UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMI-ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the period ended: June 30, 2021

| Global Cancer Technologies, Inc. |

| (Exact name of issuer as specified in its charter) |

| Nevada | | 46-1785241 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

16776 Bernardo Center Drive

Suite 203

San Diego, CA 92128

(Full mailing address of principal executive offices)

(619) 818-2411

(Issuer’s telephone number, including area code)

ITEM 1. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our interim unaudited and unreviewed financial statements included elsewhere in this Form 1-SA. In addition to historical data, this discussion contains forward-looking statements about our business, operations and financial performance based on current expectations that involve risks, uncertainties and assumptions. Actual results may differ materially from those discussed in the forward-looking statements as a result of various factors.

Results of Operations

The following discussion compares the results for the six-month period ended June 30, 2021to the same six-month period ended June 30, 2020.

Six Months Ended June 30, 2021 Compared to the Six Months Ended June 30, 2020

During the six months ended June 30, 2021 and 2020, the Company had no operating revenues. During the six months ended June 30, 2021, the Company incurred operating expenses (and a net loss) of $246,678, consisting primarily of consulting fees, research and development and travel expenses and other general and administrative costs. During the six months ended June 30, 2020, the Company incurred operating expenses (and a net loss) of $140,421. As of June 30, 2021, the Company had stockholders’ deficit of $(517,524) compared to a stockholders’ deficit of $(62,154) as of June 30, 2020.

Liquidity and Capital Resources

We have incurred losses since inception of our business and, as of June 30, 2021, we had an accumulated deficit of $2,928,449 As of June 30, 2021, we had cash of $23,083 and a negative working capital of $520,031.

To date, we have funded our operations through sales outside of our primary fields of endeavor, short-term debt, and equity financing. In the period January 1, 2021 through June 30, 2021, the Company issued 148,300 shares of common stock for cash proceeds of $177,471.

We expect our expenses will continue to increase during the foreseeable future as a result of increased operational expenses and the development of our products under license. However, we do not expect to start generating revenues from our operations for another 12 months. Consequently, we are dependent on the proceeds from future debt or equity investments to sustain our operations and implement our business plan. If we are unable to raise sufficient capital, we will be required to delay or forego some portion of our business plan, which would have a material adverse effect on our anticipated results from operations and financial condition. There is no assurance that we will be able to obtain necessary amounts of additional capital or that our estimates of our capital requirements will prove to be accurate. As of the date of this Form 1-SA we did not have any commitments from any source to provide such additional capital. Even if we are able to secure outside financing, it may not be available in the amounts or the times that we require. Furthermore, such financing would likely take the form of bank loans, private placement of debt or equity securities or some combination of these. The issuance of additional equity securities would dilute the stock ownership of current investors while incurring loans, leases or debt would increase our capital requirements and possible loss of valuable assets if such obligations were not repaid in accordance with their terms.

Off-Balance Sheet Arrangements

Since our inception, we have not engaged in any off-balance sheet arrangements.

Summary of Critical Accounting Policies

Significant Accounting Policies

This summary of significant accounting policies of GCT is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States and have been consistently applied in the preparation of the financial statements.

Basis of Presentation

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“US GAAP”) and include the accounts of the Company and its subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation.

Cash and Cash Equivalents

Cash and cash equivalents consist of deposits in one large national bank. At June 30, 2021and 2020 respectively, the Company had $23,083 and $70,706 in cash. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

Use of Estimates

The preparation of financial statements in accordance with generally accepted accounting principles requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates and assumptions and could have a material effect on the reported amounts of the Company’s financial position and results of operations.

Property and Equipment

Property and equipment are stated at cost and depreciated using the straight-line method over the estimated useful life of the asset. Equipment at June 30, 2021 and 2020 consisted of computer and lab equipment.

Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value.

The Company has abandoned its efforts in developing our Boiling Histotripsy technology and as a result may dissolve HIFU Plus, Inc. The Company recorded an impairment loss for the total value of Hi-Fu’s assets $250,000 in 2020.

Fair Value of Financial Instruments

The Company’s financial instruments as defined by ASC 825-10-50, include cash, receivables, accounts payable and accrued expenses. All instruments are accounted for on a historical cost basis, which, due to the short-term maturity of these financial instruments, approximates fair value at June 30, 2021 and 2020.

Earnings (Losses) Per Share

Basic net loss per share was computed by dividing the net loss by the weighted average number of shares outstanding during the year. Diluted net loss per share is computed using the weighted average number of common shares and potentially dilutive securities outstanding during the period. Weighted average of number of diluted securities was the same as weighted average of basic securities because the effect of dilutive securities was non-dilutive.

Share-Based Payments

The Company accounts for stock-based compensation awards to its directors, officers, and employees in accordance with Accounting Standards Codification (“ASC”) Topic 718, Compensation – Stock Compensation (“ASC 718”).

The Company accounts for stock-based compensation awards to non-employees, in accordance with ASC 718, as amended. In June 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2018-07, Compensation – Stock Compensation (Topic 718) – Improvements to Nonemployee Share-based Payment Accounting which extended the provisions of ASC 718 to share-based awards issued to non-employees by public companies. The Company has adopted the provisions of ASU 2018-07.

In the fiscal year ended December 31, 2020, consulting expense includes $82,000 in connection with shares awarded in exchange for services., including $30,000 awarded to its directors in fiscal 2020. There are no such charges in 2021.

Provision for Taxes

Income taxes are provided based upon the liability method of accounting pursuant to ASC 740-10-25 Income Taxes — Recognition. Under the approach, deferred income taxes are recorded to reflect the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year-end. A valuation allowance is recorded against deferred tax assets if management does not believe the Company has met the “more likely than not” standard imposed by ASC 740-10-25-5 to allow recognition of such an asset.

New Accounting Pronouncements

The Company has evaluated the authoritative guidance issued in the six-month period ended June 30, 2021 and does not expect the adoption of these standards to have a material effect on its financial position or results of operations.

Outlook and Recent Trends

We are in the startup phase of our development and have acquired various licenses for the development of innovative technologies in the areas of nano drug transport, surgical instrument tracking, and acoustic shock therapy. We also have a distribution license with an affiliated company which has developed a gamma-based radiosurgery device for treatment of tumors of the brain as well as the rest of the body. Our business plan is to develop and bring these new technologies to market and to continue the testing and marketing of the radiosurgery device.

From November 2017 through October 2018 we borrowed $237,500 from investors and issued promissory notes in this aggregate amount. Each note bears interest at 7% per annum and matures one year from issuance. We are not permitted to prepay these notes prior to maturity without the consent of the note holders. If we undertake a self-registered IPO prior to maturity, these notes are convertible at the rate of $0.25 to $0.50 per share, or the same terms as the IPO, whichever are more favorable to the note holder. These notes also provide for piggyback registration rights. The borrowed funds were used for general and administrative purposes. The funds were also used to support the accounting and legal costs of the qualification process. On September 23, 2019, all of the convertible notes were converted into common shares of the company. This resulted in the company issuing 836,772 additional shares for converting noteholders.

Plan of Operation

We have four unique and distinct technologies under our control:

Brain Cancer Treatment (GCT.Glio.1)

Global Cancer Technology has licensed from Neuropore Therapies two mechanistically distinct classes of potent, selective and brain penetrating modulators of mTOR–regulated autophagy targeting PI3K and VPS34. In summary we have:

In vitro data showing that the lead compound(s) in the PI3k portfolio:

| · | | Is a potent and selective PI3K inhibitor |

| · | | Up regulates autophagy of several forms |

| · | | Prevents the toxicity caused by the over expression of pathologic proteins in cell systems (presumably by enhancing the clearance of those proteins) |

| · | | Modulates immune cell function and inflammatory responses in what would be a neuroprotective manner. |

Supporting in vivo data

| · | | Life span extension in C. Elegans (worm model) |

| · | | Beneficial actions in the EAN model of Gillian Barre syndrome (MS like demyelinating disease) |

Supporting early preclinical development data

| · | | Oral PK and brain penetration |

Based on literature and commercial precedent, these compounds should have applications in certain cancers, in disorders that would benefit from upregulation of autophagy (e.g. neurodegenerative disorders, NASH) and those disorders having a chronic inflammatory component (e.g. psoriasis). Based on some mechanism related issues (mild hyperglycemia in some subjects) it may be worthwhile to focus on severe disorders without good treatment options and on those where the course of treatment may be relatively limited in duration (thus cancer indications or episodic treatment of GBS/MS). Skin or ocular disorders where systemic exposures may be minimized may also be worth examining

We have named our lead compound GCT.Glio.1

Summary to Date of Preclinical Progress with the Barrow Neurological Institute

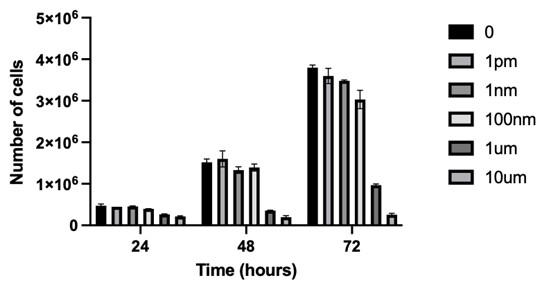

The purpose of our experiments has been to address the question of how, and if, the GCT compound(s), two inhibitors of PI3 kinase, affect glioblastoma (GBM) cells grown in culture. Our first experiments showed that treatment with the GCT compound resulted in many fewer cells after treatment than the number of cells in the untreated group, suggesting that the compound possibly caused growth arrest. Ongoing studies continue to suggest that both of our compounds cause cell cycle arrest at the G2 checkpoint.

