UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-23351

AMERICAN BEACON APOLLO TOTAL RETURN FUND

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817)391-6100

Date of fiscal year end: June 30, 2019

Date of reporting period: June 30, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

APOLLO TOTAL RETURN FUND

The Fund is anon-diversified, closed-endmanagement investment company structured as an “interval fund” and designed primarily for long-term investors. The Fund’s use offixed-incomeandvariable-ratesecurities, such as loans and related instruments of varying levels of seniority, corporate debt and notes, high-yield securities, CLOs, CLNs, RMBS, CMBS andderivativesentails interest rate, liquidity, market and credit risks. Investing inforeign and emerging market securitiesmay involve heightened risk due to currency fluctuations and economic and political risks. The Fund invests inreal estaterelated securities, which involve additional risks such as limited liquidity and greater volatility. The Fund’s ability toborrowfor investment purposes and otherwise useleveragecan magnify these risks. There is no secondary market for the Fund’s shares, and the Fund expects that no secondary market will develop. Even though the Fund will make quarterly repurchase offers for its outstanding shares (currently expected to be for 8% per quarter), investors should consider shares of the Fund to be anilliquid investment. There is no guarantee that investors will be able to sell their shares at any given time or in the quantity desired. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions, and, therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

American Beacon Interval Funds | June 30, 2019 |

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 7 | ||||

Schedule of Investments: | ||||

| 8 | ||||

| 10 | ||||

| 13 | ||||

Financial Highlights: | ||||

| 33 | ||||

| 34 | ||||

Disclosures Regarding the Approval of the Management and Investment Advisory Agreements | 35 | |||

| 39 | ||||

| 45 | ||||

| Back Cover | ||||

| Dear Shareholders,

At American Beacon, we take our heritage as a fiduciary very seriously — and we apply that mindset to all aspects of our business as a fund manager. As a result, for more than 30 years, we have endeavored to:

u Identify, engage and oversee the best money managers. As a manager of managers, our goal is to engage the most effective money managers for each asset class, investment style and market strategy we offer. We are committed to partnering with those we judge to be “the best of the best” when it comes to choosing sub-advisors for our mutual funds. Whether our due-diligence process results in the selection of one sub-advisor or multiple sub-advisors, we select those we believe show the greatest potential to help us meet the high standards you’ve come to expect. |

| u | Offer a variety of innovative investment solutions. Our mutual funds — which span the domestic, international, global, frontier and emerging markets — are sub-advised by experienced money managers who employ distinctive, proprietary investment processes to manage assets through a variety of economic and market conditions. From offering some of the first multi-manager funds, one of the first retirement income funds and the first open-ended mutual fund in the U.S. to focus primarily on frontier-market debt, our robust history includes applying a disciplined, solutions-based approach to our product development process in an effort to help you grow your assets while mitigating risk. |

| u | Provide a solutions-based approach to achieving long-term investment goals.We seek to provide investment solutions that might enable you to benefit from taking a more disciplined approach to investing. Our mutual funds provide access to institutional-quality, research-intensive investment managers with diverse processes and styles. Over the long run, having such access and spending time in the market — rather than trying to time the market — may better position you to reach your long-term investment goals during market upswings and potentially insulate against market downswings. |

Our management approach is more than a concept; it’s the cornerstone of American Beacon’s culture. And we strive to employ it at every turn as we seek to provide a well-diversified line of investment solutions to help our shareholders seek long-term rewards.

Thank you for your continued interest in American Beacon. For additional information about our mutual funds or to access your account information, please visit our website atwww.americanbeaconfunds.com

Best Regards,

Gene L. Needles, Jr.

President

American Beacon Interval Funds

1

June 30, 2019 (Unaudited)

The negative headlines that punctuated much of 2018 coalesced into a wave of pessimism in the fourth quarter of 2018. Investor concerns around a variety of issues, including higher interest rates, heightened trade tensions and slowing global growth, ultimately overwhelmed a market that had displayed remarkable resiliency during most of the year’s first nine months. The U.S. High Yield market’s -2.19% return during the last month of the year was the worst monthly performance for credit in almost three years. The S&P 500 Index’s -9.03% return in December was the worst monthly performance for U.S. stocks since February 2009 and the worst December performance since the Great Depression.

The turmoil that enveloped the market in the second half of the fourth quarter coincided with a collapse in interest rates. Ten-year U.S. Treasury yields fell approximately 40 basis points to 2.70% during the final seven weeks of the year while the market quickly abandoned its expectation for two Federal Reserve (the “Fed”) rate hikes in 2019. Given their floating-rate nature, U.S. leveraged loans were particularly hard hit by the move lower in interest rates and experienced more than $40 billion of outflows in the fourth quarter, including almost $30 billion in December alone.

The rebound in the first half of 2019 was spurred by a radical Fed pivot toward dovishness, signaling no more rate hikes and an earlier cessation of quantitative tightening. Markets applauded the Fed’s efforts to support market stability; the S&P 500 rallied 13.65% during the first quarter, its best start to a year since 1998. The U.S. High Yield market posted a 7.40% quarterly gain, its highest reading since the third quarter of 2009, and spreads collapsed more than 100 basis points. The positive inflection in the market was almost immediate as High Yield notched a 4.59% return for the month of January alone. Lower interest rates and supportive market technicals also helped drive the first quarter rally in credit. Robust, high-yield inflows drove stronger asset demand while a lack of new deal activity constrained supply. Offsetting some of this good news was a weakness in net leveraged loan new issuance, which declined 30% year-over-year during the first quarter, suggesting the year-end bout of market volatility negatively affected new deal-pipeline growth, which contributed to the lack of new supply during the first three months of 2019.

In May 2019, escalating global trade tensions brought about a broad-based sell-off in risk assets. U.S.-China trade negotiations broke down as the Trump administration announced it would move ahead with tariff increases on U.S. imports from China. In retaliation, China imposed tariff increases on U.S. exports. As hopes for a U.S.-China trade deal evaporated, the Trump administration’s unanticipated announcement about establishing a tariff on all Mexican imports unless Mexico agreed to help stem the flow of illegal immigrants served to further exacerbate trade concerns. Amid this heightened level of trade uncertainty, global equity markets fell as investment-grade and high-yield spreads widened throughout the month. The rising risk-off sentiment also led developed-market bond yields to fall sharply across the yield curve. In the U.S., the front-end of the yield curve inverted for the second time in 2019 as the spread between the three-month and 10-year Treasury yields turned negative. The three-month Treasury bill yield ended May at 2.35%, as compared to the 10-year rate at 2.14%. By June 2019,10-year Treasuries dipped to 2.00%.

While the escalating trade war was the main catalyst for market weakness, other geopolitical headwinds emanating from the United Kingdom and Europe added pressure to an already tenuous market. In the U.K., Prime Minister Theresa May announced she would step down after she was unable to gain British Parliament support for her Brexit deal. Anti-establishment and populist parties gained ground in European Parliament elections in May, increasing the outlook for policy uncertainty — particularly in Italy. After the brief setback, risk markets bounced back by the end of the quarter as U.S.-China trade tensions thawed and the Fed signaled easier monetary policy.

