UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CPG COOPER SQUARE INTERNATIONAL EQUITY, LLC

CPG FOCUSED ACCESS FUND, LLC

CPG VINTAGE ACCESS FUND, LLC

CPG VINTAGE ACCESS FUND II, LLC

CPG VINTAGE ACCESS FUND III, LLC

CPG VINTAGE ACCESS FUND IV, LLC

(Name of Registrant(s) as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| CONFIDENTIAL - FOR ADVISOR USE ONLY - NOT FOR USE WITH CLIENTS |

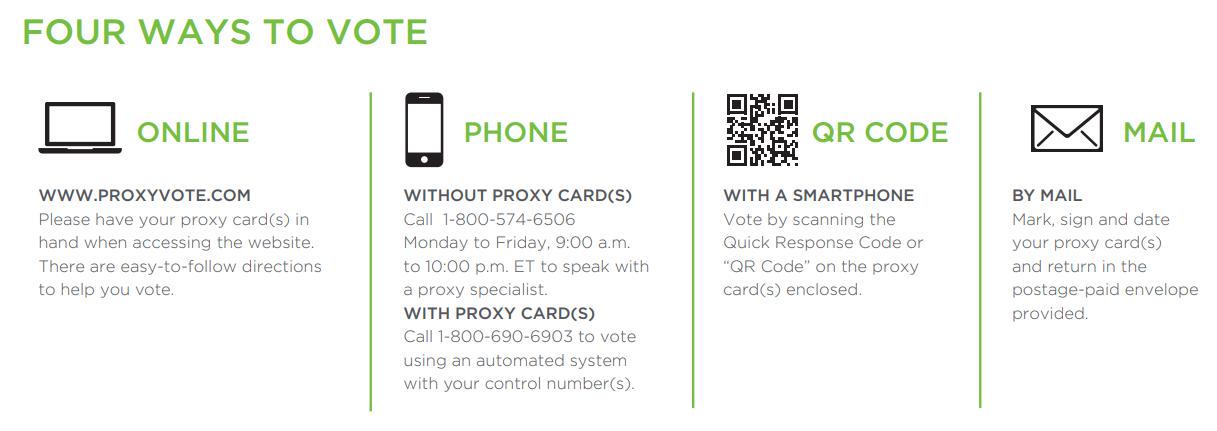

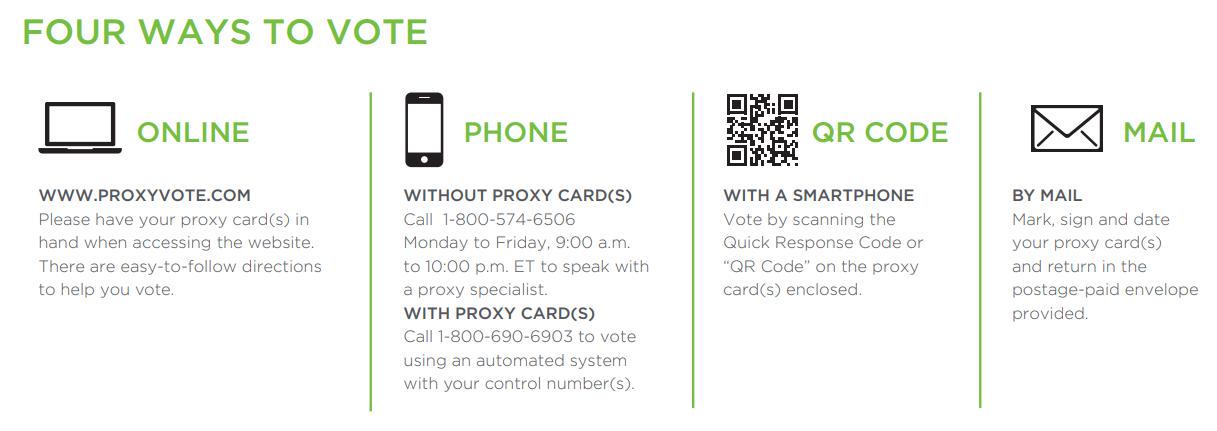

Dear Advisor, Hope 2022 is off to a great start for you and your team! By now you’re clients have received either email or hard copy proxy materials for Macquarie’s acquisition of CPG. Voting is simple and quick and can be done in one of four ways: • Online (link included in client email specific to them OR www.proxyvote.com) • Paper mail (postage paid envelope included in hard copy packages) • Phone (800-574-6506 without proxy card OR 800-690-6903 with proxy card) • QR code In addition, clients will also begin to receive calls from our third party proxy solicitation firm - Broadridge, starting this week. We’d greatly appreciate any help you can provide in directing clients to kindly submit their votes by Feb 17. As always, please don’t hesitate to reach out with any questions and/or to get important fund updates. Thank you for your help! -Central Park Group |

| CONFIDENTIAL - FOR ADVISOR USE ONLY - NOT FOR USE WITH CLIENTS |

This is not a proxy and we are not soliciting any proxy, which can only be accomplished in compliance with the Securities Exchange Act of 1934, as amended. See Proxy Statement for complete information. This material is not to be reproduced or distributed to any other persons (other than professional advisors of the investors or prospective investors, as applicable, receiving this material) and is intended solely for the use of the persons to whom it has been delivered. This material is not for distribution to the general public. Alternative investments often are speculative and include a high degree of risk. Investors could lose all or a substantial amount of their investment. Alternative investments are appropriate only for eligible, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time. They may be highly illiquid and can engage in leverage and other speculative practices that may increase the volatility and risk of loss. Alternative Investments typically have higher fees than traditional investments. Investors should carefully review and consider potential risks before investing. Certain of these risks may