As submitted to the Securities and Exchange Commission on June 6, 2018

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM1-A

REGULATION A OFFERING CIRCULAR

UNDER

THE SECURITIES ACT OF 1933

KNOWBELLA HELIX INC.

(Exact name of issuer as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

P.O. Box 30085

Cincinnati, Ohio 45230

(513)260-4400

(Address, including zip code, and telephone number,

including area code, of issuer’s principal executive office)

Copy to:

F. Mark Reuter

Allison A. Westfall

Christopher S. Brinkman

Keating Muething and Klekamp PLL

1 East 4th Street, Suite 1400

Cincinnati, Ohio 45202

Telephone: (513)579-6400

| | |

| 7389 | | 82-4566158 |

(Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification Number) |

This Offering Circular shall only be qualified upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by operation of the terms of Regulation A.

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this preliminary offering circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time an offering circular which is not designated as a preliminary offering circular is delivered and the offering statement filed with the Commission becomes qualified. This preliminary offering circular shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final offering circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the final offering circular or the offering statement in which such final offering circular was filed may be obtained.

Preliminary Offering Circular

June 6, 2018

Subject to Completion

KNOWBELLA HELIX INC.

166,666,667 Helix™ Tokens

1 Helix™ Token: $0.30

Minimum Investment: 1,600 Helix™ Token(s) ($480.00)

This Regulation A offering is for Helix™ tokens, no par value per token (the “Tokens,” “Helix™ Tokens” or “Helix™”) of Knowbella Helix Inc., a Delaware corporation (the “Company”, “Knowbella” or “Knowbella Tech”). For a description of the Tokens, see “The Tokens”. We are offering a maximum of 166,666,667 Helix™ tokens at $0.30 per Token, on a best efforts basis, for an aggregate amount of $50,000,000, in a “Tier 2 Offering” under Regulation A (the “Offering”). There is no minimum number of Tokens that needs to be sold in order for funds to be released to the Company for this Offering to close. The minimum investment per investor is 1,600 Tokens ($480) and subscriptions, once received, are revocable until they become irrevocable when both this offering statement is qualified by the SEC and the subscriptions are accepted by the Company. The Company expects to accept all subscriptions up to the maximum amount after this offering statement is qualified. This Offering is being conducted on a “best efforts” basis as provided by Rule 251(d)(3)(i)(F) of Regulation A, which means that there is no guarantee that any minimum amount will be sold. None of the Tokens offered are being sold by present security holders of the Company.

We expect to commence the Offering on or within two (2) calendar days of the date the offering circular is qualified by the United States Securities and Exchange Commission (“SEC”). The Offering will terminate on the first of: (i) all of the Tokens offered are sold; or (ii) the close of businessthirty-six (36) months after the date that this Offering is deemed qualified by the SEC, unless sooner terminated by the Company (collectively, the “Termination Date”). After this offering statement is qualified by the SEC, the Company intends to accept subscriptions and close on investments on a “rolling” basis (so not all investors will receive their Tokens on the same date). There is no escrow established for this Offering. Funds will be promptly refunded without interest for sales not consummated. Any payments made in Bitcoin, Ethereum or any othernon-U.S. Dollar currency may be converted into U.S. Dollars at any time after receipt by the Company. If the Company returns funds to an investor, it may return funds in the form of U.S. Dollars and the Company will not be responsible for any fluctuation in the price of suchnon-U.S. Dollar currency. Upon closing under the terms as set out in this offering circular, funds will be immediately transferred to the Company (where the funds will be available for use in the operations of the Company’s business, excluding paying the expenses of the Offering, in a manner consistent with the “Use of Proceeds” in this offering circular) and the Tokens for such closing will be issued to investors.

As soon as possible after the issuance of the Tokens, we intend to apply to have the Tokens listed for trading on anyalt-coin exchanges that have been registered by the SEC. For more information see “Plan of Distribution”.

The Tokens will be issued in book-entry electronic form only, provided that subsequent transfers of the Tokens will be recorded on the Ethereum blockchain and possession of the Token will signify ownership. VStock Transfer, LLC, a California limited liability company is the transfer agent and registrar for the Tokens.Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors andnon-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to visit to www.investor.gov.

THESE ARE SPECULATIVE SECURITIES. INVESTING IN THEM INVOLVES SIGNIFICANT RISKS. YOU SHOULD INVEST IN THEM ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS”.

This offering circular is following the disclosure format of Part II of Form1-A.

| | | | | | | | | | | | | | | | |

| | | Number of

Tokens(2) | | | Price to

Public | | | Underwriting

Discounts and

Commissions (3) | | | Proceeds to

Issuer (4) | |

Per Token(1) | | | 1 | | | $ | 0.30 | | | $ | 0.00 | | | $ | 0.30 | |

| | | | | | | | | | | | | | | | |

Total Maximum | | | 166,666,667 | | | $ | 0.30 | | | $ | 0.00 | | | $ | 50,000,000 | |

| | | | | | | | | | | | | | | | |

| (1) | Please refer to the section entitled “The Tokens” for a description of the Tokens. |

| (2) | Investors must purchase a minimum amount of 1,600 Tokens in this Offering. |

| (3) | The Tokens will be offered and sold by our officers and directors who will not receive any direct compensation in connection therewith. However, the Company reserves the right to engage, in its discretion, one or more FINRA-member broker-dealers or placement agents registered under Section 15 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) to participate in the offer and sale of the Tokens and to pay such persons, if any, certain cash commissions and/or the right to purchase certain Tokens. |

| (4) | Does not reflect deduction of expenses of the Offering. All offering expenses will be paid by the Company. See “Use of Proceeds.” |

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

Knowbella Helix Inc.

P.O. Box 30085

Cincinnati, Ohio 45230

Telephone:513-260-4400

Web: www.knowbella.tech

Information contained on www.knowbella.tech website is not incorporated by reference into this offering circular, and you should not consider information contained on www.knowbella.tech to be part of this offering circular.

We are offering to sell, and seeking offers to buy, our Tokens only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with any information other than the information contained in this offering circular. The information contained in this offering circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of Tokens. Neither the delivery of this offering circular, nor any sale or delivery of Tokens shall, under any circumstances, imply that there has been no change in our affairs since the date of this offering circular. This offering circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this offering circular, unless the context indicates otherwise, references to “we,” “us,” “our,” “Knowbella,” “Knowbella Tech” and “Company” refer to Knowbella Helix Inc.

The date of this offering circular is [•], 2018

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

Some of the statements in this offering circular constitute forward-looking statements. These statements relate to future events or our future financial performance, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “proposed,” “may,” “should,” “expect,” “intend,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential”, “continue”, “will”, and similar words or phrases, or the negative or other variations thereof or comparable terminology. All forward-looking statements are predictions or projections and involve known and unknown risks, estimates, assumptions, uncertainties and other factors that may cause our actual transactions, results, performance, achievements and outcomes to differ materially and adversely from those expressed or implied by such forward-looking statements.

You should not place undue reliance on forward-looking statements. The cautionary statements set forth in this offering circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| | • | | national, international and local economic and business conditions that could affect our business; |

| | • | | the lack of any existing centralized marketplace for securitized tokens; |

| | • | | our cash flows (or lack thereof) and operating performance; |

| | • | | our financing activities; |

| | • | | the ability to successfully raise and use the “Use of Proceeds” in an efficient manner and complete development of the Knowbella Platform™; |

| | • | | our tax status and the tax status of the offering; |

| | • | | industry developments affecting our business, financial condition and results of operations, including general industry developments effecting blockchain technology based securities; |

| | • | | our ability to compete effectively; |

| | • | | governmental approvals, actions and initiatives and changes in laws and regulations or the interpretation thereof, including without limitation, tax laws, SEC regulations and interpretations, states and self-regulatory organizations, including without limitation, FINRA; |

| | • | | our ability to retain our current personnel and our requirements for additional qualified personnel, upon whom the success of our business is highly dependent; and |

| | • | | other risks and uncertainties referred to in this offering circular under “Risk Factors”. |

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, tore-issue this offering circular or otherwise make public statements in order to update our forward-looking statements beyond the date of this offering circular.

