Letter to�Shareholders �Q1 2022 Momentive | Q1 2022 Exhibit 99.1

The first quarter was all about execution and driving substantial progress on the strategic changes we outlined in our February shareholder letter. Our financial results exceeded the high-end of our revenue and profitability guidance ranges. Revenue from our sales-assisted channel grew in excess of 30% year-over-year for the fourth consecutive quarter. We’re actively addressing the transitory headwinds in our self-serve channel. Non-GAAP operating margin improved to 2% from a negative 1% in Q1 2021. And, we repurchased 2.4 million Momentive shares through March 31. We’re focused on creating value for our customers and shareholders. We have conviction that the plan we’ve put in place will accelerate growth and significantly increase profitability. We have work to do, but our market opportunity is massive, our products are getting stronger every quarter, and our hybrid go-to-market strategy is operating at scale, enabling us to meet customers where they want to buy, and expand with them over time. Q1 was a record-breaking quarter for our sales-assisted channel, reaching a $165 million revenue run rate. Sales-assisted revenue increased 32% year-over-year, the fourth consecutive quarter of 30%-plus year-over-year revenue growth. Leading indicators here outpaced revenue growth. We increased our customer count 55% year-over-year, adding 1,800-plus new customers in the quarter like Ace Hardware, Bosch, CARFAX, Merck, and the US Citizenship and Immigration Services. Our high velocity sales team is helping drive substantial new logo growth - the deal cycles are fast, cost-efficient, and set the foundation for future expansion conversations. In addition, we’re winning larger customer relationships. More than 2,100 organizational customers are now spending more than $25,000 per year with Momentive. And, 700-plus sales-assisted customers are using multiple products - both metrics increasing significantly year-over-year. Our core product -- what we’ve traditionally referred to as surveys -- is resonating with customers of all sizes, across a variety of industries, for various use cases. Customers value the flexibility, ease of use, and power that our platform delivers. For instance, in 2018 Box purchased our core product for customer experience (CX) use cases. Over time, Box has expanded into multiple cases -- including marketing, enablement, internal comms, and HR -- and is expanding again into our insights solutions. Stories like this aren’t isolated - it’s why average customer sizes for sales-assisted core product customers, excluding our newer high velocity sales motion, have increased for eight straight quarters and grew 15%-plus year-over-year in Q1. Revenue 14% YoY RPO 20% YoY Revenue & RPO ($M) Sales-Assisted Channel Customers Operating Margin Sales-Assisted Channel Revenue�(% of total revenue) 55% YoY Dear Shareholders, $102.3 Q1’21 $117.0 Q1’22 $204.9 Q1’21 $245.4 Q1’22 �Q1’22 35% Q1’21 30% �Q1’22 ~13,700 Q1’21 ~8,800�-26% -0.6% Q1’21 -30% 2.3% Q1’22 GAAP Non-GAAP

Similarly, our insights solutions -- what we’ve traditionally referred to as Market Research -- are gaining significant traction. Customers love the speed-to-insight, automated analysis, and response quality; all underpinned by a panel of 175 million global respondents. The VP of Marketing at a large SaaS company tells us that running research with us is seamless, and getting actionable insights was lightning fast. And a multinational agricultural company loves our automated analysis, which enabled them to launch a study on a Wednesday and complete their presentation by Friday. Our Insights solutions generate our largest deals, largest customers, and most productive sales representatives. And in Q2, we’ll begin testing packaging that moves our Insights solutions to a subscription model. In our self-serve channel, Q1 revenue growth of 7% was in-line with our expectations. As reflected in our 2022 guidance, we’re working through two factors to drive durable growth: First, over the past three years we focused on aligning price-to-value for self-serve customers, led by meaningful pricing and packaging experiments to our user base, amending entitlements of both free users and paid users. These actions have driven exceptional growth. And now, we’re moving into the next evolution of our strategy, focused on driving sustainable user growth. Doing so is beneficial for our overall business as we graduate users from single paid plans, to Teams plans, to sales-assisted relationships. Second, we meaningfully shifted focus in 2021 to launch the new Momentive brand - a key tenet of our multi-channel go-to-market strategy to more clearly communicate the value and attributes of our products to customers. We were successful. However, we focused less on supporting the SurveyMonkey brand during that period, which was magnified by distractions from the proposed Zendesk acquisition. The good news: renewal rates are in-line with expectations and we’re not seeing evidence of competitive churn. We believe these challenges are transitory, and we’re addressing them. Led by our new COO Priyanka Carr, the plan is threefold: First, generate high quality user traffic by extending our brand leadership - specifically through new content and SEO strategies, focused brand initiatives, and SEM investments. Further, the days of VC-backed startups bidding on our brand terms without consequence are over - we’re swinging back harder than ever. Momentive | Q1 2022 First Quarter 2022 Highlights OneFootball is a Germany-based football media company. Their app has over 100 million downloads and features live scores, statistics and news from 200 leagues in 12 different languages. OneFootball began their Momentive journey with our SurveyMonkey self-serve offering, and then upgraded to the Momentive enterprise solution to seamlessly integrate with tools that they were already using to create a seamless customer service experience, including Zendesk. They will be using Momentive to capture user feedback to help drive product improvements. Europcar is a leading car rental services provider with locations in over 140 countries. As tourism and business travel has started to increase, Europcar felt that it was the right time to reinvest in optimizing their digital experience, and they chose Momentive. Europcar will be using Momentive to capture insights across their digital channels for user research and conversion rate optimization to help convert more visitors into customers. A leading provider of e-learning software, Articulate was looking to support their growth with a “Voice of Everyone” platform that was scalable, easy to use, and integrated with Salesforce. They chose Momentive to track account health and turn insights into action. “Momentive is built with respondent engagement in mind. Its slick user experience helps keep people engaged and provides the right set of authoring tools to enable scalable surveys.” Carlos Serrato, Director Analytics & Insights Program Management

Second, drive sustainable growth in users by calibrating the features offered in certain package types -- and delivering targeted, high-value functionality enhancements. Third, reduce customer friction by simplifying the buying and onboarding process so customers can adopt our products and realize value quickly. It’s an achievable set of improvements that we believe will benefit leading growth indicators in the self-serve channel starting in the second half of the year. We grew up as a product-led growth company, we are a market leader here, and we have the team in place to execute on the plan. Over the past two months we’ve aggressively pursued the focused strategic changes outlined in our February letter to shareholders - many of which were contemplated in the second half of last year, but delayed given the proposed acquisition. The progress thus far is compelling. We’re out of the gates strong on customer-centric innovation. We’ve re-organized our R&D organization, centralized our product strategy, and prioritized our roadmap around a focused set of opportunities. Our core product is the foundation. It delivers value for customers of all sizes across myriad use cases, feeds our respondent panel, and provides intelligence on what features and use cases our customers value most. We’re focused on strengthening our foundational authoring functionality, extending our admin capabilities, and advancing our analytics maturity. Our core platform extends to purpose-built solutions for markets, products, and brand insights, and customer experience. We’re planning to fuel the momentum we’ve seen in our insights solutions by deepening existing solutions in market, selectively expanding into new use cases, and enhancing our statistical analysis capabilities. And, we’re working to bring GetFeedback’s capabilities closer to our core product, leading to functionality and innovation velocity benefits over time. Momentive | Q1 2022 First Quarter 2022 Highlights (cont.) Momentive has aggressively pursued strategic changes first outlined in its February 28 letter to shareholders. Areas of focus include: Customer-Centric Innovation We’ve reorganized our R&D organization, centralized our product strategy, and prioritized our product roadmap around a focused set of opportunities. Core Product Reinvigoration Traditionally referred to as Surveys, our core product delivers value for customers of all sizes across myriad use cases, feeds our respondent panel, and provides intelligence on what features and use cases customers value most. We’re focused on strengthening the core product’s foundational authoring functionality, extending its administrative capabilities, and advancing its analytics maturity. We’ve begun executing on plans to reinvigorate our self-serve channel and align resources to the products and segments that generate the highest returns in our sales-assisted channel. Additionally, we’re simplifying our positioning and web surfaces under two brands - Momentive and SurveyMonkey. Finally, we’re seeing early success with existing customer expansion, one of our most efficient and profitable go-to-market motions. Go-to-Market Execution Organizational Changes Our streamlined leadership team and organizational structure is leading to faster, higher quality, and customer-centric execution.

Similarly, we’ve made significant progress in a short period of time in our go-to-market strategy and execution. We’ve begun executing on a plan to reinvigorate our self-serve channel. We’ve moved quickly to align our resources to the products and segments generating the highest returns in our sales-assisted channel. Resources are aligned and executing on simplifying our positioning and web surfaces under two brands - Momentive and SurveyMonkey. And, we’re seeing early success in our focus on existing customer expansion, one of our most efficient and profitable go-to-market motions. In Q1, expansion business increased significantly both sequentially and year-over-year, hitting a new high as a percentage of total business generated. Finally, the leadership and organizational changes we made are working. Our streamlined leadership team and organizational structure is leading to faster, higher quality execution - and is reinforcing our focus on customers at the center. Our global team is executing with focus and energy. Have we faced distractions since October? Without a doubt we have. But those who know our history know our resilience has been tested before - and resilience is in our DNA. Our team is focused, committed and all-in on our mission. We’re energized to be back running the business at full steam. And if a more challenging macro environment rewards companies with balanced growth and expanding margins, we like our chances. Momentive | Q1 2022 First Quarter 2022 Highlights (cont.) Box is the leading Content Cloud, a single platform that empowers organizations to manage the entire content lifecycle, work securely from anywhere, and integrate across best-of-breed apps. In 2018, Box became a Momentive customer to build out a customer experience (CX) program to better connect their employees to direct customer feedback. Today, Box has expanded its use of Momentive into multiple use cases, including customer education, marketing, internal communications, HR, and internal training and enablement. Additionally, Momentive’s ability to easily integrate with other solutions, including Salesforce and Slack, has allowed Box to easily feed data into other systems so that frontline employees can access and leverage information seamlessly. With the value they've seen, Box has both renewed with Momentive and expanded their relationship to include additional Momentive solutions, including our insights solutions. ZoomCare provides on-demand urgent, primary, and specialty care with board-certified providers in 60 clinics. In need of a solution to fuel their patient-centric culture with user insights, they turned to Momentive. Momentive will help ZoomCare establish a baseline for customer satisfaction and continue to find new ways to innovate and delight its users. Additionally, ZoomCare will measure employee engagement levels and test and hone their communication strategy over time. With Momentive, ZoomCare can impact both customer and employee experience in a comprehensive, data-driven way. “One crucial aspect of our work is that we serve a population that is traditionally overlooked, especially as it pertains to healthcare. The ability to talk directly to this group of individuals was imperative for us to do the kind of research we wanted to do — only Momentive could provide us with those insights.” Shelley DuBois, Vice President of Marketing

