1@solarwinds 2021 Analyst & Investor Day © 2021 SolarWinds Worldwide, LLC. All rights reserved.

2@solarwinds General Disclaimer Forward-Looking Statements This presentation and the accompanying oral presentation contain “forward-looking” statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding our financial outlook, our long-term model, the impact of the cyberattack that occurred in December 2020 (the “Cyber Incident”), the recently completed spin-off of the N-able business into a newly created and separately traded public company, the impact of the COVID-19 pandemic and related global economic environment on our business, and our preliminary strategic, operational and financial considerations related thereto. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “aim,” “anticipate,” “believe,” “can,” “could,” “seek,” “should,” “feel,” “expect,” “will,” “would,” “plan,” “project,” “intend,” “estimate,” “continue,” "may," or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the following: (a) risks related to the Cyber Incident, including with respect to (1) the discovery of new or different information regarding the Cyber Incident, including with respect to its scope, the threat actor’s access to SolarWinds’ environments and its related activities during such period, and the related impact on SolarWinds’ systems, products, current or former employees and customers, (2) the possibility that our mitigation and remediation efforts with respect to the Cyber Incident may not be successful, (3) the possibility that additional confidential, proprietary, or personal information, including information of SolarWinds’ current or former employees and customers, was accessed and exfiltrated as a result of the Cyber Incident, (4) numerous financial, legal, reputational and other risks to us related to the Cyber Incident, including risks that the incident or SolarWinds’ response thereto, including with respect to providing notices to any impacted individuals, may result in the loss, compromise or corruption of data and proprietary information, loss of business as a result of termination or non-renewal of agreements or reduced purchases or upgrades of our products, severe reputational damage adversely affecting customer, partner and vendor relationships and investor confidence, increased attrition of personnel and distraction of key and other personnel, U.S. or foreign regulatory investigations and enforcement actions, litigation, indemnity obligations, damages for contractual breach, penalties for violation of applicable laws or regulations, significant costs for remediation and the incurrence of other liabilities, (5) risks that our insurance coverage, including coverage relating to certain security and privacy damages and claim expenses, may not be available or sufficient to compensate for all liabilities we incur related to these matters, (6) the possibility that our steps to secure our internal environment, improve our product development environment and ensure the security and integrity of the software that we deliver to our customers may not be successful or sufficient to protect against future threat actors or attacks or be perceived by existing and prospective customers as sufficient to address the harm caused by the Cyber Incident, (b) other risks related to cyber security, including that we may experience other security incidents or have vulnerabilities in our systems and services exploited, which may result in compromises or breaches of our and our customers’ systems or, theft or misappropriation of our and our customers’ confidential, proprietary or personal information, as well as exposure to legal and other liabilities, including the related risk of higher customer, employee and partner attrition and the loss of key personnel, as well as negative impacts to our sales, renewals and upgrades; (c) risks related to the recently completed spin-off of the N-able business into a newly created and separately traded public company, including that we may not realize some or all of the anticipated strategic, financial, operational, marketing or other benefits from the separation, or such benefits may be delayed by a variety of circumstances, which may not be under our control, we may experience increased difficulties in attracting, retaining and motivating employees or maintaining or initiating relationships with partners, customers and other parties with which we currently do business, or may do business in the future, we could incur significant liability if the separation is determined to be a taxable transaction, potential indemnification liabilities incurred in connection with the separation could materially affect our business and financial results and N-able may fail to perform under various transaction agreements that were executed as part of the separation; (d) the possibility that the global COVID-19 pandemic may adversely affect our business, results of operations and financial condition; (e) any of the following factors either generally or as a result of the impacts of the Cyber Incident or the global COVID-19 pandemic on the global economy or on our business operations and financial condition or on the business operations and financial conditions of our customers, their end-customers and our prospective customers: (1) reductions in information technology spending or delays in purchasing decisions by our customers, their end-customers and our prospective customers, (2) the inability to sell products to new customers or to sell additional products or upgrades to our existing customers, (3) any decline in our renewal or net retention rates, (4) the inability to generate significant volumes of high quality sales leads from our digital marketing initiatives and convert such leads into new business at acceptable conversion rates, (5) the timing and adoption of new products, product upgrades or pricing model changes by SolarWinds or its competitors, (6) potential foreign exchange gains and losses related to expenses and sales denominated in currencies other than the functional currency of an associated entity, and (7) risks associated with our international operations; (f) the possibility that our operating income could fluctuate and may decline as percentage of revenue as we make further expenditures to support our business or expand our operations; (g) risks related to our evolving focus in our sales motion and challenges and costs associated with selling products to enterprise customers; (h) our inability to successfully identify, complete, and integrate acquisitions and manage our growth effectively; (i) risks associated with our status as a controlled company; and (j) such other risks and uncertainties described more fully in documents filed with or furnished to the Securities and Exchange Commission, including the risk factors discussed in our Annual Report on Form 10-K for the period ended December 31, 2020 filed on March 1, 2021, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 filed on May 10, 2021, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021 filed on August 6, 2021 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 filed on November 9, 2021. All information provided in this release is as of the date hereof and SolarWinds undertakes no duty to update this information except as required by law. © 2021 SolarWinds Worldwide, LLC. All rights reserved. 2

3@solarwinds General Disclaimer HISTORICAL FINANCIAL INFORMATION This presentation contains historical financial information presented to reflect the spin-off of the N-able business for all periods presented. Unless otherwise noted, all historical financial information referenced herein reflects SolarWinds as a stand-alone business and does not include any contribution from the N-able business. All of such financial information is unaudited and represents our best estimates at the time of this presentation based on information then available and will not be final until SolarWinds files its annual report on Form 10-K reporting N-able as discontinued operations for the prior periods. The unaudited financial information has been derived from the Company’s historical consolidated financial statements and give effect to the spin-off of N-able for all periods presented by subtracting the operations and assets and liabilities of N-able including adjustments related to the transaction costs to reflect the financial condition and results of operations as if SolarWinds were a separate stand-alone entity in accordance with GAAP. The unaudited financial information should be read together with SolarWinds’ historical consolidated financial statements and accompanying notes available in its filings with the Securities and Exchange Commission. USE OF PROJECTIONS This Presentation contains financial forecasts with respect to the Company’s projected financial results, including revenue and adjusted EBITDA, for the Company’s fiscal year 2022. The Company’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for purposes of this Presentation. These projections should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward-Looking Statements” above. Accordingly, there can be no assurance that the prospective results are indicative of future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. © 2021 SolarWinds Worldwide, LLC. All rights reserved. 3

4@solarwinds NON-GAAP FINANCIAL MEASURES This presentation includes the following non-GAAP financial measures: non-GAAP revenue and revenue growth, adjusted EBITDA, adjusted EBITDA margin and unlevered free cash flow. We use these non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. We believe that these non-GAAP financial measures provide supplemental information that is meaningful when assessing our operating performance because they exclude the impact of certain amounts that our management and board of directors do not consider part of core operating results when assessing our operational performance, allocating resources, preparing annual budgets and determining compensation. The non- GAAP measures have limitations, and should not be considered in isolation, or as a substitute for, the most comparable GAAP financial measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be completely comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies. See the Appendix to this presentation for information on how we define these non-GAAP financial measures as well as a reconciliation of the non-GAAP financial measures presented to their most comparable GAAP equivalents. A reconciliation of forward-looking non-GAAP financial measures used in this presentation to their most comparable GAAP measures is not available without unreasonable effort due to the uncertainty regarding, and the potential variability of, certain of the adjustments made to such measures that may be incurred in the future. UNLESS OTHERWISE STATED, YOU MAY ASSUME ALL FINANCIAL MEASURES DISCUSSED IN THIS PRESENTATION, INCLUDING STATEMENTS REGARDING PROFIT AND PROFITABILITY, ARE PRESENTED ON A NON-GAAP BASIS. Impact of Purchase Accounting Related to the Take Private and Acquisitions SolarWinds Corp. was formed by affiliates of investment firms Silver Lake and Thoma Bravo to acquire SolarWinds, Inc., then a publicly traded company, which acquisition was completed on February 5, 2016 and is referred to throughout this presentation as the “Take Private.” The comparability of our year-to-year operating results has been significantly impacted by the Take Private and to a lesser extent, other acquisitions. We account for acquired businesses, including the Take Private, using the acquisition method of accounting, which requires that the assets acquired and liabilities assumed, including deferred revenue, be recorded at the date of acquisition at their respective fair values which could differ from the historical book values. In most cases, adjusting the acquired deferred revenue balances to fair value on the date of the relevant acquisition had the effect of reducing the historical deferred revenue balance and therefore reducing the revenue recognized in subsequent periods. In addition, we incurred amortization of acquired technology and intangibles in connection with the Take Private and to a lesser extent, other acquisitions. © 2021 SolarWinds Worldwide, LLC. All rights reserved. 4

5@solarwinds Introduction & Overview Sudhakar Ramakrishna C H I E F E X E C U T I V E O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 5

6@solarwinds A g e n d a 9 : 0 0 A M Introduction and Overview Sudhakar Ramakrishna, Chief Executive Officer Market Opportunity & Strategy Sudhakar Ramakrishna, Chief Executive Officer 9 : 1 0 A M Products & Strategy Rohini Kasturi, Chief Product Officer 9 : 4 0 A M Go To Market Strategy David Gardiner, Chief Revenue Officer 1 0 : 1 0 A M Customer Success Andrea Webb, Chief Customer Officer 1 0 : 3 5 A M Financial Strategy Bart Kalsu, Chief Financial Officer 1 1 : 0 0 A M © 2021 SolarWinds Worldwide, LLC. All rights reserved. 6

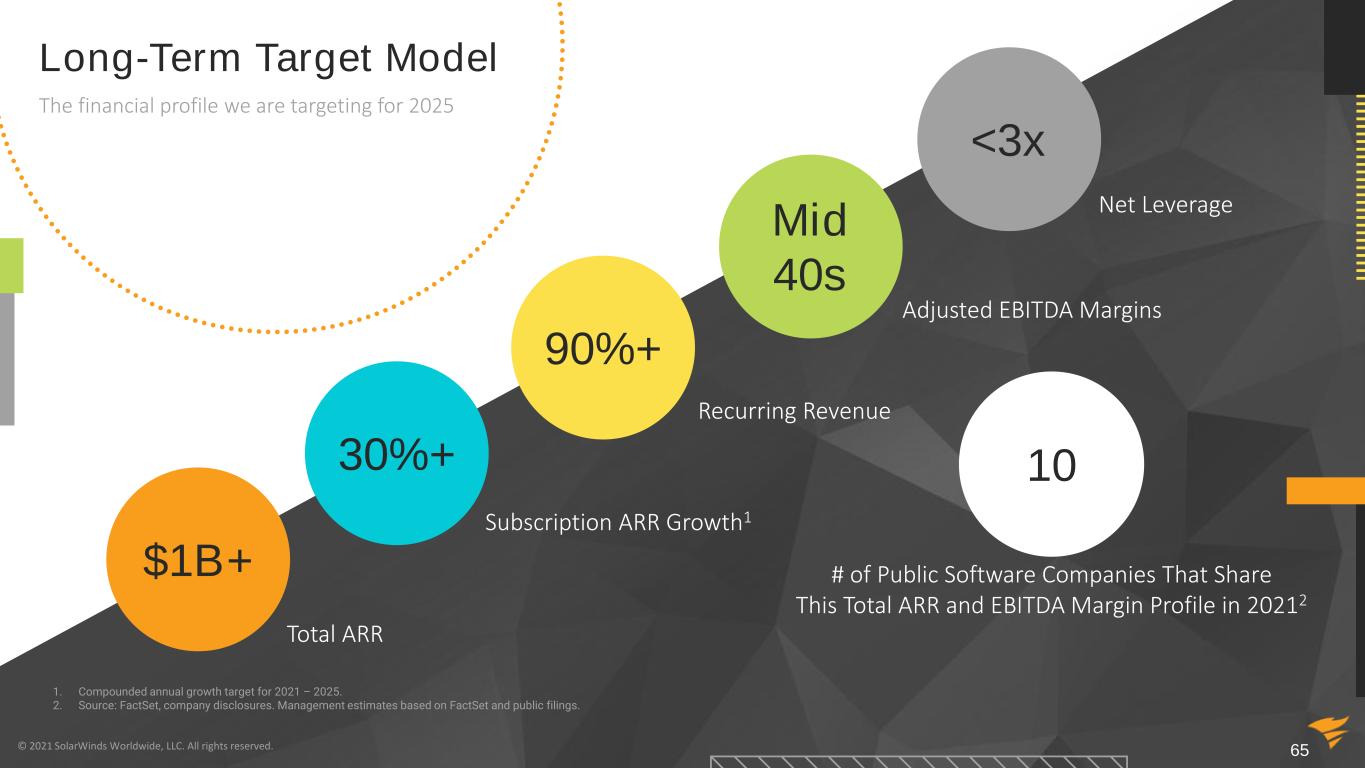

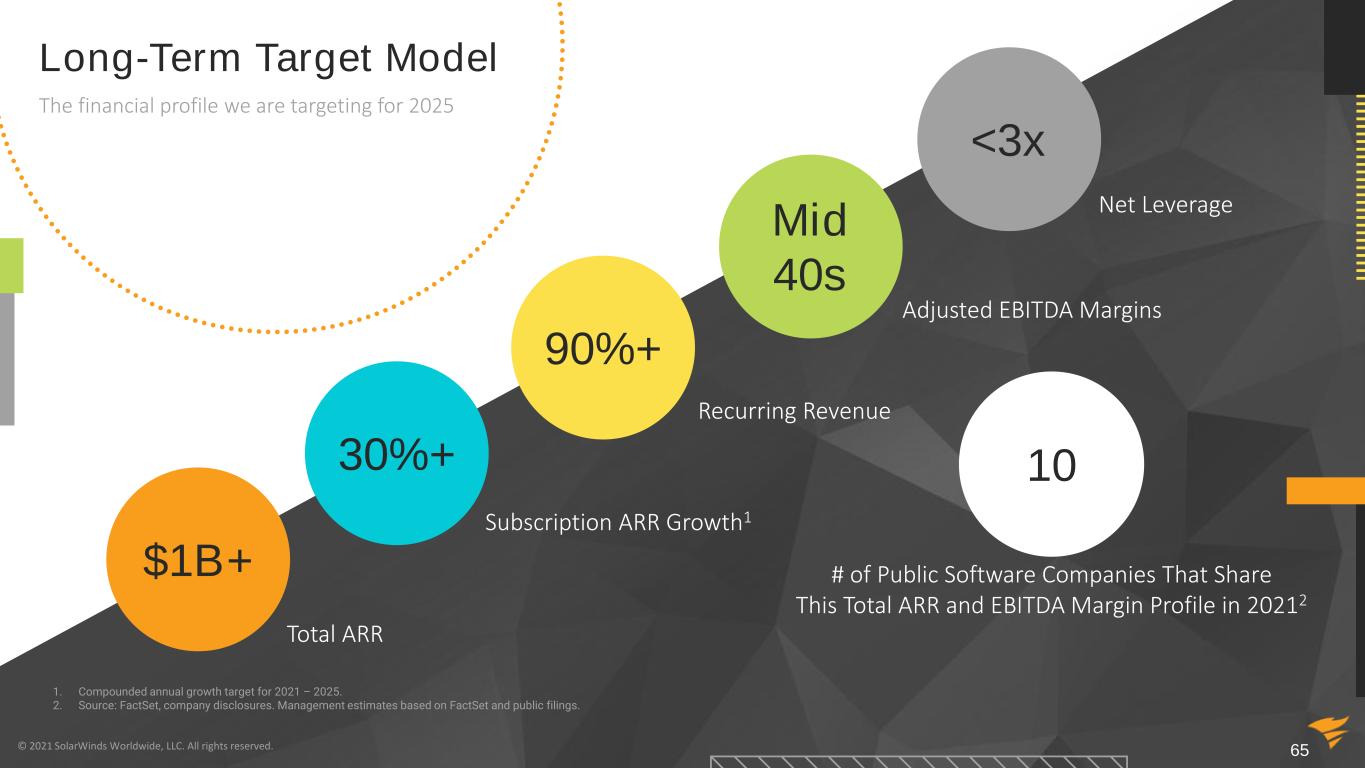

7@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 7 Retain Grow Evolve 1. Compounded annual growth target for 2021 – 2025. $1B+ Total ARR 30%+ Subscription ARR Growth1 Mid 40s Adjusted EBITDA Margins Long-Term Target Model

8@solarwinds through simple, powerful, and secure solutions designed for multi-cloud environments. Our mission is to help customers accelerate business transformation… © 2021 SolarWinds Worldwide, LLC. All rights reserved. 8

9@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 9 Collaborative Accountable Ready Empathetic O u r V a lu e s

10@solarwinds Jason Bliss Chief Administrative Officer Bart Kalsu Chief Financial Officer David Gardiner Chief Revenue Officer Sudhakar Ramakrishna President, Chief Executive Officer Rohini Kasturi Chief Product Officer Dave Hafner Strategic Finance & Investor Relations Carolyn Walsh Worldwide Marketing Andrea Webb Chief Customer Officer Global, Diverse, and Experienced Technology Executives Committed to the long-term success of SolarWinds © 2021 SolarWinds Worldwide, LLC. All rights reserved. 10

11@solarwinds Database Growth Successfully Completed Spin-Off of N-able Improving License Revenue Since Q1’21 TTM Renewal Rate of 89% Despite Cyber Incident in Q4‘202 Worldwide Leader in Network Management Software for 4th Year in a Row1 Expanded International Footprint to Capture Market Opportunity Secure by Design Expansion of Subscription Offerings Received 35+ Industry and Customer Awards Year In Review: Retain. Evolve. Grow. © 2021 SolarWinds Worldwide, LLC. All rights reserved. 11 1. IDC-defined Network Management Software functional market, IDC’s Worldwide Semiannual Software Tracker, October 15, 2021 2. Trailing 12-month through September 30, 2021

12@solarwinds O U R E N V I R O N M E N T I N D U S T R Y C U S T O M E R S Ensure integrity of build process Share learnings with community and customers Leverage and contribute to open-source initiatives Lead by example in securing the supply chain © 2021 SolarWinds Worldwide, LLC. All rights reserved. 12 Evolving with Secure by Design