SUMMARY

The following summary highlights selected information contained in this offering circular. This summary does not contain all the information that may be important to you. You should carefully read all of the information contained in this offering circular, including, but not limited to, the risks associated with an investment in the Company’s securities discussed in the “Risk Factors” section of this offering circular..

About Knowbella and the Knowbella Platform™

Knowbella Helix Inc. is a Delaware corporation with its headquarters in Cincinnati, Ohio (“Knowbella,” “Knowbella Tech,” “we,” “our,” “us” or the “Company”). Knowbella is a wholly-owned subsidiary of Knowbella Tech LLC, a Delaware limited liability company (“Knowbella Parent”). We are in a time where “open” collaboration is proliferating in areas such as computer programming (i.e., Linux®, Redhat®, Github®, etc.) and healthcare (i.e., the Gates Foundation®, Cancer Moonshot Initiative, etc.). This open collaboration is helping solve significant challenges and creating new opportunities for business. Knowbella Tech proposes to advance this movement through opening up orphan and dormant (idle) intellectual property in an open science platform known as the “Knowbella Platform™”.

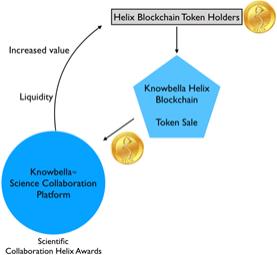

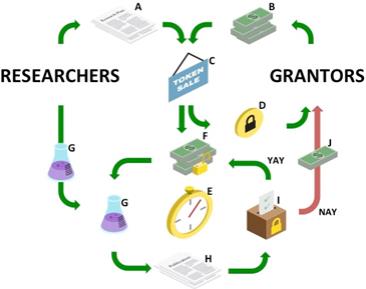

The Knowbella Platform™ is intended to be a collaborative scientific ecosystem that crowdsources the global scientific and engineering communities around orphan and dormant intellectual property, funding, and Helix™ tokens. We aim to help scientists around the world find previously hidden knowledge, connect with others to grow that knowledge, disseminate their findings more quickly than through traditional publishing models, and reward them for their contributions to the scientific community.

Knowbella plans to solve a significant problem where the era of patents and the promise of riches have severely hindered the dissemination and proliferation of knowledge. In addition, it is estimated that the global value of intellectual property that is dormant (or orphan) is $4 trillion1. We believe intellectual property is orphaned by institutions such as universities and corporations as well as individual inventors typically due to budget constraints as well as lack of market insights.

We anticipate solving this significant problem by removing the silos of innovation and building aweb-based crowdsourcing platform to enable researchers and scientists to collaborate in an open science ecosystem.

As all products and publications are based upon intellectual property utilized within the Knowbella Platform™, all progress must be made available under a Creative Commons 4.0 and Copyleft model. The contributions also serve to enhance the social good. The Knowbella Platform™ will serve as a place where inventors, institutions, researchers, educators, students and citizen scientists can work together for the benefit of humankind.

While Knowbella was formed in 2018 for the purposes of conducting this Offering, its parent company, Knowbella Tech LLC, a Delaware limited liability company (“Knowbella Parent”) was formed in September 2016 and there is a rich history behind its evolution into the “open science” collaboration platform that it is today. In 2016, Knowbella Parent solely licensed the U.S. patent-pending collaboration platform Therapoid™ (the “Therapoid™ Platform”) from Open Therapeutics, LLC, an Ohio limited liability company (“Open Therapeutics”), which has been sublicensed to Knowbella pursuant to that certain Amended & Restated License Agreement (the “License Agreement”), a copy of which is attached hereto as an exhibit. Although still in “soft launch” pilot phase, the Therapoid™ Platform has already begun to attract scientists around the world to its open collaboration value proposition. The pilot site for the Therapoid™ Platform can be found athttps://Therapoid.net. The Knowbella Platform™ will complement the Therapoid™ Platform by consisting of dormant intellectual property withnon-therapeutic applications, whereas the Therapoid™ Platform will consist of dormant intellectual property with therapeutic applications. Leveraging this existing platform saves time and resources accelerating market penetration.

| 1 | Hovis, Jeff. ISPIM Innovation Insights, Product Genesis, April 2014. |

1

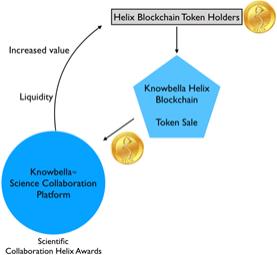

Concurrent with this Offering and pursuant to the License Agreement, the Knowbella Platform™ will be available for use by holders of Helix™ tokens. However, Knowbella will likely outsource smart contracts, wallet, and other feature developments, including further expansion of the Knowbella Platform™ to third party developers, which is expected to be finalized within three to six months after qualification of this Offering, although no guarantee can be made regarding such timeline (the “Knowbella Platform Development”). Continuous improvement and updates will occur after the Knowbella Platform Development as necessary or desirable and as determined by the Company. Prior to the Knowbella Platform Development, purchasers of Helix™ will have access to the Knowbella Platform™ in its current form and will have access to their Helix™ tokens in any wallet provided by such purchaser, with a Knowbella-specific wallet likely becoming available for the Helix™ tokens after completion of the Knowbella Platform Development.

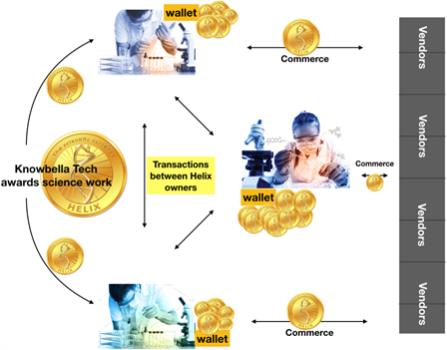

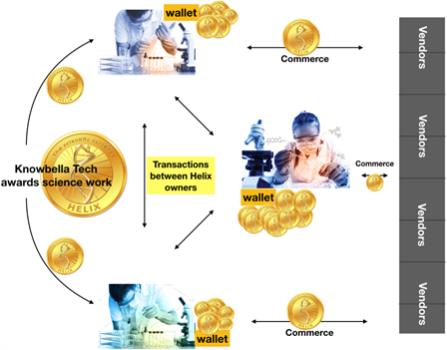

About the Helix™ Tokens

The Company intends to use the Helix™ tokens as the currency of the Knowbella Platform™. We expect that following the Knowbella Platform Development, users will be able to utilize the platform for its various benefits and offerings, including without limitation, conducting commerce with vendors and service providers, such as translating manuscripts or providing consumables and/or equipment, in exchange for your Tokens. The value of the Helix™ tokens will be determined by supply and demand. We believe that demand for the Helix™ tokens will be affected by many factors including, but not limited to, the following:

| | • | | Secondary market liquidity, if any; |

| | • | | Knowbella Platform™ utilization (after the Knowbella Platform Development); |

| | • | | The market for token securities; |

| | • | | Wide-spread interest in the crypto markets; and |

| | • | | Knowbella’s technology innovation. |

Helix™ will be stored on the Ethereum blockchain, assuring integrity and flexibility. In the quickly expanding realm of blockchain technology, Ethereum has emerged as a versatile, rigorous platform for facilitatingpeer-to-peer contracts and applications.

