UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | | | | |

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under § 240.14a-12 |

The Cigna Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | | | | | | | |

| ☒ | | | No fee required |

| | | | | | | |

☐ | | | Fee paid previously with preliminary materials |

| | | | | | | |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

March 15, 2024

900 Cottage Grove Road

Bloomfield, Connecticut 06002

Dear Fellow Shareholders:

In 2023, The Cigna Group executed well and delivered sustained growth and strong performance. Powered by our deep clinical expertise, leadership in innovation, and a highly experienced and caring team, we made significant progress advancing our mission to improve the health and vitality of those we serve.

As a result, we enter 2024 with momentum and remain focused on advancing our strategy and investing in our future. Looking forward, we will continue to expand our reach and strengthen capabilities across our Evernorth Health Services and Cigna Healthcare platforms. We will evolve and grow our businesses to deliver value for our shareholders while also building on our work toward a health care system that benefits every individual and every community.

Financial Performance

The Cigna Group successfully delivered on our financial commitments for fiscal year 2023:

•Grew full-year total revenues to $195.3 billion, an increase of 8% year over year.

•Achieved shareholders’ net income for 2023 of $5.2 billion, or $17.39 per share, compared with $6.7 billion, or $21.41 per share, for 2022, and adjusted income from operations of $7.4 billion, or $25.09 per share, compared with $7.3 billion, or $23.36 per share, for 2022.

•Generated cash flow from operations of $11.8 billion.

•Expanded our total share repurchase authority to $11.3 billion, representing a value-enhancing deployment of capital. We expect to repurchase at least $5 billion in common stock by the end of the first half of 2024, as well as use the majority of our discretionary cash flow for share repurchase in 2024.

Advancing Our Strategy

We are relentlessly focused on improving the way care is accessed, delivered, and coordinated to drive better health outcomes, affordability, and growth across our Evernorth Health Services and Cigna Healthcare benefits platforms.

Evernorth Health Services continued proving its ability to create value with differentiated pharmacy, care, and benefits capabilities.

•Pharmacological innovation is rapidly reshaping the health care landscape, and our leadership position will allow us to capitalize on substantial market opportunities addressing the growing needs of our stakeholders. In 2023, in our Pharmacy Benefits Management business, we took action to increase access to affordable medicines and drive greater transparency and predictability with new programs, such as our EncircleRxSM GLP-1 solution that helps employers and organizations manage the complexity and costs of obesity, diabetes, and cardiovascular disease. We continued to provide our clients choices in how they fund pharmacy benefits with a new pharmacy network option, Express Scripts ClearNetworkSM, introduced in November, that offers cost-based pricing for prescription drugs and pharmacy services. Also, recognizing that millions in rural America count on pharmacists to fill gaps in care and improve access, we stepped forward to provide meaningful support through our IndependentRx initiative.

•Our large and fast-growing specialty pharmacy business continues to play a critical role in the coming wave of complex drug innovation. For example, we are focused on the multi-year biosimilar wave to drive greater savings and value for our clients.

•We advanced our efforts to extend our reach, impact, and growth with new and expanded relationships with partners, including VillageMD and CarepathRx Health System Solutions. We also have a substantial new opportunity with the addition of serving Centene Corporation. Our teams did an exceptional job of starting this relationship on the right foot by readying us to transition 20 million Centene customers to our platform this year.

•Recognizing the growing need for mental health care, we launched a value-based care program to strengthen our collaboration with providers and outcomes in our behavioral health network. We also focused on expanding access to care – where and when people need it – at home, virtually, at work, or in person. We also continue to serve growing numbers of customers through MDLIVE, our virtual care platform, and achieved the notable milestone of our 10 millionth visit.

In Cigna Healthcare, we offer services and solutions to employers, organizations, and individuals, along with specialty products that improve the quality of care, health outcomes, affordability, and value. We continued to expand our reach, growing our total medical customers in 2023 by approximately 1.8 million.

•Many of our employer clients turned to us for their evolving needs in supporting healthy, engaged, and productive workforces. Our U.S. Employer business continued to make strides in 2023 toward improving affordability, as well as offering new approaches to expand care access and coordination.

•In International Health, we continued to lead in managing health needs for government organizations, non-governmental and intergovernmental organizations, and globally mobile individuals. We enhanced our portfolio of solutions and expanded our reach into existing markets, including being the first international health insurer to receive a branch license from the Saudi Central Bank to operate in the Kingdom of Saudi Arabia.

•In our Medicare Advantage and Individual Exchange businesses, we supported those we serve and our company by balancing competitive benefit offerings, targeted market expansion, and disciplined pricing activity. Our Medicare Stars Quality Rating underscored the value we provide to seniors, showing that we again have over two-thirds of our members in 4-star or higher plans.

•Earlier this year, we announced that we had reached a definitive agreement to sell our Medicare Advantage, Cigna Supplemental Benefits, Medicare Part D, and CareAllies businesses to Health Care Service Corporation for a total transaction value of approximately $3.7 billion. We expect this transaction to be accretive to our earnings per share in 2025, while also supporting our company in sharpening our focus on businesses where our investments can create significant value across our enterprise. Looking forward, we will continue to innovate and grow our government services business in our high-performing Evernorth portfolio.

Our Responsibility

As a high-performance organization, we are also guided by our purpose and commitment to make health care more sustainable, accessible, and equitable. Throughout 2023, The Cigna Group advanced impactful work in each pillar of our Environmental, Social, and Governance (ESG) strategic framework:

•Healthy Society through our continuing efforts and investments to address health disparities.

•Healthy Workforce by supporting the health and vitality of our global colleagues.

•Healthy Environment through our commitments and actions to reduce our carbon footprint.

•Healthy Company by ensuring that our company’s ethics and values are at the center of all of our interactions and business decisions.

For more information about our ESG vision to advance better health for all, please review our annual ESG report, available on TheCignaGroup.com/our-impact.

Additionally, our publicly available 2022 Diversity Scorecard Report demonstrated our progress towards our goals in three areas: culture and coworkers, clients and customers, and communities. We’re pleased that our leadership continues to be recognized, including by the Dow Jones Sustainability Indices (DJSI), which named our company as a corporate sustainability industry leader for the seventh consecutive year, and by the National LGBT Chamber of Commerce (NGLCC) and partners in the National Business Inclusion Consortium (NBIC) listed our company among the 2023 "Best-of-the-Best" Corporations for Inclusion.

Our Commitment to Governance

In June 2023, Dr. Philip Ozuah, President and CEO of Montefiore Medicine, was appointed as a new independent director to our Board of Directors. Dr. Ozuah, who has 32 years of experience in medicine, adds to the deep expertise and diverse backgrounds of our board. His national reputation as a leader in value-based care, particularly his emphasis on aligning community-based organizations and services critical to addressing the socioeconomic determinants of health, has been and will continue to be an asset for The Cigna Group.

Approximately 70% of our directors have served on our Board for less than our Board’s 7.25-average tenure, which demonstrates how we continue to bring new and relevant perspectives and skill sets into our company. In 2023, our Board composition compared favorably to the S&P benchmarks on mean age, tenure, and gender and ethnic diversity.

Annual Meeting of Shareholders

On behalf of The Cigna Group Board of Directors, we invite you to attend our 2024 Annual Meeting of Shareholders to be held April 24, 2024. The attached Notice of 2024 Annual Meeting of Shareholders and Proxy Statement contains important information about the business to be conducted.

We are proud of the progress we made in 2023 on behalf of those we serve, our communities, and our company, and we look forward to another year of positive impact, strong execution and growth. On behalf of our employees around the world, and the entire Board, we thank you for your support and investment in The Cigna Group.

Sincerely,

| | | | | |

| /s/ David M. Cordani | /s/ Eric C. Wiseman |

| David M. Cordani | Eric C. Wiseman |

| Chairman and Chief Executive Officer (CEO) | Lead Independent Director |

*Consolidated adjusted income from operations and adjusted income from operations per share are non-GAAP measures. See Annex A to the Proxy Statement for a reconciliation of GAAP to non-GAAP measures, as well as a reconciliation of segment metrics to their comparable consolidated metrics.

Notice of 2024 Annual

Meeting of Shareholders

| | | | | | | | | | | | | | | | | |

|

| Meeting Details | | Items of Business |

| | Date Wednesday, April 24, 2024 | 1 | Election of twelve director nominees named in this Proxy Statement for one-year terms to expire at the next annual meeting of shareholders. |

| 2 | Advisory approval of executive compensation. |

| Time 10:30 a.m. Eastern Time | 3 | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024. |

| 4 | Shareholder Proposal – Improve the shareholder right to call a special shareholder meeting, if properly presented. |

| Location Virtual Meeting | | |

| 5 | Shareholder Proposal – Report to shareholders on risks created by the Company's diversity, equity, and inclusion efforts, if properly presented. |

| + | Consideration of any other business properly brought before the meeting. |

| Record Date March 5, 2024 | | |

|

|

|

| | | | | | | | | | | |

The Board of Directors has fixed March 5, 2024, as the record date for determining shareholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. This Notice of Annual Meeting and the accompanying Proxy Statement are being distributed or made available, as the case may be, on or about March 15, 2024. |

