UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23377)

Tidal ETF Trust

(Exact name of registrant as specified in charter)

898 N. Broadway, Suite 2

Massapequa, New York 11758

(Address of principal executive offices) (Zip code)

Eric W. Falkeis

Tidal ETF Trust

898 N. Broadway, Suite 2

Massapequa, New York 11758

(Name and address of agent for service)

(844) 986-7676

Registrant's telephone number, including area code

Date of fiscal year end: February 28

Date of reporting period: February 28, 2021

Item 1. Reports to Stockholders.

(a)

SoFi Select 500 ETF

Ticker: SFY

SoFi Next 500 ETF

Ticker: SFYX

SoFi 50 ETF

Ticker: SFYF

SoFi Gig Economy ETF

Ticker: GIGE

SoFi Weekly Income ETF

Ticker: TGIF

Annual Report

February 28, 2021

SoFi Funds

TABLE OF CONTENTS |

A Message to our Shareholders | 1 |

Performance Summary | 6 |

Portfolio Allocations | 11 |

Schedules of Investments | 13 |

Statements of Assets and Liabilities | 37 |

Statements of Operations | 38 |

Statements of Changes in Net Assets | 39 |

Financial Highlights | 44 |

Notes to Financial Statements | 49 |

Report of Independent Registered Public Accounting Firm | 61 |

Expense Examples | 62 |

Basis for Trustees’ Approval of Investment Advisory and Sub-Advisory Agreements | 64 |

Statement Regarding Liquidity Risk Management Program | 67 |

Trustees and Executive Officers | 68 |

Additional Information | 71 |

SoFi Funds

Market Commentary

U.S. equity markets stabilized during the second half of 2020 and beginning of 2021 primarily due to an accommodative Federal Reserve policy and other fiscal stimulus, as well as the results of the U.S. presidential election. When or how the economy will fully reopen remains unclear, however, with the emergence of Covid-19 vaccines during this period the market and overall economy have seen a boost in optimism. What is clear is that many industries will struggle for quite some time and could need continued government assistance in the coming 18 months. The global trend toward digitalization and contactless transactions has been accelerated with the adoption of new ways of doing business due to the Work From Anywhere (“WFA”) phenomenon we are experiencing during the Covid-19 quarantine. Market dislocations always cause new adoptions of technology and processes. That, coupled with our need to work remotely, continues to push adoption rates of many gig economy trends to all-time highs.

The information presented in this report relates to the Funds performance for the fiscal year or fiscal period ended February 28, 2021 (the “fiscal period”), as applicable.

The SoFi Select 500 ETF

The SoFi Select 500 ETF (“SFY”) seeks to track the performance, before fees and expenses, of the Solactive SoFi US 500 Growth Index (the “SFY Index”).

Index Description:

In summary, the SFY Index is rebalanced and reconstituted annually. The process begins with the selection of the 500 largest constituents by market capitalization of the Solactive US Broad Market Index, which generally incudes common stocks and equity interests in real estate investment trusts (“REITs”). The weight of these constituents is initially based on their free-float market capitalization and then adjusted upward or downward based on three growth-oriented factors:

1) | trailing 12-month sales growth, |

2) | trailing 12-month earnings per share (“EPS”) growth, and |

3) | 12-month forward-looking EPS growth consensus estimates. |

The SFY Index’s construction does not naturally target any specific sector or industry, however, due to market conditions and certain factors, a sector such as Information Technology, may be relatively overweight/underweight for periods of time.

Fund Description:

SFY, via its index, is composed of 500 of the largest publicly traded U.S. companies and seeks to track the performance of the SFY Index.

Performance Overview:

During the fiscal period, SFY generated a total return of 36.04% (NAV) and 36.49% (Market). This compares to the 36.05% total return of the SFY Index, and the 31.29% total return of the benchmark, the S&P 500® Total Return Index, for the same period.

From a sector perspective, based on performance attribution to the overall portfolio, Technology and Financial were the leading contributors, while Consumer (Non-Cyclical), Real Estate, and Utilities were the leading detractors.

Reviewing individual stocks based on performance attribution to the overall portfolio, leading contributors included, Tesla, Inc., General Electric Co. and Berkshire Hathaway, Inc. Conversely, the leading detractors included Amazon.com, Inc., Salesforce.com, Inc., and Apple, Inc.

The SoFi Next 500 ETF

The SoFi Next 500 ETF (“SFYX”) seeks to track the performance, before fees and expenses, of the Solactive SoFi US Next 500 Growth Index (the “SFYX Index”).

Index Description:

Similar to the SFY Index described above, in summary, the SFYX Index is rebalanced and reconstituted annually, and the process begins with the selection of the next 500 largest constituents by market capitalization of the Solactive US Broad Market Index, and generally includes common stocks and equity interests in REITs. Again, the weight of these constituents is initially based on their free-float market capitalization and then adjusted upward or downward based on the same three growth-oriented factors:

1) | trailing 12-month sales growth, |

2) | trailing 12-month EPS growth, and |

1 |

SoFi Funds

3) | 12-month forward-looking EPS growth consensus estimates. |

The Index’s construction does not target any specific sector or industry but may be relatively overweight/underweight certain sectors for periods of time.

Fund Description:

SFYX, via the SFYX Index, is composed of 500 publicly traded U.S. companies in the second tier of 500 companies based on market capitalization and seeks to track the performance of the Index.

Performance Overview:

During the fiscal period, SFYX generated a total return of 40.17% (NAV) and 40.79% (Market). This compares to the 40.27% total return of the SFYX Index, and the 39.79% total return of the benchmark, the S&P MidCap 400® Total Return Index, for the same period.

From a sector perspective, based on performance attribution to the overall portfolio, Technology, Industrial, and Financial were the leading contributors, while Utilities and Energy were the leading detractors.

Reviewing individual stocks based on performance attribution to the overall portfolio, leading contributors included Enphase Energy, Inc., Axon Enterprise, Inc., and PTC, Inc. Conversely, the leading detractors included SolarWinds Corp., CyrusOne Inc., and Neurocrine Biosciences, Inc. were the leading detractors.

The SoFi 50 ETF

The SoFi 50 ETF (“SFYF”) seeks to track the performance, before fees and expenses, of the SoFi Social 50 Index (the “SFYF Index”). The investment strategy behind SFYF changed as of July 1, 2020, please see below for more information.

Index Description:

The SFYF Index is designed to reflect the 50 most widely held U.S.-listed equity securities in the self-directed brokerage accounts of SoFi Securities, LLC, an affiliate of Social Finance, Inc. (the “SoFi Accounts”), as weighted by aggregate holdings within the SoFi Accounts. Securities eligible for inclusion in the SFYF Index must: (a) be U.S.-listed equity securities held in SoFi Accounts, and (b) have an average daily trading volume of at least $10,000,000 during the preceding one-month and six-month periods (the “Eligible Universe”). The SFYF Index may include common stocks and equity interests in REITs. ETFs and other investment companies are not eligible for the SFYF Index.

Securities in the Eligible Universe are sorted based on:

1) | The number of SoFi Accounts that hold a particular security; and |

2) | The total market value of the security held in the SoFi Accounts. |

Each security in the Eligible Universe is then ranked from highest to lowest based on its “Weighted Average Value” (e.g., the security with the highest Weighted Average Value is assigned rank 1).

Subject to a “buffer rule” aimed at limiting SFYF Index turnover, securities ranked within the top 50 are included in the SFYF Index. Each security in the SFYF Index is then weighted based on its Weighted Average Value in relation to that of the other SFYF Index components and is subject to certain individual security weight and sector concentration caps. For example, the weight of each individual SFYF Index component is capped at 10%, and securities representing investments in any particular industry sector are capped at 50%. The SFYF Index is rebalanced and reconstituted monthly.

The SFYF Index’s construction does not target any specific sector or industry, however, due to market conditions and certain factors a sector may be relatively overweight/underweight for periods of time.

Fund Description:

SFYF, via the SFYF Index, is composed of the 50 most widely held U.S.-listed equity securities in the SoFi Accounts as weighted by their calculated Weighted Average Value (see above for detail) within the SoFi Accounts.

Performance Overview:

During the fiscal period, SFYF generated a total return of 57.67% (NAV) and 59.27% (Market). This compares to the 57.76% total return of the SoFi Social 50 Index for the same period, and the 31.29% total return of the benchmark, the S&P 500® Total Return Index.

2 |

SoFi Funds

From a sector perspective, based on performance attribution to the overall portfolio, Industrial, Communications, and Consumer (Non-Cyclical) were the leading contributors, while Consumer (Cyclical), Financial, and Energy were the leading detractors.

Reviewing individual stocks based on performance attribution to the overall portfolio, leading contributors included Moderna, Inc., Tesla, Inc., and Delta Air Lines, Inc. Conversely, the leading detractors included NIO, Inc., Amazon.com, Inc. and Apple, Inc.

The SoFi Gig Economy ETF

The SoFi Gig Economy ETF (“GIGE”) is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective primarily by investing in a portfolio of companies listed around the world that GIGE’s investment adviser considers part of the “gig economy”.

Fund Description:

The “gig economy” refers to the group of companies that have embraced, that support, or that otherwise benefit from a workforce where individual employees or independent contractors are empowered to create their own freelance business by leveraging recent developments in technology platforms that enable individuals to offer their services directly to retail and commercial customers. Examples of gig economy businesses include selling or reselling products through auction platforms or web-based stores and offering delivery services through an app-based platform.

The investment management team behind the strategy seeks investments in underlying companies that

● | drive the overall gig economy universe, |

● | transform the way our economy transacts goods and services, |

● | modify how work gets done, and |

● | embraces the work from home economy. |

These companies are broken up into categories, seeking direct participants, direct & indirect supportive gig economy businesses, companies that help facilitate processes within the gig economy, and any other ancillary benefiting companies because of the gig economy. These companies are put into a multi-tiered process based on their growth prospects within the gig economy and managed to allow for necessary concentration to generate alpha but not overconcentration which may cause significant volatility. The team actively rebalances the portfolio frequently, as such a new industry classification, GIGE can experience large individual position volatility and new issuances can occur frequently.

Performance Overview:

During the fiscal period, GIGE generated a total return of 124.22% (NAV) and 125.54% (Market). This compares to the 53.83% return of the Nasdaq-100® Total Return Index, and the 31.29% return of the benchmark, the S&P 500® Total Return Index, over the same period.

From a sector perspective, based on performance attribution to the overall portfolio, Consumer (Cyclical), Technology, and Communications were the largest contributors, while Financial and Real Estate detracted the most.

Reviewing individual stocks based on performance attribution to the overall portfolio, leading contributors included Upwork, Inc., Jumia Technologies AG, and Snap, Inc. Conversely, the leading detractors included Alibaba Group Holding Ltd., Momo, Inc., and Splunk, Inc.

The SoFi Weekly Income ETF

The SoFi Weekly income ETF (“TGIF”) is an actively-managed ETF that seeks to achieve weekly income by investing in investment grade and high-yield fixed income securities. TGIF expects to distribute income on Fridays. TGIF is actively managed by Income Research + Management (“IR + M”), TGIF’s sub-adviser, a value-oriented fixed income manager with over 30 years of experience. The Fund targets a duration of less than 3 years, with the goal to reduce interest rate risk relative to longer dated bonds. TGIF does not seek to replicate the performance of a specified index.