Timing of the Offering and Knowbella Business Plan

Proceeds from this Offering, and from a concurrent Regulation D, Rule 506(b) offering conducted by Knowbella Parent, will be used to launch the Knowbella Platform™ in its current form and fund the completion of the Knowbella Platform™, including the Knowbella Platform Development and development of the Helix™ wallets. We expect that the Knowbella Platform™ will be launched within three to six months of the closing of this Offering and the activation of the first users on the Knowbella Platform™ and their use of the Helix™ tokens on the Knowbella Platform™ will begin. We expect to continue developing the Knowbella Platform™, hiring personnel and developing the Helix™ token blockchain in the months following this Offering, which may include outsourcing such development to third parties.

2

Assuming the successful closing of this Offering (i.e., raising enough proceeds to fund the activities listed in the “Use of Proceeds” section), the successful Knowbella Platform Development and the availability of funds after the Offering, we intend to seek the acquisition of some or all of the outstanding equity interests of Open Therapeutics (and thus, the Therapoid™ Platform) to round out the Company’s entire intellectual property portfolio and to consolidate the Knowbella Platform™ and the Therapoid™ Platform for holders of the Helix™ tokens. See “Token Allocation” for a breakdown of the amount of Helix™ tokens reserved for issuance in the event of an acquisition of Open Therapeutics. See also “Interests of Management and Others in Certain Transactions” for information on certain relationships between management of Knowbella and management of Open Therapeutics.

Once the Company has collected the users within the Knowbella Platform™, the Company seeks to (1) monetize data and analytics, (2) sell analytics tofor-profit companies, (3) strategically select and further develop assets from the community, and (4) provide consulting and employment opportunities for the researchers.

Once we have attracted the global scientific community, additional business models and revenue streams are expected to follow. Those revenue streams may include:

| | • | | Selling analytics and subscriptions to industries for human capital resources, marketing intelligence, and competitive intelligence decision-making support. |

| | • | | Equipment and consumables advertising and sales commission. |

| | • | | Private enterprise version (white label) collaboration platform based upon the Knowbella Platform™. This may enable other organizations to use the Knowbella Platform™ in their private environments. |

| | • | | Incubate and spinout companies that use and promote Helix™. |

| | • | | Consulting services and supplemental R&D services to private industry. |

| | • | | Intellectual property offices to create potential value for dormant intellectual property. |

| | • | | Marketingnon-dormant intellectual property for institutional technology transfer officers (TTOs). |

| | • | | Hosting Innovation Challenges. |

See the Knowbella whitepaper attached hereto as an Exhibit for further information about the Knowbella Platform™, the Helix™ tokens, and the Knowbella business plan and timeline.

3

THE OFFERING

| | |

| Issuer | | Knowbella Helix Inc., a Delaware corporation and a wholly-owned subsidiary of Knowbella Tech LLC. |

| |

| Securities Offered | | Helix™ tokens |

| |

| Offering Amount | | A maximum of 166,666,667 Helix™ tokens at $0.30 per Token, on a best efforts basis, for an aggregate amount of $50,000,000, in a “Tier 2 Offering” under Regulation A. See “The Tokens.” |

| |

| Price per Token | | $0.30 |

| |

| Offering Type | | Tier 2 Regulation A offering of Tokens, being made by the Company on a best efforts basis. The Offering is being conducted in support of the ongoing operational needs of the Company. |

| |

| Minimum Investment Amount | | The minimum amount of subscriptions required per investor is 1,600 Tokens ($480), and subscriptions, once received, are revocable until they are irrevocable when both the offering statement is qualified by the SEC and the subscriptions are accepted by the Company. |

| |

| | See “Plan of Distribution”. |

| |

| Closings | | There is no escrow established for this Offering. After this offering statement is qualified by the SEC, we will hold closings upon the receipt of investors’ subscriptions and acceptance of such subscriptions by us. The Company intends to accept subscriptions and close on investments on a “rolling” basis. There is no aggregate minimum requirement for the Offering to become effective, therefore, we reserve the right, subject to applicable securities laws, to begin applying “dollar one” of the proceeds from the Offering towards our business plan, offering expenses and other uses as more specifically set forth in this offering circular. There is no escrow established for this Offering. |

| |

| Limitations on Your Investment Amount | | Non-Accredited Investors Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A, which states: “In a Tier 2 offering of securities that are not listed on a registered national securities exchange upon qualification, unless the purchaser is either an accredited investor (as defined in Rule 501 (§230.501)) or the aggregate purchase price to be paid by the purchaser for the securities (including the actual or maximum estimated conversion, exercise, or exchange price for any underlying securities that have been qualified) is no more than ten percent (10%) of the greater of such purchaser’s: |

4

| | |

| |

| | (1) Annual income or net worth if a natural person (with annual income and net worth for such natural person purchasers determined as provided in Rule 501 (§230.501)); or (2) Revenue or net assets for such purchaser’s most recently completed fiscal year end if anon-natural person.” Accredited Investors There is no limit to the amount of investment made by accredited investors. To be an accredited investor, an investor must meet one of the following: (1) An individual who had income in excess of $200,000 in each of the two most recent years (or joint income with his or her spouse in excess of $300,000 in each of those years) and has a reasonable expectation of reaching the same income level in the coming year; (2) An individual who has a net worth (or joint net worth with his or her spouse) in excess of $1,000,000 (excluding the value of such individual’s primary residence); (3) An individual retirement account (“IRA”) or revocable trust and the individual who established the IRA or each grantor of the trust is an accredited investor based on (1) or (2) above; (4) A self-directed pension plan and the participant who directed that assets of his or her account be invested in the Company is an accredited investor on the basis of (1) or (2) above and such participant is the only participant whose account is being invested in the Company; (5) A pension plan which is not a self-directed plan and which has total assets in excess of $5,000,000; (6) An irrevocable trust which consists of a single trust (i) with total assets in excess of $5,000,000, (ii) which was not formed for the specific purpose of investing in the Company and (iii) whose purchase is directed by a person who has such knowledge and experience in financial and business matters that he or she is capable of evaluating the merits and risk of the prospective investment; (7) A corporation, partnership or a Massachusetts or similar business trust, that was not formed for the specific purpose of acquiring an interest in the Company, with total assets in excess of $5,000,000; or (8) An entity in which all of the equity owners are accredited investors. For general information on investing, we encourage you to visit towww.investor.gov. |

| |

| Offering Proceeds | | Up to $15,966,667 of the Offering proceeds will be proceeds of the Company. This amount does not reflect the deduction of offering expenses, which we estimate will be $700,000 (including accounting, legal and marketing fees, any underwriting discounts or commissions) and which will be paid by the Company. See “Use of Proceeds.” See “Token Allocation” for the allocation of tokens reserved for the Company, for the potential future acquisition of some or all of Open Therapeutics and for investors investing in this Offering. |

