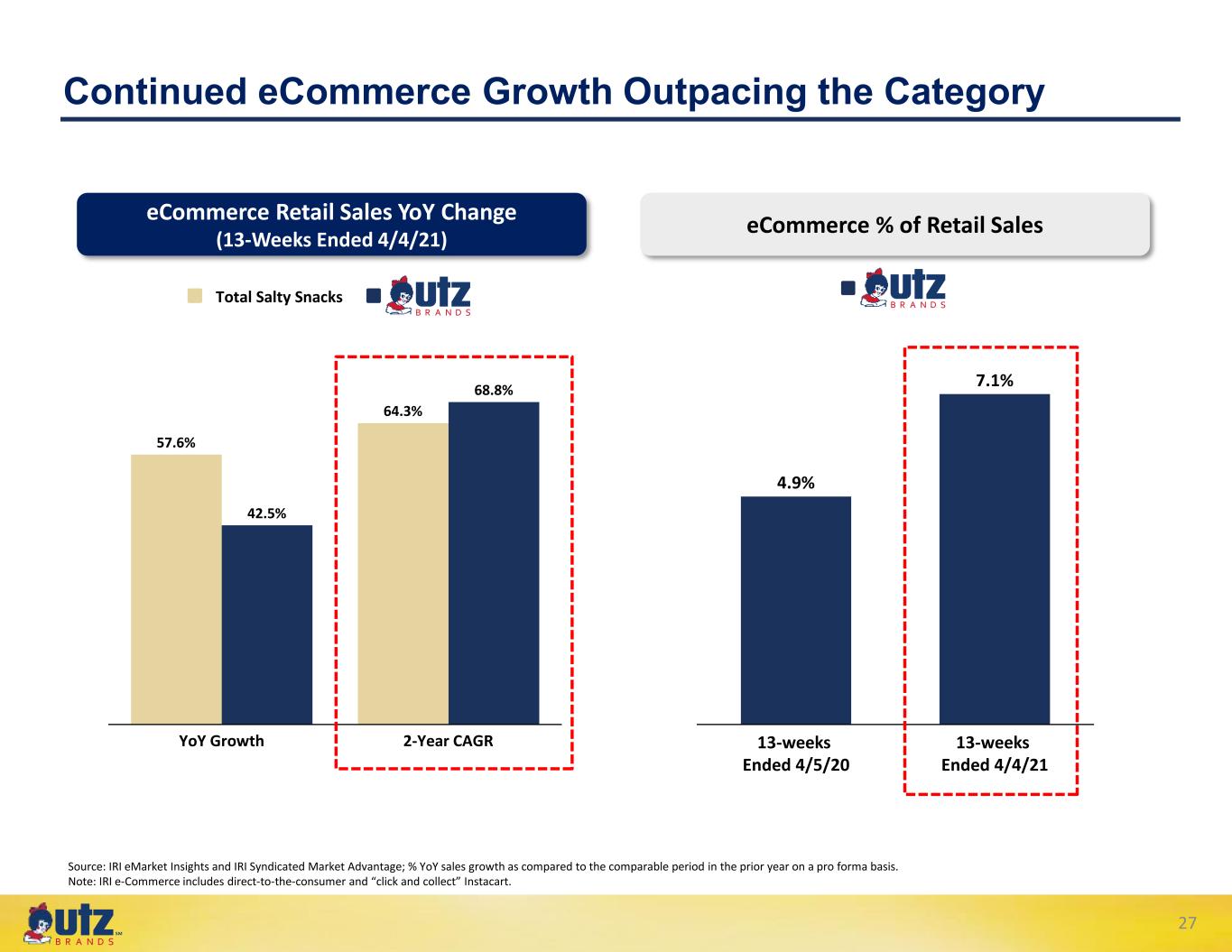

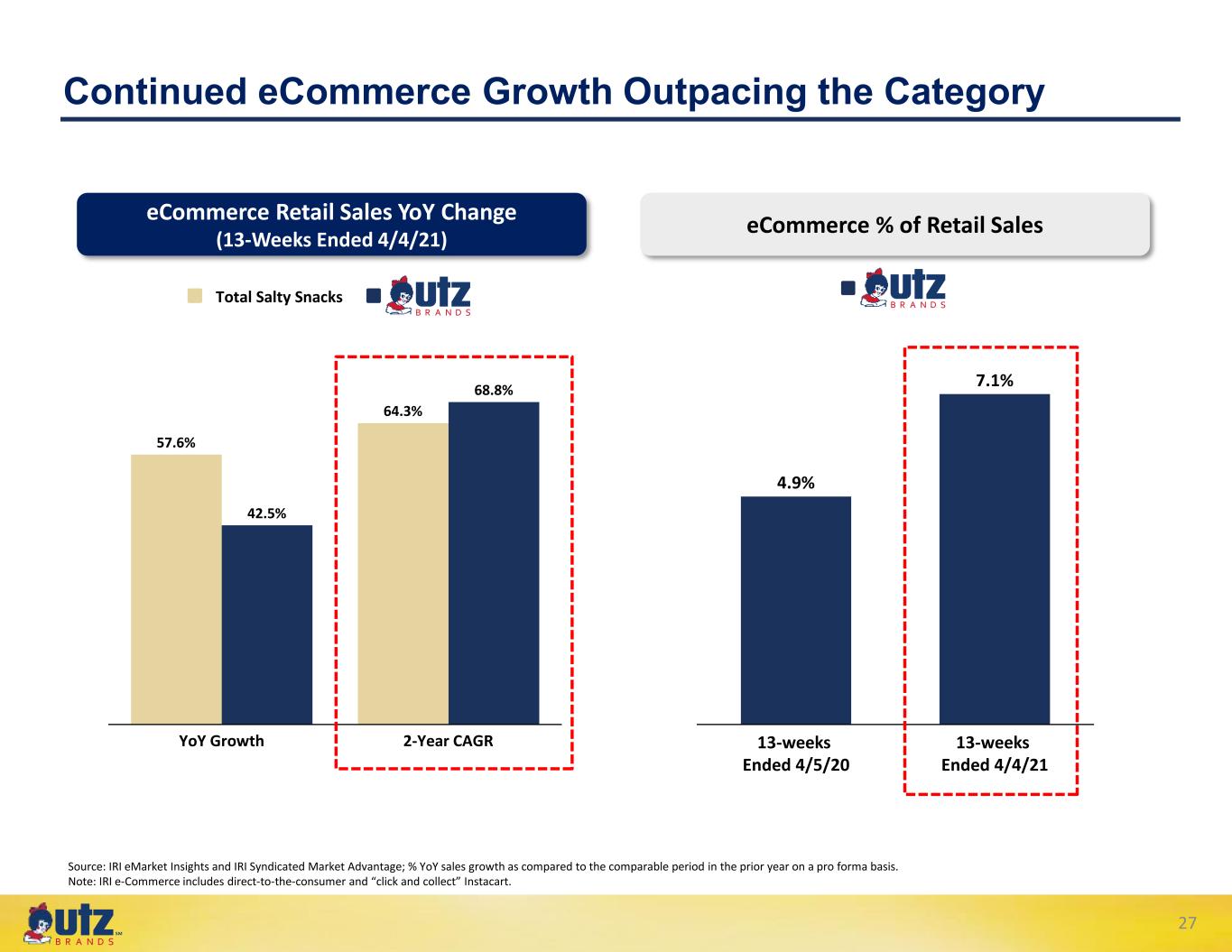

℠ 27 Source: IRI eMarket Insights and IRI Syndicated Market Advantage; % YoY sales growth as compared to the comparable period in the prior year on a pro forma basis. Note: IRI e-Commerce includes direct-to-the-consumer