13@solarwinds After the security breach, that's when the security is the best because SolarWinds fixed the problem. You brought in people to make sure it doesn't happen again and you're probably the most secure monitoring platform out there right now. So yeah, there's lots of different reasons why we decide to renew and stick with SolarWinds. M O B I L E N E T W O R K O P E R A T O R C O M P A N Y Response (to the breach) has been excellent. We appreciated the accountability aspect from your teams in multiple fronts. Reaching out in every way possible and that’s important. It’s not a small thing what you guys went through. How an organization responds in trouble says volumes. S R N E T W O R K C O M M U N I C A T I O N S S P E C I A L I S T , U N I V E R S I T Y I’ve been doing Orion-Insights monthly since last November. I think they are absolutely great, the printed word always carries more credibility than the spoken. P U B L I S H I N G C O M P A N Y SolarWinds has been extremely transparent in answering any questions we've asked and then some. That transparency made a huge difference in choosing to stay with SolarWinds. T R U C K I N G C O M P A N Y … I want to say a big thank you to you for working with us over the last couple of years. You are the main reason why we are now using this application on a daily basis. We greatly appreciate all of your help. C O U N T Y G O V E R N M E N T Retaining Customers with Focus and Transparency © 2021 SolarWinds Worldwide, LLC. All rights reserved. 13

14@solarwinds Leading to Stabilization and Strong Foundation for Growth TTM Renewal Rates1 89% © 2021 SolarWinds Worldwide, LLC. All rights reserved. 14 Subscription ARR2 $130M Total ARR2 $624M 1. Trailing 12-month through September 30, 2021 2. As of September 30, 2021

15@solarwinds Market Opportunity & Strategy Sudhakar Ramakrishna C H I E F E X E C U T I V E O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 15

16@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 16 Business Transformation is Accelerating L E A D I N G T O N E W C H A L L E N G E S … Remote work is here to stay IT budgets and resource constraints remain Complexity, security, and productivity challenges abound … A N D C R E AT I N G N E W N E E D S Multi-cloud deployments Flexible consumption models Modernization of operations, apps, and databases Need for the evolution from ‘monitoring’ to ‘observability’

17@solarwinds Our Strategy to Address Customer Needs... © 2021 SolarWinds Worldwide, LLC. All rights reserved. 17 Secure by Design Foundation Evolving and Expanding our Customer Reach Evolving from Monitoring to Observability Simplifying Packaging & Pricing Models

18@solarwinds Evolving From Monitoring Leader to Observability Leader Integrated, hybrid ‘SolarWinds Observability’ solutionsPowerful, yet affordable, and easy to use tools for IT Pros focused on IT Monitoring & IT Operations… © 2021 SolarWinds Worldwide, LLC. All rights reserved. 18 S E R V I C E D E S K M O N IT O R IN G N E T W O R K S Y S T E M S D ATA B A S E S E C U R I T Y A P P L I C AT I O N S S A A S P L A T F O R M Networks Infrastructure Cloud Services Databases ApplicationsSecurity Broad Observability Capabilities Spanning all IT and user environments Infrastructure Services Security Services Common Platform Services Data, AI/ML Services United Agent Services Act/Remediate Automate/ Configure Analyze/Predict Visualize/ Alert Current State Future State

19@solarwinds U S E R E X P E R I E N C E M E T R I C S L O G ST R A C E S Evolution of customer’s digital transformation journey with multi- cloud support The Evolution to SolarWinds Observability Evolving our full stack solution to an intelligent hyperconverged platform © 2021 SolarWinds Worldwide, LLC. All rights reserved. 19 Productivity improvements by delivering insights across infrastructure, apps and data Predict outages and improve customer experience and deliver on SLAs through AIOps Reduces time-to-value (TTV) through simple install and onboarding In d u st ry So la rW in d s S A A S P L A T F O R M Infrastructure Services Security Services Common Platform Services Data, AI/ML Services United Agent Services Networks Infrastructure Cloud Services Databases ApplicationsSecurity Act/Remediate Automate/ Configure Analyze/Predict Visualize/ Alert

20@solarwinds Simplifying Packaging and Pricing © 2021 SolarWinds Worldwide, LLC. All rights reserved. 20 P R O D U C T S T R AT E G Y − Enhanced packaging and pricing for ease of consumption and cross-sell − Implementing node-based pricing across the portfolio − Introducing SolarWinds Observability solutions for multi-cloud deployments • SaaS/subscription • Cloud Service Provider- (CSP) & Managed Service Provider- (MSP) friendly • In-product trial and acquisition C U S T O M E R S T R AT E G Y − Offering buyer flexibility with Subscription First − Implementing sales and channel incentives to drive subscription growth − Fostering expansion and retention with customer success managers − Evolving maintenance revenue to value-based subscription revenue − Developing e-commerce extensions Increasing our opportunity for subscription revenue and customer LTV

21@solarwinds − Retain velocity motion − Selective high-touch and field engagements − International expansion − E-commerce S A L E S − Focused on traditional GSIs, CSPs, and MSPs − Global program focused on building “expertise” and “accountability” PA R T N E R S − Nourish velocity motion − Account-based marketing (ABM) − Channel and customer marketing − Analyst, press, and community M A R K E T I N G− Land, adopt, expand, and retain (LAER) − CSM engagements − Enablement & award-winning support C U S T O M E R O R G A N I Z AT I O N © 2021 SolarWinds Worldwide, LLC. All rights reserved. 21 Evolving & Expanding our Customer Reach

22@solarwinds $42B 20211 2025110% CAGR $60B S O L A R W I N D S O B S E R VA B I L I T Y Monitoring Analytics IT Service Management Security Our Total Addressable Market is Large & Growing © 2021 SolarWinds Worldwide, LLC. All rights reserved. 22 Networks Infrastructure DatabasesApplications Users Go-to-market approach allows us to efficiently reach organizations of all sizes Our evolution to SolarWinds Observability will enable us to further penetrate the faster-growing segments of our addressable market (e.g., Cloud IT Operations Management, 26% CAGR2) Product ease-of-use and affordability for small business with power and scalability to address the needs of the enterprise 1. Source: IDC Semiannual Software Tracker, May 2021. Includes the IT Operations Management, Network Management, IT Service Management, Security Analytics, Intelligence, Response and Orchestration, and Database Administration and Development Tools markets. 2. Source: IDC Worldwide Intelligent CloudOps Software Forecast, July 2021

23@solarwinds Expanding Routes to Market Simplified Packaging and Pricing Multi-Cloud Observability Solutions Investing for Growth Including a Modern, Scalable Go-to- Market Motion Yet Highly Profitable and Efficient Secure by Design Well-Positioned for Growth and Profitability O U R P R I M A R Y G R O W T H D R I V E R S S U P P O R T E D BY A S O L I D B U S I N E S S F O U N D AT I O N © 2021 SolarWinds Worldwide, LLC. All rights reserved. 23

24@solarwinds Products & Strategy Rohini Kasturi C H I E F P R O D U C T O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 24

25@solarwinds 10’s 100’s 10’s 10’s100’s100’s1000’s100’s I N F R A ST R U C T U R E N O D E S A P P S D B SC LO U D S E R V I C E S Hybrid and Multi-Cloud IIoT, SD-WAN, and SASE Modernization of Apps and Databases DevSec, Cloud, and AIOps Availability Performance Cost Security Predict Customer Need: To Deliver Business Services with High SLAs Customer environments are becoming more complex than ever © 2021 SolarWinds Worldwide, LLC. All rights reserved. 25 Note: Example of a single environment for an upper-mid market customer.

26@solarwinds Our Strategy is Evolving to Simplify Customers’ Lives © 2021 SolarWinds Worldwide, LLC. All rights reserved. 26 PRODUCT OFFERINGS BUSINESS MODEL CUSTOMER / USER EXPERIENCE

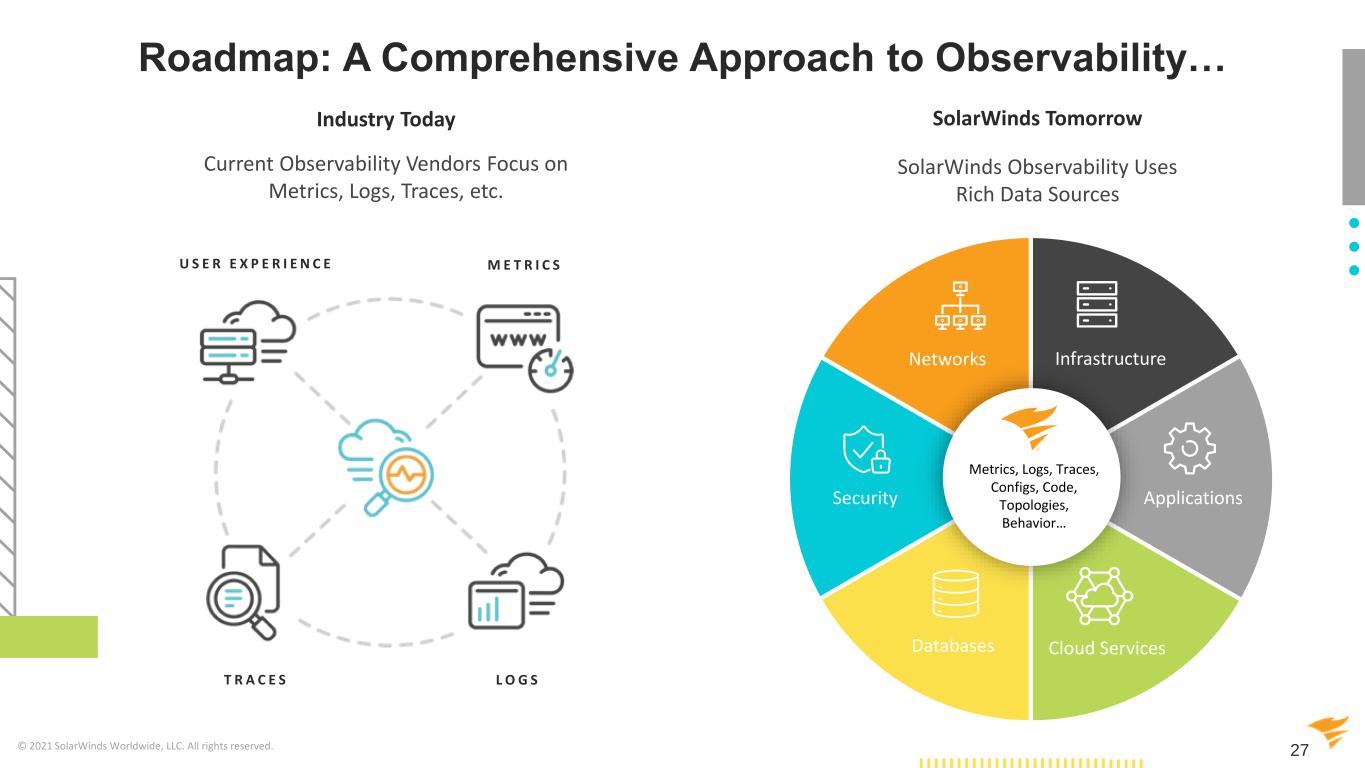

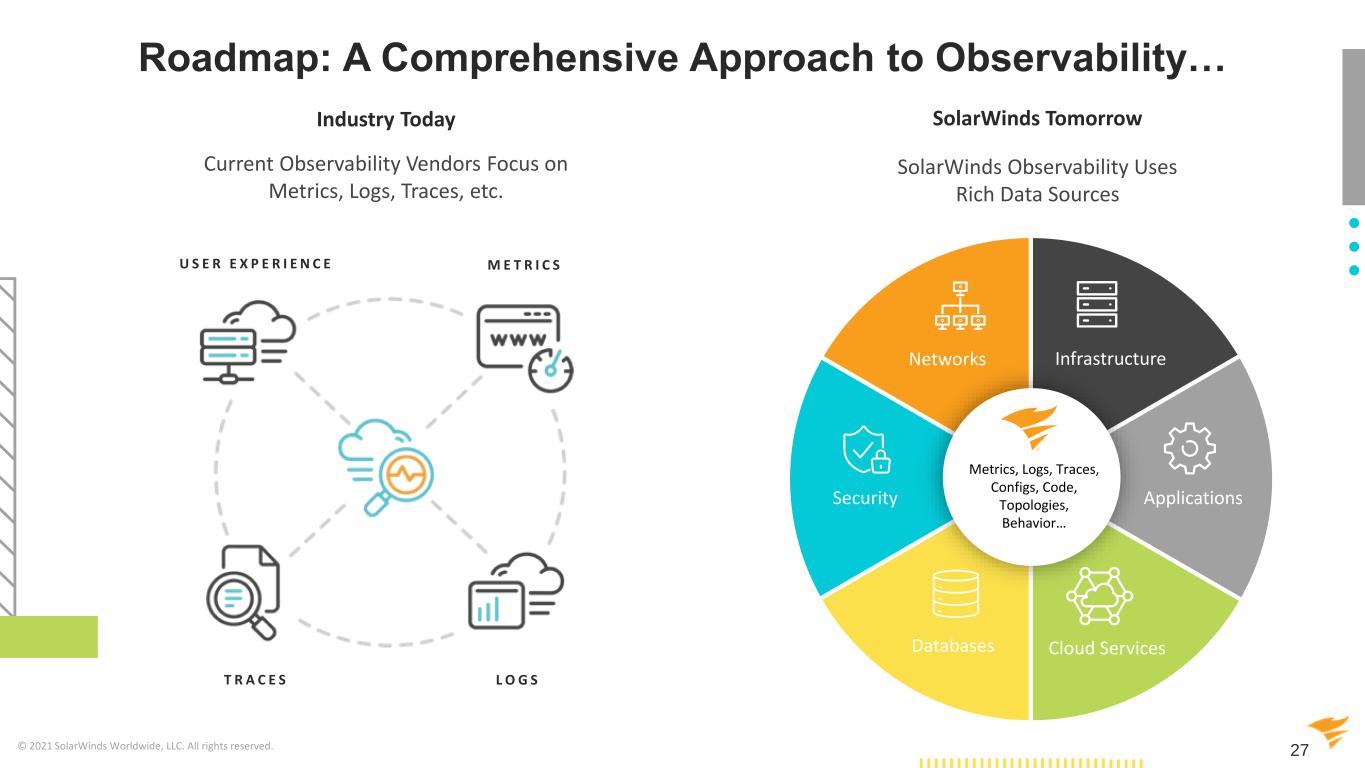

27@solarwinds Roadmap: A Comprehensive Approach to Observability… SolarWinds Observability Uses Rich Data Sources Current Observability Vendors Focus on Metrics, Logs, Traces, etc. U S E R E X P E R I E N C E M E T R I C S L O G ST R A C E S Networks Infrastructure Cloud ServicesDatabases ApplicationsSecurity Metrics, Logs, Traces, Configs, Code, Topologies, Behavior… © 2021 SolarWinds Worldwide, LLC. All rights reserved. 27 Industry Today SolarWinds Tomorrow