Fund Description:

TGIF seeks to achieve its investment objective, under normal circumstances, by investing in U.S.-dollar denominated investment grade and non-investment grade (also known as “high-yield” or “junk”) fixed income securities and instruments and expects to distribute income from its investments to shareholders weekly. TGIF anticipates making its weekly income distributions each Friday (or, in the event the New York Stock Exchange (the “NYSE “) is closed for trading on Friday, on a day earlier in the week). While obligations of any maturity may be purchased, under normal circumstances, TGIF will generally have a short to intermediate overall effective duration (i.e., typically less than three years). Effective duration is a measure of a fund’s price sensitivity to changes in yields or interest rates and

3 |

SoFi Funds

a fund with a higher effective duration will, under normal circumstances, have a greater sensitivity to interest rates. However, duration may not accurately reflect the true interest rate sensitivity of instruments held by TGIF and, therefore, the TGIF’s exposure to changes in interest rates.

Investment decisions for TGIF are made by IR +M primarily through a fundamental analysis of available debt instruments and their issuers.

IR+M applies a bottom-up investing approach focusing on the analysis of individual companies rather than on the industry or sector in which a company operates or on the economy as a whole.

IR+M’s bottom-up process focuses on the following attributes of investment opportunities:

● | Credit: IR+M evaluates the strength of a company’s management, its financial statements, and its competitive position in its industry or peer group. |

● | Structure: IR+M focuses on the shape of the curve reflecting the relationship of a bond’s price to interest rates (also known as “convexity”) with a particular interest in the extent to which an instrument may be callable (i.e., the issuer can redeem the bond prior to its maturity date) or have other such options attached to it that may affect the bond’s convexity. This analysis favors bonds with positive convexity (i.e., where the price would be expected to increase as interest rates rise) and those with structures that may add to the bond’s effective yield without increasing credit risk. |

● | Price: IR+M seeks bonds that it believes are under- or mis-priced and will seek to avoid bonds it determines are overpriced. |

Performance Overview:

During the period beginning October 1, 2020 (the Fund’s commencement of operations) and ended February 28, 2021, TGIF generated a total return of 4.91% (NAV) and 4.66% (Market). This compares to the 0.63% return of the benchmark, the Bloomberg Barclays 1-3 Year Credit Index.

From a sector perspective, based on performance attribution to the overall portfolio, Financial, Energy, and Industrial were the largest contributors, while Consumer (Non-Cyclical) and Utilities detracted the most.

Reviewing individual holdings based on performance attribution to the overall portfolio, leading contributors included Federal National Mortgage Association Interest Strips (5.000%, 1/25/43), AerCap Holdings N.V. (5.875% (5 Year CMT Rate + 4.535%, 10/10/79), and Cenovus Energy, Inc (5.375%, 7/15/25). Conversely, the leading detractors included U.S. Bancorp, Brookfield Finance, Inc. (4.625%, 10/16/80), and Federal National Mortgage Association Interest Strips (3.000%, 3/25/28).

Past performance does not guarantee future results.

Must be preceded or accompanied by a prospectus.

Investors buy and sell ETF shares through a brokerage account or an investment advisor. Like ordinary stocks, brokerage commissions, and/or transaction costs or service fees may apply. Please consult your broker or financial advisor for their fee schedule.

There is no guarantee that a Fund’s investment strategy will be successful. Shares may trade at a premium or discount to their NAV in the secondary market, and a fund’s holdings and returns may deviate from those of its index, if applicable. These variations may be greater when markets are volatile or subject to unusual conditions. A high portfolio turnover rate increases transaction costs, which may increase a Fund’s expenses. The Funds are newer and each has a limited operating history. You can lose money on your investment in a Fund. Diversification does not ensure profit or protect against loss in declining markets. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets. Because GIGE may invest in a single sector, country or industry, its shares do not represent a complete investment program. As non-diversified funds, the value of the GIGE’s and TGIF’s shares may fluctuate more than shares invested in a broader range of industries and companies because of concentration in a specific sector, country or industry.

The S&P 500® Total Return Index is an index of 500 large-capitalization companies selected by Standard & Poor’s Financial Services LLC. The S&P MidCap 400® Total Return Index is an index of 400 mid-capitalization companies selected by Standard & Poor’s Financial Services LLC. The Nasdaq-100® Total Return Index is an index of 100 of the largest non-financial securities, based on market capitalization, listed on The Nasdaq Stock Market, LLC. The Bloomberg Barclays 1-3 Year Credit Index is an index of investment grade, U.S. dollar-denominated, fixed-rate, taxable corporate and government-related debt with 1 to 3 years to maturity. It is not possible to invest directly in an index. Holdings are subject to change.

4 |

SoFi Funds

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of portfolio holdings, please refer to the Schedule of Investments provided in this report.

SoFi ETFs are distributed by Foreside Fund Services, LLC.

Social Finance, Inc. (“SoFi”) is not an affiliated person of the Funds, Toroso Investments, LLC, IR+M, the distributor, or any of their affiliates. SoFi and/or its affiliates, including SoFi Securities, LLC, do not make investment decisions, provide investment advice, or otherwise act in the capacity of an investment adviser to the Funds. SoFi has provided support in developing the methodology used by the SoFi Select 500 ETF, SoFi Next 500 ETF and SoFi 50 ETF’s underlying index to determine the securities included in such Index. However, SoFi is not involved in the maintenance of each such Index and does not act in the capacity of an index provider.

5 |

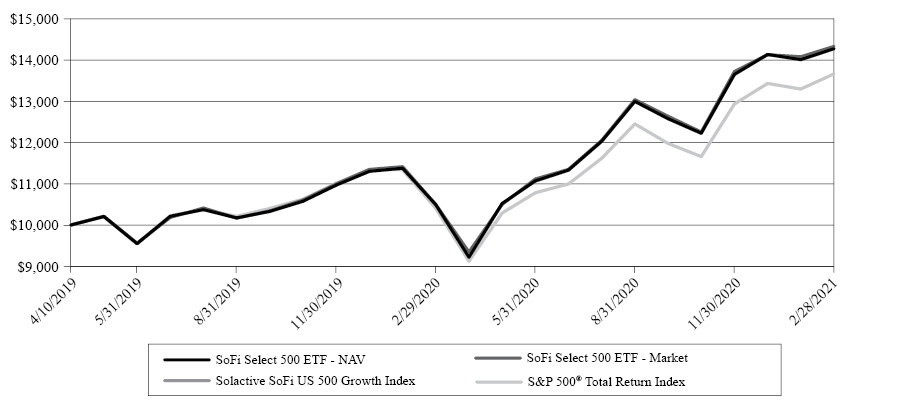

SoFi Select 500 ETF

Performance Summary (Unaudited) |

Annualized Returns for the Periods Ended February 28, 2021: | 1 Year | Since Inception | Ending Value |

SoFi Select 500 ETF - NAV | 36.04% | 20.76% | $ 14,277 |

SoFi Select 500 ETF - Market | 36.49% | 21.00% | 14,332 |

Solactive SoFi US 500 Growth Index | 36.05% | 20.75% | 14,275 |

S&P 500® Total Return Index | 31.29% | 17.99% | 13,665 |

This chart illustrates the performance of a hypothetical $10,000 investment made on April 10, 2019 (commencement of operations), and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect for the “NAV” return. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends, and return of capital, if applicable, for a fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 358-0096. The Fund’s gross expense ratio is 0.19% and net expense ratio is 0.00% (as of the Fund’s most recently filed Prospectus). The Fund’s investment adviser (defined below) has agreed to waive its Management Fees (defined below) for the Fund until at least June 30, 2021.

6 |

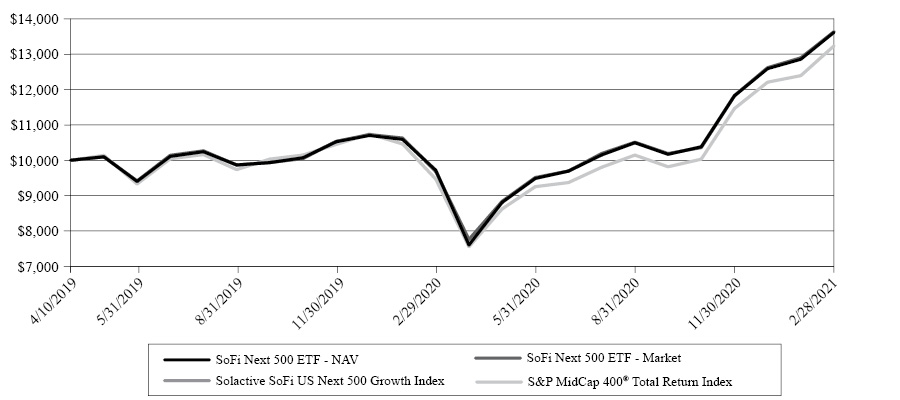

SoFi Next 500 ETF

Performance Summary (Unaudited) |

Annualized Returns for the Periods Ended February 28, 2021: | 1 Year | Since Inception | Ending Value |

SoFi Next 500 ETF - NAV | 40.17% | 17.77% | $ 13,618 |

SoFi Next 500 ETF - Market | 40.79% | 17.84% | 13,632 |

Solactive SoFi US Next 500 Growth Index | 40.27% | 17.86% | 13,636 |

S&P MidCap 400® Total Return Index | 39.79% | 16.01% | 13,236 |

This chart illustrates the performance of a hypothetical $10,000 investment made on April 10, 2019 (commencement of operations), and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect for the “NAV” return. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains, dividends, and return of capital, if applicable, for a fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 358-0096. The Fund’s gross expense ratio is 0.19% and net expense ratio is 0.00% (as of the Fund’s most recently filed Prospectus). The Fund’s investment adviser (defined below) has agreed to waive its Management Fees (defined below) for the Fund until at least June 30, 2021.

7 |

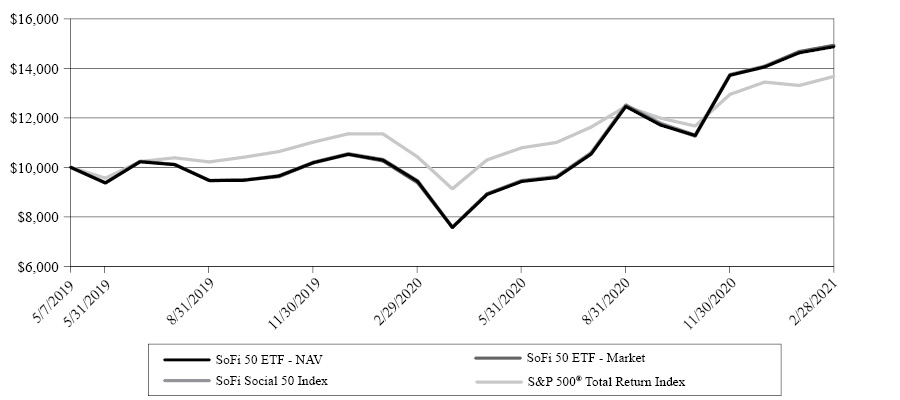

SoFi 50 ETF

Performance Summary (Unaudited) |

Annualized Returns for the Periods Ended February 28, 2021: | 1 Year | Since Inception | Ending Value |

SoFi 50 ETF - NAV | 57.67% | 24.47% | $ 14,874 |

SoFi 50 ETF - Market | 59.27% | 24.74% | 14,932 |

SoFi Social 50 Index | 57.76% | 24.68% | 14,919 |

S&P 500® Total Return Index | 31.29% | 18.84% | 13,675 |

This chart illustrates the performance of a hypothetical $10,000 investment made on May 7, 2019 (commencement of operations), and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains, dividends, and return of capital, if applicable, for a fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 358-0096. The Fund’s net expense ratio is 0.29% (as of the Fund’s most recently filed Prospectus.)

