If satisfactory evidence of payment of such taxes or exemption therefrom is not submitted with this Letter of Transmittal, the amount of such transfer taxes will be billed directly to such tendering holders.

EXCEPT AS PROVIDED IN THIS INSTRUCTION 6, IT WILL NOT BE NECESSARY FOR TRANSFER TAX STAMPS TO BE AFFIXED TO THE OLD NOTES LISTED IN THIS LETTER OF TRANSMITTAL.

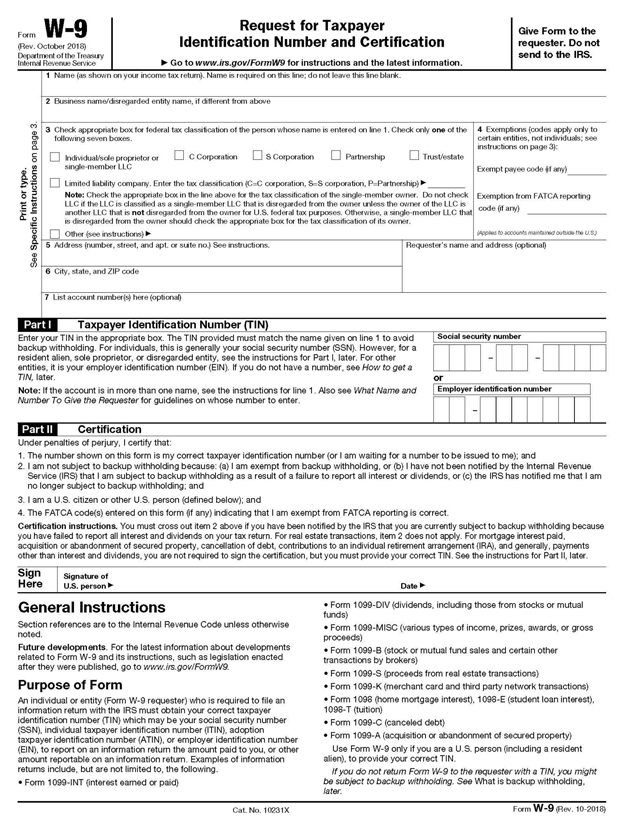

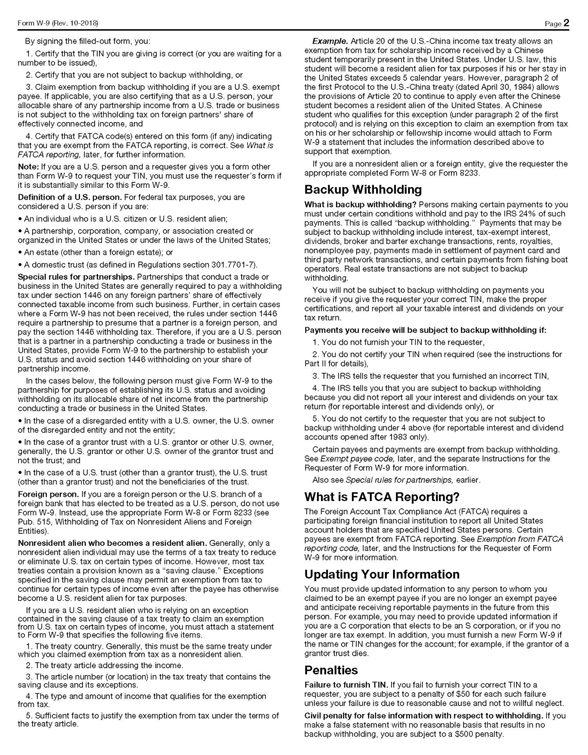

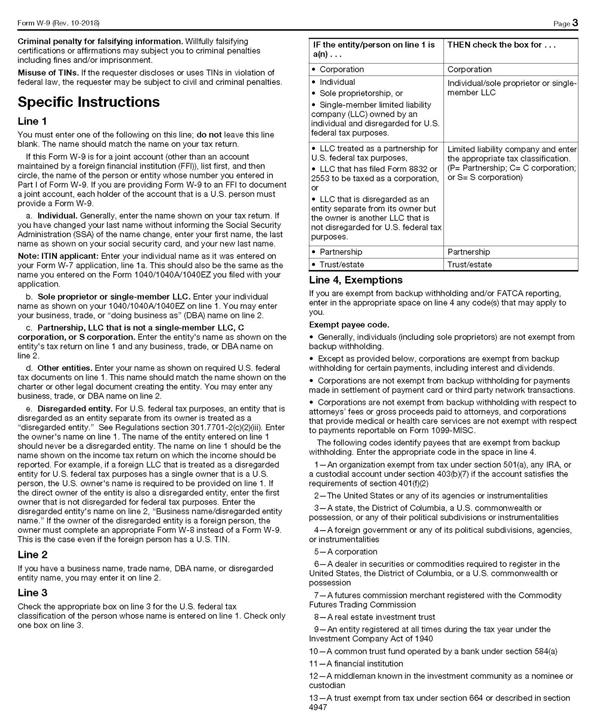

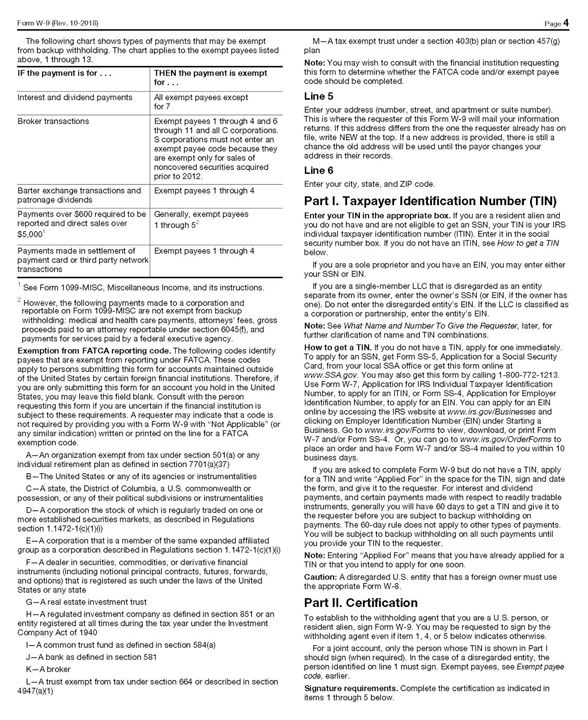

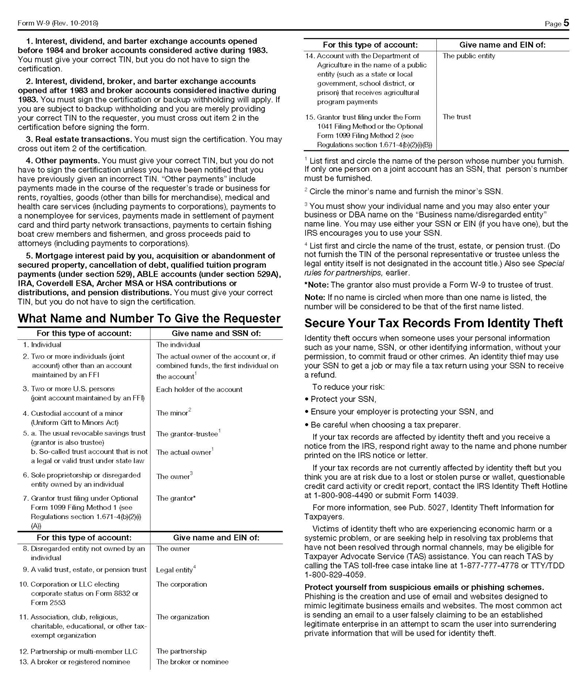

7. U.S. Federal Backup Withholding, Form W-9, Form W-8. U.S. federal income tax law requires that a holder of Old Notes, whose notes are accepted for exchange, provide the Exchange Agent, as payer, with the holder’s correct taxpayer identification number (“TIN”) or otherwise establish a basis for an exemption from backup withholding. Such holder should use the enclosed Internal Revenue Service (“IRS”) Form W-9 for this purpose and should (i) enter its name, federal tax classification, address and TIN on the face of the IRS Form W-9, (ii) if such holder is a corporation or other entity that is exempt from backup withholding, or if such holder is exempt from FATCA reporting, provide its “Exempt payee code” or “Exemption from FATCA reporting code” and (iii) sign and date the IRS Form W-9 and return it to the Exchange Agent. In the case of a holder who is an individual, other than a resident alien, the TIN is his or her social security number. For holders other than individuals, the TIN is an employer identification number. A holder must cross out item (2) in Part II on the Form W-9 if such holder is subject to backup withholding. If the holder has not been issued a TIN and has applied for a TIN or intends to apply