and “click and collect” Instacart. Continued eCommerce Growth Outpacing the Category eCommerce Retail Sales YoY Change (13-Weeks Ended 4/4/21) eCommerce % of Retail Sales Total Salty Snacks YoY Growth 2-Year CAGR 57.6% 64.3% 42.5% 68.8% 4.9% 13-weeks Ended 4/4/21 13-weeks Ended 4/5/20 7.1%

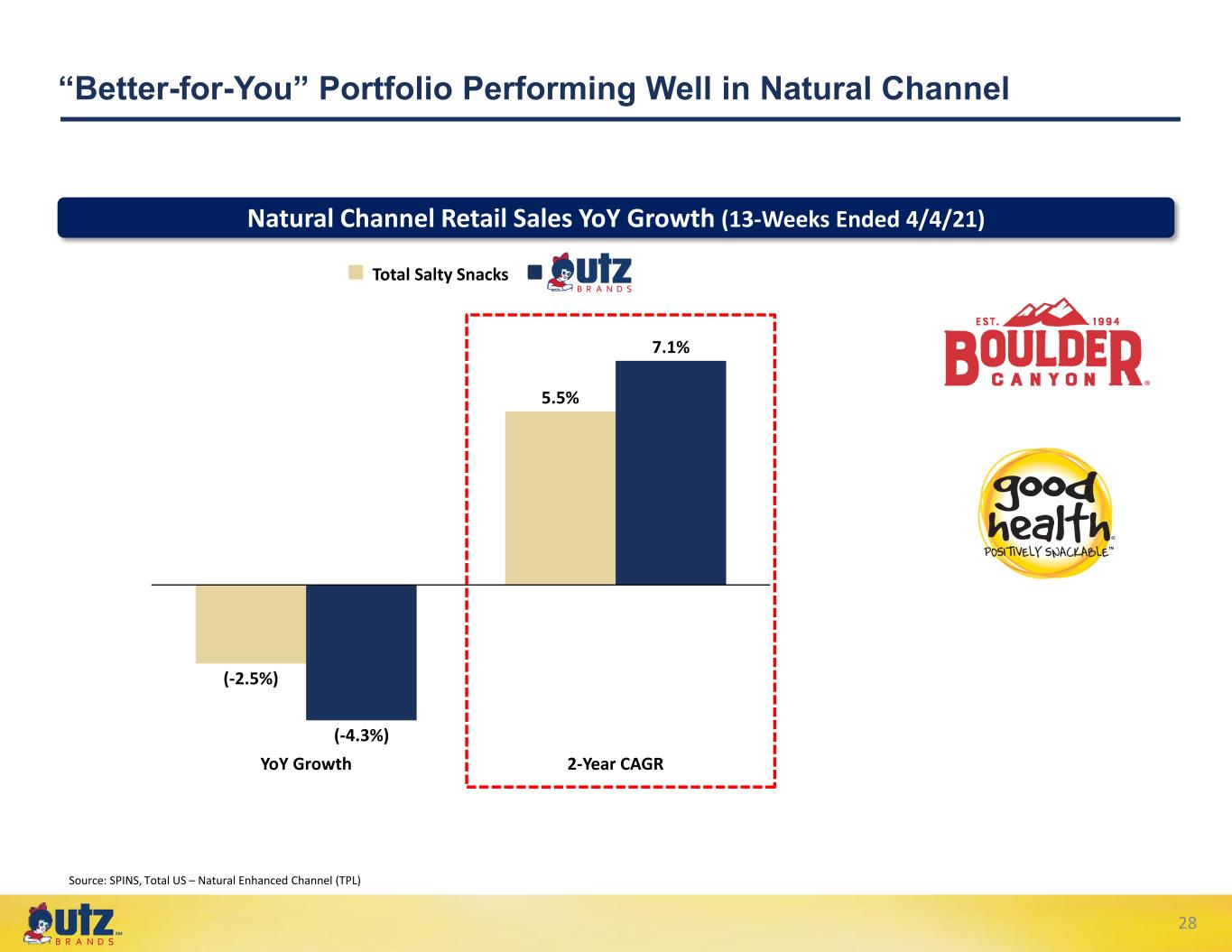

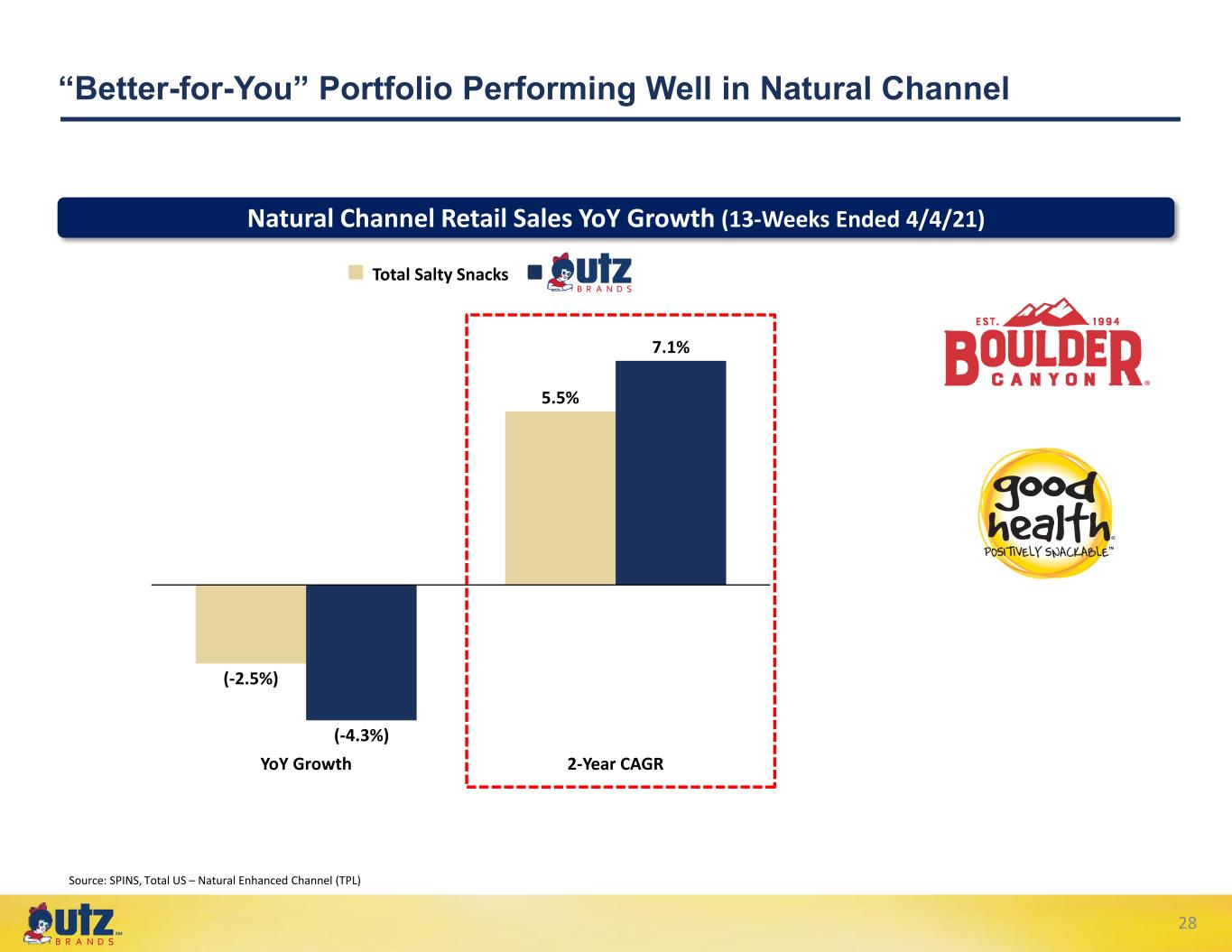

℠ 28 Source: SPINS, Total US – Natural Enhanced Channel (TPL) Natural Channel Retail Sales YoY Growth (13-Weeks Ended 4/4/21) “Better-for-You” Portfolio Performing Well in Natural Channel Total Salty Snacks (-4.3%) YoY Growth 2-Year CAGR (-2.5%) 7.1% 5.5%