5

| | |

| Use of Proceeds | | We will use the proceeds from this Offering to complete the Knowbella Platform Development and to fund ongoing operational needs of the Company as well as acquisitions that strengthen the Knowbella Platform™ product. The Company expects to use amounts for: marketing (estimated $1,500,000), platform/blockchain development (estimated $250,000), gathering intellectual property (estimated $200,000), strategic acquisitions (estimated $5,000,000), public listing expenses (estimated $250,000) and contingency funds (balance of the funds). See “Use of Proceeds” and “Risk Factors.” |

| |

| Listing | | We intend to list the Tokens on anyalt-coin exchanges registered with the SEC as soon as practicable after issuance of the Tokens under the symbol “Helix”. |

| |

| Concurrent Offering | | Knowbella Parent is conducting a concurrent private placement to accredited investors of up to $1,000,000 of Convertible Promissory Notes (the “Notes”) with a Simple Agreement for Future Tokens (the “SAFTs” and collectively with the Notes, the “Security”) at a price of $25,000 per Security in reliance on Rule 506(b) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). The tokens issued under the SAFTs, if any, will be Helix™ tokens and will have the same rights as those being sold in this Offering. The Notes are convertible into Class A Common Units of Knowbella Parent. |

| |

| Helix™ Tokens Outstanding before Offering | | 0 Helix™ tokens (as of June 1, 2018) |

| |

| Helix™ Tokens Outstanding after Offering | | 166,666,667 Helix™ tokens if the maximum amount is sold. |

| |

| Voting Rights | | Holders of Tokens are entitled to the following voting rights with respect to the Knowbella Platform™: (i) vote upon annual conference details; (ii) vote upon certain new features of the Knowbella Platform™; and (iii) vote upon certain amendments to the Company’s Stockholder Agreement or Tokenholders’ Agreement that have a negative impact on certain rights of the Helix™ tokenholders. See the entirety of the Company’s Stockholder’s Agreement and the Tokenholders’ agreement, both attached hereto, for further details. |

| |

| Risk Factors | | Our Tokens are speculative securities. Investing in them involves significant risks. You should invest in them only if you can afford a complete loss of your investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding whether to invest. |

| |

| Termination of the Offering | | The Offering will terminate on the first of: (i) all of the Tokens offered are sold; or (ii) the close of businessthirty-six (36) months after the date that this offering statement is deemed qualified by the SEC, unless sooner terminated by the Company (collectively, the “Termination Date”). |

6

| | |

| How to Subscribe | | To subscribe for Tokens, complete and execute the Subscription Agreement accompanying this offering circular and deliver it to us before the Termination Date, together with full payment for all Tokens subscribed for in accordance with the instructions provided in the Subscription Agreement. Once you subscribe, subject to acceptance by us, your subscription is irrevocable. We have the right, at any time prior to the issuance of the Tokens, to reject subscriptions in our sole discretion. |

7

RISK FACTORS

Investors should carefully consider the risks described below before making an investment decision. For the reasons set forth below, and elsewhere in this offering circular, investing in the Helix™ tokens involves a high degree of risk. If any of the following risks actually occur, the Company’s business, financial condition or results of operation could be harmed, which could cause the value of the Helix™ tokens to decline and investors could potentially lose all or part of their investment. The risks and conflicts set forth below are not the only risks and conflicts involved in an investment in the Company. See also “Cautionary Statements Regarding Forward-Looking Information.”

Risks Related to the Company

New digital currency regulations could materially adversely effect the Company and the Tokens.

Digital currency is a new type of currency and it is possible that the continued popularity of digital currency, such as the Tokens, will trigger subsequent new regulation and laws. If Congress or any state or regulatory body of the federal executive branch or a state executive office were to start regulating our business, it could prove costly. If too costly, it could make our financial model impracticable. Changes in the legislative, regulatory and commercial environments in which we operate could adversely impact our ability to collect, compile, and use and/or publish data and could impact our financial results.

The operational and financial condition of the Company and validity of the Tokens depends in large part upon the Company’s information technology; a successful cyber attack or hacking could materially affect the financial condition of the Company.

Our operations and validity of the Tokens depend on our ability, as well as that of third-party service providers to whom we have outsourced several critical functions, to protect data centers and related technology against cyber-attacks, sabotage, and hacking. A failure in the integrity of our database could harm our brand and result in a loss of sales and an increase in legal claims. Cybersecurity risks could harm our operations, the operations of our critical outsourcers, or the operations of our partners on whom we rely for data and to meet our customer needs, any of which could materially impact our business and financial results. We will rely upon the security of our information technology infrastructure to protect us from cyber-attacks and unauthorized access. Cyber-attacks can include malware, computer viruses, or other significant disruption of our information technology networks and related systems. Government agencies and security experts have warned about growing risks of hackers, cyber-criminals and other potential attacks targeting every type of information technology system. We may face increasing cyber security risks, as we receive data from new sources, such as social media sites or through data aggregators who provide us with information.

A failure of the Company’s technology infrastructure could have a material adverse effect on the Company’s operations and financial results.

Our business performance depends upon the effectiveness of our technology investments, the failure of which could materially impact our business and financial results. We will undertake significant investments in our technology infrastructure to continually strengthen our position in commercial data and improve our existing technology platform. Notwithstanding, if we experience any failures related to our technology investments, we may not achieve our expected revenue growth, or desired cost levels, and we could experience a significant competitive disadvantage in the marketplace, such as the inability to offer certain types of new services or to collect certain types of new data, which could have a material adverse effect on our business and financial results.

8

We are not currently profitable and may never become profitable.

We are an early stage company and expect to incur losses and negative operating cash flow for many months, and we may never achieve or maintain profitability. We also expect to continue to incur operating expenditures and anticipate that our expenses will increase in the foreseeable future as we:

| | • | | Complete the Knowbella Platform Development; |

| | • | | Build out our sales and marketing efforts; |

| | • | | Pursue collecting intellectual properties for the platform; |

| | • | | Invest in development of products to further utilize our intellectual property; |

| | • | | Hire additional personnel; and |

| | • | | Pursue strategic acquisitions. |

We are currently experiencing negative cash flows as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of the Tokens.The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the inception of a business operating in a relatively new, highly competitive, and developing industry.

See the “Financial Statements” attached hereto.

We may need to finance our future cash needs through public or private equity offerings, debt financings, additional token offerings or corporate collaboration or licensing arrangements. Any additional funds that we obtain may not be on terms favorable to our members or the Token holders or us and may require us to relinquish certain valuable rights.

We intend to fund much of our operations and capital expenditures from the net proceeds of this Offering and the Regulation D private offering conducted by Knowbella Parent concurrently with this Offering. We believe that the net proceeds from this Offering, if fully subscribed, will be sufficient to enable us to fund our projected operation requirements to reach profitability. However, we may need to raise additional funds more quickly if one or more of our assumptions prove to be incorrect or if we choose to expand our product development efforts more rapidly than we presently anticipate, and we may decide to raise additional funds even before we need them if the conditions for raising capital are favorable.

We may seek to sell additional tokens, equity or debt securities, obtain a bank credit facility, or enter into a corporate collaboration or licensing arrangement. The sale of additional equity or debt securities, if convertible, could result in dilution to our shareholders. The sale of additional tokens could affect the value of Tokens generally. The incurrence of indebtedness would result in increased fixed obligations and could also result in covenants that would restrict our operations. Raising additional funds through collaboration or licensing arrangements with third parties may require us to relinquish valuable rights to our technologies, future revenue streams, research programs, or to grant licenses on terms that may not be favorable to us or our shareholders.

We lack operating history because we are in an early stage of commercialization. There might be risk associated with execution of our strategy.

Knowbella and Knowbella Parent have a short operating history, although we have incurred expenses and generated losses to date in connection with the organization of our company, our initial market launch efforts, our research and development of intellectual properties, our expanded sales and marketing efforts, supply chain development and management, procurement, other related-business expenses, and the expenses of this Offering. Due to our relatively short operating history, there can be no assurance that we will successfully execute our strategy, integrate our operation, and market our platform. Due to uncertainties associated with a highly regulated industry that some of our users are subject to, we might need to raise additional capital after this Offering. Furthermore, we may incur significant unanticipated expenses which would include, for example, additional expenses for development of

9

intellectual properties, reducing dependence on any one strategic partner, expenses to establish future strategic and other business relationships necessary to operate our business as currently contemplated, or to create and execute a more aggressive marketing strategy in order to induce our intended user base to adopt our platform. If we are unsuccessful in marketing our platform, or if we incur significant unanticipated expenses, our business, financial condition, results of operations and prospects may be materially adversely affected.