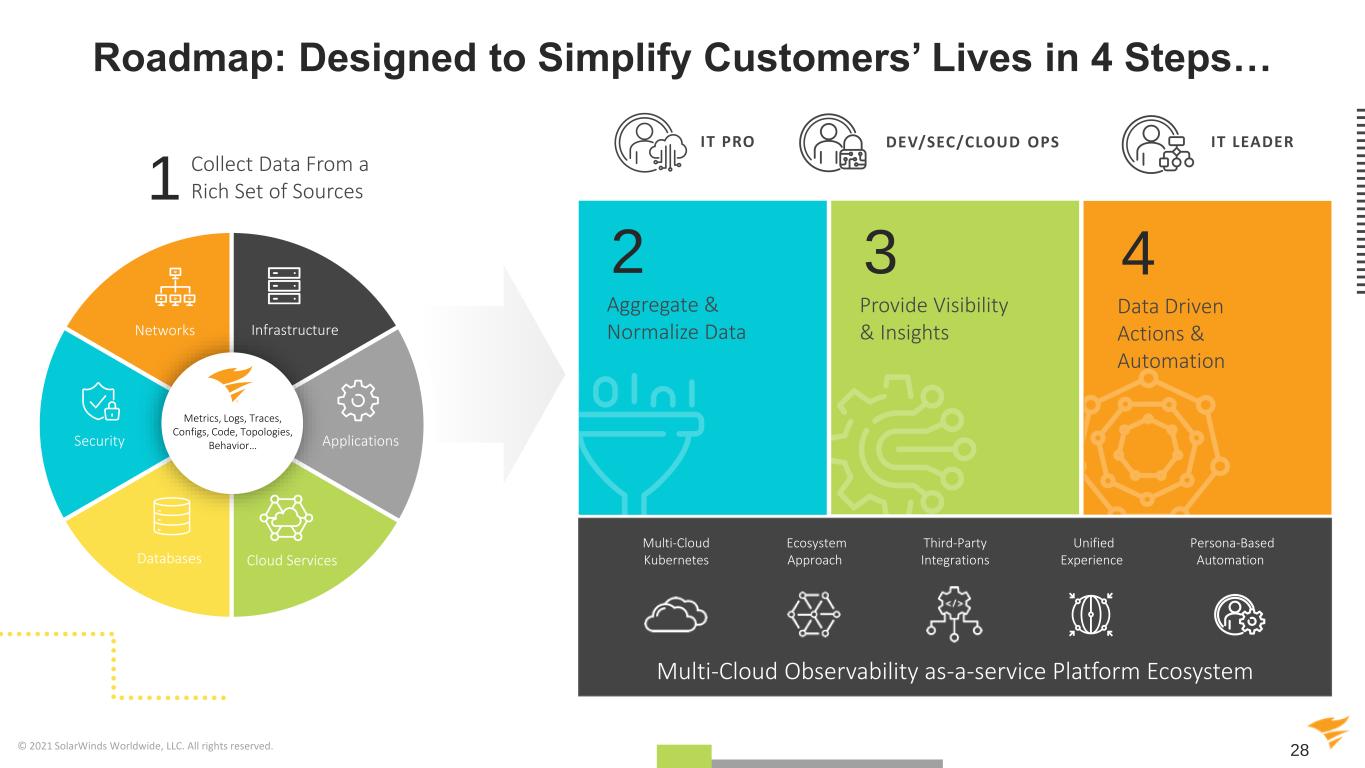

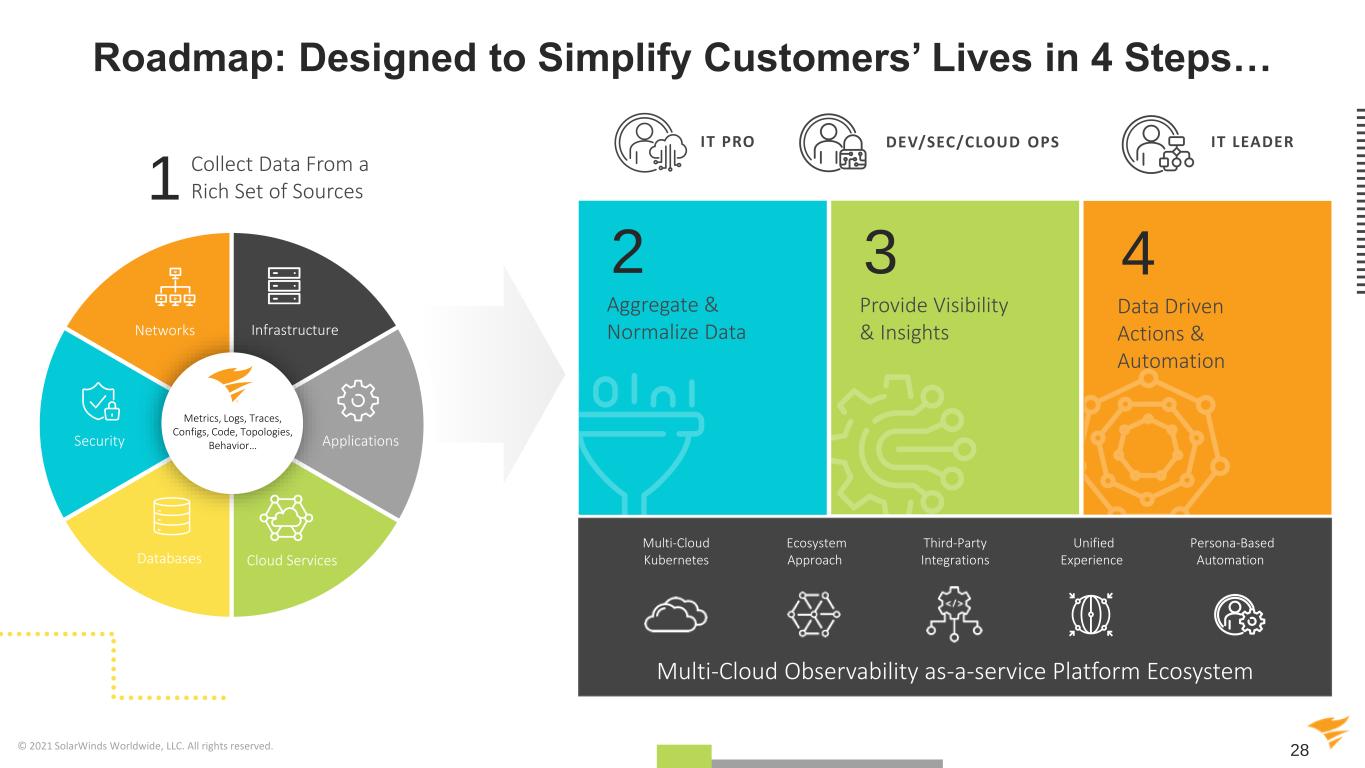

28@solarwinds Multi-Cloud Observability as-a-service Platform Ecosystem Networks Infrastructure Cloud ServicesDatabases ApplicationsSecurity Roadmap: Designed to Simplify Customers’ Lives in 4 Steps… Multi-Cloud Kubernetes Ecosystem Approach Third-Party Integrations Unified Experience Persona-Based Automation Collect Data From a Rich Set of Sources IT PRO DEV/SEC/CLOUD OPS IT LEADER Metrics, Logs, Traces, Configs, Code, Topologies, Behavior… 1 Aggregate & Normalize Data 2 Provide Visibility & Insights 3 Data Driven Actions & Automation 4 © 2021 SolarWinds Worldwide, LLC. All rights reserved. 28

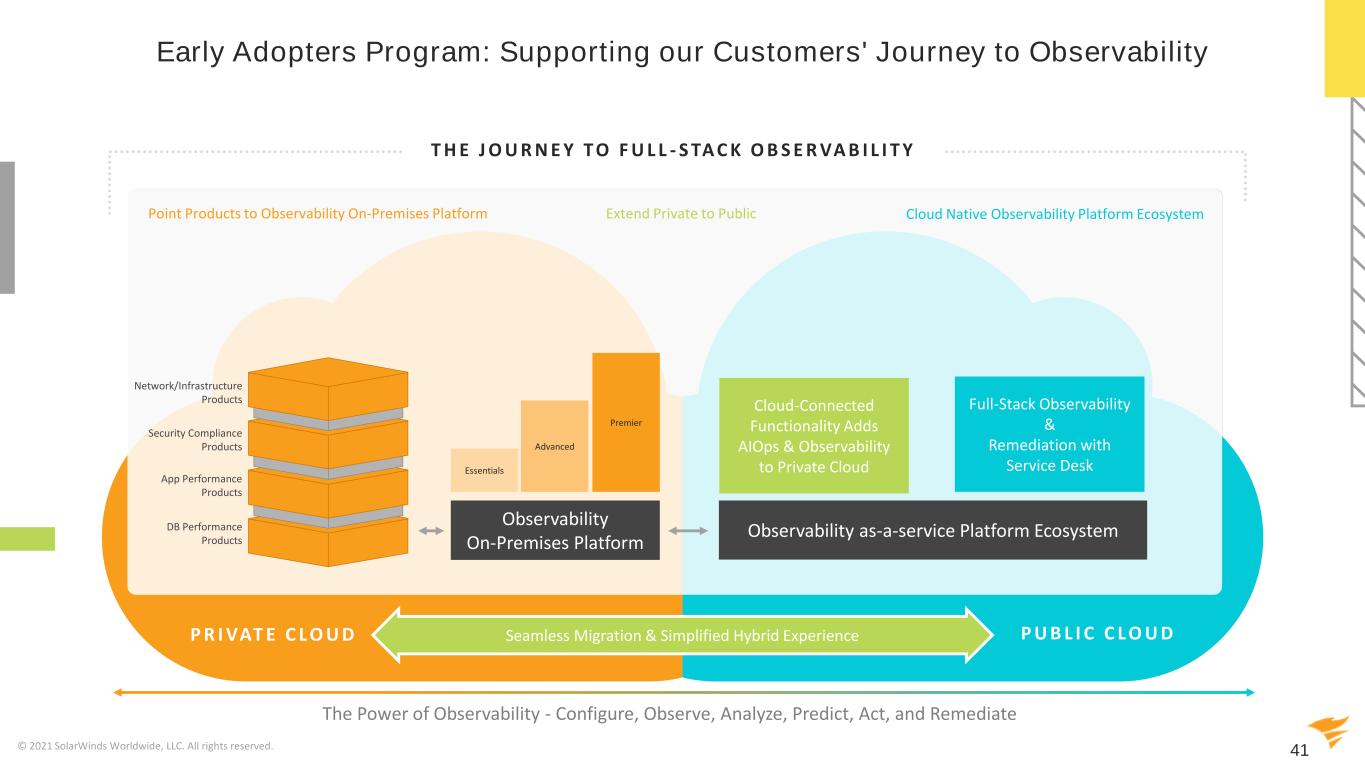

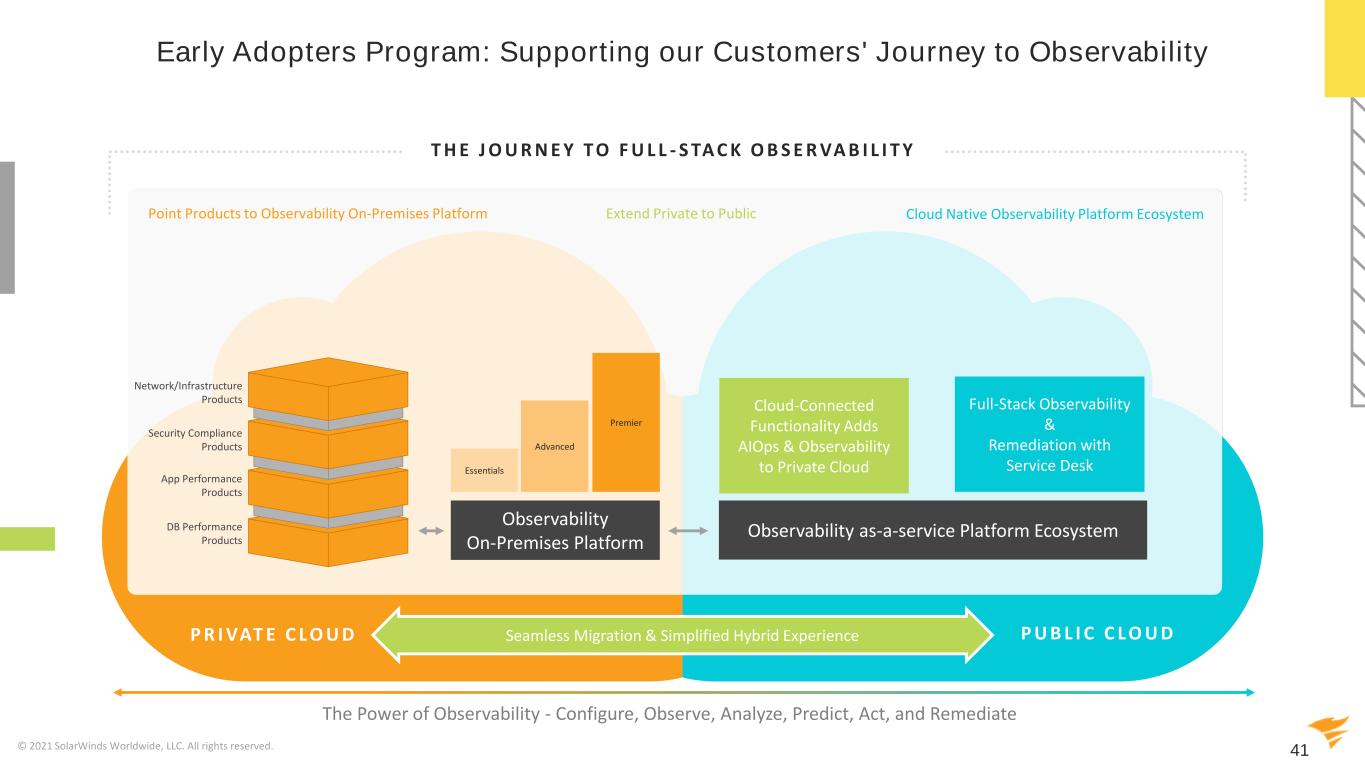

29@solarwinds T H E J O U R N E Y T O F U L L - S TA C K O B S E R VA B I L I T Y Roadmap: Evolving to Help Customers Today & Tomorrow The Power of Observability - Configure, Observe, Analyze, Predict, Act, and Remediate Essentials Advanced Premier Network/Infrastructure Products App Performance Products DB Performance Products Security Compliance Products Observability On-Premises Platform P R I VAT E C L O U D P U B L I C C L O U D Point Products to Observability On-Premises Platform Cloud Native Observability Platform Ecosystem Observability as-a-service Platform Ecosystem Cloud-Connected Functionality Adds AIOps & Observability to Private Cloud Full-Stack Observability & Remediation with Service Desk Extend Private to Public Seamless Migration & Simplified Hybrid Experience © 2021 SolarWinds Worldwide, LLC. All rights reserved. 29

30@solarwinds Pricing based on entitlements & tiered offerings Node-based licensing with data packs Standardized across on- premises and SaaS Business Model Strategy Designed for Customer Ease 30© 2021 SolarWinds Worldwide, LLC. All rights reserved.

31@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 31 − Add new features & capabilities without having to install new software − Consistent journey to land and expand An Evolved Approach to Customer & User Experience C U S TO M E R E X P E R I E N C E U S E R E X P E R I E N C E − Modern and consistent across on-premises & SaaS − APIs for automation

32@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 32 DEMO SOLARWINDS OBSERVABILITY AS -A-SERVICE

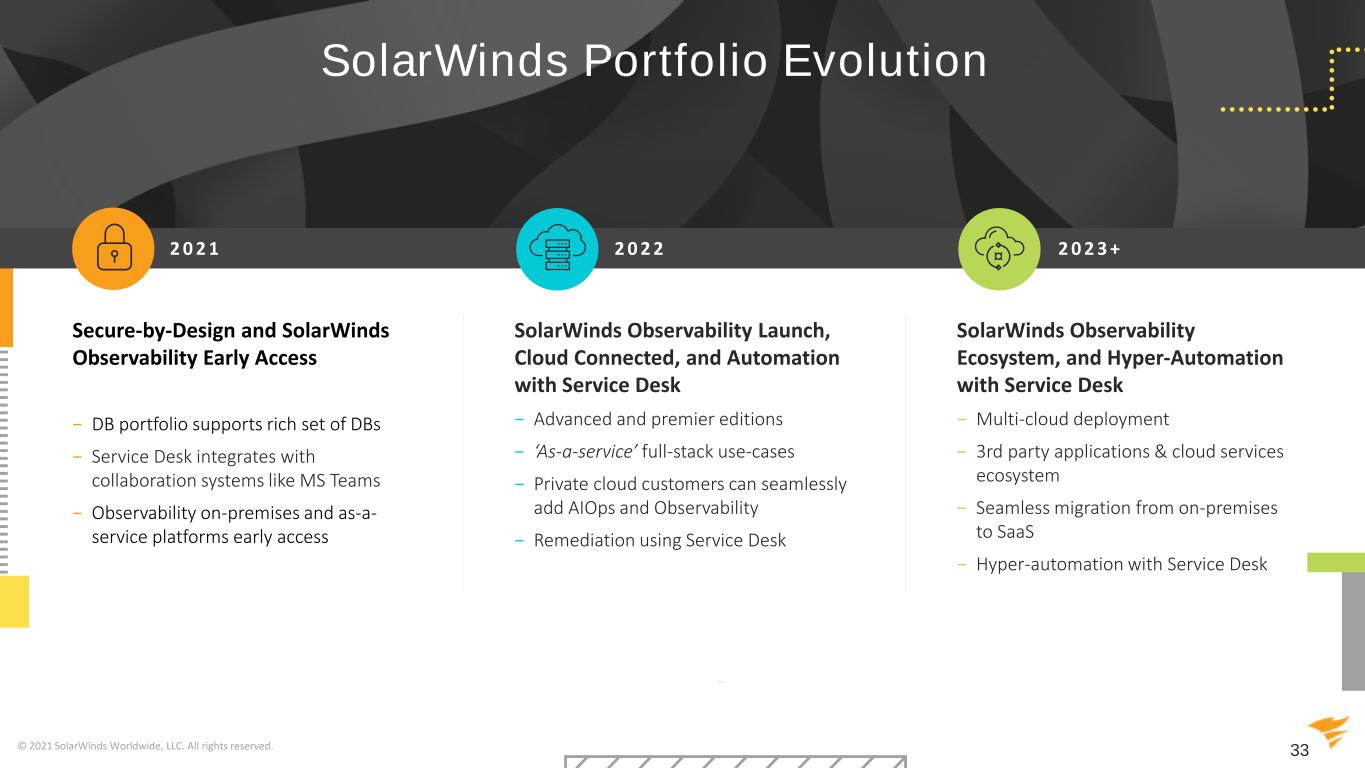

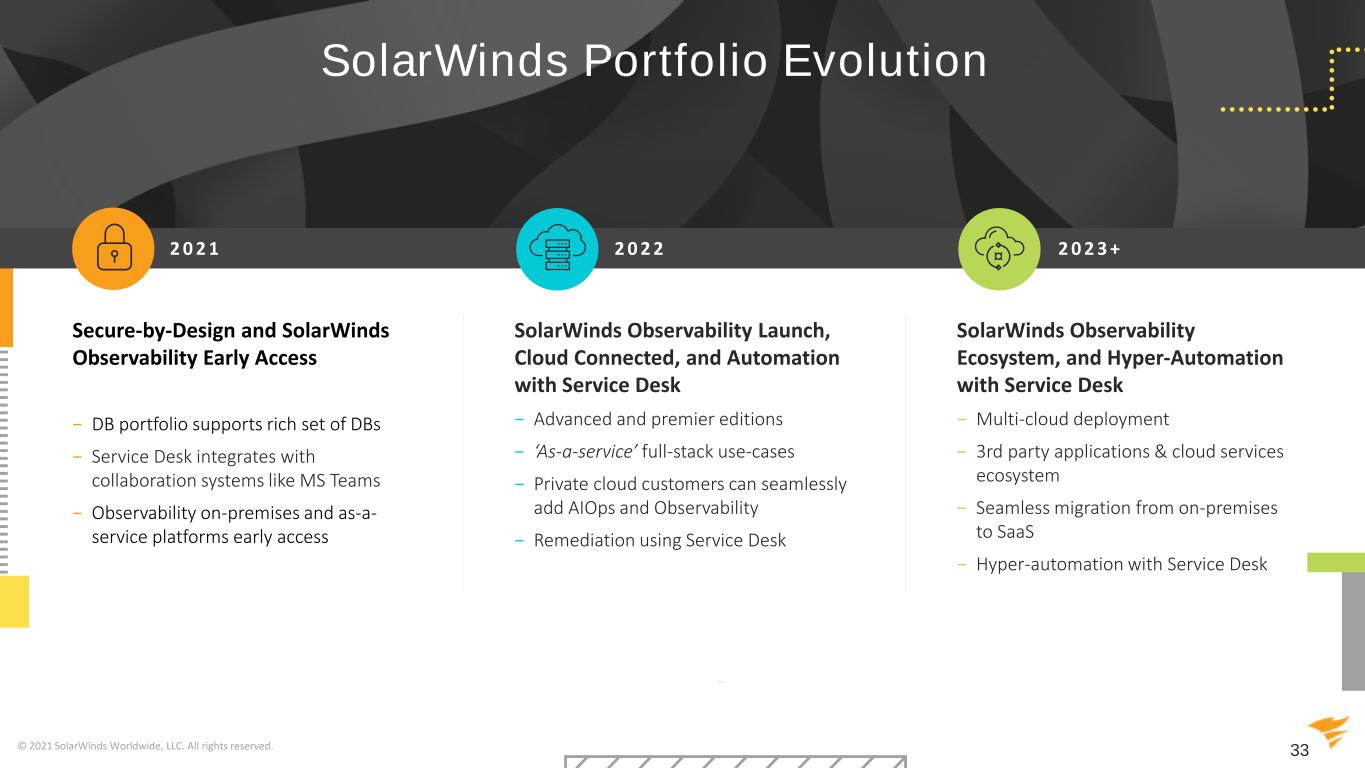

33@solarwinds 2 0 2 1 2 0 2 2 2 0 2 3 + SolarWinds Portfolio Evolution Secure-by-Design and SolarWinds Observability Early Access − DB portfolio supports rich set of DBs − Service Desk integrates with collaboration systems like MS Teams − Observability on-premises and as-a- service platforms early access SolarWinds Observability Launch, Cloud Connected, and Automation with Service Desk − Advanced and premier editions − ‘As-a-service’ full-stack use-cases − Private cloud customers can seamlessly add AIOps and Observability − Remediation using Service Desk SolarWinds Observability Ecosystem, and Hyper-Automation with Service Desk − Multi-cloud deployment − 3rd party applications & cloud services ecosystem − Seamless migration from on-premises to SaaS − Hyper-automation with Service Desk © 2021 SolarWinds Worldwide, LLC. All rights reserved. 33

