Q2 2022 FINANCIAL RESULTS August 4, 2022 Exhibit 99.2

DISCLAIMER Forward Looking Statements This presentation contains forward looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the Company's results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking statements, including, but not limited to: information or predictions concerning the Company's future financial performance, business plans and objectives, potential growth opportunities, potential pricing of products, potential market leadership, financing plans, competitive position, technological, industry or market trends and potential market opportunities. These statements are based on estimates and information available to the Company at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from the Company's current expectations as a result of many factors, including, but not limited to: the impact the COVID-19 pandemic will have on demand for the Company’s products as well as its impact on its operations and the operations of its manufacturers, retailers and other partners, and its impact on the economy overall, including capital markets; the Company’s ability to build and maintain the strength of its brand among gaming and streaming enthusiasts and its ability to continuously develop and successfully market new gear and improvements to existing gear; the introduction and success of new third-party high-performance computer hardware, particularly graphics processing units and central processing units, as well as sophisticated new video games; fluctuations in operating results; the risk that the Company is not able to compete with competitors and/or that the gaming industry, including streaming and eSports, does not grow as expected or declines; the loss or inability to attract and retain key management; delays or disruptions at manufacturing and distribution facilities of the Company or third parties; currency exchange rate fluctuations or international trade disputes resulting in the Company’s gear becoming relatively more expensive to its overseas customers or resulting in an increase in the Company’s manufacturing costs; the impact of the coronavirus on the Company’s business; and general economic conditions that adversely effect, among other things, the financial markets and consumer confidence and spending. The Company assumes no obligation, and does not intend, to update these forward-looking statements, except as required by law. Investors are urged to review in detail the risks and uncertainties outlined in Corsair’s Securities and Exchange Commission filings, including but not limited to Corsair’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 (once available) as well as the Risk Factors contained therein. You may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures, including Adjusted Operating Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Share, which are not recognized under the generally accepted accounting principles (“GAAP”) in the United States and designed to complement the financial information presented in accordance with GAAP in the United States because management believes such measures are useful to investors. The non-GAAP measures have limitations as analytical tools and you should not consider them in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. The non-GAAP measures used by the Company may differ from the non-GAAP measures used by other companies. The Company urges you to review the reconciliation of its non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in the Appendix to this presentation, and not to rely on any single financial measure to evaluate the Company's business. Market & Industry Data This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to the Company’s industry, the Company’s business and the market for the Company’s products and its future growth. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the Company’s future performance and the future performance of the market for its products are necessarily subject to a high degree of uncertainty and risk.

Q2 2022 MARKET UPDATE

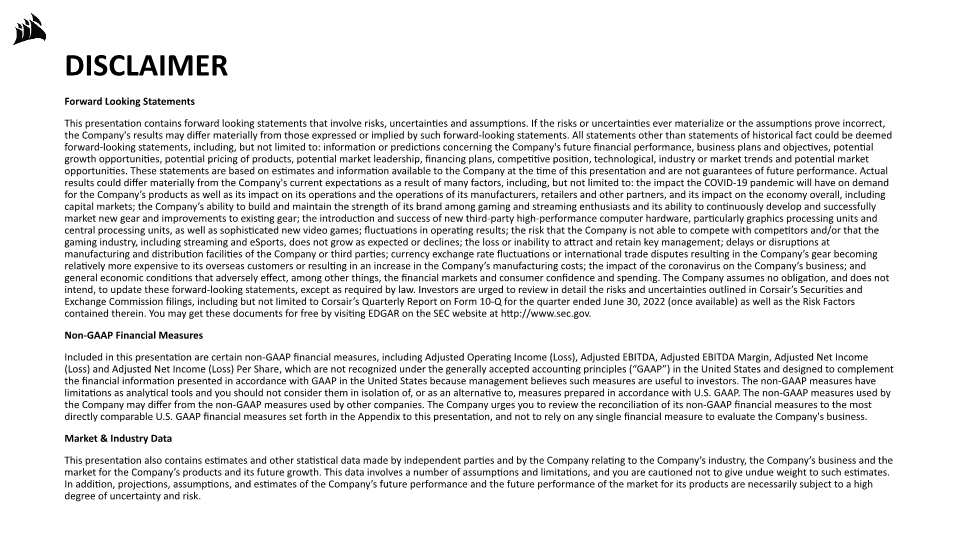

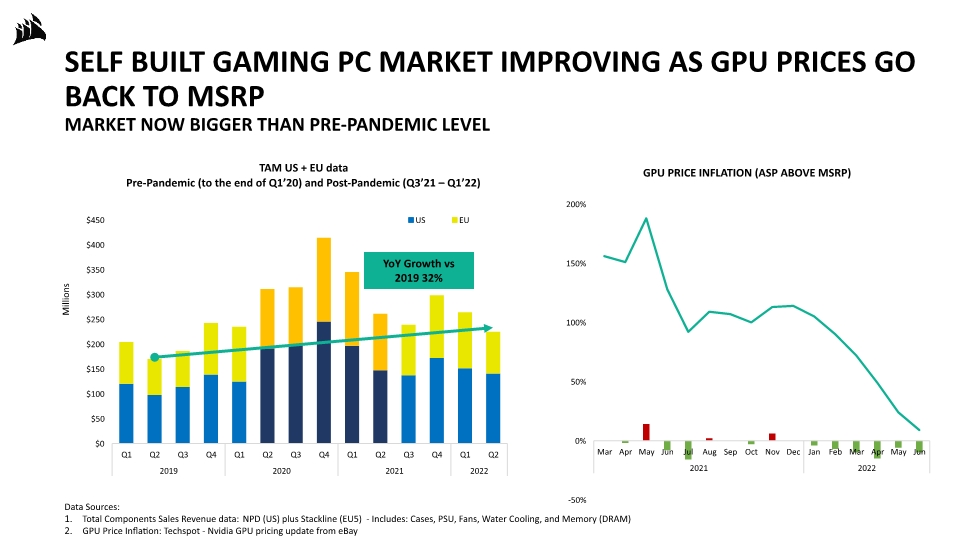

SELF BUILT GAMING PC MARKET IMPROVING AS GPU PRICES GO BACK TO MSRP MARKET NOW BIGGER THAN PRE-PANDEMIC LEVEL Data Sources: Total Components Sales Revenue data: NPD (US) plus Stackline (EU5) - Includes: Cases, PSU, Fans, Water Cooling, and Memory (DRAM) GPU Price Inflation: Techspot - Nvidia GPU pricing update from eBay YoY Growth vs 2019 32%

