Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there are at least two audit committee financial expert serving on its audit committee. Mr. Dusko Culafic and Mr. Eduardo Mendoza are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the fiscal year. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

SP Funds Dow Jones Global Sukuk ETF

| | FYE 11/30/2024 | FYE 11/30/2023 |

| ( a ) Audit Fees | $13,125 | $13,125 |

| ( b ) Audit-Related Fees | N/A | N/A |

| ( c ) Tax Fees | $2,625 | $2,625 |

| ( d ) All Other Fees | N/A | N/A |

SP Funds S&P 500 Sharia Industry Exclusions ETF

| | FYE 11/30/2024 | FYE 11/30/2023 |

| ( a ) Audit Fees | $13,125 | $13,125 |

| ( b ) Audit-Related Fees | N/A | N/A |

| ( c ) Tax Fees | $2,625 | $2,625 |

| ( d ) All Other Fees | N/A | N/A |

SP Funds S&P Global REIT Sharia ETF

| | FYE 11/30/2024 | FYE 11/30/2023 |

| ( a ) Audit Fees | $13,125 | $13,125 |

| ( b ) Audit-Related Fees | N/A | N/A |

| ( c ) Tax Fees | $2,625 | $2,625 |

| ( d ) All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Tait Weller & Baker LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 11/30/2024 | FYE 11/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 11/30/2024 | FYE 11/30/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Dusko Culafic, Eduardo Mendoza, and Mark H.W. Baltimore.

(b) Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Financial Statements

November 30, 2024

Tidal ETF Trust

| ● | SP Funds Dow Jones Global Sukuk ETF | | SPSK | | NYSE Arca, Inc. |

| ● | SP Funds S&P 500 Sharia Industry Exclusions ETF | | SPUS | | NYSE Arca, Inc. |

| ● | SP Funds S&P Global REIT Sharia ETF | | SPRE | | NYSE Arca, Inc. |

SP Funds ETFs

Table of Contents

| | SP Funds Dow Jones |

| Schedule of Investments | Global Sukuk ETF |

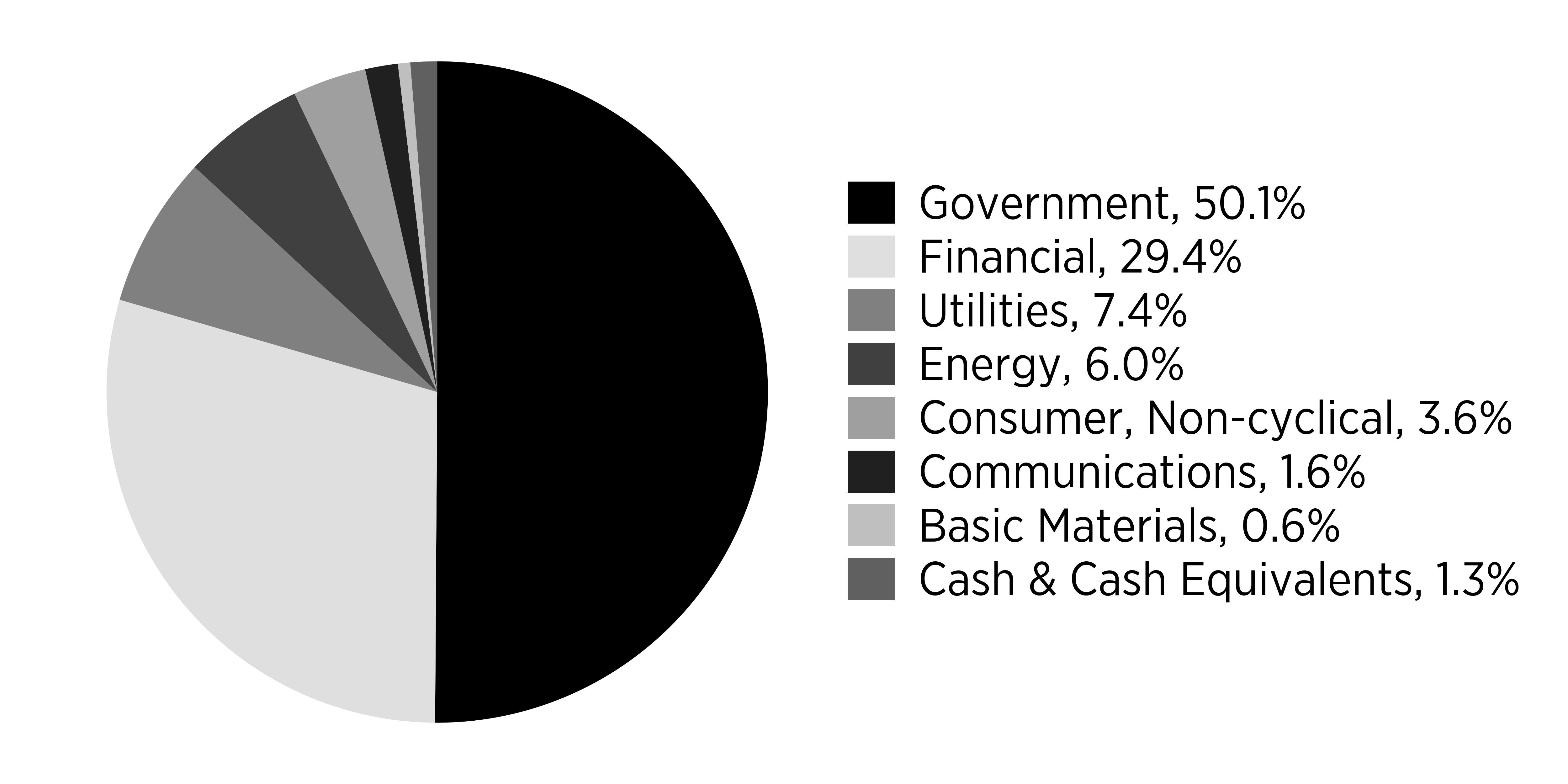

| FOREIGN GOVERNMENT SUKUK - 50.1% | | Par | | | Value | |

| Multi-National - 10.1% | | | | | | | | |

| ICDPS Sukuk Ltd., 4.95%, 02/14/2029 | | $ | 1,100,000 | | | $ | 1,104,425 | |

| Isdb Trust Services No. 2 SARL | | | | | | | | |

| 1.26%, 03/31/2026 | | | 4,800,000 | | | | 4,600,368 | |

| 1.44%, 10/21/2026 | | | 3,327,000 | | | | 3,142,310 | |

| 3.21%, 04/28/2027 | | | 3,400,000 | | | | 3,310,265 | |

| 4.75%, 10/27/2027 | | | 2,000,000 | | | | 2,017,776 | |

| 4.60%, 03/14/2028 | | | 3,900,000 | | | | 3,929,026 | |

| 4.91%, 10/03/2028 | | | 3,700,000 | | | | 3,773,783 | |

| 4.75%, 05/15/2029 | | | 3,700,000 | | | | 3,766,504 | |

| 4.05%, 10/15/2029 | | | 1,000,000 | | | | 984,784 | |

| | | | | | | | 26,629,241 | |

| | | | | | | | | |

| Sovereign - 40.0%(a) | | | | | | | | |

| Hong Kong Sukuk 2017 Ltd., 3.13%, 02/28/2027 | | | 2,000,000 | | | | 1,954,357 | |

| KSA Sukuk Ltd. | | | | | | | | |

| 3.63%, 04/20/2027 | | | 8,600,000 | | | | 8,411,927 | |

| 5.25%, 06/04/2027 | | | 2,500,000 | | | | 2,535,176 | |

| 5.27%, 10/25/2028 | | | 4,900,000 | | | | 5,000,438 | |

| 4.30%, 01/19/2029 | | | 4,000,000 | | | | 3,945,822 | |

| 4.27%, 05/22/2029 | | | 5,700,000 | | | | 5,613,344 | |

| 2.97%, 10/29/2029 | | | 4,900,000 | | | | 4,511,158 | |

| 5.25%, 06/04/2030 | | | 2,900,000 | | | | 2,950,968 | |

| 2.25%, 05/17/2031 | | | 3,900,000 | | | | 3,339,911 | |

| 4.51%, 05/22/2033 | | | 5,700,000 | | | | 5,550,731 | |

| 5.25%, 06/04/2034 | | | 4,500,000 | | | | 4,612,448 | |

| Malaysia Sovereign Sukuk Bhd., 4.24%, 04/22/2045 | | | 900,000 | | | | 837,550 | |

| Malaysia Sukuk Global Bhd. | | | | | | | | |

| 3.18%, 04/27/2026 | | | 1,850,000 | | | | 1,816,050 | |

| 4.08%, 04/27/2046 | | | 950,000 | | | | 857,721 | |

| Malaysia Wakala Sukuk Bhd. | | | | | | | | |

| 2.07%, 04/28/2031 | | | 1,650,000 | | | | 1,439,802 | |

| 3.08%, 04/28/2051 | | | 950,000 | | | | 708,791 | |

| Perusahaan Penerbit SBSN Indonesia III | | | | | | | | |

| 4.55%, 03/29/2026 | | | 3,400,000 | | | | 3,405,671 | |

| 1.50%, 06/09/2026 | | | 2,500,000 | | | | 2,385,206 | |

| 4.15%, 03/29/2027 | | | 3,900,000 | | | | 3,850,422 | |

| 4.40%, 06/06/2027 | | | 3,500,000 | | | | 3,469,438 | |

| 4.40%, 03/01/2028 | | | 3,400,000 | | | | 3,361,910 | |

| 5.40%, 11/15/2028 | | | 1,900,000 | | | | 1,936,858 | |

| 4.45%, 02/20/2029 | | | 2,500,000 | | | | 2,462,499 | |

| 5.10%, 07/02/2029 | | | 1,500,000 | | | | 1,512,937 | |

| 2.80%, 06/23/2030 | | | 2,000,000 | | | | 1,792,624 | |

| 2.55%, 06/09/2031 | | | 2,000,000 | | | | 1,738,869 | |

| 4.70%, 06/06/2032 | | | 3,000,000 | | | | 2,949,545 | |

| 5.60%, 11/15/2033 | | | 2,000,000 | | | | 2,078,211 | |

| 5.20%, 07/02/2034 | | | 2,000,000 | | | | 2,023,178 | |

| 3.80%, 06/23/2050 | | | 1,400,000 | | | | 1,095,693 | |

| 3.55%, 06/09/2051 | | | 1,400,000 | | | | 1,041,453 | |

| 5.50%, 07/02/2054 | | | 1,200,000 | | | | 1,206,659 | |

| ROP Sukuk Trust, 5.05%, 06/06/2029 | | | 2,100,000 | | | | 2,121,259 | |

| Sharjah Sukuk Program Ltd. | | | | | | | | |

| 3.85%, 04/03/2026 | | | 2,000,000 | | | | 1,963,415 | |

| 2.94%, 06/10/2027 | | | 2,000,000 | | | | 1,887,634 | |

| 4.23%, 03/14/2028 | | | 2,400,000 | | | | 2,331,618 | |

| The accompanying notes are an integral part of these financial statements. | 1 |

| | SP Funds Dow Jones |

| Schedule of Investments | Global Sukuk ETF |

| 3.23%, 10/23/2029 | | | 2,040,000 | | | | 1,858,037 | |

| 3.89%, 04/04/2030 | | | 1,400,000 | | | | 1,309,700 | |

| 3.20%, 07/13/2031 | | | 1,600,000 | | | | 1,407,546 | |

| 6.09%, 03/19/2034 | | | 1,800,000 | | | | 1,888,791 | |

| 5.43%, 04/17/2035 | | | 750,000 | | | | 747,392 | |

| | | | | | | | 105,912,759 | |

| TOTAL FOREIGN GOVERNMENT SUKUK (Cost $134,284,713) | | | | | | | 132,542,000 | |

| | | | | | | | | |

| CORPORATE SUKUK - 48.6% | | | | | | | | |

| Banks - 16.1% | | | | | | | | |

| Adib Sukuk Co. II Ltd., 5.70%, 11/15/2028 | | | 1,100,000 | | | | 1,131,869 | |