2

American Beacon Apollo Total Return FundSM

Performance Overview

June 30, 2019 (Unaudited)

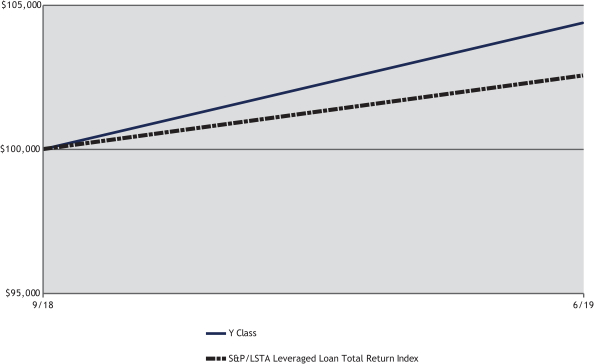

The Y Class of the American Beacon Apollo Total Return Fund (the “Fund”) returned 4.37% for the since-inception period ended June 30, 2019. The Fund’s inception was September 12, 2018, and it does not yet have a full twelve-month history. For comparison, the S&P/LSTA Leveraged Loan Total Return Index returned 2.56%, and the ICE BofA ML U.S. High Yield Index returned 5.20% during the same period.

Comparison of Changes in Value of a $100,000 Investment for the period 9/12/2018 through 6/30/2019

| Average Annual Total Returns for the Period ended June 30, 2019 |

| |||||||||||||||||||||

Ticker | 6 months | Since Inception | Value of $100,000 09/12/2018- 06/30/2019 | |||||||||||||||||||

Y Class (1,3) | SHXIX | 5.75 | % | 4.37 | % | $ | 104,370 | |||||||||||||||

S&P/LSTA Leveraged Loan Total Return Index (2) | 5.71 | % | 2.56 | % | $ | 102,560 | ||||||||||||||||

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end-of-day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visitwww.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only; and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A portion of the fees charged to the Y Class of the Fund has been waived since Fund inception. Performance prior to waiving fees was lower than the actual returns shown since inception. |

| 2. | The S&P/LSTA Leveraged Loan Index is a common benchmark and represents the 100 largest and most liquid issues of the institutional loan universe. The index is modified market value-weighted and is fully rebalanced semi-annually. In addition, the index is reviewed weekly to reflect pay-downs and ensure that it continually maintains 100 loan facilities. One cannot directly invest in an index. |

| 3. | The Total Annual Fund Operating Expense ratio set forth in the most recent Fund prospectus for the Y Class shares was 3.84%. The expense ratio above may vary from the expense ratio presented in other sections of this report that is based on expenses incurred during the period covered by this report. |

3

American Beacon Apollo Total Return FundSM

Performance Overview

June 30, 2019 (Unaudited)

The Fund primarily held secured first-lien, bank-loan instruments and high-yield bonds during the period given its size and investment opportunities available since inception. Over time, the holdings will be more broadly distributed across security types and asset classes in accordance with the Fund’s investment strategy.

The Fund launched just prior to the volatility that began in November 2018 as equity markets, trade tensions, Brexit concerns and the U.S. Federal Reserve Bank overwhelmed investor appetite for risk and led to a flight-to-quality in U.S. Treasuries. Yields fell during the final weeks of the year as the market quickly abandoned its expectation for two Fed rate hikes in 2019. U.S. leveraged loans were particularly hard hit by the move lower in interest rates given their floating-rate nature. Average U.S. leveraged loan prices fell from over $98 in early November to below $94 by the end of 2018. As of June 30, 2019, they recovered to $97.

Credit spreads rebounded in 2019 as risk markets applauded the Fed’s rediscovered concern for market stability. The U.S. high-yield market posted a strong return of 10.2% through the first half of the year. U.S. leveraged loans retraced their losses from the fourth quarter of 2018 generating a 5.7% return so far this year. Lower interest rates and supportive market technicals also helped drive the rally in credit.

The Fund benefited from the improvement in credit markets during the first half of 2019. It ended the period with a very low interest-rate duration (approximately one year) and a gross yield-to-worst of approximately 5.7%.

The sub-advisor’s investment strategy is based on the ability to adapt to markets with a flexible investment approach that seeks attractive risk-adjusted returns. The sub-advisor attempts to invest contrary to broader market sentiment to build value-based fixed-income portfolios.

| Top Ten Holdings (% Net Assets) | ||||||||

| Zayo Group LLC, 4.652%, Due 1/19/2024, 2017 Incremental Term Loan,(1-mo. LIBOR + 2.250%) | 8.2 | |||||||

| Alliant Holdings Intermediate LLC, 5.662%, Due 5/9/2025, Term Loan B,(1-mo. LIBOR + 3.250%) | 8.1 | |||||||

| Wall Street Systems Delaware, Inc., 7.402%, Due 11/21/2024, 2019 Term Loan,(1-mo. LIBOR + 5.000%) | 8.1 | |||||||

| HCA, Inc., 5.875%, Due 5/1/2023 | 4.4 | |||||||

| HCA Healthcare, Inc., 6.250%, Due 2/15/2021 | 4.3 | |||||||

| TransDigm, Inc., 6.250%, Due 3/15/2026 | 4.3 | |||||||

| Belfor Holdings, Inc., 6.402%, Due 4/6/2026, Term Loan B,(1-mo. LIBOR + 4.000%) | 4.1 | |||||||

| Intelsat Jackson Holdings S.A., 6.625%, Due 1/2/2024, 2017 Term Loan B5 | 4.1 | |||||||

| Radiology Partners Holdings LLC, Due 7/9/2025, 2018 1st Lien Term Loan B | 4.1 | |||||||

| Windstream Holdings, Inc., 4.910%, Due 2/26/2021, DIP Term Loan,(1-mo. LIBOR + 2.500%) | 4.1 | |||||||

| Total Fund Holdings | 24 | |||||||

| Sector Allocation (% Investments) | ||||||||

| Telecommunications | 20.0 | |||||||

| Consumer | 16.0 | |||||||

| Technology | 15.2 | |||||||

| Consumer,Non-Cyclical | 14.6 | |||||||

| Financial | 11.1 | |||||||

| Industrial | 8.2 | |||||||

| Health Care | 4.0 | |||||||

| Manufacturing | 3.9 | |||||||

| Utilities | 3.7 | |||||||

| Consumer, Cyclical | 3.3 | |||||||

4

American Beacon Apollo Total Return FundSM

Expense Example

June 30, 2019 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees, if applicable, and (2) ongoing costs, including management fees, distribution (12b-1) fees, sub-transfer agent fees, and other Fund expenses. The Examples are intended to help you understand the ongoing cost (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from January 1, 2019 through June 30, 2019.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information on this page, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads) or redemption fees, as applicable. Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

5

American Beacon Apollo Total Return FundSM

Expense Example

June 30, 2019 (Unaudited)

| American Beacon Apollo Total Return Fund |

| ||||||||||||||

| Beginning Account Value 1/1/2019 | Ending Account Value 6/30/2019 | Expenses Paid During Period 1/1/2019-6/30/2019* | |||||||||||||

| Y Class | |||||||||||||||

| Actual | $1,000.00 | $1,057.50 | $8.67 | ||||||||||||

| Hypothetical** | $1,000.00 | $1,016.36 | $8.50 | ||||||||||||

| * | Expenses are equal to the Fund’s annualized net expense ratio for thesix-month period of 1.70% for the Y Class, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (181) by days in the year (365) to reflect the half-year period. |

| ** | 5% return before expenses. |

6

American Beacon Apollo Total Return FundSM

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of and Shareholders of American Beacon Apollo Total Return Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of American Beacon Apollo Total Return Fund (the “Fund”) as of June 30, 2019, and the related statements of operations and changes in net assets, including the related notes, and the financial highlights for the period September 12, 2018 (commencement of operations) through June 30, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2019, the results of its operations, changes in its net assets and the financial highlights for the period September 12, 2018 (commencement of operations) through June 30, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of June 30, 2019 by correspondence with the custodian, transfer agent, agent banks and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Dallas, TX

August 27, 2019

We have served as the auditor of one or more investment companies in the American Beacon family of funds since 2016.