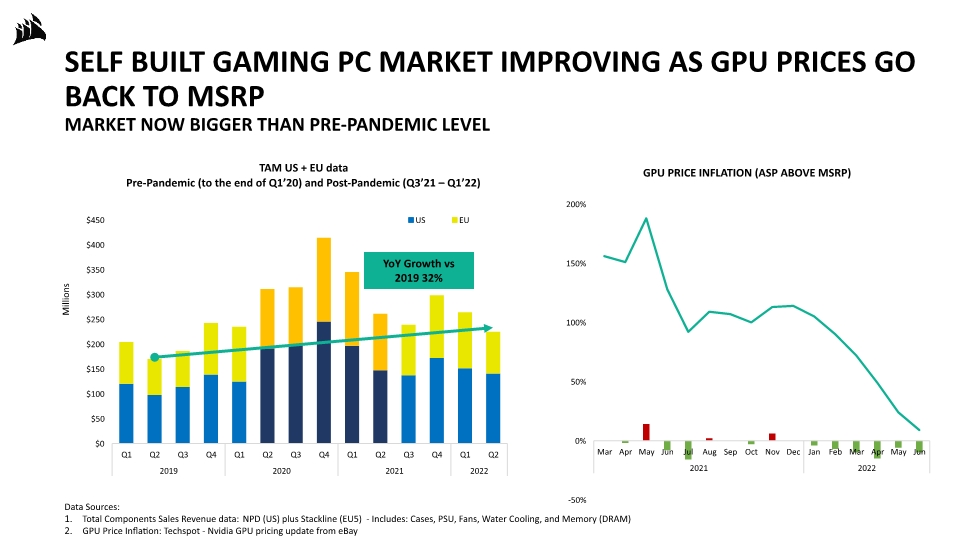

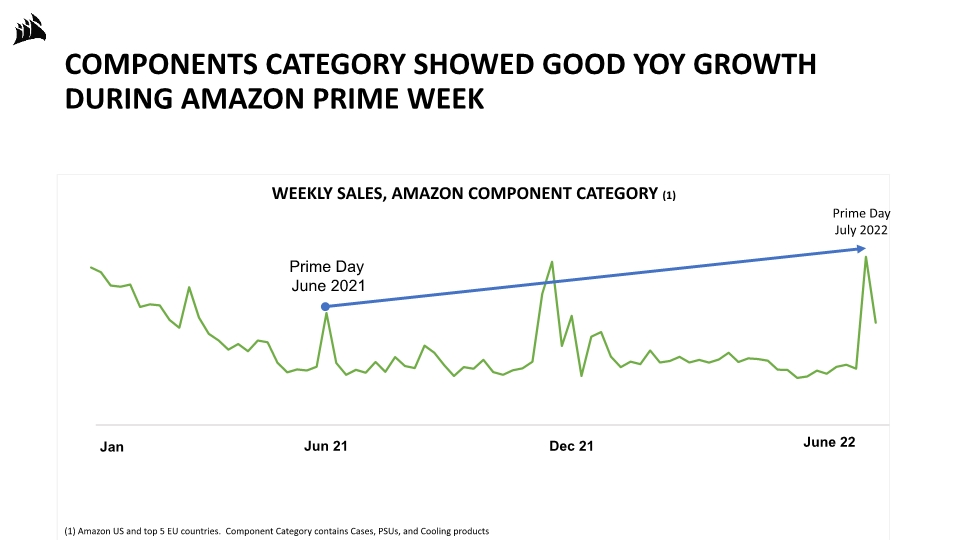

COMPONENTS CATEGORY SHOWED GOOD YOY GROWTH DURING AMAZON PRIME WEEK (1) Amazon US and top 5 EU countries. Component Category contains Cases, PSUs, and Cooling products Prime Day July 2022

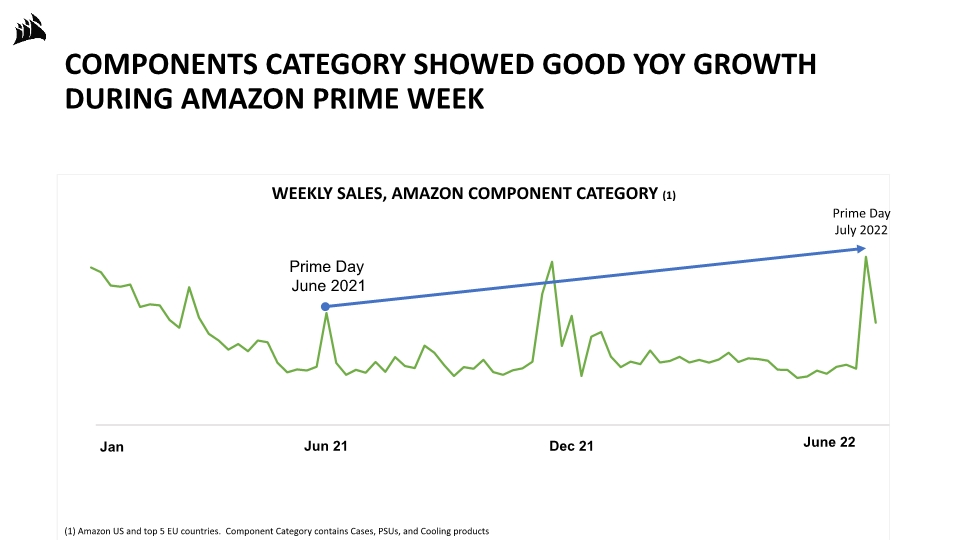

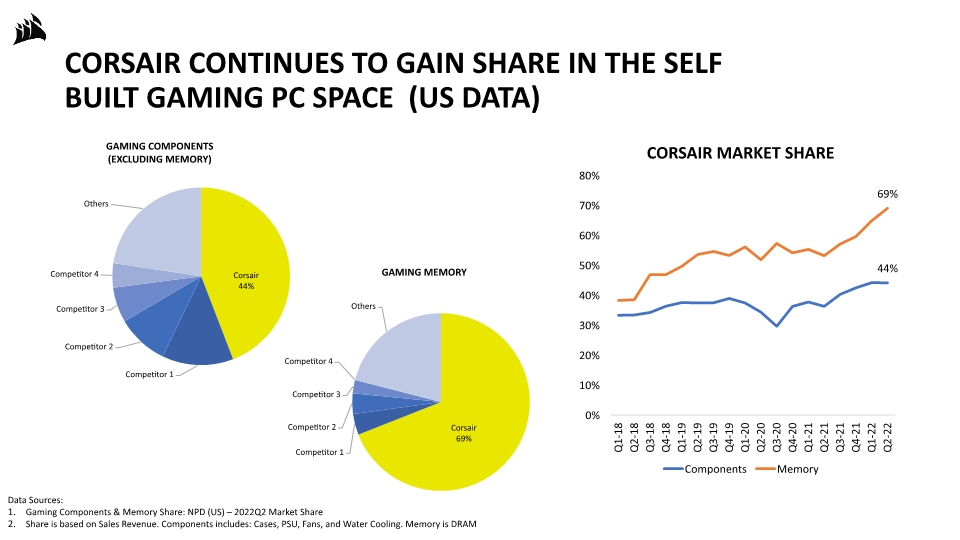

CORSAIR CONTINUES TO GAIN SHARE IN THE SELF BUILT GAMING PC SPACE (US DATA) Data Sources: Gaming Components & Memory Share: NPD (US) – 2022Q2 Market Share Share is based on Sales Revenue. Components includes: Cases, PSU, Fans, and Water Cooling. Memory is DRAM