| Al Rajhi Sukuk Ltd. | | | | | | | | |

| 4.75%, 04/05/2028 | | | 2,200,000 | | | | 2,197,198 | |

| 5.05%, 03/12/2029 | | | 1,900,000 | | | | 1,918,264 | |

| AUB Sukuk Ltd., 2.62%, 09/09/2026 | | | 1,200,000 | | | | 1,145,418 | |

| Banque Saudi Fransi, 4.75%, 05/31/2028 | | | 1,900,000 | | | | 1,890,905 | |

| BBG Sukuk Ltd., 4.56%, 10/09/2029 | | | 750,000 | | | | 747,246 | |

| Boubyan Sukuk Ltd., 3.39%, 03/29/2027 | | | 1,000,000 | | | | 969,025 | |

| BSF Sukuk Co. Ltd., 5.00%, 01/25/2029 | | | 1,400,000 | | | | 1,406,468 | |

| DIB Sukuk Ltd. | | | | | | | | |

| 2.95%, 01/16/2026 | | | 2,600,000 | | | | 2,539,950 | |

| 1.96%, 06/22/2026 | | | 2,000,000 | | | | 1,907,042 | |

| 2.74%, 02/16/2027 | | | 1,400,000 | | | | 1,333,785 | |

| 5.49%, 11/30/2027 | | | 1,600,000 | | | | 1,625,899 | |

| 4.80%, 08/16/2028 | | | 2,000,000 | | | | 1,993,235 | |

| 5.24%, 03/04/2029 | | | 1,900,000 | | | | 1,920,143 | |

| EI Sukuk Co. Ltd. | | | | | | | | |

| 2.08%, 11/02/2026 | | | 1,000,000 | | | | 948,180 | |

| 5.43%, 05/28/2029 | | | 1,500,000 | | | | 1,538,184 | |

| Fab Sukuk Co. Ltd. | | | | | | | | |

| 1.41%, 01/14/2026 | | | 1,400,000 | | | | 1,346,861 | |

| 2.59%, 03/02/2027 | | | 1,000,000 | | | | 958,913 | |

| 4.58%, 01/17/2028 | | | 1,000,000 | | | | 999,111 | |

| 4.78%, 01/23/2029 | | | 1,600,000 | | | | 1,598,972 | |

| KFH Sukuk Co., 5.01%, 01/17/2029 | | | 2,100,000 | | | | 2,106,762 | |

| QIB Sukuk Ltd. | | | | | | | | |

| 5.58%, 11/22/2028 | | | 1,700,000 | | | | 1,759,075 | |

| 4.49%, 09/17/2029 | | | 1,600,000 | | | | 1,588,652 | |

| QIIB Senior Oryx Ltd., 5.25%, 01/24/2029 | | | 1,600,000 | | | | 1,637,791 | |

| SIB Sukuk Co. III Ltd., 5.25%, 07/03/2029 | | | 1,050,000 | | | | 1,066,270 | |

| SNB Sukuk Ltd. | | | | | | | | |

| 2.34%, 01/19/2027 | | | 1,600,000 | | | | 1,521,713 | |

| 5.13%, 02/27/2029 | | | 1,700,000 | | | | 1,713,653 | |

| Warba Sukuk Ltd., 5.35%, 07/10/2029 | | | 1,050,000 | | | | 1,063,654 | |

| | | | | | | | 42,574,238 | |

| | | | | | | | | |

| Chemicals - 0.6% | | | | | | | | |

| Equate Sukuk Spc Ltd., 5.00%, 09/05/2031 | | | 1,450,000 | | | | 1,460,380 | |

| | | | | | | | | |

| Commercial Services - 3.0% | | | | | | | | |

| D.P. World Crescent Ltd. | | | | | | | | |

| 4.85%, 09/26/2028 | | | 2,000,000 | | | | 1,990,699 | |

| 3.88%, 07/18/2029 | | | 2,000,000 | | | | 1,908,946 | |

| 3.75%, 01/30/2030 | | | 1,000,000 | | | | 944,755 | |

| DP World Crescent Ltd., 5.50%, 09/13/2033 | | | 3,000,000 | | | | 3,056,160 | |

| | | | | | | | 7,900,560 | |

| The accompanying notes are an integral part of these financial statements. | 2 |

| | SP Funds Dow Jones |

| Schedule of Investments | Global Sukuk ETF |

| Diversified Financial Services - 1.0% | | | | | | |

| AIR Lease Corp. Sukuk Ltd., 5.85%, 04/01/2028 | | | 1,200,000 | | | | 1,224,417 | |

| DAE Sukuk Difc Ltd., 3.75%, 02/15/2026 | | | 1,400,000 | | | | 1,377,531 | |

| | | | | | | | 2,601,948 | |

| | | | | | | | | |

| Electric - 7.4% | | | | | | | | |

| Saudi Electricity Global Sukuk Co. 2, 5.06%, 04/08/2043 | | | 2,000,000 | | | | 1,912,903 | |

| Saudi Electricity Global Sukuk Co. 3, 5.50%, 04/08/2044 | | | 2,000,000 | | | | 1,990,264 | |

| Saudi Electricity Global Sukuk Co. 4, 4.72%, 09/27/2028 | | | 2,400,000 | | | | 2,401,332 | |

| Saudi Electricity Global Sukuk Co. 5, 2.41%, 09/17/2030 | | | 1,200,000 | | | | 1,049,716 | |

| Saudi Electricity Sukuk Programme Co. | | | | | | | | |

| 4.94%, 02/13/2029 | | | 1,600,000 | | | | 1,609,912 | |

| 4.63%, 04/11/2033 | | | 2,300,000 | | | | 2,276,489 | |

| 5.19%, 02/13/2034 | | | 2,700,000 | | | | 2,737,084 | |

| 5.68%, 04/11/2053 | | | 2,900,000 | | | | 2,866,885 | |

| TNB Global Ventures Capital Bhd. | | | | | | | | |

| 3.24%, 10/19/2026 | | | 1,400,000 | | | | 1,359,539 | |

| 4.85%, 11/01/2028 | | | 1,400,000 | | | | 1,404,614 | |

| | | | | | | | 19,608,738 | |

| | | | | | | | | |

| Food - 0.6% | | | | | | | | |

| Almarai Co. JSC, 5.23%, 07/25/2033 | | | 1,500,000 | | | | 1,536,990 | |

| | | | | | | | | |

| Investment Companies – 8.1% | | | | | | | | |

| Aercap Sukuk Ltd., 4.50%, 10/03/2029 | | | 750,000 | | | | 726,686 | |

| Dua Capital Ltd. | | | | | | | | |

| 1.66%, 05/11/2026 | | | 800,000 | | | | 764,087 | |

| 2.78%, 05/11/2031 | | | 1,200,000 | | | | 1,064,834 | |

| Khazanah Global Sukuk Bhd., | | | | | | | | |

| 4.69%, 06/01/2028 | | | 1,500,000 | | | | 1,500,300 | |

| 4.48%, 09/05/2029 | | | 1,000,000 | | | | 990,665 | |

| Mdgh Sukuk Ltd., 4.96%, 04/04/2034 | | | 1,900,000 | | | | 1,918,141 | |

| Senaat Sukuk Ltd., 4.76%, 12/05/2025 | | | 600,000 | | | | 598,247 | |

| Suci Second Investment Co. | | | | | | | | |

| 4.38%, 09/10/2027 | | | 2,950,000 | | | | 2,906,758 | |

| 6.00%, 10/25/2028 | | | 4,300,000 | | | | 4,468,884 | |

| 5.17%, 03/05/2031 | | | 4,000,000 | | | | 4,066,110 | |

| 6.25%, 10/25/2033 | | | 2,400,000 | | | | 2,609,739 | |

| | | | | | | | 21,614,451 | |

| | | | | | | | | |

| Oil & Gas - 4.8% | | | | | | | | |

| EDO Sukuk Ltd. | | | | | | | | |

| 5.66%, 07/03/2031 | | | 750,000 | | | | 760,335 | |

| 5.88%, 09/21/2033 | | | 500,000 | | | | 515,500 | |

| SA Global Sukuk Ltd. | | | | | | | | |

| 1.60%, 06/17/2026 | | | 4,000,000 | | | | 3,809,420 | |

| 4.25%, 10/02/2029 | | | 1,200,000 | | | | 1,176,720 | |

| 2.69%, 06/17/2031 | | | 5,800,000 | | | | 5,107,625 | |

| 4.75%, 10/02/2034 | | | 1,200,000 | | | | 1,188,751 | |

| | | | | | | | 12,558,351 | |

| | | | | | | | | |

| Pipelines - 1.2% | | | | | | | | |

| TMS Issuer SARL, 5.78%, 08/23/2032 | | | 3,000,000 | | | | 3,079,542 | |

| | | | | | | | | |

| Real Estate - 4.2% | | | | | | | | |

| Aldar Investment Properties Sukuk Ltd. | | | | | | | | |

| 4.88%, 05/24/2033 | | | 1,000,000 | | | | 987,703 | |

| 5.50%, 05/16/2034 | | | 1,000,000 | | | | 1,030,056 | |

| The accompanying notes are an integral part of these financial statements. | 3 |

| | SP Funds Dow Jones |

| Schedule of Investments | Global Sukuk ETF |

| Aldar Sukuk No. 2 Ltd., 3.88%, 10/22/2029 | | | 1,000,000 | | | | 953,396 | |

| Emaar Sukuk Ltd. | | | | | | | | |

| 3.64%, 09/15/2026 | | | 1,600,000 | | | | 1,564,238 | |

| 3.88%, 09/17/2029 | | | 1,000,000 | | | | 956,404 | |

| 3.70%, 07/06/2031 | | | 1,000,000 | | | | 931,848 | |

| Esic Sukuk Ltd., 5.83%, 02/14/2029 | | | 1,400,000 | | | | 1,428,021 | |

| MAF Sukuk Ltd. | | | | | | | | |

| 4.64%, 05/14/2029 | | | 1,200,000 | | | | 1,186,644 | |

| 3.93%, 02/28/2030 | | | 1,200,000 | | | | 1,143,962 | |

| 5.00%, 06/01/2033 | | | 1,000,000 | | | | 1,000,695 | |

| | | | | | | | 11,182,967 | |

| | | | | | | | | |

| Telecommunications - 1.6% | | | | | | | | |

| Axiata SPV2 Bhd. | | | | | | | | |

| 4.36%, 03/24/2026 | | | 1,000,000 | | | | 992,624 | |

| 2.16%, 08/19/2030 | | | 1,000,000 | | | | 864,821 | |

| Saudi Telecom Co., 3.89%, 05/13/2029 | | | 2,400,000 | | | | 2,338,611 | |

| | | | | | | | 4,196,056 | |

| TOTAL CORPORATE SUKUK (Cost $128,803,341) | | | | | | | 128,314,221 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 98.7% (Cost $263,088,054) | | | | | | | 260,856,221 | |

| Other Assets in Excess of Liabilities - 1.3% | | | | | | | 3,440,126 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 264,296,347 | |

Percentages are stated as a percent of net assets.

