UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 29, 2024 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission file number: 001-38686

Utz Brands, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | | 85-2751850 |

(State or other jurisdiction

of incorporation) | | | (IRS Employer

Identification No.) |

900 High Street

Hanover, PA 17331

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (717) 637-6644

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | UTZ | | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ⌧ No ◻

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicated by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery periods pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ⌧

The aggregate market value of the Common Stock held by non-affiliates was $1,115.8 million, as of June 28, 2024.

As of February 18, 2025, 86,061,319 Class A Common Stock, par value $0.0001 per share, and 55,349,000 Class V Common Stock, par value $0.0001 per share, were issued and outstanding.

Documents Incorporated by Reference:

Portions of the registrant’s definitive proxy statement for the registrant’s 2025 annual meeting (the “2025 Proxy Statement”), to be filed within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of this Annual Report on Form 10-K. Except with respect to information specifically incorporated by reference into the Annual Report, the 2025 Proxy Statement shall not be deemed to be filed as part hereof.

| | | | | | | | |

| Table of Contents |

| | |

| | Page |

| Part I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| Part III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Part IV | | |

| Item 15. | | |

| Item 16. | | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for Utz Brands, Inc. (together with its consolidated subsidiaries, the “Company”) contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for the Company’s business. Specifically, forward-looking statements may include statements relating to:

•The Company's future financial position, capital structure, indebtedness, business strategy, opportunities and plans and objectives of management for future operations, including with respect to promotional activities and efforts to build sustainable long-term demand for the Company's products;

•The benefits of the Company's acquisitions, dispositions and similar transactions;

•The likelihood of the Company completing contemplated acquisitions, dispositions and similar transactions;

•The future operating and financial performance of the Company;

•Expansion plans and opportunities;

•Cost savings plans and network optimization strategies;

•Transformation of the Company’s supply chain;

•The Company’s product mix;

•The Company’s ability to reduce debt and anticipated interest expense savings;

•The Company’s cost savings plans and logistics optimization efforts;

•The effects of inflation or supply chain disruptions on the Company or its business;

•The benefits of the Company’s productivity initiatives;

•The effects of the Company’s marketing and innovation initiatives; and

•Other statements preceded by, followed by or that include the words “may,” “can,” “should,” “will,” “estimate,” “plan,” “project,” "forecast,” "intend,” "expect,” “anticipate,” “believe,” “seek,” "target” or similar expressions.

These forward-looking statements are based on information available as of the date of this Annual Report on Form 10-K, reflect the Company management’s current expectations, forecasts and assumptions, and involve a number of judgments regarding known and unknown risks, uncertainties, and other factors, many of which are outside the control of the Company and its directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date. The Company does not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, the Company’s results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ are set forth under the heading “Risk Factor Summary” below and those described under Part I, Item 1A “Risk Factors” of this Annual Report on Form 10-K.

RISK FACTOR SUMMARY

The Company’s business involves significant risks and uncertainties that make an investment in it speculative and risky. The following is a summary list of the principal risk factors that could materially and adversely affect the Company’s business, financial condition, liquidity and results of operations. These are not the only risks and uncertainties the Company faces, and you should carefully review and consider the full discussion of the Company’s risk factors in the section titled “Risk Factors”, together with the other information in this Annual Report on Form 10-K.

Risks Related to Our Business

•We operate in the highly competitive and increasingly consolidated snack food industry. This consolidation, in tandem with our reliance on key customers and a rise in hard discounters, may limit our ability to obtain favorable contractual terms and protections with customers and maintain our profitability.

•Demand for our products may be adversely affected by changes in consumer preferences and tastes or if we are unable to innovate or market our products effectively. Relatedly, consumers’ loyalty to our brands may change due to factors beyond our control.

•Our reputation or brand image might be impacted as a result of issues or concerns relating to the quality and safety of our products, ingredients or packaging, processing techniques, which in turn could negatively impact our operating results. If our products become adulterated or are mislabeled, we might need to recall those items, and we may experience product liability claims and related losses, as well as damage to our reputation.

•Changes in retail distribution arrangements can result in the loss of retail shelf space and disrupt sales of food products, causing our sales to fall.

•Our DTW delivery network system relies on a significant number of brokers, wholesalers and logistics companies, and our DSD network system and regional third-party distributor network relies on a significant number of independent operators and third-party distributors, and such reliance could affect our ability to effectively and profitably distribute and market products, maintain existing markets and expand business into other geographic markets.

•The evolution of e-commerce retailers and sales channels may adversely affect us.

•Disruption to our manufacturing operations, supply chain or distribution channels could impair our ability to produce or deliver finished products and negatively impact our operating results.

•Our results of operations and profitability may continue to be adversely affected by inflation, including from rising labor costs and the effects of shortages of raw materials, energy, water and other supplies.

•All of our products must be compliant with laws and regulations promulgated by various governmental authorities, and changes in the legal and regulatory environment could limit our business activities, increase our operating costs, reduce demand for our products or result in litigation or other regulatory action. Additionally, potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries or investigations can have an adverse impact.

•We may not be successful in implementing our growth strategy.

•We may be unable to successfully identify and execute acquisitions or dispositions or to successfully integrate acquisitions or carve out dispositions.

•The geographic concentration of our markets may adversely impact us if we are unable to effectively diversify the markets in which we participate.

•We may not be able to attract and retain the highly skilled people we need to support our business.

•Impairment in the carrying value of goodwill or other intangible assets could have an adverse impact on our results.

•Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products and brands. However, if consumers do not identify with our trademarks or other intellectual property rights, our brand may be significantly and adversely impaired.

•Disruptions, failures or security breaches of our information technology infrastructure could have a negative impact on our operations and subject us to significant losses.

•Climate change or legal, regulatory or market measures to address climate change may negatively affect our business and operations or damage our reputation, and liabilities, claims or new laws or regulations with respect to environmental matters could have a significant negative impact on our business.

•We are subject to increasing focus on ESG issues, including those related to climate change, and any perceived failure by us to meet ESG initiatives may negatively impact our business.

•Our debt instruments contain covenants that impose restrictions on our operations that may adversely affect our ability to operate our business if we fail to meet those covenants or otherwise suffer a default thereunder. Additionally, changes in interest rates may adversely affect our earnings and/or cash flows.

•Any disruptions in the worldwide financial markets may materially and adversely affect our ability to obtain new credit.

•The imposition or proposed imposition of new or increased income or product taxes can adversely affect us.

•Pandemics, epidemics or other disease outbreaks may change or disrupt consumption patterns, supply chains, and production processes, which could materially affect our operations and results of operations.

•We are subject to risks from changes to the trade policies and tariff and import/export regulations by the U.S. and/or other foreign governments.

Risks Related to the Ownership of our Securities

•Resales of shares of our Class A Common Stock could affect the market price of our Class A Common Stock.

•We are a holding company dependent upon distributions made by our subsidiaries to pay taxes, make payments under the TRA (as defined below) and pay dividends.

