Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

LODGING FUND REIT III, INC.

(Exact name of registrant as specified in its charter)

| | |

Maryland

(State or other jurisdiction of

incorporation or organization) | | 83-1750653

(I.R.S. Employer

Identification No.) |

1635 43rd Street South, Suite 205, Fargo, North Dakota

(Address of principal executive offices) |

|

58103

(Zip Code) |

Registrant's telephone number including area code(701) 630-6500

Securities to be registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class to be so registered | | Name of each exchange on which each

class is to be registered |

|---|

| None | | None |

Securities to be registered pursuant to Section 12(g) of the Act:

| | | | |

| | Common stock, $0.01 par value | |

|

|---|

| | | (Title of class) | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company ý Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Table of Contents

TABLE OF CONTENTS

| | | | | | |

| |

| | Page No. | |

|---|

Cautionary Note Regarding Forward-Looking Statements | | | i | |

Item 1.

|

|

Business

|

|

|

3 |

|

Item 1A.

|

|

Risk Factors

|

|

|

12 |

|

Item 2.

|

|

Financial Information

|

|

|

12 |

|

Item 3.

|

|

Properties

|

|

|

20 |

|

Item 4.

|

|

Security Ownership of Certain Beneficial Owners and Management

|

|

|

21 |

|

Item 5.

|

|

Directors and Executive Officers

|

|

|

23 |

|

Item 6.

|

|

Executive Compensation

|

|

|

27 |

|

Item 7.

|

|

Certain Relationships and Related Transactions and Director Independence

|

|

|

28 |

|

Item 8.

|

|

Legal Proceedings

|

|

|

33 |

|

Item 9.

|

|

Market Price of and Dividends on the Registrant's Common Equity and Related Stockholder Matters

|

|

|

33 |

|

Item 10.

|

|

Recent Sales of Unregistered Securities

|

|

|

34 |

|

Item 11.

|

|

Description of Registrant's Securities to be Registered

|

|

|

35 |

|

Item 12.

|

|

Indemnification of Directors and Officers

|

|

|

46 |

|

Item 13.

|

|

Financial Statements and Supplementary Data

|

|

|

47 |

|

Item 14.

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

|

47 |

|

Item 15.

|

|

Financial Statement and Exhibits

|

|

|

48 |

|

|

|

Signatures

|

|

|

52 |

|

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10 of the Company other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "should," "expect," "could," "intend," "anticipate," "plan," "estimate," "believe," "potential," "continue," or other similar words. Specifically, we consider, among others, statements concerning future operating results and cash flows, our ability to meet future obligations, and the amount and timing of any future distributions to stockholders to be forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the SEC. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this Form 10, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to unknown risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered.

The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking statements:

- •

- We have a limited operating history and may not be successful at operating a real estate investment trust, or REIT, which may adversely affect our ability to make distributions to our stockholders.

- •

- Failure to qualify as a REIT would reduce our net earnings available for investment or distribution to our stockholders.

- •

- Our advisor, its executive officers and other key personnel, as well as certain of our officers and directors, whose services are essential to the Company, may be involved in other business ventures, and will face a conflict in allocating their time and other resources between us and the other activities in which they are or may become involved. Failure of our advisor, its executive officers and key personnel, and our officers and directors to devote sufficient time or resources to our operations could result in reduced returns to our stockholders.

- •

- We will pay certain prescribed fees to our advisor and its affiliates regardless of the quality of services provided.

- •

- We may utilize debt financing from third parties to acquire properties and to make capital improvements at our properties. Our ability to acquire, rehabilitate, renovate and manage our properties may be limited if we cannot obtain satisfactory financing, which will depend on capital markets conditions. There can be no assurance that we will be able to obtain financing on favorable terms, or at all.

i

Table of Contents

- •

- We intend to acquire only hotel properties. As a result, we will only have limited diversification as to the type of property we own. In the event of an economic recession affecting the economies of the areas in which the properties are located or a decline in values in general, our financial performance could be materially and adversely affected.

- •

- Demand for our properties may be affected by various factors, including an over-supply or over-building of hotel properties in our properties' markets. If demand does not increase or if demand weakens, our operating results and growth prospects could be adversely affected.

ii

Table of Contents

ITEM 1. BUSINESS.

We are filing this Form 10 to register shares of our common stock pursuant to Section 12(g) of the Exchange Act. As a result of our voluntary registration of our common stock pursuant to the Exchange Act, following the effectiveness of this Form 10, we will be subject to the requirements of the Exchange Act and the rules promulgated thereunder. In particular, we will be required to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K and otherwise comply with the disclosure obligations of the Exchange Act applicable to issuers filing registration statements to register a class of securities pursuant to Section 12(g) of the Exchange Act. We are voluntarily registering shares of our common stock pursuant to Section 12(g) of the Exchange Act to provide our stockholders with access to public disclosure regarding our business and operations of the type required in the reports filed under the Exchange Act.

General

Lodging Fund REIT III, Inc. is a Maryland corporation formed on April 9, 2018 for the principal purpose of acquiring a diversified portfolio of hotel properties (the "Projects") located primarily in the "America's Heartland," which the Company defines as the geographic area from North Dakota to Texas and the Appalachian Mountains, to the Rocky Mountains. On an infrequent and opportunistic basis, we may also originate or acquire high-yield loans secured directly or indirectly by real estate-related assets, which loans will be made to certain qualified third-party borrowers and/or affiliates of our advisor (the "Loans"). We intend to qualify as a real estate investment trust, or REIT, beginning with the taxable year ending December 31, 2018. We have not received an opinion of counsel regarding our status under the Internal Revenue Code as a REIT. We conduct substantially all of our business and own substantially all real estate investments through our operating partnership, Lodging Fund REIT III OP, LP, a Delaware limited partnership (the "Operating Partnership"). We are the sole general partner (the "General Partner") of the Operating Partnership. We and the Operating Partnership are advised by Legendary Capital REIT III, LLC, a Delaware limited liability company (the "Advisor") pursuant to an agreement (the "Advisory Agreement") under which the Advisor performs advisory services regarding acquisition, financing and disposition of the Projects and origination of the Loans, and is responsible for managing, operating and maintaining the Projects and day-to-day management of the Company. The Advisor may, in its sole discretion, perform these duties through one or more affiliates. We expect to engage NHS, LLC dba National Hospitality Services ("NHS") to manage the Projects in our initial portfolio; however, we can and may engage a third party property management company. NHS is wholly-owned by Norman Leslie, a director and executive officer of the Company and a principal of the Advisor. The Advisor has no direct employees. The employees of Legendary Capital, LLC (the "Sponsor"), an affiliate of the Advisor, provide services to the Company related to the negotiations of property acquisitions and financing, asset management, accounting, investor relations, and all other administrative services. Where applicable in this Form 10, "we," "our," "us," and "the Company" refers to Lodging Fund REIT III, Inc., the Operating Partnership and their subsidiaries except where the context otherwise requires.