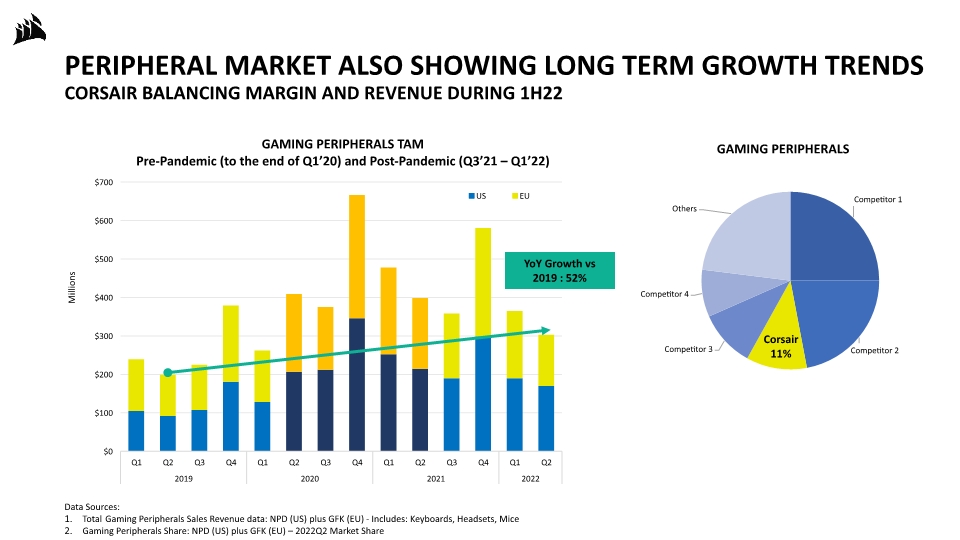

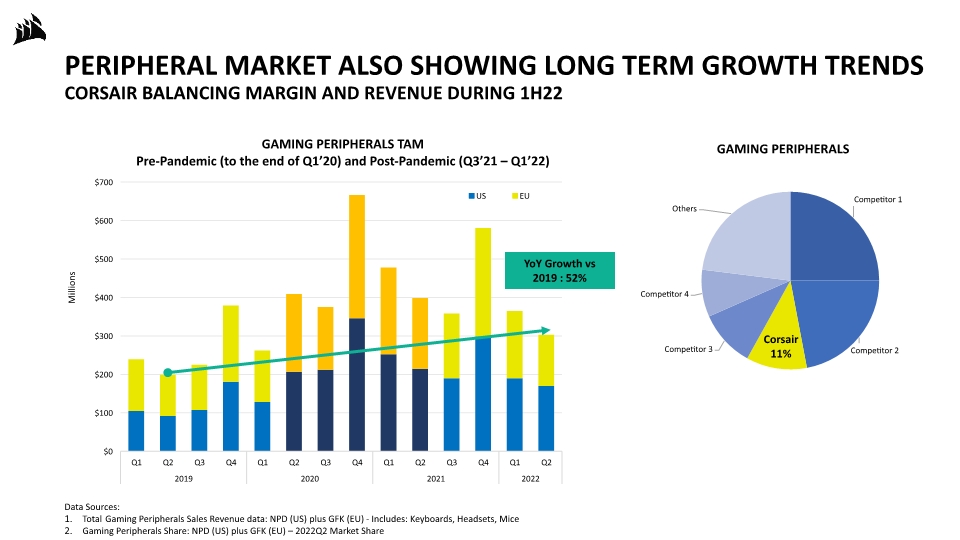

PERIPHERAL MARKET ALSO SHOWING LONG TERM GROWTH TRENDS CORSAIR BALANCING MARGIN AND REVENUE DURING 1H22 Data Sources: Total Gaming Peripherals Sales Revenue data: NPD (US) plus GFK (EU) - Includes: Keyboards, Headsets, Mice Gaming Peripherals Share: NPD (US) plus GFK (EU) – 2022Q2 Market Share YoY Growth vs 2019 : 52%

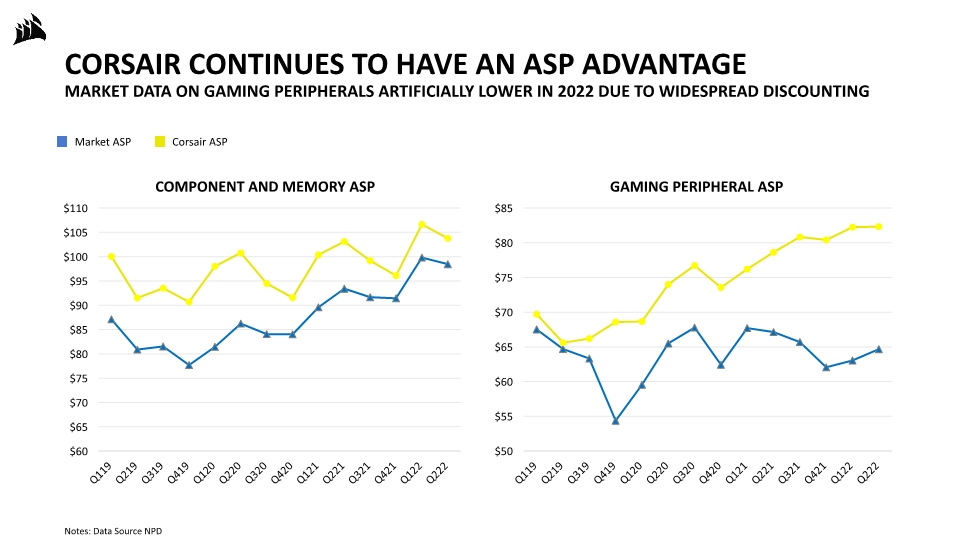

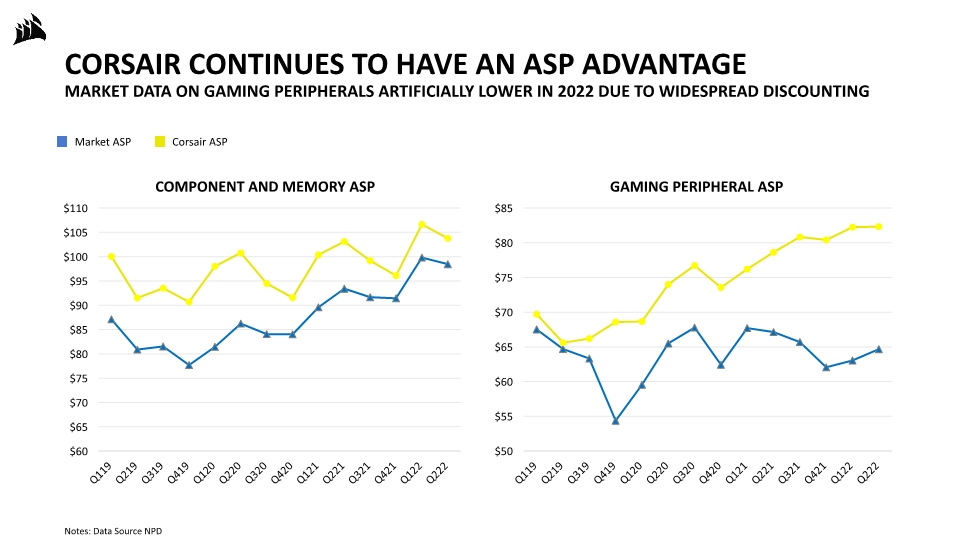

CORSAIR CONTINUES TO HAVE AN ASP ADVANTAGE MARKET DATA ON GAMING PERIPHERALS ARTIFICIALLY LOWER IN 2022 DUE TO WIDESPREAD DISCOUNTING Notes: Data Source NPD Market ASP Corsair ASP