•Pursuant to the TRA, we are required to make certain payments to certain noncontrolling interest holders of UBH ("Noncontrolling Interest Holders"), and those payments may be substantial. In certain cases, payments under the TRA may exceed the actual tax benefits we realize or be accelerated.

•Delaware law, the Certificate of Incorporation, the Bylaws and certain other agreements contain certain provisions, including anti-takeover provisions, that limit the ability of stockholders to take certain actions and could delay or discourage takeover attempts.

•The Certificate of Incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by our stockholders.

•Certain of our significant stockholders and UBH members whose interests may differ from those of our other stockholders have the ability to significantly influence our business and management.

•Our private placement warrants may have an adverse effect on the market price of our Class A Common Stock, and the valuation of our private placement warrants could increase the volatility in our earnings results.

PART I

Item 1. Business

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company,” “we,” “us” or "our” refer to Utz Brands, Inc. and its consolidated subsidiaries. Our core geographies consist of Alabama, Connecticut, Delaware, Louisiana, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Virginia, Vermont, West Virginia, and Washington (our “Core Geographies”), with the rest of the U.S. representing our Expansion geographies (our “Expansion Geographies”).

Overview

We are a leading United States manufacturer of branded salty snacks. We produce a broad offering of salty snacks, including potato chips, tortilla chips, pretzels, cheese snacks, pork skins, pub/party mixes, and other snacks. Our iconic portfolio of authentic, craft, and “better-for-you” (“BFY”) brands, which includes Utz, Zapp’s, On The Border, Golden Flake, and Boulder Canyon, among others, enjoys strong household penetration in the United States, where our products can be found in approximately half of U.S. households as of December 29, 2024. We are the second-largest producer of branded salty snacks in our Core Geographies as of December 29, 2024, based on retail sales, and we have historically expanded our geographic/distribution reach and product portfolio organically and through acquisitions. We were founded in 1921 in Hanover, Pennsylvania, and benefit from more than 100 years of brand awareness and heritage in the salty snack industry.

As of December 29, 2024, we operate eight primary manufacturing facilities with a broad range of capabilities, and our products are distributed nationally to grocery, mass, club, convenience, drug, e-commerce and other retailers through direct shipments, distributors, and approximately 2,500 DSD routes.

Our business benefits from multiple opportunities to deliver attractive long-term profitable growth. Our value creation strategies are focused on driving productivity to enhance margins, reinvesting in marketing and innovation to accelerate revenue growth and continuing to make strategic acquisitions. We believe we are well-positioned for long-term growth in the salty snack industry as we (a) gained a significant amount of new buyers over the past several years, (b) have significant opportunity in our Expansion Geographies and under-penetrated channels, (c) continue to execute productivity efforts that we believe will help to fuel incremental marketing and innovation to accelerate growth in sales relative to our peers, (d) continue to make infrastructure improvements to enable us to continue to scale to greater heights, and (e) continue to make strategic acquisitions that deliver strong synergies and that enhance our competitive positioning. We believe each of these growth avenues represents a sizeable opportunity to expand our net sales. In addition, we further anticipate expanding our margins over the long term through supply chain productivity, revenue management, a higher-margin product mix, and higher margins on incremental sales as we leverage our scalable existing platform.

Recent Acquisitions and Dispositions

The Company has focused on increasing manufacturing and streamlining distribution. In April 2022, the Company purchased a brand new, recently completed snack food manufacturing facility in Kings Mountain, North Carolina from Evans Food Group Ltd. d/b/a Benestar Brands and related affiliates. The Company paid the full cash purchase price of $38.4 million at the closing and concurrently with the facility purchase, the Company sold 2.1 million shares of the Company’s Class A Common Stock for $28.0 million, to affiliates of Benestar in a private placement pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the "Securities Act"). During fiscal years 2022, 2023 and 2024, the Company bought out and terminated the contracts of multiple distributors who had previously been providing services to the Company. These transactions were accounted for as asset purchases and contract terminations, respectively, and resulted in expense of $23.0 million, $1.5 million and $2.1 million for the fiscal years ended January 1, 2023, December 31, 2023 and December 29,2024, respectively.

On February 5, 2024, the Company sold certain assets and brands to affiliates of Our Home™, an operating company of BFY brands (“Our Home”). Under the agreement, affiliates of Our Home purchased the Good Health and R.W. Garcia brands, the Lincolnton, NC and Lititz, PA manufacturing facilities and certain related assets, and assumed the Company’s Las Vegas, NV facility lease and manufacturing operations (the "Good Health and R.W. Garcia Sale"), for $167.5 million, subject to customary adjustments.

On April 22, 2024, the Company sold to Our Home its Berlin, PA and Fitchburg, MA manufacturing facilities and certain related assets, including certain inventory (the “Manufacturing Facilities Sale”). The total consideration for the Manufacturing Facilities Sale was $18.5 million, subject to customary adjustments.

The Company and Our Home are operating under transition services agreements related to each of the Good Health and R,W. Garcia Sale and the Manufacturing Facility Sale, which are scheduled to expire during the first half of 2025. In addition, the parties will operate under reciprocal co-manufacturing agreements pursuant to which Our Home will co-manufacture certain of the Company's products and the Company will co-manufacture certain Good Health products. Certain Good Health products will continue to be distributed and sold on the Company's DSD network for Our Home pursuant to a distribution agreement. The Company received approximately $18.7 million in advance from Our Home for certain terms under these agreements, which the Company will recognize through income from operations over the terms of the transition services and co-manufacturing agreements. See Note 2. Divestitures, to our audited consolidated financial statements included under Part II, Item 8 of this Annual Report on Form 10-K (our "Audited Financial Statements"), for further discussion.

During the fiscal year ended December 29, 2024, the Company paid $9.2 million to purchase an indefinite life intangible right for use of a third-party brand name. This intangible is classified as an indefinite life trade name. See Note 5. Goodwill and Intangible Assets, Net to our Audited Financial Statements.

Growth Strategy

We have a long-term growth strategy focusing on various initiatives. Our portfolio strategy is focused on accelerating investments in marketing and innovation to drive top-line growth and achieve share gains in the Salty Snack category. We plan to further penetrate our Expansion Geographies and untapped channels and customers by further expanding our Branded Salty Snacks in Expansion Geographies, as well as maintaining our share in our Core Geographies. We plan to transform our supply chain into a more cost-efficient and flexible system. As part of our long-term growth strategy, we intend to enhance our DSD system of IOs to further improve execution and generate higher returns and strengthen other organizational capabilities while driving out costs. Additionally, we intend to improve our balance sheet flexibility by accelerating cash generation and maintaining a disciplined capital allocation approach, which will reduce leverage while opportunistically pursuing strategic acquisitions and dispositions.

