℠ Utz Brands, Inc. Third Quarter 2022 Earnings Presentation November 10, 2022 1

℠ Disclaimer 2 Forward-Looking Statements Certain statements made herein are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as “will”, “expect”, “intends”, “goal” or other similar words, phrases or expressions. These forward-looking statements include the expected effects from the COVID-19 pandemic, future plans for the Utz Brands, Inc. (“the Company”), the estimated or anticipated future results and benefits of the Company’s future plans and operations, future capital structure, future opportunities for the Company, the effects of inflation or supply chain disruptions, and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties and the Company’s business and actual results may differ materially. Factors that may cause such differences include, but are not limited to: the risk that the Company may not recognize the anticipated benefits of recently completed business combinations and other acquisitions recently completed by the Company (collectively, the “Business Combinations”), which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably and retain its key employees; the ability of the Company to close planned acquisitions; changes in applicable law or regulations; costs related to the Business Combinations and other planned acquisitions; the inability of the Company to maintain the listing of the Company’s Class A Common Stock on the New York Stock Exchange; the inability of the Company to develop and maintain effective internal controls; the risk that the Company’s gross profit margins may be adversely impacted by a variety of factors, including variations in raw materials pricing, retail customer requirements and mix, sales velocities and required promotional support; changes in consumers’ loyalty to the Company’s brands due to factors beyond the Company’s control; changes in demand for the Company’s products affected by changes in consumer preferences and tastes or if the Company is unable to innovate or market its products effectively; costs associated with building brand loyalty and interest in the Company’s products, which may be affected by actions by the Company’s competitors’ that result in the Company’s products not suitably differentiated from the products of their competitors; fluctuations in results of operations of the Company from quarter to quarter because of changes in promotional activities; the possibility that the Company may be adversely affected by other economic, business or competitive factors; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “Commission”) for the fiscal year ended January 2, 2022, and other reports filed by the Company with the Commission. In addition, forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. These forward- looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law. Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”) including, but not limited to, Organic Net Sales, Adjusted Gross Profit, Adjusted SD&A, EBITDA, Adjusted EBITDA, Normalized Adjusted EBITDA, Adjusted Net Income, and Adjusted Earnings Per Share, and certain ratios and other metrics derived there from. These non-GAAP financial measures do not represent financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of these non- GAAP measures to the most directly comparable GAAP measures are set forth in the appendix to this presentation. We believe (i) these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date; and (ii) that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance.

Business Overview Dylan Lissette, Chief Executive Officer 3

℠ 4 Third Quarter Key Messages Delivered results ahead of our expectations with Organic Net Sales growth of 12.6% Consumer demand remains robust driving record third quarter net sales Adjusted Gross and Adjusted EBITDA margins improved sequentially, and revenue management and productivity are now offsetting inflation Continuing to make investments in our people, brands, selling infrastructure, and planning capabilities to support growth Raising our fiscal 2022 net sales and Adjusted EBITDA outlook Our cost visibility continues to improve, and we are incredibly proud of our team’s execution to deliver on the financial targets we laid out at the beginning of the year

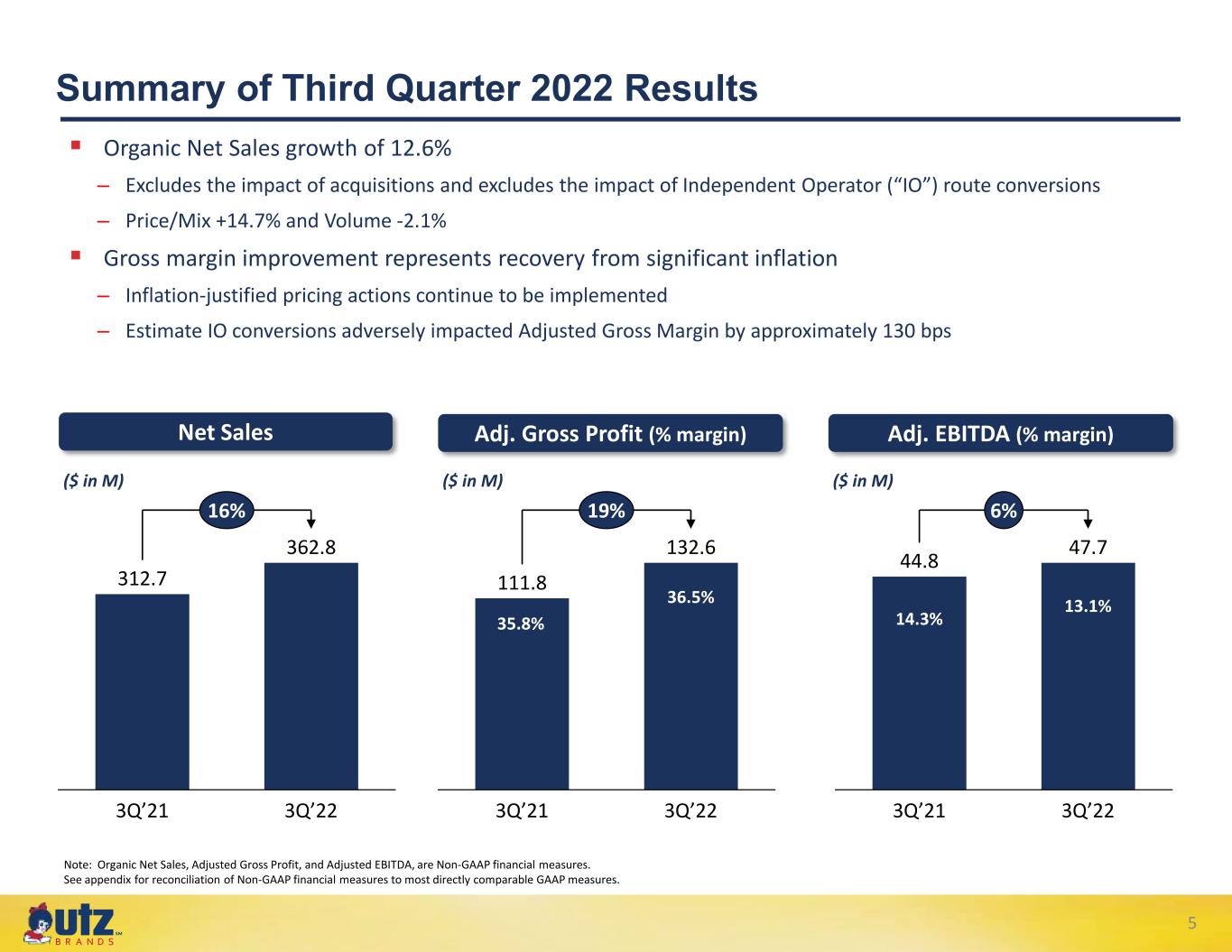

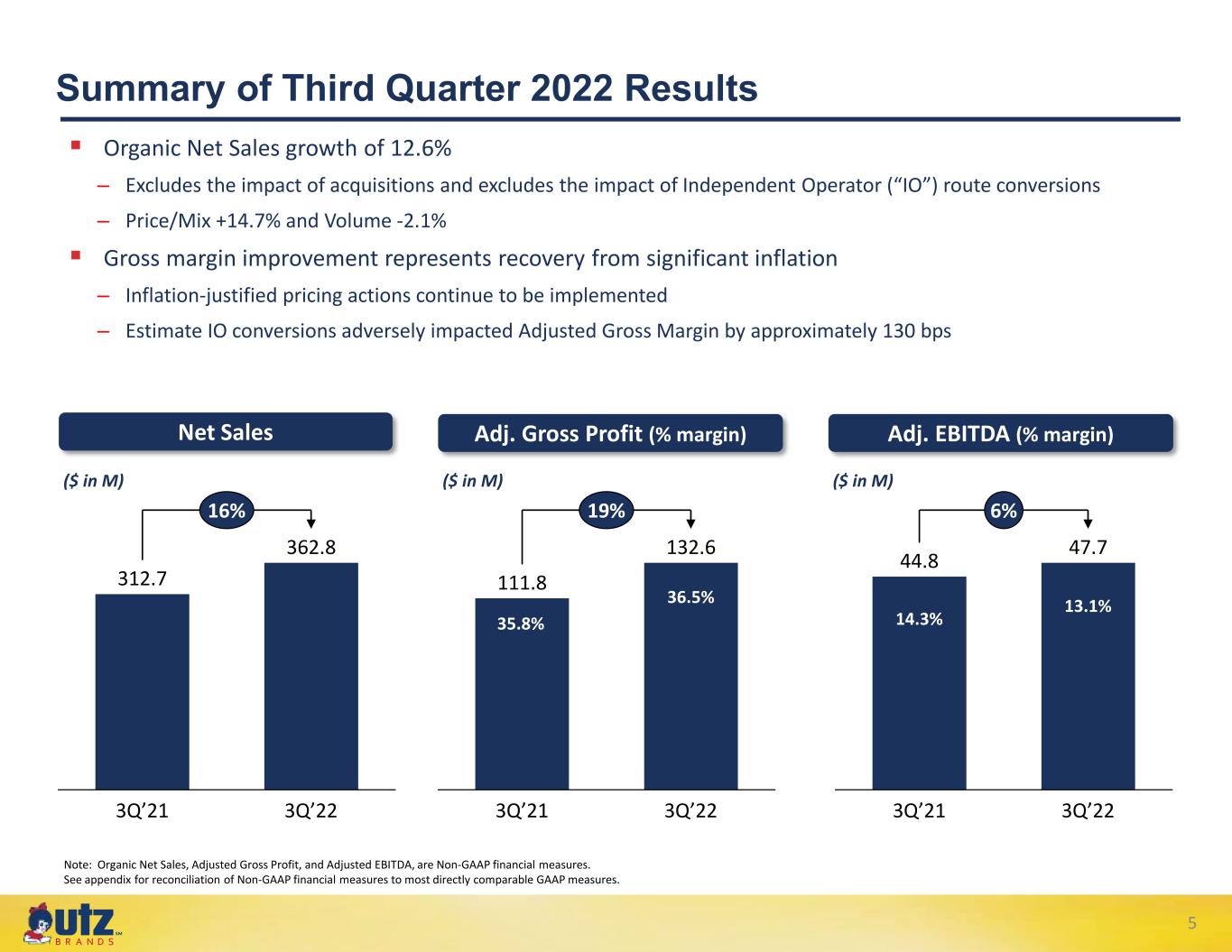

℠ 44.8 47.7 3Q’223Q’21 6% 312.7 362.8 3Q’21 3Q’22 16% 111.8 132.6 3Q’21 3Q’22 19% 5 Net Sales Adj. Gross Profit (% margin) Adj. EBITDA (% margin) ($ in M) ($ in M) ($ in M) 35.8% 36.5% 13.1% Organic Net Sales growth of 12.6% – Excludes the impact of acquisitions and excludes the impact of Independent Operator (“IO”) route conversions – Price/Mix +14.7% and Volume -2.1% Gross margin improvement represents recovery from significant inflation – Inflation-justified pricing actions continue to be implemented – Estimate IO conversions adversely impacted Adjusted Gross Margin by approximately 130 bps Summary of Third Quarter 2022 Results Note: Organic Net Sales, Adjusted Gross Profit, and Adjusted EBITDA, are Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. 14.3%

