Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant þ

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☑ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

The Walt Disney Company

(Name of Registrant as Specified in Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Nelson Peltz

Peter W. May

Matthew Peltz

Josh Frank

James A. Rasulo

Trian Partners, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Co-Investment Opportunities Fund, Ltd.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Strategic Investment Fund-N, L.P.

Trian Partners Strategic Fund-G II, L.P.

Trian Partners Strategic Fund-K, L.P.

Isaac Perlmutter

The Laura & Isaac Perlmutter Foundation Inc.

Object Trading Corp.

Isaac Perlmutter T.A.

Zib Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

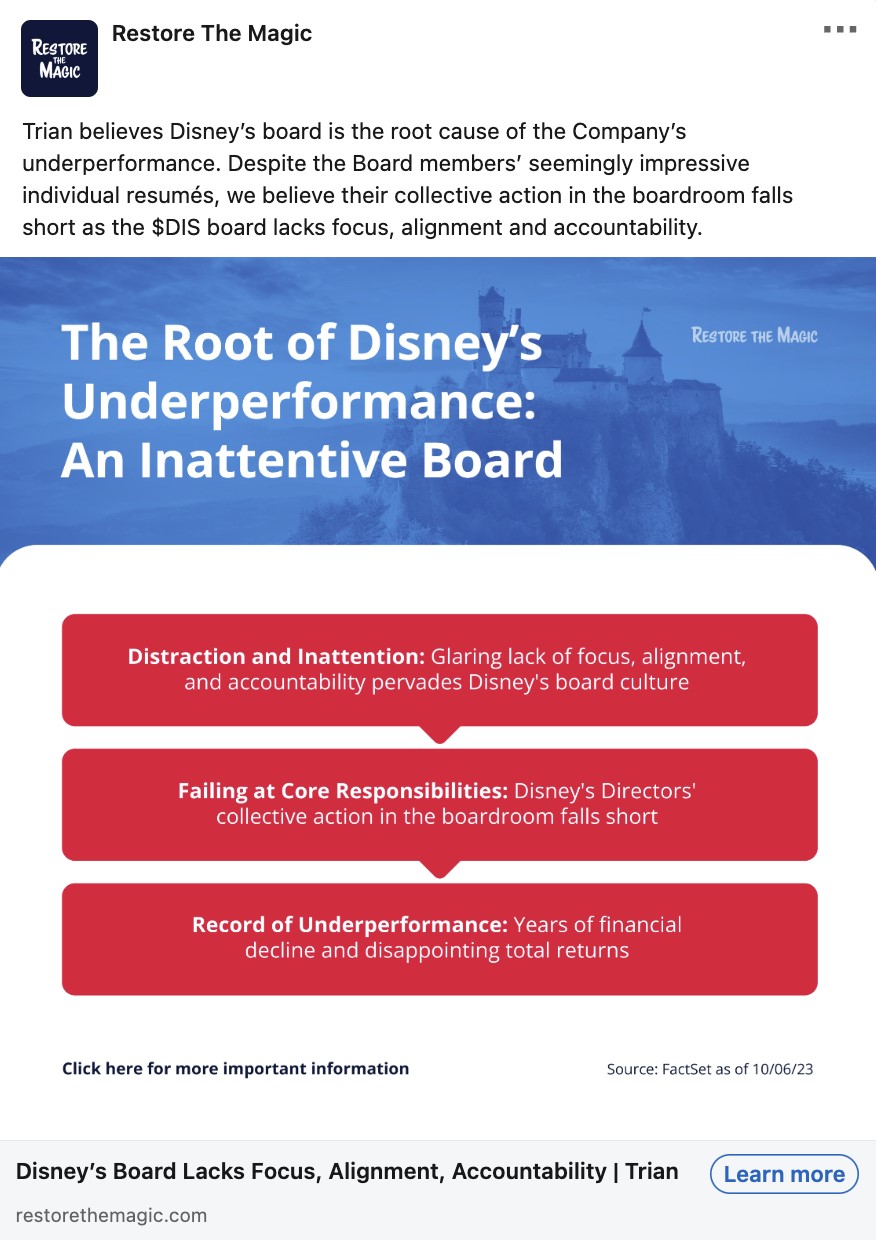

From time to time, Trian Fund Management, L.P. (“Trian”), in connection with its solicitation of proxies for the 2024 annual meeting of shareholders of The Walt Disney Company (the “Company”), may:

| | · | publish the posts filed herewith as Exhibit 1 (the “Social Media Posts”) to its X (formerly known as Twitter), LinkedIn, Facebook, Instagram, Reddit and YouTube pages (the “Social Media Pages”) or various other social media channels or to its website, www.RestoretheMagic.com (the “Website”), or may otherwise disseminate the Social Media Posts to the Company’s shareholders; |

| | | |

| | · | publish the material filed herewith as Exhibit 2 (the “Website Material”), or portions thereof, to the Website or to the Social Media Pages or various other social media channels, or may otherwise disseminate the Website Material to the Company’s shareholders; and |

| | | |

| | · | disseminate the questions filed herewith as Exhibit 3 (the “Questions”) and, from time to time, Trian may publish the Questions, or portions thereof, to the Website or to the Social Media Pages or various other social media channels, or may otherwise disseminate the Questions to the Company’s shareholders. |

Exhibit 1

Video Transcript:

Nelson Peltz: We’ve been on boards with lots of prestigious people. P&G had lots of prestigious people. Unilever had some world talent on that board of executives from all over the world. Heinz had a lot of very important people on the board. We have done this so many times. We're not there to embarrass them. We are there to help them remember their responsibility is the owners of the company.

Video Transcript:

Jim Cramer: How about Disney? We need Nelson Peltz in there and we need him badly. I am now convinced of this. I believe this company is run so poorly because there is no way you can have all this content, and all this movie making ability, and unlike Netflix, just put out bomb after bomb. Their theme parks are doing so well, but they're obscured by the bombs. They've become unimportant in the way that they own and operated television station used be important and no longer, in the way that that ESPN has now become irrelevant. I can't believe that they've run every asset down like this. As much as I like James Gorman, later Morgan Stanley, one of the new board members, we need someone from the outside. We don't want a yes man in there. We need someone to get to the bottom of this morass, shake things up. That board is chock full of smart, busy people, many of whom I know, who do not seem to realize that collectively they have become a bunch of rubber stampers. Peltz can and will change that. I know the position is not a good one, but it, it, it could be if they could do a deal with the NFL or figure out how to fix the movie business while merging Disney Plus with Hulu. But their inability to realize how poorly they are doing means, to me, it's worth bringing in a giant shareholder who can explain how the pain warrants tough action. Numbers like we got last night with Netflix just make it all the more embarrassing.

Video Transcript:

Jay Rasulo: When I was running Disneyland Paris, you know, it was really struggling when I arrived. And I think the solution was crystal clear, but no one was asking the right question. What do the guests want?

The key to success in parks and resorts is finding that balance, is to ask those questions. This is how much money we're going to invest, and how do we place it between things that are new and exciting, things that draw on new franchises and new ideas, but also at the same time maintaining what is in place and making sure it's wonderful.

I think independent voices on the board that, like me, bring passion, objectivity and experience is absolutely necessary at this point, to represent all shareholders. I spent 30 years working within this company, and to see what's happening and to sit on the sidelines was not possible for me.

Exhibit 2

| CUSIP No. 46090R104 | SCHEDULE 13D/A | Page 1 of 7 Pages |

Exhibit 3