Filed pursuant to Rule 253(g)(2)

File No. 024-10891

OFFERING CIRCULAR

REITless Impact Income Strategies LLC

Sponsored by North Capital Investment Technology, Inc.

Up to $50,000,000 in Common Shares

REITless Impact Income Strategies LLC (the “Company”) is a newly organized Delaware limited liability company formed to originate, invest in and manage a diversified portfolio of single-family, multi-family, and other commercial real estate loans, including senior and subordinated mortgage loans (also referred to as “B-Notes”), mezzanine loans, and participations in such loans. We also may invest in commercial real estate-related debt securities, including commercial mortgage-backed securities (or “CMBS”), collateralized debt obligations (or “CDOs”), REIT senior and junior debt and certain REIT preferred equity securities, and other real estate-related assets. The Company will focus its lending to companies, organizations, and projects with the intention to generate positive social and environmental impact alongside a financial return.

We are externally managed by North Capital, Inc. (the “Manager”), an SEC-registered investment advisor and an affiliate of North Capital Investment Technology, Inc. (“NCIT” or the “Sponsor”). Registration with the SEC does not imply a certain level of skill or training. NCIT owns and operates an online investment platformwww.reitless.com(the “REITless Platform”) that allows investors to become equity or debt holders in real estate opportunities that may have been historically difficult to access for some investors. Through the use of the REITless Platform, investors can browse real estate debt investments, view details of an investment, execute legal documents, and arrange for payments online. We intend to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes beginning with our taxable year ending December 31, 2018, which may be extended by our board of directors until the taxable year ending December 31, 2019.

We are offering up to $50,000,000 in our common shares, which represent limited liability company interests in the Company, to the public at $10.00 per share. The minimum investment in our common shares for initial purchases is 100 shares, or $1,000 based on the current per share price. In addition, our Sponsor and its officers and employees intend to purchase up to 50,000 common shares from us at $10.00 per share in a private placement at the time this offering is qualified by the SEC (including 100 common shares already owned by the Sponsor). We expect to offer common shares in this offering until we raise the maximum amount being offered, unless terminated by our Sponsor at an earlier time or extended in accordance with the terms of this offering circular. Until the date that is one year from the date on which the Offering Statement of which this Offering Circular forms a part is qualified by the SEC, the per share purchase price for our common shares will be $10.00 per share, an amount that was arbitrarily determined by the Manager. Thereafter, the per share purchase price in this offering will be adjusted every fiscal quarter and, as of the last business day of March, June, September, and December, and will equal the quotient of our Net Asset Value, or NAV, divided by the number of our common shares outstanding as of the end of the subject fiscal quarter (NAV per share). We have adopted a redemption plan designed to provide our shareholders with limited liquidity on a quarterly basis for their investment in our shares.

We intend to distribute the Company’s shares principally through the REITless Platform and through broker-dealers and other qualified intermediaries engaged by the Manager on behalf of the Company. See “Plan of Distribution.”

Investing in the Company’s common shares is speculative and involves substantial risks. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 24 to read about the more significant risks you should consider before buying our common shares. These risks include the following:

| · | We depend on the Manager to select our investments and conduct our operations. We will pay fees and expenses to the Manager and its affiliates that were not determined on an arm’s length basis, and therefore we do not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss. |

| · | We have no operating history. The prior performance of our Sponsor and its affiliates may not predict our future results. Therefore, there is no assurance that we will achieve our investment objectives. |

| · | Although we intend to focus our lending to companies, organizations, and projectswith the intention to generate positive social and environmental impact alongside a financial return, there is no assurance that we will be successful in sourcing such companies, organizations, or projects. |

| · | This is a “blind pool” offering because we have not identified any investments to acquire with the net proceeds of this offering. You will not be able to evaluate our investments prior to purchasing shares. |

| · | Our Manager’s executive officers are also officers, directors, managers and/or key professionals of our Sponsor and its affiliates. As a result, they will face conflicts of interest, including time constraints, allocation of investment opportunities and significant conflicts created by the Manager’s compensation arrangements with us and other affiliates of our Sponsor. |

| · | Our Sponsor and its affiliates may sponsor and/or contract with other companies that compete with the Company, and our Sponsor does not have an exclusive management arrangement with the Company. |

| · | We may change our investment guidelines without shareholder consent, which could result in investments that are different from those described in this offering circular. |

| · | Although our distribution policy is to use our cash flow from our operations to make distributions, our organizational documents permit us to pay distributions from any source, including offering proceeds, financing proceeds or proceeds from the sale of assets. We have not established a limit on the amount of proceeds we may use to fund distributions. If we pay distributions from sources other than our cash flow from operations, we will have less funds available for investments and your overall investment return is likely to be reduced. Our Sponsor has agreed to purchase our common shares in a private placement under certain circumstances in order to provide additional funds for distributions to shareholders; however, such issuances will dilute the equity ownership of public shareholders. In any event, we intend to make annual distributions as required to maintain eligibility as a REIT and to avoid U.S. federal income and excise taxes on retained income. |

| · | Our internal accountants will calculate our NAV on a quarterly basis using valuation methodologies that involve subjective judgments and estimates. As a result, our NAV may not accurately reflect the actual prices at which our investments, including related liabilities, could be liquidated on any given day. In particular, the investments held by the Company will generally be illiquid, unregistered private loans and securities, and the price at which they can be sold will necessarily involve subjective estimates regarding the marketability of such securities in secondary markets. |

| · | Our operating agreement does not require the Manager to seek shareholder approval to liquidate our assets by a specified date, nor does our operating agreement require the Manager to list the Company’s shares for trading by a specified date. No public market currently exists for our shares, no public market is expected to develop and the Manager does not expect to pursue any public market listing in the foreseeable future. Until the Company’s shares are listed, if ever, you may not be able to sell your shares except pursuant to the quarterly redemption plan described in this offering circular. If you are able to sell your shares, you may have to sell them at a substantial loss. |

| · | If we fail to qualify as a REIT for U.S. federal income tax purposes and no relief provisions apply, we would be subject to entity-level federal income tax and, as a result, our cash available for distribution to our shareholders and the value of the Company’s shares could materially decrease. |

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the SEC; however, the SEC has not made an independent determination that the securities offered are exempt from registration.

