- REZI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-12B/A Filing

Resideo (REZI) 10-12B/ARegistration of securities (amended)

Filed: 2 Oct 18, 4:18pm

Exhibit 99.1

, 2018

Dear Honeywell Shareowner:

On October 10, 2017, we announced our intention to spin our Homes and ADI global distribution business. I am pleased to confirm that we expect to distribute shares in the new company, Resideo Technologies, Inc., before the end of the year. We will provide more details on this distribution as the effective spin date is finalized.

Honeywell has been helping homeowners stay comfortable since 1885 and has one of the broadest home security and safety and comfort portfolios in the industry, with approximately 3,000 active and pending patents worldwide and sales in approximately 40 countries. Thanks to its outstanding set of offerings, Resideo will be a leader in the home heating, ventilation and air conditioning (HVAC) controls and security markets, and a leading global distributor of security and fire protection products.

Resideo will enter a long-term license agreement with Honeywell for use of the Honeywell Home brand, which will give its offerings credibility with customers around the world. In addition, its pipeline of innovative products and software, unparalleled presence in the home and low-voltage product distribution markets, large network of professional partners and customers, and strong leadership team and Board of Directors will position this company extremely well for future success.

I encourage you to read the attached information statement about Resideo, as well as the supplemental information on Honeywell’s investor relations website. The information statement describes the spin in detail and contains important business and financial information. Once the spin is effective, each Honeywell shareowner will receive shares of Resideo Technologies, Inc. based on the number of shares of Honeywell common stock held by the shareowner as of the record date.

Today’s announcement reflects our continued commitment to generate shareowner value as Honeywell becomes the premier software-industrial company. I am confident that Resideo will be successful following its separation from Honeywell, and look forward to the bright futures of both companies.

Sincerely,

Darius Adamczyk

Chairman and CEO

Honeywell

|

|

, 2018

To Our Future Resideo Shareowners:

Thank you for your interest in Resideo, Honeywell’s planned spin company that is focused on technology for the residential homeowner. We understand that a house is the biggest investment most of us will ever make. While technology makes it possible to have a home that is smarter, more energy efficient, more secure, and easier to control, consumers face overwhelming choices when it comes to modernizing their home. We believe there’s a great opportunity for a company like Resideo to offer simple solutions to connect the systems and accessories that make a home smart.

When we launch Resideo as a standalone, publicly traded company, we will be uniquely positioned to lead the global smart home market for four key reasons:

| 1) | We are a global leader in professionally installed residential comfort and security and the leading global wholesale distributor of security and low voltage products. We delivered more than $4.5 billion of sales in 2017, and that size allows us to achieve economies of scale in production, distribution and speed to market, while maintaining our status as the partner of choice in the smart home ecosystem. As a standalone company, we will be agile enough to respond to our dynamic markets and well-positioned to make strategic investments in our future. |

| 2) | We have a long-term agreement with Honeywell to license the Honeywell Home brand. That is an important ingredient to our success, but also an important recognition of our heritage. Resideo begins with more than 100 years of domain knowledge and expertise connecting the home. The Honeywell brand is in more than 150 million homes and reflects decades of trust built with dealers and installers, and a promise of reliability for consumers. More than one-third of our product sales come from connected devices, which unlock data to provide millions of consumers with better insights along with peace of mind knowing technology is making their home a better place to live. |

| 3) | We expect to benefit from major trends influencing consumer decisions around the globe. There are expected to be about 75 billion connected devices globally by 2025, up from just 20 billion in 2017. We currently have approximately 4.7 million connected customers and more than 30 million sensor points – and we expect these numbers to grow rapidly. |

| 4) | Our customers include professional contractors, service provider partners, and those who prefer to do it themselves (DIY). They want a smart home that integrates seamlessly, with devices that are compatible regardless of who manufactured them. This is why our products work effectively with the most widely used home automation systems – Amazon Alexa™, Apple HomeKit™, Google Home™, and Samsung SmartThings™. Our commitment to working well with others makes us an attractive and highly sought-after partner – in fact, it’s why we currently have 3,000 third party developers creating mobile apps to integrate with our solutions. |

We are excited about the company Resideo will be on Day 1 and the ways we intend to advance the smart home industry in the years to come. We are passionate about improving lives around the globe through leading home technologies. We have assembled a world-class team of talent to lead Resideo with the know-how to make our spin successful. The attached information statement details our strategy and plans for near and long-term growth to generate value for our shareowners.

Sincerely,

Mike Nefkens

President and CEO

Resideo Technologies, Inc.

|

|

INFORMATIONCONTAINEDHEREINISSUBJECTTOCOMPLETIONORAMENDMENT. A REGISTRATION STATEMENTON FORM 10RELATINGTOTHESESECURITIESHASBEENFILEDWITHTHE SECURITIESAND EXCHANGE COMMISSIONUNDERTHE SECURITIES EXCHANGE ACTOF 1934,ASAMENDED

SUBJECTTO COMPLETION—DATED OCTOBER 2, 2018

INFORMATION STATEMENT

Resideo Technologies, Inc.

Common Stock

(par value $.001 per share)

We are sending you this Information Statement in connection with thespin-off by Honeywell International Inc. (“Honeywell”) of its wholly owned subsidiary, Resideo Technologies, Inc. (the “Company” or “SpinCo”). To effect thespin-off, Honeywell will distribute all of the shares of SpinCo common stock on apro rata basis to the holders of Honeywell common stock. We expect that the distribution of SpinCo common stock will betax-free to holders of Honeywell common stock for U.S. federal income tax purposes, except for cash that stockholders may receive (if any) in lieu of fractional shares.

If you are a record holder of Honeywell common stock as of the close of business on October 16, 2018, which is the record date for the distribution, you will be entitled to receive one share of SpinCo common stock for every six shares of Honeywell common stock that you hold on that date. Honeywell will distribute the shares of SpinCo common stock inbook-entry form, which means that we will not issue physical stock certificates. The distribution agent will not distribute any fractional shares of SpinCo common stock.

The distribution will be effective as of 12:01 a.m., New York City time, on October 29, 2018. Immediately after the distribution becomes effective, SpinCo will be an independent, publicly traded company.

Honeywell’s stockholders are not required to vote on or take any other action to approve thespin-off. We are not asking you for a proxy, and request that you do not send us a proxy. Honeywell stockholders will not be required to pay any consideration for the shares of SpinCo common stock they receive in thespin-off, and they will not be required to surrender or exchange their shares of Honeywell common stock or take any other action in connection with thespin-off.

No trading market for SpinCo common stock currently exists. We expect, however, that a limited trading market for SpinCo common stock, commonly known as a“when-issued” trading market, will develop on or shortly before the record date for the distribution, and we expect“regular-way” trading of SpinCo common stock will begin on the first trading day after the distribution date. We intend to list SpinCo common stock on the New York Stock Exchange, under the ticker symbol “REZI.”

In reviewing this Information Statement, you should carefully consider the matters described in the section entitled “Risk Factors” beginning on page 25 of this Information Statement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

This Information Statement is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this Information Statement is October , 2018.

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 25 | ||||

| 57 | ||||

| 59 | ||||

| 68 | ||||

| 69 | ||||

Selected Historical and Unaudited Pro Forma Combined Financial Data | 70 | |||

| 75 | ||||

| 83 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 106 | |||

| 125 | ||||

| 132 | ||||

Security Ownership of Certain Beneficial Owners and Management | 137 | |||

| 139 | ||||

| 148 | ||||

| 152 | ||||

| F-1 | ||||

i

We own or have rights to various trademarks, logos, service marks and trade names that we use in connection with the operation of our business (including the Honeywell trademarks, logos, service marks and trade names, which are used under license from Honeywell International Inc.). We also own or have the rights to copyrights that protect the content of our products. Solely for convenience, certain of our trademarks, service marks, trade names and copyrights referred to in this Information Statement are listed without the ™, ® or © symbols, but such references do not constitute a waiver of any rights that might be associated with the respective trademarks, service marks, trade names and copyrights included or referred to in this Information Statement.