On June 1, 2018, we commenced an offering of up to 10,000,000 shares of our common stock under a private placement to qualified purchasers who meet the definition of "accredited investors," as provided in Regulation D of the Securities Act (the "Offering"). The Offering will continue until the earlier of (i) the date when the maximum offering amount is sold, (ii) June 1, 2020, which may be extended by our board of directors in its sole discretion, or (iii) a decision by the Company to terminate the Offering. As of June 30, 2019, the Company had issued 3,288,371 shares of common stock resulting in gross offering proceeds of approximately $32.4 million, including 37,516 shares issued under our dividend reinvestment plan. After deductions for payments of selling commissions, marketing and diligence allowances, other wholesale selling costs and expenses, and other offering expenses, we received net offering proceeds of approximately $26.0 million. The net offering proceeds have been

3

Table of Contents

used to fund property acquisitions. No public market exists for the shares of our common stock and none is expected to develop.

As of the date of this Form 10, we own four properties consisting of properties in Cedar Rapids, Iowa; Pineville, North Carolina; Eagan, Minnesota; and Prattville, Alabama, referred to in this Form 10 as the "Cedar Rapids Property," the "Pineville Property," the "Eagan Property," and the "Prattville Property," respectively. See Item 3, "Properties" for a more detailed description of our current portfolio.

Our principal executive offices are located at 1635 43rd Street South, Suite 205, Fargo, North Dakota 58103. Our telephone number is (701) 630-6500.

Our REIT Status

To qualify for REIT status, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our REIT taxable income, determined without regard for any deduction for distributions paid and excluding any net capital gain, to our stockholders. If we qualify as a REIT, we generally will not be subject to U.S. federal income tax on the REIT taxable income we distribute to our stockholders. Even if we qualify as a REIT, we may still be subject to some federal, state and local taxes on a certain portion of our income or property. If we fail to qualify as a REIT in any taxable year, including the current year, we will be subject to federal income tax at regular corporate rates.

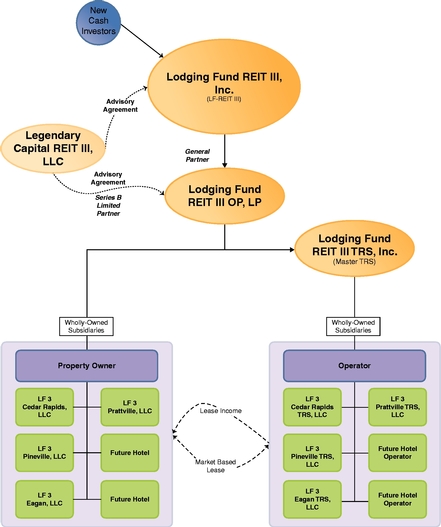

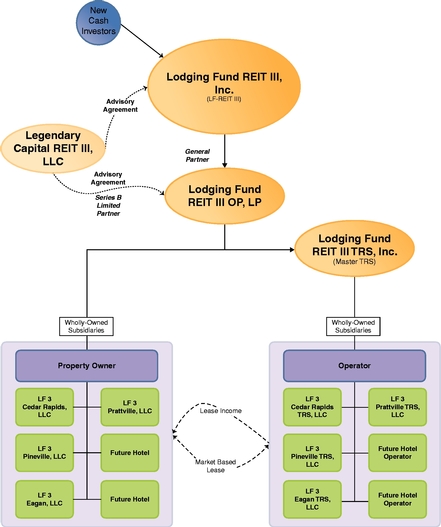

Our Operating Partnership

We plan to utilize an "umbrella partnership real estate investment trust," or "UPREIT" structure, in which substantially all of our real estate investments are owned through the Operating Partnership. The Company is the sole general partner of the Operating Partnership.

Our Taxable REIT Subsidiary (TRS) Structure

We anticipate that substantially all of our Projects will be indirectly owned by the Operating Partnership through wholly-owned special purpose limited liability companies or other subsidiaries. In order for the income from our hotel operations to constitute "rents from real property" for purposes of the gross income tests required for REIT qualification, we cannot directly or indirectly operate any of the Projects. Instead, we must lease the Projects in order to derive REIT-qualified income from rents. The Operating Partnership will form various subsidiaries ("TRS Lessees") to act as the lessees of the Projects. Rather than leasing the Projects to third-party operators not owned or controlled by us, we opted to integrate the hotel operating entities into our REIT structure through the use of our TRS Lessees. By integrating each hotel operating entity within our REIT structure, we will capture for our stockholder's benefit not only net lease income from the Project owner subsidiaries, but also 100% of the income from the hotel operating entities. To facilitate our REIT structure, the Operating Partnership formed Lodging Fund REIT III TRS, Inc., a Delaware corporation ("Master TRS"), to act as the "master" TRS entity. When we acquire a Project, the Master TRS will form a separate wholly-owned TRS Lessee. That Lessee will enter into a triple-net lease agreement with a wholly-owned subsidiary of the Operating Partnership to operate the Project.

Our TRS Lessees have entered into and will continue to enter into management agreements with management companies to operate the Projects. We anticipate that the rent paid to us by our TRS Lessees will qualify as "rents from real property," provided that the TRS Lessees engage "eligible independent contractors" (per IRC Sec 856(d)(9)(A)) to manage the Projects. Our TRS Lessees have engaged NHS to manage our initial portfolio of Projects. We believe that NHS has qualified and will continue to qualify as an eligible independent contractor. Income earned by our TRS Lessees will be fully subject to federal, state and local corporate income tax.

4

Table of Contents

Ownership Structure

The following chart shows our current ownership structure and our relationship with the Advisor as of the date hereof.

Investment Objectives and Operations

We intend to invest primarily in 80 to 200 room limited-service, select-service and extended stay hotel properties with strong mid-market brands in the America's Heartland. Our overall strategy is to purchase a diverse portfolio of hotels that presents a strong opportunity for both cash flow generation and capital appreciation. We will attempt to diversify our investment portfolio by geography, brand and asset opportunity type. Our target markets are metropolitan statistical areas in America's Heartland with populations exceeding 250,000 that exhibit well-diversified business and leisure demand generators. We intend to focus mainly on well-known and established hotel brands, such as Marriott Hotels®, Hilton®, IHG and Hyatt®, however, we may acquire lesser-known hotel brands where strategically appropriate. We will attempt to further diversify our investments based on three asset opportunity classes: "Stabilized" opportunities (steady historical performers), "Refresh" opportunities (needing capital expenditure or management upgrades) and "Value" opportunities (requiring significant upgrades and stabilization). We do not intend to add Value opportunities unless circumstances arise that would make it advantageous.

5

Table of Contents

On an infrequent and opportunistic basis, we may also originate or acquire Loans secured directly or indirectly by real estate-related assets, including, without limitation, mortgages, senior secured loans, subordinated loans, mezzanine loans and bridge loans. These Loans will typically be secured by a first or second lien on real estate and other assets of the borrower. We may also make Loans that are secured by partnership or membership interests in companies affiliated with the borrowers.

Our investment objectives are:

- •

- to preserve, protect and return investor capital contributions;

- •

- to pay regular cash distributions; and

- •

- to realize appreciation in the value of our investments upon the ultimate sale of such investments.

There is no assurance that we will attain these objectives or that there will be any return of capital to investors. Investment results may vary substantially over time and from period to period. Our board of directors may, from time to time, change our investment objectives if it determines it is advisable and in the best interest of our stockholders.