The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment in our common shares.

| | | Per Share | | | Total Minimum | | | Total Maximum | |

| Public Offering Price (1) | | $ | 10.00 | | | $ | 1,000,000.00 | (2) | | $ | 50,000,000.00 | |

| Underwriting Discounts and Commissions (3) | | $ | — | | | $ | — | | | $ | — | |

| Proceeds to Us from this Offering to the Public (Before Expenses) | | $ | 10.00 | | | $ | 500,000.00 | (2) | | $ | 50,000,000.00 | |

| Proceeds to Us from the Private Placements to our Sponsor and its | | | | | | | | | | | | |

| Affiliated Persons (Before Expenses) | | $ | 10.00 | | | $ | 500,000.00 | | | $ | 500,000.00 | |

| Total Proceeds to Us (Before Expenses) | | $ | 10.00 | | | $ | 1,000,000.00 | | | $ | 50,500,000.00 | |

| (1) | The initial price per share shown was arbitrarily determined by the Manager and will apply until the date that is one year from the date on which the Offering Statement of which this Offering Circular forms a part is qualified by the SEC Thereafter, our price per share will be adjusted at the end of each fiscal quarter based on the Net Asset Value (NAV). |

| (2) | This is a “best efforts” offering. We will not start operations or draw down on investors’ funds and admit investors as shareholders until we raise at least $1,000,000 in this offering (including the $500,000 received from our Sponsor and its officers and directors and other investors). Until the minimum threshold is met, investors’ funds will be revocable and will remain in a subscription escrow account established for the offering (the “Subscription Escrow Account”). The company has engaged The Kingdom Trust Company as an escrow agent (the “Escrow Agent”) to hold funds tendered by investors, and assuming we raise at least $500,000 in this offering, may hold a series of closings at which we receive the funds from the escrow agent and issue the shares to investors. In the event we have not raised the minimum offering amount by November 2, 2019, any money tendered by potential investors will be promptly returned by the Escrow Agent. The company may undertake one or more closings on a rolling basis once the minimum offering amount is sold. After each closing, funds tendered by investors will be available to the company. See “Plan of Distribution” and “How to Subscribe.” |

| (3) | Investors will not pay any upfront selling commissions in connection with the purchase of our common shares. Following the completion of the offering, the Company will reimburse the Manager for organization and offering costs, which are expected to be approximately $250,000. Reimbursement payments will be made in quarterly installments, but the aggregate reimbursement amount will be subject to a limit of .125% per quarter, or .50% per annum. If the sum of the total unreimbursed amount of such organization and offering costs, plus new costs incurred since the last reimbursement payment, exceeds the reimbursement limit described above for the applicable quarterly installment, the excess will be eligible for reimbursement in subsequent quarters (subject to the indicated limit), calculated on an accumulated basis, until the Manager has been reimbursed in full. See “Management Compensation” for a description of additional fees and expenses that the Company will pay the Manager. |

We will offer our common shares on a best efforts basis through the online REITless Platform. The Sponsor’s wholly owned subsidiary, North Capital Private Securities Corporation (“NCPS”), is a registered broker-dealer, member FINRA and SIPC, and will be involved in the distribution of the common shares through the REITless Platform, through selling agreements with other broker-dealers and other qualified intermediaries, and through wholesale distribution to institutional investors and registered investment advisors evaluating the common shares on behalf of their clients.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to non-natural persons and we are entitled to apply different rules to accredited investors as defined under Rule 501(a) of Regulation D. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer towww.investor.gov.

This Offering Circular follows the Form S-11 disclosure format.

The date of this offering circular is November 2, 2018

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the offering circular. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should not assume that the information contained in this offering circular is accurate as of any date later than the date of this offering circular or such other dates as are stated in this offering circular or as of the respective dates of any documents or other information incorporated by reference into this offering circular.

This offering circular is part of an offering statement that we filed with the Securities and Exchange Commission (the “SEC”), using a continuous offering process.

Periodically, as we make material investments, update our quarterly NAV per share amount, or have other material developments, we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement that we make in this offering circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website,www.sec.gov, or on the REITless Platform website,www.reitless.com. The contents of the REITless Platform website (other than the offering statement, this offering circular and the appendices and exhibits thereto) are not incorporated by reference in or otherwise a part of this offering circular.

Our Sponsor and those selling shares on our behalf in this offering will be permitted to make a determination that the purchasers of shares in this offering are “qualified purchasers” in reliance on the information and representations provided by the shareholder regarding the shareholder’s financial situation. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) ofRegulation A. For general information on investing, we encourage you to refer towww.investor.gov.

TABLE OF CONTENTS

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

The Company’s common shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our common shares are offered and sold only to “qualified purchasers” or at a time when our common shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). However, our common shares are being offered and sold only to those investors that are within the latter category (i.e., investors whose investment in our common shares does not represent more than 10% of the applicable amount), regardless of an investor’s status as an “accredited investor.” Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who has:

| 1. | an individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person;or |

| 2. | earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. |

If the investor is not a natural person, different standards for accreditation apply. SeeRule 501of Regulation D for more details.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition underRule 501of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

The following questions and answers about this offering highlight material information regarding us and this offering that is not otherwise addressed in the “Offering Summary” section of this offering circular. You should read this entire offering circular, including the section entitled “Risk Factors,” before deciding to purchase our common shares.

| Q: | What is REITless Impact Income Strategies LLC? |

| A: | The Company has been formed as a Delaware limited liability company to originate, invest in and manage a diversified portfolio of single-family, multi-family, and other commercial real estate loans, including senior and subordinated mortgage loans, mezzanine loans, participations in such loans, and other investments in real estate-related assets. The Company will focus its lending to companies, organizations, and projects with the intention to generate positive social and environmental impact alongside a financial return. The use of the terms “REITless Impact Income Strategies,” the “Company,” “we,” “us” or “our” in this offering circular refer to REITless Impact Income Strategies LLC unless the context indicates otherwise. |

| Q: | What is a real estate investment trust, or REIT? |

| A: | In general, a REIT is an entity that: |

| · | combines the capital of at least 100 investors to acquire or provide financing for a diversified portfolio of real estate investments or real estate loans under professional management; |

| · | is able to qualify as a “real estate investment trust” under the Internal Revenue Code of 1986, as amended, which we also refer to in this offering circular as the “Code,” for U.S. federal income tax purposes and is therefore generally entitled to a deduction for the dividends it pays and not subject to federal corporate income taxes on its net income distributed to its shareholders; and |

| · | generally pays distributions to investors of at least 90% of its annual ordinary taxable income. |

In this offering circular, we refer to an entity that qualifies to be taxed as a real estate investment trust for U.S. federal income tax purposes as a REIT. We intend to elect to be treated as a REIT for U.S. federal income tax purposes commencing with our taxable year ending December 31, 2018, which may be extended by our board of directors until the taxable year ending December 31, 2019.

| Q: | Who will choose which investments you make? |

| A: | We are externally managed by North Capital, Inc., which we also refer to as the Manager. Our Manager will be responsible for all of our investment decisions. North Capital, Inc. is an affiliate of the Sponsor and an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. |

| Q: | Who is North Capital Investment Technology, Inc.? |

| A: | North Capital Investment Technology, Inc., our Sponsor and an affiliate of the Manager, is also the parent company of North Capital Private Securities Corp., which we also refer to in this offering circular as NCPS. The Sponsor owns and operates the online investment platformwww.reitless.com(the “REITless Platform”). |

| Q: | What is the REITless Platform? |

| A: | The REITless Platform is an online investment platform for commercial real estate debt offerings. The REITless Platform gives investors the ability to: |

| · | review information about the Company, the Sponsor, and the Manager, including information about investments made by the Company once it has commenced operations; |

| · | review information about other real estate investment strategies offered by the Manager or NCPS; |

| · | transact entirely online, including digital legal documentation, electronic funds transfer, and shareholder registration; and |

| · | receive periodic financial reporting. |

| Q: | Why should I invest in commercial real estate loans and real estate-related loans? |

| A: | The Company intends to offer a professionally managed, diversified portfolio of commercial real estate lending assets to investors who generally have had limited access to such investments in the past. Allocating some portion of your investment portfolio to a direct investment in commercial real estate loans and real estate-related financings may offer: |

