Table of Contents

EXPLANATORY NOTE

This is a post-qualification amendment to an offering statement on Form 1-A filed by My Racehorse CA LLC (the “Company”). The offering statement was originally filed by the Company on September 10, 2018, and has been amended by the Company on numerous occasions since that date. The offering statement, as amended by pre-qualification amendments, was qualified by the U.S. Securities and Exchange Commission (the “SEC”) on February 22, 2019. Since that date, certain post-qualification amendments to the offering statement have also been qualified by the SEC.

Different Series of the Company have already been offered by the Company under the offering statement, as amended and qualified. Each such Series of the Company will continue to be offered and sold by the Company following the filing of this post-qualification amendment until sold out, subject to the offering conditions contained in the offering statement, as qualified. The Series already qualified under the offering statement are as follows:

| Series Name | Horse Name (if different) | Qualification Date: |

| Form 1-A |

| Series Palace Foal | Ocean Magic 18 | February 22, 2019 |

| POS-AM #2 |

| Series De Mystique ‘17 | Dancing Destroyer | June 6, 2019 |

| POS-AM #3 |

| Series Martita Sangrita 17 | Carpe Vinum | July 11, 2019 |

| Series Daddy’s Joy | – | July 11, 2019 |

| Series Vertical Threat | – | July 11, 2019 |

| Series Shake it Up Baby | – | July 11, 2019 |

| Series Tizamagician | – | July 11, 2019 |

| POS-AM #4 |

| Series Power Up Paynter | – | July 25, 2019 |

| Series Two Trail Sioux 17 | Annahilate | July 25, 2019 |

| Series Wayne O | – | July 25, 2019 |

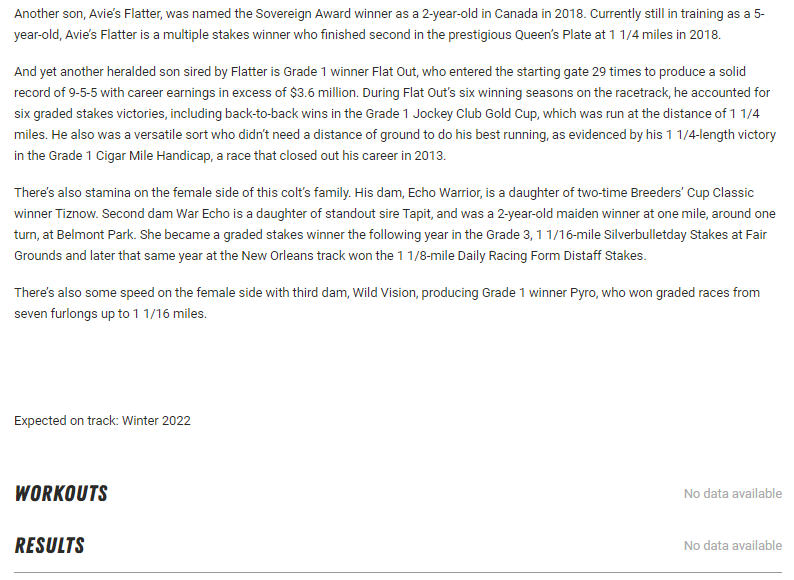

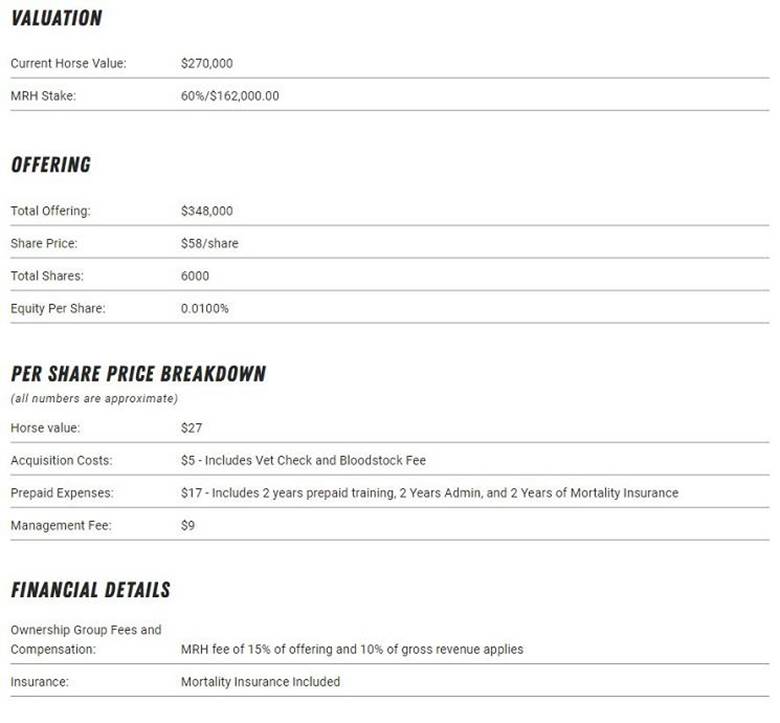

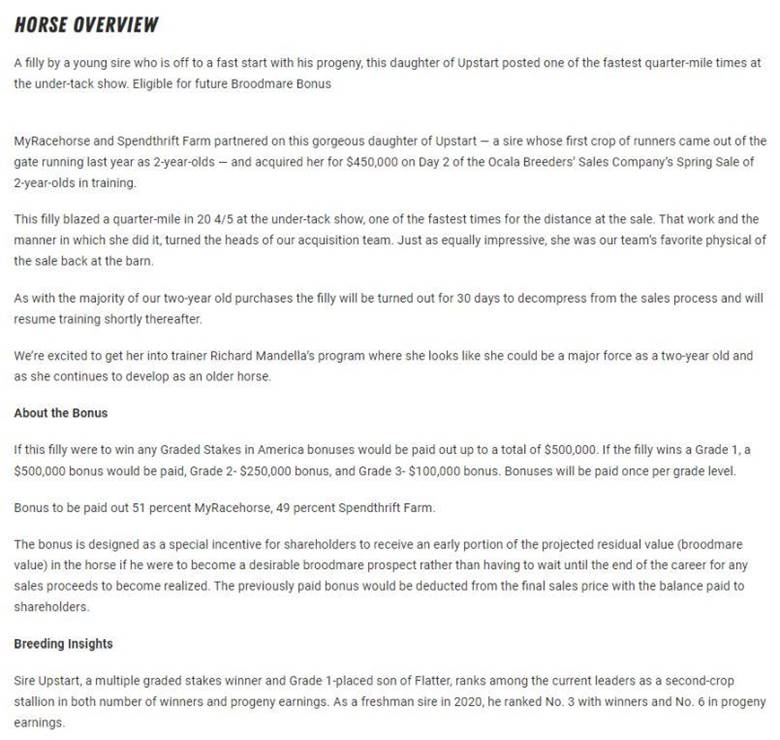

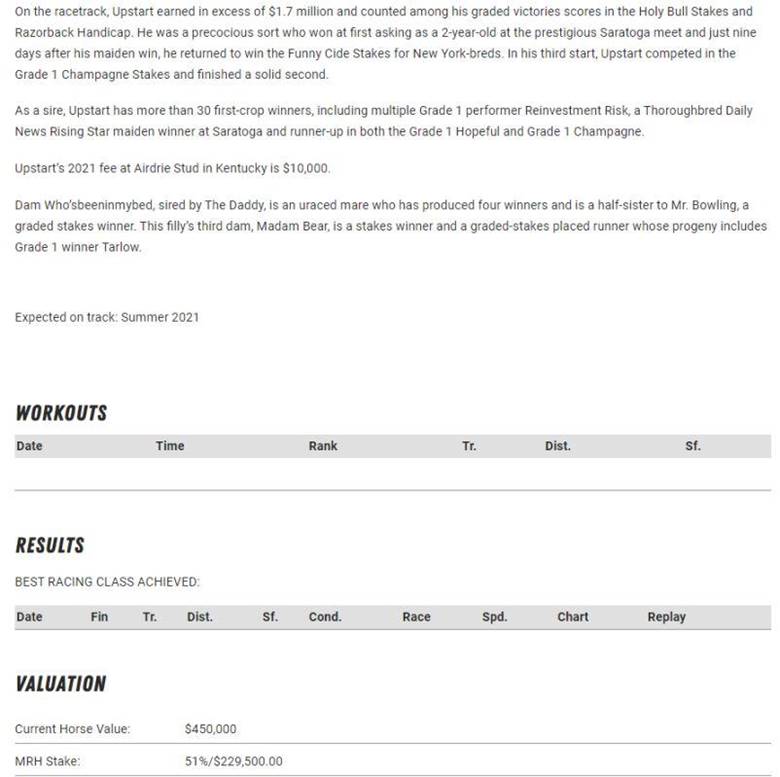

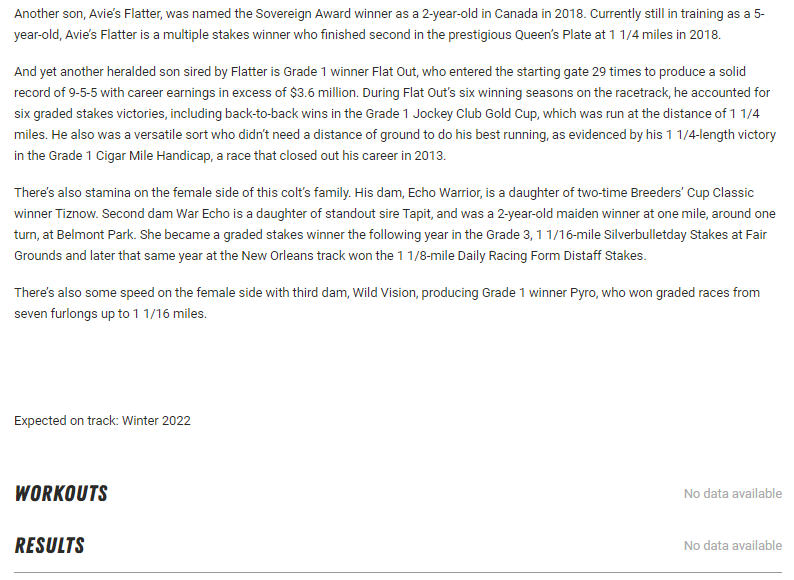

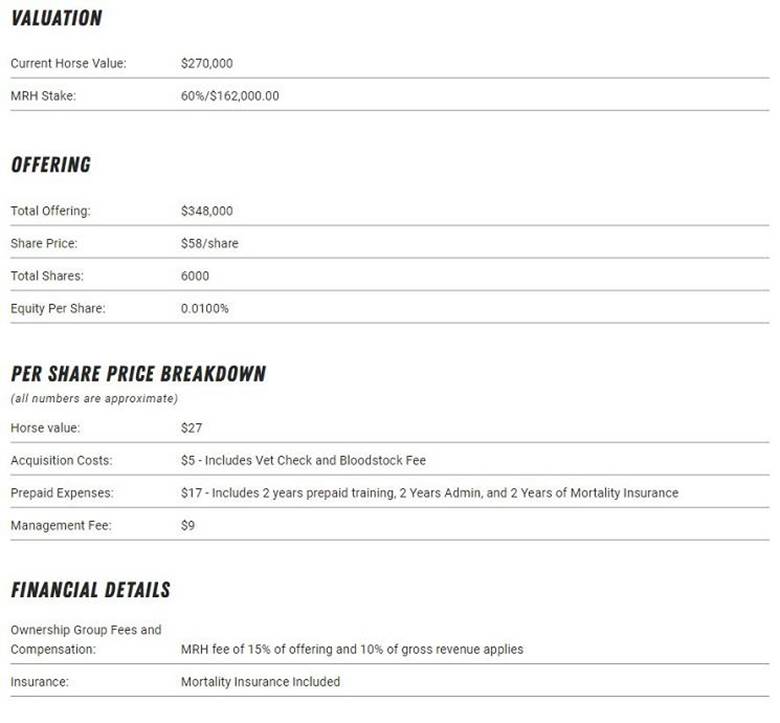

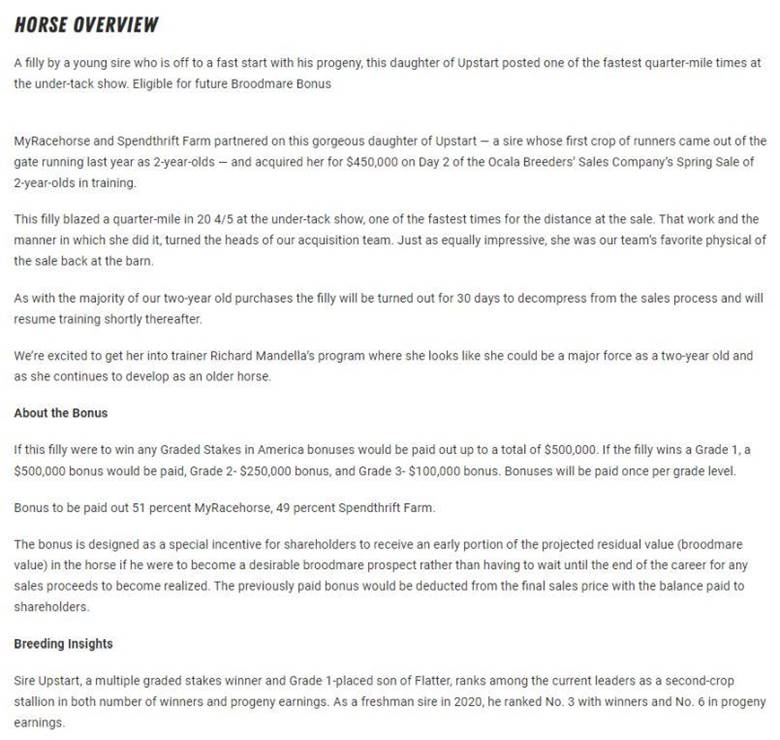

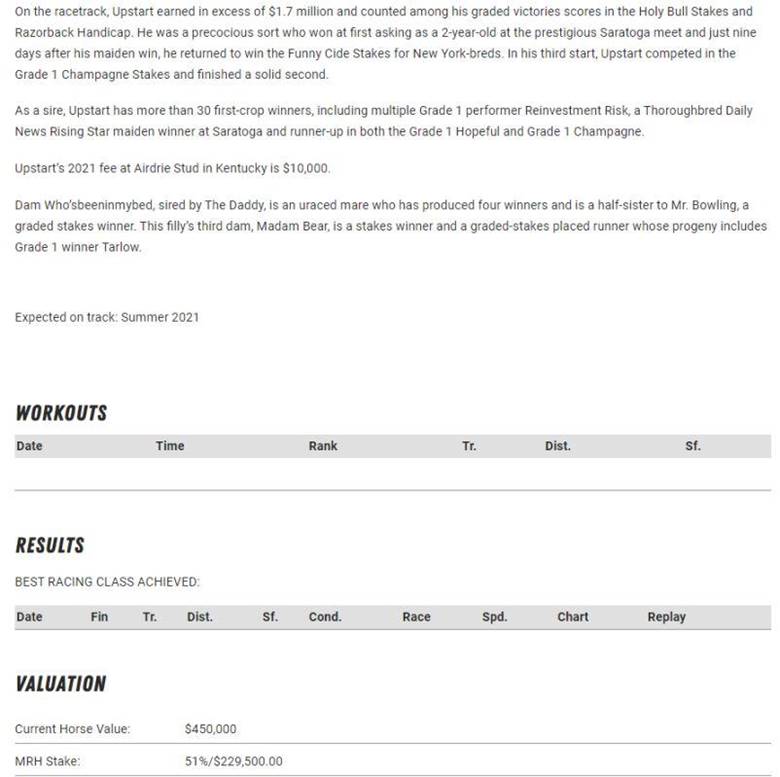

| POS-AM #5 |

| Series Big Mel | – | September 6, 2019 |

| POS-AM #6 |

| Series Amandrea | – | October 11, 2019 |

| Series Keertana 18 | American Heiress | October 11, 2019 |

| Series Sunny 18 | Solar Strike | October 11, 2019 |

| Series Lazy Daisy | – | October 11, 2019 |

| POS-AM #7 |

| Series New York Claiming Package (1) | (i) Augusta Moon; and

(ii) Hizaam | December 18, 2019 |

| Series The Filly Four (2) | (i) Moonlight d’Oro;

(ii) Joyful Addiction;

(iii) Lady Valentine; and

(iv) Shared Empire | December 18, 2019 |

| POS-AM #8 |

| Series Lane Way | – | February 19, 2020 |

| POS-AM #10 |

| Series Mo Mischief | – | May 13, 2020 |

| Series Deep Cover | – | May 13, 2020 |

| Series Big Mel (Addtl. 9% Interest) | – | May 13, 2020 |

| Series Sunny 18 (Addtl. 9% Interest) | Solar Strike | May 13, 2020 |

| POS-AM #11 |

| Series Popular Demand | – | June 5, 2020 |

| POS-AM #12 |

| Series Authentic | – | June 26, 2020 |

| Series Storm Shooter | – | June 26, 2020 |

| POS-AM #15 |

| Series Thirteen Stripes | – | August 7, 2020 |

| Series Naismith | – | August 7, 2020 |

| Series NY Exacta (3) | (i) Quick Conversation; and (ii) Psychedelic Shack | August 7, 2020 |

| POS-AM #18 |

| Series Apple Down Under 19 | Howboutdemapples | October 30, 2020 |

| Series Just Louise 19 | Forbidden Kingdom | October 30, 2020 |

| Series Lost Empire 19 | Laforgia | October 30, 2020 |

| POS-AM #19 |

| Series Man Among Men | – | November 12, 2020 |

| Series Frosted Oats | – | November 12, 2020 |

| Series Tapitry 19 | Infinite Empire | November 12, 2020 |

| Series Classofsixtythree 19 | Sixtythreecaliber | November 12, 2020 |

| Series Cayala 19 | Provocateur | November 12, 2020 |

| Series Margaret Reay 19 | A Mo Reay | November 12, 2020 |

| Series Awe Hush 19 | Can’t Hush This | November 12, 2020 |

| Series Exonerated 19 | Above Suspicion | November 12, 2020 |

| Series Speightstown Belle 19 | Ancient Royalty | November 12, 2020 |

| Series Consecrate 19 | Sacred Beauty | November 12, 2020 |

| Series Latte Da 19 | Inalattetrouble | November 12, 2020 |

| Series Midnight Sweetie 19 | Dolce Notte | November 12, 2020 |

| Series Ambleside Park 19 | Lookwhogotlucky | November 12, 2020 |

| Series Athenian Beauty 19 | Quantum Theory | November 12, 2020 |

| Series Future Stars Stable (4) | (i) Man Among Men; (ii) Frosted Oats; (iii) Infinite Empire; (iv) Sixtythreecaliber; (v) Provocateur; (vi) A Mo Reay; (vii) Can’t Hush This; (viii) Above Suspicion; (ix) Ancient Royalty; (x) Sacred Beauty; (xi) Inalattetrouble; (xii) Dolce Notte; (xiii) Lookwhogotlucky; and (xiv) Quantum Theory | November 12, 2020 |