for a TIN in the near future, the holder should write “Applied For” in the space provided for the TIN in Part I of the Form W-9. If “Applied For” is written in the space provided for the TIN in Part I of the Form W-9 and the Exchange Agent is not provided with a TIN by the time of payment, the Exchange Agent will withhold 24% from all such payments with respect to the Old Notes.

Certain holders (including, among others, corporations and certain foreign persons) are not subject to these backup withholding requirements. Exempt holders (other than foreign persons) should furnish their TIN, complete the certification in Part II of the Form W-9, and sign and return the Form W-9 to the Exchange Agent. Each holder that is a foreign person, including entities, must submit an appropriate properly completed Internal Revenue Service Form W-8, certifying, under penalties of perjury, to such holder’s foreign status in order to establish an exemption from backup withholding. An appropriate Form W-8 can be obtained via the IRS website at www.irs.gov or by contacting the Exchange Agent.

If a holder of Old Notes does not provide the Exchange Agent with its correct TIN or an adequate basis for an exemption or an appropriate completed IRS Form W-8, such holder may be subject to backup withholding on payments made in exchange for any Old Notes and a penalty imposed by the IRS. Backup withholding is not an additional federal income tax. Rather, the amount of tax withheld will be credited against the federal income tax liability of the holder subject to backup withholding. If backup withholding results in an overpayment of taxes, the taxpayer may obtain a refund from the IRS. Each holder should consult with a tax advisor regarding qualifications for exemption from backup withholding and the procedure for obtaining the exemption.