34@solarwinds Autonomous Distributed Cloud Management Monitoring for Data Center or Cloud Observability for Hybrid IT Self-discovery, self-management, self-healing, distributed cloud cockpit, and business-driven Configure, visualize, observe, predict, act, and remediate © 2021 SolarWinds Worldwide, LLC. All rights reserved. 34 A Vision for the Future Configure and visualize

35@solarwinds Customer Success Andrea Webb C H I E F C U S T O M E R O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 35

36@solarwinds Customer Success is a Mindset © 2021 SolarWinds Worldwide, LLC. All rights reserved. 36 Customer Success Technical Support Enablement & Training Programs & Paid Services Retention & Renewals Customer Ops & Strategy C H I E F C U S T O M E R O F F I C E Proliferate Customer Success mindset in EVERYTHING we do Impart timely and relevant enablement to our sales, partner, and customer communities Deliver profitable growth by delivering awesome customer support

37@solarwinds Customer Lifetime Value LAND New Customer AD OP T Creating Environment for Success EX PAND Capacity Upgrades & Cross-sell RETAIN Renew / Reactivate Working to Maximize Customer Lifetime Value © 2021 SolarWinds Worldwide, LLC. All rights reserved. 37

38@solarwinds E X PA N D R E N E W A D V O C AT ES AT I S FA C T I O NE N G A G E M E N TA D O P T I O N Customer Success Investments & Anticipated ROI I N V E S T - C U S T O M E R D R I V E R S - L E A D I N G I N D I C AT O R S R O I - B U S I N E S S O U T C O M E S Launched life cycle management, pulse checks, health scoring, self-led onboarding Customer Marketing programs to drive learning activity Additional certifications added to SW Certified Professional (SCP), and SW Sales Expert (SSE) Revised program, health score, sentiment, CSAT Customer NPS tracking Transactional CSAT THWACK – more active today than 2020 SolarWinds Success App – automation and self- serve 1:1 through Joint Technical Reviews (JTRs), QBRs, Health-Checks Orion Insights tool Ramping CCO- generated pipe contribution to sales in 2021 New advocacy program kicked off – with 248 new advocate signups TTM Q3’21 = 89% © 2021 SolarWinds Worldwide, LLC. All rights reserved. 38

39@solarwinds SolarWinds Support SolarWinds Success Center − Professional Support − Premier Support − Enterprise Support − SolarWinds Lab − THWACK Tuesday Tips − Monthly Missions © 2021 SolarWinds Worldwide, LLC. All rights reserved. 39 Helping our customers realize the value of our solutions in driving business transformation Building on a Foundation of Customer Success

40@solarwinds Creating An Environment For Success 1 : 1 C S M S E L F - L E D QBRs JTRs Health-Checks Learning App Expanded & Enhanced Support N E W C U S T O M E R S E X I S T I N G C U S T O M E R S © 2021 SolarWinds Worldwide, LLC. All rights reserved. 40

41@solarwinds T H E J O U R N E Y T O F U L L - S TA C K O B S E R VA B I L I T Y Early Adopters Program: Supporting our Customers' Journey to Observability The Power of Observability - Configure, Observe, Analyze, Predict, Act, and Remediate Essentials Advanced Premier Network/Infrastructure Products App Performance Products DB Performance Products Security Compliance Products Observability On-Premises Platform P R I VAT E C L O U D P U B L I C C L O U D Point Products to Observability On-Premises Platform Cloud Native Observability Platform Ecosystem Observability as-a-service Platform Ecosystem Cloud-Connected Functionality Adds AIOps & Observability to Private Cloud Full-Stack Observability & Remediation with Service Desk Extend Private to Public Seamless Migration & Simplified Hybrid Experience © 2021 SolarWinds Worldwide, LLC. All rights reserved. 41

42@solarwinds Our Commitment to Customer Success Laser focus on onboarding and full adoption Proactively drive real- time value creation and usage Use leading indicator metrics to drive accountability Master the art and science of customer engagement Prevent churn and drive expand (Adoption) Drive overall customer experience (Satisfaction) © 2021 SolarWinds Worldwide, LLC. All rights reserved. 42

43@solarwinds Go To Market Strategy David Gardiner C H I E F R E V E N U E O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 43

44@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 44 Retain Grow Evolve Velocity Model High-Touch, Customer-Centric Motion Partnerships & Routes to Market

45@solarwinds Evolving For A Better Customer Experience S O L A R W IN D S M A R K E T IN G S O L A R W IN D S S A L E S © 2021 SolarWinds Worldwide, LLC. All rights reserved. 45 L A N D , E X PA N D , R E N E W − Marketing Fed − Inbound Motion − Opportunity-Based − Product Specializations L A N D , A D O P T, E X PA N D , R E TA I N − Outbound to Customer − Marketing Segmented (ABM) − Account-Based − Solutions-Oriented Existing Customers S O L A R W IN D S M A R K E T IN G S O L A R W IN D S S A L E S S O L A R W IN D S C S M New Customers Existing Customers

46@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 46 Departmental Level Sales Strategic Account Level Sales Individual Point Sales P R O V E N R E L AT I O N S H I P S . P R O D U C T B R E A D T H . VA L U E . Building Opportunities to Extend our Relationships…

47@solarwinds Large Managed Healthcare Company © 2021 SolarWinds Worldwide, LLC. All rights reserved. 47 $1.0M Win Managed healthcare insurance company upgrades to a 3-year subscription bundle NOC Transformation: Proactive monitoring through a single pane of glass − Customer wanted to shift its network operations center (NOC) posture from reactive to proactive. Network technicians were missing issue alerts and requiring 30-60 minutes to pinpoint issues on its servers. − Agent-based servers also prevented the client from having cross-environment oversight. − A key selling point for SolarWinds was the ability to monitor and display the customer’s environment on a single pane of glass. Key Benefits Expanding the Relationship – Upgraded Subscription Bundle − The customer chose SolarWinds Enterprise Bundle as part of their major renewal upgrade, providing ease of consumption and a better price point for more functionality. − The bundle includes Network Automation Manager (NAM), Server & Application Monitor (SAM), Virtualization Manager (VMAN), APEs (Additional Polling Engine), High Availability (HA), Lab Licenses, and Premier Enterprise Support. Proactive Monitoring Observability that lets you stay ahead and quickly pinpoint issues Single Pane of Glass One dashboard that includes all SolarWinds products and services C L I E N T P R O F I L E − SolarWinds customer since 2008 Scale Up, Scale Out Drive NOC transformation as networking complexity grows dramatically

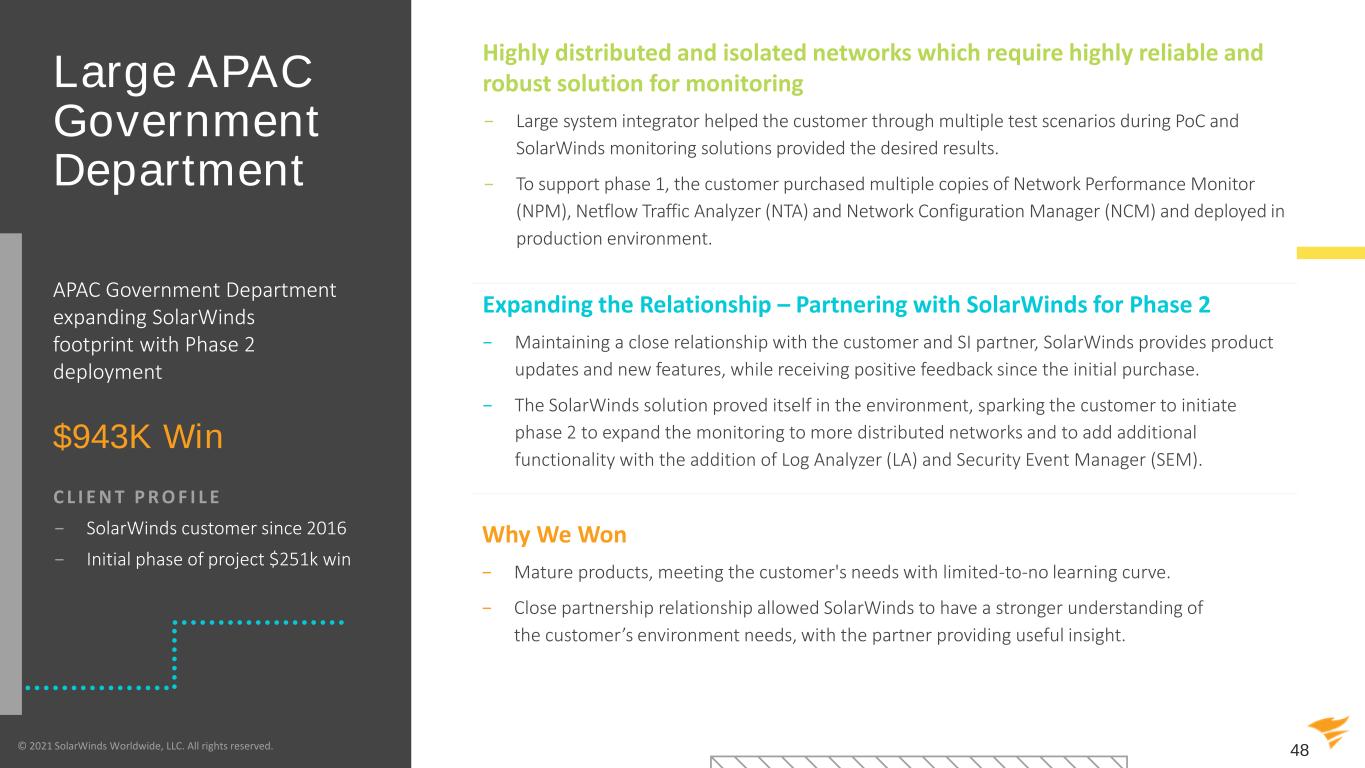

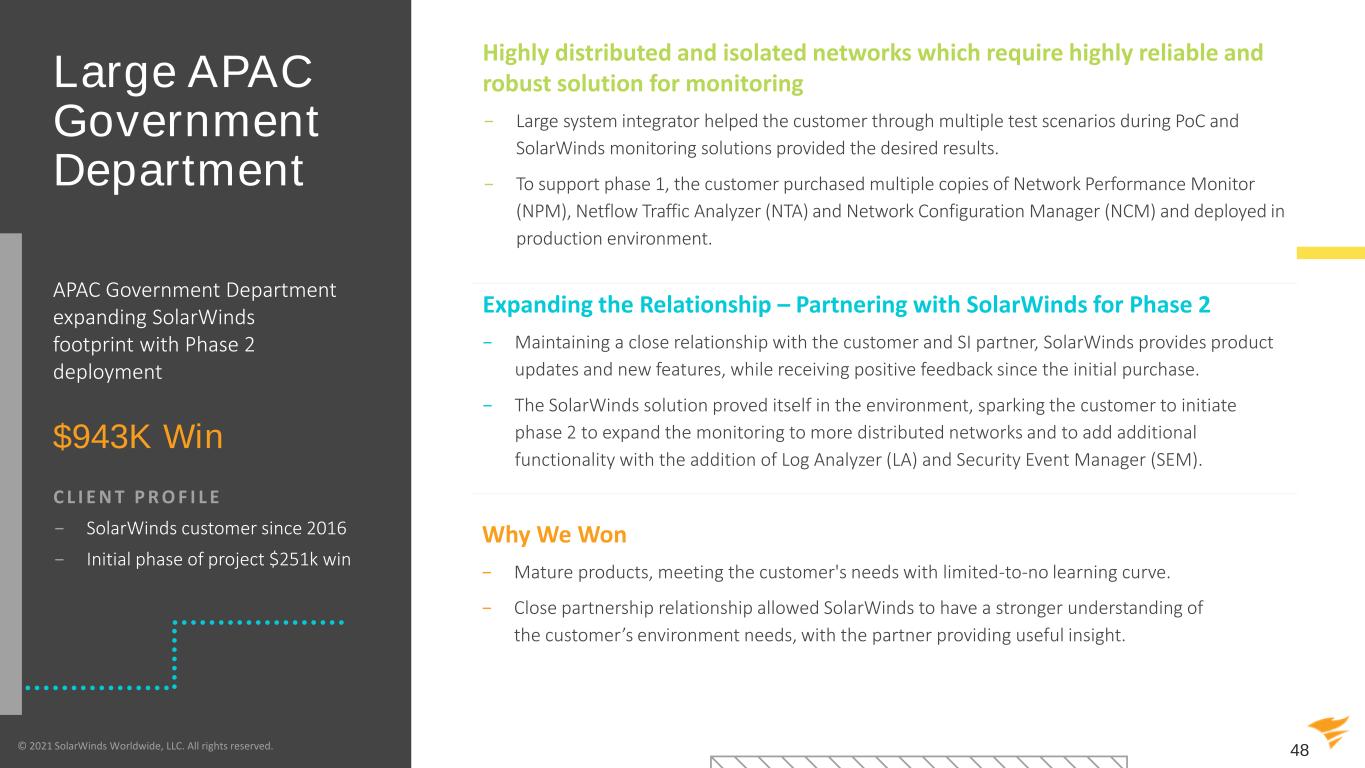

48@solarwinds Large APAC Government Department © 2021 SolarWinds Worldwide, LLC. All rights reserved. 48 $943K Win APAC Government Department expanding SolarWinds footprint with Phase 2 deployment Highly distributed and isolated networks which require highly reliable and robust solution for monitoring − Large system integrator helped the customer through multiple test scenarios during PoC and SolarWinds monitoring solutions provided the desired results. − To support phase 1, the customer purchased multiple copies of Network Performance Monitor (NPM), Netflow Traffic Analyzer (NTA) and Network Configuration Manager (NCM) and deployed in production environment. Expanding the Relationship – Partnering with SolarWinds for Phase 2 − Maintaining a close relationship with the customer and SI partner, SolarWinds provides product updates and new features, while receiving positive feedback since the initial purchase. − The SolarWinds solution proved itself in the environment, sparking the customer to initiate phase 2 to expand the monitoring to more distributed networks and to add additional functionality with the addition of Log Analyzer (LA) and Security Event Manager (SEM). C L I E N T P R O F I L E − SolarWinds customer since 2016 − Initial phase of project $251k win Why We Won − Mature products, meeting the customer's needs with limited-to-no learning curve. − Close partnership relationship allowed SolarWinds to have a stronger understanding of the customer’s environment needs, with the partner providing useful insight.

49@solarwinds A S S IG N E D U N -A S S IG N E D Broader focus on prospecting and new-to- franchise customers 1 2 3 Better efficiencies around marketing efforts and partner strategies Stronger alignment between sellers and customer cycles/needs © 2021 SolarWinds Worldwide, LLC. All rights reserved. 49 Creating Success For Both Our Sellers and Our Customers <1000 employees 1000 – 5000 employees 5000+ employees Increase Wallet Share Enterprise Increase Penetration & Expansion Mid-Market Maintain Velocity Commercial

50@solarwinds Executive Access Solution Sales Demand Aggregation Demand Generation Local Presence D I S T R I B U T O R S / R E S E L L E R S / V A R s M S P s / S I s / G S I s A L L I A N C E S / C S P s Cloud Adoption Customer Access Partner Alignment Developing a Partnership Strategy for Growth © 2021 SolarWinds Worldwide, LLC. All rights reserved. 50

51@solarwinds GSI Case Study © 2021 SolarWinds Worldwide, LLC. All rights reserved. 51 Leading Automotive Company S O L A R W I N D S R O L E − Data center consolidation strategy meant there was going to be a mixture of on- premises and multi-cloud environments. GSI partner noted the client had multiple tools running across the globe in silos. − Client needed to run all network and infrastructure, at a scale of >100,000 nodes spread across the globe, stitched together through an enterprise level console. Phase one of their purchase was for 35,000 nodes. − SolarWinds worked with the GSI partner to gain a better understanding of the environment, the opportunity expanded to monitor >2000 database instances connected to the client's mission critical applications. PA R T N E R S H I P W I T H G S I − SolarWinds has had a strategic alliance relationship with the GSI partner for over a year now, during this time, both companies have worked together on adding important logos worldwide. − SolarWinds has invested in training and certifying over 100 GSI partner tools engineers through bootcamps and regular sessions, equipping their teams to design and deliver complex implementations, integrations and customizations for larger deals. − With SolarWinds Observability, GSI partner found it brought them flexibility through the deployment while staying competitive. F U T U R E O P P O R T U N I T Y − SolarWinds offerings have expanded both the GSI partner and client’s confidence in the scale of the SolarWinds solution. Creating opportunity for a large expansion opportunity in the future . − Pivotal partnership with GSI to transform and innovate IT infrastructure strategy − Provide agile, open, scalable, and smart hybrid cloud infrastructure leveraging GSI and leading cloud providers to accelerate clients multi-cloud journey. − $680K Subscription Win C L I E N T P R O F I L E

52@solarwinds Microsoft Co-Selling Case Study © 2021 SolarWinds Worldwide, LLC. All rights reserved. 52 − Microsoft co-selling partnership established 2019 − 55 deals closed in 20211 − ~$5 million in sales1 Financial Software C U S T O M E R P R O F I L E − Virtual environment growing rapidly, customer needed more licenses to cover their growth. − Build: SQL Sentry additional licenses added to gather data queries for database performance and locate gaps and shortfalls. − Sell: Worked with PDM to connect the Microsoft representative, relationship with database team helped close the deal. − $65K deal H O W W E E X E C U T E D − Engaged with the SolarWinds representative on opportunity and discussed the growth of the customer's environment. The Microsoft representative reached out to the customer on behalf of SolarWinds to validate what was being positioned. W H Y W E W O N − Insights: We engaged the Microsoft Data and AI Specialist as they knew the account well and had a regular cadence with this customer. They were able to validate our solution which helped in closing the deal much faster. − Voice of the Partner: Having the Microsoft representative engaged with the customer and opportunity created a brand recognition with the customer and our partnership we have with Microsoft. 1. As of September 30, 2021.