| Series Collusion Illusion | – | November 12, 2020 |

| POS-AM #23 |

| Series Monomoy Girl | – | April 14, 2021 |

| Series Got Stormy | – | April 14, 2021 |

| Series Social Dilemma | – | April 14, 2021 |

| POS-AM #24 and #25 | – | |

| Series Carrothers | – | April 30, 2021 |

| Series Going to Vegas | – | April 30, 2021 |

| Series Ari the Adventurer 19 | Kanthari | April 30, 2021 |

| Series Wonder Upon a Star 19 | Star Six Nine | April 30, 2021 |

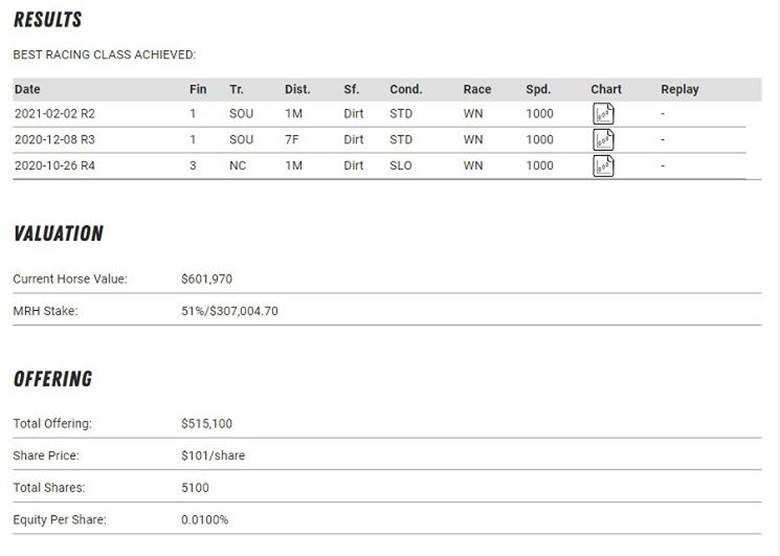

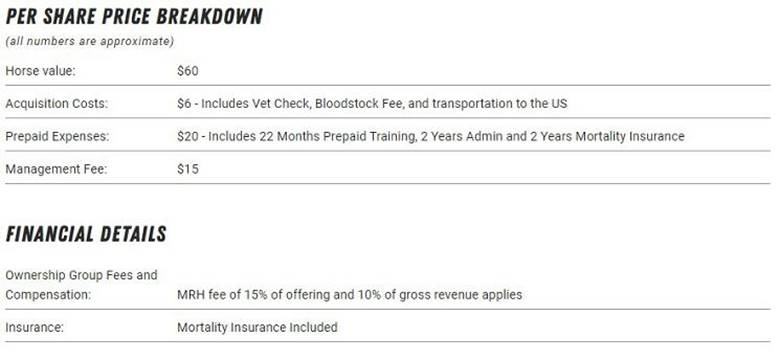

| Series Echo Warrior 19 | – | April 30, 2021 |

| POS-AM #26 |

| Series Silverpocketsfull 19 | Iron Works | May 10, 2021 |

| Series Who'sbeeninmybed 19 | Micro Share | May 10, 2021 |

| Series Into Summer 19 | Malibu Mayhem | May 10, 2021 |

| Series Mrs Whistler | – | May 10, 2021 |

| Series Race Hunter 19 | Chasing Time | May 10, 2021 |

| Series Co Cola 19 | Search Engine | May 10, 2021 |

| Series Vow | – | May 10, 2021 |

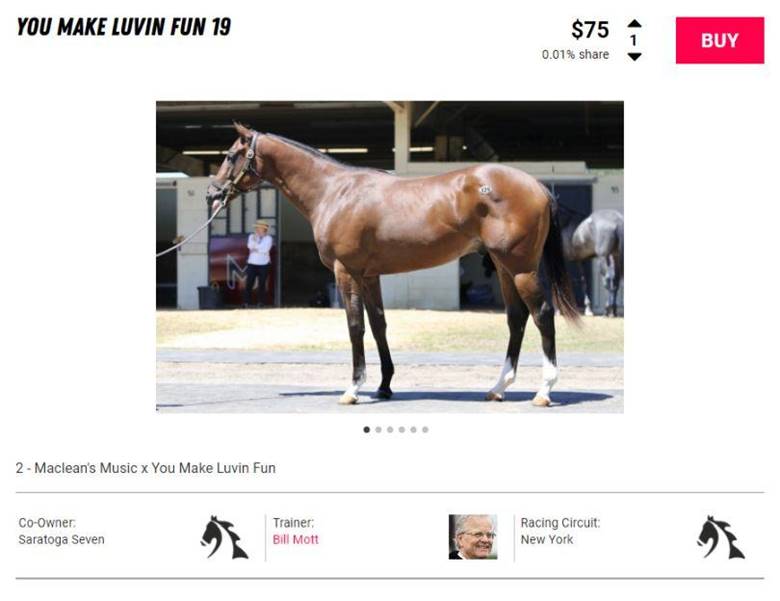

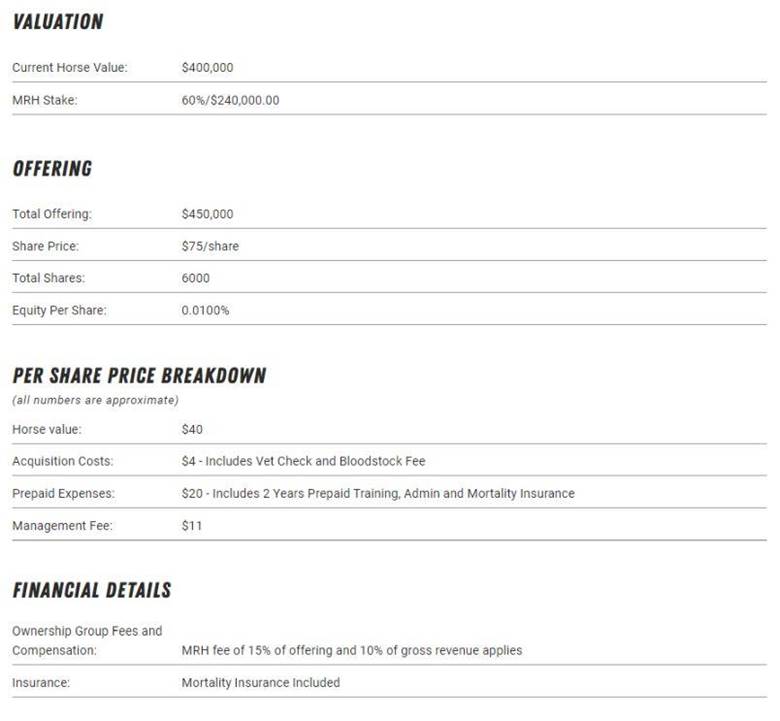

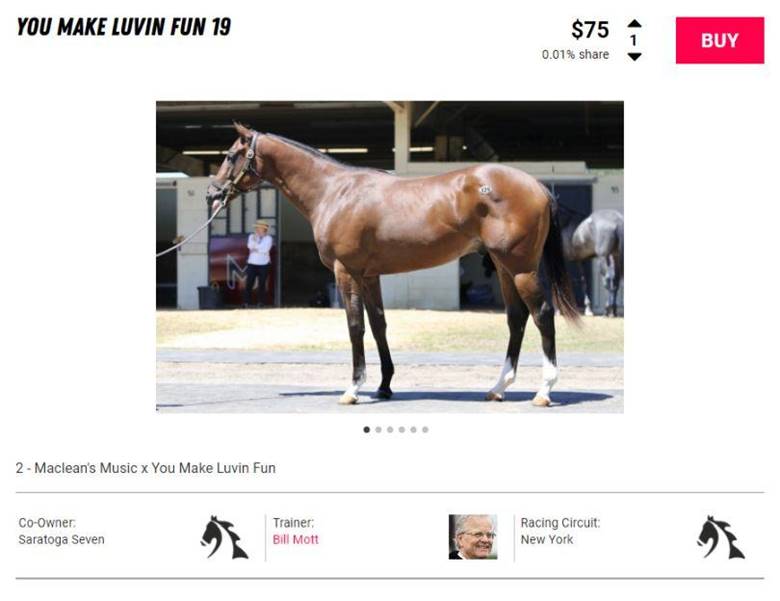

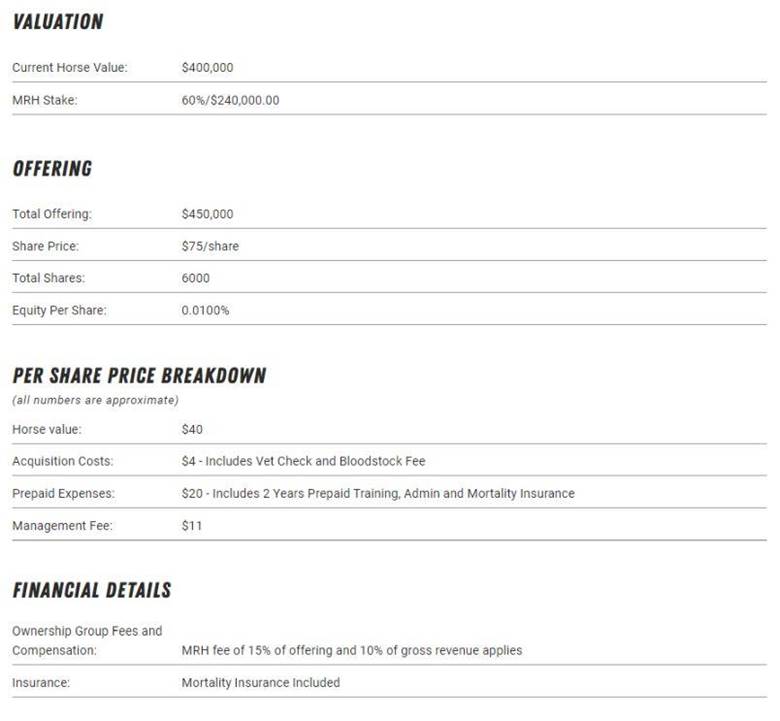

| Series You Make Luvin Fun 19 | Magical Ways | May 10, 2021 |

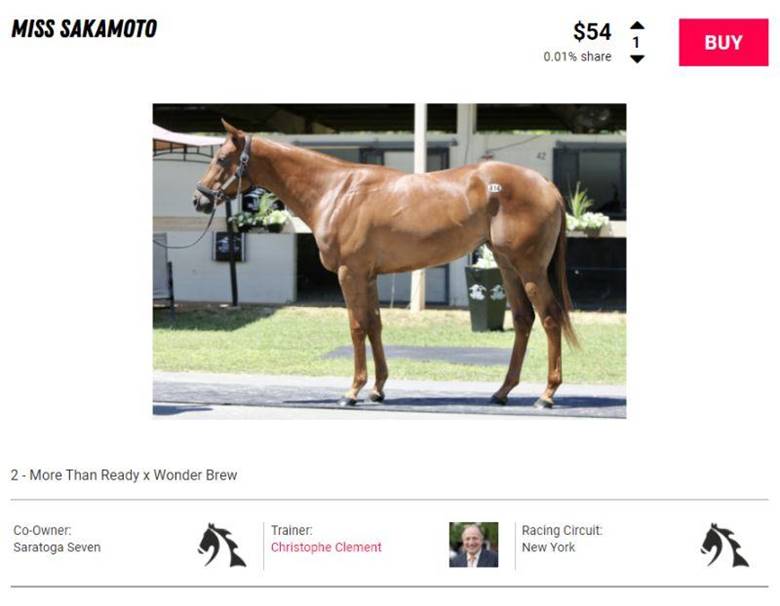

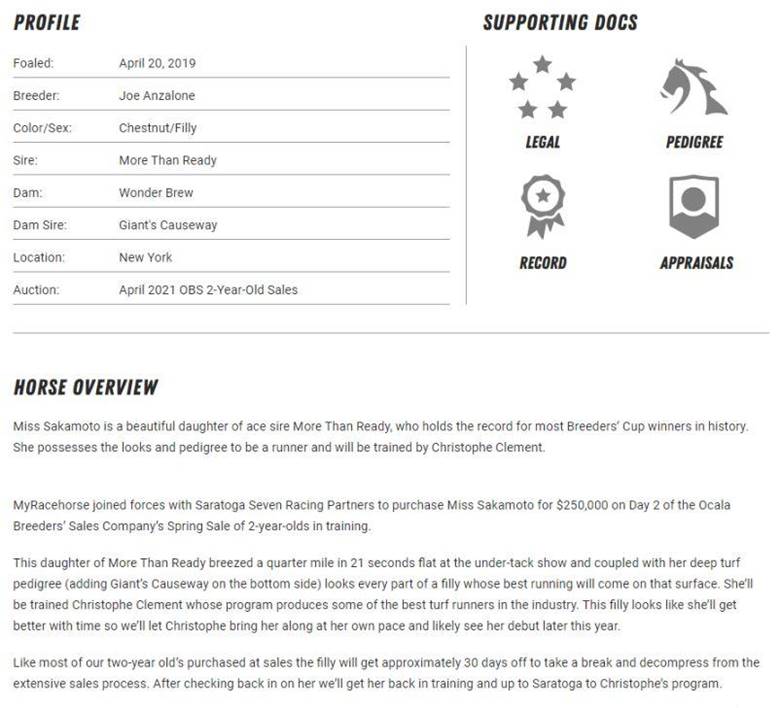

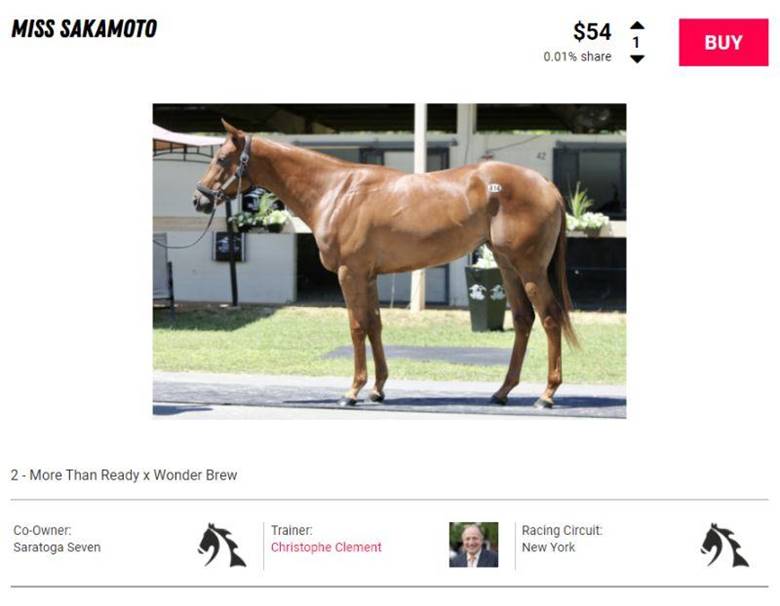

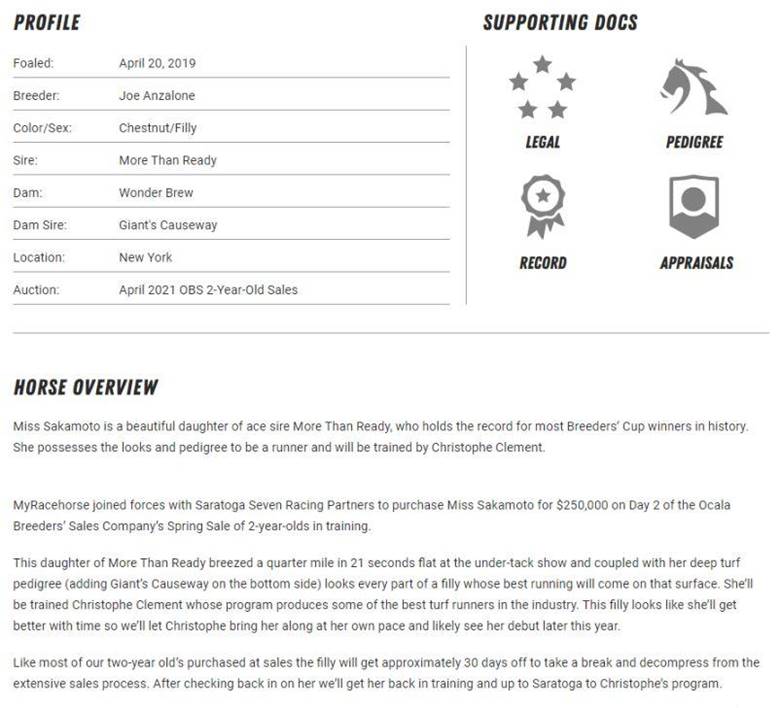

| Series Miss Sakamoto | – | May 10, 2021 |

| Series Courtisane 19 | Tap the Gavel | May 10, 2021 |

| Series Grand Traverse Bay 19 | Cornice Traverse | May 10, 2021 |

| POS-AM #27 |

| Series Our Miss Jones 19 | – | June 23, 2021 |

| Series Margarita Friday 19 | Straight No Chaser | June 23, 2021 |

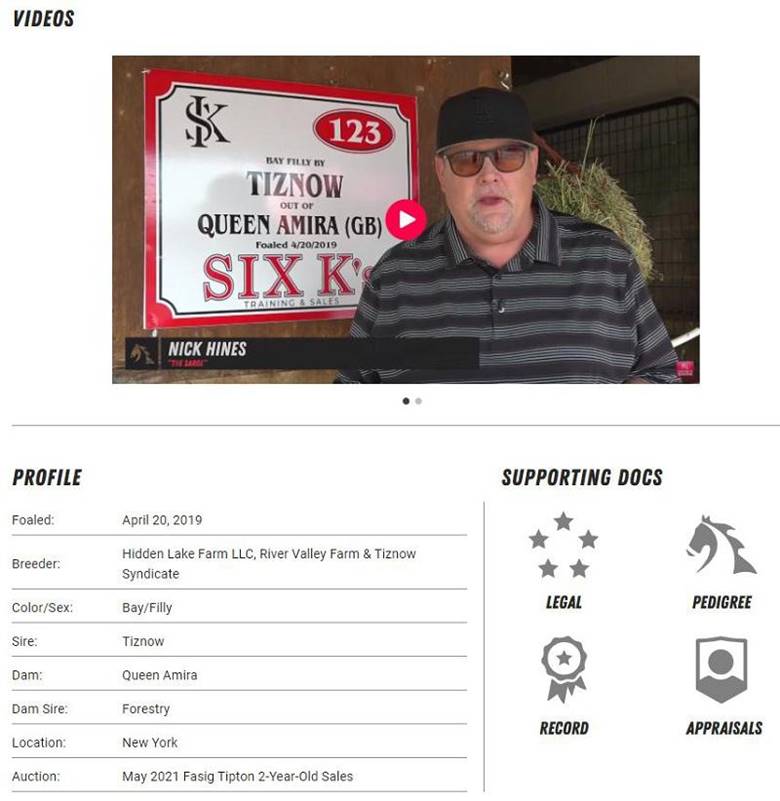

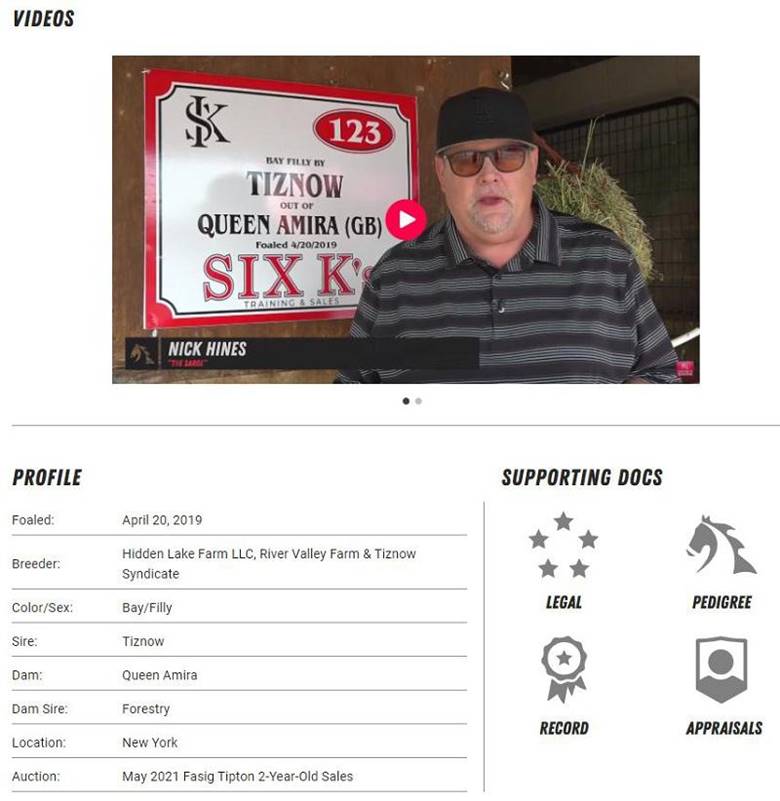

| Series Queen Amira 19 | Regal Rebel | June 23, 2021 |

| Series Salute to America | – | June 23, 2021 |

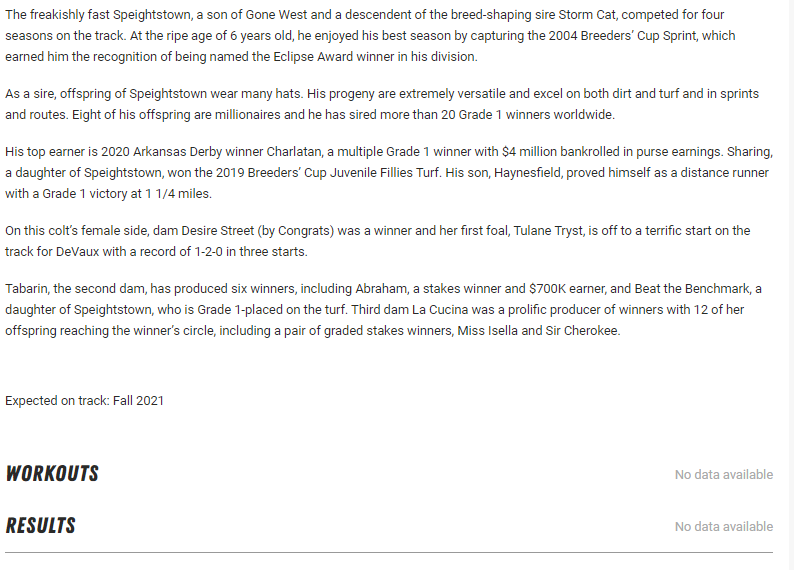

| Series Desire Street 19 | – | June 23, 2021 |

(1) Series New York Claiming Package is comprised of two (2) horses, (i) a 2016 Filly named, Augusta Moon, and (ii) a 2015 Colt named, Hizaam. On December 22, 2019, Augusta Moon, one of the two Underlying Assets of Series New York Claiming Package, was claimed/purchased from a race for $35,000. See below for more information.

(2) Series The Filly Four is comprised of four (4) horses, (i) a 2018 Filly named, Moonlight d’Oro (formerly Venetian Sonata 18), (ii) a 2018 Filly named, Joyful Addiction (formerly My Sweet Addiction 18), (iii) a 2018 Filly named, Lady Valentine (formerly My Lady Lauren 18), and (iv) a 2018 Filly named, Shared Empire (formerly Sapucai 18).

(3) Series NY Exacta is comprised of two (2) horses, (i) a 2018 Filly named Quick Conversation, and (ii) a 2018 Colt named Psychedelic Shack.