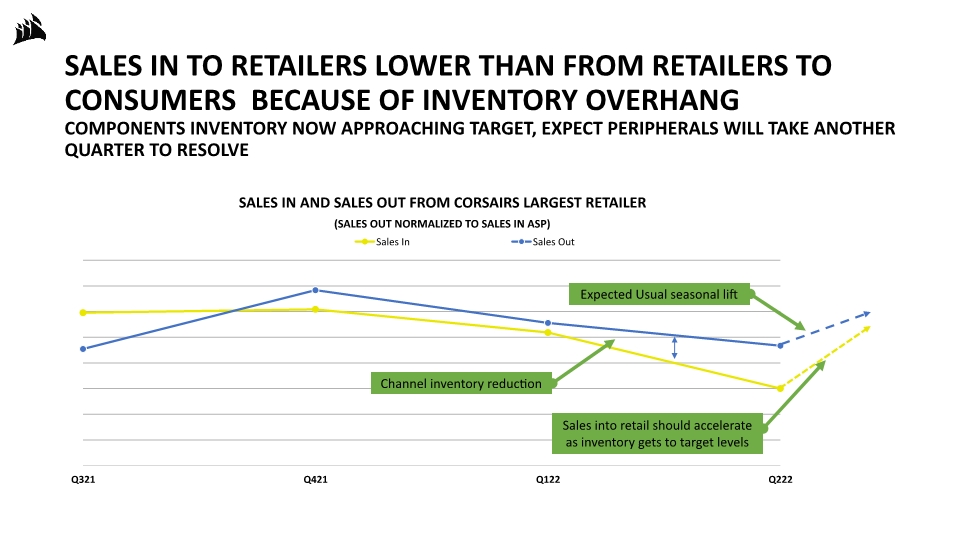

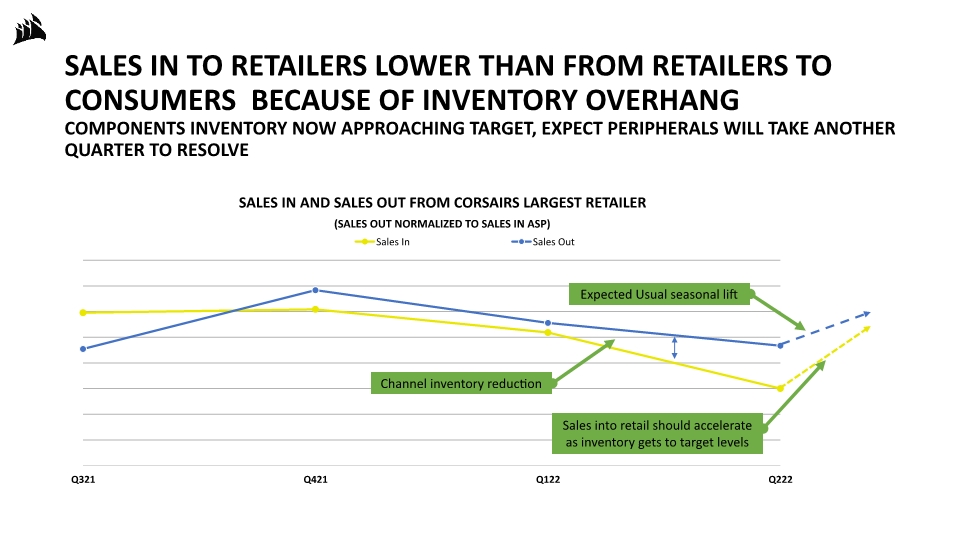

SALES IN TO RETAILERS LOWER THAN FROM RETAILERS TO CONSUMERS BECAUSE OF INVENTORY OVERHANG COMPONENTS INVENTORY NOW APPROACHING TARGET, EXPECT PERIPHERALS WILL TAKE ANOTHER QUARTER TO RESOLVE Expected Usual seasonal lift Channel inventory reduction Sales into retail should accelerate as inventory gets to target levels

Q2 2022 PRODUCT ANNOUCEMENTS

CORSAIR VOYAGER a1600 GAMING LAPTOP Announced May 23rd 2022 A world first Gaming & Streaming laptop with the integration of Elgato Stream Deck and Camera Hub Software. Powered by leading AMD Ryzen Processors and Radeon graphics for amazing mobile performance. “Corsair Is Joining The Competitive World Of Gaming Laptops, And Its Debut Machine Looks Pretty Special.” - TECHSPOT

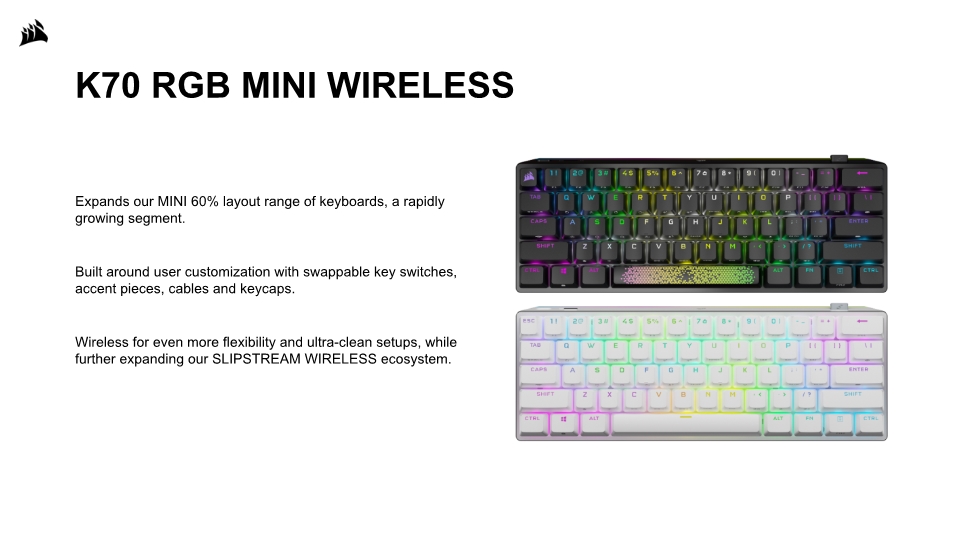

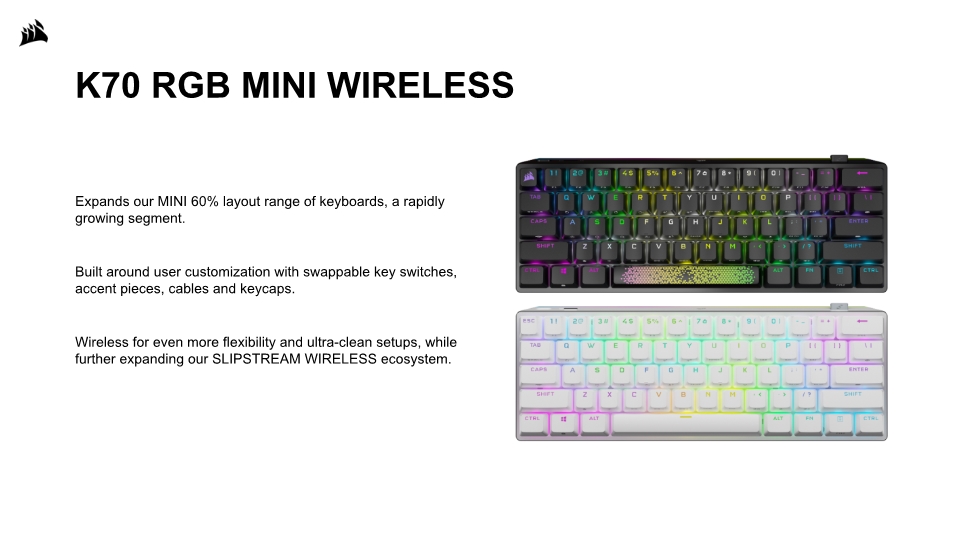

K70 RGB MINI WIRELESS Expands our MINI 60% layout range of keyboards, a rapidly growing segment. Built around user customization with swappable key switches, accent pieces, cables and keycaps. Wireless for even more flexibility and ultra-clean setups, while further expanding our SLIPSTREAM WIRELESS ecosystem.

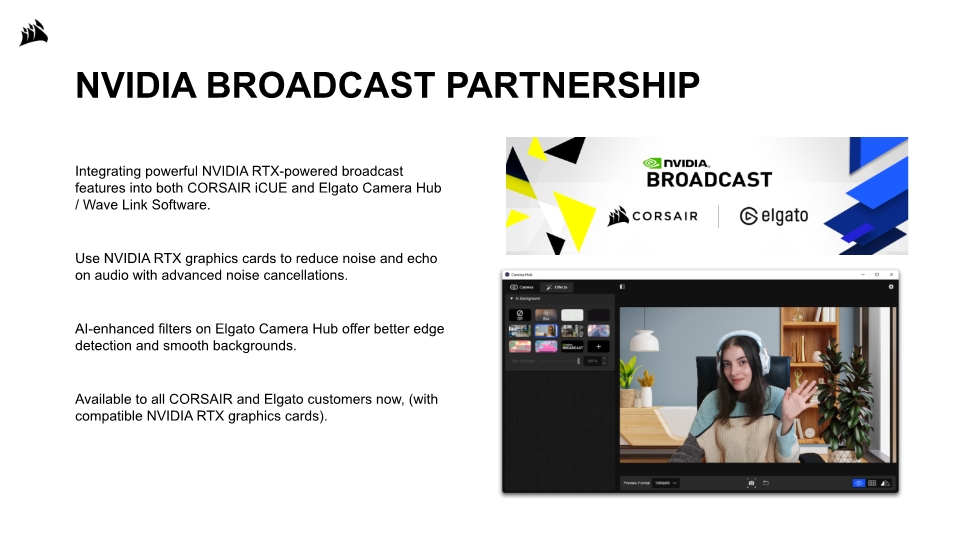

NVIDIA BROADCAST PARTNERSHIP Integrating powerful NVIDIA RTX-powered broadcast features into both CORSAIR iCUE and Elgato Camera Hub / Wave Link Software. Use NVIDIA RTX graphics cards to reduce noise and echo on audio with advanced noise cancellations. AI-enhanced filters on Elgato Camera Hub offer better edge detection and smooth backgrounds. Available to all CORSAIR and Elgato customers now, (with compatible NVIDIA RTX graphics cards).