Our Investment Strategy

We believe there is a significant inventory of properties in our target markets that are of quality construction, in good locations with well-known brands and historical track records that meet our diversified portfolio parameters. We believe that many of these hotels can be purchased at less than replacement cost. Our intent is to invest in both larger and smaller markets and create a diversified portfolio of historically steady performers blended with selected properties that have either been poorly managed or under-capitalized. Our intention is to build a diversified portfolio of hotel properties, complete certain property improvements and operate the individual Projects with a final goal of selling the entire portfolio in a single transaction.

In evaluating potential hotel properties for acquisition, we consider various factors including their historical financial and operating performance. There are many issues that may affect a hotel's profitability and cash flow. We plan to target markets that have been historically strong from a demand perspective. We also plan to focus on properties that we anticipate will require relatively modest necessary capital improvements in the short term.

We expect that the majority of the Projects will be mid-market hotels that do not provide full-service facilities to guests including the following types of franchised hotel properties:

- •

- Limited-Service Hotels. Limited-service hotels offer limited facilities and amenities, typically without a full-service restaurant.

- •

- Select-Service Hotels. Select-service hotels offer the fundamentals of limited-service properties together with a selection of services and amenities characteristic of full-service hotels. Generally, the additional amenities are restaurants and banquet facilities but on a less elaborate scale than one would find at full-service hotels.

- •

- Extended Stay Hotels. Extended stay hotels typically focus on attracting guests for extended periods. These properties quote weekly rates and blend transient and long-term bookings.

By concentrating on top-quality institutional franchisors like Marriott Hotels®, Hilton®, IHG and Hyatt®, we believe we can (i) command a Revenue Per Available Room, or RevPAR, premium over sub-market competitive sets, (ii) take advantage of the brands' strong loyalty programs, (iii) utilize brand channels to deliver guests, (iv) enjoy the benefits of premier system standards, where the brands

6

Table of Contents

drive consistent quality, high service standards, innovative design and modern amenities across each respective flag, (v) benefit from effective brand segmentation where, through a wide range of hospitality choices within each brand family, each brand appeals to a broad range of travelers with differing levels of amenities and rates and (vi) utilize the brands' institutional character to drive faster and stronger resale, financing flexibility and investor confidence. We will attempt to enter into minimum ten-year franchise agreements for each of our franchised hotel properties.

We generally will acquire a fee interest in the Projects directly through special purpose entities which are generally wholly owned subsidiaries of our Operating Partnership. We may also make investments in certain Projects through joint ventures with third-party institutions, developers, operators, investors and other third parties as well as with affiliates of the Advisor. Such joint ventures may be leveraged with debt financing or unleveraged. We anticipate that we will purchase the Projects pursuant to purchase and sale agreements with the sellers, but we may also enter into contribution agreements whereby the owner of the property desires to exchange its property for limited partnership interests in the Operating Partnership.

Our investment activities have been delegated to the Advisor under the Advisory Agreement. The Advisor will originate investment opportunities for the Company, conduct an underwriting analysis on the properties, negotiate and structure the acquisitions and related debt financing, and present its investment recommendations to our board of directors for its consideration and approval. Once a property has been identified, the Advisor will conduct a comprehensive underwriting review of the target property. During this process, the Advisor will request, review and evaluate various materials and documents relating to the property, including property plans and specifications, Phase I environmental site assessments, building condition reports, surveys, title documents, historical financial statements, title insurance policies and property insurance policies. We will also obtain independent third-party appraisals or valuations of the properties.

We plan to finance the purchase of the Projects with proceeds from the Offering and loans obtained from third-party lenders. We expect to use moderate leverage to enhance the total cash flow to our stockholders. We anticipate that the aggregate loan-to-value ratio for the Company will be between 35% and 65%. We will target a loan-to-value ratio for the Projects of between 35% and 70%, based on the purchase price of the Projects; however, we may obtain financing that is less than or higher than such loan-to-value ratio for an individual Project at the discretion of our board of directors. We will seek to obtain financing on the most favorable terms available. Loans are expected to be nonrecourse and will be secured by the applicable Project. In some cases, however, we may be required to enter into guaranties for the loans for certain non-recourse carve-outs.

We have obtained and may in the future obtain lines of credit or other financings secured by one or more of the Projects in order to bridge the acquisition of, or acquire additional Projects, to fund property improvements and other capital expenditures, to make distributions, and for other purposes. In addition, we may borrow as necessary or advisable to ensure that we maintain our qualification as a REIT for federal income tax purposes, including borrowings to satisfy the REIT requirement that we distribute at least 90% of our annual REIT taxable income to our stockholders (computed without regard to the dividends-paid deduction and excluding net capital gain). As of the date of this Form 10, we have entered into a $25,000,000 revolving line of credit (the "Revolving Loan") with TCF National Bank to provide immediate funds to acquire the Projects, and the Operating Partnership has entered into a $3,000,000 line of credit (the "Midwest Loan") with Midwest Bank to provide immediate capital to fund acquisitions of the Projects. See "Item 2, Financial Information—Liquidity and Capital Resources—Debt" for a description of these loans.

We plan on holding and managing the Projects and our other investments for approximately five years following the termination of the Offering, although our board of directors has discretion to extend this holding period indefinitely. Our intention, however, is to dispose of our entire portfolio as

7

Table of Contents

soon as practicable when market conditions are favorable. Circumstances may arise, however, that make it more beneficial to sell one or more Projects on an individual basis. The Advisor will continually evaluate each Project's performance based on market conditions and our overall objectives to determine an appropriate time to sell the Projects in an effort to maximize total returns to our stockholders. See "—Disposition Strategy" below.

On an infrequent and opportunistic basis, we may originate or acquire Loans secured directly or indirectly by real estate-related assets, including, without limitation, mortgages, senior secured loans, subordinated loans, mezzanine loans and bridge loans. These Loans will typically be secured by a first or second lien on the real property and other assets of the borrower ("Borrower Property"). We may also make mezzanine Loans to the person who owns the entity that owns the Borrower Property, which will be secured by such owner's partnership or membership interest in such entity. The borrowers of the Loans may be qualified third parties, funds or Delaware statutory trusts sponsored and/or managed by the Advisor or its affiliates, or affiliates of the Advisor. When considering whether to make or acquire a Loan, we will use substantially the same criteria to evaluate the Borrower Property as we do to evaluate potential Projects. We do not expect to invest more than 15% of the total proceeds from the Offering in Loans.

Disposition Strategy

Our investment strategy is generally to acquire a portfolio of hotel properties that presents a strong opportunity both for cash flow generation and capital appreciation and to sell the entire portfolio in a single transaction in approximately five years or sooner if we determine that market conditions are favorable or the sale would otherwise be in the best interest of the Company and our stockholders. In certain circumstances, we may decide that it is prudent to sell one or more Projects in a separate transaction, based on such factors as prevailing economic conditions, specific real estate market conditions and the performance of the Project. We anticipate that the holding period for the Loans will be shorter than that of the Projects, particularly with respect to mezzanine and bridge Loans. The determination of when a particular Project should be sold or otherwise disposed of will be made by our board of directors, upon recommendation by our Advisor.

The requirements for qualification as a REIT for U.S. federal income tax purposes also will put some limits on our ability to sell or otherwise dispose of assets after relatively short holding periods. In accordance with our investment objective of achieving maximum capital appreciation, we may, however, sell a particular Project before or after this anticipated holding period—and outside our principle objective of an entire portfolio sale—if, in the judgment of our Advisor and our board of directors, selling the Project is in our best interest.