|

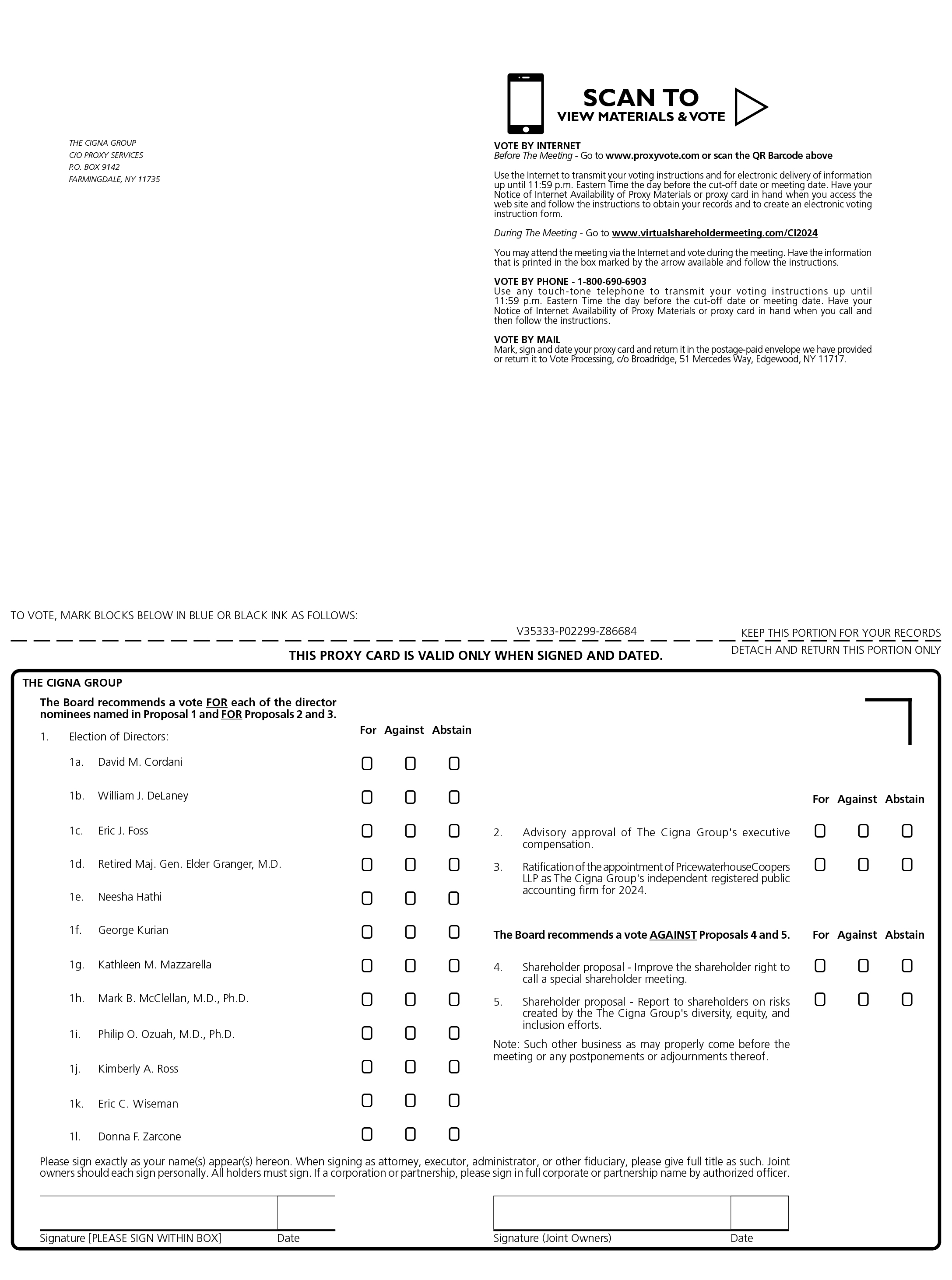

Your vote is very important, regardless of the number of shares you own. We urge you to promptly vote by telephone, by using the internet, or, if you received a proxy card or instruction form, by completing, dating, signing, and returning it by mail. By order of the Board of Directors, /s/ Kari Knight Stevens Kari Knight Stevens Corporate Secretary March 15, 2024 | | | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 24, 2024. The Notice of Annual Meeting, Proxy Statement, and Annual Report for the fiscal year ended December 31, 2023 are available at www.proxyvote.com. |

| |

Table of Contents

Proxy Statement Summary

| | | | | | | | | | | | | | | | | | | | | | | |

| Meeting Information | | | Ways to Vote |

| | | | | |

| | Date and Time Wednesday, April 24, 2024 10:30 a.m. Eastern Time | | | Over the internet. Vote at www.proxyvote.com in advance of the meeting. | | By telephone. Use the telephone number shown on your proxy card. |

| | | | | |

| | Location The Annual Meeting will be held in a virtual format only, at www.virtualshare holdermeeting.com/CI2024. | | | |

| | | | |

| | | | | | | |

| | Record Date March 5, 2024 | | | By mail. If you received a proxy card, mark your voting instructions on the card and sign, date, and return it in the postage-paid envelope provided. |

| | | | |

| | Admission To attend, vote, and submit questions during the Annual Meeting, visit www.virtualshareholdermeeting.com/CI2024 and enter the 16-digit control number included in your notice of internet availability of proxy materials, voting instruction form, or proxy card. | | |

| | |

| | |

| | | | | |

| | | At the meeting. To vote during the Annual Meeting, visit www.virtualshareholdermeeting.com/CI2024 and enter the 16-digit control number included in your notice of internet availability of proxy materials or proxy card. |

| | | | | | | | | | | | | | |

|

| Voting Recommendation |

| Items of Business | | Board

Recommendation | Page |

|

| 1 | Election of twelve director nominees named in this Proxy Statement for one-year terms to expire at the next Annual Meeting of shareholders. | | FOR the election of each director nominee | |

| 2 | Advisory approval of executive compensation. | | FOR | |

| 3 | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024. | | FOR | |

| 4 | Shareholder Proposal – Improve the shareholder right to call a special shareholder meeting, if properly presented. | | AGAINST | |

| 5 | Shareholder Proposal – Report to shareholders on risks created by the Company's diversity, equity, and inclusion efforts, if properly presented. | | AGAINST | |

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 1 |

2023 Performance and Accomplishments

Thanks to the dedicated efforts of our approximately 72,500 colleagues around the world:

•The Cigna Group delivered on our overall financial goals for fiscal year 2023.

•We continued to execute our growth strategy.

•We advanced our work to create a healthier, more sustainable, and inclusive world.

Delivered in a dynamic environment

Our financial performance underscored the strength of our growth platforms, and our service-based, capital-light business model.

In 2023, we:

•Grew both full-year total revenues and adjusted revenues* by 8% to $195.3 billion.

•Achieved full-year shareholders’ net income per share of $17.39, and adjusted income from operations per share* of $25.09.

•Returned $3.7 billion to shareholders through share repurchases and dividends in 2023.

Continued to Execute Our Growth Strategy

We innovated, partnered, expanded access to care, built stronger communities, and delivered differentiated value to advance our vision for the future of health care — and improve lives.

•We executed the pharmacy benefits industry’s largest implementation with Centene to bring Express Scripts’ best-in-class pharmacy solutions to 20 million Centene members.

•Evernorth Health Services created a new, multi-year strategic partnership with CarepathRx Health System Solutions to improve specialty and care services to providers, hospitals, and health systems.

•We enhanced MDLIVE’s rapidly growing virtual primary care experience for patients and clinicians by acquiring Bright.md’s technology and clinical capabilities. MDLIVE is also improving its virtual primary care service to include health coaching for patients with chronic conditions.

•To continue driving greater transparency of prescription medications, while preserving and protecting client choice, we launched ClearCareRX and ClearNetwork.

•Express Scripts, from Evernorth Health Services, provided clients with additional flexibility by offering a new option for simple "cost-plus" pharmacy pricing for brand, generic, and specialty medications.

•To ensure Americans living in rural areas have greater access through partnerships and independent pharmacies, Evernorth Health Services introduced IndependentRx and enhanced the MoreThanRx solution suite.

•Cigna Healthcare removed nearly 25% of medical services from prior authorization requirements to simplify the care experience for customers and clinicians.

•We partnered with Monogram Health — a leading value-based specialty provider of in-home evidence-based care and benefit management services — to provide in-home primary and specialty care to Cigna Healthcare Medicare Advantage customers with chronic kidney disease and end-stage renal disease.

•We are positioned to offer enhanced, localized health and well-being solutions with global capabilities in the Kingdom of Saudi Arabia by securing the first branch license granted to an international insurance provider.

•We completed several investments through The Cigna Group Ventures — driving innovation across the health care ecosystem, especially in mental and behavioral health care, and data analytics.

Advancing Better Health for All

We aim to transform the ecosystem of health into one that is well-functioning, sustainable, accessible, and equitable.

Our ESG approach is structured around four connected pillars — Healthy Society, Healthy Workforce, Healthy Environment, and Healthy Company — that underscore our mission to improve the health and vitality of those we serve. In 2023, we:

•Achieved our goal of $1 billion in annual total diverse supplier spend, and we did so two years ahead of schedule.

| | | | | |

| 2 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

•Continued to make progress on our Scope 3 greenhouse gas (GHG) emissions inventory, with the intent to disclose additional categories, and aim to set science-based GHG reduction targets.

•Published our 2022 Diversity Scorecard Report, which demonstrates our progress relative to goals in three key areas: culture and coworkers, clients and customers, and communities.

•Supported nearly $51 million in combined charitable giving, including approximately $15.6 million through The Cigna Group Foundation toward the following focus areas: health and well-being; education and workforce development; community and social issues; military, veterans, and first responders; disaster relief; global and trending causes; employee programs; The Cigna Group Scholars; and Healthier Kids For Our Future®.

•Expanded our caregiver leave program from four weeks to eight weeks, which provides paid leave to enable employees to bond with a child after birth or adoption or to care for a family member with a serious health condition.

•Continued to have robust engagement with our shareholders on a variety of topics, including ESG.