FINANCIAL RESULTS

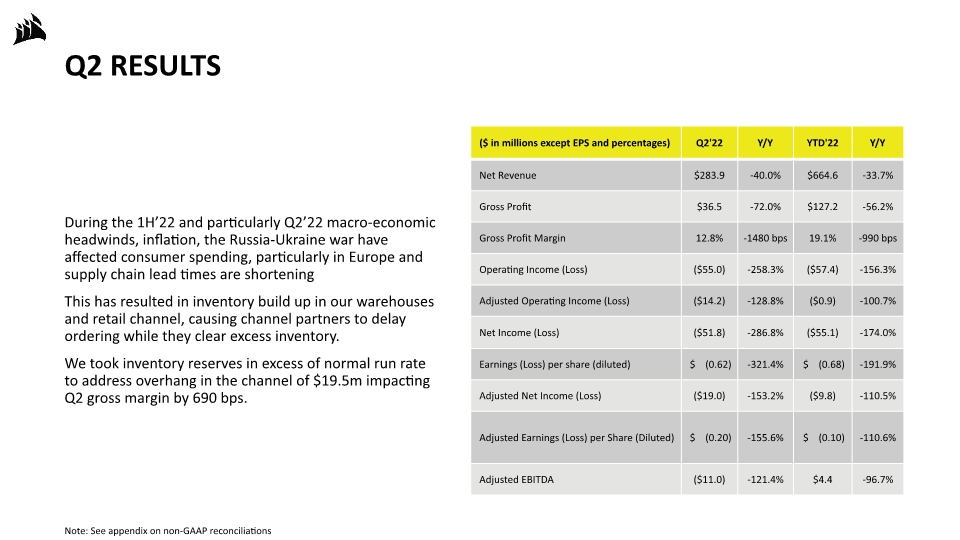

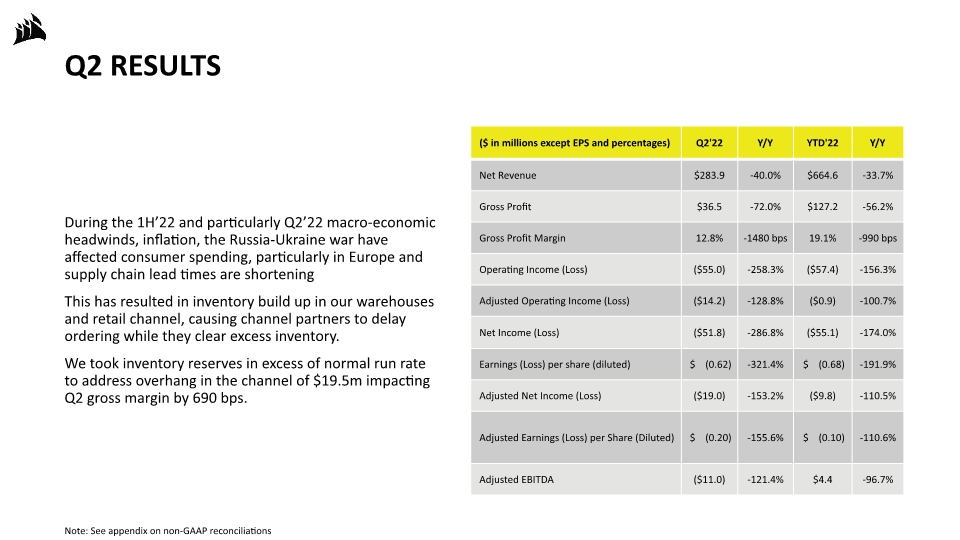

Q2 RESULTS During the 1H’22 and particularly Q2’22 macro-economic headwinds, inflation, the Russia-Ukraine war have affected consumer spending, particularly in Europe and supply chain lead times are shortening This has resulted in inventory build up in our warehouses and retail channel, causing channel partners to delay ordering while they clear excess inventory. We took inventory reserves in excess of normal run rate to address overhang in the channel of $19.5m impacting Q2 gross margin by 690 bps. Note: See appendix on non-GAAP reconciliations

