- ADN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

Advent Technologies (ADN) S-1/AIPO registration (amended)

Filed: 26 Mar 21, 5:21pm

Delaware | | | 6770 | | | 83-0982969 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification No.) |

Large accelerated filer | | | ☐ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☒ | | | Smaller reporting company | | | ☒ |

| | | | | Emerging growth company | | | ☒ |

Title of Each Class of Securities to be Registered | | | Amount to be Registered(1) | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee |

Primary offering: | | | | | | | | | ||||

Common stock, par value $0.0001 per share | | | 26,392,355(2) | | | $11.50(3) | | | $303,512,083 | | | $33,113(4) |

Secondary offering: | | | | | | | | | ||||

Common stock, par value $0.0001 per share | | | 23,210,601(5) | | | $14.38(6) | | | $333,652,389 | | | $36,402(4) |

Warrants to purchase shares of common stock | | | 4,340,278(7) | | | $11.50(3) | | | $49,913,197 | | | $5,446(4) |

Total | | | | | | | $675,006,996 | | | $74,960 |

| (1) | This registration statement (this “Registration Statement”) also covers an indeterminate number of additional shares of common stock, par value $0.0001 per share (the “common stock”), and warrants to purchase common stock, of Advent Technologies Holdings, Inc. (the “Registrant”) that may be offered or issued to prevent dilution resulting from share splits, share dividends or similar transactions in accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Represents the issuance of common stock upon the exercise of an aggregate of up to (i) 22,052,077 warrants to purchase common stock at an exercise price of $11.50 per share that were issued by AMCI Acquisition Corp. (“AMCI”) in its initial public offering (the “public warrants”); (ii) 3,940,278 warrants to purchase common stock at an exercise price of $11.50 per share that were originally sold to AMCI Sponsor LLC (“Sponsor”) in a private placement consummated simultaneously with the AMCI’s initial public offering (the “placement warrants”) and (iii) 400,000 warrants to purchase common stock at an exercise price of $11.50 per share that were issued to the Sponsor in connection with loans made by it to AMCI prior to the closing of the initial business combination (the “working capital warrants”, and together with the placement warrants and the public warrants, the “warrants”). |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(i) under the Securities Act. The price per share is based upon the exercise price per warrant of $11.50 per share of common stock. |

| (4) | Calculated by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0001091. |

| (5) | Represents the resale of (i) 18,870,323 shares of common stock held by the selling securityholders; (ii) 3,940,278 shares of common stock underlying the placement warrants held by the selling securityholders and (iii) and 400,000 shares of common stock underlying the working capital warrants held by the selling securityholders. |

| (6) | Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price per share of common stock is $14.38, which is the average of the high and low prices of the common stock on Nasdaq on March 23, 2021 such date being within five business days of the date that this Registration Statement was filed with the SEC. |

| (7) | Represents an aggregate of 3,940,278 placement warrants and 400,000 working capital warrants registered for sale by the selling securityholders named in this Registration Statement. |

| • | our ability to maintain the listing of our shares of common stock and warrants on Nasdaq; |

| • | our ability to raise financing in the future; |

| • | our success in retaining or recruiting officers, key employees or directors; |

| • | factors relating to our business, operations and financial performance, including: |

| • | our ability to grow and manage growth profitably; |

| • | our ability to maintain relationships with customers; |

| • | compete within its industry; and |

| • | retain its key employees. |

| • | market conditions and global and economic factors beyond our control, including the potential adverse effects of the ongoing global coronavirus (COVID-19) pandemic on capital markets, general economic conditions, unemployment and our liquidity, operations and personnel; |

| • | future exchange and interest rates; and |

| • | other factors detailed herein under the section entitled “Risk Factors.” |

| • | We may be unable to adequately control the costs associated with our operations. |

| • | We may need to raise additional funds and these funds may not be available to us when we need them. If we cannot raise additional funds when we need them, our operations and prospects could be negatively affected. |

| • | If we fail to manage our future growth effectively, we may not be able to market and sell our fuel cells successfully. |

| • | We will rely on complex machinery for our operations and production involves a significant degree of risk and uncertainty in terms of operational performance and costs. |

| • | Our future growth is dependent upon the market’s willingness to adopt our hydrogen-powered fuel cell and membrane technology. |

| • | If we are unable to attract and retain key employees and hire qualified management, technical and fuel cell and system engineering personnel, our ability to compete could be harmed. |

| • | Increases in costs, disruption of supply or shortage of raw materials could harm our business. |

| • | We are or may be subject to risks associated with strategic alliances or acquisitions. |

| • | We are subject to substantial regulation and unfavorable changes to, or failure by us to comply with, these regulations could substantially harm our business and operating results. |

| • | We face risks associated with our international operations, including unfavorable regulatory, political, tax and labor conditions, which could harm our business. |

| • | The unavailability, reduction or elimination of government and economic incentives could have a material adverse effect on our business, prospects, financial condition and operating results. |

| • | We may not be able to obtain or agree on acceptable terms and conditions for all or a significant portion of the government grants, loans and other incentives for which we may apply in the future. As a result, our business and prospects may be adversely affected. |

| • | We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and cause us to incur substantial costs. |

| • | Our business may be adversely affected if we are unable to protect our intellectual property rights from unauthorized use by third parties. |

| • | Our patent applications may not issue as patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours. |

| • | The unaudited pro forma condensed combined financial information in this prospectus is presented for illustrative purposes only and may not be reflective of our operating results and financial condition. |

| • | Delaware law and our second amended and restated certificate of incorporation and bylaws contain certain provisions, including anti-takeover provisions, that limit the ability of stockholders to take certain actions and could delay or discourage takeover attempts that stockholders may consider favorable. |

| • | The second amended and restated certificate of incorporation designate a state or federal court located within the State of Delaware as the exclusive forum for substantially all disputes between us and our stockholders, and also provide that the federal district courts will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act, each of which could limit the ability of our stockholders to choose the judicial forum for disputes with us or our directors, officers, or employees. |

| • | Nasdaq may delist our securities from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. |

| • | Because there are no current plans to pay cash dividends on our common stock for the foreseeable future, you may not receive any return on investment unless you sell your common stock at a price greater than what you paid for it. |

| • | We may redeem unexpired public warrants prior to their exercise at a time that is disadvantageous for warrant holders. |

| (1) | The number of shares of common stock outstanding is based on 46,105,947 shares of common stock outstanding as of March 23, 2021 and does not include: |

| • | 6,915,892 shares of common stock reserved for issuance for awards in accordance with the 2021 Equity Incentive Plan; |

| • | 22,052,077 shares of common stock underlying the public warrants, 3,940,278 shares of common stock underlying the placement warrants and 400,000 shares of common stock underyling the working capital warrants. |

| • | training new personnel; |

| • | forecasting production and revenue; |

| • | geographic expansion; |

| • | controlling expenses and investments in anticipation of expanded operations; |

| • | entry into new material contracts; |

| • | establishing or expanding design, production, licensing and sales; and |

| • | implementing and enhancing administrative infrastructure, systems and processes. |

| • | perceptions about safety, design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of alternative fuel or electric vehicles; |

| • | improvements in the fuel economy of internal combustion engines and battery powered vehicles; |

| • | the availability of service for alternative fuel vehicles; |

| • | volatility in the cost of energy, oil, gasoline and hydrogen; |

| • | government regulations and economic incentives promoting fuel efficiency, alternate forms of energy, and regulations banning internal combustion engines; |

| • | the availability of tax and other governmental incentives to sell hydrogen; |

| • | perceptions about and the actual cost of alternative fuel; and |

| • | macroeconomic factors. |

| • | increased subsidies for corn and ethanol production, which could reduce the operating cost of vehicles that use ethanol or a combination of ethanol and gasoline; and |

| • | increased sensitivity by regulators to the needs of established automobile manufacturers with large employment bases, high fixed costs and business models based on the internal combustion engine, which could lead them to pass regulations that could reduce the compliance costs of such established manufacturers or mitigate the effects of government efforts to promote alternative fuel vehicles. |

| • | difficulty in staffing and managing foreign operations; |

| • | foreign government taxes, regulations and permit requirements, including foreign taxes that we may not be able to offset against taxes imposed upon us in the U.S., and foreign tax and other laws limiting our ability to repatriate funds to the U.S.; |

| • | fluctuations in foreign currency exchange rates and interest rates; |

| • | U.S. and foreign government trade restrictions, tariffs and price or exchange controls; |

| • | foreign labor laws, regulations and restrictions; |

| • | changes in diplomatic and trade relationships; |

| • | political instability, natural disasters, war or events of terrorism; and |