53@solarwinds LAND EX PAND RENEW LAND RETAIN AD OP T EX PAND © 2021 SolarWinds Worldwide, LLC. All rights reserved. 53 Shifting to Focus on Land, Adopt, Expand, and Retain Sa le s M o ti o n

54@solarwinds Finance Strategy Bart Kalsu C H I E F F I N A N C I A L O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 54

55@solarwinds Note: Percentages shown may not add to 100% due to rounding. 1. Represents $428.7 million total revenue. Fiscal year 2014 total revenue as presented on non-GAAP and GAAP basis were consistent as there were no purchase accounting adjustments during this period. 2. FY’14, FY’18 and FY’20 are non-GAAP revenue results and include revenue from the N-able business as reported in our historical financial results filed with the Securities and Exchange Commission. 3. YTD’21 which represents the nine months ended 9/30/21 are GAAP revenue results and have been adjusted to remove revenue from the N-able business for the period. Recurring Revenue Remains High Post N-able Spin-off © 2021 SolarWinds Worldwide, LLC. All rights reserved. 55 15% 68% 17% 85% Recurring Post Spin-off3 Y T D ’ 2 1 14% 47% 39% 86% Recurring2 F Y ’ 2 0 20% 48% 32% 80% Recurring2 F Y ’ 1 8 38% 56% 7% 62% Recurring1,2 F Y ’ 1 4 License % of Total Revenue Maintenance % of Total Revenue Subscription % of Total Revenue

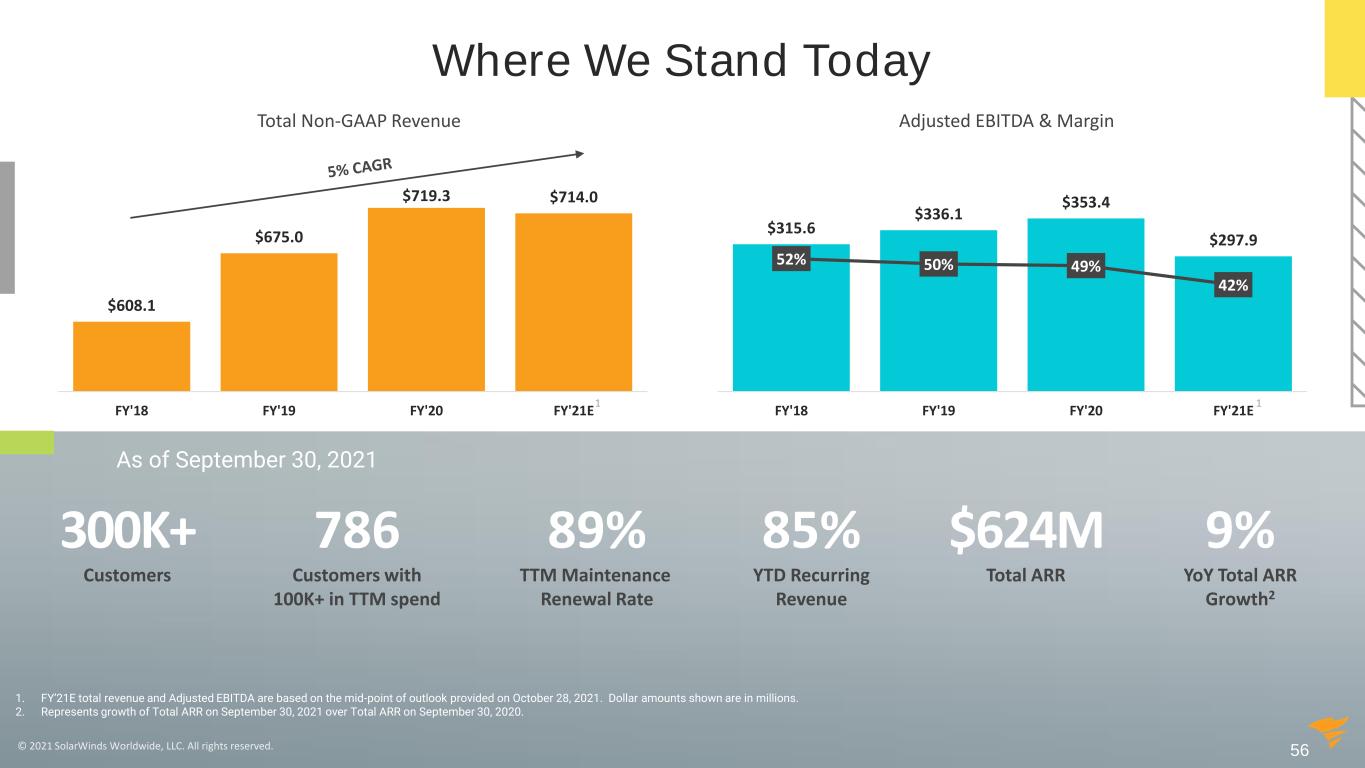

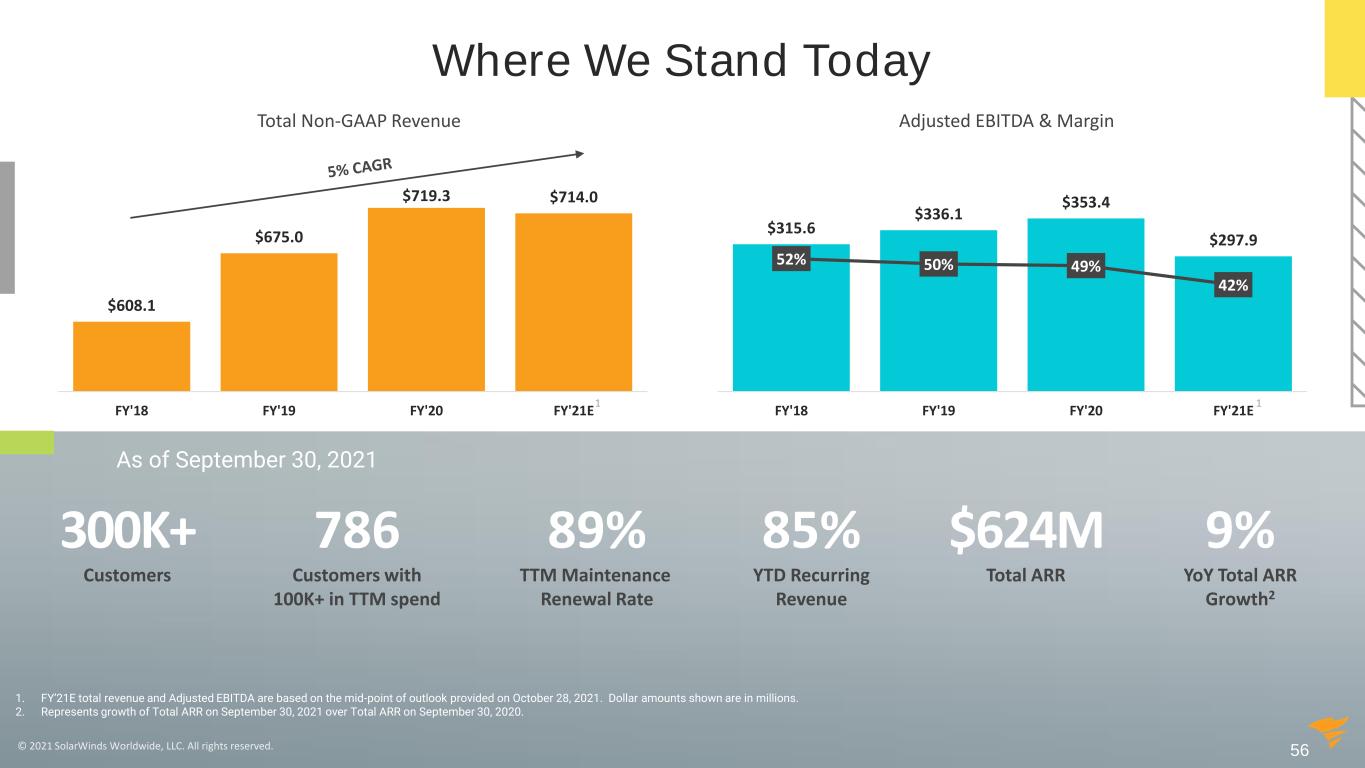

56@solarwinds Total Non-GAAP Revenue 300K+ Customers 89% TTM Maintenance Renewal Rate $624M Total ARR 9% YoY Total ARR Growth2 786 Customers with 100K+ in TTM spend 85% YTD Recurring Revenue $608.1 $675.0 $719.3 $714.0 $540.0 $560.0 $580.0 $600.0 $620.0 $640.0 $660.0 $680.0 $700.0 $720.0 $740.0 FY'18 FY'19 FY'20 FY'21E $315.6 $336.1 $353.4 $297.9 52% 50% 49% 42% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 FY'18 FY'19 FY'20 FY'21E Adjusted EBITDA & Margin © 2021 SolarWinds Worldwide, LLC. All rights reserved. 56 Where We Stand Today 1. FY’21E total revenue and Adjusted EBITDA are based on the mid-point of outlook provided on October 28, 2021. Dollar amounts shown are in millions. 2. Represents growth of Total ARR on September 30, 2021 over Total ARR on September 30, 2020. 1 1 As of September 30, 2021

57@solarwinds FY’21E Adjusted EBITDA Margin Review 1. FY’21E Adjusted EBITDA margin is based on the outlook provided on October 28, 2021. 49% ~42% 1 ~2% Secure By Design − Product & IT investments to harden our security posture; including penetration testing, MFA & headcount increases (e.g., “Red Team”) − Increased PR, awareness & other brand spend − Increased admin costs such cyber & D&O insurance ~2% N-able Spin-off Dissynergies − Facilities & IT expenses − Administrative and fixed G&A costs such as public co. and other professional fees − Royalty payments ~4% Investing for Growth − GTM initiatives: International expansion, CSM motion, & channel buildout − Product investment: Observability platform FY’20A FY’21E © 2021 SolarWinds Worldwide, LLC. All rights reserved.

58@solarwinds Investing in Existing Products & Markets − Service Desk − Database management − Improved gross & net retention Expanding our Routes to Market − Continued international expansion − CSMs − Channel partners − GSIs Delivering Innovative Products − Broad, differentiated approach to observability − Integrated platform − Simplified user-experience Focused on Growth © 2021 SolarWinds Worldwide, LLC. All rights reserved. 58 Simplifying our Packaging and Pricing − Subscription-first − Node-based pricing

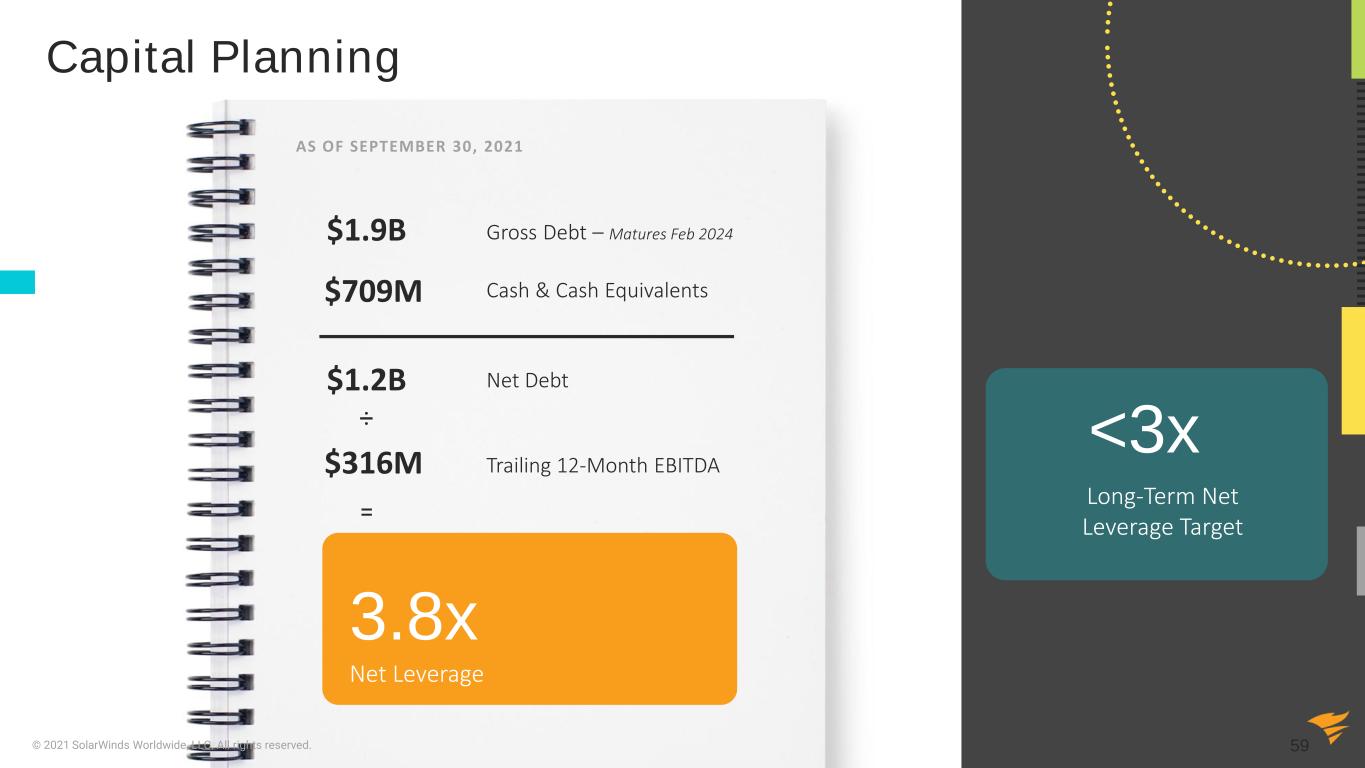

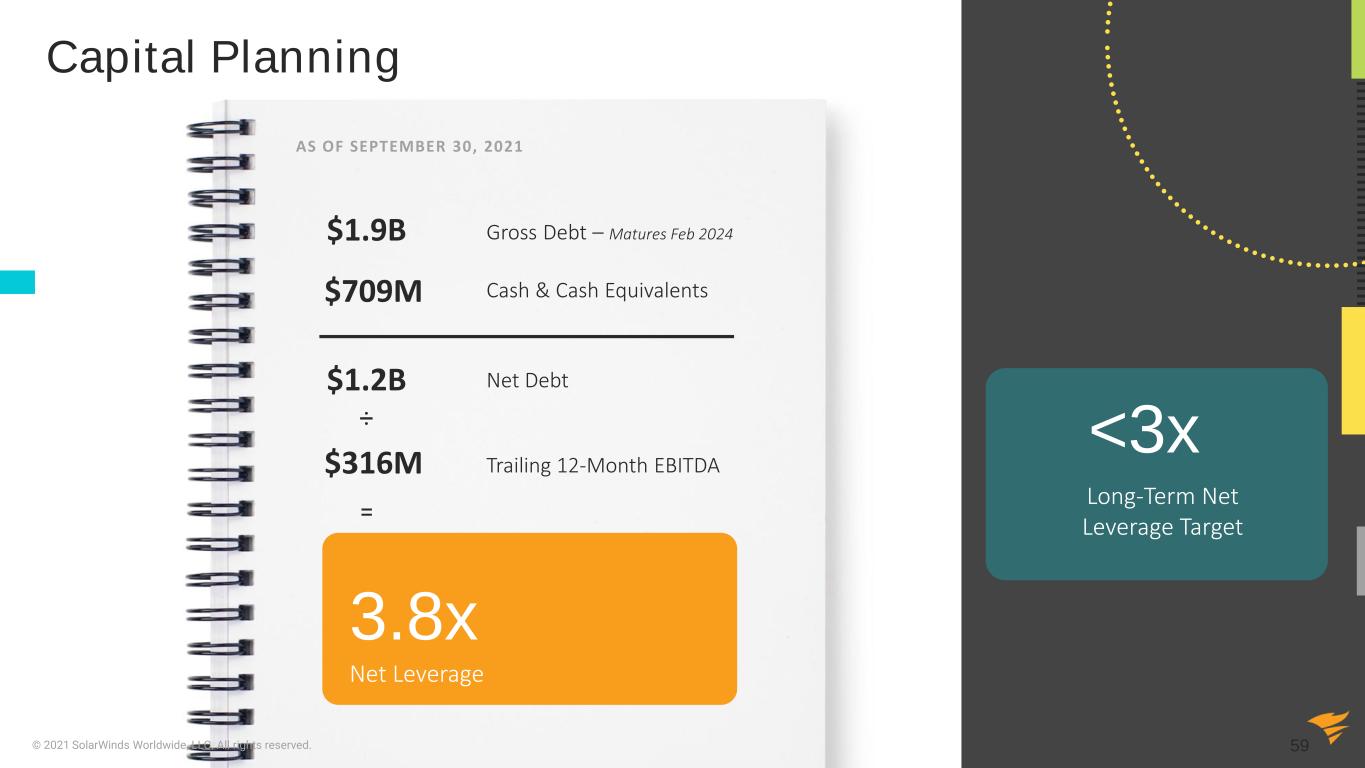

59@solarwinds Capital Planning © 2021 SolarWinds Worldwide, LLC. All rights reserved. 59 Cash & Cash Equivalents Net Debt AS OF SEPTEMBER 30, 2021 Trailing 12-Month EBITDA $1.9B $709M $1.2B $316M Long-Term Net Leverage Target <3x÷ = Net Leverage 3.8x Gross Debt – Matures Feb 2024