Our ability to dispose of Projects during the first two years following acquisition is restricted to a substantial extent as a result of our REIT status. Under applicable provisions of the Internal Revenue Code regarding prohibited transactions by REITs, a REIT that sells property other than foreclosure property that is deemed to be inventory or property held primarily for sale in the ordinary course of business is deemed a "dealer" and subject to a 100% penalty tax on the net income from any such transaction. As a result, our board of directors will attempt to structure any disposition of the Projects to avoid this penalty tax, including possibly through reliance on safe harbors available under the Internal Revenue Code for properties held at least two years or through the use of a special purpose TRS. When we determine to sell a particular Project or other investment, we will seek to achieve a selling price that maximizes the capital appreciation for investors based on then-current market conditions. There can be no assurance that this objective will be realized.

8

Table of Contents

Experience

Our Advisor is wholly-owned by Corey R. Maple and Norman H. Leslie. Although the principals of the Advisor have relevant experience acquiring, owning, developing, managing and operating hotel properties and managing REITs, the Advisor is newly formed. Legendary Capital, LLC, and its affiliates, all of which are affiliates of our Advisor, sponsored the two real estate programs described below. These programs have not yet fully liquidated and have a limited operating history. The operating results of the real estate programs sponsored by Legendary Capital and its affiliates described below may not be an accurate predictor of our future results.

Lodging Opportunity Fund, REIT

Lodging Opportunity Fund, REIT ("LOF-REIT") is a non-registered, non-traded REIT formed in 2013 with an investment thesis similar to that of the Company, which is to provide its stockholders with income and capital appreciation from the acquisition and operation of a diversified portfolio of lodging and hotel properties. LOF-REIT was the second real estate program sponsored by Legendary Capital, LLC and its affiliates. On April 30, 2018, the board of trustees of LOF-REIT announced it would terminate its initial offering on May 31, 2018. LOF-REIT is closed to new investment and has issued 13,151,502 common shares of beneficial interest and 1,180,918 limited partnership units of Lodging Opportunity Fund II, LP, the operating partnership of LOF-REIT.

As of June 30, 2019, LOF-REIT had acquired 15 hotel properties totaling 1,808 hotel rooms. LOF-REIT has not made any dispositions of hotel properties. LOF-REIT expects to acquire no more properties in the future.

LOF-REIT's Board of Trustees approved an $11.03 per share net asset value effective June 1, 2019. Shares were originally offered to investors at $10.00 per share.

Lodging Opportunity Fund, LLLP

Lodging Opportunity Fund, LLLP ("Lodging Opportunity Fund") is a non-registered, non-traded limited liability limited partnership formed in 2009 with an investment thesis similar to that of the Company, which is to provide its shareholders income and capital appreciation from the acquisition and operation of a diversified portfolio of lodging real estate assets. Lodging Opportunity Fund was the first real estate program sponsored by Legendary Capital, LLC and its affiliates. Lodging Opportunity Fund closed its initial offering in September 2013 after raising $14,925,700 from investors. As of March 31, 2019, Lodging Opportunity Fund had acquired an interest in eight hotel properties totaling 941 hotel rooms and has sold five of such properties. Lodging Opportunity Fund expects to acquire no more properties in the future.

Affiliate Transactions

Our board of directors has established a conflicts committee (the "Conflicts Committee") composed of all of our independent directors, which will review and approve all matters our board of directors believes may involve a conflict of interest, including all transactions between the Company and affiliates of the Company and the Advisor. If we decide to acquire a property in which the Advisor, one of our directors or their respective affiliates owns an interest, a majority of members of the Conflicts Committee must first make a determination that such transaction is fair and reasonable to us and the purchase price is no greater than the price of the property to the affiliated seller, unless there is substantial justification for the excess amount and such excess amount is reasonable. Notwithstanding the foregoing, in no event will we acquire any property from an affiliated seller at an amount in excess of its current appraised value as determined by an independent third-party appraiser. See "Item 5, Conflicts Committee" for additional details regarding the duties of the Conflicts Committee.

9

Table of Contents

Investment Company Act Limitations

We intend to conduct our operations so that neither we nor any of our subsidiaries will be required to register as an "investment company" under the Investment Company Act. The Company's only asset is its General Partnership Interest in the Operating Partnership. Further, the Company, as General Partner, is solely responsible for the management and operation of the Operating Partnership. As a result, the Company's interest in the Operating Partnership has significant incidents of a true general partnership interest and does not fall within the definition of a "security" for purposes of the Investment Company Act. The Operating Partnership intends to rely on exclusion from the Investment Company Act based on the type of assets it owns. We anticipate that at least 55% of the Operating Partnership's assets will consist of direct interests in real estate and at least 25% of the Operating Partnership's assets (reduced to the extent the Operating Partnership's investment in direct interests in real estate exceed 55%) will consist of real estate-related assets so that the Operating Partnership will not be required to register under the Investment Company Act. The Advisor will attempt to the monitor our portfolio of investments to ensure we do not come within the definition of an "investment company" under the Investment Company Act. If at any time the character of our investments may cause us to be deemed an investment company, we will take all necessary actions to ensure that we are not deemed an investment company for purposes of the Investment Company Act.

Additional Investment Limitations

In addition to the investment limitations described above, we will not:

- •

- make any investment that is inconsistent with our objectives of qualifying and remaining qualified as a REIT unless and until our board of directors determines, in its sole discretion, that REIT qualification is not in our best interest;

- •

- engage in securities trading or engage in the business of underwriting or the agency distribution of securities issued by other persons; or

- •

- acquire interests or securities in any entity holding investments or engaging in activities prohibited by our charter except for investments in which we hold a non-controlling interest and investments in entities having securities listed on a national securities exchange.

Underwriting Process for Real Estate Investments

We have an experienced, well-qualified underwriting team with expertise in evaluating many critical variables that lead, in our opinion, to conservative income and growth expectations with our primary priority being capital preservation. We evaluate properties through our proprietary two-phase underwriting model, examining hotel brand, geographic region, economics, demand generators, franchise performance, opportunity type and property condition. Phase One is a cursory, yet thorough, check-list and litmus-test review that typically eliminates over half the prospective hotel properties. The remaining hotels undergo an in-depth examination into local market performance and historical financials in preparation for Phase Two.

Phase Two delves into more serious underwriting, refining the model as we physically inspect each property, review the local demand generators, estimate property improvement plan ("PIP") costs and perform exhaustive research into past, present and estimated future market performance. These steps ultimately lead to elimination from consideration or to an offer.

Board Review of Investment Policies

Our board of directors has established written policies on investments and borrowing for the Company. Our board is responsible for monitoring the performance of our Advisor and the Company in implementing and complying with such policies. We anticipate that our board will review our

10

Table of Contents

investment and borrowing policies at least annually to determine that such policies are in the best interest of our stockholders. Any changes to our investment and borrowing policies must be approved by a majority of the entire board of directors and a majority of the independent directors.

We believe that our current investment and borrowing policies as described above are in the best interests of our stockholders because (i) they increase the likelihood that we will be able to acquire a diversified portfolio of income-producing properties, thereby reducing risk in our portfolio, (ii) there are sufficient property acquisition opportunities with the attributes that we seek and (iii) our borrowings will enable us to purchase assets and earn real estate revenue more quickly, thereby increasing our likelihood of generating income for our stockholders and preserving stockholder capital.