include but are not limited to: • Loss of all or a substantial portion of the investment due to leveraging, short-selling, or other speculative practices; • Lack of liquidity in that there may be no secondary market for a fund; • Volatility of returns; • Restrictions on transferring interests in a fund; • Potential lack of diversification and resulting higher risk due to concentration of trading authority when a single advisor is utilized; • Absence of information regarding valuations and pricing; • Complex tax structures and delays in tax reporting; • Less regulation and higher fees than mutual funds; • Risks associated with the operations, personnel, and processes of the manager; and • Risks associated with cybersecurity. All expressions of opinion are subject to change without notice and are not intended to be a forecast of future events or results. This is not a "research report" as defined by FINRA Rule 2241 or a "debt research report" as defined by FINRA Rule 2242. Certain information contained herein may constitute forward-looking statements. Due to various risks and uncertainties, actual events, results or the performance of a fund may differ materially from those reflected or contemplated in such forward-looking statements. Clients should carefully consider the investment objectives, risks, charges, and expenses of a fund before investing. Distribution services provided by Foreside Fund Services, LLC |

for additional information contact central park group 212.317.9200 | info@centralparkgroup.com |

Central Park Group | 500 Fifth Avenue, New York, NY 10110 Unsubscribe dtauber@centralparkgroup.com Update Profile | Constant Contact Data Notice Sent by info@centralparkgroup.com |

Central Park Group, LLC

CPG Fund Proxy FAQs

OVERVIEW

On October 21, 2021 Central Park Group, LLC (“CPG”) signed an agreement to be acquired by Macquarie Management Holdings, Inc. (together with its affiliates, “Macquarie”), with a closing anticipated to occur during the first quarter of 2022 (the “Closing”).

In connection therewith, investors in Central Park Group, LLC Funds (“Investors”) are being asked to vote to approve new investment advisory agreements &, in connection with CPG Cooper Square International Equity, LLC, a sub-investment advisory agreement.

The FAQs below provide answers to common questions. We hope this provides background on the transaction, why Investors are being asked to vote & information on the voting process. We greatly appreciate your continued support & assistance in encouraging your clients to vote.