Brands

Our business is managed and reported in one operating segment due to the similar nature of all of the products that the Company sells, the functional alignment of the Company's organizational structure, and the reports that are regularly reviewed by the chief operating decision maker (the “CODM”) for the purpose of assessing performance and allocating resources. However, we strategically manage our portfolio of brands by segregating our sole operating segment into Branded Salty Snacks and Non-Branded & Non-Salty Snacks. Branded Salty Snacks, in aggregate, enjoy a combination of higher growth and margins, greater potential for value-added innovation, and enhanced responsiveness to consumer marketing as compared to Non-Branded & Non-Salty Snacks. As a result, we focus our investment spending and brand-building activities on Branded Salty Snacks while managing Non-Branded & Non-Salty Snacks for cash flow generation to support investment in Branded Salty Snacks and fund other corporate priorities. We periodically assess the designation of brands within these segregations and reclassify brands based on their alignment with the criteria above.

Branded Salty Snacks

Our Branded Salty Snacks are comprised of our Power Four Brands, consisting of our flagship Utz® brand, On The Border®, Zapp’s®, and Boulder Canyon®, along with our Other Brands, including Golden Flake®, TORTIYAHS!®, Hawaiian®, Bachman®, Tim’s Cascade®, Dirty Potato Chips®, TGI Fridays®, and Vitner's®.

Our flagship Utz brand generated retail sales in excess of $850 million in 2024, representing an approximate 7.1% compound annual growth rate ("CAGR") (during 2020 through 2024) and making it one of the 10 largest salty snack brands in the United States by retail sales as of December 29, 2024. Recognized for its iconic logo featuring the “Little Utz Girl” since the 1920s, the Utz brand currently uses the slogan "Family Crafted Flavor Since 1921”. We sell a variety of salty snacks under the Utz brand, including potato chips, pretzels, cheese snacks, pub/party mixes, and seasonal favorites.

Our On The Border brand ("OTB") is a national brand of tortilla chips, salsa and queso. OTB is the #2 unflavored tortilla chip brand in the United States based on annual sales for the fiscal year ended December 29, 2024. The acquisition of OTB strengthened our national geographic footprint, particularly in our Expansion Geographies, and enhanced our presence in the Mass and Club retail channels.

Our Boulder Canyon brand anchors our position in the BFY category of salty snacking, which has been a high-growth category in recent years. Boulder Canyon offers a line of premium BFY potato chips, including those made with olive or avocado oils. In the Natural channel as defined by SPINS, LLC, Boulder Canyon is the #2 potato chip brand, growing 32.7% within the channel in 2024, its “Canyon Cut” rippled avocado oil-based kettle-style chip is the #1 selling salty snack item as of December 29, 2024.

Our Zapp’s brand offers a line of premium kettle-cooked potato chips with bold, authentic flavors steeped in its New Orleans roots, including “Voodoo,” “Hotter ‘N’ Hot Jalapeño,” “Spicy Cajun Crawtators,” and "Cajun Dill Gator-tators,” among others.

Our Other Brands also includes others such as: Hawaiian and Golden Flake pork skins. Hawaiian is a premium kettle chip brand that evokes the feel of the Pacific islands, with exotic flavors like “Sweet Maui Onion,” "Luau BBQ,” "Mango Habanero,” and "Hulapeño.” Our Golden Flake brand, a part of Southern culture since 1923, has a full line of Southern-style pork skins with flavors like “Louisiana Hot Sauce” and "Sweet Heat Barbecue,” which offer great taste and crunch with low carbohydrates.

Non-Branded & Non-Salty Snacks

In fiscal year 2024, our Non-Branded & Non-Salty Snacks included partner brands, private label, co-manufacturing for which we are the manufacturer, Utz branded non-salty snacks such as On The Border® Dips and Salsa, and sales not attributable to specific brands.

Products

We produce a broad range of salty snack foods, including potato chips, tortilla chips, pretzels, cheese snacks, pub/party mixes, pork skins, ready-to-eat popcorn, and other snacks which include salsa and dips. Our products are packaged in a variety of different sizes and configurations, ranging from individual packages to shareable bulk containers. We also sell certain third-party branded products through our distribution network.

We believe our ability to produce a wide range of products differentiates us from some of our competitors whose businesses focus on a particular product type because our broad product assortment enables us to gain greater distribution and shelf space with our customers. Our in-house production capabilities across a range of products also enable us to rapidly respond to evolving consumer needs and preferences and to better create new innovative products to delight consumers. We also believe that our diversified product portfolio results in more predictable and stable financial performance as we are not overly exposed to only one salty snack sub-category.

Recent Developments in Product Innovation

New product innovation is critical in the salty snacks category because consumers both enjoy long-time favorites and like to experiment with new forms, flavors, textures, and ingredients. In particular, our brands have strong competitive positions across an assortment of popular salty snacks, including potato chips, tortilla chips, pretzels, cheese snacks, pub/party mixes, and pork skins.

Investments in new product innovation support three focus areas that are rooted in the consumer and tied to our portfolio and brand strategy: Expanding Positive Choices, Delivering Craveable Flavor, and Capturing Occasions.

Within Expanding Positive Choices, the focus in 2024 was on Boulder Canyon, a brand offering solutions for consumers seeking great tasting BFY snacks via BFY oils such as avocado oil and olive oil. Innovation contributed to the brand’s 32.7% growth in the natural channel in 2024. Within the potato chip segment, Boulder Canyon launched two kettle chips: Spicy Green Chili as an everyday item following a successful 2023 limited time offer (“LTO”) launch and a Buffalo Ranch Boulder Batch LTO. Both flavors capitalized on the hot & spicy trend that continues as the #1 flavor category in salty snacks. Also, within potato chips, Boulder Canyon entered the Wavy/Ripple subcategory with the launch of Boulder Canyon Wavy chips in top category flavors, Sea Salt and Cheddar Sour Cream. Introduced in September 2024 in the Natural Channel, Boulder Canyon Wavy is off to a strong start with both Sea Salt and Cheddar Sour Cream flavors exceeding expectations. Additionally, Boulder Canyon moved beyond potato chips in 2024, entering the cheese snacks sub-category with the introduction of Canyon Poppers. This launch leverages our expertise in cheese snacks and consumer desire for BFY snacks. Two flavors, White Cheddar and Jalapeno Ranch, represent top category flavors, Cheddar and Hot & Spicy.

Within Delivering Craveable Flavor, we addressed consumer desire for flavor exploration with innovation across brands and snacking subcategories. Utz leveraged strength as the #4 brand of pretzels with an over 50% repeat purchase rate and the other positive trends in flavored pretzels, which now represents over 50% of pretzels. Utz has driven 5% growth in the category, due, in part, to the launch of Utz Mixed Minis, a line of seasoned mini pretzels in Garlic Butter, Mike’s Hot Honey and Sea Salt varieties. Within potato chips, Utz leveraged the success of the award-winning Mike’s Hot Honey to offer a Mike’s Extra Hot Honey as a Summer LTO capitalizing on the hot & spicy trend. Zapp’s, a brand that embodies the bold and vibrant flavors of New Orleans, also offered innovation against this focus area. Building on the launch of Zapp’s Sinfully Seasoned Pretzel Stix in 2023, two new flavors were launched in 2024 – Spicy Cajun and Sweet Cinnamon & Sugar. Following up on multiple product awards for Zapp’s Sinfully Seasoned Pretzel Stix in 2023, Zapp’s Spicy Cajun pretzels was named one of the year’s Best New Products by Convenience Store News for 2024. Zapp’s Sinfully Seasoned Pretzel Stix is the #6 brand in the seasoned subcategory in the fifty-two weeks ended as of December 1, 2024. Within potato chips, Zapp’s introduced the Big Cheezy New Orleans Kettle Style potato chips. While cheese flavored potato chips represent 12% of potato chips and are growing, this popular flavor is underrepresented in kettle style chips subcategory at less than 1% sales representing an opportunity for Zapp’s.

