SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2023

LIVENT CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

| 001-38694

| 82-4699376

|

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | |

1818 Market Street

Philadelphia, Pennsylvania | | 19103

|

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 215-299-5900

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 per share

| LTHM

| New York Stock Exchange

|

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

| Written communications pursuant to Rule 425 under the Securities Act |

☐

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

☐

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

☐

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. OTHER EVENTS

This Current Report on Form 8-K (the “Current Report”) is being filed to provide mineral resources and reserves disclosure in accordance with Subpart 1300 of Regulation S-K (“Subpart 1300”), issued by the Securities and Exchange Commission (“SEC”), for the Whabouchi Mine property (“Whabouchi Mine”), in which Livent Corporation (“Livent”) has a 50% economic interest. A technical report summary (the “Technical Report Summary”), dated September 8, 2023, which is filed as Exhibit 96.1 to this Current Report, was recently completed, as anticipated in previous announcements by Livent, and includes Livent’s attributable portion of the Whabouchi Mine’s mineral resources and reserves in accordance with Subpart 1300.

The information in this Current Report should be read together with the information contained in Item 2. “Properties” of Livent’s Annual Report on Form 10-K for the year ended December 31, 2022 (“2022 Form 10-K”), filed with the SEC on February 24, 2023, and Livent’s subsequent filings with the SEC. Certain capitalized terms used and not otherwise defined herein have the meanings attributed to them in the 2022 Form 10-K.

Mineral Properties

As used in this Current Report, the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” “inferred mineral resource,” “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are defined and used in accordance with S-K 1300. Under S-K 1300, mineral resources may not be classified as “mineral reserves” unless the determination has been made by a qualified person (“QP”) that the mineral resources can be the basis of an economically viable project.

Except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources are estimates based on limited geological evidence and sampling and have a degree of uncertainty as to their existence that is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Estimates of inferred mineral resources may not be converted to a mineral reserve. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. A significant amount of exploration must be completed in order to determine whether an inferred mineral resource may be upgraded to a higher category. Therefore, it cannot be assumed that all or any part of an inferred mineral resource exists, that it can be the basis of an economically viable project, that it will ever be upgraded to a higher category or that all or any part of the inferred mineral resources will ever be converted into mineral reserves.

Material Individual Property-Whabouchi Mine

Set forth below is information regarding the Whabouchi Mine in Québec, Canada, which has been prepared in accordance with the requirements of Subpart 1300. Livent owns a 50% economic interest in the Whabouchi Mine through its 100% equity ownership of Québec Lithium Partners (UK) Limited, which in turn owns 50% of the equity interest in Nemaska Lithium Inc. (“NLI”), which owns the rights in the Whabouchi Mine that are described herein. The remaining 50% economic interest in NLI is owned indirectly by the government of the province of Quebec, Canada, through Investissement Québec (“IQ”).

Mineral resource and reserve estimates for the Whabouchi Mine indicated in this Current Report are included in the Technical Report Summary filed as Exhibit 96.1 to this Current Report, which was prepared by employees of BBA Inc., DRA Americas Inc. and SGS Geological Services, and by Carl Pednault and Marc Rougier from WSP Canada Inc., who we have determined to be QPs within the meaning of Subpart 1300. The QPs who prepared the Technical Report Summary are neither employees of Livent nor affiliates of Livent or another entity that has an ownership, royalty or other interest in the Whabouchi Mine.

Financial amounts and assumptions in the Technical Report Summary and in this Current Report are generally stated in Canadian dollars (C$) and, where applicable, have been converted into U.S. dollars at an assumed exchange rate of C$1.31 to U.S.$1.00.