8 |

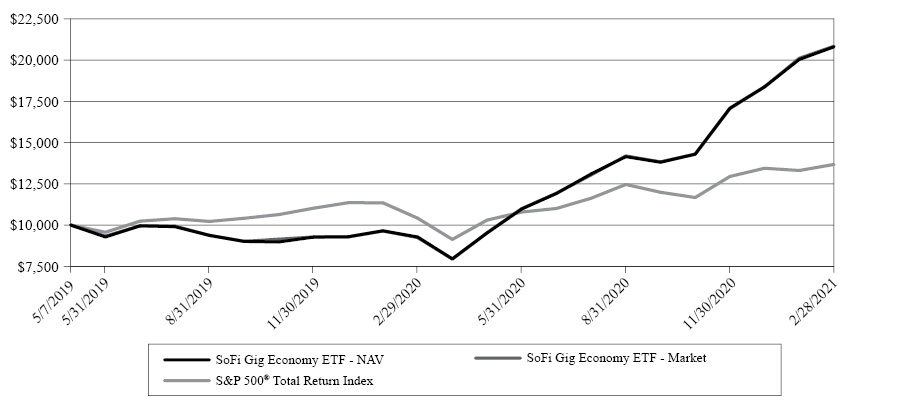

SoFi Gig Economy ETF

Performance Summary (Unaudited) |

Annualized Returns for the Periods Ended February 28, 2021: | 1 Year | Since Inception | Ending Value |

SoFi Gig Economy ETF - NAV | 124.22% | 49.77% | $ 20,804 |

SoFi Gig Economy ETF - Market | 125.54% | 49.91% | 20,840 |

S&P 500® Total Return Index | 31.29% | 18.84% | 13,675 |

This chart illustrates the performance of a hypothetical $10,000 investment made on May 7, 2019 (commencement of operations), and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains, dividends, and return of capital, if applicable, for a fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 358-0096. The Fund’s net expense ratio is 0.59% (as of the Fund’s most recently filed Prospectus).

9 |

SoFi Weekly Income ETF

Performance Summary (Unaudited) |

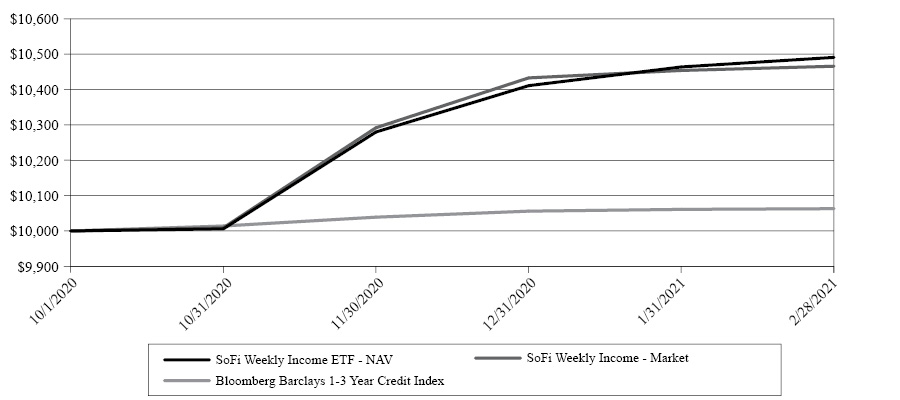

Total Return for the Period Ended February 28, 2021: | Since Inception | Ending Value |

SoFi Weekly Income ETF - NAV | 4.91% | $ 10,491 |

SoFi Weekly Income ETF - Market | 4.66% | 10,466 |

Bloomberg Barclays 1-3 Year Credit Index | 0.63% | 10,063 |

This chart illustrates the performance of a hypothetical $10,000 investment made on October 1, 2020 (commencement of operations), and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The charts assume reinvestment of capital gains, dividends, and return of capital, if applicable, for a fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 358-0096. The Fund’s net expense ratio is 0.59% (as of the Fund’s most recently filed Prospectus).

10 |

SoFi Funds

SOFI Select 500 ETF Portfolio Allocation at February 28, 2021 (Unaudited) |

Sector | % of Net Assets |

Technology | 23.6% |

Consumer (Non-Cyclical) | 22.7 |

Financial | 16.3 |

Communications | 15.3 |

Consumer (Cyclical) | 9.1 |

Industrial | 7.0 |

Utilities | 2.5 |

Basic Materials | 1.7 |

Energy | 1.7 |

Cash & Cash Equivalents (1) | 0.1 |

100.0% |

SOFI Next 500 ETF Portfolio ALLOCATION at February 28, 2021 (Unaudited) |

Sector | % of Net Assets |

Consumer (Non-Cyclical) | 22.5% |

Financial | 20.9 |

Technology | 18.6 |

Industrial | 14.3 |

Consumer (Cyclical) | 10.6 |

Communications | 5.8 |

Energy | 2.9 |

Basic Materials | 2.2 |

Utilities | 2.1 |

Cash & Cash Equivalents (1) | 0.1 |

100.0% |

SOFI 50 ETF Portfolio ALLOCATION at February 28, 2021 (Unaudited) |

Sector | % of Net Assets |

Consumer (Cyclical) | 31.1% |

Communications | 26.7 |

Technology | 20.6 |

Consumer (Non-Cyclical) | 13.8 |

Industrial | 4.3 |

Financial | 1.9 |

Energy | 1.5 |

Cash & Cash Equivalents (1) | 0.1 |

100.0% |

(1) | Represents cash, short-term investments and liabilities in excess of other assets. |

11 |

SoFi Funds

SOFI GIg Economy ETF Portfolio ALLOCATION at February 28, 2021 (Unaudited) |

Sector | % of Net Assets |

Communications | 58.7% |

Technology | 21.2 |

Consumer (Non-Cyclical) | 12.4 |

Financial | 3.7 |

Industrial | 2.5 |

Cash & Cash Equivalents (1) | 1.2 |

Consumer (Cyclical) | 0.3 |

100.0% |

(1) | Represents cash, short-term investments and liabilities in excess of other assets. |

SOFI Weekly Income ETF Portfolio ALLOCATION at February 28, 2021 (Unaudited) |

Sector | % of Net Assets |

Financial | 35.0 |

Energy | 16.4 |

Consumer (Cyclical) | 8.9 |

Industrial | 8.8 |

Communications | 6.6 |

Technology | 6.0 |

Consumer (Non-Cyclical) | 5.4 |

Cash & Cash Equivalents (2) | 2.9 |

Asset Backed Securities | 2.5 |

Mortgage Backed Securitites | 2.5 |

Municipal Bonds | 2.2 |

Basic Materials | 1.6 |

Utilities | 1.2 |

100.0 |

(2) | Represents cash, short-term investments and other assets in excess of liabilities . |

