Exhibit 99.1

Special Shareholders Meeting Nov 6, 2023

Financial Summary Andrew Winn CFO

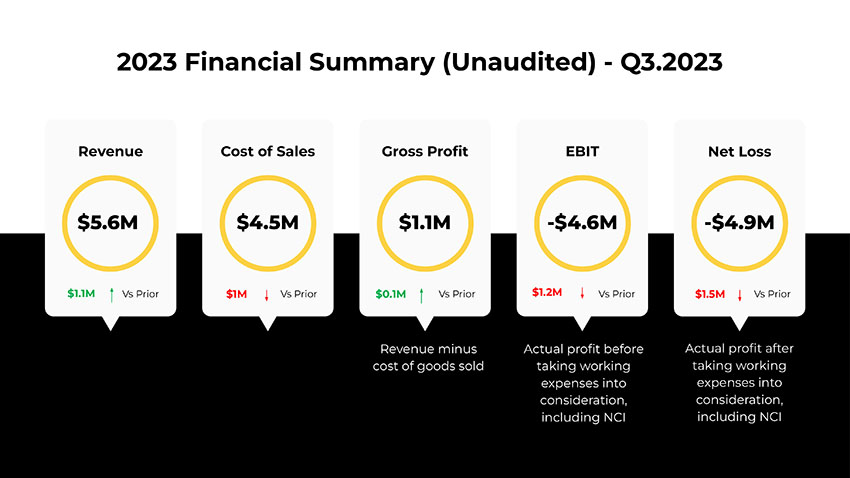

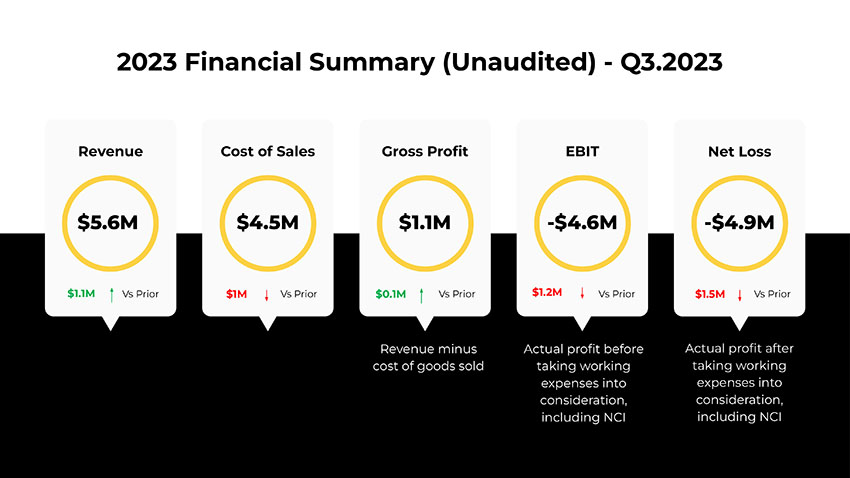

2023 Financial Summary (Unaudited) - Q3.2023 Revenue Gross Profit Revenue minus cost of goods sold Cost of Sales EBIT Actual profit before taking working expenses into consideration, including NCI Net Loss Actual profit after taking working expenses into consideration, including NCI Vs Prior $1M $0.1M $1.1M $1.2M $1.5M Vs Prior Vs Prior Vs Prior Vs Prior $5.6M $1.1M $4.5M - $4.6M - $4.9M

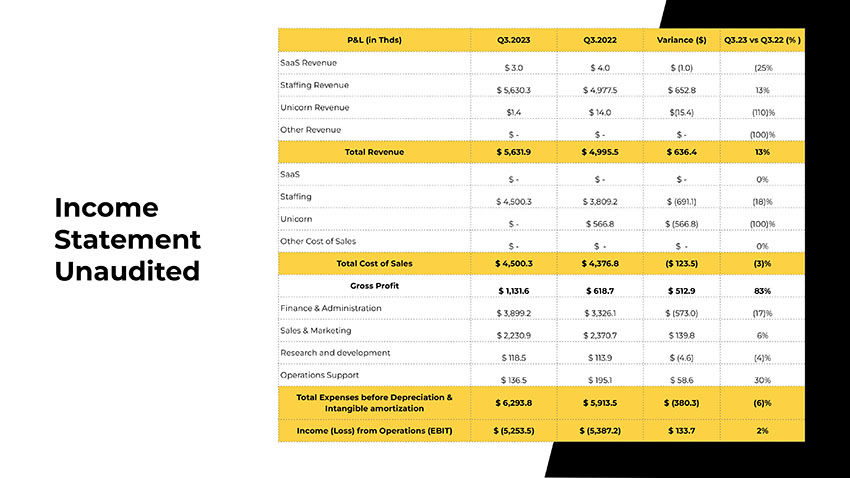

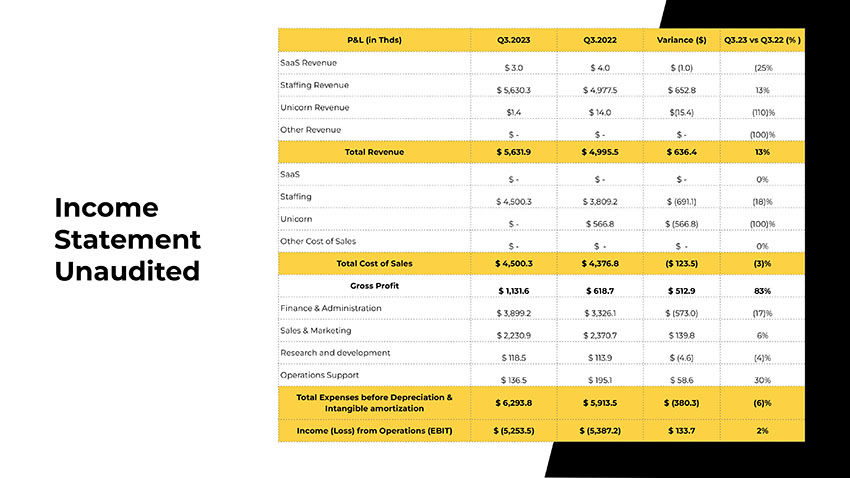

Q3.23 vs Q3.22 (% ) Variance ($) Q3.2022 Q3.2023 P&L (in Thds) (25% $ (1.0) $ 4.0 $ 3.0 SaaS Revenue 13% $ 652.8 $ 4,977.5 $ 5,630.3 Staffing Revenue (110)% $(15.4) $ 14.0 $1.4 Unicorn Revenue (100)% $ - $ - $ - Other Revenue 13% $ 636.4 $ 4,995.5 $ 5,631.9 Total Revenue 0% $ - $ - $ - SaaS (18)% $ (691.1) $ 3,809.2 $ 4,500.3 Staffing (100)% $ (566.8) $ 566.8 $ - Unicorn 0% $ - $ - $ - Other Cost of Sales (3)% ($ 123.5) $ 4,376.8 $ 4,500.3 Total Cost of Sales 83% $ 512.9 $ 618.7 $ 1,131.6 Gross Profit (17)% $ (573.0) $ 3,326.1 $ 3,899.2 Finance & Administration 6% $ 139.8 $ 2,370.7 $ 2,230.9 Sales & Marketing (4)% $ (4.6) $ 113.9 $ 118.5 Research and development 30% $ 58.6 $ 195.1 $ 136.5 Operations Support (6)% $ (380.3) $ 5,913.5 $ 6,293.8 Total Expenses before Depreciation & Intangible amortization 2% $ 133.7 $ (5,387.2) $ (5,253.5) Income (Loss) from Operations (EBIT) Income Statement Unaudited

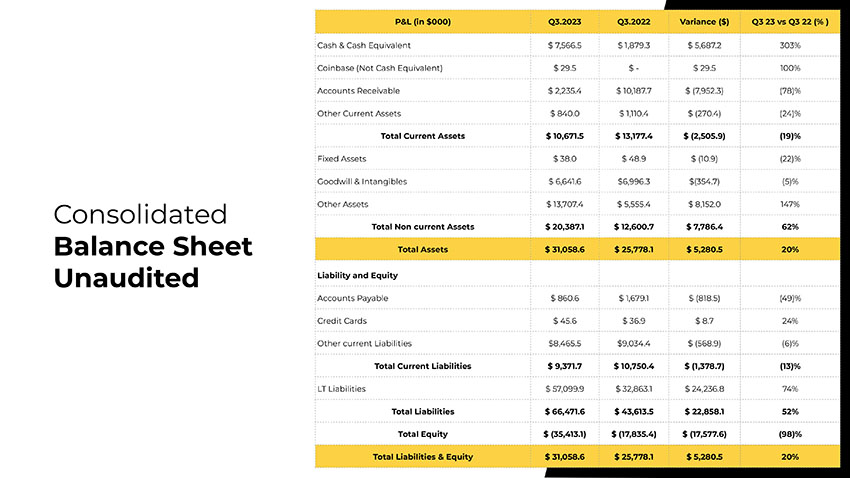

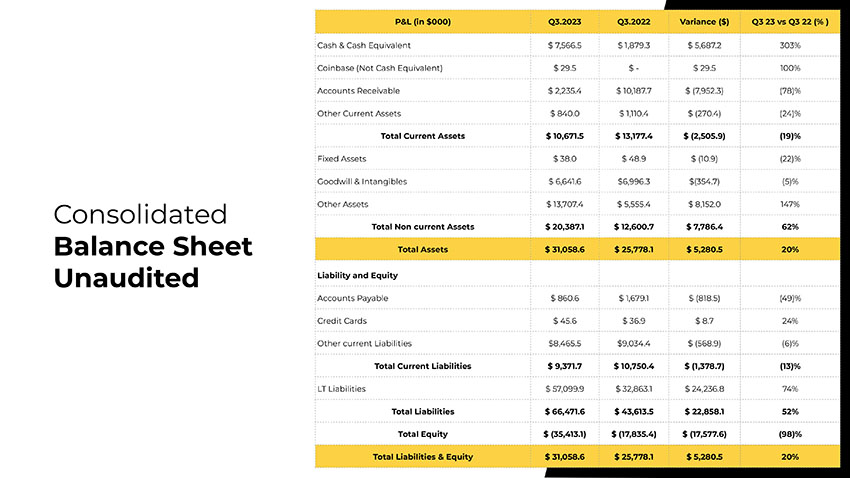

Q3 23 vs Q3 22 (% ) Variance ($) Q3.2022 Q3.2023 P&L (in $000) 303% $ 5,687.2 $ 1,879.3 $ 7,566.5 Cash & Cash Equivalent 100% $ 29.5 $ - $ 29.5 Coinbase (Not Cash Equivalent) (78)% $ (7,952.3) $ 10,187.7 $ 2,235.4 Accounts Receivable (24)% $ (270.4) $ 1,110.4 $ 840.0 Other Current Assets (19)% $ (2,505.9) $ 13,177.4 $ 10,671.5 Total Current Assets (22)% $ (10.9) $ 48.9 $ 38.0 Fixed Assets (5)% $(354.7) $6,996.3 $ 6,641.6 Goodwill & Intangibles 147% $ 8,152.0 $ 5,555.4 $ 13,707.4 Other Assets 62% $ 7,786.4 $ 12,600.7 $ 20,387.1 Total Non current Assets 20% $ 5,280.5 $ 25,778.1 $ 31,058.6 Total Assets Liability and Equity (49)% $ (818.5) $ 1,679.1 $ 860.6 Accounts Payable 24% $ 8.7 $ 36.9 $ 45.6 Credit Cards (6)% $ (568.9) $9,034.4 $8,465.5 Other current Liabilities (13)% $ (1,378.7) $ 10,750.4 $ 9,371.7 Total Current Liabilities 74% $ 24,236.8 $ 32,863.1 $ 57,099.9 LT Liabilities 52% $ 22,858.1 $ 43,613.5 $ 66,471.6 Total Liabilities (98)% $ (17,577.6) $ (17,835.4) $ (35,413.1) Total Equity 20% $ 5,280.5 $ 25,778.1 $ 31,058.6 Total Liabilities & Equity Consolidated Balance Sheet Unaudited