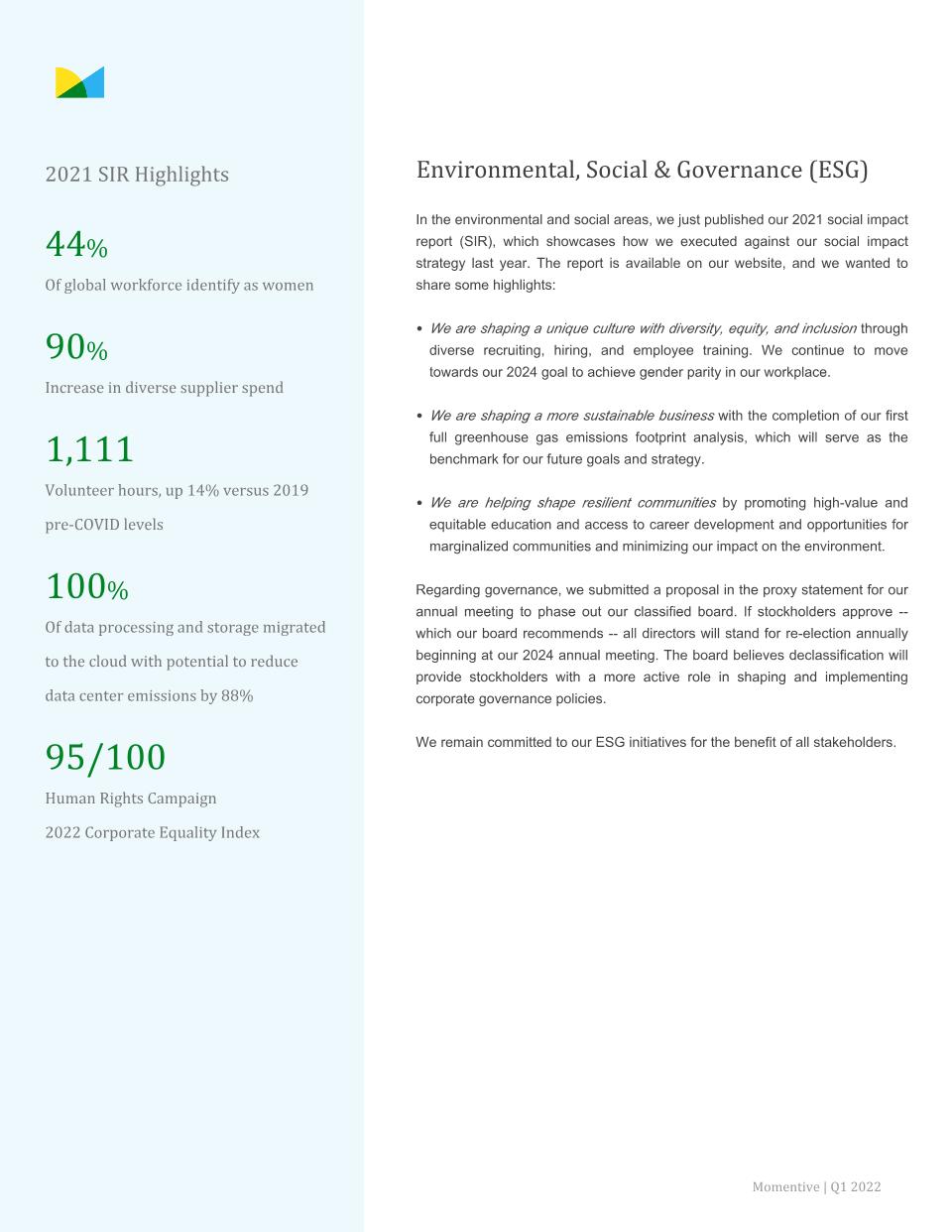

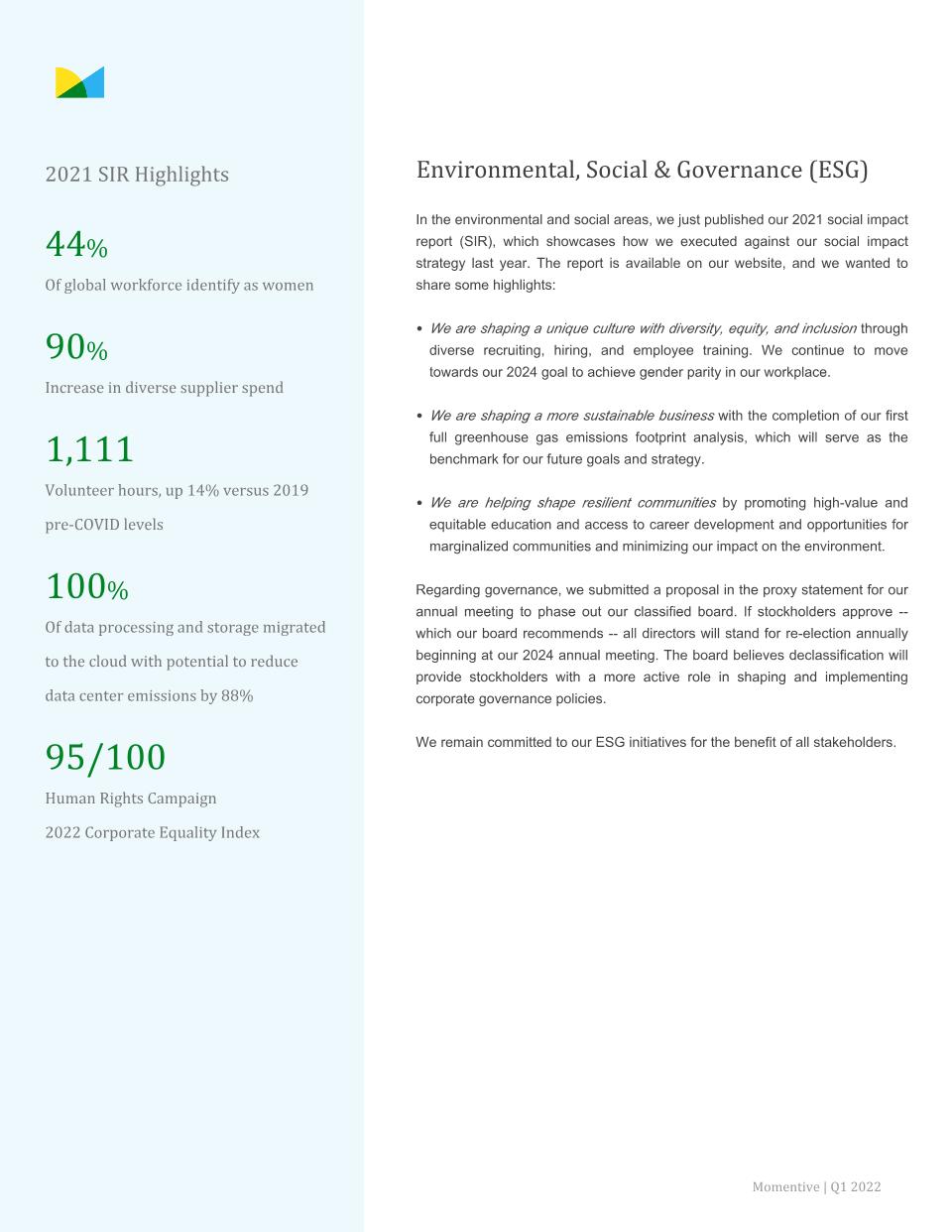

In the environmental and social areas, we just published our 2021 social impact report (SIR), which showcases how we executed against our social impact strategy last year. The report is available on our website, and we wanted to share some highlights: We are shaping a unique culture with diversity, equity, and inclusion through diverse recruiting, hiring, and employee training. We continue to move towards our 2024 goal to achieve gender parity in our workplace. We are shaping a more sustainable business with the completion of our first full greenhouse gas emissions footprint analysis, which will serve as the benchmark for our future goals and strategy. We are helping shape resilient communities by promoting high-value and equitable education and access to career development and opportunities for marginalized communities and minimizing our impact on the environment. Regarding governance, we submitted a proposal in the proxy statement for our annual meeting to phase out our classified board. If stockholders approve -- which our board recommends -- all directors will stand for re-election annually beginning at our 2024 annual meeting. The board believes declassification will provide stockholders with a more active role in shaping and implementing corporate governance policies. We remain committed to our ESG initiatives for the benefit of all stakeholders. Momentive | Q1 2022 Environmental, Social & Governance (ESG) 2021 SIR Highlights 44% Of global workforce identify as women 90% Increase in diverse supplier spend 1,111 Volunteer hours, up 14% versus 2019 pre-COVID levels 100% Of data processing and storage migrated to the cloud with potential to reduce data center emissions by 88% 95/100 Human Rights Campaign 2022 Corporate Equality Index