| • | the strength of international economies. |

| • | cease development, sales, license or use of fuel cells or membranes that incorporate the asserted intellectual property; |

| • | pay substantial damages; |

| • | obtain a license from the owner of the asserted intellectual property right, which license may not be available on reasonable terms or at all; or |

| • | redesign one or more aspects or systems of our fuel cells or membranes. |

| • | any patent applications we submit may not result in the issuance of patents; |

| • | the scope of our issued patents may not be broad enough to protect our proprietary rights; |

| • | our issued patents may be challenged and/or invalidated by our competitors; |

| • | the costs associated with enforcing patents, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; |

| • | current and future competitors may circumvent our patents; and |

| • | our in-licensed patents may be invalidated, or the owners of these patents may breach our license arrangements. |

| • | a classified board of directors with three-year staggered terms, which could delay the ability of stockholders to change the membership of a majority of our board of directors; |

| • | the ability of our board of directors to issue shares of preferred stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer; |

| • | the limitation of the liability of, and the indemnification of, our directors and officers; |

| • | the exclusive right of our board of directors to elect a director to fill a vacancy created by the expansion of our board of directors or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our board of directors; |

| • | the requirement that directors may only be removed from our board of directors for cause; |

| • | a prohibition on stockholder action by written consent, which forces stockholder action to be taken at an annual or special meeting of stockholders and could delay the ability of stockholders to force consideration of a stockholder proposal or to take action, including the removal of directors; |

| • | the requirement that a special meeting of stockholders may be called only by our board of directors, the chairperson of our board of directors, our chief executive officer or our president (in the absence of a chief executive officer), which could delay the ability of stockholders to force consideration of a proposal or to take action, including the removal of directors; |

| • | controlling the procedures for the conduct and scheduling of board of directors and stockholder meetings; |

| • | the requirement for the affirmative vote of holders of at least 65% of the voting power of all of the then outstanding shares of the voting stock, voting together as a single class, to amend, alter, change or repeal any provision of the second amended and restated certificate of incorporation or amended and restated bylaws, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in our board of directors and also may inhibit the ability of an acquirer to effect such amendments to facilitate an unsolicited takeover attempt; |

| • | the ability of our board of directors to amend the amended and restated bylaws, which may allow our board of directors to take additional actions to prevent an unsolicited takeover and inhibit the ability of an acquirer to amend the amended and restated bylaws to facilitate an unsolicited takeover attempt; and |

| • | advance notice procedures with which stockholders must comply to nominate candidates to our board of directors or to propose matters to be acted upon at a stockholders’ meeting, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay |

| • | a limited availability of market quotations for its securities; |

| • | reduced liquidity for its securities; |

| • | a determination that our common stock is a “penny stock” which will require brokers trading in the common stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| • | a limited amount of news and analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

| • | results of operations that vary from the expectations of securities analysts and investors; |

| • | results of operations that vary from our competitors; |

| • | changes in expectations as to our future financial performance, including financial estimates and investment recommendations by securities analysts and investors; |

| • | declines in the market prices of stocks generally; |

| • | strategic actions by us or our competitors; |

| • | announcements by us or our competitors of significant contracts, acquisitions, joint ventures, other strategic relationships or capital commitments; |

| • | any significant change in our management; |

| • | changes in general economic or market conditions or trends in our industry or markets; |

| • | changes in business or regulatory conditions, including new laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| • | future sales of our common stock or other securities; |

| • | investor perceptions of the investment opportunity associated with our common stock relative to other investment alternatives; |

| • | the public’s response to press releases or other public announcements by us or third parties, including our filings with the SEC; |

| • | litigation involving us, our industry, or both, or investigations by regulators into our operations or those of our competitors; |

| • | guidance, if any, that we provide to the public, any changes in this guidance or our failure to meet this guidance; |

| • | the development and sustainability of an active trading market for our common stock; |

| • | actions by institutional or activist stockholders; |

| • | changes in accounting standards, policies, guidelines, interpretations or principles; and |

| • | other events or factors, including those resulting from pandemics, natural disasters, war, acts of terrorism or responses to these events. |

| • | the merger of Advent with and into Merger Sub, a wholly owned subsidiary of AMCI, with Advent surviving the merger as a wholly owned subsidiary of AMCI; |

| • | the redemption of 1,606 shares of AMCI’s Class A common stock at a price of approximately $10.30 per share, for an aggregate of $16,536, in connection with the consummation of the Business Combination; |

| • | the issuance and sale of 6,500,000 shares of AMCI’s Class A common stock at a purchase price of $10.00 per share, for an aggregate of $65 million, in the PIPE pursuant to the Subscription Agreement; and |

| • | the issuance and sale of 400,000 Working Capital Warrants at a price of $1.00 per Warrant. |

| • | the accompanying notes to the unaudited pro forma condensed combined financial statements; |

| • | the historical audited financial statements of AMCI as of and for the year ended December 31, 2020 and the related notes, in each case, included in this prospectus; |

| • | the historical audited consolidated financial statements of Advent as of and for the year ended December 31, 2020 and the related notes, in each case, included in this prospectus; and |

| • | other information relating to AMCI and Advent contained in the Prospectus, including the merger agreement and the description of certain terms thereof set forth under “The Business Combination”. |

Stockholder | | | % | | | No. shares |

Advent | | | 54.3 | | | 25,033,398 |

Public | | | 19.6 | | | 9,059,530 |

Sponsor | | | 5.4 | | | 2,474,009 |

AMCI’s executive management | | | 1.1 | | | 485,000 |

Other AMCI holders | | | 5.5 | | | 2,554,010 |

PIPE Investors | | | 14.1 | | | 6,500,000 |

Total | | | 100% | | | 46,105,947 |

| • | Advent’s existing stockholders have the greatest voting interest in the Combined Entity with 54.3% voting interest; |

| • | the largest individual minority stockholder of the Combined Entity is an existing stockholder of Advent; |

| • | Advent’s appointed directors represent five out of seven board seats for the Combined Entity’s board of directors; |

| • | Advent selects all senior management (executives) of the Combined Entity; |

| • | Advent’s senior management comprise the majority of the senior management of the Combined Entity; and |

| • | Advent operations are the only continuing operations of the Combined Entity. |

| | | As of December 31, 2020 | | | | | | | As of December 31, 2020 | ||||||

| | | AMCI (Historical) | | | Advent (Historical) | | | Pro Forma Adjustments | | | | | Pro-Forma Combined | ||

ASSETS | | | | | | | | | | | |||||

Current assets: | | | | | | | | | | | |||||

Cash | | | $24,945 | | | $515,734 | | | $133,768,869 | | | A | | | $134,309,548 |

Inventories | | | — | | | 107,939 | | | — | | | | | 107,939 | |

Accounts receivable, net | | | — | | | 421,059 | | | — | | | | | 421,059 | |

Due from related parties | | | | | 67,781 | | | | | | | 67,781 | |||

Contract assets | | | — | | | 85,930 | | | — | | | | | 85,930 | |

Prepaid expenses | | | — | | | 1,724 | | | — | | | | | 1,724 | |

Other current assets | | | — | | | 495,021 | | | — | | | | | 495,021 | |

Prepaid income tax | | | 203,613 | | | — | | | — | | | | | 203,613 | |

Prepaid Expenses and other current assets | | | 353,959 | | | — | | | — | | | | | 353,959 | |

Total current assets | | | 582,517 | | | 1,695,188 | | | 133,768,869 | | | | | 136,046,574 | |

Cash and investments held in Trust Account | | | 93,340,005 | | | — | | | (93,340,005) | | | B | | | — |

Property and equipment | | | — | | | 198,737 | | | — | | | | | 198,737 | |

Other assets | | | — | | | 136 | | | — | | | | | 136 | |

Total Assets | | | $93,922,522 | | | $1,894,061 | | | $40,428,864 | | | | | $136,245,447 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | |||||

Current liabilities: | | | | | | ||||||||||

Accounts Payable | | | 349,439 | | | — | | | (349,439) | | | C, F | | | — |

Trade and other payables | | | — | | | 881,394 | | | (540,026) | | | E | | | 341,368 |

Due to related parties | | | — | | | 1,114,659 | | | — | | | | | 1,114,659 | |

Accrued Expenses | | | 25,000 | | | — | | | (25,000) | | | F | | | — |

Franchise tax payable | | | 40,050 | | | — | | | (40,050) | | | C | | | — |

Income Tax payable | | | — | | | 201,780 | | | | | | | 201,780 | ||

Promissory Note | | | 2,365,649 | | | — | | | (2,365,649) | | | C | | | — |

Promissory Note-Related Party | | | 400,000 | | | | | (400,000) | | | R | | | — | |