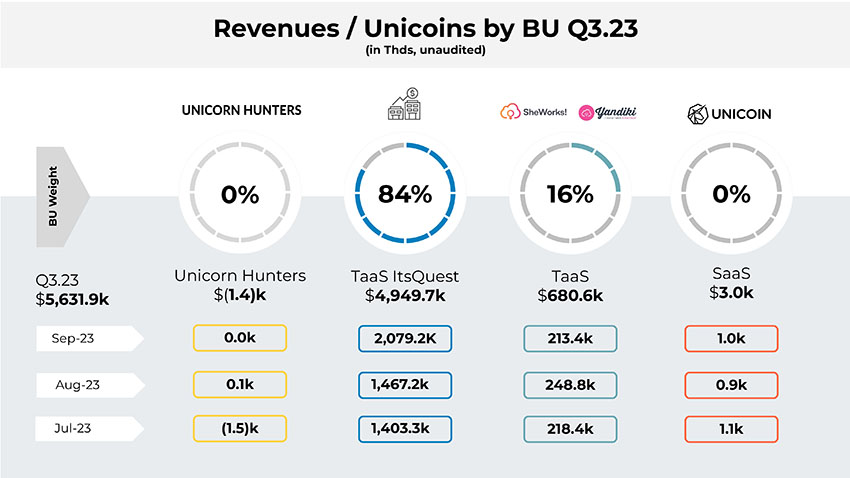

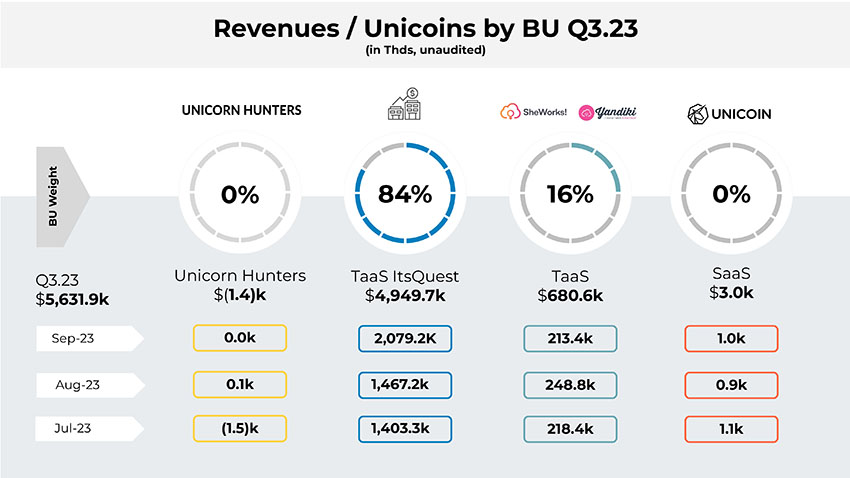

Revenues / Unicoins by BU Q3.23 (in Thds, unaudited) TaaS ItsQuest $ 4,949.7k TaaS $ 680.6k Unicorn Hunters $( 1.4)k SaaS $ 3.0k BU Weight Sep - 23 0.0k Aug - 23 0% 84% 16% 0% 0.1k 2,079.2K 1,467.2k 213.4k 248.8k 1.0k 0.9k Q3.23 $ 5,631.9k Jul - 23 (1.5)k 1,403.3k 218.4k 1.1k

Revenue Actual vs Target (in Thds, unaudited) Pr Target - 3Q 2022 % Yearly Tgt Achieved Actual 3Q 2023 2023 Yearly Target Revenue $16 1000% $10 $0 SaaS $466 23,000% $230 $0 Intuic / Yandiki (merged with Remote Talent) $1,936 37% $1,881 $3,173 Remote Talent $12,031 78% $12,292 $15,667 ItsQuest $4,139 0% $3 $4,353 Unicorn Hunters $18,588 24% $14,416 $23,193 Grand Total

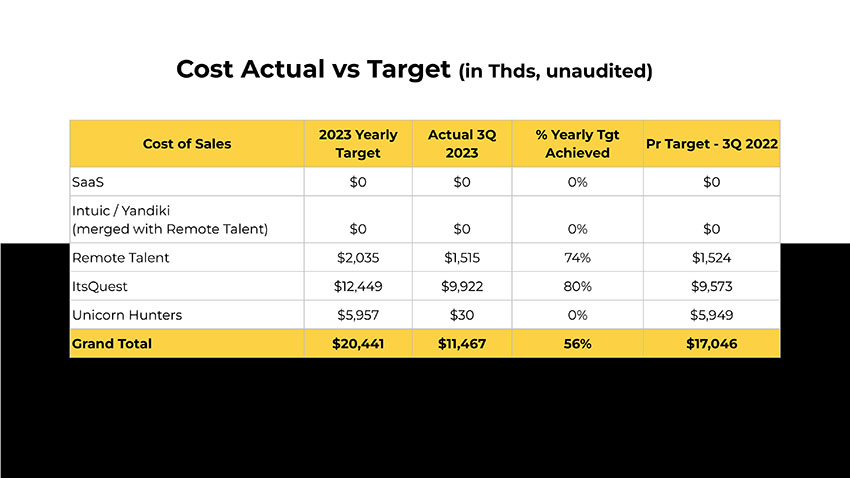

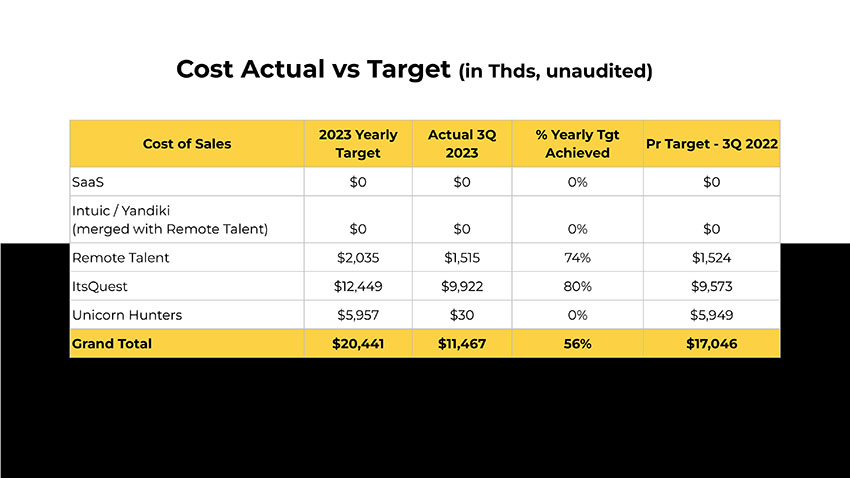

Pr Target - 3Q 2022 % Yearly Tgt Achieved Actual 3Q 2023 2023 Yearly Target Cost of Sales $0 0% $0 $0 SaaS $0 0% $0 $0 Intuic / Yandiki (merged with Remote Talent) $1,524 74% $1,515 $2,035 Remote Talent $9,573 80% $9,922 $12,449 ItsQuest $5,949 0% $30 $5,957 Unicorn Hunters $17,046 56% $11,467 $20,441 Grand Total Cost Actual vs Target (in Thds, unaudited)

Revenue by Region (in Thds, unaudited) From the SEC 10Q for Q3 2023 report: 9 Months Ended September 30,2023 2022 2023 Consolidated Foreign Countries United States Consolidated Foreign Countries United States 14,419.4 969.2 13,450.2 14,403.7 346.7 14,056.9 Staffing Revenue 15.9 14.2 1.7 8.4 7.3 1.1 Subscription Revenue 4,153.0 4,153.0 0.0 4.3 1.5 2.8 Unicorn Hunters $18,588.3 $5,136.4 $13,451.9 $14,416.4 $355.5 $14,060.8 Total Revenue

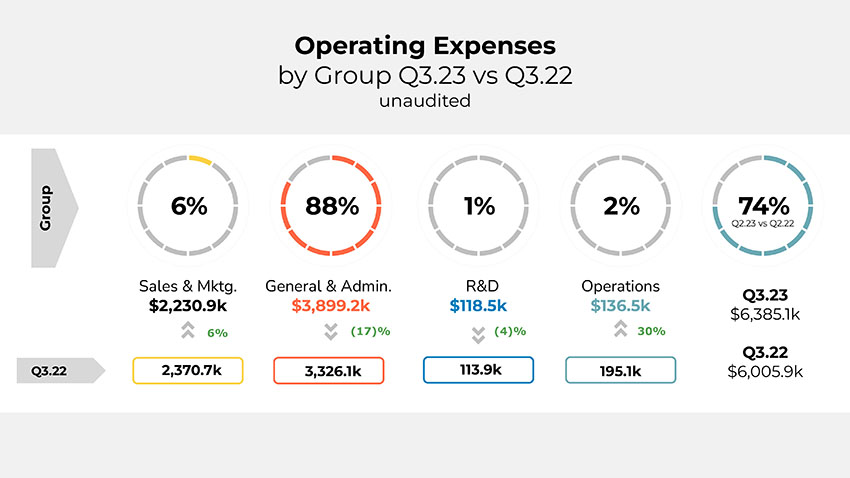

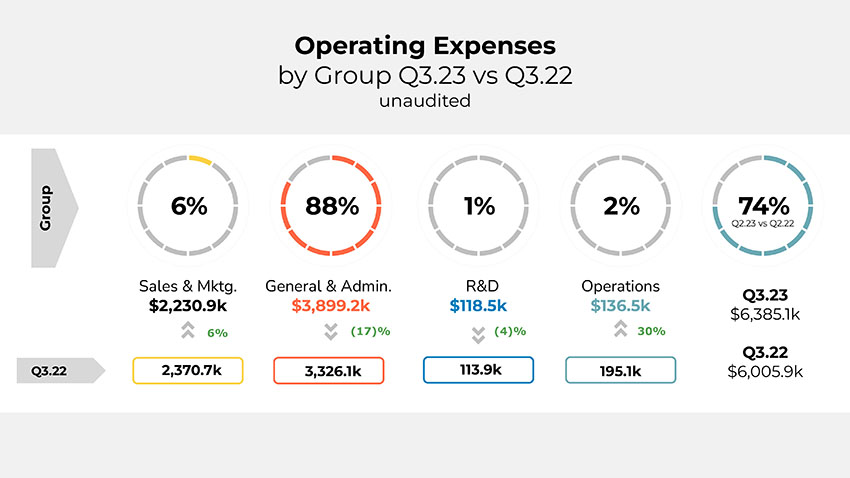

Operating Expenses by Group Q3.23 vs Q3.22 unaudited General & Admin. $3,899.2k (17)% 88% Group 2,370.7k 6% Sales & Mktg. $2,230.9k 6% 3,326.1k Q3.22 113.9k R&D $118.5k (4)% 1% 195.1k 2% Operations $136.5k 30% Q3.23 $6,385.1k Q3.22 $6,005.9k 74% Q2.23 vs Q2.22