SPV2 - Special-Purpose Vehicle2

| (a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

| The accompanying notes are an integral part of these financial statements. | 4 |

| | SP Funds S&P 500 Sharia |

| Schedule of Investments | Industry Exclusions ETF |

| | | | | | | |

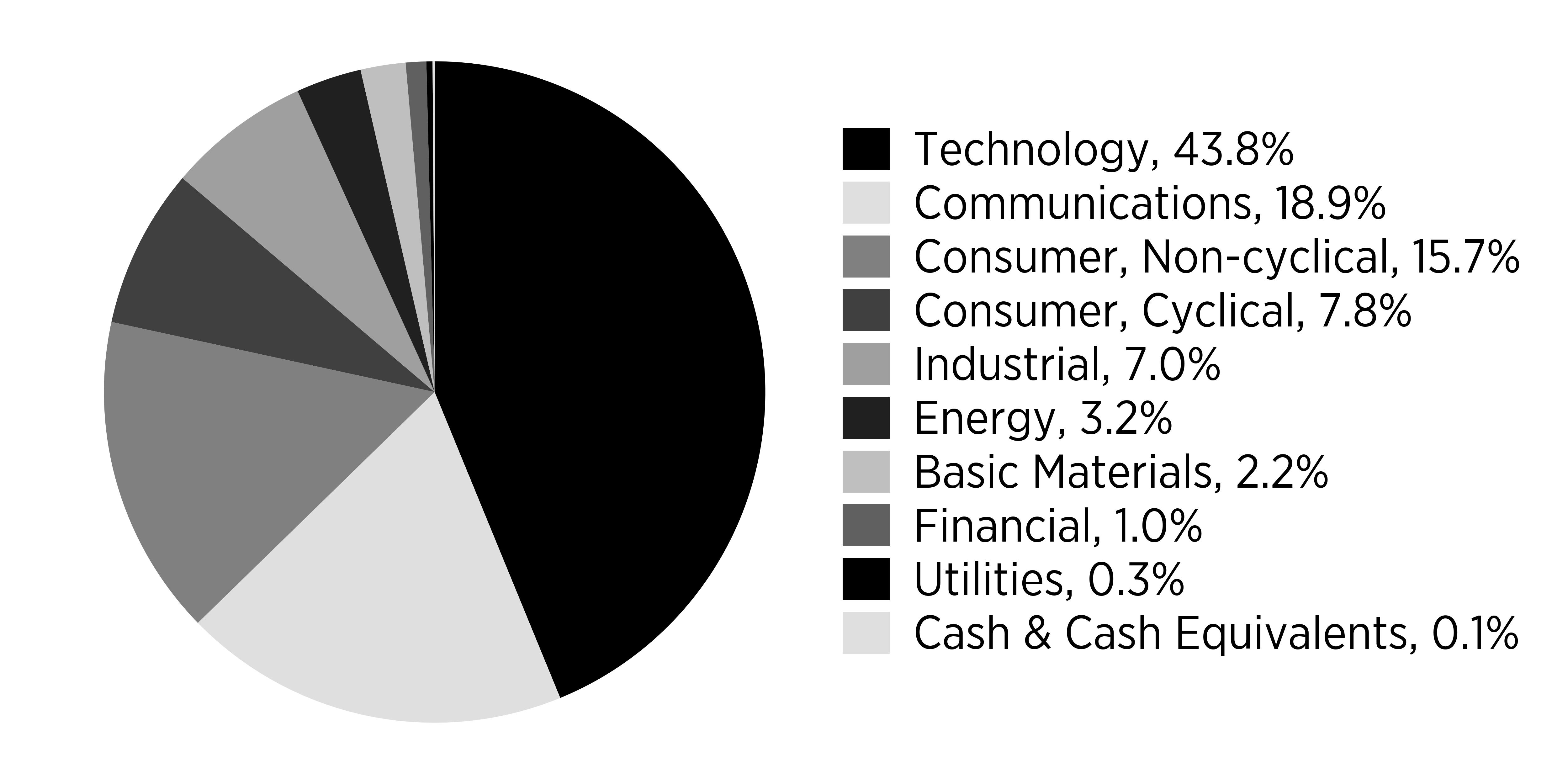

| COMMON STOCKS - 98.9% | | Shares | | | Value | |

| Agriculture - 0.1% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 13,916 | | | $ | 759,814 | |

| | | | | | | | | |

| Apparel - 0.4% | | | | | | | | |

| Deckers Outdoor Corp. (a) | | | 4,436 | | | | 869,278 | |

| Nike, Inc. - Class B | | | 34,966 | | | | 2,754,272 | |

| Ralph Lauren Corp. | | | 1,162 | | | | 268,887 | |

| | | | | | | | 3,892,437 | |

| | | | | | | | | |

| Auto Manufacturers - 3.2% | | | | | | | | |

| Cummins, Inc. | | | 3,983 | | | | 1,493,784 | |

| Tesla, Inc. (a) | | | 80,755 | | | | 27,873,396 | |

| | | | | | | | 29,367,180 | |

| | | | | | | | | |

| Auto Parts & Equipment - 0.0%(b) | | | | | | | | |

| Aptiv PLC (a) | | | 7,726 | | | | 429,025 | |

| | | | | | | | | |

| Beverages - 0.9% | | | | | | | | |

| Keurig Dr Pepper, Inc. | | | 32,761 | | | | 1,069,647 | |

| Monster Beverage Corp. (a) | | | 20,520 | | | | 1,131,267 | |

| PepsiCo, Inc. | | | 39,977 | | | | 6,534,241 | |

| | | | | | | | 8,735,155 | |

| | | | | | | | | |

| Biotechnology - 0.9% | | | | | | | | |

| Biogen, Inc. (a) | | | 4,231 | | | | 679,626 | |

| Corteva, Inc. | | | 20,146 | | | | 1,253,887 | |

| Gilead Sciences, Inc. | | | 36,228 | | | | 3,353,988 | |

| Incyte Corp. (a) | | | 4,649 | | | | 346,769 | |

| Regeneron Pharmaceuticals, Inc. (a) | | | 3,083 | | | | 2,312,928 | |

| | | | | | | | 7,947,198 | |

| | | | | | | | | |

| Building Materials - 0.8% | | | | | | | | |

| Builders FirstSource, Inc. (a) | | | 3,380 | | | | 630,269 | |

| Johnson Controls International PLC | | | 19,439 | | | | 1,630,154 | |

| Martin Marietta Materials, Inc. | | | 1,778 | | | | 1,066,800 | |

| Masco Corp. | | | 6,349 | | | | 511,475 | |

| Mohawk Industries, Inc. (a) | | | 1,517 | | | | 210,605 | |

| Trane Technologies PLC | | | 6,562 | | | | 2,731,236 | |

| Vulcan Materials Co. | | | 3,839 | | | | 1,106,131 | |

| | | | | | | | 7,886,670 | |

| | | | | | | | | |

| Chemicals - 1.7% | | | | | | | | |

| Air Products and Chemicals, Inc. | | | 6,466 | | | | 2,161,778 | |

| Albemarle Corp. | | | 3,411 | | | | 367,365 | |

| CF Industries Holdings, Inc. | | | 5,281 | | | | 473,494 | |

| DuPont de Nemours, Inc. | | | 12,151 | | | | 1,015,702 | |

| Ecolab, Inc. | | | 7,366 | | | | 1,832,440 | |

| Linde PLC | | | 13,990 | | | | 6,449,250 | |

| PPG Industries, Inc. | | | 6,782 | | | | 843,477 | |

| The Mosaic Co. | | | 9,267 | | | | 245,205 | |

| The Sherwin-Williams Co. | | | 6,759 | | | | 2,686,027 | |

| | | | | | | | 16,074,738 | |

| | | | | | | | | |

| Commercial Services - 0.5% | | | | | | | | |

| Cintas Corp. | | | 9,985 | | | | 2,254,513 | |

| The accompanying notes are an integral part of these financial statements. | 5 |

| | SP Funds S&P 500 Sharia |

| Schedule of Investments | Industry Exclusions ETF |

| Equifax, Inc. | | | 3,600 | | | | 941,616 | |

| Quanta Services, Inc. | | | 4,279 | | | | 1,474,201 | |

| Rollins, Inc. | | | 8,171 | | | | 411,247 | |

| | | | | | | | 5,081,577 | |

| | | | | | | | | |

| Computers - 12.8% | | | | | | | | |

| Accenture PLC - Class A | | | 18,231 | | | | 6,606,368 | |

| Apple, Inc. | | | 442,529 | | | | 105,025,408 | |

| Cognizant Technology Solutions Corp. - Class A | | | 14,420 | | | | 1,160,666 | |

| EPAM Systems, Inc. (a) | | | 1,648 | | | | 401,980 | |

| Fortinet, Inc. (a) | | | 18,475 | | | | 1,756,049 | |

| Gartner, Inc. (a) | | | 2,237 | | | | 1,158,609 | |

| HP, Inc. | | | 28,473 | | | | 1,008,798 | |

| NetApp, Inc. | | | 5,974 | | | | 732,651 | |

| Super Micro Computer, Inc. (a) | | | 14,648 | | | | 478,111 | |

| | | | | | | | 118,328,640 | |

| | | | | | | | | |

| Cosmetics & Personal Care - 1.8% | | | | | | | | |

| Colgate-Palmolive Co. | | | 23,777 | | | | 2,297,571 | |

| Kenvue, Inc. | | | 55,739 | | | | 1,342,195 | |

| The Estee Lauder Company, Inc. - Class A | | | 6,774 | | | | 488,541 | |

| The Procter & Gamble Co. | | | 68,515 | | | | 12,281,999 | |

| | | | | | | | 16,410,306 | |

| | | | | | | | | |

| Distribution & Wholesale - 0.6% | | | | | | | | |

| Copart, Inc. (a) | | | 25,483 | | | | 1,615,367 | |

| Fastenal Co. | | | 16,665 | | | | 1,392,527 | |

| LKQ Corp. | | | 7,654 | | | | 300,726 | |

| Pool Corp. | | | 1,111 | | | | 418,947 | |

| W.W. Grainger, Inc. | | | 1,288 | | | | 1,552,478 | |

| | | | | | | | 5,280,045 | |

| | | | | | | | | |

| Electric - 0.3% | | | | | | | | |

| Constellation Energy Corp. | | | 9,110 | | | | 2,337,262 | |

| | | | | | | | | |

| Electrical Components & Equipment - 0.9% | | | | | | | | |

| AMETEK, Inc. | | | 6,731 | | | | 1,308,372 | |

| Eaton Corp. PLC | | | 11,583 | | | | 4,348,490 | |

| Emerson Electric Co. | | | 16,734 | | | | 2,218,928 | |

| Generac Holdings, Inc. (a) | | | 1,751 | | | | 329,538 | |

| | | | | | | | 8,205,328 | |

| | | | | | | | | |

| Electronics - 1.5% | | | | | | | | |

| Allegion PLC | | | 2,527 | | | | 355,903 | |

| Amphenol Corp. - Class A | | | 35,047 | | | | 2,546,164 | |

| Fortive Corp. | | | 10,189 | | | | 808,293 | |

| Garmin Ltd. | | | 4,474 | | | | 951,172 | |

| Honeywell International, Inc. | | | 19,047 | | | | 4,436,618 | |

| Hubbell, Inc. | | | 1,554 | | | | 714,980 | |

| Jabil, Inc. | | | 3,296 | | | | 447,696 | |

| Keysight Technologies, Inc. (a) | | | 5,071 | | | | 866,330 | |

| Mettler-Toledo International, Inc. (a) | | | 610 | | | | 763,232 | |

| TE Connectivity PLC | | | 8,844 | | | | 1,336,505 | |

| Trimble, Inc. (a) | | | 7,106 | | | | 518,525 | |

| | | | | | | | 13,745,418 | |

| | | | | | | | | |

| Energy - Alternate Sources - 0.1% | | | | | | | | |

| The accompanying notes are an integral part of these financial statements. | 6 |