| · | a reasonably predictable level of current income from the investment; |

| · | diversification of your portfolio, by investing in an asset class designed to produce current income; and |

| · | the opportunity for capital appreciation if the market expands and matures over time. |

| Q: | Why should I invest specifically in a company that is focused primarily on commercial real estate loans and real estate-related assets? |

| A: | We believe that the limited sources of debt financing for small, commercial real estate developers, resulting from continued uncertain economic conditions, has and will continue to create a favorable environment for experienced lenders to produce attractive, risk-adjusted returns. The de-leveraging and risk assessment that took place among large institutional banks and traditional credit providers following the financial crisis of 2008, as well as the contraction of securitization as a means of expanding access to debt financing, has left real estate owners with fewer options to obtain debt financing for new acquisitions, redevelopment, and refinancings. As a result, the cost of real estate debt capital has increased and the terms and structure of real estate loans have become more favorable for lenders compared to the years leading up to the financial crisis of 2008. At the same time, as the real estate lending market continues to rationalize and deleverage, portfolios of existing loans and debt instruments secured by commercial real estate are likely to be continued to be offered for sale by banks and other lending institutions at attractive prices. |

| Q: | What is an “impact” investment, and how will the Company pursue an impactful investment strategy through lending? |

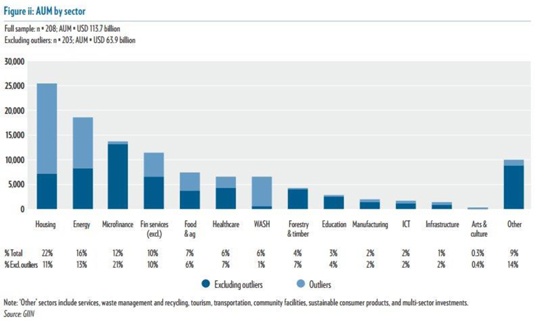

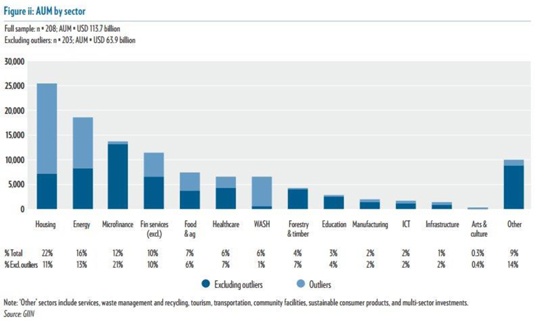

| A: | Impact investing refers to investments made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside, or in lieu of, a financial return. The growing impact investment market funnels capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education. The Company intends to focus primarily on housing through its lending programs, although it may also lend to other commercial real estate opportunities, especially in the foregoing sectors. |

| Q: | How will you measure the social impact of the Company’s activities? |

| A: | Quantifying the effect of “impact investments” is difficult, because there is no market benchmark and generally no directly comparable investments that can be used for comparative analysis. The Company intends to report on the qualitative impact of its investments on a regular basis, and to analyze its lending activities in the context of other (non-impact) market opportunities. Because the Company is focused on lending, it can establish investment underwriting parameters and thresholds that exist irrespective of the Company’s focus on impactful investments. |

| Q: | What kind of offering is the REITless Impact Income Strategies securities offering? |

| A: | We are offering securities pursuant to Regulation A of the Securities Act through the REITless online investment platformwww.reitless.com, or the REITless Platform. A maximum of $50,000,000 of our common shares will be offered to the public on a “best efforts” basis at $10.00 per share. In addition, our Sponsor and its affiliated employees and directors, will purchase an aggregate of 50,000 common shares from us at $10.00 per share in a private placement before the date this offering statement is qualified by the SEC (including 100 common shares already owned by our Sponsor). |

| Q: | How is an investment in your common shares different from investing in shares of a listed real estate investment trust? |

| A: | The fundamental difference between our common shares and the shares of a listed REIT is the continuous liquidity available with a listed REIT. Although we have adopted a limited liquidity program that generally allows investors to redeem shares on a quarterly basis, for investors with a short-term investment horizon, a listed REIT is a more appropriate investment than our common shares. Additionally, listed REITs are subject to more demanding public disclosure and corporate governance requirements than we will be subject to. While we are subject to the scaled reporting requirements of Regulation A, such periodic reports are substantially less than what would be required for a listed REIT that files reports pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| Q: | How is an investment in your common shares different from investing in shares of a traditional, non-traded REIT? |

| A: | Investors do not pay any up-front broker-dealer distribution fees, saving investors approximately 70% to 90% in upfront expenses as compared to a traditional, non-traded REIT. Traditional non-traded REITs use a highly labor-intensive method with hundreds to thousands of commissioned-based sales brokers calling on investors to sell their offerings. Our Sponsor is one of a group of pioneering digital platforms, which we intend to leverage in conducting this offering, thus reducing the transaction costs to investors to purchase our common shares. |

| Q: | What is the purchase price for your common shares? |

| A: | Our Manager set our initial offering price at $10.00 per share, which will continue to be the purchase price of the Company’s shares until the date that is one year from the date on which the Offering Statement of which this Offering Circular forms a part is qualified by the SEC. Thereafter, the per share purchase price in this offering will be adjusted every fiscal quarter, on the last business day of March, June, September, and December of each year (or as soon as commercially reasonable) and announced by us thereafter equal to the quotient of NAV divided by the number of shares outstanding as of the close of business on the last business day of the fiscal quarter. Our website,www.reitless.com, will identify the current NAV per share. Any subscriptions that we receive during a fiscal quarter will be executed at a price equal to our NAV per share in effect for that fiscal quarter. If a material event occurs in between quarterly updates of NAV that would cause our NAV per share to change by 5% or more from the last disclosed NAV, we will disclose the updated price and the reason for the change in an offering circular supplement as promptly as reasonably practicable and will update the NAV information provided on our website. See “Description of Our Common Shares—Quarterly Share Price Adjustments” for more details. |

| Q: | How will your NAV per share be calculated? |

| A: | Our NAV per share will be calculated at the end of each fiscal quarter, beginning on the date that is one year from the date on which the Offering Statement of which this Offering Circular forms a part is qualified by the SEC, by our internal accountants using a process that reflects several components, including (1) estimated values of each of our commercial real estate assets and investments, including related liabilities, based upon market default rates, discount rates, loss severity rates, and in certain instances reports of the underlying real estate provided by an independent valuation expert, (2) the price of liquid assets for which third party market quotes are available, (3) accruals of our quarterly or other periodic distributions and (4) estimated accruals of our operating revenues and expenses. In instances where an appraisal of the underlying real estate asset is necessary, we will engage an appraiser that has expertise in appraising commercial real estate loans and assets, to act as our independent valuation expert. The independent valuation expert will not be responsible for, or prepare, our quarterly NAV per share. See “Description of Our Common Shares— Valuation Policies” for more details about our NAV and how it will be calculated. |