12 |

SoFi Select 500 ETF

Schedule of Investments at February 28, 2021 |

| Shares | Value | ||||||

Common Stocks — 99.9% | ||||||||

Advertising — 0.1% | ||||||||

Omnicom Group, Inc. | 784 | $ | 53,884 | |||||

The Trade Desk, Inc. - Class A (1) | 137 | 110,339 | ||||||

| 164,223 | ||||||||

Aerospace & Defense — 1.4% | ||||||||

The Boeing Co. | 5,342 | 1,132,557 | ||||||

General Dynamics Corp. | 1,297 | 212,021 | ||||||

L3Harris Technologies, Inc. (1) | 1,694 | 308,156 | ||||||

Lockheed Martin Corp. | 1,274 | 420,739 | ||||||

Northrop Grumman Corp. | 820 | 239,161 | ||||||

Teledyne Technologies, Inc. (1) | 150 | 55,650 | ||||||

TransDigm Group, Inc. | 241 | 138,977 | ||||||

| 2,507,261 | ||||||||

Agriculture — 0.9% | ||||||||

Altria Group, Inc. | 22,944 | 1,000,359 | ||||||

Archer-Daniels-Midland Co. | 2,366 | 133,868 | ||||||

Philip Morris International, Inc. | 6,590 | 553,692 | ||||||

| 1,687,919 | ||||||||

Airlines — 0.1% | ||||||||

Delta Air Lines, Inc. | 2,152 | 103,167 | ||||||

Southwest Airlines Co. | 1,905 | 110,738 | ||||||

United Airlines Holdings, Inc. (1) | 912 | 48,044 | ||||||

| 261,949 | ||||||||

Apparel — 0.6% | ||||||||

Nike, Inc. - Class B | 6,798 | 916,234 | ||||||

VF Corp. | 1,377 | 108,962 | ||||||

| 1,025,196 | ||||||||

Auto Manufacturers — 2.8% | ||||||||

Cummins, Inc. | 512 | 129,638 | ||||||

Ford Motor Co. | 9,578 | 112,063 | ||||||

General Motors Co. | 4,629 | 237,606 | ||||||

PACCAR, Inc. | 1,231 | 112,009 | ||||||

Tesla, Inc. (1) | 6,580 | 4,444,790 | ||||||

| 5,036,106 | ||||||||

Banks — 3.7% | ||||||||

Bank of America Corp. | 30,449 | 1,056,885 | ||||||

The Bank of New York Mellon Corp. | 3,518 | 148,319 | ||||||

Citigroup, Inc. | 7,515 | 495,088 | ||||||

Citizens Financial Group, Inc. | 1,466 | 63,683 | ||||||

Fifth Third Bancorp | 2,689 | 93,281 | ||||||

First Republic Bank | 689 | 113,513 | ||||||

The Goldman Sachs Group, Inc. | 1,255 | 400,947 | ||||||

Huntington Bancshares, Inc. | 3,752 | 57,556 | ||||||

JPMorgan Chase & Co. | 11,656 | 1,715,414 | ||||||

KeyCorp | 3,431 | 69,100 | ||||||

| Shares | Value | ||||||

Banks — 3.7% (Continued) | ||||||||

Morgan Stanley | 6,910 | $ | 531,172 | |||||

Northern Trust Corp. | 823 | 78,292 | ||||||

The PNC Financial Services Group, Inc. | 1,573 | 264,830 | ||||||

Regions Financial Corp. | 3,282 | 67,708 | ||||||

State Street Corp. | 1,355 | 98,603 | ||||||

SVB Financial Group (1) | 196 | 99,051 | ||||||

Truist Financial Corp. | 5,942 | 338,456 | ||||||

U.S. Bancorp | 5,556 | 277,800 | ||||||

Wells Fargo & Co. | 14,928 | 539,946 | ||||||

| 6,509,644 | ||||||||

Beverages — 1.4% | ||||||||

Brown-Forman Corp. - Class B | 1,153 | 82,532 | ||||||

The Coca-Cola Co. | 19,691 | 964,662 | ||||||

Constellation Brands, Inc. - Class A | 665 | 142,403 | ||||||

Keurig Dr Pepper, Inc. | 10,431 | 318,354 | ||||||

Molson Coors Brewing Co. - Class B (2) | 1,301 | 57,830 | ||||||

Monster Beverage Corp. (1) | 2,177 | 191,010 | ||||||

PepsiCo, Inc. | 5,275 | 681,477 | ||||||

| 2,438,268 | ||||||||

Biotechnology — 2.3% | ||||||||

Alexion Pharmaceuticals, Inc. (1) | 5,407 | 825,919 | ||||||

Alnylam Pharmaceuticals, Inc. (1) | 539 | 79,826 | ||||||

Amgen, Inc. | 2,336 | 525,413 | ||||||

Biogen, Inc. (1) | 673 | 183,648 | ||||||

BioMarin Pharmaceutical, Inc. (1) | 2,522 | 195,278 | ||||||

Bio-Rad Laboratories, Inc. - Class A (1) | 201 | 117,485 | ||||||

Corteva, Inc. | 10,166 | 458,995 | ||||||

Exact Sciences Corp. (1) | 557 | 75,819 | ||||||

Gilead Sciences, Inc. | 6,008 | 368,891 | ||||||

Illumina, Inc. (1) | 612 | 268,919 | ||||||

Incyte Corp. (1) | 2,117 | 166,523 | ||||||

Moderna, Inc. (1)(2) | 1,176 | 182,057 | ||||||

Regeneron Pharmaceuticals, Inc. (1) | 569 | 256,374 | ||||||

Seagen, Inc. (1) | 514 | 77,671 | ||||||

Vertex Pharmaceuticals, Inc. (1) | 1,253 | 266,325 | ||||||

| 4,049,143 | ||||||||

Building Materials — 0.2% | ||||||||

Johnson Controls International PLC | 2,827 | 157,718 | ||||||

Martin Marietta Materials, Inc. | 273 | 91,966 | ||||||

Masco Corp. | 896 | 47,685 | ||||||

Vulcan Materials Co. | 588 | 98,190 | ||||||

| 395,559 | ||||||||

The accompanying notes are an integral part of these financial statements.

13 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Chemicals — 1.1% | ||||||||

Air Products and Chemicals, Inc. | 904 | $ | 231,080 | |||||

Albemarle Corp. (2) | 408 | 64,142 | ||||||

Celanese Corp. | 433 | 60,148 | ||||||

Dow, Inc. | 3,241 | 192,224 | ||||||

DuPont de Nemours, Inc. | 6,051 | 425,506 | ||||||

Eastman Chemical Co. | 461 | 50,369 | ||||||

Ecolab, Inc. | 1,071 | 224,225 | ||||||

FMC Corp. | 517 | 52,574 | ||||||

International Flavors & Fragrances, Inc. | 530 | 71,820 | ||||||

LyondellBasell Industries NV | 1,055 | 108,760 | ||||||

PPG Industries, Inc. | 961 | 129,562 | ||||||

The Sherwin-Williams Co. | 415 | 282,341 | ||||||

| 1,892,751 | ||||||||

Commercial Services — 3.2% | ||||||||

Automatic Data Processing, Inc. | 1,885 | 328,028 | ||||||

Booz Allen Hamilton Holding Corp. | 614 | 47,364 | ||||||

Cintas Corp. | 387 | 125,520 | ||||||

CoStar Group, Inc. (1) | 145 | 119,445 | ||||||

Equifax, Inc. | 455 | 73,655 | ||||||

FleetCor Technologies, Inc. (1) | 315 | 87,353 | ||||||

Gartner, Inc. (1) | 470 | 84,149 | ||||||

Global Payments, Inc. | 2,777 | 549,818 | ||||||

IHS Markit Ltd. | 2,257 | 203,491 | ||||||

MarketAxess Holdings, Inc. | 157 | 87,283 | ||||||

Moody’s Corp. | 795 | 218,537 | ||||||

PayPal Holdings, Inc. (1) | 5,509 | 1,431,514 | ||||||

Rollins, Inc. | 1,802 | 59,772 | ||||||

S&P Global, Inc. | 984 | 324,090 | ||||||

Square, Inc. - Class A (1) | 7,430 | 1,709,123 | ||||||

TransUnion | 919 | 77,389 | ||||||

United Rentals, Inc. (1) | 267 | 79,400 | ||||||

Verisk Analytics, Inc. | 749 | 122,724 | ||||||

| 5,728,655 | ||||||||

Computers — 5.6% | ||||||||

Accenture PLC - Class A | 2,568 | 644,311 | ||||||

Amdocs Ltd. | 590 | 44,728 | ||||||

Apple, Inc. | 63,571 | 7,708,619 | ||||||

Cognizant Technology Solutions Corp. | 1,979 | 145,417 | ||||||

Dell Technologies, Inc. - Class C (1) | 2,087 | 169,193 | ||||||

EPAM Systems, Inc. (1) | 241 | 90,040 | ||||||

Fortinet, Inc. (1)(2) | 763 | 128,833 | ||||||

Hewlett Packard Enterprise Co. | 7,451 | 108,487 | ||||||

HP, Inc. | 5,450 | 157,886 | ||||||

| Shares | Value | ||||||

Computers — 5.6% (Continued) | ||||||||

International Business Machines Corp. | 3,675 | $ | 437,068 | |||||

Leidos Holdings, Inc. | 596 | 52,716 | ||||||

NetApp, Inc. | 780 | 48,828 | ||||||

Seagate Technology PLC | 1,038 | 76,013 | ||||||

Western Digital Corp. | 1,317 | 90,254 | ||||||

| 9,902,393 | ||||||||

Cosmetics & Personal Care — 1.3% | ||||||||

Colgate-Palmolive Co. | 3,616 | 271,923 | ||||||

The Estee Lauder Companies, Inc. - Class A | 917 | 262,134 | ||||||

The Procter & Gamble Co. | 14,880 | 1,838,126 | ||||||

| 2,372,183 | ||||||||

Distribution & Wholesale — 0.2% | ||||||||

Copart, Inc. (1) | 893 | 97,480 | ||||||

Fastenal Co. | 2,133 | 98,907 | ||||||

LKQ Corp. (1) | 1,079 | 42,502 | ||||||

W.W. Grainger, Inc. | 219 | 81,623 | ||||||

| 320,512 | ||||||||

Diversified Financial Services — 3.2% | ||||||||

American Express Co. | 3,051 | 412,678 | ||||||

Ameriprise Financial, Inc. | 490 | 108,408 | ||||||

BlackRock, Inc. | 612 | 425,034 | ||||||

Capital One Financial Corp. | 1,450 | 174,275 | ||||||

Cboe Global Markets, Inc. (2) | 488 | 48,292 | ||||||

The Charles Schwab Corp. | 7,391 | 456,173 | ||||||

CME Group, Inc. - Class A | 1,682 | 335,895 | ||||||

Discover Financial Services | 1,054 | 99,150 | ||||||

Franklin Resources, Inc. | 1,628 | 42,605 | ||||||

Intercontinental Exchange, Inc. | 2,249 | 248,087 | ||||||

Mastercard, Inc. - Class A | 4,203 | 1,487,232 | ||||||

Nasdaq, Inc. | 817 | 112,983 | ||||||

Raymond James Financial, Inc. | 529 | 61,755 | ||||||

Synchrony Financial | 1,988 | 76,896 | ||||||

T. Rowe Price Group, Inc. | 858 | 139,116 | ||||||

Visa, Inc. - Class A | 6,820 | 1,448,500 | ||||||

The Western Union Co. | 1,548 | 35,945 | ||||||

| 5,713,024 | ||||||||

Electric — 2.3% | ||||||||

The AES Corp. | 4,153 | 110,304 | ||||||

Alliant Energy Corp. | 1,132 | 52,253 | ||||||

Ameren Corp. | 1,103 | 77,508 | ||||||

American Electric Power Co., Inc. | 2,200 | 164,670 | ||||||

Avangrid, Inc. | 1,428 | 65,345 | ||||||

CenterPoint Energy, Inc. | 2,941 | 57,173 | ||||||

CMS Energy Corp. | 1,296 | 70,127 | ||||||

Consolidated Edison, Inc. | 1,576 | 103,464 | ||||||

Dominion Energy, Inc. | 5,293 | 361,618 | ||||||

The accompanying notes are an integral part of these financial statements.

14 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Electric — 2.3% (Continued) | ||||||||

