| | | | |

| | | | 1900 K Street, NW Washington, DC 20006 +1 202 261 3300 Main +1 202 261 3333 Fax www.dechert.com |

| | | | |

April 25, 2019

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, DC 20549

Attn: David Orlic

Re: Angel Oak Financial Strategies Income Term Trust (File Nos. 333-225967 and 811-23358)

Dear Mr. Orlic:

This letter responds to comments you conveyed via telephone on April 23, 2019 to me, Stephen Cohen and Matthew Barsamian in connection with the Securities and Exchange Commission staff’s (the “Staff’s”) review of Pre-Effective Amendment No. 1 to Angel Oak Financial Strategies Income Term Trust’s (the “Fund’s”) registration statement on Form N-2 (the “Registration Statement”), which was filed on March 21, 2019, and correspondence filed by the Fund on April 5, 2019, and April 19, 2019. The Fund intends to file Pre-Effective Amendment No. 2, which will reflect the responses below. In addition, attached as Exhibit B are pages of the Fund’s prospectus that reflect the disclosure changes discussed below, which will be included in Pre-Effective Amendment No. 2. Capitalized terms not defined herein have the definitions provided to them in the Registration Statement and previously filed correspondence.

General

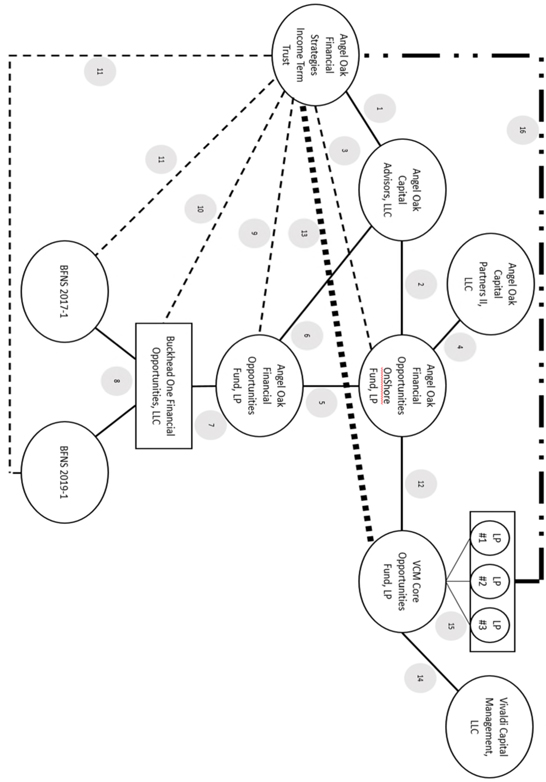

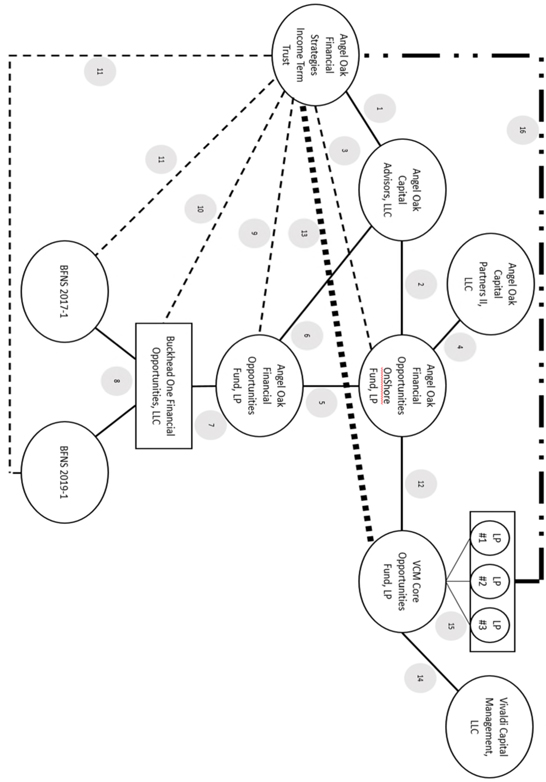

| 1. | Comment: Please provide an organizational chart detailing all relationships and potential affiliations between the various entities and illustrating the In-Kind Distribution and Concurrent Private Placement. |

Response: An organizational chart detailing all relationships and potential affiliations between various entities and illustrating the In-Kind Distribution and Concurrent Private Placement is set forth in Exhibit A to this letter.

| 2. | Comment: In connection with the above-referenced organizational chart, please explain the basis of affiliation between the Fund and each entity under Section 2(a)(3) of the Investment Company Act of 1940 (the “1940 Act”). Explain whether the Angel Oak Securitizations would be considered affiliated persons of the Fund or Angel Oak Capital Advisors, LLC (the “Adviser”). |

Response: The accompanying notes to the organizational chart in Exhibit A to this letter set forth the basis of affiliation between the Fund and each entity under Section 2(a)(3) of the 1940 Act.

As noted in Exhibit A, the Angel Oak Securitizations could be deemed to be a first- or second-tier affiliated person of the Adviser and the Fund, although, as further discussed below in the response to Comment 3, the fact that the Angel Oak Securitizations could be deemed to be affiliated persons of the Adviser and the Fund should not prohibit the proposed transactions. In addition, such affiliation would arise through Angel Oak’s role as adviser to the Fund and Buckhead One Financial Opportunities, LLC’s role as the collateral manager for each of the Angel Oak Securitizations. As noted in our April 5, 2019 letter, no voting, consent or other rights are granted to the holders of the Subordinated Notes and Class D Notes and, as a result, neither the Fund nor the Private Fund would be deemed to control, directly or indirectly, the Angel Oak Securitizations.

With respect to the Concurrent Private Placement and in-kind contribution, the Fund notes that, even when viewing certain entities as affiliated persons or affiliated persons of such persons as under common control with the Fund (notwithstanding arguments against the existence of such affiliated persons status), the Private Placement Investors, each of whom would independently determine whether to instruct VCM Core Opportunities Fund, LP to elect to participate in the In-Kind Distribution and independently determine to participate in the Concurrent Private Placement, including whether to purchase Shares with cash or to instruct VCM Core Opportunities Fund, LP to contribute on their behalf the securities received from the In-Kind Distribution to the Fund in exchange for Shares, would be no closer than third-tier affiliates of the Fund. As a result, the in-kind contribution of securities by the Private Placement Investors in the Concurrent Private Placement should not implicate Section 17 of the 1940 Act.

| 3. | Comment: Please provide additional analysis as to why the Affiliated Collateral Manager waiving and/or reimbursing any compensation it receives from the Angel Oak Securitizations would “avoid any potential joint transaction issues” under Section 17(d) of the 1940 Act. |

Response: The Fund appreciates the Staff’s comments and notes that as a general matter, under Section 17(a) of the 1940 Act, a registered fund would be permitted to purchase securities issued by a securitization where an affiliate serves as the collateral manager when such securitization is not purchased in the primary issuance or from an affiliated person. This is because Section 17(a) only prohibits principal transactions with affiliated persons or affiliated persons of such persons. As is the case here, if the securities are acquired from an unaffiliated third party, the acquisition would not be a transaction prohibited by Section 17(a) of the 1940 Act where securities are acquired in an arm’s-length transaction with an unaffiliated third party.

The language noted by the Staff from the April 5, 2019 response letter was meant to note that, in an abundance of caution and to avoid any conflicts of interest and/or potential Section 17(d) related concerns, the Affiliated Collateral Manager is waiving and/or reimbursing its fees. Although such fee waiver and/or reimbursement of expenses is not necessary to avoid Section 17(d) concerns, the Fund believes that the waiver and/or reimbursement of fees by the Affiliated Collateral Manager should help to alleviate any concerns that the Fund holding the Contribution Securities reflects any type of overreaching of the Fund by an affiliated person of the Fund or any

2

type of acting in concert between the Fund and its affiliated person in connection with the Fund’s ownership of the Contribution Securities.