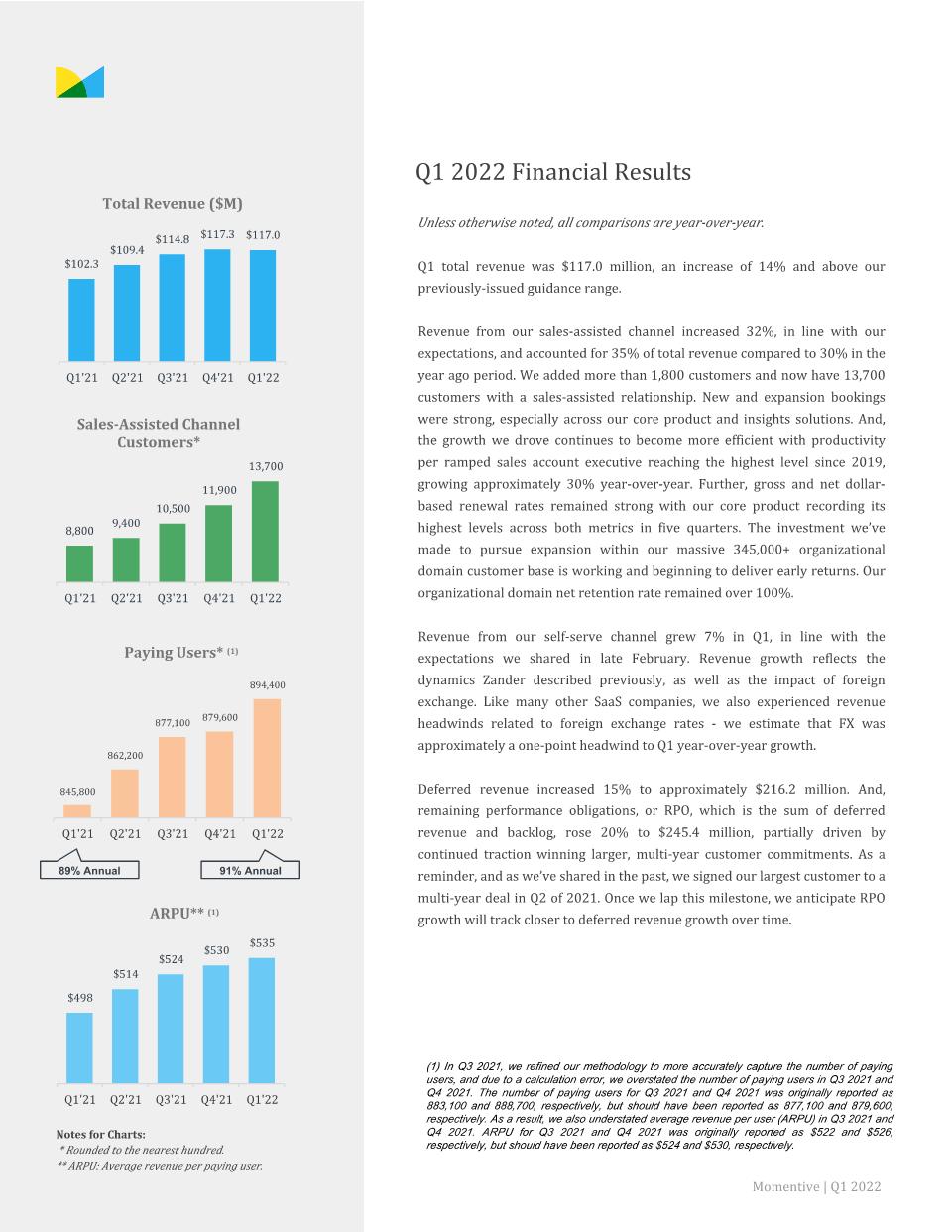

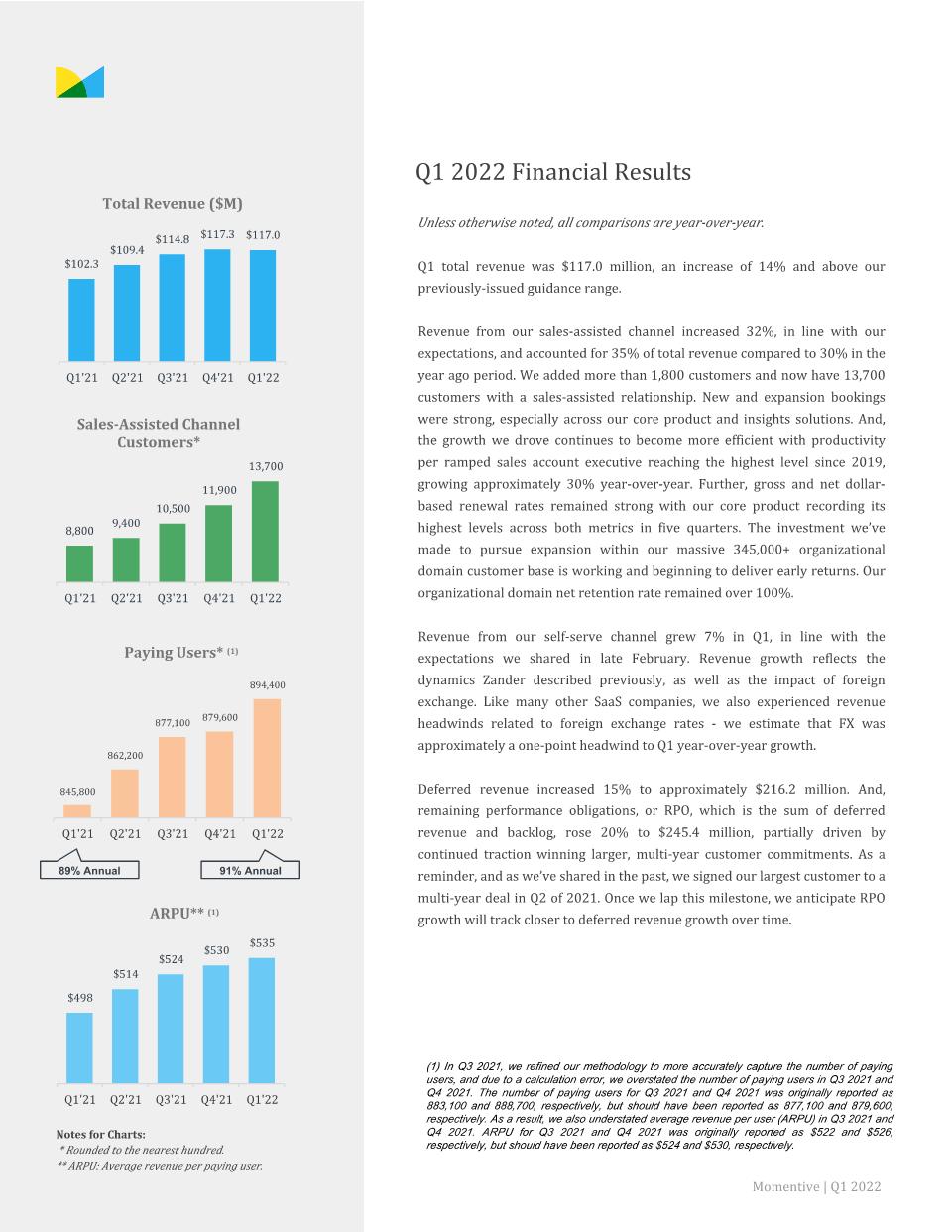

Unless otherwise noted, all comparisons are year-over-year. Q1 total revenue was $117.0 million, an increase of 14% and above our previously-issued guidance range. Revenue from our sales-assisted channel increased 32%, in line with our expectations, and accounted for 35% of total revenue compared to 30% in the year ago period. We added more than 1,800 customers and now have 13,700 customers with a sales-assisted relationship. New and expansion bookings were strong, especially across our core product and insights solutions. And, the growth we drove continues to become more efficient with productivity per ramped sales account executive reaching the highest level since 2019, growing approximately 30% year-over-year. Further, gross and net dollar-based renewal rates remained strong with our core product recording its highest levels across both metrics in five quarters. The investment we’ve made to pursue expansion within our massive 345,000+ organizational domain customer base is working and beginning to deliver early returns. Our organizational domain net retention rate remained over 100%. Revenue from our self-serve channel grew 7% in Q1, in line with the expectations we shared in late February. Revenue growth reflects the dynamics Zander described previously, as well as the impact of foreign exchange. Like many other SaaS companies, we also experienced revenue headwinds related to foreign exchange rates - we estimate that FX was approximately a one-point headwind to Q1 year-over-year growth. Deferred revenue increased 15% to approximately $216.2 million. And, remaining performance obligations, or RPO, which is the sum of deferred revenue and backlog, rose 20% to $245.4 million, partially driven by continued traction winning larger, multi-year customer commitments. As a reminder, and as we’ve shared in the past, we signed our largest customer to a multi-year deal in Q2 of 2021. Once we lap this milestone, we anticipate RPO growth will track closer to deferred revenue growth over time. 89% Annual 91% Annual Notes for Charts: * Rounded to the nearest hundred. ** ARPU: Average revenue per paying user. Momentive | Q1 2022 Q1 2022 Financial Results (1) In Q3 2021, we refined our methodology to more accurately capture the number of paying users, and due to a calculation error, we overstated the number of paying users in Q3 2021 and Q4 2021. The number of paying users for Q3 2021 and Q4 2021 was originally reported as 883,100 and 888,700, respectively, but should have been reported as 877,100 and 879,600, respectively. As a result, we also understated average revenue per user (ARPU) in Q3 2021 and Q4 2021. ARPU for Q3 2021 and Q4 2021 was originally reported as $522 and $526, respectively, but should have been reported as $524 and $530, respectively. Total revenue ($M) $102.3 Q1’21 $109.4 Q2’21 $114.8 Q3’21 $117.3 Q4’21 $117.0 Q1’22 �Sales-Assisted Channel Customers 8,800 Q1’21 9,400 Q2’21 10,500 Q3’21 11,900 Q4’21 13,700 Q1’22 �Paying Users 845,800 Q1’21 862,200 Q2’21 877,100 Q3’21 879,600 Q4’21 894,400 Q1’22�ARPU $498 Q1’21 $514 Q2’21 $524 Q3’21 $530 Q4’21 $535 Q1’22