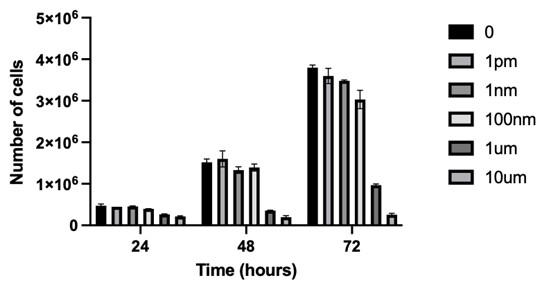

Figure 1 Legend. Cells were cultured for 24, 48 or 72 hours in the presence of GCT.GLIO.1 at the indicated concentrations. Cells were then harvested and counted.

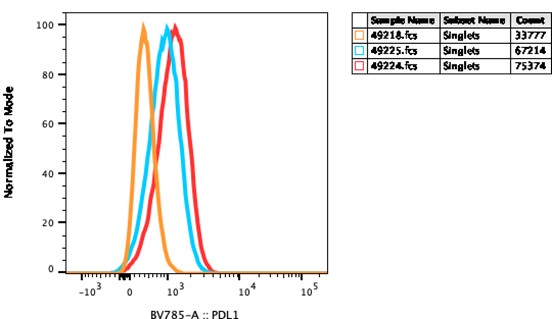

The second step in our study was to determine if the compound changed the way the GBM cells in culture “look” to the immune system. In other words, does treatment with GCT increase the likelihood of T cells getting “revved up” and releasing the “brakes” on an anti-tumor response. The first preliminary data suggest that the GCT treatment increases the amount of PD-L1 on the cell surface of the GBM potentially providing a target for “releasing the brakes,” by treating the patient with “checkpoint inhibitor”. This is important as checkpoint inhibitor drugs work by blocking PD1:PD-L1 interactions, so an increase in cell surface PD-L1 may increase the cell’s responsiveness to checkpoint inhibitor drugs.

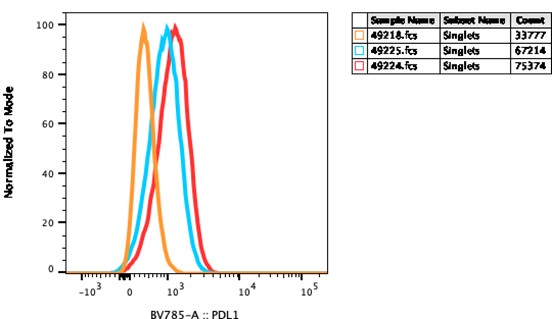

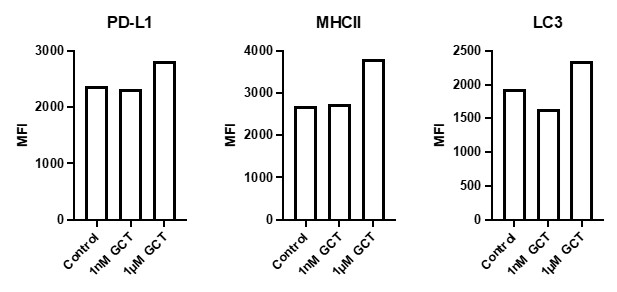

In the following experiments, we demonstrate that treatment with GCT.GLIO.1 may increase PD-L1, Figure 2.

Figure 2 Legend. GL261 cells were cultured with and without GCT.GLIO.1, for 72 hours, harvested, and stained with anti-PD-L1 as shown. The histograms indicate an increase in the cell surface expression of PD-L1 and indicate that increased PD-L1 may provide provide a target for immune checkpoint inhibitor therapy.

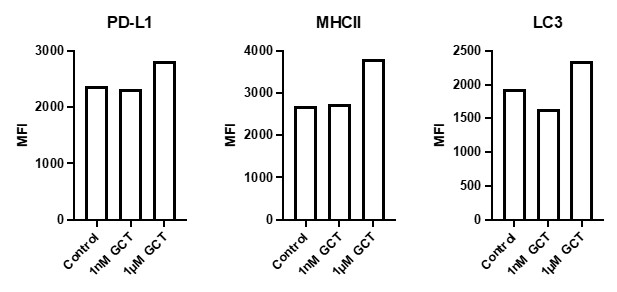

Figure 3 Legend. GL261 cells were cultured with and without GCT.GLIO.1, as indicated, for 7 days, harvested, and stained to determine changes in the cell surface expression of PD-L1 and MHC class II; or for the expression of a marker of autophagy, LC3. The increases in MHC class II and PD-L1 suggest that the drug would increase the likelihood of recognition by CD4 T cells and that increased PD-L1 would provide a target for immune checkpoint inhibitor therapy.

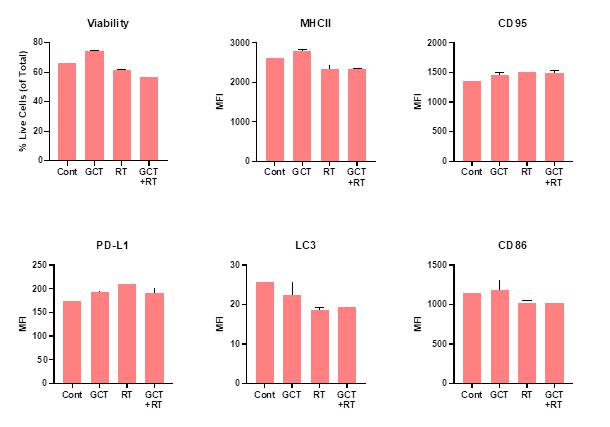

Figure 4 Legend. GL261 cells were cultured with and without GCT.GLIO.1 (NPT520-337 and GCT.GLIO.2 (NPT520-322), for 72 hours, harvested, and stained as indicated to determine changes in the cell surface expression of PD-L1 and MHC class II; or for the expression of a marker of autophagy, LC3.

These results show that both compounds increase the level of MHC class II, but compound GCT.GLIO.1 (NPT520-337) caused increases in all three molecules, whereas compound GCT.GLIO.2 (NPT520-322) causes growth arrest and increased MHC class II expression.

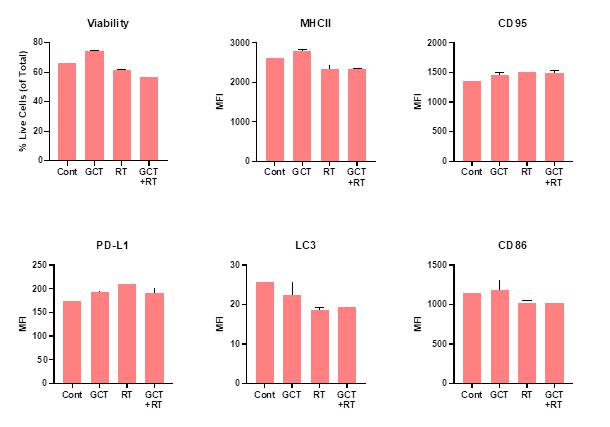

Effects of GCT.GLIO.1 on Radiation-sensitivity of GL261. In these experiments, we addressed the question of how, or if, treatment with GCT.GLIO.1 may affect subsequent treatment with irradiation, Figure 5, below. GL261 cells were cultured with and without GCT.GLIO.1 (NPT520-337) denoted GCT below, and with or without treatment with 2 Gy irradiation (denoted as R). The viability data indicate that GCT sensitizes the cells to 2 Gy as indicated by lower viability (increased cell death) following GCT and irradiation, Figure 5.

Figure 5.