Rule 17d-1(c) defines the terms “joint enterprise or other joint transaction or profit-sharing plan” broadly to include any arrangement whereby a fund and any affiliated person (or an underwriter) of the fund have “joint or joint and several participation, or share in the profits of such enterprise or undertaking.” “Section 17(d) and Rule 17d-1, taken together, are designed to prevent affiliated persons of [funds] from taking undue advantage of a [fund] in transactions in which such persons and the [fund] participate in a joint undertaking.”1

The leading case interpreting Rule 17d-1, SEC v. Talley Industries, Inc.,2 held that “some element of ‘combination’ is required” in order for there to be a joint transaction under Section 17(d) and Rule 17d-1.3 The Staff also has stated in another context that the requisite element of a combination or profit motive is present when the affiliate of a fund has both a “material pecuniary incentive” in the transaction or arrangement and “the ability to cause the investment company to participate” in the transaction.4

Here, the separateness of the transactions and the fact that unaffiliated investors will make a decision to contribute the Contribution Securities to the Fund removes the requisite elements of “combination” required to find a joint transaction under Section 17(d). Indeed, participating in the Concurrent Private Placement was not a condition to participating in the In-Kind Distribution opportunity and receiving the In-Kind Distribution was not a condition of participating in the Concurrent Private Placement. The Private Placement Investors are independently determining whether to invest in the Fund in the Concurrent Private Placement as well as determining whether to do so via cash and/or Contribution Securities. Further, by waiving and/or reimbursing any fees

| 1 | See In the Matter of Imperial Financial Services, Inc., Rel. No. 34-7684 (Aug. 26, 1965); and Mutual Fund Directors Forum, SEC No-Action Letter (pub. avail. May 9, 2002). See also Massachusetts Mutual Life Insurance Company, SEC No-Action Letter (pub. avail. Jun 7, 2000) (“MassMutual I”) citing Investment Trusts and Investment Companies: Hearings on S. 3580 Before a Subcomm. of the Senate Comm. on Banking and Currency, 76th Cong., 3rd Sess. 256 (Apr. 9, 1940) (statement of David Schenker, Chief Counsel, Securities and Exchange Commission, Investment Trust Study); and Rel. No. IC-5128 (Oct. 13, 1967) (proposing amendments to Rule 17d-1) (proposed amendments subsequently withdrawn, Notice of Withdrawal of Proposed Rule, SEC Rel. No. IC-5874 (Nov. 27, 1969)). See also SEC v. Talley Industries, Inc., 399 F.2d 396, 405 (2d Cir. 1968), cert. denied, 393 U.S. 1015 (1969); The Chase Manhattan Bank, SEC No-Action Letter (pub. avail. July 24, 2001) (“Section 17(d) and Rule 17d-1, taken together, are designed to ensure fair dealing and no overreaching in connection with joint transactions involving an investment company and its affiliated persons”); and Investment Trusts and Investment Companies: Hearings on S. 3580 Before Subcomm. of the Senate Comm. on Banking and Currency, 76th Cong., 3rd Sess. 256 (Apr. 9, 1940) (statement of David Schenker, Chief Counsel, Securities and Exchange Commission, Investment Trust Study) (indicating that the purpose of Commission rules to be promulgated under Section 17(d) (originally drafted as Section 17(a)(4)) is to “insure fair dealing and no overreaching”). |

| 2 | 399 F.2d 396 (2d Cir. 1968), cert. denied, 393 U.S. 1015 (1969). |

3

for serving as the Affiliated Collateral Manager, the requisite “material pecuniary interest” is removed.

| 4. | Comment: Please discuss in more detail the valuation procedures for any in-kind securities contributed to the Fund—in particular, any potential conflicts of interest and how such conflicts would be addressed. Please also discuss who would bear the cost for such valuation. |

Response: The Fund will value any Contribution Securities in accordance with the Fund’s Valuation Procedures, which have been adopted by the Board of Trustees (“Board”) of the Fund. Under the Valuation Procedures, the Board has approved certain independent third-party pricing services or sources (each, a “Pricing Service”). It is anticipated that, with respect to valuing the Contribution Securities, the primary Pricing Service would be Bank of America Merrill Lynch (“BAML”) and the secondary Pricing Service would be Interactive Data Corporation (“IDC”), neither of which is affiliated with the Fund or the Adviser. Each of BAML and IDC currently provide pricing coverage for the Contribution Securities, and the Fund currently has no reason to believe BAML or IDC will not continue to do so. Each of BAML and IDC may use various valuation methodologies, such as the mean between the bid and ask prices, matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. The Valuation and Risk Oversight Committee of the Board, which is comprised of all of the Independent Trustees, regularly receives reports on the inputs, methods, models and assumptions used by the Pricing Services, including BAML and IDC, as part of its oversight of the Valuation Procedures.

The Fund notes that, under the Valuation Procedures, if a price is not available from a Pricing Service (which is not anticipated on the closing of the Concurrent Private Placement), the most recent quotation obtained from one or more third-party broker-dealers known to follow the Contribution Securities would be used. In the case that only a single quote is available, the Contribution Securities would be valued at the single quote as provided. In the absence of readily available market quotations, the Contribution Securities would be priced at a fair value in accordance with the Valuation Procedures and subject to the oversight of the Valuation and Risk Oversight Committee and the Board. In the unlikely event that a Pricing Service quote and broker quote are unavailable or unreliable, the Fund would employ a fair valuation process that would include obtaining an independent valuation agent to provide a recommendation.

The Fund does not believe there are any potential conflicts of interest with respect to the valuation of the Contribution Securities, given the role of the Pricing Services, which are not affiliated with the Fund or the Adviser. The Fund also does not believe there are any potential conflicts of interest in the absence of a price from a Pricing Service because of the role of third-party broker-dealers. Finally, because Section 2(a)(41) of the 1940 Act provides that the Board, which is comprised of a majority of Independent Trustees, is responsible for determining the fair value of securities that do not have market values, the Fund does not believe there is a conflict of interest with respect to the valuation of the Contribution Securities. In the unlikely event that a Pricing Service quote and broker quote are unavailable or unreliable, in order to mitigate any conflict of interest with the Adviser, the Fund notes that the Board (or the Valuation and Risk Oversight Committee of the Board) would be directly involved in the determination of a Contribution Security’s fair value and, as noted above, would obtain a recommendation from an independent valuation agent. The Fund notes that the valuation will not be influenced by the

4

unaffiliated Private Placement Investors participating in the Concurrent Private Placement who may contribute the Contributed Securities in-kind.

Finally, with respect to the cost of such valuation, the Board has selected the Pricing Services and has approved the fees associated with those Pricing Services across all of the funds that the Board oversees. The Fund notes that the Pricing Services charge on a per security basis for the Contribution Securities and the same fees are charged as for any other security in the same asset class. The Fund notes that it would pay for the valuation for the Contribution Securities in connection with an in-kind contribution, as the Fund would with any other security for which prices were obtained from the Pricing Services for purposes of calculating the Fund’s net asset value. The Fund also notes that the Private Fund would pay the fees associated for the use of a Pricing Service at the time of the In-Kind Distribution.

| 5. | Comment: In footnote 4 to your response filed on April 5, 2019, you cite a number of no-action letters and generally state that both the In-Kind Distribution and any in-kind contribution into the Fund will be conducted in a manner not inconsistent with Staff guidance. Please identify more specifically the particular no-action letters that you would follow for each of these transactions and analyze how each transaction would be consistent with these letters. |

Response: The Fund notes that, as set forth in Exhibit A of this letter, the Private Placement Investors are not affiliated persons of the Fund (or affiliated persons of such persons) and no transaction will be effected between the Fund and the Private Fund. As a result, there are no issues under Section 17 and the no-action letters relating to in-kind transactions are not applicable in this situation. Nevertheless, as noted in the response filed on April 5, 2019, the Private Fund and Fund intend to conduct the in-kind transactions in a manner not inconsistent with Staff guidance applicable to affiliated in-kind transactions. In particular, the three most relevant no-action letters are: (1) the Signature Financial letter;5 (2) the GE Institutional Funds letter;6 and (3) the GuideStone Financial letter.7 While none of these no-action letters involved facts identical to the proposed transactions, they all require compliance with similar conditions that are designed to reduce the risk that an affiliated person (or an affiliated person of such person) would benefit at the expense of a registered investment company or its shareholders during an in-kind transaction.