DTE Energy Co. | 793 | $ | 93,352 | |||||

Duke Energy Corp. | 3,691 | 315,913 | ||||||

Edison International | 4,338 | 234,209 | ||||||

Entergy Corp. | 939 | 81,515 | ||||||

Evergy, Inc. | 1,119 | 60,012 | ||||||

Eversource Energy | 1,622 | 128,917 | ||||||

Exelon Corp. | 4,686 | 180,880 | ||||||

FirstEnergy Corp. | 2,679 | 88,782 | ||||||

NextEra Energy, Inc. | 8,353 | 613,778 | ||||||

PG&E Corp. (1) | 2,796 | 29,386 | ||||||

Pinnacle West Capital Corp. | 484 | 33,846 | ||||||

PPL Corp. | 3,259 | 85,353 | ||||||

Public Service Enterprise Group, Inc. | 2,229 | 119,987 | ||||||

Sempra Energy | 1,516 | 175,826 | ||||||

The Southern Co. | 5,578 | 316,384 | ||||||

Vistra Corp. | 10,866 | 187,438 | ||||||

WEC Energy Group, Inc. | 1,471 | 118,621 | ||||||

Xcel Energy, Inc. (2) | 2,328 | 136,397 | ||||||

| 4,063,058 | ||||||||

Electrical Components & Equipment — 0.2% | ||||||||

AMETEK, Inc. | 850 | 100,275 | ||||||

Emerson Electric Co. | 2,206 | 189,495 | ||||||

| 289,770 | ||||||||

Electronics — 1.0% | ||||||||

Agilent Technologies, Inc. | 1,187 | 144,897 | ||||||

Amphenol Corp. | 1,058 | 132,969 | ||||||

Fortive Corp. | 1,593 | 104,851 | ||||||

Garmin Ltd. | 834 | 103,433 | ||||||

Honeywell International, Inc. | 2,628 | 531,776 | ||||||

Keysight Technologies, Inc. (1) | 1,610 | 227,847 | ||||||

Mettler-Toledo International, Inc. (1) | 94 | 104,909 | ||||||

Roper Technologies, Inc. | 418 | 157,845 | ||||||

TE Connectivity Ltd. | 1,090 | 141,733 | ||||||

Vontier Corp. (1) | 634 | 19,907 | ||||||

Waters Corp. (1) | 244 | 66,827 | ||||||

| 1,736,994 | ||||||||

Engineering & Construction — 0.1% | ||||||||

Jacobs Engineering Group, Inc. | 798 | 91,834 | ||||||

Entertainment — 0.0% (3) | ||||||||

Live Nation Entertainment, Inc. (1) | 708 | 62,913 | ||||||

| ||||||||

| Shares | Value | ||||||

Environmental Control — 0.2% | ||||||||

Republic Services, Inc. | 1,249 | $ | 111,273 | |||||

Waste Management, Inc. | 1,695 | 187,959 | ||||||

| 299,232 | ||||||||

Food — 1.0% | ||||||||

Campbell Soup Co. (2) | 3,500 | 159,180 | ||||||

Conagra Brands, Inc. | 2,476 | 84,011 | ||||||

General Mills, Inc. | 2,508 | 137,965 | ||||||

The Hershey Co. | 664 | 96,712 | ||||||

Hormel Foods Corp. (2) | 2,221 | 102,988 | ||||||

The J.M. Smucker Co. (2) | 536 | 60,032 | ||||||

Kellogg Co. | 1,417 | 81,775 | ||||||

The Kraft Heinz Co. | 7,774 | 282,818 | ||||||

The Kroger Co. | 2,929 | 94,343 | ||||||

McCormick & Co., Inc. | 873 | 73,576 | ||||||

Mondelez International, Inc. | 6,096 | 324,063 | ||||||

Sysco Corp. | 2,065 | 164,436 | ||||||

Tyson Foods, Inc. - Class A | 1,365 | 92,370 | ||||||

| 1,754,269 | ||||||||

Forest Products & Paper — 0.0% (3) | ||||||||

International Paper Co. (2) | 1,339 | 66,481 | ||||||

Gas — 0.1% | ||||||||

Atmos Energy Corp. | 552 | 46,705 | ||||||

NiSource, Inc. | 8,555 | 184,788 | ||||||

| 231,493 | ||||||||

Hand & Machine Tools — 0.1% | ||||||||

Snap-on, Inc. | 197 | 40,013 | ||||||

Stanley Black & Decker, Inc. | 794 | 138,823 | ||||||

| 178,836 | ||||||||

Healthcare - Products — 3.9% | ||||||||

Abbott Laboratories | 10,147 | 1,215,408 | ||||||

ABIOMED, Inc. (1) | 159 | 51,604 | ||||||

Align Technology, Inc. (1) | 506 | 286,958 | ||||||

Baxter International, Inc. (2) | 2,355 | 182,960 | ||||||

Boston Scientific Corp. (1) | 8,017 | 310,899 | ||||||

The Cooper Companies, Inc. | 252 | 97,305 | ||||||

Danaher Corp. | 2,732 | 600,138 | ||||||

DENTSPLY SIRONA, Inc. | 1,576 | 83,638 | ||||||

Edwards Lifesciences Corp. (1) | 2,985 | 248,054 | ||||||

Hologic, Inc. (1) | 2,004 | 144,468 | ||||||

IDEXX Laboratories, Inc. (1) | 341 | 177,378 | ||||||

Insulet Corp. (1) | 868 | 224,899 | ||||||

Intuitive Surgical, Inc. (1) | 493 | 363,242 | ||||||

Masimo Corp. (1) | 187 | 46,887 | ||||||

Medtronic PLC | 5,825 | 681,350 | ||||||

PerkinElmer, Inc. | 536 | 67,584 | ||||||

QIAGEN NV (1) | 2,487 | 124,350 | ||||||

The accompanying notes are an integral part of these financial statements.

15 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Healthcare - Products — 3.9% (Continued) | ||||||||

ResMed, Inc. | 654 | $ | 126,078 | |||||

STERIS PLC | 452 | 79,010 | ||||||

Stryker Corp. | 1,486 | 360,637 | ||||||

Teleflex, Inc. | 293 | 116,649 | ||||||

Thermo Fisher Scientific, Inc. | 1,863 | 838,499 | ||||||

Varian Medical Systems, Inc. (1) | 357 | 62,571 | ||||||

West Pharmaceutical Services, Inc. | 272 | 76,337 | ||||||

Zimmer Biomet Holdings, Inc. | 2,070 | 337,534 | ||||||

| 6,904,437 | ||||||||

Healthcare - Services — 1.8% | ||||||||

Anthem, Inc. | 1,136 | 344,424 | ||||||

Catalent, Inc. (1) | 787 | 89,490 | ||||||

Centene Corp. (1) | 3,920 | 229,477 | ||||||

DaVita, Inc. (1) | 454 | 46,367 | ||||||

HCA Healthcare, Inc. | 1,368 | 235,337 | ||||||

Humana, Inc. | 613 | 232,726 | ||||||

IQVIA Holdings, Inc. (1) | 2,284 | 440,332 | ||||||

Laboratory Corp. of America Holdings (1) | 364 | 87,327 | ||||||

Molina Healthcare, Inc. (1) | 208 | 45,086 | ||||||

Quest Diagnostics, Inc. | 464 | 53,634 | ||||||

Teladoc Health, Inc. (1)(2) | 337 | 74,507 | ||||||

UnitedHealth Group, Inc. | 3,920 | 1,302,302 | ||||||

Universal Health Services, Inc. - Class B | 334 | 41,860 | ||||||

| 3,222,869 | ||||||||

Home Builders — 0.1% | ||||||||

D.R. Horton, Inc. | 1,248 | 95,934 | ||||||

Lennar Corp. - Class A | 881 | 73,096 | ||||||

NVR, Inc. (1) | 13 | 58,511 | ||||||

PulteGroup, Inc. | 935 | 42,178 | ||||||

| 269,719 | ||||||||

Home Furnishings — 0.1% | ||||||||

Whirlpool Corp. | 955 | 181,526 | ||||||

Household Products & Wares — 0.2% | ||||||||

Church & Dwight Co., Inc. | 1,027 | 80,877 | ||||||

The Clorox Co. (2) | 483 | 87,447 | ||||||

Kimberly-Clark Corp. | 1,749 | 224,449 | ||||||

| 392,773 | ||||||||

Insurance — 6.9% | ||||||||

Aflac, Inc. | 3,103 | 148,603 | ||||||

Alleghany Corp. | 335 | 216,554 | ||||||

The Allstate Corp. | 1,660 | 176,956 | ||||||

| Shares | Value | ||||||

Insurance — 6.9% (Continued) | ||||||||

American International Group, Inc. | 19,223 | $ | 844,851 | |||||

Aon PLC (2) | 1,272 | 289,647 | ||||||

Arch Capital Group Ltd. (1) | 2,188 | 78,374 | ||||||

Arthur J. Gallagher & Co. | 785 | 94,043 | ||||||

Berkshire Hathaway, Inc. - Class B (1) | 31,525 | 7,582,078 | ||||||

Brown & Brown, Inc. (2) | 1,237 | 56,778 | ||||||

Chubb Ltd. | 2,062 | 335,240 | ||||||

Cincinnati Financial Corp. (2) | 3,242 | 317,295 | ||||||

CNA Financial Corp. | 1,347 | 57,301 | ||||||

Everest Re Group Ltd. | 948 | 229,236 | ||||||

Globe Life, Inc. | 423 | 39,508 | ||||||

The Hartford Financial Services Group, Inc. | 1,686 | 85,463 | ||||||

Markel Corp. (1) | 317 | 345,150 | ||||||

Marsh & McLennan Companies, Inc. | 2,265 | 260,973 | ||||||

MetLife, Inc. | 3,656 | 210,586 | ||||||

Principal Financial Group, Inc. | 962 | 54,430 | ||||||

The Progressive Corp. | 3,028 | 260,257 | ||||||

Prudential Financial, Inc. | 1,703 | 147,684 | ||||||

The Travelers Companies, Inc. | 1,095 | 159,322 | ||||||

W.R. Berkley Corp. | 713 | 49,432 | ||||||

Willis Towers Watson PLC | 704 | 155,331 | ||||||

| 12,195,092 | ||||||||

Internet — 10.7% | ||||||||

Alphabet, Inc. - Class A (1) | 1,168 | 2,361,591 | ||||||

Alphabet, Inc. - Class C (1) | 1,313 | 2,674,397 | ||||||

Amazon.com, Inc. (1) | 2,386 | 7,379,731 | ||||||

Booking Holdings, Inc. (1) | 152 | 353,934 | ||||||

CDW Corp. | 592 | 92,879 | ||||||

eBay, Inc. | 2,921 | 164,803 | ||||||

Expedia Group, Inc. - Class A | 547 | 88,067 | ||||||

F5 Networks, Inc. (1) | 221 | 41,986 | ||||||

Facebook, Inc. - Class A (1) | 9,053 | 2,332,234 | ||||||

GoDaddy, Inc. - Class A (1) | 868 | 70,412 | ||||||

IAC/InterActiveCorp - Class A (1) | 256 | 62,676 | ||||||

Lyft, Inc. - Class A (1)(2) | 1,149 | 63,999 | ||||||

Match Group, Inc. (1) | 552 | 84,373 | ||||||

Netflix, Inc. (1) | 2,625 | 1,414,481 | ||||||

NortonLifeLock, Inc. | 12,510 | 244,070 | ||||||

Okta, Inc. - Class A (1) | 490 | 128,111 | ||||||

Palo Alto Networks, Inc. (1) | 888 | 318,179 | ||||||

Roku, Inc. - Class A (1) | 233 | 92,147 | ||||||

Snap, Inc. - Class A (1) | 5,563 | 365,267 | ||||||

Twitter, Inc. (1) | 2,924 | 225,323 | ||||||

Uber Technologies, Inc. (1) | 5,447 | 281,882 | ||||||

The accompanying notes are an integral part of these financial statements.

16 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Internet — 10.7% (Continued) | ||||||||