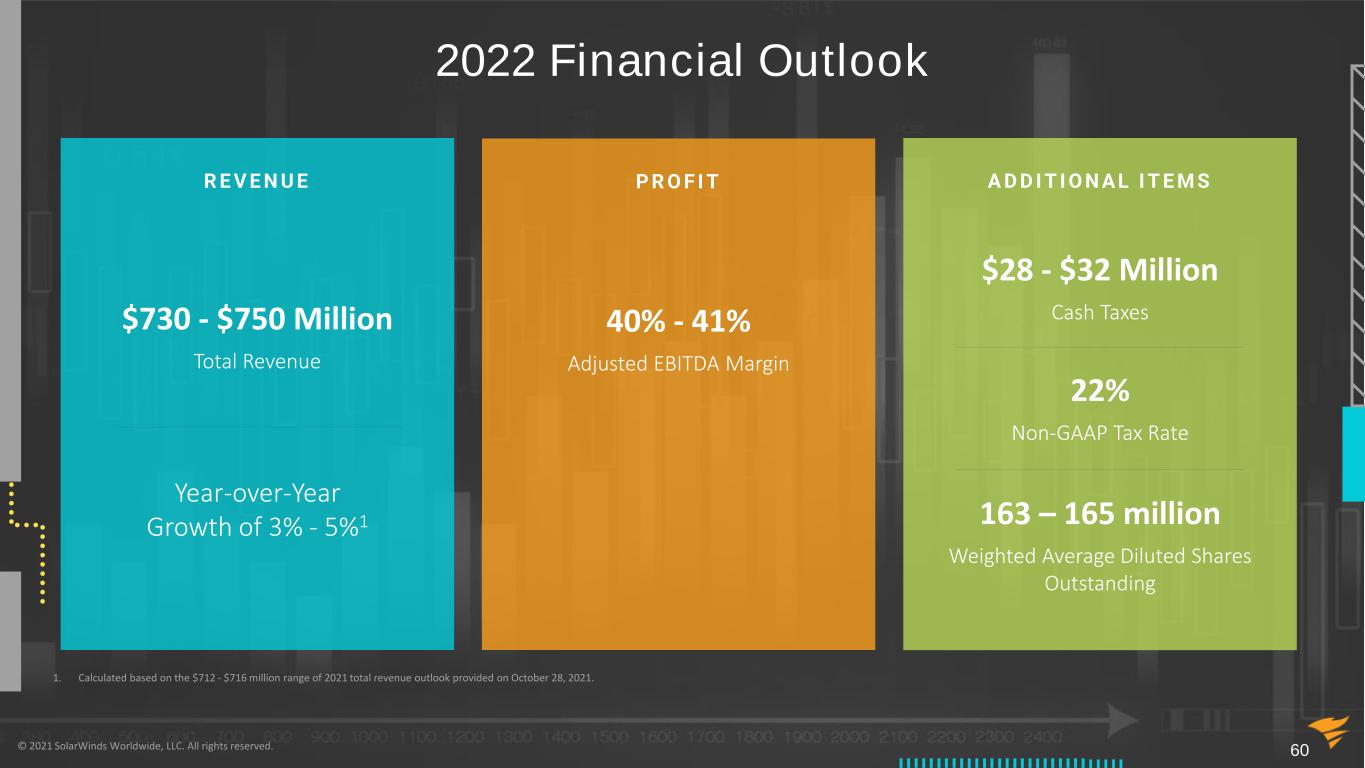

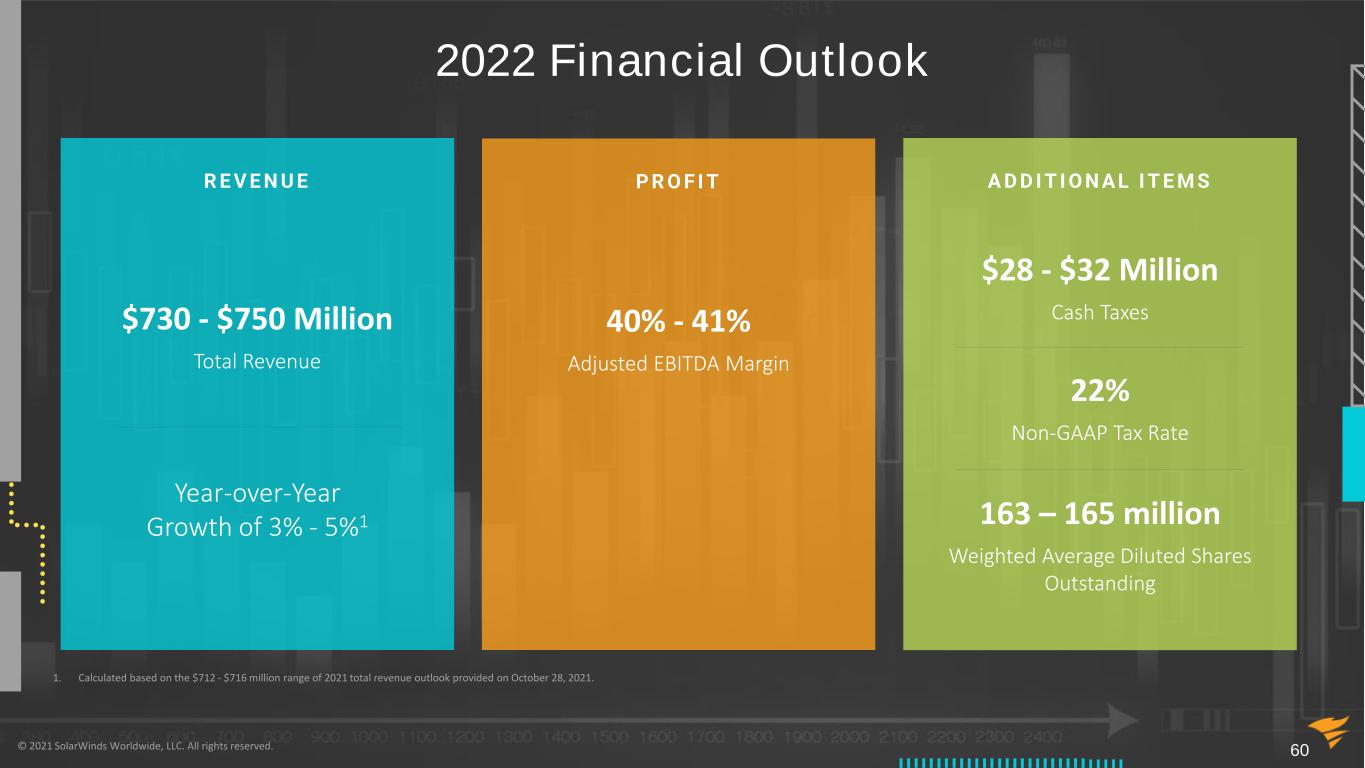

60@solarwinds A D D I T I O N A L I T E M SR E V E N U E P R O F I T 2022 Financial Outlook © 2021 SolarWinds Worldwide, LLC. All rights reserved. 60 $28 - $32 Million Cash Taxes$730 - $750 Million Total Revenue Year-over-Year Growth of 3% - 5%1 22% Non-GAAP Tax Rate 163 – 165 million Weighted Average Diluted Shares Outstanding 1. Calculated based on the $712 - $716 million range of 2021 total revenue outlook provided on October 28, 2021. 40% - 41% Adjusted EBITDA Margin

61@solarwinds 2022 Revenue Assumptions © 2021 SolarWinds Worldwide, LLC. All rights reserved. 61 $730 - $750 Million Total Revenue Year-over-Year Growth of 3% - 5%1 1. Calculated based on the $712 - $716 million range of 2021 total revenue outlook provided on October 28, 2021. • Maintain buyer purchasing flexibility with steadily increasing subscription mix • ~90% maintenance renewal rates excluding potential maintenance to subscription conversions • High-single digits year-over-year license revenue growth • ~20% year-over-year subscription revenue growth • Maintenance revenue flat-to-slightly down year-over-year

62@solarwinds Closing Remarks Sudhakar Ramakrishna C H I E F E X E C U T I V E O F F I C E R © 2021 SolarWinds Worldwide, LLC. All rights reserved. 62

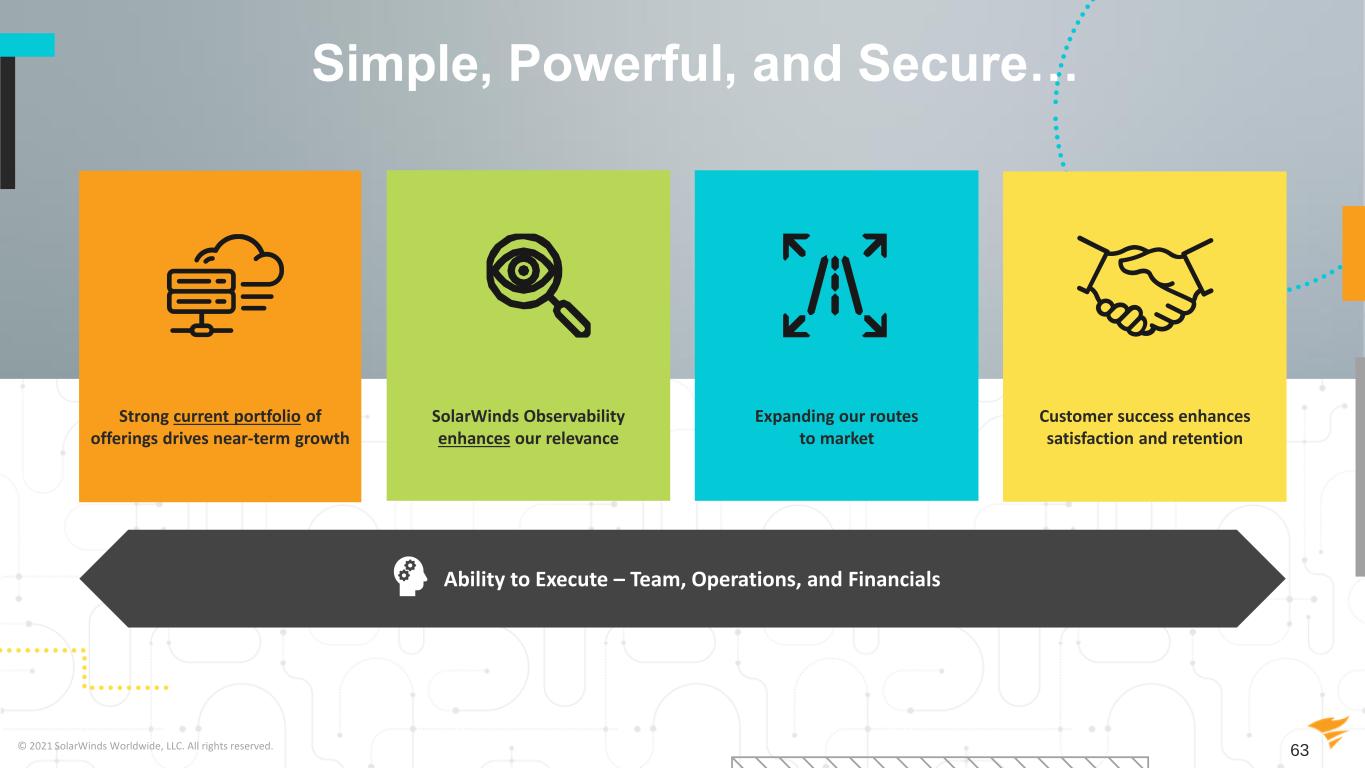

63@solarwinds Simple, Powerful, and Secure… © 2021 SolarWinds Worldwide, LLC. All rights reserved. 63 Strong current portfolio of offerings drives near-term growth SolarWinds Observability enhances our relevance Expanding our routes to market Customer success enhances satisfaction and retention Ability to Execute – Team, Operations, and Financials

64@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 64 Note: Includes non-GAAP financial measures 1. Year-to-date through September 30, 2021 Long-Term Target Model Assumptions • Maintain buyer purchasing flexibility with subscription first • Low 90%s maintenance renewal rates excluding potential maintenance-to-subscription transitions • Focused on organic growth; target model does not assume any significant M&A Top-Line Assumptions Expense Profile Assumptions FY’20 YTD’211 Long-Term Target Model COGs % of Revenue 7% 9% 10-12% Ramps to support hosting needs assoc. w/ expanded portfolio of SaaS offerings R&D % of Revenue 10% 13% 11-13% Remains ~in-line w/ YTD‘21; balance new product investment w/ efficient dev process S&M % of Revenue 28% 29% 26-28% GTM investments in international, channels, etc. drive operating leverage G&A % of Revenue 8% 9% 8-9% Remains ~in-line w/ YTD‘21; scale G&A in-line with business to support growth EBIT % of Revenue 47% 40% Low 40s Adjusted EBITDA % of Revenue 49% 42% Mid 40s

65@solarwinds Total ARR Subscription ARR Growth1 Recurring Revenue Adjusted EBITDA Margins © 2021 SolarWinds Worldwide, LLC. All rights reserved. 65 Net Leverage $1B+ 30%+ 90%+ Mid 40s <3x Long-Term Target Model The financial profile we are targeting for 2025 1. Compounded annual growth target for 2021 – 2025. 2. Source: FactSet, company disclosures. Management estimates based on FactSet and public filings. # of Public Software Companies That Share This Total ARR and EBITDA Margin Profile in 20212 10

66@solarwinds Q&A © 2021 SolarWinds Worldwide, LLC. All rights reserved. 66

67@solarwinds Appendix: Reconciliation of Non-GAAP Financial Measures © 2021 SolarWinds Worldwide, LLC. All rights reserved. 67