With respect to the In-Kind Distribution, the general partner of the Private Fund will be offering the opportunity to participate in the In-Kind Distribution to all investors of the Private Fund and will distribute securities pro rata to all investors who participate in the in-kind transaction. This is intended to ensure that there is no opportunity for overreaching, as it essentially eliminates the ability of any party to exercise any influence or control over the selection of the securities to be distributed. In addition, the In-Kind Distribution will be effected at approximately the investor’s

| 5 | See Signature Financial Group Inc., SEC No-Action Letter (pub. avail. Dec. 28, 1999) (permitting redemptions in-kind by a fund to affiliated shareholders). |

| 6 | See GE Institutional Funds, SEC No-Action Letter (pub. avail. Dec. 21, 2005) (permitting in-kind transactions in connection with an affiliate’s exchange between registered funds in the same fund complex). |

| 7 | See GuideStone Financial, et al., SEC No-Action Letter (pub. avail. December 27, 2006) (permitting in-kind transactions between unregistered funds and registered funds as part of a conversion transaction). |

5

proportionate share of the Private Fund’s current net assets, and thus does not result in the dilution of the interests of the remaining investors. The distributed securities will be valued in the same manner as they are valued for purposes of computing the Private Fund’s net asset value, which is the same manner in which the Contribution Securities will be valued under the Fund’s Valuation Procedures. The In-Kind Distribution is also consistent with the Private Fund’s offering materials and organizational documents.

With respect to the in-kind contribution, the Board has approved procedures, which will be followed in effecting the in-kind contributions and which will track the relevant requirements of these no-action letters, except that the In-Kind Distribution from the Private Fund and in-kind contribution by Private Placement Investors will not be concurrent. The Fund believes that this departure from the conditions is reasonable, because, unlike the no-action letters, the Private Placement Investors are not affiliates of the Fund (or affiliates of such persons). Accordingly, each in-kind contribution will be effected in accordance with the following conditions:

| | ● | | The in-kind contribution will not dilute the interests of the other shareholders of the Fund because the Private Placement Investors that elect to purchase Shares in exchange for an in-kind contribution of Contribution Securities will receive Shares having an aggregate value equal to the value of the Contribution Securities as determined in accordance with the Fund’s Valuation Procedures; |

| | ● | | The in-kind contribution is in the best interest of the Fund and will not favor a transferring investor to the detriment of another shareholder of the Fund because, as stated above, the Fund will determine the value of Contribution Securities in accordance with the Fund’s Valuation Procedures; |

| | ● | | The Contribution Securities accepted by the Fund will consist only of permitted securities that the Fund has deemed to be appropriate, in type and amount, for investment by the Fund in light of its investment objective, investment policies and current holdings; |

| | ● | | If any securities are not acceptable to the Fund, either the Adviser or the transferring shareholders will bear the cost associated with selling the portfolio securities (although the Fund does not expect that securities contributed in-kind would not be acceptable to the Fund as only the Contribution Securities, which the Fund has deemed acceptable, are eligible to be contributed); |

| | ● | | The Fund and the Private Fund will use the same valuation methodology to determine: (i) the amount of in-kind redemption proceeds to be paid to the investors withdrawing from the Private Fund; and (ii) the amount of shares to be issued to the Private Placement Investors who contribute Contribution Securities to the Fund (i.e., the Fund and the Private Fund will ascribe the same value to the Contribution Securities, subject to any price movement during the period between the In-Kind Distribution and the in-kind contribution); |

| | ● | | Adequate records will be kept of the in-kind contribution by the Fund, in accordance with the federal securities laws; |

6

| | ● | | The Fund’s Registration Statement will disclose that the Fund may accept in-kind contributions as part of the Concurrent Private Placement; and |

| | ● | | The proposed in-kind contributions will be effected in accordance with the procedures, as noted above. |

Fund Summary (pages i-iii)

| 6. | Comment: Please revise footnote 3 on page ii to properly cross reference the “Summary of fees and expenses” section. |

Response: The Fund will revise footnote 3 on page ii to properly cross reference the “Summary of fees and expenses” section.

| 7. | Comment: Under “Limited Term” on page ii, the disclosure states “Following the completion of an Eligible Tender Offer, the Board may eliminate the Termination Date upon the affirmative vote of a majority of the Board and without Shareholder approval.” Please supplementally explain the source of the Board’s authority to eliminate the Termination Date in the manner described. |

Response: Section 3(d) of Article VIII of the Fund’s Declaration of Trust provides that the Board may eliminate the Termination Date following the completion of an Eligible Tender Offer and upon the affirmative vote of a majority of the Board and without Shareholder approval. The Fund’s Declaration of Trust will be filed as an exhibit to Pre-Effective Amendment No. 2.

| 8. | Comment: Please file as an exhibit to the Registration Statement the subscription agreements between the Fund and the Private Placement Investors or supplementally explain the Fund’s reasoning for not filing those agreements. |

Response: The Fund notes that the subscription agreements between the Fund and the Private Placement Investors do not involve the sale of the Shares that are being registered pursuant to the Registration Statement. Rather, the subscription agreements set forth the subscription rights pursuant to a private placement that will occur concurrent with—opposed to prior to—the Fund launch. The Fund believes that disclosure of the subscription agreements does not provide potential Fund investors with meaningful information related to the offering of the Shares in the public offering. Thus, the subscription agreements do not constitute the types of agreements required to be field pursuant to Items 25(2)(k) and 25(2)(p) of Form N-2. Accordingly, the Fund does not intend to file those agreements as exhibits to the Registration Statement. The Fund notes that it will file as an exhibit to the Registration Statement the Subscription Agreement relating to the Adviser’s initial seed investment in the Fund.

| 9. | Comment: Please file final the (rather than the “form of”) agreements as exhibits to the Registration Statement. |

Response: The Fund acknowledges the Staff’s comment and will file all exhibits as required by Form N-2 and relevant Staff guidance. The Fund notes that agreements to be signed after the

7

Registration Statement’s effectiveness will be filed as “form of” agreements in accordance with Staff guidance.

| 10. | Comment: In connection with the Concurrent Private Placement, please disclose that the Fund will determine the value of the Contribution Securities in accordance with procedures adopted by, and subject to the supervision of, the Board. |

Response: The Fund will amend the disclosure to clarify that the Contribution Securities will be valued in accordance with the Valuation Procedures adopted by, and subject to the supervision of, the Board.

| 11. | Comment: Please update disclosure in the prospectus and Statement of Additional Information to be as of March 31, 2019 or a later date, to the extent required by Form N-2. |

Response: The Fund will update disclosure in the prospectus and Statement of Additional Information to be as of March 31, 2019 or a later date, to the extent required by Form N-2.

| 12. | Comment: Please supplementally confirm whether the Fund plans to file as an exhibit a “Contribution Agreement” relating to the Concurrent Private Placement. |

Response: The Fund will not be entering into a “Contribution Agreement” relating to the Concurrent Private Placement. Each Private Placement Investor will enter into a subscription agreement with the Fund, as noted in the response to Comment 8 above, pursuant to which the Private Placement Investor may purchase Shares in exchange for either cash or securities acceptable to the Fund, which cash or securities will be delivered to the Fund concurrently with the closing of the public offering contemplated in the Registration Statement.