This Information Statement includes industry and market data that we obtained from various third party industry and market data sources. While we believe the projections of the industry sources referenced in this Information Statement are reasonable, forecasts based upon such data involve inherent uncertainties, and actual results are subject to change based upon various factors beyond our control. These third party sources include but are not limited to the Building Services Research and Information Association (“BSRIA”), the Bureau of Economic Analysis (“BEA”), the U.S. Census Bureau, Gartner Inc. (“Gartner”), International Data Corporation (“IDC”), IHS Markit (“IHS”), the National Association of Home Builders (“NAHB”), Parks Associates, Inc. (“Parks Associates”), Statista.com (“Statista”) and Navigant Consulting (“Navigant”). All such industry data is available publicly or for purchase and was not commissioned specifically for us. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, forecasts based upon such data involve inherent uncertainties, and actual results regarding the subject matter of such forecasts are subject to change based upon various factors, including those beyond our control and those discussed under the headings “Risk Factors” and “Cautionary Statement ConcerningForward-Looking Statements” in this Information Statement.

NON-GAAP FINANCIAL INFORMATION

We provide financial information not in accordance with accounting principles generally accepted in the United States (“non-GAAP” financial information) to enhance the understanding of our financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), and it should be considered by the reader in addition to, but not instead of, the financial statements prepared in accordance with GAAP. The non-GAAP financial information presented may be determined or calculated differently by other companies. See “Selected Historical and Unaudited Pro Forma Combined Financial Data” for more information.

ii

In this Information Statement, unless the context otherwise requires:

| • | The “Company,” “Resideo,” “SpinCo,” “we,” “our” and “us” refer to Resideo Technologies, Inc. and its consolidated subsidiaries after giving effect to theSpin-Off; and |

| • | “Honeywell” or “Parent” refers to Honeywell International Inc. and its consolidated subsidiaries. |

The transaction in which Honeywell will distribute to its stockholders all of the shares of our common stock is referred to in this Information Statement as the “Share Distribution” or the“Spin-Off.” Prior to Honeywell’s Share Distribution of the shares of our common stock to its stockholders, Honeywell will undertake a series of internal reorganization transactions, following which SpinCo will hold, directly or through its subsidiaries, Honeywell’s residential Comfort & Care and Security & Safety product portfolio and ADI Global Distribution businesses, which we refer to as the “Business.” We refer to this series of internal reorganization transactions as the “Reorganization Transactions.”

TheSpin-Off

On October 10, 2017, Honeywell announced plans for the complete legal and structural separation of our Business from Honeywell. In reaching the decision to pursue theSpin-Off, Honeywell considered a range of potential structural alternatives for the Business and concluded that theSpin-Off is the most attractive alternative for enhancing stockholder value.

To effect the separation, first, Honeywell will undertake the series of Reorganization Transactions. Honeywell will subsequently distribute all of our common stock to Honeywell’s stockholders, and following the Share Distribution, SpinCo, holding the Business, will become an independent, publicly traded company.

Prior to completion of theSpin-Off, we intend to enter into a Separation and Distribution Agreement and several other agreements with Honeywell related to theSpin-Off. These agreements including Transition Services, Tax Matters, Employee Matters, Trademark License, Patent Cross-License and Indemnification and Reimbursement Agreements, will govern the relationship between Honeywell and SpinCo up to and after completion of theSpin-Off and allocate between Honeywell and SpinCo various assets, liabilities and obligations, including employee benefits, intellectual property, environmental andtax-related assets and liabilities and in certain cases will result in certain significant ongoing payments from SpinCo to Honeywell. See “Certain Relationships and Related Party Transactions” for more information.

Completion of theSpin-Off is subject to the satisfaction or waiver of a number of conditions. In addition, Honeywell has the right not to complete theSpin-Off if, at any time, Honeywell’s board of directors (the “Honeywell Board”) determines, in its sole and absolute discretion, that theSpin-Off is not in the best interests of Honeywell or its stockholders, or is otherwise not advisable. See “TheSpin-Off—Conditions to theSpin-Off” for more information.

Following the Spin-Off, SpinCo and Honeywell will each have a more focused business better positioned to invest in growth opportunities through tailored capital allocation and will be better able to execute on each company’s specific strategic plans. SpinCo primarily serves residential end markets through its Products segment and non-residential end markets through its Distribution segment. SpinCo will specifically focus on the professional installer and OEM channels while developing innovative consumer solutions. SpinCo also plans to target investments to grow in attractive distribution markets and invest selectively in growth areas including connected home solutions. Further, the Spin-Off will allow our management team to devote its time and attention to corporate strategies and policies that are based specifically on the needs of our Business and its dynamic end

1

markets. We plan to create incentives for our management and employees that are more closely tied to business performance and our stockholders’ expectations, which we believe will help us attract and retain highly qualified personnel. Additionally, we believe the Spin-Off will help align our stockholder base with the characteristics and risk profile of our business. See “The Spin-Off—Reasons for the Spin-Off” for more information.

Aspects of the Spin-Off may increase the risks associated with ownership of shares of SpinCo. In connection with the Spin-Off, we expect to incur substantial indebtedness in an aggregate principal amount of approximately $1,225 million in the form of senior secured term loans and senior unsecured notes, the net proceeds of which will be received by Honeywell substantially concurrently with the consummation of the Spin-Off. We also intend to enter into a revolving credit facility to be available for our working capital and other cash needs from time to time in an aggregate committed amount as of the date of the Spin-Off of $350 million. The terms of such indebtedness are subject to change and will be finalized prior to the closing of the Spin-Off. See “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” for more information. In addition, we intend to enter into an Indemnification and Reimbursement Agreement, pursuant to which we will have an obligation to make cash payments to Honeywell related to certain of Honeywell’s environmental-related liabilities (as defined herein). See “Certain Relationships and Related Party Transactions—Agreements with Honeywell—Indemnification and Reimbursement Agreement.” Furthermore, as an independent entity we may lose some of the benefits of purchasing power, borrowing leverage and available capital for investments associated with being a larger entity. See “Risk Factors” in this Information Statement. As a consequence of the foregoing, there is no guarantee that any dividends will be declared on our common stock by our board of directors (our “Board”), or if so declared, will be continued in the future. For more information, see “Dividend Policy.”

Following theSpin-Off, we expect our common stock to trade on the New York Stock Exchange under the ticker symbol “REZI.”

On October 10, 2017, together with the announcement of theSpin-Off, Honeywell announced plans for the complete legal and structural separation of its Transportation Systems business, which business will be operated under the company name Garrett Motion Inc. We refer to this potential transaction as the “GarrettSpin-Off.” The GarrettSpin-Off is separate from theSpin-Off of our Company and neitherspin-off is conditioned upon completion of the other.