Employees

Lodging Fund REIT III, Inc. has no direct employees. The employees of the Sponsor perform substantially all of the services related to our asset management, accounting, investor relations, and other administrative activities. See Item 7, "Certain Relationships and Related Transactions, and Director Independence" for a summary of the fees paid to the Advisor and its affiliates during the year ended December 31, 2018 and the three-months ended March 31, 2019.

Competition

As we purchase properties to build our portfolio, we are in competition with other potential buyers for the same properties, which may result in an increase in the amount we must pay to acquire a property or may require us to locate another property that meets our investment criteria. Such other potential buyers may include other listed and non-listed REITs or private investors. These potential buyers may have substantially greater financial resources and experience than we do. At the time we elect to dispose of our properties, we may be in competition with sellers of similar properties to locate suitable purchasers.

Economic Dependency

We depend on the Advisor and its affiliates to provide certain services essential to the Company, including asset management services, supervision of the management of the Projects, asset acquisition and disposition services, as well as other administrative responsibilities for the Company, including accounting services, investor communications and investor relations. As a result of these relationships, we are dependent upon our Advisor and its affiliates.

Environmental

As an owner of real estate, we are subject to various environmental laws of federal, state, and local governments. Compliance with existing laws has not had a material adverse effect on our financial condition or results of operations, and management does not believe it will have such an impact in the future. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed laws or regulations on properties we currently own, or on properties that may be acquired in the future.

Industry Segments

Our current business consists of acquiring, managing, investing in and disposing of real estate assets. We internally evaluate all of our real estate assets as one industry segment and, accordingly, we do not report segment information.

Seasonality

Some hotel properties have business that is seasonal in nature. This seasonality can be expected to cause quarterly fluctuations in revenues. Quarterly earnings may be adversely affected by factors outside our control, including weather conditions and poor economic factors. As a result, we may have to enter into short-term borrowings in order to offset these fluctuations in revenue and to make distributions to our stockholders.

11

Table of Contents

ITEM 1A. RISK FACTORS.

The Registrant has omitted a discussion of risk factors because as a smaller reporting company, it is not required to provide such information.

ITEM 2. FINANCIAL INFORMATION.

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the accompanying financial statements and notes thereto. See also "Cautionary Note Regarding Forward-Looking Statements" preceding Item 1 of this Form 10.

Overview

Where applicable in this Form 10, "we," "our," "us," and "the Company" refers to Lodging Fund REIT III, Inc., the Operating Partnership, the Master TRS and their subsidiaries except where the context otherwise requires. We were formed on April 9, 2018 for the primary purpose of acquiring a diversified portfolio of hotel properties (the "Projects") located primarily in the America's Heartland. On an infrequent and opportunistic basis, we may also originate or acquire high-yield loans secured directly or indirectly by real estate-related assets, which loans will be made to certain qualified third-party borrowers and/or affiliates of our advisor (the "Loans"). We intend to qualify as a real estate investment trust, or REIT, beginning with the taxable year ending December 31, 2018. We conduct substantially all of our business and own substantially all real estate investments through the Operating Partnership. We are the sole general partner of the Operating Partnership. We and the Operating Partnership are advised by Legendary Capital REIT III, LLC, a Delaware limited liability company (the "Advisor") pursuant to an agreement (the "Advisory Agreement") under which the Advisor performs advisory services regarding acquisition, financing and disposition of the Projects and origination of the Loans, is responsible for managing, operating and maintaining the Projects and day-to-day management of the Company. The Advisor may, in its sole discretion, perform these duties through one or more affiliates. We expect that NHS, LLC dba National Hospitality Services ("NHS") will primarily manage the Projects in our initial portfolio. The Advisor has no direct employees. The employees of Legendary Capital, LLC (the "Sponsor"), an affiliate of the Advisor, provide services to the Company related to the negotiations of property acquisitions and financing, asset management, accounting, investor relations, and all other administrative services.

On June 1, 2018, we commenced an offering of up to 10,000,000 shares of our common stock under a private placement to qualified purchasers who meet the definition of "accredited investors," as provided in Regulation D of the Securities Act (the "Offering"). The Offering will continue until the earlier of (i) the date when the maximum offering amount is sold, (ii) June 1, 2020, which may be extended by our board of directors in its sole discretion, or (iii) a decision by the Company to terminate the Offering. As of June 30, 2019, the Company had issued 3,288,371 shares of common stock resulting in gross offering proceeds of approximately $32.4 million, including 37,516 shares issued under our dividend reinvestment plan. After deductions for payments of selling commissions, marketing and diligence allowances, other wholesale selling costs and expenses, and other offering expenses, we received net offering proceeds of approximately $26.0 million. The net offering proceeds have been used to fund property acquisitions. No public market exists for the shares of our common stock and none is expected to develop.

As of the date of this Form 10, we own four properties consisting of properties in Cedar Rapids, Iowa; Pineville, North Carolina; Eagan, Minnesota; and Prattville, Alabama. In connection with the acquisition of each property, the Operating Partnership formed a subsidiary to own the property. The owner subsidiary entered into an operating lease agreement pursuant to which the owner leases the property to the TRS Lessee. NHS is the manager of each of the four properties pursuant to a

12

Table of Contents

management agreement by and between NHS and the applicable TRS Lessee. The property in Pineville, North Carolina, is sub-managed by Beacon IMG, Inc. ("Beacon"), a non-affiliated entity, pursuant to a sub-management agreement between NHS and Beacon.

Market Outlook

The hospitality industry is closely related to the U.S. general economic cycle because business and leisure travelers are directly affected by economic conditions that drive demand. The U.S. economy, measured by gross domestic product ("GDP") growth, has been growing since the third quarter of 2009. The 2019 Consensus Outlook, published November 30, 2018 by the Federal Reserve Bank of Chicago, indicated a 2.4% 2019 real GDP growth. Hospitality cycles are also influenced by supply factors which, depending on general economic timing, can exacerbate downturns if there is over-supply in a market. Supply in America's Heartland, the location of our primary target markets, has been growing at or below industry averages.

Hospitality industry fundamentals have stabilized and will continue to grow at a slightly slower pace. According to the Smith Travel Research, or STR, January 2019 outlook, the U.S. Hotel Forecast points to a growth in the upcoming two years, at a rate slightly slower than previous years. According to STR's and Tourism Economics' initial forecast for 2019 released at the Americas Lodging Investment Summit in January 2019, as reported by Hotel News Now, RevPAR is expected to grow by 2.3% in 2019 and 1.9% in 2020, down from 2.9% in 2018, which was the lowest reported since 2009.

The limited-service, select-service and extended stay hotels we intend to target are generally classified by STR in the Upscale and Upper Midscale categories. According to the CBRE Hotels' Hotel Horizons® June - August 2019 Edition, the compound average annual demand in the Upscale category is projected to increase 4.3% from 2019 to 2023, increasing 18.5% over the five-year period. Upper Midscale demand is projected to grow by 3.0% per year over the same period, increasing 11.8% overall. Compound annual RevPAR growth in the two categories for 2019 to 2023 is expected to be 1.7% and 1.3%, respectively. We believe these segments provide some of the best opportunities across the various hotel classifications.