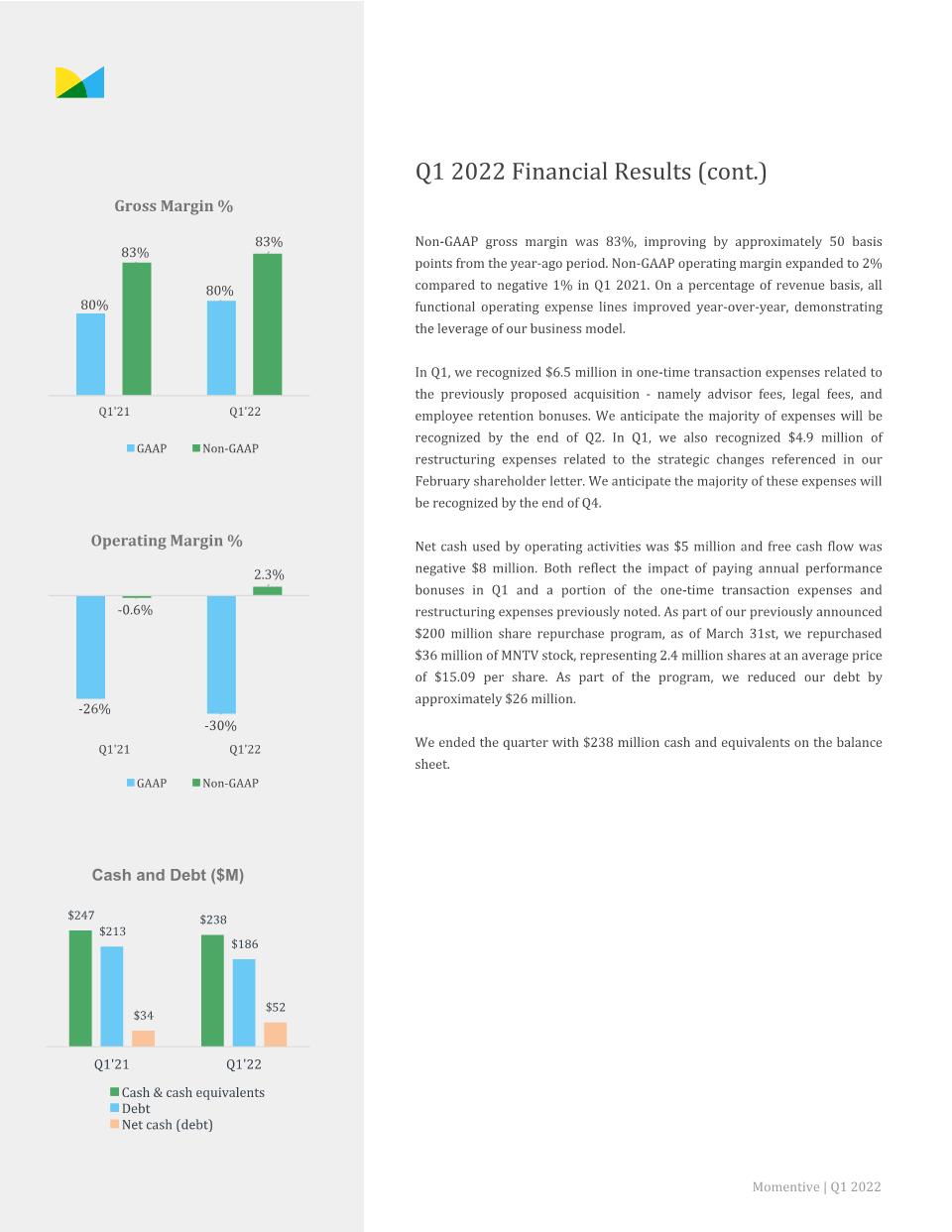

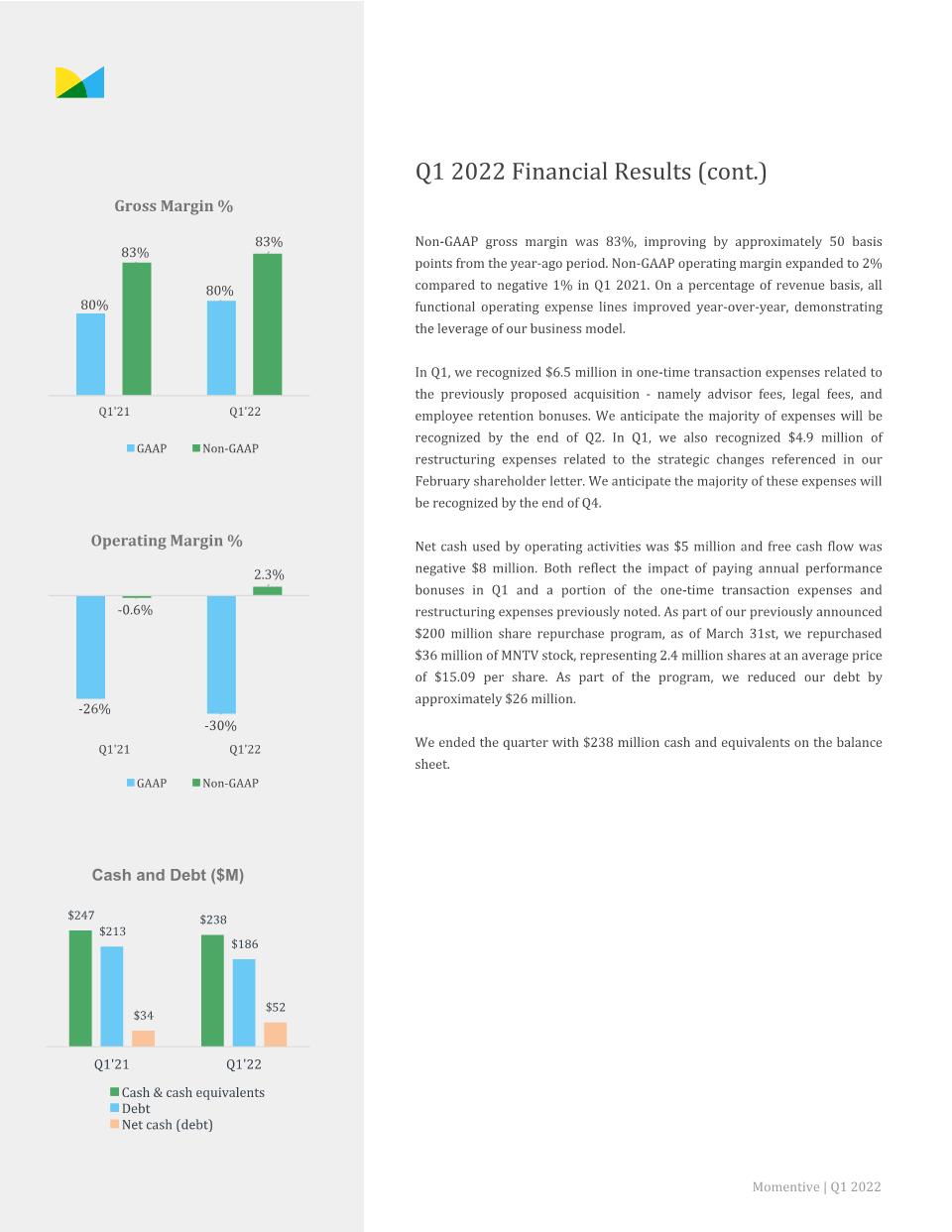

Non-GAAP gross margin was 83%, improving by approximately 50 basis points from the year-ago period. Non-GAAP operating margin expanded to 2% compared to negative 1% in Q1 2021. On a percentage of revenue basis, all functional operating expense lines improved year-over-year, demonstrating the leverage of our business model. In Q1, we recognized $6.5 million in one-time transaction expenses related to the previously proposed acquisition - namely advisor fees, legal fees, and employee retention bonuses. We anticipate the majority of expenses will be recognized by the end of Q2. In Q1, we also recognized $4.9 million of restructuring expenses related to the strategic changes referenced in our February shareholder letter. We anticipate the majority of these expenses will be recognized by the end of Q4. Net cash used by operating activities was $5 million and free cash flow was negative $8 million. Both reflect the impact of paying annual performance bonuses in Q1 and a portion of the one-time transaction expenses and restructuring expenses previously noted. As part of our previously announced $200 million share repurchase program, as of March 31st, we repurchased $36 million of MNTV stock, representing 2.4 million shares at an average price of $15.09 per share. As part of the program, we reduced our debt by approximately $26 million. We ended the quarter with $238 million cash and equivalents on the balance sheet. Momentive | Q1 2022 Q1 2022 Financial Results (cont.) Gross Margin % 80% 83% Q1’21 80% 83% Q1’22 GAAP Non-GAAP �Operating Margin % -26% -0.6% Q1’21 -30% 2.3% Q1’22 GAAP Non-GAAP �Cash and Debt ($M) $247 $213 $34 Q1’21 $238 $186 $52 Q1’22 Cash & cash equivalents Debt Net cash (debt)

For Q2, we expect revenue to be in the range of approximately $120 to $122 million. We expect non-GAAP operating margin to be in the range of approximately 1% to 3%. As a reminder, Non-GAAP operating margin tends to be lower in Q1 and Q2 based on our seasonal investment pattern in sales and marketing and R&D. For the full year 2022, we expect revenue in the range of approximately $494 to $500 million. We anticipate similar year-over-year revenue growth rates for Q2 and Q3 implying modest year-over-year revenue growth acceleration in Q4. However, as we’ve noted in the past, revenue from our insights solutions -- previously referred to as Market Research -- is recognized on a consumption basis as projects are completed, impacting quarter-to-quarter revenue growth trends. We’ll continue to provide transparency on this dynamic as we transition this area of our business to a subscription model over time. We expect the sales-assisted channel’s year-over-year revenue growth rate will be in the 30’s for 2022. Self-serve channel revenue will reflect the dynamics discussed previously with low single digit growth for the remainder of the year. We expect full-year 2022 non-GAAP operating margin of 6% to 7%, which assumes a consistent gross margin profile and operating leverage acceleration in the second half. We expect to exit 2022 with operating margin in the low double-digits. We expect full-year 2022 free cash flow in the range of $24 to $29 million, which includes the impact of approximately $27 million in one-time transaction-related and restructuring expenses - a portion of which were accrued as expenses in Q4 2021 but will result in cash outflows in 2022. We’ve made widely accepted assumptions on foreign exchange rates in our guidance. Should conditions necessitate we amend those assumptions in a material way, we’ll update this group accordingly. Q2 2022 FY 2022 Revenue $120 to 122M $494 to $500M Non-GAAP operating margin 1% to 3% 6% to 7% Free cash flow NA $24M to $29M Highlights 32% YoY Sales-Assisted Channel Revenue Growth 13,700 Sales-assisted channel customers, 1,800+ added in Q1’22 90%+ Of bookings from organizational domain-based customers 100%+ Dollar-based net retention �rate for 345,000+ organizational �customers* $36.4M to Repurchase 2.4M Shares of MNTV in Q1 2022 * We calculate organizational dollar-based net retention rate as of a period end by starting with the trailing 12 months of bookings from the cohort of all domain-based customers as of the 12 months prior to such period end (“Prior Period Bookings”). We then calculate the trailing 12 months of bookings from these same customers as of the current period end (“Current Period Bookings”). Current Period Bookings includes any upsells and is net of contraction or attrition but excludes bookings from new domain-based customers in the current period. We then divide the total Current Period Bookings by the total Prior Period Bookings to arrive at the organizational dollar-based net retention rate. Momentive | Q1 2022 Financial Outlook

. Q1 was all about focus and execution. We moved with speed and operating rigor to make targeted strategic changes and align resources to the areas of our business with the highest growth potential and return profile. You can see the green shoots in our sales-assisted channel results. The remainder of 2022 will build on the same operating discipline and lay the foundation for durable and profitable growth, coupled with expanding margins. As always, we remain focused on and committed to driving value for shareholders. We look forward to updating you further at our upcoming investor day, including a refreshed long-term operating model and our path to achieving Rule of 40. We plan on announcing the date in the near future. Momentive senior management will host a conference call today to discuss the company’s Q1 2022 financial results. This call is scheduled to begin at 2:00 pm PT / 5:00 pm ET and can be accessed by dialing (844) 200-6205 or (646) 904-5544 (ID: 354437). An archived webcast of the conference call will be accessible on Momentive’s Investor Relations page, investor.momentive.ai. A telephonic replay of the conference call will be available until Wednesday, May 11, 2022, and can be accessed by dialing (866) 813-9403 or (929) 458-6194 and entering the passcode 947080. From all of us at Momentive, please stay safe and prioritize �your health. Sincerely, Contacts: Investor Relations: Media: Gary J. Fuges, CFA Katie Miserany investors@momentive.ai pr@momentive.ai Our vision is to raise the bar for human experiences by amplifying individual voices. Our mission is to power the curious so they can shape what’s next. Momentive | Q1 2022 Justin Coulombe CFO Closing & Conference Call Information Priyanka Carr COO Zander Lurie CEO