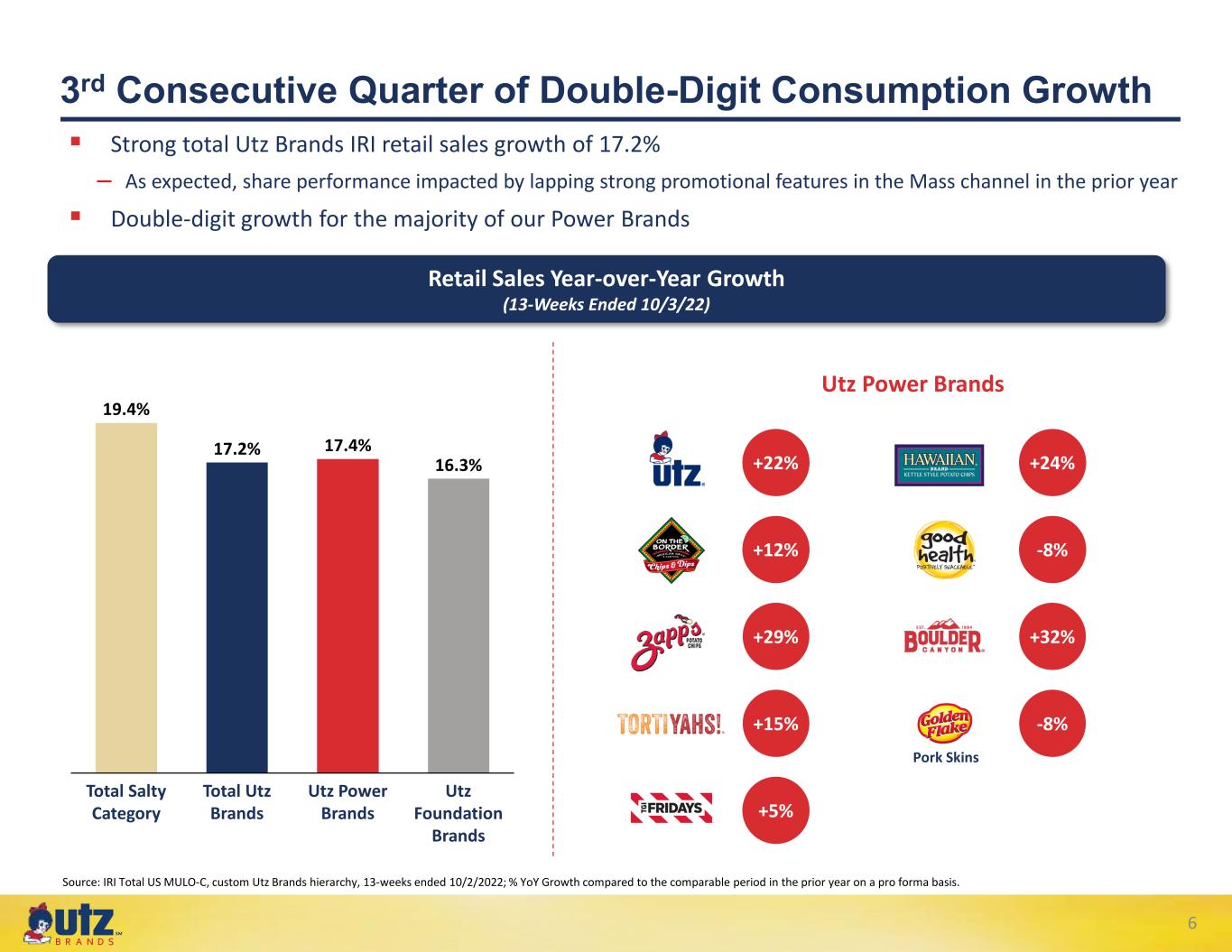

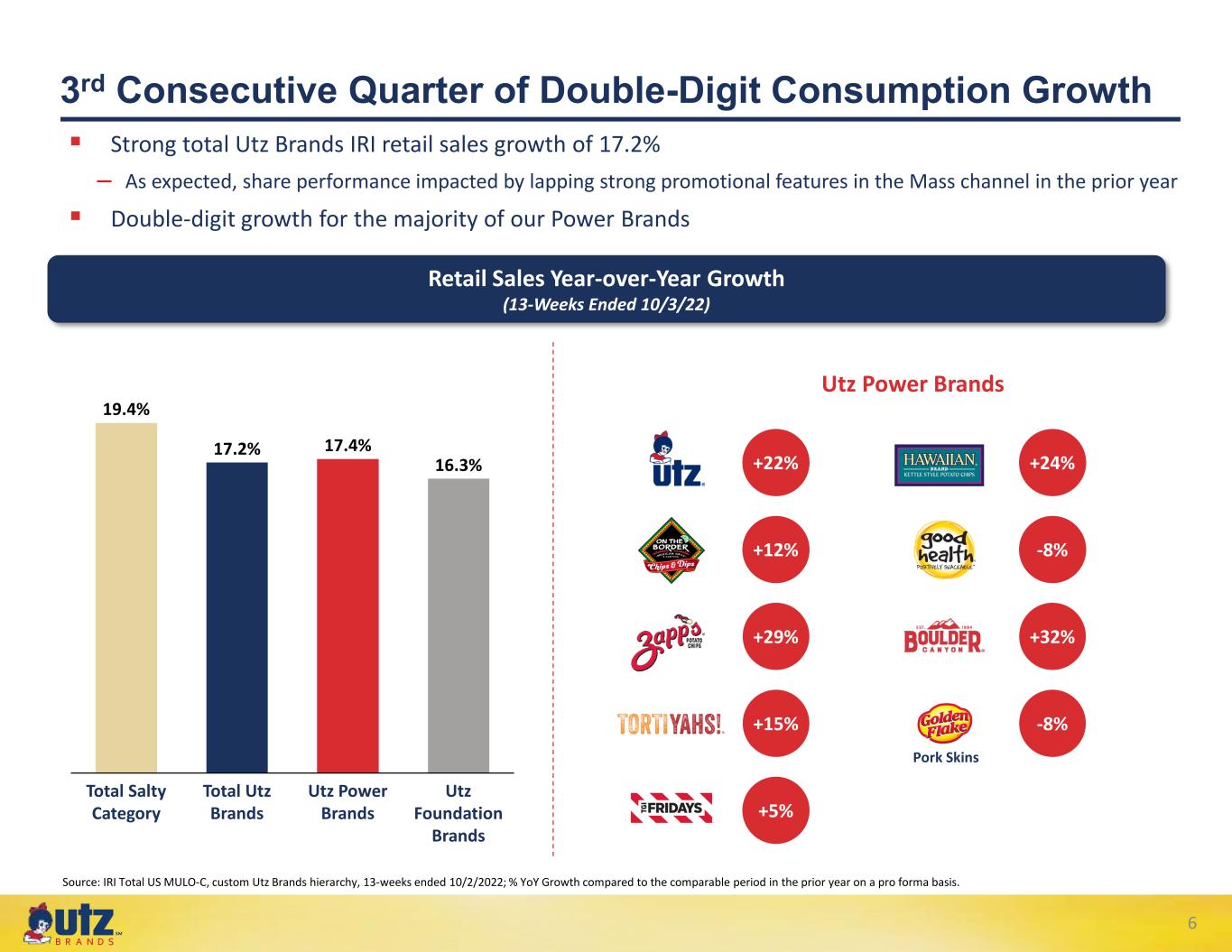

℠ 6 Source: IRI Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/2/2022; % YoY Growth compared to the comparable period in the prior year on a pro forma basis. 3rd Consecutive Quarter of Double-Digit Consumption Growth 19.4% Utz Foundation Brands 16.3% Total Salty Category Total Utz Brands Utz Power Brands 17.4%17.2% Retail Sales Year-over-Year Growth (13-Weeks Ended 10/3/22) Pork Skins +22% +12% +29% +5% +15% +24% -8% +32% -8% Strong total Utz Brands IRI retail sales growth of 17.2% – As expected, share performance impacted by lapping strong promotional features in the Mass channel in the prior year Double-digit growth for the majority of our Power Brands Utz Power Brands

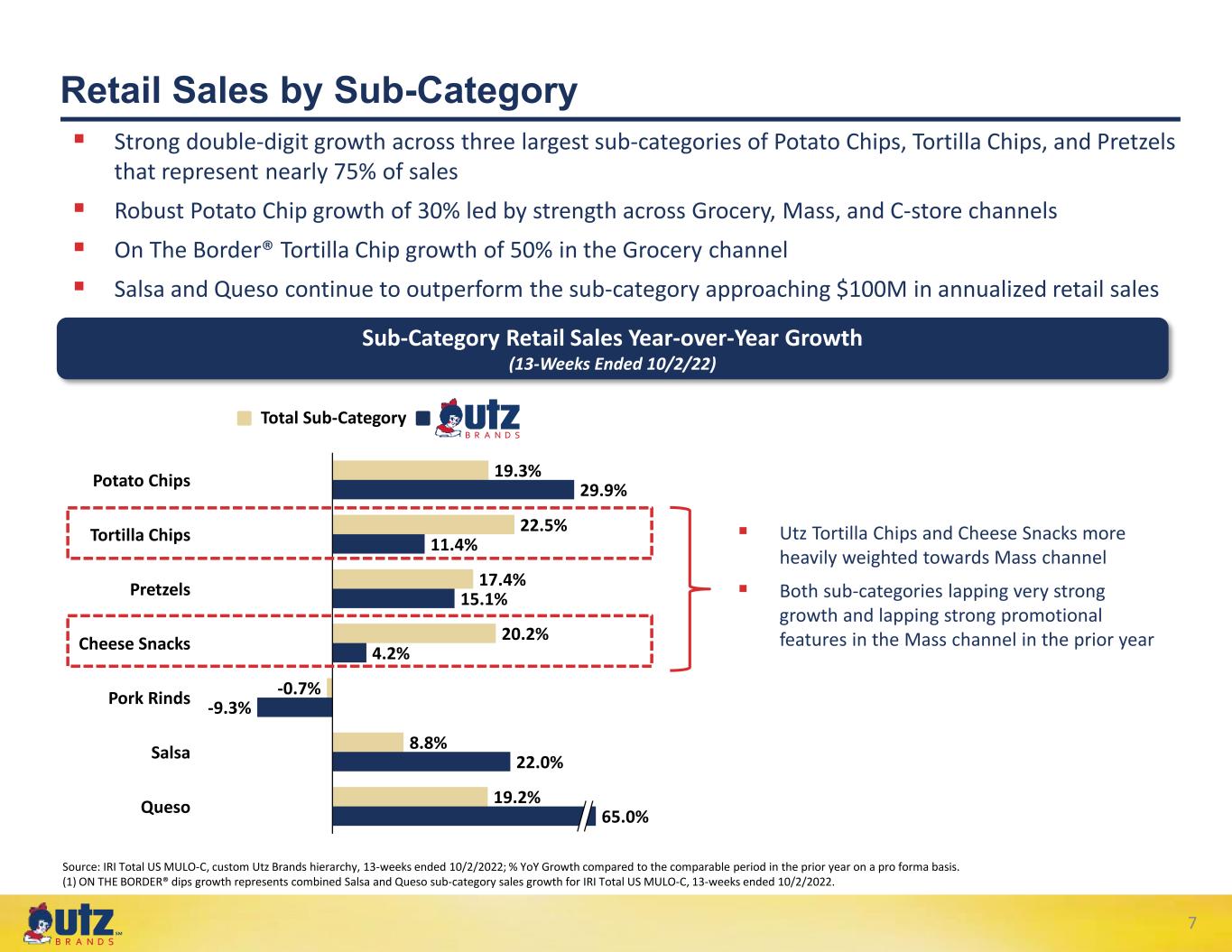

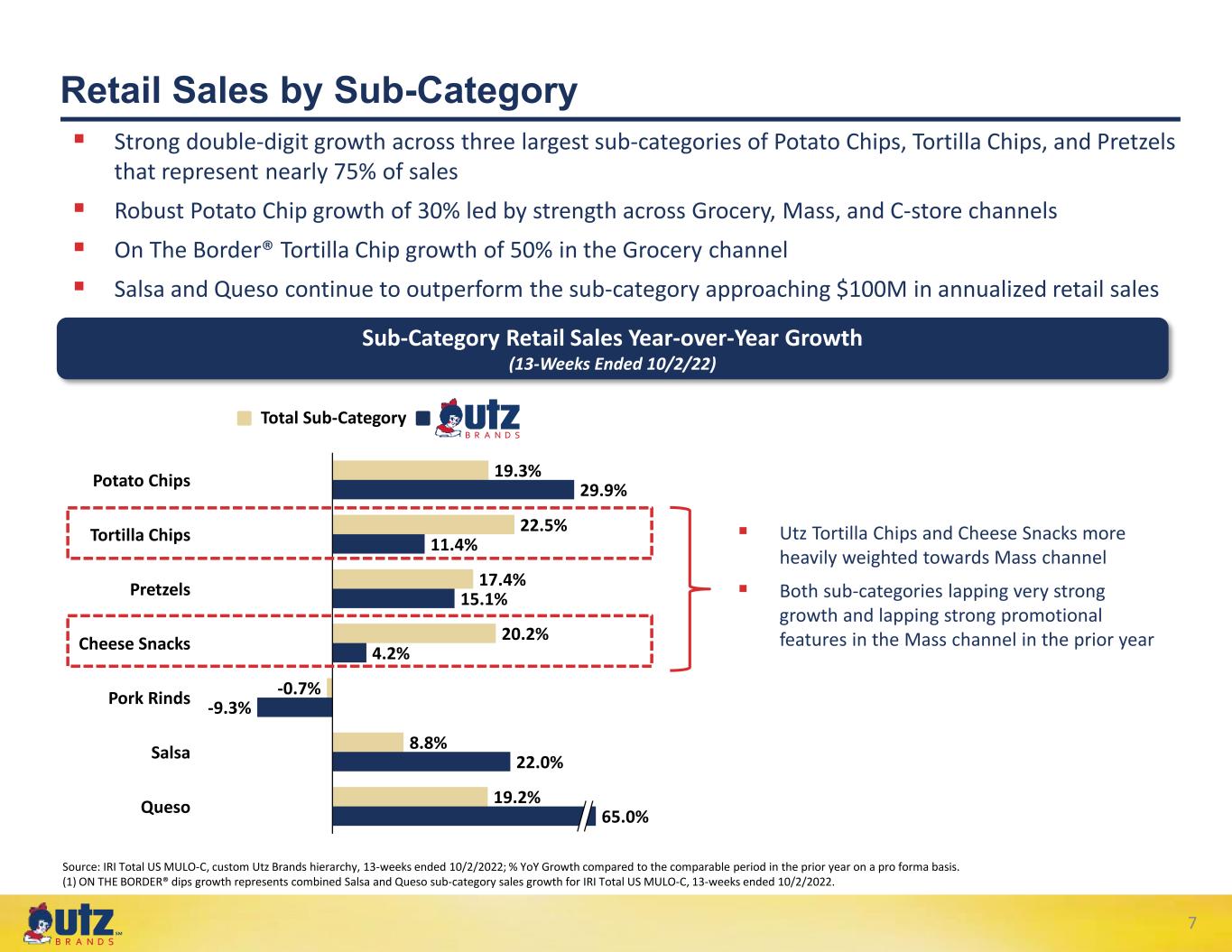

℠ 7 Source: IRI Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/2/2022; % YoY Growth compared to the comparable period in the prior year on a pro forma basis. (1) ON THE BORDER® dips growth represents combined Salsa and Queso sub-category sales growth for IRI Total US MULO-C, 13-weeks ended 10/2/2022. Retail Sales by Sub-Category Sub-Category Retail Sales Year-over-Year Growth (13-Weeks Ended 10/2/22) Total Sub-Category Strong double-digit growth across three largest sub-categories of Potato Chips, Tortilla Chips, and Pretzels that represent nearly 75% of sales Robust Potato Chip growth of 30% led by strength across Grocery, Mass, and C-store channels On The Border® Tortilla Chip growth of 50% in the Grocery channel Salsa and Queso continue to outperform the sub-category approaching $100M in annualized retail sales 19.2% Pretzels Potato Chips Pork Rinds Tortilla Chips Cheese Snacks Salsa 15.1% Queso 19.3% 20.2% 29.9% 22.5% 11.4% 17.4% 4.2% -0.7% -9.3% 8.8% 22.0% 65.0% Utz Tortilla Chips and Cheese Snacks more heavily weighted towards Mass channel Both sub-categories lapping very strong growth and lapping strong promotional features in the Mass channel in the prior year