2

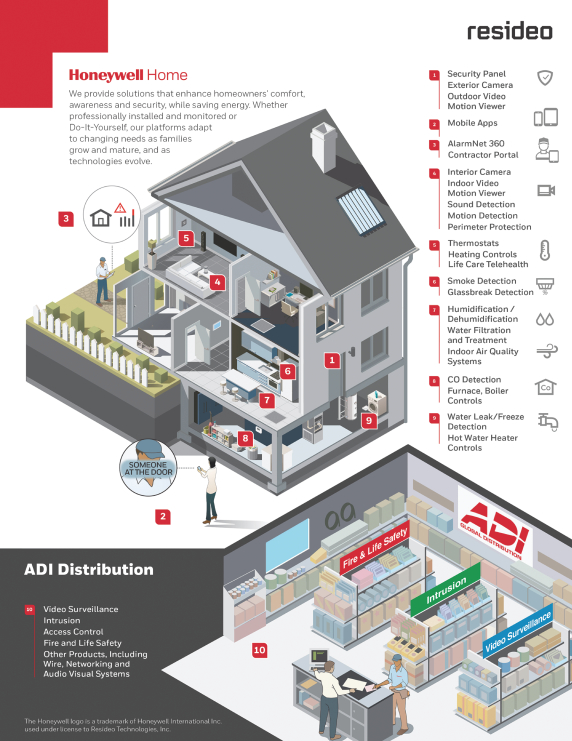

When it’s really important to your family and home, it’s Resideo

3

4

5

Our Company

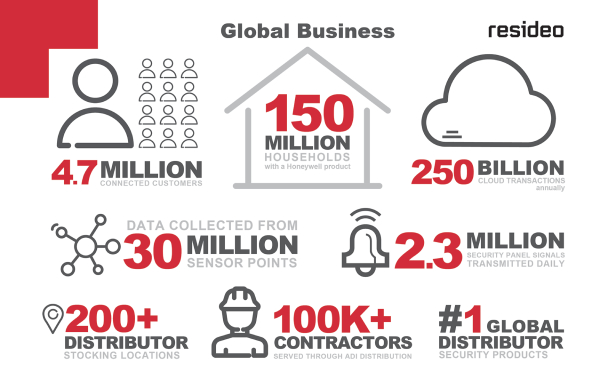

We are a leading global provider of critical comfort and security solutions primarily in residential environments, with a presence in over 150 million homes globally. Our products, which benefit from the trusted,well-established Honeywell brand, are installed in over 15 million homes annually, allowing SpinCo to launch innovative technologies and services at scale. After the Spin-Off, these products will be marketed and sold under the Honeywell Home brand pursuant to a 40 year license agreement with Honeywell. We have a long-standing leadership position in thetraditional/non-connected products space that contributes significantly to our net sales. Our growing portfolio of connected home solutions is one of the largest and most comprehensive in the market. Our connected solutions are supported by software platforms (which we expect to consolidate in a single platform and mobile application) that allow consumers and channel partners to easily install, use and maintain our solutions and third party devices. These platforms interact with other ecosystems to control SpinCo’s and others’ home automation devices. Over 4.7 million of our customers are connected, providing access to control, monitoring and alerts, and we have approximately 30 million installed sensors generating more than 250 billion data transmissions annually. Our broad portfolio of innovative products is supported by approximately 3,000 worldwide active and pending patents, delivered through a comprehensive network of over 110,000 professional contractors, more than 3,000 distributors and over 1,200 original equipment manufacturers (“OEMs”), as well as major retailers and online merchants.

Our ADI Global Distribution business (“ADI”) is the leading wholesale distributor of security products, and is independently recognized for superior customer service. Through over 200 stocking locations in 17 countries, ADI distributes more than 350,000 products from over 1,000 manufacturers to a customer base of over 100,000 contractors. We believe this global footprint gives us distinct scale and network advantages in our core products over our competitors. Further, we believe our customers derive great value from the advice and recommendations of our knowledgeable design specialists allowing our customers to better meet the technical and systems integration expertise requirements to install and service professional security systems. We continue to transform the industry withvalue-added services such as presales system design and 24/7 orderpick-up, and the selective introduction of new product categories such as professional audio visual. Additionally, ADI has long been an important channel to market for our security products, providing a level ofend-customer intimacy that drives our ability to develop successful new products at an accelerated rate and insights into current market trends that help us quickly adapt our product portfolio to meet evolving customer needs. Similarly, ADI is an important channel to market for third party manufacturers, whose products represent a significant majority of ADI’s net sales.

We intend to expand and market our extensive portfolio and distribution base in several ways. We view ourlong-standing, mutually beneficial relationships with professional contractors and OEM channels as a key differentiator in our Products segment and plan to continue to invest in and grow with these channel partners. We believe the global connected home market is in the early stages of broad consumer adoption, with Gartner projecting the installed base of “connected things” in the consumer segment to grow from approximately four billion in 2016 to more than 12 billion in 2020 and we intend to expand our connected solutions and services offerings to capitalize on this trend. We also intend to expand ADI’s geographic footprint, product categories and services to drive overall sales, including SpinCo’s security products business.

Segments

We manage our business operations through two segments, Products and Distribution, which contributed 49% and 51%, respectively, of our net sales before intersegment eliminations for the year ended December 31, 2017.

6

Products

Our Products segment had net sales before intersegment eliminations of $2,379 million for the year ended December 31, 2017, of which $337 million were sold to ADI. Management estimates that net sales generated from our Products segment are primarily from residentialend-markets. Included in our Products segment are traditional products, as well as connected products, which we define as any device with the capability to be monitored or controlled from a remote location by anend-user or service provider. Products consist of solutions in the following Comfort & Care and Security & Safety categories:

| • | Comfort & Care: Our Comfort & Care solutions have historically been marketed and sold primarily under the Honeywell brand, and after the Spin-Off, these products and solutions will be marketed and sold under the Honeywell Home brand pursuant to a 40 year license agreement with Honeywell. These solutions include home products, services and technologies including: |

| • | Temperature and Humidity Control Solutions: Devices to control air conditioners and heating equipment, thermostats and zoning devices, control panels, dampers and actuators, through brands and product families such as Lyric, Prestige, RedLINK,T-Series, TrueZone, FocusPro and VisionPro. |

| • | Thermal Solutions:Devices to control heating and cooling equipment, such as water heaters, boilers, furnaces, heat pumps and air heaters and combustion critical components such as electronic controls, actuators, gas valves and ignition controls, through brands and product families such as SCOT and Ermaf. |

| • | Water Solutions: Devices to control hydronic heating, cooling, and potable water solutions, including control panels, zone valves, balancing valves, thermostatic radiator valves, temperature valves, floor temperature sensors and accessories, pressure regulators, backflow preventers and potable water care products to filter, clean and soften water, through brands and product families such as SmartT and Aquatrol. |

| • | Air Solutions: Devices to control air quality, such as whole home humidifiers and dehumidifiers, air filters, air purification and odor control solutions and ventilation systems and controls, through brands and product families such as TrueEASE, Micro Defense and TrueDRY. |

| • | Remote Patient Monitoring Software Solutions (telehealth):Systems that record, organize and transmit patient health data to health service providers to monitor patientwell-being, helping patients continue treatment and recovery in their homes under remote supervision, through brands and product families such as Life Stream and Life Care Solutions. |

| • | Software Solutions:Global software platforms and mobile applications that provide contractors and consumers with access to services such as demand response, energy management,auto-replenishment services and predictive appliance diagnostics, through brands and product families such as Lyric and Total Connect Comfort. |

| • | Security & Safety:Our Security & Safety solutions have historically been marketed and sold primarily under the Honeywell brand and after the Spin-Off will be sold under the Honeywell brand. They include professionally-installed and monitored intrusion and life safety detection and alarm systems, as well asself-installed andself-monitored awareness solutions including: |

| • | Security Panels:Control devices that communicate with sensors that receive event or condition signals and send those signals to a monitoring station and cloud infrastructure, through brands and product families such as Vista, Lyric and Lynx. |

| • | Sensors:Devices that detect intrusion (for example, motion, opening of doors and windows and breaking of glass), smoke, carbon monoxide and water and transmit a signal to a security panel, through brands and product families such as 5800 and SiX. |

