Exhibit 5.1

May 13, 2020

The Walt Disney Company

$1,500,000,000 1.750% Notes due 2026

$1,000,000,000 2.200% Notes due 2028

$2,500,000,000 2.650% Notes due 2031

$1,750,000,000 3.500% Notes due 2040

$2,750,000,000 3.600% Notes due 2051

$1,500,000,000 3.800% Notes due 2060

Ladies and Gentlemen:

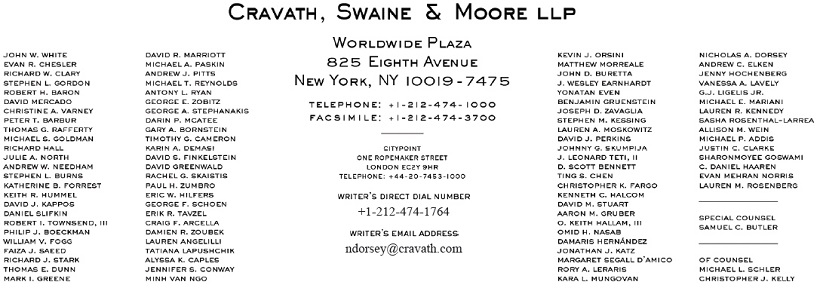

We have acted as counsel for The Walt Disney Company, a Delaware corporation (the “Company”), and the Guarantor (as defined below), in connection with the public offering and sale by the Company of $1,500,000,000 aggregate principal amount of its 1.750% Notes due 2026 (the “2026 Notes”), $1,000,000,000 aggregate principal amount of its 2.200% Notes due 2028 (the “2028 Notes”), $2,500,000,000 aggregate principal amount of its 2.650% Notes due 2031 (the “2031 Notes”), $1,750,000,000 aggregate principal amount of its 3.500% Notes due 2040 (the “2040 Notes”), $2,750,000,000 aggregate principal amount of its 3.600% Notes due 2051 (the “2051 Notes”) and $1,500,000,000 aggregate principal amount of its 3.800% Notes due 2060 (the “2060 Notes” and, together with the 2026 Notes, 2028 Notes, 2031 Notes, 2040 Notes and 2051 Notes, the “Notes”) to be issued pursuant to the Indenture dated as of March 20, 2019 (the “Indenture”), among the Company, the Guarantor and Citibank, N.A., as trustee (the “Trustee”). The Notes will be unconditionally guaranteed (the “Guarantee”) by TWDC Enterprises 18 Corp., a Delaware corporation (the “Guarantor”).

In that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records and other instruments as we have deemed necessary or appropriate for the purposes of this opinion, including: (a) the Indenture; (b) the Registration Statement onForm S-3 (RegistrationNo. 333-233595) filed with the Securities and Exchange Commission (the “Commission”) on September 3, 2019 (the