Overview

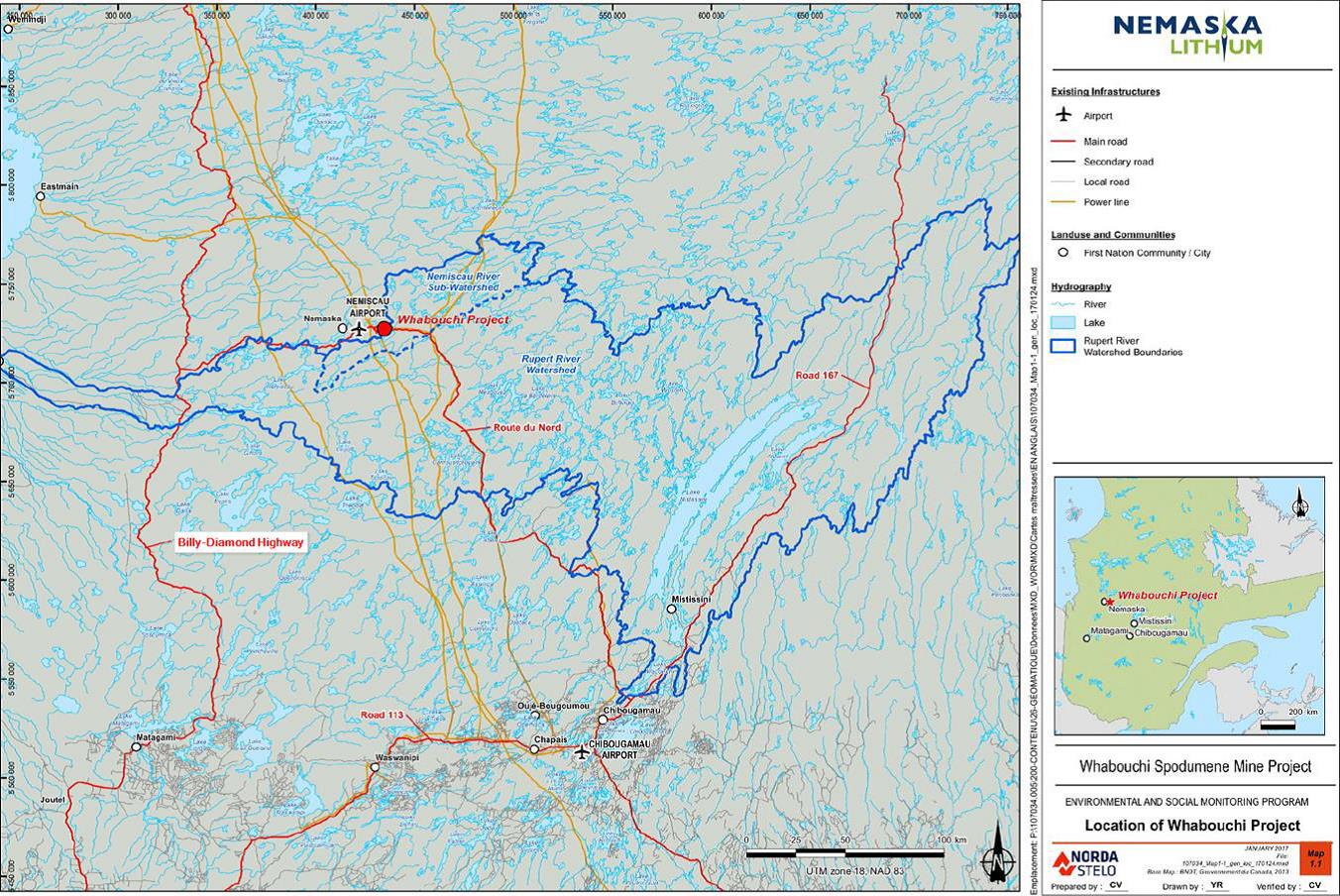

The Whabouchi Mine is located in the James Bay area in the Province of Québec (latitude 51° 40’ 46.62” North, longitude 75° 51’ 12.07” West), UTM Zone 18N 441000 m E; 5725750 m N, approximately 30 kilometers east of the Cree Nation of Nemaska and 300 kilometers north-northwest of the town of Chibougamau, as indicated in the map below.

The Whabouchi Mine is owned by NLI, in which we own a 50% economic interest. It is accessible by the Route du Nord, the main all-season gravel road linking Chibougamau and Nemaska, through Matagami by the Route Billy-Diamond Highway and by air through the Nemiscau airport.

The Whabouchi Mine covers a total of approximately 1,632 hectares, comprised of one block containing 35 map-designated claims and one mining lease covering 138 hectares from the Ministère des Ressources naturelles et des Forêts of the Province of Québec.