7

| • | Peripherals: Accessories that interact with security systems, such as keypads andkey-fobs, through brands and product families such as 5800 and Videofied. |

| • | Wire and Cable: Low voltage electrical wiring and category cable, through brands and product families such as Genesis Series. |

| • | Software Solutions: Global software platforms and mobile applications that provide contractors and consumers with access to services such as alarm monitoring, communication, automation and video services. In addition, we provide our contractors with data analytics tools, through our AlarmNet 360 software suite. These solutions are sold through brands and product families such as Total Connect 2.0 and AlarmNet 360. |

| • | Communication Devices: Devices that transmit notifications and security information from security systems to monitoring stations, such as cellular radios and internet and telephone line communicators, through brands and product families such as LTE radio. |

| • | Video Cameras:Battery-operated indoor and outdoor video motion viewers that detect motion and enable live“look-in” remotely, andWi-Fi cameras for indoor and outdoor use, through brands and product families such as Videofied and Total Connect cameras. |

| • | Awareness Solutions:Self-installed andself-monitored systems that include a home gateway/hub, cameras and awareness sensors to detect motion and sounds, opening and closing of doors, entry and exit of known users of the system (facial recognition) and provide alerts to the user via a mobile app, through brands and product families such as Honeywell Smart Home System and Lyric. |

| • | Cloud Infrastructure: Network operating center that routes signals between home and monitoring station and enables secured, remote data transmissions, through brands and product families such as AlarmNet and Total Connect. |

| • | Installation and Maintenance Tools:Software tools and applications to enable security contractors to install, program and maintain security systems, through brands and product families such as AlarmNet 360 and Compass. |

Eleven of the top twelve most appealing smart home use cases reported by Parks Associates concern comfort, security and safety solutions that are directly addressed by our product offerings, and a number of ourend-to-end solutions have applications across Comfort & Care and Security & Safety products. We are strongly positioned to provide products that enhance consumers’ comfort, convenience and sense of security and work together to contribute to a connected home ecosystem. Some of thesecross-product offerings are discussed in greater detail in “Business—Products.”

8

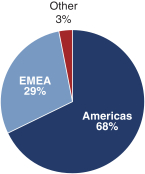

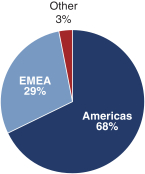

Products Segment: Net Sales for the year ended December 31, 2017(1)

By Geography(2)

| By Traditional/Connected Status(3)

| By Product Category

| ||

|  |

| ||

| (1) | Includes external and intercompany sales. |

| (2) | Americas represents North and South America. EMEA represents Europe, the Middle East and Africa. Other principally represents Australia, China, New Zealand and South Korea. |

| (3) | Connected is defined as any device with the capability to be monitored or controlled from a remote location by anend-user or service provider. |

Distribution

ADI, our Distribution segment, is the leading wholesale distributor of security and low voltage electronics products, which include security, safety and audio visual products and related accessories. These products, which are commonly referred to as “low voltage”, are traditionally defined as products operating at or below 24 volts. According to IHS data, ADI has the leading global market share in security equipment distribution. ADI operates through a distribution network of over 200 stocking locations throughout the world, delivering to over 100,000 contractors. The Distribution segment had net sales of $2,477 million for the year ended December 31, 2017.

ADI distributes a broad selection of SpinCo and third party products to meet customer needs, including:

| • | Security products |

| • | Video Surveillance: Internet protocol (“IP”) andhigh-definition analog cameras, recording and storage devices, video management and analytics software, and related system accessories. |

| • | Intrusion: Residential and commercial alarm systems, keypads, detection and sensing devices, alarm communication equipment, and related systems accessories. |

| • | Access Control: Access control panels and software, readers, credentials, locking hardware, gate control, intercoms and related system accessories. |

| • | Other products |

| • | Fire and Life Safety: Fire alarm control panels, fire detection equipment, fire notification equipment, manual call points/stations and related system accessories. |

| • | Wire, networking and professional audio visual systems. |

In addition to our own Security & Safety products, ADI distributes products fromindustry-leading manufacturers including Assa Abloy, Axis Communications, Honeywell and Nortek Security & Control, and

9

ADI also carries a line of private label products. ADI sells these products to contractors that servicenon-residential and residentialend-users. Management estimates that in 2017 approximatelytwo-thirds of ADI net sales were attributed tonon-residential end markets andone-third to residential end markets.

Distribution Segment: Net Sales for the year ended December 31, 2017

By Geography(1)

| By Product Category

| |

|

| |

| (1) | Americas represents North and South America. EMEA represents Europe, the Middle East and Africa. Other principally represents India. |

| (2) | Other includes fire and life safety, wire, networking and professional audio visual systems. |

History of Innovation

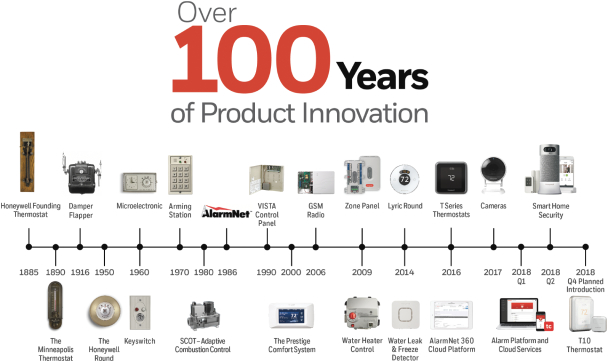

We have a long history of innovation and industry firsts in our Comfort & Care and Security & Safety markets and have a reputation for providing trusted, tested and proven products and solutions. We trace some of our innovations as far back as the 1880s when we invented the predecessor to the modern thermostat. From the first clock thermostats to the world’s first gas burner control, we have consistently driven progress and innovation in home comfort and security, including the introduction of the iconicT-86 “Round” thermostat in 1952. In 2000, we acquired the ADEMCO business, a leader in monitored burglary and fire alarm systems with roots back to 1929 and the early days of wired burglar alarms, expanding our presence in fire and security systems.

In the 1980s, ADEMCO developed the first reliable wireless security system and sensor and the AlarmNet radio technology that served as the first affordableback-up and alternative to alarm transmission over telephone lines. Through ADI, we introducedlarge-scale wholesale security products distribution, and now contractors of all sizes count on ADI for convenient access to low voltage security products, local inventory,e-commerce ordering, as well as product training and the extension of credit.

SpinCo was the first company to introduce professionally-monitored residential smoke and carbon monoxide detection systems. We also invented the popular Dual Tech detector to detect both motion and heat from an intruder, and we were the first to widely deploy an alarm platform with cloud services to consumers and a mobile app for home security monitoring. As the world becomes more connected and mobile, we believe we are well positioned to extend our track record of delivering leading solutions for the home, combining our experience and expertise in hardware and sensor technology with a focus onworld-class excellence in software.

10

Our Strengths

We believe we benefit from the following competitive strengths:

| I. | Global Leader with Iconic Brand and Unparalleled Presence in the Home |

Our iconic Honeywell brand is globally recognized for quality, innovation, security and reliability. Our products and solutions are present in over 150 million homes worldwide and we believe, based on management estimates, that we have the leading global market position in thermostats and residential security products and in security products distribution. Our solutions are installed in more than 15 million homes annually, allowing SpinCo to launch innovative technologies and services at scale. Our leading position extends to our connected platform, where we currently have over 4.7 million connected customers and 30 million sensors generating over 250 billion data transmissions annually.

