Inhibrx, Inc.

11025 N. Torrey Pines Rd., Suite 200

La Jolla, CA 92037

September 23, 2022

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549

Attention: Sasha Parikh and Tracie Mariner

Re: Inhibrx, Inc.

Form 10-K for the Fiscal Year Ended December 31, 2021

Filed February 28, 2022

Form 10-Q for the Fiscal Quarter Ended June 30, 2022

Filed August 8, 2022

File No. 001-39452

Dear Sir or Madam:

This letter sets forth responses of Inhibrx, Inc. (the “Company” or “we”) to the comments of the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (“SEC”) set forth in your letter, dated September 15, 2022, with respect to the above referenced Form 10-K for the fiscal year ended December 31, 2021 (the “Form 10-K”) and Form 10-Q for the fiscal quarter ended June 30, 2022 (the “Form 10-Q”).

The text of the Staff’s comments has been included in this letter for your convenience, and we have numbered the paragraphs below to correspond to the numbers in the Staff’s letter. For your convenience, we have also set forth the Company’s response to each of the numbered comments immediately below each numbered comment.

Form 10-Q for the Fiscal Quarter Ended June 30, 2022

Item 6. Exhibits, page 43

1.Staff’s Comment:

Please revise your future filings to include the opening language of paragraph 4 related to your internal control over financial reporting in accordance with Item 601 of Regulation S-K for exhibits 31.1 and 31.2. Provide us with your proposed revisions in your response.

Response:

We respectfully advise the Staff that we will revise future filings to include the opening language of paragraph 4 related to our internal control over financial reporting in accordance with Item 601 of Regulation S-K for exhibits 31.1 and 31.2 as follows:

“The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:”

Form 10-K for the Fiscal Year Ended December 31, 2021

Cover Page

2.Staff’s Comment:

We note that your cover page reflects your filing status to be a large accelerated filer and a smaller reporting company. This was also noted on the cover of your Form 10-Q for the period ended June 30, 2022. As your public float as of June 30, 2021 is greater than $700 million, as reported on the front cover of your Form 10-K, it appears you are not eligible to use the requirements for smaller reporting companies under the revenue test to meet the condition to be considered a smaller reporting company. Please address the following points regarding your filer status:

•Tell us how your reported filer status is consistent with Release No. 34-88365: Accelerated Filer and Large Accelerated Filer Definitions; Final Rule.

•Revise the cover page of your document in future filings to report your filer status consistent with the above guidance, and provide us with a summary of such proposed disclosure.

•Tell us how the change in filer status impacts the adoption of recent accounting pronouncements, specifically ASU 2016-13, Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Statements (Topic 362) as disclosed on page 131.

Response:

The Company respectfully acknowledges that we concluded we meet the definitions of both a large accelerated filer and a smaller reporting company in the Form 10-K and Form 10-Q.

Prior to the end of its 2021 fiscal year, the Company was a smaller reporting company. The Company determined that, as of the end of its fiscal 2021 year, it was no longer a smaller reporting company, but rather a large accelerated filer. The Company considered the following definition of a large accelerated filer per SEC’s Release No. 34-88365: Accelerated Filer and Large Accelerated Filer Definitions; Final Rule and SEC Rule, § 240.12b-2: “The term large accelerated filer means an issuer after it first meets the following conditions as of the end of its fiscal year:

(i)The issuer had an aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates of $700 million or more, as of the last business day of the issuer’s most recently completed second fiscal quarter;

(ii)The issuer has been subject to the requirements of section 13(a) or 15(d) of the Act for a period of at least twelve calendar months; and

(iii)The issuer has filed at least one annual report pursuant to section 13(a) or 15(d) of the Act; and

(iv)The issuer is not eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or 3(iii)(B) of the ‘smaller reporting company’ definition in this section, as applicable.”

To reach its conclusion that the Company was a large accelerated filer, the Company considered each of the above conditions as of the end of its most recent fiscal year, December 31, 2021, as follows:

(i)The market value of the voting and non-voting common equity held by non-affiliates exceeded $700 million as of the end of its second quarter of fiscal 2021.