| Q: | How exact will the calculation of the quarterly NAV per share be? |

| A: | Our goal is to provide a reasonable estimate of the market value of our common shares as of the end of each fiscal quarter. Our assets will consist principally of a diversified portfolio of single-family, multi-family, and other commercial real estate loans, including senior and subordinated mortgage loans, mezzanine loans, participations in such loans, and other real estate-related debt investments. Our independent valuation expert and internal accountants’ valuation of the real estate underlying these assets is subject to a number of judgments and assumptions that may not prove to be accurate. The use of different judgments or assumptions would likely result in different estimates of the value of the real estate underlying our assets. Moreover, although we evaluate and provide our NAV per share on a quarterly basis, our NAV per share may fluctuate daily, so that the NAV per share in effect for any fiscal quarter may not reflect the precise amount that might be paid for the Company’s shares in a market transaction. Further, our published NAV per share may not fully reflect certain material events to the extent that they are not known or their financial impact on our portfolio is not immediately quantifiable. Any resulting potential disparity in our NAV per share may be in favor of either shareholders who redeem their shares, or shareholders who buy new shares, or existing shareholders. See “Description of our Common Shares—Valuation Policies.” |

| Q: | Will I have the opportunity to redeem my common shares? |

| A: | Yes. While you should view this investment as long-term, with poor liquidity, we have adopted a redemption plan whereby, on a quarterly basis, an investor may have the opportunity to obtain limited liquidity. The Manager has designed our redemption plan with a view towards offering investors an initial period during which to decide whether a long-term investment in the Company is appropriate for their portfolio. In addition, despite the illiquid nature of the assets expected to be held by the Company, the Manager believes it is in the best interest of all shareholders to provide the opportunity for limited quarterly liquidity in the event a shareholder needs it, by offering a discounted redemption price prior to year 5. The redemption terms offer non-redeeming shareholders an economic benefit to compensate for potential transaction costs and the opportunity cost of maintaining a cash reserve for such redemptions. Neither the Manager nor our Sponsor receives any economic benefit as a result of the discounted redemption price through year 5. |

Pursuant to our redemption plan, shareholders may request that we redeem at least 10% of their shares on a quarterly basis. In addition, the redemption plan is subject to certain aggregate redemption limits, which may vary depending on the underlying liquidity of the real estate assets held by us. Specifically, we are required to limit the number of shares to be redeemed during any calendar year to no more than 5.0% of the weighted average number of common shares outstanding during the prior calendar year (or 1.25% per calendar quarter, with excess capacity carried over to later calendar quarters in that calendar year).

For the first quarter following the settlement of the common shares subject to the redemption request (the “Preliminary Investment Period”), the per share redemption price will be equal to the purchase price of the shares being redeemedreduced by

| (i) | the aggregate sum of distributions paid with respect to such shares, rounded down to the nearest cent and |

| (ii) | the aggregate sum of distributions, if any, declared but unpaid on the shares subject to the redemption request. |

In other words, a shareholder would receive back their original investment amount, from the redemption price paid, prior distributions received and distributions that have been declared (and that will be received when paid), but would not receive any amounts in excess of their original investment amount.

Beginning with the first day of the second quarter following the settlement of the common shares subject to the redemption request (the “Regular Investment Period”), the per share redemption price will be calculated based on a declining discount to the per share price for our common shares in effect at the time of the redemption request, and rounded down to the nearest cent. In addition, the redemption plan is subject to certain liquidity limitations, which may fluctuate depending on the liquidity of the real estate assets held by us. During the Regular Investment Period, the redemption price with respect to the common shares that are subject to the redemption request will not be reduced by the aggregate sum of distributions, if any, that have been (i) paid with respect to such shares prior to the date of the redemption request or (ii) declared but unpaid on such shares with record dates during the period between the redemption request date and the redemption date.

| Holding Period from Date of Settlement | | Effective Redemption Price (as

percentage of per share

redemption price)(1) | |

| Less than 90 days (Preliminary Investment Period) | | | 100 | %(2)(3) |

| 90 days until 3 years | | | 97.0 | %(4) |

| 3 years to 4 years | | | 98.0 | %(5) |

| 4 years to 5 years | | | 99.0 | %(6) |

| More than 5 years | | | 100.0 | %(7) |

| (1) | The Effective Redemption Price will be rounded down to the nearest $0.01. |

| (2) | The per share redemption price during the Preliminary Investment Period is calculated based upon the purchase price of the shares, not the per share price in effect at the time of the redemption request. |

| (3) | The Effective Redemption Price during the Preliminary Investment Period will be reduced by the aggregate sum of distributions paid or payable on such shares, the amount of which we are unable to calculate at this time. |

| (4) | For shares held at least ninety (90) days but less than three (3) years, the Effective Redemption Price includes the fixed 3% discount to the per share price for our common shares in effect at the time of the redemption request. |

| (5) | For shares held at least three (3) years but less than four (4) years, the Effective Redemption Price includes the fixed 2% discount to the per share price for our common shares in effect at the time of the redemption request. |

| (6) | For shares held at least four (4) years but less than five (5) years, the Effective Redemption Price includes the fixed 1% discount to the per share price for our common shares in effect at the time of the redemption request. |

| (7) | For shares held at least five (5) years, the Effective Redemption Price does not include any discount to the per share price for our common shares in effect at the time of the redemption request. |

Furthermore, any shareholder requesting redemption will be responsible for any third-party costs incurred in effecting such redemption, including but not limited to, bank transaction charges, custody fees, and/or transfer agent charges. The redemption plan may be changed or suspended at any time without notice. See “Description of Our Common Shares—Quarterly Redemption Plan” for more details.

| Q: | Will there be any limits on my ability to redeem my shares? |

| A: | Yes. While we designed our redemption plan to allow shareholders to request redemptions on a quarterly basis, we need to impose limitations on the total amount of net redemptions per calendar quarter in order to maintain sufficient sources of liquidity to satisfy redemption requests without impacting our ability to invest in single-family, multi-family, and other commercial real estate loans and maximize investor returns. |

In the event the Manager determines, in its sole discretion, that we do not have sufficient funds available to redeem all of the common shares for which redemption requests have been submitted in any given calendar quarter, as applicable, such pending requests will be honored on a pro rata basis In the event that not all redemptions are being honored in a given quarter, the pro rata distributions will be rounded down to the nearest share for each shareholder. For investors who hold common shares with more than one record date, redemption requests will be applied to such common shares in the order in which they settled, on a last in first out basis – meaning, those common shares that have been continuously held for the shortest amount of time will be redeemed first.

In accordance with the SEC’s current guidance on redemption plans contained inT-REIT Inc.(June 4, 2001) andWells Real Estate Investment Trust II, Inc.(Dec. 3, 2003), we are prohibited from redeeming more than 5.0% of the weighted average number of common shares outstanding during the prior calendar year. Accordingly, we presently intend to limit the number of shares to be redeemed during any calendar quarter to 1.25% of the common shares outstanding, with excess capacity carried over to later calendar quarters in that calendar year. However, as we intend to make a number of different commercial real estate loans of varying terms and maturities, the Manager may elect to increase or decrease the amount of common shares available for redemption in any given calendar quarter, as these commercial real estate assets are paid off or sold, but in no event will we redeem more than 5.0% during any calendar year.