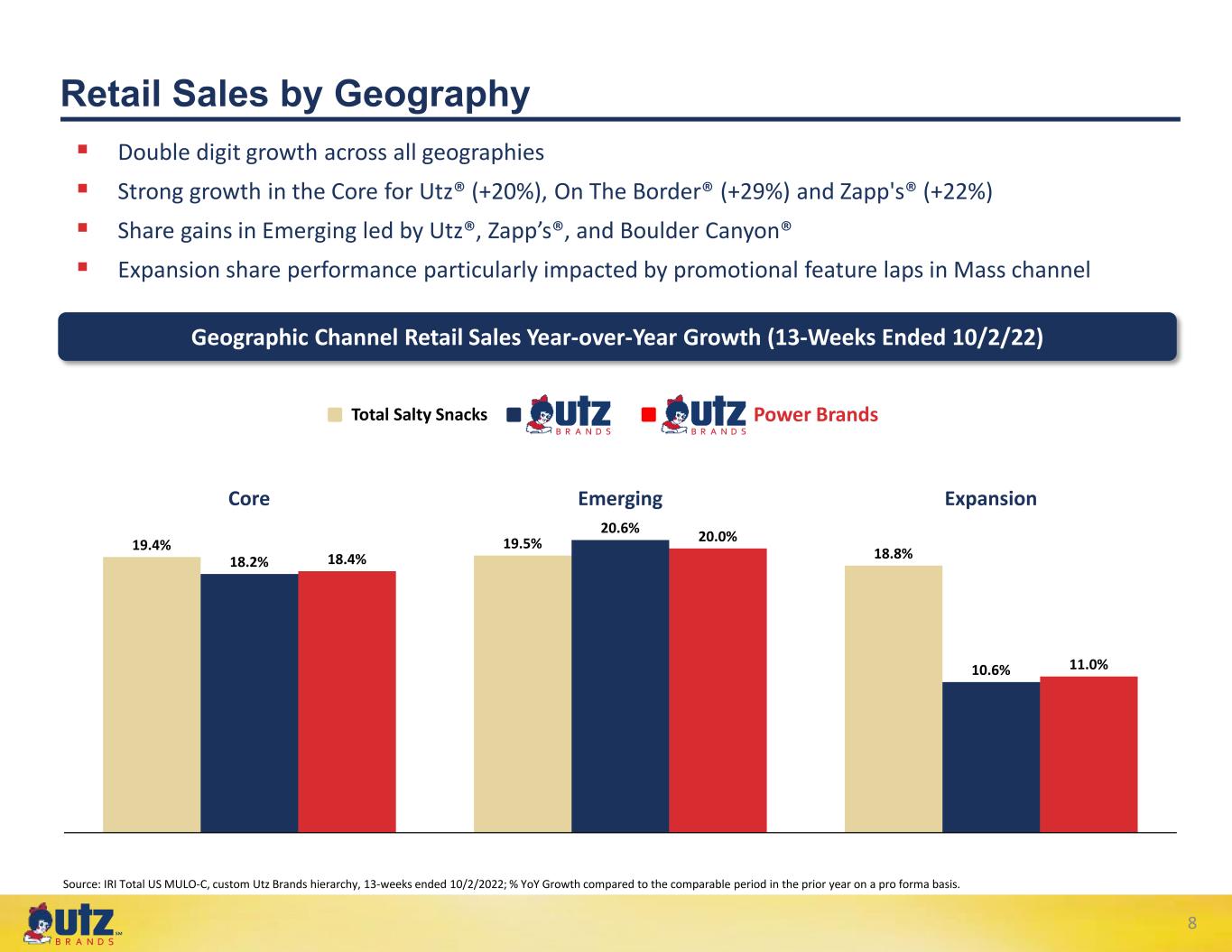

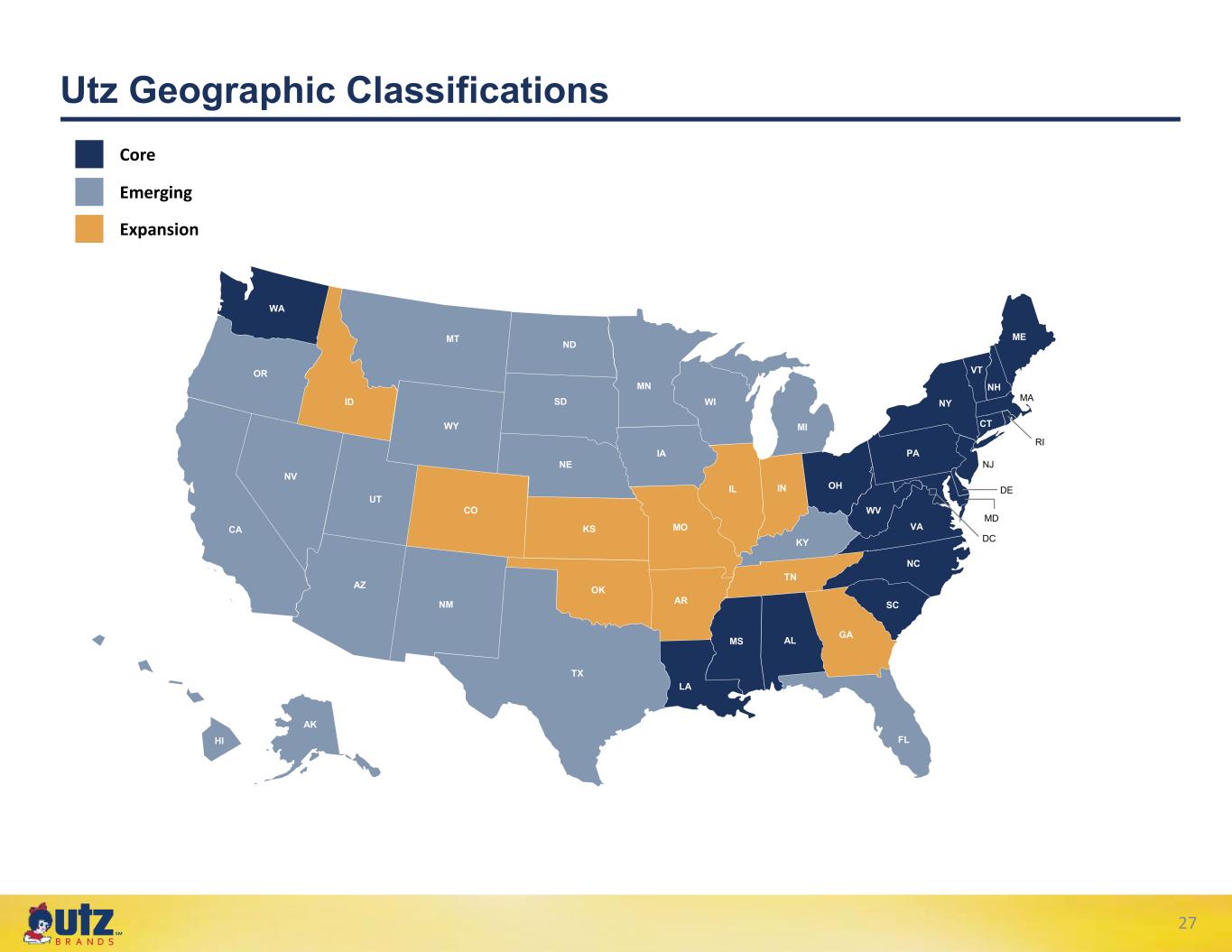

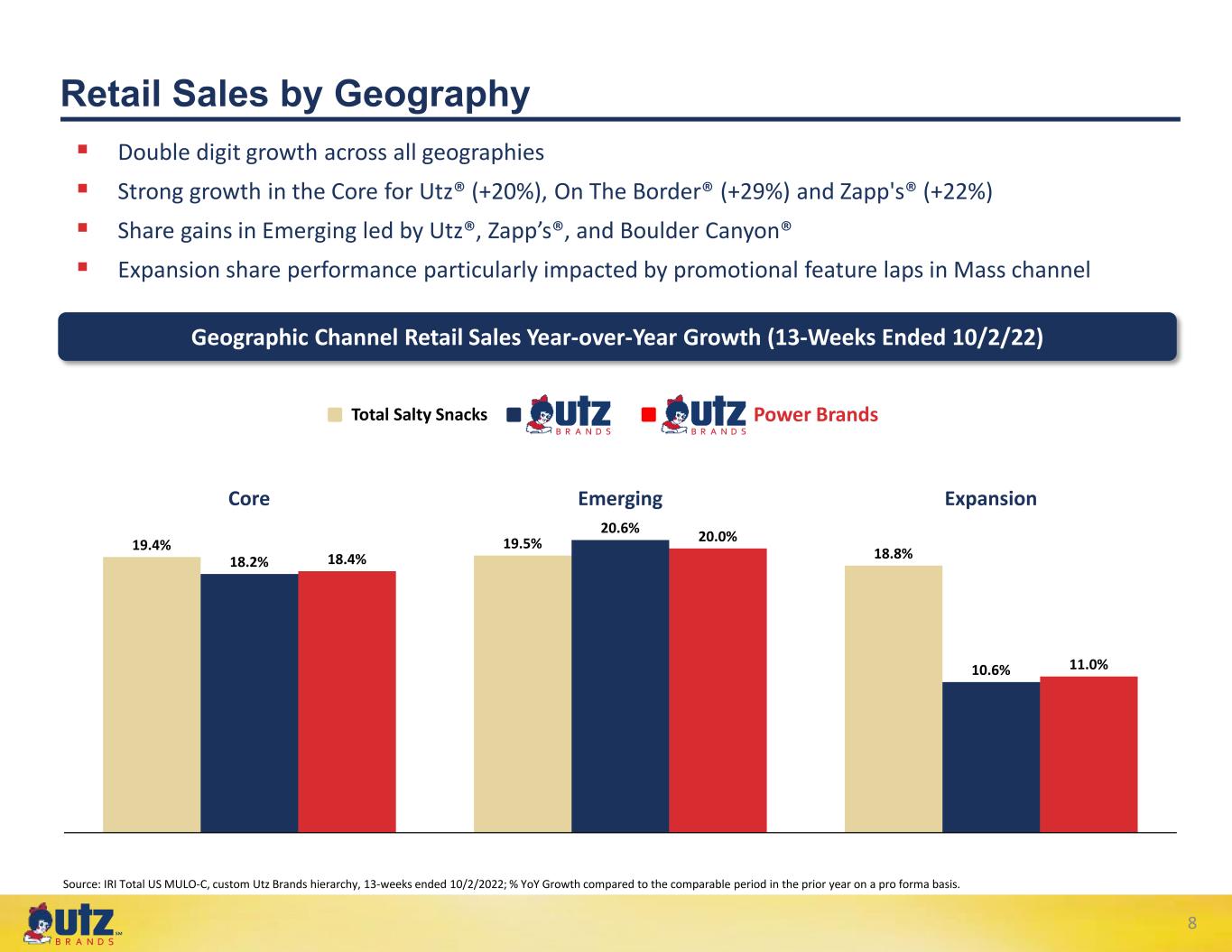

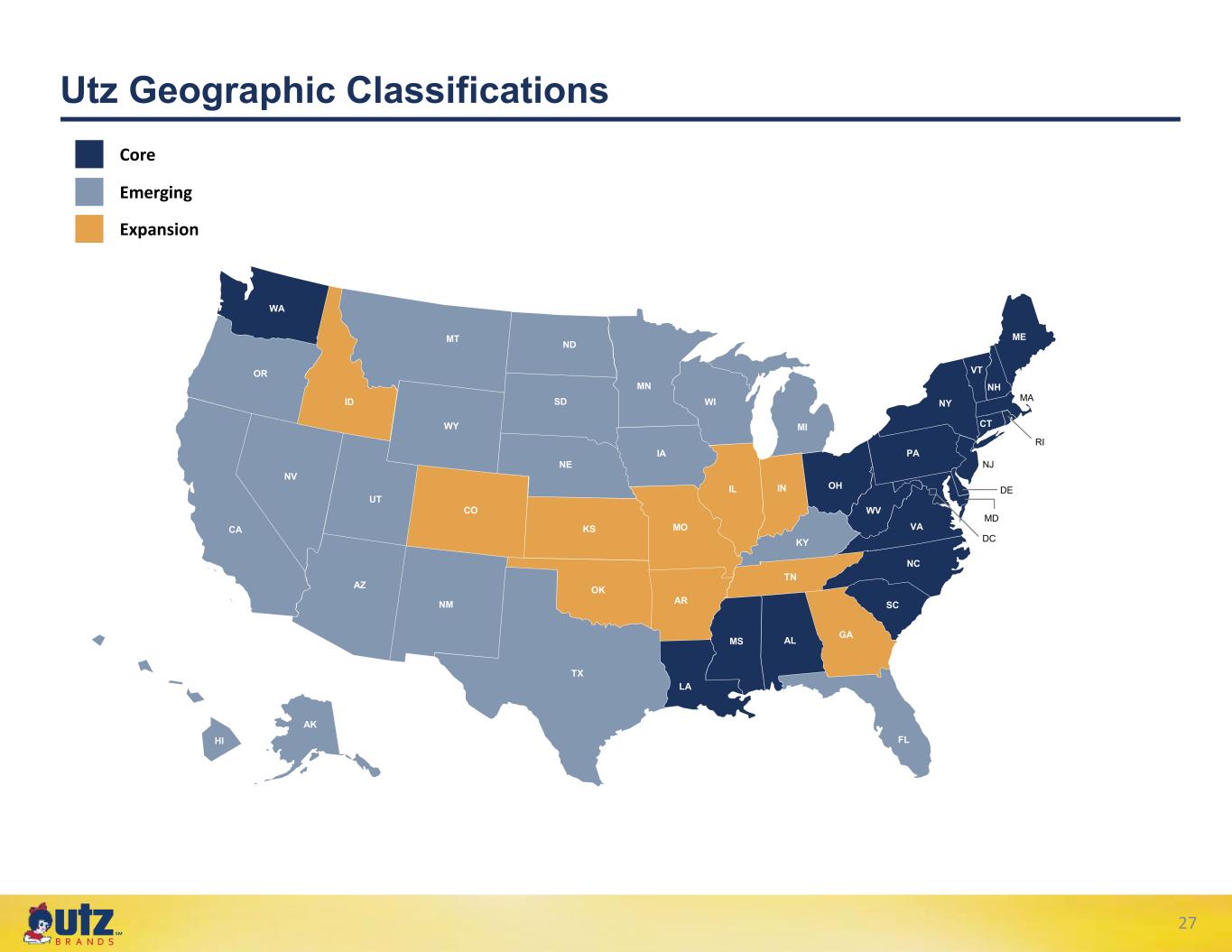

℠ 8 Retail Sales by Geography Geographic Channel Retail Sales Year-over-Year Growth (13-Weeks Ended 10/2/22) EmergingCore Expansion 20.6% 19.4% 18.2% 18.4% 19.5% 20.0% 18.8% 10.6% 11.0% Total Salty Snacks Power Brands Double digit growth across all geographies Strong growth in the Core for Utz® (+20%), On The Border® (+29%) and Zapp's® (+22%) Share gains in Emerging led by Utz®, Zapp’s®, and Boulder Canyon® Expansion share performance particularly impacted by promotional feature laps in Mass channel Source: IRI Total US MULO-C, custom Utz Brands hierarchy, 13-weeks ended 10/2/2022; % YoY Growth compared to the comparable period in the prior year on a pro forma basis.

