Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267430

PROSPECTUS SUPPLEMENT

(To Prospectus dated September 15, 2022)

Tencent Music Entertainment Group

Class A Ordinary Shares

Scarlet Punk Investment Limited, a wholly-owned special purpose vehicle of ours, is lending to the Designated Dealer (as defined in “Description of Liquidity Arrangements”) up to 42,000,000 of our Class A ordinary shares, US$0.000083 per share, or approximately 2.5% of our total Class A ordinary shares issued and outstanding as of September 7, 2022, to facilitate the proposed listing of our Class A ordinary shares on the Main Board of The Stock Exchange of Hong Kong Limited, or the Hong Kong Stock Exchange, by way of introduction, or the Listing. Our Class A ordinary shares will be traded on the Hong Kong Stock Exchange under the stock code “1698.”

The Class A ordinary shares being lent hereby will be used by the designated dealers to create additional liquidity of our Class A ordinary shares on the Hong Kong Stock Exchange through sales at market prices during a period of 30 calendar days from and including the listing date of our Class A ordinary shares on the Hong Kong Stock Exchange, which is expected to be on or about September 21, 2022. See “Description of Liquidity Arrangements.” The Class A ordinary shares are being registered hereby in connection with the sale of such shares to the extent that they are sold to U.S. persons, as defined under Regulation S, or for the account or benefit of U.S. persons.

Neither we nor Scarlet Punk Investment Limited will receive any proceeds from the lending of the Class A ordinary shares being registered hereby, which will be sold at prevailing market prices at the time of sale in liquidity trades on the Hong Kong Stock Exchange during the bridging period with delivery expected to occur from time to time in accordance with the rules of the Hong Kong Stock Exchange.

Our ADSs are listed on the New York Stock Exchange, or the NYSE, under the symbol “TME.” Each ADS represents two Class A ordinary shares. On September 14, 2022, the last reported sale price of the ADSs on the NYSE was US$4.78 per ADS.

Investing in our ADSs and Class A ordinary shares involves risks. See “Risk Factors” beginning on page S-34 of this prospectus supplement and in any documents incorporated by reference into this prospectus supplement for a discussion of certain risks that should be considered in connection with an investment in our Class A ordinary shares.

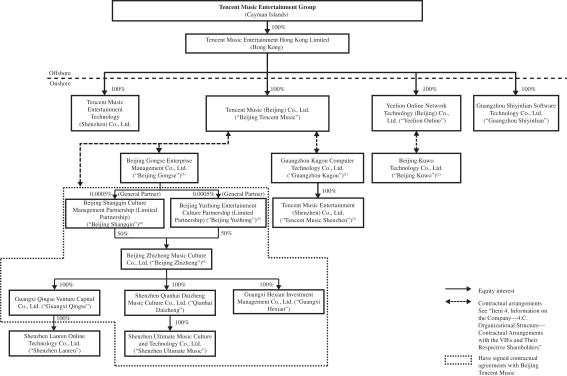

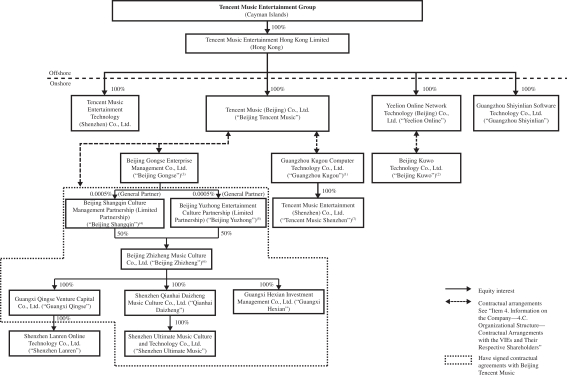

Tencent Music Entertainment Group is a Cayman Islands holding company. It does not engage in operations itself but rather conducts its operations through its PRC subsidiaries and consolidated variable interest entities, or the VIEs. However, we and our direct and indirect subsidiaries do not, and it is virtually impossible for them to, have any equity interests in the VIEs in practice as current PRC laws and regulations restrict foreign investment in companies that engage in value-added telecommunication services and online cultural services. As a result, we depend on certain contractual arrangements with the VIEs to operate a significant portion of our business. The VIEs are owned by certain nominee shareholders, not us. Investors of our ADSs are purchasing equity securities of a Cayman Islands holding company rather than equity securities issued by our subsidiaries and the VIEs. Investors who are non-PRC residents may never directly hold equity interests in the VIEs under current PRC laws and regulations. As used in this prospectus supplement, “we,” “us,” “our company,” “our,” or “TME” refers to Tencent Music Entertainment Group and its subsidiaries, and, in the context of describing our consolidated financial information, business operations and operating data, our consolidated VIEs.

Our corporate structure involves unique risks to investors in the ADSs. In 2019, 2020 and 2021, the amount of revenues generated by the VIEs accounted for 99.8%, 99.8% and 99.1%, respectively, of our total net revenues. As of December 31, 2020 and 2021, total assets of the VIEs, excluding amounts due from other companies in the Group, equaled to 26.5% and 26.9% of our consolidated total assets as of the same dates, respectively. Our contractual arrangements with the VIEs have not been tested in court. If the PRC government deems that our contractual arrangements with the VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to material penalties or be forced to relinquish our interests in those operations or otherwise significantly change our corporate structure. We and our investors face significant uncertainty about potential future actions by the PRC government that could affect the legality and enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect our ability to consolidate the financial results of the VIEs and the financial performance of our company as a whole. Our ADSs may decline in value or become worthless if we are unable to effectively enforce our contractual control rights over the assets and operations of the VIEs that conduct a significant portion of our business in China. See “Item 3. Key Information—3.D. Risk Factors—Risks Related to Our Corporate Structure” in our annual report on Form 20-F for the fiscal year ended December 31, 2021, or the 2021 Form 20-F, and “Risk Factors—Risks Related to Our Corporate Structure” in Exhibit 99.1 to our current report on Form 6-K furnished to the SEC on September 15, 2022, or the Supplemental 6-K, both of which documents are incorporated herein by reference.

We face various legal and operational risks and uncertainties as a company based in and primarily operating in China. The PRC regulatory authorities have significant authority to exert influence on the ability of a China-based company, like us,