7

American Beacon Apollo Total Return FundSM

Schedule of Investments

June 30, 2019

| Principal Amount* | Fair Value | ||||||||||||||

| BANK LOAN OBLIGATIONSA - 71.04% | |||||||||||||||

| Consumer - 16.14% | |||||||||||||||

| Allied Universal Holdco LLC, | |||||||||||||||

Due 6/26/2026, 2019 Delayed Draw Term LoanB C | $ | 22,523 | $ | 22,297 | |||||||||||

Due 6/26/2026, 2019 Term Loan BB | 227,477 | 225,050 | |||||||||||||

| Belfor Holdings, Inc., 6.402%, Due 4/6/2026, Term Loan B,(1-mo. LIBOR + 4.000%) | 250,000 | 251,250 | |||||||||||||

| Getty Images, Inc., 6.938%, Due 2/19/2026, 2019 1st Lien Term Loan,(1-mo. LIBOR + 4.500%) | 248,750 | 247,091 | |||||||||||||

Penn National Gaming, Inc., 4.402%, Due 10/19/2023, 2017 Term Loan A,(1-mo. LIBOR + 2.000%) | 243,750 | 241,566 | |||||||||||||

|

| ||||||||||||||

| 987,254 | |||||||||||||||

|

| ||||||||||||||

| Financial - 11.21% | |||||||||||||||

| Alliant Holdings Intermediate LLC, 5.662%, Due 5/9/2025, Term Loan B,(1-mo. LIBOR + 3.250%) | 500,000 | 492,815 | |||||||||||||

| NFP Corp., 5.402%, Due 1/8/2024, Term Loan B,(1-mo. LIBOR + 3.000%) | 198,980 | 193,227 | |||||||||||||

|

| ||||||||||||||

| 686,042 | |||||||||||||||

|

| ||||||||||||||

| Health Care - 4.07% | |||||||||||||||

| Radiology Partners Holdings LLC, Due 7/9/2025, 2018 1st Lien Term Loan BB | 250,000 | 249,220 | |||||||||||||

|

| ||||||||||||||

| 249,220 | |||||||||||||||

|

| ||||||||||||||

| Manufacturing - 3.93% | |||||||||||||||

Associated Asphalt Partners LLC, 7.652%, Due 4/5/2024, 2017 Term Loan B,(1-mo. LIBOR + 5.250%) | 247,111 | 240,110 | |||||||||||||

|

| ||||||||||||||

| 240,110 | |||||||||||||||

|

| ||||||||||||||

| Technology - 15.43% | |||||||||||||||

ION Trading Technologies S.a.r.l., 6.651%, Due 11/21/2024, USD Incremental Term Loan B,(3-mo. LIBOR + 4.000%) | 241,433 | 233,543 | |||||||||||||

| Riverbed Technology, Inc., 5.660%, Due 4/24/2022, 2016 Term Loan,(1-mo. LIBOR + 3.250%) | 249,758 | 215,209 | |||||||||||||

Wall Street Systems Delaware, Inc., 7.402%, Due 11/21/2024, 2019 Term Loan,(1-mo. LIBOR + 5.000%) | 500,000 | 495,000 | |||||||||||||

|

| ||||||||||||||

| 943,752 | |||||||||||||||

|

| ||||||||||||||

| Telecommunications - 20.26% | |||||||||||||||

| CenturyLink, Inc., 5.152%, Due 11/1/2022, 2017 Term Loan A,(1-mo. LIBOR + 2.750%) | 240,260 | 239,359 | |||||||||||||

| Intelsat Jackson Holdings S.A., 6.625%, Due 1/2/2024, 2017 Term Loan B5D | 250,000 | 250,832 | |||||||||||||

| Windstream Holdings, Inc., 4.910%, Due 2/26/2021, DIP Term Loan,(1-mo. LIBOR + 2.500%) | 250,000 | 250,000 | |||||||||||||

| Zayo Group LLC, 4.652%, Due 1/19/2024, 2017 Incremental Term Loan,(1-mo. LIBOR + 2.250%) | 500,000 | 499,430 | |||||||||||||

|

| ||||||||||||||

| 1,239,621 | |||||||||||||||

|

| ||||||||||||||

Total Bank Loan Obligations (Cost $4,382,541) | 4,345,999 | ||||||||||||||

|

| ||||||||||||||

| CORPORATE OBLIGATIONS - 26.54% | |||||||||||||||

| Consumer, Cyclical - 3.30% | |||||||||||||||

| Scientific Games International, Inc., 5.000%, Due 10/15/2025E | 200,000 | 202,000 | |||||||||||||

|

| ||||||||||||||

| Consumer,Non-Cyclical - 11.23% | |||||||||||||||

| Centene Corp., 4.750%, Due 5/15/2022 | 150,000 | 153,187 | |||||||||||||

| HCA Healthcare, Inc., 6.250%, Due 2/15/2021 | 250,000 | 261,875 | |||||||||||||

| HCA, Inc., 5.875%, Due 5/1/2023 | 250,000 | 271,845 | |||||||||||||

|

| ||||||||||||||

| 686,907 | |||||||||||||||

|

| ||||||||||||||

| Industrial - 8.27% | |||||||||||||||

Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC / Reynolds Group Issuer Lu, 5.750%, Due 10/15/2020 | 242,277 | 242,883 | |||||||||||||

| TransDigm, Inc., 6.250%, Due 3/15/2026E | 250,000 | 263,125 | |||||||||||||

|

| ||||||||||||||

| 506,008 | |||||||||||||||

|

| ||||||||||||||

| Utilities - 3.74% | |||||||||||||||

| Clearway Energy Operating LLC, 5.750%, Due 10/15/2025E | 225,000 | 228,375 | |||||||||||||

|

| ||||||||||||||

Total Corporate Obligations (Cost $1,611,440) | 1,623,290 | ||||||||||||||

|

| ||||||||||||||

See accompanying notes

8

American Beacon Apollo Total Return FundSM

Schedule of Investments

June 30, 2019

| Principal Amount* | Fair Value | ||||||||||||||

| FOREIGN CORPORATE OBLIGATIONS - 3.53% (Cost $216,300) | |||||||||||||||

| Consumer,Non-Cyclical - 3.53% | |||||||||||||||

| JBS USA LUX S.A. / JBS USA Finance, Inc., 5.875%, Due 7/15/2024E | $ | 210,000 | $ | 216,038 | |||||||||||

|

| ||||||||||||||

| Shares | |||||||||||||||

| SHORT-TERM INVESTMENTS - 12.78% (Cost $781,731) | |||||||||||||||

| Investment Companies - 12.78% | |||||||||||||||

| American Beacon U.S. Government Money Market Select Fund, Select Class, 2.32%F G | 781,731 | 781,731 | |||||||||||||

|

| ||||||||||||||

TOTAL INVESTMENTS - 113.89% (Cost $6,992,012) | 6,967,058 | ||||||||||||||

LIABILITIES, NET OF OTHER ASSETS - (13.89%) | (849,578 | ) | |||||||||||||

|

| ||||||||||||||

TOTAL NET ASSETS - 100.00% | $ | 6,117,480 | |||||||||||||

|

| ||||||||||||||

Percentages are stated as a percent of net assets. *In U.S. Dollars unless otherwise noted. | |||||||||||||||

A Bank loan obligations, unless otherwise stated, carry a floating rate of interest. The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

B Coupon rates may not be available for bank loans that are unsettled and/or unfunded as of June 30, 2019.