(4) Series Future Stars Stable is comprised of fourteen (14) horses, (i) a 2019 Colt named, Man Among Men, (ii) a 2019 Filly named, Frosted Oats, (iii) a 2019 Filly named, Infinite Empire (formerly Tapitry 19), (iv) a 2019 Filly named, Sixtythreecaliber (formerly Classofsixtythree 19), (v) a 2019 Colt named, Provocateur (formerly Cayala 19), (vi) a 2019 Filly named, A Mo Reay (formerly Margaret Reay 19), (vii) a 2019 Colt named, Can’t Hush This (formerly Awe Hush 19), (viii) a 2019 Filly named, Above Suspicion (formerly Exonerated 19), (ix) a 2019 Colt named, Ancient Royalty (formerly Speightstown Belle 19), (x) a 2019 Filly named, Sacred Beauty (formerly Consecrate 19), (xi) a 2019 Filly named Inalattetrouble (formerly Latte Da 19), (xii) a 2019 Filly named, Dolce Notte (formerly Midnight Sweetie 19), (xiii) a 2019 Colt named, Lookwhogotlucky (formerly Ambleside Park 19), and (xiv) a 2019 Colt named, Quantum Theory (formerly Athenian Beauty 19).

The purpose of this post-qualification amendment is to amend, update and/or replace certain information contained in the Offering Circular and to add additional Series to the offering statement by means of this post-qualification amendment.

Table of Contents

Post-Qualification Offering Circular Amendment No. 30

File No. 024-10896

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. To the extent not already qualified under Regulation A, these securities may not be sold nor may offers to buy be accepted prior to the time an offering circular that is not designated as a Preliminary Offering Circular is delivered and the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR

SUBJECT TO COMPLETION; DATED OCTOBER 8, 2021

MY RACEHORSE CA LLC

250 W. 1st Street, Suite 256

Claremont, CA 91711

(909) 740-9175

www.myracehorse.com

Series Membership Interests Overview Newly Added (To be Qualified) |

| | Number of

Shares | Price to Public | Underwriting

Discounts and

Commissions (1)(2) | Proceeds to

Issuer (3) |

| | Total Maximum | | | | |

| Series Duke of Love | Per Unit | 1 | $142.00 | $1.42 | $140.58 |

| | Total Maximum | 2,000 | $284,000.00 | $2,840.00 | $281,160.00 |

| | | | | | |

| Series War Safe | Per Unit | 1 | $146.00 | $1.46 | $144.54 |

| | Total Maximum | 2,000 | $292,000.00 | $2,920.00 | $289,080.00 |

| | | | | | |

| Series Tufnel | Per Unit | 1 | $62.00 | $0.62 | $61.38 |

| | Total Maximum | 5,200 | $322,400.00 | $3,224.00 | $319,176.00 |

| | | | | | |

| Series Classic Cut | Per Unit | 1 | $51.00 | $0.51 | $50.49 |

| | Total Maximum | 10,000 | $510,000.00 | $5,100.00 | $504,900.00 |

| | | | | | |

| Series Essential Rose 20 | Per Unit | 1 | $105.00 | $1.05 | $103.95 |

| | Total Maximum | 10,000 | $1,050,000.00 | $10,500.00 | $1,039,500.00 |

| | | | | | |

| Series Who Runs the World | Per Unit | 1 | $104.00 | $1.04 | $102.96 |

| | Total Maximum | 5,100 | $530,400.00 | $5,304.00 | $525,096.00 |

| | | | | | |

| Series Balletic | Per Unit | 1 | $80.00 | $0.80 | $79.20 |

| | Total Maximum | 10,000 | $800,000.00 | $8,000.00 | $792,000.00 |

| | | | | | |

| Series Song of Bernadette 20 | Per Unit | 1 | $97.00 | $0.97 | $96.03 |