Contract Liabilities | | | — | | | 167,761 | | | — | | | | | 167,761 | |

Other current liabilities | | | — | | | 904,379 | | | (208,245) | | | E,I | | | 696,134 |

Deferred income from grants, current | | | — | | | 158,819 | | | — | | | | | 158,819 | |

Total current liabilities | | | 3,180,138 | | | 3,428,792 | | | (3,928,409) | | | | | 2,680,521 | |

Deferred underwriting fees | | | 7,718,227 | | | — | | | (7,718,227) | | | D | | | — |

Provision for staff leave indemnities | | | — | | | 33,676 | | | — | | | | | 33,676 | |

Deferred income from grants, non-current | | | | | 182,273 | | | — | | | | | 182,273 | ||

Other long term liabilities | | | — | | | 42,793 | | | — | | | | | 42,793 | |

Total liabilities | | | 10,898,365 | | | 3,687,534 | | | (11,646,636) | | | | | 2,939,263 | |

Commitments | | | | | | | | | | | |||||

Class A common stock subject to possible redemption | | | 78,024,156 | | | — | | | (78,024,156 ) | | | K | | | — |

Stockholders Equity | | | | | | | | | | | |||||

Class A common stock | | | 150 | | | — | | | 4,460 | | | L | | | 4,610 |

Class B common stock | | | 551 | | | — | | | (551) | | | N | | | — |

Common Stock (Advent) | | | — | | | 3,037 | | | (3,037) | | | O | | | — |

Preferred stock series A (Advent) | | | — | | | 844 | | | (844) | | | O | | | — |

Preferred stock series seed (Advent) | | | — | | | 2,096 | | | (2,096) | | | O | | | — |

Additional paid-in capital | | | 2,812,626 | | | 10,990,288 | | | 137,971,434 | | | O | | | 151,774,348 |

Accumulated other comprehensive income | | | — | | | 111,779 | | | | | | | 111,779 | ||

Retained earnings | | | 2,186,674 | | | | | (2,186,674) | | | P | | | — | |

Accumulated Deficit (Advent) | | | — | | | (12,901,517) | | | (5,683,036) | | | Q | | | (18,584,553) |

Total stockholders Equity | | | 5,000,001 | | | (1,793,473) | | | 130,099,656 | | | | | 133,306,184 | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | | $93,922,522 | | | $1,894,061 | | | $40,428,864 | | | | | $136,245,447 | |

| | | Year Ended December 31, 2020 | | | | | Year Ended December 31, 2020 | ||||||||

| | | AMCI (Historical) | | | Advent (Historical) | | | Pro Forma Adjustments | | | | | Pro Forma Combined | ||

Revenue, net | | | $— | | | $882,652 | | | $— | | | | | $882,652 | |

Cost of revenues | | | — | | | (513,818) | | | — | | | | | (513,818) | |

Income from grants | | | | | 206,828 | | | — | | | | | 206,828 | ||

Administrative and selling expenses | | | — | | | (3,536,889) | | | 70,089 | | | (CC), (EE) | | | (3,466,800) |

Research and development | | | — | | | (102,538) | | | — | | | | | (102,538) | |

Operating Costs | | | (1,422,570) | | | — | | | 489,561 | | | (AA), (EE) | | | (933,009) |

Franchise tax expense | | | (208,794) | | | — | | | — | | | | | (208,794) | |

Other operating expenses | | | — | | | (9,967) | | | | | | | (9,967) | ||

Loss from operations | | | (1,631,364) | | | (3,073,732) | | | 559,650 | | | | | (4,145,446) | |

Other income – dividends and interest | | | 836,541 | | | — | | | (836,541) | | | (DD) | | | — |

Finance costs | | | — | | | (5,542) | | | — | | | | | (5,542) | |

Foreign exchange differences, net | | | — | | | (26,072) | | | — | | | | | (26,072) | |

| | | | | | | | | | | ||||||

Other expenses | | | | | (15,696) | | | | | | | (15,696) | |||

(Loss) Income before provision for income tax | | | (794,823) | | | (3,121,042) | | | (276,891) | | | | | (4,192,756) | |

Provision for income tax | | | (199,030) | | | — | | | 199,030 | | | (FF) | | | — |

Net (loss) income | | | $(993,853) | | | $(3,121,042) | | | $(77,861) | | | | | $(4,192,756) | |

Weighted average number of common shares outstanding, basic and diluted | | | 6,807,313 | | | | | | | | | 46,105,947 | |||

Basic and diluted net loss per share | | | $(0.20) | | | | | | | | | $(0.09) | |||

| • | AMCI’s audited balance sheet as of December 31, 2020 and the related notes included in this prospectus into this prospectus; and |

| • | Advent’s audited consolidated balance sheet as of December 31, 2020 and the related notes included in this prospectus into this prospectus. |

| • | AMCI’s audited statement of operations for the year ended December 31, 2020 and the related notes included elsewhere in this prospectus; and |

| • | Advent’s audited statement of operations for the year ended December 31, 2020 and the related notes included elsewhere in this prospectus. |

| (A) | Represents pro forma adjustments to the cash balance to reflect the following: |

Investment held in Trust Account | | | $93,349,005 | | | (B) |

Net proceeds from subscription agreement | | | 65,000,000 | | | (J) |

Settlement of AMCI’s current liabilities | | | (2,410,578) | | | (C) |

Payment of deferred underwriter fees | | | (7,718,227) | | | (D) |

Payment of transaction costs for Advent | | | (3,515,643) | | | (E) |

Payment of transaction costs for AMCI | | | (4,740,442) | | | (F) |

Payment of unrecognized contingent liability | | | (474,508) | | | (G) |

Transaction bonus payments | | | (4,995,202) | | | (H) |

One time signing bonus to executives | | | (700,000) | | | (I) |

Total | | | $133,768,869 | | | (A) |

| (B) | Reflects the reclassification of the amount of $93,349,005 of cash and cash equivalents held in the Trust Account that becomes available following the merger, after giving effect to the redemption of 1,606 shares of AMCI’s Class A common stock at a redemption value of $16,536 resulted in connection with the consummation of the Business Combination. |

| (C) | Reflects the repayment of AMCI’s current liabilities of $2,410,578 (amount $40,050 of franchise tax payables, amount $2,365,649 of the promissory note, and amount $4,879 of the remaining accounts payable after the effect of payment of the transaction costs as described in note 3(F) below), upon close of the Business Combination. |

| (D) | Reflects the payment of $7,718,227 of deferred underwriters’ fees incurred during the AMCI initial public offering due upon completion of the Business Combination. |

| (E) | Represents transaction costs incurred or expected to be incurred by Advent of approximately $3,785,206 for advisory, banking, printing, legal, and accounting fees as part of the merger. These costs consist of $269,563 incurred and paid, of $540,026 incurred and recognized in trade and other payables, of $908,245 incurred and recognized as other current liabilities, and of $ 2,067,372 expected as part of the transaction. An amount of $1,717,834 has been incurred and has been recorded on Advent's statement of operations. The unaudited pro forma condensed combined balance sheet reflects these costs as a reduction of cash of $3,515,643, a decrease in additional paid in capital by $2,067,372, a decrease of trade and other payables by $540,026 and decrease of current liabilities by $908,245. |

| (F) | Represents transaction costs and underwriting costs incurred or expected to be incurred by AMCI of approximately $4,740,442 ($3,275,000 relates to the PIPE and $1,465,442 for advisory, banking, printing, legal and accounting fees). These costs consist of $349,439 previously incurred and recognized in accounts payables, of $25,000 previously incurred and recognized as accrued expenses, and of $4,370,882 expected as part of the transaction. The amount of previously incurred of $369,561 |

| (G) | Reflects the payment of AMCI’s deferred unrecognized contingent liability of $474,508, payable at the consummation of the Business combination. The unaudited pro forma condensed combined balance sheet reflects this cost as a reduction of cash of $474,508 with a corresponding decrease of $474,508 in retained earnings. This cost is not included in the unaudited pro forma condensed combined statement of operations as it is nonrecurring. |

| (H) | Reflects Combined Entity’s Transaction Bonus Agreements with Advent’s management team for aggregate cash bonus payments of $4,995,202 payable in connection with the Closing. This cost is not included in the unaudited pro forma condensed combined statement of operations as it is nonrecurring. |

| (I) | Represents one time signing bonus of an aggregate amount of $ 1,400,000 to the Chief Executive Officer, Chief Financial Officer, Chief Technology Officer and Chief Operating Officer and General Counsel of the Combined Entity, payable in two equal installments, with the first being payday following the Closing, and the second one payday following the first anniversary of the Closing. The unaudited pro forma condensed combined balance sheet reflects these costs as a reduction of cash of $700,000 and an increase in other current liabilities of $700,000. |

| (J) | Reflects the proceeds of $65 million from the issuance and sale of 6,500,000 shares of AMCI’s Class A common stock at $10.00 per share pursuant to the subscription agreements entered on December 22, 2020 (($650 Class A common stock (L) and $64,999,350 at additional paid-in capital (O)). |

| (K) | Reflects the redemption of $16,536 of AMCI Class A common stock on February 2, 2021 and the reclassification of the remaining $78,007,620 of AMCI Class A common stock subject to possible redemption to permanent equity ($756 Class A common stock (L) and $78,006,864 at additional paid-in capital (O)). |

| (L) | Represents pro forma adjustments to the AMCI Class A common stock balance to reflect the following: |