If we do not use the proceeds from the Offering in an efficient manner, our business may suffer.

Our management will retain broad discretion as to the use and allocation of the net proceeds from this Offering, which allocation may be revised from time to time in response to certain contingencies discussed herein. Accordingly, our investors will not have the opportunity to evaluate the economic, financial and other relevant information that we may consider in the application of the net proceeds from this Offering. We cannot guarantee that we will make the most efficient use of the net proceeds from this Offering or that you will agree with the way in which such net proceeds are used. Our failure to apply these funds effectively could have a material adverse effect on our business, results of operations and financial condition. See “Use of Proceeds” set forth in this offering circular.

This offering circular contains our best estimates of future operations that are based on uncertainties and other factors beyond our control and are difficult to predict.

This offering circular and the statements contained within it are based on our current plans and contemplated future activities, and our financial condition and results of operations may be materially different from those set forth in the forward-looking statements as a result of known or unknown risks and uncertainties, including, among other things:

| | • | | Risks and uncertainties relating to market demand and acceptance of our platform and technology; |

| | • | | Dependence on strategic partners for development, commercialization and distribution of the platform; |

| | • | | Concentration of our revenue in a limited number of strategic partners, some of which may be experiencing decreased demand for their products utilizing or incorporating our technology, budget or finance constraints in the current economic environment, or periodic variability in their purchasing patterns or practices; |

| | • | | The impact of the ongoing uncertainty in the U.S. and global finance markets and changes in government funding, including its effects on the capital spending policies of our partners and end users and their ability to finance purchases of our products; |

| | • | | Our ability to obtain and enforce intellectual property protections on our products and technologies; |

| | • | | Potential shortages, or increases in costs, of components or the disruption to our operations; |

| | • | | Our ability to successfully complete the Knowbella Platform Development and launch the Knowbella Platform™ and new products; |

| | • | | The timing implementation, including any modification, of our strategic operating plans; |

| | • | | The uncertainty regarding the outcome or expense of any litigation brought against or initiated by us; and |

| | • | | Risks and uncertainties associated with implementing our operating strategy, including our ability to obtain financing or raise additional capital. |

The Company will be subject to various conflicts of interest arising out of its relationships with Open Therapeutics.

Jason E. Barkeloo, the holder of a majority of Knowbella Parent’s outstanding voting units and a member of the Board of Directors of the Company, also maintains a controlling interest in, is the board chairman of, and has a consulting arrangement with, Open Therapeutics. In addition, Mark Pohlkamp is an advisor and less than 1% owner of Open Therapeutics. Knowbella Parent has entered into a sole license agreement with Open Therapeutics, which is

10

sublicensed by Knowbella Parent to the Company pursuant to the License Agreement, and the Company may engage in other transactions with Open Therapeutics, including, without limitation, amending the License Agreement and the acquisition of some or all of the equity interests in Open Therapeutics. Messrs. Barkeloo and Pohlkamp may have certain conflicts of interest with respect to any additional transaction between the Company, Knowbella Parent and Open Therapeutics and may profit from any transaction we (or Knowbella Parent) may have with Open Therapeutics.

Our business model is dependent on continued investment in and development of distributed ledger technologies.

Our business model is dependent on continued investment in and development of distributed ledger technologies. If as a result of regulatory changes, hackers, general market conditions or innovations, investments in distributed ledger technologies become less attractive to investors or innovators and developers, it could have a material adverse impact on our prospects and possibly our ability to continue our developmental operations. It is not possible to accurately predict the potential adverse impacts on us, if any, of current economic conditions on our prospects.

Risks Related to the Offering

The Knowbella Platform™ may not be widely adopted and may have limited users.

It is possible that the Knowbella Platform™ will not be used by a large number of individuals, companies and other entities or that there will be limited public interest in the creation and development of distributed ecosystems (such as the Knowbella Platform™) more generally or the distributed applications to be used on the Knowbella Platform™. Such a lack of use or interest could negatively impact the development of the Knowbella Platform™ and therefore the potential utility of the Tokens. Additionally, there can be no assurances that the Company will be able to collect or continue to collect dormant or orphan intellectual property which may adversely affect the continued usability of the Knowbella Platform™ and the Company.

The Knowbella Platform Development may never be completed, or may not be completed in the manner expected by management, which could materially adversely affect the rights of holders of Helix™ tokens.

It is possible that the Knowbella Platform Development will not be completed, depending upon the successful launch of this Offering, the amount of proceeds raised in this Offering and the steps required to complete the Knowbella Platform Development. In addition, it cannot be anticipated whether the Knowbella Platform Development will occur in the manner expected by management or if significant differences in the Knowbella Platform™ may occur between the time of this Offering and the completion of the Knowbella Platform Development. Such a failure of, or substantial deviation from the currently anticipated, Knowbella Platform Development could negatively impact the development of the Knowbella Platform™ and therefore the potential utility of the Tokens.

Alternative networks may be established that compete with or are more widely used than the Knowbella Platform™.

The Knowbella Platform™ includes a hybrid of open source code and proprietary software. It is possible that alternative networks could be established that utilize the same or similar open source code and protocol underlying the Knowbella Platform™ and attempt to facilitate services that are materially similar to the Knowbella Platform™ services. The Knowbella Platform™ may compete with these alternative networks, which could negatively impact the Knowbella Platform™ and the Tokens.

Our proposed Knowbella Platform™ and our Helix™ tokens are new untested concepts and may not achieve market acceptance.

Our concept of creating a blockchain-based token security issuance and trading network based on the Knowbella Platform™ and Helix™ tokens is new and untested. There can be no assurance that our proposed Knowbella Platform™ will achieve market acceptance. Investors acquiring Tokens will bear the risks of investing in a novel, untested type of securities transaction that will trade exclusively on a novel type of trading platform and be subject to a number of unusual restrictions, as well as the risks of investing in our business. Any failure of the Knowbella Platform™ or the Helix™ tokens to perform as expected will have a material adverse effect on our prospects.

11

The Knowbella Platform™ may be the targets of malicious cyberattacks or may contain exploitable flaws in its underlying code, which may result in security breaches and the loss or theft of Tokens. If the Knowbella Platform™ security is compromised or if the Knowbella Platform™ is subjected to attacks that frustrate or thwart our users’ ability to access the platform, the Tokens or the products and services on such platform, users may cut back on or stop using the platform altogether, which could seriously curtail the utilization of the Tokens and cause a decline in the market price of the Tokens.

The Knowbella Platform’s™ structural foundation, the hybrid open-source protocol and proprietary software, the software application and other interfaces or applications built upon such platforms are still in an early development stage and are unproven, and there can be no assurances that the Knowbella Platform™ and the creating, transfer or storage of the Tokens thereon will be uninterrupted or fully secure which may result in a complete loss of users’ Tokens or an unwillingness of users to access, adopt and utilize the Knowbella Platform™. Further, the Knowbella Platform™ may also be the target of malicious attacks seeking to identify and exploit weaknesses in the software or the platforms which may result in the loss or theft of Tokens. For example, if Helix™orthe Knowbella Platform™ are subject to unknown or known security attacks (such as double-spend attacks, 51% attacks, or other malicious attacks), this may materially and adversely affect the Tokens or the platform. In any such event, if the network launch does not occur, if the Knowbella Platform Development is not completed or if the Knowbella Platform™ is not widely adopted, investors may lose all of their investment.

The Offering, along with any subsequent offering, may be subject to registration under the Securities Exchange Act of 1934 if the Company has assets above $10 million and more than 2,000 holders of record of its equity securities.