℠ 9 Utz Better-for-You Brands Gaining Share in Natural Channel 18.2% 10.2% 12-Weeks Ending 10/2/22 52-Weeks Ending 10/2/22 19.5% 7.9% Total Salty Snacks Natural Channel Retail Sales Year-over-Year Growth (13-Weeks Ended 10/2/22) Source: SPINS, Total US – Natural Enhanced Channel (TPL) Nearly 60bps of share gains in the 12-week period ended October 2, 2022 #3 share ranking in the Natural Channel Salty Snack Category

℠ 10 Building Momentum for our Next Phase of Growth 2019(1) 52-weeks ended October 2, 2022(2) Executing Well Across Strategies Since Going Public Total Utz Retail Sales $972M Salty Category Sales Rank #3#4 DSD Routes 2,100+~1,650 $1.55B (1) 52-weeks ended December 29, 2019. IRI data is Total US MULO-C, custom Utz Brands hierarchy. (2) 52-weeks ended October 2, 2022. IRI data is Total US MULO-C , custom Utz Brands hierarchy. (3) IRI Custom Panel, Total US - All Outlets; “Buyers” equivalent to est. households. Mass Channel Rank #3 Club Channel Rank #4 4%<1%Tortilla Chip Share #2#3 91%77%% Independent Operator Market Share 4.6%3.8% Buyers(3) 63M48M

℠ 11 Key Takeaways Strong growth momentum in resilient and growing Salty Snack Category Continuing to make investments to support our significant white space growth opportunities Margins recovering as revenue management and productivity are now offsetting inflation Recent acquisitions enabling increased scale of manufacturing capabilities to efficiently support strong demand Ensuring the announced CEO transition leverages our strong momentum and heritage to take the Company to the next level

12 Financial Performance Ajay Kataria, Chief Financial Officer

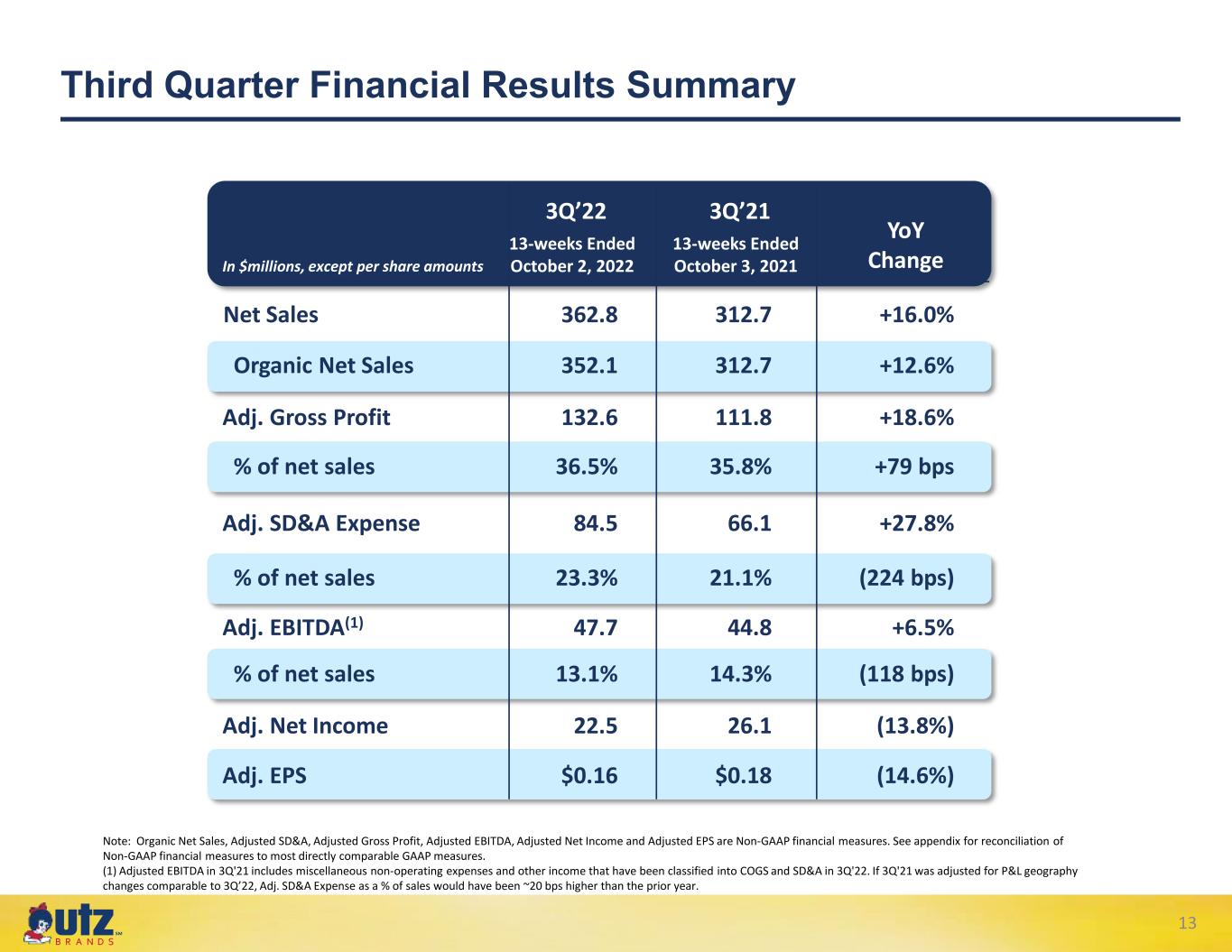

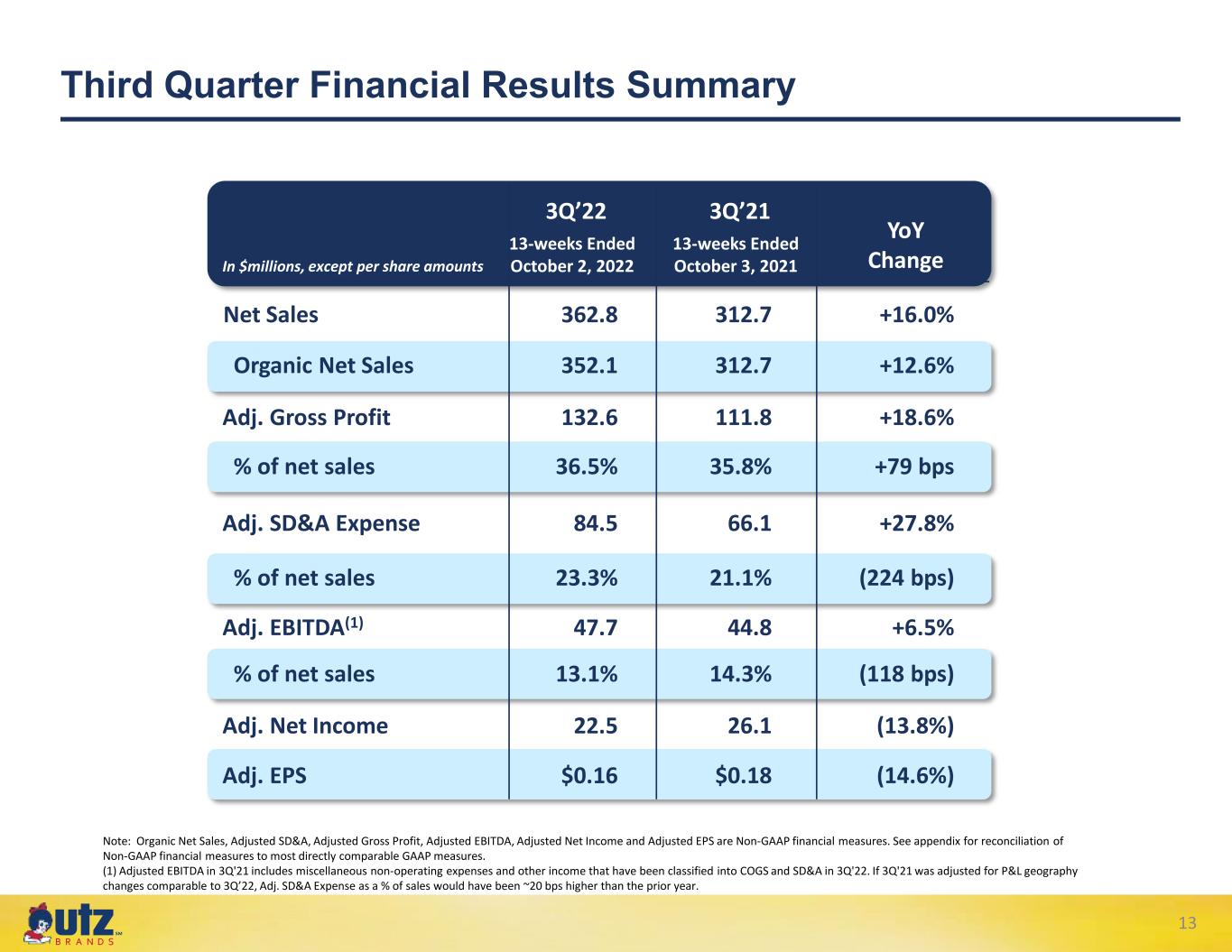

℠ Third Quarter Financial Results Summary 13 Note: Organic Net Sales, Adjusted SD&A, Adjusted Gross Profit, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS are Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) Adjusted EBITDA in 3Q'21 includes miscellaneous non-operating expenses and other income that have been classified into COGS and SD&A in 3Q'22. If 3Q'21 was adjusted for P&L geography changes comparable to 3Q’22, Adj. SD&A Expense as a % of sales would have been ~20 bps higher than the prior year. 13-weeks Ended October 2, 2022In $millions, except per share amounts Net Sales Adj. SD&A Expense % of net sales Adj. Gross Profit % of net sales YoY Change Adj. EBITDA(1) % of net sales Adj. Net Income Organic Net Sales +16.0% +27.8% (224 bps) +18.6% +79 bps +12.6% +6.5% (118 bps) (13.8%) Adj. EPS 13-weeks Ended October 3, 2021 3Q’22 3Q’21 312.7 66.1 21.1% 111.8 35.8% 44.8 14.3% 26.1 $0.18 312.7 362.8 84.5 23.3% 132.6 36.5% 47.7 13.1% 22.5 $0.16 352.1 (14.6%)

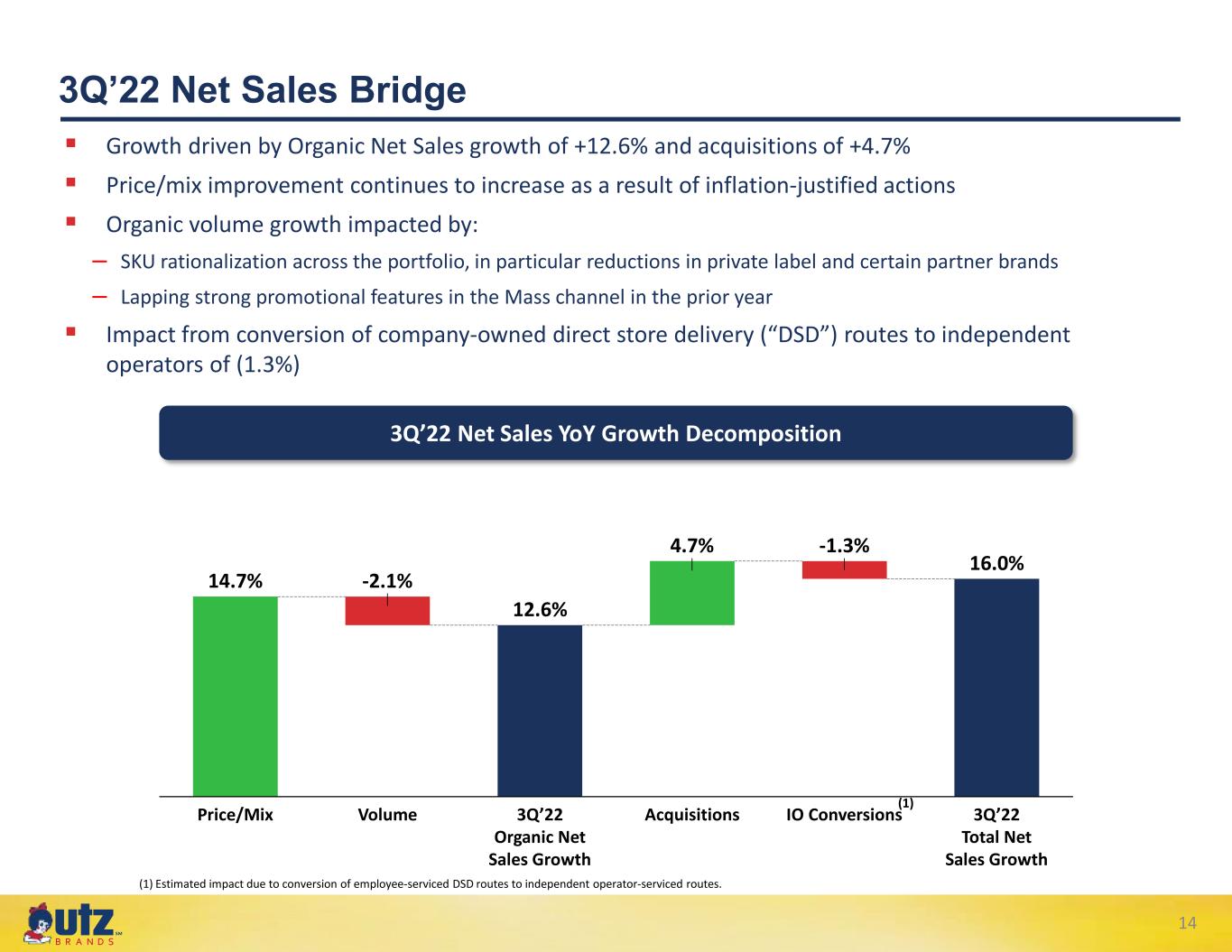

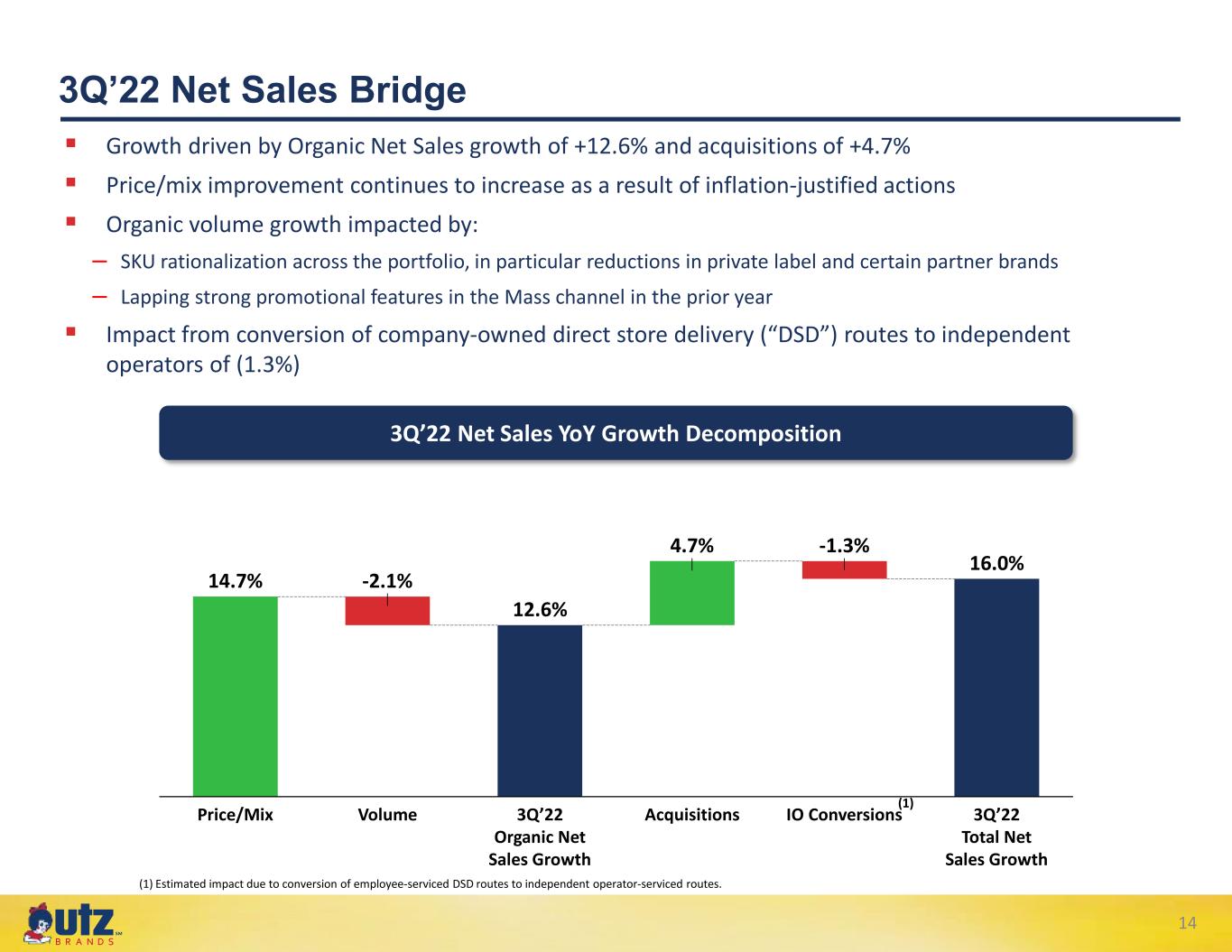

℠ VolumePrice/Mix -2.1% 3Q’22 Organic Net Sales Growth 4.7% 16.0% Acquisitions -1.3% IO Conversions 3Q’22 Total Net Sales Growth 14.7% 12.6% 14 3Q’22 Net Sales Bridge 3Q’22 Net Sales YoY Growth Decomposition (1) (1) Estimated impact due to conversion of employee-serviced DSD routes to independent operator-serviced routes. Growth driven by Organic Net Sales growth of +12.6% and acquisitions of +4.7% Price/mix improvement continues to increase as a result of inflation-justified actions Organic volume growth impacted by: – SKU rationalization across the portfolio, in particular reductions in private label and certain partner brands – Lapping strong promotional features in the Mass channel in the prior year Impact from conversion of company-owned direct store delivery (“DSD”) routes to independent operators of (1.3%)