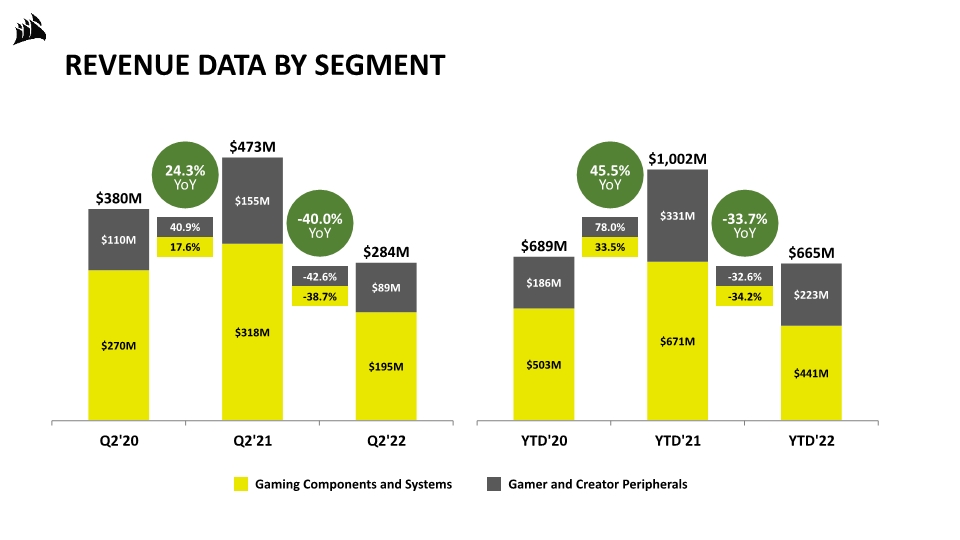

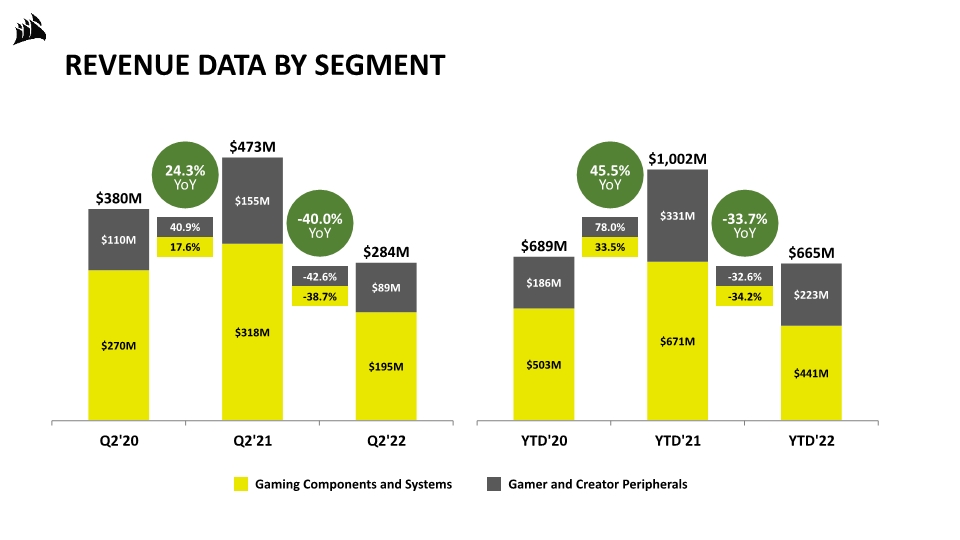

REVENUE DATA BY SEGMENT 17.6% 40.9% 24.3% YoY -38.7% -42.6% -40.0% YoY 33.5% 78.0% 45.5% YoY -34.2% -32.6% -33.7% YoY

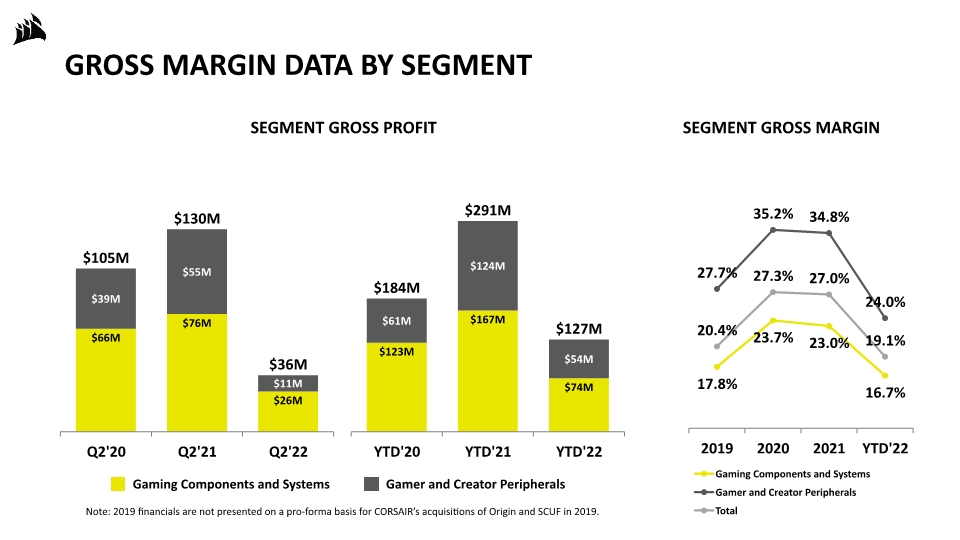

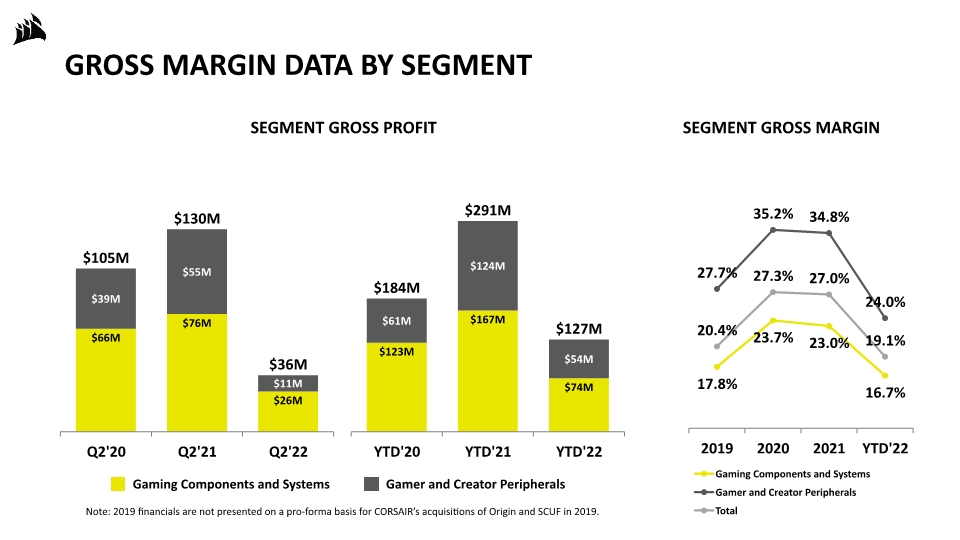

GROSS MARGIN DATA BY SEGMENT SEGMENT GROSS PROFIT SEGMENT GROSS MARGIN Note: 2019 financials are not presented on a pro-forma basis for CORSAIR’s acquisitions of Origin and SCUF in 2019.

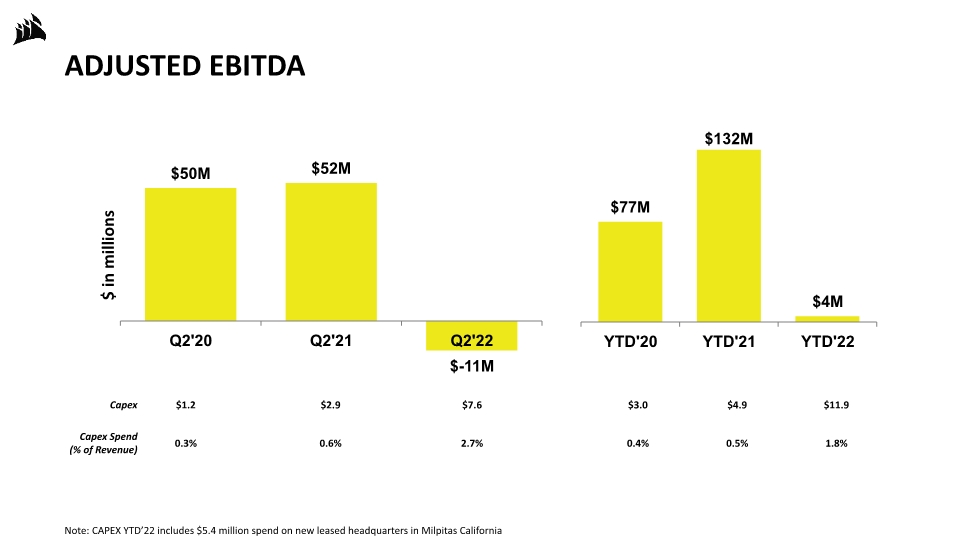

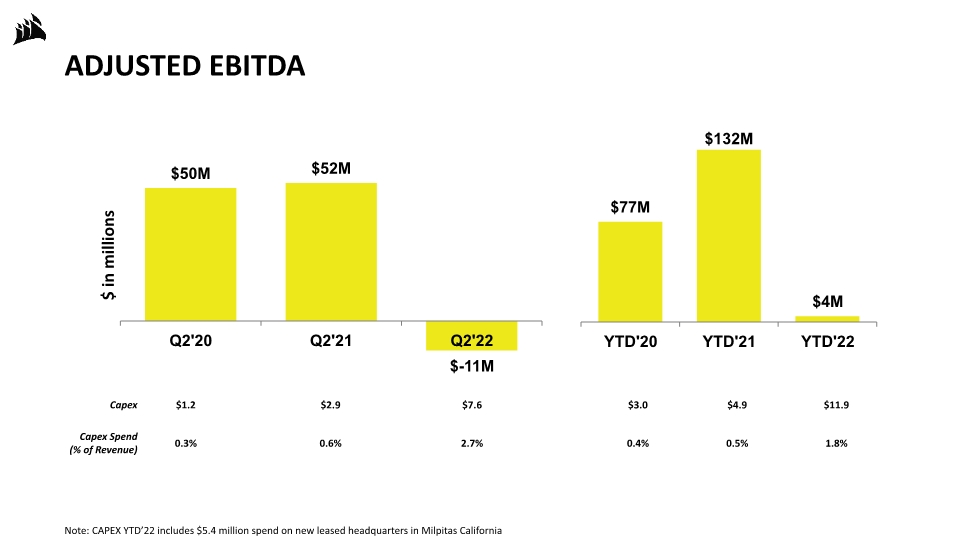

ADJUSTED EBITDA $ in millions 0.3% 0.6% 2.7% $1.2 $2.9 $7.6 $3.0 $4.9 0.4% 0.5% $11.9 1.8% Capex Spend (% of Revenue) Capex Note: CAPEX YTD’22 includes $5.4 million spend on new leased headquarters in Milpitas California