Within Capturing Occasions, our focus is expanding usage via variety/multipack innovation to address consumers' preference for portioned packs and seasonal offerings that are designed to attract consumers that are engaging in celebration. In 2024, we introduced a portfolio of variety/multipacks across our Power Four Brands and our Targeted Brands.

Our Approach to Product Innovation

Given our long-standing customer relationships, broad production capabilities, and scalable distribution platform, we plan to continue expanding our presence in certain salty snack sub-categories that we believe are highly synergistic to our existing business. We intend to continue to expand our presence in key salty snack sub-categories through a combination of line extensions of our existing brands, new brand introductions, licensing partnerships with established brands, and/or acquisitions. We believe our expanded presence across key salty snack sub-categories will enhance our competitive position with customers and allow us to leverage our existing manufacturing and distribution infrastructure.

As such, the level of new product innovation and the speed to market with these innovations are critical components of our business. Our innovation process begins with our marketing team, which understands our brands and consumers, and works collaboratively with our research & development and innovation leaders to identify new product opportunities that best suit our brand positions. We develop insights about unsatisfied consumer needs using our market research capabilities, and we track competitive product introductions to ensure appropriate responses. We also collaborate with third-party seasoning and flavor houses to understand the latest trends in consumer flavors and emerging consumer flavor preferences. Going forward, we intend to continue to increase our investments in market research and other resources to generate more consumer insights and new product innovations.

We also utilize our flexible manufacturing and distribution platform to streamline the new product innovation process from idea conception through development and commercialization to market. The strategic location of our primary corporate office adjacent to our largest manufacturing plants facilitates strong coordination between our marketing, sales, research & development, and manufacturing professionals, leveraging the innovation experience of senior management and our in-house innovation leaders. Our broad in-house manufacturing capabilities across different product forms and packaging allow us to develop and commercialize new products quickly, and we have the manufacturing flexibility to handle many types of ingredients, including on-trend BFY oils such as avocado and olive. Our DSD distribution system allows us to efficiently experiment with new products at retail stores driven by the ability to quickly place new items and collect immediate feedback on sell-through trends. Finally, given the importance of in-store presence, we are working with world-class design agency partners to implement new packaging, impactful point-of-sale materials, and retail-ready displays.

Marketing, Advertising, and Consumer Engagement

Our marketing strategy is focused on driving stronger consumer pull for, and building brand equity of, our Branded Salty Snacks. We conduct marketing efforts through three principal sets of activities: (i) consumer marketing and advertising, including digital and eCommerce, social media, sponsorships, and other consumer promotions; (ii) consumer sales incentives including coupons and rebates; and (iii) trade promotions to support features, displays and other merchandising of our products by our customers. Historically we have relied more heavily on sponsorships, trade promotions, and in-store merchandising for consumer engagement; however, we are making shifts of spending more on consumer awareness and brand-building advertising. In fiscal year 2024, we spent approximately $17.8 million related to consumer marketing and advertising and $33.8 million in cooperative advertising. Consistent with our value creation strategies, we intend to continue to increase our investments in digital and social consumer marketing and advertising focused on our Branded Salty Snacks as well as continue to allocate our current mix of media spending toward activities we believe will generate the highest return on investment. We will continue to expand our investments in digital and social media, including as part of our strategy to grow our eCommerce and retailer marketing investments. We believe these marketing strategies will drive long term net sales growth by increasing brand equity, and supporting geographic expansion.

Customers

In fiscal year 2024, our top 10 customers, all of which are retailers, represented approximately 40% of our invoiced sales, and one customer provided in excess of 10% of our net sales in fiscal year 2024. Although orders are processed through purchase orders, as opposed to volume commitments, we have historically benefited from long-term relationships with our key customers, having a sales relationship for more than 20 years on average across our top 15 retail customers.

International

Substantially all of our invoiced sales occurred in the United States in fiscal year 2024, and we are focused on growing our business in the United States. Since substantially all of our business is in the United States, we believe we have more limited exposure to global economic conditions and foreign exchange fluctuations than companies with more substantial international sales and operations.

Competition

Our products primarily compete with other salty snacks but also compete more broadly for certain eating occasions with other snack foods. We believe that the principal competitive factors in the salty snacks industry include taste, convenience, product variety, product quality, price, nutrition, consumer brand awareness, media and promotional activities, in-store merchandising execution, customer service, cost-efficient distribution, and access to retailer shelf space. We believe we compete effectively with respect to each of these factors.

The salty snacking industry is competitive and includes a number of diverse participants. Our principal identified competitors include PepsiCo (Frito Lay), Campbell’s (Snyder’s-Lance), Kellanova (Pringles)(to be acquired by Mars), General Mills, Grupo Bimbo, Hershey’s, Hain Celestial, and Arca Continental (Wise), among others. Our products also compete with private label or retailer-branded salty snacks. However, private label branded salty snacks represented only approximately 6.7% of U.S. category retail sales for the year ended December 29, 2024, less than its approximately 7.0% average share of retail sales since 2019.

Historically, the salty snacks category has benefited from favorable competitive dynamics, including low private label penetration and category leaders who compete primarily via marketing and innovation. Importantly, as of December 29, 2024, we are the #2 brand platform in our Core Geographies, and our brands represent approximately 7% of total salty snacks category retail sales in our Core Geographies based on Circana data. As of December 29, 2024, in our Core Geographies, we have the #2 position in pork skins, pretzels and cheese snacks with 17%, 14% and 7% of sub-category retail sales, respectively. We have the #3 position in potato chips and tortilla chips with 11% and 4% of sub-category retail sales, respectively. We believe we have a strong and defensible position in our Core Geographies with a significant opportunity to enhance our national position by expanding sales in Expansion Geographies (where we represent 2.8% of category retail sales). As of December 29, 2024, we are the #4 salty snack brand platform in the U.S., representing 4.3% of total salty snacks category retail sales.

Notably, in 2024, approximately $2.8 billion of salty snack retail sales were generated by approximately 1,200 smaller competitors, each with retail sales of less than $200 million. We believe this fragmented group of smaller brands provides an attractive opportunity for us to expand our retail sales by either acquiring or gaining share from smaller regional or product-specific competitors.