Notwithstanding the foregoing, we are not obligated to redeem common shares under the redemption plan, and, further, the Manager may, in its sole discretion, amend, suspend, or terminate the redemption plan at any time without notice, in order to protect our operations and/or our non-redeeming shareholders, to prevent an undue burden on our liquidity, to preserve our status as a REIT, following any material change in our NAV, or for any other reason. However, in the event that we amend, suspend or terminate our redemption plan, we will file an offering circular supplement and/or Form 1-U, as appropriate, to disclose such amendment. The Manager also may, in its sole discretion, decline any particular redemption request if it believes such action is necessary to preserve the Company’s status as a REIT. See “Description of Our Common Shares—Quarterly Redemption Plan” for more details.

| Q: | Will I be charged upfront selling commissions? |

| A: | No. Investors will not pay upfront selling commissions as part of the price per common share purchased in this offering. Additionally, there is no dealer manager fee or other service-related fee in connection with the offering and sale of our common shares through the REITless Platform. |

| Q: | Who will pay our organization and offering costs? |

| A: | Our Manager or its affiliates will pay on our behalf all costs incurred in connection with our organization and the offering of our shares. See “Estimated Use of Proceeds” for more information about the types of costs that may be incurred. Following the completion of the offering, we will start to reimburse the Manager, without interest, for these organization and offering costs incurred both before and after that date. Reimbursement payments will be made in quarterly installments, but the aggregate amount reimbursed cannot exceed 0.50% per annum of the aggregate gross offering proceeds from this offering. If the sum of the total unreimbursed amount of such organization and offering costs, plus new costs incurred since the last reimbursement payment, exceeds the reimbursement limit described above for the applicable quarterly installment, the excess will be eligible for reimbursement in subsequent quarters (subject to the 0.50% annual limit), calculated on an accumulated basis, until the Manager has been reimbursed in full. As of the date of this offering circular, the Manager has not begun to require reimbursement of offering expenses. |

| Q: | What fees and expenses will you pay to the Manager or any of its affiliates? |

| A: | We will pay the Manager a quarterly asset management fee at an annualized rate of up to 1.00% calculated on our net offering proceeds as of the end of each quarter until November 2, 2019, and thereafter will be based on our NAV at the end of each prior quarter. We will also pay the Manager a special servicing fee for any non-performing asset at an annualized rate of 1.00%, which will be based on the original value of such non-performing asset. Our Manager will determine, in its sole discretion, whether an asset is non-performing. |

Following the completion of the offering, we will reimburse the Manager for the organization and offering expenses that the Manager has paid or will pay on our behalf. We will also reimburse the Manager for out-of-pocket expenses in connection with the origination of our commercial real estate loans and other real estate related investments, to the extent not reimbursed by the borrower. Additionally, we will reimburse the Manager for out-of-pocket expenses paid to third parties in connection with providing services to us, including license fees, auditing fees, fees associated with SEC reporting requirements, increases in insurance costs, Delaware taxes and filing fees, administration fees, fees for the services of an independent representative, and third-party costs associated with these expenses. This does not include overhead, employee costs, utilities or technology costs of the Manager, NCIT or their affiliates. The expense reimbursements that we will pay to the Manager include expenses incurred by our Sponsor in the performance of services under the shared services agreement between the Manager and our Sponsor. See “Management—Shared Services Agreement.”

The payment by us of fees and expenses will reduce the cash available for investment and distribution and will directly impact our quarterly NAV. See “Management Compensation” for more details regarding the fees that will be paid to the Manager and its affiliates.

| A: | Yes, we intend to use direct or indirect leverage through financing or the issuance of preferred securities by the Company. Our targeted portfolio leverage, after we have acquired a substantial pool of assets and assembled a diversified portfolio, is between 0-75% of the fair market value of our assets. During the period when we are acquiring our initial portfolio, we may employ greater leverage on individual assets (that will also result in greater leverage of the initial portfolio) in order to quickly build a diversified portfolio of assets. Please see “Investment Objectives and Strategy” for more details. |

| Q: | How often will I receive distributions? |

| A: | We expect that the Manager will declare and pay distributions quarterly in arrears commencing in the first full quarter after the quarter in which we make our first real estate-related investment; however, the Manager may declare other periodic distributions as circumstances dictate. Any distributions we make will be at the discretion of the Manager, and will be based on, among other factors, our present and reasonably projected future cash flow. The Manager’s discretion as to the payment of distributions will be limited by the REIT distribution requirements, which generally require that we make aggregate annual distributions to our shareholders of at least 90% of our REIT taxable income, computed without regard to the dividends paid deduction and excluding net capital gain. Moreover, even if we make the required minimum distributions under the REIT rules, we will be subject to federal income and excise taxes on our undistributed taxable income and gains. As a result, the Manager intends to make such additional distributions, beyond the minimum REIT distribution, to avoid such taxes. See “Description of Our Common Shares — Distributions” and “U.S. Federal Income Tax Considerations.” |

Any distributions that we make will directly impact our NAV, by reducing the amount of our assets. Our goal is to provide a reasonably predictable and stable level of current income, through quarterly distributions, while at the same time maintaining a fair level of consistency in our NAV. Over the course of your investment, your distributions plus the change in NAV per share (either positive or negative) will produce your total return.

| Q: | What will be the source of your distributions? |

| A: | We may pay distributions from sources other than cash flow from operations, including from the proceeds of this offering and the private placements to our Sponsor and its employees and directors, interest or dividend income received from our investments, principal repayment of the loans that we make, and the sale of investments, among others, and we have no limit on the amounts we may pay from such sources. We expect that our cash flow from operations available for distribution will be lower in the initial stages of this offering until we have raised significant capital and made substantial investments. As a result, we expect that during the early stages of our operations, and from time to time thereafter, we may pay distributions from sources other than cash flows from operations. Distributions that represent a return of capital or exceed our operating cash flow will be reflected in our quarterly calculation of NAV. |

| Q: | Will the distributions I receive be taxable as ordinary income? |

| A: | Unless your investment is held in a qualified tax-deferred or tax-exempt account or we designate certain distributions as capital gain dividends, distributions that you receive generally will be taxed as ordinary income to the extent they are from current or accumulated earnings and profits. The portion of your distribution in excess of current and accumulated earnings and profits is considered a return of capital for U.S. federal income tax purposes and will reduce the tax basis of your investment, rather than result in current tax, until your basis is reduced to zero. Return of capital distributions made to you in excess of your tax basis in our common shares will be treated for U.S. federal income tax purposes as sales proceeds from the sale of our common shares. Distributions we designate as capital gain dividends will generally be taxable at long-term capital gains rates for U.S. federal income tax purposes. However, because each investor’s tax considerations are different, we recommend that you consult with your tax advisor. You also should review the section of this offering circular entitled “U.S. Federal Income Tax Considerations,” including for a discussion of the special rules applicable to distributions in redemption of shares and liquidating distributions. |

| Q: | May I reinvest my cash distributions in additional shares? |

| A: | Yes. While we have not adopted a distribution reinvestment plan whereby investors may elect to have their cash distributions automatically reinvested in additional common shares, so long as this offering remains ongoing, you may choose to use the proceeds of any distribution to purchase additional shares hereunder. The purchase price for such shares will be $10.00 until the date that is one year from the date on which the Offering Statement of which this Offering Circular forms a part is qualified by the SEC. Thereafter, the per share purchase price in this offering will be adjusted every fiscal quarter and, as of the end of March, June, September, and December of each year (or as soon as commercially reasonable and announced by us thereafter), will be equal to our NAV divided by the number of shares outstanding as of the close of business on the last business day of the fiscal quarter. Note, however, that under the rules applicable to us under Regulation A, we are only permitted to publicly offer up to $50,000,000 of our common shares in any twelve-month period. |