Reclassification of AMCI common stock subject to redemption | | | $756 | | | (K) |

Issuance of AMCI Class A common stock from subscription agreement | | | 650 | | | (J) |

Recapitalization between Advent Common Stock and AMCI Common Stock | | | 2,503 | | | (M) |

Conversion of AMCI’s Class B common stock to Class A common stock | | | 551 | | | (N) |

Total | | | $4,460 | | | (L) |

| (M) | Represents recapitalization of common shares between Advent common stock and AMCI common stock. |

| (N) | Reflects the reclassification of AMCI’s Class B common stock to Class A common stock on Closing. |

| (O) | Represents pro forma adjustments to additional paid-in capital balance to reflect the following: |

Reclassification of AMCI Class A common stock subject to redemption | | | $78,006,864 | | | (K) |

Issuance of AMCI Class A common stock from subscription agreement | | | 64,999,350 | | | (J) |

Recapitalization between Advent Common Stock and AMCI Common Stock | | | (2,503) | | | (M) |

Repayment of AMCI’s promissory note due to related party with warrants | | | 1,400,000 | | | (R) |

Payment of Advent’s transaction costs | | | 2,067,372 | | | (E) |

Payment of AMCI’s transaction costs | | | 4,370,882 | | | (F) |

Advent’s equity reclassification adjustment | | | 5,977 | | | |

Total | | | $137,971,434 | | | (O) |

| (P) | Elimination of AMCI’s historical retained earnings after recording, (i) the unrecognized contingent liability of AMCI as described in note 3(G), and (ii) issuance and sale of Working Capital Warrants as described in note 3(R). |

| (Q) | Represents pro forma adjustments to Accumulated Deficit balance to reflect the following: |

Transaction bonus payments | | | $ (4,995,202) | | | (H) |

One time signing bonus to executives | | | (1,400,000) | | | (I) |

Elimination of AMCI retained earnings after adjustments | | | 712,166 | | | (P) |

Total | | | $(5,683,036) | | | (Q) |

| (R) | On November 20, 2020, AMCI issued a promissory note to the Sponsor in the principal amount of up to $1,000,000 as a working capital loan and borrowed $400,000 on such working capital loan. On the Business Combination the additional current liability was repaid through issuance and sale of 400,000, Working Capital Warrants at a price of $1.00 per Warrant. As a result, the promissory note- related party liability was decreased by $400,000, APIC increased by $ 1,400,000 and retained earnings decreased by $1 million (assuming the market value of $3.50 per warrant on the Business Combination date). |

| (AA) | Represents pro forma adjustments to operating costs: |

| | | Year Ended December 31, 2020 | ||||

Elimination of historical expenses related to AMCI’s office space and related support services | | | $(120,000) | | | (BB) |

Total | | | $(120,000) | | | (AA) |

| (BB) | Represents pro forma adjustment to eliminate historical expenses related to AMCI Acquisition Corp office space and general administrative services pursuant to the Administrative Service Agreement terminated on the Business Combination. |

| (CC) | Represents pro forma adjustment to reflect the new compensation arrangements with five key executives of the Combined Entity (Chief Executive Officer, Chief Financial Officer, Chief Marketing Officer, Chief Technology Officer, Chief Operating Officer and General Counsel and Business Development Representative) in connection with the Business Combination based on the Employment Agreements or Term Sheets entered into on the date of the Merger Agreement, resulting in an aggregate $1,647,745 increase in the annual compensation for these executives from their previous compensation, which are reflected in the pro forma statements of operations. |

| (DD) | Represents pro forma adjustment to eliminate investment income related to the investment held in the Trust Account: |

| | | Year Ended December 31, 2020 | ||||

Adjustment to eliminate investment income | | | $(836,541) | | | |

| | | $(836,541) | | | (DD) | |

| (EE) | Reflects the elimination of non-recurring transaction expenses incurred in connection with the Business Combination. These costs are $1,717,834 for Advent as described in note 3(E) affecting administrative and selling expenses and $369,561 for AMCI as described in note 3(F) affecting operating costs. |

| (FF) | Reflects income tax effect of pro forma adjustments using the estimated statutory tax rate of 21% (which is capped to the historical income tax expense incurred by AMCI). |

| | | Year Ended December 31, 2020 | |

Pro forma net loss | | | $(4,192,756) |

Basic weighted average shares outstanding | | | 46,105,947 |

Net loss per share—basic and diluted(1) | | | $(0.09) |

| (1) | For the purposes of applying the if converted method for calculating diluted earnings per share, it was assumed that all outstanding warrants sold in the initial public offering and the private placement are converted to Class A common stock of AMCI. However, since this results in anti-dilution, the effect of such exchange was not included in calculation of diluted loss per share. |

| • | Fuel cells generate electricity from hydrogen-based fuels, thereby substantially reducing, if not virtually eliminating, emissions of carbon-dioxide and other pollutants generated by the combustion process in Internal Combustion Engines (“ICE”). |

| • | Fuel cells utilize fuels with extremely high energy density relative to lithium-ion batteries and other battery technology (according to ARPA-E, hydrogen contains 33,304 Wh/kg while lithium-ion batteries carry only about 240Wh/kg). This makes fuel cells an ideal technology for transportation and off-grid energy generation applications where battery technology faces limitations with lifespan, weight and recharge time. |

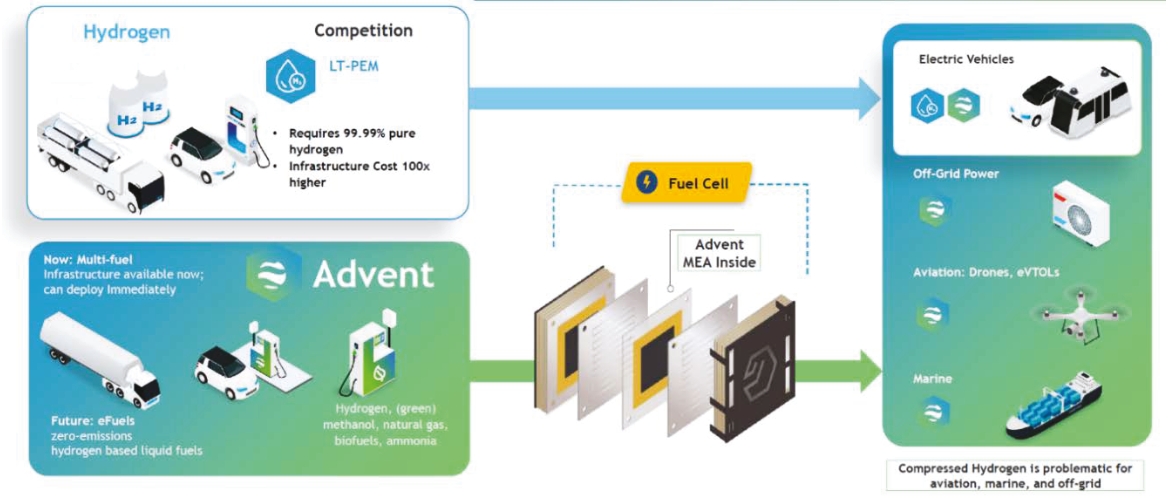

| • | Advent has developed its products under the principle of “Any Fuel, Anywhere,” which can be distilled into the two components: |

| ○ | Any Fuel: While LT-PEMs require high-purity hydrogen to operate, HT-PEMs can utilize low cost and abundant hydrogen-carrier fuels, including methanol, natural gas, ammonia, and renewable biofuels. The infrastructure required for a high-purity hydrogen economy is immense, estimated at approximately $15 trillion dollars globally, based on an extrapolation of Joule published market study of high-purity hydrogen infrastructure in China. In contrast, many of the hydrogen-carrier fuels can use existing or in-development infrastructure. |