| | Total Maximum | 5,100 | $494,700.00 | $4,947.00 | $489,753.00 |

| Series Membership Interests Overview |

| Active Offerings (Previously Qualified) |

| | | Number of Shares | Price to Public | Underwriting Discounts and Commissions (1)(2) | Proceeds to

Issuer (3) |

| Series Carrothers | Per Unit | 1 | $101.00 | $1.01 | 99.99 |

| | Total Maximum | 5,100 | $515,100.00 | $5,151.00 | $509,949.00 |

| | | | | | |

| Series Echo Warrior 19 | Per Unit | 1 | $58.00 | $0.58 | $57.42 |

| | Total Maximum | 6,000 | $348,000.00 | $3,480.00 | $344,520.00 |

| | | | | | |

| Series Who'sbeeninmybed 19 | Per Unit | 1 | $74.00 | $0.74 | $73.26 |

| | Total Maximum | 5,100 | $377,400.00 | $3,774.00 | $373,626.00 |

| | | | | | |

| Series Into Summer 19 | Per Unit | 1 | $386.00 | $3.86 | $382.14 |

| | Total Maximum | 650 | $250,900.00 | $2,509.00 | $248,391.00 |

| | | | | | |

| Series Mrs Whistler | Per Unit | 1 | $137.00 | $1.37 | $135.63 |

| | Total Maximum | 2,000 | $274,000.00 | $2,740.00 | $271,260.00 |

| | | | | | |

| Series Race Hunter 19 | Per Unit | 1 | $52.00 | $0.52 | $51.48 |

| | Total Maximum | 10,000 | $520,000.00 | $5,200.00 | $514,800.00 |

| | | | | | |

| Series Vow | Per Unit | 1 | $179.00 | $1.79 | $177.21 |

| | Total Maximum | 2,000 | $358,000.00 | $3,580.00 | $354,420.00 |

| | | | | | |

| Series You Make Luvin Fun 19 | Per Unit | 1 | $75.00 | $0.75 | $74.25 |

| | Total Maximum | 6,000 | $450,000.00 | $4,500.00 | $445,500.00 |

| | | | | | |

| Series Miss Sakamoto | Per Unit | 1 | $54.00 | $0.54 | $53.46 |

| | Total Maximum | 6,000 | $324,000.00 | $3,240.00 | $320,760.00 |

| | | | | | |

| Series Courtisane 19 | Per Unit | 1 | $49.00 | $0.49 | $48.51 |

| | Total Maximum | 10,000 | $490,000.00 | $4,900.00 | $485,100.00 |

| | | | | | |

| Series Grand Traverse Bay 19 | Per Unit | 1 | $447.00 | $4.47 | $442.53 |

| | Total Maximum | 750 | $335,250.00 | $3,352.50 | $331,897.50 |

| | | | | | |

| Series Our Miss Jones 19 | Per Unit | 1 | $156.00 | $1.56 | $154.44 |

| | Total Maximum | 1,200 | $187,200.00 | $1,872.00 | $185,328.00 |

| | | | | | |

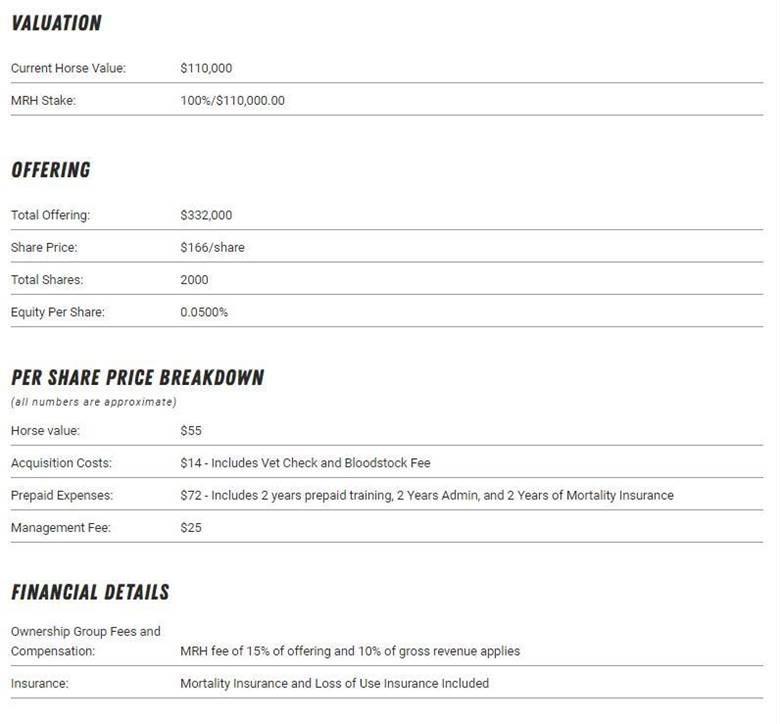

| Series Margarita Friday 19 | Per Unit | 1 | $166.00 | $1.66 | $164.34 |

| | Total Maximum | 2,000 | $332,000.00 | $3,320.00 | $328,680.00 |

| | | | | | |

| Series Queen Amira 19 | Per Unit | 1 | $165.00 | $1.65 | $163.35 |

| | Total Maximum | 2,000 | $330,000.00 | $3,300.00 | $326,700.00 |

| | | | | | |

| Series Salute to America | Per Unit | 1 | $273.00 | $2.73 | $270.27 |

| | Total Maximum | 1,000 | $273,000.00 | $2,730.00 | $270,270.00 |

| | | | | | |

| Series Desire Street 19 | Per Unit | 1 | $201.00 | $2.01 | $198.99 |

| | Total Maximum | 1,020 | $205,020.00 | $2,050.20 | $202,969.80 |

| Series Membership Interests Overview |

| Closed/Terminated Offerings (18) |

| | | Number of Shares | Price to Public | Underwriting Discounts and Commissions (1)(2) | Proceeds to