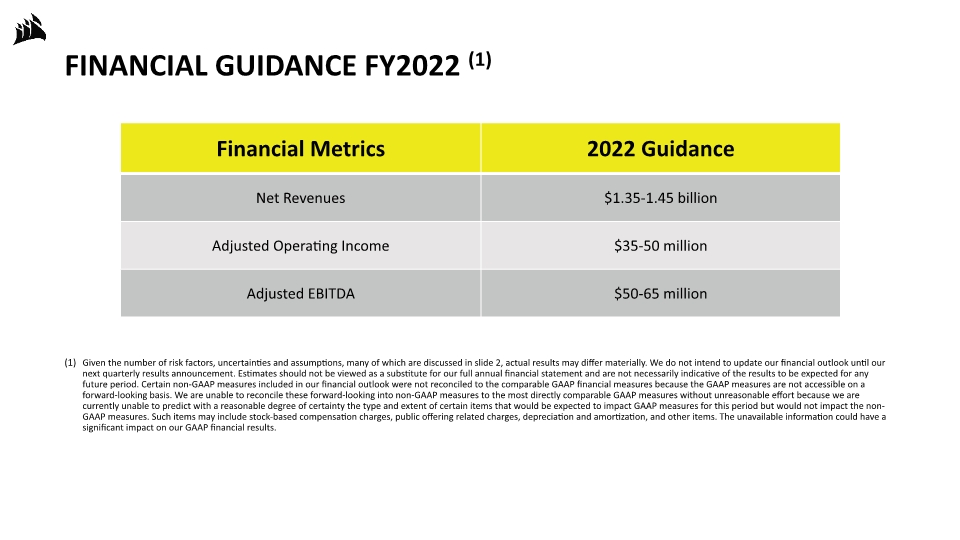

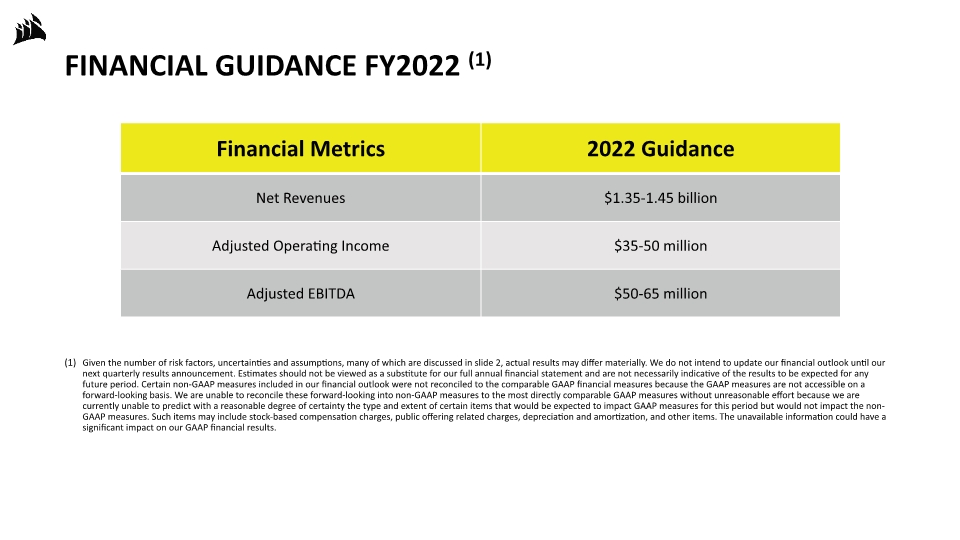

FINANCIAL GUIDANCE FY2022 (1) Given the number of risk factors, uncertainties and assumptions, many of which are discussed in slide 2, actual results may differ materially. We do not intend to update our financial outlook until our next quarterly results announcement. Estimates should not be viewed as a substitute for our full annual financial statement and are not necessarily indicative of the results to be expected for any future period. Certain non-GAAP measures included in our financial outlook were not reconciled to the comparable GAAP financial measures because the GAAP measures are not accessible on a forward-looking basis. We are unable to reconcile these forward-looking into non-GAAP measures to the most directly comparable GAAP measures without unreasonable effort because we are currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for this period but would not impact the non-GAAP measures. Such items may include stock-based compensation charges, public offering related charges, depreciation and amortization, and other items. The unavailable information could have a significant impact on our GAAP financial results.