Supply Chain

Sourcing. The principal ingredients used to manufacture our products include potatoes, oil, flour, wheat, corn, cheese, spices, and seasonings. Our primary packaging materials include flexible films and rigid containers, such as barrels, lids, cartons, and trays. All of our core ingredients are purchased according to rigorous standards to assure food quality and safety. Our principal ingredients are generally available from multiple suppliers but became more difficult to source beginning in 2021 and continuing into 2024 due to ongoing supply chain constraints. We do not source any of our top 10 inputs under any single-supplier arrangement. As such, we have been able to make satisfactory alternative arrangements in the event of this interruption of supply from our suppliers. No single category of direct material purchases represented more than 15% of our Cost of Goods Sold in fiscal year 2024. In addition to raw ingredients and packaging, we source energy and liquid fuels for our manufacturing facilities and in-house distribution assets.

We utilize various buying strategies to mitigate the impact of changes in input prices, including fixed-price forward purchases as well as commodity hedging arrangements with third parties (particularly for energy, vegetable oils, wheat, and corn). A number of external factors such as weather, commodity markets, and governmental or agricultural programs can affect the cost of raw materials used in our products. To provide greater visibility and mitigate risks, we typically look to enter into pricing arrangements covering a meaningful portion of our forecasted purchases over the next three to 18 months. As of December 29, 2024, we estimate that we have entered into pricing arrangements covering approximately 36% of our budgeted direct material needs in fiscal year 2025.

Manufacturing. As of December 29, 2024, we manufacture our products primarily through eight company-operated manufacturing facilities across the United States. These include three legacy Utz facilities and five facilities that were added over the last ten years from acquisition (for more details see Item 2 “Properties” in this Annual Report on Form 10-K for more details). Our facilities have the capacity to produce approximately 500 million pounds of salty snacks annually based on management’s estimate of available capacity, excluding weekly sanitation, over a seven-day work schedule, providing us with significant available capacity to accommodate increased sales. We believe this available capacity across our manufacturing footprint will enable us to leverage existing fixed costs to generate higher margins on incremental organic sales or acquired brands as well as generate potential future cost savings through consolidating our manufacturing footprint. Our manufacturing facilities are well-maintained, and we have a program to ensure appropriate maintenance capital expenditures are undertaken. While we are purposefully shifting toward moving manufacturing in-house, we also continue to utilize several co-manufacturers for certain products, with the most significant being our OTB branded tortilla chips as well as branded salsa and queso. During fiscal 2022, we began investing in talent and process improvements, associated with setting up our integrated business planning (“IBP”) process, which uses supply and demand planning to optimize manufacturing and other supply chain and logistics processes.

Distribution. We offer national distribution of our products through our flexible, hard-to-replicate distribution system that combines DSD, DTW, direct-to-consumer and distributor capabilities. We believe this hybrid system, which we have built and enhanced over nearly a century, offers us flexibility to cost-effectively distribute our products to a wide range of retail locations where salty snacks are sold. Additionally, we believe our distribution system is highly scalable, resulting in the ability to drive higher margins on incremental revenues and enabling us to realize significant cost savings when integrating acquired brands onto our established platform.

We have historically expanded the geographic reach of our distribution network from our Core Geographies, where we benefit from strong brand awareness and heritage, to our Expansion Geographies, where we have expanded both organically and through acquisitions. During the fiscal year ended December 29, 2024, we were able to expand our market share in our Expansion Geographies. We plan to continue to expand our distribution and sales of Branded Salty Snacks in these geographies, supported by our increased brand investments, expansion of our direct-to-customer and DSD distribution capabilities, and potentially through strategic acquisitions.

Direct-to-Warehouse: For a number of our customers, we either ship products directly from our facilities to their distribution centers or allow them to pick-up products directly from our facilities. These customers are then responsible for fulfilling shipments to their own retail stores. The DTW model is often preferred by some of our national mass, club, and grocery customers that have sufficient scale and capabilities to efficiently manage distribution and replenishment for their own retail stores.

Direct-Store-Delivery: We are one of few scaled U.S. salty snack providers with extensive DSD capabilities. Within our DSD system, our IOs pick up products from our manufacturing facilities, distribution centers, storage facilities, or small bins and distribute and sell these products to retail stores within a geographic territory. Our DSD system provides service to both large and small customers, and it provides us a competitive advantage in expanding distribution, increasing shelf space, executing in-store merchandising activities, and ensuring products are fresh and available wherever consumers shop. Our DSD network includes approximately 2,500 routes reaching over 81,500 retail stores in 2024. While we expect to have a small number of routes under the ownership of the Company as we acquire and re-sell routes as part of our normal operations, as of December 29, 2024, substantially all of our DSD routes are managed by IOs. Over the last several years, we have converted from a predominately company-owned route sales professionals ("RSP") model toward the use of IOs. We believe this transition benefits us by creating motivated IOs and a more variable cost structure for our company. (See “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations of Utz Brands Holdings — Recent Developments and Significant Items Affecting Comparability — Independent Operator Conversions” for more details).

Third Party Distributors: We also use third-party distributors in certain regions where their capabilities enhance the cost effectiveness and reach of our overall distribution system. For third-party distributors, we either ship products directly from our facilities to their distribution centers or allow them to pick up products directly from our facilities. The distributors are then responsible for selling our products to our customers and ensuring optimal retail presence within the stores they serve, utilizing both DTW and DSD capabilities. Our third-party distributors operated an additional approximately 500 DSD-style routes, reaching over 15,000 retail stores.

Direct-to-Consumer: We also distribute our products directly to consumers. Our direct-to-consumer shipments primarily originate from orders received via our company website (www.utzsnacks.com) or select third party retailer sites, including Amazon and Sam’s Club, which extend our reach to virtually every household in America. Our direct-to-consumer shipments are delivered from our central warehouse facility to consumers using FedEx, U.S. Postal Service, or other third-party carriers and is an accelerating part of our business, with the channel having grown significantly since 2019.

Food Safety and Quality: Food safety and quality are top priorities and we dedicate substantial resources to ensure that consumers receive consistently safe and high-quality food products. Our products are manufactured in facilities that have programs and controls in place regarding consistent quality and food safety. These comprehensive programs include Safe Quality Food (SQF) certifications and Good Manufacturing Practices (GMPs) that are designed to produce a safe, wholesome product. Our suppliers are required to have similarly robust processes in place and confirm their compliance for shipments of all ingredients to be used in our products. Finally, in addition to real-time product testing during production, we frequently monitor product attributes including taste, aroma, texture, and appearance, and random samples of finished goods are regularly sent to third-party laboratories for testing and verification.

Human Capital Resources

Our values lead the way we work and are rooted in over a century of heritage that focuses on our people. Acting with respect, working collaboratively and in an integrated way, focusing on ownership and accountability, and continuously pursuing excellence are core values that have underpinned our success in attracting, engaging, and developing our associates. Our Board of Directors (“Company Board”), Company Board committees, and Executive Leadership management oversee various associate initiatives including compensation and benefits programs, succession planning, leadership development, and diversity, equity and inclusion. We aim to both attract and engage a qualified workforce through competitive compensation and benefits, training and development opportunities, as well as through listening initiatives designed to uncover opportunities to improve the ways we work.