C Unfunded Loan Commitment. At period end, the amount of unfunded loan commitments was $22,523 or 0.37% of net assets. Of this amount, $22,523 relates to Allied Universal Holdco LLC.

D Fixed Rate.

E Security exempt from registration under the Securities Act of 1933. These securities may be resold to qualified institutional buyers pursuant to Rule 144A. At the period end, the value of these securities amounted to $909,538 or 14.87% of net assets. The Fund has no right to demand registration of these securities.

F The Fund is affiliated by having the same investment advisor.

G7-day yield.

DIP –Debtor-in-possession.

LIBOR – London Interbank Offered Rate.

LLC - Limited Liability Company.

USD United States Dollar.

The Fund’s investments are summarized by level based on the inputs used to determine their values. As of June 30, 2019, the investments were classified as described below:

Apollo Total Return Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||||||||||

Assets | ||||||||||||||||||||||||||||

Bank Loan Obligations(1) | $ | - | $ | 4,345,999 | $ | - | $ | 4,345,999 | ||||||||||||||||||||

Corporate Obligations | - | 1,623,290 | - | 1,623,290 | ||||||||||||||||||||||||

Foreign Corporate Obligations | - | 216,038 | - | 216,038 | ||||||||||||||||||||||||

Short-Term Investments | 781,731 | - | - | 781,731 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Investments in Securities - Assets | $ | 781,731 | $ | 6,185,327 | $ | - | $ | 6,967,058 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

| (1) | Unfunded loan commitments represent $22,523 at year end. |

U.S. GAAP requires transfers between all levels to/from level 3 be disclosed. During the year ended June 30, 2019, there were no transfers into or out of Level 3.

See accompanying notes

9

American Beacon Apollo Total Return FundSM

Statement of Assets and Liabilities

June 30, 2019

Assets: |

| |||

Investments in unaffiliated securities, at fair value† | $ | 6,185,327 | ||

Investments in affiliated securities, at fair value‡ | 781,731 | |||

Cash | 3,227 | |||

Dividends and interest receivable | 56,761 | |||

Receivable for investments sold | 5,468,328 | |||

Deferred offering costs | 87,868 | |||

Prepaid expenses | 9,922 | |||

|

| |||

Total assets | 12,593,164 | |||

|

| |||

Liabilities: |

| |||

Payable for investments purchased | 6,122,020 | |||

Payable to Manager (Note 2) | 147,651 | |||

Dividends payable | 35,847 | |||

Management andsub-advisory fees payable (Note 2) | 6,423 | |||

Unfunded loan commitments | 22,523 | |||

Service fees payable (Note 2) | 2,670 | |||

Transfer agent fees payable | 9,791 | |||

Custody and fund accounting fees payable | 11,197 | |||

Professional fees payable | 116,851 | |||

Other liabilities | 711 | |||

|

| |||

Total liabilities | 6,475,684 | |||

|

| |||

Net assets | $ | 6,117,480 | ||

|

| |||

Analysis of net assets: |

| |||

Paid-in-capital | $ | 6,019,529 | ||

Total distributable earnings (deficits)A | 97,951 | |||

|

| |||

Net assets | $ | 6,117,480 | ||

|

| |||

Shares outstanding at no par value (unlimited shares authorized): |

| |||

Y Class | 601,006 | |||

|

| |||

Net assets: |

| |||

Y Class | $ | 6,117,480 | ||

|

| |||

Net asset value, offering and redemption price per share: |

| |||

Y Class | $ | 10.18 | ||

|

| |||

† Cost of investments in unaffiliated securities | $ | 6,210,281 | ||

‡ Cost of investments in affiliated securities | $ | 781,731 | ||

A The Fund’s investments in affiliated securities did not have unrealized appreciation (depreciation) at period end. |

| |||

See accompanying notes

10

American Beacon Apollo Total Return FundSM

Statement of Operationsc

For the period ended June 30, 2019

Investment income: |

| |||

Dividend income from affiliated securities (Note 7) | $ | 30,596 | ||

Interest income | 145,523 | |||

|

| |||

Total investment income | 176,119 | |||

|

| |||

Expenses: |

| |||

Management andsub-advisory fees (Note 2) | 55,959 | |||

Transfer agent fees: | ||||

Y Class | 42,213 | |||

Custody and fund accounting fees | 54,574 | |||

Professional fees | 749,181 | |||

Registration fees and expenses | 47,603 | |||

Service fees (Note 2): | ||||

Y Class | 6,457 | |||

Prospectus and shareholder report expenses | 25,046 | |||

Trustee fees (Note 2) | 306 | |||

Other expenses | 15,157 | |||

|

| |||

Total expenses | 996,496 | |||

|

| |||

Net fees waived and expenses (reimbursed) (Note 2) | (923,319 | ) | ||

|

| |||

Net expenses | 73,177 | |||

|

| |||

Net investment income | 102,942 | |||

|

| |||

Realized and unrealized gain (loss) from investments: |

| |||

Net realized gain from: | ||||

Investments in unaffiliated securitiesA | 151,569 | |||

Change in net unrealized (depreciation) of: | ||||

Investments in unaffiliated securitiesB | (24,954 | ) | ||

|

| |||

Net gain from investments | 126,615 | |||

|

| |||

Net increase in net assets resulting from operations | $ | 229,557 | ||

|

| |||

A The Fund did not recognize net realized gains (losses) from the sale of investments in affiliated securities. |

| |||

B The Fund’s investments in affiliated securities did not have a change in unrealized appreciation (depreciation) at period end. |

| |||

C Commencement of operations, September 12, 2018 through June 30, 2019. (Note 1) |

| |||

See accompanying notes

11

American Beacon Apollo Total Return FundSM

Statement of Changes in Net Assets

| Period EndedA June 30, 2019 | ||||

Increase (decrease) in net assets: |

| |||

Operations: |

| |||

Net investment income | $ | 102,942 | ||

Net realized gain (loss) from investments in unaffiliated securities | 151,569 | |||

Change in net unrealized (depreciation) of investments in unaffiliated securities | (24,954 | ) | ||

|

| |||

Net increase in net assets resulting from operations | 229,557 | |||

|

| |||

Distributions to shareholders: |

| |||

Total retained earnings: | ||||

Y Class | (131,606 | ) | ||

|

| |||

Net distributions to shareholders | (131,606 | ) | ||

|

| |||

Capital share transactions (Note 8): |

| |||

Proceeds from sales of shares | 823,769 | |||

Reinvestment of dividends and distributions | 95,760 | |||

|

| |||

Net increase in net assets from capital share transactions | 919,529 | |||

|

| |||

Net increase in net assets | 1,017,480 | |||

|

| |||

Net assets: |

| |||

Beginning of period | 5,100,000 | B | ||

|

| |||

End of period | $ | 6,117,480 | ||

|

| |||

A Fund commenced operations September 12, 2018 (Note 1). |

| |||

B Seed capital. |

| |||

See accompanying notes

12

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

1. Organization and Significant Accounting Policies

The American Beacon Apollo Total Return Fund (the “Fund”) is a series of a recently organized,non-diversified,closed-end management investment company of the same name (the “Trust”) that continuously offers one class of shares of beneficial interest (“Shares”), Y Class Shares, and is operated as an “interval fund” (as defined below). The Trust was formed on February 16, 2018 as a Delaware statutory trust. The Fund commenced operations on September 12, 2018. Prior to commencing operations, the Fund had no operations other than matters relating to its organization and registration as a series ofnon-diversified,closed-end management investment company.