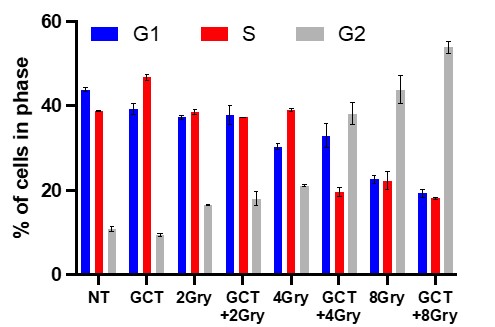

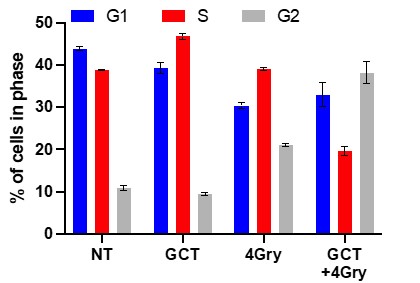

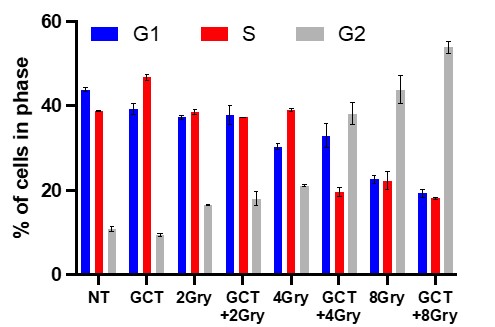

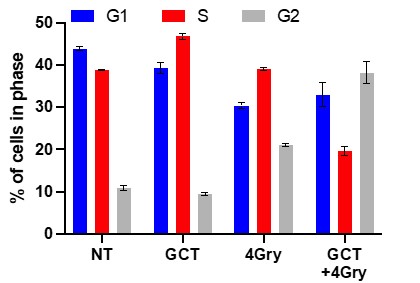

Effects of GCT.GLIO.1 on Radiation-sensitivity and Cell Cycle Arrest of GL261. In the next experiment, we sought to identify the optimum dose of radiation following treatment with GCT.Glio.1. In these studies, we treated with GCT.Glio.1 for 24 hours followed by increasing doses of irradiation, including 2, 4, and 8 Gy. The results show that retreatment with GCT.Glio.1 significantly amplified the response to radiation and caused significant increase in cells arrested at the G2 cell cycle checkpoint, Figures 6 and 7 below.

Figure 6. GL261 cells were treated with GCT.Glio.1 followed 24 hrs later with irradiation as indicated. GCT.Glio.1 potentiated cell cycle arrest at G2 as indicated.

Figure 7. GL261 cells were treated with GCT.Glio.1 followed 24 hrs later with irradiation as indicated. GCT.Glio.1 potentiated cell cycle arrest at G2 as indicated, with the most striking sensitization following 4 Gy radiation.

Market and Competition. Because many tumors, including GBM, show a marked and increased use of PI3kinase that supports the growth and survival of the tumors, there have been several efforts to target PI3K with new pharmaceutical compounds. At least several are now in clinical trials for GBM, including the following pan PI3K inhibitors:

| Pictilisib (GDC-0941) |  | | Copanlisib (BAY 80–6946) |  |

| | | | | |

| Taselisib (GDC-0032) |  | | Sonolisib (PX-866) | |

There are several isoform-specific PI3K inhibitors in early stage clinical trials as well. A key problem has been drug delivery beyond the blood brain barrier, however Genentech’s GDC 0084 is an orally availale small molecule PI3K inhibitor that can permeate the blood brain barrier.

The GCT compounds were also designed to be brain permeant. The novel aspects of GCT.GLIO.1 and GCT.GLIO.2 are the combined advantages of being able to cross the blood brain barrier and to alter the “visibility” of the GBM to the immune system.

GCT has established a platform to circumvent three issues. First, GCT has developed GCT.BC.1 to be a novel, small molecule PI3Kinas inhibitor. Second, GCT has generated preliminary data that suggest GCT.BC.1 can turn an immunologically “cold” tumor to one that expresses many of the target molecules for immune therapies, thus turning the tumor from “cold” to “hot” with regards to immune therapy. Third, GCT has created a partnership with specialists in nanoparticle physics to activate its prodrug locally. [Note: Toward that end, It has long been recognized that a nontoxic prodrug activated into a toxic form only in a specific region by a focused beam of low dose radiation would solve the key issue of systemic toxicities. Radiation can penetrate deeply even through bone, it can cover small or large areas, and low doses are comparatively non-toxic. Thus, a radiation activatable prodrug would also reduce the amount of radiation needed to control tumors and thereby significantly diminish normal tissue damage. If the prodrug were sequestered, and washed out of normal tissues, the drug could be delivered with much less danger to normal peripheral tissues].

GCT has partnered with experts in the fields of chemistry and nanoparticle physics to bypass the key challenges of breast cancer treatment by attaching a drug via a UV sensitive linker to a radiation-activated nano-scintillator. The potential advantage of the linker system is the possibility of being able to simply and easily accommodate virtually any cancer drug chemotype without restructuring the compound. When the drug delivery platform accumulates at the tumor, a focused beam of low dose radiation triggers light emissions from the scintillator. This light then disrupts the linker which releases the fully active drug only in the vicinity of the tumor. Thus, drug doses may be significantly concentrated at the target because release of active drug is only at the target. Moreover, multiple drugs may be released in a timed sequence to maximize pharmacodynamic synergy and efficacy. The combination of nanoscintillator, linker, and bound drug that is inactive and nontoxic until it is released locally, are the novel distinctions of this technology.

Go to Market Strategy

At this stage, our brain cancer technology is at a research stage. We have no plans to be able to bring the technology to market within the next 12 months.

Scintillating Nanoparticles for Drug Delivery

NanoDrug Transport, Inc, in collaboration with the University of California, San Diego, is developing scintillating nanoparticles. NanoDrug Transport is a subsidiary of Global Cancer Technology with the IP for a drug delivery technology for treating breast cancer tumors. The technology involves using intravenous injection to deliver 25-50 nanometer engineered nano-scintillator particles coated with cancer-treating drugs administered directly to the cancer cells. Once the particles enter the cancer cells, small doses of external radiation are used to activate the particles and release the drugs directly into the cancer cells, destroying the cancer cells without affecting healthy tissues.

Preliminary Results

Over the past three years, we have developed a nanoscale radiation scintillator composed of nontoxic products. We have coated the scintillator with aminosilica to allow the attachment to of functional moieties such as the linker, stealth molecules, and targeting ligands. The stealth ligands prevent opsonization and removal of the nanoparticles from the blood stream and they prevent particle accumulation. We have shown that the coated nanoscintillator still emits light, and the coating also serves to reduce agglomeration. We have tested an early form of the linker, shown it to be very stable, and we have attached the linker and an anticancer drug (doxorubicin) to the nanocrystal.

Future Plans and Development

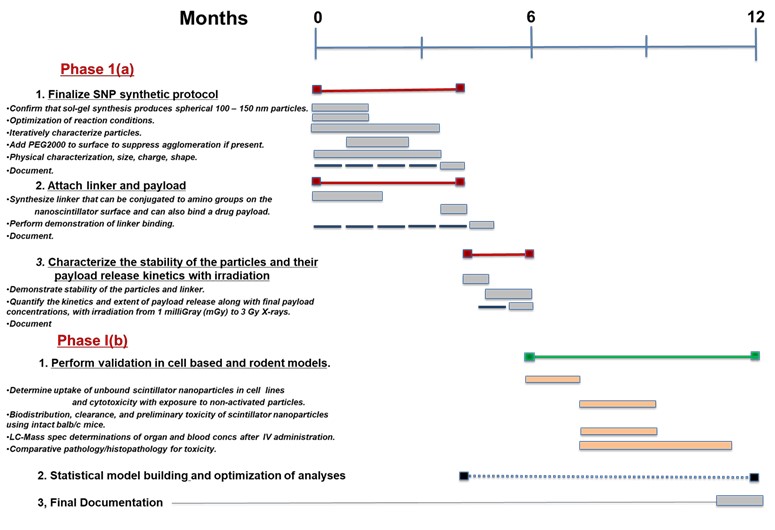

It is our intent to complete preclinical studies leading to an IND and clinical trials. However, at the present juncture, which is herein dubbed ‘Phase I’, the aims are pragmatic and the scope of the proposed work is intended to be satisfied within the next year, and with approximately $100 K of funding.

If these studies are successful, they will set the stage for subsequent, larger and more comprehensive preclinical studies designed to provide a basis for formal pre-IND preclinical development. We also describe herein initial Phase II studies to provide a context for later preclinical development. Phase II studies and beyond may be formulated and defined in extensive consultation with partners.