After years of robust growth coming out of the deep trough that followed the recession that begin in 2008, we believe the hospitality industry has reached a relative plateau of stability. We believe that, in general, when markets mature and stabilize there will be more consolidation opportunities as the industry looks to generate scale benefits through acquisitions and there will be portfolio sale opportunities as this economic cycle continues to mature.

Liquidity and Capital Resources

We are dependent upon the net proceeds from our Offering to conduct our proposed operations. The Offering will continue until the earlier of (i) the date when the maximum offering amount is sold, (ii) June 1, 2020, which may be extended by our board of directors in its sole discretion, or (iii) a decision by the Company to terminate the Offering. We intend to obtain the capital required to make real estate and real estate-related investments and conduct our operations from the proceeds of our Offering, from secured or unsecured financings from banks and other lenders and from any undistributed funds from our operations. As of March 31, 2019, we had raised approximately $19.0 million in gross offering proceeds from the sale of shares of our common stock in the Offering. If we are unable to raise substantial funds in the Offering, we will make fewer investments resulting in less diversification in terms of the type, number and size of investments we make and the value of an investment in us will fluctuate more significantly with the performance of the specific assets we acquire. There may be a delay between the sale of shares of our common stock and our purchase of assets, which could result in a delay in the benefits to our stockholders, if any, of returns generated from our

13

Table of Contents

investment operations. Further, we will have certain fixed operating expenses, including certain expenses as a public reporting company, regardless of whether we are able to raise substantial funds in the Offering. Our inability to raise substantial funds would increase our fixed operating expenses as a percentage of gross income, reducing our net income and cash flow and limiting our ability to make distributions to our stockholders.

As of December 31, 2018, we owned one property, and as of March 31, 2019, we owned two properties. We acquired these investments with the proceeds from the sale of our common stock in the Offering and debt financing. Operating cash needs during the fiscal year ended December 31, 2018 and the three months ended March 31, 2019 were met through cash flow generated by these real estate investments and with proceeds from our Offering.

Our investments in real estate will generate cash flow in the form of hotel room rentals and guest expenditures, which are reduced by operating expenditures, debt service payments and corporate general and administrative expenses. Each of our properties will be owned by a direct special purpose entity subsidiary of the Operating Partnership, which will lease the properties to TRS Lessees, which will be direct special purpose entity subsidiaries of the Master TRS. The TRS Lessees will be required to make rent payments to the owners of the properties pursuant to the lease agreements relating to each property. Such TRS Lessees' ability to make rent payments to the owner subsidiaries and our liquidity, including our ability to make distributions to our stockholders, are dependent upon the TRS Lessees ability to generate cash flow from the operations of the hotels. The TRS Lessees are dependent upon the management companies with whom they have entered or will enter into management agreements to operate the hotel properties.

Cash flow from operations from real estate investments will be primarily dependent upon the occupancy level and average daily rate, or ADR, of our portfolio, and how well we manage our expenditures.

Debt

On November 15, 2018, we entered into a $25,000,000 revolving line of credit (the "Revolving Loan") with TCF National Bank to provide immediate funds to acquire the Projects. The Operating Partnership and each of the wholly-owned entities that acquire the Projects and are advanced funds under the Revolving Loan (the "Hotel Borrowers") are the "borrowers" under the Revolving Loan. The Revolving Loan will have a variable interest rate equal to 30-day LIBOR, plus 3.25% and has an initial term of 12 months, with one 12-month extension option. The Revolving Loan may be prepaid in whole or in part without penalty or premium. Each advance made to a Hotel Borrower (each a "Hotel Loan") under the Revolving Loan will be secured by the applicable Project and will have a term of 12 months. Payments of interest will be due and payable on the first day of each calendar month following disbursement, and payments of principal will be due and payable on the first day of each calendar month beginning 90 days following disbursement. In no event can more than three Hotel Loans be outstanding at any time under the Revolving Loan and each Hotel Borrower may only request one advance under the Revolving Loan. Each of the Company, the Operating Partnership and Master TRS are jointly and severally liable as guarantors under the Revolving Loan. As of December 31, 2018 and March 31, 2019, the interest rate was 5.60% and 5.74%, respectively. As of December 31, 2018, the Company had drawn $5.2 million on the line of credit in connection with the acquisition of the Cedar Rapids Property, which was repaid in full in March 2019. As of March 31, 2019, there was no outstanding balance on the Revolving Loan.

14

Table of Contents

On August 22, 2018, the Operating Partnership entered into a $3,000,000 line of credit (the "Midwest Loan") with Midwest Bank to provide immediate capital to fund acquisitions of the Projects. The Midwest Loan is collateralized by 300,000 partnership units of the Operating Partnership. The Company is a guarantor under the Midwest Loan. The Midwest Loan has an interest rate equal to the prime rate plus 1.0%, with a minimum rate of 6.0%. As of December 31, 2018 and March 31, 2019, the interest rate was 6.50%. The Midwest Loan had an initial term of 12 months, which was extended three months, and requires interest only payments until maturity. All of the outstanding principal on the Midwest Loan will be due and payable on November 22, 2019. The Midwest Loan is subordinate to the Revolving Loan. As of December 31, 2018, there was no outstanding balance on the Midwest Loan. As of March 31, 2019, there was an outstanding balance on the Midwest Loan of $0.5 million, which was repaid in full in April 2019.

Mortgage Loans

On March 5, 2019, we refinanced the draw that was made under the Revolving Loan in connection with the purchase of the Cedar Rapids Property. The original principal amount under the loan was $5.9 million. The loan has a fixed interest rate of 5.33% with interest only payments until March 1, 2020. The maturity date of the loan is March 1, 2024. Each of the Operating Partnership and the Master TRS are guarantors under this loan.

On March 19, 2019, a wholly-owned subsidiary of the Operating Partnership assumed an existing loan in connection with its purchase of the Pineville Property. As of the date of purchase, the loan had an outstanding balance of $9.3 million. The loan has a fixed interest rate of 5.13%. The maturity date of the loan is June 6, 2024.

Results of Operations

We expect that revenue, operating expenses, maintenance costs, real estate taxes and insurance, interest expense and asset management fees will each increase in future periods as a result of anticipated future acquisitions of real estate investments.

Our results of operations for the year ended December 31, 2018 and for the three months ended March 31, 2019 are not indicative of those expected in future periods, as we were formed on April 9, 2018 and did not complete our first acquisition until November 30, 2018.

Room revenues totaled $123,024 and $601,289 for the year ended December 31, 2018 and for the three months ended March 31, 2019, respectively. Other revenue, which consists of vending and gift shop sales, was $706 and $3,201 for the year ended December 31, 2018 and the three months ended March 31, 2019, respectively. We expect that room revenue, other revenue and total revenue will each increase in future periods as a result of owning the Cedar Rapids Property and Pineville Property for an entire operating period and as a result of anticipated future acquisitions of real estate assets.

General and administrative expenses were $589,427 and $655,151 for the year ended December 31, 2018 and for the three months ended March 31, 2019, respectively. These general and administrative expenses consisted primarily of legal and accounting costs, administrative personnel costs, and the cost of office supplies and facilities. We expect corporate general and administrative expenses to increase in the future based on a full year of real estate operations and as a result of anticipated future acquisitions of real estate assets, but to decrease as a percentage of total revenue.