| Schedule of Investments | SP Funds S&P 500 Sharia Industry Exclusions ETF |

| November 30, 2024 | | | | | | |

| | | | | | | |

| Enphase Energy, Inc. (a) | | | 3,936 | | | | 280,833 | |

| First Solar, Inc. (a) | | | 3,110 | | | | 619,730 | |

| | | | | | | | 900,563 | |

| Engineering & Construction - 0.1% | | | | | | | | |

| Jacobs Solutions, Inc. | | | 3,642 | | | | 514,360 | |

| | | | | | | | | |

| Environmental Control - 0.5% | | | | | | | | |

| Pentair PLC | | | 4,811 | | | | 524,351 | |

| Republic Services, Inc. | | | 5,933 | | | | 1,295,174 | |

| Veralto Corp. | | | 7,189 | | | | 777,778 | |

| Waste Management, Inc. | | | 10,627 | | | | 2,425,294 | |

| | | | | | | | 5,022,597 | |

| Food - 0.6% | | | | | | | | |

| General Mills, Inc. | | | 16,194 | | | | 1,073,014 | |

| Kellanova | | | 7,804 | | | | 634,387 | |

| Lamb Weston Holdings, Inc. | | | 4,173 | | | | 322,323 | |

| McCormick & Co., Inc. | | | 7,330 | | | | 574,745 | |

| Mondelez International, Inc. - Class A | | | 38,871 | | | | 2,524,671 | |

| The Hershey Co. | | | 4,289 | | | | 755,422 | |

| | | | | | | | 5,884,562 | |

| Healthcare - Products - 4.7% | | | | | | | | |

| Abbott Laboratories | | | 50,636 | | | | 6,014,038 | |

| Agilent Technologies, Inc. | | | 8,484 | | | | 1,170,537 | |

| Align Technology, Inc. (a) | | | 2,040 | | | | 474,851 | |

| Bio-Techne Corp. | | | 4,584 | | | | 345,450 | |

| Boston Scientific Corp. (a) | | | 42,857 | | | | 3,885,416 | |

| Danaher Corp. | | | 18,702 | | | | 4,482,682 | |

| Edwards Lifesciences Corp. (a) | | | 17,531 | | | | 1,250,837 | |

| GE HealthCare Technologies, Inc. | | | 13,294 | | | | 1,106,327 | |

| Hologic, Inc. (a) | | | 6,752 | | | | 536,784 | |

| IDEXX Laboratories, Inc. (a) | | | 2,388 | | | | 1,007,139 | |

| Insulet Corp. (a) | | | 2,037 | | | | 543,431 | |

| Intuitive Surgical, Inc. (a) | | | 10,315 | | | | 5,590,730 | |

| Medtronic PLC | | | 37,330 | | | | 3,230,538 | |

| ResMed, Inc. | | | 4,267 | | | | 1,062,568 | |

| STERIS PLC | | | 2,867 | | | | 628,045 | |

| Stryker Corp. | | | 9,974 | | | | 3,911,304 | |

| Teleflex, Inc. | | | 1,368 | | | | 263,819 | |

| The Cooper Cos., Inc. (a) | | | 5,789 | | | | 604,719 | |

| Thermo Fisher Scientific, Inc. | | | 11,110 | | | | 5,884,189 | |

| Waters Corp. (a) | | | 1,718 | | | | 660,949 | |

| West Pharmaceutical Services, Inc. | | | 2,107 | | | | 686,208 | |

| Zimmer Biomet Holdings, Inc. | | | 5,919 | | | | 663,520 | |

| | | | | | | | 44,004,081 | |

| Healthcare - Services - 0.1% | | | | | | | | |

| Charles River Laboratories International, Inc. (a) | | | 1,495 | | | | 297,595 | |

| Labcorp Holdings, Inc. | | | 2,436 | | | | 587,466 | |

| Molina Healthcare, Inc. (a) | | | 1,696 | | | | 505,238 | |

| | | | | | | | 1,390,299 | |

| Home Builders - 0.2% | | | | | | | | |

| D.R. Horton, Inc. | | | 8,532 | | | | 1,440,031 | |

| PulteGroup, Inc. | | | 6,030 | | | | 815,678 | |

| | | | | | | | 2,255,709 | |

| The accompanying notes are an integral part of these financial statements. | 7 |

| Schedule of Investments | SP Funds S&P 500 Sharia Industry Exclusions ETF |

November 30, 2024

| Household Products & Wares - 0.3% | | | | | | |

| Avery Dennison Corp. | | | 2,337 | | | | 481,305 | |

| Church & Dwight Co., Inc. | | | 7,142 | | | | 786,548 | |

| Kimberly-Clark Corp. | | | 9,800 | | | | 1,365,630 | |

| The Clorox Co. | | | 3,603 | | | | 602,314 | |

| | | | | | | | 3,235,797 | |

| Internet - 17.4% | | | | | | | | |

| Alphabet, Inc. - Class A | | | 170,532 | | | | 28,811,382 | |

| Alphabet, Inc. - Class C | | | 139,794 | | | | 23,833,479 | |

| Amazon.com, Inc. (a) | | | 271,880 | | | | 56,521,133 | |

| Booking Holdings, Inc. | | | 974 | | | | 5,066,729 | |

| CDW Corp. | | | 3,883 | | | | 683,136 | |

| eBay, Inc. | | | 14,228 | | | | 900,490 | |

| F5, Inc. (a) | | | 1,687 | | | | 422,341 | |

| Meta Platforms, Inc. - Class A | | | 63,584 | | | | 36,517,563 | |

| Palo Alto Networks, Inc. (a) | | | 9,416 | | | | 3,651,713 | |

| Uber Technologies, Inc. (a) | | | 61,143 | | | | 4,399,850 | |

| VeriSign, Inc. (a) | | | 2,435 | | | | 455,783 | |

| | | | | | | | 161,263,599 | |

| Iron & Steel - 0.2% | | | | | | | | |

| Nucor Corp. | | | 6,898 | | | | 1,067,051 | |

| Steel Dynamics, Inc. | | | 4,169 | | | | 605,631 | |

| | | | | | | | 1,672,682 | |

| Machinery - Diversified - 0.8% | | | | | | | | |

| Dover Corp. | | | 3,995 | | | | 822,571 | |

| IDEX Corp. | | | 2,198 | | | | 506,925 | |

| Ingersoll Rand, Inc. | | | 11,738 | | | | 1,222,747 | |

| Nordson Corp. | | | 1,575 | | | | 411,059 | |

| Otis Worldwide Corp. | | | 11,699 | | | | 1,204,763 | |

| Rockwell Automation, Inc. | | | 3,294 | | | | 972,191 | |

| Westinghouse Air Brake Technologies Corp. | | | 5,090 | | | | 1,021,156 | |

| Xylem, Inc. | | | 7,068 | | | | 895,869 | |

| | | | | | | | 7,057,281 | |

| Mining - 0.3% | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 41,818 | | | | 1,848,356 | |

| Newmont Corp. | | | 33,391 | | | | 1,400,418 | |

| | | | | | | | 3,248,774 | |

| Miscellaneous Manufacturers - 0.8% | | | | | | | | |

| 3M Co. | | | 16,069 | | | | 2,145,693 | |

| A.O. Smith Corp. | | | 3,491 | | | | 260,045 | |

| Illinois Tool Works, Inc. | | | 7,863 | | | | 2,182,140 | |

| Parker-Hannifin Corp. | | | 3,738 | | | | 2,627,440 | |

| | | | | | | | 7,215,318 | |

| Office & Business Equipment - 0.1% | | | | | | | | |

| Zebra Technologies Corp. - Class A (a) | | | 1,494 | | | | 608,058 | |

| | | | | | | | | |

| Oil & Gas - 2.7% | | | | | | | | |

| ConocoPhillips | | | 33,799 | | | | 3,661,784 | |

| Coterra Energy, Inc. | | | 21,509 | | | | 574,720 | |

| The accompanying notes are an integral part of these financial statements. | 8 |

| Schedule of Investments | SP Funds S&P 500 Sharia Industry Exclusions ETF |

| November 30, 2024 | | | | | | |

| | | | | | | |

| Devon Energy Corp. | | | 18,214 | | | | 691,221 | |

| EOG Resources, Inc. | | | 16,548 | | | | 2,205,186 | |

| Exxon Mobil Corp. | | | 129,309 | | | | 15,253,290 | |

| Hess Corp. | | | 8,042 | | | | 1,183,622 | |

| Valero Energy Corp. | | | 9,317 | | | | 1,295,808 | |

| | | | | | | | 24,865,631 | |

| Oil & Gas Services - 0.4% | | | | | | | | |

| Baker Hughes Co. | | | 28,911 | | | | 1,270,638 | |

| Halliburton Co. | | | 25,689 | | | | 818,452 | |

| Schlumberger NV | | | 41,323 | | | | 1,815,733 | |

| | | | | | | | 3,904,823 | |

| Packaging & Containers - 0.1% | | | | | | | | |

| Packaging Corp. of America | | | 2,597 | | | | 646,263 | |

| | | | | | | | | |

| Pharmaceuticals - 5.8% | | | | | | | | |

| AbbVie, Inc. | | | 51,407 | | | | 9,403,883 | |

| Becton Dickinson & Co. | | | 8,406 | | | | 1,865,291 | |

| Cardinal Health, Inc. | | | 7,095 | | | | 867,293 | |

| Cencora, Inc. | | | 5,080 | | | | 1,277,874 | |

| Dexcom, Inc. (a) | | | 11,659 | | | | 909,285 | |

| Eli Lilly & Co. | | | 22,993 | | | | 18,287,483 | |

| Henry Schein, Inc. (a) | | | 3,685 | | | | 283,929 | |

| Johnson & Johnson | | | 70,066 | | | | 10,860,931 | |

| McKesson Corp. | | | 3,771 | | | | 2,370,073 | |

| Merck & Co., Inc. | | | 73,776 | | | | 7,498,593 | |

| | | | | | | | 53,624,635 | |

| Retail - 3.4% | | | | | | | | |

| AutoZone, Inc. (a) | | | 491 | | | | 1,556,244 | |

| Best Buy Co., Inc. | | | 5,707 | | | | 513,630 | |

| Genuine Parts Co. | | | 4,048 | | | | 513,003 | |

| Lowe’s Company, Inc. | | | 16,584 | | | | 4,517,979 | |

| Lululemon Athletica, Inc. (a) | | | 3,339 | | | | 1,070,684 | |

| O’Reilly Automotive, Inc. (a) | | | 1,679 | | | | 2,087,366 | |

| Ross Stores, Inc. | | | 9,707 | | | | 1,503,323 | |

| Target Corp. | | | 13,460 | | | | 1,780,893 | |

| The Home Depot, Inc. | | | 28,858 | | | | 12,383,834 | |

| The TJX Company, Inc. | | | 32,894 | | | | 4,134,447 | |

| Tractor Supply Co. | | | 3,133 | | | | 888,738 | |

| Ulta Beauty, Inc. (a) | | | 1,383 | | | | 534,723 | |

| | | | | | | | 31,484,864 | |

| Semiconductors - 17.2% | | | | | | | | |

| Advanced Micro Devices, Inc. (a) | | | 47,103 | | | | 6,461,354 | |

| Analog Devices, Inc. | | | 14,436 | | | | 3,147,770 | |

| Applied Materials, Inc. | | | 24,091 | | | | 4,208,939 | |

| Broadcom, Inc. | | | 135,480 | | | | 21,958,598 | |

| KLA Corp. | | | 3,907 | | | | 2,527,946 | |

| Lam Research Corp. | | | 37,939 | | | | 2,802,933 | |

| Microchip Technology, Inc. | | | 15,606 | | | | 1,063,861 | |

| Micron Technology, Inc. | | | 32,271 | | | | 3,160,944 | |

| Monolithic Power Systems, Inc. | | | 1,413 | | | | 802,075 | |

| NVIDIA Corp. | | | 716,006 | | | | 98,987,830 | |

| NXP Semiconductors NV | | | 7,409 | | | | 1,699,402 | |

| ON Semiconductor Corp. (a) | | | 12,464 | | | | 886,440 | |

| The accompanying notes are an integral part of these financial statements. | 9 |

