In both cases, interest will be calculated from the prepayment date to the Maturity Date. In no event shall the Breakage Costs be less than zero.

If the indebtedness evidenced by this Note is accelerated in accordance with the terms of this Note or the Loan Agreement, the resulting balance due shall be considered a prepayment due and payable as of the date of acceleration.

The Borrower agrees and acknowledges that the Lender will have suffered damages on account of the early repayment of the Loan and that, in view of the difficulty in ascertaining the amount of such damages, the Breakage Costs constitute reasonable compensation and liquidated damages to compensate the Lender on account thereof.

The Breakage Costs and their payment shall not in any way reduce, affect or impair any other obligation of the Borrower under this Note or the other Loan Documents.

(c) Prepayment Fee. The “Prepayment Fee” will equal (i) 3.0% of the prepaid principal, if made prior to the first anniversary of the Original Note Date; (ii) 2.0% of the prepaid principal, if made on or after the first anniversary of the Original Note Date but prior to the second anniversary of the Original Note Date, and (iii) 1.0% of the prepaid principal, if made on or after the second anniversary of the Original Note Date; provided that in the event that the Site is sold by Borrower to an independent third party (i.e.: not an Affiliate of the Borrower) in an arms’ length transaction, the Prepayment Fee will be waived.

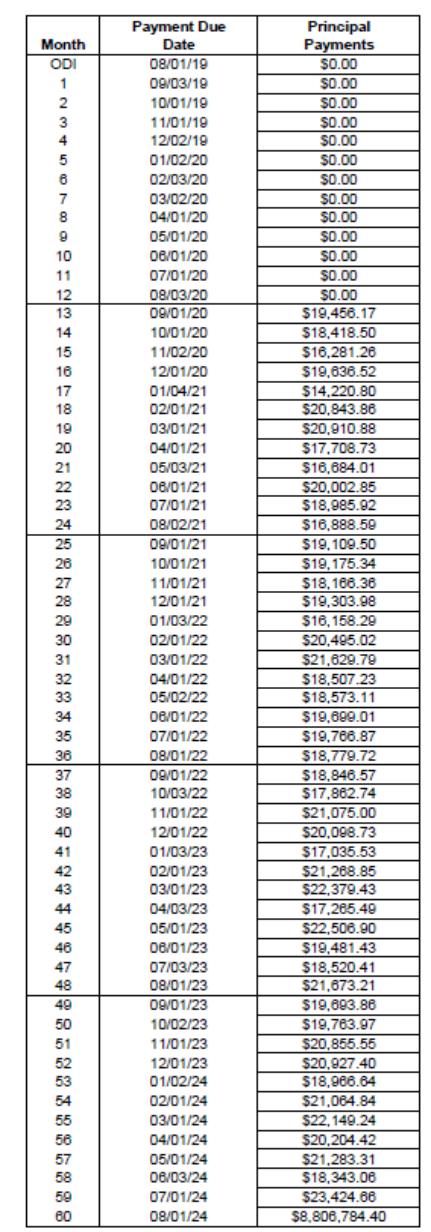

(d) Application of Prepayment Amounts. Subject to the provisions of Section 2.8(c) of the Loan Agreement: (i) amounts paid pursuant to Section 3(a) shall be applied in payment of the amounts specified therein; (ii) all prepaid principal shall be applied to the unpaid principal balance of this Note; provided, however, that any permitted partial prepayment of principal shall be applied to principal in the inverse order of maturity, such that the scheduled Monthly Payment amounts for the Loan otherwise calculated do not change; and (iii) all other payments pursuant to this Note shall be applied first to accrued and unpaid interest on the Note and the balance to reduction of principal on the Note, in the inverse order of maturity.

4. General Payment Provisions. All payments due pursuant to this Note shall be payable at the place and in the manner provided in Section 2.8 of the Loan Agreement and otherwise in accordance with the provisions of that Section, which Section is incorporated herein by this reference.

5. Default Interest. From and after the maturity date of this Note, or such earlier date as all principal owing hereunder becomes due and payable by acceleration or otherwise, or upon the occurrence and during the continuance of an Event of Default, then at the option of Lender, in its sole and absolute discretion, the outstanding principal balance of this Note shall bear interest at an increased rate per annum (computed on the basis of a 360-day year, actual days elapsed) equal to 4% above the rate of interest from time to time applicable to this Note (the “Default Rate”).

6. Late Fees. If Borrower fails to make any payment pursuant to this Note or any other Loan Document on or before the 5th day after the due date for such payment, then Borrower shall pay Lender a late fee equal to 5% of such past-due payment. Such late fee will be immediately due and payable and is in addition to any other charges, costs, fees, and expenses that Borrower may owe as a result of the late payment, including the imposition of a default rate of interest pursuant to this Note or any other Loan Document.

7. Waivers. Borrower and all endorsers, guarantors, and sureties of this Note waive presentment, demand for payment, notice of dishonor, notice of protest, and protest, notice of intent to accelerate, notice of acceleration and all other notices or demands in connection with delivery, acceptance, performance, default or endorsement of this Note.

8. Lender Computations Final. Lender’s computations, in accordance with the terms of this Note and the Loan Agreement, of interest rates, Monthly Payment amounts, and final payment amounts, and other amounts due and owing from Borrower to Lender shall be final and conclusive, absent manifest error.