THANK YOU

APPENDIX

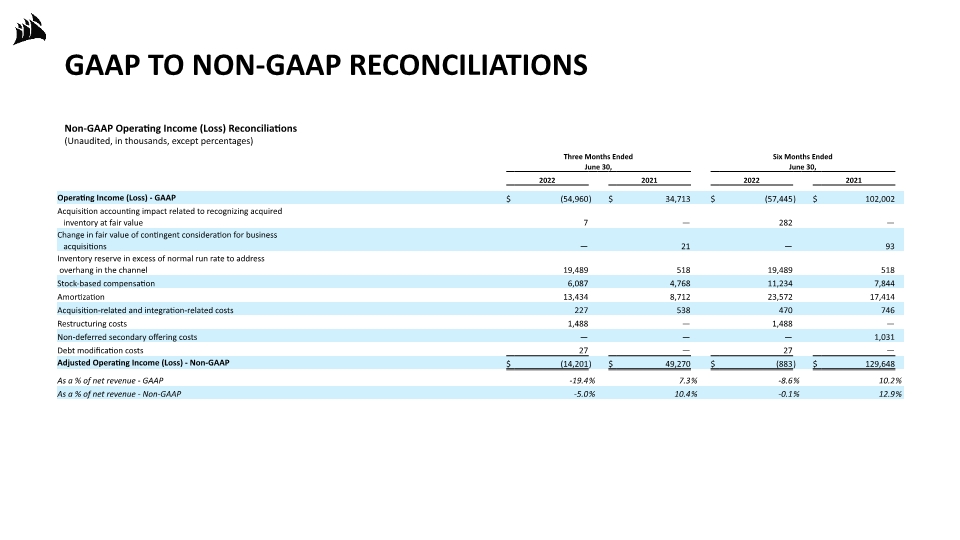

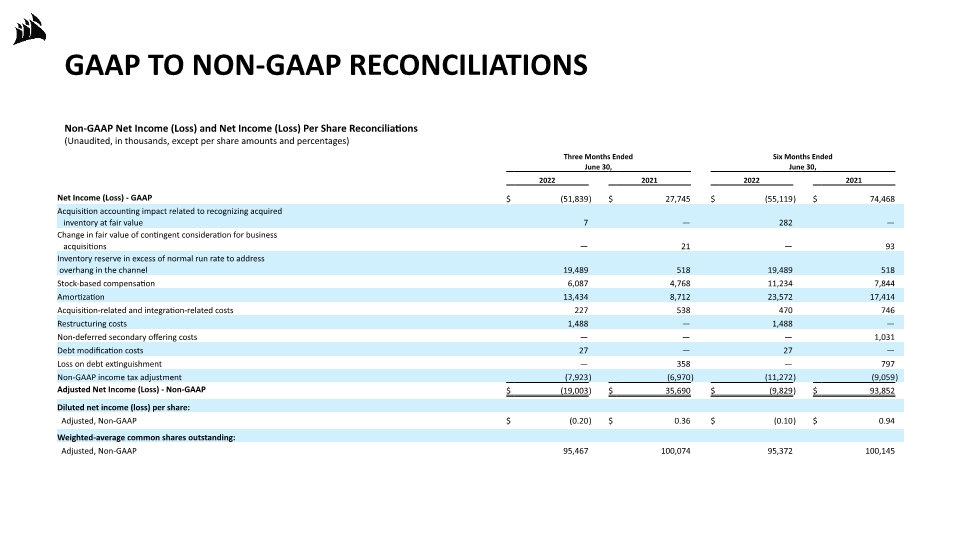

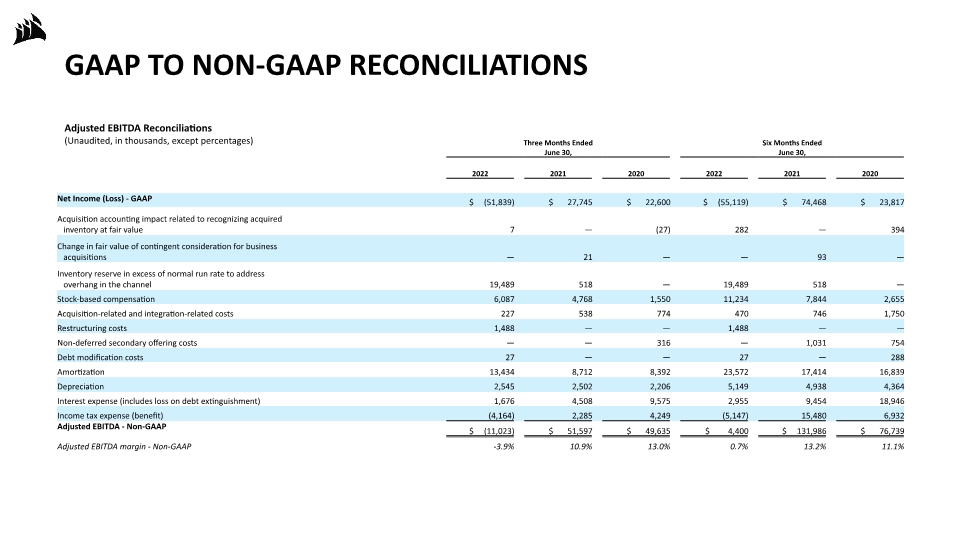

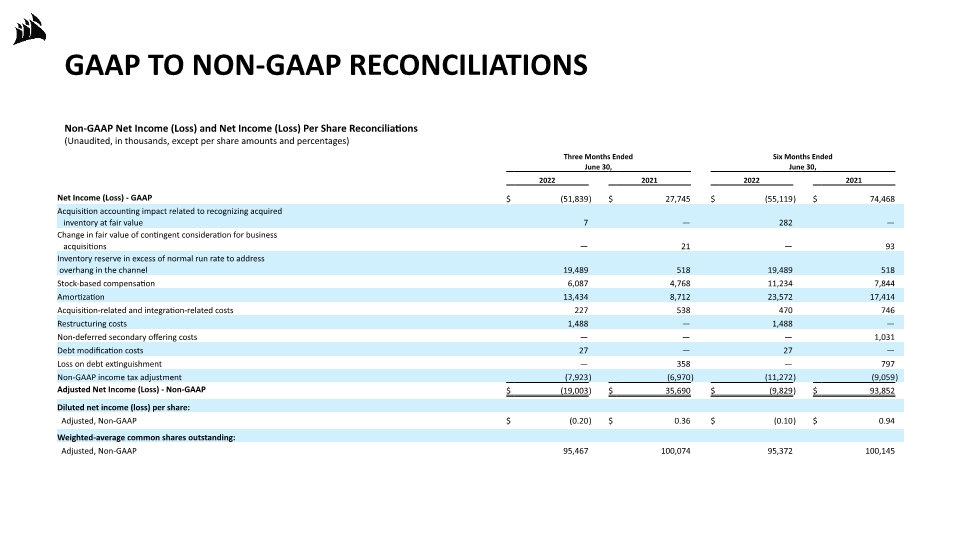

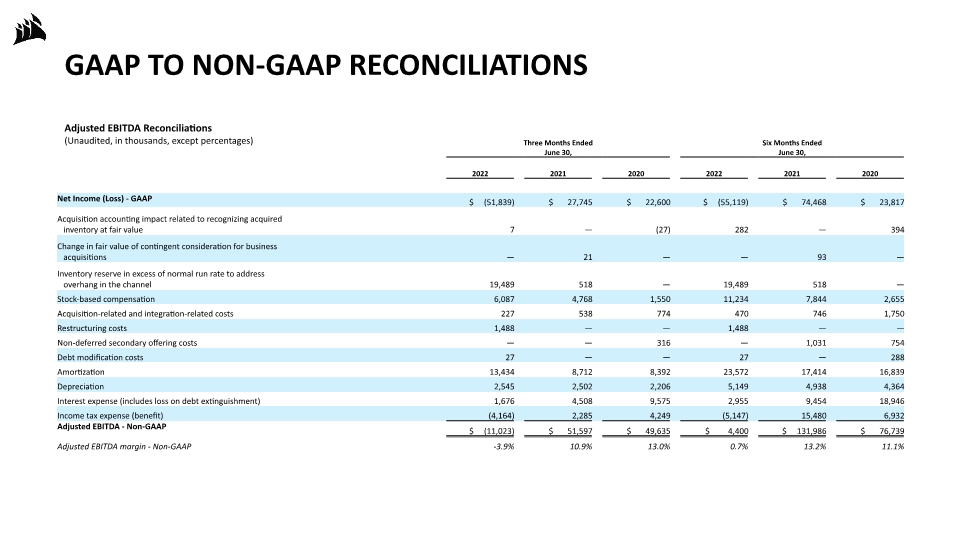

USE OF NON-GAAP FINANCIAL MEASURES To supplement the financial results presented in accordance with GAAP, this presentation includes certain non-GAAP financial information, including Adjusted Operating Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Share. These are important financial performance measures for us but are not financial measures as defined by GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in such non-GAAP financial measures. Accordingly, we believe that these non-GAAP financial provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to the key financial metrics used by our management in our financial and operational decision-making. We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider them useful in measuring our ability to meet our debt service obligations. Our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to revenues, operating income, net income, cash provided by operating activities or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these measures to the most directly comparable GAAP financial measures are presented in the appendix. We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view these non-GAAP financial measures in conjunction with the related GAAP financial measures.

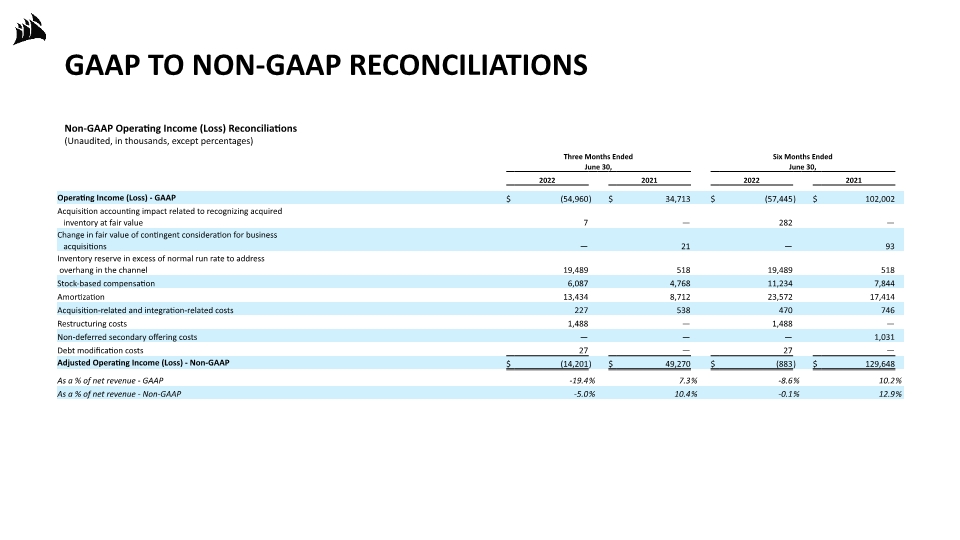

GAAP TO NON-GAAP RECONCILIATIONS Non-GAAP Operating Income (Loss) Reconciliations (Unaudited, in thousands, except percentages)

GAAP TO NON-GAAP RECONCILIATIONS Non-GAAP Net Income (Loss) and Net Income (Loss) Per Share Reconciliations (Unaudited, in thousands, except per share amounts and percentages)

GAAP TO NON-GAAP RECONCILIATIONS Adjusted EBITDA Reconciliations (Unaudited, in thousands, except percentages)