Inclusivity

We recognize that the diverse perspectives and backgrounds of our associates are vital to maximize our performance, and by embracing a workplace where every associate feels that they are valued and that they can contribute not only to our success, but to their success as well, we believe that we are able to provide high-quality products for our consumers, drive efficiencies for our business and business partners, and improve our results for our stockholders.

To foster a work environment that values all people, Utz partnered with a nationally recognized consulting firm to help develop a comprehensive strategy, which includes various aspects of human resources, including recruiting, training, and leadership development. We developed a three year strategy that is underway that includes various initiatives, projects and actions that have yielded positive results.

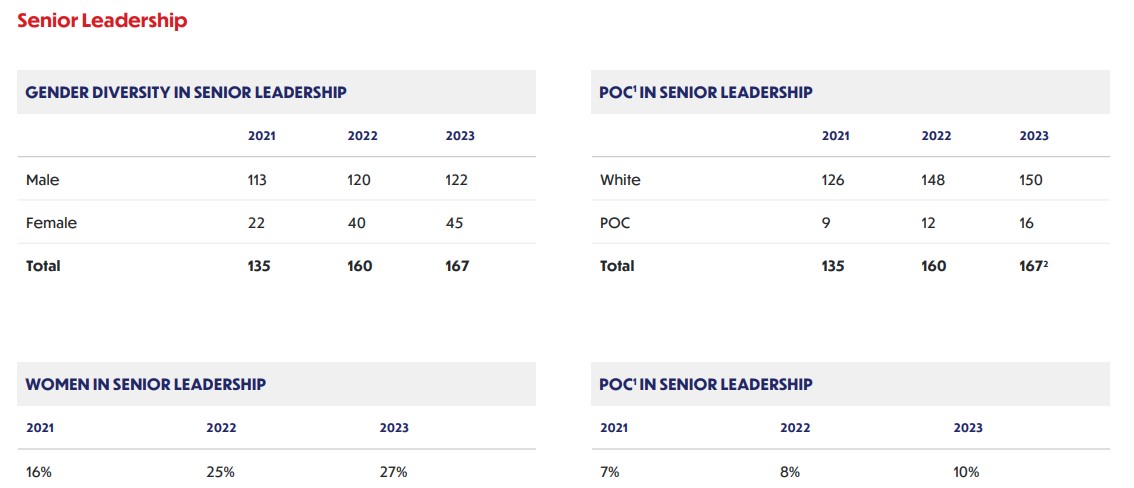

As of our 2023 ESG report published in August 2024, our associate demographics in the U.S. (based on self-reported data from our associates) were:

1 Includes all races except White.

2 One associate did not specify a self-identified race but was included in the total; however, this individual's data was not reflected in either the White or POC categories

Health and Safety

We believe that a safe and healthy workplace is essential and that the safety, health and well-being of our associates is one of our most important responsibilities. Our approach to operational health and safety is based on creating a culture of collective learning to build systems that safeguard all of our associates.

Our health and safety approach is the foundation for keeping our associates and workplaces safe and secure, and is aligned with Occupational Safety and Health Association's ("OSHA") 1910 standards and meet all regulatory requirements. We also look to International Organization for Standardization and other respected standards to inform our approach.

The pillars of our health and safety approach are as follows:

•Associate engagement: Leading indicators are used to both encourage and measure regular safety related activities throughout the organization;

•Training: Safety trainings relevant to each work group’s operation are distributed throughout the organization monthly, quarterly and/or annually;

•Compliance: Regular audits in various formats are used to review and ensure compliance with applicable agency regulations; and

•Performance metrics: Traditional OSHA metrics are maintained on a quarterly and annual basis to measure actual performance and help identify continuous improvement opportunities.

Total Rewards

We have a demonstrated history of investing in our workforce by providing competitive wages and benefits. Our benefits package includes:

•Comprehensive health insurance coverage to associates working 30 hours or more each week;

•Parental leave to all new parents for birth, adoption or foster placement;

•Short term disability to provide partial wage protection for up to 13 weeks;

•Participation in the Employee Stock Purchase Plan;

•Wellness and disease management programs, health advocacy partner and associates assistance programs;

•Health & Wellness Center – free to all Hanover-based associates and dependents covered under the health plan; and

•401(k) plan with competitive company match and profit sharing.

Associate Headcount

As of December 29, 2024, we employed approximately 3,000 full-time associates and 200 part-time associates.

Over the last several years, we have meaningfully reduced our number of full-time associates and our selling, distribution and administrative expenses through our business transformation initiatives, particularly our DSD shift from RSPs to IOs and the associated restructuring of our sales management and corporate organization structure (see “— Supply Chain — Distribution” and "Part II, Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations of Utz Brands Holdings — Recent Developments and Significant Items Affecting Comparability —Independent Operator Conversions” for more information). Additionally, we have reduced the number of associates and operating expenses through several network optimization initiatives that reduced our plant footprint by three plants in fiscal year 2023 and consolidated certain of our transportation and warehousing operations. In the first quarter of fiscal year 2024, we further reduced our number of full-time associates and our selling, distribution and administrative expenses through our business transformation initiatives, including the Good Health and R.W. Garcia Sale and Manufacturing Facilities Sale, which further reduced our plant footprint by an additional five plants.

Sustainability

We recognize the importance of ESG issues for all stakeholders. We use leading ESG and sustainability frameworks and guiding principles, such as the Sustainability Accounting Standards Board ("SASB"), the Task Force on Climate-related Financial Disclosures ("TCFD") and the U.N. Sustainable Development Goals ("SDGs"), as well as stakeholder engagement to inform our ESG program. We recognize our responsibility to uphold the Company’s founding values, which for more than 100 years, have centered on working ethically, responsibly, and with integrity to benefit all of our stakeholders. We consistently look for ways to make a positive difference for our associates, customers and in the communities in which we operate. By collaborating with stakeholders, including associates, consumers, business partners, suppliers, stockholders and customers, we are taking the necessary steps to become a more sustainable company. We believe that it is in our stakeholders’ best interests that we place safety-focused, sustainability-minded, and transparent best practices at the heart of our operations. With this stakeholder framework, in 2020 we formed our ESG Committee, composed of subject matter experts from across our operations, including facilities management, packaging innovation, human resources, corporate governance, legal affairs and communications.

We released our 2023 ESG Report in August 2024, which outlines our strategic priorities for ESG matters and the continued growth of our sustainability program. To learn more about our sustainability goals, progress and initiatives, access the ESG Report by clicking “ESG” on our Investor Relations website at www.investors.utzsnacks.com. See “Available Information” below for additional information regarding our website.

Intellectual Property

We own numerous domestic and foreign trademarks and other proprietary rights that are important to our business. These include the U.S. trademark registrations, which protect certain rights in the following brands: Utz, ON THE BORDER, Zapp’s, Golden Flake, Boulder Canyon, Hawaiian, TORTIYAHS!, Tim’s Cascade, Snyder of Berlin, “Dirty”, Kitchen Cooked, and Bachman and Jax, among others. Depending upon the jurisdiction, trademarks are valid as long as they are used in the regular course of trade and/or their registrations are properly maintained.