To prevent backup withholding, each holder of Old Notes must either (1) provide a completed IRS Form W-9 and indicate either (a) its correct TIN, or (b) an adequate basis for an exemption, or (2) provide a completed Form W-8.

The Company reserves the right in its sole discretion to take whatever steps are necessary to comply with the Company’s obligations regarding backup withholding.

8. Validity of Tenders. All questions as to the form of all documents and the validity, eligibility (including time of receipt), acceptance and withdrawal of tendered Old Notes will be determined by the Company in its sole discretion, which determination will be final and binding. The Company reserves the absolute right to reject any and all Old Notes not properly tendered or any Old Notes the acceptance of which would, in the opinion of the Company or its counsel, be unlawful. The Company also reserves the absolute right to waive any conditions of the exchange offer or defects or irregularities in tenders as to particular Old Notes. The interpretation of the terms and conditions by the Company of the exchange offer (which includes this Letter of Transmittal and the instructions hereto) shall be final and binding on all parties. Unless waived, any defects or irregularities in connection with tenders of Old Notes must be cured within such time as the Company shall determine. The Company will not consider the tender of Old Notes to have been validly made until all defects and irregularities have been waived or cured. Neither the Company, the Exchange Agent nor any other person shall be under any duty to give notification of defects or irregularities with regard to tenders of Old Notes nor shall any of them incur any liability for failure to give such information.

10