The brand recognition associated with our installed base provides an additional opportunity for expansion with new connected products and solutions, and after the Spin-Off, we will retain the right to market and sell these products under the Honeywell Home brand pursuant to a 40 year license agreement with Honeywell. We are actively facilitating the transition of our customers andend-users from traditional to connected products by transforming our product portfolio, educating professional installers, creating value for OEMs and engaging consumers. Through these efforts, we have increased the portion of our product sales generated by connected solutions to approximately 37% in 2017. Gartner projects the connected things consumer segment will grow from approximately four billion in 2016 to more than 12 billion in 2020.

| II. | Broadest Portfolio Providing InnovativeEnd-to-End Solutions Across Comfort & Care and Security & Safety with Domain and Regulatory Standards Expertise and Differentiated Technology |

Our comprehensive Products portfolio providesend-to-end solutions that focus on critical needs within the home, where product reliability and ease of use are of utmost importance. This portfolio is comprised of traditional product offerings as well as a growing connected offering. Our deep domain expertise allows us to consistently provide trusted, tested and proven solutions that meet robust standards for cybersecurity and regulatory, as well as certification standards for devices addressing critical life safety needs. Our portfolio distinguishes us from our competitors, most of whom focus on niche solutions within the home. We provide solutions that address multiple consumer connected home needs under a common platform. As new devices anduse-cases emerge, we believe the continuing development of our common platform across devices and all levels of connectivity (device, software, cloud, analytics and consumer interface) will become vital to ensure a seamless and reliable experience. Our broad portfolio also enables us to achieve profitable economies of scale in production, distribution and speed to market while making us a “go to” partner in the smart home ecosystem. However, after the Spin-Off our economies of scale with respect to the Products segment may be diminished with respect to certain purchasing activities, such as IT infrastructure and other support services, as compared to when we were a part of Honeywell.

Our innovation is supported by the SpinCo User Experience design group, which creates value by understanding and translating the needs of consumers and channel partners to develop intuitive, desirable and brand differentiatedend-to-end experiences. Our products are regularly recognized in professionally judged international design competitions, winning the highly coveted iF Design Award, Red Dot Design Award and the IDEA Design Award over a dozen times since 2015.

We believe our product quality philosophy, which combines rigorous internal testing with external certification of our products, gives us a competitive advantage. Our laboratories are certified for testing to meet various industry standards, such as Underwriters Laboratories (“UL”), CSA Group and Intertek, combining

11

SpinCo’s internal testing resources with these agencies’ global recognition to substantially reducetime-to-market for new solutions and to help ensure quality and reliability.

Our Secure Software Development Lifecycle initiative sets a robust protocol for establishing and enhancing product and system cybersecurity at the outset of, and throughout, product development and for responding to potential vulnerabilities in existing products.

We have over 1,300 engineers creating innovative solutions in dedicated software centers of excellence located in Atlanta, Georgia, Bengaluru and Madurai, India and other locations. Our deep domain expertise, proprietary technology and brands are protected by a combination of patents, trademarks, copyrights, trade secrets,non-disclosure agreements and contractual provisions. We own approximately 3,000 proprietary worldwide active patents and pending patent applications.

| III. | Major Player in the Connected Home, Providing Solutions that Seamlessly Integrate with Leading Smart Home Players |

Our broad suite of connected solutions allows end customers to use mobile apps to control their thermostats, security systems, cameras and home automation devices such as electronic locks, lights and garage doors. We currently service over 4.7 million connected customers and transmit over 40 million consumer notifications, including more than two million security panel signals, every day. Adoption rates of our connected home solutions in the future will depend on a number of factors, including development of competitive and attractive products and the cost to customers of installation of new solutions or upgrade or renovation from older connected platforms or products. We are well positioned to leverage the growing demand for connected home solutions with our innovative products that are easy to purchase, install and deploy within the broader smart home ecosystem including our thermostats portfolio. We expect to benefit from the over 17% compound annual growth rate (“CAGR”) projected by IDC for connected thermostats over the next five years. Beyond that, our expanding portfolio of self-installed and self-monitored solutions such as the Smart Home Security System and Lyric Cameras are well positioned to participate in the growth of DIY solutions unit sales which according to IHS are expected to grow at a rate of over 20% per year from 2015 through 2020. In security, we continue to see strong support for our professionally-installed and monitored solutions.

Our systems integrate easily with the most widely used home automation systems, including Amazon Alexa®, Apple HomeKit®, Google Home®, and Samsung SmartThings®. We have one of the widest portfolios of Apple HomeKit enabled connected products and were the first company whose security system communicated with the Apple HomeKit ecosystem. We plan to continue to expand the range of our ecosystem partners through, among other things, the “Works with Honeywell” program which currently has 3,000 third party developers creating mobile apps that integrate with our solutions. Approximately one in six of our users already connect their systems to partner APIs (application programming interfaces) or solutions from other manufacturers through this program, and we believe that the openness of our architecture and adaptability of our products reduce contractor training and installation time, which further enhancesend-user demand for our products.

| IV. | Well Positioned to Serve Professional, OEM and Consumer Channels |

We have amulti-channel strategy to serveend-users through our professional contractors, OEMs, retail ande-commerce partners that allowend-users and consumers to purchase our products in ways that suit their needs, whether directly for DIY or through a professional installer.

Our security and Comfort & Care solutions are generally installed professionally, and our channel partners rely on our high-quality OEM parts for repair and remodel services to meet their customers’ needs. We have deep and long-standing relationships, many of which extend over 20 years, with our global contractor base and we continually strengthen and renew these relationships through various channel management and training

12

programs. For example, Contractor Pro (loyalty program) has over 29,000 participants and has been a leading industry program for 14 years. Our training programs include Homes University (technical training) and S.T.E.P.S. (sales training). In 2017, through our trainings, we educated more than 31,000 contractors and distributors.

We also havelong-standing relationships with important OEMs and service providers such as ADT Security Services, United Technologies and A.O. Smith Corporation. A number of these relationships extend more than 25 years, including some spanning over 40 years. These deep partnerships are possible because OEMs value our design capabilities, innovation, domain expertise, supply chain capabilities and product quality.

Our DIY andself-install products are sold through retail channels includingdirect-to-consumer,e-commerce and brick and mortar locations, such as The Home Depot, Lowe’s, Amazon.com, Walmart and Kingfisher. Ouraward-winning,best-selling thermostats are our most recognizable products and we market certain models directly to end consumers. Growth of the retail market, including the self-installed or do-it-yourself and e-commerce markets could affect our business by attracting new competitors. In addition, growth of these retail markets relative to the professional installation markets may negatively impact our margins.

| V. | Pre-eminent Global Distributor of Security, Safety and Other Low Voltage Products |

According to IHS, ADI has the leading global market share in security equipment distribution. ADI distributes a wide offering of low voltage product categories comprised of over 350,000 products from over 1,000 manufacturers, all supported by a disciplined category management process to ensure our offerings are comprehensive and meet the needs of important customer segments. ADI’s sizable market share, coupled with its breadth of inventory, creates opportunities for security contractors in particular to identify and purchase complementary ADI product offerings. ADI has over 200 stocking locations across 17 countries, supplemented by a customer friendlye-commerce platform that serves a customer base of over 100,000 contractors. Our extensive global footprint, combined with our strategic supplier relationships and focus on customer service, enables ADI to effectively serve both local and national customers with a range of product and service solutions. Additionally, we believe being the largest distributor of security equipment results in meaningful procurement efficiencies and that ADI’s offering of a line of private label products further enhances our margin profile. However, after the Spin-Off our economies of scale with respect to the ADI business may be diminished with respect to certain purchasing activities, such as IT infrastructure and other support services, as compared to when we were a part of Honeywell.

Manufacturers/Suppliers

ADI is an important channel to market for third party manufacturers, whose products represent a significant majority of ADI’s net sales. Through our global network of branches, inventory stocking programs and over 1,000 sales representatives, each of whom are highly trained in the brands and products that we distribute, we help manufacturers grow their business by facilitating direct and relevant engagement with our customers. We provide manufacturers the ability to offerin-store selling tools, such as interactive product displays and demonstration equipment, that help contractors evaluate products before purchase. We also offer branch stocking programs, which manufacturers use to make their products available in local markets, and provide local market inventory to serve contractors who require same day fulfillment. We believe this strong value proposition supports our position as a preferred channel to the market for leading industry manufacturers.