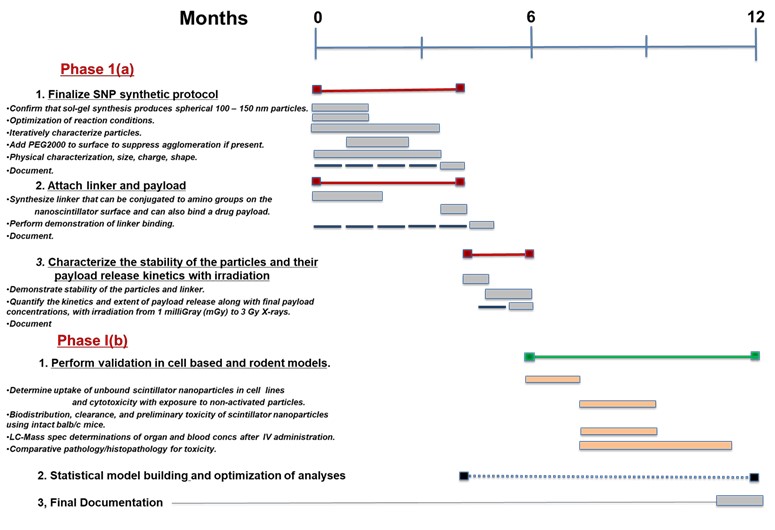

Currently we are seeking Phase I pilot funding to execute the following:

Phase I(a)

| 1. | | Finalize the synthetic protocol for making large quantities of the coated nanoscintillator. |

| 2. | | Attach our optimized, and already designed, linker, together with payload. |

| 3. | | Complete in silico tests to quantitatively characterize the stability of the particles and their payload release kinetics in response to radiation exposure. |

Phase I(b)

| 1. | | Perform cell based studies and preliminary studies in rodent models: |

| - | | C57/Blabc mice biodistribution. |

| - | | Efficacy in a flank tumor model – multiple cell lines. |

The data obtained from Phase I above may inform subsequently funded studies:

Phase II(a) – perform efficacy studies in murine flank xenografts of liver cancer.

Phase II(b) – perform efficacy and preliminary toxicity studies in murine and rabbit orthotopic models of liver cancer.

Phase I Tasks and Methodology

Phase I(a)

| 1. | | finalize the synthetic protocol for making large quantities of the coated nanoscintillator. |

Status

We have succeeding in fabricating 100 – 200 nm scintillator nanoparticles (drug delivery platform) coated with a 10 nm thick layer of aminosilica. The basic methodology has been developed over the past three years, is successful, and has been clearly established with publications.

Remaining Tasks

| (i) | | Confirm that sol-gel synthetic methods can consistently produce spherical 100 – 150 nm particles. |

| (ii) | | Perform relatively minor optimization if needed in terms of reaction conditions and times. Iteratively characterize particles with zeta measurements and EM imaging to assess shape and agglomeration, and make adjustments. |

| (iii) | | If needed add PEG2000 to surface to suppress agglomeration if present. |

| (iv) | | Perform physical characterization, size, charge, shape. |

| 2. | | Attach linker and payload to nanoscintillator particle. |

Status

We have already designed and tested a photocleavable linker and shown it to be stable in the mammalian tissue environment. We have redesigned this linker to be able to bind amino groups on the surface of the nanoscintillator and also a drug payload, for demonstration purposes, doxorubicin. We have showed that a single attachment site linker can be conjugated to the nanoscintillator surface. The linker can bind a wide range of chemotypes and release them intact in response to scintillator generated light emissions.

Remaining Tasks:

| (i) | | Synthesize linker that can be conjugated to amino groups on the nanoscintillator surface and can also bind a drug payload. |

| (ii) | | Perform demonstration of linker binding. |

| (iii) | | Document. Expect that tasks (i) and (ii) will require 4 months and will be performed in parallel with part 1 of Phase I(a). |

| 3. | | Complete in silico tests to quantitatively characterize the stability of the particles and their payload release kinetics in response to radiation exposure. |

Status

We have shown that release of a drug payload attached to a nanoscintillator via streptavidin and photocleavable linker binding is dependent on radiation dose. This was a preliminary proof of concept demonstration. Streptavidin is not desirable as an attachment agent as it sloughs off at a baseline level without irradiation, and creates a very thick layer that renders the particle footprint much too large and can block and diffuse scintillator emitted light.

The system has been redesigned to incorporate a 10 nm thick aminosilica layer and a photocleavable linker directly bound to the amino groups presented by the aminosilica. So the linker, which is only a few Angstroms long, is on the surface of the particle to directly receive emitted photon flux.

Remaining Tasks:

| (i) | | Demonstrate stability of the particles and linker in and in mouse circulation human blood |

| (ii) | | Quantify the kinetics and extent of payload release along with final payload concentrations, on the benchtop using exposure to escalating doses of radiation |

| (iii) | | from 1 milliGray (mGy) to 3 Gy X-rays at clinically relevant dose rates, and energies ranging from KeV to MeV. |

Phase I(b)

| 1. | | Perform validation in cell based and rodent models. |

Tasks

| (i) | | Determine if there is uptake of unbound scintillator nanoparticles in fibroblast and tumor cell lines, determine uptake of particle bound and released small molecule (Doxorubicin). Although toxicity is not expected determine whether cytotoxicity occurs with exposure to non-activated particles. |

| (ii) | | Determine biodistribution, clearance, and preliminary toxicity of scintillator nanoparticles using intact balb/c mice. |

| a) | | LC-Mass spec determinations of organ and blood concentrations at 4, 8 and 24 hours after intravenous administration. |

| b) | | Compare histopathology evidence of cardiac, bone marrow, and footpad injury one week after native doxorubicin versus nanoscintillator bound (nonreleased) dox. |

Proposed Budget

Phase I(a)

| | · | PhD materials scientist 4 months 50% effort | $30 K |

| | · | Materials | $10 K |

| | · | Recharge for structural confirmation/EM | $10 K |

| | · | Polymer chemist 4 months 50% | $10 K |

Phase I(b)

| | · | Cell culture reagents/cell lines | $10 K |

| | · | Purchase mice/husbandry | $15 K |

| | · | Materials to make particles/labor/validation | $18 K |

| | · | LC-Mass spec recharge | $ 7 K |

| | · | Cell biology and animal research associate | $20 K |

| | | | |

| | · | TOTAL for Phase I Studies | $130 K |

Workflow for Subsequent Phase II Preclinical Studies

Phase II(a)

| 1. | | Measure tumor concentrations and efficacy in a murine flank tumor model of hepatocellular carcinoma. |

| a) | | Quantify tumor concentrations of intravenously injected scintillator nanoparticles along with concentrations of radiation released drug payload. |

| b) | | Quantify efficacy of radiation released drug payload versus native, unbound drug, delivery platform without drug, and buffered saline. Irradiate only flank tumor – shield rest of mouse body. Measure tumor size and extent |

Phase II (b)

| 1. | | Perform efficacy and preliminary toxicity studies in rabbit orthotopic model of liver cancer. |

| a) | | Prepare rabbit VX2 model of liver cancer. Implant tumors and allow to grow for two weeks. |

| b) | | CT scan liver to determine site and margins of tumor. |

| c) | | Catheterize marginal vein to infuse agents. |

| · | | Four experimental groups: nanoscintillator platform alone; Sorafenib alone given intravenously; Intravenous nanoscintillator platform bound to Sorafenib; |

| · | | Phosphate buffered saline (PBS). |

| · | | Treat initially and then three more times over 12 days (every 4 days) using a liver focused radiation low dose beam (shielding) to activate release of sorafenib only in vicinity of the tumor, i.e, spare uninvolved liver to protect hepatic reserve and function. |

| · | | Radiation dose will be informed by benchtop studies of payload release kinetics from Phase I. |

| · | | Four days after the final treatment evaluate efficacy and toxicity: |

| o | | Tumor size, extent, and histology. |

| o | | Compare toxicity in terms of organ gross pathology and histopathology, blood panel and smears, liver panel and bodyweight. |

| o | | Use LC-Mass Spec to measure levels of sorafenib in tumor and surrounding liver tissue. |

Phase II(c)

| 1. | | Potentially investigate effects of pulsed radiotherapy together with immune active agents including checkpoint inhibitors. Perform studies in concert with Verity. |

| a) | | Prepare rabbit VX2 model of liver cancer. |

| b) | | Evaluate pulsed, focused radiotherapy with immunomodulators and immunostimulants delivered at tumor site with nanoscintillator platform, with/out sorafenib, also delivered only to tumor. |

| c) | | Develop this methodology in concert with Verity/NanKantWest scientists |