Issuer (3) |

| Series Vertical Threat (4) | Per Unit | 1 | $210.00 | $0.00 | $210.00 |

| | Total Maximum | 537 | $112,770.00 | $0.00 | $112,770.00 |

| | | | | | |

| Series Amandrea (16) | Per Unit | 1 | $295.00 | $0.00 | $295.00 |

| | Total Maximum | 550 | $162,250.00 | $0.00 | $162,250.00 |

| | | | | | |

| Series Keertana 18 | Per Unit | 1 | $100.00 | $0.00 | $100.00 |

| | Total Maximum | 5,100 | $510,000.00 | $0.00 | $510,000.00 |

| | | | | | |

| Series Lazy Daisy | Per Unit | 1 | $115.00 | $0.00 | $115.00 |

| | Total Maximum | 1,250 | $143,750.00 | $0.00 | $143,750.00 |

| | | | | | |

| Series The Filly Four (7) | Per Unit | 1 | $180.00 | $0.00 | $180.00 |

| | Total Maximum | 8,000 | $1,440,000.00 | $0.00 | $1,440,000.00 |

| | | | | | |

| Series Popular Demand | Per Unit | 1 | $244.00 | $0.00 | $244.00 |

| | Total Maximum | 1,020 | $248,880.00 | $0.00 | $248,880.00 |

| | | | | | |

| Series Authentic | Per Unit | 1 | $206.00 | $0.00 | $206.00 |

| | Total Maximum | 12,500 | $2,575,000.00 | $0.00 | $2,575,000.00 |

| | | | | | |

| Series Storm Shooter | Per Unit | 1 | $162.00 | $0.00 | $162.00 |

| | Total Maximum | 2,000 | $324,000.00 | $0.00 | $324,000.00 |

| | | | | | |

| Series Naismith | Per Unit | 1 | $152.00 | $0.00 | $152.00 |

| | Total Maximum | 2,000 | $304,000.00 | $0.00 | $304,000.00 |

| | | | | | |

| Series NY Exacta (8) | Per Unit | 1 | $228.00 | $0.00 | $228.00 |

| | Total Maximum | 2,000 | $456,000.00 | $0.00 | $456,000.00 |

| | | | | | |

| Series Palace Foal | Per Unit | 1 | $120.00 | $0.00 | $120.00 |

| | Total Maximum | 510 | $61,200.00 | $0.00 | $61,200.00 |

| | | | | | |

| Series De Mystique '17 | Per Unit | 1 | $140.00 | $0.00 | $140.00 |

| | Total Maximum | 250 | $35,000.00 | $0.00 | $35,000.00 |

| | | | | | |

| Series Martita Sangrita 17 (12) | Per Unit | 1 | $320.00 | $0.00 | $320.00 |

| | Total Maximum | 576 | $184,320.00 | $0.00 | $184,320.00 |

| | | | | | |

| Series Daddy's Joy | Per Unit | 1 | $180.00 | $0.00 | $180.00 |

| | Total Maximum | 600 | $108,000.00 | $0.00 | $108,000.00 |

| | | | | | |

| Series Shake It Up Baby | Per Unit | 1 | $130.00 | $0.00 | $130.00 |

| | Total Maximum | 250 | $32,500.00 | $0.00 | $32,500.00 |

| | | | | | |

| Series Tizamagician (13) | Per Unit | 1 | $320.00 | $0.00 | $320.00 |

| | Total Maximum | 339 | $108,480.00 | $0.00 | $108,480.00 |

| | | | | | |

| Series Power Up Paynter | Per Unit | 1 | $190.00 | $0.00 | $190.00 |

| | Total Maximum | 600 | $114,000.00 | $0.00 | $114,000.00 |

| | | | | | |

| Series Wayne O | Per Unit | 1 | $95.00 | $0.00 | $95.00 |

| | Total Maximum | 6,000 | $570,000.00 | $0.00 | $570,000.00 |

| | | | | | |

| Series New York Claiming Package | Per Unit | 1 | $140.00 | $0.00 | $140.00 |

| | Total Maximum | 510 | $71,400.00 | $0.00 | $71,400.00 |

| | | | | | |

| Series Lane Way (14) | Per Unit | 1 | $90.00 | $0.00 | $90.00 |

| | Total Maximum | 6,000 | $540,000.00 | $0.00 | $540,000.00 |

| | | | | | |

| Series Big Mel (5) | Per Unit | 1 | $121.00 | $0.00 | $121.00 |

| | Total Maximum | 6,000 | $726,000.00 | $0.00 | $726,000.00 |

| | | | | | |

| Series Two Trail Sioux 17 | Per Unit | 1 | $300.00 | $0.00 | $300.00 |

| | Total Maximum | 450 | $135,000.00 | $0.00 | $135,000.00 |

| | | | | | |

| Series Sunny 18 (6) | Per Unit | 1 | $65.00 | $0.00 | $65.00 |

| | Total Maximum | 6,000 | $390,000.00 | $0.00 | $390,000.00 |

| | | | | | |

| Series Mo Mischief (17) | Per Unit | 1 | $75.00 | $0.00 | $75.00 |

| | Total Maximum | 5,100 | $382,500.00 | $0.00 | $382,500.00 |

| | | | | | |

| Series Deep Cover (11) | Per Unit | 1 | $220.00 | $0.00 | $220.00 |

| | Total Maximum | 800 | $176,000.00 | $0.00 | $176,000.00 |

| | | | | | |

| Series Thirteen Stripes | Per Unit | 1 | $229.00 | $0.00 | $229.00 |

| | Total Maximum | 1,000 | $229,000.00 | $0.00 | $229,000.00 |

| | | | | | |

| Series Man Among Men | Per Unit | 1 | $273.00 | $2.73 | $270.27 |

| | Total Maximum | 820 | $223,860.00 | $2,238.60 | $221,621.40 |

| | | | | | |

| Series Frosted Oats | Per Unit | 1 | $42.00 | $0.42 | $41.58 |

| | Total Maximum | 4,100 | $172,200.00 | $1,722.00 | $170,478.00 |

| | | | | | |

| Series Tapitry 19 | Per Unit | 1 | $273.00 | $2.73 | $270.27 |

| | Total Maximum | 820 | $223,860.00 | $2,238.60 | $221,621.40 |

| | | | | | |

| Series Classofsixtythree 19 | Per Unit | 1 | $193.00 | $1.93 | $191.07 |

| | Total Maximum | 1,000 | $193,000.00 | $1,930.00 | $191,070.00 |

| | | | | | |

| Series Margaret Reay 19 | Per Unit | 1 | $301.00 | $3.01 | $297.99 |

| | Total Maximum | 820 | $246,820.00 | $2,468.20 | $244,351.80 |

| | | | | | |

| Series Awe Hush 19 | Per Unit | 1 | $164.00 | $1.64 | $162.36 |

| | Total Maximum | 1800 | $295,200.00 | $2,952.00 | $292,248.00 |

| | | | | | |

| Series Exonerated 19 | Per Unit | 1 | $169.00 | $1.69 | $167.31 |

| | Total Maximum | 820 | $138,580.00 | $1,385.80 | $137,194.20 |

| | | | | | |

| Series Speightstown Belle 19 | Per Unit | 1 | $139.00 | $1.39 | $137.61 |

| | Total Maximum | 900 | $125,100.00 | $1,251.00 | $123,849.00 |

| | | | | | |

| Series Latte Da 19 | Per Unit | 1 | $35.00 | $0.35 | $34.65 |

| | Total Maximum | 4,100 | $143,500.00 | $1,435.00 | $142,065.00 |

| | | | | | |

| Series Midnight Sweetie 19 | Per Unit | 1 | $148.00 | $1.48 | $146.52 |

| | Total Maximum | 820 | $121,360.00 | $1,213.60 | $120,146.40 |

| | | | | | |

| Series Ambleside Park 19 | Per Unit | 1 | $205.00 | $2.05 | $202.95 |

| | Total Maximum | 410 | $84,050.00 | $840.50 | $83,209.50 |

| | | | | | |

| Series Athenian Beauty 19 | Per Unit | 1 | $47.00 | $0.47 | $46.53 |

| | Total Maximum | 1,800 | $84,600.00 | $846.00 | $83,754.00 |

| | | | | | |

| Series Apple Down Under 19 | Per Unit | 1 | $173.00 | $1.73 | $171.27 |

| | Total Maximum | 600 | $103,800.00 | $1,038.00 | $102,762.00 |

| | | | | | |

| Series Motion Emotion | Per Unit | 1 | $84.00 | $0.84 | $83.16 |

| | Total Maximum | 1,020 | $85,680.00 | $856.80 | $84,823.20 |

| | | | | | |

| Series Action Bundle (10) | Per Unit | 1 | $31.00 | $0.31 | $30.69 |

| | Total Maximum | 10,000 | $310,000.00 | $3,100.00 | $306,900.00 |

| | | | | | |

| Series Just Louise 19 | Per Unit | 1 | $229.00 | $2.29 | $226.71 |

| | Total Maximum | 1,020 | $233,580.00 | $2,335.80 | $231,244.20 |

| | | | | | |

| Series Lost Empire 19 | Per Unit | 1 | $35.00 | $0.35 | $34.65 |

| | Total Maximum | 10,200 | $357,000.00 | $3,570.00 | $353,430.00 |

| | | | | | |

| Series Cayala 19 | Per Unit | 1 | $91.00 | $0.91 | $90.09 |

| | Total Maximum | 4,100 | $373,100.00 | $3,731.00 | $369,369.00 |

| | | | | | |

| Series Consecrate 19 | Per Unit | 1 | $157.00 | $1.57 | $155.43 |

| | Total Maximum | 410 | $64,370.00 | $643.70 | $63,726.30 |

| | | | | | |

| Series Future Stars Stable (9) | Per Unit | 1 | $50.00 | $0.50 | $49.50 |

| | Total Maximum | 10,000 | $500,000.00 | $5,000.00 | $495,000.00 |

| | | | | | |

| Series Collusion Illusion (15) | Per Unit | 1 | $30.00 | $0.30 | $29.70 |

| | Total Maximum | 25,000 | $750,000.00 | $7,500.00 | $742,500.00 |

| | | | | | |

| Series Monomoy Girl | Per Unit | 1 | $46.00 | $0.46 | $45.54 |

| | Total Maximum | 10,200 | $469,200.00 | $4,692.00 | $464,508.00 |

| | | | | | |

| Series Got Stormy | Per Unit | 1 | $45.00 | $0.45 | $44.55 |

| | Total Maximum | 5,100 | $229,500.00 | $2,295.00 | $227,205.00 |

| | | | | | |

| Series Social Dilemma | Per Unit | 1 | $167.00 | $1.67 | $165.33 |

| | Total Maximum | 510 | $85,170.00 | $851.70 | $84,318.30 |

| | | | | | |

| Series Going to Vegas | Per Unit | 1 | $86.00 | $0.86 | $85.14 |

| | Total Maximum | 5,100 | $438,600.00 | $4,386.00 | $434,214.00 |

| | | | | | |

| Series Ari the Adventurer 19 | Per Unit | 1 | $85.00 | $0.85 | $84.15 |

| | Total Maximum | 5,100 | $433,500.00 | $4,335.00 | $429,165.00 |

| | | | | | |

| Series Wonder Upon a Star 19 | Per Unit | 1 | $37.00 | $0.37 | $36.63 |

| | Total Maximum | 10,000 | $370,000.00 | $3,700.00 | $366,300 |

| | | | | | |

| Series Silverpocketsfull 19 | Per Unit | 1 | $89.00 | $0.89 | $88.11 |

| | Total Maximum | 5,100 | $453,900.00 | $4,539.00 | $449,361.00 |

| | | | | | |

| Series Co Cola 19 | Per Unit | 1 | $106.00 | $1.06 | $104.94 |

| | Total Maximum | 5,100 | $540,600.00 | $5,406.00 | $535,194.00 |

| | (1) | The Company has engaged Dalmore Group, LLC (“Dalmore”), Member FINRA/SIPC, to act as the broker/dealer of record for all offerings and, thus, they will be entitled to a Brokerage Fee as reflected herein and described in greater detail under “Plan of Distribution and Subscription Procedure – Broker” and “– Fees and Expenses” and per the Broker-Dealer Agreement. |

| | | |

| | (2) | No underwriter has been engaged in connection with the Offering. The securities being offered hereby will only be offered by us and persons associated with us, in reliance on the exemption from registration contained in Rule 3a4-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend to distribute all offerings of membership interests in any series of the Company principally through the MyRacehorse™ Platform as described in greater detail under “Plan of Distribution and Subscription Procedure.” |

| | (3) | The use of proceeds for each Series assumes a fully subscribed Series, including interests previously issued under prior offerings of the applicable Series Interests, if any. |

| | (4) | The Company has authorized an offering of up to 600 series interests in Vertical Threat. The Company previously sold 63 series interests in Vertical Threat pursuant to an exemption based California intrastate offering permit (the “Prior Vertical Threat Sale”). These series interests were sold for $210 per series interest, the same price as in the Series Vertical Threat Offering. As a result, the Company is only offering a total of 537 Series Vertical Threat Interests in the Series Vertical Threat Offering under Regulation A. |

| | | |

| | (5) | On December 30, 2019, the Company approved a forward split of the Series Membership Interests of Series Big Mel (the “Series Big Mel Interests”), at a ratio of 5-for-1 (the “Split”). As a result of the foregoing, the total number of Series Big Mel Interests held by each member of Series Big Mel only will be converted automatically into the number of Series Big Mel Interests equal to (i) the number of issued and outstanding Series Big Mel Interests held by such member immediately prior to the Split, multiplied by (ii) 5. No fractional Series Big Mel Interests will be issued, and no cash or other consideration will be paid. The Series Big Mel Interests are held in electronic form with the Company’s transfer agent. Members do not have to take any action as the effect of the Split will be automatically reflected in each member’s online account. Immediately after the Split, each member’s percentage ownership interest in Series Big Mel will remain unchanged. The rights and privileges of the Series Big Mel members will be otherwise unaffected by the Split. As a result of the Split, the terms of the Series Big Mel Offering will be proportionally adjusted as follows: (i) the Total Maximum of Series Big Mel Interests offered will be increased to 5,100 and (ii) the price per Series Big Mel Interest will be decreased to $121. The overall value of Series Big Mel, including the aggregate offering amount of $617,100 and the corresponding use of proceeds will remain unchanged. The practical effect of the Split is to allow the Company to issue Series Big Mel Interests in smaller increments than originally contemplated without affecting any existing member’s percentage interests in Series Big Mel or the overall economics of the Series Big Mel Offering. See also the Company’s Form 1-U filed with the SEC on December 30, 2019. On March 25, 2020, the Company acquired an additional 9% interest in Big Mel, taking its total interest to 60%. As such, the Company has added an additional 900 Series Big Mel Interests to the Offering Statement to be qualified on the same terms as previously sold such that 6,000 total Series Big Mel Interests are authorized in Series Big Mel. On December 9, 2020, the Company purchased the remaining 40% ownership interest in Big Mel. As a result, Series Big Mel will now hold a 100% interest in Big Mel. In exchange, Series Big Mel now also has responsibility for 100% of the operating expenses associated with Big Mel. See also the Company’s Form 1-U filed with the SEC on December 11, 2020. On August 5, 2021, Big Mel was retired from racing and will be re-trained as an off track thoroughbred horse. After making the applicable, pro rata distribution payment to members of Series Big Mel, net of any and all expenses, the Manager intends to terminate and wind up Series Big Mel because Series Big Mel would no longer have any assets or liabilities. See also the Company’s Form 1-U filed with the SEC on August 10, 2021. |

| | | |

| | (6) | On March 25, 2020, the Company acquired an additional 9% interest in Solar Strike (Series Sunny 18), taking its total interest to 60%. As such, the Company has added an additional 900 Series Sunny 18 Interests to the Offering Statement to be qualified on the same terms as previously sold such that 6,000 Series Sunny 18 Interests are authorized in Series Sunny 18.