| Q: | Who might benefit from an investment in our shares? |

| A: | An investment in the Company’s shares may be beneficial for you if you seek to diversify your portfolio with a commercial real estate investment vehicle focused primarily on single-family, multi-family, and other commercial real estate loans, including senior and subordinated mortgage loans, mezzanine loans, participations in such loans, and other select real estate-related assets, seek to receive current income, seek to preserve capital and are able to hold your investment for a time period consistent with our liquidity strategy. On the other hand, we caution persons who require immediate liquidity or guaranteed income, or who seek a short-term investment, that an investment in the Company’s shares will not meet those needs. |

| Q: | Are there any risks involved in buying our shares? |

| A: | Investing in our common shares involves a high degree of risk. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives, and therefore, you should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” for a description of the risks relating to this offering and an investment in our shares. |

| Q: | How does a “best efforts” offering work? |

| A: | When common shares are offered to the public on a “best efforts” basis, we are only required to use our best efforts to sell our common shares. None of our Sponsor, Manager or any other party has a firm commitment or obligation to purchase any of our common shares (other than our Sponsor’s and its officers’ and directors’ commitment to purchase an aggregate of 50,000 common shares from us at $10.00 per share in private placements). |

| A: | Generally, you may purchase shares if you are a “qualified purchaser” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include: |

| · | “accredited investors” under Rule 501(a) of Regulation D; and |

| · | all other investors so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). |

However, our common shares are being offered and sold only to those investors that are within the latter category (i.e., investors whose investment in our common shares does not represent more than 10% of the applicable amount), regardless of an investor’s status as an “accredited investor.”

Net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A. Please refer to the section above entitled “State Law Exemption and Purchase Restrictions” for more information.

| A: | You may purchase our common shares in this offering by creating a new account, or logging into your existing account, at the REITless Platform. You will need to fill out a subscription agreement like the one attached to this offering circular as Appendix A for a certain investment amount and pay for the shares at the time you subscribe. |

| Q: | Is there any minimum investment required? |

| A: | Yes. You must initially purchase at least 100 shares in this offering, or $1,000 based on the current per share price. There is no minimum investment requirement on additional purchases after you have purchased a minimum of 100 shares. |

| Q: | May I make an investment through my IRA or other tax-deferred retirement account? |

| A: | Yes. You may make an investment through your IRA or other tax-deferred retirement account. In making these investment decisions, you should consider, at a minimum, (1) whether the investment is in accordance with the documents and instruments governing your IRA, plan or other retirement account, (2) whether the investment would constitute a prohibited transaction under applicable law, (3) whether the investment satisfies the fiduciary requirements associated with your IRA, plan or other retirement account, (4) whether the investment will generate unrelated business taxable income (“UBTI”) to your IRA, plan or other retirement account, and (5) whether there is sufficient liquidity for such investment under your IRA, plan or other retirement account. You should note that an investment in our common shares will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Code |

| Q: | Is there any minimum initial offering amount required to be sold? |

| A: | Yes. We will not start operations until we have raised at least $500,000 in this offering (not including the $500,000 received or to be received in the private placements to our Sponsor). Until the minimum threshold is met, investors’ funds will remain at the investors’ bank/financial institution and investors will not be admitted as shareholders. The funds will be drawn by us using an ACH electronic fund transfer through the Automated Clearing House network or wire transfer only after the $500,000 minimum threshold has been met. Investors may revoke their subscriptions until the minimum threshold has been reached. |

| Q: | What happens to my subscription if you don’t raise at least the $500,000 minimum threshold from third parties in this offering? |

| A: | We will not accept subscription payments associated with subscription agreements until the minimum threshold is met. At the time the minimum threshold is met, we will accept subscription payments, common shares will be issued, and investors will become shareholders. If we do not meet the minimum threshold within 12 months after commencing the offering, we will cancel the offering and release all investors from their commitments. |

| Q: | What will you do with the proceeds from your offering? |

| A: | We expect to use substantially all of the net proceeds from this offering (after paying or reimbursing organization and offering expenses) to invest in and manage a diverse portfolio of single-family, multi-family, and other commercial real estate loans, including senior and subordinated mortgage loans, mezzanine loans, participations in such loans, and other select real estate-related assets. We expect that any expenses or fees payable to the Manager for its services in connection with managing our daily affairs, including but not limited to, the selection and acquisition or origination of our investments, will be paid from cash flow from operations. If such fees and expenses are not paid from cash flow (or waived) they will reduce the cash available for investment and distribution and will directly impact our quarterly NAV. See “Management Compensation” for more details regarding the fees that will be paid to the Manager and its affiliates. |

We may not be able to promptly invest the net proceeds of this offering in commercial real estate loans and other select real estate-related assets. In the interim, we may invest in short-term, highly liquid or other authorized investments. Such short-term investments will not earn as high of a return as we expect to earn on our real estate-related investments.

| Q: | How long will this offering last? |

| A: | We currently expect that this offering will remain open for investors until we raise the maximum amount being offered, unless terminated by us at an earlier time. We reserve the right to terminate this offering for any reason at any time. |

| Q: | Will I be notified of how my investment is doing? |

| A: | Yes, we will provide you with periodic updates on the performance of your investment in us, including: |

| · | current event reports for specified material events within four business days of their occurrence; |

| · | supplements to the offering circular, if we have material information to disclose to you; and |

| · | other reports that we may file or furnish to the SEC from time to time. |

We will provide this information to you by posting such information on the SEC’s website atwww.sec.gov, on the REITless Platform atwww.reitless.com, via e-mail, or, upon your consent, via U.S. mail.

| Q: | When will I get my detailed tax information? |

| A: | Your IRS Form 1099-DIV tax information, if required, will be provided by January 31 of the year following each taxable year. |

| Q: | Who can help answer my questions about the offering? |

| A: | If you have more questions about the offering, or if you would like additional copies of this offering circular, you should contact us by email atinfo@reitless.com or by mail at: |

REITless Impact Income Strategies LLC

c/o North Capital, Inc.

623 E Fort Union Blvd., Suite 101

Salt Lake City, UT 84121

info@reitless.com

OFFERING SUMMARY

This offering summary highlights material information regarding our business and this offering that is not otherwise addressed in the “Questions and Answers About this Offering” section of this offering circular. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire offering circular carefully, including the “Risk Factors” section before making a decision to invest in our common shares.

REITless Impact Income Strategies LLC

REITless Impact Income Strategies LLC is a newly organized Delaware limited liability company formed to invest in and manage a diversified portfolio of single-family, multi-family, and other commercial real estate loans, including senior and subordinated mortgage loans, mezzanine loans, participations in such loans, and other real estate-related assets. The Company will focus its lending to companies, organizations, and projects with the intention to generate positive social and environmental impact alongside a financial return.

We intend to operate in a manner that will allow us to qualify as a REIT for U.S. federal income tax purposes. Among other requirements, REITs are required to distribute to shareholders at least 90% of their annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain).

Our office is located at 623 E Fort Union Blvd., Suite 101, Salt Lake City, UT 84047. Our telephone number is (888) 625-7768. Information regarding the Company is also available on our web site atwww.reitless.com.Information about the Sponsor and the Manager is available on the NCIT website, at www.northcapital.com.