| ○ | Anywhere: Advent’s HT-PEMs have the ability to operate in virtually any practical conditions, including a wide range of external temperatures (-20oC to +55oC) and in humid or polluted environments. LT-PEMs, on the other hand, struggle in the heat and can be damaged by dry climates or pollution. The relative durability of Advent’s products in a range of environments also provides a longer life of operation relative to LT-PEMs. |

| • | Advent’s HT-PEM technology significantly reduces the balance of plant (“BoP”) requirements of a fuel cell system. This means that fuel cells using Advent’s HT-PEM have simplified requirements for supporting components and auxiliary systems, which reduces cost and increases application range for the end-user. It does this through two methods: |

| ○ | HT-PEM fuel cells operate at high temperatures (today between 160°C and 220°C, tomorrow 80°C to 230°C). Therefore the temperature differential between a HT-PEM fuel cell and the outside environment is large. As a result, only a small radiator, similar or smaller than the radiator in an ICE vehicle, is needed to transfer heat away from the fuel cell. Conversely, because LT-PEM fuel cells run relatively cooler, a significantly larger radiator is be required to effectively maintain temperatures at ideal operating conditions for a LT-PEM under certain conditions |

| ○ | HT-PEM fuel cells use phosphoric acid as an electrolyte rather than water-assisted membranes; thus they reduce the need for water balance and other compensating engineering systems. |

| • | Electric vehicles: By continuously charging electric vehicles’ batteries through the conversion of high-purity hydrogen or hydrogen-carrier fuels into electricity, Advent’s fuel cells solve the range and recharge issue that electric vehicles face, especially heavy-duty and commercial vehicles. Because Advent’s fuel cells can use hydrogen-carrier fuels such as natural gas, methanol, biofuels, and others, fuels that are of growing in importance in China, India, and Western Europe, Advent’s technology will be critical in accelerating the mass adoption of electric vehicles and the shift away from internal combustion engines (ICEs). Advent believes that existing battery and LT-PEM technology is unable to meet the needs of automotive OEMs, which require long-range, heavy payloads, fast refill times, and the ability to operate in diverse environments. For example, because LT-PEM technology operates at low temperatures, LT-PEM fuel cells are unable to operate in hot environments (such as Nevada) because the radiator required to cool the MEA to the appropriate temperature range would be too large. The use of battery-only technology will result insufficient power capacity as well as a significant reduction in cargo capacity. |

| • | Aviation: Advent’s fuel cells promise much longer range (autonomy) and better utilization (through faster time to refill and greater payload) for commercial drones, eVTOLs, and auxiliary power. Existing commercial drones based on battery technology have limited flight time given the power limitations, while high-purity hydrogen required by LT-PEM is considered unsafe for commercial use. Advent’s HT-PEM provides sufficient range using safer liquid fuels. Advent expects drone prototypes based on Advent technology by 2022. |

| • | Off-grid and portable power generation: Because Advent’s fuel cells can use easily transportable and readily available liquid fuels, such as methanol, Advent can provide efficient, clean power generation at a low operating cost in any environment. This is particularly important in areas that aren’t fully connected to the electric grid, such as remote areas in China, where installing off-grid power generators supports electricity generation that can then be used to recharge electric vehicles or to satisfy other power needs. |

| • | Electrochemical gas sensors: HT-PEM is the only material that has been demonstrated to withstand demanding manufacturing conditions required for producing miniaturized gas sensors, including the heat of a soldering line. These sensors have potential uses in air quality, medical, and food quality applications. |

| • | Expand U.S.-based operations to increase capacity for MEA testing, development projects and associated research and development activities; |

| • | Expand Greece-based production facilities to increase and automate MEA assembly and production; |

| • | Develop improved MEA and other products for both existing and new markets, such as ultra-light MEAs designed for aviation applications, to remain at the forefront of the fast-developing hydrogen economy; |

| • | Increase business development and marketing activities; |

| • | Increase headcount in management and head office functions in order to appropriately manage Advent’s increased operations; |

| • | Improve its operational, financial and management information systems; |

| • | Obtain, maintain, expand, and protect its intellectual property portfolio; and |

| • | Operate as a public company. |

| | | Years ended December 31, | | | $ change | | | % change | ||||

| | | 2020 | | | 2019 | | ||||||

| | | (dollar amounts in thousands) | ||||||||||

| | | | | | | | | |||||

Revenue, net | | | 883 | | | 620 | | | 263 | | | 42.4% |

Cost of revenues | | | (514) | | | (397) | | | (117) | | | 29.5% |

Gross profit | | | 369 | | | 223 | | | 146 | | | 65.5% |

| | | | | | | | | |||||

Income from grants | | | 207 | | | 602 | | | (395) | | | (65.6)% |

Research and development expenses | | | (103) | | | (125) | | | 22 | | | (17.6)% |

Administrative and selling expenses | | | (3,537) | | | (864) | | | (2,673) | | | 309.4% |

Other operating expenses | | | (10) | | | (10) | | | 0 | | | —% |

Operating loss | | | (3,074) | | | (174) | | | (2,900) | | | 1,666.7% |

| | | | | | | | | |||||

Finance costs | | | (6) | | | (72) | | | 66 | | | (91.7)% |

Finance costs – Related parties | | | — | | | (35) | | | 35 | | | (100.0)% |

Foreign exchange differences, net | | | (26) | | | 12 | | | (38) | | | (316.7)% |

Other income | | | — | | | 1 | | | (1) | | | (100.0)% |

Other expenses | | | (16) | | | (2) | | | (14) | | | (700.0)% |

Loss before tax | | | (3,122) | | | (270) | | | (2,852) | | | 1,056.3% |

| | | | | | | | | |||||

Income tax expense | | | — | | | (88) | | | 88 | | | (100.0)% |

Net loss | | | (3,122) | | | (358) | | | (2,764) | | | 772.1% |

Other Comprehensive income / (loss) | | | | | | | | | ||||

Net foreign currency translation | | | (7) | | | (10) | | | 3 | | | (30.0)% |

| | | | | | | | | |||||

Other Comprehensive income / (loss) | | |||||||||||

Comprehensive loss | | | (3,129) | | | (368) | | | (2,761) | | | 750.3% |

| | | Years ended December 31, | | | $ change | | | % change | ||||

| | | 2020 | | | 2019 | | ||||||

| | | (dollar amounts in thousands) | ||||||||||

| | | | | | | | | |||||

Net Loss | | | (3,122) | | | (358) | | | (2,764) | | | (772.1)% |

Adjustments to reconcile net loss to net cash flows provided by operating activities: | | | | | | | | | ||||

Depreciation of property, plant and equipment | | | 23 | | | 17 | | | 6 | | | 35.3% |

Non cash interest and service cost | | | 2 | | | 3 | | | (1) | | | (33.3)% |

Income tax expense | | | 0 | | | 88 | | | (88) | | | (100.0)% |

Movements in stock grant plans | | | 869 | | | —- | | | 869 | | | 100.0% |

Changes in operating assets and liabilities: | | | | | | | | | ||||

Decrease in accounts receivable and other current assets | | | (557) | | | (191) | | | (366) | | | 191.6% |

Decrease in trade payables and other current liabilities | | | 1,359 | | | 209 | | | 1,149 | | | 547.14% |

Net cash used in operating activities | | | (1,426) | | | (232) | | | (1,195) | | | 517.3% |

| | | | | | | | | |||||

| | | Years ended December 31, | | | $ change | | | % change | ||||

| | | 2020 | | | 2019 | | ||||||

| | | (dollar amounts in thousands) | ||||||||||

Cash flows from investing activities: | | | | | | | | | ||||

Purchase of property, plant and equipment | | | (123) | | | (35) | | | (88) | | | 251.4% |

Net cash used in investing activities | | | (123) | | | (35) | | | (88) | | | 251.4% |

| | | | | | | | | |||||

Cash flows from financing activities: | | | | | | | | | ||||

Proceeds of issuance of preferred stock | | | 1,430 | | | 1,349 | | | 81 | | | 6% |

Repurchase of common stock - cancellation of shares | | | (69) | | | 0 | | | (69) | | | 100.0% |

Repayment of Debt | | | (500) | | | 0 | | | (500) | | | 100.0% |

Proceeds from exercise of stock options | | | 22 | | | 2 | | | 20 | | | 1,000.0% |