| Schedule of Investments | SP Funds S&P 500 Sharia Industry Exclusions ETF |

| November 30, 2024 | | | | | | |

| | | | | | | |

| Qorvo, Inc. (a) | | | 2,759 | | | | 190,509 | |

| QUALCOMM, Inc. | | | 32,419 | | | | 5,139,384 | |

| Skyworks Solutions, Inc. | | | 4,645 | | | | 406,856 | |

| Teradyne, Inc. | | | 4,745 | | | | 521,950 | |

| Texas Instruments, Inc. | | | 26,568 | | | | 5,340,965 | |

| | | | | | | | 159,307,756 | |

| Software - 13.7% | | | | | | | | |

| Adobe, Inc. (a) | | | 12,897 | | | | 6,653,949 | |

| Akamai Technologies, Inc. (a) | | | 4,409 | | | | 414,534 | |

| ANSYS, Inc. (a) | | | 2,534 | | | | 889,687 | |

| Autodesk, Inc. (a) | | | 6,268 | | | | 1,829,629 | |

| Cadence Design Systems, Inc. (a) | | | 7,968 | | | | 2,444,662 | |

| Fair Isaac Corp. (a) | | | 705 | | | | 1,674,396 | |

| Microsoft Corp. | | | 216,347 | | | | 91,614,301 | |

| Paycom Software, Inc. | | | 1,410 | | | | 327,007 | |

| PTC, Inc. (a) | | | 3,496 | | | | 699,410 | |

| Roper Technologies, Inc. | | | 3,114 | | | | 1,763,894 | |

| Salesforce, Inc. | | | 28,198 | | | | 9,305,058 | |

| ServiceNow, Inc. (a) | | | 5,987 | | | | 6,282,997 | |

| Synopsys, Inc. (a) | | | 4,458 | | | | 2,489,749 | |

| Tyler Technologies, Inc. (a) | | | 1,238 | | | | 778,913 | |

| | | | | | | | 127,168,186 | |

| Telecommunications - 1.5% | | | | | | | | |

| Arista Networks, Inc. (a) | | | 7,491 | | | | 3,039,998 | |

| Cisco Systems, Inc. | | | 117,258 | | | | 6,942,846 | |

| Corning, Inc. | | | 22,549 | | | | 1,097,460 | |

| Juniper Networks, Inc. | | | 9,574 | | | | 343,898 | |

| Motorola Solutions, Inc. | | | 4,850 | | | | 2,423,545 | |

| | | | | | | | 13,847,747 | |

| Transportation - 1.5% | | | | | | | | |

| C.H. Robinson Worldwide, Inc. | | | 3,404 | | | | 359,394 | |

| CSX Corp. | | | 56,427 | | | | 2,062,407 | |

| Expeditors International of Washington, Inc. | | | 4,100 | | | | 498,724 | |

| J.B. Hunt Transport Services, Inc. | | | 2,338 | | | | 442,139 | |

| Norfolk Southern Corp. | | | 6,575 | | | | 1,813,714 | |

| Old Dominion Freight Line, Inc. | | | 5,485 | | | | 1,234,893 | |

| Union Pacific Corp. | | | 17,726 | | | | 4,336,843 | |

| United Parcel Service, Inc. - Class B | | | 21,314 | | | | 2,892,736 | |

| | | | | | | | 13,640,850 | |

| TOTAL COMMON STOCKS (Cost $710,617,385) | | | | | | | 917,245,228 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS - 1.0% | | | | | | | | |

| AvalonBay Communities, Inc. | | | 4,126 | | | | 971,054 | |

| Camden Property Trust | | | 3,098 | | | | 389,728 | |

| Equinix, Inc. | | | 2,762 | | | | 2,710,848 | |

| Equity Residential | | | 9,926 | | | | 760,927 | |

| Mid-America Apartment Communities, Inc. | | | 3,392 | | | | 556,831 | |

| Prologis, Inc. | | | 26,948 | | | | 3,146,987 | |

| Weyerhaeuser Co. | | | 21,165 | | | | 682,783 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $8,350,409) | | | | | | | 9,219,158 | |

| The accompanying notes are an integral part of these financial statements. | 10 |

| Schedule of Investments | SP Funds S&P 500 Sharia Industry Exclusions ETF |

| November 30, 2024 | | | | | | |

| | | | | | | |

| RIGHTS – 0.0%(b) | | | | | | |

| Healthcare - Products - 0.0% | | | | | | | | |

| ABIOMED, Inc. - CVR(a)(c) | | | 405 | | | | 0 | |

| TOTAL RIGHTS (Cost $0) | | | | | | | 0 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 99.9% (Cost $718,967,794) | | | | | | | 926,464,386 | |

| Other Assets in Excess of Liabilities - 0.1% | | | | | | | 1,239,332 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 927,703,718 | |

Percentages are stated as a percent of net assets.

CVR – Contingent Value Rights

PLC - Public Limited Company

| (a) | Non-income producing security. |

| (b) | Represents less than 0.05% of net assets. |

| (c) | Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of November 30, 2024. |

| The accompanying notes are an integral part of these financial statements. | 11 |

| Schedule of Investments | SP Funds S&P Global REIT Sharia ETF |

November 30, 2024

| REAL ESTATE INVESTMENT TRUSTS - 99.6% | | Shares | | | Value | |

| Arena REIT | | | 263,475 | | | $ | 710,592 | |

| AvalonBay Communities, Inc. | | | 73,754 | | | | 17,358,004 | |

| Avrupakent Gayrimenkul Yatirim Ortakligi AS | | | 56,786 | | | | 94,917 | |

| Axis Real Estate Investment Trust | | | 944,812 | | | | 367,722 | |

| BWP Trust | | | 376,825 | | | | 832,185 | |

| Camden Property Trust | | | 61,675 | | | | 7,758,715 | |

| Charter Hall Group | | | 320,260 | | | | 3,279,711 | |

| Citicore Energy REIT Corp. | | | 1,768,794 | | | | 92,007 | |

| CubeSmart | | | 150,716 | | | | 7,469,485 | |

| Dexus Industria REIT | | | 143,929 | | | | 252,221 | |

| EastGroup Properties, Inc. | | | 32,879 | | | | 5,662,093 | |

| Equinix, Inc. | | | 20,794 | | | | 20,408,895 | |

| Equity LifeStyle Properties, Inc. | | | 104,946 | | | | 7,485,798 | |

| Equity Residential | | | 100,651 | | | | 7,715,906 | |

| First Industrial Realty Trust, Inc. | | | 89,441 | | | | 4,780,621 | |

| Goodman Group | | | 781,638 | | | | 19,303,664 | |

| IGB Real Estate Investment Trust | | | 952,148 | | | | 447,692 | |

| IMPACT Growth Real Estate Investment Trust | | | 424,172 | | | | 138,515 | |

| Innovative Industrial Properties, Inc. | | | 19,148 | | | | 2,087,515 | |

| Kizilbuk Gayrimenkul Yatirim Ortakligi AS (a) | | | 70,982 | | | | 61,778 | |

| Lotus’s Retail Growth Freehold And Leasehold Property Fund | | | 1,034,957 | | | | 383,234 | |

| Mid-America Apartment Communities, Inc. | | | 47,126 | | | | 7,736,204 | |

| MREIT, Inc. | | | 755,522 | | | | 177,042 | |

| Ozak Gayrimenkul Yatirim Ortakligi (a) | | | 265,757 | | | | 98,492 | |

| Parkway Life Real Estate Investment Trust | | | 262,094 | | | | 742,891 | |

| PotlatchDeltic Corp. | | | 48,532 | | | | 2,176,175 | |

| Prologis, Inc. | | | 162,860 | | | | 19,018,791 | |

| Rayonier, Inc. | | | 90,617 | | | | 2,887,964 | |

| Rexford Industrial Realty, Inc. | | | 148,046 | | | | 6,229,776 | |

| RL Commercial REIT, Inc. | | | 2,898,731 | | | | 291,677 | |

| Terreno Realty Corp. | | | 65,488 | | | | 3,970,537 | |

| Torunlar Gayrimenkul Yatirim Ortakligi AS | | | 101,403 | | | | 169,056 | |

| Weyerhaeuser Co. | | | 243,190 | | | | 7,845,309 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $139,664,662) | | | | | | | 158,035,184 | |

| | | | | | | | | |

| COMMON STOCKS - 0.2% | | | | | | | | |

| Private Equity - 0.2% | | | | | | | | |

| Servet Gayrimenkul Yatirim Ortakligi AS (a) | | | 9,843 | | | | 79,639 | |

| Ziraat Gayrimenkul Yatirim Ortakligi AS | | | 602,866 | | | | 228,814 | |

| TOTAL COMMON STOCKS (Cost $245,748) | | | | | | | 308,453 | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 99.8% (Cost $139,910,410) | | | | | | | 158,343,637 | |

| Other Assets in Excess of Liabilities - 0.2% | | | | | | | 385,332 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 158,728,969 | |

Percentages are stated as a percent of net assets.

REIT - Real Estate Investment Trust

(a) Non-income producing security.

| The accompanying notes are an integral part of these financial statements. | 12 |

| Statements of Assets and Liabilities | SP Funds ETFs |

November 30, 2024

| | | SP Funds Dow Jones Global Sukuk ETF | | | SP Funds S&P 500 Sharia Industry Exclusions ETF | | | SP Funds S&P Global REIT Sharia ETF | |

| ASSETS: | | | | | | | | | |

| Investments, at value (Note 2) | | $ | 260,856,221 | | | $ | 926,464,386 | | | $ | 158,343,637 | |

| Receivable for investments sold | | | 2,866,795 | | | | — | | | | — | |

| Interest receivable | | | 2,596,276 | | | | — | | | | — | |

| Cash | | | 1,113,718 | | | | 788,229 | | | | 293,981 | |

| Dividends receivable | | | — | | | | 775,704 | | | | 157,379 | |

| Dividend tax reclaims receivable | | | — | | | | 1,832 | | | | 1,013 | |

| Foreign currency, at value | | | — | | | | — | | | | 1,378 | |

| Prepaid expenses and other assets | | | — | | | | — | | | | 898 | |

| Total assets | | | 267,433,010 | | | | 928,030,151 | | | | 158,798,286 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Payable for investments purchased | | | 3,018,078 | | | | — | | | | — | |

| Payable to adviser (Note 4) | | | 118,585 | | | | 326,433 | | | | 69,317 | |

| Total liabilities | | | 3,136,663 | | | | 326,433 | | | | 69,317 | |

| NET ASSETS | | $ | 264,296,347 | | | $ | 927,703,718 | | | $ | 158,728,969 | |

| | | | | | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 264,612,956 | | | $ | 730,652,377 | | | $ | 152,241,199 | |

| Total distributable earnings/(accumulated losses) | | | (316,609 | ) | | | 197,051,341 | | | | 6,487,770 | |

| Total net assets | | $ | 264,296,347 | | | $ | 927,703,718 | | | $ | 158,728,969 | |