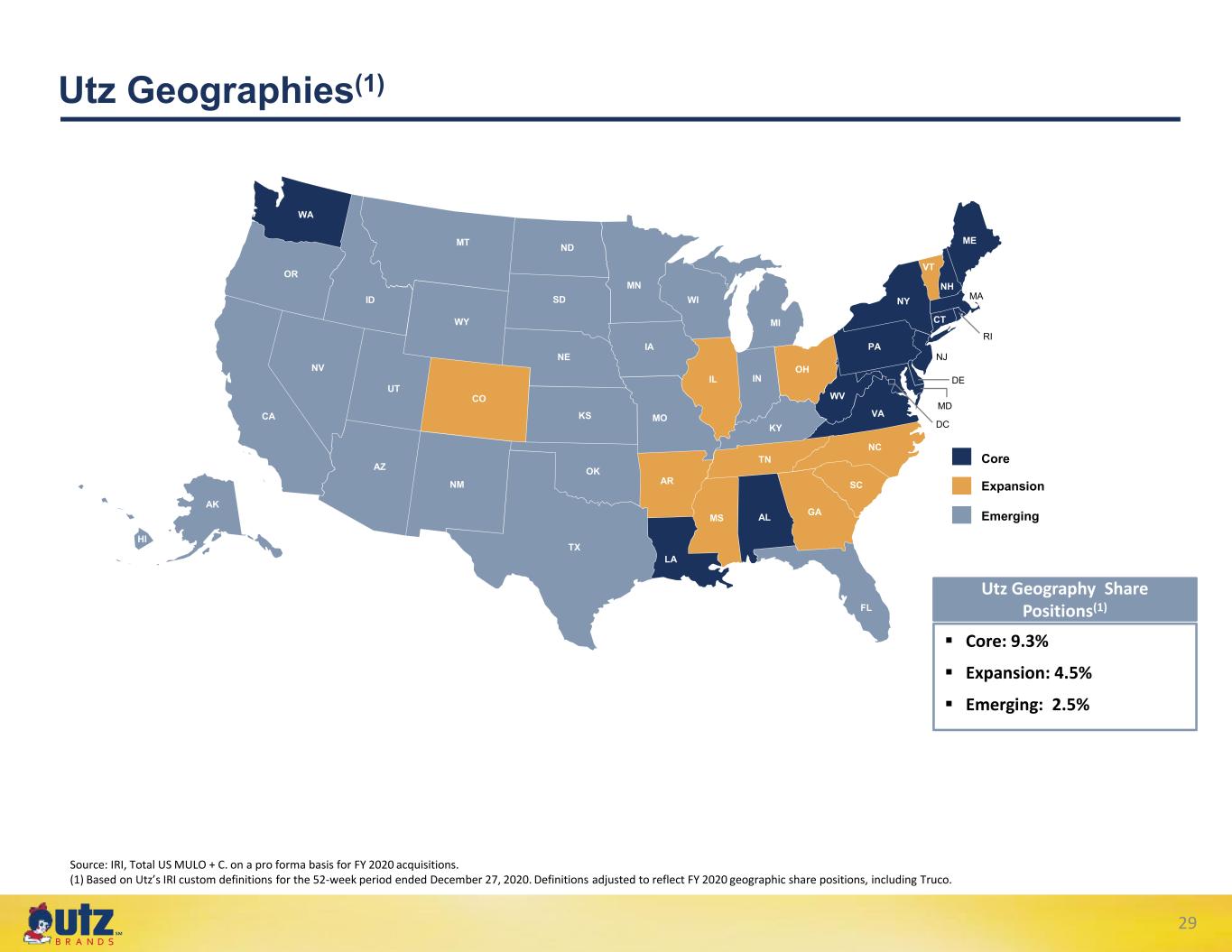

℠ Core Expansion Emerging FL NM DE MD TX OK KS NE SD NDMT WY CO UT ID AZ NV WA CA OR KY ME NY PA VT NH MA RI CT WV INIL NC TN SC ALMS AR LA MO IA MN WI NJ GA DC VA OH MI 29 HI AK Utz Geographies(1) Utz Geography Share Positions(1) Core: 9.3% Expansion: 4.5% Emerging: 2.5% Source: IRI, Total US MULO + C. on a pro forma basis for FY 2020 acquisitions. (1) Based on Utz’s IRI custom definitions for the 52-week period ended December 27, 2020. Definitions adjusted to reflect FY 2020 geographic share positions, including Truco.