(ii)The Company had been subject to the requirements of 13(a) or 15(d) for a period of more than 12 months as of the end of fiscal 2021.

(iii)The Company had filed an annual report pursuant to section 13(a) or 15(d) of the Act as of the end of fiscal 2021.

(iv)The Company was not then eligible to use the requirements for smaller reporting companies.

We also considered the SEC’s Compliance and Disclosure Interpretations, specifically Regulations S-K CDI 102.01, and Section 5120(C) of the Financial Reporting Manual for the smaller reporting company transition rules:

“Question 102.01

Question: Could a company with a fiscal year ended December 31, 2018 be both a ‘smaller reporting company,’ as defined in Item 10(f), and an ‘accelerated filer,’ as defined in Rule 12b-2 under the Exchange Act, for filings due in 2019, if it was an accelerated filer with respect to filings due in 2018 and had a public float of $80 million on the last business day of its second fiscal quarter of 2018?

Answer: Yes. A company must look to the definitions of ‘smaller reporting company’ and ‘accelerated filer’ to determine if it qualifies as a smaller reporting company and non-accelerated filer for each year. This company will qualify as a smaller reporting company for filings due in 2019 because on the last business day of its second fiscal quarter of 2018 it had a public float below $250 million. However, because the company was an accelerated filer with respect to filings due in 2018, it is required to have less than $50 million in public float on the last business day of its second fiscal quarter in 2018 to exit accelerated filer status for filings due in 2019, as provided in paragraph (3)(ii) of the definition of ‘accelerated filer’ in Rule 12b-2. This company had a public float of $80 million on the last business day of its second fiscal quarter of 2018, and therefore is unable to transition to non-accelerated filer status. As this example illustrates, a company can be both an accelerated filer and a smaller reporting company at the same time. Such a company may use the scaled disclosure rules for smaller reporting companies in its annual report on Form 10-K, but the report is due 75 days after the end of its fiscal year and must include the Sarbanes-Oxley Section 404 auditor attestation report described in Item 308(b) of Regulation S-K. [November 7, 2018] (Regulations S-K CDI 102.01)

An issuer that no longer qualifies as a smaller reporting company at the determination date may continue to use the scaled disclosures permitted for a smaller reporting company through its annual report on Form 10-K and begin providing non-scaled larger company disclosure in the first Form 10-Q of the next fiscal year. (Section 5120(C) of the Financial Reporting Manual)”

Pursuant to the guidance provided above, the Company continued to be eligible to use the scaled disclosures permitted for a smaller reporting company through its annual report on Form 10-K. Accordingly, the Company properly checked both the large accelerated filer and the smaller reporting company boxes on the cover page of its Form 10-K. The Company first reflected its determination that the Company was no longer eligible to use the scaled disclosures by checking only the large accelerated filer box (and not the smaller reporting company box) on the cover page of the Company’s quarterly report on Form 10-Q for the first quarter ended March 31, 2022, which was filed with the SEC on May 9, 2022 (within 40 days after March 31, 2022).

As a large accelerated filer, we considered SEC Rule, § 240.12b-2(3): Entering and exiting accelerated filer and large accelerated filer status:

“(iii) Once an issuer becomes a large accelerated filer, it will remain a large accelerated filer unless: It determines, at the end of a fiscal year, that the aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates (“aggregate worldwide market value”) was less than $560 million, as of the last business day of the issuer’s most recently completed second fiscal quarter or it determines that it is eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the ‘smaller reporting company’ definition in this section, as applicable.”