| | | | | | | | | | | | | |

| Net assets | | $ | 264,296,347 | | | $ | 927,703,718 | | | $ | 158,728,969 | |

| Shares issued and outstanding | | | 14,600,000 | | | | 21,625,000 | | | | 7,400,000 | |

| Net asset value per share | | $ | 18.10 | | | $ | 42.90 | | | $ | 21.45 | |

| | | | | | | | | | | | | |

| COST: | | | | | | | | | | | | |

| Investments, at cost | | $ | 263,088,054 | | | $ | 718,967,794 | | | $ | 139,910,410 | |

| Foreign currency, at cost | | $ | — | | | $ | — | | | $ | 1,525 | |

| The accompanying notes are an integral part of these financial statements. | 13 |

| Statements of Operations | SP Funds ETFs |

For the Year Ended November 30, 2024

| | | SP Funds Dow Jones Global Sukuk ETF | | | SP Funds S&P 500 Sharia Industry Exclusions ETF | | | SP Funds S&P Global REIT Sharia ETF | |

| INVESTMENT INCOME: | | | | | | | | | |

| Dividend income | | $ | — | | | $ | 5,822,852 | | | $ | 3,102,432 | |

| Less: Dividend withholding taxes | | | — | | | | (3,138 | ) | | | (28,029 | ) |

| Sukuk income | | | 9,078,084 | | | | — | | | | — | |

| Total investment income | | | 9,078,084 | | | | 5,819,714 | | | | 3,074,403 | |

| | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | |

| Investment advisory fee (Note 4) | | | 1,129,963 | | | | 2,668,431 | | | | 636,885 | |

| Total expenses | | | 1,129,963 | | | | 2,668,431 | | | | 636,885 | |

| NET INVESTMENT INCOME | | | 7,948,121 | | | | 3,151,283 | | | | 2,437,518 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN | | | | | | | | | | | | |

| Net realized loss from: | | | | | | | | | | | | |

| Investments | | | (520,216 | ) | | | (7,698,307 | ) | | | (4,625,312 | ) |

| Foreign currency transactions | | | — | | | | — | | | | (18,467 | ) |

| Net realized loss | | | (520,216 | ) | | | (7,698,307 | ) | | | (4,643,779 | ) |

| Net change in unrealized appreciation on: | | | | | | | | | | | | |

| Investments | | | 3,704,396 | | | | 156,967,856 | | | | 23,367,386 | |

| Foreign currency translation | | | — | | | | — | | | | (201 | ) |

| Net change in unrealized appreciation | | | 3,704,396 | | | | 156,967,856 | | | | 23,367,185 | |

| Net realized and unrealized gain | | | 3,184,180 | | | | 149,269,549 | | | | 18,723,406 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 11,132,301 | | | $ | 152,420,832 | | | $ | 21,160,924 | |

| The accompanying notes are an integral part of these financial statements. | 14 |

| Statements of Changes in Net Assets | SP Funds ETFs |

| | | | | | | | | | | | | |

| | | SP Funds Dow Jones Global Sukuk ETF | | | SP Funds S&P 500 Sharia Industry Exclusions ETF | |

| | | Year ended November 30, 2024 | | | Year ended November 30, 2023 | | | Year ended November 30, 2024 | | | Year ended November 30, 2023 | |

| OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 7,948,121 | | | $ | 3,457,731 | | | $ | 3,151,283 | | | $ | 2,072,202 | |

| Net realized loss | | | (520,216 | ) | | | (473,537 | ) | | | (7,698,307 | ) | | | (1,136,881 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 3,704,396 | | | | (1,040,662 | ) | | | 156,967,856 | | | | 46,084,935 | |

| Net increase in net assets from operations | | | 11,132,301 | | | | 1,943,532 | | | | 152,420,832 | | | | 47,020,256 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Distributions to shareholders | | | (5,756,705 | ) | | | (2,373,600 | ) | | | (3,139,234 | ) | | | (2,081,082 | ) |

| Return of capital | | | — | | | | — | | | | (1,552,247 | ) | | | (566,368 | ) |

| Total distributions to shareholders | | | (5,756,705 | ) | | | (2,373,600 | ) | | | (4,691,481 | ) | | | (2,647,450 | ) |

| | | | | | | | | | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Subscriptions | | | 107,934,082 | | | | 85,916,855 | | | | 427,344,387 | | | | 134,572,228 | |

| Redemptions | | | — | | | | — | | | | (854,060 | ) | | | — | |

| ETF transaction fees (Note 8) | | | 37,138 | | | | 27,699 | | | | — | | | | — | |

| Net increase in net assets from capital transactions | | | 107,971,220 | | | | 85,944,554 | | | | 426,490,327 | | | | 134,572,228 | |

| | | | | | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | 113,346,816 | | | | 85,514,486 | | | | 574,219,678 | | | | 178,945,034 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of the year | | | 150,949,531 | | | | 65,435,045 | | | | 353,484,040 | | | | 174,539,006 | |

| End of the year | | $ | 264,296,347 | | | $ | 150,949,531 | | | $ | 927,703,718 | | | $ | 353,484,040 | |

| | | | | | | | | | | | | | | | | |

| SHARES TRANSACTIONS | | | | | | | | | | | | | | | | |

| Subscriptions | | | 6,025,000 | | | | 4,850,000 | | | | 10,875,000 | | | | 4,425,000 | |

| Redemptions | | | — | | | | — | | | | (25,000 | ) | | | — | |

| Total increase in shares outstanding | | | 6,025,000 | | | | 4,850,000 | | | | 10,850,000 | | | | 4,425,000 | |

| The accompanying notes are an integral part of these financial statements. | 15 |

| Statements of Changes in Net Assets | SP Funds ETFs |

| | | SP Funds S&P Global REIT Sharia ETF | |

| | | Year ended November 30, 2024 | | | Year ended November 30, 2023 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 2,437,518 | | | $ | 1,022,265 | |

| Net realized loss | | | (4,643,779 | ) | | | (3,655,309 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 23,367,185 | | | | (130,689 | ) |

| Net increase/(decrease) in net assets from operations | | | 21,160,924 | | | | (2,763,733 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions to shareholders | | | (3,312,054 | ) | | | (1,158,718 | ) |

| Return of capital | | | (1,544,676 | ) | | | (1,471,032 | ) |

| Total distributions to shareholders | | | (4,856,730 | ) | | | (2,629,750 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | |

| Subscriptions | | | 67,339,690 | | | | 48,081,853 | |

| Redemptions | | | — | | | | (6,861,610 | ) |

| Net increase in net assets from capital transactions | | | 67,339,690 | | | | 41,220,243 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS | | | 83,643,884 | | | | 35,826,760 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of the year | | | 75,085,085 | | | | 39,258,325 | |

| End of the year | | $ | 158,728,969 | | | $ | 75,085,085 | |

| | | | | | | | | |

| SHARES TRANSACTIONS | | | | | | | | |

| Subscriptions | | | 3,350,000 | | | | 2,450,000 | |

| Redemptions | | | — | | | | (350,000 | ) |

| Total increase in shares outstanding | | | 3,350,000 | | | | 2,100,000 | |

| The accompanying notes are an integral part of these financial statements. | 16 |

| Financial Highlights | SP Funds ETFs |

For a share outstanding throughout the years/period presented

SP Funds Dow Jones Global Sukuk ETF

| | | | | | Year ended November 30, | | | | | | Period ended | |

| | | | | | | | | | | | | | | November 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020(a) | |

| PER SHARE DATA: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 17.60 | | | $ | 17.57 | | | $ | 19.76 | | | $ | 20.41 | | | $ | 20.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.69 | | | | 0.57 | | | | 0.35 | | | | 0.27 | | | | 0.30 | |

| Net realized and unrealized gain (loss) on investments(c) | | | 0.34 | | | | (0.16 | ) | | | (2.09 | ) | | | (0.42 | ) | | | 0.39 | |

| Total from investment operations | | | 1.03 | | | | 0.41 | | | | (1.74 | ) | | | (0.15 | ) | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.53 | ) | | | (0.38 | ) | | | (0.36 | ) | | | (0.26 | ) | | | (0.28 | ) |

| Return of capital | | | — | | | | — | | | | (0.09 | ) | | | (0.24 | ) | | | — | |

| Total distributions | | | (0.53 | ) | | | (0.38 | ) | | | (0.45 | ) | | | (0.50 | ) | | | (0.28 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| ETF transaction fees per share | | | 0.00 | (d) | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 18.10 | | | $ | 17.60 | | | $ | 17.57 | | | $ | 19.76 | | | $ | 20.41 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN(e) | | | 5.87 | % | | | 2.46 | % | | | -8.92 | % | | | -0.73 | % | | | 3.48 | %(f) |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 264,296 | | | $ | 150,950 | | | $ | 65,435 | | | $ | 37,542 | | | $ | 31,123 | |

| Ratio of expenses to average net assets(g) | | | 0.55 | %(h) | | | 0.59 | % | | | 0.59 | %(i) | | | 0.65 | % | | | 0.65 | % |

| Ratio of net investment income to average net assets(g) | | | 3.87 | % | | | 3.23 | % | | | 1.91 | % | | | 1.32 | % | | | 1.61 | % |

| Portfolio turnover rate(e)(j) | | | 15 | % | | | 19 | % | | | 9 | % | | | 28 | % | | | 15 | % |

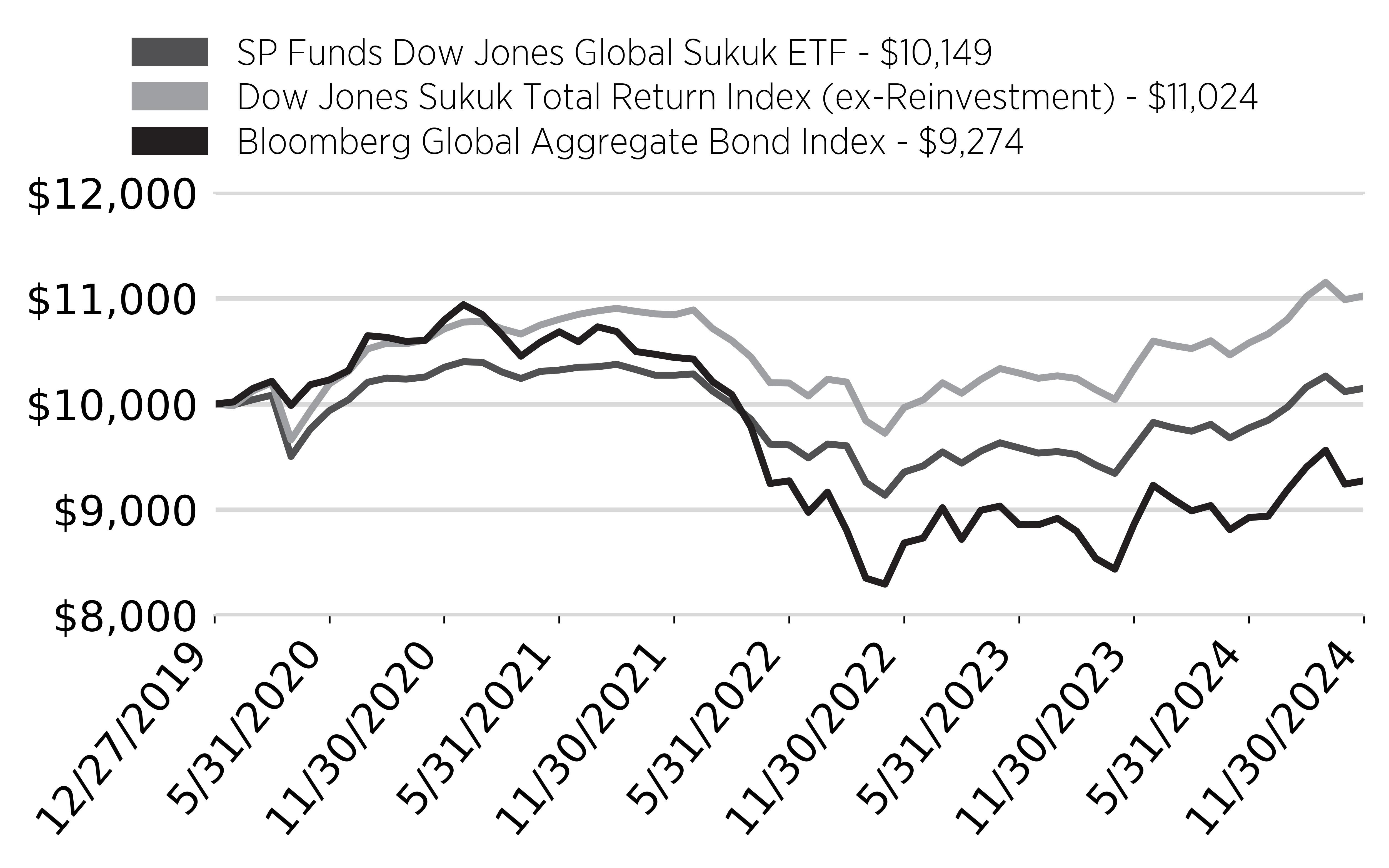

| (a) | Inception date of the Fund was December 27, 2019. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the year. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (d) | Amount represents less than $0.005 per share. |