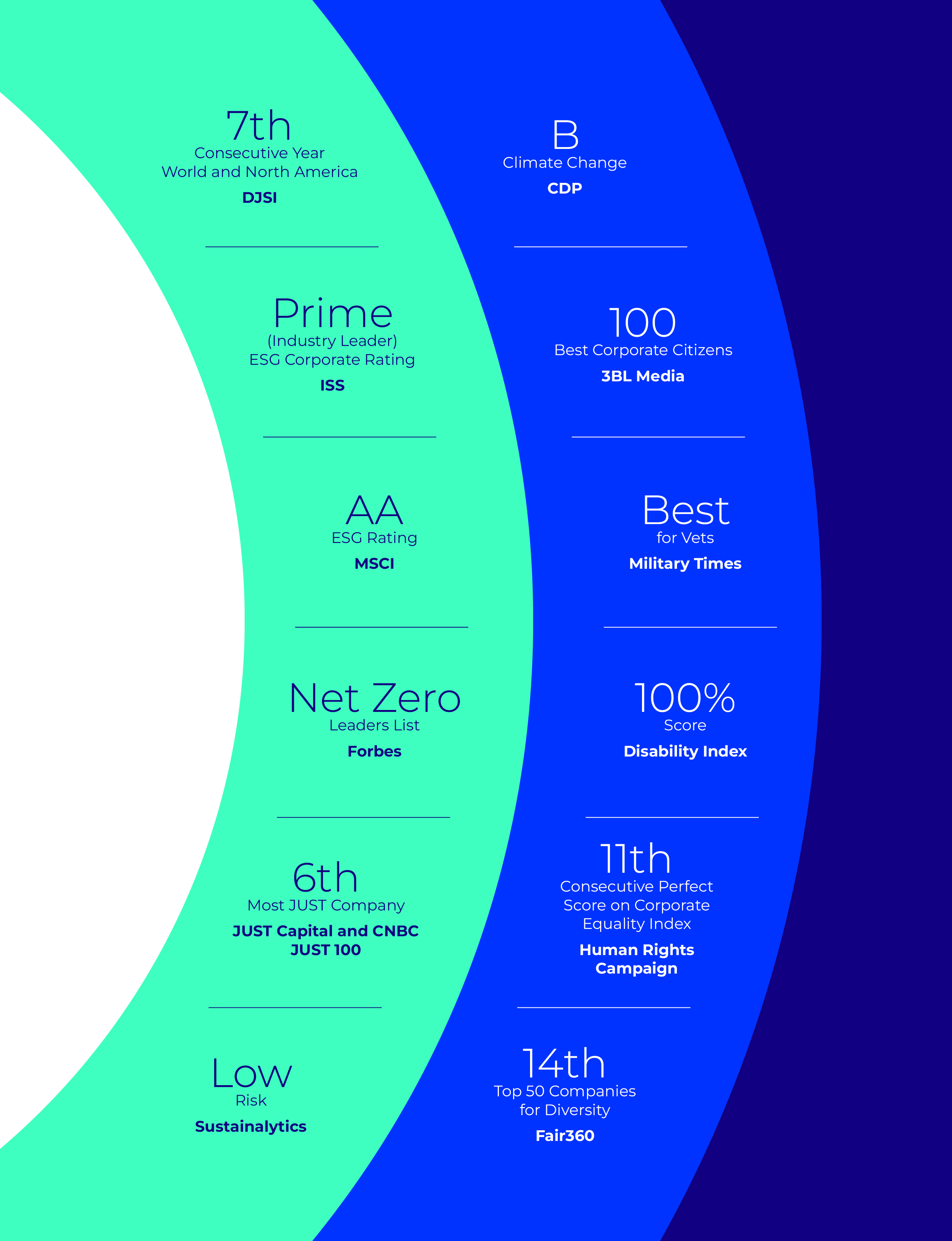

•Received the following ESG-related recognitions:

•Named one of America’s Most JUST Companies for the fourth year by JUST Capital and CNBC, including No. 1 in the Health Care Providers industry and No. 6 overall in the JUST 100 for 2024.

•Member of Dow Jones Sustainability Index for both the World and North America for the seventh consecutive year.

•Ranked No. 14 on Fair360’s (formerly known as DiversityInc) Top 50 Companies For Diversity, a 10-place jump forward from 2022.

•Honored by Business Group on Health as Best Employer for Health and Well-being.

•Achieved perfect score for the 11th consecutive year on the Human Rights Campaign Foundation’s 2023—2024 Corporate Equality Index, earning the Equality 100 Award: Leader in LGBTQ+ Workplace Inclusion.

•Scored 100 on the 2023 Disability Equality Index, which is considered the most robust assessment for disability inclusion in business.

•Earned top spot for sustainability in the health care industry on Forbes’ inaugural Net Zero Leaders List.

| | | | | | | | | | | | | | |

|

| *We encourage you to review our Annual Report on Form 10-K for the year ended December 31, 2023. Consolidated adjusted income from operations, per share, and consolidated adjusted revenues are not determined in accordance with accounting principles generally accepted in the United States (GAAP) and should not be viewed as a substitute for the most directly comparable GAAP measures, shareholders’ net income, per share, and total revenues, respectively. Additional information regarding our use of non-GAAP measures and reconciliations to the most directly comparable GAAP measure can be found on Annex A. | |

|

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 3 |

ESG at The Cigna Group

At The Cigna Group, we advance better health for all. Our environmental, social, and governance (ESG) approach is rooted in our drive to make the health care system well-functioning, sustainable, and equitable. This approach is structured around four connected pillars that underscore our mission to improve the health and vitality of those we serve.

Building a well-functioning, sustainable, accessible, and equitable health care system requires understanding and addressing social determinants of health and improving medical quality and access, while lowering health risks, promoting preventive health interventions, and coordinating all aspects of care.

Sustainable Health Care: We are committed to transforming how care is accessed, delivered, and coordinated to drive better health outcomes and affordability for our clients and customers. Core to our approach to sustainable health care is influencing how patients access care and connect to the highest-quality physicians, medications, and optimized care modalities – with a focus on value.

Product Service and Quality: Our portfolio of offerings solves diverse challenges across the health care system. We offer a differentiated set of pharmacy, medical, behavioral, dental, and supplemental products and services. The experiences of our customers, clients, and strategic partners are critical to protecting and improving our customers’ health and vitality, as well as enabling our business strategy and being a source of competitive differentiation.

Health Equity: Our purpose is to ensure that all people have the opportunity to achieve their full health potential regardless of social, economic, or environmental circumstances. To this end, we collaborate with providers to integrate health equity and social determinants of health into value-based reimbursement models and address the root causes of health disparities through innovative and measurable interventions that are impactful and scalable.

| | | | | | | | |

| | |

| Every day, we work to make a difference in the health of our communities. | |

| | |

Community Resilience: Every day, we work to make a difference in the health of our communities. Our commitment to local communities continues to align to our mission of improving the health and vitality of those we serve. Our community engagement is through the work of The Cigna Group Foundation, corporate giving, and employee giving and volunteerism.

We believe that employers play a vital role in the health care system, and we strive to be a model for others by prioritizing the health and vitality of employees within our own company. A healthy and diverse workforce is essential to achieving our mission, and we continually invest in our employees to support their health and vitality, to foster their growth and development, and to further cultivate diversity and inclusion.

Employee Health, Safety and Well-Being: Higher vitality is linked to better mental and physical health, to higher levels of job satisfaction and performance, and to a more motivated, connected, and productive workforce. Our enterprise well-being strategy and benefits programs are designed to provide holistic support for the eight dimensions of vitality for each of our approximately 72,500 employees worldwide and their families.

| | | | | |

| 4 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | | | | |

| | |

| We strongly believe that investing in our people is one of the most important decisions we can make as a company. | |

| | |

Diversity, Equity, and Inclusion within Our Workforce: We recognize that our continued success depends on the collective strengths of our employees. We are committed to nurturing an inclusive culture of belonging that is powerfully diverse, strives for equity, and values every person’s unique differences and talents because we know this supports better decision-making, greater innovation, and higher levels of engagement within our company, which help us improve the health and vitality of those we serve.

Human Capital Development: We strongly believe that investing in our people is one of the most important decisions we can make as a company. Our focus on the growth and development of our people is essential to attracting, retaining, and engaging our workforce and ultimately achieving our mission and business growth.

We believe that responsible environmental stewardship can improve health and vitality — and also makes sound business sense. We strive to identify new efficiencies and make strategic investments that reduce our environmental impacts and our operating costs. In addition, we see an opportunity to measure the positive impact on the environment with ways we are advancing our business, including through our continued investment toward the growing use of virtual care.

Climate Change and Emissions: As a global health company, we are keenly focused on the connection between planetary health and human health. We set targets to drive progress on our operational sustainability and strategies to achieve them in the coming years.

Sustainable Operations: To further support our operational sustainability targets and reduce our environmental impact, we prioritize efficiency in our buildings, responsible water management, and proper waste reduction.

We have a deep and long-held commitment to strong governance, as well as ethical and resilient business practices. The strength of our Board of Directors contributes meaningfully to upholding these commitments.

Leadership and Accountability: Our Board is committed to principles of good corporate governance. Our Corporate Governance Guidelines set forth the key governance principles that guide the Board. These guidelines, together with the charters for the Board’s Audit, Compliance, Corporate Governance, Finance, and People Resources Committees, provide the framework for effective governance to promote oversight, accountability, and successful outcomes. Our Board has ultimate oversight for our ESG strategy and performance.

Business Ethics and Compliance: Earning, building, and maintaining the trust of our customers, clients, employees, business partners, and regulators is critical to the success and sustainability of our business. We strive to meet consistent standards of integrity in everything that we do. Our ethics, compliance, and employee relations teams play a critical role in driving ethical behavior across our business. Through a company culture that emphasizes ethics and integrity, we empower employees to be responsible corporate citizens and support the dignity of workers across our value chain.

Data Protection: As a global health company, we collect, store, and process a high volume of sensitive data in connection with the services we provide. We understand the critical importance of securing personal information and maintaining a robust and agile data protection program in an ever-evolving landscape. We take the trust our clients and customers place in us very seriously and are committed to protecting their information.

Responsible Supply Chain: As we drive sustainability across our operations, we look to ensure our indirect (procured goods and services to support our day-to-day operations) and direct supply chains (procured goods and services to be delivered to our customers) embody our ESG aspirations and commitments. The Cigna Group achieved our goal of $1 billion in total diverse supplier spend two years ahead of schedule. Our Supplier Code of Ethics underscores our support of fundamental human rights for all, as well as our environmental expectations.

