Exhibit 5.1

March 23, 2020

The Walt Disney Company

$1,750,000,000 3.350% Notes due 2025

$500,000,000 3.700% Notes due 2027

$1,250,000,000 3.800% Notes due 2030

$750,000,000 4.625% Notes due 2040

$1,750,000,000 4.700% Notes due 2050

Ladies and Gentlemen:

We have acted as counsel for The Walt Disney Company, a Delaware corporation (the “Company”), and the Guarantor (as defined below), in connection with the public offering and sale by the Company of $1,750,000,000 aggregate principal amount of its 3.350% Notes due 2025 (the “2025 Notes”), $500,000,000 aggregate principal amount of its 3.700% Notes due 2027 (the “2027 Notes”), $1,250,000,000 aggregate principal amount of its 3.800% Notes due 2030 (the “2030 Notes”), $750,000,000 aggregate principal amount of its 4.625% Notes due 2040 (the “2040 Notes”), $1,750,000,000 aggregate principal amount of its 4.700% Notes due 2050 (the “2050 Notes” and, together with the 2025 Notes, 2027 Notes, 2030 Notes and 2040 Notes, the “Notes”) to be issued pursuant to the Indenture dated as of March 20, 2019 (the “Indenture”), among the Company, the Guarantor and Citibank, N.A., as trustee (the “Trustee”). The Notes will be unconditionally guaranteed (the “Guarantee”) by TWDC Enterprises 18 Corp., a Delaware corporation (the “Guarantor”).

In that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records and other instruments as we have deemed necessary or appropriate for the purposes of this opinion, including: (a) the Indenture; (b) the Registration Statement onForm S-3 (RegistrationNo. 333-233595) filed with the Securities and Exchange Commission (the “Commission”) on September 3, 2019 (the “Registration Statement”), with respect to registration under the Securities Act of 1933, as amended (the “Securities Act”) of an unlimited aggregate amount of various securities of the Company and the Guarantor, to be issued from time to time by the Company and the Guarantor; (c) the related Prospectus dated September 3, 2019 (together with the documents incorporated therein by reference, the “Basic Prospectus”); (d) the Prospectus Supplement dated March 19, 2020, filed with the Commission pursuant to Rule 424(b) and Rule 430B of the General Rules and Regulations under the Securities Act (together with the Basic Prospectus, the “Prospectus”); and (e) specimen global certificates for the Notes. As to various questions of fact material to this opinion, we have relied upon representations of officers or directors of the Company and the Guarantor and documents furnished to us by the Company and the Guarantor without independent verification of their accuracy. In expressing the opinions set forth herein, we have assumed, with your consent and without independent investigation or verification, the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to authentic original documents of all documents submitted to us as duplicates or copies. We also have assumed, with your consent, that the Indenture has been duly authorized, executed and delivered by, and represents a legal, valid and binding obligation of, the Trustee.

Based on the foregoing and subject to the qualifications set forth herein, we are of opinion that when the Notes are authenticated in accordance with the provisions of the Indenture and delivered and paid for (i) the Notes will constitute legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms and entitled to the benefits of the Indenture (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether considered in a proceeding in equity or at law) and (ii) the Guarantee will constitute a legal, valid and binding obligation of the Guarantor, enforceable against the Guarantor in accordance with its terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether considered in a proceeding in equity or at law).

We hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Company’s Current Report on Form8-K filed on March 23, 2020, and to the incorporation by reference of this opinion into the Registration Statement. We also consent to the reference to our firm under the caption “Legal Matters” in the Prospectus Supplement dated March 19, 2020 forming a part of the Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

We are admitted to practice in the State of New York, and we express no opinion as to matters governed by any laws other than the laws of the State of New York, the General Corporation Law of the State of Delaware and the Federal laws of the United States of America.

2

| Very truly yours, |

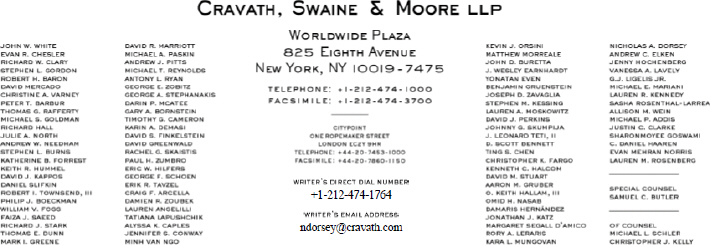

/s/ Cravath, Swaine & Moore LLP |

The Walt Disney Company

500 South Buena Vista Street,

Burbank, California 91521

TWDC Enterprises 18 Corp.

500 South Buena Vista Street,

Burbank, California 91521

O

3