| (e) | Not annualized for periods less than one year. |

| (f) | Net increase from payments by affiliates on the disposal of investments due to trade error added 0.11% to this return. |

| (g) | Annualized for periods less than one year. |

| (h) | Effective December 1, 2023, the Fund’s management fee was reduced from 0.59% to 0.55%. |

| (i) | Effective November 30, 2021, the Fund’s management fee was reduced from 0.65% to 0.59%. |

| (j) | Portfolio turnover rate excludes in-kind transactions. |

| The accompanying notes are an integral part of these financial statements. | 17 |

| Financial Highlights | SP Funds ETFs |

For a share outstanding throughout the years/period presented

SP Funds S&P 500 Sharia Industry Exclusions ETF

| | | | | | Year ended November 30, | | | | | | Period ended | |

| | | | | | | | | | | | | | | November 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020(a) | |

| PER SHARE DATA: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 32.81 | | | $ | 27.49 | | | $ | 32.48 | | | $ | 24.26 | | | $ | 20.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.21 | | | | 0.25 | | | | 0.25 | | | | 0.17 | | | | 0.22 | |

| Net realized and unrealized gain (loss) on investments(c) | | | 10.18 | | | | 5.38 | | | | (4.83 | ) | | | 8.36 | | | | 4.25 | |

| Total from investment operations | | | 10.39 | | | | 5.63 | | | | (4.58 | ) | | | 8.53 | | | | 4.47 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.20 | ) | | | (0.24 | ) | | | (0.25 | ) | | | (0.18 | ) | | | (0.21 | ) |

| Net realized gains | | | — | | | | — | | | | (0.07 | ) | | | (0.13 | ) | | | — | |

| Return of capital | | | (0.10 | ) | | | (0.07 | ) | | | (0.09 | ) | | | — | | | | — | |

| Total distributions | | | (0.30 | ) | | | (0.31 | ) | | | (0.41 | ) | | | (0.31 | ) | | | (0.21 | ) |

| Net asset value, end of period | | $ | 42.90 | | | $ | 32.81 | | | $ | 27.49 | | | $ | 32.48 | | | $ | 24.26 | |

| | | | | | | | | | | | | | | | | | | | | |

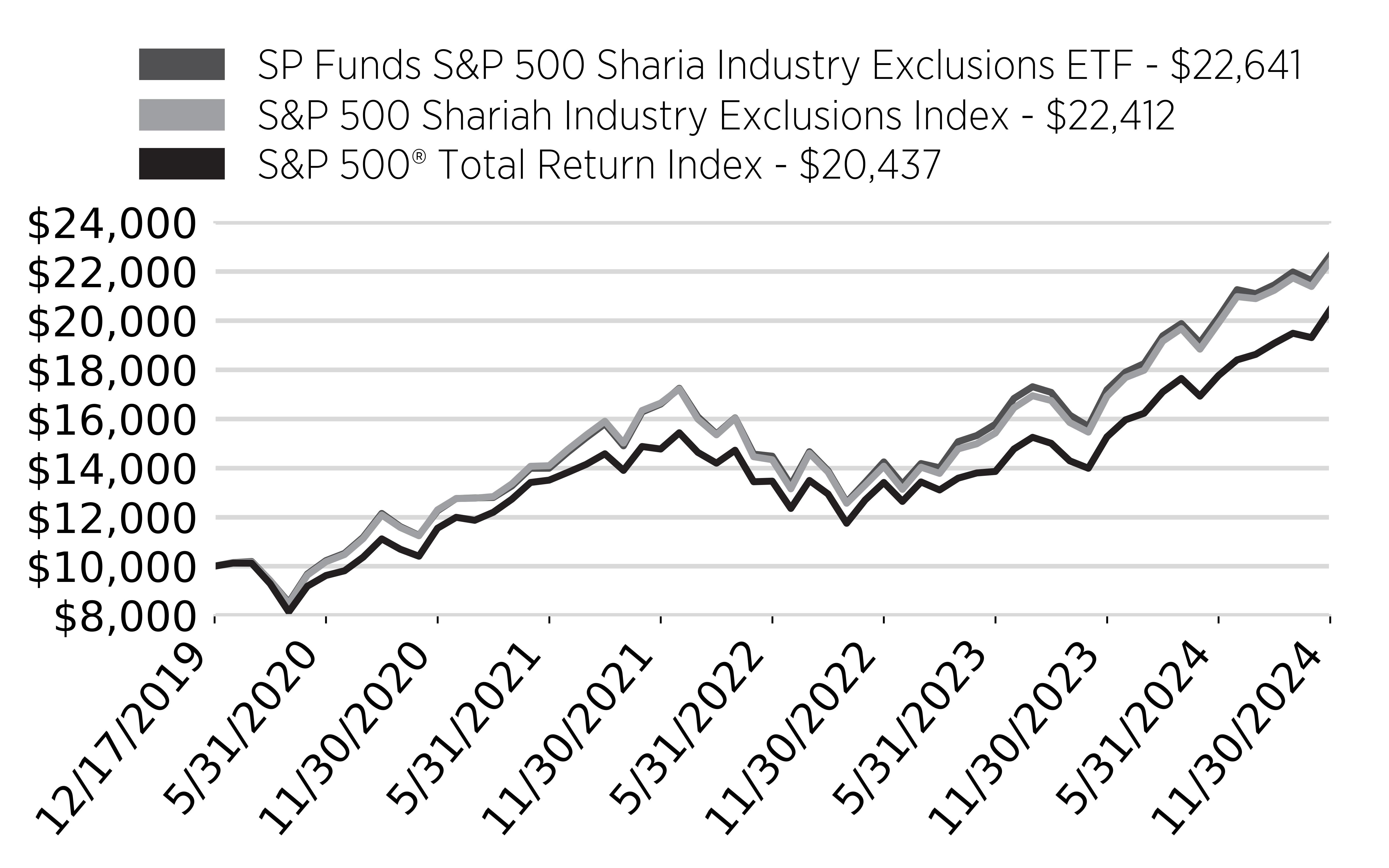

| TOTAL RETURN(d) | | | 31.77 | % | | | 20.62 | % | | | -14.17 | % | | | 35.40 | % | | | 22.58 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 927,704 | | | $ | 353,484 | | | $ | 174,539 | | | $ | 123,430 | | | $ | 38,821 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets(e) | | | 0.45 | %(f) | | | 0.49 | % | | | 0.49 | % | | | 0.49 | % | | | 0.49 | % |

| Ratio of net investment income to average net assets(e) | | | 0.53 | % | | | 0.82 | % | | | 0.89 | % | | | 0.60 | % | | | 1.06 | % |

| Portfolio turnover rate(d)(g) | | | 18 | % | | | 5 | % | | | 4 | % | | | 18 | % | | | 46 | % |

| (a) | Inception date of the Fund was December 17, 2019. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the year. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Effective December 1, 2023, the Fund’s management fee was reduced from 0.49% to 0.45%. |

| (g) | Portfolio turnover rate excludes in-kind transactions. |

| The accompanying notes are an integral part of these financial statements. | 18 |

| Financial Highlights | SP Funds ETFs |

For a share outstanding throughout the years/period presented

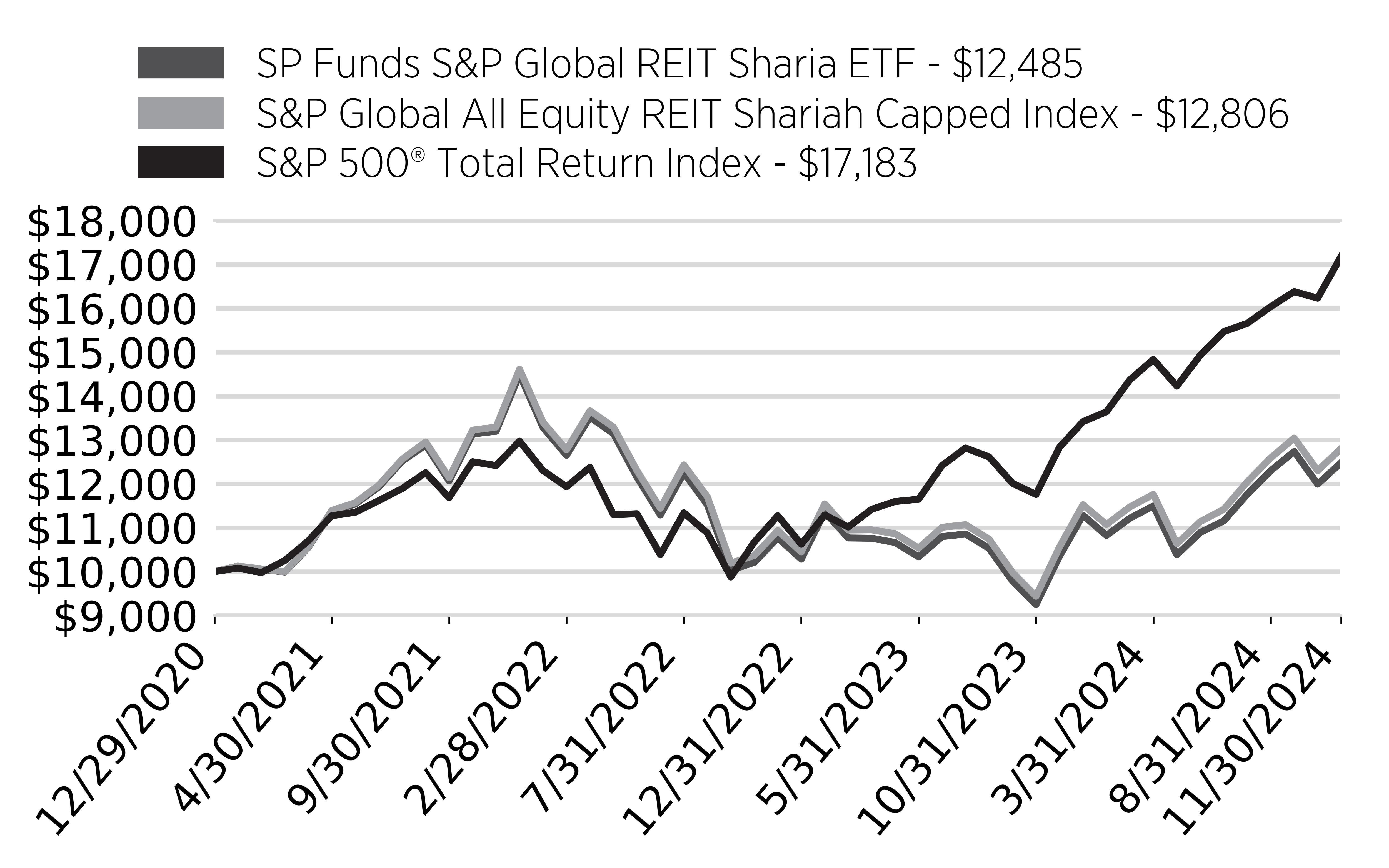

SP Funds S&P Global REIT Sharia ETF

| | | Year ended November 30, | | | Period ended | |

| | | | | | | | | | | | November 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021(a) | |