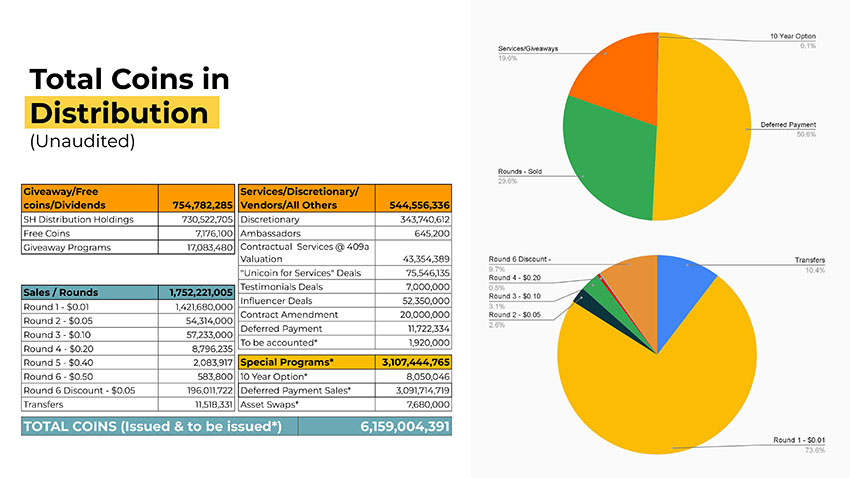

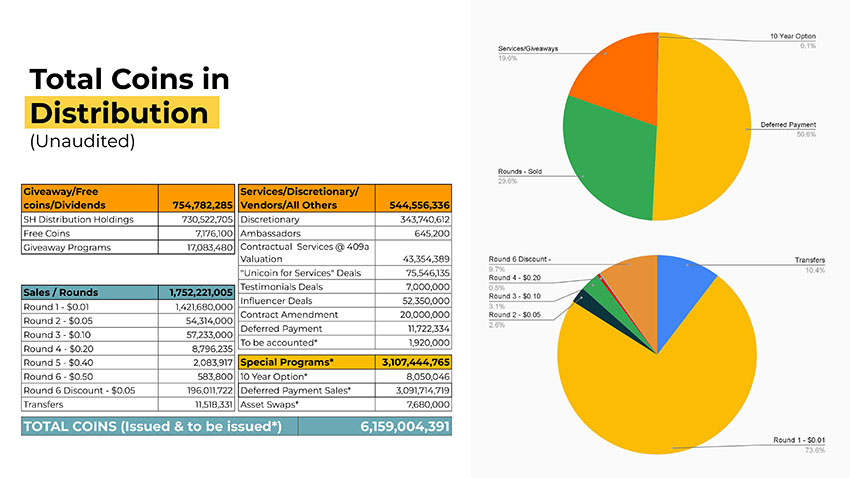

544,556,336 Services/Discretionary/ Vendors/All Others 754,782,285 Giveaway/Free coins/Dividends 343,740,612 Discretionary 730,522,705 SH Distribution Holdings 645,200 Ambassadors 7,176,100 Free Coins 43,354,389 Contractual Services @ 409a Valuation 17,083,480 Giveaway Programs 75,546,135 "Unicoin for Services" Deals 7,000,000 Testimonials Deals 52,350,000 Influencer Deals 20,000,000 Contract Amendment 11,722,334 Deferred Payment 1,920,000 To be accounted* 1,752,221,005 Sales / Rounds 1,421,680,000 Round 1 - $0.01 54,314,000 Round 2 - $0.05 57,233,000 Round 3 - $0.10 8,796,235 Round 4 - $0.20 3,107,444,765 Special Programs* 2,083,917 Round 5 - $0.40 8,050,046 10 Year Option* 583,800 Round 6 - $0.50 3,091,714,719 Deferred Payment Sales* 196,011,722 Round 6 Discount - $0.05 7,680,000 Asset Swaps* 11,518,331 Transfers TOTAL COINS (Issued & to be issued*) 6,159,004,391 Total Coins in Distribution (Unaudited)

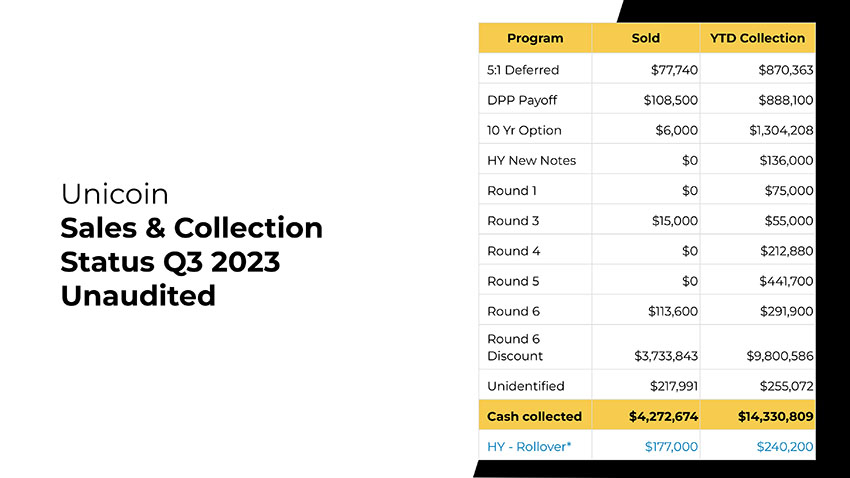

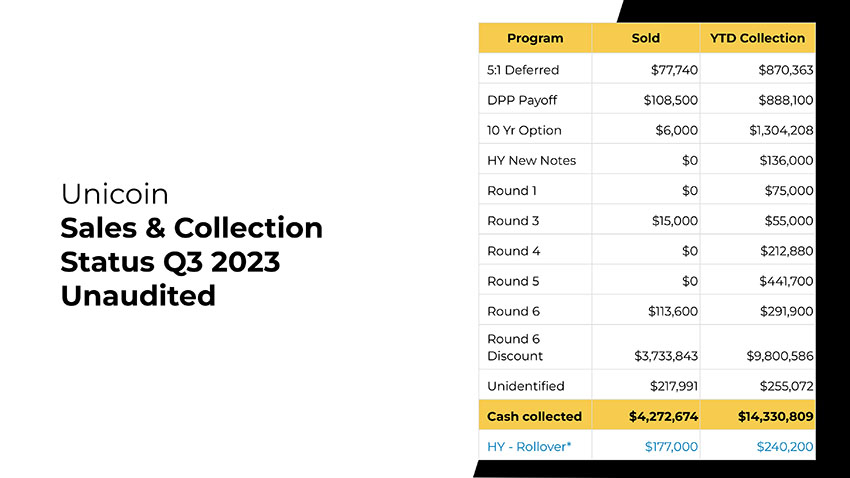

YTD Collection Sold Program $870,363 $77,740 5:1 Deferred $888,100 $108,500 DPP Payoff $1,304,208 $6,000 10 Yr Option $136,000 $0 HY New Notes $75,000 $0 Round 1 $55,000 $15,000 Round 3 $212,880 $0 Round 4 $441,700 $0 Round 5 $291,900 $113,600 Round 6 $9,800,586 $3,733,843 Round 6 Discount $255,072 $217,991 Unidentified $14,330,809 $4,272,674 Cash collected $240,200 $177,000 HY - Rollover* Unicoin Sales & Collection Status Q3 2023 Unaudited

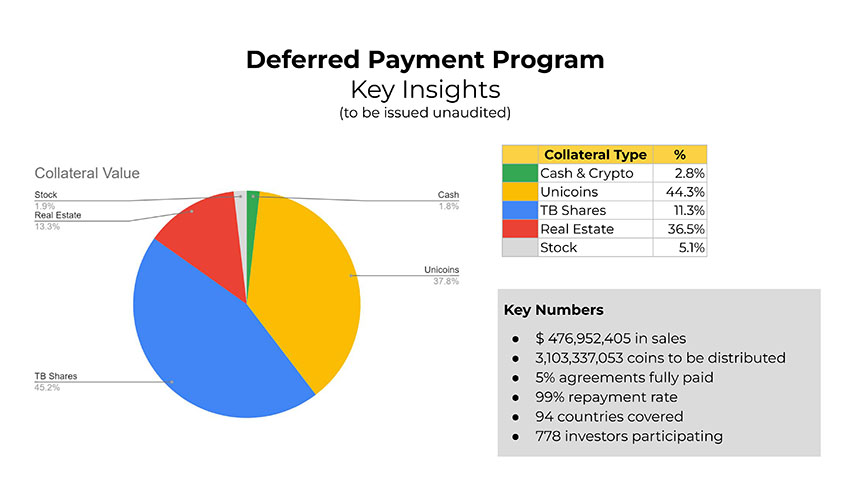

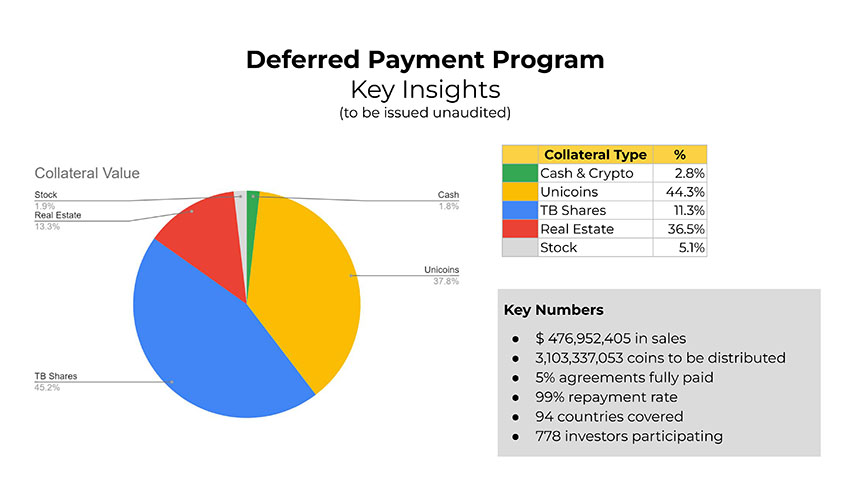

Deferred Payment Program Key Insights (to be issued unaudited) Key Numbers ● $ 476,952,405 in sales ● 3,103,337,053 coins to be distributed ● 5% agreements fully paid ● 99% repayment rate ● 94 countries covered ● 778 investors participating % Collateral Type 2.8% Cash & Crypto 44.3% Unicoins 11.3% TB Shares 36.5% Real Estate 5.1% Stock