Investment Strategy

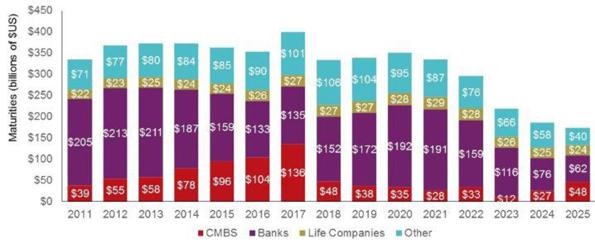

We intend to use substantially all of the proceeds of this offering to originate, invest in and manage a diversified portfolio of commercial real estate loans. We expect to use substantially all of the net proceeds from this offering to originate, acquire and structure single-family, multi-family, and other commercial real estate loans (including senior mortgage loans, subordinated mortgage loans or B-Notes, mezzanine loans, participations in such loans, other commercial real estate-related debt securities (including CMBS, CDOs and REIT senior and junior debt and certain REIT preferred equity securities), and other real estate-related assets.

We will seek to create and maintain a diversified portfolio of loans that generate cashflow through the periodic payment of interest and principal, allowing us to make regular dividend distributions to our shareholders. Our focus on investing in debt instruments will emphasize the payment of current returns to investors and preservation of invested capital as our primary investment objectives.

In addition to financial returns, The Company will focus on commercial real estate lending opportunities that have a high potential togenerate positive social and environmental impact, especially in housing, sustainable businesses, and other impactful business areas.

Our Manager intends to directly structure, underwrite and originate many of the debt products in which we invest, as this provides for the best opportunity to control our borrower and partner relationships and optimize the terms of our investments. Our underwriting process will involve comprehensive and systematic financial, structural, operational and legal due diligence of our borrowers and partners in order to identify and structure loans that meet our investment objectives. We feel the market environment offers a broad range of opportunities to source compelling investments with attractive risk-return profiles.

Investment Objectives

Our primary investment objectives are:

| · | to preserve, protect and return investors’ capital contributions; |

| · | to pay competitive and consistent cash distributions; |

| · | to create a positive social impact through our investments; |

| · | to create a repeatable investment process that allows the Company to continue to redeploy capital to achieve our investment objectives. |

We will also seek to realize growth in the value of our investments to the extent possible, although we expect most investments to be held to their maturity date or redeemed early at the option of the borrower. As such, we will likely have little ability to affect the timing of any asset dispositions.

Market Opportunities

We believe that the near- and medium-term market for investment in commercial real estate loans and commercial real estate-related debt securities is compelling from a risk-return perspective. Our strategy is expected to be weighted toward secured senior and mezzanine debt that maximizes current income, with significant subordinate capital and downside structural protections, while targeting our impact objectives. We believe that our investment strategy, combined with the investment expertise of the Manager’s management team, will provide opportunities to originate investments with attractive expected returns and strong structural features directly with real estate companies, in order to seek an attractive risk-return profile for the Company and our shareholders. We also believe that we will be able to create a favorable social and/or environmental impact through our investments.

Our Manager

North Capital, Inc., the Manager, manages our day-to-day operations. Our Manager is an affiliate of our Sponsor. A team of investment professionals, acting through the Manager, will make all the decisions regarding the selection, negotiation, financing and disposition of our investments, subject to the limitations in our operating agreement. Our Manager will also be responsible for asset management, marketing, investor relations and other administrative services on our behalf with the goal of maximizing our operating cash flow and preserving our invested capital. NCIT, our Sponsor, is also able to exercise significant control over our business. North Capital, Inc. is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training.

About the REITless Platform

The Company is an affiliate of the Sponsor, which is the owner and operator of an online financial platform focused on real estate debt investments, which may be found on the website:www.reitless.com(the “REITless Platform”).

James P. Dowd is the founder and Chief Executive Officer of NCIT, our Sponsor. Mr. Dowd is responsible for overseeing the day-to-day operations of the Sponsor, the Manager, and their affiliates.

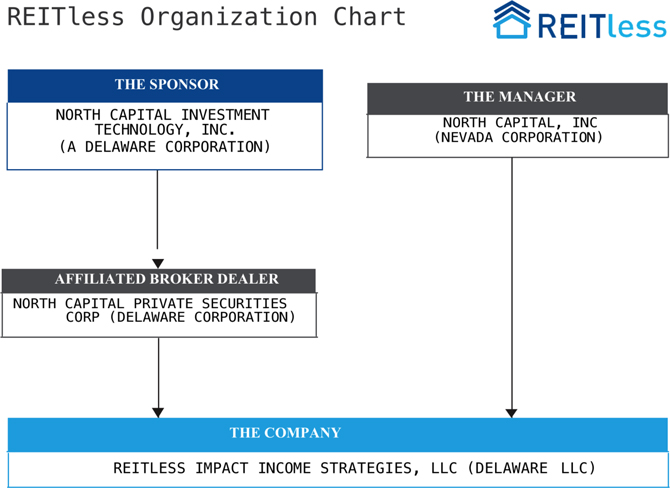

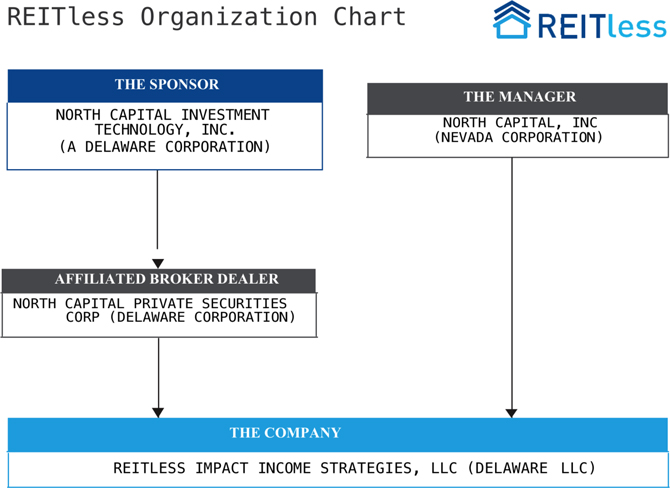

Our Structure

The chart below shows the relationship among various NCIT affiliates and the Company as of the date of this offering circular.

Management Compensation

Our Manager and its affiliates will receive fees and expense reimbursements for services relating to this offering and the investment and management of our assets. The items of compensation are summarized in the following table. Neither the Manager nor its affiliates will receive any selling commissions or dealer manager fees in connection with the offer and sale of our common shares.

No portion of the fees detailed below will be allocated to any individual in his or her capacity as an executive officer of our Sponsor or Manager.