The Whabouchi Mine is located in the northeast part of the Superior Province of the Canadian Shield craton, in the Lac des Montagnes volcano-sedimentary formation, which comprises metasediments and amphibolites (mafic and ultramafic metavolcanics). A spodumene-bearing pegmatite dyke swarm, mostly steeply dipping towards the southeast, occurs and is composed of interconnecting dykes and plug shaped intrusions. The corridor occupied by the dyke swarm has been recognized on a strike length of 1,340 meters with a width ranging from 60 meters to 330 meters.

The Whabouchi Mine is characterized by a relatively flat topography, with the exception of a local pegmatite ridge. The elevation above sea level ranges from 275 meters, at the lowest point on the property, to 325 meters at the top of the pegmatite ridge, with an average elevation of 300 meters. Lakes and rivers cover approximately 15% of the property area.

The Whabouchi Mine is an exploration stage property and does not currently have any production or operating production facilities. The Nemaska Lithium Project is undergoing late stage engineering work. The Whabouchi Mine comprises planned mining operations as well as the crushing and concentrating of the ore to produce spodumene concentrate. The concentrator was designed to nominally produce up to 235,000 metric tons (“MT”) per year of 5.5% Li₂O of spodumene concentrate, which is intended to be transported by truck to Matagami and then by train to Bécancour.

NLI is in the process of site clearing for a conversion facility designed to convert spodumene concentrate to lithium hydroxide in Bécancour, Québec (approximately 1300 kilometers, by road and rail, from the mine). The conversion facility and other downstream facilities, including a transshipment site at Matagami, Québec are not part of the Whabouchi Mine property and are not within the scope of the Technical Report Summary.

As of December 31, 2022, the total cost of Livent’s interest in the Whabouchi Mine property and its associated plant and equipment, measured as the carrying value of its equity interest in NLI, was approximately $437.1 million.

Mineral Resources and Reserves

Mineral Resources Estimate

The following table provides a summary of Livent’s attributable portion, based on its 50% economic ownership interest in the Whabouchi Mine, of the estimated mineral resources at the Whabouchi Mine, exclusive of reserves, as of December 31, 2022. The below mineral resource amounts are rounded and shown in millions of MT of ore resources and the average grade of the resource (measured as a percentage thereof) comprised of lithium oxide (Li₂O). A summary of the material technical information and assumptions supporting mineral resources are included below the table, and set forth in further detail in the Technical Report Summary filed as Exhibit 96.1 to this Current Report.

| | Measured Mineral Resources | | Indicated Mineral Resources | | Measured and Indicated Mineral Resources | | Inferred Mineral Resources |

| | Amount (MT in millions) | | Grade (Li2O%) | | Amount (MT in millions) | | Grade (Li2O%) | | Amount (MT in millions) | | Grade (Li2O%) | | Amount (MT in millions) | | Grade (Li2O%) |

| Lithium - Hard Rock: | | | | | | | | | | | | | | | |

| Canada | | | | | | | | | | | | | | | |

| Whabouchi Mine | — | | n.a. | | 3.9 | | 1.61% | | 3.9 | | 1.61% | | 4.1 | | 1.31% |

Notes:

| • | The above table represents Livent’s attributable portion (50%) of the property’s total mineral resources. |

| • | The reference point for the mineral resources is in-situ and undiluted. |

| • | Density is applied by rock type and the proportion of waste inside each block. A density of 2.77 was used for mineralized pegmatites. |

| • | Mineral resources are reported exclusive of mineral reserves and were calculated by subtracting resources representing proven mineral reserves from the property’s measured mineral resources and resources representing probable reserves from the property’s indicated mineral resources. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| • | The lithium resources were calculated based on: drillhole database validations and selection of the drillholes and channels for the Mineral Resource estimation database; 3D modelling of spodumene-bearing pegmatite wireframes, based on lithology and lithium content (% Li₂O); geostatistical analysis for data conditioning: density assignment, capping, compositing and variography; block modelling and grade estimation; resource classification and grade interpolation validations; grade and tonnage sensitivities to spodumene concentrate selling prices. |

| • | The drilling database used for the mineral resource estimate comprised 258 diamond drillholes and 108 channels. Assaying is predominantly within the pegmatite dyke occurrences. A three-dimensional geological model based on the drilling database was used to estimate resources for the property as a whole. |