We also considered paragraph (3)(iii)(B) of the “smaller reporting company” definition:

(iii) Once an issuer determines that it does not qualify for smaller reporting company status because it exceeded one or more of the current thresholds, it will remain unqualified unless when making its annual determination either:

(A) It determines that its public float was less than $200 million; or

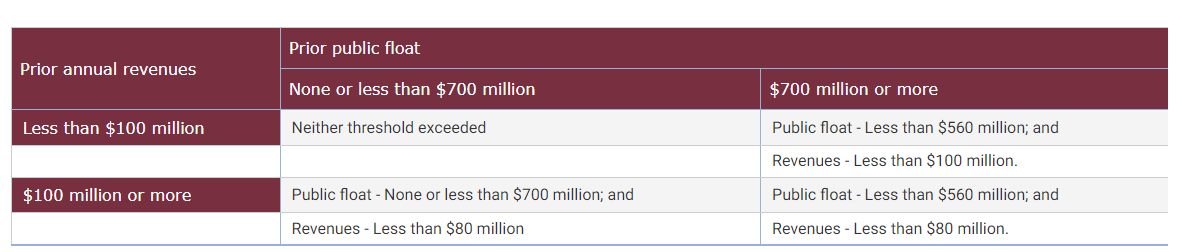

(B) It determines that its public float and its annual revenues meet the requirements for subsequent qualification included in the following chart:

We determined that, as of June 30, 2022, our aggregate worldwide market value and the value of our public float was less than $560 million and that our prior annual revenues were less than $100 million. So, we concluded

that we would be eligible to use the requirements for smaller reporting companies under the revenue test (pursuant to SEC Rule, § 240.12b-2).

We also considered Item 10(f)(2)(i)(C) of Regulation S-K:

“An issuer must reflect the determination of whether it came within the definition of smaller reporting company in its quarterly report on Form 10-Q for the first fiscal quarter of the next year, indicating on the cover page of that filing, and in subsequent filings for that fiscal year, whether it is a smaller reporting company, except that, if a determination based on public float indicates that the issuer is newly eligible to be a smaller reporting company, the issuer may choose to reflect this determination beginning with its first quarterly report on Form 10-Q following the determination, rather than waiting until the first fiscal quarter of the next year.”

Based on the determination that we qualify as a smaller reporting company, we are permitted under Item 10(f)(2)(i)(C) to transition to the scaled disclosure requirements in the Form 10-Q quarterly report corresponding to the determination date’s second fiscal quarter rather than the following fiscal year’s first quarterly report. As such, the Company chose to reflect that determination by checking the smaller reporting company box on the cover page of the Form 10-Q.

Accordingly, the Company properly checked both the large accelerated filer and the smaller reporting company boxes on its Form 10-K and Form 10-Q.

With respect to the recent accounting pronouncements, specifically ASU 2016-13, Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Statements (Topic 362), the Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company was a smaller reporting company at the determination date, and therefore the new standard will be effective for the Company on January 1, 2023.

The Company considered the Financial Accounting Standards Board’s Accounting Standards Updates – Effective Dates:

| | | | | | | | |

| FINAL DOCUMENT | DATE ISSUED | EFFECTIVE DATES |

| Accounting Standards Updates |

| Update 2016-13—Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments | June 2016 | For public business entities that meet the definition of an U.S. Securities and Exchange(SEC) filer, excluding entities eligible to be smaller reporting companies as defined by the SEC, the amendments in this Update are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. For all other entities, the amendments in this Update are effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Early application of the amendments is permitted. |

As noted before, the Company was a smaller reporting company for its fiscal years ended December 31, 2019 and December 31, 2020, so the amendments to 2016-13 are effective for the Company on January 1, 2023. The Company is currently evaluating the potential impact that the adoption of ASU 2016-13 may have on its consolidated financial statements and related disclosure.

We hope that the foregoing has been responsive to the Staff’s comments. If you have any questions related to this letter, please contact Melanie Ruthrauff Levy of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. at (858) 314-1873.

| | | | | | | | |

| Sincerely, |

| | |

| By: | /s/ Kelly D. Deck |

| Name: | Kelly D. Deck, C.P.A. |

| Title: | Chief Financial Officer |

Via E-mail:

cc: Leah Pollema, Esq., Inhibrx, Inc.

Melanie Ruthrauff Levy, Esq., Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.