VeriSign, Inc. (1) | 465 | $ | 90,224 | |||||

| 18,930,766 | ||||||||

Iron & Steel — 0.0% (3) | ||||||||

Nucor Corp. | 883 | 52,821 | ||||||

Leisure Time — 0.1% | ||||||||

Carnival Corp. (2) | 1,713 | 45,823 | ||||||

Royal Caribbean Cruises Ltd. | 631 | 58,853 | ||||||

| 104,676 | ||||||||

Lodging — 0.4% | ||||||||

Hilton Worldwide Holdings, Inc. | 1,050 | 129,864 | ||||||

Las Vegas Sands Corp. | 2,316 | 144,982 | ||||||

Marriott International, Inc. | 1,172 | 173,538 | ||||||

MGM Resorts International | 3,653 | 138,047 | ||||||

Wynn Resorts Ltd. | 287 | 37,806 | ||||||

| 624,237 | ||||||||

Machinery - Construction & Mining — 0.2% | ||||||||

Caterpillar, Inc. | 1,988 | 429,169 | ||||||

Machinery - Diversified — 0.5% | ||||||||

Deere & Co. | 1,189 | 415,104 | ||||||

Dover Corp. | 574 | 70,751 | ||||||

IDEX Corp. | 293 | 57,185 | ||||||

Ingersoll Rand, Inc. (1) | 2,754 | 127,620 | ||||||

Rockwell Automation, Inc. | 407 | 99,015 | ||||||

Westinghouse Air Brake Technologies Corp. | 1,423 | 103,068 | ||||||

Xylem, Inc. | 767 | 76,362 | ||||||

| 949,105 | ||||||||

Media — 2.3% | ||||||||

Altice USA, Inc. - Class A (1) | 8,382 | 281,719 | ||||||

Cable One, Inc. (2) | 23 | 44,041 | ||||||

Charter Communications, Inc. - Class A (1)(2) | 1,169 | 717,088 | ||||||

Comcast Corp. - Class A | 19,282 | 1,016,547 | ||||||

DISH Network Corp. - Class A (1) | 1,004 | 31,636 | ||||||

FactSet Research Systems, Inc. | 171 | 51,969 | ||||||

Liberty Broadband Corp. - Class C (1) | 1,857 | 277,640 | ||||||

Sirius XM Holdings, Inc. (2) | 16,422 | 96,069 | ||||||

ViacomCBS, Inc. - Class B (2) | 3,229 | 208,238 | ||||||

The Walt Disney Co. | 6,805 | 1,286,417 | ||||||

| 4,011,364 | ||||||||

| Shares | Value | ||||||

Mining — 0.6% | ||||||||

Freeport-McMoRan, Inc. | 5,743 | $ | 194,745 | |||||

Newmont Corp. | 15,973 | 868,612 | ||||||

| 1,063,357 | ||||||||

Miscellaneous Manufacturers — 1.5% | ||||||||

3M Co. | 2,250 | 393,885 | ||||||

Eaton Corp PLC | 1,498 | 195,025 | ||||||

General Electric Co. | 136,103 | 1,706,731 | ||||||

Illinois Tool Works, Inc. | 1,172 | 236,955 | ||||||

Parker-Hannifin Corp. | 419 | 120,236 | ||||||

Textron, Inc. | 800 | 40,272 | ||||||

| 2,693,104 | ||||||||

Office & Business Equipment — 0.1% | ||||||||

Zebra Technologies Corp. (1)(2) | 197 | 98,388 | ||||||

Oil & Gas — 1.2% | ||||||||

Cabot Oil & Gas Corp. | 1,531 | 28,339 | ||||||

Chevron Corp. | 5,126 | 512,600 | ||||||

ConocoPhillips | 4,077 | 212,045 | ||||||

EOG Resources, Inc. | 1,735 | 112,011 | ||||||

Exxon Mobil Corp. | 12,940 | 703,548 | ||||||

Hess Corp. | 762 | 49,934 | ||||||

Marathon Petroleum Corp. | 1,861 | 101,648 | ||||||

Occidental Petroleum Corp. | 2,169 | 57,717 | ||||||

Phillips 66 | 1,194 | 99,162 | ||||||

Pioneer Natural Resources Co. | 534 | 79,336 | ||||||

Valero Energy Corp. | 1,132 | 87,141 | ||||||

| 2,043,481 | ||||||||

Oil & Gas Services — 0.1% | ||||||||

Baker Hughes Co. - Class A | 3,125 | 76,500 | ||||||

Halliburton Co. | 2,485 | 54,247 | ||||||

Schlumberger NV | 4,438 | 123,865 | ||||||

| 254,612 | ||||||||

Packaging & Containers — 0.1% | ||||||||

Ball Corp. | 1,695 | 144,736 | ||||||

Packaging Corp. of America | 316 | 41,718 | ||||||

Westrock Co. | 1,171 | 51,044 | ||||||

| 237,498 | ||||||||

Pharmaceuticals — 6.6% | ||||||||

AbbVie, Inc. | 10,125 | 1,090,868 | ||||||

AmerisourceBergen Corp. | 1,137 | 115,087 | ||||||

Becton Dickinson and Co. | 2,362 | 569,596 | ||||||

Bristol-Myers Squibb Co. | 20,837 | 1,277,933 | ||||||

Cardinal Health, Inc. | 1,095 | 56,414 | ||||||

Cigna Corp. | 2,605 | 546,790 | ||||||

CVS Health Corp. | 30,748 | 2,094,861 | ||||||

The accompanying notes are an integral part of these financial statements.

17 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Pharmaceuticals — 6.6% (Continued) | ||||||||

DexCom, Inc. (1) | 735 | $ | 292,368 | |||||

Elanco Animal Health, Inc. (1) | 4,863 | 159,798 | ||||||

Eli Lilly and Co. | 4,643 | 951,304 | ||||||

Henry Schein, Inc. (1) | 493 | 30,492 | ||||||

Johnson & Johnson | 12,265 | 1,943,512 | ||||||

McKesson Corp. | 1,252 | 212,239 | ||||||

Merck & Co., Inc. | 14,661 | 1,064,682 | ||||||

Pfizer, Inc. | 23,092 | 773,351 | ||||||

Viatris, Inc. (1) | 7,997 | 118,756 | ||||||

Zoetis, Inc. | 2,032 | 315,448 | ||||||

| 11,613,499 | ||||||||

Pipelines — 0.4% | ||||||||

Cheniere Energy, Inc. (1) | 1,214 | 81,811 | ||||||

Kinder Morgan, Inc. | 9,928 | 145,942 | ||||||

ONEOK, Inc. | 1,679 | 74,363 | ||||||

The Williams Companies, Inc. | 18,914 | 431,996 | ||||||

| 734,112 | ||||||||

Private Equity — 0.2% | ||||||||

The Blackstone Group, Inc. - Class A | 3,174 | 219,736 | ||||||

KKR & Co., Inc. | 2,578 | 117,454 | ||||||

| 337,190 | ||||||||

Real Estate — 0.1% | ||||||||

CBRE Group, Inc. (1) | 1,435 | 108,730 | ||||||

Real Estate Investment Trusts (REITs) — 2.2% | ||||||||

Alexandria Real Estate Equities, Inc. | 515 | 82,240 | ||||||

American Tower Corp. | 2,211 | 477,863 | ||||||

Annaly Capital Management, Inc. | 5,822 | 48,381 | ||||||

AvalonBay Communities, Inc. | 538 | 94,554 | ||||||

Boston Properties, Inc. | 693 | 68,697 | ||||||

Crown Castle International Corp. | 2,011 | 313,213 | ||||||

Digital Realty Trust, Inc. | 1,117 | 150,493 | ||||||

Duke Realty Corp. | 1,393 | 54,675 | ||||||

Equinix, Inc. | 431 | 279,435 | ||||||

Equity Residential | 2,148 | 140,501 | ||||||

Essex Property Trust, Inc. | 269 | 68,539 | ||||||

Extra Space Storage, Inc. | 582 | 73,157 | ||||||

Healthpeak Properties, Inc. | 2,343 | 68,158 | ||||||

Host Hotels & Resorts, Inc. | 2,131 | 35,353 | ||||||

Invitation Homes, Inc. | 4,994 | 145,525 | ||||||

Iron Mountain, Inc. (2) | 1,327 | 46,166 | ||||||

Mid-America Apartment Communities, Inc. | 492 | 66,287 | ||||||

Prologis, Inc. | 2,973 | 294,535 | ||||||

| Shares | Value | ||||||

Real Estate Investment Trusts (REITs) — 2.2% (Continued) | ||||||||

Public Storage | 717 | $ | 167,735 | |||||

Realty Income Corp. | 1,528 | 92,077 | ||||||

Regency Centers Corp. | 607 | 33,252 | ||||||

SBA Communications Corp. | 1,011 | 257,936 | ||||||

Simon Property Group, Inc. | 1,140 | 128,729 | ||||||

Sun Communities, Inc. | 386 | 58,653 | ||||||

UDR, Inc. | 976 | 40,182 | ||||||

Ventas, Inc. | 1,287 | 68,082 | ||||||

Vornado Realty Trust | 2,855 | 122,594 | ||||||

W.P. Carey, Inc. | 686 | 47,019 | ||||||

Welltower, Inc. | 1,869 | 126,905 | ||||||

Weyerhaeuser Co. | 7,272 | 246,303 | ||||||

| 3,897,239 | ||||||||

Retail — 4.6% | ||||||||

Advance Auto Parts, Inc. (2) | 267 | 42,813 | ||||||

AutoZone, Inc. (1) | 92 | 106,713 | ||||||

Best Buy Co., Inc. (2) | 942 | 94,530 | ||||||

Burlington Stores, Inc. (1) | 254 | 65,740 | ||||||

CarMax, Inc. (1) | 542 | 64,774 | ||||||

Chipotle Mexican Grill, Inc. (1) | 149 | 214,858 | ||||||

Costco Wholesale Corp. | 1,920 | 635,520 | ||||||

Darden Restaurants, Inc. | 444 | 60,975 | ||||||

Dollar General Corp. | 1,092 | 206,377 | ||||||

Dollar Tree, Inc. (1) | 1,657 | 162,717 | ||||||

Domino’s Pizza, Inc. (2) | 168 | 58,214 | ||||||

Genuine Parts Co. | 581 | 61,208 | ||||||

The Home Depot, Inc. | 3,884 | 1,003,393 | ||||||

Lowe’s Companies, Inc. | 3,362 | 537,080 | ||||||

McDonald’s Corp. | 3,024 | 623,367 | ||||||

O’Reilly Automotive, Inc. (1) | 272 | 121,674 | ||||||

Ross Stores, Inc. | 1,276 | 148,833 | ||||||

Starbucks Corp. | 5,003 | 540,474 | ||||||

Target Corp. | 1,934 | 354,773 | ||||||

The TJX Companies, Inc. | 4,486 | 296,031 | ||||||

Tractor Supply Co. | 426 | 67,717 | ||||||

Ulta Beauty, Inc. (1) | 204 | 65,755 | ||||||

Walgreens Boots Alliance, Inc. | 3,792 | 181,751 | ||||||

Walmart, Inc. | 17,185 | 2,232,675 | ||||||

Yum! Brands, Inc. | 1,140 | 118,024 | ||||||

| 8,065,986 | ||||||||

Semiconductors — 5.3% | ||||||||

Advanced Micro Devices, Inc. (1) | 11,815 | 998,486 | ||||||

Analog Devices, Inc. | 1,485 | 231,393 | ||||||

Applied Materials, Inc. | 3,652 | 431,630 | ||||||

Broadcom, Inc. | 3,011 | 1,414,779 | ||||||

Intel Corp. | 17,126 | 1,040,918 | ||||||

IPG Photonics Corp. (1) | 141 | 32,056 | ||||||

KLA Corp. | 667 | 207,590 | ||||||

The accompanying notes are an integral part of these financial statements.

18 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Semiconductors — 5.3% (Continued) | ||||||||