Phase II – Budget Estimates

Phase II(a)

| | · | Cell culture reagents/cell lines | $10 K |

| | · | Window chamber fabrication/purchase | $ 8 K |

| | · | Purchase mice/husbandry | $13 K |

| | · | Materials to make particles/labor/validation | $18 K |

| | · | Fluorescent imaging instrument recharge | $ 2 K |

| | · | LC-Mass spec recharge | $ 7 K |

| | · | Irradiation dosimetry/planning/execution | $10 K |

Phase II(b)

| | · | Cell culture reagents/cell line | $ 8 K |

| | · | Purchase rabbits/husbandry | $ 8 K |

| | · | Materials to make particles/labor/validation | $18 K |

| | · | Fluorescent imaging instrument recharge | $ 2 K |

| | · | LC-Mass spec recharge | $ 7 K |

| | · | CT scanning - recharge | $ 5 K |

| | · | Blood and liver panels | $ 8 K |

| | · | Pathology/histopathology | $15 K |

| | · | Irradiation dosimetry/planning/execution | $20 K |

| | · | Serafenib | $30 K |

Phase II(c)

| | · | Cell culture reagents/cell line | $15 K |

| | · | Purchase rabbits/husbandry | $25 K |

| | · | Materials to make particles/labor/validation | $18 K |

| | · | Fluorescent imaging instrument recharge | $ 2 K |

| | · | LC-Mass spec recharge | $ 7 K |

| | · | CT scanning - recharge | $ 5 K |

| | · | Blood and liver panels | $ 8 K |

| | · | Pathology/histopathology | $15 K |

| | · | Irradiation dosimetry/planning/execution | $20 K |

| | · | Reagents (immunomodulators) | $40 K |

| | · | Serafenib | $30 K |

| | · | Personnel for Phase II – Salary and benefits | $400 K |

| | | | |

| | | Estimated Total For Phase II | $ 774 K |

| | | |

After these parameters are identified and satisfactory results achieved, we will then go to clinical trials and make all the appropriate applications. The clinical trials will replicate all the testing that has been done in the preclinical trials. It is estimated that the preclinical trials will take approximately one year to finish and that the clinical studies will take approximately three years to finish. We have identified potential partners to assist us in the preclinical phase of this drug transport technology, although we have not entered into any specific arrangements or binding agreements. We believe most clinical trials will utilize the scientists from UCSD to conduct initial preclinical studies in combination with local private corporations. We have not begun any preclinical studies at this point. With successful funding, management believes up to $1 million will be required to complete the above validations.

Go to Market Strategy

We are actively seeking a strategic partner for initiating our preclinical studies. We have entered into a preclinical nanoparticle producing agreement with Imagion Biosystems, a San Diego company who is a leader in the use of nano crystal scintillators and iron oxide particles for a new and advanced imaging technique. If successful, we believe this would create the first nano crystal scintillator carrying the ability to image a tumor and simultaneously treat the tumor with the therapeutic agent. If completed, this partnership with Imagion Biosystems could produce a large part of preclinical data that we could integrate with other strategic partners we are developing for the preclinical work. We are currently seeking funding for these activities. The exact cost of these activities is undetermined, but we believe proceeds from this offering would cover expenses incurred. Once preclinical testing is accomplished, we would then proceed to the clinical phase trial. This period could take up to two years and cost approximately $3 million. We plan to implement traditional equity or debt funding methods to proceed with clinical trials. It is anticipated that the $3 million necessary for clinical trials would be raised through a financing provided by institutional partners or venture capitalists, although we currently have no commitment for this funding. If we obtain FDA acceptance and approval, we would need to raise additional funds for full marketing implementation, which we estimate could require an additional $5 million or more. We intend to seek a corporate partnership to secure the funding.

Covid-19 Treatment

Our team of research scientists and doctors has developed, licensed, and patented a series of technologies and methods based on the photo-dynamic properties of nanocrystal scintillators for application in the treatment of COVID-19 and other diseases. Natural and synthetic nanocrystal scintillators are reasonably available on the market today. These particles generally exhibit high levels of x-ray absorption in combination with intense radioluminescence at visible wavelengths when activated.

Nanocrystal scintillators can be prepared in solution at low temperatures and activated with low doses of radiation: in some cases, less than 400x that of a standard x-ray dose. Additionally, they can serve as a platform which provides a surface to which proteins and other molecular entities can be affixed. The novel coronavirus that characterizes COVID-19 has distinctive spike proteins which are exposed on the surface of the virus and hence, readily accessible for binding. GCT has modified the surface of a select nanocrystal scintillator so that it has been rendered highly attractive to the spike proteins of the virus, binding viral particles specifically, tightly and irreversibly.

The nanoparticles can be rapidly synthesized and modified to bind the virus; this means, they can be produced in bulk, on-demand, at any regulated biomanufacturing facility. As a next step, the modified nanoparticles can be readily solubilized at low temperature and at low cost, without the need for specialized equipment. The solution mixture containing a liquid with the suspended nanoparticles can easily be administered into the respiratory tubing which is standard for ventilators of all makes and models.

Once the modified nanoparticles enter the lungs, they bind to the virus particles with high-affinity and high-specificity: meaning, they bind only selectively and preferentially, not randomly. Once the nanoparticles irreversibly bind to the virus, low-dose radiation – which is many times lower than typical x-rays and can be achieved without the use of sophisticated equipment – can be applied to the lungs. Doing so activates the nanoparticles which, based on their composition, readily absorb radiation energy. The energy absorbed via radiation is transformed so that a burst of ultra-violet light (which can be observed by the human eye) is blasted into the virus particle, rendering it incapable of reproducing and eventually killing it.

Our technology has been designed to operate much like a powerful magnetic light sabre set to “seek and destroy.” As soon as our modified nanoparticles contact a coronavirus particle, they bind irreversibly and transfer all their electromagnetic energy into a light burst which is selectively pinpointed – like a laser beam – into the virus particle. As a result, the virus particle dies soon thereafter.

At this stage, our nanoparticle scintillator has not been tested in humans. However, in vitro laboratory studies show our approach to targeting, binding, and killing the virus is effective and offers an affordable, compelling, and easily administered treatment that can potentially be used as a standalone alternative to remdesivir or in combination with it. Additional funding is needed to further our research and commence clinical trials.

Go to Market Strategy

While we believe the pre-clinical evidence regarding our Covid-19 treatment is promising, we need to move our treatment modality into the clinic to test it and ensure that is as safe and effective in humans as it is in the lab. At this point we have no treatment that we believe would make it to market in the next 12 months.

Nano Quantum Dots and Optical Recording License

We hold a license agreement from UCSD for utilizing nano quantum dots and optical recording to mark and track materials. Our first launch of this technology will be in marking medical instruments with a polymer containing nano quantum dots that we have licensed to our subsidiary, NanoMed Tracking, Inc., to develop and commercialize the product. Our plan of operation for this technology is as follows:

Quantum Dot/Polymer Marker

The beta for this technology has been completed and validated. This technology is planned to be developed and finalized within one year of successful funding and will consist of a polymer formulation blended with quantum dots that emit a unique fluorescent spectral signature when exposed to a source of light. We plan on completing the quantum dot code validation and optimization in the same year, contingent upon successful funding. We anticipate successful reliability testing, autocalving and sterilization to also occur within that same year.

Optical Reader

The beta for this technology has been completed and validated and will successfully read the Qdot/Polymer Marker through the use of an amplifier-digitizer configured to filter the spectral signature and digitized the signal into a readable format. Size reduction is currently underway, and we anticipate hi-pass through scanning to be achieved within one year of successful funding.

The next steps in order to develop the technology are as follows:

| | · | Qdot Polymer: Optimize formulation for volume production |

| | · | Optical Reader: Design and develop hospital ready unit from proof of concept |

| | · | Polymer Applicator: Design & develop desk top unit from existing HP printer technology |

| | · | Software: Modify platform from existing software provider for initial product launch |

| | · | Develop proprietary software platform |

Go to Market Strategy

Our strategy to bringing the technology to market is as follows:

| | · | Complete all testing with our beta site partner, UCSD School of Medicine. Much of this testing is completed as we have cycled instruments with polymer marking to be durable over 1,000 cycles of sterilization. |

| | · | Extend and implement instrument marking in all eight UCSD centers. Conversations have been initiated with these additional centers and they are awaiting more product development information. These eight centers are under UCSD control and management believes it can implement our technology into these centers. |

| | · | From UCSD Centers, expand to all hospitals in the California University system. Once we can show efficacy with our product within the UCSD hospital system, we believe we will be able to approach all University of California hospitals to demonstrate our technology. We intend to organize a “Road show” dedicated to all hospitals in the California University system. |

| | · | Complete national and international distribution system for sales pipeline. We have begun preliminary conversations with distributors, both nationally and internationally, and these distributors have expressed interest in purchasing and representing the product once at market. |

| | · | Create strategic partnership with leading sterilization and instrument manufactures. We have contacted instrument manufacturers and sterilization companies and demonstrated our technology. We believe initial response have been positive. |

| | · | Identify and explore all other medical marking opportunities. We believe there are other opportunities for our technology in addition to instrument marking. We believe we have the capability to mark the smallest of needles and gauges. We also believe we can find opportunities in internally marking implantable catheters and other devices used in the human body. |

We intend to develop fully both the Quantum Dot/Polymer Marker and the Optical Reader within one year of successful funding. At that point, we believe the product would be ready to market. To achieve the above steps in our go to market strategy we will require additional funding. Our projections estimate approximately $3 million in additional funding for successful implementation and scaling of our operations. We plan to seek an additional $3 million through financing provided by institutional partners or venture capitalists, although we currently have no arrangements or agreements for the additional funding.