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 5 |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Committee Membership |

| Name and Title | Director

Since | Independent | Audit | Compliance | Corporate Governance | Finance | People Resources | Executive |

| | | | | | | | |

| | | | | | | | |

David M. Cordani Chairman and Chief Executive Officer of The Cigna Group | 2009 | | | | | | | |

William J. DeLaney Former Chief Executive Officer of Sysco Corporation | 2018 | l | l | | l | | | |

Eric J. Foss Former Chair, President, and Chief Executive Officer of Aramark | 2011 | l | | | | | l | l |

Retired Maj. Gen. Elder Granger, M.D. President and Chief Executive Officer of THE 5Ps, LLC | 2018 | l | | | l | | | l |

Neesha Hathi Head of Wealth and Advice Solutions of The Charles Schwab Corporation | 2021 | l | l | | | l | | |

George Kurian Chief Executive Officer of NetApp, Inc. | 2021 | l | | l | | | l | |

Kathleen M. Mazzarella Chair, President, and Chief Executive Officer of Graybar Electric Company, Inc. | 2018 | l | | | | l | | l |

Mark B. McClellan, M.D., Ph.D. Director, Duke-Robert J. Margolis, M.D., Center for Health Policy | 2018 | l | | l | l | | | |

Philip O. Ozuah, M.D., Ph.D. President and Chief Executive Officer of Montefiore Medicine | 2023 | l | | l | | | l | |

Kimberly A. Ross Former Chief Financial Officer of Baker Hughes Company | 2020 | l | | | | l | | l |

Eric C. Wiseman Lead Independent Director of The Cigna Group; Former Executive Chair, President, and Chief Executive Officer of VF Corporation | 2007 | l | | | | | | l |

Donna F. Zarcone Former President and Chief Executive Officer of The Economic Club of Chicago | 2005 | l | l | | | | | l |

| | | | | | l= MEMBER  = CHAIR = CHAIR |

| | | | | |

| 6 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

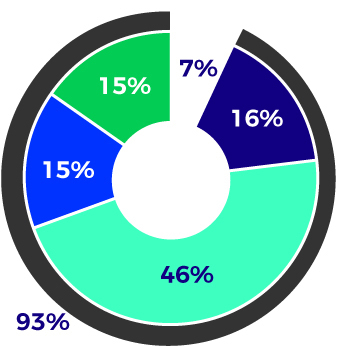

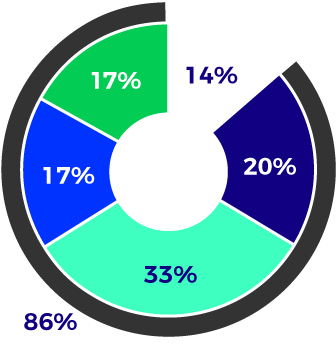

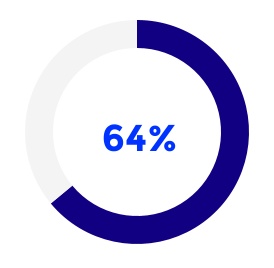

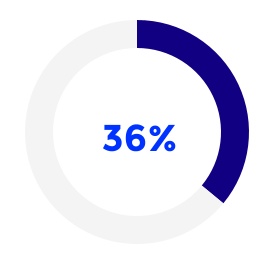

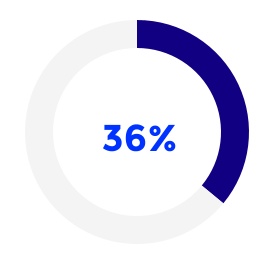

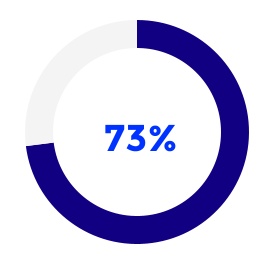

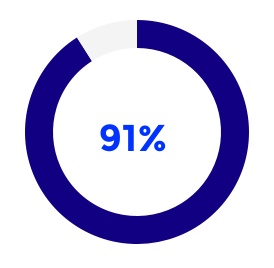

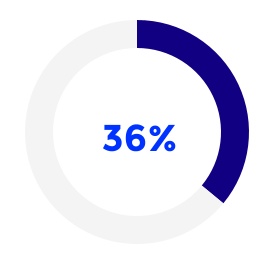

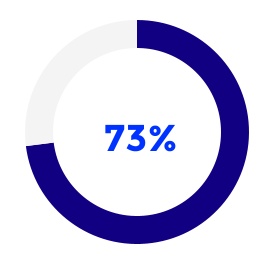

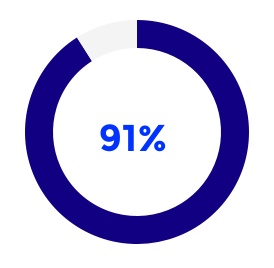

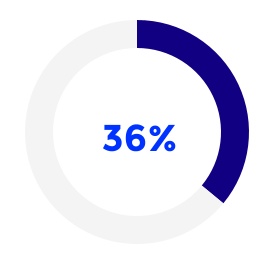

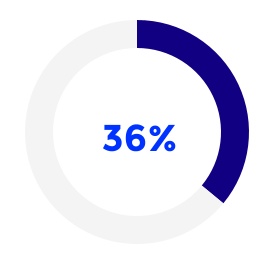

Independent Director Diversity

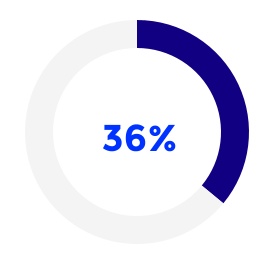

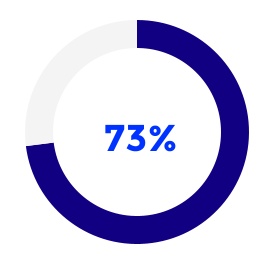

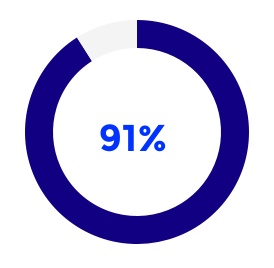

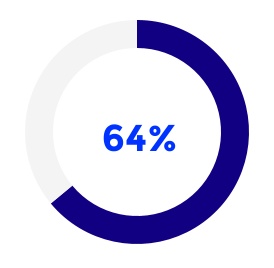

Our Board is composed of individuals with expertise in fields relevant to The Cigna Group business; experience from different professions and industries; a diversity of age, race, ethnicity, gender, and global experience; and a range of tenures. Together, this diverse mix of skills and experience effectively supports our strategy. Among our director nominees, four are women and four are racially or ethnically diverse individuals (meaning an individual who self-identifies as Black/African American, Hispanic or Latinx, Asian, Pacific Islander, American Indian/Alaskan, or two races or more). The following graphics represent the diversity of our independent director nominees.

| | | | | | | | | | | | | | |

Overall Diversity | Gender Diversity | Racial/Ethnic Diversity | Tenure Diversity | Public Company Service Diversity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| n | Independent diverse director nominees | n | Independent female director nominees | n | Independent racially or ethnically diverse director nominees | n | Independent director nominees with less than average tenure 7.25 years average tenure | n | Independent director nominees with past experience serving on a public company board |

Corporate Governance

The Board is committed to ensuring corporate governance practices that best protect the interests of our shareholders. We believe that strong corporate governance and an independent Board provide the foundation for financial and operational integrity and shareholder confidence.

Shareholder Engagement

The Board and the Corporate Governance Committee oversee the Company’s shareholder engagement practices. Our engagement with shareholders helps us better understand our shareholders’ priorities and perspectives. The Board considers feedback and insights from our shareholders as it reviews and evolves our governance and executive compensation practices and disclosures.

We engage with shareholders throughout the year on a number of topics related to corporate governance, executive compensation, corporate responsibility, Company performance, and other areas of focus for shareholders. Over the past year, we engaged on governance-related topics with holders of approximately 40% of our outstanding stock.(1)

| | | | | | | | |

| | |

| In 2023, we invited holders of approximately 70% of our outstanding stock, including our 100 largest shareholders, to engage with us to discuss corporate governance topics.(1) | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Topics |

| Corporate governance and shareholder rights | | Board composition and refreshment | | Executive compensation and human capital matters | | Diversity, equity, and inclusion efforts | | ESG initiatives and performance |

Beyond specific engagement around corporate governance, the Investor Relations team and senior management engage with investors regularly to discuss our operating performance and growth strategy.

(1)Based on holdings as of December 31, 2023.

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Governance Practices |

| Independence | | | Best Practices | | | Accountability | | | Shareholder Rights |

| | | | | | | | | |

| | | | | | | | | |

•Other than the Chair/CEO, all directors are independent •Lead Independent Director with clearly defined responsibilities •100% independent Audit, Compliance, Corporate Governance, Finance, and People Resources Committees •Regular meetings of the independent directors of the Board and its committees, without management present •Board and its committees may hire outside advisors independently of management | | | •Active shareholder engagement •Diverse Board in terms of gender, race and ethnicity, experiences, and specific skills and qualifications •Adoption of policy to ensure a diverse candidate pool for all director searches •Separate Code of Business Conduct and Ethics for the Board •Majority of director compensation delivered in common stock of The Cigna Group •Robust stock ownership guidelines for directors | | | •Annual election of all directors •Directors elected by majority vote standard for uncontested election •Annual self-evaluations of the Board, its committees, and individual directors, and periodic independent third-party assessments, including in 2024 •Annual evaluation of the Board leadership structure •Annual evaluation of CEO (including compensation) by independent directors •Clawback policies that comply with and go beyond the requirements of the Dodd-Frank Act and NYSE rules | | | •Shareholder right to call a special meeting •Proxy access right allowing shareholders to include their nominees in proxy materials for election at annual meetings •Shareholders can amend our Certificate of Incorporation or By-Laws with a support of holders of a majority of outstanding stock; no supermajority vote provisions •No shareholder rights plan or poison pill |

|

| | | | | |

| 8 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

Executive Compensation

We firmly believe that executive compensation must be aligned with shareholder interests. Additionally, we believe that aligning executive compensation to the achievement of enterprise goals that are designed to support our business strategy and drive our innovation will result in the creation of meaningful and sustained long-term value for our shareholders.

| | | | | | | | | | | | | | | | | |

| Compensation Practices | Incentivize Performance | Align Interests | Emphasize At-Risk Pay | Focus on Long Term | Pay Competitively |

|

Performance-Based Pay •93% of 2023 CEO total direct pay at risk | | | | | |

Long-Term Incentives •77% of 2023 CEO total direct pay in equity award incentives •No payment of dividends on restricted stock prior to vesting | | | | | |