15

Table of Contents

Sales and marketing expenses were $334,442 and $176,562 for the year ended December 31, 2018 and the three months ended March 31, 2019, respectively. We expect sales and marketing expenses to increase in the future as a result of owning the Cedar Rapids Property and Pineville Property for a full year and as a result of anticipated future acquisitions of real estate assets.

Property operating expenses were $65,059 and $250,698 for the year ended December 31, 2018 and the three months ended March 31, 2019, respectively. These property operating expenses consisted primarily of property taxes, insurance, repair and maintenance, and other costs of operating our hotel properties. We expect property operating expenses to increase in the future as a result of owning the Cedar Rapids Property and Pineville Property for a full year and as a result of anticipated future acquisitions of real estate assets.

Franchise fees were $11,412 and $54,085 for the year ended December 31, 2018 and the three months ended March 31, 2019 respectively. Franchise fees include the amortization of initial franchise fees, as well as monthly fees paid to franchisors for royalty, marketing, reservation fees and other related costs. We expect franchise fees to increase in the future as a result of owning the Cedar Rapids Property and Pineville Property for a full year and as a result of anticipated future acquisitions of real estate assets.

Management fees were $22,446 and $59,898 for the year ended December 31, 2018 and the three months ended March 31, 2019 respectively. Management fees include the monthly asset management fees paid to the Advisor and property management fees paid to NHS. We expect management fees to increase in the future as a result of owning the Cedar Rapids Property and Pineville Property for a full year and as a result of anticipated future acquisitions of real estate assets.

Acquisition expenses were $212,464 and $188,121 for the year ended December 31, 2018 and the three months ended March 31, 2019 respectively. Acquisition-related and due diligence costs that relate to a property that is not acquired, as well as costs related to hotel property acquisitions that are not attributable to a single identifiable property, are expensed and included in acquisition expense on the accompanying consolidated statement of operations. We expect acquisition expenses to increase in the future as a result of anticipated future acquisitions of real estate assets, but to decrease as a percentage of total revenue.

Depreciation expense was $43,810 and $103,589 for the year ended December 31, 2018 and the three months ended March 31, 2019 respectively. We expect these amounts to increase in the future as a result of owning the Cedar Rapids Property and Pineville Property for a full year and as a result of anticipated future acquisitions of real estate assets.

Our acquisition of the Cedar Rapids Property involved a $5.2 million draw on our Revolving Loan, which was refinanced on March 5, 2019. The Pineville Property involved the assumption of an existing

16

Table of Contents

loan. During the year ended December 31, 2018 and the three months ended March 31, 2019, we incurred interest expense of $74,858 and $161,502, respectively. We expect that in future periods our interest expense will vary based on the amount of our borrowings, which will depend on the cost of borrowings, the amount of proceeds we raise in our Offering and our ability to identify and acquire real estate and real estate-related assets that meet our investment objectives.

Critical Accounting Policies

The Company, as an emerging growth company, has elected to use the extended transition period which allows us to defer compliance with new or revised accounting standards. This allows the Company to adopt new or revised accounting standards as of the effective date for non-public business entities.

Basis of Presentation and Principles of Consolidation

The consolidated financial statements and related notes have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The consolidated financial statements include the accounts of the Company, the Operating Partnership, the Master TRS and its wholly-owned subsidiaries. For controlled subsidiaries that are not wholly-owned, the interests owned by an entity other than the Company represent a noncontrolling interest, which is presented separately in the consolidated financial statements. The Company has no foreign operations or assets and its operating structure includes only one reportable segment. All intercompany balances and transactions are eliminated in consolidation.

Use of Estimates

The preparation of the Company's consolidated financial statements and the accompanying notes in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of certain assets and liabilities and the amounts of contingent assets and liabilities as of the balance sheet date and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

Revenues consist of amounts derived from hotel operations, including room sales and other hotel revenues, and are presented on a disaggregated basis in the Company's consolidated statement of operations. These revenues are recorded net of any sales and occupancy taxes collected from the hotel guests. All revenues are recorded on an accrual basis as they are earned. Any cash received prior to a guest's arrival is recorded as an advance deposit from the guest and recognized as revenue at the time of the guest's occupancy at the hotel property.

Investment in Hotel Properties

The Company evaluates whether each hotel property acquisition should be accounted for as an asset acquisition or a business combination. If substantially all of the fair value of the gross assets acquired is concentrated in a single asset or a group of similar identifiable assets, then the transaction is considered to be an asset acquisition. All of the Company's acquisitions since inception have been determined to be asset acquisitions. Transaction costs associated with asset acquisitions will be capitalized and transaction costs associated with business combinations will be expensed as incurred.

The Company's acquisitions generally consist of land, land improvements, buildings, building improvements, and furniture, fixtures and equipment ("FF&E"). The Company may also acquire intangible assets or liabilities related to in-place leases, management agreements, debt, franchise agreements and advanced bookings. For transactions determined to be asset acquisitions, the Company

17

Table of Contents

allocates the purchase price among the assets acquired and the liabilities assumed based on their respective fair values at the date of acquisition. For transactions determined to be business combination, the Company records the assets acquired and the liabilities assumed at their respective fair values at the date of acquisition. The Company determines the fair value by using market data and independent appraisals available to us and making numerous estimates and assumptions.

The difference between the relative fair value and the face value of debt assumed in connection with an acquisition is recorded as a premium or discount and amortized to interest expense over the remaining term of the debt assumed. The valuation of assumed liabilities is based on our estimate of the current market rates for similar liabilities in effect at the acquisition date.

The Company's investments in hotel properties are carried at cost and are depreciated using the straight-line method over the estimated useful lives of 15 years for land improvements, 15 years for building improvements, 40 years for buildings and three to seven years for FF&E. Maintenance and repairs are expensed and major renewals or improvements to the hotel properties are capitalized. Interest used to finance the real estate under development is capitalized as an additional cost of development. The Company discontinues the capitalization of interest once the real estate development project is substantially complete.

The Company assesses the carrying value of its hotel properties whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable. The recoverability is measured by comparing the carrying amount to the estimated future undiscounted cash flows which take into account current market conditions and the Company's intent with respect to holding or disposing of the hotel properties. If the Company's analysis indicates that the carrying value is not recoverable on an undiscounted cash flow basis, the Company will recognize an impairment loss for the amount by which the carrying value exceeds the fair value. The fair value is determined through various valuation techniques, including internally developed discounted cash flow models, comparable market transactions or third-party appraisals.

The use of projected future cash flows is based on assumptions that are consistent with a market participant's future expectations for the travel industry and the economy in general and the Company's expected use of the underlying hotel properties. The assumptions and estimates related to the future cash flows and the capitalization rates are complex and subjective in nature. Changes in economic and operating conditions that occur subsequent to a current impairment analysis and the Company's ultimate use of the hotel property could impact the assumptions and result in future impairment losses to the hotel properties.

Non-controlling Interests

Non-controlling interests represent the portion of equity in a subsidiary held by owners other than the Company. Non-controlling interests are reported in the consolidated balance sheet within equity, separate from shareholders' equity. Revenue and expenses attributable to both the Company and the non-controlling interests are reported in the consolidated statement of operations, with net income attributable to non-controlling interests reported separately from net income attributable to the Company.