Net cash flows from financing activities | | | 883 | | | 1,351 | | | (468) | | | (34.6)% |

| | | | | | | | | |||||

Net increase (decrease) in cash and cash equivalents | | | (665) | | | 1,085 | | | (1,750) | | | (161.3)% |

Net foreign exchange difference | | | (18) | | | (32) | | | 14 | | | (43.8)% |

Cash and cash equivalents at 1 January | | | 1,199 | | | 147 | | | 1,052 | | | 715.7% |

Cash and cash equivalents at 31 December | | | 516 | | | 1,200 | | | (684) | | | (57.0)% |

| • | identify the contract with a customer, |

| • | identify the performance obligations in the contract, |

| • | determine the transaction price, |

| • | allocate the transaction price to performance obligations in the contract, and |

| • | recognize revenue as the performance obligation is satisfied. |

Name | | | Position | | | Age |

Vassilios Gregoriou | | | Chairman, Chief Executive Officer and Director | | | 56 |

William Hunter | | | President, Chief Financial Officer and Director | | | 52 |

Emory De Castro | | | Chief Technology Officer and Director | | | 63 |

Katherine E. Fleming | | | Director | | | 55 |

Anggelos Skutaris | | | Lead Director | | | 56 |

Katrina Fritz | | | Director | | | 48 |

Lawrence M. Clark | | | Director | | | 48 |

Name | | | Position | | | Age |

Vassilios Gregoriou | | | Chairman, Chief Executive Officer and Director | | | 56 |

William Hunter | | | President, Chief Financial Officer and Director | | | 52 |

Christos Kaskavelis | | | Chief Marketing Officer | | | 52 |

Emory De Castro | | | Chief Technology Officer and Director | | | 63 |

James F. Coffey | | | Chief Operating Officer and General Counsel | | | 58 |

| • | the Class I directors are Anggelos Skutaris, and Katrina Fritz, and their terms will expire at the annual meeting of stockholders to be held in 2021; |

| • | the Class II directors are Katherine E. Fleming and Lawrence M. Clark, Jr., and their terms will expire at the annual meeting of stockholders to be held in 2022; and |

| • | the Class III directors are Vassilios Gregoriou, Emory De Castro, and William Hunter, and their terms will expire at the annual meeting of stockholders to be held in 2023. |

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| • | helping to ensure the independence and performance of the independent registered public accounting firm; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing policies on risk assessment and risk management; |

| • | reviewing related party transactions; |

| • | obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and |

| • | approving (or, as permitted, pre-approving) all audit and all permissible non-audit service to be performed by the independent registered public accounting firm. |

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration (if any) of our Chief Executive Officer based on such evaluation; |

| • | reviewing and approving the compensation of our other executive officers; |

| • | reviewing and recommending to our board of directors the compensation of our directors; |

| • | reviewing our executive compensation policies and plans; |

| • | reviewing and approving, or recommending that our board of directors approve, incentive compensation and equity plans, severance agreements, change-of-control protections and any other compensatory arrangements for our executive officers and other senior management, as appropriate; |

| • | administering our incentive compensation equity-based incentive plans; |

| • | selecting independent compensation consultants and assessing whether there are any conflicts of interest with any of the committee’s compensation advisors; |

| • | assisting management in complying with our proxy statement and Annual Report disclosure requirements; |

| • | if required, producing a report on executive compensation to be included in our annual proxy statement; |

| • | reviewing and establishing general policies relating to compensation and benefits of our employees; and |

| • | reviewing our overall compensation philosophy. |

| • | identifying, evaluating and selecting, or recommending that our board of directors approve, nominees for election to our board of directors; |

| • | evaluating the performance of our board of directors and of individual directors; |

| • | reviewing developments in corporate governance practices; |

| • | evaluating the adequacy of our corporate governance practices and reporting; |

| • | reviewing management succession plans; and |

| • | developing and making recommendations to our board of directors regarding corporate governance guidelines and matters. |

| • | Vassilios Gregoriou, Advent’s Chief Executive Officer and Chairman of its Board of Directors; |

| • | Emory De Castro, Advent’s Chief Technology Officer; and |

| • | Christos Kaskavelis, Advent’s Chief Marketing Officer. |

Name and Principal Position(1) | | | Year | | | Salary ($)(1)(2) | | | Bonus ($) | | | Stock Awards ($)(3) | | | Total ($) |

Vassilios Gregoriou, Chairman of the Board of Directors and Chief Executive Officer | | | 2020 | | | $170,000 | | | — | | | $323,966 | | | $493,966 |

| | 2019 | | | $170,000 | | | — | | | — | | | $170,000 | ||

| | | | | | | | | | | ||||||

Emory De Castro, Chief Technology Officer | | | 2020 | | | $150,000 | | | — | | | $173,896 | | | $323,896 |

| | | 2019 | | | $150,000 | | | — | | | — | | | $150,000 | |

| | | | | | | | | | | ||||||

Christos Kaskavelis, Chief Marketing Officer | | | 2020 | | | $120,000 | | | — | | | $173,896 | | | $293,896 |

| | | 2019 | | | $68,909 | | | — | | | — | | | $68,909 |

| (1) | As described in further detail below in the “Employment Agreements and Other Arrangements with Executive Officers and Directors— Payment of Accrued but Unpaid Base Compensation” of this section and in Note 3 of the Company’s audited financial statements for fiscal year 2019 included as part of this joint prospectus, although Messrs. Gregoriou, De Castro, and Kaskavelis have earned the base compensation identified above, all or a portion of these amounts have not yet been paid to them. As of December 31, 2020, an aggregate of $613,970, $426,422, and $120,000 is due in unpaid compensation for prior service to, respectively, Messrs. Gregoriou, De Castro, and Kaskavelis. These amounts were repaid to Messrs. Gregoriou, De Castro, and Kaskavelis in connection with the Business Combination. |

| (2) | Mr. Kaskavelis compensation was paid to Mamaya IKE, a Greek company owned by Mr. Kaskavelis and his wife. |

| (3) | The amounts included under the “Stock Awards” column reflect the aggregate grant date fair value of the stock awards granted during the 2020 fiscal year. For more information regarding these share-based compensation arrangements, see Note 12 to the Audited Consolidated Financial Statements for the year ended December 31, 2020 included as part of this prospectus. |

Named Executive Officer | | | Current Annual Base Salary |

Vassilios Gregoriou | | | $170,000 |

Emory De Castro | | | $150,000 |

Christos Kaskavelis | | | $120,000 |

| • | Mr. Gregoriou serves as our Chief Executive Officer and Chairman of our board of directors, with an initial annual base salary of $800,000, a one-time signing bonus of $500,000, and beginning in fiscal year 2021, eligibility to earn an annual performance bonus with a target equal to 150% of his annual base salary. |

| • | Mr. Coffey serves as our Chief Operating Officer and General Counsel, with an annual base salary of $475,000, a one-time signing bonus of $250,000, and beginning in fiscal year 2021, eligibility to earn an annual performance bonus with a target equal to 100% of his annual base salary. |

| • | Mr. De Castro serves as our Chief Technology Officer, with an annual base salary of $350,000, a one-time signing bonus of $250,000, and beginning in fiscal year 2021, eligibility to earn an annual performance bonus with a target equal to 100% of his annual base salary. |

| • | Mr. Kaskavelis serves as our Chief Marketing Officer, with an annual base salary of €315,000, and beginning in fiscal year 2021, eligibility to earn an annual performance bonus with a target equal to 100% of his annual base salary. |

| • | Mr. Hunter serves as our President and Chief Financial Officer, with an annual base salary of $475,000, a one-time signing bonus of $400,000, and eligibility to earn an annual performance bonus with a target equal to 125% of his annual base salary. |

| • | in whole and not in part; |

| • | at a price of $0.01 per warrant; |

| • | upon not less than 30 days’ prior written notice of redemption (the “30-day redemption period”) to each warrant holder; and |

| • | if, and only if, the closing price of our common stock equals or exceeds $18.00 per share (as adjusted for stock splits, stock capitalizations, reorganizations, recapitalizations and the like) for any 20 trading days within a 30-trading day period ending three business days before we send the notice of redemption to the warrant holders. |

| • | a stockholder who owns 15% or more of our outstanding voting stock (otherwise known as an “interested stockholder”); |

| • | an affiliate of an interested stockholder; or |

| • | an associate of an interested stockholder, for three years following the date that the stockholder became an interested stockholder. |

| • | our board of directors approves the transaction that made the stockholder an “interested stockholder,” prior to the date of the transaction; or |

| • | after the completion of the transaction that resulted in the stockholder becoming an interested stockholder, that stockholder owned at least 85% of our voting stock outstanding at the time the transaction commenced, other than statutorily excluded shares of common stock. |

| • | 1% of the total number of shares of our common stock then outstanding; or |

| • | the average weekly reported trading volume of our common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

| • | the issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| • | the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| • | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| • | at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

| • | each person known to us to be the beneficial owner of more than 5% of outstanding common stock; |

| • | each of our executive officers and directors; and |

| • | all executive officers and directors as a group. |

Name and Address of Beneficial Owner | | | Number of Shares | | | % |

Directors and Executive Officers Post-Business Combination | | | | | ||

Vassilios Gregoriou | | | 5,465,506 | | | 11.9% |

William Hunter | | | 100,000 | | | * |

Christos Kaskavelis(1) | | | 3,704,113 | | | 8.0% |

Emory De Castro | | | 2,124,999 | | | 4.6% |

James F. Coffey | | | 590,705 | | | 1.3% |

Katherine E. Fleming | | | — | | | — |

Anggelos Skutaris | | | — | | | — |

Katrina Fritz | | | — | | | — |

Lawrence M. Clark, Jr. | | | 35,000 | | | * |

All directors and executive officers post-Business Combination as a group (nine individuals)(2) | | | 12,020,323 | | | 26.1% |