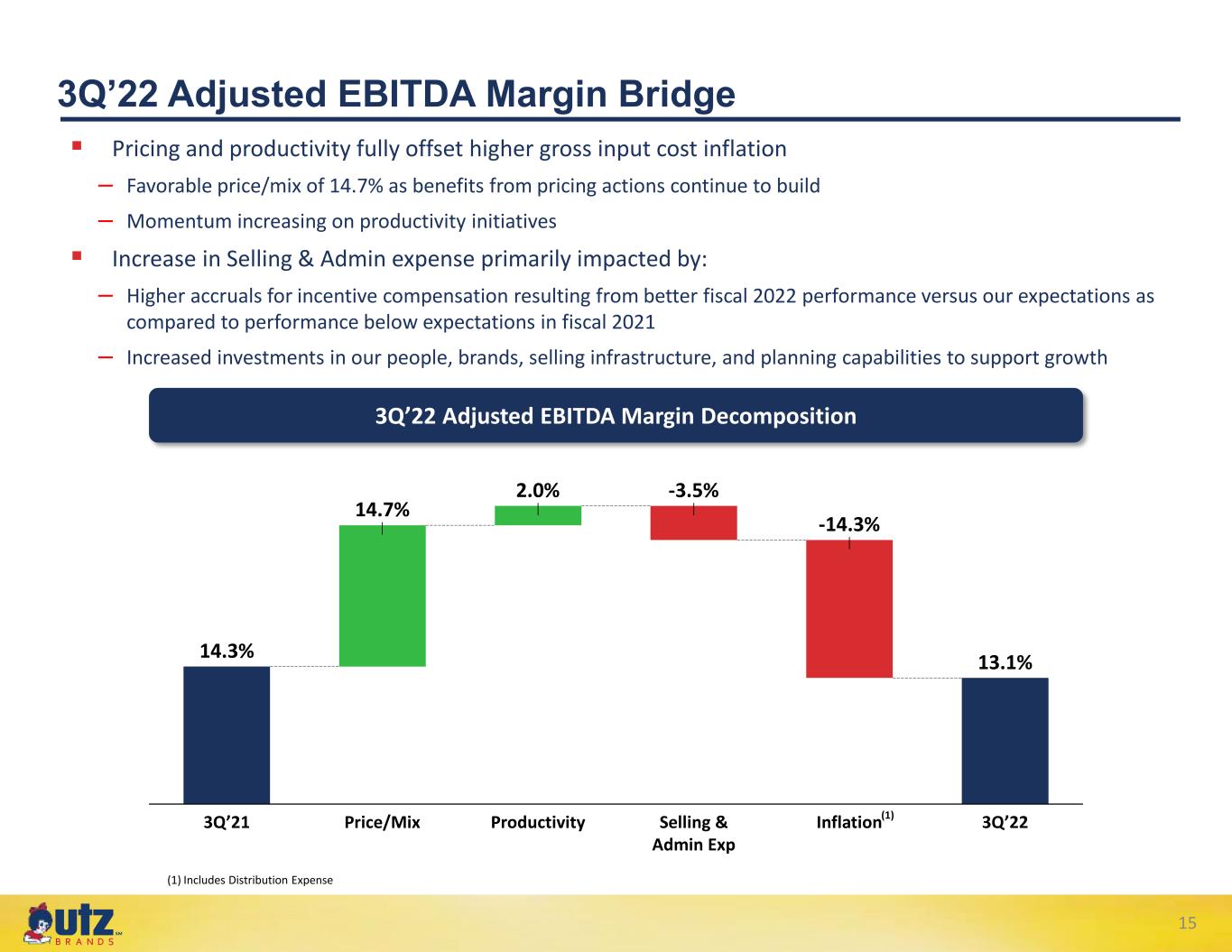

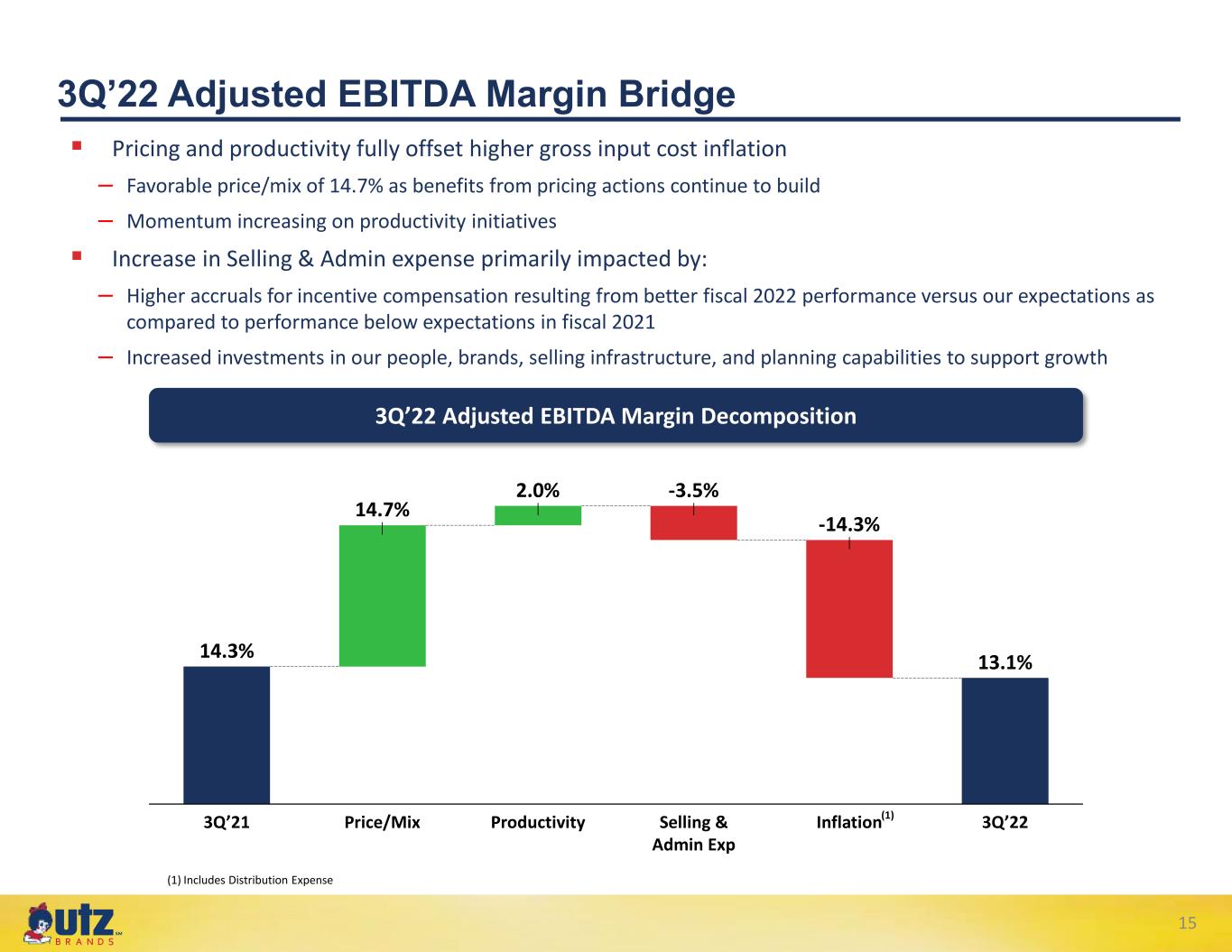

℠ 15 3Q’22 Adjusted EBITDA Margin Bridge 3Q’22 Adjusted EBITDA Margin Decomposition (1) Includes Distribution Expense Pricing and productivity fully offset higher gross input cost inflation – Favorable price/mix of 14.7% as benefits from pricing actions continue to build – Momentum increasing on productivity initiatives Increase in Selling & Admin expense primarily impacted by: – Higher accruals for incentive compensation resulting from better fiscal 2022 performance versus our expectations as compared to performance below expectations in fiscal 2021 – Increased investments in our people, brands, selling infrastructure, and planning capabilities to support growth (1) -3.5%2.0% -14.3% 14.7% 3Q’21 ProductivityPrice/Mix 13.1%14.3% Selling & Admin Exp Inflation 3Q’22

℠ 16 Driving FY’22 Programs to Enhance Margins 2023E2020 Actual 2021 Actual 2022E 1% ~2% ~3% Productivity(1) (Annual Savings as % of COGS) 12.1% 2Q’221Q’22 3Q’22 10.7% 13.1% Adjusted EBITDA Margin 1) Excluding FY2020 and FY2021 acquisitions. SKU Rationalization – Eliminated more than 350 SKUs primarily focused on private label and certain partner brands with program ongoing Revenue Management Capabilities – Driving price pack architecture programs, improving mix management, and optimizing trade spend M&A Cost Synergies From Recent Acquisitions – Driving expected cost synergies and all recent acquisitions now fully integrated to a common ERP platform as of early 4Q’22 Kings Mountain Facility – First pork production run in September ’22 – Kettle chip production planned for 2H '23 – Increases supply of key sub-categories previously affected by capacity constraints Productivity Programs – Focused on manufacturing efficiencies, logistics, network optimization, packaging design, and product formulation (as % of Net Sales) 3 – 4%