Commitment to Performance Equity •100% of 2023 CEO long-term incentive award is performance-based | | | | | |

Rigorous Goals Underpin Incentives •Minimum level of performance required for any payout under annual incentive •No overlap between short- and long-term metrics, and incentives use both absolute and relative metrics | | | | | |

Benchmarked Compensation •Committee review of compensation targets •Named executive officer total direct compensation within the competitive range of the market median | | | | | |

Strong Compensation Governance •Robust clawback, anti-hedging, and anti-pledging policies •Annual compensation risk assessment by People Resources Committee | | | | | |

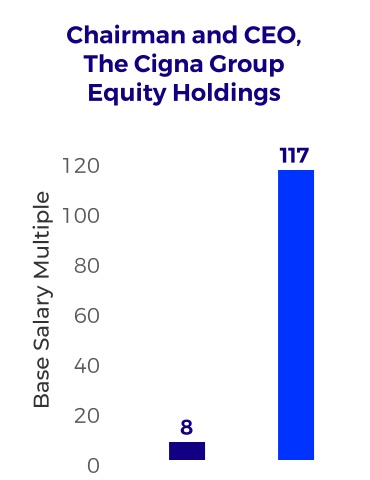

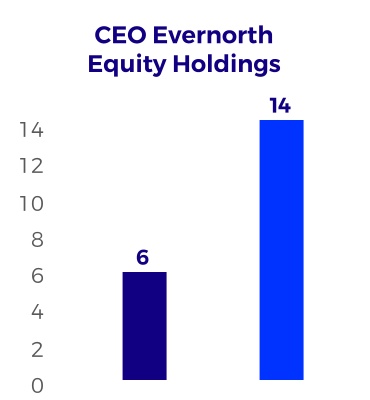

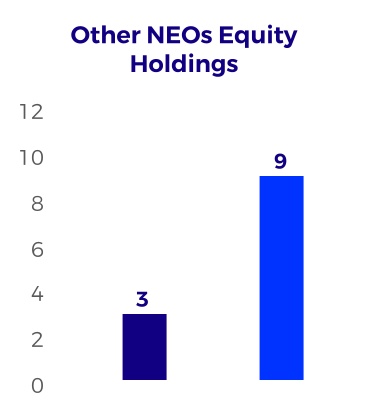

Rigorous Stock Ownership Requirements •Significant stock ownership requirements •Stock retention requirements that encourage a long-term ownership philosophy | | | | | |

Prudent Equity Usage •No repricing without shareholder approval •Annual share usage limit to manage burn rate | | | | | |

| | | | | |

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 9 |

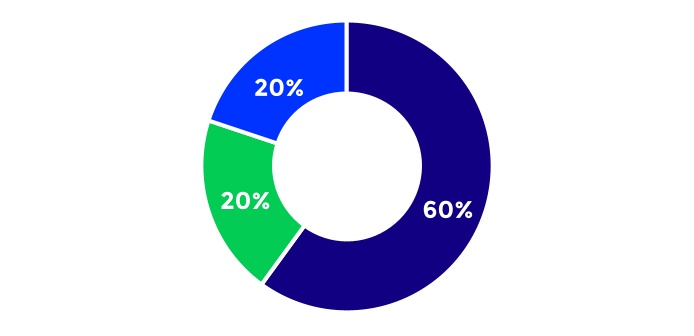

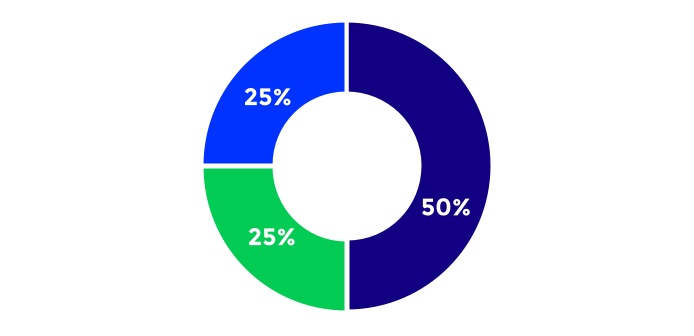

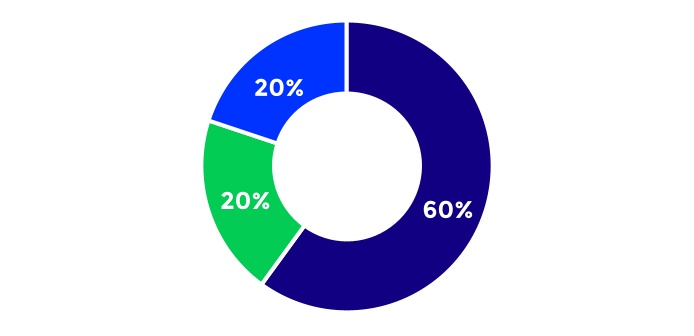

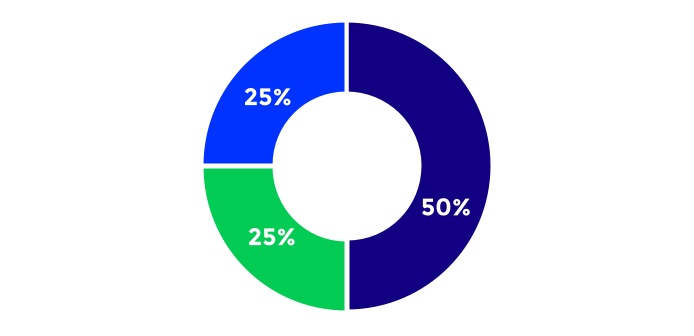

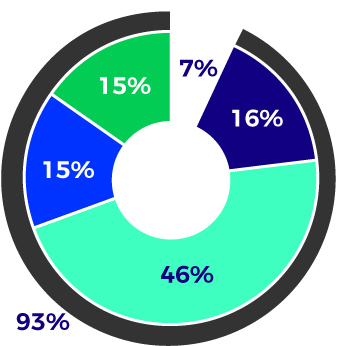

2023 CEO Compensation

Guided by the principles summarized above, for 2023, performance-based incentives represented approximately 93% of Mr. Cordani’s total direct compensation, including 77% in long-term incentive (LTI) and 16% in Enterprise Incentive Plan (EIP) awards. This compensation structure is designed to reward Mr. Cordani for performance achieved and align his interests with those of our long-term shareholders.

| | | | | | | | | | | | | | |

CEO Total Direct Pay Mix* |

|

| £ | Base salary | | ¢ | Stock options |

| ¢ | Annual Incentive | | ¢ | Restricted stock |

| ¢ | SPS award | | ¢ | Performance-based |

| *Totals may not add to 100% due to rounding |

| | | | | |

| 10 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | | | | | | | |

Executive Compensation CEO compensation demonstrates our pay-for-performance philosophy and is aligned with the interests of our shareholders. The performance-based orientation of Mr. Cordani’s compensation reflects the Board’s view that executive compensation should incentivize superior performance, reward executives for the performance achieved, and be strongly aligned with the interests of our long-term shareholders. Grouping Mr. Cordani’s 2023 compensation into three distinct categories demonstrates the execution of this philosophy: |

| 1 | | Exercise of Vested Awards Previously Earned. In certain years, the sale of shares realized from the exercise of options comprises a significant component of Mr. Cordani’s realized compensation. Various factors may drive Mr. Cordani’s decision to exercise stock options, such as the option expiration date, the trading price of the Company’s stock, and his diversification plans. Any value realized upon the sale of shares acquired from the exercise of options is a direct reflection of sustained shareholder value creation between the time the options were granted and the time they were exercised. In 2023, Mr. Cordani did not exercise options. | |

|

| 2 | | 2023 performance-based payouts to Mr. Cordani in consideration of the Company’s performance. The 2023 payout for Mr. Cordani, which includes his 2023 EIP award at 110% of target and the payout of his 2021–2023 strategic performance share (SPS) award at 106% of target, reflects the Total Shareholder Return (TSR) performance of the Company relative to its peers (see page 79) as well as the Company’s achievement of certain financial goals and the advancement of key strategic objectives designed to address pressing needs of the Company’s key stakeholders (i.e., improving affordability and effectiveness to provide greater value to our clients and improve health outcomes for our customers; advancing environmental, social, and governance initiatives, including advancing health equity; and increasing cross-enterprise leverage, deepening our relationships with, and creating greater value for, our stakeholders) (see pages 70 – 73). | |

|

| | •2023 EIP award. In determining the amount of Mr. Cordani’s EIP payout, the independent members of the Board started their consideration with the calculated funding percentage of the EIP as the baseline for Mr. Cordani’s EIP award, and then also considered the Company’s 2023 financial results, Mr. Cordani’s leadership in the successful execution of strategic initiatives, and the continued focus on the well-being of our employees and culture of integrity. Taking all of these factors into account, the independent members of the Board awarded Mr. Cordani an EIP payout for 2023 of $3,300,000, or 110% of his 2023 EIP target. Additional information about the 2023 EIP and the factors considered by the independent members of the Board in determining the amount of Mr. Cordani’s EIP payout can be found on pages 70 – 73. | |