Lam Research Corp. | 613 | $ | 347,687 | |||||

Marvell Technology Group Ltd. (2) | 13,017 | 628,461 | ||||||

Maxim Integrated Products, Inc. | 984 | 91,679 | ||||||

Microchip Technology, Inc. | 1,716 | 261,913 | ||||||

Micron Technology, Inc. (1) | 3,469 | 317,518 | ||||||

NVIDIA Corp. | 2,395 | 1,313,849 | ||||||

Qorvo, Inc. (1) | 1,393 | 243,399 | ||||||

QUALCOMM, Inc. | 6,554 | 892,589 | ||||||

Skyworks Solutions, Inc. | 574 | 102,069 | ||||||

Teradyne, Inc. | 725 | 93,242 | ||||||

Texas Instruments, Inc. | 3,322 | 572,281 | ||||||

Xilinx, Inc. | 1,061 | 138,248 | ||||||

| 9,359,787 | ||||||||

Software — 12.7% | ||||||||

Activision Blizzard, Inc. | 2,769 | 264,744 | ||||||

Adobe, Inc. (1) | 2,382 | 1,094,934 | ||||||

Akamai Technologies, Inc. (1) | 1,019 | 96,296 | ||||||

ANSYS, Inc. (1) | 377 | 128,553 | ||||||

Autodesk, Inc. (1) | 3,532 | 974,832 | ||||||

Black Knight, Inc. (1) | 857 | 65,723 | ||||||

Broadridge Financial Solutions, Inc. | 471 | 67,113 | ||||||

Cadence Design Systems, Inc. (1) | 1,738 | 245,214 | ||||||

Cerner Corp. | 1,568 | 108,412 | ||||||

Citrix Systems, Inc. | 534 | 71,332 | ||||||

Coupa Software, Inc. (1) | 309 | 106,994 | ||||||

DocuSign, Inc. (1) | 1,248 | 282,872 | ||||||

Electronic Arts, Inc. | 1,288 | 172,553 | ||||||

Fidelity National Information Services, Inc. | 7,103 | 980,214 | ||||||

Fiserv, Inc. (1)(2) | 5,540 | 639,150 | ||||||

Intuit, Inc. | 1,122 | 437,737 | ||||||

Jack Henry & Associates, Inc. (2) | 273 | 40,524 | ||||||

Microsoft Corp. | 32,530 | 7,559,321 | ||||||

MSCI, Inc. | 341 | 141,351 | ||||||

Oracle Corp. | 21,847 | 1,409,350 | ||||||

Paychex, Inc. | 1,537 | 139,975 | ||||||

Paycom Software, Inc. (1) | 255 | 95,431 | ||||||

RingCentral, Inc. - Class A (1) | 534 | 201,938 | ||||||

salesforce.com, Inc. (1) | 10,097 | 2,186,001 | ||||||

ServiceNow, Inc. (1) | 3,667 | 1,956,198 | ||||||

Slack Technologies, Inc. - Class A (1) | 1,099 | 44,982 | ||||||

Splunk, Inc. (1) | 812 | 116,124 | ||||||

SS&C Technologies Holdings, Inc. | 2,925 | 193,869 | ||||||

| Shares | Value | ||||||

Software — 12.7% (Continued) | ||||||||

Synopsys, Inc. (1) | 673 | $ | 165,026 | |||||

Take-Two Interactive Software, Inc. (1) | 510 | 94,075 | ||||||

Twilio, Inc. - Class A (1)(2) | 461 | 181,118 | ||||||

Tyler Technologies, Inc. (1)(2) | 160 | 74,147 | ||||||

Veeva Systems, Inc. - Class A (1) | 658 | 184,312 | ||||||

VMware, Inc. - Class A (1)(2) | 634 | 87,625 | ||||||

Workday, Inc. - Class A (1) | 1,257 | 308,191 | ||||||

Zoom Video Communications, Inc. - Class A (1) | 4,237 | 1,582,986 | ||||||

| 22,499,217 | ||||||||

Telecommunications — 2.2% | ||||||||

Arista Networks, Inc. (1) | 476 | 133,204 | ||||||

AT&T, Inc. | 30,567 | 852,513 | ||||||

Cisco Systems, Inc. | 17,532 | 786,661 | ||||||

Corning, Inc. (2) | 3,112 | 119,003 | ||||||

Juniper Networks, Inc. (2) | 1,426 | 33,197 | ||||||

Lumen Technologies, Inc. | 3,918 | 48,152 | ||||||

Motorola Solutions, Inc. | 935 | 164,074 | ||||||

T-Mobile US, Inc. (1) | 5,609 | 672,912 | ||||||

Ubiquiti, Inc. | 265 | 84,514 | ||||||

Verizon Communications, Inc. | 18,810 | 1,040,193 | ||||||

| 3,934,423 | ||||||||

Toys, Games & Hobbies — 0.1% | ||||||||

Hasbro, Inc. | 951 | 89,118 | ||||||

Transportation — 1.5% | ||||||||

C.H. Robinson Worldwide, Inc. (2) | 482 | 43,790 | ||||||

CSX Corp. | 2,860 | 261,833 | ||||||

Expeditors International of Washington, Inc. | 622 | 57,124 | ||||||

FedEx Corp. | 3,076 | 782,842 | ||||||

J.B. Hunt Transport Services, Inc. | 419 | 61,539 | ||||||

Kansas City Southern | 392 | 83,237 | ||||||

Norfolk Southern Corp. | 915 | 230,635 | ||||||

Old Dominion Freight Line, Inc. | 396 | 85,049 | ||||||

Union Pacific Corp. | 2,507 | 516,342 | ||||||

United Parcel Service, Inc. - Class B | 3,239 | 511,211 | ||||||

| 2,633,602 | ||||||||

Water — 0.1% | ||||||||

American Water Works Co., Inc. (2) | 847 | 120,172 | ||||||

Total Common Stocks | ||||||||

(Cost $144,874,048) | 176,831,735 | |||||||

| ||||||||

The accompanying notes are an integral part of these financial statements.

19 |

SoFi Select 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Short-Term Investments — 0.2% | ||||||||

Money Market Funds — 0.2% | ||||||||

First American Government Obligations Fund - Class X, 0.036% (4) | 311,077 | $ | 311,077 | |||||

Total Short-Term Investments | ||||||||

(Cost $311,077) | 311,077 | |||||||

Investments Purchased With Collateral From Securities Lending — 2.8% | ||||||||

Mount Vernon Liquid Assets Portfolio, LLC, 0.130% (4) | 5,073,884 | 5,073,884 | ||||||

Total Investments Purchased With Collateral From Securities Lending | ||||||||

(Cost $5,073,884) | 5,073,884 | |||||||

Total Investments in Securities — 102.9% | ||||||||

(Cost $150,259,009) | 182,216,696 | |||||||

Liabilities in Excess of Other Assets — (2.9)% | (5,146,342 | ) | ||||||

Total Net Assets — 100.0% | $ | 177,070,354 | ||||||

(1) | Non-income producing security. |

(2) | This security or a portion of this security was out on loan as of February 28, 2021. Total loaned securities had a value of $4,997,369 or 2.8% of net assets. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

(3) | Does not round to 0.1% or (0.1)%, as applicable. |

(4) | The rate shown is the annualized seven-day effective yield as of February 28, 2021. |

The accompanying notes are an integral part of these financial statements.

20 |

SoFi Next 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 |

| Shares | Value | ||||||

Common Stocks — 99.9% | ||||||||

Advertising — 0.2% | ||||||||

The Interpublic Group of Companies, Inc. | 1,798 | $ | 46,964 | |||||

| ||||||||

Aerospace & Defense — 0.5% | ||||||||

Aerojet Rocketdyne Holdings, Inc. | 435 | 22,302 | ||||||

HEICO Corp. (2) | 289 | 36,350 | ||||||

Hexcel Corp. | 397 | 21,343 | ||||||

Mercury Systems, Inc. (1) | 407 | 26,602 | ||||||

Spirit AeroSystems Holdings, Inc. | 417 | 17,860 | ||||||

| 124,457 | ||||||||

Agriculture — 0.5% | ||||||||

Bunge Ltd. | 374 | 28,641 | ||||||

Darling Ingredients, Inc. (1) | 1,364 | 85,986 | ||||||

| 114,627 | ||||||||

Airlines — 0.5% | ||||||||

Alaska Air Group, Inc. | 637 | 41,418 | ||||||

American Airlines Group, Inc. | 1,911 | 40,016 | ||||||

JetBlue Airways Corp. (1) | 1,741 | 32,087 | ||||||

| 113,521 | ||||||||

Apparel — 0.9% | ||||||||

Carter’s, Inc. | 198 | 16,527 | ||||||

Columbia Sportswear Co. (2) | 374 | 38,548 | ||||||

Deckers Outdoor Corp. (1) | 133 | 43,373 | ||||||

Hanesbrands, Inc. | 1,539 | 27,225 | ||||||

Ralph Lauren Corp. - Class A | 247 | 28,919 | ||||||

Skechers USA, Inc. - Class A (1) | 639 | 23,387 | ||||||

Tapestry, Inc. | 1,262 | 53,181 | ||||||

| 231,160 | ||||||||

Auto Manufacturers — 0.1% | ||||||||

Navistar International Corp. (1) | 376 | 16,567 | ||||||

Auto Parts & Equipment — 0.6% | ||||||||

Allison Transmission Holdings, Inc. | 491 | 18,619 | ||||||

BorgWarner, Inc. | 869 | 39,105 | ||||||

Gentex Corp. | 1,149 | 40,651 | ||||||

Lear Corp. (2) | 235 | 39,031 | ||||||

| 137,406 | ||||||||

Banks — 3.2% | ||||||||

Bank of Hawaii Corp. | 190 | 16,625 | ||||||

Bank OZK | 561 | 23,125 | ||||||

BOK Financial Corp. | 358 | 30,810 | ||||||

Comerica, Inc. | 605 | 41,201 | ||||||

| Shares | Value | ||||||

Banks — 3.2% (Continued) | ||||||||

Commerce Bancshares, Inc. (2) | 547 | $ | 40,495 | |||||

Community Bank System, Inc. | 263 | 18,723 | ||||||

Cullen/Frost Bankers, Inc. | 281 | 29,336 | ||||||

East West Bancorp, Inc. | 593 | 42,791 | ||||||

First Financial Bankshares, Inc. | 712 | 31,798 | ||||||

First Hawaiian, Inc. | 644 | 17,961 | ||||||

First Horizon National Corp. | 1,445 | 23,409 | ||||||

FNB Corp. | 1,645 | 19,460 | ||||||

Glacier Bancorp, Inc. | 456 | 24,715 | ||||||

Home BancShares, Inc. | 723 | 17,670 | ||||||

Pinnacle Financial Partners, Inc. | 367 | 29,789 | ||||||

Prosperity Bancshares, Inc. | 472 | 34,678 | ||||||

Signature Bank (2) | 250 | 54,585 | ||||||

Synovus Financial Corp. | 790 | 33,425 | ||||||

TCF Financial Corp. | 1,093 | 48,988 | ||||||

UMB Financial Corp. (2) | 254 | 21,430 | ||||||

Umpqua Holdings Corp. | 1,085 | 18,521 | ||||||

United Bankshares, Inc. | 495 | 18,290 | ||||||

Valley National Bancorp | 2,197 | 26,913 | ||||||

Webster Financial Corp. | 414 | 22,898 | ||||||

Western Alliance Bancorp | 491 | 44,931 | ||||||

Wintrust Financial Corp. | 283 | 20,846 | ||||||

Zions Bancorp N.A. | 742 | 39,452 | ||||||

| 792,865 | ||||||||

Beverages — 0.2% | ||||||||

The Boston Beer Co., Inc. - Class A (1) | 53 | 54,522 | ||||||

Biotechnology — 3.1% | ||||||||

ACADIA Pharmaceuticals, Inc. (1) | 962 | 47,109 | ||||||

Acceleron Pharma, Inc. (1) | 317 | 43,163 | ||||||

Amicus Therapeutics, Inc. (1) | 1,936 | 23,774 | ||||||

Arrowhead Pharmaceuticals, Inc. (1) | 1,133 | 90,255 | ||||||

Bluebird Bio, Inc. (1) | 233 | 7,246 | ||||||

Blueprint Medicines Corp. (1) | 306 | 30,055 | ||||||

ChemoCentryx, Inc. (1) | 222 | 15,060 | ||||||

Emergent BioSolutions, Inc. (1) | 467 | 44,832 | ||||||

Exelixis, Inc. (1) | 1,192 | 25,819 | ||||||

FibroGen, Inc. (1) | 476 | 23,814 | ||||||

Guardant Health, Inc. (1) | 481 | 70,794 | ||||||

Halozyme Therapeutics, Inc. (1) | 1,437 | 65,024 | ||||||

Ionis Pharmaceuticals, Inc. (1) | 674 | 35,318 | ||||||

Mirati Therapeutics, Inc. (1) | 141 | 28,330 | ||||||

Nektar Therapeutics (1)(2) | 597 | 13,546 | ||||||

NeoGenomics, Inc. (1) | 1,144 | 58,310 | ||||||

PTC Therapeutics, Inc. (1) | 271 | 15,474 | ||||||

The accompanying notes are an integral part of these financial statements.