American Beacon Advisors, Inc. (the “Manager”) is a Delaware corporation and a wholly-owned subsidiary of Resolute Investment Managers, Inc. (“RIM”) organized in 1986 to provide business management, advisory, administrative, and asset management consulting services to the Trust and other investors. The Manager is registered as an investment advisor under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). RIM is, in turn, a wholly-owned subsidiary of Resolute Acquisition, Inc., which is a wholly-owned subsidiary of Resolute Topco, Inc., a wholly-owned subsidiary of Resolute Investment Holdings, LLC (“RIH”). RIH is owned primarily by Kelso Investment Associates VIII, L.P., KEP VI, LLC and Estancia Capital Partners L.P., investment funds affiliated with Kelso & Company, L.P. (“Kelso”) or Estancia Capital Management, LLC (“Estancia”), which are private equity firms.

The Fund’s Shares are offered on a continuous basis at net asset value (“NAV”) per share. The Fund may close at any time to new investors or new investments and, during such closings, only purchases of Shares by existing shareholders of the Fund (“Shareholders”) or the reinvestment of distributions by existing Shareholders, as applicable, will be permitted. The Fund mayre-open to new investments and subsequently close again to new investors or new investments at any time at the discretion of the Manager. Any such opening and closing of the Fund will be disclosed to investors via a supplement to the Prospectus.

The Fund’s Shares are offered through Resolute Investment Distributors, Inc. (the “Distributor”), which is the exclusive distributor of Shares, on a best-efforts basis. The minimum investment is $100,000, subject to certain exceptions. The Fund reserves the right to reject a purchase order for any reason. Shareholders will not have the right to redeem their Shares. However, as described below, in order to provide liquidity to Shareholders, the Fund will conduct periodic offers to repurchase a portion of its outstanding Shares.

The Fund is an “interval fund,” a type of fund which, in order to provide liquidity to shareholders, has adopted a fundamental investment policy to make quarterly offers to repurchase at least 5% and not more than 25% of its outstanding Shares at NAV per share, reduced by any applicable repurchase fee. Subject to applicable law and approval of the Trust’s Board of Trustees (the “Board”), the Fund will seek to conduct such quarterly repurchase offers typically in the amount of 8% of its outstanding Shares at NAV per share. On June 5, 2019, the Board approved an increase in the repurchase offer percentage from the prior level of 5% to 8% of outstanding Shares. Quarterly repurchase offers will occur in the months of January, April, July, and October. Written notification of each quarterly repurchase offer (the “Repurchase Offer Notice”) is sent to Shareholders of record at least 21 calendar days before the repurchase request deadline (i.e., the latest date on which Shareholders can tender their Shares in response to a repurchase offer) (the “Repurchase Request Deadline”). If you invest in the Fund through a financial intermediary, the Repurchase Offer Notice will be provided to you by your financial intermediary. The Fund’s Shares are not listed on any national securities exchange, and the Fund anticipates that no secondary market will develop for its Shares. Accordingly, you may not be able to sell Shares when and/or in the amount that you desire. Thus, the Shares are appropriate only as a long-term investment. In addition, the Fund’s repurchase offers may subject the Fund and Shareholders to special risks. See “Repurchase Offers Risk/Interval Fund Risk” in Footnote 5 – Principal Risks.

The Fund’s investment objective seeks to generate attractive risk-adjusted total returns using a multi-sector approach to fixed income value investing. The Fund seeks to achieve its investment objective by investing in U.S. corporate credit, global corporate credit, structured credit, and real estate credit. The Fund expects to utilize

13

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

leverage, as discussed below. To the extent consistent with the applicable liquidity requirements for interval funds operating pursuant to Rule23c-3 under the Investment Company Act of 1940, as amended (“Investment Company Act”), the Fund may invest without limit in illiquid securities.

The Fund may seek to use leverage directly or indirectly to enhance the return to Shareholders, subject to any applicable restrictions of the Investment Company Act; however, there can be no assurance that a leveraging strategy will be successful during any period in which it is employed. The Fund currently expects to borrow through a credit facility in an amount that would typically be up to 20% of the Fund’s total assets (which include any assets attributable to leverage) under normal market conditions. If the Fund borrowed 20% of its total assets that would represent 25% of its net assets. However, the Fund may borrow up to the maximum amount permitted by the Investment Company Act, which, for debt leverage such as borrowings under the credit facility, is 331/3% of the Fund’s total assets (reduced by liabilities and indebtedness except for indebtedness representing senior securities, as defined in the Investment Company Act); this represents 50% of the Fund’s net assets. The Fund currently does not expect to engage in such borrowings for investment purposes until its assets reach approximately $50 million but may engage in borrowings before Fund assets reach this level.

Recent Accounting Pronouncements

In March 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)2017-08,Premium Amortization of Purchased Callable Debt Securities. The amendments in the ASU shorten the premium amortization period on a purchased callable debt security from the security’s contractual life to the earliest call date. It is anticipated that this change will enhance disclosures by reducing losses recognized when a security is called on an earlier date. This ASU is effective for fiscal years beginning after December 15, 2018. The Manager continues to evaluate the impact this ASU will have on the financial statements and other disclosures.

In August 2018, the FASB issued ASU2018-13,Fair Value Measurement (“Topic 820”). The amendments in the ASU impact disclosure requirements for fair value measurement. It is anticipated that this change will enhance the effectiveness of disclosures in the notes to the financial statements. This ASU is effective for fiscal years beginning after December 15, 2019. Early adoption is permitted and can include the entire standard or certain provisions that exclude or amend disclosures. For the period ended June 30, 2019, the Fund has chosen to adopt the standard. The adoption of this ASU guidance did not have a material impact on the financial statements and other disclosures.

In August 2018, the U.S. Securities and Exchange Commission (“SEC”) adopted amendments to certain disclosure requirements in Securities Act ReleaseNo. 33-10532, Disclosure Update and Simplification, which is intended to facilitate the disclosure of information to investors and simplify compliance without significantly altering the total mix of information provided to investors. Effective with the current reporting period, the Fund adopted the amendments with the impacts being that the Fund is no longer required to present components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributable earnings and the amount of undistributed net investment income on the Statement of Changes in Net Assets.

Significant Accounting Policies

The following is a summary of significant accounting policies, consistently followed by the Fund in preparation of the financial statements. The Fund is considered an investment company and accordingly, follows the investment company accounting and reporting guidance of the FASB Accounting Standards Codification Topic 946,Financial Services – Investment Companies,a part of Generally Accepted Accounting Principles (“U.S. GAAP”).

14

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

Security Transactions and Investment Income

Security transactions are recorded as of the trade date for financial reporting purposes. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled beyond a standard settlement period for the security after the trade date.