For additional information, contact Central Park Group at info@centralparkgroup.com or (212) 317-9200.

FAQs

Why are Investors being asked to vote?

Following the Transaction, CPG will be part of an organization with greater scale, broader distribution capabilities & new opportunities to grow. CPG believes that the combination of Macquarie & CPG will position CPG under its new ownership to address the needs of individual investors & advisors by providing increased access to alternative investments along with an enhanced client experience. Approval of the new agreements will provide continuity of the Funds’ investment programs & allow operations to continue uninterrupted after the sale.

Upon the Closing of the Transaction, the below listed Funds’ investment advisory agreements will automatically terminate. Accordingly, Investors are being asked to vote on a proposal to approve a new investment advisory agreement to replace the agreement that will terminate.

CPG FOCUSED ACCESS FUND, LLC

CPG VINTAGE ACCESS FUND, LLC

CPG VINTAGE ACCESS FUND II, LLC

CPG VINTAGE ACCESS FUND III, LLC

CPG VINTAGE ACCESS FUND IV, LLC

CPG COOPER SQUARE INTERNATIONAL EQUITY, LLC

CPG Cooper Square International Equity, LLC Investors are also being asked to approve a new sub-investment advisory agreement.

How do the Funds’ Boards recommend that Investors vote on the Proposals?

The Funds’ Boards unanimously approved & recommend that Investors vote FOR the Proposals.

When will the proxy launch?

On or about January 4, 2022.

When is the deadline for voting?

Investors can vote until 11:59 p.m. Eastern Time on February 17, 2022. Investors can also attend the virtual Shareholder meeting on February 18, 2022 & transmit their voting instructions online during the meeting. See Proxy Statement for instructions on how to attend the meeting.

Why did my client receive more than one proxy?

Investors with more than one CPG Fund investment will receive proxy cards &/or emails with a unique control number for each investment. It is important that Investors vote with each & every control number.

Can Financial Advisors vote on behalf of an Investor?

Unless the advisor has discretion, Investors must cast their own votes.

How do Investors vote?

Why is it important for Investors to vote?

Votes & participation are very important to us, no matter how many units an Investor owns. If an Investor does not vote, we may have difficulty achieving a quorum & obtaining the necessary approvals.

To express our appreciation for Investor participation, Central Park Group will make a charitable donation to Ronald McDonald House New York in the amount of $1 per Investor that votes. Ronald McDonald House New York provides temporary housing & support services for families battling pediatric cancer & other serious illnesses as they travel to New York City for potentially lifesaving treatment.

How will Investors receive the proxy card?

Investors will receive their materials in hard-copy through the mail. Investors who provided CPG with their email & who have affirmatively consented to receive materials via email will receive their materials electronically.

Will Fund fees increase?

Fees will not change.

Will the proposed New Investment Advisory Agreements result in any changes to portfolio management, investment objective, or investment strategy of the Funds?

There will be no changes to the Funds’ investment objectives, strategies, risks or restrictions. Portfolio managers will continue in their current roles upon the Closing.

When is the Shareholder meeting?

February 18, 2022. Investors should cast their votes by February 17, 2022 or at the virtual Shareholder meeting.

Who is Broadridge?

CPG has engaged Broadridge as its proxy solicitor.

Are the Funds paying for the Transaction or proxy solicitation?

No. The Funds will not bear any portion of the costs associated with the Transaction or proxy solicitation.

Can Investors request paper or email copies of the proxy materials?

Copies may be requested from our proxy solicitor, Broadridge, at no charge:

- By Internet: www.proxyvote.com

- By Phone: 1-800-574-6506

How can Investors opt out of telephone calls about the proxy voting?

Once an Investor votes, phone solicitation should cease.

Will the date of investment change for tax &/or reporting purposes?

No.

What if I still have questions or need additional information?

Contact Central Park Group at (212) 317-9200 | email at info@centralparkgroup.com.