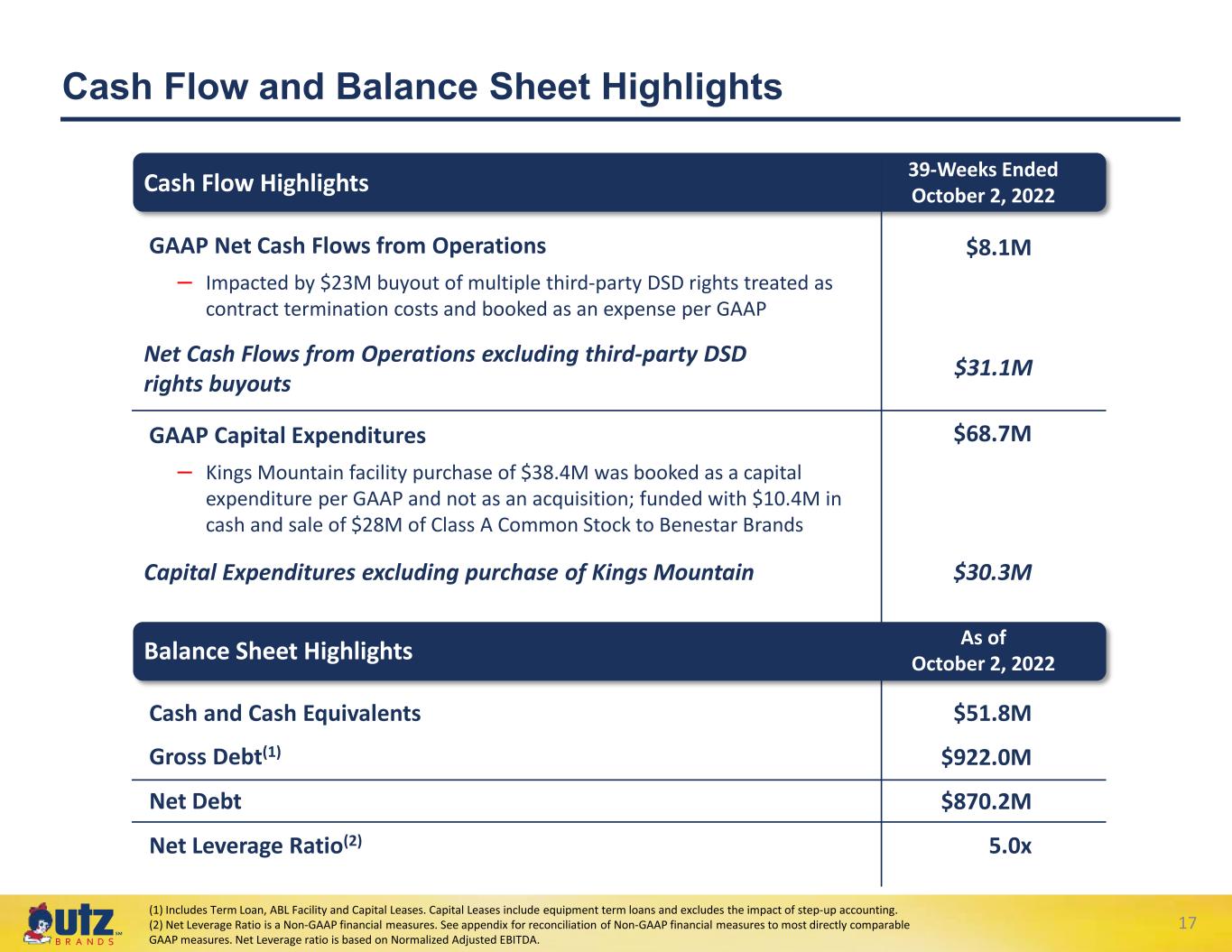

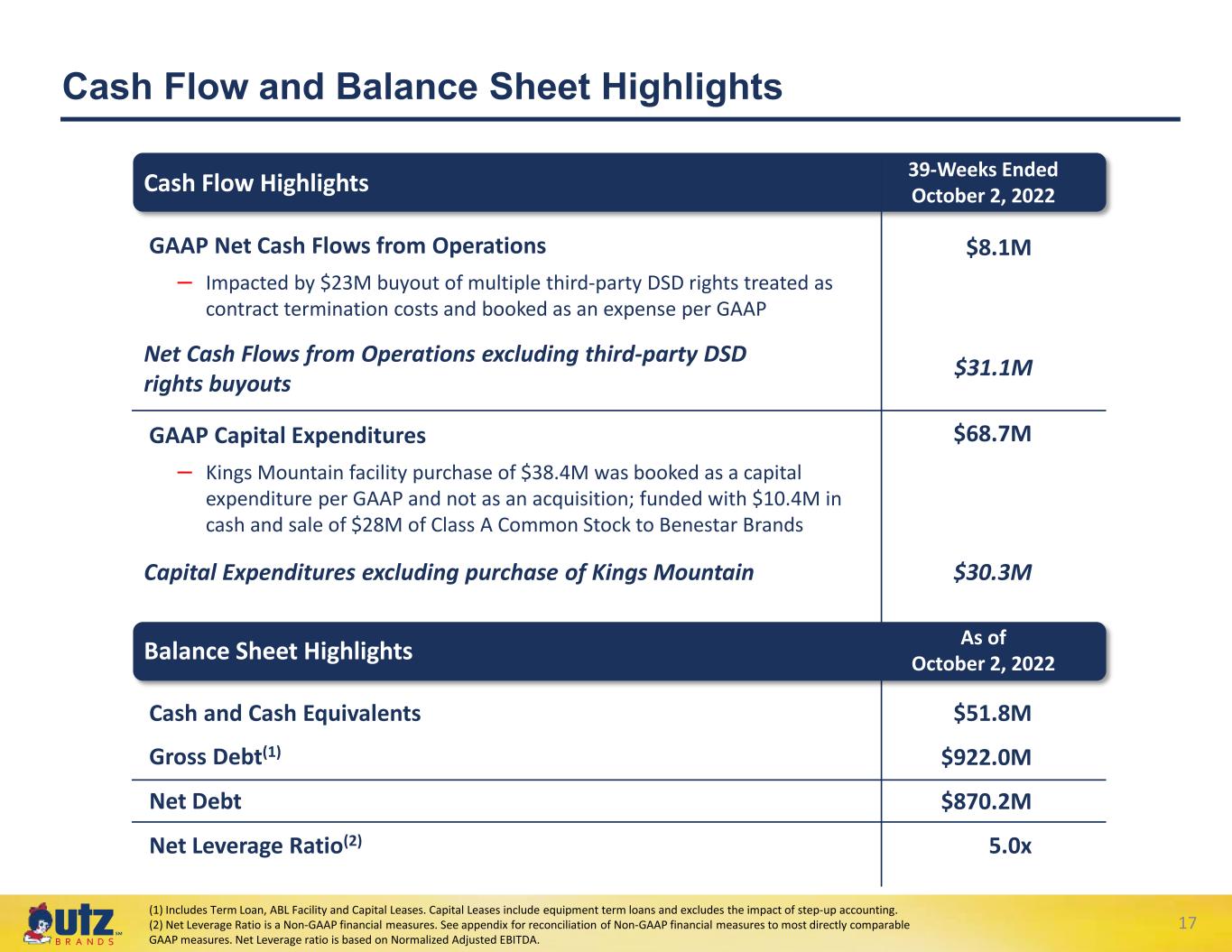

℠ Cash Flow and Balance Sheet Highlights 17 (1) Includes Term Loan, ABL Facility and Capital Leases. Capital Leases include equipment term loans and excludes the impact of step-up accounting. (2) Net Leverage Ratio is a Non-GAAP financial measures. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Net Leverage ratio is based on Normalized Adjusted EBITDA. 39-Weeks Ended October 2, 2022 As of October 2, 2022 GAAP Net Cash Flows from Operations – Impacted by $23M buyout of multiple third-party DSD rights treated as contract termination costs and booked as an expense per GAAP $8.1M $31.1MNet Cash Flows from Operations excluding third-party DSD rights buyouts Cash Flow Highlights GAAP Capital Expenditures – Kings Mountain facility purchase of $38.4M was booked as a capital expenditure per GAAP and not as an acquisition; funded with $10.4M in cash and sale of $28M of Class A Common Stock to Benestar Brands $68.7M $30.3MCapital Expenditures excluding purchase of Kings Mountain As of October 2, 2022 Cash and Cash Equivalents $51.8M Balance Sheet Highlights Gross Debt(1) Net Debt Net Leverage Ratio(2) 5.0x $922.0M $870.2M

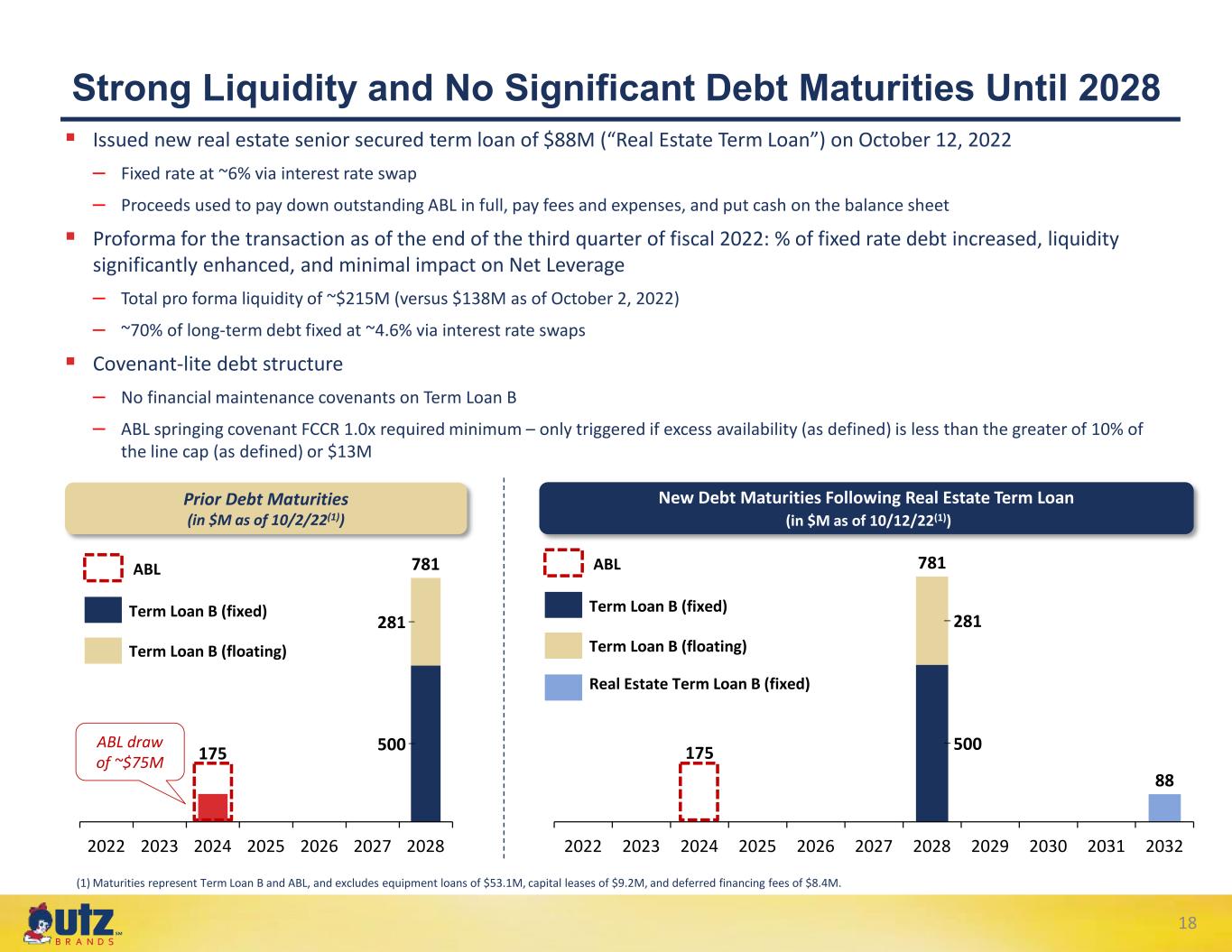

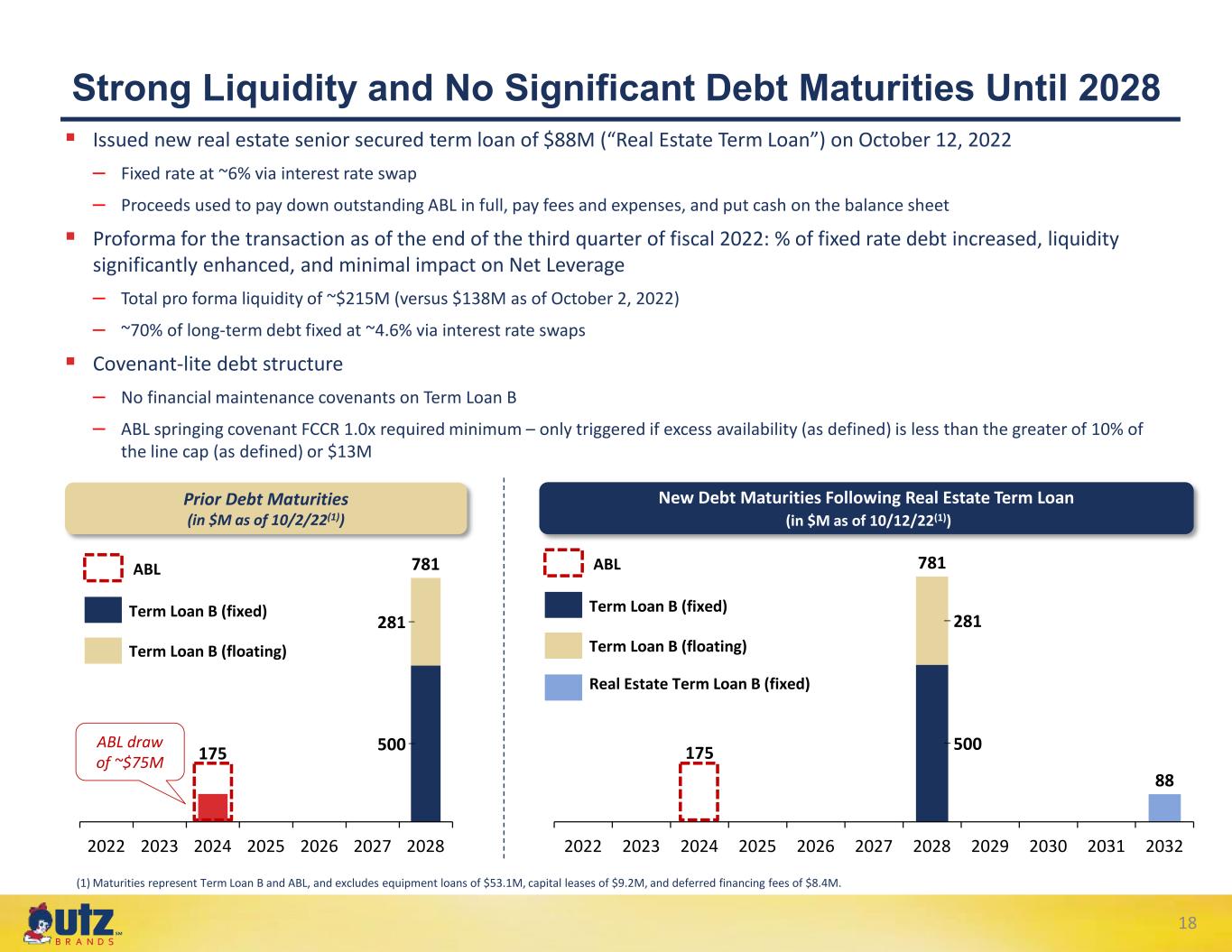

℠ 18 Strong Liquidity and No Significant Debt Maturities Until 2028 500 281 781 20242022 2023 20272025 2026 2028 175 ABL Term Loan B (fixed) Term Loan B (floating) Prior Debt Maturities (in $M as of 10/2/22(1)) 175 500 88 281 2022 2023 20252024 20272026 2028 2029 2030 2031 2032 781ABL Term Loan B (fixed) Term Loan B (floating) New Debt Maturities Following Real Estate Term Loan (in $M as of 10/12/22(1)) Real Estate Term Loan B (fixed) Issued new real estate senior secured term loan of $88M (“Real Estate Term Loan”) on October 12, 2022 – Fixed rate at ~6% via interest rate swap – Proceeds used to pay down outstanding ABL in full, pay fees and expenses, and put cash on the balance sheet Proforma for the transaction as of the end of the third quarter of fiscal 2022: % of fixed rate debt increased, liquidity significantly enhanced, and minimal impact on Net Leverage – Total pro forma liquidity of ~$215M (versus $138M as of October 2, 2022) – ~70% of long-term debt fixed at ~4.6% via interest rate swaps Covenant-lite debt structure – No financial maintenance covenants on Term Loan B – ABL springing covenant FCCR 1.0x required minimum – only triggered if excess availability (as defined) is less than the greater of 10% of the line cap (as defined) or $13M (1) Maturities represent Term Loan B and ABL, and excludes equipment loans of $53.1M, capital leases of $9.2M, and deferred financing fees of $8.4M. ABL draw of ~$75M

℠ 19 Fiscal 2022 Outlook Raising net sales outlook to reflect our year-to-date performance, continued strong consumer demand, and better than expected price elasticity Raising Adjusted EBITDA outlook due to stronger sales outlook and accelerating benefits from pricing and productivity actions to fully offset gross input cost inflation while we continue to make investments to support growth Fiscal 2021 Results Fiscal 2022 Outlook (Previous) Net Sales Adjusted EBITDA $1,180.7M $156.2M Fiscal 2022 Outlook versus Fiscal 2021 Actual Results: Additional Assumptions: Capital expenditures of approximately $40M excluding the impact from the Kings Mountain Transaction(1) Effective tax rate of approximately 20%(2) Net leverage consistent with fiscal 2021 Mid-to-high-teens % gross input cost inflation which includes commodities, labor, and transportation Note: Adjusted EBITDA Margin is a Non-GAAP financial measure. See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) In accordance with GAAP, the $38.4 million purchase of the Kings Mountain facility was booked on the Company’s Statement of Cash Flows as a capital expenditure and not as an acquisition. (2) Normalized GAAP basis tax expense, which excludes one-time items. Fiscal 2022 Outlook (Updated) +17% to 19% Total growth +13% to 15% Organic growth $166M to $170M (+6% to 9% growth) +13% to 15% Total growth +10% to 12% Organic growth +2% to 5% growth

℠ 20 Well-Positioned to Navigate the Current Environment Enhanced planning capabilities helping to improve throughput and unlock bottlenecks Strong Salty Snack category with minimal price elasticity and private label penetration Proven capabilities to offset continued inflation with price and productivity Mitigated interest expense exposure in a rising rate environment Immaterial foreign currency exposure and no pension liabilities Confident in our ability to drive Organic Net Sales and Adjusted EBITDA growth in fiscal 2023 while we continue to invest in the business