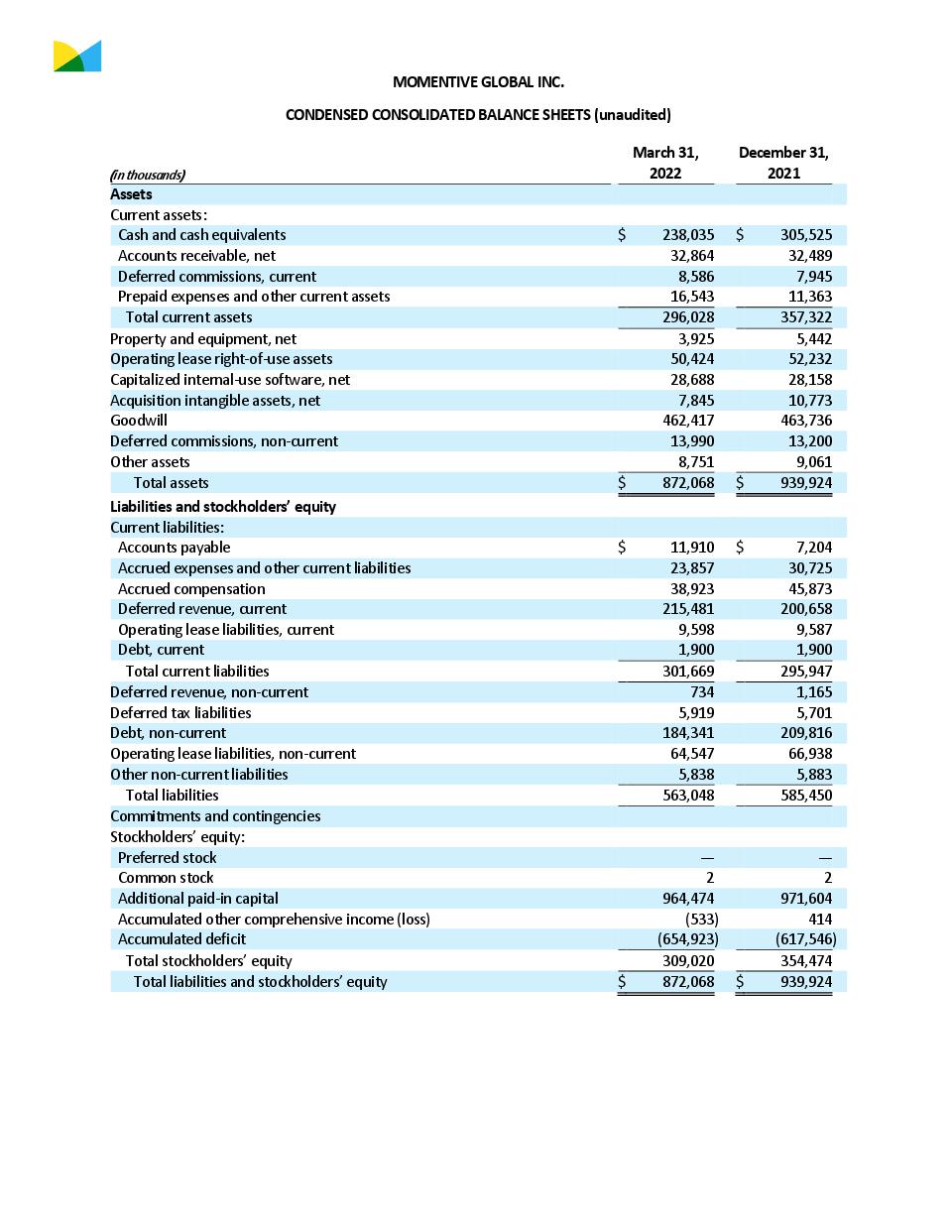

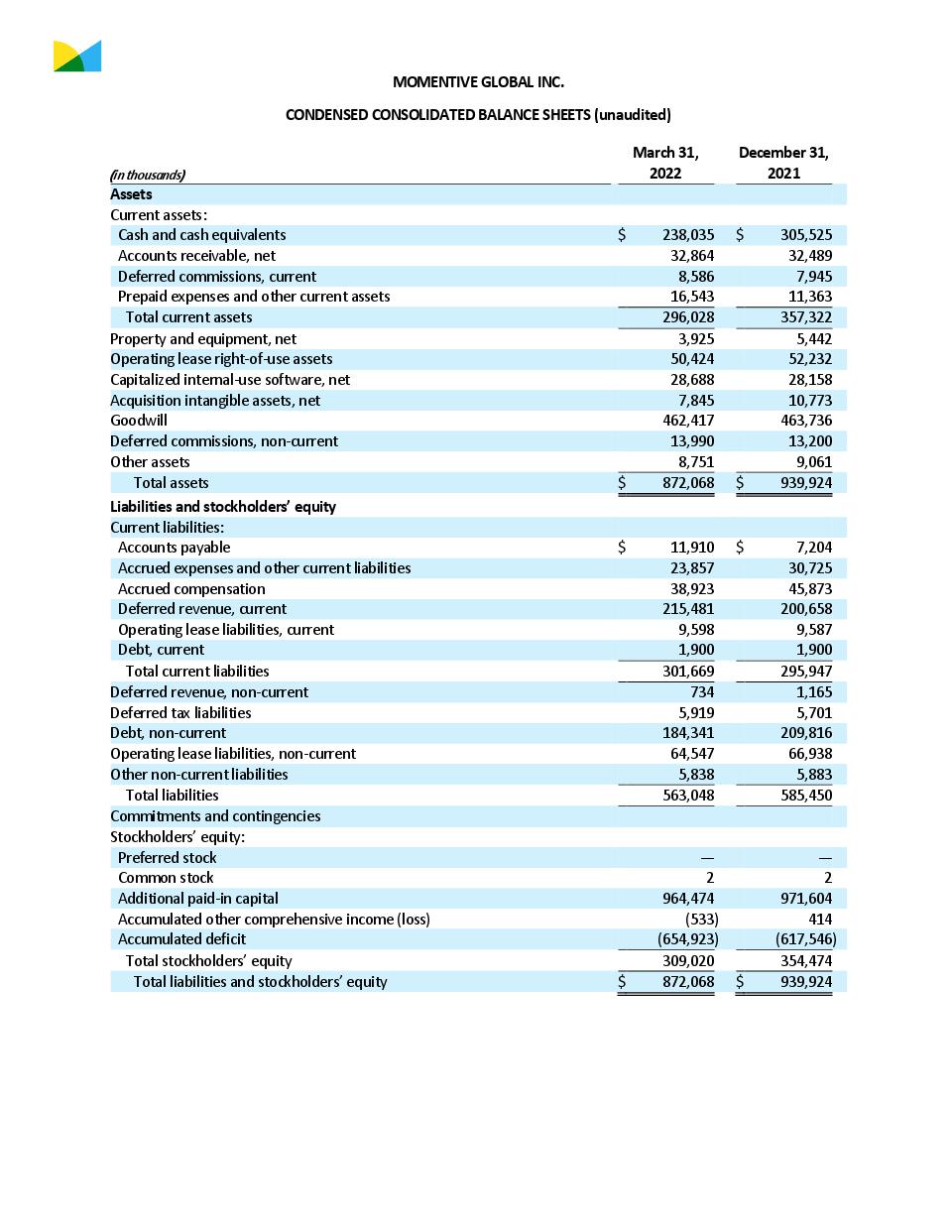

MOMENTIVE GLOBAL INC. CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) (in thousands) March 31, 2022 December 31, 2021 Assets Current assets: Cash and cash equivalents $238,035 $305,525 Accounts receivable, net 32,864 32,489 Deferred commissions, current 8,586 7,945 Prepaid expenses and other current assets 16,543 11,363 Total current assets 296,028 357,322 Property and equipment, net 3,925 5,442 Operating lease right-of-use assets 50,424 52,232 Capitalized internal-use software, net 28,688 28,158 Acquisition intangible assets, net 7,845 10,773 Goodwill 462,417 463,736 Deferred commissions, non-current 13,990 13,200 Other assets 8,751 9,061 Total assets $872,068 $939,924 Liabilities and stockholders’ equity Current liabilities: Accounts payable $11,910 $7,204 Accrued expenses and other current liabilities 23,857 30,725 Accrued compensation 38,923 45,873 Deferred revenue, current 215,481 200,658 Operating lease liabilities, current 9,598 9,587 Debt, current 1,900 1,900 Total current liabilities 301,669 295,947 Deferred revenue, non-current 734 1,165 Deferred tax liabilities 5,919 5,701 Debt, non-current 184,341 209,816 Operating lease liabilities, non-current 64,547 66,938 Other non-current liabilities 5,838 5,883 Total liabilities 563,048 585,450 Commitments and contingencies Stockholders’ equity: Preferred stock — — Common stock 2 2 Additional paid-in capital 964,474 971,604 Accumulated other comprehensive income (loss) (533) 414 Accumulated deficit (654,923) (617,546) Total stockholders’ equity 309,020 354,474 Total liabilities and stockholders’ equity $872,068 $939,924

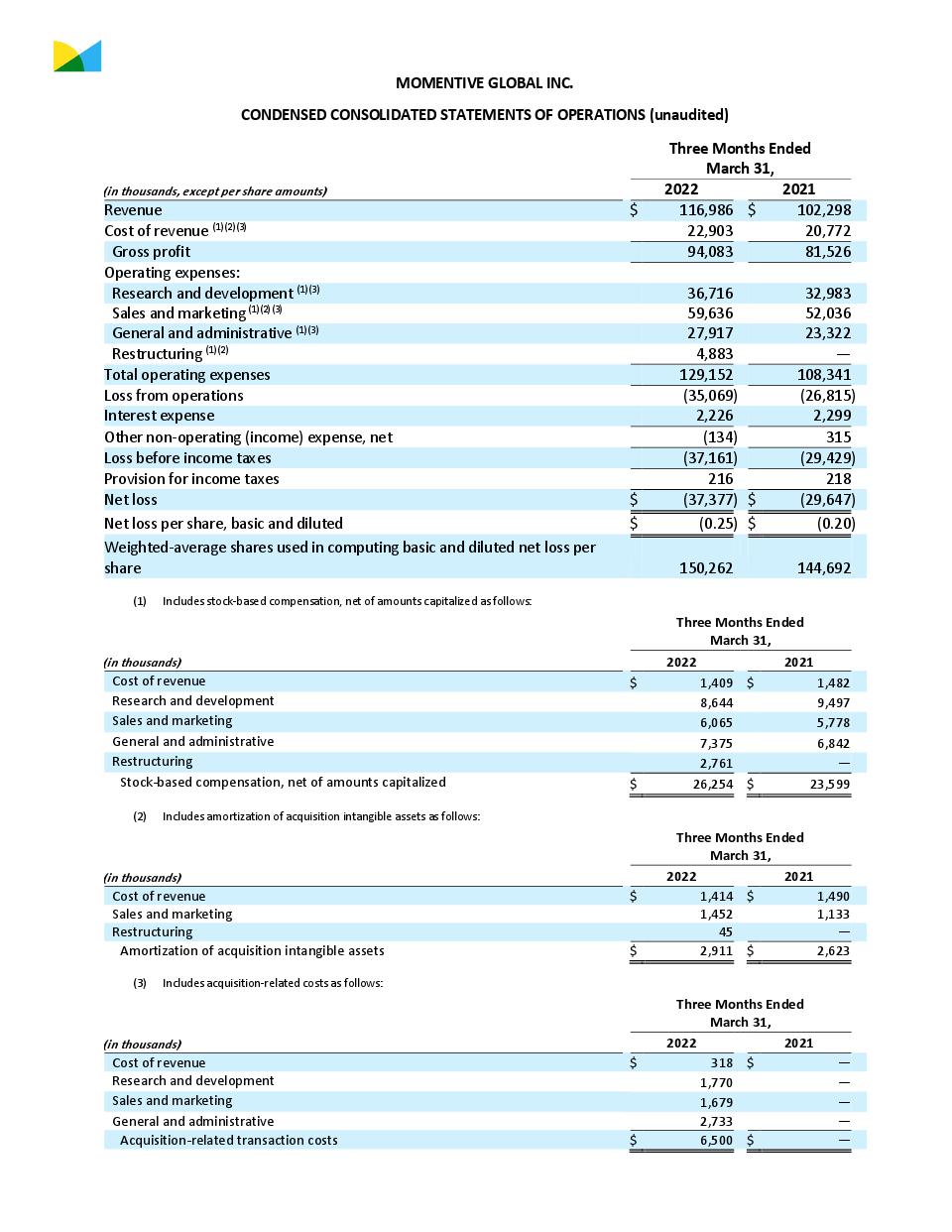

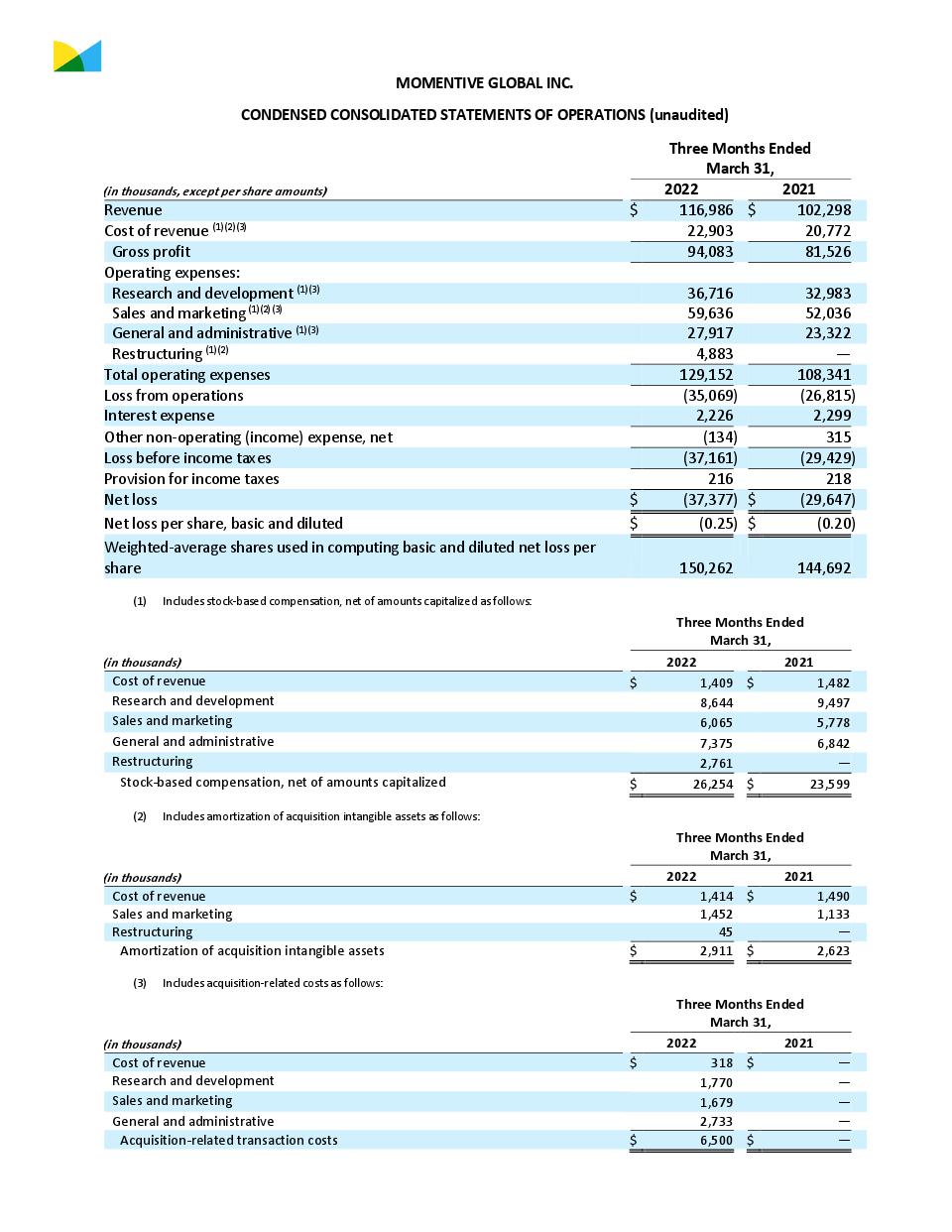

MOMENTIVE GLOBAL INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) Three Months Ended March 31, (in thousands, except per share amounts) 2022 2021 Revenue $116,986 $102,298 Cost of revenue (1)(2)(3) 22,903 20,772 Gross profit 94,083 81,526 Operating expenses: Research and development (1)(3) 36,716 32,983 Sales and marketing (1)(2)(3) 59,636 52,036 General and administrative (1)(3) 27,917 23,322 Restructuring (1)(2) 4,883 — Total operating expenses 129,152 108,341 Loss from operations (35,069) (26,815) Interest expense 2,226 2,299 Other non-operating (income) expense, net (134) 315 Loss before income taxes (37,161) (29,429) Provision for income taxes 216 218 Net loss $(37,377) $(29,647) Net loss per share, basic and diluted $(0.25) $(0.20) Weighted-average shares used in computing basic and diluted net loss per share 150,262 144,692 (1) Includes stock-based compensation, net of amounts capitalized as follows: Three Months Ended March 31, (in thousands) 2022 2021 Cost of revenue $1,409 $1,482 Research and development 8,644 9,497 Sales and marketing 6,065 5,778 General and administrative 7,375 6,842 Restructuring 2,761 — Stock-based compensation, net of amounts capitalized $26,254 $23,599 (2) Includes amortization of acquisition intangible assets as follows: Three Months Ended March 31, (in thousands) 2022 2021 Cost of revenue $1,414 $1,490 Sales and marketing 1,452 1,133 Restructuring 45 — Amortization of acquisition intangible assets $2,911 $2,623 (3) Includes acquisition-related costs as follows: Three Months Ended March 31, (in thousands) 2022 2021 Cost of revenue $318 $— Research and development 1,770 — Sales and marketing 1,679 —General and administrative 2,733 — Acquisition-related transaction costs $6,500 $—