| • | Resources were categorized, based on the opinion of SGS Geological Services, into measured, indicated and inferred resources based on average drill hole spacing, the number of samples used in the interpolation, specific geological units, and manual editing to avoid isolated blocks. Measured resources are generally blocks with an average distance between the three nearest drill holes of less than 30 meters; indicated resources are generally blocks with an average distance between the three nearest drill holes of less than 60 meters; and inferred resources are generally blocks with an average distance between the three nearest drill holes of less than 90 meters. Blocks that did not have reasonable prospects for the economic extraction of minerals were removed. |

| • | Reasonable prospects for economic recovery assume: |

| o | A spodumene concentrate (at an average concentrate grade of 5.5% Li₂O) selling price of C$1,264/MT (U.S.$1,011/MT). |

| o | A metallurgical recovery of 85%. |

For the Open Pit Mineral Resources:

| • | The cut-off grade used to report open pit mineral resources is 0.30% Li₂O. |

| • | Pit optimization parameters are described as follows: |

| o | Total ore-based costs of approximately C$58.00/MT. |

| o | Geotechnical pit slope parameters of 55 degrees (North wall) and 52 degrees (South wall), assuming no underground mining or a crown pillar thick enough that pit-underground stability interactions do not occur. |

For the Underground Mineral Resources:

| • | The cut-off grade used to report underground mineral resources is 0.60% Li₂O. |

| • | Underground optimization parameters assume total costs (including total ore-based and milling costs) of approximately C$100.00/MT. |

Mineral Reserves Estimate

The following table provides a summary of Livent’s attributable portion, based on its 50% economic ownership interest in the Whabouchi Mine, of the estimated mineral reserves at the Whabouchi Mine as of December 31, 2022. The below mineral reserves amounts are rounded and shown in millions of MT of ore reserves and the average grade of the reserves (measured as a percentage thereof) comprised of lithium oxide (Li₂O). A summary of the material technical information and assumptions supporting mineral reserves are included below the table, and set forth in further detail in the Technical Report Summary filed as Exhibit 96.1 to this Current Report.

| | Proven Mineral Reserves | | Probable Mineral Reserves | | Total Mineral Reserves |

| | Amount (MT in millions) | | Grade (Li2O%) | | Amount (MT in millions) | | Grade (Li2O%) | | Amount (MT in millions) | | Grade (Li2O%) |

Lithium – Hard Rock: | | | | | | | | | | | |

| Canada | | | | | | | | | | | |

| Whabouchi Mine | 5.2 | | 1.40% | | 13.8 | | 1.28% | | 19.1 | | 1.31% |

Notes:

| • | The above table represents Livent’s attributable portion (50%) of the property’s total mineral reserves. |

| • | Lithium reserves were calculated based on modeled production for the 34-year life of the mine. Development of the life-of-mine plan included pit optimization, pit design, mine scheduling and the application of modifying factors to the measured and indicated mineral resources. |

| • | The reference point for the mineral reserves is the feed to the primary crusher of the Whabouchi concentrator. The tonnages and grades reported are inclusive of mining dilution, geological losses and operational mining losses. |

| • | The reported mineral reserves include 5.2 million MT and 8.0 million MT of open pit proven and probable reserves, respectively. All underground reserves have been classified as probable. |

| • | Assumes a spodumene concentrate (at an average concentrate grade of 5.5% Li₂O) selling price of C$1,264/MT (U.S.$1,011/MT). |

For the Open Pit Mineral Reserves:

| • | The cut-off grade used to report open pit mineral reserves is 0.40% Li₂O. |

| • | Pit optimization parameters are described as follows: |

| o | An assumed metallurgical recovery of 85%. |

| o | Estimated variable mining costs of C$2.25/MT for overburden and C$3.46/MT of rock, variable processing and tailings management costs of C$11.00/MT milled, transportation costs of C$159.00/MT of concentrate and estimated aggregate fixed costs C$46.7 million/year. |

| o | An open pit has been designed which includes 12 meter high benches, a 25 meter wide haul ramp at a maximum grade of 10% and which considers a minimum mining width of 30 meters. The open pit is approximately 1,400 meters long and 400 meters wide at surface, and has a total surface area of approximately 42 hectares and maximum depth of approximately 230 meters below surface. |

| • | The stripping ratio for the open pit is 2.8 to 1. |

For the Underground Mineral Reserves:

| • | A variable cut-off grade between 0.5% Li₂O to 0.72% Li₂O was used to report underground mineral reserves, depending on the anticipated mining method used in a particular location. |

| • | Underground optimization parameters are described as follows: |

| o | An assumed mining recovery of 90%, based on estimated mining dilution and ore losses. |

| o | Estimated processing costs of C$48.00/MT (including mill operation and administration and infrastructure costs), transportation costs of C$32.00/MT and mining costs of C$46.00/MT (including haulage and backfill). |

| • | The reported mineral reserves include nil MT and 5.8 million MT of underground proven and probable reserves, respectively. The Whabouchi deposit will be mined using conventional open pit mining for the first 24 years of operation, followed by 10 years of underground mining. |

| • | Underground mineral reserves reflect both internal dilution, which refers to waste occurring within an ore body, and external dilution, which refers to waste outside the ore body that is mined during the mining process. With respect to the long-hole mining method, external dilution included a mining dilution of 0.5 meters on the hanging and footwalls. |

| • | A minimum true mining width of 4 meters was used. |

The key assumptions and parameters relating to the Whabouchi Mine’s lithium mineral resources and reserves are discussed in more detail in sections 11 and 12, respectively, of the Technical Report Summary. The mineral resource and reserve estimates are subject to a number of uncertainties, including future changes in product prices or the market trends underlying price estimates, production costs and/or other factors affecting the life of mine plan, differences in size and grade and recovery rates from those expected and changes in project parameters.

Mineral Concession Rights, Certain Third Party Rights and Claims

On October 26, 2017, NLI obtained the mining lease (number 1022) under the Loi sur les mines (Mining Act) of the province of Québec, Canada. The lease gives the tenant the right to extract all mineral substances owned by the Crown in the above-named land, but it does not give entitlement to surface mineral substances, petroleum, natural gas, or brine. This lease is for a period of 20 years from October 26, 2017 and will end on October 25, 2037, and is eligible for renewal for three further 10-year increments at a nominal fee.

The Whabouchi Mine’s 35 map-designated claims have expiry dates ranging from November 2, 2024 to January 24, 2025, but are renewable by NLI subject to declaring proof of exploration and paying renewal rights.

There are no royalty obligations on any of the claims of the Whabouchi Mine.

Certain of NLI’s mining titles are in areas in which native communities have exclusive rights to hunt and fish. These claims fall under the Chinuchi Agreement executed in 2014 by and among NLI and certain Cree entities. The Chinuchi Agreement will be in effect throughout the life of the Whabouchi Mine and contains provisions related to environmental involvement, training, employment and business opportunities for the Crees during construction, operation and closure of the Whabouchi Mine. Should NLI seek to develop or mine in the areas covered by the Chinuchi Agreement, the Chinuchi Agreement establishes a procedure for the parties to facilitate such plans, including filing a notice of intent and preparing an environmental and social impact statement, among other steps.

On October 15, 2020, in connection with NLI’s proceedings under the Companies’ Creditors Arrangement Act (“CCAA”), the Superior Court of Québec issued a reverse vesting order (“RVO”) pursuant to which NLI was acquired and declared free and clear of the claims of creditors. A holder of a pre-proceeding royalty asserted that such royalty is a “sui generis real right or royalty right in and to the assets and properties of the Nemaska Entities” which the RVO cannot purge. NLI contested the claim, and the Monitor appointed in connection with the CCAA proceedings supported NLI’s view. On September 11, 2023, the Québec Superior Court dismissed the holder’s claim that he acquired a real right and declared that NLI owns and holds the property free and clear of any right of the claimant. At this time, the delay to seek leave to appeal of this decision has not yet expired.

Operations, Accessibility and Infrastructure

Exploration of Nemaska began in 1962 by Canico Resource Corp. Between 1962 and 2008, various entities, including James Bay Nickel Ventures (Canex Placer), the Société de Développement de la Baie James, Westmin Resources, Muscocho Exploration and Golden Goose Resources, conducted exploration work intermittently, including geochemical surveys, lithium exploration and sampling.