| | | |

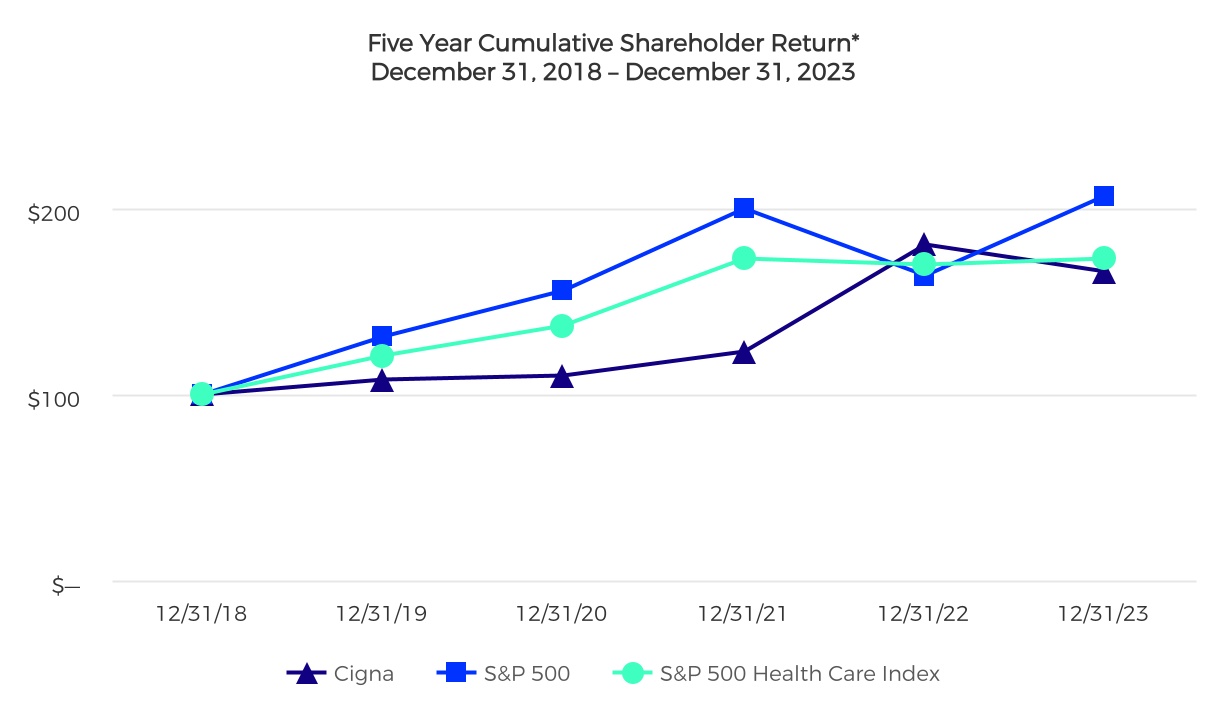

| | •2021–2023 SPS payout. At the time the 2021–2023 SPS award was granted, when the fair market value of our stock was $213.80, the value of Mr. Cordani’s award was $7,250,000, assuming a payout at target. The 2021–2023 SPS program included two performance measures, each weighted 50%: (1) relative TSR; and (2) adjusted income from operations per share, measured on a cumulative basis. Over the three-year performance period, The Cigna Group's TSR was 14.9%, placing us very close to the median of our SPS peer group and resulting in a 99% payout for the relative TSR measure. Cumulative adjusted income from operations, per share, for the three-year period grew to $68.93, resulting in a payout at 113% for this measure, and, coupled with the payout for TSR, a 106% payout for the program overall. Based on the closing stock price of $332.96 on March 1, 2024, the date the award was paid out, the actual value of Mr. Cordani’s award was approximately $12 million, or approximately 165% of the value at the time the award was made. Additional information about the 2021–2023 SPS program and Company performance can be found on pages 77 – 79. | |

|

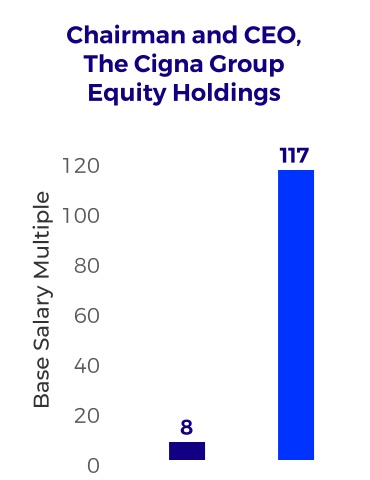

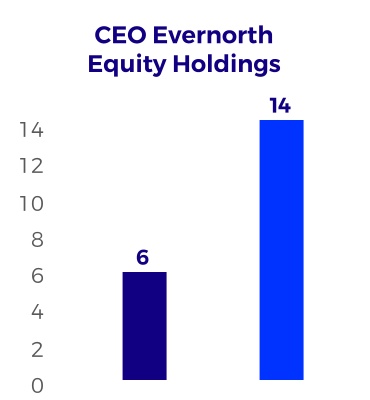

| 3 | | Equity awards incentivize future performance, fully aligning his interests with the Company’s shareholders. Mr. Cordani is required to hold The Cigna Group stock valued at eight times his base salary. In fact, Mr. Cordani’s stock holdings are valued at $198.4 million(1), 132 times his base salary, in addition to equity awards that have not yet vested or have not been exercised. This includes Mr. Cordani’s 2023 and 2024 equity grants, which will be measured over the long-term and which incentivize sustainable long-term Company performance (see pages 76 – 77). | |

|

| | •2024 LTI Award Mix. In 2024, as in 2023 and 2022, 60% of Mr. Cordani’s LTI award comprised SPS awards, and the remaining 40% was split evenly between restricted stock and options, at 20% each. The 2024 SPS program will again include two measures, each weighted at 50%: (1) adjusted income from operations per share, measured on a cumulative basis; and (2) relative TSR. The significant proportion of SPSs more heavily weights Mr. Cordani’s interests in improving the Company’s relative TSR over the long term and puts more of his award at risk if that improvement does not occur. | |

(1)Based on Mr. Cordani’s holdings and the closing price of the Company’s common stock on March 1, 2024 ($332.96).

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 11 |

Voting Matters and Board Recommendations

| | | | | | | | |

| | For the reasons set forth below and as further detailed throughout this Proxy Statement, the Board of Directors unanimously recommends that you vote FOR each of the management proposals. |

| | | | | |

| Management Proposals | More Information |

| |

Proposal 1. Election of Directors. The Board and the Corporate Governance Committee believe that the twelve director nominees named in this Proxy Statement bring a combination of diverse qualifications, skills, and experiences that contribute to a well-functioning Board. As determined by the Board and Corporate Governance Committee, each director nominee has proven leadership ability, has demonstrated good judgment and is a valued participant on the Board. | |

Proposal 2. Advisory Approval of Executive Compensation. Our executive compensation program is designed to base the substantial majority of our executive officers’ compensation on the performance of The Cigna Group, aligning the interests of our executive officers with those of our shareholders and other stakeholders and rewarding them for the creation of long-term value. Because your vote is advisory, it will not be binding upon the Board. However, the Board and the People Resources Committee value your opinion and will review and consider the voting results when making future executive compensation decisions. | |

Proposal 3. Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for 2024. The Audit Committee approved the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for The Cigna Group for 2024. The Audit Committee and the Board believe that the continued retention of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm is in the best interests of the Company and its shareholders. As a matter of good corporate governance, the Board is seeking shareholder ratification of the appointment. | |

| | | | | |

| 12 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | | | | |

| | For the reasons set forth below and as further detailed throughout this Proxy Statement, the Board of Directors unanimously recommends that you vote AGAINST each of the shareholder proposals. |

| | | | | |

| Shareholder Proposals | More Information |

| |

Proposal 4. Improve the Shareholder Right to Call a Special Shareholder Meeting. The Board continues to believe in the importance of shareholders having the ability to call special shareholder meetings. Our By-Laws already permit shareholders with net long ownership of 25% or more of our outstanding common stock for a period of at least one year to call special meetings – a threshold established in response to extensive shareholder outreach and feedback and in line with the threshold adopted by many other public companies. Our Board believes that the 25% threshold balances providing shareholders with a meaningful right to call a special meeting in the event of exigent circumstances against providing a small minority of shareholders – who may have narrow, short-term interests – from causing The Cigna Group to incur the unnecessary expense or disruption of a special meeting to pursue matters that may not universally require immediate attention. Given the current special meeting right, our Board strongly believes that the implementation of this proposal is unnecessary and not in the best interests of The Cigna Group or its shareholders. | |

Proposal 5. Report to Shareholders on Risks Created by the Company's Diversity, Equity, and Inclusion Efforts. The Cigna Group is committed to fostering equity and inclusion, and aims to promote fair and equitable treatment of our employees, customers, partners, and communities to advance our ability to improve the health and vitality of those we serve. We have instituted robust governance structures at the Board and management levels to further our extensive diversity, equity, and inclusion (DEI) efforts and ensure active and engaged oversight. Upon consideration of the extensive policies, procedures, and governance structures of The Cigna Group related to its DEI efforts, as well as its related DEI reporting, our Board believes that the implementation of this proposal is not in the best interests of The Cigna Group or its shareholders and that the information sought by the report would not advance the interests of the Company’s stakeholders in any meaningful way. Rather, it could adversely impact our shareholders given the potential that such a report could prejudice the Company. | |

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 13 |

| | | | | | | | | | | | | | |

| Corporate Governance Matters The Cigna Group is committed to ensuring strong corporate governance practices that protect the best interests of our shareholders. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Corporate Governance Matters

Election of Directors (Proposal 1) | | | | | | | | |

| | The Board of Directors unanimously recommends that shareholders vote FOR each of the nominees. |

Our Board has nominated the twelve directors named in this Proxy Statement for election at the Annual Meeting. Our Board is composed of individuals with expertise in fields relevant to The Cigna Group business; experience from different professions and industries; a diversity of age, race and ethnicity, gender, and global experience; and a range of tenures. Together, this diverse mix of skills and experience effectively supports our strategy. The role of the Board, its leadership structure, and its governance practices are described in “Corporate Governance Policies and Practices” below. This section identifies the director expectations and qualifications considered by the Board and the Corporate Governance Committee in selecting and nominating directors, describes the process for director nominations and elections, discusses recent board composition developments, details our commitment to diversity, and presents the biographies, skills, and qualifications of the director nominees.

Director Expectations and Qualifications

The Corporate Governance Committee, in consultation with the Board, has identified individual director expectations and qualifications that it believes every member of the Board should have. In addition, the Corporate Governance Committee has identified areas of expertise that are directly relevant to The Cigna Group’s business strategy in the short- and long-term, enable the Board to exercise its oversight function, and contribute to a well-functioning Board. In developing these areas of expertise, the Board also considered best practices among other large companies. The Board regularly reviews these identified areas of expertise to ensure they support the evolution of the Company’s strategy and the Board’s needs. The Corporate Governance Committee and the Board take into consideration these criteria and the mix of skills and experience as part of the director recruitment, selection, evaluation, and nomination process.