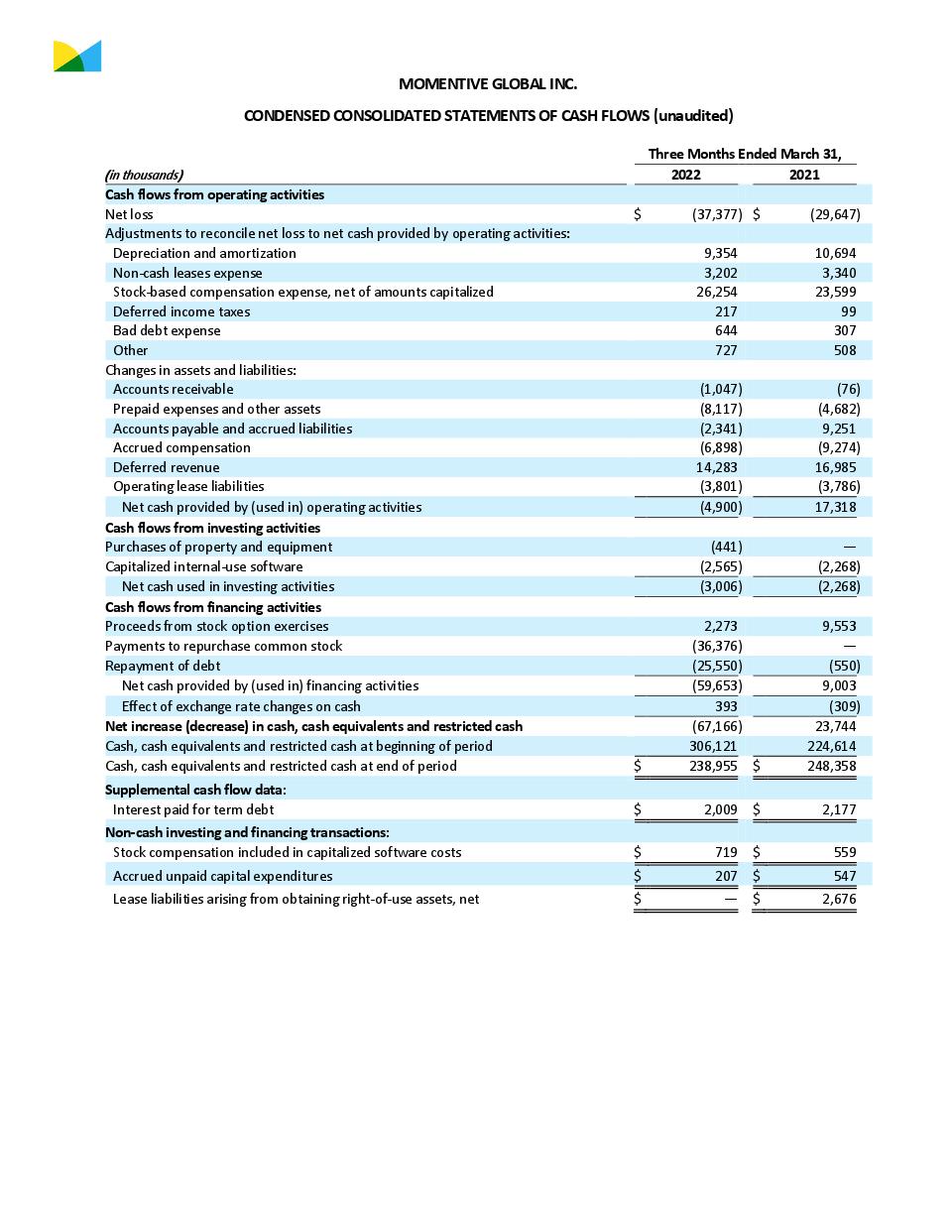

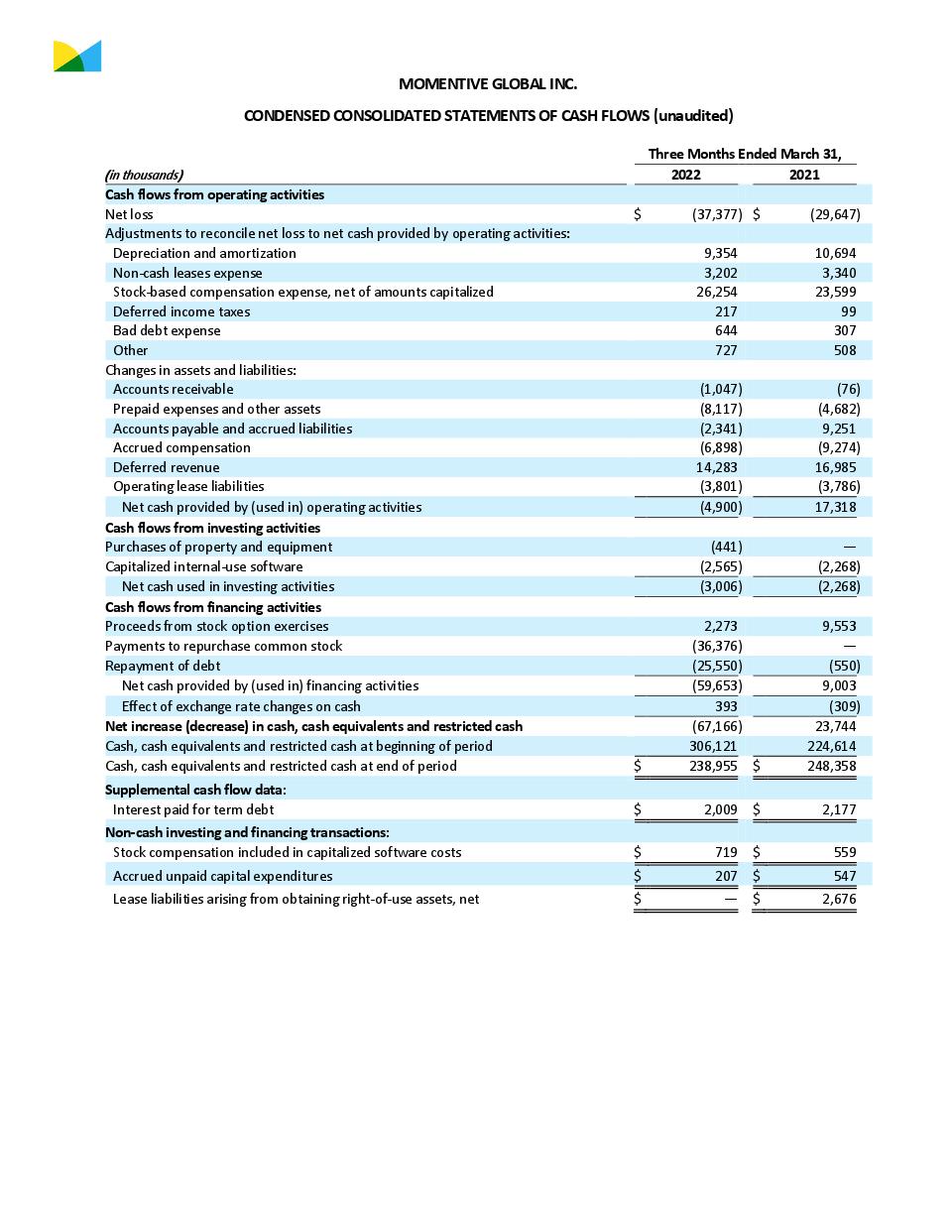

MOMENTIVE GLOBAL INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) Three Months Ended March 31 (in thousands) 2022 2021 Cash flows from operating activities Net loss $(37,377) $(29,647) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 9,354 10,694 Non-cash leases expense 3,202 3,340 Stock-based compensation expense, net of amounts capitalized 26,254 23,599 Deferred income taxes 217 99 Bad debt expense 644 307 Other 727 508 Changes in assets and liabilities: Accounts receivable (1,047) (76) Prepaid expenses and other assets (8,117) (4,682) Accounts payable and accrued liabilities (2,341) 9,251 Accrued compensation (6,898) (9,274) Deferred revenue 14,283 16,985 Operating lease liabilities (3,801) (3,786) Net cash provided by (used in) operating activities (4,900) 17,318 Cash flows from investing activities Purchases of property and equipment (441) — Capitalized internal-use software (2,565) (2,268) Net cash used in investing activities (3,006) (2,268) Cash flows from financing activities Proceeds from stock option exercises 2,273 9,553 Payments to repurchase common stock (36,376) — Repayment of debt (25,550) (550) Net cash provided by (used in) financing activities (59,653) 9,003 Effect of exchange rate changes on cash 393 (309) Net increase (decrease) in cash, cash equivalents and restricted cash (67,166) 23,744 Cash, cash equivalents and restricted cash at beginning of period 306,121 224,614 Cash, cash equivalents and restricted cash at end of period $238,955 $248,358 Supplemental cash flow data: Interest paid for term debt $2,009 $2,177 Non-cash investing and financing transactions: Stock compensation included in capitalized software costs $719 $559 Accrued unpaid capital expenditures $207 $547 Lease liabilities arising from obtaining right-of-use assets, net $— $2,676