Unicoin 2023 Deal Sales YTD unaudited $ Deal - Pipeline 3,457,500 USD 5 to 1 Deals 10,827,300 USD Discount Offer 958,900 USD Unicoin 1,772,000 USD Unicoin 10 - year Option Grand Total 17,015,700 USD

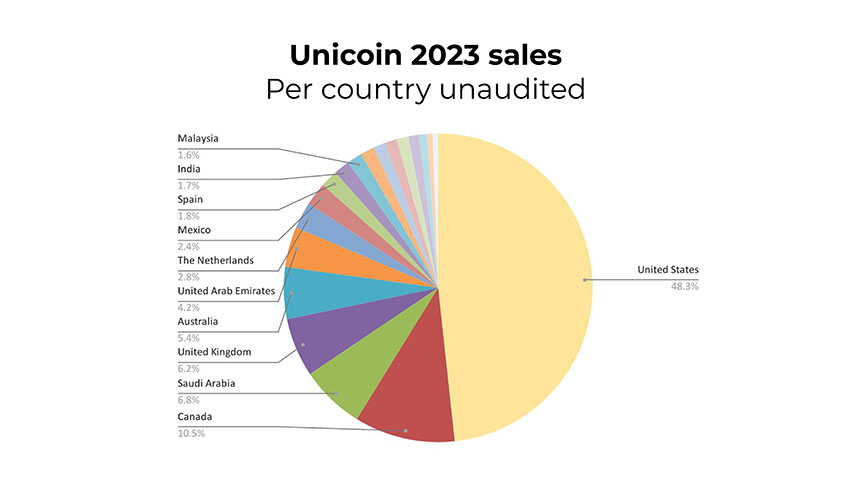

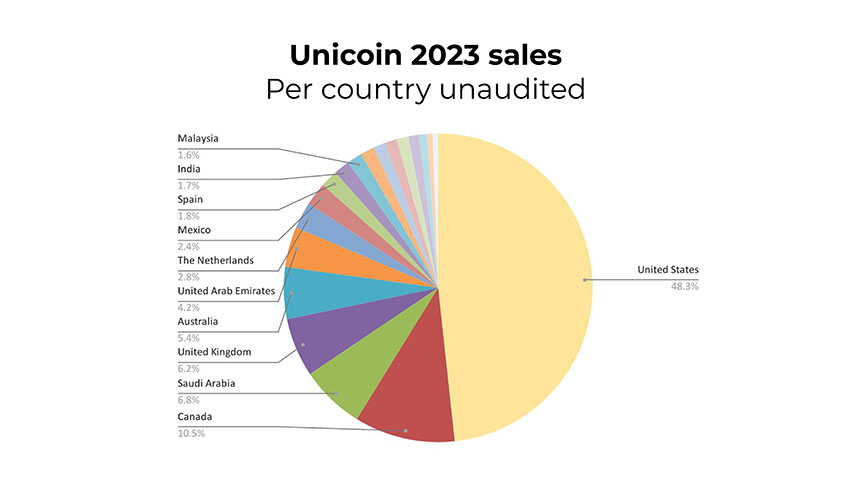

Unicoin 2023 sales Per country unaudited

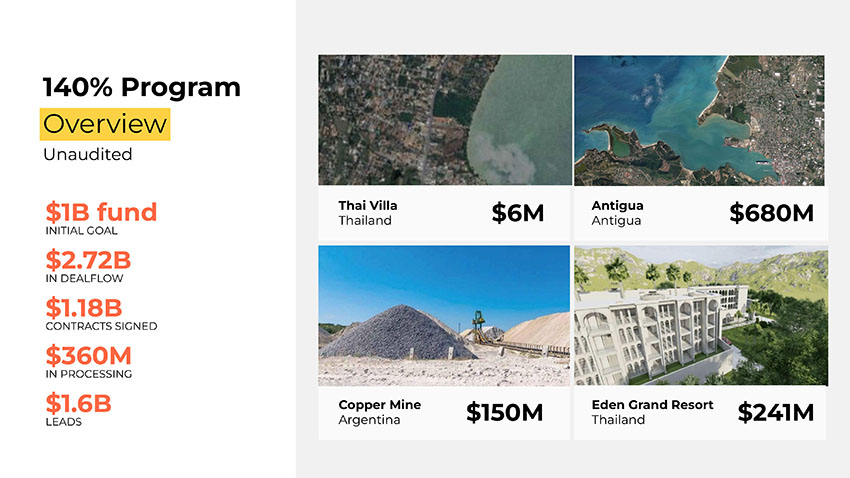

Real Estate portfolio Alex Dominguez Chief Investor Relations Officer

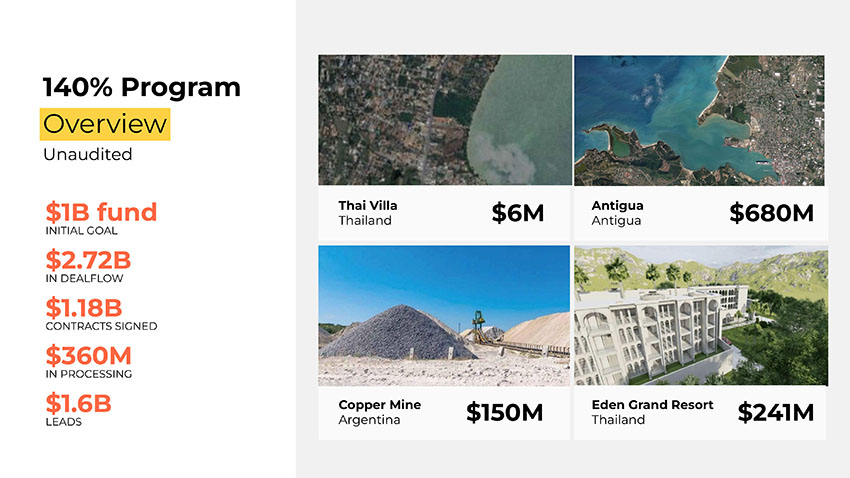

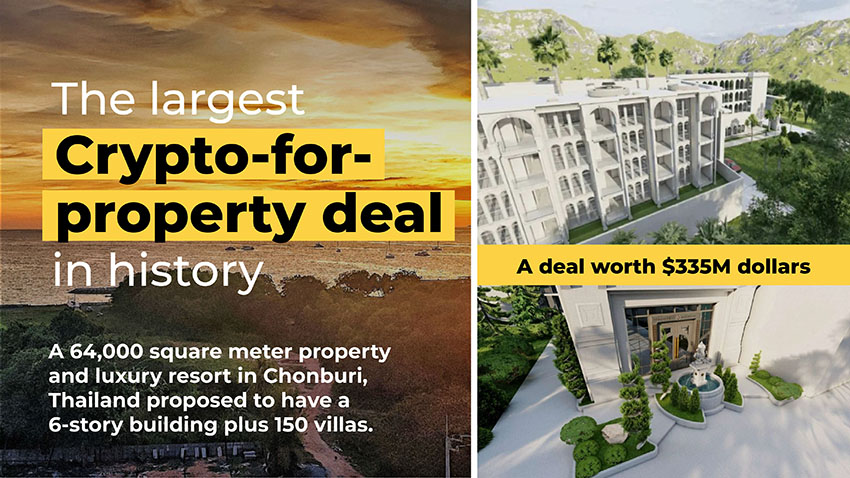

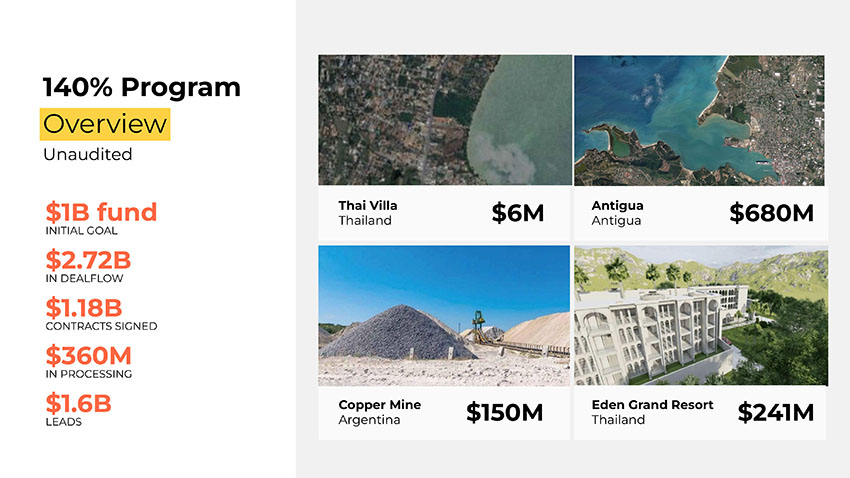

$1B fund INITIAL GOAL $2.72B IN DEALFLOW $1.18B CONTRACTS SIGNED $360M IN PROCESSING $1.6B LEADS 140% Program Overview Unaudited Thai Villa Thailand $6M Antigua Antigua $680M Copper Mine Argentina $150M $241M Eden Grand Resort Thailand

The largest property - for - crypto deal in history The new deal is a copper mine known as the Barda Gonzalez Project, in the Neuquen Province of Argentina. A deal worth $210M dollars

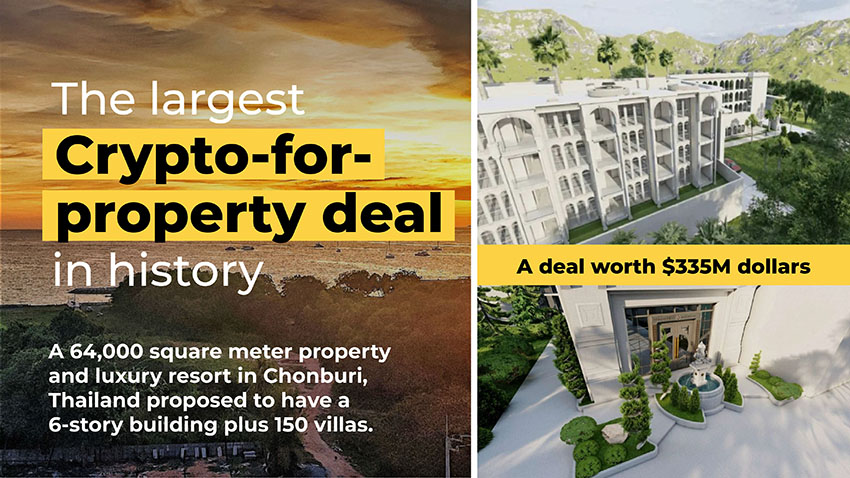

A 64,000 square meter property and luxury resort in Chonburi, Thailand proposed to have a 6 - story building plus 150 villas. A deal worth $335M dollars The largest Crypto - for - property deal in history