Appendix 21

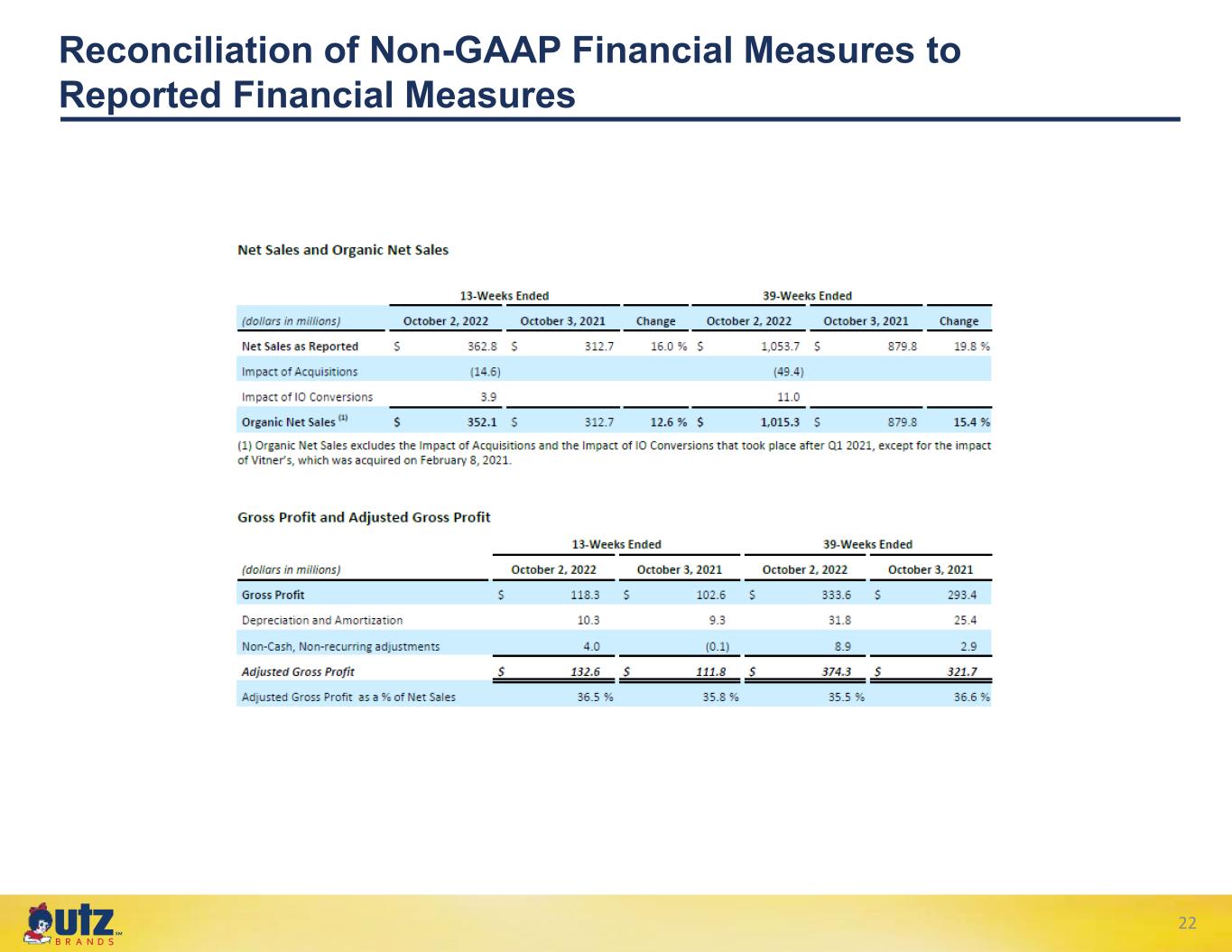

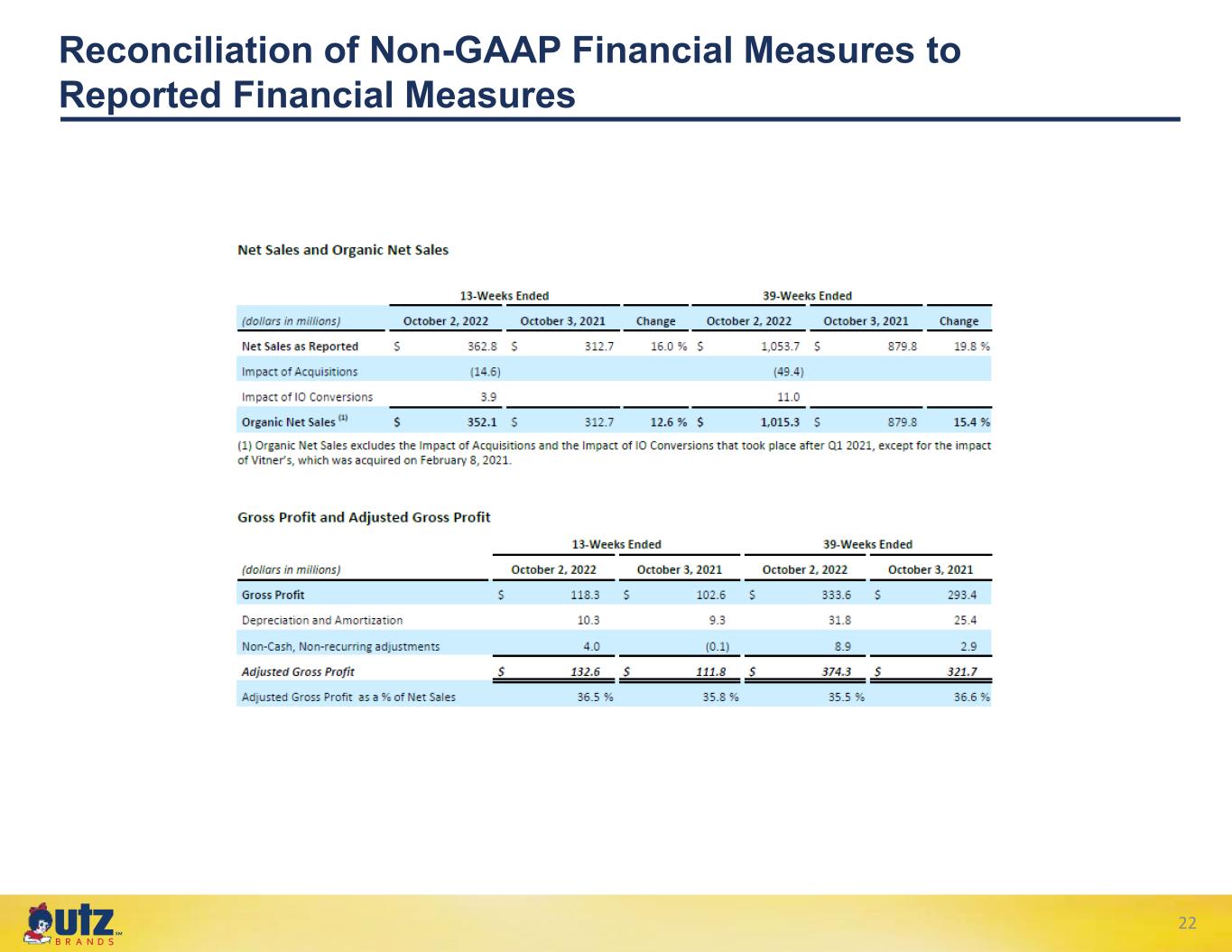

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 22

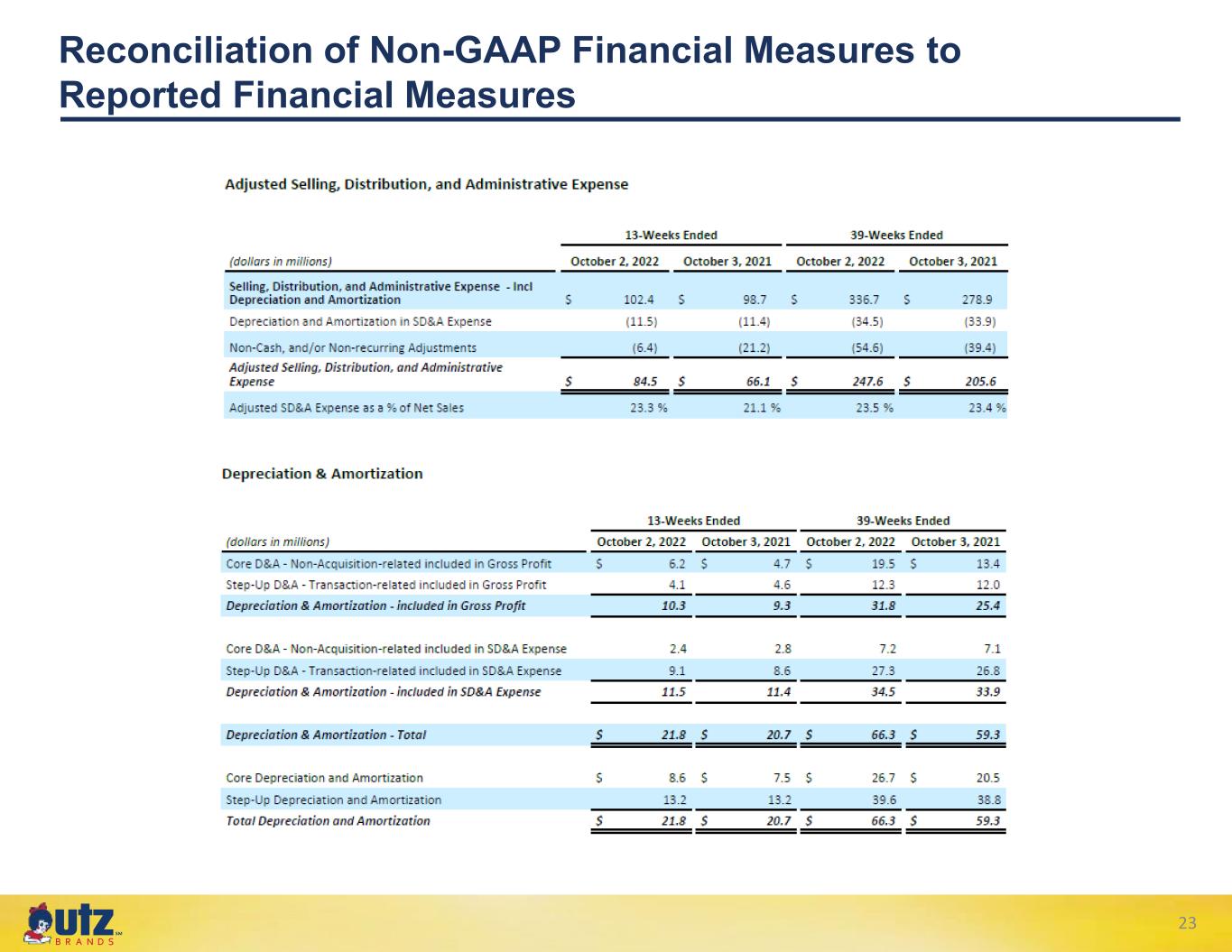

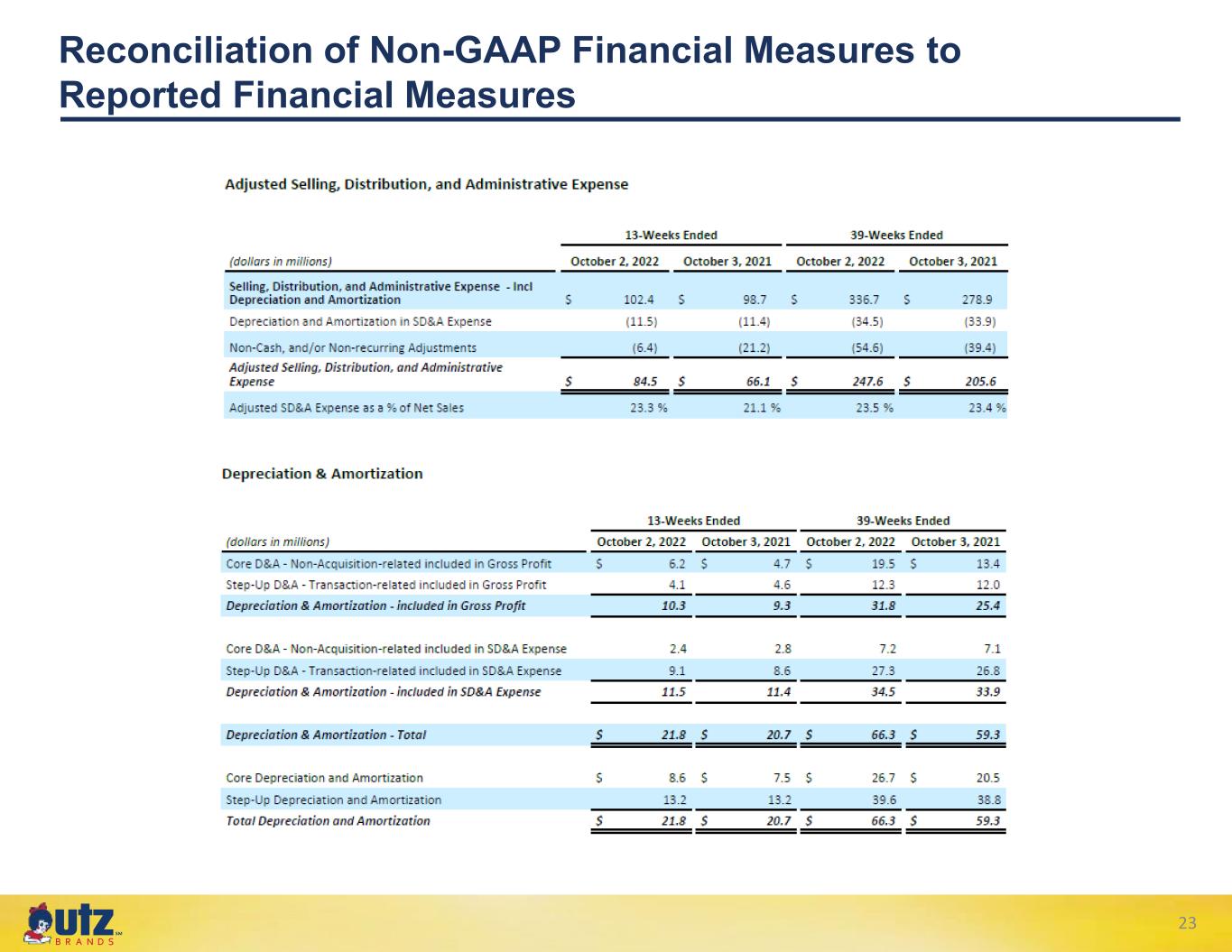

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 23

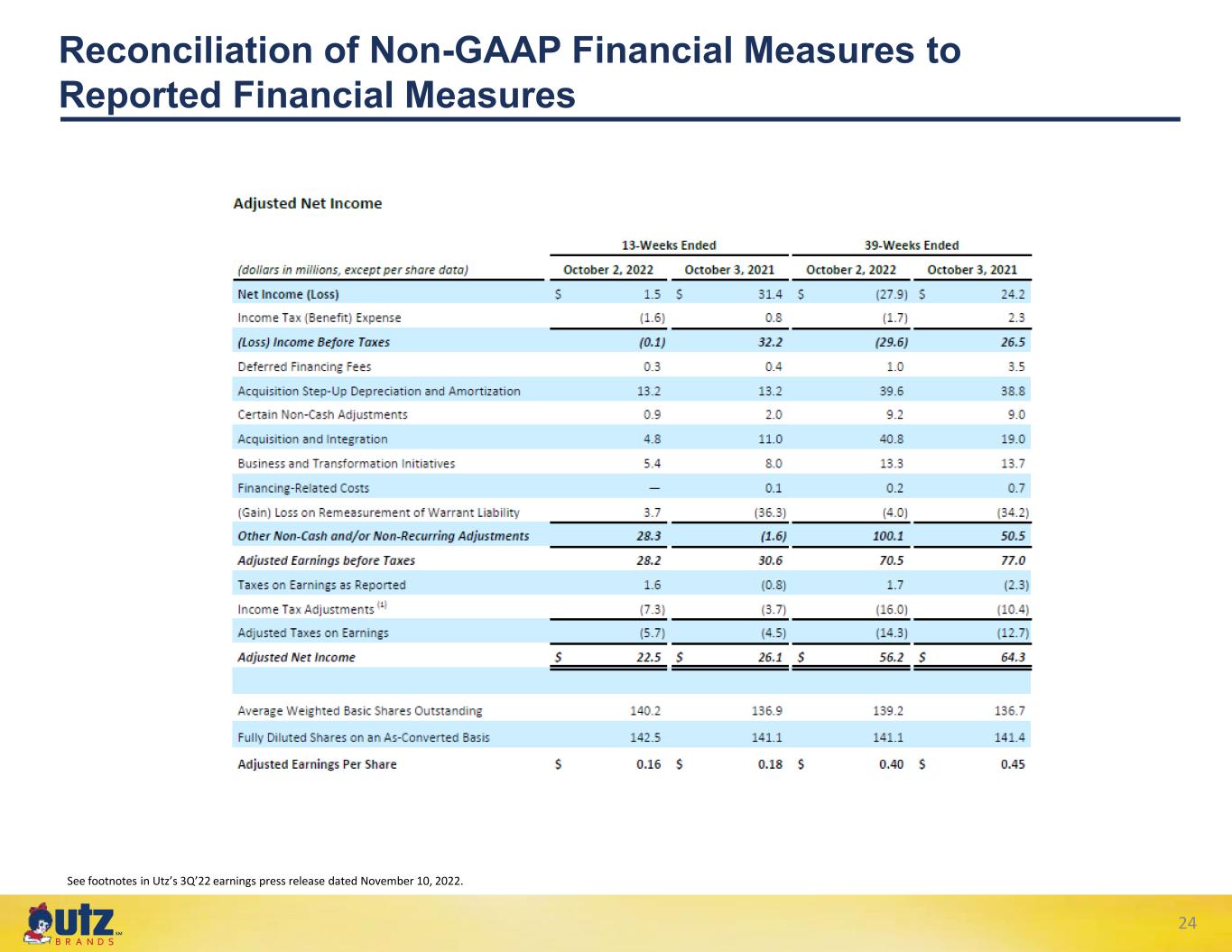

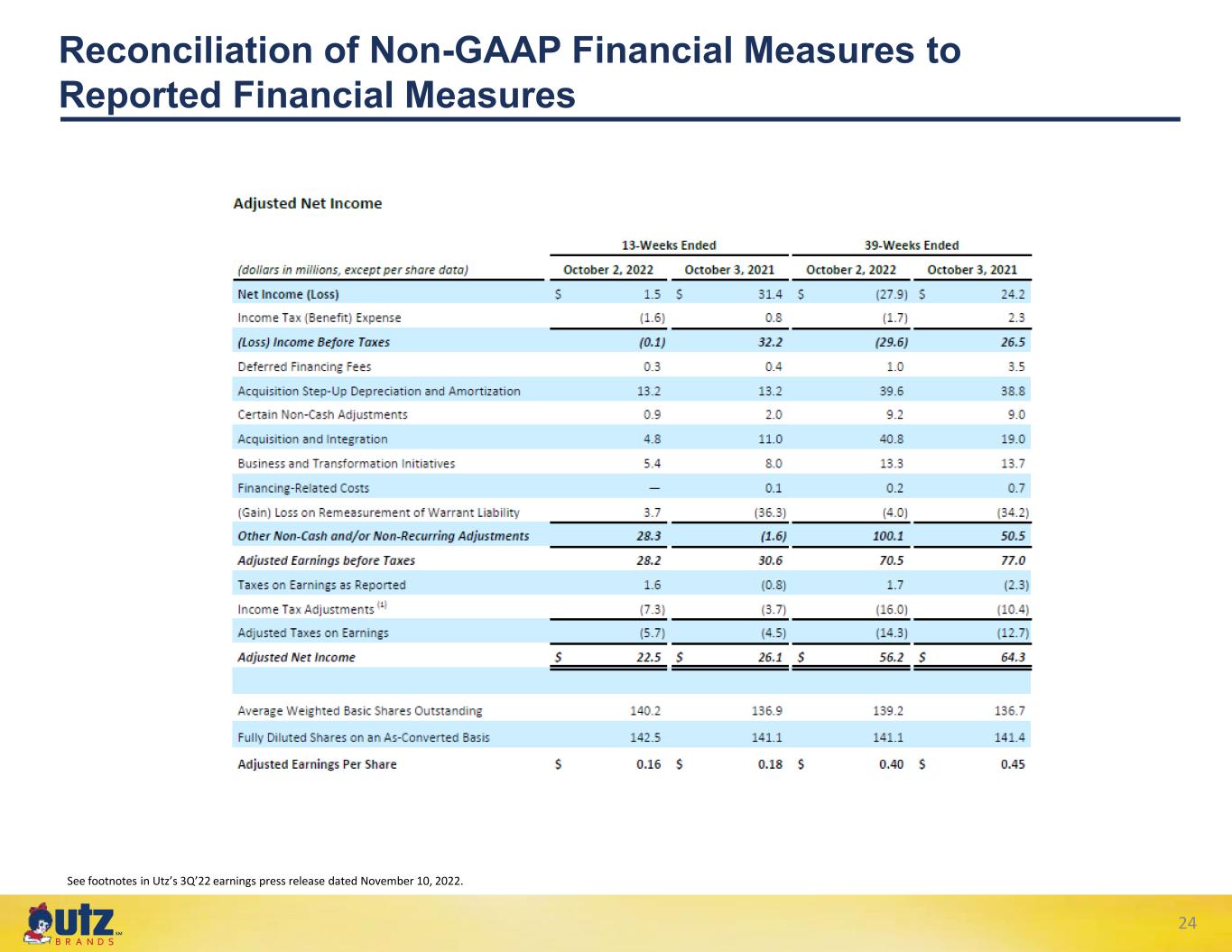

℠ Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 24 See footnotes in Utz’s 3Q’22 earnings press release dated November 10, 2022.

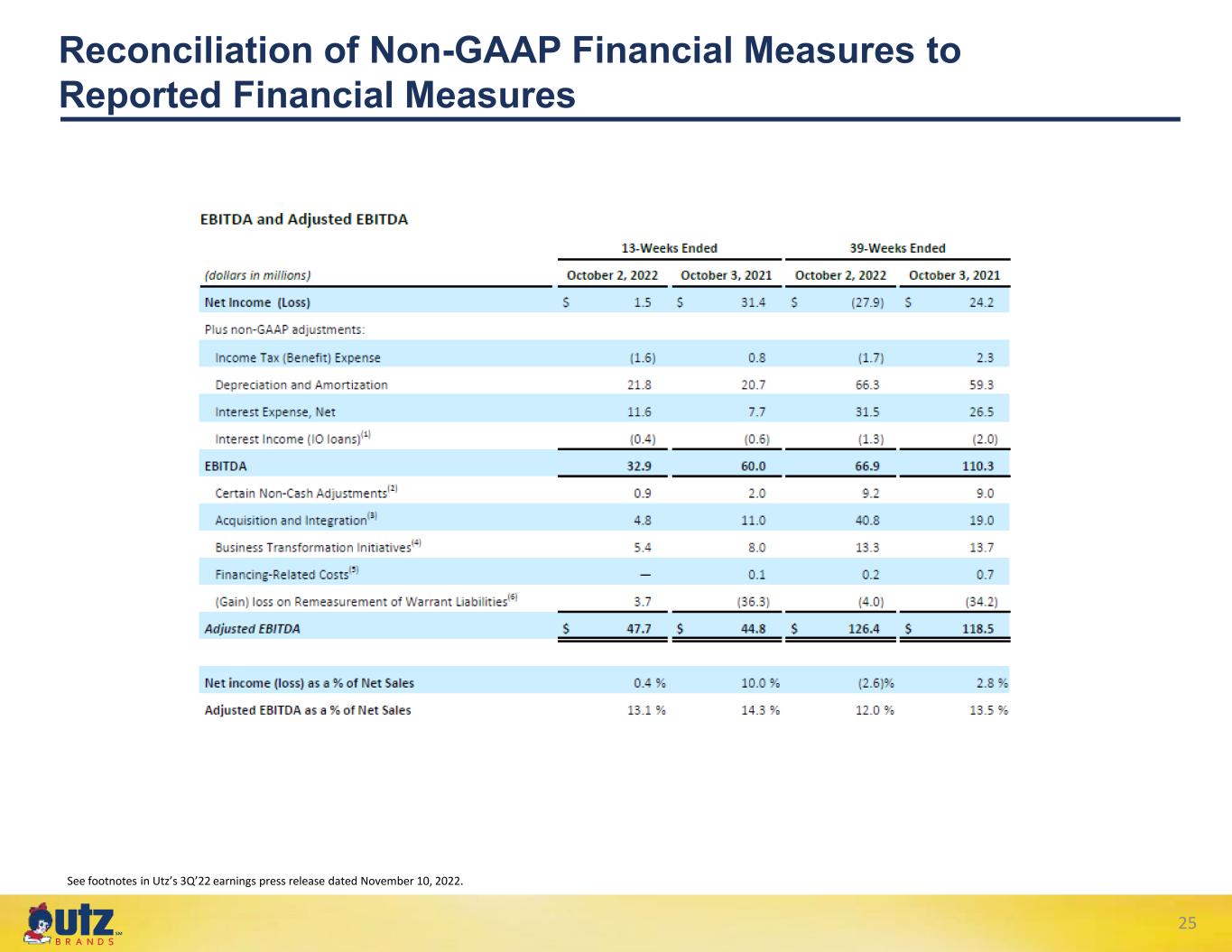