On July 27, 2020, the Company elected to geld Solar Strike due to health and safety concerns. Solar Strike still has the ability to race but will no longer be able to breed. In connection with the gelding, the Company and Spendthrift entered into an amendment to the Solar Strike Co-Ownership Agreement to clarify the right to geld and the effect of gelding on breeding rights and bonuses. See also the Company’s Form 1-U filed with the SEC on July 28, 2020. On November 23, 2020, the Company purchased the remaining 40% ownership interest in Solar Strike, the 2018 Colt that is the Underlying Asset of Series Sunny 18. As a result, Series Sunny 18 will now hold a 100% interest in Solar Strike. In exchange, Series Sunny 18 now also has responsibility for 100% of the operating expenses associated with Solar Strike. See also the Company’s Form 1-U filed with the SEC on November 30, 2020. On July 19, 2020, the Series Sunny 18 Offering was sold out and closed. On July 20, 2021, Solar Strike was sold for nominal value to a qualified individual. After making the applicable, pro rata distribution payment to members of Series Sunny 18, net of any and all expenses, the Manager intends to terminate and wind up Series Sunny 18 because Series Sunny 18 would no longer have any assets or liabilities. See also the Company’s Form 1-U filed with the SEC on July 26, 2021. |

| | (7) | Series The Filly Four is comprised of four (4) horses, (i) a 2018 Filly named, Venetian Sonata 18, (ii) a 2018 Filly named, My Sweet Addiction 18, (iii) a 2018 Filly named, My Lady Lauren 18, and (iv) a 2018 Filly named, Sapucai 18. |

| | | |

| | (8) | Series NY Exacta is comprised of two (2) horses, (i) a 2018 Filly named, Quick Conversation, and (ii) a 2018 Colt named, Psychedelic Shack |

| | | |

| | (9) | Series Future Stars Stable is comprised of fourteen (14) horses, (i) a 2019 Colt named, Man Among Men, (ii) a 2019 Filly named, Frosted Oats, (iii) a 2019 Filly named, Infinite Empire (formerly Tapitry 19), (iv) a 2019 Filly named, Sixtythreecaliber (formerly Classofsixtythree 19), (v) a 2019 Colt named, Provocateur (formerly Cayala 19), (vi) a 2019 Filly named, A Mo Reay (formerly Margaret Reay 19), (vii) a 2019 Colt named, Can’t Hush This (formerly Awe Hush 19), (viii) a 2019 Filly named, Above Suspicion (formerly Exonerated 19), (ix) a 2019 Colt named, Ancient Royalty (formerly Speightstown Belle 19), (x) a 2019 Filly named, Sacred Beauty (formerly Consecrate 19), (xi) a 2019 Filly named Inalattetrouble (formerly Latte Da 19), (xii) a 2019 Filly named, Dolce Notte (formerly Midnight Sweetie 19), (xiii) a 2019 Colt named, Lookwhogotlucky (formerly Ambleside Park 19), and (xiv) a 2019 Colt named, Quantum Theory (formerly Athenian Beauty 19. On December 18, 2020, the Company filed Post-Qualification Amendment No. 20 to its offering statement on Form 1-A with the SEC and disclosed that all of the Series Interests offered for Series Future Stars Stable were sold out as of November 21, 2020. However, certain investors that tried to purchase Series Interests of Series Future Stars Stable were not able to complete their transaction because of failed ACH payment attempts. As a result, the Company is reoffering only those remaining amounts of Series Interests in Series Future Stars Stable that were not sold. On April 26, 2021, Ancient Royalty, one of the underlying assets of Series Future Stars Stable, died. The Company held mortality insurance on Ancient Royalty. See the Company’s Form 1-U filed with the SEC on April 30, 2021. Due to the value of mortality insurance and the large volume of other assets in Series Future Stars Stable, the Series Future Stars Stable Offering will remain active. |

| | | |

| | (10) | Series Action Bundle is comprised of three (3) horses: (i) a 2017 Filly named His Glory, (ii) a 2015 Filly named Altea, and (iii) a 2016 Filly named Bohemian Bourbon. |

| | | |

| | (11) | On April 2, 2021, the Company purchased the remaining 20% ownership interest in Deep Cover, the 2018 Colt that is the Underlying Asset of Series Deep Cover. As a result, Series Deep Cover will now hold a 100% interest in Deep Cover. In exchange, Series Deep Cover now also has responsibility for 100% of the operating expenses associated with Deep Cover as of March 28, 2021. See also the Company’s Form 1-U filed with the SEC on April 7, 2021. |

| | | |

| | (12) | The Company has authorized an offering of up to 600 series interests in Carpe Vinum (f.k.a. Martita Sangrita 17). The Company previously sold 24 series interests in Carpe Vinum pursuant to an exemption based California intrastate offering permit (the “Prior Carpe Vinum Sale”). These series interests were sold for $320 per series interest, the same price as in the Series Martita Sangrita 17 Offering. As a result, the Company is only offering a total of 576 Series Martita Sangrita 17 Interests in the Series Martita Sangrita 17 Offering under Regulation A. |

| | | |

| | (13) | The Company has authorized an offering of up to 600 series interests in Tizamagician. The Company previously sold 261 series interests in Tizamagician pursuant to an exemption based California intrastate offering permit (the “Prior Tizamagician Sale”). These series interests were sold for $320 per series interest, the same price as in the Series Tizamagician Offering. As a result, the Company is only offering a total of 339 Series Tizamagician Interests in the Series Tizamagician Offering under Regulation A. |

| | | |

| | (14) | On March 9, 2021, the Company purchased the remaining 40% ownership interest in Lane Way, the 2017 Colt that is the Underlying Asset of Series Lane Way. As a result, Series Lane Way will now hold a 100% interest in Lane Way. In exchange, Series Lane Way now also has responsibility for 100% of the operating expenses associated with Lane Way. See also the Company’s Form 1-U filed with the SEC on March 15, 2021. |

| | | |

| | (15) | As of December 31, 2020, Series Interests in Series Collusion Illusion were fully subscribed. However, certain investors that tried to purchase Series Interests in Series Collusion Illusion were not able to complete their transaction either because of (a) failed ACH payment attempts, or (b) a cancellation/refund of such transaction. As a result, the Company is reoffering only those remaining amounts of Series Interests in Series Collusion Illusion that were not sold. |

| | (16) | On December 30, 2020, the Company purchased the remaining 45% ownership interest in Amandrea, the 2016 Filly that is the Underlying Asset of Series Amandrea, for $11,250. As a result, Series Amandrea will now hold a 100% interest in Amandrea. In exchange, Series Amandrea now also has responsibility for 100% of the operating expenses associated with Amandrea. See also the Company’s Form 1-U filed with the SEC on January 6, 2021. On July 12, 2021, Amandrea was sold at public auction as a broodmare prospect for $7,000. After making the applicable, pro rata distribution payment to members of Series Amandrea, net of any and all expenses, the Manager intends to terminate and wind up Series Amandrea because Series Amandrea would no longer have any assets or liabilities. See also the Company’s Form 1-U filed with the SEC on July 16, 2021. |

| | (17) | On September 24, 2021, Mo Mischief, the Underlying Asset of Series Mo Mischief, was entered into a claiming race. Mo Mischief was claimed and thereby sold for $25,000, the listed claiming price. In addition, Mo Mischief won the claiming race and thus earned net race earnings from the race a portion of which are revenues to Series Mo Mischief. After making the applicable, pro rata distribution payment to members of Series Mo Mischief, net of any and all expenses, the Manager intends to terminate and wind up Series Mo Mischief because Series Mo Mischief would no longer have any assets or liabilities See also the Company’s Form 1-U filed with the SEC on September 30, 2021. |

| | (18) | The following offerings were terminated/closed: |

| | • | On February 6, 2020, the Series Palace Foal Offering was terminated prior to any securities being offered. |

| | • | On September 6, 2019, the Series De Mystique ‘17 Offering was sold out and closed. |

| | • | On October 18, 2019, the Series Martita Sangrita 17 Offering was sold out and closed. |

| | • | On September 23, 2019, the Series Daddy’s Joy Offering was sold out and closed. |

| | • | On January 22, 2020, Shake it Up Baby died. The Company held mortality insurance on Shake it Up Baby. See the Company’s Form 1-U filed with the SEC on February 6, 2020. |

| | • | On September 9, 2019, the Series Tizamagician Offering was sold out and closed. |

| | • | On October 11, 2019, the Series Power Up Paynter Offering was sold out and closed. |

| | • | On October 26, 2019, the Series Wayne O Offering was sold out and closed. |

| | • | On or around November 30, 2020, Wayne O, the 2017 Colt that is the Underlying Asset of Series Wayne O, was gelded. See also the Company’s Form 1-U filed with the SEC on November 30, 2020. |

| | • | On December 22, 2019, Augusta Moon, one of the two Underlying Assets of Series New York Claiming Package, was claimed/purchased from a race for $35,000. The sale contains no other material terms and conditions. As a result of Augusta Moon being sold, the Company plans to issue a dividend of $65.93 per each Series New York Claiming Package Membership Interest which dividend represents such member’s pro rata share of the sale proceeds from the claim, the unused training reserve, unused insurance and the unrealized manager fee. See also the Company’s Form 1-U filed with the SEC on December 30, 2019. As a result of the claiming of Augusta Moon, the Series New York Claiming Package Offering was closed. |

| | • | On May 25, 2020, the Series Lane Way Offering was sold out and closed. |

| | • | On June 1, 2020, the Series Big Mel Offering was sold out and closed. |

| | • | On July 9, 2020, Annahilate, the 2017 Colt that is the Underlying Asset for Series Two Trail Sioux 17, suffered a fracture to his lateral sesamoid in his front left limb after a workout. Although this injury is not life threatening, the nature of this injury is career ending. Because Annahilate will no longer be able to generate revenue since he will need to be retired from racing, the Series Two Trail Sioux 17 was closed. As a result, the Manager will terminate and wind up Series Two Trail Sioux 17 because Series Two Trail Sioux 17 would no longer have any assets or liabilities. See also the Company’s Form 1-U filed with the SEC on July 15, 2020. |

| | • | On July 28, 2020, the Company elected to geld Solar Strike due to health and safety concerns. Solar Strike still has the ability to race and generate revenues but will no longer be able to breed. In connection with the gelding, the Company and Spendthrift entered into an amendment to the Solar Strike Co-Ownership Agreement to clarify the right to geld and the effect of gelding on breeding rights and bonuses. See also the Company’s Form 1-U filed with the SEC on July 28, 2020. As a result, the Series Sunny 18 offering was closed. On July 20, 2021, Solar Strike was sold for nominal value to a qualified individual due to Solar Strike’s training history and having been gelded. After making the applicable, pro rata distribution payment to members of Series Sunny 18, net of any and all expenses, the Manager intends to terminate and wind up Series Sunny 18 because Series Sunny 18 would no longer have any assets or liabilities. See also the Company’s Form 1-U filed with the SEC on July 26, 2021. |

| | • | On September 18, 2020, the Series Vertical Threat Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Amandrea Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Keertana 18 Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Lazy Daisy Offering was sold out and closed. |

| | • | On September 18, 2020, the Series The Filly Four Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Mo Mischief Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Deep Cover Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Popular Demand Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Authentic Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Storm Shooter Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Naismith Offering was sold out and closed. |

| | • | On September 18, 2020, the Series NY Exacta Offering was sold out and closed. |

| | • | On September 18, 2020, the Series Thirteen Stripes Offering was sold out and closed. |

| | • | On November 9, 2020, Authentic, the 2017 Colt that is the Underlying Asset for Series Authentic, was retired from racing and began his stud career. See also the Company’s Form 1-U filed with the SEC on November 12, 2020. |

| | • | On November 16, 2020, the Series Man Among Men Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Frosted Oats Offering was sold out and closed. |

| | • | On November 16, 2020, the Series Tapitry 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Classofsixtythree 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Margaret Reay 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Awe Hush 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Exonerated 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Speightstown Belle 19 Offering was sold out and closed. |

| | • | On April 26, 2021, Ancient Royalty, the underlying asset of Series Speightstown Belle 19, died. The Company held mortality insurance on Ancient Royalty. See the Company’s Form 1-U filed with the SEC on April 30, 2021. |

| | • | On November 17, 2020, the Series Latte Da 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Midnight Sweetie 19 Offering was sold out and closed. |

| | • | On November 16, 2020, the Series Ambleside Park 19 Offering was sold out and closed. |

| | • | On November 16, 2020, the Series Athenian Beauty 19 Offering was sold out and closed. |

| | • | On January 16, 2021, the Series Apple Down Under 19 Offering was sold out and closed. |

| | • | On April 2, 2021, the Series Motion Emotion Offering was terminated prior to any securities being offered. |

| | • | On April 2, 2021, the Series Action Bundle Offering was terminated prior to any securities being offered. |

| | • | On April 14, 2021, the Series Just Louise 19 Offering was sold out and closed. |

| | • | On May 6, 2021, the Series Lost Empire 19 Offering was sold out and closed. |

| | • | On May 11, 2021, the Series Future Stars Stable Offering was sold out and closed. |

| | • | On January 4, 2021, the Series Collusion Illusion Offering was sold out and closed. |

| | • | On June 2, 2021, the Series Monomoy Girl Offering was sold out and closed. |

| | • | On June 24, 2021, the Series Got Stormy Offering was sold out and closed. |

| | • | On June 24, 2021, the Series Social Dilemma Offering was sold out and closed. |

| | • | On July 18, 2021, the Series Going to Vegas Offering was sold out and closed. |

| | • | On May 21, 2021, the Series Ari the Adventurer 19 Offering was sold out and closed. |

| | • | On June 25, 2021, the Series Wonder Upon a Star 19 Offering was sold out and closed. |

| | • | On August 6, 2021, the Series Silverpocketsfull 19 Offering was sold out and closed. |

| | • | On November 18, 2020, the Series Cayala 19 Offering was sold out and closed. |

| | • | On November 17, 2020, the Series Consecrate 19 Offering was sold out and closed. |

| | ∙• | On August 11, 2021, the Series Co Cola 19 Offering was sold out and closed. |