U.S. - only or two classes Richard Devlin General Counsel

INX - Increasing its Capabilities

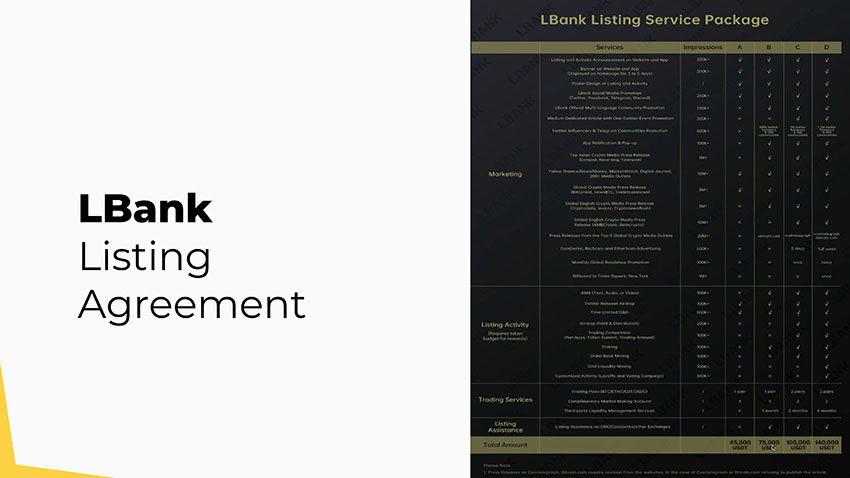

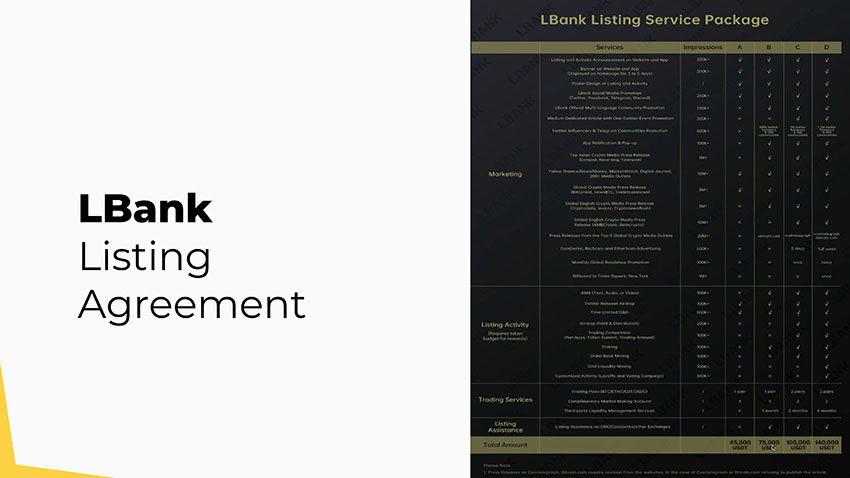

LBank Listing Agreement

Unicoin EMEA Julian Sperring - Toy Chief Development Officer - MEA

Dubai chosen as our Middle East & African hub Commenced operations 1st September ● Largest per capita crypto adoption in the world at 27.7% ● Forward looking, regulatory driven business environment ● Supportive government agencies ● Drive to make Dubai, and the UAE the worlds global crypto center Why

Dubai chosen as our Middle East & African hub Commenced operations 1st September ● Build the brand and the supporting ecosystem ● Achieve full coin issuer regulatory approval from VARA ● Obtain UAE Central Bank Approval ● List on the UAE based exchanges Strategy

Dubai chosen as our Middle East & African hub Commenced operations 1st September ● Become a the first fully certified general crypto currency in the UAE ● THE trusted and de - facto choice for a new generation of investors ● Where we lead with Dubai we will mirror across the region Objectives

Optimizing Operations Mariano DallOrso COO

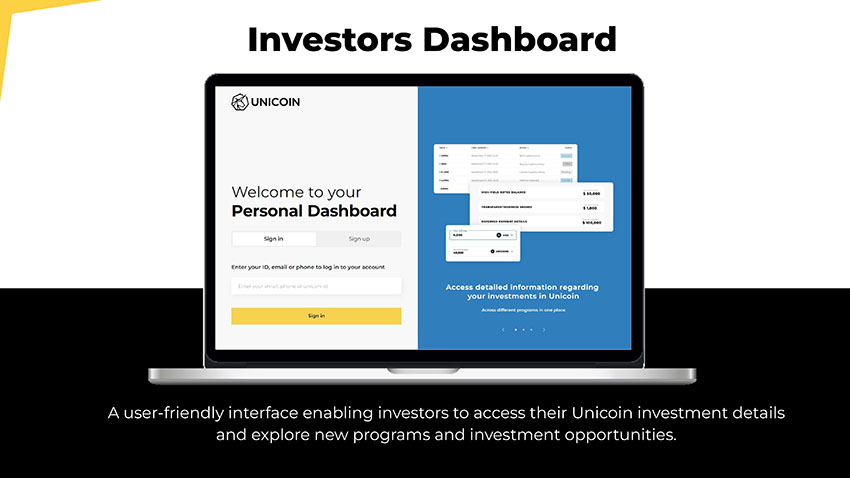

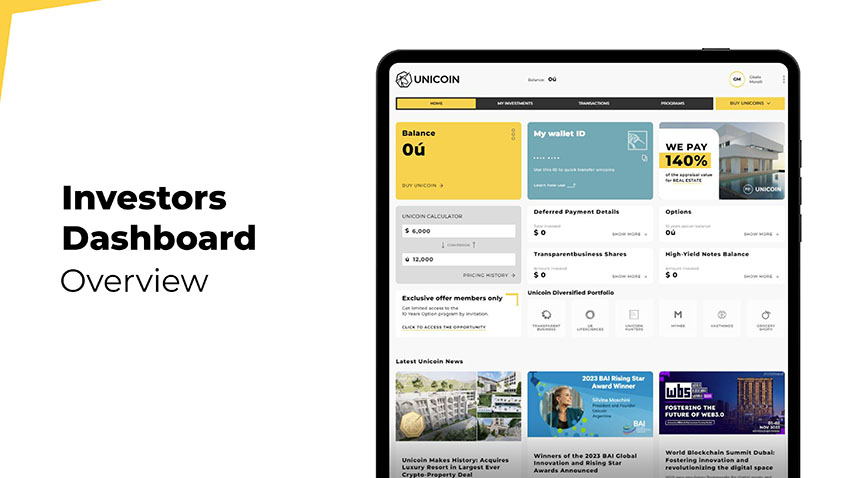

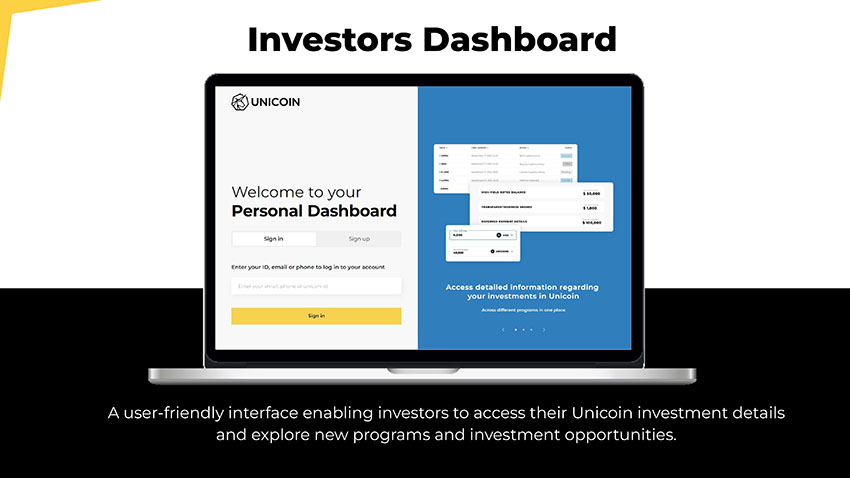

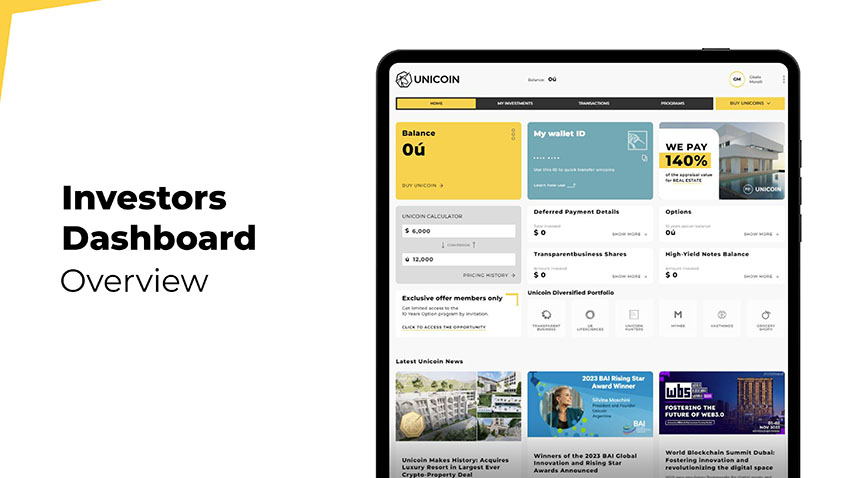

Investors Dashboard A user - friendly interface enabling investors to access their Unicoin investment details and explore new programs and investment opportunities.

Investors Dashboard Overview

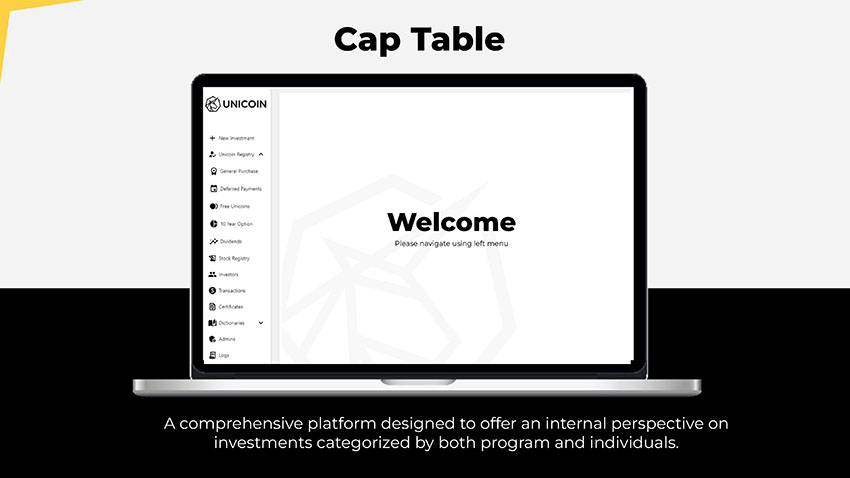

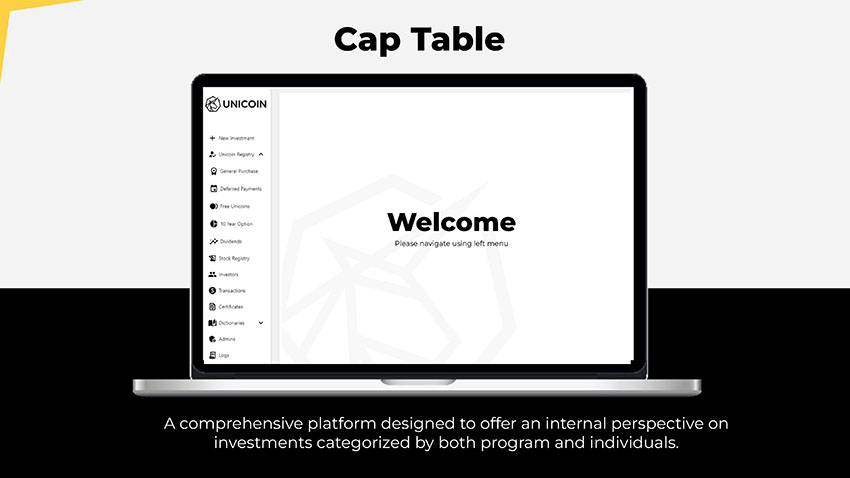

Cap Table A comprehensive platform designed to offer an internal perspective on investments categorized by both program and individuals. Welcome Please navigate using left menu

