UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

Monroe Capital Income Plus Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Subject: Monroe Capital Income Plus Corporation – Special Stockholder Meeting – Action Requested

Hello Valued Advisor,

I hope you are doing well and thank you for your support of Monroe Capital Income Plus Corporation.

We are reaching out because there is a Special Shareholder Meeting (the “Special Meeting”) of Monroe Capital Income Plus Corporation (the “Company”) scheduled for February 21, 2025. As an advisor with clients invested in Monroe Capital Income Plus, those clients will be eligible to vote at the upcoming Special Meeting.

Under the Securities Exchange Act of 1934, as amended, all the Company’s shareholders must receive the proxy solicitation, therefore, we wanted you to be aware of this direct outreach.

We expect that shareholders will begin receiving proxy materials related to the Special Meeting shortly.

Their vote is very important.

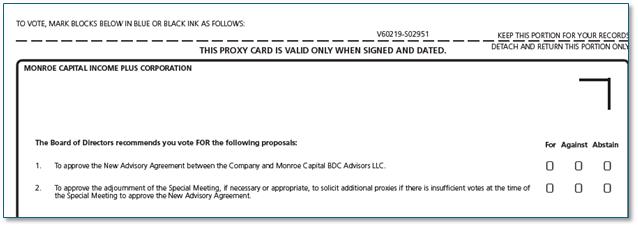

At this meeting, they will be asked to vote for two proposals:

| 1. | To approve the new investment management agreement (the “New Advisory Agreement”) between the Company and its current investment advisor, Monroe Capital BDC Advisors LLC (the “Adviser”) (the “New Advisory Agreement Proposal”); and |

| 2. | To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the New Advisory Agreement. |

In connection with the New Advisory Agreement Proposal, there will not be any changes to the terms, including the fee structure and services to be provided, under the existing advisory agreement between the Company and the Adviser compared to the New Advisory Agreement, other than the date and term of the New Advisory Agreement. No fees or expenses currently paid by the Company will change pursuant to the New Advisory Agreement. The Adviser will continue to serve as the investment adviser to the Company.

The Company’s Board of Directors recommend that the shareholders vote “FOR” both proposals, which we believe will benefit Monroe Capital Income Plus Corporation and its stockholders as outlined in the proxy materials you have received.

Monroe cannot accept shareholders’ vote directly, but your clients can easily go online to complete their vote. It takes less than 1 minute.

In the solicitation materials being sent, your clients will have access to a link to vote and they will be provided a personal control number.

www.proxyvote.com

If you need to assist your clients in finding their control number, please reach out to wealthmanagementir@monroecap.com for assistance.

For reference, here is a screen shot of the voting request:

We appreciate the support.

Thank you,

Dayna

Subject: Monroe Capital Income Plus Corporation – Special Stockholder Meeting – Action Requested

Hello Valued Shareholder,

I hope you are doing well and thank you for being an investor in Monroe Capital Income Plus Corporation.

We are reaching out because there is a Special Shareholder Meeting (the “Special Meeting”) of Monroe Capital Income Plus Corporation (the “Company”) scheduled for February 21, 2025. As a stockholder, you are eligible to participate in the proxy voting. Your vote is very important.

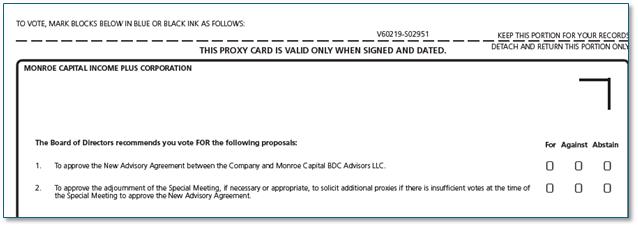

At this meeting, you are being asked to vote for two proposals:

| 1. | To approve the new investment management agreement (the “New Advisory Agreement”) between the Company and its current investment advisor, Monroe Capital BDC Advisors LLC (the “Adviser”) (the “New Advisory Agreement Proposal”); and |

| 2. | To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the New Advisory Agreement. |

In connection with the New Advisory Agreement Proposal, there will not be any changes to the terms, including the fee structure and services to be provided, under the existing advisory agreement between the Company and the Adviser compared to the New Advisory Agreement, other than the date and term of the New Advisory Agreement. No fees or expenses currently paid by the Company will change pursuant to the New Advisory Agreement. The Adviser will continue to serve as the investment adviser to the Company.

The Company’s Board of Directors recommend that you vote “FOR” both proposals, which we believe will benefit Monroe Capital Income Plus Corporation and its stockholders as outlined in the proxy materials you have received.

Monroe cannot accept your vote directly, but if you would, please go online to complete your vote. It takes less than 1 minute.

If you have already voted, thank you, and please disregard!

Please use the following link to vote with your personal control number highlighted below:

www.proxyvote.com

xxxxxxxxxxxxxxxx

Please let me know if you have any issues voting online.

For reference, here is a screen shot of the voting request:

Thank you,

Dayna