The Whabouchi Mine is a development property aiming to vertically integrate, from extracting, processing and concentrating spodumene to conversion of spodumene into battery grade lithium hydroxide, primarily intended for energy storage applications. Once it reaches the production stage, the Whabouchi pit is expected to be mined using conventional open pit mining methods for the first 24 years of operation, consisting of drilling, blasting, loading and hauling. Underground mining will start production once open pit mining is completed, and is expected to run for ten years. Various methods will be utilized, including the transverse long-hole mining method and longitudinal long-hole mining methods. The mine workforce is expected to total approximately 84 employees at the start of pre-production and to reach a peak of approximately 148 employees.

The Whabouchi Mine has been under development for several years prior to Livent’s acquisition of its economic interest, and has several partially completed facilities. The mine garage building, concentrator building, ore sorter building, concentrate storage dome, fine ore dome, laboratories, the main electrical and crusher E-Rooms, the administration building and the gate house are enclosed with some equipment and services installed. Other supporting facilities and infrastructure such as the potable water treatment plant, sewage treatment plant, roads, propane infrastructure and various roads have been established to support legacy execution activities. The main substation and emergency power generator, the fire water tank and the raw water supply have been completed and have been supplying power and water for construction activities. Some of the aforementioned infrastructure will require completion, modification, or replacement.

The Whabouchi Mine includes the Whabouchi concentrator, which was originally designed in 2014 and initially erected in 2016 and is located 675 meters northeast of the open pit mine. The concentrator design has been updated to produce an average of 220,846 MT per year for years 1-4, 227,021 MT per year for years 5-24 and finally 238,841 MT per for years 25-34 of spodumene concentrate at 5.5% Li₂O. The average spodumene concentrate production over the life of the mine averages 229,797 MT per year. In determining such production figures, DRA Americas Inc. estimated plant availability to lie between 75% to 91.5%, noting that reductions in plant capacity would lead to a reduction in MT of concentrate produced by the plant.

The nearest infrastructure with general services is the Relais Routier Nemiscau Camp, located 12 kilometers west of the Whabouchi Mine, where NLI has access to lodging facilities, if needs exceed the capacity of the camp installed on the property. The community of Nemaska, located 30 kilometers west of the property, can also provide accommodation and general services. The area is serviced by the Nemiscau airport, serviced by regular scheduled and charter flights, and by mobile phone network from the main Canadian service providers.

Hydro-Québec owns several infrastructure facilities in the area including two electrical stations, located approximately 20 kilometers east and 12 kilometers west from the property. Electrical (735 kV) transmission lines connecting both stations run alongside the Route du Nord and cross the property near its center. Also, a 69 kV power line connecting one of the electrical stations to the mine site has been put in service and is supplying power to the Whabouchi Mine’s facilities.

The Whabouchi Mine is currently expected to enter production in 2025. As of December 31, 2022, the total expected capital expenditure with respect to the Whabouchi Mine was approximately C$473.2 million (U.S.$359.4 million) for initial capital costs and C$198.4 million ($150.7 million) for sustaining costs over the 34-year life of the mine.

Mineral Processing

Mineral processing will occur in the Whabouchi concentrator described herein to produce a spodumene concentrate. The spodumene concentrate is expected to be shipped and treated at a new lithium hydroxide conversion plant to be located in Bécancour.

Mineralized material is expected to be fed into the jaw crusher by wheel loader and then screened to feed a coarse and fine ore sorter, as well as a fines by-pass. The ore sorters will reject coarse waste rock and the sorted material will combine with the fine material and get further crushed in two additional stages of crushing. The final crushed product will be sent to the concentrator feed hopper or fine ore stockpile to act as a buffer between the crushing area and concentrator. Within the concentrator, the crushed material will first be screened, and the coarse material will undergo treatment to remove coarse muscovite and separation to produce a coarse spodumene product, a middling product, and a tailings/waste stream. The coarse spodumene product will be dried and separated from remaining waste materials. The middling product will be further ground and combined with the previously screened fine ore. The fine ore will then be treated to, among other things, remove remaining waste materials and produce a fine spodumene concentrate. The fine spodumene concentrate will be thickened and filtered and combined with the coarse spodumene concentrate before being loaded into containers for shipment.