21 |

SoFi Next 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Biotechnology — 3.1% (Continued) | ||||||||

Ultragenyx Pharmaceutical, Inc. (1) | 306 | $ | 43,311 | |||||

United Therapeutics Corp. (1) | 557 | 93,119 | ||||||

| 774,353 | ||||||||

Building Materials — 1.0% | ||||||||

Armstrong World Industries, Inc. | 274 | 23,449 | ||||||

Eagle Materials, Inc. | 259 | 32,473 | ||||||

Fortune Brands Home & Security, Inc. | 634 | 52,711 | ||||||

Lennox International, Inc. | 177 | 49,519 | ||||||

Owens Corning | 465 | 37,674 | ||||||

Trex Co., Inc. (1)(2) | 481 | 44,079 | ||||||

| 239,905 | ||||||||

Chemicals — 1.6% | ||||||||

Ashland Global Holdings, Inc. | 524 | 44,079 | ||||||

Axalta Coating Systems Ltd. (1) | 1,335 | 36,499 | ||||||

Balchem Corp. | 188 | 22,440 | ||||||

CF Industries Holdings, Inc. | 1,333 | 60,358 | ||||||

Huntsman Corp. | 984 | 26,863 | ||||||

The Mosaic Co. | 1,276 | 37,514 | ||||||

Olin Corp. | 643 | 19,895 | ||||||

RPM International, Inc. | 792 | 63,075 | ||||||

Valvoline, Inc. | 870 | 21,715 | ||||||

W.R. Grace & Co. | 373 | 22,104 | ||||||

Westlake Chemical Corp. | 509 | 43,565 | ||||||

| 398,107 | ||||||||

Commercial Services — 5.4% | ||||||||

ADT, Inc. | 4,389 | 33,400 | ||||||

AMERCO | 99 | 56,897 | ||||||

ASGN, Inc. (1)(2) | 191 | 17,757 | ||||||

Avalara, Inc. (1) | 548 | 86,003 | ||||||

Bright Horizons Family Solutions, Inc. (1) | 287 | 45,823 | ||||||

The Brink’s Co. | 1,334 | 102,491 | ||||||

Chegg, Inc. (1) | 2,856 | 275,690 | ||||||

CoreLogic, Inc. | 452 | 38,266 | ||||||

Euronet Worldwide, Inc. (1) | 280 | 42,087 | ||||||

FTI Consulting, Inc. (1) | 245 | 28,065 | ||||||

Grand Canyon Education, Inc. (1) | 222 | 23,241 | ||||||

H&R Block, Inc. | 897 | 17,249 | ||||||

HealthEquity, Inc. (1)(2) | 303 | 24,952 | ||||||

LiveRamp Holdings, Inc. (1) | 199 | 12,569 | ||||||

Macquarie Infrastructure Corp. | 484 | 15,169 | ||||||

ManpowerGroup, Inc. | 253 | 23,893 | ||||||

Nielsen Holdings PLC | 3,522 | 78,928 | ||||||

Paylocity Holding Corp. (1) | 296 | 56,592 | ||||||

| Shares | Value | ||||||

Commercial Services — 5.4% (Continued) | ||||||||

Quanta Services, Inc. | 820 | $ | 68,757 | |||||

Robert Half International, Inc. | 526 | 40,918 | ||||||

Service Corp. International | 894 | 42,698 | ||||||

Strategic Education, Inc. | 438 | 39,823 | ||||||

Terminix Global Holdings, Inc. (1) | 939 | 42,264 | ||||||

TriNet Group, Inc. (1) | 346 | 27,774 | ||||||

WEX, Inc. (1) | 375 | 78,131 | ||||||

| 1,319,437 | ||||||||

Computers — 3.9% | ||||||||

CACI International, Inc. (1) | 139 | 30,766 | ||||||

Cognyte Software Ltd. (1) | 1,241 | 35,828 | ||||||

Crowdstrike Holdings, Inc. - Class A (1) | 939 | 202,824 | ||||||

DXC Technology Co. | 1,076 | 27,137 | ||||||

Genpact Ltd. | 1,083 | 43,797 | ||||||

Lumentum Holdings, Inc. (1)(2) | 2,434 | 219,060 | ||||||

MAXIMUS, Inc. | 364 | 29,586 | ||||||

NCR Corp. (1) | 2,369 | 82,346 | ||||||

Parsons Corp. (1)(2) | 470 | 16,798 | ||||||

Perspecta, Inc. | 980 | 28,616 | ||||||

Pure Storage, Inc. (1)(2) | 1,865 | 43,604 | ||||||

Qualys, Inc. (1)(2) | 265 | 25,747 | ||||||

Science Applications International Corp. | 422 | 36,347 | ||||||

Zscaler, Inc. (1) | 714 | 146,391 | ||||||

| 968,847 | ||||||||

Cosmetics & Personal Care — 0.1% | ||||||||

Coty, Inc. | 4,256 | 32,643 | ||||||

| ||||||||

Distribution & Wholesale — 0.8% | ||||||||

IAA, Inc. (1) | 585 | 34,299 | ||||||

Pool Corp. | 182 | 60,928 | ||||||

SiteOne Landscape Supply, Inc. (1) | 167 | 26,471 | ||||||

Univar Solutions, Inc. (1) | 1,235 | 24,589 | ||||||

Watsco, Inc. | 160 | 38,896 | ||||||

| 185,183 | ||||||||

Diversified Financial Services — 4.2% | ||||||||

Affiliated Managers Group, Inc. | 1,612 | 225,632 | ||||||

Air Lease Corp. | 537 | 24,627 | ||||||

Ally Financial, Inc. | 1,790 | 74,285 | ||||||

Ares Management Corp. | 1,453 | 75,527 | ||||||

Credit Acceptance Corp. (1)(2) | 76 | 27,590 | ||||||

Eaton Vance Corp. | 619 | 45,230 | ||||||

Evercore, Inc. - Class A | 185 | 22,157 | ||||||

Interactive Brokers Group, Inc. - Class A | 377 | 27,291 | ||||||

Invesco Ltd. | 3,261 | 73,112 | ||||||

Jefferies Financial Group, Inc. | 2,229 | 64,730 | ||||||

The accompanying notes are an integral part of these financial statements.

22 |

SoFi Next 500 ETF

SCHEDULE OF INVESTMENTS at February 28, 2021 (Continued) |

| Shares | Value | ||||||

Common Stocks — 99.9% (Continued) | ||||||||

Diversified Financial Services — 4.2% (Continued) | ||||||||

Lazard Ltd. | 531 | $ | 20,544 | |||||

LendingTree, Inc. (1)(2) | 60 | 16,132 | ||||||

LPL Financial Holdings, Inc. | 343 | 45,118 | ||||||

OneMain Holdings, Inc. | 910 | 42,688 | ||||||

Santander Consumer USA Holdings, Inc. | 1,297 | 32,425 | ||||||

SEI Investments Co. | 742 | 41,552 | ||||||

SLM Corp. | 1,888 | 29,812 | ||||||

Stifel Financial Corp. | 528 | 32,250 | ||||||

Tradeweb Markets, Inc. - Class A | 668 | 48,624 | ||||||

Virtu Financial, Inc. - Class A | 2,556 | 69,702 | ||||||

| 1,039,028 | ||||||||

Electric — 1.5% | ||||||||

ALLETE, Inc. | 283 | 17,583 | ||||||

Avista Corp. | 410 | 16,486 | ||||||

Black Hills Corp. | 351 | 20,765 | ||||||

Hawaiian Electric Industries, Inc. | 643 | 22,479 | ||||||

IDACORP, Inc. | 282 | 24,320 | ||||||

NorthWestern Corp. | 282 | 16,491 | ||||||

NRG Energy, Inc. | 4,133 | 150,896 | ||||||

OGE Energy Corp. | 1,130 | 33,075 | ||||||

Ormat Technologies, Inc. | 254 | 21,760 | ||||||

PNM Resources, Inc. | 668 | 32,071 | ||||||

Portland General Electric Co. | 557 | 23,483 | ||||||

| 379,409 | ||||||||

Electrical Components & Equipment — 1.3% | ||||||||

Acuity Brands, Inc. | 187 | 23,057 | ||||||

Energizer Holdings, Inc. (2) | 945 | 39,501 | ||||||

EnerSys | 203 | 18,327 | ||||||

Generac Holdings, Inc. (1)(2) | 329 | 108,425 | ||||||

Littelfuse, Inc. | 112 | 29,145 | ||||||

Universal Display Corp. | 426 | 90,180 | ||||||

| 308,635 | ||||||||

Electronics — 2.5% | ||||||||

Allegion PLC | 453 | 49,277 | ||||||

Arrow Electronics, Inc. (1) | 673 | 67,475 | ||||||

Avnet, Inc. | 1,011 | 38,489 | ||||||

Coherent, Inc. (1) | 209 | 50,566 | ||||||

FLIR Systems, Inc. (2) | 630 | 33,642 | ||||||

Hubbell, Inc. | 289 | 51,300 | ||||||

Jabil, Inc. | 1,258 | 54,308 | ||||||

National Instruments Corp. | 703 | 31,213 | ||||||

nVent Electric PLC | 966 | 25,367 | ||||||

Sensata Technologies Holding PLC (1) | 775 | 44,400 | ||||||

| Shares | Value | ||||||

Electronics — 2.5% (Continued) | ||||||||

SYNNEX Corp. | 264 | $ | 23,538 | |||||

Trimble, Inc. (1) | 1,593 | 118,105 | ||||||

Woodward, Inc. | 329 | 37,578 | ||||||

| 625,258 | ||||||||

Energy - Alternate Sources — 1.8% | ||||||||

Enphase Energy, Inc. (1) | 1,805 | 317,788 | ||||||

First Solar, Inc. (1)(2) | 1,087 | 88,069 | ||||||

NextEra Energy Partners LP | 347 | 25,206 | ||||||

| 431,063 | ||||||||

Engineering & Construction — 0.6% | ||||||||

AECOM (1) | 446 | 25,819 | ||||||

EMCOR Group, Inc. | 313 | 30,477 | ||||||

Exponent, Inc. | 310 | 29,906 | ||||||

frontdoor, Inc. (1) | 415 | 21,733 | ||||||

MasTec, Inc. (1) | 388 | 33,659 | ||||||

| 141,594 | ||||||||

Entertainment — 0.7% | ||||||||

Churchill Downs, Inc. | 185 | 42,667 | ||||||

Marriott Vacations Worldwide Corp. | 446 | 75,691 | ||||||

Vail Resorts, Inc. | 191 | 59,053 | ||||||

| 177,411 | ||||||||

Environmental Control — 0.7% | ||||||||

Clean Harbors, Inc. (1) | 309 | 26,311 | ||||||

Pentair PLC | 802 | 44,856 | ||||||

Stericycle, Inc. (1)(2) | 659 | 42,749 | ||||||

Tetra Tech, Inc. (2) | 346 | 47,876 | ||||||

| 161,792 | ||||||||

Food — 2.7% | ||||||||

Beyond Meat, Inc. (1)(2) | 592 | 86,124 | ||||||

Flowers Foods, Inc. | 1,322 | 28,754 | ||||||

Grocery Outlet Holding Corp. (1) | 952 | 34,263 | ||||||

The Hain Celestial Group, Inc. (1)(2) | 4,073 | 171,799 | ||||||

Ingredion, Inc. | 347 | 31,299 | ||||||

Lamb Weston Holdings, Inc. | 697 | 55,600 | ||||||

Lancaster Colony Corp. | 139 | 24,279 | ||||||