Dividend income, net of foreign taxes, is recorded on theex-dividend date, except certain dividends from foreign securities which are recorded as soon as the information is available to the Fund. Interest income, net of foreign taxes, is earned from settlement date, recorded on the accrual basis, and adjusted, if necessary, for accretion of discounts and amortization of premiums. Realized gains (losses) from securities sold are determined based on specific lot identification.

Currency Translation

All assets and liabilities initially expressed in foreign currency values are converted into U.S. dollar values at the mean of the bid and ask prices of such currencies against U.S. dollars as last quoted by a recognized dealer. Income, expenses, and purchases and sales of investments are translated into U.S. dollars at the rate of the exchange prevailing on the respective dates of such transactions. The effect of changes in foreign currency exchange rates on investments is separately identified from the fluctuations arising from changes in market values of securities held and is reported with all other foreign currency gains and losses on the Fund’s Statement of Operations.

Distributions to Shareholders

The Fund intends to declare income distributions daily and distribute them quarterly to Shareholders of record. The Fund’s final distribution for each calendar year will include any remaining taxable net investment income undistributed during the year, as well as all net realized capital gains during the year. Dividends to shareholders are determined in accordance with federal income tax regulations, which may differ in amount and character from net investment income and realized gains recognized for purposes of U.S. GAAP. If all or a portion of any Fund distribution exceeds the sum of the Fund’s taxable net investment income and net realized capital gain for a taxable year, the excess would be treated (i) first, as dividend income to the extent of the Fund’s current or accumulated earnings and profits, as calculated for federal income tax purposes (“E&P”), (ii) then as a tax-free “return of capital,” reducing a Shareholder’s adjusted tax basis in his or her Shares (which would result in a higher tax liability when the Shares are sold, even if they had not increased in value, or, in fact, had lost value), and (iii) then, after that basis is reduced to zero, as realized capital gain (assuming the Shares are held as capital assets), long-term or short-term, depending on the Shareholder’s holding period for the Shares.

Allocation of Income, Trust Expenses, Gains, and Losses

Investment income, realized and unrealized gains and losses from investments of the Fund is allocated daily to each class of shares, when there is more than one class in the Fund, based upon the relative proportion of net assets of each class to the total net assets of the Fund. Expenses directly charged or attributable to the Fund will be paid from the assets of the Fund. Generally, expenses of the Trust will be allocated among and charged to the assets of the Fund on a basis that the Board deems fair and equitable, which may be based on the relative net assets of the Fund or nature of the services performed and relative applicability to the Fund.

Organization and Offering Costs

Organizational costs consist of the costs of forming the Fund, drafting the bylaws, administration, custody and transfer agency agreements, and legal services in connection with the initial meeting of trustees, and were expensed immediately as incurred. Offering costs consist of the costs of preparation, review and filing with the SEC the Fund’s registration statement (including the Prospectus and the Statement of Additional Information (“SAI”)),

15

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

the costs of preparation, the costs associated with the printing, mailing or other distribution of the Prospectus, SAI and the amounts of associated filing fees and legal fees associated with the offering. Organizational costs and offering costs are subject to the Fund’s expense limitation agreement discussed in Note 2 and offering costs require amortization over twelve months on a straight-line basis from the commencement of operations. For the period ended June 30, 2019, the Fund recorded $211,100 of organization costs and $345,534 of amortized offering costs.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Other

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In the normal course of business, the Trust enters into contracts that provide indemnification to the other party or parties against potential costs or liabilities. The Trust’s maximum exposure under these arrangements is dependent on claims that may be made in the future and, therefore, cannot be estimated. The Trust has had no prior claims or losses pursuant to any such agreement.

2. Transactions with Affiliates

Management and InvestmentSub-Advisory Agreements

The Fund and the Manager are parties to a Management Agreement that obligates the Manager to provide the Fund with investment advisory and administrative services. As compensation for performing the duties under the Management Agreement, the Manager will receive an annualized management fee based on a percentage of the Fund’s average daily managed assets that is calculated and accrued daily according to the following schedule:

First $1 billion | 0.40 | % | ||

Next $4 billion | 0.375 | % | ||

Next $5 billion | 0.35 | % | ||

Over $10 billion | 0.325 | % |

The Trust, on behalf of the Fund, and the Manager have entered into an Investment Advisory Agreement with Apollo Credit Management, LLC pursuant to which the Fund has agreed to pay an annualizedsub-advisory fee that is calculated and accrued daily based on the Fund’s average daily managed assets according to the following schedule:

First $1 billion | 0.90 | % | ||

Over $1 billion | 0.80 | % |

For purposes of the Management Agreement and Investment Advisory Agreement, the Fund’s “managed assets” are its total gross assets (including assets attributable to the proceeds of leverage) minus accrued liabilities (other than liabilities attributable to such leverage). For purposes of calculating “managed assets”, the Fund’s derivative investments are valued based on their market value.

The Management andSub-Advisory Fees paid by the Fund for the period ended June 30, 2019 were as follows:

| Effective Fee Rate | Amount of Fees Paid | |||||||||||

Management Fees | 0.40 | % | $ | 17,218 | ||||||||

Sub-Advisor Fees | 0.90 | % | 38,741 | |||||||||

|

|

|

| |||||||||

Total | 1.30 | % | $ | 55,959 | ||||||||

|

|

|

| |||||||||

16

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

Service Plans

The Manager and the Trust entered into a Service Plan that obligates the Manager to oversee additional shareholder servicing of the Class Y of the Fund. As compensation for performing the duties required under the Service Plan, the Manager receives an annualized fee up to 0.25% of the average daily net assets of the Class Y of the Fund.

Investments in Affiliated Funds

The Fund may invest in the American Beacon U.S. Government Money Market Select Fund (the “USG Select Fund”). Cash collateral received by the Fund in connection with securities lending may also be invested in the USG Select Fund. The Fund and the USG Select Fund have the same investment advisor and therefore, are considered to be affiliated. The Manager serves as investment advisor to the USG Select Fund and receives management fees and administrative fees totaling 0.10% of the average daily net assets of the USG Select Fund. During the period ended June 30, 2019, the Manager earned fees on the Fund’s direct investments in the USG Select Fund as shown below:

Fund | Direct Investments in USG Select Fund | |||

Apollo Total Return | $ | 1,376 | ||

Expense Reimbursement Plan

The Manager contractually agreed to reduce fees and/or reimburse expenses for the Y Class Shares of the Fund to the extent that total operating expenses exceed 0.25% of average daily net assets (excluding management fees, shareholder service fees, taxes, interest including interest on borrowings, brokerage commissions, securities lending fees, expenses associated with securities sold short and the Fund’s use of leverage, litigation, and other extraordinary expenses). During the period ended June 30, 2019, the Manager waived and/or reimbursed expenses as follows:

| Expense Cap | Expiration of Reimbursed Expenses | |||||||||||||||||

Fund | Class | 9/12/2018 - 6/30/2019 | Reimbursed Expenses | (Recouped) Expenses | ||||||||||||||

Apollo Total Return | Y | 0.25 | % | $ | 923,319 | $ | – | 2021-2022 | ||||||||||

Of these amounts, $147,651 was disclosed as a payable to the Manager on the Statement of Assets and Liabilities at June 30, 2019.