Prospectus Summary (pages 1-23)

| 13. | Comment: According to ABS-15G filings by the Angel Oak Securitizations, the Adviser is also a service provider to the BFNS Securitizations. Please add disclosure describing this arrangement and any other related-party arrangements relating to the Contribution Securities. |

Response: The Adviser serves as a service provider to each of the Angel Oak Securitizations pursuant to a Services Agreement between the Adviser and the Affiliated Collateral Manager. In that capacity, the Adviser performs certain day-to-day administrative and collateral management duties delegated to it by the Affiliated Collateral Manager, including accounting, trading, risk management, compliance support, portfolio analysis, operations, legal, research and other administrative services. The Affiliated Collateral Manager reserves absolute discretion with respect to the disposition of assets of the Angel Oak Securitizations. Neither Angel Oak Securitization is liable to make any payment to the Adviser in connection with the issuance of securities by the Angel Oak Securitization or the management of its assets. The Registration Statement will be revised to describe this arrangement.

| 14. | Comment: It appears that BFNS 2019-1 and the Fund were intended to be launched around the same period. Please supplementally describe the extent, if any, to which investors in BFNS |

8

| | 2019-1 were provided with information about other investment funds advised by the Adviser, whether currently existing or prospective, in connection with the BFNS 2019-1 offering. |

Response: The offering circular for BFNS 2019-1 references Angel Oak Financial Opportunities Fund, L.P. for purposes of describing its ownership of the Affiliated Collateral Manager. Investors in BFNS 2019-1 were not provided with disclosure concerning other investment funds advised by the Adviser, whether currently existing or prospective, in connection with the offering of BFNS 2019-1. The Fund notes that the target investor base for the senior tranches of BFNS 2019-1 (i.e., institutional investors) differ from the target investor base for the Fund (i.e., retail investors) and are not related in any way. The Fund further notes that the closing of BFNS 2019-1 and the launch of the Fund were not initially intended to happen contemporaneously, as evidenced by the fact that the Fund filed its initial Registration Statement in June 2018 but did not view market conditions as ready for a successful offering until the present. The launch of BFNS 2019-1 was prepared and organized before the proposed 2019 launch of the Fund, and the launch of BFNS 2019-1 and the proposed 2019 launch of the Fund are independent of one another.

| 15. | Comment: Under “Conflicts of interest risk” on page 13, please clarify whether references to the Fund purchasing Structured Products sponsored by the Adviser or its affiliates from third parties in secondary market transactions is intended to refer only to the Contribution Securities or whether there are other specific investments sponsored by the Adviser or an affiliate in which the Fund will invest. |

Response: The Fund has no current intent to purchase other Structured Products sponsored by the Adviser or its affiliates and, therefore, the disclosure is not intended to refer specifically to any other such investment. Although the Fund does not currently contemplate making investments in any specific securities sponsored by the Adviser or an affiliate other than the Contribution Securities, to the extent the Fund does make such investments in the future, it will do so only as permitted under the 1940 Act and the rules thereunder. The Fund will revise the disclosure to read:

While the Fund generally may not purchase Structured Products sponsored by the Adviser or its affiliates directly from the issuer thereof, the Fund may, under certain circumstances, purchase Structured Products sponsored by the Adviser or its affiliates from third parties in secondary market transactions (e.g., acquiring the Contribution Securities from the Private Placement Investors in the Concurrent Private Placement). The Fund does not currently contemplate making investments in any specific investments sponsored by the Adviser or an affiliate other than the Contribution Securities; however, to the extent the Fund does, it will do so only as permitted under the 1940 Act and the rules thereunder.

| 16. | Comment: Under “Structured Products risk” on page 20, please clarify whether references to the Fund purchasing Structured Products sponsored by the Adviser or its affiliates from third parties in secondary market transactions is intended to refer only to the Contribution Securities or whether there are other specific investments sponsored by the Adviser or an affiliate in which the Fund will invest. |

9

Response: Please see the response to Comment 15 above. The Fund will revise the disclosure to read:

To the extent that an affiliate of the Adviser serves as the sponsor and/or collateral manager of a Structured Product in which the Fund invests (e.g., the Contribution Securities), or the Adviser or its affiliates hold other interests in Structured Products in which the Fund invests, the Fund may be limited in its ability to participate in certain transactions with the Structured Product and may not be able to dispose of its interests in the Structured Product if no secondary market exists for the interests. Even if a secondary market exists, the Adviser or its affiliates at times may possess material non-public information that may restrict the Fund’s ability to dispose of its interests in the Structured Product. The Fund does not currently contemplate making investments in any specific investments sponsored by the Adviser or an affiliate other than the Contribution Securities; however, to the extent the Fund does, it will do so only as permitted under the 1940 Act and the rules thereunder.

| 17. | Comment: Under “Structured Products risk” on pages 20 and 54, please revise the reference to “Contribution Assets” to read “Contribution Securities.” |

Response: The Fund will revise the references to “Contribution Assets” to read “Contribution Securities.”

| 18. | Comment: Under “Structured Products risks” on pages 20 and 42, the disclosure states, “[t]he Fund may have the right to receive payments only from the Structured Product, and generally does not have direct rights against the issuer or the entity that sold the underlying collateral assets.” In light of this, please supplementally confirm why the prospectus contains extensive disclosure regarding the collateral underlying the Structured Products. |

Response: The ability of a Structured Product to make principal and interest payments to investors is dependent on the performance of its underlying collateral. Accordingly, the Fund (and other investors in Structured Products) is indirectly exposed to the credit and other risks associated with the underlying collateral. Disclosure regarding the characteristics of the collateral is therefore relevant to understanding the risks of investing in Structured Products. The disclosure referenced in the Staff’s comment is intended to make clear to investors that notwithstanding the fact that the value of an investment in a Structured Product depends on the performance of the underlying collateral, in the event of a default or other credit event, the Fund generally has no direct rights with respect to the underlying collateral. Supplementally, the Fund notes that its discussion of risks related to the underlying collateral of Structured Products is consistent with disclosure from other registrants that may invest in Structured Products.

| 19. | Comment: Please supplementally confirm that the Expense Limit will remain in place for at least one year from the date of the prospectus and that the Fund will file the Expense Limitation Agreement as an exhibit to the Registration Statement. |

10

Response: The Fund confirms that the Expense Limit will remain in place for at least one year from the date of the prospectus. The Fund will file the Expense Limitation Agreement as an exhibit to the Registration Statement.

Principal Risks of Investing in the Fund (pages 35-59)

| 20. | Comment: Under “Structured Products risks” on page 54, the disclosure states, “[m]ost Structured Products are issued in multiple tranches that offer investors various maturity and credit risk characteristics, which are often categorized as senior, mezzanine, and subordinated/equity.” Please specify in the disclosure which tranches of Structured Products the Fund will invest in and tailor the principal risk disclosure accordingly. |

Response: The Fund will add the following disclosure to Structured Product risks: “The Fund may invest in any tranche of a Structured Product, including the subordinated/equity tranches.” The Fund will amend the principal risk disclosure to clarify the risks associated with the various tranches of Structured Product, in particular the subordinated/equity tranche.

| 21. | Comment: Under “Structured Products risks” on page 55, the disclosure states, “[u]p to all of the Fund’s investments in Structured Products may be in the equity tranches.” Supplementally, please explain whether such equity tranches are the same as the subordinated debt and preferred securities described in “Senior debt, subordinated debt and preferred securities of banks and diversified financial companies risk” on page 54. |

Response: Such equity tranches are not the same as the subordinated debt and preferred securities described in “Senior debt, subordinated debt and preferred securities of banks and diversified financial companies risk.” “Equity tranches” in the above disclosure refers to the equity tranches of Structured Products, which are the most junior tranche of a Structured Product and the first to absorb losses in the event of default by the underlying collateral. In contrast, subordinated debt and preferred securities refer to certain securities issued by banks, which the Fund may acquire directly or, in the context of Structured Products, may constitute underlying collateral.

| 22. | Comment: Under “Structured Products risks” on page 55, the disclosure states, “[t]o the extent that any losses are incurred by the Structured Product in respect of any collateral, such losses will be borne first by the owners of the equity interests.” Please disclose that the Fund may incur such losses to the extent it holds such equity interests. |

Response: The Fund will revise the disclosure to read: “To the extent that any losses are incurred by the Structured Product in respect of any collateral, such losses will be borne first by the owners of the equity interests, which may include the Fund.”

| 23. | Comment: Under “Structured Products risks” on page 55, please revise the first sentence of the last paragraph to read, “[t]he Fund generally may have the right to receive payments only from the Structured Product, and generally does not have direct rights against the issuer or the entity that sold the underlying collateral assets.” |

11

Response: The Fund will revise the disclosure to read: “The Fund generally may have the right to receive payments only from the Structured Product, and generally does not have direct rights against the issuer or the entity that sold the underlying collateral assets.”

| 24. | Comment: Under “Structured Products risks” on page 56, please replace the term “Trust” with “Fund.” |

Response: The Fund will replace the term “Trust” with “Fund.”

* * *

Should you have any questions or comments, please contact me at 202.261.3386 or Stephen Cohen at 202.261.3304.