Contractors/Customers

ADI’s global presence enables the delivery of supply chain services that help contractors reduce their procurement costs, better manage working capital through the advancement of credit, and operate more

13

efficiently. For example, we offer services such as job kitting and staging, IP device programming, 24/7pick-up anytime lockers andone-hour pick up service at ADI branches for online orders. We also offer convenient electronic ordering options, which accounted for approximately 17% of our ADI net sales for the fiscal year ended December 31, 2017.

These services and convenient ordering options, combined with our global presence of more than 200 stocking locations, allow us to serve a range of customers across geographies and be a single source of supply for contractors in the industry. We also help our customers grow their businesses through services such aspre-sales technical support, product certifications and trainings, project support and knowledgeable sales specialists including third party certified systems design specialists. In 2017, we offered more than 1,500 manufacturer and industry association led training opportunities. Many of our trainings were conducted at ADI Expos, which are the largest series ofone-day product showcase and training events in the security industry where manufacturers present the latest technology to our customers. In 2017, we held more than 80 ADI Expos globally, delivering more than 300 Continuing Education Unit accredited programs.

Inside an ADI Branch

VI. Consistent Revenue Growth and Strong Segment Performance Supported by Best-in-Class Honeywell Operating System (“HOS”)

We believe we have an attractive financial profile highlighted by our diversified revenue streams, strong segment profits and limited capital expenditure needs. We have delivered strong net sales growth over the period from 2013 to 2017, during which our net sales grew at a CAGR of 3.7%. In addition, the overall nature of our business is not capital intensive. For the years 2015 to 2017, our capital expenditures averaged 1.3% of our net sales.

Our financial performance is underpinned by the foundation of the Honeywell Operating System (“HOS”). HOS is ingrained in our organization and was founded on the lean and six sigma principles of continuous improvement in quality, delivery, cost, growth and innovation, and we plan to continue the HOS model after the

14

Spin-Off. Our commitment to HOS has resulted in improved manufacturing productivity, more rapid product innovation and increased cost efficiencies. Important parts of our supply chain are strategically positioned in low cost regions that are located in or near key markets, consistent with a strategy of optimizing our supply chain and reducing delivery times. We have extended HOS concepts beyond lean manufacturing to our Distribution business, customer service and product development areas. We are applying these practices to develop global platforms to drive standardization for scale and cost efficiency, while at the same time incorporating key technologies and functionalities to drive speed and faster innovation for customers.

The Company’s future growth may be limited due to the substantial indebtedness we expect to incur in connection with the Spin-Off and our payments under and the terms of the Indemnification and Reimbursement Agreement, as well as other risks which we may be presently unable to predict. See “Risk Factors.”

Our Growth Strategies

| I. | Continue to Develop Innovative New Products and Solutions |

We are developing new, innovative products and solutions across Comfort & Care and Security & Safety to grow our core business and differentiate ourselves from our competitors. Over the past three years, we have launched over 200 new products such as the Lyric family of connected home solutions, which includes thermostats, water leak detectors and awareness cameras. Our next generation alarm systems are expected to launch in late 2018. We have also launched cloud service offerings such as AlarmNet 360 and Total Connect 2.0 that allow consumers to control their systems remotely and contractors to provide efficient installation, maintenance and support services. We plan to further expand our portfolio by bringing to market an extensive set of new solutions for everyday problems, including remote furnace and boiler monitoring, smart vents,shut-off valve solutions, battery-operated video motion cameras and a residential global intrusion system. While we believe we are well positioned to capitalize on future trends and opportunities for innovation, the constantly evolving needs of our customers make it difficult to predict the pace or scope of future technological developments and our business may be affected if our new products or upgrades are not adopted by consumers.

We collaborate with consumer driven technology companies that havemarket-leading, complementary offerings such as August (door lock) to provide our customers with a seamless experience, which in turn supports customer acquisition and retention. Our systems are compatible with the most widely used home automation systems, including Amazon Alexa®, Apple HomeKit®, Google Home® and Samsung SmartThings®. Our compatibility with these platforms, some of which are owned by competitors and may compete with our solutions, has helped anchor our devices in millions of homes around the world, and we expect these relationships to continue to drive growth.

We employ Agile methods for software development, and are developing a single mobile application which, together with our global platforms, is designed to enable faster introduction of new products and implementation of new features while driving cost efficiencies through our global scale. At the same time, our Secure Software Development Lifecycle initiative sets a robust protocol for establishing and enhancing product and system cybersecurity at the outset of, and throughout, product development and for responding to potential vulnerabilities in existing products.

| II. | Continue to Invest in and Grow with Professional and OEM Channel Partners |

Our professional channel partners are an integral part of our sales and go to market strategy, and we invest in their growth to help drive our product sales. While the DIY ande-commerce markets for our solutions continue to grow, the vast majority of our products are installed professionally through our contractor and OEM channels. We plan to continue to extend growth in these professional channels through channel partner marketing

15

programs, designing solutions with simplified installation and maintenance, and by helping contractors provide better service to the end customer. We plan to continue investment in these programs, as well as to provide enhanced sales and technical training, hiring and talent development for our contractors. For example, we host the annual CONNECT national conference, the largest independent dealer event in the security industry which gives security contractor partners the opportunity to share best practices and participate in specialized trainings. In addition, our plan is to continue to develop new relationships with leading channel partners, using these strategies to expand our presence in the market in all regions. We plan to continue to collaborate with OEM channel partners to provide design services, bring to market new technologies and deliver innovative, connected solutions that increase the lifetime value of their equipment. For example, we plan to deliver remote diagnostic capabilities for furnaces and water heaters that will enable technicians to resolve problems quickly and improve equipment uptime.

| III. | Leverage Connected Home Expertise to Grow Software and Services Revenue |

We believe we are well positioned to benefit from the growing demand for connected solutions in homes due to our breadth of offerings, customer reach and strong brand. As consumer preferences drive increasing demand for connected home solutions, we believe our portfolio ofend-to-end solutions will become increasingly important. Compelling connected home use cases require careful orchestration of multiple solutions to create an ecosystem that can be reliably accessed by consumers on a common platform. A seamless experience is a key differentiator relative tosingle-purpose product providers.

We plan to further enhance the customer value proposition by expanding remote functionality andreal-time access to information and analytics that help theend-user control their home environment. We also intend to support this effort by extending our suite of proprietary service offerings as well as the range of options for controlling our devices in conjunction with third party systems. These innovations require that we navigate a complex and changing technological and regulatory landscape.

We have recently launched Software as a Service (“SaaS”) subscription services to consumers and intend to grow through services such as video storage, energy management and automated replenishment services. We also provide Platform as a Service (“PaaS”) offerings such as AlarmNet and Total Connect as fee-based services to the professional channel to enable remote management, control and monitoring of security systems, and plan to provide Honeywell Home, a global cloud and application platform for use by consumers and professional channel partners. We intend to consolidate our service offerings under Honeywell Home to increase scale efficiencies and improve speed to market with new features and enhancements and to drive global expansion of connected offerings and services. This platform is expected to make it easier for partners to integrate with our solutions, and allow SpinCo to host third party connected products in our cloud as well as enable faster implementation of new connected device products and services such as demand response and security monitoring services, allowing them to use the ecosystem of their choice and providing customers with energy savings, security and peace of mind. This platform will enable meaningful new services for our professional channels, our connected consumers and third parties that value the insights derived from data. Connectivity also enables data analytics andData-as-a-Service (“DaaS”), which allows service technicians to provideafter-sales services in the form of remote diagnostics and preventive maintenance and also enables them to resolve more problems on the first service call. Furthermore, our LifeCare telehealth DaaS enables remote patient monitoring and assists hospitals in significantly reducing readmission rates. We believe analytics provide a growing service revenue opportunity.

| IV. | Expand Presence of Product Portfolio Through Alternative Channels and Geographies |

According to IHS, DIY andself-installed solutions unit sales are expected to grow by over 20% per year from 2015 through 2020. We are increasing our presence in retail ande-commerce channels by expanding our

16

range of partners and the breadth of products withself-install capabilities, such as Lyric Thermostats and Cameras and the Honeywell Smart Home Security System.