The Fund has adopted an Expense Reimbursement Plan whereby the Manager may seek repayment of such fee reductions and expense reimbursements. Under the policy, the Manager can be reimbursed by the Fund for any contractual or voluntary fee reductions or expense reimbursements if reimbursement to the Manager (a) occurs within three years from the date of the Manager’s waiver/reimbursement and (b) does not cause the Fund’s annual operating expenses to exceed the lesser of the contractual percentage limit in effect at the time of the waiver/reimbursement or time of recoupment. The reimbursed expenses listed above will expire in 2021 and 2022. The Fund did not record a liability for potential reimbursement due to the current assessment that a reimbursement is uncertain.

Concentration of Ownership

From time to time, the Fund may have a concentration of one or more accounts constituting a significant percentage of shares outstanding. Investment activities by holders of accounts that represent a significant ownership of more than 5% of the Fund’s outstanding shares could have a material impact on the Fund. As of June 30, 2019, based on management’s evaluation of the shareholder account base, exclusive of omnibus accounts, one account has been identified as representing an affiliated significant ownership of approximately 86% of the Fund’s outstanding shares.

17

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

Trustee Fees and Expenses

As compensation for their service to the Trusts, each Trustee receives an annual retainer of $120,000, plus $10,000 for each Board meeting attended in person or via teleconference, $2,500 for attendance by Committee members at meetings of the Audit Committee and the Investment Committee, and $1,500 for attendance by Committee members at meetings of the Nominating and Governance Committee, plus reimbursement of reasonable expenses incurred in attending Board meetings, Committee meetings, and relevant educational seminars. The Trustees also may be compensated for attendance at special Board and/or Committee meetings from time to time. The Board Chair receives an additional annual retainer of $50,000 as well as a $2,500 fee each quarter for attendance at the committee meetings. The Chairpersons of the Audit Committee and the Investment Committee each receive an additional annual retainer of $25,000 and the Chairman of the Nominating and Governance Committee receives an additional annual retainer of $10,000. These expenses are allocated on a prorated basis to each fund of the Trusts according to its respective net assets.

3. Security Valuation and Fair Value Measurements

The price of the Fund’s shares is based on its NAV per share. The Fund’s NAV is computed by adding total assets, subtracting all the Fund’s liabilities, and dividing the result by the total number of shares outstanding.

The NAV of the Fund’s shares is determined based on a pro rata allocation of the Fund’s investment income, expenses and total capital gains and losses. The Fund’s NAV per share is determined each business day as of the regular close of trading on the New York Stock Exchange (“NYSE” or “Exchange”), which is typically 4:00 p.m. Eastern Time (“ET”). However, if trading on the NYSE closes at a time other than 4:00 p.m. ET, the Fund’s NAV per share typically would still be determined as of the regular close of trading on the NYSE. The Fund does not price its shares on days that the NYSE is closed. Foreign exchanges may permit trading in foreign securities on days when the Fund is not open for business, which may result in the value of the Fund’s portfolio investments being affected at a time when you are unable to buy or sell shares.

Equity securities, including shares ofclosed-end funds and exchange-traded funds (“ETFs”), are valued at the last sale price or official closing price taken from the primary exchange in which each security trades. Investments in other mutual funds are valued at the closing NAV per share on the day of valuation. Debt securities are valued at bid quotes from broker/dealers or evaluated bid prices from pricing services, who may consider a number of inputs and factors, such as prices of comparable securities, yield curves, spreads, credit ratings, coupon rates, maturity, default rates, and underlying collateral. Futures are valued based on their daily settlement prices. Exchange-traded andover-the-counter (“OTC”) options are valued at the last sale price. Options with no last sale for the day are priced at mid quote. Swaps are valued at evaluated mid prices from pricing services.

The valuation of securities traded on foreign markets and certain fixed income securities will generally be based on prices determined as of the earlier closing time of the markets on which they primarily trade unless a significant event has occurred. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. ET.

Securities may be valued at fair value, as determined in good faith and pursuant to procedures approved by the Board, under certain limited circumstances. For example, fair value pricing will be used when market quotations are not readily available or reliable, as determined by the Manager, such as when (i) trading for a security is restricted or stopped; (ii) a security’s trading market is closed (other than customary closings); or (iii) a security has beende-listed from a national exchange. A security with limited market liquidity may require fair value pricing if the Manager determines that the available price does not reflect the security’s true market value. In addition, if a significant event that the Manager determines to affect the value of one or more securities held by the Fund occurs after the close of a related exchange but before the determination of the Fund’s NAV, fair value pricing may be used on the affected security or securities. Securities of small-capitalization companies are also more likely to require a fair value determination using these procedures because they are more thinly traded and

18

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

less liquid than the securities of larger-capitalization companies. The Fund may fair value securities as a result of significant events occurring after the close of the foreign markets in which the Fund invests as described below. In addition, the Fund may invest in illiquid securities requiring these procedures.

The Fund may use fair value pricing for securities primarily traded innon-U.S. markets because most foreign markets close well before the Fund’s pricing time of 4:00 p.m. ET. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. If the Manager determines that the last quoted prices ofnon-U.S. securities will, in its judgment, materially affect the value of some or all its portfolio securities, the Manager can adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the Exchange. In deciding whether it is necessary to adjust closing prices to reflect fair value, the Manager reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. These securities are fair valued using a pricing service, using methods approved by the Board, that considers the correlation of the trading patterns of the foreign security to intraday trading in the U.S. markets, based on indices of domestic securities and other appropriate indicators such as prices of relevant American Depositary Receipts (“ADRs”) and futures contracts. The Valuation Committee, established by the Board, may also fair value securities in other situations, such as when a particular foreign market is closed but the Fund is open. The Fund uses outside pricing services to provide closing prices and information to evaluate and/or adjust those prices. As a means of evaluating its security valuation process, the Valuation Committee routinely compares closing prices, the next day’s opening prices in the same markets and adjusted prices.

Attempts to determine the fair value of securities introduce an element of subjectivity to the pricing of securities. As a result, the price of a security determined through fair valuation techniques may differ from the price quoted or published by other sources and may not accurately reflect the market value of the security when trading resumes. If a reliable market quotation becomes available for a security formerly valued through fair valuation techniques, the Manager compares the new market quotation to the fair value price to evaluate the effectiveness of the Fund’s fair valuation procedures. If any significant discrepancies are found, the Manager may adjust the Fund’s fair valuation procedures.

Valuation Inputs

Various inputs may be used to determine the fair value of the Fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

| Level 1 | - | Quoted prices in active markets for identical securities. | ||

| Level 2 | - | Prices determined using other significant observable inputs. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, and others. | ||

| Level 3 | - | Prices determined using other significant unobservable inputs. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in pricing an investment. | ||

Level 1 and Level 2 trading assets and trading liabilities, at fair value

Fixed-income securities including corporate, convertible and municipal bonds and notes, U.S. government agencies, U.S. Treasury obligations, sovereign issues, bank loans, convertible preferred securities, andnon-U.S. bonds are normally valued by pricing service providers that use broker dealer quotations, reported trades or valuation estimates from their internal pricing models. The service providers’ internal models use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates, and quoted prices for similar assets. Securities that use similar valuation techniques and inputs as described

19

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

above are categorized as Level 2 of the fair value hierarchy. Fixed-income securities purchased on a delayed-delivery basis aremarked-to-market daily until settlement at the forward settlement date and are categorized as Level 2 of the fair value hierarchy.

Investments in registeredopen-end investment management companies will be valued based upon the NAVs of such investments and are categorized as Level 1 of the fair value hierarchy.