Companies with total assets above $10 million and more than 2,000 holders of record of its equity securities, or 500 holders of record of its equity securities who are not accredited investors, must register that class of equity securities with the SEC under the Exchange Act. With the capital raised from the Offering, the Company may surpass $10 million in assets as it builds out the Knowbella Platform™. Furthermore, there is the possibility that this Offering may surpass 2,000 holders of equity securities, or 500non-accredited investors, and the Company may have more than 2,000 holders of record of its equity securities (or 500non-accredited holders of equity) following the offering. If these two conditions are met then the Company will have to register the offering with the SEC, which will be a laborious and expensive process and maintaining such registration will also be expensive.

There is no assurance that investors in this Offering will receive a return on their investment.

There is no assurance that investors will realize a return on their investments or that their entire investments will not be lost. For this reason, each investor should carefully read this offering circular and the exhibits to the offering circular and should consult with their own attorney and business advisors prior to making any investment decision with respect to the Tokens.

Risks related to Blockchain Technologies and Digital Assets

The further development and acceptance of digital asset systems, which represent a new and rapidly changing industry, are subject to a variety of factors that are difficult to evaluate. The slowing or stopping of the development or acceptance of cryptocurrency may adversely affect an investment in the Tokens.

A digital asset such as cryptocurrency may be used, among other things, to buy and sell goods and services. Digital asset networks are a new and rapidly evolving industry. The growth of the digital asset industry is subject to a high degree of uncertainty. The factors affecting the further development of the digital asset industry include:

12

| | • | | continued worldwide growth in the adoption and use of digital assets; |

| | • | | government and quasi-government regulation of digital assets and their use, or restrictions on or regulation of access to and operation of digital asset systems; |

| | • | | the maintenance and development of the open-source software protocol; |

| | • | | changes in consumer demographics and public tastes and preferences; |

| | • | | the availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; and |

| | • | | general economic conditions and the regulatory environment relating to digital assets. |

A decline in the popularity or acceptance of digital assets may harm the market price of the Tokens. There is no assurance that any service providers necessary to accommodate the cryptocurrency network will continue in existence or grow. Furthermore, there is no assurance that the availability of and access to digital asset service providers will not be negatively affected by government regulation or supply and demand of cryptocurrency.

The regulatory regime governing the blockchain technologies, cryptocurrencies, tokens and token offerings such as the Knowbella Platform™ and the Tokens is uncertain, and new regulations or policies may materially adversely affect the development of the Knowbella Platform™ and the utility of the Tokens.

Regulation of tokens (including Helix™) and token offerings such as this Offering, cryptocurrencies, blockchain technologies, and cryptocurrency exchanges currently is undeveloped and likely to rapidly evolve, vary significantly among international, federal, state and local jurisdictions and are subject to significant uncertainty. Various legislative and executive bodies in the United States and in other countries may in the future, adopt laws, regulations, guidance, or other actions, which may severely impact the development and growth of the Knowbella Platform™ and the adoption and utility of the Tokens. Failure by the Company, Company management or certain users of the Knowbella Platform™ to comply with any laws, rules and regulations, some of which may not exist yet or are subject to interpretation and may be subject to change, could result in a variety of adverse consequences, including civil penalties and fines.

As blockchain networks and blockchain assets have grown in popularity and in market size, federal and state agencies have begun to take interest in, and in some cases regulate, their use and operation. In the case of virtual currencies, state regulators like the New York Department of Financial Services have created new regulatory frameworks. Others, as in Texas, have published guidance on how their existing regulatory regimes apply to virtual currencies. Some states, like New Hampshire, North Carolina, and Washington, have amended their state’s statutes to include virtual currencies into existing licensing regimes. Treatment of virtual currencies continues to evolve under federal law as well. The Department of the Treasury, the Securities Exchange Commission, and the Commodity Futures Trading Commission (“CFTC”), for example, have published guidance on the treatment of virtual currencies. The IRS released guidance treating virtual currency as property that is not currency for U.S. federal income tax purposes, although there is no indication yet whether other courts or federal or state regulators will follow this classification. Both federal and state agencies have instituted enforcement actions against those violating their interpretation of existing laws. The treatment of tokens and cryptocurrency in general is not consistent across government agencies and the Company offers no such tax advice. Purchasers of Helix™ tokens are advised to consult their own tax advisors.

The regulation ofnon-currency use of blockchain assets is also uncertain. The CFTC has publicly taken the position that certain blockchain assets are commodities, and the SEC has issued a public report stating federal securities laws require treating some blockchain assets as securities. To the extent that a domestic government or quasi-governmental agency exerts regulatory authority over a blockchain network or asset, the Knowbella Platform™ and the Tokens may be materially and adversely affected.

Blockchain networks also face an uncertain regulatory landscape in many foreign jurisdictions such as the European Union, China, South Korea and Russia. Various foreign jurisdictions may, in the near future, adopt laws, regulations or directives that affect the Knowbella Platform™. Such laws, regulations or directives may conflict

13

with those of the United States or may directly and negatively impact our business. The effect of any future regulatory change is impossible to predict, but such change could be substantial and materially adverse to the development and growth of the Knowbella Platform™ and the adoption and utility of the Tokens.

New or changing laws and regulations or interpretations of existing laws and regulations, in the United States and other jurisdictions, may materially and adversely impact the value of the currency in which the Tokens may be exchanged, the value of the distributions that may be made, the liquidity of the Tokens, the ability to access marketplaces or exchanges on which to trade the Tokens, and the structure, rights and transferability of Tokens.

The investors will have no control and the Company may only have limited control once the network launch occurs.

Helix™ is comprised of a hybrid of open-source and proprietary technologies that depend on a network of computers to run certain software programs to process transactions. Because of this less centralized model, the Company has limited control over Helix™ and the Knowbella Platform™. In addition, the holders of Helix™ are not and will not be entitled to receive dividends or be deemed the holder of common stock of the Company (prior to any conversion of such Tokens into Class H Common Stock, at which point holders will have an ownership interest in the Company) and will have a limited right to vote on certain matters.

There may be occasions when certain individuals involved in the development and launch of the Knowbella Platform™ may encounter potential conflicts of interest in connection with the Knowbella Platform™ such that said party may avoid a loss, or even realize a gain, when other investors in thepre- sale or in Helix™ are suffering losses.

There may be occasions when certain individuals involved in the development and launch of the Knowbella Platform™ or Helix™ may encounter potential conflicts of interest in connection with this Offering and the Knowbella Platform™, such that said party may avoid a loss, or even realize a gain, when other investors in the Offering are suffering losses. Decisions made by the key employees of the Company on such matters may be more beneficial for some investors than for others.

See the risk factor above titled “The Company will be subject to various conflicts of interest arising out of its relationships with Open Therapeutics” regarding the conflict of interest between the Company, Messrs. Barkeloo and Pohlkamp, Knowbella Parent and Open Therapeutics.

Investors may lack information for monitoring their investment.

The investor may not be able to obtain all information it would want regarding Knowbella, Helix™ or the Knowbella Platform™ on a timely basis or at all. It is possible that the investor may not be aware on a timely basis of material adverse changes that have occurred with respect to certain of its investments. While Knowbella has made efforts to use open-source development for the Tokens, this information may be highly technical by nature. As a result of these difficulties, as well as other uncertainties, an investor may not have accurate or accessible information about the Knowbella Platform™.

If the Knowbella Platform™ is unable to satisfy data protection, security, privacy, and other government- and industry-specific requirements, its growth could be harmed.

There are a number of data protection, security, privacy and other government- and industry-specific requirements, including those that require companies to notify individuals of data security incidents involving certain types of personal data. Security compromises could harm the Knowbella Platform’s™ reputation, erode user confidence in the effectiveness of its security measures, negatively impact its ability to attract new users, or cause existing users to stop using the Knowbella Platform™.