Offering Costs

The Company incurs certain costs related directly to the Company's equity offering consisting of, among other costs, commissions, legal, accounting, bona fide out-of-pocket itemized and detailed due diligence costs, printing, marketing, filing fees, postage, data processing fees, and other offering related costs. These costs are capitalized and recorded as a reduction of equity on the consolidated balance sheets.

18

Table of Contents

Acquisition Costs

The Company incurs costs during the review of potential hotel property acquisitions including legal fees, environmental reviews, market studies, financial advisory services, and other professional service fees. If the Company completes a property acquisition, an acquisition fee of up to 1.4% is charged by the Advisor, based on the purchase price of the property plus any estimated PIP costs. For transactions determined to be asset acquisitions, these costs are capitalized as part of the overall cost of the Project if the property is ultimately acquired. For transactions determined to be business combinations, these costs would be expensed in the period incurred. Acquisition-related and due diligence costs that relate to a property that is not acquired are expensed and included in acquisition expense on the accompanying consolidated statement of operations. Prior to the ultimate determination of whether a property will be acquired or not, acquisition-related and due diligence costs are recorded as, and included in, prepaid expenses and other assets on the accompanying consolidated balance sheet.

Income Taxes

The Company intends to qualify as a REIT for U.S. federal income tax purposes commencing with its taxable year ending December 31, 2018, and has elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended. To qualify as a REIT, the Company must meet a number of organizational and operational requirements, including a requirement that it distribute at least 90% of its REIT taxable income, subject to certain adjustments and excluding any net capital gain, to stockholders. The Company's intention is to adhere to the REIT qualification requirements and to maintain its qualification for taxation as a REIT.

As a REIT, the Company is generally not subject to U.S. federal corporate income tax on the portion of taxable income that is distributed to stockholders. If the Company fails to qualify for taxation as a REIT in any taxable year, the Company will be subject to U.S. federal income taxes at regular corporate rates and it may not be able to qualify as a REIT for four subsequent taxable years. As a REIT, the Company may be subject to certain state and local taxes on its income and property, and to U.S. federal income and excise taxes on undistributed taxable income. Taxable income from non-REIT activities managed through the Company's taxable REIT subsidiary ("TRS") is subject to U.S. federal, state, and local income taxes at the applicable rates.

The TRS accounts for income taxes using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to the differences between the financial statement carrying amounts of existing assets and liabilities and their respective income tax basis, and for net operating loss, capital loss and tax credit carryforwards. The deferred tax assets and liabilities are measured using the enacted income tax rates in effect for the year in which those temporary differences are expected to be realized or settled. The effect on the deferred tax assets and liabilities from a change in tax rates is recognized in earnings in the period when the new rate is enacted. However, deferred tax assets are recognized only to the extent that it is more likely than not that they will be realized based on consideration of all available evidence, including the future reversals of existing taxable temporary differences, future projected taxable income and tax planning strategies. Valuation allowances are provided if, based upon the weight of the available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The Company performs an annual review for any uncertain tax positions and, if necessary, will record the expected future tax consequences of uncertain tax positions in the consolidated financial statements.

19

Table of Contents

Fair Value Measurement

The Company establishes fair value measures based on the fair value definition and hierarchy levels established by GAAP. These fair values are based on a three-tiered fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

| | |

| Level 1 | | Observable inputs such as quoted prices in active markets. |

| Level 2 | | Directly or indirectly observable inputs, other than quoted prices in active markets. |

| Level 3 | | Unobservable inputs in which there is little or no market data, which require a reporting entity to develop its own assumptions. |

The Company's estimates of fair value were determined using available market information and appropriate valuation methods. Considerable judgment is necessary to develop estimated fair value. The use of different market assumptions or estimation methods may have a material effect on the estimated fair value amounts. The Company classifies assets and liabilities in the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement

Off-Balance Sheet Arrangements

As of December 31, 2018 and March 31, 2019, we had no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Related-Party Transactions and Agreements

We have entered into agreements with the Advisor and its affiliates whereby we have paid, and may continue to pay, certain fees to, or reimburse certain expenses of, the Advisor or its affiliates for acquisition and advisory fees and expenses, organization and offering costs, and asset and property management fees and expenses. See Item 7, "Certain Relationships and Related Transactions, and Director Independence" for a discussion of the various related-party transactions, agreements and fees.

Subsequent Events

On June 19, 2019, we acquired the Eagan Property, which is a Hampton Inn, a Hilton branded hotel in Eagan, Minnesota for $13.95 million. In connection with this acquisition, a wholly-owned subsidiary of the Operating Partnership entered into a $9.4 million loan agreement. The loan has a fixed interest rate of 4.6%. The maturity date of the loan is July 1, 2024. The Operating Partnership and the Master TRS are guarantors under this loan.

On July 9, 2019, we extended the maturity date of the Midwest Loan to November 22, 2019.

On July 11, 2019, we acquired the Prattville Property, which is a Home2 Suites, a Hilton branded hotel in Prattville, Alabama for $14.75 million. In connection with this acquisition, a wholly-owned subsidiary of the Operating Partnership entered into a $9.6 million loan agreement. The loan has a fixed interest rate of 4.13%. The maturity date of the loan is August 1, 2024. Mr. Maple is a guarantor under this loan, with full recourse liability for certain bad acts by him or by the borrowers.

ITEM 3. PROPERTIES.

We intend to acquire a diversified portfolio of hotel properties (the "Projects") located primarily in America's Heartland. On an infrequent and opportunistic basis, we may also originate or acquire high-yield loans secured directly or indirectly by real estate-related assets, which will be made to certain qualified third-party borrowers and/or affiliates of our advisor (the "Loans"). We intend to qualify as a real estate investment trust, or REIT, beginning with the taxable year ending December 31, 2018.

20

Table of Contents

As of the date of this filing we owned the following properties.

| | | | | | | | | | | | | | |

Property | | Location | | Date of Acquisition | | Number of

Guest

Rooms | | Year

Built | | Purchase

Price | |

|---|

Holiday Inn Express Cedar Rapids ("Cedar Rapids Property") | | Cedar Rapids, Iowa | | November 30, 2018 | | | 83 | | | 1995 | | $ | 7.7 million | |

Hampton Inn Pineville ("Pineville Property") | | Pineville, North Carolina | | March 19, 2019 | | |

111 | | |

1997 | |

$ |

13.9 million | |

Hampton Inn Eagan ("Eagan Property") | | Eagan, Minnesota | | June 19, 2019 | | |

122 | | |

1994 | |

$ |

14.0 million | |

Home2 Suites Prattville ("Prattville Property") | | Prattville, Alabama | | July 11, 2019 | | |

90 | | |

2016 | |

$ |

14.8 million | |

Each of the properties will be managed by NHS pursuant to a property management agreement with an initial term expiring on December 31st of the fifth full calendar year following the effective date of the agreement, which will automatically renew for successive 5-year periods unless earlier terminated in accordance with its terms. The Pineville Property is currently being managed by Beacon, an affiliate of the seller of the Pineville Property, pursuant to a sub-management agreement until certain conditions in the purchase agreement are met but no later than May 31, 2023.