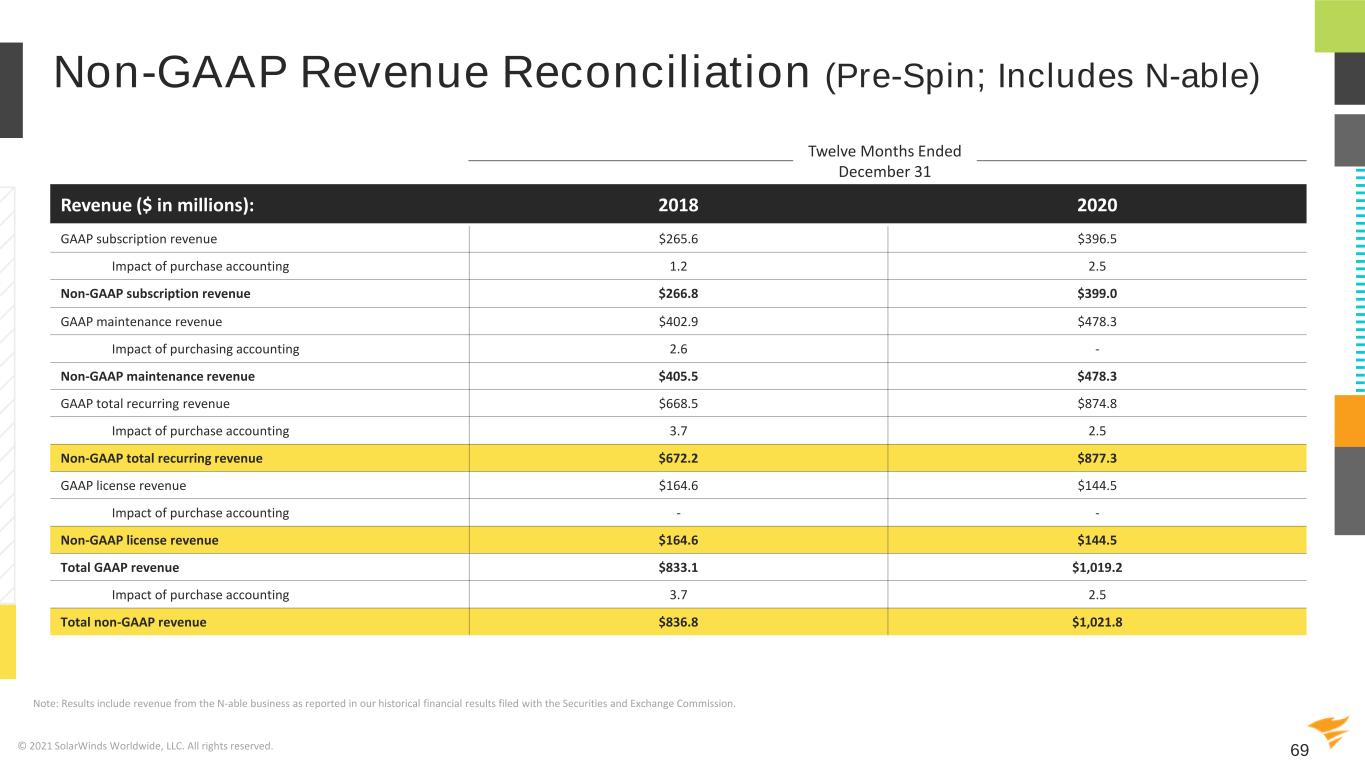

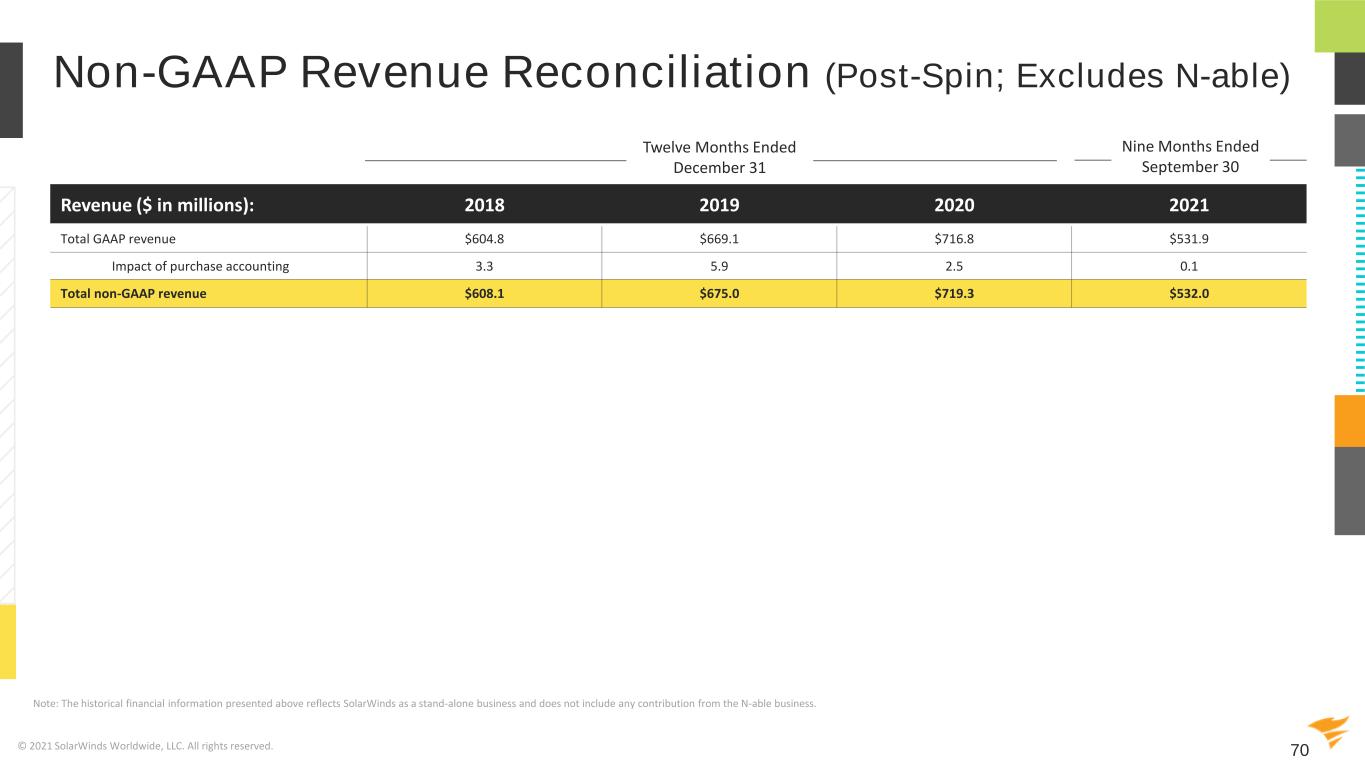

68@solarwinds Definitions Non-GAAP Revenue. We define non-GAAP total revenue as total revenue excluding the impact of purchase accounting from acquisitions. The non-GAAP revenue growth rates we provide are calculated using non-GAAP revenue from the comparable prior period. For the third quarter of 2021, there was no impact of purchase accounting on revenue, so our non-GAAP total revenue is equivalent to our GAAP total revenue. Adjusted EBITDA and Adjusted EBITDA Margin. We define adjusted EBITDA as net income or loss, excluding the impact of purchase accounting on total revenue, amortization of acquired intangible assets and developed technology, depreciation expense, stock-based compensation expense and related employer-paid payroll taxes, restructuring costs, acquisition and other costs, Cyber Incident costs, interest expense, net, debt related costs including fees related to our credit agreements, debt extinguishment and refinancing costs, unrealized foreign currency (gains) losses, and income tax expense (benefit). We define adjusted EBITDA margin as adjusted EBITDA divided by non-GAAP revenue. Unlevered Free Cash Flow. Unlevered free cash flow is a measure of our liquidity used by management to evaluate cash flow from operations, after the deduction of capital expenditures and prior to the impact of our capital structure, acquisition and other costs, Cyber Incident costs, restructuring costs, employer-paid payroll taxes on stock awards and other one-time items, that can be used by us for strategic opportunities and strengthening our balance sheet. However, given our debt obligations, unlevered free cash flow does not represent residual cash flow available for discretionary expenses. Annual Recurring Revenue (ARR). ARR is annual run-rate revenue of maintenance and subscription agreements from all customers at a point in time. ARR for a given point in time excludes the impact of future price increases from that point in time and forward. Maintenance Renewal Rate. Maintenance renewal rate represents sales of maintenance services for all existing maintenance contracts expiring in a period, divided by the sum previous sales of maintenance services corresponding to those services expiring in the current period. Sales of maintenance services includes sales of maintenance renewals for a previously purchased product and the amount allocated to maintenance revenue from a license purchase. Subscription Net Retention Rate. Net retention rate for subscription products is the implied monthly subscription revenue at the end of a period for the base set of customers from which we generated subscription revenue in the year prior to the calculation, divided by the implied monthly subscription revenue one year prior to the date of calculation for that same customer base. Customers. We define customers as individuals or entities that have purchased one or more of our products under a unique customer identification number since our inception for our perpetual license products and individuals or entities that have an active subscription for at least one of our subscription products. Each unique customer identification number constitutes a separate customer regardless of the amount purchased. We may have multiple purchasers of our products within a single organization, each of which may be assigned a unique customer identification number and deemed a separate customer. © 2021 SolarWinds Worldwide, LLC. All rights reserved. 68

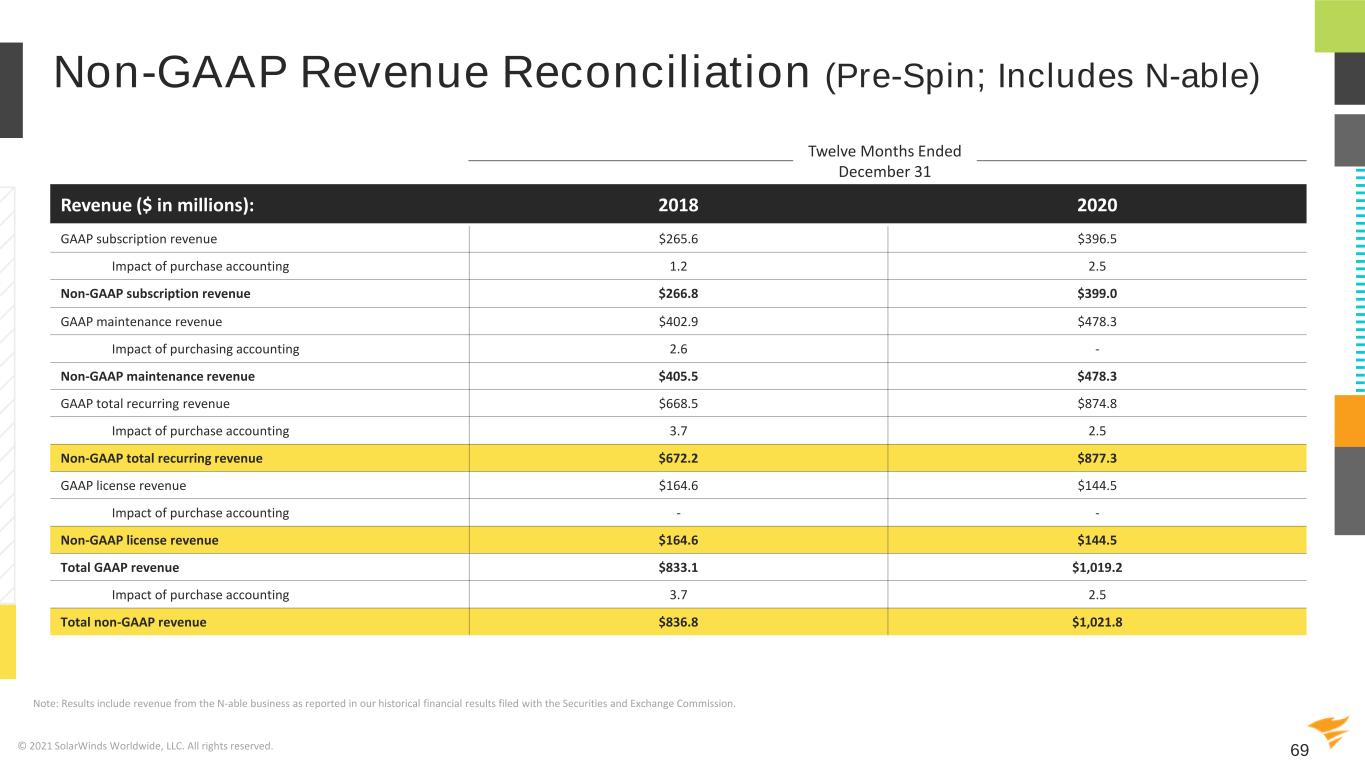

69@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 69 Non-GAAP Revenue Reconciliation (Pre-Spin; Includes N-able) Note: Results include revenue from the N-able business as reported in our historical financial results filed with the Securities and Exchange Commission. Revenue ($ in millions): 2018 2020 GAAP subscription revenue $265.6 $396.5 Impact of purchase accounting 1.2 2.5 Non-GAAP subscription revenue $266.8 $399.0 GAAP maintenance revenue $402.9 $478.3 Impact of purchasing accounting 2.6 - Non-GAAP maintenance revenue $405.5 $478.3 GAAP total recurring revenue $668.5 $874.8 Impact of purchase accounting 3.7 2.5 Non-GAAP total recurring revenue $672.2 $877.3 GAAP license revenue $164.6 $144.5 Impact of purchase accounting - - Non-GAAP license revenue $164.6 $144.5 Total GAAP revenue $833.1 $1,019.2 Impact of purchase accounting 3.7 2.5 Total non-GAAP revenue $836.8 $1,021.8 Twelve Months Ended December 31

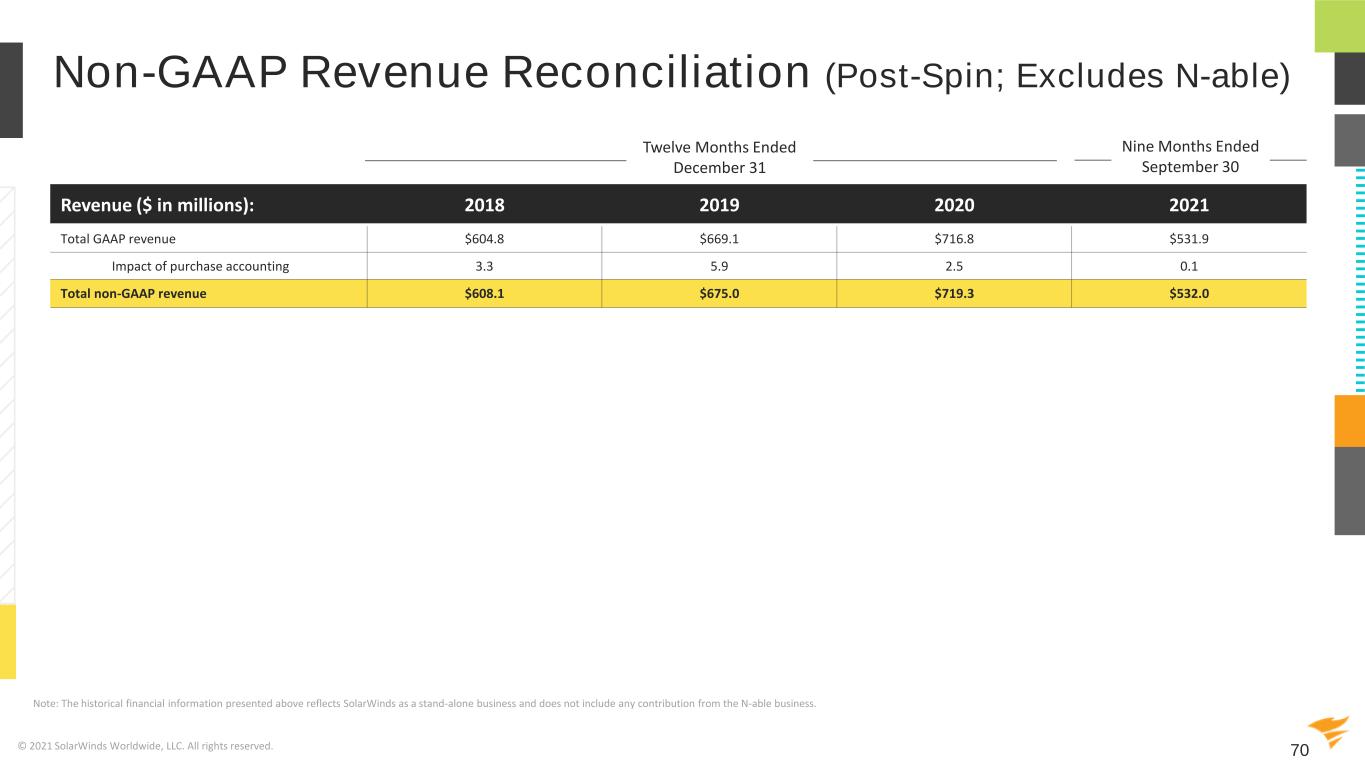

70@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 70 Non-GAAP Revenue Reconciliation (Post-Spin; Excludes N-able) Note: The historical financial information presented above reflects SolarWinds as a stand-alone business and does not include any contribution from the N-able business. Revenue ($ in millions): 2018 2019 2020 2021 Total GAAP revenue $604.8 $669.1 $716.8 $531.9 Impact of purchase accounting 3.3 5.9 2.5 0.1 Total non-GAAP revenue $608.1 $675.0 $719.3 $532.0 Twelve Months Ended December 31 Nine Months Ended September 30

71@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 71 Non-GAAP Reconciliation (Post-Spin; Excludes N-able) ($ in millions, except margin data): 2020 2021 GAAP total cost of revenue $211.4 $169.7 Stock-based compensation expense and related employer-paid payroll taxes (1.9) (1.6) Amortization of acquired technologies (157.1) (120.4) Acquisition and other costs (0.0) (0.0) Restructuring costs (0.0) (0.5) Cyber Incident costs (0.1) (1.8) Non-GAAP total cost of revenue $52.3 $45.3 GAAP gross profit $505.3 $362.2 Impact of purchase accounting 2.5 0.1 Stock-based compensation expense and related employer-paid payroll taxes 1.9 1.6 Amortization of acquired technologies 157.1 120.4 Acquisition and other costs 0.0 0.0 Restructuring costs 0.0 0.5 Cyber Incident costs 0.1 1.8 Non-GAAP gross profit $667.0 $486.7 GAAP gross margin 70.5% 68.1% Non-GAAP gross margin 92.7% 91.5% Twelve Months Ended December 31 Nine Months Ended September 30

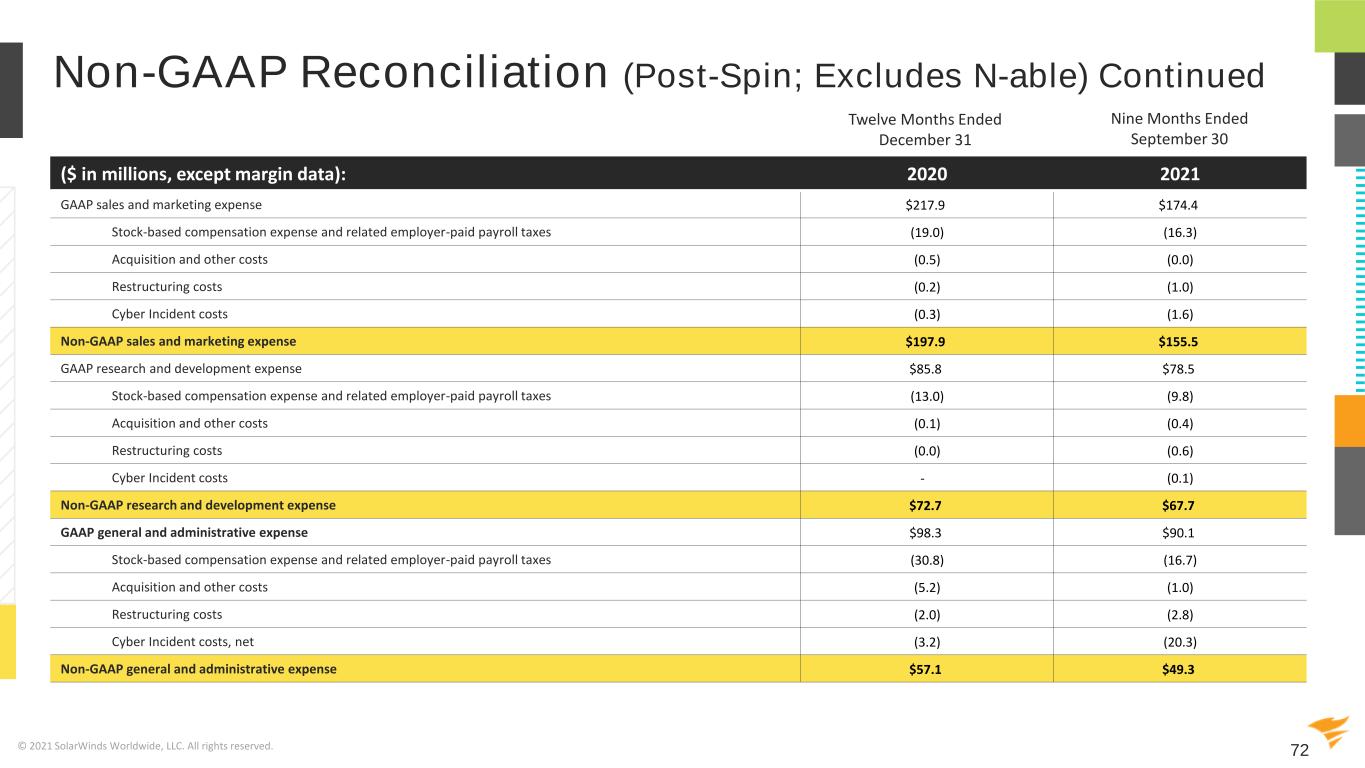

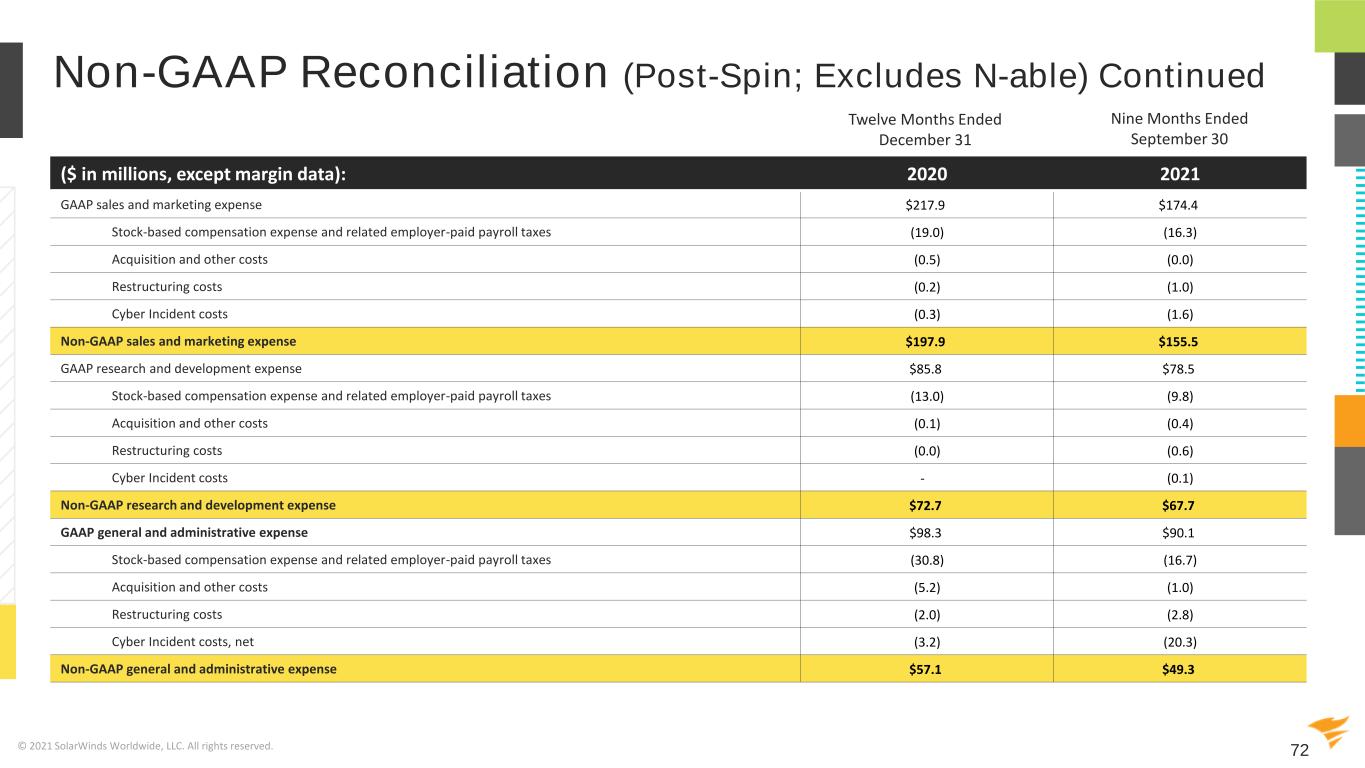

72@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 72 Non-GAAP Reconciliation (Post-Spin; Excludes N-able) Continued ($ in millions, except margin data): 2020 2021 GAAP sales and marketing expense $217.9 $174.4 Stock-based compensation expense and related employer-paid payroll taxes (19.0) (16.3) Acquisition and other costs (0.5) (0.0) Restructuring costs (0.2) (1.0) Cyber Incident costs (0.3) (1.6) Non-GAAP sales and marketing expense $197.9 $155.5 GAAP research and development expense $85.8 $78.5 Stock-based compensation expense and related employer-paid payroll taxes (13.0) (9.8) Acquisition and other costs (0.1) (0.4) Restructuring costs (0.0) (0.6) Cyber Incident costs - (0.1) Non-GAAP research and development expense $72.7 $67.7 GAAP general and administrative expense $98.3 $90.1 Stock-based compensation expense and related employer-paid payroll taxes (30.8) (16.7) Acquisition and other costs (5.2) (1.0) Restructuring costs (2.0) (2.8) Cyber Incident costs, net (3.2) (20.3) Non-GAAP general and administrative expense $57.1 $49.3 Twelve Months Ended December 31 Nine Months Ended September 30