Sincerely,

/s/ William J. Bielefeld

William J. Bielefeld

12

EXHIBIT A

A-1

Angel Oak Organizational Chart Legend

| 1 – | Angel Oak Capital Advisors, LLC is a Delaware limited liability company registered as an investment adviser under the Investment Advisers Act of 1940. Angel Oak Capital Advisors, LLC is controlled by Sreeniwas Prabhu and Michael Fierman. Angel Oak Capital Advisors, LLC serves as the investment adviser to Angel Oak Financial Strategies Income Term Trust and therefore is an affiliated person of Angel Oak Financial Strategies Income Term Trust under Section 2(a)(3)(E) of the 1940 Act. In addition, if it is assumed that an adviser controls an entity (which we do not concede in light of the fact that the Angel Oak Financial Strategies Income Term Trust has an independent board, among other reasons), the Angel Oak Financial Strategies Income Term Trust could be deemed to be controlled by Angel Oak Capital Advisors, LLC and therefore a first-tier affiliated person of Angel Oak Capital Advisors, LLC under Section 2(a)(3)(C) of the 1940 Act. |

| 2 – | Angel Oak Financial Opportunities OnShore Fund, LP is a Delaware limited partnership advised by Angel Oak Capital Advisors, LLC. If it is assumed that an adviser controls an entity, the Angel Oak Financial Opportunities OnShore Fund, LP could be deemed to be controlled by Angel Oak Capital Advisors, LLC and a first-tier affiliated person of Angel Oak Capital Advisors, LLC. |

| 3 – | If it is assumed that an adviser controls an entity, Angel Oak Financial Opportunities OnShore Fund, LP could be deemed to be under common control with Angel Oak Financial Strategies Income Term Trust and, as a result, Angel Oak Financial Opportunities OnShore Fund, LP could be deemed to be a first-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. Alternatively, if it is assumed that Angel Oak Capital Advisors, LLC does not control Angel Oak Financial Strategies Income Term Trust, Angel Oak Financial Opportunities OnShore Fund, LP could be deemed a second-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. |

| 4 – | Angel Oak Capital Partners II, LLC is a Delaware limited liability company registered as an investment adviser under the Investment Advisers Act of 1940 and serves as the general partner of Angel Oak Financial Opportunities OnShore Fund, LP. Angel Oak Capital Partners II, LLC is controlled by Sreeniwas Prabhu and Michael Fierman. Angel Oak Capital Partners II, LLC could be deemed to be under common control with Angel Oak Capital Advisors, LLC. |

| 5 – | Angel Oak Financial Opportunities Fund, LP is a master fund into which Angel Oak Financial Opportunities OnShore Fund, LP invests. Angel Oak Financial Opportunities OnShore Fund, LP could be deemed to control the Angel Oak Financial Opportunities Fund, LP. |

| 6 – | Angel Oak Financial Opportunities Fund, LP is a Delaware limited partnership advised by Angel Oak Capital Advisors, LLC. If it is assumed that an adviser controls an entity, the Angel Oak Financial Opportunities Fund, LP could be deemed to be controlled by Angel Oak Capital Advisors, LLC and a first-tier affiliated person of Angel Oak Capital Advisors, LLC under Section 2(a)(3)(C) of the 1940 Act. |

| 7 – | Buckhead One Financial Opportunities, LLC is a Delaware series limited liability company registered as an investment adviser under the Investment Advisers Act of 1940. Buckhead One Financial Opportunities, LLC is wholly-owned by Angel Oak Financial Opportunities Fund, LP. |

A-2

| 8 – | Buckhead One Financial Opportunities, LLC serves as the collateral manager for each of BFNS 2017-1 and BFNS 2019-1. If it is assumed that the collateral manager controls an entity (which we do not concede in light of the limited authority that a collateral manager has in a securitization), each of BFNS 2017-1 and BFNS 2019-1 could be deemed to be controlled by Buckhead One Financial Opportunities, LLC and a first-tier affiliated person of Buckhead One Financial Opportunities, LLC. Under the proposed In-Kind Distribution, BFNS 2017-1 (subordinated notes), BFNS 2019-1 (subordinated notes) and BFNS 20019-1 (Class D) will be distributed through Buckhead One Financial Opportunities, LLC; Angel Oak Financial Opportunities Fund, LP; Angel Oak Financial Opportunities OnShore Fund, LP; and VCM Core Opportunities Fund, LP for the benefit of the Limited Partners and be contributed in-kind by the Limited Partners as part of the Concurrent Private Placement. |

| 9 – | If it is assumed that an adviser controls an entity, Angel Oak Financial Opportunities Fund, LP could be deemed to be under common control with Angel Oak Financial Strategies Income Term Trust and, as a result, Angel Oak Financial Opportunities Fund, LP could be deemed to be a first-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. Alternatively, if it is assumed that Angel Oak Capital Advisors, LLC does not control Angel Oak Financial Strategies Income Term Trust, Angel Oak Financial Opportunities Fund, LP could be deemed a second-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. |

| 10 – | If it is assumed that an adviser controls an entity, Buckhead One Financial Opportunities, LLC could be deemed to be indirectly under common control with Angel Oak Financial Strategies Income Term Trust and, as a result, Buckhead One Financial Opportunities, LLC could be deemed to be a first-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. Alternatively, if it is assumed that Angel Oak Capital Advisors, LLC does not control Angel Oak Financial Strategies Income Term Trust, Buckhead One Financial Opportunities, LLC could be deemed a second-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. |

| 11 – | If it is assumed that an adviser controls an entity, each of BFNS 2017-1 and BFNS 2019-1 could be deemed to be indirectly under common control with Angel Oak Financial Strategies Income Term Trust and, as a result, BFNS 2017-1 and BFNS 2019-1 could be deemed to be a first-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. Alternatively, if it is assumed that Angel Oak Capital Advisors, LLC does not control Angel Oak Financial Strategies Income Term Trust, each of BFNS 2017-1 and BFNS 2019-1 could be deemed a second-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. |

| 12 – | VCM Core Opportunities Fund, LP is a Delaware limited partnership that owns over 50% of the limited partner interests of Angel Oak Financial Opportunities OnShore Fund, LP and could be deemed to control and be a first-tier affiliated person of Angel Oak Financial Opportunities OnShore Fund, LP. |

| 13 – | Given that Angel Oak Financial Opportunities OnShore Fund could be deemed to be a first-tier affiliated person of Angel Oak Financial Strategies Income Term Trust and VCM Core Opportunities Fund, LP could be deemed to be a first-tier affiliated person of Angel Oak Financial Opportunities OnShore Fund, LP, VCM Core Opportunities Fund, LP could be deemed to be a second-tier affiliated person of Angel Oak Financial Strategies Income Term Trust. |

A-3

| 14 – | Vivaldi Capital Management, LLC is Delaware limited liability company and registered as an investment adviser under the Investment Advisers Act of 1940 and serves as adviser and managing member to VCM Core Opportunities Fund, LP. Vivaldi Capital Management, LLC is not affiliated with Angel Oak Capital Advisors, LLC. |

| 15 – | The Limited Partners are individual investors who hold limited partnership interests in VCM Core Opportunities Fund, LP. The Limited Partners are the individuals who will be participating in the Concurrent Private Placement and the potential in-kind contribution. Each Limited Partner is a client of Vivaldi Capital Management, LLC. However, neither VCM Core Opportunities Fund, LP nor Vivaldi Capital Management, LLC have discretion to make investment decisions related to the In-Kind Distribution or participation in the Concurrent Private Placement. The Limited Partners will each be making individual investment decisions to (i) instruct VCM Core Opportunities Fund, LP to participate in the In-Kind Distribution on its behalf and (ii) participate in the Concurrent Private Placement, including whether to purchase Shares with cash or instruct VCM Core Opportunities Fund, LP to contribute Contribution Securities on its behalf. Each Limited Partner that participates in the Concurrent Private Placement will individually execute a subscription document related to the Concurrent Private Placement. |

| 16 – | Even if VCM Core Opportunities Fund, LP was deemed to be a second-tier affiliated person of Angel Oak Financial Strategies Income Term Trust, each of the Limited Partners would be third-tier affiliated persons of Angel Oak Financial Strategies Income Term Trust. |

A-4

Exhibit B

| | | | | | | | |

| | | price | | (2) | | costs (3) | | to the Fund |

Per Share | | $20.00 | | None | | None | | $20.00 |

Total | | $ | | None | | None | | $ |

Total assuming full exercise of overallotment option(1) | | $ | | None | | None | | $ |

(see notes on inside front cover page)

The underwriters expect to deliver the Shares to purchasers on or about [ ], 2019.