Other Developments

We are in the process of obtaining a license for certain glioblastoma biomarker technology. We anticipate finalizing the license in the near future with the intent of imitating preliminary trials by the end of 2021. If the trials go as expected, we may be able to bring products to market by late 2022.

Technologies no longer in development with Global Cancer Technology

Small Molecule and Nanoparticle-Based Radiation Chemotherapy Sensitizers for Solid Tumor Therapy

The company had previously held a license from UCSD for a tumor sensitizer called UCN-01. This is a compound that is a 7-hydroxy staurosporine. The company, after initial testing sequences, determined that the compound may not be commercially viable. In order to concentrate the limited resources of the company with other promising technologies, the company abandoned it license without any recourse.

RGS Orbiter

The company has exited the RGS Orbiter field in its entirety. The company wishes to focus completely on biopharma technologies and not expensive capital radiosurgery equipment.

ITEM 2. OTHER INFORMATION

In the fourth quarter of 2022, the company entered into an agreement with Neuropore Therapies, a San Diego based biopharma company, to license 2 compounds to treat a deadly brain disease called glioblastoma.

As of December 1, 2021, our relationship with Manhattan Street Capital has been terminated.

ITEM 3. FINANCIAL STATEMENTS

UNAUDITED AND UNREVIEWED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE 6-MONTH PERIODS ENDED JUNE 30, 2021 AND 2020

Global Cancer Technology, Inc.

Consolidated Balance Sheets (Unaudited and Unreviewed)

| | | As of

June 30, 2021 | | | As of

June 30, 2020 | |

| Assets | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | $ | 23,083 | | | $ | 70,706 | |

| Total current assets | | | 23,083 | | | | 70,706 | |

| | | | | | | | | |

| Property and Equipment, net | | | 2,507 | | | | 175 | |

| Intangible Assets | | | – | | | | 250,000 | |

| Total assets | | $ | 25,590 | | | $ | 320,881 | |

| | | | | | | | | |

| | | | | | | | | |

| Liabilities and Stockholders' Deficit | | | | | | | | |

| Liabilities | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 277,342 | | | $ | 153,923 | |

| Accrued Liabilities | | | 83,869 | | | | 79,670 | |

| Deferred Compensation | | | 181,904 | | | | 149,442 | |

| Convertible notes payable | | | – | | | | – | |

| Total current liabilities | | | 543,114 | | | | 383,035 | |

| Accrued Liabilities due after one year | | | – | | | | – | |

| Total liabilities | | | 543,114 | | | | 383,035 | |

| | | | | | | | | |

| Stockholders' Deficit | | | | | | | | |

| Common Stock, $.001 par value; 100,000,000 shares authorized; 13,202,138 shares and 12,882,838 shares and issued and outstanding as of June 30, 20210 and 2020, respectively. | | | 13,202 | | | | 12,883 | |

| Additional Paid in Capital | | | 2,402,921 | | | | 2,061,091 | |

| Shares to be Issued | | | – | | | | – | |

| Stock subscription receivable | | | – | | | | – | |

| Treasury Stock | | | (5,198 | ) | | | – | |

| Accumulated Deficit | | | (2,928,449 | ) | | | (2,083,074 | ) |

| Total GCT Stockholders' deficit | | | (517,524 | ) | | | (9,100 | ) |

| Noncontrolling interest | | | – | | | | (53,054 | ) |

| Total consolidated deficit | | | (517,524 | ) | | | (62,154 | ) |

| Total liabilities and stockholders' deficit | | $ | 25,590 | | | $ | 320,881 | |

The accompanying notes are an integral part of these unaudited and unreviewed consolidated financial statements.

Global Cancer Technology, Inc.

Consolidated Statement of Operations (Unaudited and Unreviewed)

For the Six Months Ended June 30, 2021 and 2020

| | | 2021 | | | 2020 | |

| Operating Revenue, net | | $ | – | | | $ | – | |

| Costs of sales | | | – | | | | – | |

| Gross profit | | | – | | | | – | |

| Operating expenses: | | | | | | | | |

| Consulting expenses | | | 28,234 | | | | 46,500 | |

| Research and Development | | | 101,325 | | | | 6,450 | |

| General and administrative expenses | | | 117,119 | | | | 87,471 | |

| Loss before income taxes | | | (246,678 | ) | | | (140,421 | ) |

| Provision for income taxes (benefit) | | | – | | | | – | |

| Consolidated Net loss | | | (246,678 | ) | | | (140,421 | ) |

| | | | | | | | | |

| Net loss per share, basic and fully diluted | | $ | (0.02 | ) | | $ | (0.01 | ) |

| | | | | | | | | |

| Weighted average common equivalent shares outstanding, basic and fully diluted | | | 13,057,500 | | | | 12,823,519 | |

The accompanying notes are an integral part of these unaudited and unreviewed consolidated financial statements.

Global Cancer Technology, Inc.

Consolidated Statement of Stockholders' Deficit (Unaudited and Unreviewed)

For the Six Months ended June 30, 2021

| | | Common Stock | | | | | | | | | |

| | | Number of Shares | | | Amount | | | Additional Paid-in Capital | | | Shares to be Issued | | | Subscription Receivable | | | Treasury Stock | | | Accumulated

Deficit | | | Non-controlling Interest | | | Total

Deficit | |

| Balance December 31, 2020 | | | 13,053,838 | | | $ | 13,054 | | | $ | 2,238,720 | | | $ | 14,000 | | | $ | (29,100 | ) | | $ | (3,220 | ) | | $ | (2,681,771 | ) | | $ | – | | | $ | (448,317 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued for cash | | | 148,300 | | | | 148 | | | | 164,201 | | | | – | | | | 29,100 | | | | – | | | | – | | | | – | | | | 193,449 | |

| Shares issued for services | | | – | | | | – | | | | – | | | | – | �� | | | – | | | | – | | | | – | | | | – | | | | – | |

| Shares to be issued | | | – | | | | – | | | | – | | | | (14,000 | ) | | | – | | | | (1,978 | ) | | | – | | | | – | | | | (15,978 | ) |

| Loss from operations | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | (246,678 | ) | | | – | | | | (246,678 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance June 30, 2021 | | | 13,202,138 | | | $ | 13,202 | | | $ | 2,402,921 | | | $ | – | | | $ | – | | | $ | (5,198 | ) | | $ | (2,928,449 | ) | | $ | – | | | $ | (517,524 | ) |

The accompanying notes are an integral part of these unaudited and unreviewed consolidated financial statements.

Global Cancer Technology, Inc.

Consolidated Statement of Cash Flows (Unaudited and Unreviewed)

For the Six Months Ended June 30, 2021 and 2020

| | | 2021 | | | 2020 | |

| Cash flows provided by (used in) operating activities: | | | | | | | | |

| Net loss from operations | | $ | (246,678 | ) | | $ | (140,421 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities | | | | | | | | |

| Depreciation | | | 320 | | | | 174 | |

| Amortization of debt discount | | | – | | | | – | |

| Issuance of common stock for services | | | – | | | | 30,000 | |

| Increase (decrease) in noncontrolling interest | | | – | | | | – | |

| Changes in assets and liabilities | | | | | | | | |

| Increase (decrease) in: | | | | | | | | |

| Accounts payable and accrued liabilities | | | 14,914 | | | | 20,431 | |

| Deferred compensation | | | 27,919 | | | | (27,117 | ) |

| Accrued Liabilities due after one year | | | – | | | | (69,669 | ) |

| Net cash used in operating activities | | | (203,525 | ) | | | (186,602 | ) |

| | | | | | | | | |

| Cash flows provided by (used in) investing activities | | | | | | | – | |

| | | | | | | | | |

| Cash flows provided by (used in) financing activities | | | | | | | | |

| Proceeds from issuance of common stock | | | 177,471 | | | | 256,237 | |

| Net cash provided by financing activities | | | 177,471 | | | | 256,237 | |

| Net increase (decrease) in cash and cash equivalents | | | (26,054 | ) | | | 69,635 | |

| | | | | | | | | |

| Cash and cash equivalents at beginning of period | | | 49,137 | | | | 1,071 | |

| Cash and cash equivalents at end of period | | $ | 23,083 | | | $ | 70,706 | |

The accompanying notes are an integral part of these unaudited and unreviewed consolidated financial statements.

Global Cancer Technology, Inc.