We also maintain rights to the domain names www.utzsnacks.com and www.getutz.com, among others.

We believe the protection of our intellectual property, particularly our trademarks, trade dress, trade secrets, copyrights and domain names, is important to our success. We aggressively protect our intellectual property rights by, among other methods, relying on a combination of watch services and enforcement under intellectual property laws and/or through the domain name dispute resolution system.

In addition, from time to time, we may be subject to legal proceedings and claims in the ordinary course of business. We take proactive measures in attempts to avoid infringement of third party marks by conducting trademark clearance searches and taking other industry standard measures. However, this does not prevent third parties from asserting claims against us. We have received, and may in the future continue to receive, claims from third parties asserting, among other things, infringement of their intellectual property rights. The results of any current or future litigation cannot be predicted with certainty and regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources, and other factors. See Part I, Item 1A, “Risk Factors — Potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries or investigations can have an adverse impact on our business, financial condition or results of operations.” Moreover, future litigation may be necessary to defend ourselves, our partners, and our customers by determining the scope, enforceability, and validity of third-party proprietary rights or to establish our proprietary rights.

We also license certain third-party brand names for use on our products, including the Grillo’s Pickles, and Mike's Hot Honey. We use these trademarks in connection with production and distribution of snack products to be sold under the trademarked labels. Under some of the agreements governing our use of such trademarks, we are required to make guaranteed annual royalty payments. Sales under our trademark licensing agreements represent approximately 1% of our 2024 invoice sales.

In addition, we license certain of our owned brands, including Utz, for use by third parties in certain food categories (such as frozen foods), however these arrangements do not materially impact our results of operations or financial position. Finally, we have historically engaged in certain cross-marketing and/or promotional activities with third parties, thereby increasing the visibility of our brands.

Seasonality

Although the demand for our products is relatively stable throughout the year as compared to other consumer goods, we have experienced in the past, and expect to continue to experience, seasonal fluctuations in our retail sales as a result of consumer and customer spending patterns. Historically, the months of April to September, as well as December have resulted in higher retail sales than average due to increased consumer demand during the spring and summer months and holiday season, as well as significant retailer merchandising and promotions around those times. Additionally, we have historically generated seasonal cash flow from decreases in working capital levels in the fourth quarter and invested cash flow in working capital increases in the first quarter. We expect these historical trends to continue in the future.

Government Regulation and Compliance

We are subject to various laws and regulations in the United States by federal, state and local government authorities. In the United States, the federal agencies governing the manufacture, distribution and advertising of our products include, among others, the Federal Trade Commission (“FTC”); the U.S. Food and Drug Administration (“FDA”); the United States Department of Agriculture (“USDA”); the U.S. Environmental Protection Agency ("EPA"); and the OSHA and similar state and local agencies. Under various statutes, these agencies, among other things, prescribe the requirements and establish the standards for quality and safety and regulate marketing and advertising to consumers.

We are subject to labor and employment laws, laws governing advertising, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate retailers or govern the promotion and sale of merchandise. Our operations, and those of our distributors and suppliers, also are subject to various laws and regulations relating to environmental protection and worker health and safety matters. We monitor these regulatory requirements and our compliance on a regular basis.

Available Information

Our website is www.utzsnacks.com. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this Annual Report on Form 10-K. We file or furnish annual, quarterly and current reports, proxy statements and other information with the United States Securities and Exchange Commission (“SEC”). You may obtain a copy of any of these reports, free of charge, from the Investors Relations section of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains an Internet site that also contains these reports at: www.sec.gov. In addition, paper copies of the Company's annual report will be made available, free of charge, on written request to the Company.

Item 1A. Risk Factors

Our business is subject to numerous risks and uncertainties. You should carefully consider the following risks as well as the other information included in this Annual Report on Form 10-K. We operate in a changing environment that involves numerous known and unknown risks and uncertainties that could materially adversely affect our operations. Any of the following risks could materially and adversely affect our business, financial condition, results of operations or prospects. However, the selected risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition, results of operations or prospects. In such a case, the trading price of our securities could decline, and you may lose all or part of your investment in us.

Risks Related to Our Business

We operate in the highly competitive and increasingly consolidated snack food industry. If we are unable to compete effectively, it may reduce our ability to sell our products to our customers or consumers.

The sales of most of our products are subject to significant competition due to factors including product quality and taste, brand awareness among consumers, access to shelf space at retail customers’ locations, price, advertising and promotion, innovation of on-trend snacks, variety of snacks offered, nutritional content, product packaging and package design. We compete in the snack food market against numerous multinational, regional and local companies, as well as emerging companies, including in the BFY product subcategory, principally on the basis of product taste and quality, but also brand recognition and loyalty, price, marketing, advertising and the ability to satisfy specific consumer dietary needs.

Due to the competitive landscape in the snack food industry, price increases for our products that we initiate or failure to effectively advertise and promote our products may negatively impact our financial results if not properly implemented or accepted by our customers, IOs, third-party distributors or consumers. Substantial advertising and promotional expenditures may also be required to maintain or improve our brands’ market position or to introduce a new product to the market, and participants in our industry may be engaging in new advertising trends or channels which we are not. Historically, we have offered a variety of sales and promotion incentives to our customers, IOs, third-party distributors and consumers, such as price discounts, consumer coupons, volume rebates, cooperative marketing programs, product placement fees and in-store displays, often in connection with seasonal social events, holidays and sporting events. The promotional environment has intensified in recent years, including but not limited to robust promotional launches, and .we have been, and may in the future be, limited in our ability to increase prices or adjust product sizes sufficiently on a timely basis, or at all, in order to offset increased input costs, such as raw materials, packaging, energy, freight, labor, and overhead costs or other expenditures, such as advertising and promotion costs, which has the effect of reducing overall sales volume, revenue and operating profit. In addition, advertising and promotional expenditures may be ineffective if consumers prioritize price over other factors and purchase lower-cost alternatives, such as private label, generic or store branded products.

Our ability to compete may also be dependent on the availability of product category-appropriate snack aisles at our retail customers’ locations and whether our products are placed in the appropriate snack aisle, such as the BFY snack food aisle or in the traditional snack food aisle. An increasing focus on BFY products and other specialty products in the marketplace will likely increase these competitive pressures within the category in future periods. Further, companies in the BFY product segment providing innovative or trendy snack foods often receive investments from private equity, venture capital or other investors, who may be more willing to accept lower product margins or sustained losses in order to gain market share. If such emerging companies are able to attract a loyal consumer base through more innovative or trendier snack foods or offer their snack food products at lower prices than us, our market share and results of operations may be materially and adversely affected.

If our advertising or promotional efforts do not increase brand awareness or sales of our products, our expenses may increase without a corresponding increase in revenue, and our operating profit may be reduced. Additionally, if market prices for certain inputs decline significantly, in some instances we may be required by contract to pay customers the difference or experience customer pressure to reduce the prices for our products, which could lower our revenue and operating profit.