(continued on inside front cover page)

| (1) | The Fund has granted the underwriters an option to purchase up to an additional [ ] Shares at the public offering price within 45 days of the date of this prospectus solely to cover over-allotments, if any. |

| (2) | The Adviser (and not the Fund) has agreed to pay, from its own assets, compensation of [up to $0.50 per Share plus $ ] to the Underwriters in connection with the offering, which aggregate amount will not exceed [ ]% of the total public offering price of the Shares sold in this offering. Separately, the Adviser (and not the Fund) has agreed to pay, from its own assets, upfront structuring fees to [ ], and may pay certain other qualifying Underwriters a structuring fee in connection with the offering. The Adviser (and not the Fund) has also agreed to pay Destra Capital Investments LLC for distribution assistance in connection with this offering of up to $[ ]. See “Underwriting.” |

| (3) | The Adviser has agreed to pay all organizational expenses of the Fund and all offering costs associated with this offering and the Concurrent Private Placement (as described below). The Fund is not obligated to repay any such organizational expenses or offering costs paid by the Adviser. See “Summary of fees and expenses.” |

(continued on inside front cover page)

Limited Term. The Fund will terminate on or before May 29, 2031 (the “Termination Date”); provided, that if the Board of Trustees (“Board”) believes that, under then-current market conditions, it is in the best interests of the Fund to do so, the Fund may extend the Termination Date: (i) once for up to one year (i.e., up to May 29, 2032), and (ii) once for up to an additional six months (i.e., up to November 29, 2032), in each case upon the affirmative vote of a majority of the Board and without Shareholder (as defined below) approval. In addition, as of a date within twelve months preceding the Termination Date, the Board may cause the Fund to conduct a tender offer to all Shareholders to purchase Shares (as defined below) of the Fund at a price equal to the net asset value (“NAV”) per Share on the expiration date of the tender offer (an “Eligible Tender Offer”). The Board has established that, following an Eligible Tender Offer, the Fund must have at least $100 million of net assets to ensure the continued viability of the Fund (the “Termination Threshold”). In an Eligible Tender Offer, the Fund will offer to purchase all Shares held by each Shareholder; provided, that if the number of properly tendered Shares would result in the Fund’s net assets totaling less than the Termination Threshold, the Eligible Tender Offer will be terminated and no Common Shares will be repurchased pursuant to the Eligible Tender Offer. Instead, the Fund will begin (or continue) liquidating its portfolio and proceed to terminate on or before the Termination Date. The Adviser will pay all costs and expenses associated with the making of an Eligible Tender Offer, other than brokerage and related transaction costs associated with disposition of portfolio investments in connection with the Eligible Tender Offer, which will be borne by the Fund and its Shareholders. An Eligible Tender Offer would be made, and Shareholders would be notified thereof, in accordance with the requirements of the Investment Company Act of 1940 (the “1940 Act”), the Securities Exchange Act of 1934 (the “Exchange Act”) and the applicable tender offer rules thereunder (including Rule 13e-4 and Regulation 14E under the Exchange Act). If the number of properly tendered Shares would result in the Fund’s net assets totaling greater than the Termination Threshold, all Shares properly tendered and not withdrawn will be purchased by the Fund pursuant to the terms of the Eligible Tender Offer. See “Risks—Limited Term Risk.” Following the completion of an Eligible Tender Offer, the Board may eliminate the Termination Date upon the

affirmative vote of a majority of the Board and without Shareholder approval. In making a decision to eliminate the Termination Date to provide for the Fund’s perpetual existence, the Board will take such actions with respect to the continued operations of the Fund as it deems to be in the best interests of the Fund, based on market conditions at such time, the extent of Shareholder participation in the Eligible Tender Offer and all other factors deemed relevant by the Board in consultation with the investment adviser to the Fund, Angel Oak Capital Advisors, LLC (the “Adviser”), taking into account that the Adviser may have a potential conflict of interest in seeking to convert to a perpetual trust. The Fund is not a so called “target date” or “life cycle” fund whose asset allocation becomes more conservative over time as its target date, often associated with retirement, approaches. In addition, the Fund is not a “target term” fund whose investment objective is to return its original NAV on the termination date. The Fund’s investment objective and policies are not designed to seek to return to investors that purchase Shares in this offering their initial investment of $20.00 per Share on the Termination Date or in an Eligible Tender Offer, and such investors and investors that purchase Shares after the

ii

completion of this offering may receive more or less than their original investment upon termination or in an Eligible Tender Offer. See “Risks—Limited Term Risk.”

No Prior History. Because the Fund is recently organized, its common shares of beneficial interest, $0.001 par value per share (the “Shares”), have no history of public trading. The shares of closed-end investment companies often trade at a discount from their NAV, which may increase investors’ risk of loss. The returns earned by holders of the Shares (“Shareholders”) who purchase their Shares in this offering and sell their Shares below NAV will be reduced. This risk may be greater for investors who intend to sell their Shares in a relatively short period after completion of the public offering.

Concurrent Private Placement. Concurrently with the closing of this offering, pursuant to a separate private placement of the Fund’s Shares, certain “accredited investors,” as defined in the Securities Act of 1933, as amended, who are not affiliated persons of the Fund or the Adviser (collectively, the “Private Placement Investors”), have agreed to purchase approximately $[35] million in Shares of the Fund at the initial public offering price of $20.00 per share (the “Concurrent Private Placement”) in exchange for cash and/or an in-kind contribution of securities deemed acceptable to the Fund (the “Contribution Securities”). The Contribution Securities consist primarily of subordinated notes (commonly referred to as the “residual” or “equity” tranche) of two community bank debt securitizations for which an affiliate of the Adviser (as defined below) serves as the sponsor and collateral manager (the “Affiliated Collateral Manager”). These securitizations were formed by private funds managed by the Adviser and private fund investors were offered an opportunity to receive a pro rata in-kind distribution of subordinated notes of the securitizations, which in-kind distribution will be made on or about May 21, 2019. The Contribution Securities will be valued in accordance with the Fund’s valuation procedures adopted by, and under the supervision of, the Board. The Affiliated Collateral Manager has agreed to waive and/or reimburse any compensation it receives from such securitizations, with respect to the Contribution Securities contributed to and held by the Fund.

To the extent that Private Placement Investors elect to purchase Shares in exchange for an in-kind contribution of Contribution Securities, the Private Placement Investors will receive Shares of the Fund having an aggregate initial offering price equal to the value of the Contribution Securities as of the end of the business day next preceding the closing of the Concurrent Private Placement, as determined by the Fund in accordance with the Fund’s valuation procedures, at an initial offering price per share of $20.00.

The Private Placement Investors are obligated to complete the purchase of Shares of the Fund, subject to certain conditions outlined in their subscription agreements, including, among others, the completion of the public offering of the Shares. See “Concurrent Private Placement.”

Investment Adviser. The investment adviser to the Fund is Angel Oak Capital Advisors, LLC (the “Adviser” or “Angel Oak”), an investment adviser registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser oversees the management of the Fund’s activities and is responsible for making investment decisions for the Fund’s portfolio. Angel Oak manages approximately $9.4 billion in assets specializing in structured and corporate credit as of February 28, 2019. Angel Oak was formed and has been investing in structured credit since 2009.

Leverage. The Fund may use leverage to the extent permitted by the 1940 Act. Initially, the Fund expects to use leverage through borrowings from certain financial institutions or reverse repurchase agreements. The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities, the issuance of preferred shares or notes and the leverage attributable to reverse repurchase agreements, dollar rolls or similar transactions or derivatives that have the effect of leverage in an aggregate amount up to 40% of the Fund’s Managed Assets (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes) (“Managed Assets”) immediately after giving effect to the leverage. The Fund intends to enter into a credit facility within twelve months after the completion of this offering. The Fund’s use of leverage is subject to risks and will cause the Fund’s NAV per Share to be more volatile than if leverage were not used. See “Leverage” and “Risks—Leverage Risk.”

Listing. It is expected that the Shares will be approved for listing on the New York Stock Exchange under the symbol FINS, subject to notice of issuance.