Unicoin Brand Visibility and Value Silvina Moschini Founder & President

@ UNICOIN ® UNICOIN

New coin design

Top Headlines Top Events

Spot bitcoin ETFs could bring a 'new level of trust' to the crypto market #EntMETalks with Unicoin co - founder Silvina Moschini at Biban 2023 Silvina Moschini, la maga de los negocios digitales Crypto isn’t dead, it’s evolving rapidly to create a new world Del Monopoly a la tokenización: lecciones del juego más famoso del mundo Bitcoin Pizza: What You Could Buy for 10,000 BTC Over the Course of Bitcoin’s Life How to Become a Unicorn in the Crowded Startup World Activos de Real Estate le darán soporte a criptomonedas TOP HEADLINES Q2

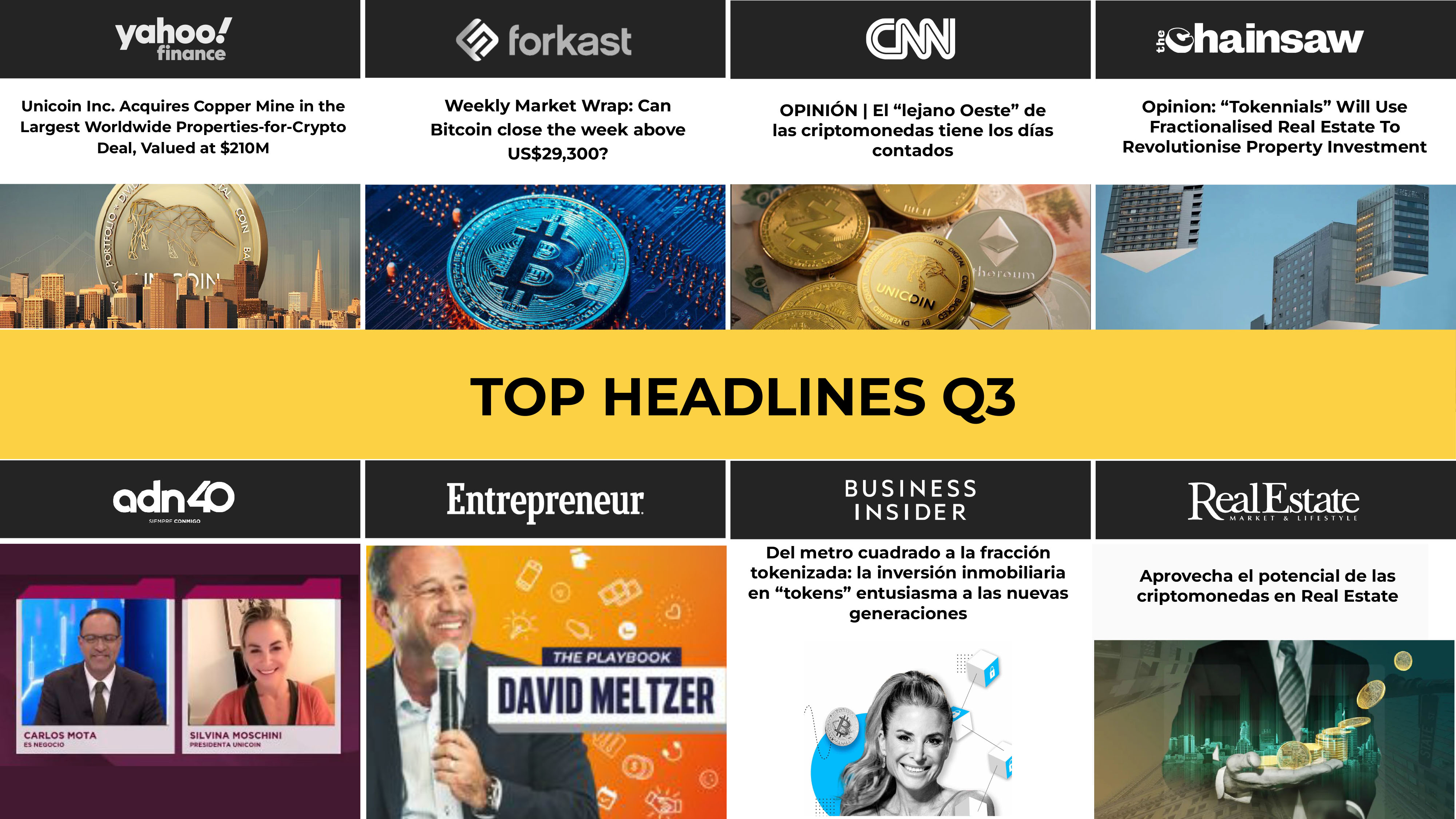

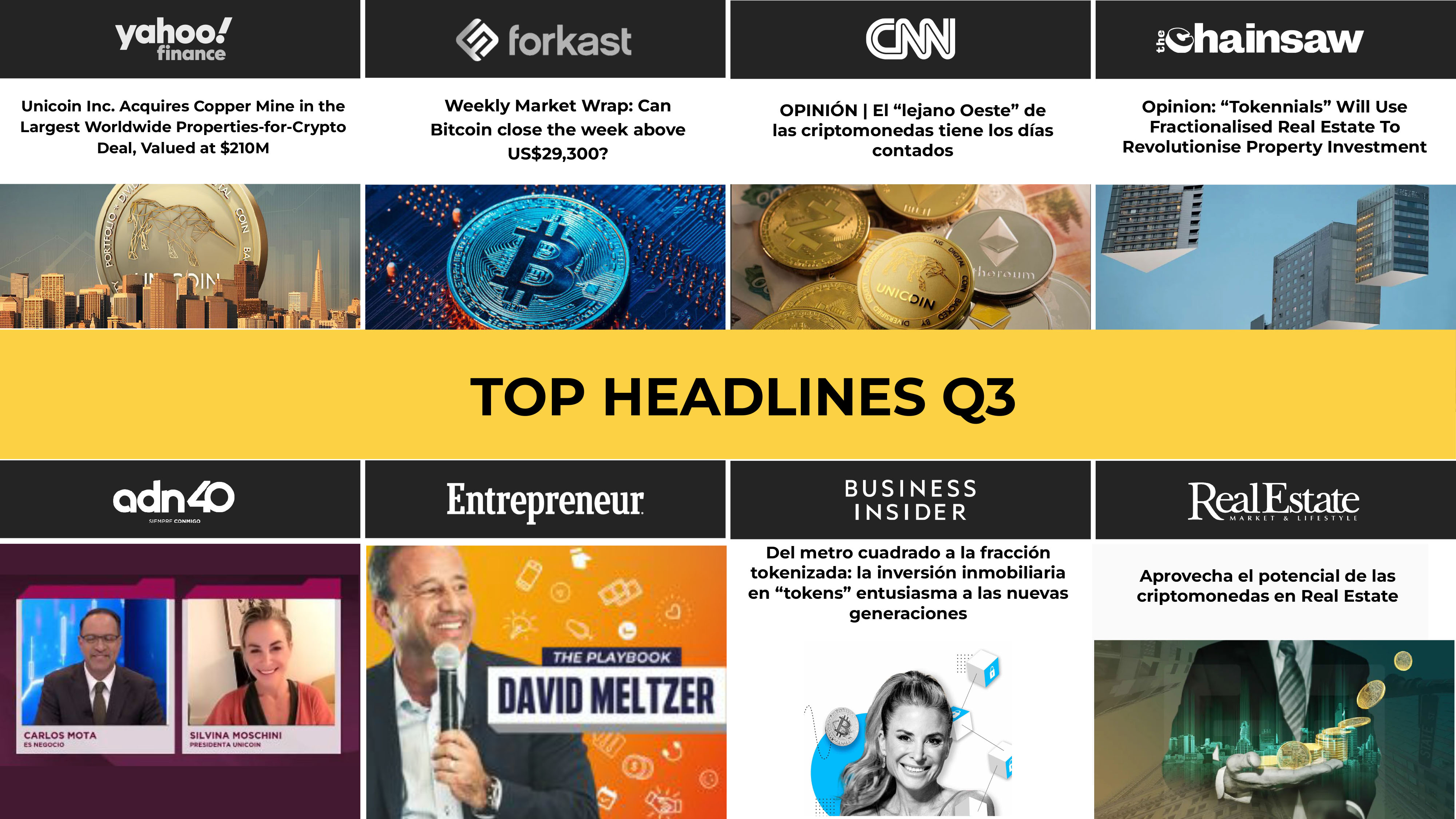

Unicoin Inc. Acquires Copper Mine in the Largest Worldwide Properties - for - Crypto Deal, Valued at $210M Del metro cuadrado a la fracción tokenizada: la inversión inmobiliaria en “tokens” entusiasma a las nuevas generaciones Aprovecha el potencial de las criptomonedas en Real Estate Weekly Market Wrap: Can Bitcoin close the week above US$29,300? OPINIÓN | El “lejano Oeste” de las criptomonedas tiene los días contados Opinion: “Tokennials” Will Use Fractionalised Real Estate To Revolutionise Property Investment TOP HEADLINES Q3

This week in Fintech: TFT Bi - Weekly News Roundup Compran en "unicoins" los derechos de una minera argentina por 210 millones de dólares Compraron por 420 millones de unicoins los derechos de una propiedad minera en Argentina Unicoin compra mina de cobre: es el mayor trato cripto - inmobiliario del mundo La reina argentina de la innovación digital apuesta a la minería por 210 millones de dólares en moneda cibernética COPPER MINE - 210 M DEAL Compran en "unicoins" los derechos de una minera argentina por 210 millones de dólares Compran en "unicoins" los derechos de una minera argentina por 210 millones de dólares Unicoin Inc. Acquires Copper Mine in the Largest Worldwide Properties - for - Crypto Deal, Valued at $210M