4. Securities and Other Investments

Bank Loans

The Fund may invest in bank loans. A bank loan is a debt financing obligation issued by a bank or other financial institution to a borrower that generally holds legal claim to the borrower’s assets. By purchasing a bank loan, the Fund acquires some or all of the interest of a bank or other lending institution in a loan to a particular borrower. The Fund also may purchase loans by assignment from another lender, and in such cases would act as part of a lending syndicate. Many loans are secured by the assets of the borrower, and most impose restrictive covenants that must be met by the borrower. Loans are typically made by a syndicate of banks, represented by an agent bank which has negotiated and structured the loan and which is responsible generally for collecting interest, principal, and other amounts from the borrower on its own behalf and on behalf of the other lending institutions in the syndicate, and for enforcing its and their other rights against the borrower. Each of the lending institutions, including the agent bank, lends to the borrower a portion of the total amount of the loan, and retains the corresponding interest in the loan.

The Fund may acquire bank loans directly through the lending agent or as an assignment from another lender who holds a direct interest in the loan. In either case, the Fund will acquire direct rights against the borrower on the loan, and will not have exposure to a counterparty’s credit risk. The value of collateral, if any, securing a loan can decline, or may be insufficient to meet the borrower’s obligations or difficult to liquidate. In addition, the Fund’s access to collateral may be limited by bankruptcy or other insolvency laws. The failure by the Fund to receive scheduled interest or principal payments on a loan would adversely affect the income of the Fund and would likely reduce the value of its assets, which would be reflected in a reduction in the Fund’s NAV per share. Banks and other lending institutions generally perform a credit analysis of the borrower before originating a loan or participating in a lending syndicate. In selecting the loans in which the Fund will invest, however, theSub-Advisor will not rely solely on that credit analysis, but will perform its own investment analysis of the borrowers. TheSub-Advisor analysis may include consideration of the borrower’s financial strength and managerial experience, debt coverage, additional borrowing requirements or debt maturity schedules, changing financial conditions, and responsiveness to changes in business conditions and interest rates. TheSub-Advisor generally will not have access tonon-public information to which other investors in syndicated loans may have access. Because loans in which the Fund may invest may not be rated by independent credit rating agencies, a decision by the Fund to invest in a particular loan will depend almost exclusively on theSub-Advisor’s, and the original lending institution’s, credit analysis of the borrower. Investments in loans may be of any quality, including “distressed” loans, and will be subject to the Fund’s credit quality policy. The loans in which the Fund may invest include those that pay fixed rates of interest and those that pay floating rates – i.e., rates that adjust periodically based on a known lending rate, such as a bank’s prime rate, London Inter-Bank Offered Rate (“LIBOR”), a money market index, or a Treasury bill rate.

Cash Management Investments

The Fund may invest cash balances in money market funds that are registered as investment companies under the Investment Company Act, including money market funds that are advised by the Manager. If the Fund invests in money market funds, Shareholders will bear their proportionate share of the expenses, including, for example, advisory and administrative fees of the money market funds in which the Fund invests, such as advisory fees charged by the Manager to any applicable money market funds advised by the Manager. Shareholders also

20

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

would be exposed to the risks associated with money market funds and the portfolio investments of such money market funds, including the risk that a money market fund’s yield will be lower than the return that the Fund would have derived from other investments that provide liquidity.

Convertible Securities

Convertible securities are hybrid securities that combine the investment characteristics of bonds and common stocks. Convertible securities include corporate bonds, notes, preferred stock or other securities that may be converted into or exchanged for a prescribed amount of common stock of the same or a different issuer within a particular period of time at a specified price or formula. A convertible security entitles the holder to receive interest paid or accrued on debt or dividends paid on preferred stock until the convertible security matures or is redeemed, converted or exchanged. While no securities investment is without some risk, investments in convertible securities generally entail less risk than the issuer’s common stock, although the extent to which such risk is reduced depends in large measure upon the degree to which the convertible security sells above its value as a fixed income security. The market value of convertible securities tends to decline as interest rates increase and, conversely, to increase as interest rates decline. While convertible securities generally offer lower interest or dividend yields thannon-convertible debt securities of similar quality, they do enable the investor to benefit from increases in the market price of the underlying common stock. Holders of convertible securities have a claim on the assets of the issuer prior to the common stockholders, but may be subordinated to holders of similarnon-convertible securities of the same issuer. Because of the conversion feature, certain convertible securities may be considered equity equivalents.

Corporate Debt and Other Fixed-Income Securities

The Fund may hold debt, including government and corporate debt, and other fixed-income securities. The investment return of corporate debt securities reflects interest earning and changes in the market value of the security. Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of these types of securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause a Fund’s NAV to likewise decrease, and vice versa. How specific fixed-income securities may react to changes in interest rates will depend on specific characteristics of each security. Fixed-income securities are also subject to credit risk, which is the risk that the credit strength of an issuer of a fixed-income security will weaken and/or that the issuer will be unable to make timely principal and interest payments and that the security may go into default.

Delayed Funding Loans and Revolving Credit Facilities

The Fund may enter into delayed funding loans and revolving credit facilities. Delayed funding loans and revolving credit facilities are borrowing arrangements in which the lender agrees to make loans up to a maximum amount upon demand by the borrower during a specific term. A revolving credit facility differs from a delayed funding loan in that as the borrower repays the loan, an amount equal to the repayment may be borrowed again during the term of the revolving credit facility. Delayed funding loans and revolving credit facilities usually provide for floating or variable rates of interest. These commitments may have the effect of requiring a Fund to increase its investment in a company at a time when it might not otherwise decide to do so (including at a time when the company’s financial condition makes it unlikely that such amounts will be repaid). To the extent that a Fund is committed to advance additional funds, it will at all times segregate or “earmark” assets, determined to be liquid in accordance with procedures established by the Board, in an amount sufficient to meet such commitments.

The Fund may invest in delayed funding loans and revolving credit facilities with credit quality comparable to that of issuers of its securities investments. Delayed funding loans and revolving credit facilities may be subject to restrictions on transfer, and only limited opportunities may exist to resell such instruments. As a result, a Fund may be unable to sell such investments at an opportune time or may have to resell them at less than fair market value.

21

American Beacon Apollo Total Return FundSM

Notes to Financial Statements

June 30, 2019

Foreign Securities

The Fund may invest in U.S. dollar-denominated andnon-U.S. dollar denominated equity and debt securities of foreign issuers and foreign branches of U.S. banks, including negotiable certificates of deposit (“CDs”), bankers’ acceptances, and commercial paper. Foreign issuers are issuers organized and doing business principally outside the United States and include corporations, banks,non-U.S. governments, and quasi-governmental organizations. While investments in foreign securities may be intended to reduce risk by providing further diversification, such investments involve sovereign and other risks, in addition to the credit and market risks normally associated with domestic securities. These additional risks include the possibility of adverse political and economic developments (including political or social instability, nationalization, expropriation, or confiscatory taxation); the potentially adverse effects of unavailability of public information regarding issuers, different governmental supervision and regulation of financial markets, reduced liquidity of certain financial markets, and the lack of uniform accounting, auditing, and financial reporting standards or the application of standards that are different or less stringent than those applied in the United States; different laws and customs governing securities tracking; and possibly limited access to the courts to enforce the Fund’s rights as an investor.

High-Yield Securities