Notes to Consolidated Unaudited and Unreviewed Financial Statements

For the Six Months Ended June 30, 2021

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

Global Cancer Technology, Inc. (“GCT” or the “Company”) was incorporated under the laws of the State of Nevada on May 18, 2017. It was originally formed as a limited liability company in the State of Texas on January 2, 2013 and converted to its present corporate status on May 18, 2017.

On July 12, 2017 the Company filed Articles of Incorporation in the State of Nevada for a subsidiary called NanoMed Tracking Inc. (“NanoMed”). GCT is a 51% owner of NanoMed and the minority owners are scientists integral to the development of the licensed products.

On June 11, 2018 the Company filed Articles of Incorporation in the State of Montana for a subsidiary called MCW Pharmaceuticals Inc. (“MCW”). The Company intends to transfer into this subsidiary a license obtained from UCSD. GCT is a 51% owner of MCW and the minority owners are scientists integral to the development of the licensed products.

On April 24, 2019 the Company filed Articles of Incorporation in the State of Montana for a subsidiary called HIFU Plus. The Company has transferred into this subsidiary a license obtained from the University of Washington. GCT is an 86.7% owner of HIFU Plus and the minority owners are the University of Washington and scientists integral to the development of the licensed products.

Business Overview

GCT has no products or services which it provides, except in connection with a license agreement with American Radiosurgery described below. GCT has acquired licenses from universities which permit it to market certain technologies.

GCT was formed to acquire a portfolio of various medical licenses for unique and promising patents and intellectual properties. The company has acquired licenses from the University of California San Diego - John Moores Cancer Center and from the University of Washington. In addition, GCT holds an exclusive technology license from American Radiosurgery, Inc., an affiliated entity, to promote and sell high technology radiosurgery and cancer treatment products.

GCT is a startup stage company and has not yet achieved meaningful operating status.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies of GCT is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States and have been consistently applied in the preparation of the financial statements.

Basis of Presentation

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“US GAAP”) and include the accounts of the Company and its subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation.

Cash and Cash Equivalents

Cash and cash equivalents consist of deposits in one large national bank. At June 30, 2021 and 2020 respectively, the Company had $23,083 and $70,706 in cash. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

Use of Estimates

The preparation of financial statements in accordance with generally accepted accounting principles requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates and assumptions and could have a material effect on the reported amounts of the Company’s financial position and results of operations.

Property and Equipment

Property and equipment are stated at cost and depreciated using the straight-line method over the estimated useful life of the asset. Equipment consists of computer and lab equipment.

Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value.

The Company has abandoned its efforts in developing our Boiling Histotripsy technology and as a result may dissolve HIFU Plus, Inc. The Company recorded an impairment loss for the total value of Hi-Fu’s assets $250,000 in 2020.

Fair Value of Financial Instruments

The Company’s financial instruments as defined by ASC 825-10-50, include cash, receivables, accounts payable and accrued expenses. All instruments are accounted for on a historical cost basis, which, due to the short-term maturity of these financial instruments, approximates fair value at June 30, 2021 and 2020.

Earnings (Losses) Per Share

Basic net loss per share was computed by dividing the net loss by the weighted average number of shares outstanding during the year. Diluted net loss per share is computed using the weighted average number of common shares and potentially dilutive securities outstanding during the period. Weighted average of number of diluted securities was the same as weighted average of basic securities because the effect of dilutive securities was non-dilutive.

Share-Based Payments

The Company accounts for stock-based compensation awards to its directors, officers, and employees in accordance with Accounting Standards Codification (“ASC”) Topic 718, Compensation – Stock Compensation (“ASC 718”).

The Company accounts for stock-based compensation awards to non-employees, in accordance with ASC 718, as amended. In June 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2018-07, Compensation – Stock Compensation (Topic 718) – Improvements to Nonemployee Share-based Payment Accounting which extended the provisions of ASC 718 to share-based awards issued to non-employees by public companies. The Company has adopted the provisions of ASU 2018-07.

In the fiscal year ended December 31, 2020 consulting expense includes $82,000 in connection with shares awarded in exchange for services., including $30,000 awarded to its directors in fiscal 2020. There were no such charges in 2021

Provision for Taxes

Income taxes are provided based upon the liability method of accounting pursuant to ASC 740-10-25 Income Taxes — Recognition. Under the approach, deferred income taxes are recorded to reflect the tax consequences in future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year-end. A valuation allowance is recorded against deferred tax assets if management does not believe the Company has met the “more likely than not” standard imposed by ASC 740-10-25-5 to allow recognition of such an asset.

New Accounting Pronouncements

The Company has evaluated the authoritative guidance issued during the six-month period ended June 30, 2021 and does not expect the adoption of these standards to have a material effect on its financial position or results of operations.

NOTE 3 - GOING CONCERN

The accompanying financial statements have been prepared on a going concern basis, which assumes the Company will be able to realize its assets and settle its liabilities in the ordinary course of business in the foreseeable future. As shown in the accompanying financial statements, the Company has incurred operating losses since inception. As of June 30, 2021, the Company has limited financial resources with which to achieve its objectives and obtain profitability and positive cash flows. As shown in the accompanying balance sheets and statements of operations, as

of June 30, 2021 the Company has an accumulated deficit of $2,928,449 and the Company’s working capital is a deficit of $520,031. Achievement of the Company’s objectives will be dependent upon the ability to obtain additional financing, and generate revenue from current and planned business operations, and control costs. The Company is in the development stage and has generated no operating income.

The Company plans to fund its future operations by obtaining additional financing from investors and/or lenders. However, there is no assurance that the Company will be able to achieve these objectives, therefore, substantial doubt about its ability to continue as a going concern exists. The financial statements do not include adjustments relating to the recoverability of recorded assets nor the implication of associated bankruptcy costs should the Company be unable to continue as a going concern.

NOTE 4 – COMMON STOCK

As of June 30, 2021, GCT had 100,000,000 authorized shares of common stock, par value $.001 per share, of which 13,202,138 were issued and outstanding. Although the Company has had difficulty in obtaining working lines of credit from financial institutions and trade credit from vendors, management has been able to raise capital from private placements and further expand the Company’s operations to continue its growth. In addition, the Company has issued shares as compensation for services provided.

Between January 1, 2021 and June 30, 2021, the Company has issued an additional 148,300 shares of common for $177,471 in cash.

In addition, the Company provided a reserve of $5,198 ($1,798 in the si-months ended June 30, 2021) for the prospective repurchase of treasury shares from existing shareholders in pursuant to the terms of its Reg A filing in late 2020.

The Company had received $14,000 for 7,000 shares to be issued as of December 31, 2020 and also had stock subscriptions receivable for $29,100 for 29,100 shares that had been issued prior to December 31. Those matters have since been settled.

NOTE 5– RELATED PARTY TRANSACTIONS

On October 1, 2017, GCT entered into an exclusive distributorship agreement with American Radiosurgery, Inc., an entity controlled by the Founder. No payments have been made to American Radiosurgery since commencement of the agreement.

The Company has an executive agreement with its sole officer for an annual compensation of $100,000 per annum. At June 30, 2021 and 2020, the balance of unpaid compensation was $181,904 and $149,442, respectively.

NOTE 6 – COMMITMENTS AND CONTINGENCIES

GCT was formed to acquire a portfolio of various medical licenses for unique and promising patents and intellectual properties. The company has acquired licenses from the University of California San Diego-John Moores Cancer Center (USCD) and from the University of Washington (UW) for several patents governing the use of advanced High Intensity Focused Ultrasound to treat cancer. In addition, it holds an exclusive technology license from American Radiosurgery, Inc (ARI)., an affiliated entity, to promote and sell high technology radiosurgery and cancer treatment products. The licenses have financial terms that require certain minimum payments and include:

Licenses with UCSD

GCT is required to make certain payments to UCSD to maintain the two licenses it has with them. The financial obligations are as follows:

| | | License #1 | | License # 2 |

| | | | | |

| In 2017 a license issue fee of | | $12,500 | | $10,000 |

| Annual Maintenance Fees | | | | |

| Year 1 | | $5,000 | | $5,000 |

| Year 2 | | $7,500 | | $7,500 |

| Year 3 and beyond | | $10,000 | | $10,000 |

| | | | | |

| Royalties on net sales of licensed products | | 2.50% | | 2.50% |

| Reimbursement of Patent costs | | $20,000 | | $21,500 |

GCT has agreed to diligently develop, manufacture, and sell the licensed products, and has further agreed to accomplish certain tasks or milestones related to the technology. If GCT fails to perform these tasks, USCD may either terminate the agreement or change the license to a non-exclusive one. GCT has further agreed to obtain all necessary government approvals for the manufacture, use, and sale of the licensed products and to fill market demand for them.