Five Percent Holders: | | | | | ||

AMCI Sponsor LLC(3)(4) | | | 4,844,148 | | | 9.99% |

Charalampos Antoniou(5) | | | 2,775,049 | | | 6.0% |

| * | less than 1% |

| (1) | Christos Kaskavelis’ ownership includes 1,802,405 shares owned by Nemaland Ltd, an entity in which Mr. Kaskavelis and his wife each hold a 50% stake and for which Mr. Kaskavelis holds shared voting and dispositive power with his wife with regard to such shares of Company common stock. The business address of Mr. Kaskavelis is 200 Clarendon Street, Boston, MA 02116. The business address of Nemaland Ltd is 77 Strovolou, Office 204, 2018 Strovolos, 2018, Cyprus. |

| (2) | Unless otherwise indicated, the business address of each of the individuals is 200 Clarendon Street, Boston, MA 02116. |

| (3) | The number of shares includes 2,474,009 shares of Company common stock issued to the Sponsor upon conversion of its founder shares and 2,370,139 shares of Company common stock issued upon exercise of warrants owned by the Sponsor. Pursuant to the Merger Agreement, the Sponsor entered into a letter agreement with AMCI and Advent, which provided that the Sponsor would forfeit one-third (1/3rd) of the placement warrants that it owned as of the Closing. The business address of the Sponsor is c/o AMCI Acquisition Corp., 1501 Ligonier Street, Suite 370, Latrobe, PA 15650. |

| (4) | In connection with a loan previously made by Orion Resource Partners (USA) LP to AMCI, the Sponsor transferred one-half of its founder shares and one-half of its remaining placement warrants after the forfeiture described above to permitted transferees of Sponsor and Orion Resource Partners (USA) LP at the closing of the Business Combination. |

| (5) | Charalampos Antoniou’s ownership includes 1,784,389 shares owned by Neptune International AG, an entity for which Mr. Antoniou holds shared voting and dispositive power with regard to such shares of Company common stock. The business address of Mr. Antoniou is Bernoldweg 14, ZUG, 6300, Switzerland. The business address of Neptune International AG is Bahnhofstrasse 7, ZUG, 6300, Switzerland. |

Selling Securityholder(1) | | | Shares of Common Stock Beneficially Owned Prior to Offering | | | Placement Warrants or Working Capital Warrants Beneficially Owned Prior to Offering | | | Shares of Common Stock Offered | | | Placement Warrants or Working Capital Warrants Offered | | | Shares of Common Stock Beneficially Owned After the Offered Shares are Sold | | | % | | | Placement Warrants or Working Capital Warrants Beneficially Owned After the Offered Private Placement Warrants are Sold | | | % |

Helikon Investments Limited(2) | | | 2,000,000 | | | — | | | 2,000,000 | | | — | | | — | | | — | | | — | | | — |

BNP Paribas Funds Energy Transition(3) | | | 1,800,000 | | | — | | | 1,800,000 | | | — | | | — | | | — | | | — | | | — |

D.E. Shaw Valence Portfolios, L.L.C.(4) | | | 750,000 | | | — | | | 750,000 | | | — | | | — | | | — | | | — | | | — |

Apollo Asset Ltd.(5) | | | 384,000 | | | — | | | 384,000 | | | — | | | — | | | — | | | — | | | — |

D.E. Shaw Oculus Portfolios, L.L.C.(6) | | | 250,000 | | | — | | | 250,000 | | | — | | | — | | | — | | | — | | | — |

Delphi Global(7) | | | 220,000 | | | — | | | 220,000 | | | — | | | — | | | — | | | — | | | — |

Glazer Capital LLC(8) | | | 200,000 | | | — | | | 200,000 | | | — | | | — | | | — | | | — | | | — |

Songa Capital AS(9) | | | 100,000 | | | — | | | 100,000 | | | — | | | — | | | — | | | — | | | — |

Klaveness Marine Finance AS(10) | | | 100,000 | | | — | | | 100,000 | | | — | | | — | | | — | | | — | | | — |

VB Capital Management AG(11) | | | 100,000 | | | — | | | 100,000 | | | — | | | — | | | — | | | — | | | — |

Investeringsfondet Viking AS(12) | | | 95,000 | | | — | | | 95,000 | | | — | | | — | | | — | | | — | | | — |

Pala Investments Limited(13) | | | 75,000 | | | — | | | 75,000 | | | — | | | — | | | — | | | — | | | — |

Istvan Zollei(14)(15)(16) | | | 539,812 | | | 416,406 | | | 539,812 | | | 416,406 | | | — | | | — | | | — | | | — |

Dov Lader (15)(16)(17) | | | 269,906 | | | 208,203 | | | 269,906 | | | 208,203 | | | — | | | — | | | — | | | — |

Daniel Zier(15)(16)(18) | | | 107,962 | | | 83,281 | | | 107,962 | | | 83,281 | | | — | | | — | | | — | | | — |

2012 Lewnowski Family Trust UAD 12/19/2012(15)(16)(19) | | | 1,636,330 | | | 1,262,249 | | | 1,636,330 | | | 1,262,249 | | | — | | | — | | | — | | | — |

AMCI Sponsor LLC(15)(16)(20) | | | 2,474,009 | | | 2,370,139 | | | 2,474,009 | | | 2,370,139 | | | — | | | — | | | — | | | — |

William Hunter(15)(21) | | | 100,000 | | | — | | | 100,000 | | | — | | | — | | | — | | | — | | | — |

Brian Beem(15)(22) | | | 100,000 | | | — | | | 100,000 | | | — | | | — | | | — | | | — | | | — |

Nimesh Patel(15)(23) | | | 100,000 | | | — | | | 100,000 | | | — | | | — | | | — | | | — | | | — |

Gary Uren(15)(24) | | | 35,000 | | | — | | | 35,000 | | | — | | | — | | | — | | | — | | | — |

Lawrence M. Clark, Jr.(15)(25) | | | 35,000 | | | — | | | 35,000 | | | — | | | — | | | — | | | — | | | — |

Jason Grant(15)(26) | | | 35,000 | | | — | | | 35,000 | | | — | | | — | | | — | | | — | | | — |

Patrick Murphy(15)(27) | | | 80,000 | | | — | | | 80,000 | | | | | | | | | | ||||||

Vassilios Gregoriou(28)(29) | | | 5,465,506 | | | — | | | 5,465,506 | | | — | | | — | | | — | | | — | | | — |

Christos Kaskavelis(29)(30) | | | 3,704,113 | | | — | | | 3,704,113 | | | — | | | — | | | — | | | — | | | — |

Emory De Castro(29)(31) | | | 2,124,999 | | | — | | | 2,124,999 | | | — | | | — | | | — | | | — | | | — |