Expectations and Qualifications of Every Director

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 15 |

| | | | | |

| CORPORATE GOVERNANCE MATTERS | |

Areas of Expertise of our Director Nominees

The chart below identifies the balance of skills and qualifications each director nominee brings to the Board. Each director nominee brings his or her own unique background and range of expertise, knowledge, and experience, which we believe provides an appropriate and diverse mix of qualifications necessary for our Board to effectively fulfill its oversight responsibilities. We believe the combination of the skills and qualifications shown below demonstrates how our Board is well positioned to oversee strategy, performance, culture, and risk at the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Business Leader | Finance | Global Operations | Health Services & Delivery Systems | Marketing & Consumer Insights | Regulated Industry/Public Policy | Risk Management | Technology - Strategy, Security and Operations |

| | | | | | | | |

| David M. Cordani | | | | | | | | |

| William J. DeLaney | | | | | | | | |

| Eric J. Foss | | | | | | | | |

| Elder Granger | | | | | | | | |

| Neesha Hathi | | | | | | | | |

| George Kurian | | | | | | | | |

| Kathleen M. Mazzarella | | | | | | | | |

| Mark B. McClellan | | | | | | | | |

| Philip O. Ozuah | | | | | | | | |

| Kimberly A. Ross | | | | | | | | |

| Eric C. Wiseman | | | | | | | | |

| Donna F. Zarcone | | | | | | | | |

Nomination Process

The Corporate Governance Committee assesses the Board’s composition as part of the annual self-evaluation of the Board (described in the “Corporate Governance Policies and Practices – Board Evaluations and Board Effectiveness” section of this Proxy Statement). On an ongoing basis, the Corporate Governance Committee engages in Board succession planning, taking into account input from Board discussions and from the Board and committee evaluation process.

Renomination of Current Directors

When considering whether to nominate current directors for re-election, the Corporate Governance Committee and the Board review individual directors’ performance against the expectations for Board membership, as well as how the directors’ skills and experiences support the Company’s mission, values, and strategy and the Board’s needs.

| | | | | |

| 16 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | |

| CORPORATE GOVERNANCE MATTERS |

Board Composition Developments

Dr. Philip Ozuah, M.D., Ph.D., joined the Board effective June 1, 2023. Dr. Ozuah’s appointment was supported by a search firm and the result of the Board’s ongoing refreshment work. When considering Dr. Ozuah’s appointment, the Board considered, among other factors, his 32 years of experience in medicine and his national reputation as a leader in value-based care, particularly his emphasis on aligning community-based organizations and services critical to addressing the socioeconomic determinants of health. Dr. Ozuah also further enhances the Board’s diversity, which is of high importance to the Board.

Identification of New Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assessment of Needs | | | Identification of Potential Candidates | | | Candidate Review Process | | | Recommendation |

| | | | | | | | | |

| | | | | | | | | |

•The Corporate Governance Committee considers the diversity of skills represented on the Board and focuses on identifying candidates that possess skills and qualifications that are complementary to the existing Board members’ skills and will support the Company’s short- and long-term strategy. | | | •The Corporate Governance Committee may retain a third-party search firm to assist in identifying and evaluating candidates for Board membership. •The Corporate Governance Committee also considers suggestions for Board nominees submitted by shareholders, who are evaluated using the same criteria as new director candidates and current director nominees. | | | •Once identified, the Corporate Governance Committee reviews the candidate’s background, experiences, skills, and/or prior board and committee service, and considers how the candidate’s background and diversity would support the Board’s oversight of the Company’s strategy, performance, culture, and risk. •Candidates interview with the Chair of the Board and CEO, the Chair of the Corporate Governance Committee, and the Lead Independent Director, as well as other members of the Board, as appropriate. | | | •Following a thorough review process, the Corporate Governance Committee will recommend a candidate to the Board for consideration. |

|

Process for Director Elections

Directors are elected for one-year terms, expiring at the next annual meeting of shareholders. The Cigna Group has adopted a majority voting standard for the election of directors in uncontested elections. Under this standard, directors must receive more votes cast in favor of his or her election than against in order to be elected to the Board. Each director has agreed to tender, and not withdraw, a resignation if such director does not receive a majority of the votes cast at the Annual Meeting. The Corporate Governance Committee will make a recommendation to the Board on whether to accept the resignation. The Board has discretion to accept or reject the resignation. A director whose resignation is under consideration will not participate in the decisions of the Corporate Governance Committee or the Board concerning the resignation. In a contested election, where the number of director nominees exceeds the number of directors to be elected, the voting standard is a plurality of votes cast.

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 17 |

| | | | | |

| CORPORATE GOVERNANCE MATTERS | |

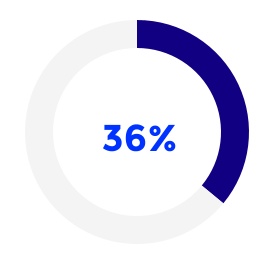

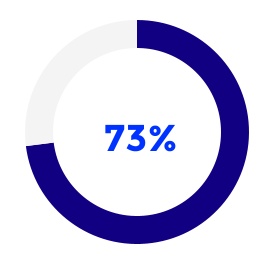

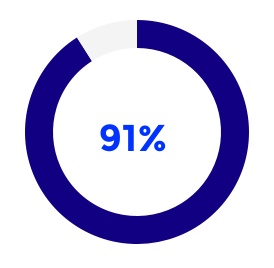

Commitment to Board Diversity

We are committed to a diverse and inclusive culture that values individuals’ unique differences and talent because we know this supports better decision-making, greater innovation, and higher levels of engagement and that this commitment starts at the Board. The Board remains committed to ensuring that the Board is composed of individuals with expertise in fields relevant to The Cigna Group business; experience from different professions and industries; a diversity of age, race, ethnicity, gender, and global experience; and a range of tenures. Several board leadership positions are held by diverse directors, and more than half of our independent director nominees are diverse. Among our director nominees, four are women and four are racially or ethnically diverse individuals (meaning, an individual who self-identifies as Black/African American, Hispanic or Latinx, Asian, Pacific Islander, American Indian/Alaskan, or as two races or more). Our directors also have diverse backgrounds, with experience gained in corporate, academic, government, public policy, and military settings. The Corporate Governance Guidelines require the Corporate Governance Committee, and any search firm it engages, to include women and racially and ethnically diverse candidates in the pool from which the Committee selects director candidates. In addition, the Committee also considers directors with a range of backgrounds and experiences, consistent with our refreshment planning. The following graphics represent the diversity of our independent director nominees:

| | | | | | | | | | | | | | |

Overall Diversity | Gender Diversity | Racial/Ethnic Diversity | Tenure Diversity | Public Company Service Diversity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| n | Independent diverse director nominees | n | Independent female director nominees | n | Independent racially or ethnically diverse director nominees | n | Independent director nominees with less than average tenure 7.25 years average tenure | n | Independent director nominees with past experience serving on a public company board |

| | | | | |

| 18 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | |

| CORPORATE GOVERNANCE MATTERS |

Other Practices

In addition to working to ensure that the Board is composed of diverse and qualified individuals, the Board has adopted the following governance policies and practices that contribute to a well-functioning Board.

| | | | | | | | |

Limits on Public

Company Directorships | To ensure directors are able to devote sufficient time and attention to their responsibilities as board members, the Board has established the following limits on outside directorships: •Directors who also are chief executive officers of public companies may not serve on more than one other public company board in addition to The Cigna Group Board and the board of their employer (for a total of three public company directorships). •Directors who are not chief executive officers of public companies may serve on no more than four boards of other public companies (for a total of five such directorships). •Directors may not serve on more than three public company audit committees. •All of our directors are in compliance with these limits on outside directorships. | |

Change in Director’s

Principal Position | If there is a change in a director’s principal employment position, that director must tender a resignation from the Board to the Corporate Governance Committee. The Committee will then recommend to the Board whether to accept or decline the resignation. | |

| Retirement Age | Our Corporate Governance Guidelines provide that directors are expected to retire by the annual meeting of shareholders coinciding with or following their 72nd birthday. The Board may exercise discretion to waive the expected retirement age in individual cases. | |

Continuing Education

for Directors | The Board is regularly updated on The Cigna Group’s businesses, strategies, customers, operations, and employee matters, as well as external trends and issues that affect the Company. Directors also are encouraged to attend continuing education courses relevant to their service on The Cigna Group’s Board. The Corporate Governance Committee oversees the continuing education practices, and the Company is kept apprised of director participation. | |

Board of Directors’ Nominees

Upon the recommendation of the Corporate Governance Committee, the Board is nominating the twelve directors listed below for election to one-year terms to expire at the next annual meeting of shareholders. All nominees have consented to serve, and the Board does not know of any reason why any nominee would be unable to serve. If a nominee becomes unavailable or unable to serve before the Annual Meeting, the Board may either reduce its size or designate another nominee. If the Board designates a substitute nominee, your proxy will be voted for the substitute nominee.

Below are biographies, skills, and qualifications for each of the nominees. Each of the director nominees currently serves on the Board. The Board believes that the combination of the various experiences, skills, and qualifications represented by the nominees contribute to an effective and well-functioning Board and that the nominees possess the qualifications, based on the criteria described above, to provide meaningful oversight of The Cigna Group’s business and strategy.