My Racehorse CA LLC, a Nevada series limited liability company (“we,” “us,” “our,” “MRH” or the “Company”) is offering, on a best efforts basis, up to the amount of membership interests of each of the series of the Company (the “Maximum”) without any minimum target as set forth in the above table entitled “Series Membership Interests Overview.”

All of the series of the Company offered hereunder may collectively be referred to herein as the “Series” and each, individually, as a “Series”. The interests of all Series described above may collectively be referred to herein as the “Interests” and each, individually, as an “Interest” and the offerings of the Interests may collectively be referred to herein as the “Offerings” and each, individually, as an “Offering”.

An Offering Circular, presented in Offering Circular format, was filed with the Securities and Exchange Commission (the “Commission”) with respect to the Series Palace Foal Offering and was qualified by the Commission on February 22, 2019 (the “Original Offering Circular”). This Post-Qualification Amendment No. 30 to the Original Offering Circular describes each individual Series set forth in the above table entitled “Series Membership Interests Overview.”

Series Interests are available for purchase exclusively through the MyRacehorse™ Platform and will be issued in book-entry electronic form only. StartEngine Secure LLC has been engaged as the Company’s SEC-registered transfer agent and registrar of the Series Interests pursuant to Section 17A(c) of the Exchange Act.

A purchaser of the Interests shall be deemed an “Investor” or “Interest Holder.” There will be separate closings with respect to each Offering. The Company will commence such offerings within two calendar days of qualification with the SEC as provided in Rule 251(d)(3)(i)(F). The Company may undertake one or more closings on a rolling basis with respect to each Offering (each, a “Closing”). After each Closing, funds tendered by Investors will be available to the Company. Because the Offering is being made on a best efforts basis and without a minimum offering amount, the Company may close the offering at any level of proceeds raised. Each such Offering shall be terminated on the earlier of (i) the date subscriptions for the Maximum Interests of such Series have been accepted, (ii) a date determined by the Manager in its sole discretion, or (iii) the date which is one year from the date this Offering Circular is qualified by the Commission which period may be extended by an additional six months by the Manager in its sole discretion.

No securities are being offered by existing security holders. Each Offering is being conducted under Regulation A (17 CFR 230.251 et. seq.) and the information contained herein is being presented in Offering Circular format. See “Plan of Distribution and Subscription Procedure” and “Description of Interests Offered” for additional information.

GENERALLY, NO SALE MAY BE MADE TO YOU IN ANY OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sales of these securities in, any state in which such offer, solicitation or sale would be unlawful before registration or qualification of the offer and sale under the laws of such state.

An investment in the Interests involves a high degree of risk. See the section titled, “Risk Factors”, herein for a description of some of the risks that should be considered before investing in the Interests.

TABLE OF CONTENTS

MY RACEHORSE CA LLC

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding:

| | ∙ | our development plans for our business; |

| | ∙ | our strategies and business outlook; |

| | ∙ | the racing prospects for the respective Underlying Assets; |

| | ∙ | potential distributions or dividends of race winnings and other revenue sources; |

| | ∙ | anticipated development of the Company, the Manager and each Series of the Company; |

| | ∙ | the overall growth of the horse racing industry; |

| | ∙ | our compliance with regulatory matters (including the Investment Company Act, Investment Advisers Act and state securities regulations); |

| | ∙ | the development of the MyRacehorse™ Platform (defined below); and |

| | ∙ | various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). |

These forward-looking statements express the Manager’s expectations, hopes, beliefs, and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates”, “believes”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “might”, “plans”, “possible”, “potential”, “predicts”, “projects”, “seeks”, “should”, “will”, “would” and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. Neither the Company nor the Manager can guarantee future performance, or that future developments affecting the Company, the Manager or the MyRacehorse™ Platform will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the parties’ assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

OFFERING SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere herein and in the Exhibits hereto. You should read the entire Offering Circular and carefully consider, among other things, the matters set forth in the section captioned “Risk Factors.” You are encouraged to seek the advice of your attorney, tax consultant, and business advisor with respect to the legal, tax, and business aspects of an investment in the Interests. All references in this Offering Circular to “$” or “dollars” are to United States dollars.

| The Company: | The Company is My Racehorse CA LLC, a Nevada series limited liability company formed on December 27, 2016. |

| | |

| Underlying Asset(s) and Offering Per Series Interest: | The Underlying Asset for each Series and the Offering Price per Interest for each respective Series is set forth in the description for such asset herein. |

| | The assets of all Series described below may collectively be referred to herein as the “Underlying Assets” and each, individually, as an “Underlying Asset.” It is not anticipated that any of the Series would own any assets other than said interest in such Underlying Asset, plus certain prepaid cash reserves for insurance and other administrative expenses pertaining to the Series and amounts earned from the monetization of such Underlying Asset. |

| Securities Offered: | Investors will acquire membership interests in a Series of the Company, each of which is intended to be a separate series of the Company for purposes of assets and liabilities. It is intended that owners of interests in a Series will only have assets, liabilities, profits and losses pertaining to the specific Underlying Assets owned by that Series. For example, an owner of interests in Series Carrothers will only have an interest in the assets, liabilities, profits and losses pertaining to Series Carrothers and its related operations and not as it relates to Series Echo Warrior 19 or any other series. See the “Description of Interests Offered” section for further details. The Interests will be non-voting except with respect to certain matters set forth in the Amended and Restated Series Limited Liability Company Agreement of the Company (the “Operating Agreement”). The purchase of membership interests in a Series of the Company is an investment only in that Series (and with respect to that Series’ Underlying Asset) and not an investment in the Company as a whole. |

| | |

| Investors: | Each Investor must be a “qualified purchaser.” See “Plan of Distribution and Subscription Procedure – Investor Suitability Standards” for further details. The Manager may, in its sole discretion, decline to admit any prospective Investor, or accept only a portion of such Investor’s subscription, regardless of whether such person is a “qualified purchaser”. |

| Manager: | Experiential Squared, Inc., a Delaware corporation, will serve as the manager of the Company and of each Series (the “Manager”) pursuant to that certain Management Services Agreement (the “Management Agreement”). Experiential Squared, Inc., also owns and operates a mobile app-based investment platform called MyRacehorse™ (the MyRacehorse™ platform and any successor platform used by the Company for the offer and sale of interests, the “MyRacehorse™ Platform”), which is licensed to the Company pursuant to the terms of the Management Agreement, through which the Interests are sold. The Manager and/or its affiliates may, from time to time, purchase Interests at their discretion on the same terms and conditions as the Investors. The Company, the Manager, its affiliates and/or third parties may also (1) acquire horses that are listed on MyRacehorse.com pursuant to a promissory note between the Series and lender or (2) have the Series acquire the horses upon close of the respective offering. In many instances, said lender will have a right, prior to completion of the Offering, to participate in pre-closing dividends from revenue generated by its interest in the Underlying Asset and the right to convert into the unsold portion of the offering prior to being fully funded. |

| | |

| Broker: | The Company has entered into an agreement with Dalmore Group, LLC (“Dalmore” or the “Broker”) a New York limited liability company and a broker-dealer which is registered with the Commission and is registered in each state where such Offering will be made prior to the launch of such Offering. Dalmore will act as the broker/dealer of record for each transaction and provide related services in connection with such Offering as described in the Broker-Dealer Agreement incorporated by reference as Exhibit 6.60. Dalmore is a member of FINRA. |

| | |

| Minimum Interest purchase: | The minimum subscription by an Investor is 1 Interest in a Series. Notwithstanding the foregoing, the Manager has discretion to increase the minimum subscription by an Investor to greater than 1 Interest in a Series. |

| Purchase Price Consideration; Gift Cards: | The Purchase price for an Investor’s subscription will be payable in cash in United States Dollars at the time of subscription. In addition, the Company sells gift cards for cash that are redeemable only on www.myracehorse.com for merchandise, race track experiences and also as consideration for the purchase of Interests. The gift cards are valued at the cash value paid (e.g. if a purchaser pays $100 they get a gift card with a $100 value), are not redeemable for cash, (except as required by applicable law) have no expiration date and may be used solely on myracehorse.com. There are no discounts, differentiated pricing or other more favorable offering terms given or credited to investors that use gift cards in connection with the purchase of Interests. To the extent even a $1 balance on a gift card remains, it can be used towards the purchase of Interests in combination with cash. The recipient or user of a gift card will still need to qualify as a “qualified purchaser” to invest and will be subject to the same subscription process as investors that subscribe for cash. See “Investor Suitability Standards” and “Plan of Distribution and Subscription Procedure” for more information. |

| | |

| Offering size: | There is no minimum offering amount for the sale of Interests in each Offering. The Maximum Interests offered per Series is set forth in the “Series Membership Interests Overview” table set forth above. |

| Offering Period: | There will be a separate closing for each Offering. Each Offering is being conducted on a best efforts basis without any minimum target. The Company may undertake one or more closings on a rolling basis for each Offering. After each closing, funds tendered by Investors will be available to the Company. Because each Offering is being made on a best efforts basis and without a minimum offering amount, the Company may close each Offering at any level of proceeds raised. Each respective Offering shall be terminated on the earlier of (i) the date subscriptions for the Maximum Interests of such Series have been accepted, (ii) a date determined by the Manager in its sole discretion, or (iii) the date which is one year from the date this Offering Circular is qualified by the Commission which period may be extended by an additional six months by the Manager in its sole discretion. |

| Additional Investors: | After the Closing of each Offering, no Member will be required to make additional capital contributions. If a Series’ funds are insufficient to meet the needs of the Series, the Manager may (a) advance funds and not seek reimbursement, (b) loan funds to such Series, on which the Manager may impose a reasonable rate of interest, which shall not be lower than the Applicable Federal Rate (as defined in the Internal Revenue Code), and be entitled to reimbursement of such amount from future revenues generated by such Series, and/or (c) cause additional Interests to be issued in order to cover such additional amounts. |

| | In the event that the Manager determines to issue additional Interests (as described in (c) above), the Manager shall notify the Members of the need for additional capital and the Members may be permitted, but not required, to make additional capital contributions to the Series on a pro-rata basis. In the event all Members do not make additional capital contributions, the Manager has discretion to sell additional Interests to third parties to meet the capital needs of such Series. |

| Use of proceeds: | The proceeds received by a Series from its respective Offering will be applied in the following order of priority of payment: (i) Brokerage Fee: A fee equal to 1.0% of the amount raised through this Offering (which excludes any Interests purchased by the Manager, its affiliates or the Horse Sellers) paid to Dalmore as compensation for brokerage services; (ii) Due Diligence Fee: A fee equal to approximately 15.0% of the amount raised through this Offering, on average, paid to Manager as compensation for due diligence services in evaluating, investigation and discovering the Underlying Assets (fee is subject to change in sole discretion of Manager as disclosed in each Series Agreement); (iii) Bloodstock Fee: A fee up to 5.0% of the cost of the Underlying Asset paid to the Manager, an affiliate of the Manager, or a third party service provider as compensation for bloodstock services for creating and facilitating breeding plans for the Underlying Asset, analyzing pedigrees to assess the Underlying Asset’s value, and purchasing and/or selling the Underlying Asset on behalf of the Company; (iv) Asset Cost of the Underlying Asset: Actual cost of the Underlying Asset paid to the Horse Seller (which may have been paid off prior to such Offering through a loan to the Company), including any accrued interest under potential loans to the Company and through down-payments by the Manager and/or its affiliates to acquire an interest in the Underlying Asset prior to an Offering; and (v) Offering Expenses: In general these costs include actual legal, accounting, underwriting, filing and compliance costs incurred by the Company in connection with an Offering of a series of Interests (and excludes ongoing costs described in Operating Expenses), as applicable, paid to legal advisors, printing and accounting firms, as the case may be. In the case of the Offerings hereunder, the Manager has agreed to pay and not be reimbursed for Offering Expenses. The Manager bears all expenses related to item (iv) above on behalf of a Series and may be reimbursed by a Series through the proceeds of a successful offering. In addition, the Manager or an affiliate may loan the Company or a Series the funds required to pay any costs identified in items (ii) and (iii), which will be reimbursed through the proceeds of a successful offering or refunded if an offering is aborted. Any loans made under item (iv), other than down-payments, accrue interest at the Applicable Federal Rate (as defined in the Internal Revenue Code). See “Use of Proceeds” and “Plan of Distribution and Subscription Procedure – Fees and Expenses” sections for further details. |

