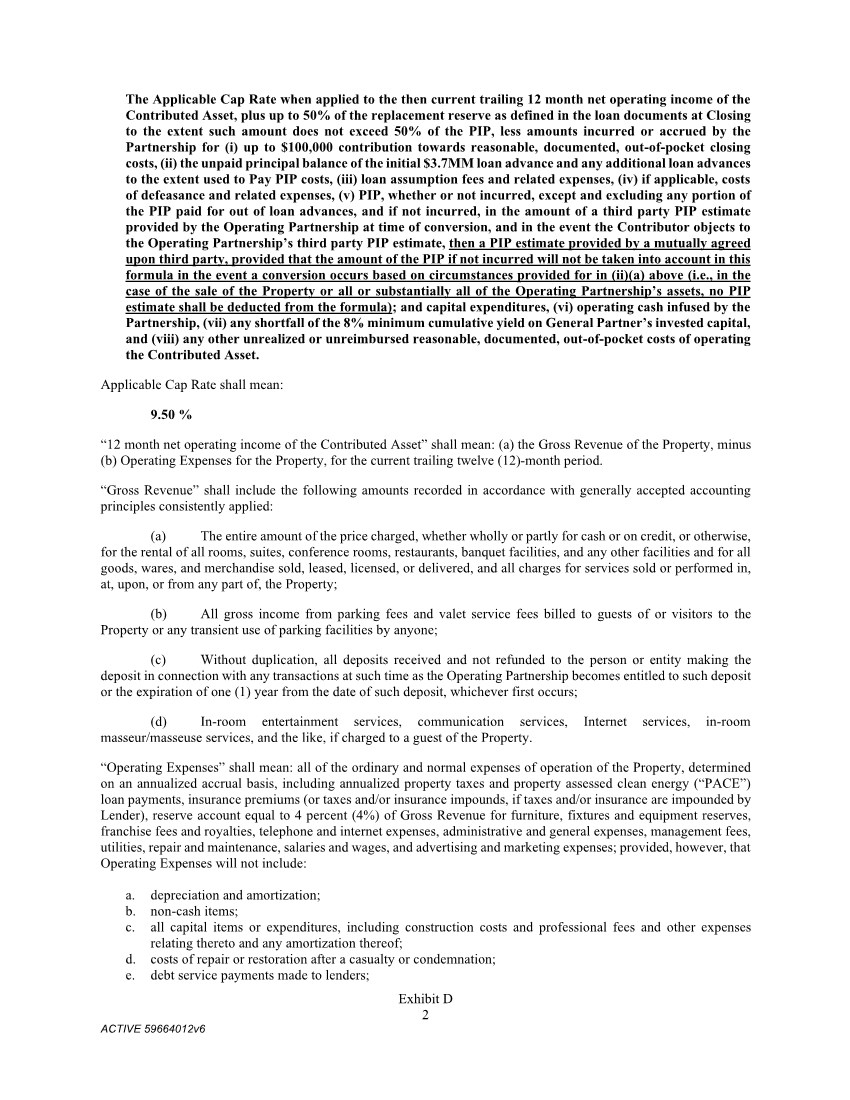

| Exhibit D 2 ACTIVE 59664012v6 The Applicable Cap Rate when applied to the then current trailing 12 month net operating income of the Contributed Asset, plus up to 50% of the replacement reserve as defined in the loan documents at Closing to the extent such amount does not exceed 50% of the PIP, less amounts incurred or accrued by the Partnership for (i) up to $100,000 contribution towards reasonable, documented, out-of-pocket closing costs, (ii) the unpaid principal balance of the initial $3.7MM loan advance and any additional loan advances to the extent used to Pay PIP costs, (iii) loan assumption fees and related expenses, (iv) if applicable, costs of defeasance and related expenses, (v) PIP, whether or not incurred, except and excluding any portion of the PIP paid for out of loan advances, and if not incurred, in the amount of a third party PIP estimate provided by the Operating Partnership at time of conversion, and in the event the Contributor objects to the Operating Partnership’s third party PIP estimate, then a PIP estimate provided by a mutually agreed upon third party, provided that the amount of the PIP if not incurred will not be taken into account in this formula in the event a conversion occurs based on circumstances provided for in (ii)(a) above (i.e., in the case of the sale of the Property or all or substantially all of the Operating Partnership’s assets, no PIP estimate shall be deducted from the formula); and capital expenditures, (vi) operating cash infused by the Partnership, (vii) any shortfall of the 8% minimum cumulative yield on General Partner’s invested capital, and (viii) any other unrealized or unreimbursed reasonable, documented, out-of-pocket costs of operating the Contributed Asset. Applicable Cap Rate shall mean: 9.50 % “12 month net operating income of the Contributed Asset” shall mean: (a) the Gross Revenue of the Property, minus (b) Operating Expenses for the Property, for the current trailing twelve (12)-month period. “Gross Revenue” shall include the following amounts recorded in accordance with generally accepted accounting principles consistently applied: (a) The entire amount of the price charged, whether wholly or partly for cash or on credit, or otherwise, for the rental of all rooms, suites, conference rooms, restaurants, banquet facilities, and any other facilities and for all goods, wares, and merchandise sold, leased, licensed, or delivered, and all charges for services sold or performed in, at, upon, or from any part of, the Property; (b) All gross income from parking fees and valet service fees billed to guests of or visitors to the Property or any transient use of parking facilities by anyone; (c) Without duplication, all deposits received and not refunded to the person or entity making the deposit in connection with any transactions at such time as the Operating Partnership becomes entitled to such deposit or the expiration of one (1) year from the date of such deposit, whichever first occurs; (d) In-room entertainment services, communication services, Internet services, in-room masseur/masseuse services, and the like, if charged to a guest of the Property. “Operating Expenses” shall mean: all of the ordinary and normal expenses of operation of the Property, determined on an annualized accrual basis, including annualized property taxes and property assessed clean energy (“PACE”) loan payments, insurance premiums (or taxes and/or insurance impounds, if taxes and/or insurance are impounded by Lender), reserve account equal to 4 percent (4%) of Gross Revenue for furniture, fixtures and equipment reserves, franchise fees and royalties, telephone and internet expenses, administrative and general expenses, management fees, utilities, repair and maintenance, salaries and wages, and advertising and marketing expenses; provided, however, that Operating Expenses will not include: a. depreciation and amortization; b. non-cash items; c. all capital items or expenditures, including construction costs and professional fees and other expenses relating thereto and any amortization thereof; d. costs of repair or restoration after a casualty or condemnation; e. debt service payments made to lenders; |