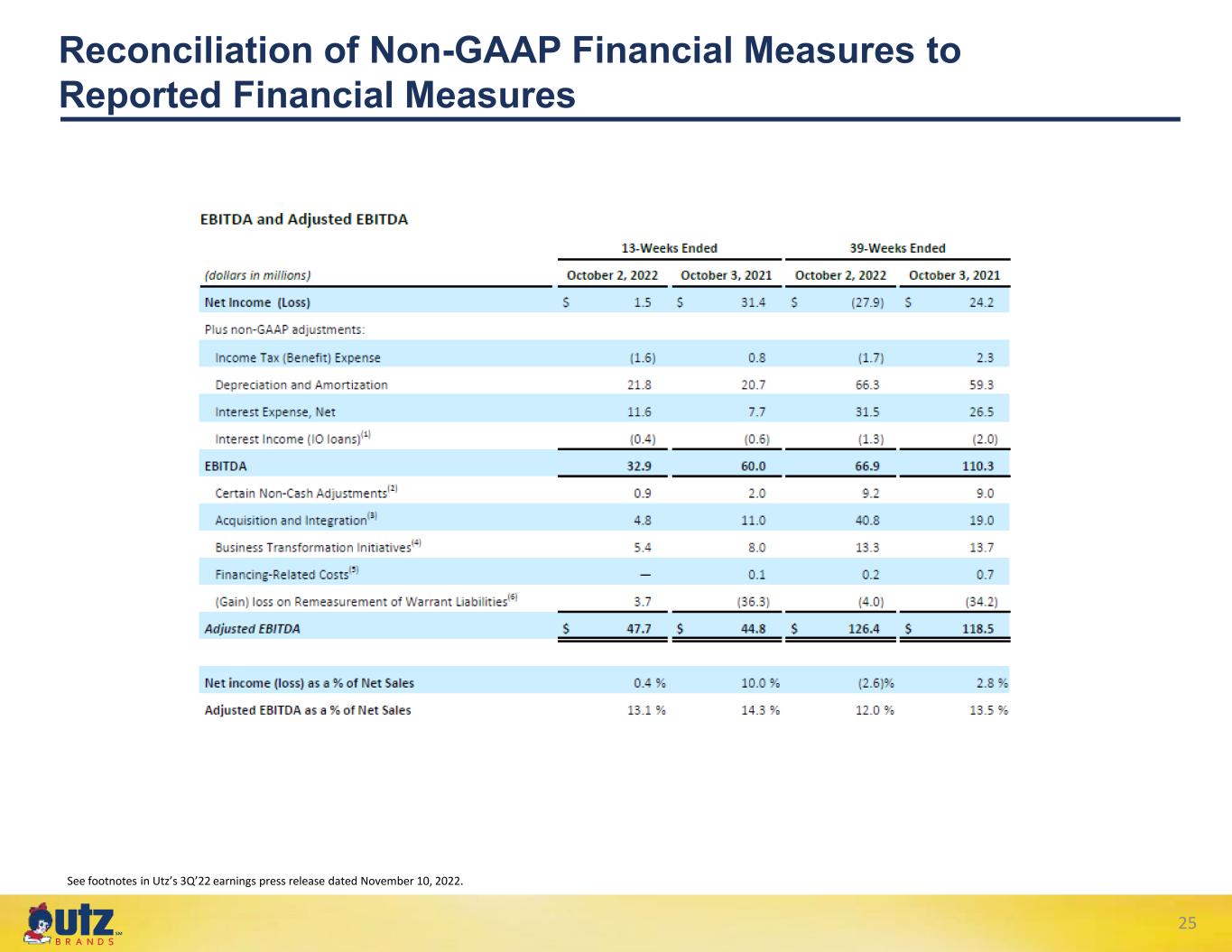

℠ 25 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures See footnotes in Utz’s 3Q’22 earnings press release dated November 10, 2022.

℠ 26 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures See footnotes in Utz’s 3Q’22 earnings press release dated November 10, 2022.

℠ 27 Utz Geographic Classifications FL NM DE MD TX OK KS NE SD NDMT WY CO UT ID AZ NV WA CA OR KY ME NY PA VT NH MA RI CT WV INIL NC TN SC ALMS AR LA MO IA MN WI NJ GA DC VA OH MI AK HI Core Expansion Emerging