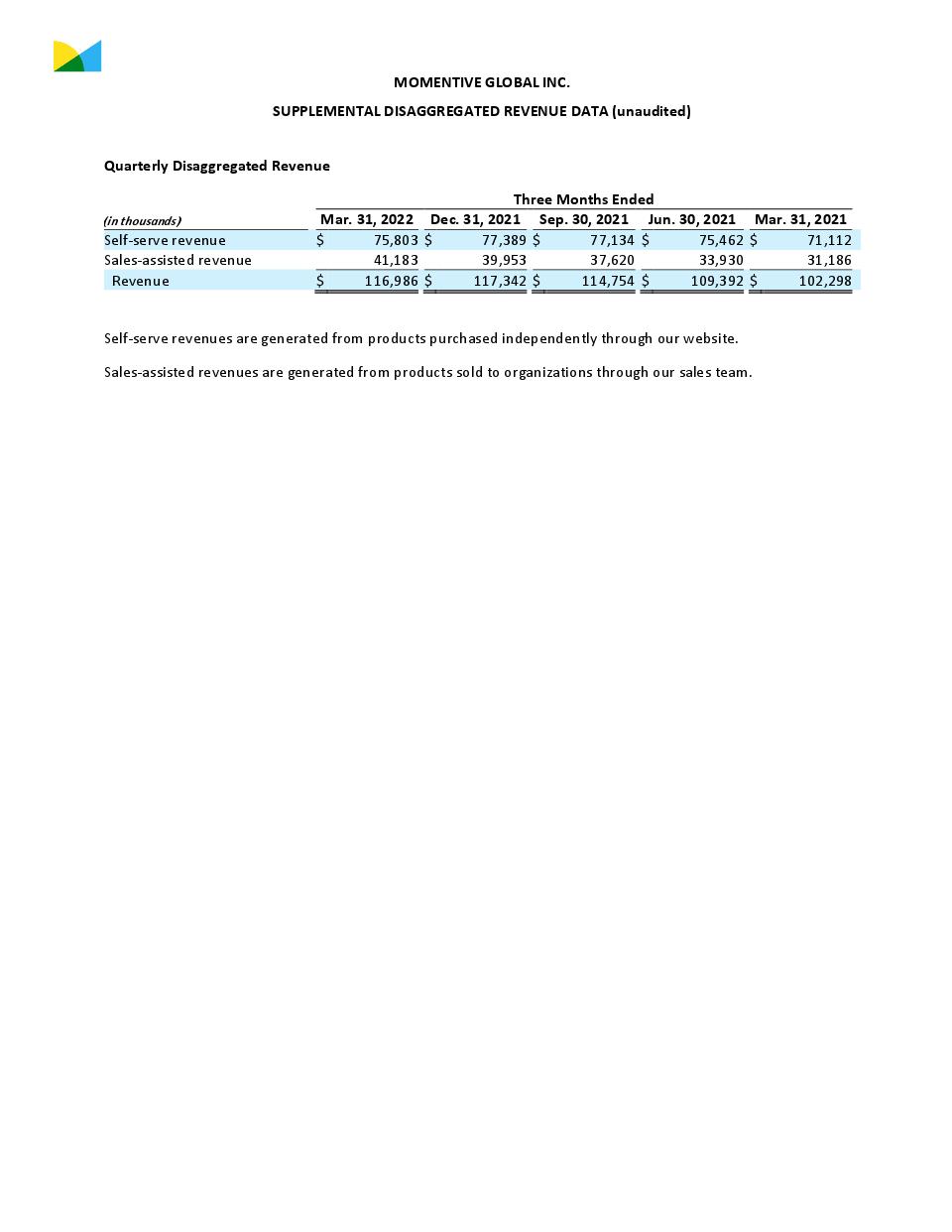

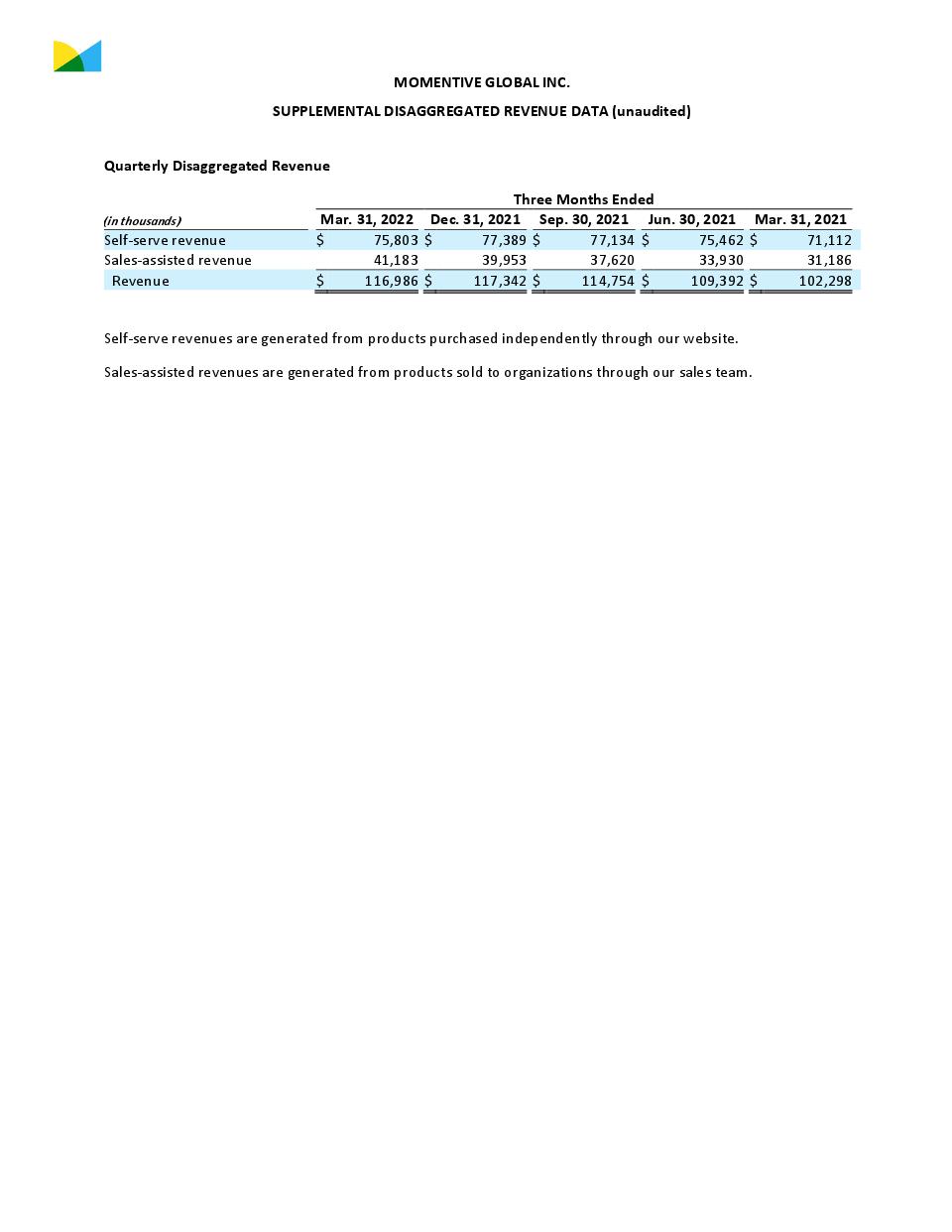

MOMENTIVE GLOBAL INC. SUPPLEMENTAL DISAGGREGATED REVENUE DATA (unaudited) Quarterly Disaggregated Revenue Three Months Ended (in thousands) Mar. 31, 2022 Dec. 31, 2021 Sep. 30, 2021 Jun. 30, 2021 Mar. 31, 2021 Self-serve revenue $75,803 $77,389 $77,134 $75,462 $71,112 Sales-assisted revenue 41,183 39,953 37,620 33,930 31,186 Revenue $116,986 $117,342 $114,754 $109,392 $102,298�Self-serve revenues are generated from products purchased independently through our website. Sales-assisted revenues are generated from products sold to organizations through our sales team.

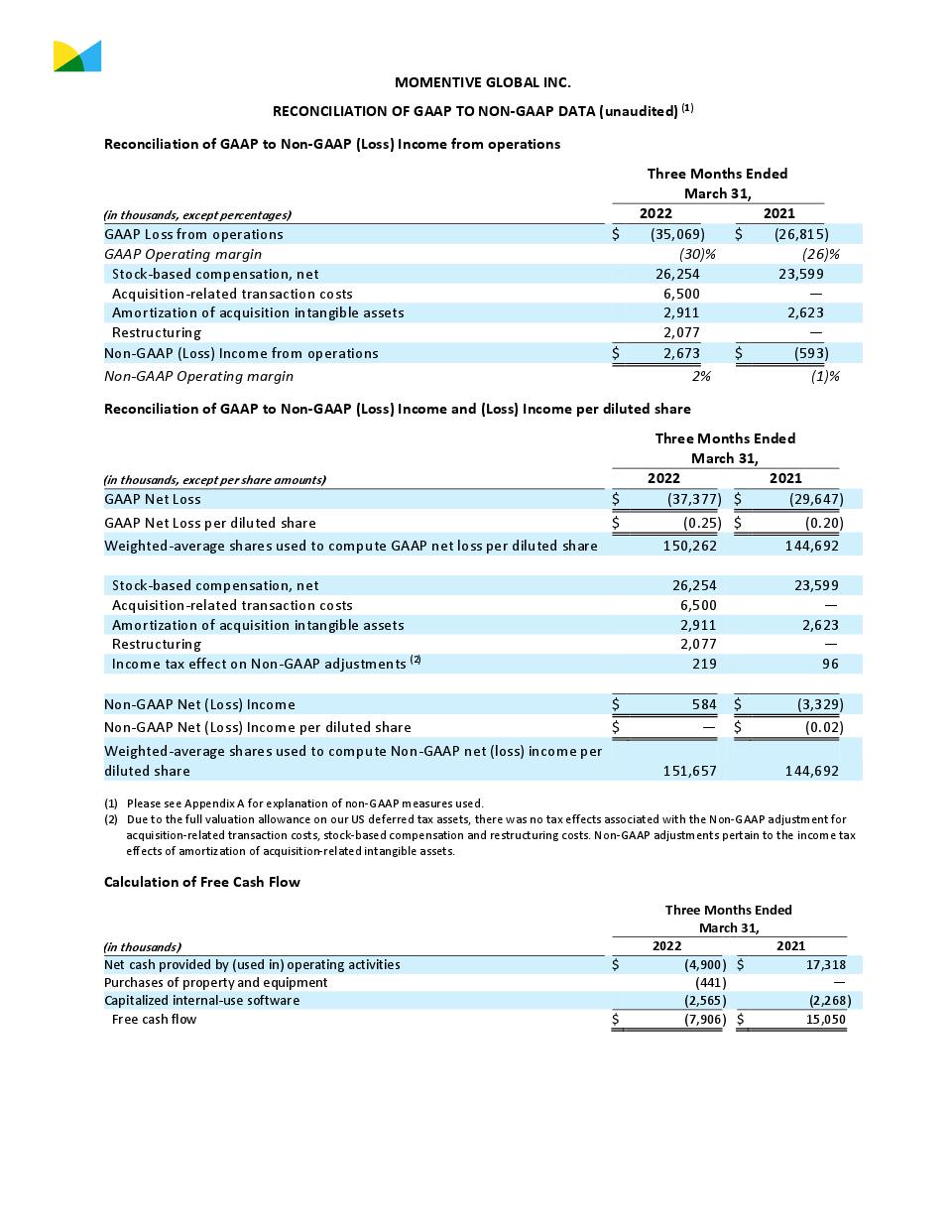

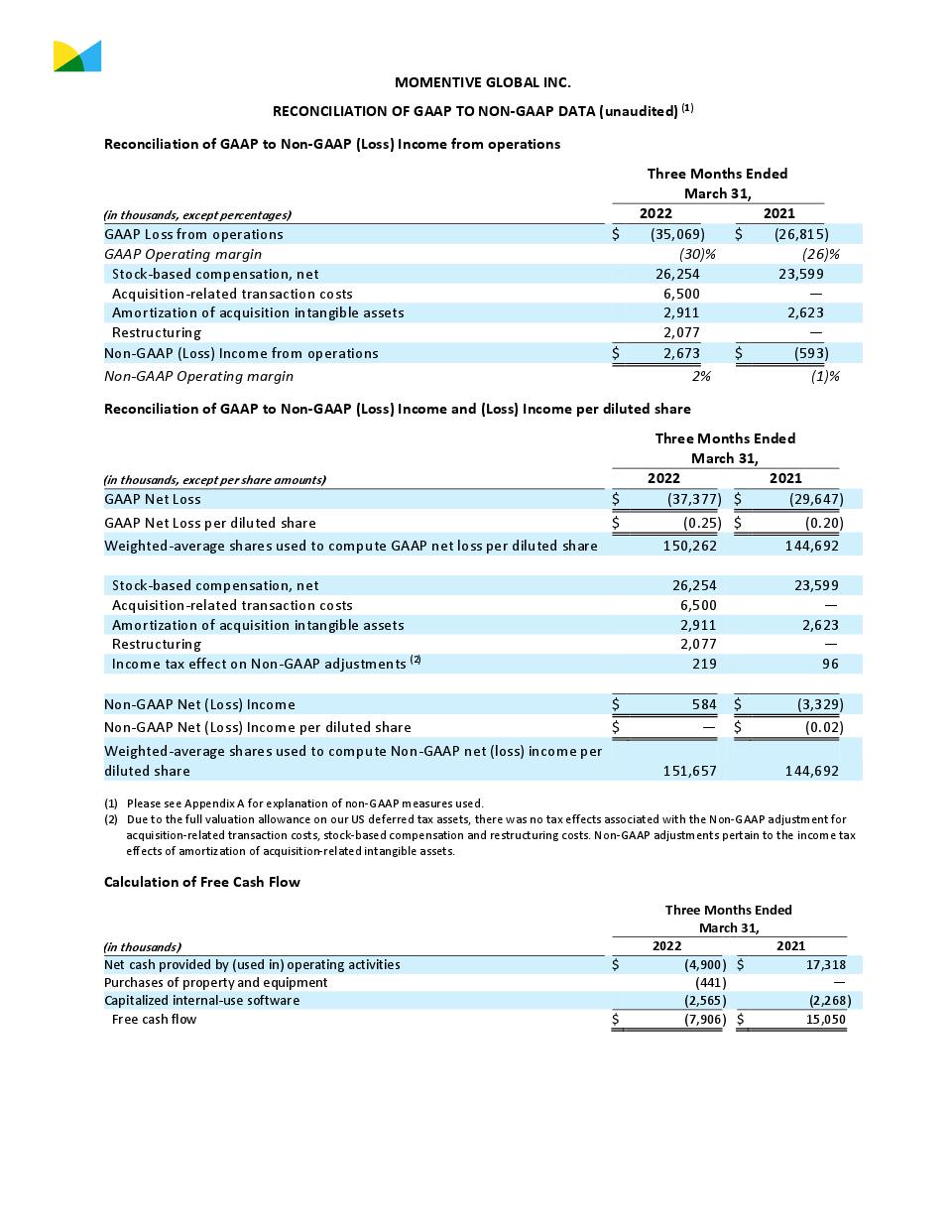

MOMENTIVE GLOBAL INC. RECONCILIATION OF GAAP TO NON-GAAP DATA (unaudited) (1) Reconciliation of GAAP to Non-GAAP (Loss) Income from operations Three Months Ended March 31, (in thousands, except percentages) 2022 2021 GAAP Loss from operations $(35,069) $(26,815) GAAP Operating margin (30)% (26)% Stock-based compensation, net 26,254 23,599 Acquisition-related transaction costs 6,500 — Amortization of acquisition intangible assets 2,911 2,623 Restructuring 2,077 — Non-GAAP (Loss) Income from operations $2,673 $(593) Non-GAAP Operating margin 2% (1)% Reconciliation of GAAP to Non-GAAP (Loss) Income and (Loss) Income per diluted share Three Months Ended March 31, (in thousands, except per share amounts) 2022 2021 GAAP Net Loss $(37,377) $(29,647) GAAP Net Loss per diluted share $(0.25) $(0.20) Weighted-average shares used to compute GAAP net loss per diluted share 150,262 144,692 Stock-based compensation, net 26,254 23,599 Acquisition-related transaction costs 6,500 — Amortization of acquisition intangible assets 2,911 2,623 Restructuring 2,077 — Income tax effect on Non-GAAP adjustments (2) 219 96 Non-GAAP Net (Loss) Income $584 $(3,329) Non-GAAP Net (Loss) Income per diluted share $— $(0.02) Weighted-average shares used to compute Non-GAAP net (loss) income per diluted share 151,657 144,692 (1) Please see Appendix A for explanation of non-GAAP measures used. (2) Due to the full valuation allowance on our US deferred tax assets, there was no tax effects associated with the Non-GAAP adjustment for acquisition-related transaction costs, stock-based compensation and restructuring costs. Non-GAAP adjustments pertain to the income tax effects of amortization of acquisition-related intangible assets. Calculation of Free Cash Flow Three Months Ended March 31, (in thousands) 2022 2021 Net cash provided by (used in) operating activities $(4,900) $17,318 Purchases of property and equipment (441) — Capitalized internal-use software (2,565) (2,268) Free cash flow $(7,906) $15,050