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 19 |

| | | | | |

| CORPORATE GOVERNANCE MATTERS | |

| | | | | | | | | | | |

| | | |

Age 58 Director Since 2009 Education MBA, University of Hartford; BBA, Texas A&M University Board Committees Executive (Chair) Prior Public Company Boards General Mills, Inc. | | David M. Cordani Chairman and Chief Executive Officer | The Cigna Group Business Experience David Cordani was appointed Chairman of the Board in January 2022. He has served as The Cigna Group’s Chief Executive Officer since 2009 and President since 2008. Since joining The Cigna Group in 1991, Mr. Cordani has served in a number of senior leadership roles, including Chief Operating Officer; President, Cigna HealthCare; and Senior Vice President, Customer Segments and Marketing. During his tenure, The Cigna Group has grown into a Fortune 15 global health company with approximately 189 million customer and patient relationships and approximately 72,500 colleagues. Qualifications Mr. Cordani brings a deep understanding of customer engagement and brand building as well as of the critical role data analytics and digital capabilities play in the growth of the enterprise. He offers unique perspective and insight into the health services industry and the innovation of health delivery models, and he is actively engaged in public policy in furtherance of the mission of The Cigna Group. Mr. Cordani leads the organization in advancing its environmental, social, and governance (ESG) areas of focus, including expanding and accelerating efforts in support of sustainable health care, health equity, and enterprise diversity, equity, inclusion and equality. The Company’s progress has been recognized by a number of prominent organizations, including the Dow Jones Sustainability Indices for six consecutive years. Mr. Cordani is also the co-author of the best-selling book The Courage to Go Forward: The Power of Micro Communities. Mr. Cordani currently serves in various capacities with the Achilles International Freedom Team of Wounded Veterans, The Cigna Group Foundation, and the David and Sherry Cordani Family Foundation. Mr. Cordani is an Executive Committee member of America’s Health Insurance Plans (AHIP) and previously was appointed and served as Chair of the AHIP Board. With a commitment to international business relations, Mr. Cordani also served as Chairman of the U.S. Chamber of Commerce’s U.S.-Korea Business Council and on the U.S.-India Business Council Board of Directors. |

| | | | | |

| 20 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | |

| CORPORATE GOVERNANCE MATTERS |

| | | | | | | | | | | |

| | | |

Age 68 Director Since 2018 Education MBA, University of Pennsylvania, Wharton Graduate Division; BBA, University of Notre Dame Board Committees Audit Corporate Governance Other Public Company Boards Union Pacific Corporation •Audit Committee •Compensation and Benefits Committee Past Public Company Directorships Express Scripts Holding Company Sanmina Corporation Sysco Corporation | | William J. DeLaney Former Chief Executive Officer | Sysco Corporation Business Experience William DeLaney served as Chief Executive Officer of Sysco Corporation (Sysco), a food marketing and distribution company, from March 2009 until his retirement in December 2017. Previously, Mr. DeLaney served as President of Sysco from March 2010 to January 2016, served as Executive Vice President and Chief Financial Officer from July 2007 to October 2009, and held multiple corporate and operating positions of increasing responsibility throughout his 29-year career with Sysco. Qualifications Mr. DeLaney has broad and deep leadership experience, having led Sysco, a large, complex, global organization, as Chief Executive Officer and Chief Financial Officer through a decade of significant growth and customer-centric-driven change. Mr. DeLaney brings deep financial and risk expertise from his tenure as Sysco’s Chief Financial Officer, where he oversaw accounting, financial operations, and financial reporting matters. In addition, his leadership roles with Sysco provided him with a strong background in business mergers and acquisitions, restructuring, strategic planning, supply chain management, and global technology operations oversight. In addition to his corporate work, Mr. DeLaney previously served as an active member of his community through his involvement with the Center for Houston’s Future and the Greater Houston Partnership. |

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 21 |

| | | | | |

| CORPORATE GOVERNANCE MATTERS | |

| | | | | | | | | | | |

| | | |

Age 65 Director Since 2011 Education BS, Ball State University Board Committees Finance (Chair) Executive People Resources Other Public Company Boards Primo Water Corporation •Audit Committee •ESG and Nominating Committee Past Public Company Directorships Aramark (Chair) Diversey, Inc. (Non-Executive Chair) Pepsi Bottling Group (Chair) Selina Hospitality PLC (Non-Executive Chair) UDR, Inc. | | Eric J. Foss Former Chair, President, and Chief Executive Officer | Aramark Business Experience Eric Foss served as President and Chief Executive Officer of Aramark, a provider of food services, facilities management, and uniform services, starting in May 2012. He also served as Aramark Chair of the Board starting in February 2015 until his retirement in August 2019. He served as Chief Executive Officer of Pepsi Beverages Company, a beverage manufacturer, seller, and distributor and a division of PepsiCo, Inc., from 2010 until December 2011. He was the Chair and Chief Executive Officer of The Pepsi Bottling Group, Inc., from 2008 until 2010, President and Chief Executive Officer from 2006 until 2008, and Chief Operating Officer from 2005 until 2006. Qualifications As Chief Executive Officer of both Aramark and The Pepsi Bottling Group, he led each company’s initial public offerings, giving him a deep knowledge of the capital markets and prudent risk management while creating strong stakeholder value. While leading Aramark, Mr. Foss gained significant experience in managing the operations of a global business with risk management, strategic planning, transactions, technology, and financial oversight. He also delivered increased shareholder value by improving customer loyalty and building a diverse, inclusive and engaged workforce. During his tenure, Aramark received several recognitions, including being named to Fortune magazine’s World’s Most Admired Companies list, to DiversityInc’s Top 50 Employers list, and as a Best Place to Work by the Human Rights Campaign and the Disability Equality Index. Mr. Foss also serves on the National Board of Directors for the Back on My Feet Foundation. |

| | | | | |

| 22 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | |

| CORPORATE GOVERNANCE MATTERS |

| | | | | | | | | | | |

| | | |

Age 70 Director Since 2018 Education M.D., University of Arkansas School of Medicine; BS, Arkansas State University Board Committees Compliance (Chair) Corporate Governance Executive Other Public Company Boards Better Therapeutics, Inc. •Audit Committee DLH Holdings Corporation •Cybersecurity, Technology and Medical Research Committee (Chair) •Management Resources and Compensation Committee Past Public Company Directorships Cerner Corporation Express Scripts Holding Company | | Retired Maj. Gen. Elder Granger, M.D. President and Chief Executive Officer | THE 5Ps, LLC Business Experience Retired Army Major General Elder Granger, M.D., has served as the President and Chief Executive Officer of THE 5Ps, LLC, a health care, education, and leadership consulting firm, since August 2009. He served in the U.S. Army for more than 35 years before retiring in June 2009, and he was the Deputy Director and Program Executive Officer of TRICARE Management Activity, Office of the Assistant Secretary of Defense (Health Affairs), in Washington, D.C., from December 2005 to June 2009. Qualifications General Granger is board certified by the American Association for Physician Leadership, American College of Healthcare Executives, American Board of Medical Quality, and the American Board of Internal Medicine. He is also a National Association of Corporate Directors (NACD) Certified Director and was recognized by NACD in 2022 as part of the NACD Directorship 100. He holds a Certificate in Cybersecurity Oversight from Carnegie Mellon University, is certified in Healthcare Compliance by the Healthcare Compliance Association, and is a Certified Compliance Officer by the American Association of Professional Coders, in addition to holding numerous medical certifications. General Granger has extensive experience in health care management and operations, including health policy, planning, budgeting, and execution related to the health program for uniformed service members around the globe through his tenure with TRICARE. General Granger has unique leadership and policy experience through his 35-year career with the U.S. Army. |

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 23 |

| | | | | |

| CORPORATE GOVERNANCE MATTERS | |

| | | | | | | | | | | |

| | | |

Age 50 Director Since 2021 Education MBA, University of California; BS, University of Michigan Board Committees Audit Finance Other Public Company Boards N/A | | Neesha Hathi Head of Wealth and Advice Solutions | The Charles Schwab Corporation Business Experience Neesha Hathi has served as Head of Wealth and Advice Solutions of The Charles Schwab Corporation (Charles Schwab), a financial services company, since 2022. Over the course of her 18-year career with Charles Schwab, Ms. Hathi has held positions of increasing responsibility. Notably, she was Chief Digital Officer from 2017 to 2022, during which time she was responsible for digital transformation, business innovation, and data and analytics. Prior to that role, she served as Executive Vice President of Investor Services Platforms, Strategy and Client Experience, from 2016 to 2017, as Senior Vice President of Advisor Services and Chief Operating Officer of Schwab Performance Technologies from 2012 through 2016. Qualifications Ms. Hathi has been broadly recognized across the financial services industry for her digital expertise and transformative leadership, and she speaks frequently at industry events to provide thought leadership on digital transformation and related topics. In 2021, InvestmentNews named her among the top Icons & Innovators who have shaped and transformed the financial advice profession. Business Insider named her one of the 10 People Transforming Investing in 2020, and she was listed among the Top Women in WealthTech by Think Advisor in 2019. Ms. Hathi serves on the Advisory Board of the Morrison Center for Marketing & Data Analytics at the University of California, Los Angeles, as well as The Charles Schwab Foundation. |

| | | | | |

| 24 | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | The Cigna Group |

| | | | | |

| CORPORATE GOVERNANCE MATTERS |

| | | | | | | | | | | |

| | | |

Age 57 Director Since 2021 Education MBA, Stanford University; BS, Princeton University Board Committees Compliance People Resources Other Public Company Boards NetApp, Inc. | | George Kurian Chief Executive Officer | NetApp, Inc. Business Experience George Kurian has served as Chief Executive Officer of NetApp, Inc. (NetApp), a cloud-led, data-centric software company, since 2015. He was NetApp’s President from 2016 through 2020; Executive Vice President, Product Development, from 2013 through 2015; and Senior Vice President, Software Group, from 2011 through 2013. Previously, Mr. Kurian held various roles at Cisco Systems, Inc., a technology company, having served as Vice President and General Manager, Application Networking and Switching Technology Group, from 2009 to 2011; Vice President and General Manager, Application Delivery Business Unit, from 2005 to 2009; and Vice President and General Manager, Video Networking Business Unit, from 2002 to 2005. Qualifications Mr. Kurian brings significant leadership experience and a deep understanding of business transformation, strategic planning, corporate growth and risk assessment on a global basis through his 10-year career with NetApp. He is well-versed in customer-oriented technology as a result of having led client service teams focused on helping companies advance strategy and operational initiatives and his background as an engineer. Mr. Kurian has spent more than 20 years in leadership positions at technology-focused companies, through which he has developed expertise in innovative technology and related operations. His extensive background and experience provide a deep understanding of how technology fits into a business from both an operational and strategic perspective. |

| | | | | |

The Cigna Group | 2024 Notice of Annual Meeting of Shareholders and Proxy Statement | 25 |

| | | | | |

| CORPORATE GOVERNANCE MATTERS | |

| | | | | | | | | | | |

| | | |