| PER SHARE DATA: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.54 | | | $ | 20.13 | | | $ | 25.63 | | | $ | 20.00 | |

| | | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.43 | | | | 0.32 | | | | 0.36 | | | | 0.26 | |

| Net realized and unrealized gain (loss) on investments(c) | | | 3.32 | | | | (1.11 | ) | | | (4.99 | ) | | | 6.04 | |

| Total from investment operations | | | 3.75 | | | | (0.79 | ) | | | (4.63 | ) | | | 6.30 | |

| | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.57 | ) | | | (0.35 | ) | | | (0.38 | ) | | | (0.29 | ) |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.15 | ) |

| Return of capital | | | (0.27 | ) | | | (0.45 | ) | | | (0.49 | ) | | | (0.23 | ) |

| Total distributions | | | (0.84 | ) | | | (0.80 | ) | | | (0.87 | ) | | | (0.67 | ) |

| Net asset value, end of period | | $ | 21.45 | | | $ | 18.54 | | | $ | 20.13 | | | $ | 25.63 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(d) | | | 20.65 | % | | | -3.92 | % | | | -18.39 | % | | | 31.98 | % |

| | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 158,729 | | | $ | 75,085 | | | $ | 39,258 | | | $ | 23,068 | |

| Ratio of expenses to average net assets(e) | | | 0.55 | %(f) | | | 0.59 | %(g) | | | 0.69 | % | | | 0.69 | % |

| Ratio of net investment income to average net assets(e) | | | 2.10 | % | | | 1.69 | % | | | 1.59 | % | | | 1.19 | % |

| Portfolio turnover rate(d)(h) | | | 46 | % | | | 29 | % | | | 50 | % | | | 79 | % |

| (a) | Inception date of the Fund was December 29, 2020. |

| (b) | Net investment income per share has been calculated based on average shares outstanding during the year. |

| (c) | Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to share transactions for the year. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | Effective December 1, 2023, the Fund’s management fee was reduced from 0.59% to 0.55%. |

| (g) | Effective December 1, 2022, the Fund’s management fee was reduced from 0.69% to 0.59%. |

| (h) | Portfolio turnover rate excludes in-kind transactions. |

| The accompanying notes are an integral part of these financial statements. | 19 |

| Notes to the Financial Statements | SP Funds ETFs |

November 30, 2024

The SP Funds Dow Jones Global Sukuk ETF (the “Sukuk ETF”), the SP Funds S&P 500 Sharia Industry Exclusions ETF (the “Sharia ETF”), and the SP Funds S&P Global REIT ETF (the “Global REIT ETF”) (each a “Fund”, and collectively, the “Funds”) are each a series of shares of beneficial interest of Tidal ETF Trust (the “Trust”). The Sukuk ETF is a diversified series and each of the Sharia ETF and the Global REIT ETF is a non-diversified series of the Trust. The Sukuk ETF commenced operations as a non-diversified series, however, the Fund continuously operated as diversified for three years and as of December 27, 2022, is now classified as diversified. The Trust was organized as a Delaware statutory trust on June 4, 2018 and is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of each Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended. The Trust is governed by the Board of Trustees (the “Board”). Tidal Investments LLC (“Tidal Investments” or the “Adviser”), a Tidal Financial Group company, serves as investment adviser to the Funds and ShariaPortfolio, Inc. (the “Sub-Adviser”) serves as sub-adviser to the Funds. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services—Investment Companies.” The Sharia ETF commenced operations on December 17, 2019, the Sukuk ETF commenced operations on December 27, 2019 and the Global REIT ETF commenced operations on December 29, 2020.

The investment objective of the Sukuk ETF is to seek to track the performance, before fees and expenses, of the Dow Jones Sukuk Total Return (ex-Reinvestment) Index (the “Sukuk Index”). The investment objective of the Sharia ETF is to seek to track the performance, before fees and expenses, of the S&P 500 Shariah Industry Exclusions Index (the “Sharia Index”) . The investment objective of the Global REIT ETF is to seek to track the performance, before fees and expenses, of the S&P Global All Equity REIT Sharia Capped Index (the “Global REIT Index”).

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| A. | Security Valuation. Equity securities, which may include Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDCs”), and Master Limited Partnerships (“MLPs”), listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the Nasdaq Stock Market, LLC (the “NASDAQ”)), including securities traded over-the-counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on the valuation date (or at approximately 4:00 p.m. EST if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price or mean between the most recent quoted bid and ask prices for long and short positions. For a security that trades on multiple exchanges, the primary exchange will generally be considered the exchange on which the security is generally most actively traded. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Prices of securities traded on the securities exchange will be obtained from recognized independent pricing agents each day that the Funds are open for business. |

Sukuk securities are valued by using an evaluated mean of the bid and ask prices provided by independent pricing agents. The Independent Pricing Agents may employ methodologies that utilize actual market transactions (if the security is actively traded), broker-dealer supplied valuations, or other methodologies designed to identify the market value for such securities. In arriving at valuations, such methodologies generally consider factors such as security prices, yields, maturities, call features, ratings and developments relating to specific securities.

Under Rule 2a-5 of the 1940 Act, a fair value will be determined for securities for which quotations are not readily available by the Valuation Designee (as defined in Rule 2a-5) in accordance with the Pricing and Valuation Policy and Fair Value Procedures, as applicable, of the Adviser, subject to oversight by the Board. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the Adviser’s Pricing and Valuation Policy and Fair Value Procedures, as applicable. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value (“NAV”) of its shares to differ significantly from the NAV that would be calculated without regard to such considerations.

| Notes to the Financial Statements | SP Funds ETFs |

November 30, 2024

As described above, the Funds utilize various methods to measure the fair value of their investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value each Fund’s investments as of November 30, 2024:

| | | Sukuk ETF | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Foreign Government Sukuk | | $ | — | | | $ | 132,542,000 | | | $ | — | | | $ | 132,542,000 | |

| Corporate Sukuk | | | — | | | | 128,314,221 | | | | — | | | | 128,314,221 | |

| Total Investments | | $ | — | | | $ | 260,856,221 | | | $ | — | | | $ | 260,856,221 | |

| | | Sharia ETF | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 917,245,228 | | | $ | — | | | $ | — | | | $ | 917,245,228 | |

| Real Estate Investment Trusts | | | 9,219,158 | | | | — | | | | — | | | | 9,219,158 | |

| Rights | | | — | | | | — | | | | 0 | | | | 0 | |

| Total Investments | | $ | 926,464,386 | | | $ | — | | | $ | 0 | | | $ | 926,464,386 | |

| | | Global REIT ETF | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Real Estate Investment Trusts | | $ | 157,651,950 | | | $ | 383,234 | | | $ | — | | | $ | 158,035,184 | |

| Common Stocks | | | 308,453 | | | | — | | | | — | | | | 308,453 | |

| Total Investments | | $ | 157,960,403 | | | $ | 383,234 | | | $ | — | | | $ | 158,343,637 | |

Refer to the Schedules of Investments for further disaggregation of investment categories.

| Notes to the Financial Statements | SP Funds ETFs |

November 30, 2024

The following is a reconciliation of Level 3 investments for the Sharia ETF for which significant unobservable inputs were used to determine fair value:

| | | Rights(a) | |

| Balance as of November 30, 2023 | | $ | 0 | |

| Accrued discounts/premiums | | | — | |

| Realized gain (loss) | | | — | |

| Change in unrealized appreciation/depreciation | | | — | |

| Purchases | | | — | |

| Sales | | | — | |

| Transfer into and/or out of Level 3 | | | — | |

| Balance as of November 30, 2024 | | $ | 0 | |

| | | | | |

| Change in unrealized appreciation/depreciation during the period for Level 3 investments held at November 30, 2024: | | $ | — | |

| (a) | The securities (Rights) are classified as Level 3 securities due to a lack of market activity. |

| B. | Federal Income Taxes. Each Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income taxes or excise taxes has been made. |

In order to avoid imposition of the excise tax applicable to regulated investment companies, the Funds intend to declare as dividends in each calendar year at least 98.0% of its net investment income (earned during the calendar year) and at least 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years. As a registered investment company, each Fund is subject to a 4% excise tax that is imposed if a Fund does not distribute by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one year period generally ending on October 31 of the calendar year (unless an election is made to use the fund’s fiscal year). The Funds generally intend to distribute income and capital gains in the manner necessary to minimize (but not necessarily eliminate) the imposition of such excise tax. The Funds may retain income or capital gains and pay excise tax when it is determined that doing so is in the best interest of shareholders. Management, in consultation with the Board of Trustees, evaluates the costs of the excise tax relative to the benefits of retaining income and capital gains, including that such undistributed amounts (net of the excise tax paid) remain available for investment by the Funds and are available to supplement future distributions. Tax expense is disclosed in the Statements of Operations, if applicable.

As of November 30, 2024, the Funds did not have any tax positions that did not meet the threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all the tax returns filed for the last three years. The Funds identify their major tax jurisdiction as U.S. Federal and the Commonwealth of Delaware; however, the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statements of Operations.

| C. | Securities Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on sukuk securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date. Dividends received from REITs generally are comprised of ordinary income, capital gains, and may include return of capital. Sukuk income is recorded on an accrual basis. Other non-cash dividends are recognized as investment income at the fair value of the property received. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. |

| D. | Foreign Currency. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. |

| Notes to the Financial Statements | SP Funds ETFs |

November 30, 2024

The Funds does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

The Funds reports net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

| E. | Distributions to Shareholders. Distributions to shareholders from net investment income, if any, for the Funds are declared and paid at least monthly. Distributions to shareholders from net realized gains on securities, if any, for the Funds normally are declared and paid on an annual basis. Distributions are recorded on the ex-dividend date. |

| F. | Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| G. | Share Valuation. The NAV per share of each Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading. |

| H. | Guarantees and Indemnifications. In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

| I. | Illiquid Securities. Pursuant to Rule 22e-4 under the 1940 Act, the Funds have adopted a Board-approved Liquidity Risk Management Program (the “Program”) that requires, among other things, that each Fund limit its illiquid investments that are assets to no more than 15% of the value of the Fund’s net assets. An illiquid investment is any security that a Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. If a Fund should be in a position where the value of illiquid investments held by the Fund exceeds 15% of the Fund’s net assets, the Fund will take such steps as set forth in the Program. |

| J. | Reclassification of Capital Accounts. U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications are primarily due to adjustments for redemptions in-kind. These reclassifications have no effect on net assets or NAV per share. For the year ended November 30, 2024, the following reclassification adjustments were made: |

| Fund | | Paid-In Capital | | | Total Distributable Earnings/(Accumulated Losses) | |

| | | | | | | | | |

| Sukuk ETF | | $ | — | | | $ | — | |

| | | | | | | | | |

| Sharia ETF | | | 440,563 | | | | (440,563 | ) |

| | | | | | | | | |