14

The further development and acceptance of blockchain networks, including the Knowbella Platform™, which are part of a new and rapidly changing industry, are subject to a variety of factors that are difficult to evaluate. The slowing or stopping of the development or acceptance of blockchain networks and blockchain assets would have an adverse material effect on the successful development and adoption of the Knowbella Platform™ and the Tokens.

The growth of the blockchain industry in general, as well as the blockchain networks with which the Knowbella Platform™ will rely and interact, is subject to a high degree of uncertainty. The factors affecting the further development of the cryptocurrency industry, as well as blockchain networks, include, without limitation:

| | • | | Worldwide growth in the adoption and use of Ethereum and other blockchain technologies; |

| | • | | Government and quasi-government regulation of Ethereum and other blockchain assets and their use, or restrictions on or regulation of access to and operation of blockchain networks or similar systems; |

| | • | | The maintenance and development of the open-source software protocol of the Ethereum networks; |

| | • | | Changes in consumer demographics and public tastes and preferences; |

| | • | | The availability and popularity of other forms or methods of buying and selling goods and services, or trading assets including new means of using fiat currencies or existing networks; |

| | • | | General economic conditions and the regulatory environment relating to cryptocurrencies; or |

| | • | | A decline in the popularity or acceptance of Ethereum or other blockchain-based tokens would adversely affect our results of operations. |

The slowing or stopping of the development, general acceptance and adoption and usage of blockchain networks and blockchain assets may deter or delay the acceptance and adoption of the Knowbella Platform™ and the Tokens.

The prices of blockchain assets are extremely volatile. Fluctuations in the price of digital assets could materially and adversely affect our business, and the Tokens may also be subject to significant price volatility.

The prices of blockchain assets such as Bitcoin or Ethereum have historically been subject to dramatic fluctuations and are highly volatile, and the market price of the Tokens may also be highly volatile. Several factors may influence the market price of the Tokens, including, but not limited to:

| | • | | Global blockchain asset supply; |

| | • | | Global blockchain asset demand, which can be influenced by the growth of retail merchants’ and commercial businesses’ acceptance of blockchain assets like cryptocurrencies as payment for goods and services, the security of online blockchain asset exchanges and digital wallets that hold blockchain assets, the perception that the use and holding of blockchain assets is safe and secure, and the regulatory restrictions on their use; |

| | • | | Investors’ expectations with respect to the rate of inflation; |

| | • | | Changes in the software, software requirements or hardware requirements underlying the Knowbella Platform™; |

| | • | | Changes in the rights, obligations, incentives, or rewards for the various participants in the Knowbella Platform™; |

| | • | | Currency exchange rates, including the rates at which digital assets may be exchanged for fiat currencies; |

| | • | | Fiat currency withdrawal and deposit policies of blockchain asset exchanges on which the Tokens may be traded and liquidity on such exchanges; |

| | • | | Interruptions in service from or failures of major blockchain asset exchanges on which the Tokens may be traded; |

| | • | | Investment and trading activities of large investors, including private and registered funds, that may directly or indirectly invest in the Knowbella Platform™ or Tokens or other blockchain assets; |

| | • | | Monetary policies of governments, trade restrictions, currency devaluations and revaluations; |

| | • | | Regulatory measures, if any, that affect the use of blockchain assets such as the Tokens; |

15

| | • | | The maintenance and development of the hybrid open-source and proprietary software protocol of the Knowbella Platform™; |

| | • | | Global or regional political, economic or financial events and situations; or |

| | • | | Expectations among the Knowbella Platform™ or other blockchain assets participants that the value of the Tokens or other blockchain assets will soon change. |

A decrease in the price of a single blockchain asset may cause volatility in the entire blockchain asset industry and may affect other blockchain assets including the Tokens. For example, a security breach that affects investor or user confidence in Bitcoin or Ethereum may affect the industry as a whole and may also cause the price of the Tokens and other blockchain assets to fluctuate.

Investors may lose access to their Tokens due to loss of private keys, custodial error or purchaser error.

A private key, or a combination of private keys, is necessary to control and dispose of Tokens stored in a user’s digital wallet or vault. Thus, a loss of a user’s requisite private key(s) associated with such user’s digital wallet or vault storing Tokens could result in a loss of such Tokens. In addition, any third party that gains access to such private key(s), including by gaining access to a user’s login credentials of a hosted wallet service, may be able to misappropriate a user’s Tokens. Any errors or malfunctions caused by or otherwise related to the digital wallet or vault a user chooses to receive and store Tokens, including a user’s own failure to properly maintain or use such digital wallet or vault, may also result in the loss of a user’s Tokens. Failure to follow precisely the procedures set forth for buying and receiving Tokens, including, for instance, if a user provides the wrong address, or provides an address that is notERC-20 compatible, may result in a loss of such user’s Tokens. Investors should be aware of such risk and the Company can make no assurances that a loss of a private key(s), and the resulting Tokens, will not happen.

PROSPECTIVE INVESTORS ARE URGED TO CONSULT THEIR OWN LEGAL COUNSEL OR OTHER PROFESSIONAL ADVISORS AS TO ANY LEGAL RESTRICTIONS ON THEIR ABILITY TO OWN THE TOKENS AND AS TO THE PRECISE FEDERAL, STATE, LOCAL AND OTHER TAX CONSEQUENCES OF ACQUIRING, OWNING AND DISPOSING OF THE TOKENS.

16

TOKEN ALLOCATION

The Company intends to allocate the maximum amount of Helix™ tokens qualified in this Offering in the manner set forth below:

| | | | | | | | | | | | |

Token Allocation | | Amount of Tokens

Allocated | | | Amount of Proceeds | | | Allocation Percentage | |

Tokens issued to investing public in this Regulation A Offering | | | 55,555,556 | | | $ | 16,666,667 | | | | 33.3 | % |

Tokens reserved for use by the Company | | | 111,111,111 | | | $ | 33,333,333 | | | | 66.7 | % |

• Reserved for Operations | | | 17,500,000 | | | $ | 5,250,000 | | | | 10.5 | % |

• Reserved for Knowbella Platform™ Users | | | 77,777,778 | | | $ | 23,333,333 | | | | 46.7 | % |

• Company Reserves (1) | | | 15,833,333 | | | $ | 4,750,000 | | | | 9.5 | % |

| | | | | | | | | | | | |

Total | | | 166,666,667 | | | $ | 50,000,000 | | | | 100 | % |

| | | | | | | | | | | | |

| (1) | In accordance with Knowbella Parent’s concurrent Rule 506(b) Regulation D private offering to certainpre-seed investors, Simple Agreements for Future Tokens (“SAFTs”) were issued (and may continue to be issued until either the qualification of this Offering Circular or until $1,000,000 is raised in such private offering) to such investors upon various terms and conditions. In the event of the full exercise of such SAFTs, the Company will issue such investors up to 4,166,667 Helix™ tokens, which will be allocated from the Company reserves set forth above. |

17

USE OF PROCEEDS

This Use of Proceeds section is based upon the amount of Tokens sold to the investing public pursuant to the Token Allocation set forth above. See “Token Allocation.”