James F. Coffey(29)(32) | | | 590,705 | | | — | | | 590,705 | | | — | | | — | | | — | | | — | | | — |

| * | Less than one percent. |

| (1) | The disclosure with respect to the remaining Selling Securityholders is being made on an aggregate basis, as opposed to on an individual basis, because their aggregate holdings are less than 1% of the outstanding shares of common stock. The address for these Selling Securityholders is c/o Advent Technologies Holdings, Inc., 200 Clarendon Street, Boston, MA 02116. |

| (2) | The address of Helikon Investments Limited is 105 Jermyn Street, London, SW1Y 6EE, UK. |

| (3) | The address of BNP Paribas Funds Energy Transition is c/o BNP Paribas Asset Management UK Limited, 5 Aldermanbury Square, London EC2V 7BP, UK. |

| (4) | The address of D.E. Shaw Valence Portfolios, L.L.C. is 1166 Avenue of the Americas, New York, New York 10036. |

| (5) | The address of Apollo Asset Ltd. is 34 Avenue De L’Annunciade, 98000 Monaco, MC. |

| (6) | The address of D.E. Shaw Oculus Portfolios, L.L.C. 1166 Avenue of the Americas, New York, New York 10036. |

| (7) | The address of Delphi Global is Professor Kohts VEI 9, PO Box 484, 1327 Lysaker, Norway. |

| (8) | The address of Glazer Capital LLC is 250 West 55th Street, Suite 30A, New York, New York 10019. |

| (9) | The address of Songa Capital AS is Haakon Vlls gt 7, 0251 Oslo, Norway. |

| (10) | The address of Klaveness Marine Finance AS is Harbizalleen 2A, 0275 PO Box 399 Skoyen, Norway. |

| (11) | The address of VB Capital Management AG is Lowenstrasse 2, Zurich CH 8001, Switzerland. |

| (12) | The address of Investeringsfondet Viking AS is Bogstadveien 6, 0355 Oslo, Norway. |

| (13) | The address of Pala Investments Limited is Gatthardstrasse 26, Zug, Switzerland. |

| (14) | Consists of securities held by Orion prior to the Business Combination. The address of Istvan Zollei is 425 West 53rd Street, TH# 409, New York, New York 10019. |

| (15) | These shares are subject to a contractual lock-up pursuant to a letter agreement as of November 15, 2018. Subject to certain limited exceptions, such securities cannot be transferred for one year following the Business Combination; provided that the lock-up will terminate if the closing price of the common stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20 trading days within any 30-trading day period commencing at least 150 days after the date of the Business Combination. |

| (16) | These warrants and the shares underlying the warrants are subject to a contractual lock-up pursuant to a letter agreement as of November 15, 2018. Subject to certain limited exceptions, such warrants and the shares underlying such warrants cannot be transferred for 30 days following the Business Combination. |

| (17) | Consists of securities held by Orion prior to the Business Combination. The address of Dov Lader is 598 Barnard Avenue, Woodmere, New York, 11598. |

| (18) | Consists of securities held by Orion prior to the Business Combination. The address of Daniel Zier is 1050 S Josephine Street, Denver, Colorado 80209. |

| (19) | Consists of securities held by Orion prior to the Business Combination. The address of the 2012 Lewnowski Family Trust UAD 12/19/2012 is 75 Stuyvesant Avenue, Rye, New York 10580. |

| (20) | Consists of securities held by Orion prior to the Business Combination. The address of AMCI Sponsor LLC is 1501 Ligonier Street, Suite 370, Latrobe, PA 15650. |

| (21) | The address of William Hunter is 200 Clarendon Street, Boston, MA 02116. |

| (22) | The address of Brian Beem is 1501 Ligonier Street, Suite 370, Latrobe, PA 15650. |

| (23) | The address of Nimesh Patel is 1501 Ligonier Street, Suite 370, Latrobe, PA 15650. |

| (24) | The address of Gary Uren is 1501 Ligonier Street, Suite 370, Latrobe, PA 15650. |

| (25) | The address of Lawrence M. Clark, Jr. is 200 Clarendon Street, Boston, MA 02116. |

| (26) | The address of Jason Grant is 1501 Ligonier Street, Suite 370, Latrobe, PA 15650 |

| (27) | The address of Patrick Murphy is 1501 Ligonier Street, Suite 370, Latrobe, PA 15650. |

| (28) | The address of Vassilios Gregoriou is 200 Clarendon Street, Boston, MA 02116. |

| (29) | These securities are subject to a contractual lock-up pursuant to a letter agreement dated October 12, 2020. Subject to certain limited exceptions, such securities cannot be transferred for one year following the Business Combination; provided that the lock-up will terminate if the closing price of the common stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20 trading days within any 30-trading day period commencing at least 150 days after the date of the Business Combination. |

| (30) | The address of Christos Kaskavelis is 200 Clarendon Street, Boston, MA 02116. |

| (31) | The address of Emory De Castro is 200 Clarendon Street, Boston, MA 02116. |

| (32) | The address of James F. Coffey is 200 Clarendon Street, Boston, MA 02116. |

| • | financial institutions or financial services entities; |

| • | broker-dealers; |

| • | governments or agencies or instrumentalities thereof; |

| • | regulated investment companies; |

| • | real estate investment trusts; |

| • | expatriates or former long-term residents of the U.S.; |

| • | persons that actually or constructively own five percent or more of our voting shares; |

| • | insurance companies; |

| • | dealers or traders subject to a mark-to-market method of accounting with respect to the securities; |

| • | persons holding the securities as part of a “straddle,” hedge, integrated transaction or similar transaction; |

| • | persons that receive shares upon the exercise of employee stock options or otherwise as compensation; |

| • | U.S. holders (as defined below) whose functional currency is not the U.S. dollar; |

| • | partnerships or other pass-through entities for U.S. federal income tax purposes and any beneficial owners of such entities; and |

| • | tax-exempt entities. |

| • | an individual who is a citizen or resident of the U.S.; |

| • | a corporation (or other entity taxable as a corporation) organized in or under the laws of the U.S., any state thereof or the District of Columbia; or |

| • | an estate the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source; or |

| • | a trust, if (i) a court within the U.S. is able to exercise primary supervision over the administration of the trust and one or more U.S. persons (as defined in the Code) have authority to control all substantial decisions of the trust or (ii) it has a valid election in effect under Treasury Regulations to be treated as a U.S. person. |

| • | a non-resident alien individual (other than certain former citizens and residents of the U.S. subject to U.S. tax as expatriates); |

| • | a foreign corporation or |

| • | an estate or trust that is not a U.S. holder; |

| • | the gain is effectively connected with the conduct of a trade or business by the Non-U.S. holder within the U.S. (and, under certain income tax treaties, is attributable to a U.S. permanent establishment or fixed base maintained by the Non-U.S. holder); or |

| • | we are or have been a “U.S. real property holding corporation” for U.S. federal income tax purposes at any time during the shorter of the five-year period ending on the date of disposition or the period that the Non-U.S. holder held our common stock, and, in the case where shares of our common stock are regularly traded on an established securities market, the Non-U.S. holder has owned, directly or constructively, more than 5% of our common stock at any time within the shorter of the five-year period preceding the disposition or such Non-U.S. holder’s holding period for the shares of our common stock. There can be no assurance that our common stock will be treated as regularly traded on an established securities market for this purpose. |

| • | purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| • | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| • | block trades in which the broker-dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | an over-the-counter distribution in accordance with the rules of The Nasdaq Stock Market; |

| • | through trading plans entered into by a Selling Securityholder pursuant to Rule 10b5-1 under the Exchange Act that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans; |

| • | through one or more underwritten offerings on a firm commitment or best efforts basis; |

| • | settlement of short sales entered into after the date of this prospectus; |

| • | agreements with broker-dealers to sell a specified number of the securities at a stipulated price per share or warrant; |

| • | in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| • | directly to purchasers, including through a specific bidding, auction or other process or in privately negotiated transactions; |

| • | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| • | through a combination of any of the above methods of sale; or |

| • | any other method permitted pursuant to applicable law. |

| • | the specific securities to be offered and sold; |

| • | the names of the selling securityholders; |

| • | the respective purchase prices and public offering prices, the proceeds to be received from the sale, if any, and other material terms of the offering; |

| • | settlement of short sales entered into after the date of this prospectus; |

| • | the names of any participating agents, broker-dealers or underwriters; and |

| • | any applicable commissions, discounts, concessions and other items constituting compensation from the selling securityholders. |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | December 31, 2020 | | | December 31, 2019 | |

ASSETS | | | | | ||

Current Assets | | | | | ||

Cash | | | $24,945 | | | $520,422 |

Prepaid income tax | | | 203,613 | | | — |

Prepaid expenses and other current assets | | | 353,959 | | | 57,109 |

Total Current Assets | | | 582,517 | | | 577,531 |

Cash and cash equivalents held in Trust Account | | | 93,340,005 | | | 225,433,349 |

Total Assets | | | $93,922,522 | | | $226,010,880 |

| | | | | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | ||

Current Liabilities | | | | | ||

Accounts payable | | | $349,439 | | | $25,496 |

Accrued expenses | | | 25,000 | | | 25,000 |