Following the concentrator, the spodumene concentrate will be transported in containers by road trucks (400 km from Whabouchi) to a transshipment that is expected to constructed in Matagami. It is expected that the concentrate containers will be transloaded onto railcars in Matagami, for transport (900 km by rail from Matagami) to the Bécancour conversion facility, which is in the design stage, for further processing into lithium hydroxide.

Exploration and Expansion Activities

There are currently no new exploration activities being undertaken at the Whabouchi Mine, but NLI is assessing options to conduct further exploration on the property. NLI is also in the process of site clearing for a conversion facility designed to convert spodumene concentrate to lithium hydroxide in Bécancour, Québec. While the Bécancour conversion facility itself falls outside the scope of the Technical Report Summary, it is contemplated as the principal delivery point for the Whabouchi Mine’s entire production of spodumene concentrate. The determination of the required capital expenditures, environmental and other permits, infrastructure development (including an anticipated rail link from the locale of the property to Bécancour), and construction and operational design plans for the conversion facility and other downstream facilities remain subject to the completion of a feasibility study and the approval of NLI’s shareholders, Livent and IQ.

Livent currently provides, and expects to continue to provide, certain technical advisory support, marketing and sales, and other related services to NLI pursuant to contractual arrangements that are in place (and which Livent believes were negotiated on an arm’s length basis) or under negotiation.

Internal Controls

The development of the Whabouchi Mine’s mineral resources and reserves estimates, including related assumptions, were prepared by the QPs. We reviewed the mineral resources and reserves, and engaged third-party consultants and independent laboratories to generally review the data.

When determining resources and reserves, as well as the differences between resources and reserves, QPs developed specific criteria, each of which must be met to qualify as a resource or reserve, respectively. These criteria, such as demonstration of economic viability, points of reference and grade, are specific and attainable. The management agree on the reasonableness of the criteria for the purposes of estimating resources and reserves used by the QPs.

All estimates require a combination of historical data and key assumptions and parameters. When possible, historical data and resources and data from public information and generally accepted industry sources were used to develop these estimations.

We have developed, together with NLI, internal Quality Assurance and Quality Control (“QA/QC”) procedures at the Whabouchi Mine, which were reviewed by the QPs, to ensure the processes for developing mineral resource and reserve estimates were sufficiently accurate. QA/QC procedures include independent checks on samples by third party laboratories, duplicate sampling and analytical procedures, among others. In addition, the qualified persons reviewed the consistency of historical production as part of their analysis of the QA/QC procedures. See details of the controls in the Technical Report Summary filed as Exhibit 96.1 to this Current Report.

We recognize the risks inherent in mineral resource and reserve estimates, such as the geological complexity, the interpretation and extrapolation of field and well data, changes in operating approach, macroeconomic conditions and new data, among others. The capital, operating and economic analysis estimates rely on a range of assumptions and forecasts that are subject to change. Any changes to access rights or to assumptions described in the respective technical report summaries could impact the estimates of mineral resources and reserves calculated in these reports. Overestimated or underestimated resources and reserves resulting from these risks could have a material effect on future profitability.

Forward-Looking Statements

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Certain statements in this report are forward-looking statements. In some cases, we have identified forward-looking statements by such words or phrases as “will likely result,” “is confident that,” “expect,” “expects,” “should,” “could,” “may,” “will continue to,” “believe,” “believes,” “anticipates,” “predicts,” “forecasts,” “estimates,” “projects,” “potential,” “intends” or similar expressions identifying “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including the negative of those words and phrases. These forward-looking statements, which are subject to risks, uncertainties and assumptions about Livent, may include projections of Livent’s future financial performance, Livent’s anticipated growth strategies and anticipated trends in Livent’s business, including without limitation, our capital expansion plans and development of the Nemaska project and the anticipated timing for, and outcome and effects of, the proposed merger with Allkem. Such forward-looking statements are based on our current views and assumptions regarding future events, future business conditions and the outlook for the Company based on currently available information. There are important factors that could cause Livent’s actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including the factors described under the caption entitled “Risk Factors” in Livent’s 2022 Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 24, 2023 as well as other SEC filings and public communications. Although Livent believes the expectations reflected in the forward-looking statements are reasonable, Livent cannot guarantee future results, level of activity, performance or achievements. Moreover, neither Livent nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Livent is under no duty to update any of these forward-looking statements after the date of this news release to conform its prior statements to actual results or revised expectations.