| Operating expenses: | “Operating Expenses” are costs and expenses attributable to the activities of the Series (collectively, “Operating Expenses”), which may be as much as or greater than the actual cost of a Series’ interest in the applicable Underlying Asset, including: |

| | • | costs incurred in managing the Underlying Asset, including, but not limited to boarding, maintenance, training and transportation costs (the “Upkeep Fees”); |

| | • | costs incurred prior to the offering of the Underlying Asset, including, but not limited to costs associated with the initial acquisition of the Underlying Asset, vet checks, blood stock fees, etc. related to the pre-offering operation of the Underlying Asset (“Prepaid Expenses”), and, to the extent that Prepaid Expenses are lower than anticipated, any overage would be maintained in an operating account for future Operating Expenses and/or Distributable Cash which occur after the acquisition of the Underlying Asset; |

| | • | costs incurred in preparing any reports and accounts of the Series, including any tax filings and any annual audit of the accounts of the Series (if applicable) or costs payable to any third party registrar or transfer agent and any reports to be filed with the Commission including periodic reports on Forms 1-K, 1-SA and 1-U; |

| | • | any indemnification payments; and |

| | • | any and all insurance premiums or expenses in connection with the Underlying Asset, including mortality, loss of use, liability and/or medical insurance of the Underlying Asset to insure against the death, injury or third party liability of racehorse ownership (as described in “Description of the Business – Business of the Company”). The decision to purchase insurance on a horse is made on a horse-by-horse basis. THERE IS NO GUARANTEE THAT A HORSE YOU INVEST IN WILL BE INSURED. |

| | The Company has purchased mortality insurance for Carrothers, Echo Warrior 19, Micro Share (f.k.a. Who’sbeeninmybed 19), Malibu Mayhem (f.k.a Into Summer 19), Mrs Whistler, Chasing Time (f.k.a Race Hunter 19), Vow, Magical Ways (f.k.a. You Make Luvin Fun 19), Miss Sakamoto, Tap the Gavel (f.k.a. Courtisane 19), Cornice Traverse (f.k.a Grand Traverse Bay 19), Our Miss Jones 19, Straight No Chaser (f.k.a Margarita Friday 19), Regal Rebel (f.k.a. Queen Amira 19), Salute to America, Desire Street 19, Duke of Love, War Safe, Tufnel, Classic Cut, Essential Rose 20, Who Runs the World, Balletic, and Song of Bernadette 20. |

| | For certain Offerings, the Manager has agreed to pay and not be reimbursed for Operating Expenses related to each Series incurred prior to Closing. In such instances, only Operating Expenses incurred post-Closing shall be the responsibility of a Series. See “Use of Proceeds” for each such Series for reference to inclusion of Prepaid Expenses in Operating Expenses for a Series-by-Series determination. |

| | We anticipate that for a majority of the Offerings, we will allocate a sizable portion of such Offering to a cash reserve to be spent on Upkeep Fees which cover operating expenses related specifically to the training, upkeep and maintenance of the applicable Underlying Asset. However, if the Operating Expenses exceed the amount of revenues generated from the applicable Underlying Asset, the Manager may (a) pay such Operating Expenses and not seek reimbursement, (b) loan the amount of the Operating Expenses to such Series, on which the Manager may impose a reasonable rate of interest, which shall not be lower than the Applicable Federal Rate (as defined in the Internal Revenue Code), and be entitled to reimbursement of such amount from future revenues generated by such Series (“Operating Expenses Reimbursement Obligation(s)”), and/or (c) cause additional Interests to be issued in order to cover such additional amount. In such cases, until a Series generates revenues from its interest in the applicable Underlying Asset, we expect a Series to, initially, deplete only the Upkeep Fees. We may incur Operating Expenses Reimbursement Obligations or the Manager pays such Operating Expenses incurred and will not seek reimbursement if Operating Expenses exceed revenues and Upkeep Fees. See discussion of “Description of the Business – Operating Expenses” for additional information. From time to time, certain Offerings will not have an allocated upfront cash reserve for Upkeep Fees as part of such Offering proceeds. Instead, the Manager or an affiliate will, in connection with such Offering, incur liabilities related to Upkeep Fees on behalf of the Series and be entitled to reimbursement of such amount only upon a sale of the Underlying Asset or a dissolution or termination of such Series and not from Distributable Cash (as defined below) from ongoing revenues generated by such Series. Notwithstanding the foregoing, in these types of Offerings, there will still exist a smaller pre-paid cash reserve for Prepaid Expenses and insurance, administrative and general Operating Expenses which is intended to cover three years of such projected Operating Expenses (excluding Upkeep Fees). In addition, the Manager, in these types of Offerings, retains discretion to also (a) loan the amount of the Operating Expenses to such Series, on which the Manager may impose a reasonable rate of interest, which shall not be lower than the Applicable Federal Rate (as defined in the Internal Revenue Code), and/or (b) cause additional Interests to be issued in order to cover such additional amounts. Regardless of the type of Offering, an Interest Holder will be liable only to the extent of their agreed upon capital contributions and, if no such capital remains at dissolution, such Interest Holder will not be liable for the failure of a Series to repay its underlying debt or liabilities, including the Operating Expenses Reimbursement Obligations. |

| | |

| Further issuance of Interests: | A further issuance of Interests of a Series may be made in the event the Operating Expenses of that Series exceed the income generated from its interest in the Underlying Asset and cash reserves of that particular Series. This may occur if the Company does not take out sufficient amounts under an Operating Expenses Reimbursement Obligation to pay such excess Operating Expenses, or the Manager does not pay such amounts without seeking reimbursement. |

| Co-Ownership Agreements; Bonuses; Kickers: | The Company, through individual Series, intends to purchase interests in racehorses, but generally will not own 100% of such horse. The Series’ percentage ownership in a specific horse is determined on a series-by-series basis. This means that the Series will enter into an agreement with other owners of the Underlying Asset (“Co-Owners”) which will govern the rights of the Series vis-à-vis the other Co-Owners and the Underlying Asset (the “Co-Ownership Agreements”). As an owner of a racehorse, the individual Series will receive a percentage of the purse winnings that is equal to its ownership percentage, as well as other revenue-generating events including, but not limited to claiming races (which may result in a sale of a racehorse held by a series), race Bonuses (as described below), sales of the racehorse, marketing or sponsorship activities and the sale of future breeding rights less expenses and liabilities (including “Kickers” if any as described below). Similarly, the individual Series will be responsible for the expenses of the racehorse at a rate equal to its ownership percentage. These expenses will often be payable directly by the Series. Copies of such Co-Ownership Agreements for each respective Series are attached as exhibits hereto and descriptions of such terms are included with each Series’ respective description herein. Certain of the Series’ Co-Ownership Agreements may include bonuses related to winning of graded stakes races in the form of future stallion bonuses (“Future Stallion Bonuses”) or future broodmare bonuses (“Future Broodmare Bonuses, and together with Future Stallion Bonuses, “Bonuses”). Such Bonuses may be voided prior to being earned to the extent a decision is made by the Co-Owners to geld the Stallion in the discretion of the Manager or the Syndicate Manager (typically due to health and safety concerns or to better maximize its racing career prospects). These Bonuses will be distributable (less expenses, reserves, etc.) as in the same manner generic race winnings as described in “Distributable Cash” below. |

| | In addition, certain Co-Ownership Agreements may be negotiated with the original Horse Seller for a payment to Horse Seller upon a horse winning certain races or awards (the “Kickers”). Kickers are contractual obligations of a Series to the original seller of a horse which could result in a payment obligation to the original horse seller upon the happening of certain events like Grade 1 race wins. They act as a “performance bonus” and are tied to certain revenue-generating events in the life of the Series. In the event that a co-ownership agreement contains a Kicker, the campaign page, which screenshots are included in each series description contained herein, will contain express descriptions of the Kicker, its terms and its impact on such Series. Such Kickers are payable out of race winnings but are often offset but the upside associated with lifetime breeding rights which, although it may reduce the short-term Distributable Cash of a Series, can significantly increase the long-term value of a Series whether upon a sale of the Underlying Asset or the future revenue generated by lifetime breeding rights. Each Kicker can be generally seen as a contingent liability of that Series that, when triggered, becomes a liability payable by that Series prior to any distributions to that Series’ members. This is the same case as it relates to any expenses of the Series or reserves needed to be maintained for the ongoing operations of such Series. As a result of such liability, Distributable Cash (as defined below) may be considerably less than stated race winnings. In any event, a Series member will be liable only to the extent of their agreed upon capital contributions and, if no such capital remains at dissolution or at the time a Kicker payment is due, such Series member will not be liable for the failure of a Series to repay its underlying debt or liabilities, including the payment of any Kickers. |

| | |

| Racing Leases: | As an alternative to the Co-Ownership structures discussed above, which include the purchase, sale and breeding rights associated with the full ownership of a horse, for certain Series, the Company, through individual Series, may enter into lease agreements or “racing leases” which will entitle the Series to the exclusive right to “all of the racing qualities of an ownership interest in the horse” including the operation of such horse during a set racing term (typically 1 year) in exchange for an upfront lease fee. The Series’ percentage lease interest in a specific horse is determined on a series-by-series basis. This means that the Series will enter into an agreement with other owners of the Underlying Asset (“Owners”) which will govern the rights of the Series during the lease term and the operation of the Underlying Asset (the “Lease Agreement”). As the lessee of a racehorse, the individual Series will receive a percentage of the purse winnings that is equal to its lessee percentage, as well as other revenue-generating events as well as marketing and advertising related revenues. Similar to the Co-Ownership arrangements, the individual Series in the Lease Agreement will be responsible for the expenses of the racehorse at a rate equal to its lessee percentage. These expenses will often be payable directly by the Series. At the end of such lease term, however, the ownership rights in the horse revert back to the Owner along with the obligation to cover any future expenses associated with such horse. In the event that the Owner intends to retire the horse and elects to terminate the Lease Agreement due to health, breeding or economic interest concerns, the pro rata portion of the lease fee remaining on the Series will be re-paid to the Series. The Company’s intent with racing leases is to capture the value of the racing career of said horse without the complexities, time and expense associated with the purchase, sale or breeding of a horse outside of its useful racing life. Copies of such Lease Agreements for each respective Series, and any amendments to such Lease Agreements, if applicable, are attached as exhibits hereto and descriptions of such additional terms are included with each Series’ respective description herein. |

| Distributable Cash: | “Distributable Cash” shall mean the net income (as determined under U.S. generally accepted accounting principles (“GAAP”)) generated by a Series plus any change in net working capital and depreciation and amortization (and any other non-cash Operating Expenses) for such Series and less any liabilities (including obligations to pay Kickers to Horse Sellers) related to its interest in the applicable Underlying Asset. The Manager may maintain Distributable Cash funds in a deposit account or an investment account for the benefit of each Series. A Series will typically generate Distributable Cash from revenue-generating events of such Series. The frequency with which such event occurs, or the timing of when such revenue is actually distributed to Members, is dependent on the racing schedule of the Underlying Asset, cash reserves in such Series, ongoing contractual obligations of a Series, potential sales of the Underlying Asset, the terms of such Series’ Co-Ownership Agreement and other revenue-generating events which do not occur on a fixed or set time period (e.g. quarterly or monthly) but which will recur on an ongoing basis so long as revenue is generated. |

| Management Fee: | As compensation for the services provided by the Manager under the Management Agreement, the Manager will be paid an initial one-time 15% Due Diligence Fee from each Series and a subsequent fee of 10% of Gross Proceeds generated by each Series. “Gross Proceeds” is defined as the sum of all money generated by a Series, prior to any deductions that have been made or will be used for expenses. In the event that the Manager performs bloodstock services for an Underlying Asset, the Manager will also be paid up to 5.0% of the cost of the Underlying Asset for providing such services. The Management Fee does not accumulate if no Gross Proceeds are generated. The Management Fee is due only upon each revenue-generating event of such Series. The frequency with which such event occurs is dependent on the racing schedule of the Underlying Asset, cash reserves in such Series, potential sales of the Underlying Asset, the terms of such Series’ Co-Ownership Agreement and other revenue-generating events which do not occur on a fixed or set time period (e.g. quarterly or monthly) but which will recur on an ongoing basis so long as revenue is generated. |

| Distribution Rights: | The Manager has sole discretion in determining what distributions of Distributable Cash, if any, are made to Interest Holders of a Series. Any Distributable Cash generated by a Series from the utilization of the Underlying Asset shall be applied by that Series in the following order of priority (after payment of liabilities, including contractual obligations under Co-Ownership Agreements, if any): |