There is continuing consolidation in the snack food industry and in retail outlets for snack foods by other market participants. Although we benefit from the execution of our own acquisition strategy within the snack food industry and with respect to snack distribution channels, ongoing consolidation in the snack food industry and retail outlets by others may prevent us from effectively competing if others in the industry that have greater resources than us or if retail customers or potential retail customers enter into long-term purchase contracts or promotional arrangements. Significant consolidation by others increases the possibility that we could lose one or more major customers, lose existing product authorizations or shelf space at customer locations, or lose market share. For example, our competitors vie for the same shelf placement and may offer incentives to retail customers that we cannot match, particularly as a result of consolidation. Even if we obtain shelf space or preferable shelf placement for any of our brands, our new and existing products may fail to achieve the sales expectations set by our retail customers, potentially causing these retailers to remove our products from the shelf or place them in less favorable locations. Additionally, an increase in the number and quality of private-label products in the product categories in which we compete has reduced available shelf space and could continue to hamper the placement for our branded products, which could adversely affect our sales. To obtain and keep shelf placement for our products, we may need to increase our marketing and advertising spending in order to create consumer awareness, protect and grow our existing market share or to promote new products, which could impact our operating results. We also consistently evaluate our product lines to determine whether it may be necessary to discontinue certain products. Discontinuing product lines may increase our profitability but could reduce our sales and hurt our brand and consumer loyalty, and a reduction in sales of certain of our products could result in a reduction in sales of other of our products.

Our reliance on key customers and consolidation within the retail industry, in tandem with a rise in hard discounters, may limit our ability to obtain favorable contractual terms and protections with customers and maintain our profitability.

Our business relies heavily on maintaining strong relationships with key customers, including wholesale distributors, grocery stores, convenience stores, discount stores, mass merchandisers, membership club stores, hard discounters, specialty retailers, and e-commerce platforms. Given the limited number of retail customers in the U.S. grocery market, the loss of, or a significant reduction in sales to, any key customer can adversely affect our business, financial condition, or results of operations. Any significant dispute, change in the financial condition of a key customer, or reduction in sales to a key customer could have a detrimental impact on our business. Accordingly, our ability to negotiate key terms may be constrained by our need for limited shelf space, our reliance on key customers, and increasing consolidation within the industry. See Customers within Part I, Item 1 Business for further discussion of our exposure to large customers.

As retail customers continue to consolidate and our retail customers grow larger and become more sophisticated, our consolidated retail customers may demand lower pricing and increased promotional programs. If we lower our prices or increase promotional support for our products and are unable to increase the volume of our products sold, our profitability and financial condition may be adversely affected. In addition, our customers offer branded and private label products that compete directly with our products for retail shelf space and consumer purchases. Accordingly, there is a risk that our customers may give higher priority to the products of our competitors. In the future, our customers may not continue to purchase our products or provide our products with adequate levels of promotional support. It is also possible that our customers may replace our branded products with private label products.

Retailers in the grocery industry also often charge product placement fees for access to shelf space and require manufacturers to participate in promotional and advertising arrangements. These arrangements can result in substantial costs for promotion allowances, cooperative advertising, and product or packaging damages. As the retail grocery industry becomes more competitive and consolidated, retailers are increasingly passing on unanticipated promotional and advertising costs to manufacturers and distributors. Additionally, retailers are more frequently taking deductions for damaged, undelivered, or unsold products, or returning unsold products to manufacturers and distributors. These practices can significantly harm our operating results and liquidity. An unresolved disagreement with a retail customer over these charges could disrupt or terminate the customer relationship, leading to an immediate reduction in sales and liquidity. Because of the limited number of retail customers in the U.S. grocery market, the loss of even a single retail customer, a single stock-keeping unit previously maintained by a retail customer, or a customer of one of our significant IOs or third-party distributors, could have a long-term negative impact on our financial condition and net sales.

Furthermore, we do not have many contracts with our customers that require the purchase of a minimum amount of our products. This lack of firm, long-term or short-term volume purchase commitments means we experience periods with no or limited orders, while still incurring fixed costs to maintain our workforce and other expenses. During such periods, we may not be able to find new customers quickly enough, due, in part, to the consolidation in the retail industry, to offset the reduced purchase orders, which could adversely affect our net income. Unanticipated fluctuations in product requirements by our customers could also result in significant fluctuations in our results.

Meanwhile, the rapid expansion of hard discounters, which focus on selling a limited number of predominantly private label items, may reduce our ability to sell products through these retailers and lead to consumer price deflation, affecting our relationships with key traditional retail customers. Failure to respond appropriately to the expansion of hard discounters could reduce our market share and adversely affect our business, financial condition, or results of operations. If hard discounters continue to gain market share from traditional retailers, or if we fail to adapt to the changing retail landscape, our profitability and market share could be significantly impacted.

Demand for our products may be adversely affected by changes in consumer preferences and tastes or if we are unable to innovate or market our products effectively, which could reduce our revenues.

We are a consumer products company operating in highly competitive markets, and we rely on continued demand for our products. To generate revenue and profits, we must sell products that appeal to our customers and consumers. Any significant changes in consumer preferences or any inability on our part to anticipate or react to such changes could result in reduced demand for our products and erosion of our competitive and financial position. Our success depends on our ability to respond to consumer trends regarding food, including increasing concerns of consumers regarding health and wellness, obesity, product attributes and ingredient sourcing and content, as demonstrated through the BFY movement in our industry, and other matters relating to our operations, including packaging and shipping practices. In addition, changes in product category consumption or consumer demographics could result in reduced demand for our products. Consumer preferences may shift due to a variety of factors, including the changes in social trends and activity patterns. Any of these changes may affect consumers’ willingness to purchase our products and negatively impact our financial results.

Our continued success also is dependent on product innovation, such as new flavors and formats, as well as the introduction of BFY products in response to evolving consumer preference. In order to successfully compete within our industry, we must maintain a robust pipeline of new products, and effective advertising and promotional campaigns, marketing programs and product packaging. Although we devote significant resources to meet this goal, we may not be able to continue to develop and launch successful new products or variants of existing products, or to effectively execute advertising and promotional campaigns and marketing programs.

Consumers’ loyalty to our brands may change due to factors beyond our control, which could have a material adverse effect on our business and operating results.

Our business currently depends in large part on repeat purchases by the same consumers, many of whom are based in our Core Geographies where we have built strong regional brands and distribution capabilities. We believe this purchasing pattern is indicative of loyalty to our brands. However, these consumers could stop or materially reduce purchasing our products at any time, including due to changing consumer trends, increasing household debt, negative publicity regarding our brand, real or perceived quality or health issues with our products, an increased preference for BFY brands or other specialty brands by consumers, the availability of premium-branded or lower-priced alternative snack products, or for no reason at all. Loss of consumers’ loyalty to our brands and the resulting decreased sales to consumers could have an adverse effect on our business and operating results.

Our reputation or brand image might be impacted as a result of issues or concerns relating to the quality and safety of our products, ingredients or packaging, processing techniques, which in turn could negatively impact our operating results.