See “Management Compensation” for a more detailed explanation of the fees and expenses payable to the Manager and its affiliates.

| Form of Compensation and Recipient | | Determination of Amount | | Estimated Amount |

| | | | | |

| | | Organization and Offering Stage | | |

| Organization and Offering Expenses — Manager | | To date, the Manager has paid $60,000 organization and offering expenses on our behalf. We will reimburse the Manager for these costs and future organization and offering costs it may incur on our behalf. We expect organization and offering expenses to not exceed $250,000 or, if we raise the maximum offering amount, approximately 0.5% of gross offering proceeds. | | $250,000 |

| | | | | |

| Distribution Sales and Marketing Allowance — Broker Sales Commission | | Investors will not pay upfront selling commissions as part of the price per share of our common shares purchased in this offering. The Manager will pay NCPS and certain brokers participating in the offering selling commissions quarterly from their asset management fee equal to an annualized rate of 0.25% of the proceeds from the sale of any shares that the broker executed. A portion of that sales commission will be paid to employees of our affiliates, who are serving as registered representatives of NCPS and to other broker-dealers not affiliated with us for their services in connection with the sale of our common shares. | | Actual amounts are dependent upon the offering proceeds we raise. The broker sales commission, assuming the maximum amount of this offering is raised and up to a 0.25% commission is paid on each executed sale, will be $125,000. These amounts will be paid quarterly by the Manager from its annual management fee and will not be directly charged to either the Company or its investors. |

| | | | | |

| | | Acquisition and Development Stage | | |

| Acquisition / Origination Fee — Sponsor or its Affiliate (2) | | The borrower may pay up to 5.0% of the amount funded by our Sponsor or affiliates of our Sponsor to acquire or originate commercial real estate loans or the amount invested in the case of other real estate investments, excluding any acquisition and origination expenses and any debt attributable to such investments. We will not be entitled to this fee. | | Paid directly by borrowers to our Sponsor or affiliates of our Sponsor, not by us.

Actual amounts are dependent upon the total equity and debt capital provided by the Company, the Sponsor, or their affiliates; we cannot determine these amounts at the present time. |

| | | | | |

| Reimbursement of Acquisition / Origination Expenses — Manager | | We will reimburse the Manager for actual expenses incurred in connection with the selection, acquisition, origination or due diligence of a prospective investment, to the extent not reimbursed by the borrower, subject to a 1% limit on the amount of the prospective investment, whether or not we ultimately acquire or originate the investment. | | Actual amounts are dependent upon the offering proceeds we raise (and any leverage we employ) and the number of investment opportunities considered by the Company. The maximum acquisition fee in a year, assuming the maximum amount of this offering is raised and we utilize leverage of 75% (the high end of the Company’s disclosed target leverage range), would be $2,000,000. |

| | | Operational Stage | | |

| Asset Management Fee — Manager (3) | | Quarterly asset management fee equal to an annualized rate of 1.00%, which, until November 2, 2019, will be based on our net offering proceeds as of the end of each quarter, and thereafter will be based on our NAV at the end of each prior quarter. | | Actual amounts are dependent upon the offering proceeds we raise (and any leverage we employ) and the results of our operations. The asset management fee, assuming the maximum amount of this offering is raised and we utilize leverage of 75% (the high end of the Company’s disclosed target leverage range), would be $500,000 per year. |

| | | | | |

| Other Operating Expenses — Manager | | We will reimburse the Manager for out of pocket expenses paid to third parties in connection with providing services to us, including license fees, auditing fees, fees associated with SEC reporting requirements, increases in insurance costs, Delaware taxes and filing fees, administration fees, fees for the services of an independent representative, and third-party costs associated with these expenses. This does not include overhead, employee costs, utilities or technology costs of the Manager, NCIT or their affiliates. The expense reimbursements that we will pay to the Manager also include expenses incurred by our Sponsor in the performance of services under the shared services agreement between the Manager and our Sponsor, including any increases in insurance attributable to the management or operation of the Company. | | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

| | | | | |

| | | Liquidation – Listing Stage | | |

| Disposition Fees | | None | | — |

| (1) | After we raise $1,000,000 in this offering and have begun our operations, we will start to reimburse the Manager, without interest, for these organization and offering costs incurred both before and after that date. Reimbursement payments will be made in quarterly installments, but the aggregate quarterly amount reimbursed can never exceed 0.50% of the aggregate gross offering proceeds from this offering. If the sum of the total unreimbursed amount of such organization and offering costs, plus new costs incurred since the last reimbursement payment, exceeds the reimbursement limit described above for the applicable quarterly installment, the excess will be eligible for reimbursement in subsequent quarters (subject to the 0.50% limit), calculated on an accumulated basis, until the Manager has been reimbursed in full. |

| (2) | The acquisition/origination fee paid to the Sponsor or its affiliates by borrowers is a percentage of the purchase price of an investment or the amount funded by us to acquire or originate a loan. The amount of the origination fee is determined through direct negotiations with a borrower and is generally a higher percentage (3-5%) for loan amounts below $500,000 and a lower percentage (1-2%) for loan amounts of $500,000 or more. |

| (3) | Our Manager in its sole discretion may defer or waive any fee payable to it under the operating agreement. All or any portion of any deferred fees will be deferred without interest and paid when the Manager determines. |

Summary of Risk Factors

Investing in our common shares involves a high degree of risk. You should carefully review the “Risk Factors” section of this offering circular, beginning on page24, which contains a detailed discussion of the material risks that you should consider before you invest in our common shares.

Conflicts of Interest

Our Manager and its affiliates will experience conflicts of interest in connection with the management of our business. Some of the material conflicts that the Manager and its affiliates will face include the following:

| · | Our Sponsor’s investment professionals, acting on behalf of the Manager, must determine which investment opportunities to recommend for the Company and for other investors whose accounts may be managed by the Sponsor or its affiliates. |

| · | Our Sponsor’s investment professionals, acting on behalf of the Manager will have to allocate their time among us, our Sponsor’s business and other programs and activities in which they are involved. At the date of this offering circular, the Sponsor is not involved in other real estate-related programs. |

| · | The terms of our operating agreement (including the Manager’s rights and obligations and the compensation payable to our Manager and its affiliates) were not negotiated at arm’s length and may be less attractive than an agreement negotiated with an independent third party. |

| · | The terms of our operating agreement limit the ability of our shareholders to remove the Manager. Our shareholders may only remove the Manager for “cause” following the affirmative vote of shareholders holding two-thirds of the outstanding common shares. Unsatisfactory financial performance does not constitute “cause” under the operating agreement. |

| · | At some future date after we have acquired a substantial investment portfolio that the Manager determines would be most effectively managed by our own personnel, we may seek shareholder approval to internalize the management of the Company by directly acquiring assets and employing the key investment and real estate and debt finance professionals performing services to us for consideration that would be negotiated at that time. The payment of such consideration could result in dilution to your interest in us and could reduce the net income per share and funds from operations per share attributable to your investment. Additionally, in an internalization transaction, the investment and real estate and debt finance professionals who become our employees may receive more compensation than they previously received from our Sponsor or its affiliates. These possibilities may provide incentives to these individuals to pursue an internalization transaction, even if an alternative strategy might otherwise be in our shareholders’ best interest. |

| · | Our Manager may, without shareholder consent (unless otherwise required by law), determine that we should merge or consolidate through a roll-up or other similar transaction involving other entities, into or with such other entities, including entities affiliated with the Manager. |

| · | As a non-traded company conducting an exempt offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements, including the requirements for a board of directors or independent board committees. |

Distributions

We expect the Manager to declare and pay distributions quarterly in arrears commencing in the second full quarter after the quarter in which we make our first real estate-related investment; however, the Manager may declare other periodic distributions as circumstances dictate. In order that investors may generally begin receiving distributions immediately upon our acceptance of their subscription, we expect to authorize and declare distributions based on daily record dates.