MOMENTIVE GLOBAL INC. RECONCILIATION OF GAAP TO NON-GAAP DATA (unaudited) (1) Supplemental GAAP and Non-GAAP Information Three Months Ended March 31, (in thousands, except percentages) 2022 2021 GAAP Gross profit $94,083 $81,526 GAAP Gross margin 80% 80% Stock-based compensation, net 1,409 1,482 Amortization of acquisition intangible assets 1,414 1,490 Acquisition-related transaction costs 318 — Non-GAAP Gross profit $97,224 $84,498 Non-GAAP Gross margin 83% 83% GAAP Research and development $36,716 $32,983 GAAP Research and development margin 31% 32% Stock-based compensation, net 8,644 9,497 Acquisition-related transaction costs 1,770 — Non-GAAP Research and development $26,302 $23,486 Non-GAAP Research and development margin 22% 23% GAAP Sales and marketing $59,636 $52,036 GAAP Sales and marketing margin 51% 51% Stock-based compensation, net 6,065 5,778 Amortization of acquisition intangible assets 1,452 1,133 Acquisition-related transaction costs 1,679 — Non-GAAP Sales and marketing $50,440 $45,125 Non-GAAP Sales and marketing margin 43% 44% GAAP General and administrative $27,917 $23,322 GAAP General and administrative margin 24% 23% Stock-based compensation, net 7,375 6,842 Acquisition-related transaction costs 2,733 — Non-GAAP General and administrative $17,809 $16,480 Non-GAAP General and administrative margin 15% 16% GAAP Restructuring $4,883 $— GAAP Restructuring margin 4% 0% Stock-based compensation, net 2,761 — Amortization of acquisition intangible assets 45 - Other restructuring costs 2,077 - Non-GAAP Restructuring $— $— Non-GAAP Restructuring margin 0% 0% (1) Please see Appendix A for explanation of non-GAAP measures used.

APPENDIX A MOMENTIVE GLOBAL INC. EXPLANATION OF NON-GAAP MEASURES To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with US GAAP (“GAAP”), we use the following Non-GAAP financial measures: Non-GAAP (loss) income from operations, Non-GAAP operating margin, Non-GAAP net (loss) income, Non-GAAP net (loss) income per diluted share, Non-GAAP gross profit, Non-GAAP gross margin, Non-GAAP research and development, Non-GAAP research and development margin, Non-GAAP sales and marketing, Non-GAAP sales and marketing margin, Non-GAAP general and administrative, Non-GAAP general and administrative margin, Non-GAAP restructuring, Non-GAAP restructuring margin, and free cash flow. Our definition for each Non-GAAP measure used is provided below, however a limitation of Non-GAAP financial measures is that they do not have uniform definitions. Accordingly, our definitions for Non-GAAP measures used will likely differ from similarly titled Non-GAAP measures used by other companies thereby limiting comparability. With regards to the Non-GAAP guidance provided above, a reconciliation to the corresponding GAAP amounts is not provided as the quantification of certain items excluded from each respective Non-GAAP measure, which may be significant, cannot be reasonably calculated or predicted at this time without unreasonable efforts. For example, the Non-GAAP adjustment for stock-based compensation expense, net, requires additional inputs such as number of shares granted and market price that are not currently ascertainable. Non-GAAP (loss) income from operations, Non-GAAP operating margin: We define Non-GAAP (loss) income from operations as GAAP loss from operations excluding stock-based compensation, net, acquisition-related transaction costs, amortization of acquisition intangible assets, and restructuring. Non-GAAP operating margin is defined as Non-GAAP (loss) income from operations divided by revenue. Non-GAAP net (loss) income, Non-GAAP net (loss) income per diluted share: We define Non-GAAP net (loss) income as GAAP net loss excluding stock-based compensation, net, acquisition-related transaction costs, amortization of acquisition intangible assets, restructuring, and including the income tax effect on Non-GAAP adjustments. Non-GAAP net (loss) income per diluted share is defined as Non-GAAP net (loss) income divided by the weighted-average shares outstanding. Non-GAAP gross profit, Non-GAAP gross margin: We define Non-GAAP gross profit as GAAP gross profit excluding stock-based compensation, net, amortization of acquisition intangible assets, and acquisition-related transaction costs. Non-GAAP gross margin is defined as Non-GAAP gross profit divided by revenue. Non-GAAP research and development, Non-GAAP research and development margin: We define Non-GAAP research and development as GAAP research and development excluding stock-based compensation, net and acquisition-related transaction costs. Non-GAAP research and development margin is defined as Non-GAAP research and development divided by revenue. Non-GAAP sales and marketing, Non-GAAP sales and marketing margin: We define Non-GAAP sales and marketing as GAAP sales and marketing excluding stock-based compensation, net, amortization of acquisition intangible assets, and acquisition-related transaction costs. Non-GAAP sales and marketing margin is defined as Non-GAAP sales and marketing divided by revenue. Non-GAAP general and administrative, Non-GAAP general and administrative margin: We define Non-GAAP general and administrative as GAAP general and administrative excluding stock-based compensation, net and acquisition-related transaction costs. Non-GAAP general and administrative margin is defined as Non-GAAP general and administrative divided by revenue. Non-GAAP restructuring, Non-GAAP restructuring margin: We define Non-GAAP restructuring as GAAP Restructuring excluding stock-based compensation, net, amortization of acquisition intangible assets, and other restructuring costs. Non-GAAP Restructuring margin is defined as Non-GAAP Restructuring divided by revenue. We use these Non-GAAP measures to compare and evaluate our operating results across periods in order to manage our business, for purposes of determining executive and senior management incentive compensation, and for budgeting and developing our strategic operating plans. We believe that these Non-GAAP measures provide useful information about our operating results, enhance the overall understanding of our past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by our management in evaluating our financial performance and for operational decision making, but they are not meant to be considered

in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. We have excluded the effect of the following items from the aforementioned Non-GAAP measures because they are non-cash and/or are non-recurring in nature and because we believe that the Non-GAAP financial measures excluding these items provide meaningful supplemental information regarding operational performance and liquidity. We further believe these measures are useful to investors in that it allows for greater transparency to certain line items in our financial statements and facilitates comparisons to historical operating results and comparisons to peer operating results. A description of the Non-GAAP adjustments for the above measures is as follows: •Stock-based compensation, net: We incur stock based-compensation expense on a GAAP basis resulting from equity awards granted to our employees. Although stock-based compensation is a key incentive offered to our employees, and we believe such compensation contributed to the revenues earned during the periods presented and also believe it will contribute to the generation of future period revenues, we continue to evaluate our business performance excluding stock-based compensation expenses. Stock-based compensation expenses will recur in future periods. •Acquisition-related transaction costs: We incur transaction costs on a GAAP basis resulting from our acquisitions, including our terminated acquisition by Zendesk. These costs relate to advisory, legal and accounting services, and retention payments to certain employees. Acquisition-related transaction costs is inconsistent in amount and frequency and is significantly affected by the timing and size of any acquisitions and are therefore excluded from our Non-GAAP results as they do not otherwise relate to our core business operations. However, we may incur these expenses in future periods in connection with any new acquisitions. • Amortization of acquisition intangible assets: We incur amortization expense on intangible assets on a GAAP basis resulting from prior acquisitions. Amortization of acquired intangible assets is inconsistent in amount and frequency and is significantly affected by the timing and size of any acquisitions. Investors should note that the use of intangible assets contributed to our revenues earned during the periods presented and will contribute to our future period revenues as well. Amortization of acquisition intangible assets will recur in future periods. •Restructuring: Restructuring expenses consist of employee severance and other exit costs. We believe it is useful for investors to understand the effects of these items on our total operating expenses. We expect that restructuring costs will generally diminish over time with respect to strategic initiatives and/or past acquisitions. However, we may incur these expenses in future periods in connection with any new strategic initiatives and/or acquisitions. For more information on the Non-GAAP financial measures, please see the “Reconciliation of GAAP to Non-GAAP Data” section of this shareholder letter. The accompanying tables provide details on the GAAP financial measures that are most directly comparable to the Non-GAAP financial measures and the related reconciliations between those financial measures. Free cash flow: We define free cash flow as GAAP net cash provided by or used in operating activities less purchases of property and equipment and capitalized internal-use software. We consider free cash flow to be an important measure because it measures our liquidity after deducting capital expenditures for purchases of property and equipment and capitalized software development costs, which we believe provides a more accurate view of our cash generation and cash available to grow our business. We expect to generate positive free cash flow over the long term. Free cash flow has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of other GAAP financial measures, such as net cash provided by or used in operating activities. Some of the limitations of free cash flow are that free cash flow does not reflect our future contractual commitments and may be calculated differently by other companies in our industry, limiting its usefulness as a comparative measure. Safe Harbor Statement “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This shareholder letter may contain forward-looking statements about our financial outlook, outstanding shares, products, including our investments in products, technology and other key strategic areas. The achievement of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any of these risks or uncertainties materialize or if any of the assumptions prove incorrect, the company’s results could differ materially from the results expressed or implied by the forward-looking statements the company makes.

The risks and uncertainties referred to above include - but are not limited to - risks related to the COVID-19 coronavirus pandemic; our ability to retain and upgrade customers; our revenue growth rate; our brand (including our recent rebranding); our marketing strategies; our self-serve business model; the length of our sales cycles; the growth and development of our salesforce; security measures; expectations regarding our ability to timely and effectively scale and adapt existing technology and network infrastructure to ensure that our products and services are accessible at all times; competition; our debt; revenue recognition; our ability to manage our growth; our culture and talent; our data centers; privacy, security and data transfer concerns, as well as changes in regulations, which could impact our ability to serve our customers or curtail our monetization efforts; litigation and regulatory issues; expectations regarding the return on our strategic investments; execution of our plans and strategies, including with respect to mobile products and features and expansion into new areas and businesses; our international operations; intellectual property; the application of U.S. and international tax laws on our tax structure and any changes to such tax laws; acquisitions we have made or may make in the future; the price volatility of our common stock; and general economic conditions. Further information on these and other factors that could affect our financial results are included in documents filed with the Securities and Exchange Commission from time to time, including the section entitled “Risk Factors” in the Quarterly Report on Form 10-Q that will be filed for the quarter ended March 31, 2022, which should be read in conjunction with these financial results. These documents are or will be available on the SEC Filings section of our Investor Relations website page at investor.momentive.ai. All information provided in this release and in the attachments is as of May 4, 2022, and we undertake no obligation to update this information.

Shape what’s next.