Investors should rely only on the information contained in this prospectus. No dealer, salesperson or other individual has been authorized to give any information or to make any representations that are not contained in this prospectus. If any such information or statements are given or made, investors should not rely upon such information or representations. This prospectus does not constitute an offer to sell any securities other than those to which this prospectus relates, or an offer to sell to, or a solicitation of an offer to buy from, any person in any jurisdiction where such an offer or solicitation would be unlawful. This prospectus speaks as of the date set

iii

Prospectus summary

This is only a summary and does not contain all of the information that a prospective investor should consider before investing in the Fund. Before investing, a prospective investor in the Fund should carefully read the more detailed information appearing elsewhere in this prospectus and the Statement of Additional Information.

THE FUND

Angel Oak Financial Strategies Income Term Trust (“Fund”) is a newly organized Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a non-diversified, closed-end management investment company. The Fund will have a limited term unless otherwise determined by the Fund’s Board of Trustees (“Board”). See “Limited Term” and “Risks—Limited Term Risk.”

The Fund intends to elect to be treated, and intends to comply with the requirements to qualify annually, as a regulated investment company (“RIC”) under Subchapter M under the Internal Revenue Code of 1986, as amended (the “Code”).

THE OFFERING

The Fund is offering common shares of beneficial interest (“Shares” and the holders of such Shares, “Shareholders”) at $20.00 per Share through a group of underwriters led by [ ], [ ], and [ ]. You must purchase at least 50 Shares ($1,000) in this offering. The Fund has given the Underwriters an option to purchase up to [ ] additional Shares within 45 days of the date of this prospectus solely to cover over-allotments, if any. See “Underwriting.” The investment adviser to the Fund, Angel Oak Capital Advisors, LLC (the “Adviser” or “Angel Oak”), has agreed to pay underwriting compensation of [up to $0.50 per Share plus $ ] to the Underwriters in connection with the offering, which aggregate amount will not exceed [ ]% of the total public offering price of the Shares sold in this offering. The Adviser also has agreed to pay all of the Fund’s organizational expenses and all offering costs associated with this offering and the Concurrent Private Placement (as defined below). The Fund is not obligated to repay any such organizational expenses or offering costs paid by the Adviser.

In April 2018, a similar closed-end fund which was to be advised by the Adviser commenced a public offering, but that offering was never completed and that fund’s registration statement was withdrawn in May 2018 (the “Prior Offering”). This offering is unrelated to the Prior Offering and the Fund is a newly-formed closed-end fund, which is separate and distinct from the fund offered in the Prior Offering. In making a determination to invest in the Fund, an investor should rely only on the information contained in this prospectus and should not rely on any information that may have been received in connection with the Prior Offering or of which the investor is aware that related to the Prior Offering.

CONCURRENT PRIVATE PLACEMENT

Concurrently with the closing of this offering, pursuant to a separate private placement of the Fund’s Shares certain “accredited investors,” as defined in the Securities Act of 1933, as amended, who are not affiliated persons of the Fund or the Adviser (collectively, the “Private Placement Investors”), have agreed to purchase approximately $35 million in Shares of the Fund at the initial public offering price of $20.00 per share (the “Concurrent Private Placement”) in exchange for cash and/or an in-kind contribution of securities deemed acceptable to the Fund (the “Contribution Securities”). The Contribution Securities consist primarily of subordinated notes (commonly referred to as the “residual” or “equity” tranche) of two community bank debt securitizations for which Buckhead One Financial Opportunities, LLC, an affiliate of the Adviser serves as the sponsor and collateral manager (the “Affiliated Collateral Manager”). The Contribution Securities will be valued in accordance with the Fund’s valuation procedures adopted by, and under the supervision of, the Board.

To the extent that Private Placement Investors elect to purchase Shares in exchange for an in-kind contribution of Contribution Securities, the Private Placement Investors will receive Shares of the Fund having an aggregate initial offering price equal to the value of the Contribution Securities as of the end of the business day next preceding the closing of the Concurrent Private Placement, as determined by the Fund in accordance with the Fund’s valuation procedures, at an initial offering price per share of $20.00. In the absence of readily accessible market quotations for the Contribution Securities, the ability of the Fund to assign an accurate value to such securities may be limited and the Adviser may be required to perform a fair valuation of the Contribution Securities. Fair value determinations are inherently subjective and reflect good faith judgments based on available information. Accordingly, there can be no assurance that the determination of the Contribution Securities fair value, conducted in accordance with the Fund’s valuation procedures, will in fact approximate the price at which the Fund could sell the Contribution Securities at the time of the fair valuation.

1

The Private Placement Investors are obligated to complete the purchase of Shares of the Fund, subject to certain conditions outlined in their subscription agreements, including, among others, the completion of the public offering of the Shares.

The Contribution Securities consist of subordinated notes issued by BFNS 2017-1 and subordinated notes and Class D notes issued by BFNS 2019-1. BFNS 2017-1 and BFNS 2019-1 are community bank debt securitizations sponsored and managed by the Affiliated Collateral Manager. These securitizations were formed by private funds managed by the Adviser, which initially held all of the subordinated notes issued by BFNS 2017-1 and BFNS 2019-1 and the Class D notes issued by BFNS 2019-1 (the “Retained Notes”). Private fund investors were offered an opportunity to receive a pro rata in-kind distribution of the Retained Notes, which in-kind distribution will be made on or about , 2019. After giving effect to this distribution, the private funds will hold approximately [ ]% of the subordinated notes of each securitization and [ ]% of the Class D notes of BFNS 2019-1. The Adviser serves as a service provider to each of the securitizations pursuant to a Services Agreement between the Adviser and the Affiliated Collateral Manager. In that capacity, the Adviser performs certain day-to-day administrative and collateral management duties delegated to it by the Affiliated Collateral Manager, including accounting, trading, risk management, compliance support, portfolio analysis, operations, legal, research and other administrative services. The Affiliated Collateral Manager reserves absolute discretion with respect to the disposition of assets of the securitizations. Neither securitization is liable to make any payment to the Adviser in connection with the issuance of securities by the securitization or the management of its assets. The Affiliated Collateral Manager has agreed to waive and/or reimburse any compensation it receives from such securitizations, with respect to the Contribution Securities contributed to and held by the Fund. The activities of the issuers of the Contribution Securities will generally be directed by the Affiliated Collateral Manager. In the Fund’s capacity as holder of Contribution Securities, the Fund is generally not able to make decisions with respect to the management, disposition or other realization of any investment or other decisions regarding the business and affairs of the securitizations. Consequently, the success of the securitizations in will depend, in part, on the financial and managerial expertise of the Affiliated Collateral Manager. The securitization of BFNS 2017-1 was completed on January 30, 2018 and the securitization of BFNS 2019-1 was completed on , 2019. While the Affiliated Collateral Manager has extensive experience in this sector, there is limited performance history with which to evaluate BFNS 2017-1 and no performance history with which to evaluate BFNS 2019-1.

Below is a description of the Contribution Securities as of , 2019, on a per note basis:

| | | | | | | | |

| Investment | | Par | | Maturity | | Cost | | Fair Value* |

| BFNS 2017-1 (subordinated notes) | | | | | | | | |

| BFNS 2019-1 (subordinated notes) | | | | | | | | |

BFNS 2019-1 (Class D) | | | | | | | | |

| * | As determined in accordance with the valuation policies of the Fund. |

A summary of the collateral characteristics of the Contribution Securities as of , 2019 is provided below. The collateral characteristics of the Contribution Securities as of the closing of the Concurrent Private Placement and at any time thereafter may differ, potentially materially, from that set forth below as of , 2019.

| | | | |

| | | BFNS

2017-1 | | BFNS

2019-1 |

Number of unique underlying issuers | | | | |

Largest exposure to any individual issuer | | | | |

Average individual issuer exposure | | | | |

Top 10 largest issuers | | | | |

Aggregate exposure to subordinated bonds | | | | |

Aggregate exposure to senior unsecured bonds | | | | |

Average coupon | | | | |

Average reset spread | | | | |

Average credit rating of underlying collateral | | | | |

Average maturity of underlying collateral | | | | |

While the Fund currently anticipates that all or a significant portion of the investments in the Concurrent Private Placement will be made through an in-kind contribution of the Contribution Securities, the Private Placement Investors may purchase Shares in exchange for cash and/or an in-kind contribution of the Contribution Securities. Therefore, as of the date hereof, there can be no assurance as to the portion of the Concurrent Private Placement investment that will consist of cash or in-kind contribution of Contribution Securities. To the extent that the Private Placement Investors invest in cash, the Fund may incur additional expense in investing such cash in

2

INVESTMENT OPPORTUNITIES

The primary market for new debt issuance for depository financial institutions is about $100 billion annually. New issuance for banks with less than $30 billion in assets, the segment the Adviser finds most attractive, is expected by the Adviser to reach approximately $3 to $5 billion in 2019. The Adviser believes it can find attractive opportunities in banks at the smaller end of the asset size spectrum that are issuing unrated sub-debt. The Adviser believes there is an opportunity to identify community bank securities that will provide compelling risk-adjusted returns on an absolute basis. In addition, the Adviser believes these investments have the potential to provide returns that are more attractive relative to other opportunities in corporate credit. The Adviser also believes there is an opportunity for capital appreciation on unrated securities.