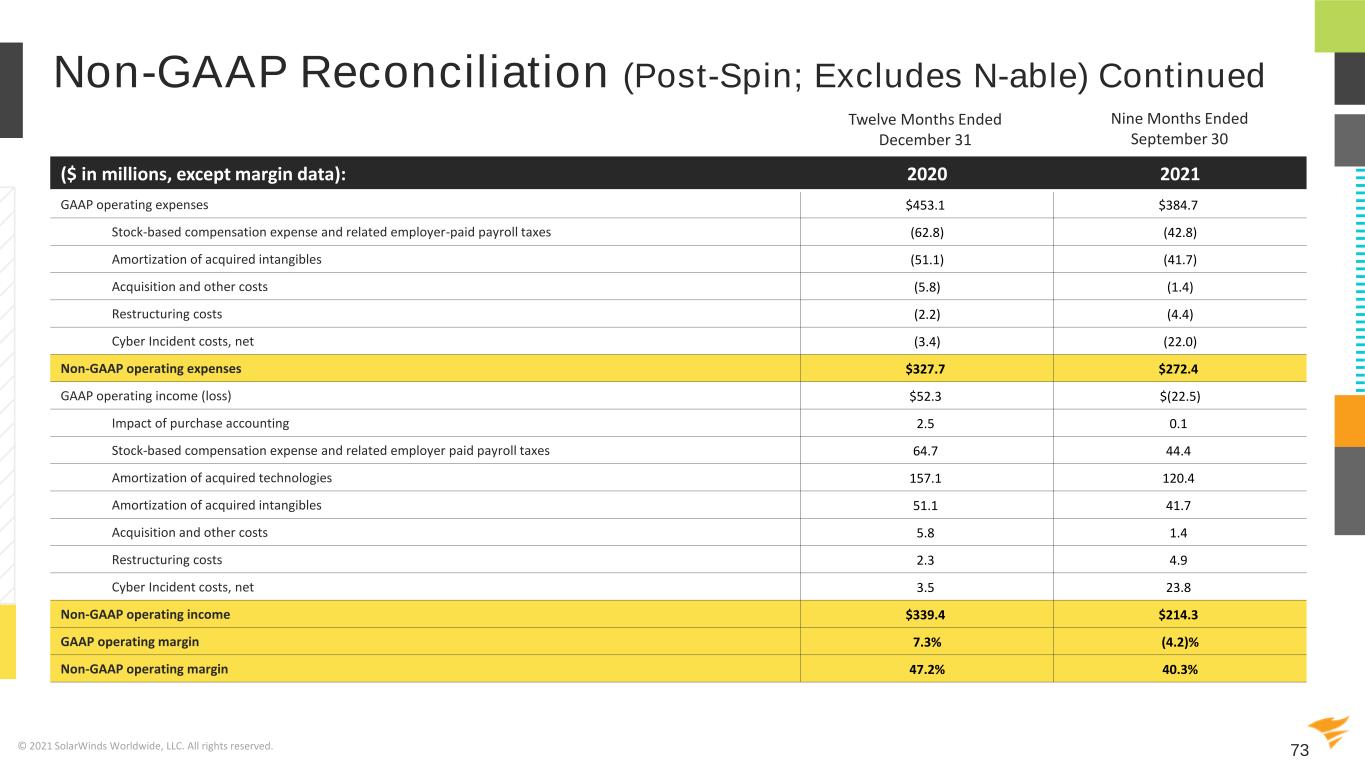

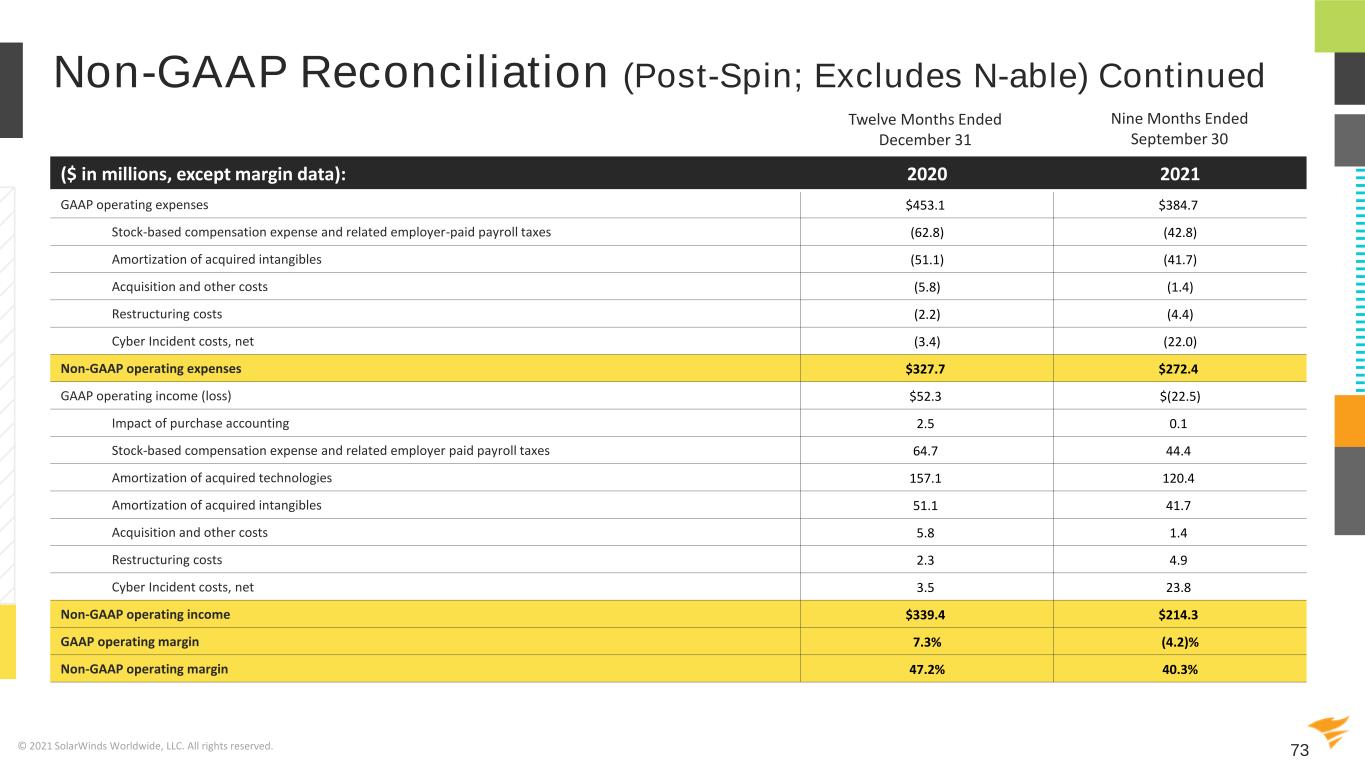

73@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 73 Non-GAAP Reconciliation (Post-Spin; Excludes N-able) Continued ($ in millions, except margin data): 2020 2021 GAAP operating expenses $453.1 $384.7 Stock-based compensation expense and related employer-paid payroll taxes (62.8) (42.8) Amortization of acquired intangibles (51.1) (41.7) Acquisition and other costs (5.8) (1.4) Restructuring costs (2.2) (4.4) Cyber Incident costs, net (3.4) (22.0) Non-GAAP operating expenses $327.7 $272.4 GAAP operating income (loss) $52.3 $(22.5) Impact of purchase accounting 2.5 0.1 Stock-based compensation expense and related employer paid payroll taxes 64.7 44.4 Amortization of acquired technologies 157.1 120.4 Amortization of acquired intangibles 51.1 41.7 Acquisition and other costs 5.8 1.4 Restructuring costs 2.3 4.9 Cyber Incident costs, net 3.5 23.8 Non-GAAP operating income $339.4 $214.3 GAAP operating margin 7.3% (4.2)% Non-GAAP operating margin 47.2% 40.3% Twelve Months Ended December 31 Nine Months Ended September 30

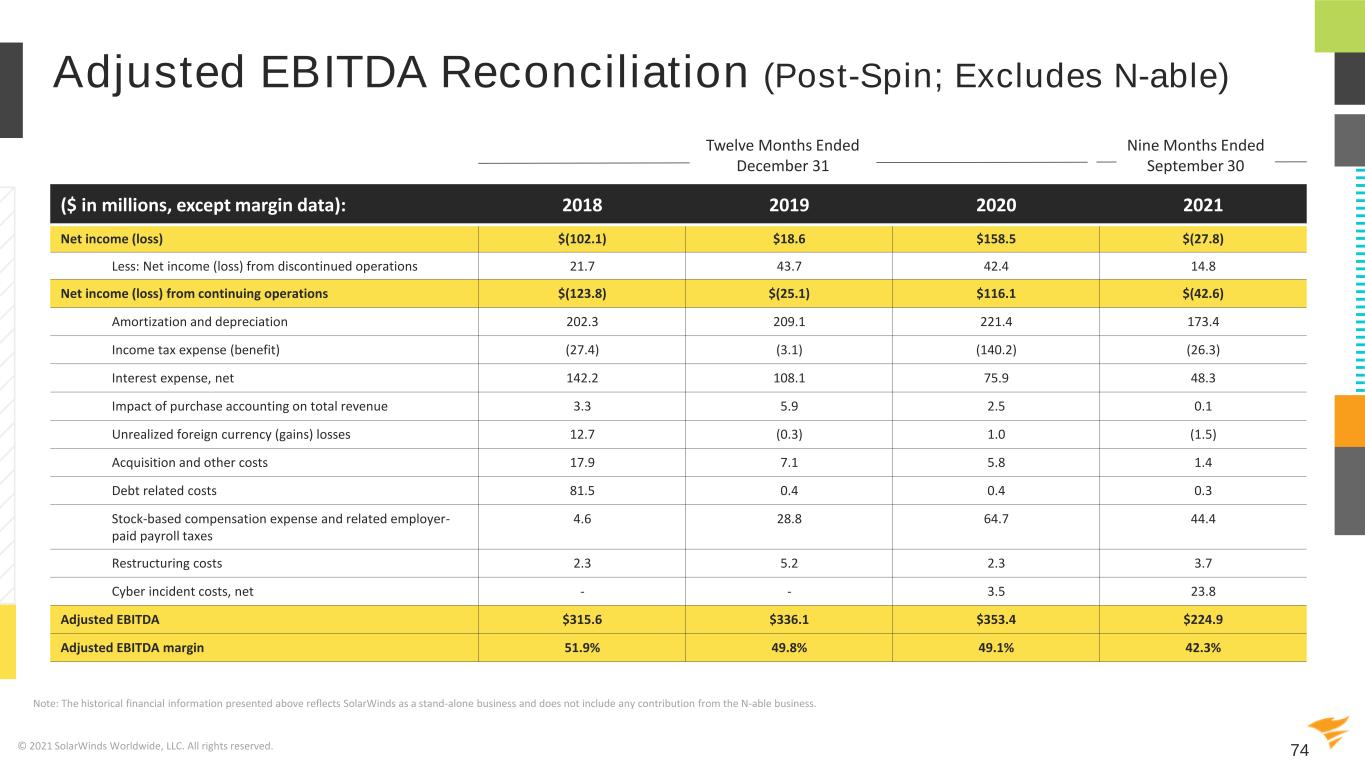

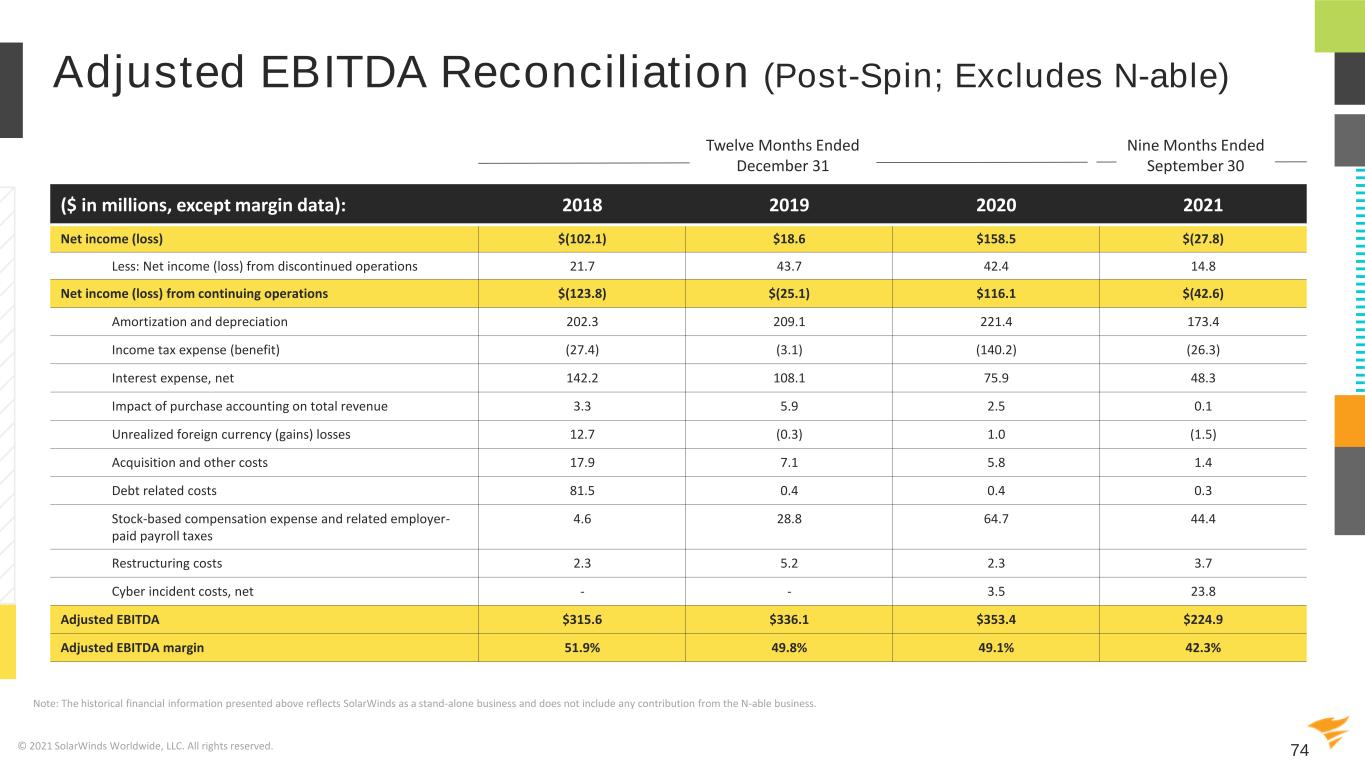

74@solarwinds© 2021 SolarWinds Worldwide, LLC. All rights reserved. 74 Adjusted EBITDA Reconciliation (Post-Spin; Excludes N-able) Note: The historical financial information presented above reflects SolarWinds as a stand-alone business and does not include any contribution from the N-able business. ($ in millions, except margin data): 2018 2019 2020 2021 Net income (loss) $(102.1) $18.6 $158.5 $(27.8) Less: Net income (loss) from discontinued operations 21.7 43.7 42.4 14.8 Net income (loss) from continuing operations $(123.8) $(25.1) $116.1 $(42.6) Amortization and depreciation 202.3 209.1 221.4 173.4 Income tax expense (benefit) (27.4) (3.1) (140.2) (26.3) Interest expense, net 142.2 108.1 75.9 48.3 Impact of purchase accounting on total revenue 3.3 5.9 2.5 0.1 Unrealized foreign currency (gains) losses 12.7 (0.3) 1.0 (1.5) Acquisition and other costs 17.9 7.1 5.8 1.4 Debt related costs 81.5 0.4 0.4 0.3 Stock-based compensation expense and related employer- paid payroll taxes 4.6 28.8 64.7 44.4 Restructuring costs 2.3 5.2 2.3 3.7 Cyber incident costs, net - - 3.5 23.8 Adjusted EBITDA $315.6 $336.1 $353.4 $224.9 Adjusted EBITDA margin 51.9% 49.8% 49.1% 42.3% Twelve Months Ended December 31 Nine Months Ended September 30

75@solarwinds The SolarWinds, SolarWinds & Design, Orion, and THWACK trademarks are the exclusive property of SolarWinds Worldwide, LLC or its affiliates, are registered with the U.S. Patent and Trademark Office, and may be registered or pending registration in other countries. All other SolarWinds trademarks, service marks, and logos may be common law marks or are registered or pending registration. All other trademarks mentioned herein are used for identification purposes only and are trademarks of (and may be registered trademarks) of their respective companies. © 2021 SolarWinds Worldwide, LLC. All rights reserved. 75