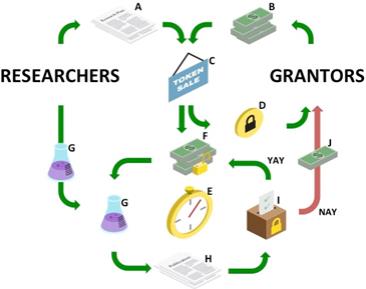

We intend to use the net proceeds for the following purposes in the following order: (a) towards the fees and expenses associated with qualification of this Offering under Regulation A, including legal, auditing, accounting, transfer agent and other professional fees; (b) towards the implementation of our business plan, including but not limited to: (i) completion of the Knowbella Platform Development, (ii) ongoing legal and regulatory interaction and relations, (iii) community building/development around the Helix™ community, (iv) marketing of the Knowbella Platform™; and (v) potential strategic acquisitions; and (c) the balance towards operating capital and reserves. In the event that we sell less than the maximum amount of Tokens offered hereunder, our first priority is to pay fees associated with the qualification of this Offering under Regulation A. No proceeds will be used to compensate or otherwise make payments to officers except for ordinary payments under employment, consulting or retainer agreements; see “Compensation of Directors and Executive Officers.”

If the maximum amount of Tokens offered hereunder are purchased, we expect to receive net proceeds from this Offering of approximately $15,966,667 after deducting estimated maximum expenses of $700,000. However, we cannot guarantee that we will sell all of the Tokens being offered by us. The following table summarizes how we anticipate using the net proceeds of this Offering, depending upon whether we sell 25%, 50%, 75% or 100% of the Tokens being offered in the Offering:

| | | | | | | | | | | | | | | | |

| | | If 25% of Tokens

are sold | | | If 50% of Tokens are

sold | | | If 75% of Tokens

are sold | | | If 100% of Tokens

are sold | |

Gross Proceeds | | $ | 4,166,666.75 | | | $ | 8,333,333.50 | | | $ | 12,500,000.20 | | | $ | 16,666,667 | |

Our intended use of the gross proceeds is as follows: Fees for qualification of Offering under Regulation A (includes legal, auditing, accounting, broker/dealer and other professional fees) | | $ | 300,000 | | | $ | 300,000 | | | $ | 300,000 | | | $ | 300,000 | |

Completion of Knowbella Platform Development | | $ | 400,000 | | | $ | 400,000 | | | $ | 400,000 | | | $ | 400,000 | |

Legal/regulatory matters | | $ | 200,000 | | | $ | 200,000 | | | $ | 200,000 | | | $ | 200,000 | |

Community building/development/IP collection/grant issuance | | $ | 1,000,000 | | | $ | 2,000,000 | | | $ | 2,000,000 | | | $ | 2,000,000 | |

Promotion/marketing | | $ | 1,000,000 | | | $ | 2,000,000 | | | $ | 4,000,000 | | | $ | 4,000,000 | |

Working capital and general corporate purposes | | $ | 500,000 | | | $ | 2,000,000 | | | $ | 3,000,000 | | | $ | 3,000,000 | |

Potential Strategic Acquisition of Open Therapeutics | | | — | | | | — | | | | — | | | $ | 5,000,000 | |

Contingency Funds | | | Balance | | | | Balance | | | | Balance | | | | Balance | |

Net Proceeds | | $ | 3,991,666.75 | | | $ | 7,983,333.50 | | | $ | 11,975,000.20 | | | $ | 15,966,667 | |

Assuming the successful closing of this Offering, the successful Knowbella Platform Development and the availability of funds after the Offering, we intend to seek the acquisition of some or all of Open Therapeutics to round out the Company’s intellectual property portfolio and to consolidate the Knowbella Platform™ and the Therapoid™ Platform for holders of the Helix™ tokens. The Company estimates that such strategic acquisition may cost around $5,000,000.

18

We believe that if we sell the maximum amount of Tokens in this Offering, the net proceeds together with our current resources will allow us to operate for at least the next 36 months. We also reserve the right to change the use of the proceeds if our business plans change in response to market and regulatory conditions. Accordingly, our management will have significant flexibility in allocating the net proceeds of this Offering.

19

THE COMPANY

Summary of the Company

Knowbella Helix Inc. is a Delaware corporation with its headquarters in Cincinnati, Ohio and is a wholly-owned subsidiary of Knowbella Tech LLC, a Delaware limited liability company. We are in a time where “open” collaboration is proliferating in areas such as computer programming (i.e., Linux®, Redhat®, Github®, etc.) and healthcare (i.e., the Gates Foundation®, Cancer Moonshot Initiative, etc.). This open collaboration is helping solve significant challenges and creating new opportunities for business. Knowbella proposes to advance this movement through opening up orphan and dormant (idle) intellectual property in an open science platform known as the “Knowbella Platform™”.

The Knowbella Platform™ is intended to be a collaborative scientific ecosystem that crowdsources the global scientific and engineering communities around orphan and dormant intellectual property, funding, and Helix™ tokens. We aim to help scientists around the world find previously hidden knowledge, connect with others to grow that knowledge, disseminate their findings more quickly than through traditional publishing models, and reward them for their contributions to the scientific community.

Knowbella plans to solve a significant problem where the era of patents and the promise of riches has severely hindered the dissemination and proliferation of knowledge. In addition, it is estimated that the global value of intellectual property that is dormant (or orphan) is $4 trillion (Hovis, 2014). We believe intellectual property is orphaned by institutions such as universities and corporations as well as individual inventors typically due to budget constraints as well as lack of market insights.

We anticipate solving this significant problem by removing the silos of innovation and building aweb-based crowdsourcing platform to enable researchers and scientists to collaborate in an open science ecosystem.

As all products and publications are based upon intellectual property utilized within the Knowbella Platform™, all progress must be made available under a Creative Commons 4.0 and Copyleft model. The contributions also serve to enhance the social good. The Knowbella Platform™ will serve as a place where inventors, institutions, researchers, educators, students and citizen scientists can work together for the benefit of humankind.

While Knowbella was formed in 2018 for the purposes of conducting this Offering, its parent company, Knowbella Tech LLC, a Delaware limited liability company (“Knowbella Parent”) was formed in September 2016 and there is a rich history behind its evolution into the “open science” collaboration platform that it is today. In 2016, Knowbella Parent solely licensed the U.S. patent-pending collaboration platform Therapoid™ (the “Therapoid™ Platform”) from Open Therapeutics, LLC, an Ohio limited liability company (“Open Therapeutics”), which has been sublicensed to Knowbella pursuant to that certain Amended & Restated License Agreement (the “License Agreement”), a copy of which is attached hereto as an exhibit. Although still in “soft launch” pilot phase, the Therapoid™ Platform has already begun to attract scientists around the world to its open collaboration value proposition. The pilot site for the Therapoid™ Platform can be found at https://Therapoid.net. The Knowbella Platform™ will complement the Therapoid™ Platform by consisting of dormant intellectual property withnon-therapeutic applications, whereas the Therapoid™ Platform will consist of dormant intellectual property with therapeutic applications. Leveraging this existing platform saves time and resources accelerating market penetration.

Concurrent with this Offering and pursuant to the License Agreement, the Knowbella Platform™ will be available for use by holders of Helix™ tokens. However, Knowbella will likely outsource smart contracts, wallet, and other feature developments, including further expansion of the Knowbella Platform™ to third party developers, which is expected to be finalized within three to six months after qualification of this Offering, although no guarantee can be made regarding such timeline (the “Knowbella Platform Development”). Continuous improvement and updates will occur after the Knowbella Platform Development as necessary or desirable and as determined by the Company. Prior to the Knowbella Platform Development, purchasers of Helix™ will have access to the Knowbella Platform™ in its current form and will have access to their Helix™ tokens in any wallet provided by such purchaser, with a Knowbella-specific wallet likely becoming available for the Helix™ tokens after completion of the Knowbella Platform Development.

20

The Knowbella Mission

The Knowbella Platform™ is intended to provide a matching service for intellectual property producers looking to derive value from dormant intellectual property, and intellectual property consumers, the scientists who perform new research based on that intellectual property. Knowbella has the potential to add market value to the nearly $4 trillion of underused intellectual property.