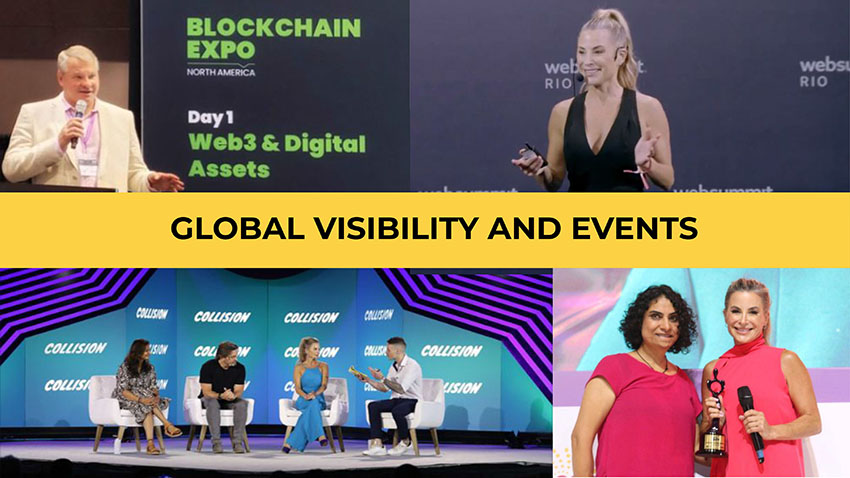

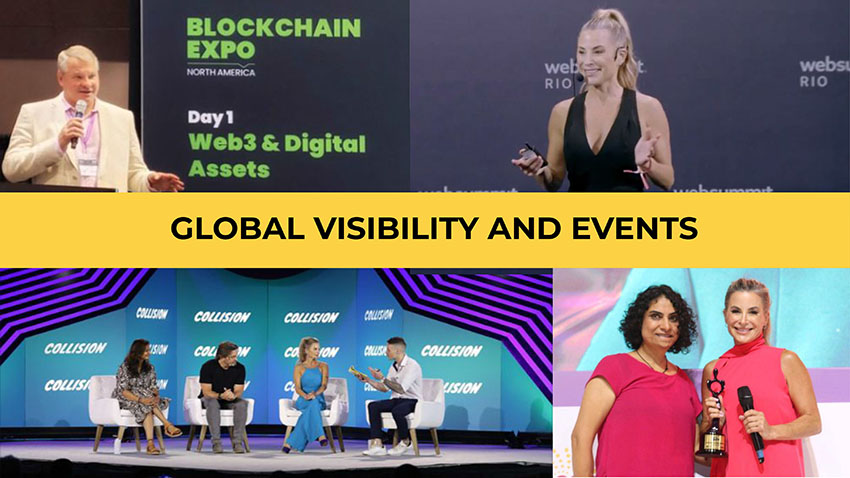

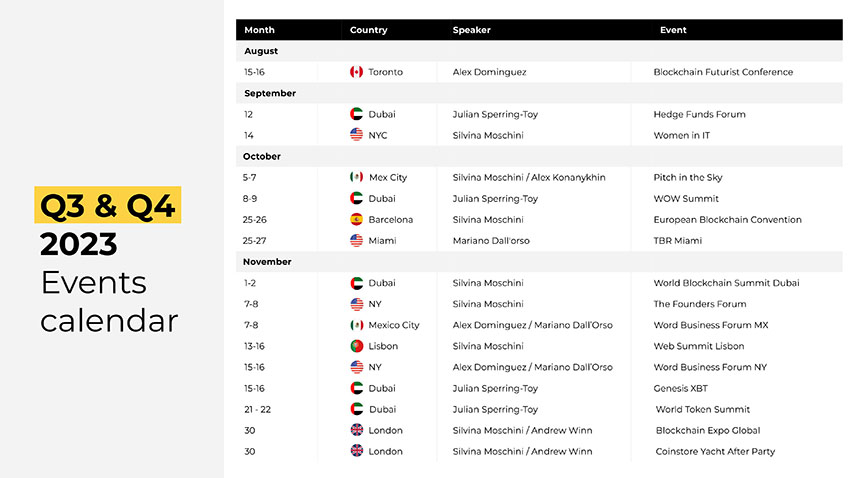

GLOBAL VISIBILITY AND EVENTS

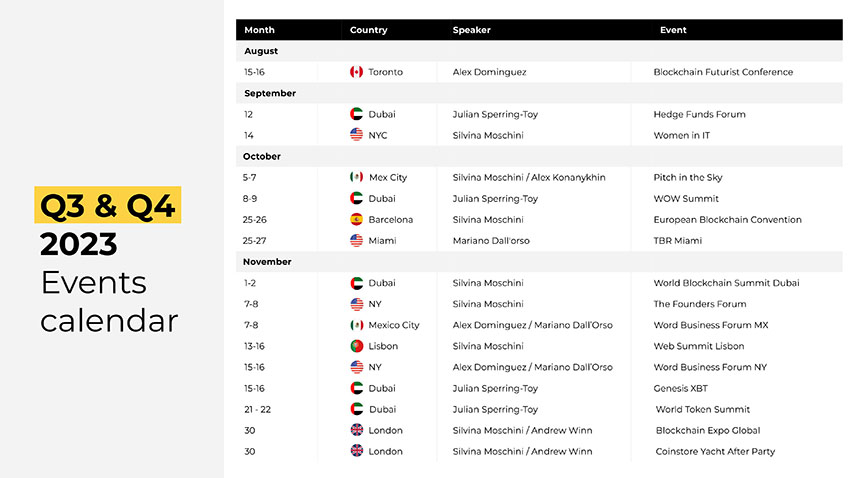

Month Country Speaker Event August Blockchain Futurist Conference Alex Dominguez Toronto 15 - 16 September Hedge Funds Forum Women in IT Julian Sperring - Toy Silvina Moschini Dubai NYC 12 14 October Pitch in the Sky WOW Summit European Blockchain Convention TBR Miami Silvina Moschini / Alex Konanykhin Julian Sperring - Toy Silvina Moschini Mariano Dall'orso Mex City Dubai Barcelona Miami 5 - 7 8 - 9 25 - 26 25 - 27 November World Blockchain Summit Dubai The Founders Forum Word Business Forum MX Web Summit Lisbon Word Business Forum NY Genesis XBT World Token Summit Blockchain Expo Global Coinstore Yacht After Party Silvina Moschini Silvina Moschini Alex Dominguez / Mariano Dall’Orso Silvina Moschini Alex Dominguez / Mariano Dall’Orso Julian Sperring - Toy Julian Sperring - Toy Silvina Moschini / Andrew Winn Silvina Moschini / Andrew Winn Dubai NY Mexico City Lisbon NY Dubai Dubai London London 1 - 2 7 - 8 7 - 8 13 - 16 15 - 16 15 - 16 21 - 22 30 30 Q3 & Q4 2023 Events calendar