PORTFOLIO COMPOSITION

The Fund’s portfolio will consist primarily of:

Subordinated debt, senior debt and preferred securities of banks and diversified financial companies

Subordinated debt securities, sometimes also called “junior debt” or “sub-debt,” are debt securities for which the issuer’s obligations to make principal and interest payment are secondary to the issuer’s payment obligations to more senior debt securities. Such investments will consist primarily of debt issued by community banks or savings institutions (or their holding companies), which are subordinated to senior debt issued by the banks and deposits held by the bank, but are senior to trust preferred obligations, preferred stock, and common stock issued by the bank. Many subordinated debt securities may be unrated and some may be considered high-yield securities or “junk bonds.” See “—High Yield Securities.” Preferred securities may pay fixed or adjustable rates of return and are subject to many of the risks associated with debt securities, as well as issuer-specific and market risks applicable generally to equity securities. A company’s preferred securities generally pay dividends only after the company makes required payments to holders of its bonds and other debt.

High yield securities

The Fund may invest up to 50% of its net assets plus the amount of any borrowings for investment purposes in below investment grade securities, including certain securities issued by U.S. community banks and other financial institutions. These “high-yield” securities (also known as “junk bonds”) will generally be rated BB or lower by S&P or of equivalent quality rating from another Nationally Recognized Statistical Ratings Organization, or if unrated, considered by the Adviser to be of comparable quality. There is no minimum credit quality for securities in which the Fund may invest, provided that not more than 15% of the Fund’s net assets plus the amount of any borrowings for investment purposes may be invested in debt securities rated CCC+ or below by S&P or Fitch Ratings or Caa1 or below by Moody’s Investors Service.

Structured Products

The Fund may invest in Structured Products, including the Contribution Securities and other community bank debt securitizations and other asset-backed securities and debt securitizations (which may be referred to as collateralized debt securities or CDOs), which are collateralized by a portfolio consisting primarily of unsecured, subordinated loans made to, and unsecured, subordinated debentures, notes or other securities issued by, community banks or other financial institutions. Some Structured Products have credit ratings, but are typically issued in various classes with various priorities. Normally, Structured Products are privately offered and sold (that is, they are not registered under the securities laws) and may be characterized by the Fund as illiquid securities; however, an active dealer market may exist for Structured Products that qualify for Rule 144A transactions.

Subordinated/equity tranche of Structured Products

The Fund may also invest in the equity tranches of a Structured Product, which typically represent the first loss position in the Structured Product, are unrated and are subject to higher risks.

Derivatives

Derivatives, which are instruments that have a value based on another instrument, exchange rate or index, may be used as substitutes for securities in which the Fund can invest. The Fund uses derivatives to gain or adjust exposure to markets, sectors, securities and currencies and to manage exposure to risks relating to creditworthiness, interest rate spreads, volatility and changes in yield curves. In certain market environments, the Fund may use interest rate swaps and futures contracts to help protect its portfolio from interest rate risk. The Fund may also invest in swaps, including total return swaps and credit default swaps, options and warrants. The Fund will,

5

appreciation. However, the use of leverage also involves risks, which can be significant. see “Risks—Leverage Risk”. The Adviser intends to leverage the Fund only when it believes that the potential return on the additional investments acquired through the use of leverage is likely to exceed the costs incurred in connection with the use of leverage and is in the best interests of the Fund.

THE ADVISER

Angel Oak, an investment adviser registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), oversees the management of the Fund’s activities and is responsible for making investment decisions for the Fund’s portfolio. Angel Oak manages approximately $9.4 billion in assets specializing in structured and corporate credit as of February 28, 2019. Angel Oak was formed and has been investing in structured credit since 2009. Angel Oak is located at One Buckhead Plaza, 3060 Peachtree Rd. NW, Suite 500, Atlanta, Georgia 30305. The Adviser is controlled by Michael A. Fierman, Sreeniwas V. Prabhu, and Brad A. Friedlander, each a Managing Partner of Angel Oak.

MANAGEMENT FEE

The Fund will pay the Adviser a monthly fee computed at the annual rate of [1.35]% of the Fund’s average daily Managed Assets. If the Fund utilizes leverage, the fees paid to the Adviser for investment advisory and management services will be higher than if the Fund did not utilize leverage because the fees paid will be calculated based on the Fund’s Managed Assets, which includes the principal amount of outstanding borrowings from banks or other financial institutions (i.e., a credit facility), margin facilities, the issuance of preferred shares or notes and the leverage attributable to reverse repurchase agreements, dollar rolls or similar transactions. See “Leverage.”

EXPENSE LIMITATION AGREEMENT

[The Adviser has contractually agreed to waive its fees and/or reimburse certain expenses (exclusive of any management fees, taxes, interest on borrowings, dividends on securities sold short, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization and extraordinary expenses) to limit the Fund’s Total Annual Fund Operating Expenses to 0.25% (the Expense Limit”) through at least [ , 2020/the Termination Date] (the “Limitation Period”). The Expense Limit may be eliminated at any time by the Board, on behalf of the Fund, upon 60 days’ written notice to the Adviser. Prior to the end of the Limitation Period, the Expense Limit may not be terminated by the Adviser without the consent of the Board of Trustees. The Adviser may recoup from the Fund any waived amount or reimbursed expenses pursuant to the Expense Limit if such recoupment does not cause the Fund to exceed the current Expense Limit or the Expense Limit in place at the time of the waiver or reimbursement (whichever is lower) and the recoupment is made within three years after the end of the month in which the Adviser incurred the expense.]

ADMINISTRATOR, FUND ACCOUNTANT, CUSTODIAN AND TRANSFER AGENT AND DIVIDEND DISBURSING AGENT

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”) acts as administrator and fund accountant to the Fund and U.S. Bank National Association (“U.S. Bank”) acts as the custodian to the Fund.

Pursuant to the Fund’s agreements with Fund Services and U.S. Bank, they will receive a portion of fees from the Fund for services performed as administrator, fund accountant and custodian, as applicable. Fund Services expects to receive a fee based on the average daily net assets of the Fund, subject to an annual minimum amount.

Fund Services acts as transfer agent and dividend disbursing agent to the Fund.

DISTRIBUTIONS

The Fund intends to make regular monthly cash distributions of all or a portion of its investment company taxable income (which includes ordinary income and short-term capital gains) to Shareholders. The Fund also intends to make annual distributions of its realized “net capital gains” (which is the excess of net long-term capital gains over net short-term capital losses). The Fund expects its initial distribution will be declared approximately 45 to 60 days, and paid approximately 60 to 90 days, after the completion of this offering. At times, the Fund may pay out less than all of its investment income or pay out accumulated undistributed income in addition to current net investment income. Distributions by the Fund may include a return of capital, if the Board determines that such distributions are in the best interests of Shareholders. Dividend and capital gains distributions generally are used to purchase additional

8

investment risks before deciding whether to invest in the Fund. An investment in the Fund is not a deposit at a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

For a more complete discussion of the risks of investing in the Fund, see “Risks.” Shareholders should consider carefully the following principal risks before investing in the Fund.

Banks and diversified financials concentration risk