We are developing new relationships with utilities, insurance providers, telecom and cable companies, homebuilders and property managers for multifamily residences, all of which are looking to providevalue-added services to their customer base. For example, utilities offer our connected thermostats for energy demand management and insurance companies offer water leak detectors for risk mitigation of property damage and to reduce claims. Our connected home solutions help property managers remotely manage heating and cooling to reduce energy costs and help homebuilders improve the commercial value of new homes.

We plan to expand our presence in certain high growth regions (“HGRs”) as favorable macro trends such as urbanization, improving living standards and growing internet and smartphone usage support adoption of our solutions. As large, growing markets, China and India presentnear-term opportunities to grow with our professional and OEM channel partners. Local legislation, driven by safety and security concerns, should also provide an opportunity to expand our presence in the Middle East and Latin American regions. We expect to localize our portfolio in HGRs, primarily by investing in tailored solutions to be competitive in local markets. However, competition in HGRs is often intense, which may affect our ability to execute our strategy.

| V. | Grow ADI by Expanding Geographic Footprint, Product Categories and Services |

We intend to increase our geographic footprint for distribution by expanding our presence in markets where we already operate and entering selected new geographies within established distribution markets. We plan to implement this by opening new branches, deploying field sales and telesales teams, and taking advantage ofe-commerce opportunities. For example, we have established a strong foundation in India, where according to IHS we already have a market share of approximately 18% and the distribution market is expected to grow at an approximate 11% CAGR from 2016 through 2021.

We intend to continue expanding our portfolio of core and adjacent products that are relevant and attractive to our customers to drive incremental sales across our existing footprint. In 2016, we added professional audio visual products, a growing and attractive product category to respond to customer demand and since then we have added manywell-recognized brands to supplement our core product lines, including Kantech access control systems, Code Blue emergency communications, Seagate storage solutions, Sonos wireless audio, and LG professional displays. We have also added a line of new ADI private label products.

We intend to continue to introduce newvalue-added services and electronic ordering options to deepen relationships with our contractors. Recently, we launched a feature called “Shop My Branch”, which allows customers to shop and place orders for products that are specifically available in their local branch, along with aone-hour pick up service for orders placed online or through the ADI app. We also plan to continue to improve our capabilities in electronic data interchange (“EDI”) through our customized integration with SedonaOffice, a leading business management software for security companies, which allows contractors to establish electronic data transmission with ADI without requiring significant IT support.

| VI. | Accelerate Growth Through Selective Strategic Acquisitions |

We intend to selectively pursue acquisitions that will broaden our product portfolio, gain access to new technologies, expand our geographic footprint and enhance our position in strategic market segments. For example, our acquisition in 2016 of RSI Video Technologies, a company that manufactures battery-powered cameras, allowed us to offer security solutions that combine video clips and motion sensors to provide video alarm verification, which mitigates false alarms, a key differentiator in our security platform. The substantial indebtedness we expect to incur in connection with the Spin-Off and our payments under and the terms of the Indemnification and Reimbursement Agreement may limit our ability to successfully pursue certain transactions.

17

Industry Overview

Our Markets

Our business operations are conducted through two segments, Products and Distribution, serving multiple customer segments through multiple channels. We separate our Products segment into Comfort & Care and Security & Safety. Through ADI, we are a distributor of security and low voltage products such as video surveillance, intrusion, access control, and fire and life safety.

Trends and Drivers

We believe our addressable markets benefit from several favorable trends:

| • | Growth in Residential Construction and Renovation and Remodeling (“R&R”). Recent years in the U.S. have been characterized by rising new housing starts and an increase in investment in residential construction. According to the U.S. Census Bureau, new housing starts reached 1.2 million units in 2017, growing at a CAGR of approximately 10% since 2009. However, new housing starts remain significantly below the long term annual median of 1.5 million units since 1960, and we believe this represents significant growth potential over the next several years. The NAHB projects that new housing starts will grow at a CAGR of approximately 4% through 2019. Additionally, per the BEA, R&R spend, as measured by U.S. residential private fixed investment (“RPFI”), has grown at a CAGR of approximately 8% since 2009 to reach approximately $748 million in 2017. U.S. RPFI as a percentage of U.S. gross domestic product (“GDP”) reached 3.9% in 2017, but remains below the long term median of 4.5% since 1960, which we believe represents significant growth potential over the next several years. Continued growth in residential housing spending has the potential to generate increased demand for home comfort and security products and services. |

| • | Energy Efficiency and Safety Megatrends. Higher energy efficiency standards, driven by legislation, industry and consumer preferences, are leading to faster adoption of advanced energy control devices for furnaces, boilers and cooling equipment. Similarly, legislation in the area of fire safety is driving greater use of smoke and carbon monoxide detection and monitoring. |

| • | Internet of Things and Proliferation of Connected Devices.The connectivity driven by the Internet and various communication protocols and technologies, such asWi-Fi, Bluetooth,Z-Wave and Zigbee, has led to a massive expansion in the number of connected devices and enables the expansion of DIY solutions available to homeowners. According to Statista, the Internet of Things (“IoT”) installed base worldwide is expected to grow from 20 billion connected devices in 2017 to over 75 billion connected devices in 2025. The desire to monitor and control devices remotely through cloud based applications is creating a growing market for connected solutions. |

| • | Mobile Lifestyle and Ubiquity of Broadband.The proliferation of smartphones, tablets, and high speed, high bandwidth data networks including 4G, LTE, next generation 5G and other wireless technologies have changed the way people communicate, use information and manage various applications in their lives. Consumers are increasingly expecting a similarly convenient and mobile experience to manage their homes and businesses. |

| • | Cloud and Connectivity Infrastructure.Advances in cloud technologies, software and wireless technologies have improved reliability and enabled efficient scale in a way that facilitates delivery of connected home services at an exponential rate. The ability to provide such services at an affordable price is helping grow the connected solution market. |

| • | Big Data and Data Analytics Capabilities. The increasing number of connected devices, combined with the decreasing cost of connectivity, results in the generation of vast amounts of data related to |

18

equipment operation and consumer interaction with these devices. Synthesizing this information provides useful insight for manufacturers, contractors and service providers to diagnose and fix problems quickly, schedule preventive maintenance, and provide better customer service. |

| • | Need for Technical Expertise and Training.New technologies, fueled by the proliferation of connected devices, require greater technicalknow-how to design, install and maintain. Contractors, therefore, increasingly rely on distribution partners and manufacturers to provide design services, product and services consultation and training to support their business needs. |

| • | Demand for Same Day Order Fulfillment. Contractors are increasingly being asked to install complexinter-connected systems. As a result, they tend to place frequent orders across a broad range of low voltage technologies and depend on distributors and manufacturers to stock these products locally for immediate fulfillment. |

| • | Non-Residential Construction and Equipment Replacement. The majority of our distribution sales are tonon-residential end markets, driven by investment in construction and equipment replacement. Adjusted for inflation, totalnon-residential construction remains 14% below peak levels. According to JP Morgan estimates, annualnon-residential construction is expected to grow at a CAGR of approximately 3 to 4% through 2019. Sustained strength and further growth in new and replacementnon-residential construction could lead to increased demand for low voltage products. |

Addressable Markets

Products and Solutions

The elements of the addressable market for Comfort & Care products and solutions are analyzed by IHS, Navigant and BSRIA. Based on management analysis of these sources, we believe that the total addressable market is approximately $10 billion in annual sales for 2018, of which $0.6 billion is comprised of services associated with Comfort & Care solutions which includes demand management and telehealth.