140 Real estate program: Social Media Buzz

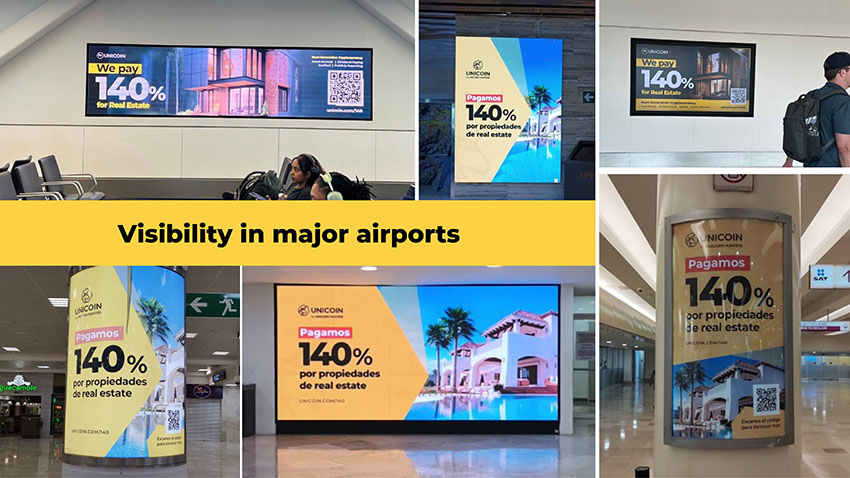

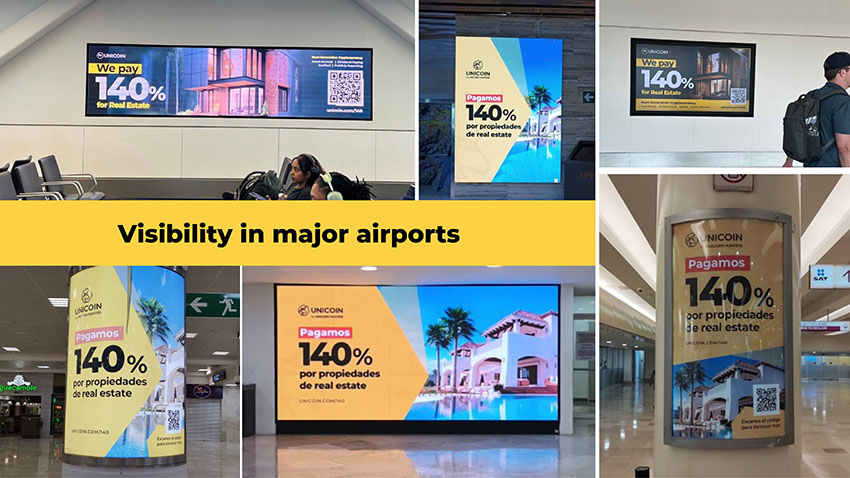

Visibility in major airports

Visibility in Miami Street

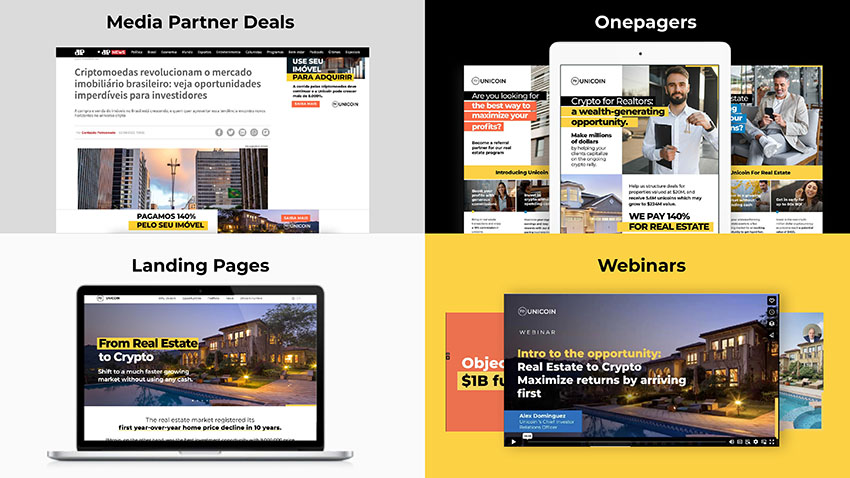

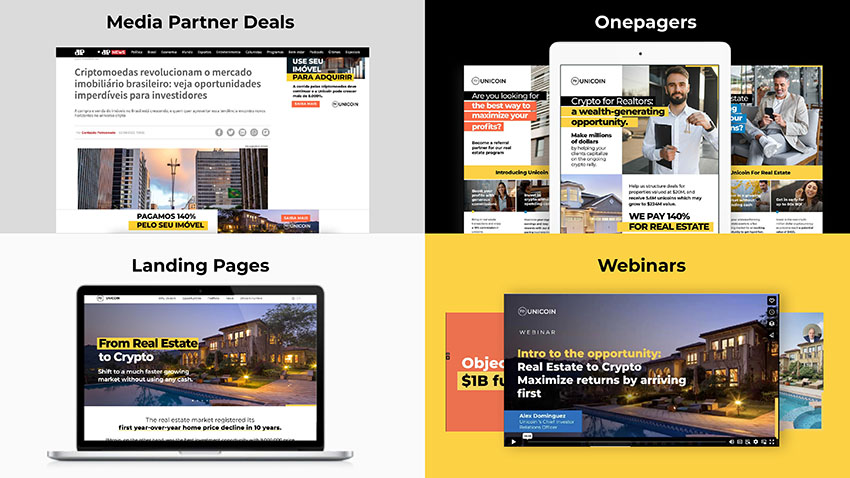

Onepagers Media Partner Deals Webinars Landing Pages

Liquidity Strategy Alex Konanykhin Founder & CEO

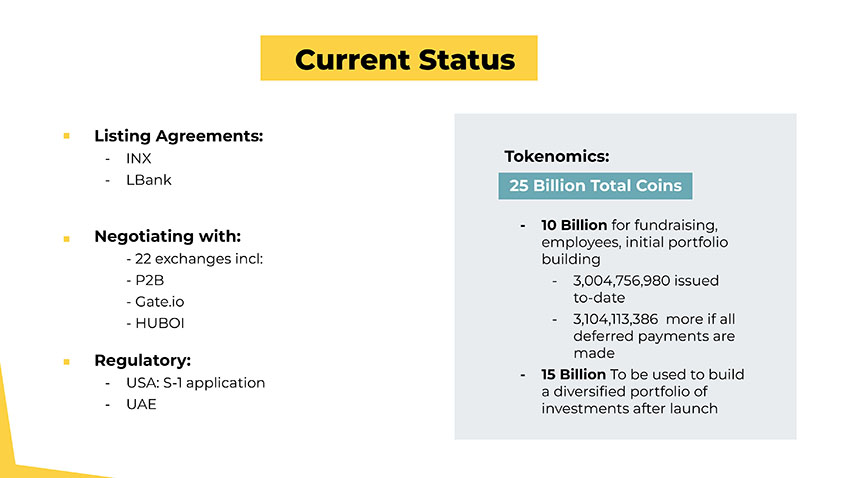

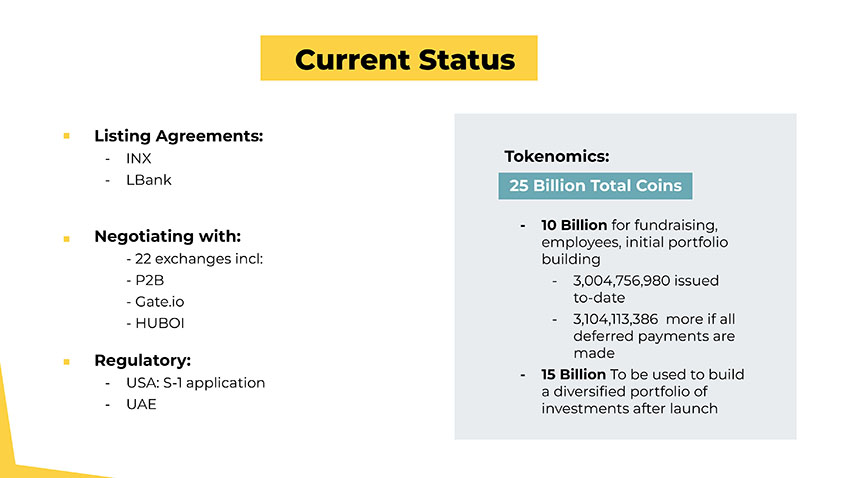

Current Status Listing Agreements: - INX - LBank 25 Billion Total Coins Tokenomics: - 10 Billion for fundraising, employees, initial portfolio building - 3,004,756,980 issued to - date - 3 , 104 , 113 , 386 more if all deferred payments are made - 15 Billion To be used to build a diversified portfolio of investments after launch Negotiating with: - 22 exchanges incl: - P2B - Gate.io - HUBOI Regulatory: - USA: S - 1 application - UAE

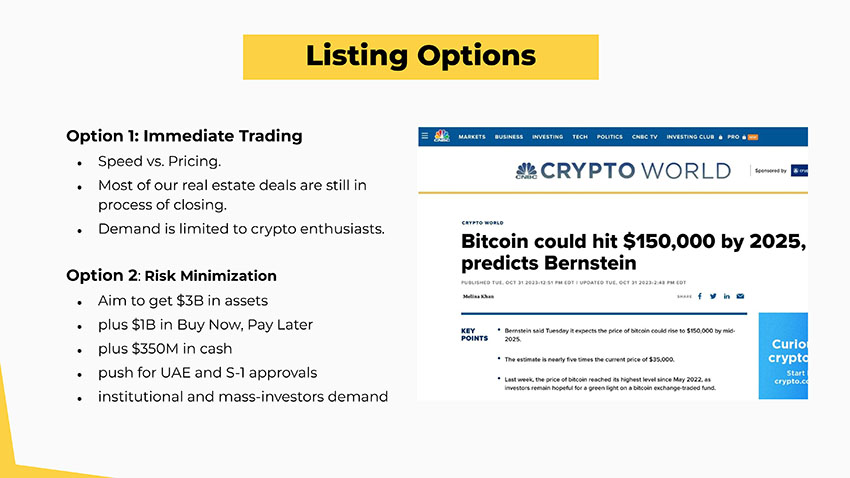

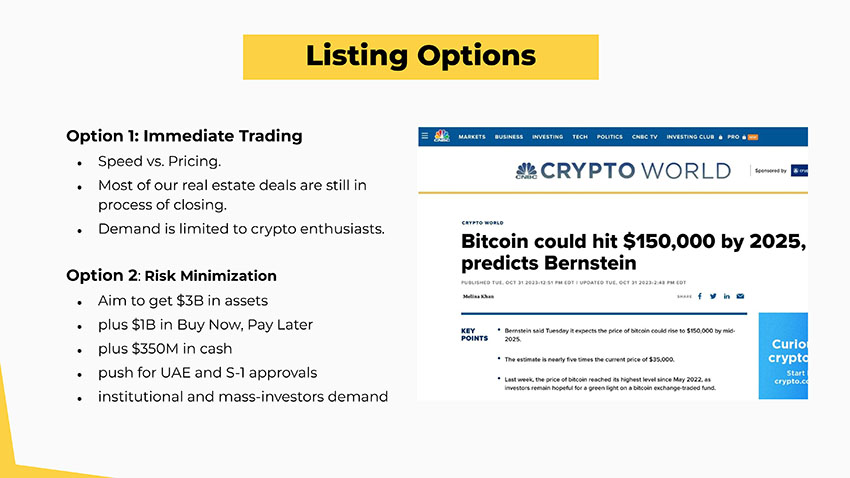

Listing Options Option 1: Immediate Trading ● Speed vs. Pricing. ● Most of our real estate deals are still in process of closing. ● Demand is limited to crypto enthusiasts. Option 2 : Risk Minimization ● Aim to get $3B in assets ● plus $1B in Buy Now, Pay Later ● plus $350M in cash ● push for UAE and S - 1 approvals ● institutional and mass - investors demand

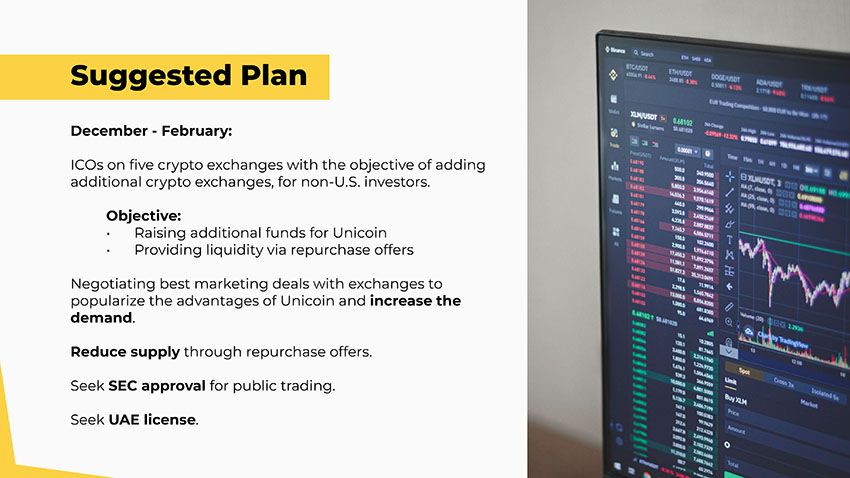

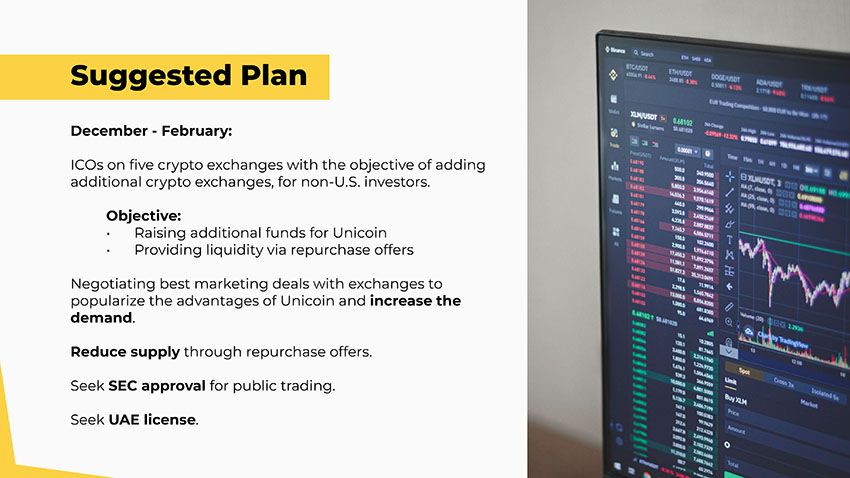

Suggested Plan December - February: ICOs on five crypto exchanges with the objective of adding additional crypto exchanges, for non - U.S. investors. Objective: • Raising additional funds for Unicoin • Providing liquidity via repurchase offers Negotiating best marketing deals with exchanges to popularize the advantages of Unicoin and increase the demand . Reduce supply through repurchase offers. Seek SEC approval for public trading. Seek UAE license .

Seeking Your Vote 1. Tokenize Unicoin as… [ ] a U.S. security token only; [ ] a U.S. and International classes. 2. Your Liquidity Preferences: [ ] Seek immediate liquidity of unicoins. [ ] Seek to increase the portfolio of assets to $3B, and then proceed with listings and ICOs on crypto exchanges with the Board of Directors deciding on the optimal market conditions for General Trading.

Thank you! unicoin.com Unicoins Unicoin_News Unicoin_News unicoin_news