UCSD may terminate the license agreement generally if GCT is delinquent in any reports or payments, if it does not diligently develop and commercialize the licensed product, if it breaches any provision of the agreement, subject to the right to cure any default within 60 days after receiving notice of default. GCT may terminate the agreement for any reason upon 90 days’ written notice. The term of the license agreement expires on the date of the longest-lived patent right granted under the license.

On June 26, 2020 in exchange for a $5,000 fee, the Company signed a license agreement amendment with UCSD to commercialize a new way to treat COVID-19 using UV light to destroy the virus.

The company is delinquent under the terms of its milestone payments under the license agreements and is negotiating the timing of future payments.

In early 2021 we received a notice from the University of California regrading delinquent payments related to our nanotechnology license. On April 22, 2021, we signed an addendum to the original license agreement with the University of California to postpone milestone payments until funds can be raised through our current Reg A offering.

On April 27, 2021, we entered into an addendum with UCSD to cure certain defaults under the original license agreement. As part of the addendum, we agreed that UCSD would be allowed to issue additional licenses related to this technology. As such, our license is no longer exclusive. Moreover, we agreed to continue our Regulation A offering and to use some of the proceeds from the offering to develop the nano-crystal scintillator technology.

License with American Radiosurgery Distributorship Agreement

On October 1, 2017, GCT entered into an exclusive worldwide Technology License Agreement with American Radiosurgery, Inc. (ARI) to market and service products developed by American Radiosurgery, a related party via common ownership of our principal shareholder. Under the terms of the agreement, GCT will receive a commission on sales of the devices and is obligated to sell at least one device per year. Since commencement of the agreement, GCT has not sold any ARI devices.

| · | | GCT is also required to provide all warranty work for existing devices sold by American Radiosurgery and devices sold by GCT. There are 6 devices currently installed which are covered by warranty. |

| · | | GCT is also permitted to provide removal services for existing devices throughout the world. |

| · | | The agreement may be terminated by American Radiosurgery upon 30 days’ prior notice by American Radiosurgery if GCT fails to meet its selling quotas, or by either party for breach of the agreement or without cause. |

License with the University of Washington

Effective March 8, 2018, GCT entered into an exclusive world-wide Start-up License Agreement with the University of Washington under certain patents licensed by the university and a non-exclusive world-wide license for certain of know-how for the development and commercialization of a new form of High Intensity Focused Ultrasound called ‘Boiling Histotripsy’.

In January of 2021, our license for our Boiling Histotripsy technology terminated. We have consequently abandoned any efforts to develop Boiling Histotripsy and as a result may dissolve HIFU Plus, Inc. The Company recorded an impairment loss for the total value of Hi-Fu’s assets $250,000 in 2020.

Dalmore Group

Global Cancer Technology, Inc. has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with its A-1 offering, but not for underwriting or placement agent services. As part of its relationship with Dalmore, the Company has agreed to pay a 2% commission on all sales that does not include the $5,000 one-time setup fee for out of pocket expenses or the $20,000 consulting fee after the issuance of the FINRA No Objection Letter and SEC Qualification, that is payable by the Company to Dalmore.

Manhattan Street Capital

Effective February 25, 2021 we entered into a material agreement with Manhattan Street Capital (MSC). The purpose of the agreement is to engage the services of MSC to list our Regulation A offering on MSC’s platform. As part of the agreement we have agreed to issue 40,000 shares of the Company’s Common Stock per month as a project management retainer fee and listing fee. In lieu of the shares, the Company may instead opt to pay a monthly project management fee in the amount of $10,000 for a 9-month period from February 25, 2021 and a $5,000 per month listing fee, plus the same value of ten-year cashless exercise warrants priced at the lowest price the Shares will be sold in the Offering. We will also pay a $25.00 per investment technology admin and service fee, plus the same value of ten-year cashless exercise warrants priced at the lowest price the Shares will be sold in the Offering.

All fees are due to MSC regardless of whether investors are rejected after AML checks or the success of the Offering. In addition, there may also be hourly and/or other fees for compliance, processing, custodial, support, and/or administrative services.

As of December 1, 2021, our relationship with MSC has been terminated.

NOTE 8 – EMPLOYMENT AGREEMENTS

Employment Agreement

On May 1, 2018 the Company entered into an employment agreement with its sole officer. Under the terms of agreement, the officer is entitled to compensation of $100,000 per annum. In addition, GCT issued the officer 100,000 shares of common stock as a signing bonus. He is also eligible to receive an annual bonus of a minimum of 50% and a maximum of 400% upon achievement of performance objectives, none of which have yet been determined. He is also entitled to participate in employee benefits available to other senior executives and 12 weeks paid vacation per year.

2018 Stock Incentive Plan

On May 1, 2018, our board of directors adopted the 2018 Stock Incentive Plan (the “Plan”) which was subsequently approved by a majority of the outstanding votes of our shareholders. The purposes of the Plan are (a) to enhance GCT’s ability to attract and retain the services of qualified employees, officers, directors, consultants, and other service providers upon whose judgment, initiative and efforts the successful conduct and development of the business largely depends, and (b) to provide additional incentives to such persons or entities to devote their utmost effort and skill to the advancement and betterment of the company, by providing them an opportunity to participate in the ownership of the Company and thereby have an interest in the success and increased value of the Company.

There are 500,000 shares of common stock authorized for non-qualified and incentive stock options, restricted stock units, restricted stock grants, and stock appreciation rights under the Plan, which are subject to adjustment in the event of stock splits, stock dividends, and other situations.

NOTE 9 – SUBSEQUENT EVENTS

Additional Issuance of Common Stock

Subsequent to June 30, 2021, the Company has issued 77,000 shares of common stock for $80,000 in cash.

Item 4. Exhibits

| | | Incorporated by Reference | |

| Exhibit Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Filed

Herewith |

| 2.1 | Plan of Conversion dated January ___, 2017 | DOS | 367-00167 | 2.1 | 9/7/18 | |

| 2.2 | Articles of Incorporation | DOS | 367-00167 | 2.2 | 9/7/18 | |

| 2.3 | Nevada Articles of Conversion | DOS | 367-00167 | 2.3 | 9/7/18 | |

| 2.4 | Texas Certificate of Conversion | DOS | 367-00167 | 2.4 | 9/7/18 | |

| 2.5 | Current Bylaws | 1-A | 024-10909 | 2.5 | 10/15/18 | |

| 3.1 | 2018 Stock Incentive Plan | 1-A | 024-10909 | 3.1 | 10/15/18 | |

| 4.1 | Subscription Agreement | 1-A | 024-10909 | 4.1 | 10/15/18 | |

| 6.1 | CEO Employment Agreement dated May 1, 2018 | DOS | 367-00167 | 6.1 | 9/7/18 | |

| 6.2 | NanoMed Tracking Shareholder Agreement dated June 26, 2017 | 1-A | 024-10909 | 6.2 | 10/15/18 | |

| 6.3 | MCW Pharmaceuticals Shareholder Agreement dated May 17, 2018 | 1-A | 024-10909 | 6.3 | 10/15/18 | |

| 6.4 | Sponsored Research Agreement with the University of Washington as of August 21, 2018 | DOS | 367-00167 | 6.4 | 9/7/18 | |

| 6.5 | License Agreement dated October 13, 2016 with UCSD | 1-A | 024-10909 | 6.5 | 10/15/18 | |

| 6.6 | License Agreement dated November 18, 2016 with UCSD | 1-A | 024-10909 | 6.6 | 10/15/18 | |

| 6.7 | License Agreement dated March 18, 2018 with University of Washington | 1-A | 024-10909 | 6.7 | 10/15/18 | |

| 6.8 | License Agreement dated October 1, 2017 with American Radiosurgery | 1-A | 024-10909 | 6.8 | 10/15/18 | |

| 6.9 | Amendment No. 1 to License Agreement dated June 26, 2020 with UCSD | 1-K | 24R-00315 | 6.9 | 09/02/2020 | |

| 6.10 | Broker-Dealer Agreement Between the Company and Dalmore Group, LLC | 1-K | 24R-00315 | 6.10 | 09/02/2020 | |

| 6.11 | Agreement with Neuropore Therapies | | | | | X |

| 15.1 | Code of Ethics | DOS | 367-00167 | 15.1 | 9/7/18 | |

| 15.2 | Part I - Item 6 explanation | DOS | 367-00167 | 15.2 | 9/7/18 | |

Signatures

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Global Cancer Technologies, Inc.

By: /s/ John Clark

CEO, Principal Financial Officer, Principal Accounting Officer

Global Cancer Technologies, Inc.

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

By: /s/ John Clark

Director, CEO, Principal Financial Officer, Principal Accounting Officer

Date: December 23, 2021

By: /s/ Peter Hanson

Director, Global Cancer Technologies, Inc.

Date: December 23, 2021

By: /s/ Tom Silberg

Director, Global Cancer Technologies, Inc.

Date: December 23, 2021