The elements of the addressable market for Security & Safety products and solutions are analyzed by IHS and management estimates. Based on management analysis of this source, we believe that the total addressable market is approximately $4.5 billion in annual sales for 2018, of which $1.1 billion is comprised of services associated with Security & Safety solutions which includes security monitoring services and remote video services.

Distribution

Based on IHS, we estimate that the global total addressable market for the security and low voltage products (which includes video surveillance, intrusion, access control and fire and life safety) distribution market is approximately $20 billion in sales in 2018.

Corporate Information

We are a Delaware corporation that was incorporated on April 24, 2018. Our principal executive offices are located at 1985 Douglas Drive North, Golden Valley, Minnesota 55422. Our telephone number is(763) 954-5204. Our website address is https://www.resideo.com. Information contained on, or connected to, our website or Honeywell’s website does not and will not constitute part of this Information Statement or the Registration Statement on Form 10 of which this Information Statement is a part. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website. On July 24, 2018 the Company was renamed Resideo Technologies, Inc.

19

Risk Factors

You should carefully consider all of the information in this Information Statement and each of the risks described in this Information Statement, which we believe are the principal risks that we face, including but not limited to:

| • | Risks relating to our business, as described in “Risk Factors—Risks Relating to Our Business,” |

| • | Risks relating to the Spin-Off, as described in “Risk Factors—Risks Relating to the Spin-Off,” |

| • | Risks relating to ownership of our common stock and the securities markets, as described in “Risk Factors—Risks Relating to Our Common Stock and the Securities Market.” |

Among the factors included in these risk factors are risks related to the substantial indebtedness expected to be incurred in connection with the Spin-Off, our payments under the Indemnification and Reimbursement Agreement, and the benefits associated with Honeywell’s size, reputation and purchasing power that will not be available to us following the Spin-Off.

Questions and Answers about theSpin-Off

The following provides only a summary of certain information regarding theSpin-Off. You should read this Information Statement in its entirety for a more detailed description of the matters described below.

| Q: | What is theSpin-Off? |

| A: | TheSpin-Off is the method by which we will separate from Honeywell. In theSpin-Off, Honeywell will distribute to its stockholders all the outstanding shares of our common stock. Following theSpin-Off, we will be an independent, publicly traded company, and Honeywell will not retain any ownership interest in our Company. |

| Q: | What are the reasons for theSpin-Off? |

| A: | The Honeywell Board believes that the separation of the residential Comfort & Care and Security & Safety product portfolio and ADI Global Distribution from Honeywell is in the best interests of Honeywell stockholders and for the success of the Business for a number of reasons. Primarily, Honeywell and SpinCo will each have a more focused business and be better able to dedicate financial, management and other resources to leverage their respective areas of strength and differentiation once theSpin-Off occurs. See “TheSpin-Off—Reasons for theSpin-Off” for more information. |

| Q: | Is the completion of theSpin-Off subject to the satisfaction or waiver of any conditions? |

| A: | Yes, the completion of theSpin-Off is subject to the satisfaction, or the Honeywell Board’s waiver, of certain conditions. Any of these conditions may be waived by the Honeywell Board to the extent such waiver is permitted by law. In addition, Honeywell may at any time until the Share Distribution decide to abandon the Share Distribution or modify or change the terms of the Share Distribution. See “TheSpin-Off—Conditions to theSpin-Off” for more information. |

| Q: | Will the number of Honeywell shares I own change as a result of theSpin-Off? |

| A: | No, the number of shares of Honeywell common stock you own will not change as a result of theSpin-Off. |

20

| Q: | Will theSpin-Off affect the trading price of my Honeywell common stock? |

| A: | We expect the trading price of shares of Honeywell common stock immediately following the Share Distribution to be lower than the trading price immediately prior to the Share Distribution because the trading price will no longer reflect the value of SpinCo. There can be no assurance that, following the Share Distribution, the combined trading prices of the Honeywell common stock and our common stock will equal or exceed what the trading price of Honeywell common stock would have been in the absence of theSpin-Off. |

It is possible that after theSpin-Off, the combined equity value of Honeywell and SpinCo will be less than Honeywell’s equity value before theSpin-Off. |

| Q: | What will I receive in theSpin-Off in respect of my Honeywell common stock? |

| A: | As a holder of Honeywell common stock, you will receive a dividend of one share of our common stock for every six shares of Honeywell common stock you hold on the Record Date (as defined below). The distribution agent will distribute only whole shares of our common stock in theSpin-Off. See “TheSpin-Off—Treatment of Fractional Shares” for more information on the treatment of the fractional share you may be entitled to receive in the Share Distribution. Your proportionate interest in Honeywell will not change as a result of theSpin-Off. For a more detailed description, see “TheSpin-Off.” |

| Q: | What is being distributed in theSpin-Off? |

| A: | Honeywell will distribute approximately 123,451,420 shares of our common stock in theSpin-Off, based on the approximately 740,708,523 shares of Honeywell common stock outstanding as of September 18, 2018. The actual number of shares of our common stock that Honeywell will distribute will depend on the total number of shares of Honeywell common stock outstanding on the Record Date. The shares of our common stock that Honeywell distributes will constitute all of the issued and outstanding shares of our common stock immediately prior to the Share Distribution. For more information on the shares being distributed in theSpin-Off, see “Description of Our Capital Stock—Common Stock.” |

| Q: | What is the record date for the Share Distribution? |

| A: | Honeywell will determine record ownership as of the close of business on October 16, 2018, which we refer to as the “Record Date.” |

| Q: | When and how will the Share Distribution occur? |

| A: | The Share Distribution will be effective as of 12:01 a.m., New York City time, on October 29, 2018, which we refer to as the “Share Distribution Date.” On the Share Distribution Date, Honeywell will release the shares of our common stock to the distribution agent to distribute to Honeywell stockholders. The whole shares of our common stock will be credited inbook-entry accounts for Honeywell stockholders entitled to receive the shares in the Share Distribution. |

| Q: | What do I have to do to participate in the Share Distribution? |

| A: | You are not required to take any action in order to participate, but we urge you to read this Information Statement carefully. All holders of Honeywell’s common stock as of the Record Date will participate in the Share Distribution. Holders of Honeywell common stock on the Record Date will not need to pay any cash or deliver any other consideration, including any shares of Honeywell common stock, in order to receive shares of our common stock in the Share Distribution. In addition, no stockholder approval of the Share Distribution is required. We are not asking you for a vote and request that you do not send us a proxy card. |

21

| Q: | If I sell my shares of Honeywell common stock on or before the Share Distribution Date, will I still be entitled to receive shares of SpinCo common stock in the Share Distribution? |

| A: | If you sell your shares of Honeywell common stock before the Record Date, you will not be entitled to receive shares of SpinCo common stock in the Share Distribution. If you hold shares of Honeywell common stock on the Record Date and you decide to sell them on or before the Share Distribution Date, you may have the ability to choose to sell your Honeywell common stock with or without your entitlement to receive our common stock in the Share Distribution. You should discuss the available options in this regard with your bank, broker or other nominee. See “TheSpin-Off—Trading Prior to the Share Distribution Date” for more information. |

| Q: | How will fractional shares be treated in the Share Distribution? |